Cis And Asia Building Management System Market

Taille du marché en milliards USD

TCAC :

%

USD

18,600,033.21 Thousand

USD

27,366,169.09 Thousand

2022

2030

USD

18,600,033.21 Thousand

USD

27,366,169.09 Thousand

2022

2030

| 2023 –2030 | |

| USD 18,600,033.21 Thousand | |

| USD 27,366,169.09 Thousand | |

|

|

|

Marché des systèmes de gestion des bâtiments de la CEI et de l'Asie, par type de système (systèmes de gestion des installations (FMS), systèmes de sécurité et de contrôle d'accès, systèmes de gestion de l'énergie, logiciels de gestion des bâtiments (BMS), systèmes de protection incendie et autres), technologie (technologies sans fil, technologies filaires), application (résidentielle, commerciale et industrielle) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et taille du marché des systèmes de gestion des bâtiments dans la CEI et en Asie

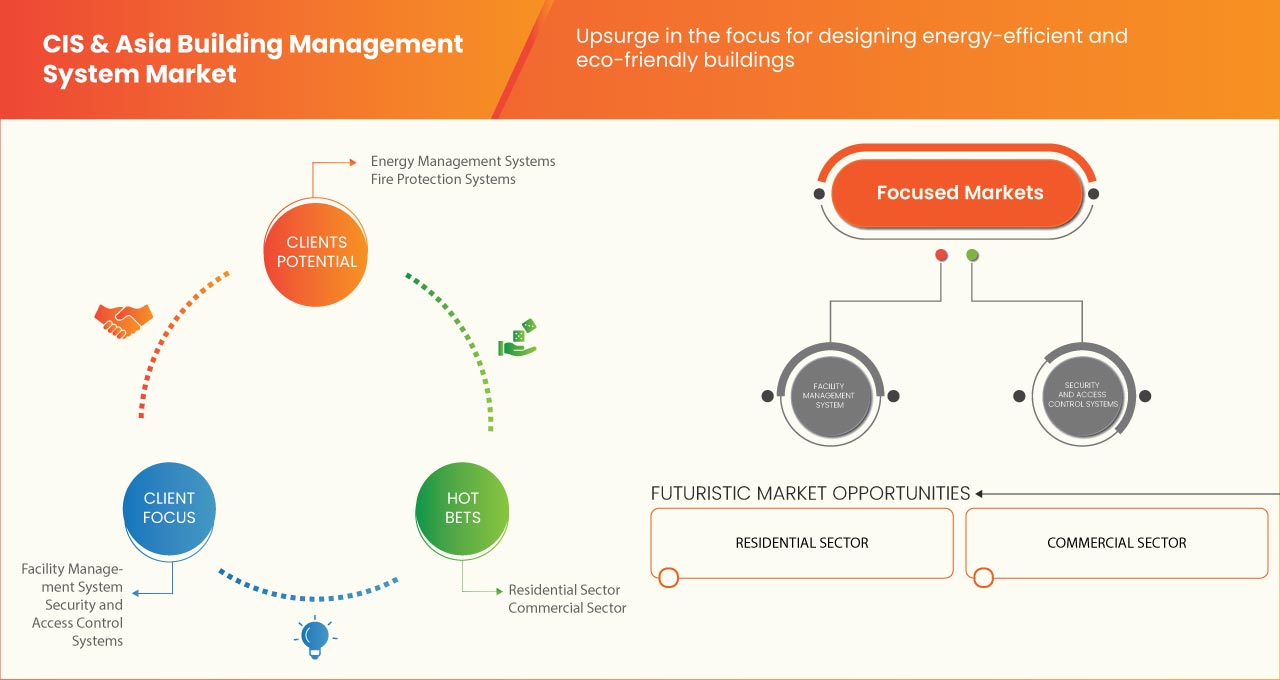

Le marché des systèmes de gestion des bâtiments de la CEI et de l'Asie est stimulé par l'accent croissant mis sur la conception de bâtiments économes en énergie et respectueux de l'environnement. En outre, l'adoption croissante de systèmes de sécurité automatisés dans les bâtiments commerciaux devrait alimenter la croissance du marché. En outre, les initiatives et incitations gouvernementales favorables aux villes intelligentes émergentes ouvriront davantage de potentiel commercial pour le marché des systèmes de gestion des bâtiments au cours de la période de prévision 2023-2030.

Data Bridge Market Research analyse que le marché des systèmes de gestion des bâtiments de la CEI et de l'Asie devrait atteindre 27 366 169,09 milliers USD d'ici 2030, contre 18 600 033,21 milliers USD en 2022, avec un TCAC substantiel de 5,1 % au cours de la période de prévision de 2023 à 2030. L'adoption croissante de systèmes de sécurité automatisés dans les bâtiments commerciaux contribue à la croissance du marché.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Année historique |

2021 (Personnalisable de 2015 à 2020) |

|

Unités quantitatives |

Chiffre d'affaires en milliers de dollars américains |

|

Segments couverts |

Type de système (systèmes de gestion des installations (FMS), systèmes de sécurité et de contrôle d'accès, systèmes de gestion de l'énergie, logiciels de gestion des bâtiments (BMS), systèmes de protection contre les incendies et autres), technologie (technologies sans fil, technologies filaires), application (résidentielle, commerciale et industrielle) |

|

Pays couverts |

Chine, Japon, Corée du Sud, Singapour, Inde, Malaisie, Thaïlande, Philippines, Indonésie, Reste de l'Asie, Russie, Ukraine, Kazakhstan, Biélorussie, Kirghizistan, Géorgie, Moldavie, Reste de la CEI |

|

Acteurs du marché couverts |

Honeywell International Inc. (États-Unis), Siemens (Allemagne), Schneider Electric (France), Trane Technologies plc (Irlande), ACUITY BRANDS, INC. (États-Unis), Axonator Inc (États-Unis), Beckhoff Automation (Allemagne), Johnson Controls (États-Unis), Convergint Technologies LLC (États-Unis), Crestron Electronics (États-Unis), Robert Bosch GmbH (Allemagne), Bajaj Electricals Ltd (Inde), Delta Electronics, Inc (Taïwan) et Hitachi, Ltd (Japon) entre autres |

Définition du marché

Le marché des systèmes de gestion des bâtiments fait référence à l'industrie axée sur la fourniture de solutions complètes de contrôle automatisées et commandées par ordinateur pour la gestion et la surveillance de divers systèmes mécaniques et électriques au sein des bâtiments. Ces systèmes comprennent la ventilation, l'éclairage, l'électricité, l'extinction d'incendie et les systèmes de sécurité. Le marché s'adresse à diverses installations telles que les bureaux commerciaux, les magasins de détail, les hôtels, les usines de fabrication, les entrepôts et les bâtiments résidentiels. Les systèmes de gestion des bâtiments jouent un rôle crucial pour assurer le fonctionnement efficace et efficient des structures modernes en optimisant la consommation d'énergie, en améliorant le confort des occupants et en rationalisant les processus de maintenance. La tendance croissante vers les bâtiments intelligents et la demande croissante de solutions écoénergétiques contribuent à l'expansion et à l'innovation continues du marché des systèmes de gestion des bâtiments.

Dynamique du marché des systèmes de gestion des bâtiments dans la CEI et en Asie

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

CONDUCTEURS :

- L'accent est mis de plus en plus sur la conception de bâtiments économes en énergie et respectueux de l'environnement

Les économies d'énergie par l'efficacité énergétique dans les bâtiments ont acquis une importance majeure dans le monde entier. Les principaux aspects de l'efficacité énergétique dans un bâtiment comprennent la conception d'un bâtiment passif avant la construction et l'utilisation de matériaux de construction à faible consommation d'énergie pendant la construction. L'accent principal de la construction de bâtiments écologiques est mis sur l'intégration de technologies d'énergie renouvelable et l'utilisation d'équipements efficaces ayant de faibles besoins énergétiques opérationnels.

La consommation d'énergie dans les bâtiments et les infrastructures augmente de manière exponentielle, ce qui suggère la nécessité de développer des alternatives pour économiser l'énergie et exploiter les bâtiments de manière durable. L'efficacité énergétique peut être obtenue grâce à l'isolation, à des techniques de construction améliorées et à des méthodes de construction modifiées pour les bâtiments, ce qui augmente la demande de systèmes de gestion durable des bâtiments.

La demande d'énergie pour faire fonctionner les bâtiments doit être réduite pour développer des bâtiments économes en énergie et durables pour l'avenir. En outre, la conception d'un bâtiment économe en énergie implique la construction ou la modernisation d'un bâtiment capable d'effectuer la majeure partie du travail en fournissant l'alimentation énergétique appropriée. Les maisons économes en énergie sont moins coûteuses à exploiter, plus confortables à vivre et plus respectueuses de l'environnement, qu'elles aient été rénovées de manière économe en énergie ou construites pour être économes en énergie.

En outre, la sensibilisation croissante des consommateurs à la conception de bâtiments économes en énergie lors de toute nouvelle construction est efficace pour rendre les maisons plus efficaces et est également moins coûteuse pour le propriétaire à long terme. Cela augmente par conséquent la demande de systèmes de gestion des bâtiments et contribue ainsi à la croissance du marché des systèmes de gestion des bâtiments dans la CEI et en Asie.

- Adoption croissante de systèmes de sécurité automatisés dans les bâtiments commerciaux

Les systèmes de sécurité sont essentiels pour tous les bâtiments, en particulier pour les bâtiments commerciaux. Ils garantissent la cohérence des opérations commerciales et la sécurité des biens physiques et intellectuels. Les propriétés commerciales telles que les entreprises industrielles, les institutions financières et gouvernementales, les écoles, les établissements médicaux et les sociétés pétrolières et gazières nécessitent un ensemble unique de mesures de sécurité et de sûreté, car chaque type de propriété est vulnérable à différents dangers.

Un système de sécurité pour bâtiments commerciaux offre une solution plus complète que les systèmes de sécurité classiques des immeubles d'appartements et comprend différents systèmes de gestion. Cela comprend notamment un contrôle d'accès commercial multicouche, divers capteurs et détecteurs, tels que des capteurs infrarouges, micro-ondes ou laser, et une sécurité périmétrique (CCTV), entre autres. Tous les systèmes de sécurité commerciaux peuvent être intégrés dans une solution de sécurité complexe offrant une plus grande flexibilité et une plus grande évolutivité.

De plus, de nombreux gestionnaires d'immeubles commerciaux font appel à des agents de sécurité pour assurer la sécurité de leurs bâtiments. Cependant, les agents humains ne peuvent pas être partout à la fois, c'est pourquoi il est préférable de disposer d'un système d'automatisation de la sécurité pour protéger la propriété. Les systèmes de sécurité des bâtiments offrent un moyen sûr et efficace de couvrir la propriété avec une surveillance complète. L'automatisation de la sécurité archive également toutes les activités sur les lieux pour traiter les vulnérabilités des bâtiments, les angles morts, les zones sombres et d'autres problèmes de sécurité.

De plus, les systèmes de sécurité automatiques pour les bâtiments commerciaux offrent une solution viable aux problèmes de sécurité avec des options de contrôle d'accès aux ascenseurs et aux bâtiments, des caméras complètes et des dispositifs de sécurité d'enregistrement, des solutions d'imagerie thermique, accélérant ainsi la croissance du marché des systèmes de gestion des bâtiments de la CEI et de l'Asie.

Retenue/Défi

Émergence de problèmes de sécurité

Ces dernières années, de nombreux bâtiments ont été équipés de systèmes de communication bidirectionnels pour une surveillance et un contrôle avancés des ressources du centre de données, ce qui renforce le besoin de systèmes de gestion des bâtiments. Par conséquent, la diffusion des systèmes de gestion des bâtiments a également augmenté la prévalence des cyberattaques sur les entreprises, les institutions gouvernementales et d'autres bâtiments nouvellement construits, ce qui est susceptible de susciter de véritables inquiétudes concernant les systèmes de sécurité des bâtiments.

Les logiciels malveillants peuvent pénétrer dans un système de bâtiment via des réseaux non sécurisés et provoquer des perturbations. Les problèmes techniques et autres menaces virales peuvent souvent entraîner une perte de communication et d'accès à des données sensibles, affectant le fonctionnement d'appareils tels que la vidéosurveillance dans les bâtiments. En outre, les cyberattaques compromettent la sécurité et les pare-feu du bâtiment et des autres systèmes qui le relient.

L’intégration du cloud, de l’analyse des données et de l’IoT offre également une large gamme de plateformes d’innovation qui peuvent transformer un géant consommateur d’énergie en une entreprise efficace. Cependant, avec l’augmentation des nœuds de connectivité des données et la production d’énormes quantités de données, il existe un risque de menaces de cybersécurité. L’apparition de problèmes technologiques en termes de connexions Internet et de fonctionnement des appareils intelligents peut également créer plusieurs problèmes dans le bon fonctionnement des systèmes de gestion des bâtiments.

De plus, lorsqu'un bâtiment connecte tous les appareils du système à un seul réseau de contrôle, il existe un risque qu'un utilisateur malveillant ou un étranger puisse pirater efficacement le bâtiment, ce qui diminue la demande de systèmes de gestion de bâtiment et est susceptible d'entraver la croissance du marché des systèmes de gestion de bâtiment de la CEI et de l'Asie.

Opportunité

- Initiatives et incitations gouvernementales favorables aux villes intelligentes émergentes

Les bâtiments intelligents comprennent un système de gestion de bâtiment avancé qui améliore la manière dont les gouvernements surveillent et contrôlent les machines, les systèmes de chauffage, de refroidissement et d'éclairage dans les bâtiments fédéraux de tous les pays, augmentant ainsi l'efficacité de ces systèmes. La technologie du système de gestion des bâtiments collecte des données brutes provenant de systèmes mécaniques ou électriques, les analyse et utilise les résultats pour identifier les inefficacités qui peuvent être corrigées immédiatement.

L’initiative des bâtiments intelligents permet aux gouvernements de faire une réelle différence en mettant en œuvre des technologies innovantes et en identifiant des possibilités d’économie d’énergie. Le gouvernement intensifie ses efforts pour améliorer la gestion de la performance énergétique dans les bâtiments fédéraux grâce à l’initiative des bâtiments intelligents. Cela entraînera une réduction de l’empreinte environnementale et des coûts énergétiques grâce à la mise en œuvre de systèmes de gestion de bâtiments intelligents.

L'efficacité énergétique implique une utilisation efficace des ressources énergétiques qui favorise le développement durable. Dans un contexte de croissance économique et de croissance des revenus, le secteur immobilier de plusieurs économies émergentes comme l'Inde, le Japon et le Brésil a connu une transformation radicale au cours des dernières années. Les politiques gouvernementales ont joué un rôle crucial, en fournissant une impulsion vitale à la croissance du secteur et en encourageant les petites et moyennes entreprises à investir dans le secteur immobilier.

En outre, grâce à l'initiative sur les bâtiments intelligents, les gouvernements de chaque pays améliorent la gestion de la performance énergétique des bâtiments fédéraux, ce qui se traduit par une réduction des émissions de gaz à effet de serre et des coûts énergétiques. Ainsi, il est prévu de créer une opportunité significative pour la croissance du marché des systèmes de gestion des bâtiments dans la CEI et en Asie.

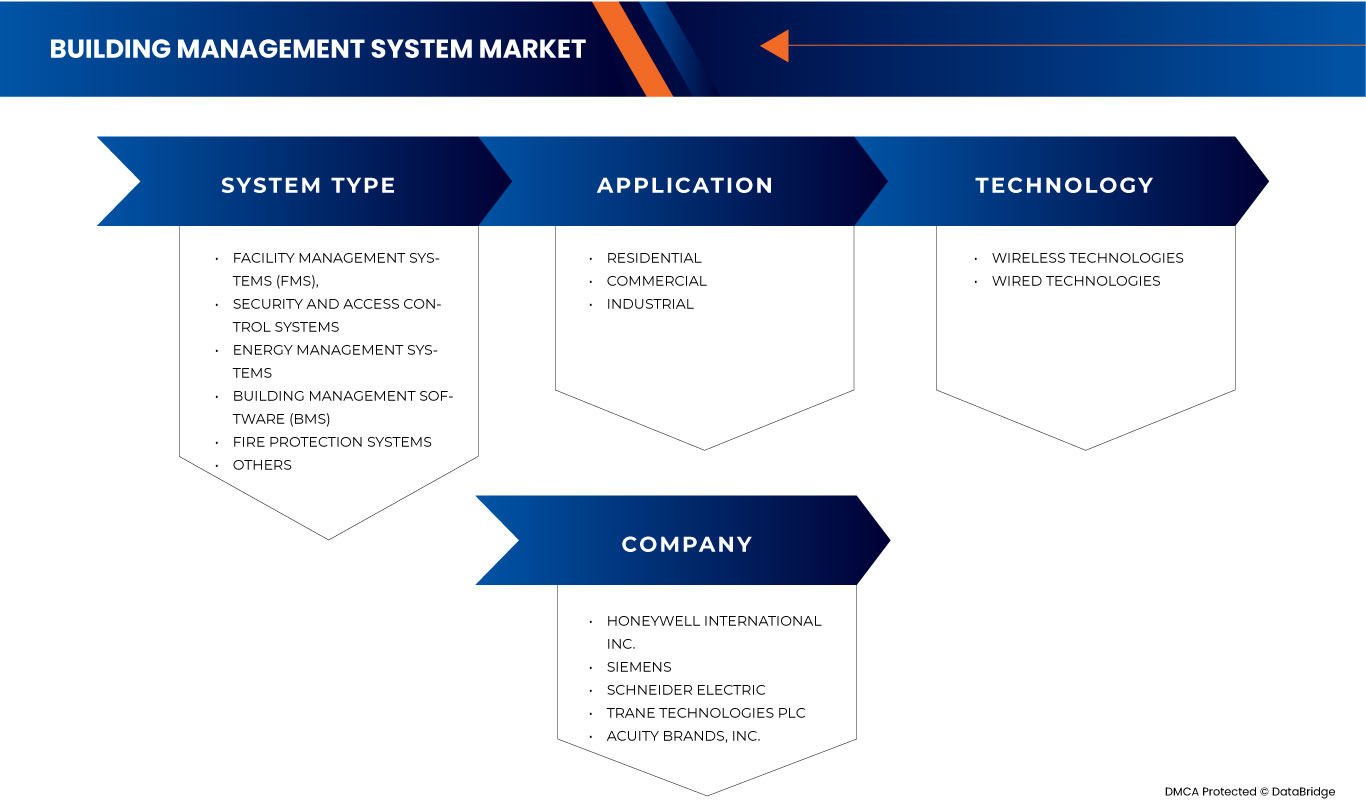

Portée du marché des systèmes de gestion des bâtiments de la CEI et de l'Asie

Le marché des systèmes de gestion des bâtiments de la CEI et de l'Asie est segmenté en trois segments notables en fonction du type de système, de la technologie et de l'application. La croissance de ces segments vous aidera à analyser les principaux segments de croissance des industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Type de système

- Systèmes de gestion des installations (FMS)

- Systèmes de sécurité et de contrôle d'accès

- Systèmes de gestion de l'énergie

- Logiciel de gestion de bâtiment (BMS)

- Systèmes de protection contre les incendies

- Autres

Sur la base du type de système, le marché est segmenté en systèmes de gestion des installations (FMS), systèmes de sécurité et de contrôle d'accès, systèmes de gestion de l'énergie, logiciels de gestion des bâtiments (BMS), systèmes de protection incendie et autres.

Technologie

- Technologies sans fil

- Technologies câblées

Sur la base de la technologie, le marché est segmenté en technologies sans fil et technologies filaires.

Application

- Résidentiel

- Commercial

- Industriel

Sur la base des applications, le marché est segmenté en résidentiel, commercial et industriel.

Analyse/perspectives régionales du marché des systèmes de gestion des bâtiments de la CEI et de l'Asie

Le marché des systèmes de gestion des bâtiments de la CEI et de l’Asie est analysé et des informations et tendances sur la taille du marché sont fournies par pays, type de système, technologie et application comme référencé ci-dessus.

Les pays couverts dans le rapport sur le marché des systèmes de gestion des bâtiments de la CEI et de l'Asie sont la Chine, le Japon, la Corée du Sud, Singapour, l'Inde, la Malaisie, la Thaïlande, les Philippines, l'Indonésie, le reste de l'Asie, la Russie, l'Ukraine, le Kazakhstan, la Biélorussie, le Kirghizistan, la Géorgie, la Moldavie et le reste de la CEI.

L'Asie domine le marché et devrait connaître la plus forte croissance au cours de la période de prévision en raison de l'adoption croissante de systèmes de sécurité automatisés dans les bâtiments commerciaux. Les entreprises commerciales ont besoin d'un ensemble unique de mesures de sécurité et de sûreté, car chaque type de propriété est vulnérable à différents dangers.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques et l'analyse des cinq forces de Porter, ainsi que des études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour chaque pays. En outre, la présence et la disponibilité des marques et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des systèmes de gestion des bâtiments dans la CEI et en Asie

Le paysage concurrentiel du marché des systèmes de gestion des bâtiments de la CEI et de l'Asie fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence mondiale, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises sur le marché des systèmes de gestion des bâtiments de la CEI et de l'Asie.

Certains des principaux acteurs opérant sur le marché des systèmes de gestion des bâtiments de la CEI et de l'Asie sont Honeywell International Inc., Siemens, Schneider Electric, Trane Technologies plc, ACUITY BRANDS, INC., Axonator Inc, Beckhoff Automation, Johnson Controls, Convergint Technologies LLC, Crestron Electronics, Robert Bosch GmbH, Bajaj Electricals Ltd, Delta Electronics, Inc et Hitachi, Ltd., entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET APPLICATION COVERAGE GRID

2.1 DBMR VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES:

4.1.1 THREAT OF NEW ENTRANTS:

4.1.2 THREAT OF SUBSTITUTES:

4.1.3 CUSTOMER BARGAINING POWER:

4.1.4 SUPPLIER BARGAINING POWER:

4.1.5 INTERNAL COMPETITION (RIVALRY):

4.2 BUILDING MANAGEMENT SYSTEM REGULATIONS

4.2.1 THE NATIONAL BUILDING CODE OF INDIA (NBC)

4.2.2 INTERNATIONAL ORGANIZATION FOR STANDARDIZATION

4.3 GOVERNMENT REGULATION - FAIR AND TRANSPARENT USE OF BIOMETRIC SYSTEM-POWERED ACCESS CONTROL

4.3.1 ISO/IEC 2382-37

4.3.2 ISO/IEC JOINT TECHNICAL COMMITTEE 1

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 UPSURGE IN THE FOCUS FOR DESIGNING ENERGY-EFFICIENT AND ECO-FRIENDLY BUILDINGS

5.1.2 RISING ADOPTION OF AUTOMATED SECURITY SYSTEMS IN COMMERCIAL BUILDINGS

5.1.3 GROWING POPULARITY OF IOT BASED BUILDING MANAGEMENT SYSTEMS

5.2 RESTRAINTS

5.2.1 EMERGENCE OF SECURITY ISSUES

5.2.2 HIGH MAINTENANCE COST OF BUILDING MANAGEMENT SYSTEMS

5.3 OPPORTUNITIES

5.3.1 FAVOURABLE GOVERNMENT INITIATIVES AND INCENTIVES FOR EMERGING SMART CITIES

5.4 CHALLENGES

5.4.1 INVOLVEMENT OF VARIOUS LENGTHY COMMUNICATION PROTOCOLS DURING THE INSTALLATION PROCEDURE

5.4.2 FALSE NOTION ABOUT HIGH INSTALLATION COSTS OF BUILDING MANAGEMENT SYSTEMS

6 COMPANY SHARE ANALYSIS: CIS & ASIA

6.1 LAUNCH OF BUILDING AUTOMATION

6.2 AWARD

6.3 ACQUISITION

6.4 PARTNERSHIP

7 COMPANY PROFILES

7.1 SCHNEIDER ELECTRIC

7.1.1 COMPANY SNAPSHOT

7.1.2 REVENUE ANALYSIS

7.1.3 PRODUCT PORTFOLIO

7.1.4 RECENT DEVELOPMENTS

7.2 JOHNSON CONTROLS

7.2.1 COMPANY SNAPSHOT

7.2.2 REVENUE ANALYSIS

7.2.3 PRODUCT PORTFOLIO

7.2.4 RECENT DEVELOPMENTS

7.3 SIEMENS

7.3.1 COMPANY SNAPSHOT

7.3.2 REVENUE ANALYSIS

7.3.3 PRODUCT PORTFOLIO

7.3.4 RECENT DEVELOPMENTS

7.4 HONEYWELL INTERNATIONAL INC.

7.4.1 COMPANY SNAPSHOT

7.4.2 REVENUE ANALYSIS

7.4.3 PRODUCT PORTFOLIO

7.4.4 RECENT DEVELOPMENTS

7.5 TRANE TECHNOLOGIES PLC

7.5.1 COMPANY SNAPSHOT

7.5.2 REVENUE ANALYSIS

7.5.3 PRODUCT PORTFOLIO

7.5.4 RECENT DEVELOPMENT

7.6 ACUITY BRANDS, INC.

7.6.1 COMPANY SNAPSHOT

7.6.2 REVENUE ANALYSIS

7.6.3 PRODUCT PORTFOLIO

7.6.4 RECENT DEVELOPMENTS

7.7 AXONATOR INC

7.7.1 COMPANY SNAPSHOT

7.7.2 PRODUCT PORTFOLIO

7.7.3 RECENT DEVELOPMENT

7.8 BAJAJ ELECTRICALS LTD

7.8.1 COMPANY SNAPSHOT

7.8.2 REVENUE ANALYSIS

7.8.3 PRODUCT PORTFOLIO

7.8.4 RECENT DEVELOPMENT

7.9 BECKHOFF AUTOMATION

7.9.1 COMPANY SNAPSHOT

7.9.2 PRODUCT PORTFOLIO

7.9.3 RECENT DEVELOPMENT

7.1 CONVERGINT TECHNOLOGIES LLC

7.10.1 COMPANY SNAPSHOT

7.10.2 PRODUCT PORTFOLIO

7.10.3 RECENT DEVELOPMENTS

7.11 CRESTON ELECTRONICS

7.11.1 COMPANY SNAPSHOT

7.11.2 PRODUCT PORTFOLIO

7.11.3 RECENT DEVELOPMENT

7.12 DELTA ELECTRONICS, INC

7.12.1 COMPANY SNAPSHOT

7.12.2 REVENUE ANALYSIS

7.12.3 PRODUCT PORTFOLIO

7.12.4 RECENT DEVELOPMENT

7.13 HITACHI, LTD.

7.13.1 COMPANY SNAPSHOT

7.13.2 REVENUE ANALYSIS

7.13.3 PRODUCT PORTFOLIO

7.13.4 RECENT DEVELOPMENTS

7.14 ROBERT BOSCH GMBH

7.14.1 COMPANY SNAPSHOT

7.14.2 REVENUE ANALYSIS

7.14.3 PRODUCT PORTFOLIO

7.14.4 RECENT DEVELOPMENTS

8 QUESTIONNAIRE

9 RELATED REPORTS

Liste des figures

FIGURE 1 CIS & ASIA BUILDING MANAGEMENT SYSTEM MARKET: SEGMENTATION

FIGURE 2 CIS & ASIA BUILDING MANAGEMENT SYSTEM MARKET: DATA TRIANGULATION

FIGURE 3 CIS & ASIA BUILDING MANAGEMENT SYSTEM MARKET: DROC ANALYSIS

FIGURE 4 CIS & ASIA BUILDING MANAGEMENT SYSTEM MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 CIS & ASIA BUILDING MANAGEMENT SYSTEM MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 CIS & ASIA BUILDING MANAGEMENT SYSTEM MARKET: MULTIVARIATE MODELLING

FIGURE 7 CIS & ASIA BUILDING MANAGEMENT SYSTEM MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 CIS & ASIA BUILDING MANAGEMENT SYSTEM MARKET: DBMR MARKET POSITION GRID

FIGURE 9 CIS & ASIA BUILDING MANAGEMENTS SYSTEM MARKET: APPLICATION COVERAGE GRID

FIGURE 10 CIS & ASIA BUILDING MANAGEMENTS SYSTEM: VENDOR SHARE ANALYSIS

FIGURE 11 CIS & ASIA BUILDING MANAGEMENT SYSTEM MARKET: SEGMENTATION

FIGURE 12 RISING ADOPTION OF AUTOMATED SECURITY SYSTEMS IN COMMERCIAL BUILDINGS IS EXPECTED TO DRIVE THE GROWTH OF THE CIS & ASIA BUILDING MANAGEMENT SYSTEM IN THE FORECAST PERIOD

FIGURE 13 THE FACILITY MANAGEMENT SYSTEM (FMS) SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST MARKET SHARE OF THE CIS & ASIA BUILDING MANAGEMENT SYSTEM MARKET IN 2023 AND 2030

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE CIS & ASIA BUILDING MANAGEMENT SYSTEM MARKET

FIGURE 15 CIS & ASIA BUILDING MANAGEMENT SYSTEM MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.