Marché du traitement des eaux usées industrielles du Chili, de la Turquie, des Pays-Bas, de l'Espagne et du Royaume-Uni, par type (coagulants, floculants , inhibiteurs de tartre, biocides et désinfectants, inhibiteurs de corrosion, membranes, antimousse, piégeurs d'oxygène, échange d'ions, neutralisant de pH et autres), installation (point d'entrée et point d'utilisation), application (eau de chaudière, eau de refroidissement et eau membranaire), technologie (ZLQ, évaporation/cristallisation, osmose inverse, ionisation fractionnée à l'électrure et autres), utilisation finale (production d'électricité, industrie alimentaire, industrie des boissons, industrie pharmaceutique, industrie du fer et de l'acier, industrie automobile, usines textiles, fabrication de batteries, produits chimiques, déchets agricoles, exploitation minière et autres) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et perspectives du marché du traitement des eaux usées industrielles au Chili, en Turquie, aux Pays-Bas, en Espagne et au Royaume-Uni

Le traitement des eaux usées le plus approprié fait référence à la méthode ou à la combinaison de méthodes qui éliminent efficacement les contaminants et les polluants des eaux usées afin de répondre à des normes de qualité et à des exigences réglementaires spécifiques. Il implique une série de processus physiques, chimiques et biologiques conçus pour traiter les eaux usées et les rendre sûres pour leur élimination ou leur réutilisation, minimisant ainsi leur impact sur l'environnement et la santé publique.

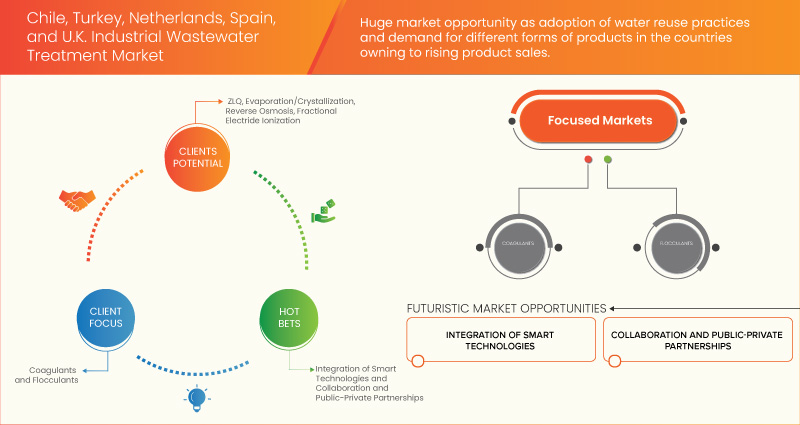

L'augmentation des dépenses environnementales et la croissance du marché des produits chimiques devraient également propulser la croissance du marché. La prévalence des maladies chroniques augmente, ce qui nécessite une méthode intégrée de diagnostic, de traitement et une plus grande sensibilisation parmi les différents plans d'eau. Une vaste population souffre de maladies chroniques qui ont généré un fardeau important. Ce marché devrait croître au cours de la période de prévision en raison de l'augmentation du nombre d'acteurs du marché et de la présence d'appareils avancés de traitement des eaux usées. Parallèlement à cela, les fabricants sont engagés dans des activités de R&D pour lancer de nouveaux systèmes sur le marché. Les avancées technologiques accrues et l'augmentation des partenariats public-privé pour faciliter les nouveaux développements d'outils de diagnostic innovants et efficaces influencent davantage le marché. Cependant, les réactions indésirables à l'eau sur le marché et le manque de professionnels qualifiés devraient freiner la croissance du marché.

Data Bridge Market Research analyse que le marché du traitement des eaux usées industrielles du Chili, de la Turquie, des Pays-Bas, de l'Espagne et du Royaume-Uni devrait atteindre la valeur de 1 361,81 millions USD d'ici 2030, à un TCAC de 3,5 % au cours de la période de prévision. Le type représente le segment le plus important du marché en raison des avancées technologiques accrues et des besoins d'urgence croissants. Ce rapport de marché couvre également en profondeur l'analyse des prix, l'analyse des brevets et les avancées technologiques.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable de 2015 à 2020) |

|

Unités quantitatives |

Chiffre d'affaires en millions, prix en USD |

|

Segments couverts |

Type (coagulants, floculants, inhibiteurs de tartre, biocides et désinfectants, inhibiteurs de corrosion, membranes, antimousse, piégeurs d'oxygène, échange d'ions, neutralisant de pH et autres), installation (point d'entrée et point d'utilisation), application (eau de chaudière, eau de refroidissement et eau de membrane), technologie (ZLQ, évaporation/cristallisation, osmose inverse, ionisation fractionnée à l'électrure et autres), utilisation finale (production d'électricité, industrie alimentaire, industrie des boissons, industrie pharmaceutique, industrie sidérurgique, industrie automobile, usines textiles, fabrication de batteries, industrie chimique, déchets agricoles, exploitation minière et autres) |

|

Pays couverts |

Chili, Turquie, Pays-Bas, Espagne et Royaume-Uni |

|

Acteurs du marché couverts |

Thermax Limited, Lenntech BV, Accepta Water Treatment, MCC CHEMICALS, Dorfketal Chemicals (I) Pvt. Ltd, Geo Speciality Chemicals Inc, Kemira., Ecolab, SNF et Feralco AB, entre autres |

Définition du marché

Le traitement des eaux usées est le processus de conversion des eaux usées, c'est-à-dire de l'eau qui n'est plus nécessaire ou qui ne convient plus à l'utilisation conformément aux normes de sécurité. L'objectif principal du traitement des eaux usées est d'éliminer autant de solides en suspension que possible avant que l'eau restante, appelée effluent, ne soit rejetée dans l'environnement. Lorsque les matières solides se décomposent, elles consomment de l'oxygène, dont les plantes et les animaux vivant dans l'eau ont besoin. Si les eaux usées ne sont pas traitées, elles nuisent à l'environnement et à la santé humaine. Ces conséquences peuvent inclure des dommages aux populations de poissons et d'animaux sauvages, un appauvrissement en oxygène, des fermetures de plages, des infections et des troubles viraux et d'autres restrictions sur l'utilisation des eaux récréatives, la récolte de poissons et de crustacés et la contamination de l'eau potable.

Dynamique du marché

Cette section traite de la compréhension des moteurs, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Industrialisation et urbanisation croissantes

La croissance démographique, le développement économique, l’urbanisation et l’industrialisation augmentent la consommation d’eau et la production de déchets. La croissance des zones urbaines et la construction d’industries entraînent une augmentation du volume des eaux usées domestiques et industrielles, ce qui met à rude épreuve les installations de traitement des eaux usées. La tendance à l’urbanisation et à l’industrialisation croissantes met en évidence la nécessité d’une approche intégrée de la gestion de l’eau. Cela implique de fusionner l’approvisionnement en eau, la gestion des eaux pluviales, les techniques d’économie d’eau et le traitement des eaux usées. L’optimisation des ressources en eau, la réduction de la pollution et la garantie d’une croissance durable dans les zones urbaines et industrielles peuvent être réalisées en mettant en œuvre des techniques de gestion intégrée de l’eau.

- Diminution des sources d'eau douce

Les ressources en eau douce sont essentielles pour l'environnement, l'économie et la société. Elles sont réparties de manière très variable entre les pays et au sein de ceux-ci. Les prélèvements d'eau pour l'irrigation industrielle, l'irrigation publique et d'autres usages ont un impact sur leur disponibilité et leur qualité, sur les procédures de refroidissement des centrales électriques, sur les charges polluantes domestiques, industrielles et agricoles, ainsi que sur les changements climatiques et météorologiques.

Les sources d’eau douce deviennent de plus en plus accessibles, ce qui constitue un problème mondial majeur aux conséquences profondes. La pénurie d’eau peut s’aggraver en raison du déclin des sources d’eau douce, en particulier dans les zones à forte densité de population, à urbanisation rapide et à accès limité à l’eau douce. En raison du manque d’eau, la concurrence pour ces ressources est plus forte entre les différentes industries, les villes et les secteurs agricoles et industriels. Cette concurrence peut être atténuée et la pression sur les ressources en eau douce peut être réduite grâce à une gestion efficace des eaux usées, qui comprend le traitement et la réutilisation des eaux usées.

Opportunité

- Adoption croissante des systèmes de traitement biologique des eaux usées

Les produits pharmaceutiques et les produits de soins personnels peuvent nuire à l'environnement et à la santé humaine. En particulier, on trouve fréquemment dans les stations d'épuration des eaux usées des contaminants qui interfèrent avec le traitement biologique. Comparé à des technologies de traitement plus sophistiquées, le procédé à boues activées nécessite un investissement initial plus faible et des exigences opérationnelles moins importantes.

La municipalité métropolitaine d'Istanbul a inauguré la plus grande usine moderne de traitement biologique de Turquie, qui traitera 650 000 mètres cubes d'eaux usées par jour. Ekrem Mamolu, le maire d'Istanbul, a officiellement inauguré l'usine, qui fournira de l'électricité à près de 2,6 millions de personnes vivant dans les districts de Tuzla, Pendik, Kartal et Maltepe. Les polluants des eaux usées seront éliminés, grâce à une nouvelle étape de traitement biologique avancé, protégeant l'environnement, la santé des personnes et la vie marine de la mer de Marmara.

Les systèmes de traitement biologique des eaux usées sont conformes aux règles de durabilité environnementale. Ils nettoient les eaux usées à l'aide de processus microbiens naturels, réduisant ainsi le besoin d'ajouts chimiques ou de techniques de traitement à forte consommation d'énergie. Les systèmes de traitement biologique offrent une polyvalence en matière de traitement et d'optimisation énergétique car ils peuvent fonctionner dans des environnements anaérobies, aérobies ou anoxiques. Les stratégies de conservation des ressources et d'économie circulaire peuvent bénéficier de l'utilisation de la biomasse produite pendant le traitement, qui peut également être utilisée pour générer du biogaz ou récupérer des nutriments. Ainsi, l'adoption croissante des systèmes de traitement biologique des eaux usées devrait créer des opportunités de croissance du marché.

Retenue

- Coûts d'installation et d'exploitation élevés

Les systèmes de traitement des eaux usées doivent être installés et exploités de manière à garantir que la qualité des effluents respecte les valeurs limites établies. Même dans les pays en développement, les dépenses énormes associées à l'installation, à l'entretien et à l'exploitation des systèmes de traitement conventionnels pèsent sur l'économie et la société. Les coûts de personnel, les coûts d'entretien, les coûts énergétiques, les coûts des produits chimiques et des matériaux, les coûts d'élimination et les autres coûts d'administration, d'assurance, de droits de déversement (le cas échéant), de services extérieurs et autres sont tous des coûts d'exploitation.

Ainsi, le coût plus élevé de l’installation et de l’exploitation des stations d’épuration devrait freiner la croissance du marché.

Défi

- Exploitation et maintenance des systèmes de traitement

L'efficacité des performances, le respect des exigences légales et la longévité des infrastructures dépendent de l'exploitation et de l'entretien efficaces des systèmes de traitement des eaux usées. Il est essentiel de surveiller régulièrement les paramètres essentiels tels que les débits, les caractéristiques des eaux entrantes et des effluents, les niveaux d'oxygène dissous, le pH et les concentrations en nutriments pour évaluer l'efficacité du système de traitement. La surveillance permet de prendre des mesures correctives lorsque les conditions opérationnelles souhaitées sont rapidement violées. En outre, des tests de routine des propriétés des boues et des indicateurs d'efficacité du processus (tels que l'indice de volume des boues et le temps de rétention des solides) donnent un aperçu de l'état général du système.

Les opérateurs doivent recevoir une formation et un enseignement appropriés pour bien exploiter le système de traitement des eaux usées. Les opérateurs doivent être informés de l'équipement, des exigences d'entretien et des procédures de traitement. Les opérateurs sont tenus au courant des dernières technologies, des lois et des meilleures pratiques grâce à des programmes de formation et de développement professionnel continu, ce qui leur permet d'exploiter et d'entretenir efficacement le système de traitement.

Ainsi, l’exploitation et la maintenance du système de traitement devraient constituer un défi à la croissance du marché.

Développement récent

- En 2018, le Chili a adopté une législation régissant la gestion et la réutilisation des eaux grises, mais elle doit encore être approuvée par le ministère de la Santé (Minsal) avant de pouvoir être mise en œuvre. Le Fonds Santiago-Maipo, le premier fonds pour l'eau du pays, collabore désormais avec des acteurs publics et privés pour planifier des initiatives de gestion et de conservation de l'eau dans la zone métropolitaine.

Portée du marché du traitement des eaux usées industrielles au Chili, en Turquie, aux Pays-Bas, en Espagne et au Royaume-Uni

Le marché du traitement des eaux usées industrielles du Chili, de la Turquie, des Pays-Bas, de l'Espagne et du Royaume-Uni est segmenté en fonction du type, de l'installation, de l'application, de la technologie et de l'utilisation finale. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles.

Taper

- Coagulants

- Floculants

- Inhibiteurs de tartre

- Biocides et désinfectants

- Inhibiteurs de corrosion

- Membranes

- Antimousse

- Pièges à oxygène

- Échange d'ions

- Neutralisant de pH

- Autres

Sur la base du type, le marché est segmenté en coagulants, floculants, inhibiteurs de tartre, biocides et désinfectants, inhibiteurs de corrosion, membranes, antimousse, piégeurs d'oxygène, échange d'ions, neutralisant de pH et autres.

Installation

- Point d'entrée

- Point d'utilisation

Sur la base de l’installation, le marché est segmenté en point d’entrée et point d’utilisation.

Application

- Eau de chaudière

- Eau de refroidissement

- Eau membranaire

Sur la base de l’application, le marché est segmenté en eau de chaudière, eau de refroidissement et eau membranaire.

Technologie

- ZLQ

- Évaporation/Cristallisation

- Osmose inverse

- Ionisation fractionnée par électride

- Autres

Sur la base de la technologie, le marché est segmenté en ZLQ, évaporation/cristallisation, osmose inverse, ionisation électrique fractionnée et autres.

Utilisation finale

- Production d'énergie

- Industrie alimentaire

- Industrie des boissons

- Industrie pharmaceutique

- Industrie du fer et de l'acier

- Industrie automobile

- Usines textiles

- Fabrication de batteries

- Chimique

- Déchets agricoles

- Exploitation minière

- Autres

Sur la base de l'utilisation finale, le marché est segmenté en production d'électricité, industrie alimentaire, industrie des boissons, industrie pharmaceutique, industrie sidérurgique, industrie automobile, usines textiles, fabrication de batteries, industrie chimique, déchets agricoles, exploitation minière et autres.

Analyse/perspectives régionales du marché du traitement des eaux usées industrielles au Chili, en Turquie, aux Pays-Bas, en Espagne et au Royaume-Uni

Le marché du traitement des eaux usées industrielles du Chili, de la Turquie, des Pays-Bas, de l’Espagne et du Royaume-Uni est analysé et des informations sur la taille du marché sont fournies par type, installation, application, technologie et utilisation finale.

Les pays couverts par ce rapport de marché sont le Chili, la Turquie, les Pays-Bas, l'Espagne et le Royaume-Uni.

La section par pays du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements dans la réglementation du marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie du pays, les actes réglementaires et les tarifs douaniers d'import-export sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario du marché pour les différents pays. En outre, la présence et la disponibilité des marques mondiales et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, ainsi que l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Paysage concurrentiel et analyse des parts de marché du traitement des eaux usées industrielles au Chili, en Turquie, aux Pays-Bas, en Espagne et au Royaume-Uni

Le paysage concurrentiel du marché du traitement des eaux usées industrielles du Chili, de la Turquie, des Pays-Bas, de l'Espagne et du Royaume-Uni fournit des détails sur les concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements en R&D, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et l'ampleur du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation de l'entreprise sur le marché.

Certains des principaux acteurs du marché opérant sur ce marché sont Thermax Limited, Lenntech BV, Accepta Water Treatment, MCC CHEMICALS, Dorfketal Chemicals (I) Pvt. Ltd, Geo Speciality Chemicals Inc, Kemira., Ecolab, SNF et Feralco AB, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT TYPE LIFELINE CURVE

2.8 PRODUCT TYPE LIFELINE CURVE

2.9 PRODUCT TYPE LIFELINE CURVE

2.1 PRODUCT TYPE LIFELINE CURVE

2.11 PRODUCT TYPE LIFELINE CURVE

2.12 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.13 DBMR MARKET POSITION GRID

2.14 MARKET END USE COVERAGE GRID

2.15 VENDOR SHARE ANALYSIS

2.16 SECONDARY SOURCES

2.17 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER FIVE FORCES MODEL

4.3 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.4 VENDOR SELECTION CRITERIA

4.5 SUPPLY CHAIN ANALYSIS

4.6 LOGISTIC COST SCENARIO

4.7 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

5 CHILE, TURKEY, NETHERLANDS, SPAIN AND UK INDUSTRIAL WASTEWATER TREATMENT MARKET, REGULATIONS

5.1 REGULATORY SCENARIO IN CHILE

5.2 REGULATORY SCENARIO IN TURKEY

5.3 REGULATORY SCENARIO IN NETHERLANDS

5.4 REGULATORY SCENARIO IN SPAIN

5.5 REGULATORY SCENARIO IN U.K.

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING INDUSTRIALIZATION AND URBANIZATION

6.1.2 DECLINING FRESHWATER SOURCES

6.1.3 TECHNOLOGICAL ADVANCEMENTS

6.1.4 GOVERNMENT INITIATIVES TOWARDS WASTEWATER TREATMENT

6.2 RESTRAINTS

6.2.1 HIGH INSTALLATION AND OPERATIONAL COSTS

6.2.2 COMPLEX TREATMENT REQUIREMENTS

6.3 OPPORTUNITIES

6.3.1 RISING ADOPTION OF BIOLOGICAL WASTEWATER TREATMENT SYSTEMS

6.3.2 INTEGRATION OF SMART TECHNOLOGIES

6.3.3 ADOPTION OF WATER REUSE PRACTICES

6.3.4 COLLABORATION AND PUBLIC-PRIVATE PARTNERSHIPS

6.4 CHALLENGES

6.4.1 REGULATORY AND TECHNOLOGICAL BARRIER

6.4.2 TREATMENT SYSTEMS OPERATION AND MAINTENANCE

7 CHILE, TURKEY, NETHERLANDS, SPAIN AND U.K. INDUSTRIAL WASTEWATER TREATMENT MARKET, BY TYPE

7.1 OVERVIEW

7.2 COAGULANTS

7.3 FLOCCULANTS

7.4 SCALE INHIBITORS

7.5 BIOCIDES AND DISINFECTANTS

7.6 CORROSION INHIBITORS

7.7 MEMBRANES

7.8 DEFOAMER

7.9 OXYGEN SCAVENGERS

7.1 ION EXCHANGE

7.11 PH NEUTRALIZER

7.12 OTHERS

8 CHILE, TURKEY, NETHERLANDS, SPAIN AND U.K. INDUSTRIAL WASTEWATER TREATMENT MARKET, BY INSTALLATION

8.1 OVERVIEW

8.2 POINT OF ENTRY

8.3 POINT OF USE

9 CHILE, TURKEY, NETHERLANDS, SPAIN AND U.K. INDUSTRIAL WASTEWATER TREATMENT MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 BOILER WATER

9.3 COOLING WATER

9.4 MEMBRANE WATER

10 CHILE, TURKEY, NETHERLANDS, SPAIN AND U.K. INDUSTRIAL WASTEWATER TREATMENT MARKET, BY TECHNOLOGY

10.1 OVERVIEW

10.2 ZLQ

10.3 EVAPORATION/ CRYSTALLIZATION

10.4 REVERSE OSMOSIS

10.5 FRACTIONAL ELECTRIDE IONIZATION

10.6 OTHERS

11 CHILE, TURKEY, NETHERLANDS, SPAIN AND U.K. INDUSTRIAL WASTEWATER TREATMENT MARKET, BY END USE

11.1 OVERVIEW

11.2 POWER GENERATION

11.3 FOOD INDUSTRY

11.4 BEVERAGE INDUSTRY

11.5 PHARMACEUTICAL INDUSTRY

11.6 IRON AND STEEL INDUSTRY

11.7 AUTOMOTIVE INDUSTRY

11.8 TEXTILE MILLS

11.9 BATTERY MANUFACTURING

11.1 CHEMICAL

11.11 AGRICULTURAL WASTE

11.12 MINING

11.13 OTHERS

12 CHILE, TURKEY, NETHERLANDS, SPAIN AND U.K. INDUSTRIAL WASTEWATER TREATMENT MARKET, BY COUNTRY

12.1 CHILE

12.2 TURKEY

12.3 NETHERLANDS

12.4 SPAIN

12.5 U.K.

13 CHILE, TURKEY, NETHERLANDS, SPAIN AND UK INDUSTRIAL WASTEWATER TREATMENT MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: CHILE

13.2 COMPANY SHARE ANALYSIS: TURKEY

13.3 COMPANY SHARE ANALYSIS: NETHERLANDS

13.4 COMPANY SHARE ANALYSIS: SPAIN

13.5 COMPANY SHARE ANALYSIS: UK

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 ECOLAB

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 SWOT ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 KEMIRA

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 SWOT ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.3 SNF

15.3.1 COMPANY SNAPSHOT

15.3.2 SWOT ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENT

15.4 FERALCO AB

15.4.1 COMPANY SNAPSHOT

15.4.2 SWOT ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENT

15.5 DORFKETAL CHEMICALS (I) PVT. LTD.

15.5.1 COMPANY SNAPSHOT

15.5.2 SWOT ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENT

15.6 ACCEPTA WATER TREATMENT

15.6.1 COMPANY SNAPSHOT

15.6.2 SWOT ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENT

15.7 GEO SPECIALITY CHEMICALS INC

15.7.1 COMPANY SNAPSHOT

15.7.2 SWOT ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENT

15.8 LENNTECH B.V.

15.8.1 COMPANY SNAPSHOT

15.8.2 SWOT ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENT

15.9 MCC CHEMICALS

15.9.1 COMPANY SNAPSHOT

15.9.2 SWOT ANALYSIS

15.9.3 PROUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENT

15.1 THERMAX LIMITED

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 SWOT ANALYSIS

15.10.4 PRODUCT PORTFOLIO

15.10.5 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

Liste des figures

FIGURE 1 CHILE, TURKEY, NETHERLANDS, SPAIN AND UK INDUSTRIAL WASTEWATER TREATMENT MARKET: SEGMENTATION

FIGURE 2 CHILE, TURKEY, NETHERLANDS, SPAIN AND UK INDUSTRIAL WASTEWATER TREATMENT MARKET: DATA TRIANGULATION

FIGURE 3 CHILE, TURKEY, NETHERLANDS, SPAIN AND UK INDUSTRIAL WASTEWATER TREATMENT MARKET: DROC ANALYSIS

FIGURE 4 CHILE INDUSTRIAL WASTEWATER TREATMENT MARKET: COUNTRY VS REGIONAL MARKET ANALYSIS

FIGURE 5 TURKEY INDUSTRIAL WASTEWATER TREATMENT MARKET: COUNTRY VS REGIONAL MARKET ANALYSIS

FIGURE 6 NETHERLANDS INDUSTRIAL WASTEWATER TREATMENT MARKET: COUNTRY VS REGIONAL MARKET ANALYSIS

FIGURE 7 SPAIN INDUSTRIAL WASTEWATER TREATMENT MARKET: COUNTRY VS REGIONAL MARKET ANALYSIS

FIGURE 8 UK INDUSTRIAL WASTEWATER TREATMENT MARKET: COUNTRY VS REGIONAL MARKET ANALYSIS

FIGURE 9 CHILE INDUSTRIAL WASTEWATER TREATMENT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 10 TURKEY INDUSTRIAL WASTEWATER TREATMENT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 11 NETHERLANDS INDUSTRIAL WASTEWATER TREATMENT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 12 SPAIN INDUSTRIAL WASTEWATER TREATMENT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 13 U.K INDUSTRIAL WASTEWATER TREATMENT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 14 CHILE, TURKEY, NETHERLANDS, SPAIN AND UK INDUSTRIAL WASTEWATER TREATMENT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 15 CHILE, TURKEY, NETHERLANDS, SPAIN AND UK INDUSTRIAL WASTEWATER TREATMENT MARKET: DBMR MARKET POSITION GRID

FIGURE 16 CHILE, TURKEY, NETHERLANDS, SPAIN AND UK INDUSTRIAL WASTEWATER TREATMENT MARKET: MARKET END USE COVERAGE GRID

FIGURE 17 CHILE, TURKEY, NETHERLANDS, SPAIN AND UK INDUSTRIAL WASTEWATER TREATMENT MARKET: VENDOR SHARE ANALYSIS

FIGURE 18 CHILE, TURKEY, NETHERLANDS, SPAIN AND UK INDUSTRIAL WASTEWATER TREATMENT MARKET: SEGMENTATION

FIGURE 19 THE GROWING INDUSTRIALIZATION AND URBANIZATION ARE EXPECTED TO DRIVE THE CHILE INDUSTRIAL WASTEWATER TREATMENT MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 20 THE DECLINING FRESHWATER SOURCES ARE EXPECTED TO DRIVE THE TURKEY INDUSTRIAL WASTEWATER TREATMENT MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 21 THE GOVERNMENT INITIATIVES TOWARDS WASTEWATER TREATMENT ARE EXPECTED TO DRIVE THE NETHERLANDS INDUSTRIAL WASTEWATER TREATMENT MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 22 THE RISING TECHNOLOGICAL ADVANCEMENTS ARE EXPECTED TO DRIVE THE SPAIN INDUSTRIAL WASTEWATER TREATMENT MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 23 THE RISING ADOPTION OF BIOLOGICAL WASTEWATER TREATMENT SYSTEMS IS EXPECTED TO DRIVE THE UK INDUSTRIAL WASTEWATER TREATMENT MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 24 COAGULANTS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE CHILE INDUSTRIAL WASTEWATER TREATMENT MARKET IN 2023 AND 2030

FIGURE 25 COAGULANTS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE TURKEY INDUSTRIAL WASTEWATER TREATMENT MARKET IN 2023 AND 2030

FIGURE 26 COAGULANTS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NETHERLANDS INDUSTRIAL WASTEWATER TREATMENT MARKET IN 2023 AND 2030

FIGURE 27 COAGULANTS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE SPAIN INDUSTRIAL WASTEWATER TREATMENT MARKET IN 2023 AND 2030

FIGURE 28 COAGULANTS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE UK INDUSTRIAL WASTEWATER TREATMENT MARKET IN 2023 AND 2030

FIGURE 29 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF THE CHILE, TURKEY, NETHERLANDS, SPAIN AND UK INDUSTRIAL WASTEWATER TREATMENT MARKET

FIGURE 30 CHILE INDUSTRIAL WASTEWATER TREATMENT MARKET: BY TYPE, 2022

FIGURE 31 TURKEY INDUSTRIAL WASTEWATER TREATMENT MARKET: BY TYPE, 2022

FIGURE 32 NETHERLANDS INDUSTRIAL WASTEWATER TREATMENT MARKET: BY TYPE, 2022

FIGURE 33 SPAIN INDUSTRIAL WASTEWATER TREATMENT MARKET: BY TYPE, 2022

FIGURE 34 U.K. INDUSTRIAL WASTEWATER TREATMENT MARKET: BY TYPE, 2022

FIGURE 35 CHILE INDUSTRIAL WASTEWATER TREATMENT MARKET: BY TYPE, 2023-2030 (USD MILLION)

FIGURE 36 TURKEY INDUSTRIAL WASTEWATER TREATMENT MARKET: BY TYPE, 2023-2030 (USD MILLION)

FIGURE 37 NETHERLANDS INDUSTRIAL WASTEWATER TREATMENT MARKET: BY TYPE, 2023-2030 (USD MILLION)

FIGURE 38 SPAIN INDUSTRIAL WASTEWATER TREATMENT MARKET: BY TYPE, 2023-2030 (USD MILLION)

FIGURE 39 U.K. INDUSTRIAL WASTEWATER TREATMENT MARKET: BY TYPE, 2023-2030 (USD MILLION)

FIGURE 40 CHILE INDUSTRIAL WASTEWATER TREATMENTMARKET: BY TYPE, CAGR (2023-2030)

FIGURE 41 TURKEY INDUSTRIAL WASTEWATER TREATMENT MARKET: BY TYPE, CAGR (2023-2030)

FIGURE 42 NETHERLANDS INDUSTRIAL WASTEWATER TREATMENT MARKET: BY TYPE, CAGR (2023-2030)

FIGURE 43 SPAIN INDUSTRIAL WASTEWATER TREATMENT MARKET: BY TYPE, CAGR (2023-2030)

FIGURE 44 U.K. INDUSTRIAL WASTEWATER TREATMENT MARKET: BY TYPE, CAGR (2023-2030)

FIGURE 45 CHILE INDUSTRIAL WASTEWATER TREATMENTMARKET: BY TYPE, LIFELINE CURVE

FIGURE 46 TURKEY INDUSTRIAL WASTEWATER TREATMENT MARKET: BY TYPE, LIFELINE CURVE

FIGURE 47 NETHERLANDS INDUSTRIAL WASTEWATER TREATMENT MARKET: BY TYPE, LIFELINE CURVE

FIGURE 48 SPAIN INDUSTRIAL WASTEWATER TREATMENT MARKET: BY TYPE, LIFELINE CURVE

FIGURE 49 U.K. INDUSTRIAL WASTEWATER TREATMENT MARKET: BY TYPE, LIFELINE CURVE

FIGURE 50 CHILE INDUSTRIAL WASTEWATER TREATMENT MARKET: BY INSTALLATION, 2022

FIGURE 51 TURKEY INDUSTRIAL WASTEWATER TREATMENT MARKET: BY INSTALLATION, 2022

FIGURE 52 NETHERLANDS INDUSTRIAL WASTEWATER TREATMENT MARKET: BY INSTALLATION, 2022

FIGURE 53 SPAIN INDUSTRIAL WASTEWATER TREATMENT MARKET: BY INSTALLATION, 2022

FIGURE 54 U.K. INDUSTRIAL WASTEWATER TREATMENT MARKET: BY INSTALLATION, 2022

FIGURE 55 CHILE INDUSTRIAL WASTEWATER TREATMENT MARKET: BY INSTALLATION, 2023-2030 (USD MILLION)

FIGURE 56 TURKEY INDUSTRIAL WASTEWATER TREATMENT MARKET: BY INSTALLATION, 2023-2030 (USD MILLION)

FIGURE 57 NETHERLANDS INDUSTRIAL WASTEWATER TREATMENT MARKET: BY INSTALLATION, 2023-2030 (USD MILLION)

FIGURE 58 SPAIN INDUSTRIAL WASTEWATER TREATMENT MARKET: BY INSTALLATION, 2023-2030 (USD MILLION)

FIGURE 59 U.K. INDUSTRIAL WASTEWATER TREATMENT MARKET: BY INSTALLATION, 2023-2030 (USD MILLION)

FIGURE 60 CHILE INDUSTRIAL WASTEWATER TREATMENT MARKET: BY INSTALLATION, CAGR (2023-2030)

FIGURE 61 TURKEY INDUSTRIAL WASTEWATER TREATMENT MARKET: BY INSTALLATION, CAGR (2023-2030)

FIGURE 62 NETHERLANDS INDUSTRIAL WASTEWATER TREATMENT MARKET: BY INSTALLATION, CAGR (2023-2030)

FIGURE 63 SPAIN INDUSTRIAL WASTEWATER TREATMENT MARKET: BY INSTALLATION, CAGR (2023-2030)

FIGURE 64 U.K. INDUSTRIAL WASTEWATER TREATMENT MARKET: BY INSTALLATION, CAGR (2023-2030)

FIGURE 65 CHILE INDUSTRIAL WASTEWATER TREATMENTMARKET: BY INSTALLATION, LIFELINE CURVE

FIGURE 66 TURKEY INDUSTRIAL WASTEWATER TREATMENT MARKET: BY INSTALLATION, LIFELINE CURVE

FIGURE 67 NETHERLANDS INDUSTRIAL WASTEWATER TREATMENT MARKET: BY INSTALLATION, LIFELINE CURVE

FIGURE 68 SPAIN INDUSTRIAL WASTEWATER TREATMENT MARKET: BY INSTALLATION, LIFELINE CURVE

FIGURE 69 U.K. INDUSTRIAL WASTEWATER TREATMENT MARKET: BY INSTALLATION, LIFELINE CURVE

FIGURE 70 CHILE INDUSTRIAL WASTEWATER TREATMENT MARKET: BY APPLICATION, 2022

FIGURE 71 TURKEY INDUSTRIAL WASTEWATER TREATMENT MARKET: BY APPLICATION, 2022

FIGURE 72 NETHERLANDS INDUSTRIAL WASTEWATER TREATMENT MARKET: BY APPLICATION, 2022

FIGURE 73 SPAIN INDUSTRIAL WASTEWATER TREATMENT MARKET: BY APPLICATION, 2022

FIGURE 74 U.K. INDUSTRIAL WASTEWATER TREATMENT MARKET: BY APPLICATION, 2022

FIGURE 75 CHILE INDUSTRIAL WASTEWATER TREATMENT MARKET: BY APPLICATION, 2023-2030 (USD MILLION)

FIGURE 76 TURKEY INDUSTRIAL WASTEWATER TREATMENT MARKET: BY APPLICATION, 2023-2030 (USD MILLION)

FIGURE 77 NETHERLANDS INDUSTRIAL WASTEWATER TREATMENT MARKET: BY APPLICATION, 2023-2030 (USD MILLION)

FIGURE 78 SPAIN INDUSTRIAL WASTEWATER TREATMENT MARKET: BY APPLICATION, 2023-2030 (USD MILLION)

FIGURE 79 U.K. INDUSTRIAL WASTEWATER TREATMENT MARKET: BY APPLICATION, 2023-2030 (USD MILLION)

FIGURE 80 CHILE INDUSTRIAL WASTEWATER TREATMENT MARKET: BY APPLICATION, CAGR (2023-2030)

FIGURE 81 TURKEY INDUSTRIAL WASTEWATER TREATMENT MARKET: BY APPLICATION, CAGR (2023-2030)

FIGURE 82 NETHERLANDS INDUSTRIAL WASTEWATER TREATMENT MARKET: BY APPLICATION, CAGR (2023-2030)

FIGURE 83 SPAIN INDUSTRIAL WASTEWATER TREATMENT MARKET: BY APPLICATION, CAGR (2023-2030)

FIGURE 84 U.K. INDUSTRIAL WASTEWATER TREATMENT MARKET: BY APPLICATION, CAGR (2023-2030)

FIGURE 85 CHILE INDUSTRIAL WASTEWATER TREATMENT MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 86 TURKEY INDUSTRIAL WASTEWATER TREATMENT MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 87 NETHERLANDS INDUSTRIAL WASTEWATER TREATMENT MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 88 SPAIN INDUSTRIAL WASTEWATER TREATMENT MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 89 U.K. INDUSTRIAL WASTEWATER TREATMENT MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 90 CHILE INDUSTRIAL WASTEWATER TREATMENT MARKET: BY TECHNOLOGY, 2022

FIGURE 91 TURKEY INDUSTRIAL WASTEWATER TREATMENT MARKET: BY TECHNOLOGY, 2022

FIGURE 92 NETHERLANDS INDUSTRIAL WASTEWATER TREATMENT MARKET: BY TECHNOLOGY, 2022

FIGURE 93 SPAIN INDUSTRIAL WASTEWATER TREATMENT MARKET: BY TECHNOLOGY, 2022

FIGURE 94 U.K. INDUSTRIAL WASTEWATER TREATMENT MARKET: BY TECHNOLOGY, 2022

FIGURE 95 CHILE INDUSTRIAL WASTEWATER TREATMENT MARKET: BY TECHNOLOGY, 2023-2030 (USD MILLION)

FIGURE 96 TURKEY INDUSTRIAL WASTEWATER TREATMENT MARKET: BY TECHNOLOGY, 2023-2030 (USD MILLION)

FIGURE 97 NETHERLANDS INDUSTRIAL WASTEWATER TREATMENT MARKET: BY TECHNOLOGY, 2023-2030 (USD MILLION)

FIGURE 98 SPAIN INDUSTRIAL WASTEWATER TREATMENT MARKET: BY TECHNOLOGY, 2023-2030 (USD MILLION)

FIGURE 99 U.K. INDUSTRIAL WASTEWATER TREATMENT MARKET: BY TECHNOLOGY, 2023-2030 (USD MILLION)

FIGURE 100 CHILE INDUSTRIAL WASTEWATER TREATMENT MARKET: BY TECHNOLOGY, CAGR (2023-2030)

FIGURE 101 TURKEY INDUSTRIAL WASTEWATER TREATMENT MARKET: BY TECHNOLOGY, CAGR (2023-2030)

FIGURE 102 NETHERLANDS INDUSTRIAL WASTEWATER TREATMENT MARKET: BY TECHNOLOGY, CAGR (2023-2030)

FIGURE 103 SPAIN INDUSTRIAL WASTEWATER TREATMENT MARKET: BY TECHNOLOGY, CAGR (2023-2030)

FIGURE 104 U.K. INDUSTRIAL WASTEWATER TREATMENT MARKET: BY TECHNOLOGY, CAGR (2023-2030)

FIGURE 105 CHILE INDUSTRIAL WASTEWATER TREATMENT MARKET: BY TECHNOLOGY, LIFELINE CURVE

FIGURE 106 TURKEY INDUSTRIAL WASTEWATER TREATMENT MARKET: BY TECHNOLOGY, LIFELINE CURVE

FIGURE 107 NETHERLANDS INDUSTRIAL WASTEWATER TREATMENT MARKET: BY TECHNOLOGY, LIFELINE CURVE

FIGURE 108 SPAIN INDUSTRIAL WASTEWATER TREATMENT MARKET: BY TECHNOLOGY, LIFELINE CURVE

FIGURE 109 U.K. INDUSTRIAL WASTEWATER TREATMENT MARKET: BY TECHNOLOGY, LIFELINE CURVE

FIGURE 110 CHILE INDUSTRIAL WASTEWATER TREATMENT MARKET: BY END USE, 2022

FIGURE 111 TURKEY INDUSTRIAL WASTEWATER TREATMENT MARKET: BY END USE, 2022

FIGURE 112 NETHERLANDS INDUSTRIAL WASTEWATER TREATMENT MARKET: BY END USE, 2022

FIGURE 113 SPAIN INDUSTRIAL WASTEWATER TREATMENT MARKET: BY END USE, 2022

FIGURE 114 U.K. INDUSTRIAL WASTEWATER TREATMENT MARKET: BY END USE, 2022

FIGURE 115 CHILE INDUSTRIAL WASTEWATER TREATMENT MARKET: BY END USE, 2023-2030 (USD MILLION)

FIGURE 116 TURKEY INDUSTRIAL WASTEWATER TREATMENT MARKET: BY END USE, 2023-2030 (USD MILLION)

FIGURE 117 NETHERLANDS INDUSTRIAL WASTEWATER TREATMENT MARKET: BY END USE, 2023-2030 (USD MILLION)

FIGURE 118 SPAIN INDUSTRIAL WASTEWATER TREATMENT MARKET: BY END USE, 2023-2030 (USD MILLION)

FIGURE 119 U.K. INDUSTRIAL WASTEWATER TREATMENT MARKET: BY END USE, 2023-2030 (USD MILLION)

FIGURE 120 CHILE INDUSTRIAL WASTEWATER TREATMENT MARKET: BY END USE, CAGR (2023-2030)

FIGURE 121 TURKEY INDUSTRIAL WASTEWATER TREATMENT MARKET: BY END USE, CAGR (2023-2030)

FIGURE 122 NETHERLANDS INDUSTRIAL WASTEWATER TREATMENT MARKET: BY END USE, CAGR (2023-2030)

FIGURE 123 SPAIN INDUSTRIAL WASTEWATER TREATMENT MARKET: BY END USE, CAGR (2023-2030)

FIGURE 124 U.K. INDUSTRIAL WASTEWATER TREATMENT MARKET: BY END USE, CAGR (2023-2030)

FIGURE 125 CHILE INDUSTRIAL WASTEWATER TREATMENT MARKET: BY END USE, LIFELINE CURVE

FIGURE 126 TURKEY INDUSTRIAL WASTEWATER TREATMENT MARKET: BY END USE, LIFELINE CURVE

FIGURE 127 NETHERLANDS INDUSTRIAL WASTEWATER TREATMENT MARKET: BY END USE, LIFELINE CURVE

FIGURE 128 SPAIN INDUSTRIAL WASTEWATER TREATMENT MARKET: BY END USE, LIFELINE CURVE

FIGURE 129 U.K. INDUSTRIAL WASTEWATER TREATMENT MARKET: BY END USE, LIFELINE CURVE

FIGURE 130 CHILE VETERINARY MARKET: COMPANY SHARE 2022 (%)

FIGURE 131 TURKEY VETERINARY MARKET: COMPANY SHARE 2022 (%)

FIGURE 132 NETHERLANDS INDUSTRIAL WASTEWATER TREATMENT MARKET: COMPANY SHARE 2022 (%)

FIGURE 133 SPAIN INDUSTRIAL WASTEWATER TREATMENT MARKET: COMPANY SHARE 2022 (%)

FIGURE 134 UK INDUSTRIAL WASTEWATER TREATMENT MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.