Australia And New Zealand Non Stick Cookware Market

Taille du marché en milliards USD

TCAC :

%

USD

254.62 Million

USD

356.78 Million

2024

2032

USD

254.62 Million

USD

356.78 Million

2024

2032

| 2025 –2032 | |

| USD 254.62 Million | |

| USD 356.78 Million | |

|

|

|

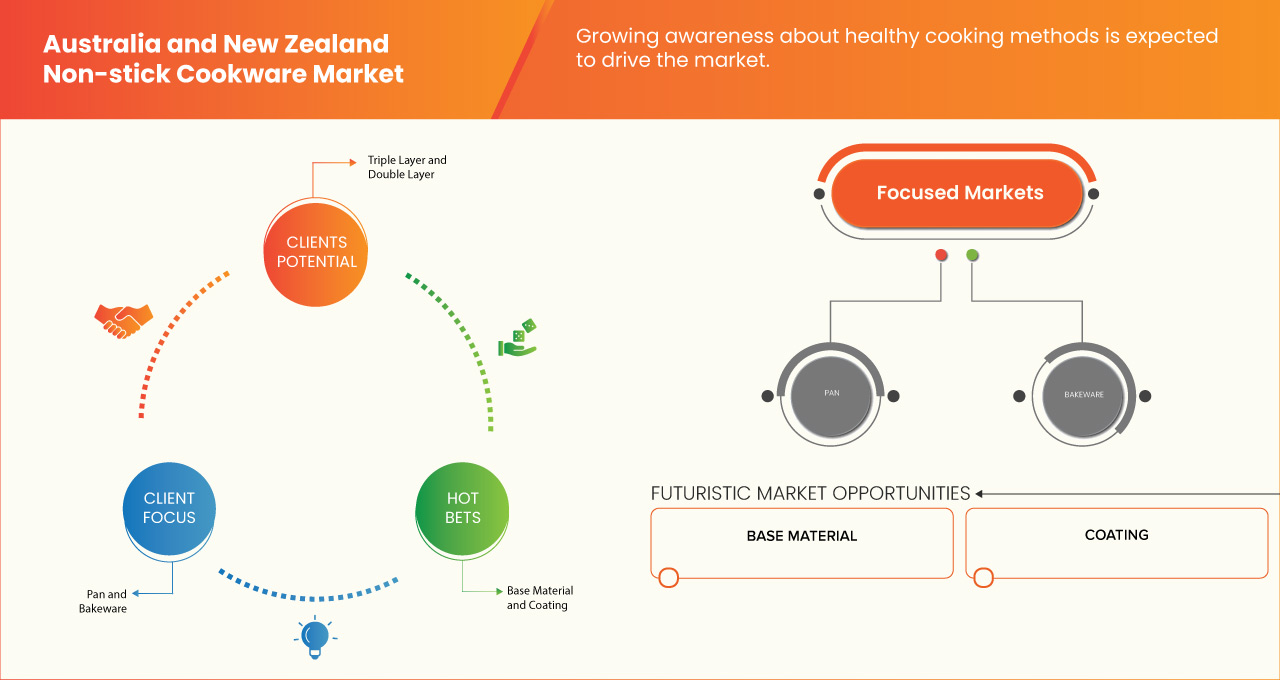

Australia and New Zealand Non-Stick Cookware Market Segmentation, By Product (Pan, Pot, Bakeware, Pressure Cooker, Skillet, Square Grill, Oven Tray, Dutch Oven, Loaf Tin, Sandwich Toaster, Wok, Egg Poacher, and Others), Raw Material (Base Material and Coating), Coating Layer (Triple Layer, Double Layer, and Single Layer), Distribution Channel (Supermarkets/Hypermarkets, E-Commerce, Utensil Store, and Others), End-User (Residential and Commercial) – Industry Trends and Forecast to 2032

Australia and New Zealand Non-Stick Cookware Market Analysis

Non-stick cookware market has an increased demand for quick, easy-to-clean cookware due to busy work schedule, as consumers are increasingly seek rising interest in personalized cookware while ensuring healthy cooking methods, again advancements and innovations in non-stick coatings, materials and designs helps consumers to choose the products according to the various cooking needs thereby driving market growth globally.

Australia and New Zealand Non-Stick Cookware Market Size

Australia and New Zealand non-stick cookware market is expected to reach USD 356.78 million by 2032 from USD 254.62 million in 2024, growing with a substantial CAGR of 4.41% in the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Australia and New Zealand Non-Stick Cookware Market Trends

“Growing Awareness about Healthy Cooking Methods ”

The increasing consumer emphasis on health-conscious lifestyles is significantly propelling the demand for non-stick cookware in the Australia and New Zealand markets. With rising awareness of the health risks associated with excessive oil consumption, modern consumers are seeking cookware solutions that enable low-fat cooking. Non-stick cookware, with its ability to reduce or eliminate the need for cooking oils or butter, aligns seamlessly with this growing trend, positioning itself as a preferred choice among health-conscious households.

The surge in health-focused cooking practices is further amplified by the influence of social media, rising trend of health-focused cooking shows, and online content promoting nutritious recipes. These platforms frequently highlight the advantages of non-stick cookware in preparing meals that retain their nutritional value while reducing calorie intake. As a result, this segment of cookware is witnessing robust adoption across diverse demographic groups, from young professionals to families prioritizing healthier eating habits. Additionally, the expansion of wellness-oriented product portfolios by leading cookware brands in these regions is fueling market growth. Manufacturers are innovating with eco-friendly, toxin-free, non-stick coatings, such as ceramic or PFOA-free options, which resonate with environmentally conscious consumers. This commitment to safety and sustainability not only enhances consumer trust but also aligns with the region's growing emphasis on green and ethical consumption.

Report Scope and Market Segmentation

|

Attributes |

Australia and New Zealand Non-Stick Cookware Market Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Australia and New Zealand |

|

Key Market Players |

Cuisinart - Conair Australia (Australia), Scanpan Australia (Denmark), Tefal (France), SOLIDTEKNICS PTY LTD. (Australia), Made In (U.S.), GreenPan Australia (Australia), and Biome (Australia) among others |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Australia and New Zealand Non-Stick Cookware Market Definition

Les ustensiles de cuisine antiadhésifs sont des récipients de cuisson, tels que des poêles, des casseroles et des plaques de cuisson, conçus avec une surface qui empêche les aliments d'adhérer pendant la cuisson. Cette caractéristique est obtenue grâce à l'application d'un revêtement antiadhésif, généralement en polytétrafluoroéthylène (PTFE), comme le Téflon, ou en matériaux à base de céramique. Les ustensiles de cuisine antiadhésifs offrent des avantages significatifs, notamment le besoin d'un minimum d'huile ou de beurre, favorisant une cuisine plus saine et une facilité de nettoyage. La surface garantit que les aliments délicats comme les œufs, les crêpes ou le poisson peuvent être préparés sans se déchirer ni coller. Les ustensiles de cuisine antiadhésifs modernes comprennent souvent des revêtements exempts de produits chimiques nocifs comme le PFOA (acide perfluorooctanoïque), ce qui les rend plus sûrs pour une utilisation à long terme. Cependant, ces articles nécessitent un entretien spécifique, comme éviter les ustensiles en métal et la chaleur élevée, pour maintenir l'intégrité de leur revêtement. Les ustensiles de cuisine antiadhésifs sont largement utilisés dans les cuisines domestiques et professionnelles pour leur commodité, leur efficacité et leur adéquation à une cuisson à faible teneur en matières grasses.

Dynamique du marché des ustensiles de cuisine antiadhésifs en Australie et en Nouvelle-Zélande

Conducteurs

- Demande accrue d'ustensiles de cuisine rapides et faciles à nettoyer en raison d'un horaire de travail chargé

La prévalence croissante des modes de vie rapides et des horaires de travail exigeants alimente la demande d'ustensiles de cuisine antiadhésifs en Australie et en Nouvelle-Zélande. Alors qu'une grande partie de la population jongle entre le travail, les responsabilités familiales et les engagements personnels, les consommateurs privilégient de plus en plus les produits de cuisine qui simplifient la préparation et le nettoyage des repas. Les ustensiles de cuisine antiadhésifs, conçus pour faciliter le démoulage des aliments et minimiser l'effort de nettoyage, apparaissent comme une solution incontournable pour les ménages pressés par le temps.

Alors que les familles à double revenu et les professionnels qui travaillent dans les zones urbaines cherchent à optimiser leur temps, la commodité offerte par les ustensiles de cuisine antiadhésifs est devenue un facteur de motivation d'achat important. Sa capacité à réduire les résidus alimentaires et à empêcher l'adhérence élimine les tracas du frottement et du trempage, ce qui le rend particulièrement attrayant pour les consommateurs qui considèrent l'efficacité comme une priorité. La compatibilité du produit avec les techniques de cuisson rapide, telles que la friture et le sauté, renforce encore son attrait pour les personnes occupées qui cherchent à préparer des repas avec un minimum d'effort.

L’essor des batteries de cuisine compactes et multifonctions destinées aux petits ménages et aux appartements est une autre tendance qui soutient cette croissance. Des marques leaders comme Tefal, Scanpan et Circulon ont répondu à cette demande en proposant des batteries de cuisine peu encombrantes. Ces collections polyvalentes d’ustensiles de cuisine antiadhésifs répondent aux besoins des cuisines modernes tout en offrant une facilité d’entretien. Les détaillants en Australie et en Nouvelle-Zélande, tels que Kmart et Target, et les plateformes en ligne comme Catch et Mighty Ape, ont également capitalisé sur cette demande en proposant des batteries de cuisine antiadhésives abordables et durables.

Par exemple

- En janvier, selon un article publié sur NCBI en Australie et en Nouvelle-Zélande, l’augmentation du nombre de ménages à double revenu, passant de 56 % en 2001 à 66 % en 2017, reflète l’évolution des rôles entre les sexes et la prise de décision partagée. Avec des modes de vie chargés, les couples à double revenu privilégient la commodité, ce qui stimule la demande d’ustensiles de cuisine antiadhésifs qui permettent de préparer des repas rapides et sains, en adéquation avec leur besoin de solutions de cuisson efficaces et permettant de gagner du temps.

Progrès et innovations dans les revêtements, matériaux et conceptions antiadhésifs

Les avancées technologiques et les innovations en matière de revêtements, de matériaux et de conceptions antiadhésifs stimulent considérablement la croissance du marché des ustensiles de cuisine antiadhésifs en Australie et en Nouvelle-Zélande. Face à la demande croissante des consommateurs pour des ustensiles de cuisine performants, sûrs et durables, les fabricants font évoluer en permanence leur offre de produits pour répondre à ces attentes.

L’une des évolutions les plus notables a été l’adoption de revêtements antiadhésifs plus sûrs et plus respectueux de l’environnement. Les revêtements traditionnels, tels que ceux à base de PTFE (Téflon), ont évolué pour inclure des alternatives sans PFOA et à base de céramique, qui ont gagné en popularité en Australie et en Nouvelle-Zélande en raison de leurs avantages en matière de sécurité et de leur attrait écologique. Des marques comme GreenPan et Scanpan ont été les pionnières de l’introduction de ces revêtements innovants, non toxiques et résistants à la chaleur, qui répondent à la préférence croissante des consommateurs pour des options de cuisson plus saines sans sacrifier les performances. De plus, les progrès réalisés en matière de durabilité et de résistance aux rayures des matériaux antiadhésifs ont encore renforcé l’attrait des ustensiles de cuisine antiadhésifs. Les nouvelles surfaces antiadhésives, conçues pour résister à des températures plus élevées et à une utilisation plus agressive, offrent aux consommateurs des produits plus durables. Par exemple, les ustensiles de cuisine antiadhésifs avec des revêtements renforcés en céramique ou infusés de diamant offrent une longévité supérieure et une plus grande résistance à l’usure, ce qui répond aux préoccupations antérieures concernant la durée de vie des poêles antiadhésives. Cette innovation a encouragé les achats au détail et en ligne, car les consommateurs sont de plus en plus disposés à investir dans des ustensiles de cuisine de haute qualité.

De plus, l'évolution de la conception des ustensiles de cuisine a amélioré la fonctionnalité des produits antiadhésifs. Les conceptions modernes, notamment les poignées ergonomiques, les bases à faible consommation de chaleur et même les ustensiles de cuisine antiadhésifs pouvant être utilisés sur les cuisinières à induction, répondent aux divers besoins des ménages actifs d'aujourd'hui. Les détaillants en Australie et en Nouvelle-Zélande, dont Kmart, Target et les plateformes en ligne comme Catch, ont élargi leur portefeuille pour proposer ces produits technologiquement avancés, stimulant ainsi les ventes et la pénétration du marché.

Par exemple

- GreenPan est devenue une marque leader en Australie et en Nouvelle-Zélande en introduisant des ustensiles de cuisine antiadhésifs à base de céramique. Leur revêtement « Thermolon » est exempt de produits chimiques toxiques comme le PTFE et le PFOA, répondant à la demande croissante de solutions de cuisson plus saines et respectueuses de l'environnement. Cette innovation a renforcé la popularité de GreenPan, en particulier sur les marchés soucieux de leur santé, et a considérablement influencé les décisions d'achat des consommateurs

Opportunités

- Intérêt croissant pour les ustensiles de cuisine personnalisés

L’intérêt croissant des consommateurs pour les ustensiles de cuisine personnalisés représente une opportunité importante pour le marché des ustensiles de cuisine antiadhésifs en Australie et en Nouvelle-Zélande. Les consommateurs étant de plus en plus à la recherche de produits qui reflètent leurs préférences culinaires, leur style de vie et leur esthétique, les fabricants et les détaillants peuvent tirer parti de cette tendance pour introduire des offres personnalisables et accroître leur part de marché.

Les ustensiles de cuisine personnalisés incluent des options telles que des tailles, des couleurs, des motifs et des matériaux personnalisables qui répondent aux besoins spécifiques des consommateurs. Par exemple, les professionnels urbains peuvent préférer des ustensiles de cuisine compacts et multifonctionnels adaptés aux petites cuisines, tandis que les chefs amateurs passionnés peuvent rechercher des poêles antiadhésives spécialisées adaptées à des cuisines ou des recettes spécifiques. Proposer des fonctionnalités personnalisables permet aux fabricants de cibler efficacement des segments de marché de niche et de renforcer la fidélité à la marque. De plus, les ustensiles de cuisine personnalisés répondent à la demande croissante d'options de cadeaux uniques et attentionnées. Les poêles antiadhésives personnalisées ou les ensembles d'ustensiles de cuisine gravés de noms ou de messages spéciaux gagnent en popularité en tant que cadeaux haut de gamme pour les mariages, les anniversaires et les pendaisons de crémaillère.

L’essor des plateformes de commerce électronique renforce encore cette opportunité. Les marques peuvent mettre en place des configurateurs conviviaux sur leurs sites Web, permettant aux clients de sélectionner leurs modèles de poignées, types de revêtement ou couleurs préférés. Des entreprises comme Le Creuset ont déjà commencé à proposer des options de personnalisation limitées sur les marchés mondiaux, ouvrant la voie aux marques locales pour reproduire des initiatives similaires en Australie et en Nouvelle-Zélande.

Par exemple,

- En janvier 2024, selon un article publié par l'International Trade Administration, le commerce électronique en Australie a connu une croissance modeste en 2022, représentant 18 % des dépenses de détail (45 milliards USD), avec 82 % des ménages effectuant leurs achats en ligne et une forte croissance dans les zones rurales. Cette évolution soutient le marché des ustensiles de cuisine antiadhésifs, car les consommateurs s'appuient de plus en plus sur les plateformes en ligne pour accéder à des solutions de cuisson haut de gamme et pratiques, quel que soit leur emplacement.

Une culture culinaire en pleine croissance, avec notamment les émissions de cuisine, les influenceurs et la cuisine maison

La culture culinaire en plein essor en Australie et en Nouvelle-Zélande, alimentée par les émissions de cuisine, les influenceurs des médias sociaux et la popularité croissante de la cuisine maison, représente une opportunité importante pour le marché des ustensiles de cuisine antiadhésifs. Alors que de plus en plus de consommateurs considèrent la cuisine comme un passe-temps et un moyen de se rapprocher de leur famille et de leurs amis, la demande d'ustensiles de cuisine de haute qualité et conviviaux s'intensifie, en particulier dans le segment des ustensiles antiadhésifs.

Les émissions de cuisine, notamment les programmes populaires comme MasterChef Australia et My Kitchen Rules, ont joué un rôle essentiel dans l’évolution des attitudes des consommateurs à l’égard de la cuisine. Ces plateformes présentent non seulement de nouvelles techniques culinaires, mais soulignent également l’importance d’utiliser les bons ustensiles de cuisine, sensibilisant ainsi à la commodité et à la polyvalence des poêles antiadhésives. Les téléspectateurs sont de plus en plus incités à recréer des plats de niveau professionnel à la maison, recherchant souvent des ustensiles de cuisine antiadhésifs pour leur facilité d’utilisation et leur besoin minimal d’huile. De plus, les influenceurs des médias sociaux et les blogueurs culinaires façonnent les tendances en présentant leurs expériences culinaires avec des ustensiles de cuisine antiadhésifs. Les plateformes comme Instagram, YouTube et TikTok sont inondées d’influenceurs partageant des recettes et des critiques d’ustensiles de cuisine, les produits antiadhésifs étant souvent présentés pour leur attrait pratique et esthétique. Alors que les influenceurs font la promotion d’ustensiles de cuisine qui rendent la cuisine plus simple, plus élégante et plus saine, les consommateurs sont plus enclins à investir dans des ustensiles de cuisine antiadhésifs pour leur maison.

L’essor de la cuisine à domicile, notamment en réponse à la pandémie, a modifié l’état d’esprit de nombreux consommateurs qui considèrent désormais leur cuisine comme un espace de créativité et d’expression personnelle. Les ustensiles de cuisine antiadhésifs sont considérés comme un incontournable pour les cuisiniers novices comme pour les chefs chevronnés en raison de leur facilité de nettoyage, de leur polyvalence et de leur capacité à préparer des repas plus sains avec moins d’huile. Cette culture culinaire croissante génère une demande pour des ustensiles de cuisine antiadhésifs haut de gamme, avec des opportunités pour les fabricants de lancer des produits innovants, tels que des poêles à frire antiadhésives spécialisées ou des ustensiles de cuisine conçus pour des styles de cuisson ou des cuisines spécifiques.

Par exemple

- La culture culinaire en pleine croissance, portée par les émissions de cuisine, les influenceurs et les tendances de la cuisine maison, a fait progresser les ustensiles de cuisine comme la gamme Pro IQ de Scanpan. Avec ses caractéristiques de haute performance, notamment une poignée rivetée en acier inoxydable et un corps en aluminium moulé par compression pour induction, elle est devenue un choix privilégié pour les amateurs de cuisine, y compris ceux présentés dans des émissions comme MasterChef Australia. Cet intérêt croissant pour la culture culinaire stimule la demande d'ustensiles de cuisine haut de gamme, qui allient fonctionnalité et attrait esthétique

Contraintes/Défis

- Réglementations strictes concernant les normes de sécurité alimentaire et l'utilisation de produits chimiques dans les revêtements antiadhésifs

Les réglementations strictes concernant les normes de sécurité alimentaire et l'utilisation de produits chimiques dans les revêtements antiadhésifs représentent des défis importants pour le marché des ustensiles de cuisine antiadhésifs en Australie et en Nouvelle-Zélande. Les consommateurs étant de plus en plus préoccupés par la santé et la sécurité, les fabricants d'ustensiles de cuisine doivent se conformer à des cadres juridiques en constante évolution, qui nécessitent souvent des ajustements coûteux des processus de production et des matériaux.

L’Australie et la Nouvelle-Zélande ont des normes rigoureuses pour les produits de consommation, en particulier ceux qui entrent en contact direct avec les aliments. Les ustensiles de cuisine antiadhésifs sont soumis à des réglementations concernant les produits chimiques utilisés dans les revêtements, tels que l’acide perfluorooctanoïque (PFOA) et le sulfonate de perfluorooctyle (PFOS), qui sont interdits ou limités sur de nombreux marchés en raison de préoccupations concernant leur impact environnemental et sanitaire. Les fabricants doivent s’assurer que leurs produits sont conformes aux normes locales et internationales, telles que les directives de la Commission australienne de la concurrence et de la consommation (ACCC) et de Food Standards Australia New Zealand (FSANZ), qui peuvent nécessiter des certifications et des tests coûteux. Par exemple, les marques d’ustensiles de cuisine doivent s’assurer que leurs revêtements antiadhésifs sont exempts de substances nocives, telles que le PFOA, un produit chimique auparavant courant dans les produits antiadhésifs. En réponse aux préoccupations croissantes des consommateurs, de nombreux fabricants ont opté pour des revêtements alternatifs, qui peuvent être plus chers et moins facilement disponibles, ce qui augmente encore les coûts de production. Cette évolution peut mettre à mal les fabricants de petite et moyenne taille qui n’ont pas les ressources nécessaires pour répondre aux nouvelles exigences en matière de matériaux. En outre, le respect de ces normes de sécurité nécessite souvent des tests et des vérifications continus, ce qui ajoute à la complexité du processus de production. Tout manquement à ces réglementations peut entraîner des problèmes juridiques, des rappels de produits ou des atteintes à la réputation de la marque, ce qui peut gravement affecter la stabilité du marché.

Par exemple

- L'organisme Food Standards Australia New Zealand (FSANZ) et l'Australian Competition and Consumer Commission (ACCC) imposent des exigences strictes en matière de sécurité des matériaux en contact direct avec les aliments. Ces réglementations garantissent que les revêtements antiadhésifs utilisés dans les ustensiles de cuisine ne libèrent pas de produits chimiques nocifs lorsqu'ils sont exposés à une chaleur élevée. Cela oblige les fabricants à investir dans des

Prix élevés des ustensiles de cuisine antiadhésifs

Les prix relativement élevés des ustensiles de cuisine antiadhésifs, en particulier des produits haut de gamme et innovants, constituent un frein important sur le marché australien et néo-zélandais. Les consommateurs de ces régions accordant de plus en plus d'importance à l'accessibilité en raison de l'augmentation du coût de la vie, la sensibilité au prix dans les décisions d'achat d'ustensiles de cuisine s'est intensifiée. Cette dynamique limite l'adoption d'ustensiles de cuisine antiadhésifs de haute qualité parmi les ménages à revenus moyens et faibles.

Les marques d’ustensiles de cuisine antiadhésifs haut de gamme, telles que Scanpan, Tefal et Circulon, sont souvent associées à des caractéristiques avancées telles que des revêtements sans PFOA, une durabilité améliorée et une efficacité thermique. Cependant, ces attributs s’accompagnent de coûts de production plus élevés, qui se traduisent par des prix de détail élevés. Par exemple, une seule poêle antiadhésive de haute qualité peut coûter plus de 150 AUD (160 NZD), ce qui la rend inaccessible aux consommateurs soucieux de leur budget. En conséquence, de nombreux acheteurs optent pour des alternatives moins chères comme les ustensiles de cuisine standard en acier inoxydable ou en fonte, qui sont perçus comme plus rentables à long terme.

De plus, la durabilité des revêtements antiadhésifs peut soulever des problèmes de coût supplémentaires. Même les produits haut de gamme peuvent nécessiter un remplacement après quelques années d'utilisation fréquente, ce qui dissuade les acheteurs soucieux des coûts qui recherchent des solutions d'ustensiles de cuisine plus durables. Ce cycle de vie court, combiné à un coût initial élevé, réduit les achats répétés, ce qui a un impact sur la croissance globale du marché.

Par exemple,

- La poêle à frire Scanpan Classic est proposée entre 180 et 380 AUD chez les principaux détaillants australiens comme Myer et David Jones. Ces prix élevés peuvent dissuader les consommateurs soucieux des prix, les incitant à opter pour des alternatives moins chères en matière d'ustensiles de cuisine

Impact et scénario actuel du marché en cas de pénurie de matières premières et de retards d'expédition

Data Bridge Market Research propose une analyse de haut niveau du marché et fournit des informations en tenant compte de l'impact et de l'environnement actuel du marché en matière de pénurie de matières premières et de retards d'expédition. Cela se traduit par l'évaluation des possibilités stratégiques, la création de plans d'action efficaces et l'assistance aux entreprises dans la prise de décisions importantes.

Outre le rapport standard, nous proposons également une analyse approfondie du niveau d'approvisionnement à partir des retards d'expédition prévus, de la cartographie des distributeurs par région, de l'analyse des produits de base, de l'analyse de la production, des tendances de la cartographie des prix, de l'approvisionnement, de l'analyse des performances des catégories, des solutions de gestion des risques de la chaîne d'approvisionnement, de l'analyse comparative avancée et d'autres services d'approvisionnement et de soutien stratégique.

Impact attendu du ralentissement économique sur les prix et la disponibilité des produits

Lorsque l'activité économique ralentit, les industries commencent à souffrir. Les effets prévus du ralentissement économique sur les prix et l'accessibilité des produits sont pris en compte dans les rapports d'analyse du marché et les services de renseignements fournis par DBMR. Grâce à cela, nos clients peuvent généralement garder une longueur d'avance sur leurs concurrents, projeter leurs ventes et leurs revenus et estimer leurs dépenses de profits et pertes.

Portée du marché des ustensiles de cuisine antiadhésifs en Australie et en Nouvelle-Zélande

Le marché est segmenté en fonction du produit, de la matière première, de la couche de revêtement, du canal de distribution et de l'utilisateur final. La croissance parmi ces segments vous aidera à analyser les segments de croissance faibles dans les industries et fournira aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Produit

- Poêle

- Pot

- Ustensiles de cuisson

- Autocuiseur

- Poêlon

- Grille carrée

- Plaque de cuisson

- Cocotte

- Moule à pain

- Grille-pain à sandwich

- Wok

- Pocheuse à œufs

- Autres

Matière première

- Matériau de base

- Matériau de base, par type

- Fonte

- Aluminium

- Cuivre

- Acier inoxydable

- Acier au carbone

- Argile et grès

- Autres

- Matériau de base, par type

- Revêtement

- Revêtement, par type

- Revêtement en téflon

- Fluoropolymère

- Revêtement en céramique

- Revêtement en aluminium anodisé

- Revêtement en fer émaillé

- Silicones/Siloxanes

- Polyesters de silicone

- Hybrides

- Superhydrophobe

- Autres

- Revêtement, par type

Couche de revêtement

- Triple couche

- Double couche

- Couche unique

Canal de distribution

- Supermarchés/Hypermarchés

- Commerce électronique

- Magasin d'ustensiles

- Autres

Utilisateur final

- Résidentiel

- Commercial

Part de marché des ustensiles de cuisine antiadhésifs en Australie et en Nouvelle-Zélande

Le paysage concurrentiel du marché fournit des détails par concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence dans le pays, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises par rapport au marché.

Les leaders du marché des ustensiles de cuisine antiadhésifs en Australie et en Nouvelle-Zélande opérant sur le marché sont :

- Conair Australia (Australie)

- Scanpan Australie (Danemark)

- Tefal (France)

- SOLIDTEKNICS PTY LTD. (Australie)

- Fabriqué aux États-Unis

- GreenPan Australia (Australie)

- Biome (Australie)

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET END-USER COVERAGE GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING AWARENESS OF HEALTHY COOKING METHODS

5.1.2 INCREASED DEMAND FOR QUICK, EASY-TO-CLEAN COOKWARE DUE TO BUSY WORK SCHEDULE

5.1.3 ADVANCEMENTS AND INNOVATIONS IN NON-STICK COATINGS, MATERIALS AND DESIGNS

5.2 RESTRAINTS

5.2.1 CONCERNS ABOUT POTENTIAL HEALTH RISKS ASSOCIATED WITH SOME NON-STICK COATING

5.2.2 HIGH PRICES OF NON-STICK COOKWARE

5.3 OPPORTUNITIES

5.3.1 RISING INTEREST IN PERSONALIZED COOKWARE

5.3.2 RAPIDLY GROWING CULINARY CULTURE, SUCH AS COOKING SHOWS, INFLUENCERS, AND HOME COOKING

5.4 CHALLENGES

5.4.1 STRICT REGULATIONS REGARDING FOOD SAFETY STANDARDS AND THE USE OF CHEMICALS IN NON-STICK COATINGS

5.4.2 HIGH COMPETITION FROM ALTERNATIVE COOKWARE

6 AUSTRALIA AND NEW ZEALAND NON-STICK COOKWARE MARKET, BY PRODUCT

6.1 OVERVIEW

6.2 PAN

6.3 POT

6.4 BAKEWARE

6.5 PRESSURE COOKER

6.6 SKILLET

6.7 SQUARE GRILL

6.8 OVEN TRAY

6.9 DUTCH OVEN

6.1 LOAF TIN

6.11 SANDWICH TOASTER

6.12 WOK

6.13 EGG POACHER

6.14 OTHERS

7 AUSTRALIA AND NEW ZEALAND NON-STICK COOKWARE MARKET, BY RAW MATERIAL

7.1 OVERVIEW

7.2 BASE MATERIAL

7.3 COATING

8 AUSTRALIA AND NEW ZEALAND NON-STICK COOKWARE MARKET, BY COATING LAYER

8.1 OVERVIEW

8.2 TRIPLE LAYER

8.3 DOUBLE LAYER

8.4 SINGLE LAYER

9 AUSTRALIA AND NEW ZEALAND NON-STICK COOKWARE MARKET, BY END-USER

9.1 OVERVIEW

9.2 RESIDENTIAL

9.3 COMMERCIAL

10 AUSTRALIA AND NEW ZEALAND NON-STICK COOKWARE MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 SUPERMARKETS/HYPERMARKETS

10.3 E-COMMERCE

10.4 UTENSIL STORE

10.5 OTHERS

11 AUSTRALIA AND NEW ZEALAND NON-STICK COOKWARE MARKET…………..

11.1 AUSTRALIA NON-STICK COOKWARE MARKET

11.2 NEW ZEALAND NON-STICK COOKWARE MARKET

12 AUSTRALIA AND NEW ZEALAND NON-STICK COOKWARE MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: AUSTRALIA AND NEW ZEALAND

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 CUISINART - CONAIR AUSTRALIA

14.1.1 COMPANY SNAPSHOT

14.1.2 PRODUCT PORTFOLIO

14.1.3 RECENT UPDATES

14.2 SCANPAN AUSTRALIA

14.2.1 COMPANY SNAPSHOT

14.2.2 PRODUCT PORTFOLIO

14.2.3 RECENT UPDATES

14.3 TEFAL

14.3.1 COMPANY SNAPSHOT

14.3.2 PRODUCT PORTFOLIO

14.3.3 RECENT UPDATES

14.4 SOLIDTEKNICS PTY LTD.

14.4.1 COMPANY SNAPSHOT

14.4.2 PRODUCT PORTFOLIO

14.4.3 RECENT UPDATES

14.5 MADE IN

14.5.1 COMPANY SNAPSHOT

14.5.2 PRODUCT PORTFOLIO

14.5.3 RECENT UPDATES

14.6 BIOME

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT UPDATES

14.7 GREENPAN AUSTRALIA

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT UPDATES

15 QUESTIONNAIRE

16 RELATED REPORTS

Liste des tableaux

TABLE 1 AUSTRALIA AND NEW ZEALAND NON-STICK COOKWARE MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 2 AUSTRALIA AND NEW ZEALAND NON-STICK COOKWARE MARKET, BY PRODUCT, 2018-2032 (THOUSAND UNITS)

TABLE 3 AUSTRALIA AND NEW ZEALAND NON-STICK COOKWARE MARKET, BY RAW MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 4 AUSTRALIA AND NEW ZEALAND BASE MATERIAL IN NON-STICK COOKWARE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 5 AUSTRALIA AND NEW ZEALAND COATING IN NON-STICK COOKWARE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 6 AUSTRALIA AND NEW ZEALAND NON-STICK COOKWARE MARKET, BY COATING LAYER, 2018-2032 (USD THOUSAND)

TABLE 7 AUSTRALIA AND NEW ZEALAND NON-STICK COOKWARE MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 8 AUSTRALIA AND NEW ZEALAND NON-STICK COOKWARE MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 9 AUSTRALIA AND NEW ZEALAND NON-STICK COOKWARE MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 10 AUSTRALIA AND NEW ZEALAND NON-STICK COOKWARE MARKET, BY COUNTRY, 2018-2032 (THOUSAND UNITS)

TABLE 11 AUSTRALIA NON-STICK COOKWARE MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 12 AUSTRALIA NON-STICK COOKWARE MARKET, BY PRODUCT, 2018-2032 (THOUSAND UNITS)

TABLE 13 AUSTRALIA NON-STICK COOKWARE MARKET, BY RAW MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 14 AUSTRALIA BASE MATERIAL IN NON-STICK COOKWARE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 15 AUSTRALIA COATING IN NON-STICK COOKWARE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 16 AUSTRALIA NON-STICK COOKWARE MARKET, BY COATING LAYER, 2018-2032 (USD THOUSAND)

TABLE 17 AUSTRALIA NON-STICK COOKWARE MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 18 AUSTRALIA NON-STICK COOKWARE MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 19 NEW ZEALAND NON-STICK COOKWARE MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 20 NEW ZEALAND NON-STICK COOKWARE MARKET, BY PRODUCT, 2018-2032 (THOUSAND UNITS)

TABLE 21 NEW ZEALAND NON-STICK COOKWARE MARKET, BY RAW MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 22 NEW ZEALAND BASE MATERIAL IN NON-STICK COOKWARE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 23 NEW ZEALAND COATING IN NON-STICK COOKWARE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 24 NEW ZEALAND NON-STICK COOKWARE MARKET, BY COATING LAYER, 2018-2032 (USD THOUSAND)

TABLE 25 NEW ZEALAND NON-STICK COOKWARE MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 26 NEW ZEALAND NON-STICK COOKWARE MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

Liste des figures

FIGURE 1 AUSTRALIA AND NEW ZEALAND NON-STICK COOKWARE MARKET

FIGURE 2 AUSTRALIA AND NEW ZEALAND NON-STICK COOKWARE MARKET: DATA TRIANGULATION

FIGURE 3 AUSTRALIA AND NEW ZEALAND NON-STICK COOKWARE MARKET: DROC ANALYSIS

FIGURE 4 AUSTRALIA AND NEW ZEALAND NON-STICK COOKWARE MARKET: AUSTRALIA AND NEW ZEALAND VS REGIONS MARKET ANALYSIS

FIGURE 5 AUSTRALIA AND NEW ZEALAND NON-STICK COOKWARE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 AUSTRALIA AND NEW ZEALAND NON-STICK COOKWARE MARKET: MULTIVARIATE MODELLING

FIGURE 7 AUSTRALIA AND NEW ZEALAND NON-STICK COOKWARE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 AUSTRALIA AND NEW ZEALAND NON-STICK COOKWARE MARKET: DBMR MARKET POSITION GRID

FIGURE 9 AUSTRALIA AND NEW ZEALAND NON-STICK COOKWARE MARKET: END-USER COVERAGE GRID

FIGURE 10 AUSTRALIA AND NEW ZEALAND NON-STICK COOKWARE MARKET: SEGMENTATION

FIGURE 11 AUSTRALIA AND NEW ZEALAND NON-STICK COOKWARE MARKET: BY PRODUCT

FIGURE 12 EXECUTIVE SUMMARY

FIGURE 13 GROWING AWARENESS ABOUT HEALTHY COOKING METHODS IS EXPECTED TO DRIVE THE AUSTRALIA AND NEW ZEALAND NON-STICK COOKWARE MARKET

FIGURE 14 THE PAN SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE AUSTRALIA AND NEW ZEALAND NON-STICK COOKWARE MARKET IN 2025 AND 2032

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR AUSTRALIA AND NEW ZEALAND NON-STICK COOKWARE MARKET

FIGURE 16 AUSTRALIA AND NEW ZEALAND NON-STICK COOKWARE MARKET: BY PRODUCT, 2024

FIGURE 17 AUSTRALIA AND NEW ZEALAND NON-STICK COOKWARE MARKET: BY RAW MATERIAL, 2024

FIGURE 18 AUSTRALIA AND NEW ZEALAND NON-STICK COOKWARE MARKET: BY COATING LAYER, 2024

FIGURE 19 AUSTRALIA AND NEW ZEALAND NON-STICK COOKWARE MARKET: BY END-USER, 2024

FIGURE 20 AUSTRALIA AND NEW ZEALAND NON-STICK COOKWARE MARKET: BY DISTRIBUTION CHANNEL, 2024

FIGURE 21 AUSTRALIA AND NEW ZEALAND NON-STICK COOKWARE MARKET: COMPANY SHARE 2024 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.