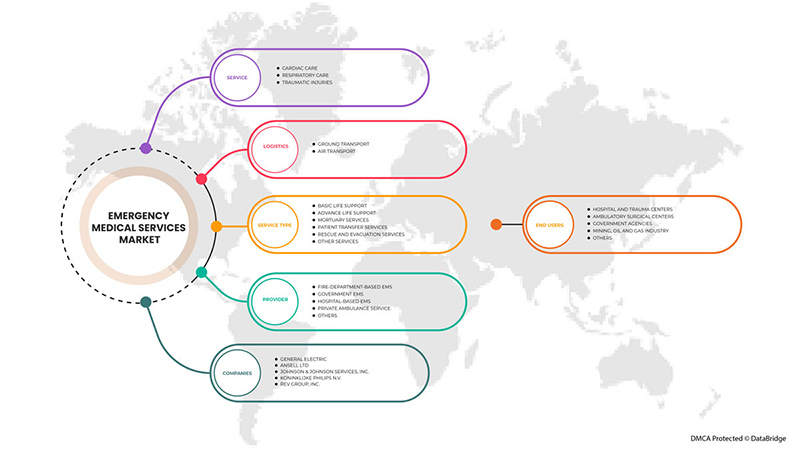

Canada Emergency Medical Services Market, By Service (Cardiac Care, Respiratory Care and Traumatic Injuries), Logistics (Ground Transport and Air Transport), Service Type (Basic Life Support, Advance Life Support, Patient Transfer Services, Rescue and Evacuation Services, Mortuary Services and Other Services), Provider (Hospital-Based Ems, Private Ambulance Service, Government Ems, Fire-Department-Based Ems and Others), End User (Hospital and Trauma Centers, Ambulatory Surgical Centers, Government Agencies, Mining, Oil and Gas industry and Others) - Industry Trends and Forecast to 2029.

Canada Emergency Medical Services Market Analysis and Insights

An emergency medical service is a system that offers the medical care that is needed at the time of the emergency. It is a proactive service provided to people experiencing any form of disease. An increase in the number of product launches with innovation and technologically advanced to meet the needs of the market is expected to foster the market’s growth. The key market players are increasingly interested in employing the new technologies to attract the end-users attention. The usage of medical devices in emergency medical service is rapidly growing and offers a tremendous opportunity in this sector. Consequentially, the growing in demand for the medical devices such as oximeter, blood pressure monitors, and hand held instruments have increased the market growth.

Additionally, increase in healthcare expenditure by government and increase in geriatric population have propelled the demand for emergency medical services. These increase in the demand for medical devices in many emergency care has encouraged the key market players to implement newer technologies and strategies to improve products and devices in the respective categories through product launches, acquisition, strategies and agreements.

However, the higher costs associated with emergency medical services and issues associated with interoperability is anticipated to restrain the market growth.

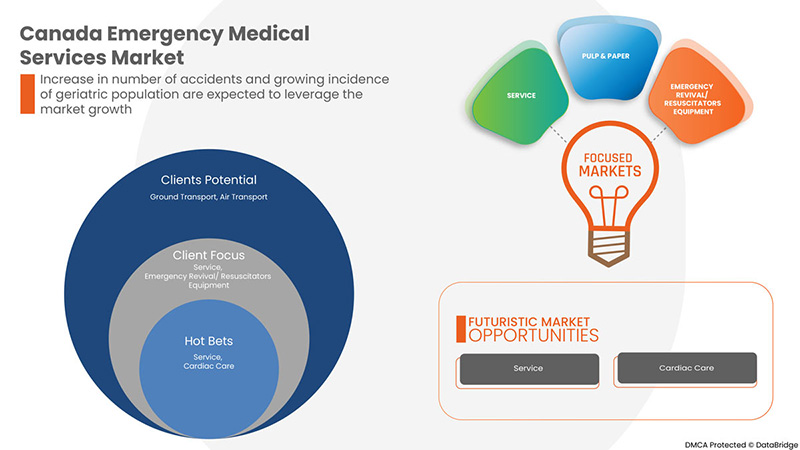

Data Bridge Market Research analyzes that the Canada emergency medical services market is expected to reach the value of USD 853.42 million by 2029, at a CAGR of 6.3% during the forecast period. Services accounts for the largest type segment in the market due to rapid demand of ambulance emergency medical services in Canada. This market report also covers pricing analysis, patent analysis, and technological advancements in depth.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019-2014) |

|

Quantitative Units |

Revenue in USD Million, Pricing in USD |

|

Segments Covered |

By Service (Cardiac Care, Respiratory Care and Traumatic Injuries), Logistics (Ground Transport and Air Transport), Service Type (Basic Life Support, Advance Life Support, Patient Transfer Services, Rescue and Evacuation Services, Mortuary Services and Other Services), Provider (Hospital-Based Ems, Private Ambulance Service, Government Ems, Fire-Department-Based Ems and Others), End User (Hospital and Trauma Centers, Ambulatory Surgical Centers, Government Agencies, Mining, Oil and Gas industry and Others) |

|

Countries Covered |

Canada |

|

Market Players Covered |

Stryker, Medtronic, Asahi Kasei Corporation, Koninklijke Philips N.V., General Electric Company, Demers Ambulances, Allied Medical Limited, Medline Industries, and Nonin among others. |

Canada Emergency Medical Services Market Definition

Emergency medical services (EMS), also known as ambulance services or paramedic services, are emergency services that provide urgent pre-hospital treatment and stabilization for serious illness and injuries and transport to definitive care. The term emergency medical service evolved to reflect a change from a simple transportation system (ambulance service) to a system in which actual medical care occurred in addition to transportation. The most basic emergency medical services are provided as a transport operation only, simply to take patients from their location to the nearest medical treatment. Emergency medical services exists to fulfill the basic principles of first aid, which are to preserve life, prevent further injury, and promote recovery.

- In most places, the EMS is summoned by members of the public via an emergency telephone number which puts them in contact with a control facility, which will then dispatch a suitable resource to deal with the situation.

Canada Emergency Medical Services Market Dynamics

This section deals with understanding the market drivers, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

-

GROWING INCIDENCE OF GERIATRIC POPULATION NEEDS MORE EMERGENCY MEDICAL SERVICES

- In Canada, approximately 2.3% of the population is aged 85 and elder. Although the COVID-19 pandemic claimed a large number of older Canadian deaths, this group continued to expand quickly and over the next 25 years, the population aged 85 and older could triple to almost 2.5 million. With this, the rising geriatric population in this region is expected to drive the segment growth.

For instance,

- According to Statistics Canada, the number of people aged 85+ increased by around 12% from the year 2016-to 2021. Thus, due to the factors above, the ground emergency medical services segment is expected to dominate the market

The senior population group aged 65 and over can have an increased necessity of emergency medical services needs in Canada and other regions. Thus, the growing pace of the senior population demonstrates the escalation in demand for emergency medical services and solutions. Owing to this, it is estimated that the ever-increasing geriatric population is expected to drive the global bladder disorder market in the forecast period.

-

INCREASE IN NUMBER OF ACCIDENTS TO PROPEL EMERGENCY MEDICAL SERVICES MARKET

Growing usage of personal and commercial vehicles has led to an increase in accidents. Accidents frequently require urgent hospital admissions for medical care and support. As a result, patients need emergency medical services to get to and from hospitals. Around 1,591 fatal car accidents take place in 2020 in Canada. Among these, almost a third of all fatalities that occur on Canadian roads are a direct result of speeding. Every year the lives of approximately 1.3 million people are cut short as a result of a road traffic crash. Between 20 and 50 million more people suffer non-fatal injuries, thus, surge in number of accidents is anticipated to propel the emergency medical services market growth.

Restraint

-

HIGH COST OF AIR AMBULANCE MEDICAL SERVICES & REIMBURSEMENT CHALLENGES

Air ambulance emergency medical services are significantly costly than the ground ambulance services. Although some level of coverage is available in air ambulance services in Canada. But due to the under private and government health insurance, the reimbursement rates are significantly low compared to the billing of air or advance ambulatory medical services providers. Medicaid and Medicare cover about 60% and 34% of the average air medical transport cost leaving the patients to bear a huge out of pocket expense in various cases.

Therefore, the high cost of ambulance medical services for Canadian and health care is comparatively expensive and imposes enormous costs on for Canadians in the form of waiting for services, and limited access to physicians and medical technology. This isn't something any country should consider replicating and reimbursement challenges creates a restrain for the growth of the market in Canada.

Opportunity

-

RISING PREVALENCE OF TRAUMA INJURIES AND DEMAND OF THEIR QUICK SERVICES IN EMERGENCY SITUATIONS

Emergency departments have become an essential frontline of medicine. The providers treat all the patients suffering from traumatic injuries. From techs, doctors, nurses, secretaries to therapists, every member makes split decisions and helps in patients’ survival. Life and death situations are shared every day in emergency care. Although it is still emerging slowly then also it plays an essential role in our medical world.

Emergency departments are under immense pressure as it is filled with critical cases of the hospital. But despite the situation, it has a significant impact on saving the lives of many people and run hospitals successfully. However, emergency medical services assisting patients who require emergency medical assistance at critical moments helping them to reach the hospital on time thus saving their life. Today, Private and public emergency medical transport services are operating in more numbers, as an inevitable service servicing the critical patients at crucial moments.

Challenge

-

SHORTAGE OF SKILLED PROFESSIONALS

The shortage of nurses and other unskilled healthcare professionals to operate the medical equipment’s is greater restraint of market, as many hospitals and clinics lack enough human resources. Various types of equipment’s are used in any emergency medical services setups includes ventilators, multipara monitor, foetal monitor, slit lamp, Tonometer, Monitor with defibrillator with external pacing facility. So the nurse or any healthcare professionals must be trained to operate with enough care. For an emergency medical services to be fully functional with the devices that requires superior power source and maintenance which only skilled professionals can enable. But various hospitals in rural areas and developing countries lack the knowledge and unawareness of modernized medical equipment’s thereby the healthcare professionals are not trained or skilled to operate such devices in their hospitals.

Thereby shortage of skilled professionals to operate the emergency medical equipment’s and devices for better outcome becomes a restraint for emergency medical services market.

Post-COVID-19 Impact on Canada Emergency Medical Services market

The COVID-19 outbreak had a drastic effect on Canada emergency medical services market. In Canada, the demand for emergency medical services with life support facilities has increased due to the global spread of the coronavirus pandemic, which is anticipated to grow the medical services market. Medical services such as ambulances care used to detect and prevent major illnesses that are hazardous to life, and they are categorized as either advanced life support with ventilators or basic life support without ventilators. Moreover, governments are also focusing on deploying additional medical services with emergency medical technicians who are suitable for the requirements of the pandemic, which is anticipated to offer profitable prospects for the expansion of the emergency medical services industry. Owing to this affirmative factors demand for emergency medical services. Thus, it is estimated that Canada emergency market anticipated to boom up in the forecasted year.

Industry market players are making various strategic decisions to bounce back post-COVID-19. The players are conducting multiple R&D activities and product launch and strategic partnerships to improve the technology and services involved in the emergency medical services market.

Recent Developments

- In September 2022, Medtronic announced that its LINQ II insertable cardiac monitor received 510(k) clearance from the U.S. Food and Drug Administration (FDA) for pediatric patients who have heart rhythm abnormalities and require long-term, continuous monitoring. This has increased company sales

- In March 2022, Stryker announced the industry's first connected ambulance cot. The Power-PRO 2 powered ambulance cot offers improved maneuverability, increased safety, and connectivity tools to help optimize time and budget. This new product will help the organization to generate more revenue

Canada Emergency Medical Services Market Scope

Canada emergency medical services market is segmented into service, logistics, service type, provider and end user. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

BY SERVICES

- Cardiac Care

- Respiratory Care

- Traumatic Injuries

On the basis of services, the Canada emergency medical services market is into cardiac care, respiratory care, traumatic injuries, infection control supplies and others.

BY LOGISTICS

- Ground Transport

- Air Transport

On the basis of logistics, the Canada emergency medical services market is segmented into ground transport and air transport.

BY SERVICES TYPE

- Basic Life Support

- Advance Life Support

- Patient Transfer Services

- Rescue And Evacuation Services

- Mortuary Services

- Other Services

On the basis of services type, the Canada emergency medical services market is segmented into basic life support, advance life support, mortuary services, patient transfer services, rescue and evacuation services and other services.

BY PROVIDER

- Hospital-Based EMS

- Private Ambulance Service

- Government Ems

- Fire-Department-Based Ems

- Others

On the basis of provider, the Canada emergency medical services market is segmented into fire-department-based EMS, government EMS, hospital-based EMS, private ambulance service and others.

BY END USER

- Hospital and Trauma Centers

- Ambulatory Surgical Centers

- Government Agencies

- Mining, Oil and Gas industry

- Others

On the basis of end user, the Canada emergency medical services market is segmented into hospitals and trauma centers, ambulatory surgical centers, government agencies mining, oil and gas industry and others.

Canada Emergency Medical Services market Analysis/Insights

Canada emergency medical services market is analyzed and market size information is services, logistics, services type, providers and end user.

The country covered in this market report is Canada.

Canada is growing in the demand of emergency medical services after the global pandemic situation and the key market players in the largest consumer market with high GDP. As well as the growing geriatric population and increasing roads accidents requires instant medical services that rise the instant demand of emergency medical services market in Canada.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual country. Also, presence and availability of Canada brands and their challenges faced due to large or scarce competition from local and domestic brands, and impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Canada Emergency Medical Services Market Share Analysis

Canada emergency medical services market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in R&D, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breath, application dominance, technology lifeline curve. The above data points provided are only related to the company’s focus on the Canada emergency medical services market.

Some of the key players operating in the Canada emergency medical services market are Stryker, Medtronic, Asahi Kasei Corporation, Koninklijke Philips N.V., General Electric Company, Demers Ambulances, Allied Medical Limited, Medline Industries, and Nonin among others.

Research Methodology: Canada Emergency Medical Services market

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, North America vs Regional, and Vendor Share Analysis. Please request analyst call in case of further inquiry.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF CANADA EMERGENCY MEDICAL SERVICES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHIC SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 SERVICE SEGMENT LIFELINE CURVE

2.8 DBMR MARKET POSITION GRID

2.9 MARKET APPLICATION COVERAGE GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 NUMBER OF ACCIDENT AND EMERGENCY DEPARTMENTS IN CANADA

4.2 THE EMERGENCY DEPARTMENT IN CANADA

4.3 NUMBER OF AMBULANCES

4.4 NUMBER OF AMBULATORY SURGICAL CENTERS

4.5 INCIDENCE NUMBER OF TRAUMATIC INJURIES

5 INDUSTRIAL INSIGHTS:

6 REGULATIONS OF CANADA EMERGENCY MEDICAL SERVICES MARKET

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 GROWING INCIDENCE OF GERIATRIC POPULATION NEEDS MORE EMERGENCY MEDICAL SERVICES

7.1.2 INCREASE IN NUMBER OF ACCIDENTS TO PROPEL EMERGENCY MEDICAL SERVICES MARKET

7.1.3 FAVORABLE REIMBURSEMENT POLICIES TO PROPEL THE EMERGENCY MEDICAL SERVICES MARKET

7.2 RESTRAINT

7.2.1 HIGH COSTS ASSOCIATED WITH EMERGENCY MEDICAL SERVICES

7.2.2 HIGH COST OF AIR AMBULANCE MEDICAL SERVICES & REIMBURSEMENT CHALLENGES

7.2.3 INTENSIFIED VENDOR COMPETITION

7.3 OPPORTUNITIES

7.3.1 HIGH PREVALENCE OF COVID-19 CASES

7.3.2 RISING PREVALENCE OF TRAUMA INJURIES AND DEMAND FOR THEIR QUICK SERVICES IN EMERGENCY SITUATIONS

7.4 CHALLENGES

7.4.1 SHORTAGE OF SKILLED PROFESSIONALS

7.4.2 STRINGENT REGULATIONS REGARDING EMERGENCY MEDICAL SERVICES

8 CANADA EMERGENCY MEDICAL SERVICES MARKET, BY SERVICE

8.1 OVERVIEW

8.2 CARDIAC CARE

8.2.1 LIFE SUPPORT EQUIPMENT

8.2.1.1 DEFIBRILLATORS

8.2.1.2 VENTILATORS

8.2.1.3 ENDOTRACHEAL TUBES

8.2.1.4 LARYNGOSCOPES

8.2.1.5 OTHERS

8.2.2 PATIENT MONITORING SYSTEM

8.2.2.1 CARDIAC MONITORS

8.2.2.1.1 ECG MONITORS

8.2.2.1.2 CARDIAC OUTPUT MONITORS

8.2.2.1.3 EVENT MONITORS

8.2.2.2 HEMODYNAMIC MONITORS

8.2.2.2.1 BLOOD PRESSURE MONITORS

8.2.2.2.2 BLOOD GLUCOSE MONITORS

8.2.2.2.3 BLOOD GAS AND ELECTROLYTE ANALYZERS

8.2.2.2.4 MULTI-PARAMETER MONITORS

8.2.2.3 NEUROLOGICAL MONITORS

8.2.2.3.1 EEG MONITORS

8.2.2.3.2 INTRACRANIAL PRESSURE MONITORS

8.2.2.3.3 CEREBRAL OXIMETRY MONITORS

8.2.2.3.4 MAGNETOENCEPHALOGRAPHY MONITORS

8.2.2.3.5 TRANSCRANIAL DOPPLER

8.2.3 EMERGENCY REVIVAL/ RESUSCITATORS EQUIPMENT

8.3 RESPIRATORY CARE

8.3.1 PULSE OXIMETERS

8.3.2 CAPNOGRAPHY

8.3.3 SPIROMETERS

8.3.4 ANAESTHESIA MONITORS

8.3.5 SLEEP APNOEA MONITORS

8.4 TRAUMATIC INJURIES

8.4.1 WOUND CARE CONSUMABLES

8.4.1.1 DRESSINGS & BANDAGES

8.4.1.2 SUTURES & STAPLES

8.4.1.3 DISPOSABLES

8.4.2 INFECTION CONTROL SUPPLIES

8.4.2.1 PERSONAL PROTECTION EQUIPMENT

8.4.2.1.1 HAND & ARM PROTECTION EQUIPMENT

8.4.2.1.2 EYE & FACE PROTECTION EQUIPMENT

8.4.2.1.3 HEAD PROTECTION EQUIPMENT

8.4.2.1.4 FOOT & LEG PROTECTION EQUIPMENT

8.4.2.1.5 OTHER PROTECTION EQUIPMENT

8.4.2.2 DISINFECTANT AND CLEANING AGENTS

8.4.2.3 OTHER SUPPLIES

8.4.3 PATIENT HANDLING EQUIPMENT

8.4.3.1 WHEELCHAIRS AND SCOOTERS

8.4.3.2 MEDICAL BEDS

8.4.3.3 OTHERS

8.4.4 OTHERS

8.4.4.1 TEMPERATURE MONITORING DEVICES

8.4.4.2 MICROELECTROMECHANICAL SYSTEMS (MEMS)

8.4.4.3 PRENATAL AND NEONATAL MONITORS

9 CANADA EMERGENCY MEDICAL SERVICES MARKET, BY SERVICE TYPE

9.1 OVERVIEW

9.2 BASIC LIFE SUPPORT

9.2.1 CARDIOPULMONARY RESUSCITATION (CPR)

9.2.2 AIRWAY MANAGEMENT

9.2.2.1 ORAL AND NASAL AIRWAYS

9.2.2.2 BAG-MASK VENTILATION

9.2.3 FRACTURE AND SPINE IMMOBILIZATION

9.2.4 HAEMORRHAGE CONTROL

9.2.5 CHILDBIRTH ASSISTANCE

9.2.6 OTHER SERVICES

9.3 ADVANCE LIFE SUPPORT

9.4 PATIENT TRANSFER SERVICES

9.5 RESCUE AND EVACUATION SERVICES

9.6 MORTUARY SERVICES

9.7 OTHERS

10 GLOBAL AUTOMATED CELL CULTURES MARKET, BY PROVIDER

10.1 OVERVIEW

10.2 HOSPITAL-BASED EMS

10.3 PRIVATE AMBULANCE SERVICE

10.4 GOVERNMENT EMS

10.5 FIRE-DEPARTMENT-BASED EMS

10.6 OTHERS

11 CANADA EMERGENCY MEDICAL SERVICES MARKET, BY LOGISTICS

11.1 OVERVIEW

11.2 GROUND TRANSPORT

11.2.1 CAR AMBULANCE

11.2.2 MOTORBIKE AMBULANCE

11.3 AIR TRANSPORT

11.3.1 AIR AMBULANCE

11.3.2 DRONES

12 CANADA EMERGENCY MEDICAL SERVICES MARKET, BY END USER

12.1 OVERVIEW

12.2 HOSPITAL AND TRAUMA CENTERS

12.3 AMBULATORY SURGICAL CENTERS

12.4 GOVERNMENT AGENCIES

12.5 MINING, OIL AND GAS INDUSTRY

12.6 OTHERS

13 CANADA EMERGENCY MEDICAL SERVICES MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: GLOBAL

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 REV GROUP, INC.

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENTS

15.2 GENERAL ELECTRIC

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENT

15.3 JOHNSON & JOHNSON SERVICES, INC.

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENTS

15.4 ANSELL LTD

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENT

15.5 KONINKLIJKE PHILIPS N.V.

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENTS

15.6 ABRONN

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENTS

15.7 ALLIED MEDICAL LIMITED

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENTS

15.8 ALBERTA PARAMEDICAL SERVICES LTD

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENTS

15.9 AMBULANCEMED

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENTS

15.1 ASAHI KESEI CORPORATION

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENT

15.11 C. MIESEN

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 CARDINAL HEALTH

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCTPORTFOLIO

15.12.4 RECENT DEVELOPMENTS

15.13 COLOPLAST

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENTS

15.14 DEMERS AMBULANCES

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 MEDTRONICS

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT DEVELOPMENTS

15.16 MEDLINE INDUSTRIES, LP

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 NONIN

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENTS

15.18 STRYKER

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 PRODUCT PORTFOLIO

15.18.4 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

Liste des tableaux

TABLE 1 COLLISIONS AND CASUALTIES IN CANADA- 2001-2020

TABLE 2 CANADA EMERGENCY MEDICAL SERVICES MARKET, BY SERVICE, 2020-2029 (USD MILLION)

TABLE 3 CANADA CARDIAC CARE IN EMERGENCY MEDICAL SERVICES MARKET, BY SERVICE, 2020-2029 (USD MILLION)

TABLE 4 CANADA LIFE SUPPORT EQUIPMENT IN EMERGENCY MEDICAL SERVICES MARKET, BY SERVICE, 2020-2029 (USD MILLION)

TABLE 5 CANADA PATIENT MONITORING SYSTEM IN EMERGENCY MEDICAL SERVICES MARKET, BY SERVICE, 2020-2029 (USD MILLION)

TABLE 6 CANADA CARDIAC MONITORS IN EMERGENCY MEDICAL SERVICES MARKET, BY SERVICE, 2020-2029 (USD MILLION)

TABLE 7 CANADA HEMODYNAMIC MONITORS IN EMERGENCY MEDICAL SERVICES MARKET, BY SERVICE, 2020-2029 (USD MILLION)

TABLE 8 CANADA NEUROLOGICAL MONITORS IN EMERGENCY MEDICAL SERVICES MARKET, BY SERVICE, 2020-2029 (USD MILLION)

TABLE 9 CANADA RESPIRATORY CARE IN EMERGENCY MEDICAL SERVICES MARKET, BY SERVICE, 2020-2029 (USD MILLION)

TABLE 10 CANADA TRAUMATIC INJURIES IN EMERGENCY MEDICAL SERVICES MARKET, BY SERVICE, 2020-2029 (USD MILLION)

TABLE 11 CANADA WOUND CARE CONSUMABLES IN EMERGENCY MEDICAL SERVICES MARKET, BY SERVICE, 2020-2029 (USD MILLION)

TABLE 12 CANADA INFECTION CONTROL SUPPLIES IN EMERGENCY MEDICAL SERVICES MARKET, BY SERVICE, 2020-2029 (USD MILLION)

TABLE 13 CANADA PERSONAL PROTECTION EQUIPMENT IN EMERGENCY MEDICAL SERVICES MARKET, BY SERVICE, 2020-2029 (USD MILLION)

TABLE 14 CANADA PATIENT HANDLING EQUIPMENT IN EMERGENCY MEDICAL SERVICES MARKET, BY SERVICE, 2020-2029 (USD MILLION)

TABLE 15 CANADA OTHERS IN EMERGENCY MEDICAL SERVICES MARKET, BY SERVICE, 2020-2029 (USD MILLION)

TABLE 16 CANADA EMERGENCY MEDICAL SERVICES MARKET, BY SERVICE TYPE, 2020-2029 (USD MILLION)

TABLE 17 CANADA BASIC LIFE SUPPORT IN EMERGENCY MEDICAL SERVICES MARKET, BY SERVICE TYPE, 2020-2029 (USD MILLION)

TABLE 18 CANADA AIRWAY MANAGEMENT IN EMERGENCY MEDICAL SERVICES MARKET, BY SERVICE TYPE, 2020-2029 (USD MILLION)

TABLE 19 CANADA EMERGENCY MEDICAL SERVICES MARKET, BY PROVIDER, 2020-2029 (USD MILLION)

TABLE 20 CANADA EMERGENCY MEDICAL SERVICES MARKET, BY LOGISTICS, 2020-2029 (USD MILLION)

TABLE 21 CANADA GROUND TRANSPORT IN EMERGENCY MEDICAL SERVICES MARKET, BY LOGISTICS, 2020-2029 (USD MILLION)

TABLE 22 CANADA AIR TRANSPORT IN EMERGENCY MEDICAL SERVICES MARKET, BY LOGISTICS, 2020-2029 (USD MILLION)

TABLE 23 CANADA EMERGENCY MEDICAL SERVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 CANADA EMERGENCY MEDICAL SERVICES MARKET: SEGMENTATION

FIGURE 2 CANADA EMERGENCY MEDICAL SERVICES MARKET: GEOGRAPHIC SCOPE

FIGURE 3 CANADA EMERGENCY MEDICAL SERVICES MARKET: DATA TRIANGULATION

FIGURE 4 CANADA EMERGENCY MEDICAL SERVICES MARKET: SNAPSHOT

FIGURE 5 CANADA EMERGENCY MEDICAL SERVICES MARKET: BOTTOM UP APPROACH

FIGURE 6 CANADA EMERGENCY MEDICAL SERVICES MARKET: TOP DOWN APPROACH

FIGURE 7 CANADA EMERGENCY MEDICAL SERVICES MARKET: INTERVIEWS BY REGION AND DESIGNATION

FIGURE 8 CANADA EMERGENCY MEDICAL SERVICES MARKET: DBMR MARKET POSITION GRID

FIGURE 9 CANADA EMERGENCY MEDICAL SERVICES MARKET: END USER COVERAGE GRID

FIGURE 10 CANADA EMERGENCY MEDICAL SERVICES MARKET SEGMENTATION

FIGURE 11 RISE PREVALENCE OF TRAUMA INJURIES IS EXPECTED TO DRIVE THE MARKET FOR CANADA EMERGENCY MEDICAL SERVICES MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 CARDIAC CARE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE CANADA EMERGENCY MEDICAL SERVICES MARKET IN 2022 & 2029

FIGURE 13 PESTEL ANALYSIS

FIGURE 14 PORTER'S FIVE FORCES

FIGURE 15 PERCENTAGE OF ALL INJURY DEATHS WITH AN ASSOCIATED TRAUMATIC BRAIN INJURY DIAGNOSIS, BY AGE AND SEX, ALL EXTERNAL CAUSES, CANADA, 2002 TO 2016

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE CANADA EMERGENCY MEDICAL SERVICES MARKET

FIGURE 17 CANADA EMERGENCY MEDICAL SERVICES MARKET: BY SERVICE, 2021

FIGURE 18 CANADA EMERGENCY MEDICAL SERVICES MARKET: BY SERVICE, 2022-2029 (USD MILLION)

FIGURE 19 CANADA EMERGENCY MEDICAL SERVICES MARKET: BY SERVICE, CAGR (2022-2029)

FIGURE 20 CANADA EMERGENCY MEDICAL SERVICES MARKET: BY SERVICE, LIFELINE CURVE

FIGURE 21 CANADA EMERGENCY MEDICAL SERVICES MARKET : BY SERVICE TYPE, 2021

FIGURE 22 CANADA EMERGENCY MEDICAL SERVICES MARKET : BY SERVICE TYPE, 2022-2029 (USD MILLION)

FIGURE 23 CANADA EMERGENCY MEDICAL SERVICES MARKET : BY SERVICE TYPE, CAGR (2022-2029)

FIGURE 24 CANADA EMERGENCY MEDICAL SERVICES MARKET : BY SERVICE TYPE, LIFELINE CURVE

FIGURE 25 CANADA EMERGENCY MEDICAL SERVICES MARKET : BY PROVIDER, 2021

FIGURE 26 CANADA EMERGENCY MEDICAL SERVICES MARKET : BY PROVIDER, 2022-2029 (USD MILLION)

FIGURE 27 CANADA EMERGENCY MEDICAL SERVICES MARKET : BY PROVIDER, CAGR (2022-2029)

FIGURE 28 CANADA EMERGENCY MEDICAL SERVICES MARKET : BY PROVIDER, LIFELINE CURVE

FIGURE 29 CANADA EMERGENCY MEDICAL SERVICES MARKET : BY LOGISTICS, 2021

FIGURE 30 CANADA EMERGENCY MEDICAL SERVICES MARKET : BY LOGISTICS, 2022-2029 (USD MILLION)

FIGURE 31 CANADA EMERGENCY MEDICAL SERVICES MARKET : BY LOGISTICS, CAGR (2022-2029)

FIGURE 32 CANADA EMERGENCY MEDICAL SERVICES MARKET : BY LOGISTICS, LIFELINE CURVE

FIGURE 33 CANADA EMERGENCY MEDICAL SERVICES MARKET : BY END USER, 2021

FIGURE 34 CANADA EMERGENCY MEDICAL SERVICES MARKET : BY END USER, 2022-2029 (USD MILLION)

FIGURE 35 CANADA EMERGENCY MEDICAL SERVICES MARKET : BY END USER, CAGR (2022-2029)

FIGURE 36 CANADA EMERGENCY MEDICAL SERVICES MARKET : BY END USER, LIFELINE CURVE

FIGURE 37 CANADA EMERGENCY MEDICAL SERVICES MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.