Marché de la logistique des soins de santé en Australie et en Nouvelle-Zélande, par services (transport, emballage, stockage et entrepôt, surveillance et autres), température (ambiante, réfrigérée, congelée et cryogénique), type de logistique (logistique de fret maritime, logistique de fret aérien, logistique terrestre), application (médicaments, manutentionnaires de médicaments en vrac, logistique des patients, vaccins, matériel biologique et organes, marchandises dangereuses et autres), utilisateur final (sociétés biopharmaceutiques, sociétés de dispositifs médicaux, laboratoires de référence et de diagnostic, hôpitaux et cliniques, instituts universitaires et de recherche, sociétés de services médicaux d'urgence et autres), canal de distribution (logistique tierce et conventionnelle) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et perspectives du marché de la logistique des soins de santé en Australie et en Nouvelle-Zélande

Les soins de santé concernent le maintien ou l'amélioration du bien-être par la conclusion, l'anticipation, le traitement, la récupération ou la réparation d'une infection, d'une maladie, d'une blessure et de divers troubles physiques et mentaux chez les individus. L'aide aux soins de santé est fournie par des professionnels de la santé dans des domaines connexes de la santé. La dentisterie, la pharmacie, les soins infirmiers, l'audiologie, la médecine, l'optométrie, la sage-femme, la psychologie, l'ergothérapie et la physiothérapie, ainsi que d'autres professions de la santé sont autant de compléments aux soins de santé.

La gestion logistique des soins de santé est utilisée pour divers modes de transport tels que les routes, les chemins de fer, les voies maritimes et aériennes. Le transport de marchandises effectué par la route est appelé segment. Il s'agit du type de mode de transport le plus courant car il nécessite un processus de document douanier unique. Le mode de transport ferroviaire est très économe en carburant et peut être qualifié de mode de transport « vert ». Les expéditions maritimes sont utilisées pour le transport de marchandises en vrac. Les voies aériennes sont le mode de transport le plus rapide et sont très utilisées pour réaliser le réapprovisionnement des stocks « juste à temps » (JIT) dans la logistique des soins de santé

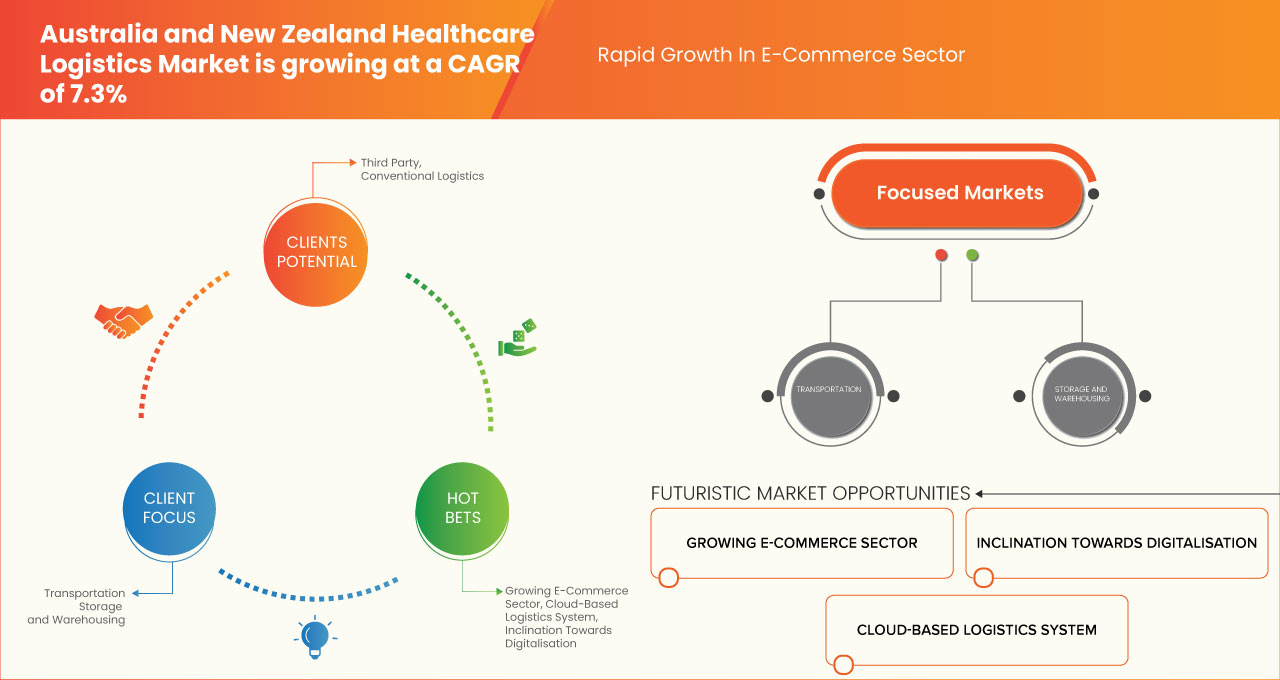

Selon les analyses de Data Bridge Market Research, le marché australien de la logistique des soins de santé devrait atteindre la valeur de 843,59 millions USD d'ici 2030, à un TCAC de 7,6 %, et le marché néo-zélandais de la logistique des soins de santé devrait atteindre la valeur de 108,03 millions USD d'ici 2030, à un TCAC de 5,5 % au cours de la période de prévision. Le transport est le segment de service le plus important du marché en raison de l'utilisation croissante de la logistique sur le marché australien et néo-zélandais de la logistique des soins de santé.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable de 2015 à 2020) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, prix en USD |

|

Segments couverts |

Par services (transport, emballage, stockage et entrepôt, surveillance et autres), température (ambiante, réfrigérée, congelée et cryogénique), type de logistique (logistique de fret maritime, logistique de fret aérien, logistique terrestre), application (médicaments, manutentionnaires de médicaments en vrac, logistique des patients, vaccins, matériel biologique et organes, marchandises dangereuses et autres), utilisateur final (sociétés biopharmaceutiques, sociétés de dispositifs médicaux, laboratoires de référence et de diagnostic, hôpitaux et cliniques, instituts universitaires et de recherche, sociétés de services médicaux d'urgence et autres), canal de distribution (logistique tierce et conventionnelle) |

|

Pays couverts |

Australie et Nouvelle-Zélande |

|

Acteurs du marché couverts |

Français ACFS Port Logistics Pty Ltd., United Parcel Service of America, Inc., Logistics Bureau Pty Ltd., AP MOLLER-MAERSK, Linfox Pty Ltd, KERRY LOGISTICS NETWORK LIMITED, Kuehne+Nagel, DSV, CEVA Logistics, Rhenus Group, Deutsche Post AG, Toll Holdings Limited., DB Schenker, FedEx, EBOS Group Limited, CH Robinson Worldwide, Inc., YUSEN LOGISTICS CO., LTD, CRYOPDP, MTF Logistics Pty Ltd, Pik Pak entre autres. |

Définition du marché de la logistique des soins de santé en Australie et en Nouvelle-Zélande

Les soins de santé concernent le maintien ou l'amélioration du bien-être par la conclusion, l'anticipation, le traitement, la récupération ou la réparation d'une infection, d'une maladie, d'une blessure et de divers troubles physiques et mentaux chez les individus. Les soins de santé sont dispensés par des professionnels de la santé dans des domaines connexes de la santé. La dentisterie, la pharmacie, les soins infirmiers, l'audiologie, la médecine, l'optométrie, la sage-femme, la psychologie, l'ergothérapie et la physiothérapie, ainsi que d'autres professions de la santé font tous partie des soins de santé.

La gestion logistique des soins de santé est utilisée pour divers modes de transport tels que les routes, les chemins de fer, les voies maritimes et aériennes. Le transport de marchandises effectué par la route est appelé segment. Il s'agit du type de mode de transport le plus courant car il nécessite un processus de document douanier unique. Le mode de transport ferroviaire est très économe en carburant et peut être qualifié de mode de transport « vert ». Les expéditions maritimes sont utilisées pour le transport de marchandises en vrac. Les voies aériennes sont le mode de transport le plus rapide et sont très utilisées pour réaliser le réapprovisionnement des stocks « juste à temps » (jit) dans la logistique des soins de santé. L'augmentation de la croissance de la logistique par voie aérienne et par différents autres modes de transport sont quelques-uns des facteurs qui stimulent la demande globale en logistique.

Dynamique du marché de la logistique des soins de santé en Australie et en Nouvelle-Zélande

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

Croissance rapide du secteur du commerce électronique

Le commerce électronique est le processus d'achat et de vente de biens et de services sur un réseau électronique ou une plateforme en ligne, principalement Internet. Ces derniers temps, l'utilisation généralisée de plateformes de commerce électronique telles qu'Amazon, Flipkart et eBay a contribué à une croissance substantielle de l'achat et de la vente de biens en ligne. Cela a fourni une plateforme aux consommateurs pour acheter librement des produits de santé et les utiliser selon leurs besoins.

La Nouvelle-Zélande et l'Australie sont des marchés de commerce électronique caractérisés par des dépenses transfrontalières élevées et une bonne participation aux événements de commerce électronique. Divers facteurs contribuent à la croissance du commerce électronique, tels que la pénétration d'Internet, l'augmentation du nombre d'utilisateurs de smartphones et l'influence des médias sociaux, entre autres. En outre, les initiatives gouvernementales visant à stimuler le secteur du commerce électronique sont également une raison majeure de la croissance du marché. Dans diverses régions, les gouvernements ont pris diverses mesures pour stimuler le commerce électronique.

La justification ci-dessus implique que l’industrie du commerce électronique est en plein essor à l’échelle mondiale et qu’elle devrait agir comme un moteur majeur de la croissance du marché de la logistique des soins de santé en Australie et en Nouvelle-Zélande.

Avantages considérables offerts par la logistique tierce partie

La logistique tierce partie est essentiellement externalisée avec la logistique opérationnelle de l'entreposage à la livraison, et cela comprend la fourniture d'un certain nombre de services dans la chaîne d'approvisionnement, tels que le transport de fret, l'emballage, l'exécution des commandes, la prévision des stocks, la préparation et l'emballage, l'entreposage et le transport. La logistique tierce partie offre un large éventail d'avantages car elle aide les propriétaires d'entreprise à se concentrer davantage sur les autres aspects de l'entreprise, tels que le développement de produits, le marketing et les ventes. Les avantages importants offerts par la logistique tierce partie agissent donc comme le facteur majeur de stimulation de la croissance du marché de la logistique des soins de santé en Australie et en Nouvelle-Zélande.

La logistique tierce partie permet de réduire les coûts d'entreposage et de logistique, ce qui est très bénéfique pour la nouvelle logistique médicale. De plus, la demande de produits de santé fluctue constamment au cours de l'année et, sans engagement de capital, l'entreprise réduit ses risques. Ces avantages aident les entreprises à investir leurs dépenses de manière plus judicieuse, ce qui devrait constituer un facteur de croissance majeur pour le marché de la logistique des soins de santé en Australie et en Nouvelle-Zélande.

Retenue

Coût élevé associé à la logistique inverse

Le coût associé aux services de logistique inverse proposés par divers fabricants et prestataires de services est élevé. Les services de logistique inverse sont très populaires dans le secteur de la santé en raison de la forte demande de divers produits liés à la santé. Selon Thomas Publishing Company, les taux de retour des équipements industriels sont d'environ 4 à 8 %, tandis que les équipements de santé ont des taux de retour de 8 à 20 %. La raison pour laquelle les services de logistique inverse sont si chers est une combinaison de divers facteurs qui déterminent le prix de ces services.

Ce sont les facteurs qui déterminent les services de logistique inverse offerts par divers prestataires de services de santé. En général, la logistique inverse des soins de santé représente en moyenne entre 7 et 10 % du coût des marchandises, ce qui est assez élevé. On peut s'attendre à ce que cela constitue un frein majeur à la croissance du marché de la logistique des soins de santé en Australie et en Nouvelle-Zélande.

Opportunité

Adoption de solutions logistiques basées sur le Cloud

La technologie cloud est une technologie en ligne essentielle utilisée dans le monde entier. Elle permet aux utilisateurs d'accéder au stockage, aux fichiers, aux logiciels et aux serveurs à l'aide de leurs appareils connectés à Internet. Elle signifie également avoir la possibilité de stocker et d'accéder aux données et aux programmes via Internet plutôt que sur un disque dur qui peut être utilisé par les entreprises de logistique de toute taille. Contrairement aux méthodes matérielles et logicielles traditionnelles, les technologies cloud peuvent aider les entreprises de logistique à rester à la pointe de la technologie.

Les technologies cloud peuvent aider à optimiser la logistique des soins de santé et à améliorer la gestion de la chaîne d'approvisionnement des retours. Par conséquent, l'adoption des technologies cloud devrait constituer une opportunité lucrative pour la croissance du marché de la logistique des soins de santé en Australie et en Nouvelle-Zélande.

Défi

Insuffisance des ressources en main d'œuvre pour gérer le retour

Le processus global de gestion de la chaîne logistique implique l'analyse d'une grande quantité de données et d'un grand nombre de retours. En raison de la croissance rapide du secteur du commerce électronique, la main-d'œuvre doit prendre les mesures nécessaires au bon moment. Les informations fournies doivent être bien exécutées afin de fournir des résultats et une qualité de services optimaux.

Cependant, le manque de main-d'œuvre qualifiée et de formation des employés peut entraîner plusieurs erreurs entraînant une inefficacité dans les services offerts, ce qui constitue un défi majeur pour la croissance du secteur de la logistique des soins de santé. Cela peut constituer un obstacle majeur car la satisfaction du client est primordiale dans le secteur de la logistique des soins de santé. La main-d'œuvre travaillant dans la logistique des soins de santé doit être formée à l'identification de numéros de série ou de pièces spécifiques. De plus, la main-d'œuvre doit connaître l'inventaire faisant autorité, la politique de garantie et les informations comptables hébergées dans son système central de planification des ressources de l'entreprise (ERP), mais il est difficile de trouver une main-d'œuvre qualifiée pour gérer les retours de produits de santé.

Développements récents

- En mars 2023, AP Moller - Maersk a annoncé avoir étendu sa présence en Amérique latine avec de nouveaux entrepôts au Chili et au Pérou. Cela aide l'organisation à développer davantage de revenus.

- En février 2022, ACFS Port Logistics Pty Ltd. a annoncé qu'elle s'était associée à Sany Heavy Forklifts. Cette collaboration aide l'organisation à développer davantage de portefeuille de produits et contribue également à générer des revenus.

Portée du marché de la logistique des soins de santé en Australie et en Nouvelle-Zélande

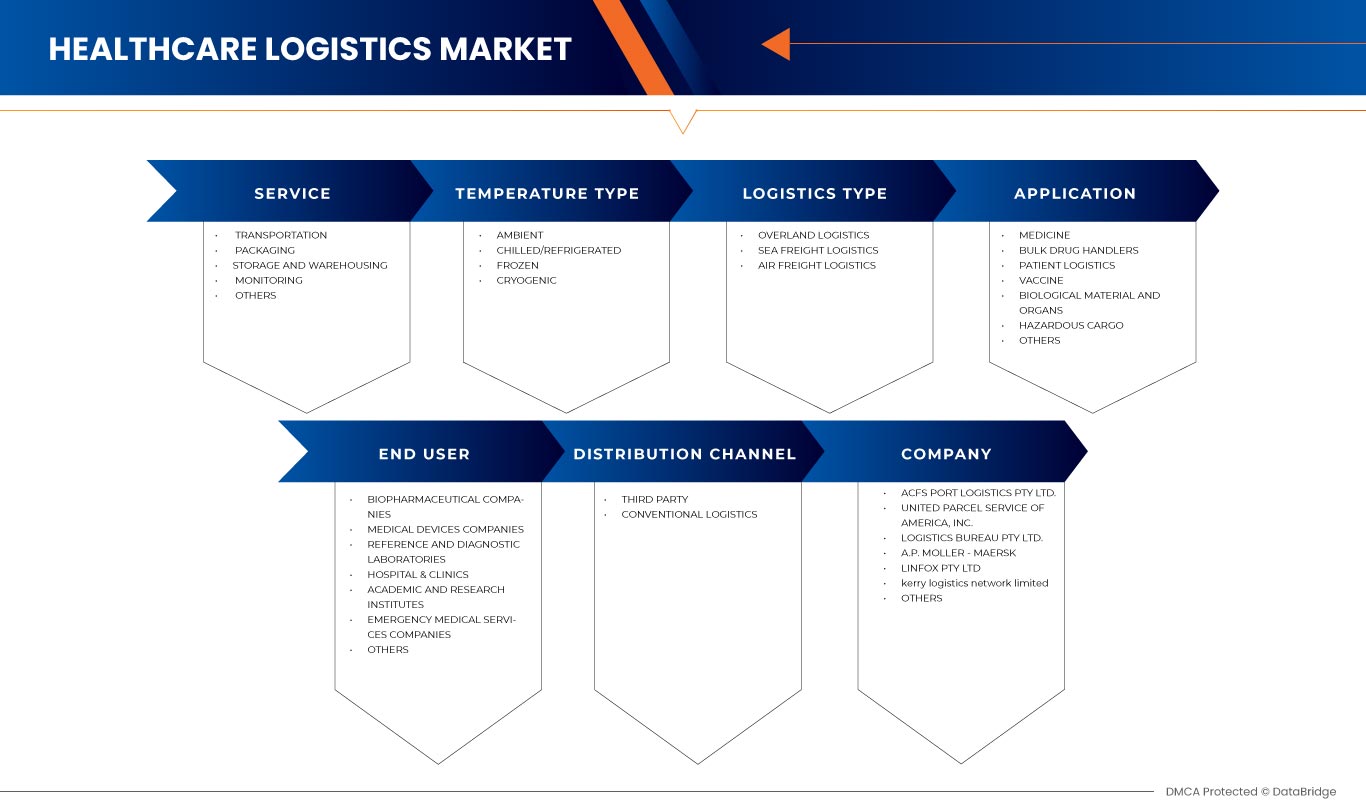

Le marché de la logistique des soins de santé en Australie et en Nouvelle-Zélande est segmenté en six segments notables tels que les services, le type de température, le type de logistique, l'application, l'utilisateur final et le canal de distribution. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles.

MARCHÉ DE LA LOGISTIQUE SANITAIRE EN AUSTRALIE ET EN NOUVELLE-ZÉLANDE, PAR SERVICES

- Transport

- Conditionnement

- Stockage et entreposage

- Surveillance

- Autres

Sur la base des services, le marché de la logistique des soins de santé en Australie et en Nouvelle-Zélande est segmenté en transport, emballage, stockage et entreposage, surveillance et autres.

MARCHÉ DE LA LOGISTIQUE SANITAIRE EN AUSTRALIE ET EN NOUVELLE-ZÉLANDE, PAR TYPE DE TEMPÉRATURE

- Réfrigéré/Réfrigéré

- Congelé

- Ambiant

- Cryogénique

Sur la base des applications, le marché de la logistique des soins de santé en Australie et en Nouvelle-Zélande est segmenté en produits réfrigérés, congelés, ambiants et cryogéniques.

MARCHÉ DE LA LOGISTIQUE SANITAIRE EN AUSTRALIE ET EN NOUVELLE-ZÉLANDE, PAR TYPE DE LOGISTIQUE

- Logistique de fret maritime

- Logistique de fret aérien

- Logistique terrestre

Sur la base du type de logistique, le marché de la logistique des soins de santé en Australie et en Nouvelle-Zélande est segmenté en logistique de fret maritime, logistique de fret aérien et logistique terrestre.

MARCHÉ DE LA LOGISTIQUE SANITAIRE EN AUSTRALIE ET EN NOUVELLE-ZÉLANDE, PAR APPLICATION

- Médecine

- Manutentionnaires de médicaments en vrac

- Logistique des patients

- Vaccin

- Matériel et organes biologiques

- Marchandises dangereuses

- Autres

Sur la base des applications, le marché de la logistique des soins de santé en Australie et en Nouvelle-Zélande est segmenté en médicaments, manutentionnaires de médicaments en vrac, logistique des patients, vaccins, matériel biologique et organes, marchandises dangereuses et autres.

MARCHÉ DE LA LOGISTIQUE SANITAIRE EN AUSTRALIE ET EN NOUVELLE-ZÉLANDE, PAR UTILISATEUR FINAL

- Sociétés biopharmaceutiques

- Entreprises de dispositifs médicaux

- Laboratoires de référence et de diagnostic

- Hôpitaux et cliniques

- Instituts universitaires et de recherche

- Entreprises de services médicaux d'urgence

- Autres

Sur la base de l'utilisateur final, le marché de la logistique des soins de santé en Australie et en Nouvelle-Zélande est segmenté en sociétés biopharmaceutiques, sociétés de dispositifs médicaux, laboratoires de référence et de diagnostic, hôpitaux et cliniques, instituts universitaires et de recherche, sociétés de services médicaux d'urgence et autres.

MARCHÉ DE LA LOGISTIQUE SANITAIRE EN AUSTRALIE ET EN NOUVELLE-ZÉLANDE, PAR CANAL DE DISTRIBUTION

- Tierce personne

- Logistique conventionnelle

Sur la base du canal de distribution, le marché de la logistique des soins de santé en Australie et en Nouvelle-Zélande est segmenté en logistique tierce et conventionnelle.

Analyse/perspectives régionales du marché de la logistique des soins de santé en Australie et en Nouvelle-Zélande

Le marché de la logistique des soins de santé en Australie et en Nouvelle-Zélande est segmenté en six segments notables tels que les services, le type de température, le type de logistique, l'application, l'utilisateur final et le canal de distribution.

Les pays couverts par ce rapport de marché sont l'Australie et la Nouvelle-Zélande.

La section du rapport sur les pays fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie des pays, les actes réglementaires et les tarifs d'importation et d'exportation sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario du marché pour les différents pays. En outre, la présence et la disponibilité des marques de soins de santé et les défis auxquels elles sont confrontées en raison du transport sont prises en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché de la logistique des soins de santé en Australie et en Nouvelle-Zélande

Le paysage concurrentiel du marché de la logistique des soins de santé en Australie et en Nouvelle-Zélande fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, l'expansion commerciale, les installations de service, le partenariat, le développement stratégique, la domination des applications et la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation de l'entreprise vers le marché de la logistique des soins de santé en Australie et en Nouvelle-Zélande.

Français Certains des principaux acteurs opérant sur le marché de la logistique des soins de santé en Australie et en Nouvelle-Zélande sont ACFS Port Logistics Pty Ltd., United Parcel Service of America, Inc., Logistics Bureau Pty Ltd., AP Moller –MAERSK, Linfox Pty Ltd, KERRY LOGISTICS NETWORK LIMITED, Kuehne+Nagel, DSV, CEVA logistics, Rhenus Group, Deutsche Post AG, Toll Holdings Limited., DB Schenker, FedEx, EBOS Group Limited, CH Robinson Worldwide, Inc., YUSEN LOGISTICS CO., LTD, CRYOPDP, MTF Logistics Pty Ltd, Pik Pak entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF AUSTRALIA AND NEW ZEALAND HEALTHCARE LOGISTICS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 AUSTRALIA TRANSPORTATION MODE TIMELINE CURVE

2.1 NEW ZEALAND TRANSPORTATION MODE TIMELINE CURVE

2.11 MARKET INDUSTRY COVERAGE GRID

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES

4.3 TRANSPORT

4.3.1 MEDICAL TUBS- TRANSPORT FLEET

4.3.2 PARCELS

4.3.3 MEDICAL DEVICES, PRODUCTS TRANSPORTATION

4.3.4 MED PHARMA PRODUCTS TRANSPORTATION

4.3.5 GLASS MATERIAL TRANSPORTATION

4.3.6 RADIOACTIVE MATERIAL TRANSPORTATION

4.3.7 SENSITIVE FREIGHT TRANSPORTATION

4.4 VALUE ADDED SERVICES

4.4.1 TEMPERATURE CONTROLLED PACKAGING

4.4.2 STOCK COUNTING SERVICES

4.4.3 DRY ICE

4.4.4 CRYO VALUE ADDED SERVICES

4.5 WAREHOUSE

4.5.1 3PL –KITTING

4.5.2 3PL - TEMP-CONTROLLED PACKAGING

4.6 PATENT ANALYSIS

4.7 INCREASING VISIBILITY THROUGH THE INTERNET OF THINGS

4.8 STRATEGIC INITIATIVES SHAPING FUTURE OF LOGISTICS

5 GLOBAL HEALTHCARE LOGISTICS MARKET, BY REGION

5.1 OVERVIEW

6 AUSTRALIA AND NEW ZEALAND HEALTHCARE LOGISTICS MARKET, INDUSTRY INSIGHTS

6.1 KEY PRICING STRATEGIES

6.1.1 OVERVIEW

7 AUSTRALIA AND NEW ZEALAND HEALTHCARE LOGISTICS MARKET, REGULATORY FRAMEWORK

7.1 OVERVIEW

8 MARKET OVERVIEW

8.1 DRIVERS

8.1.1 RAPID GROWTH IN THE E-COMMERCE SECTOR

8.1.2 HIGH BENEFITS OFFERED BY THIRD-PARTY LOGISTICS

8.1.3 RISING GROWTH IN CROSS BORDER TRADES AND GLOBALIZATION

8.1.4 INCREASE IN GROWTH OF LOGISTICS THROUGH AIRWAY AND DIFFERENT OTHER TRANSPORT MODES

8.2 RESTRAINTS

8.2.1 CONGESTION ASSOCIATED WITH TRADE ROUTES

8.2.2 HIGH COST ASSOCIATED WITH REVERSE LOGISTICS

8.2.3 CONCERNS RELATED TO INVENTORY MANAGEMENT IN HEALTHCARE LOGISTICS

8.3 OPPORTUNITIES

8.3.1 INCLINATION TOWARDS DIGITALIZATION OF THE SECTOR

8.3.2 ADOPTION OF CLOUD BASED LOGISTICS SOLUTIONS

8.3.3 INCREASING GROWTH INVESTMENTS AND EXPANSIONS MADE BY THE MARKET PLAYERS

8.3.4 EMERGENCE OF NEW ADVANCED TECHNOLOGIES

8.4 CHALLENGES

8.4.1 INADEQUATE LABOUR RESOURCES TO HANDLE RETURN

8.4.2 FREQUENT DELAYS IN THE DELIVERY OF PRODUCTS DUE TO VARIOUS TECHNICAL FACTORS

9 AUSTRALIA AND NEW ZEALAND HEALTHCARE LOGISTICS MARKET, BY SERVICE

9.1 OVERVIEW

9.2 TRANSPORATATION

9.2.1 COLD CHAIN

9.2.1.1 PHARMACEUTICS

9.2.1.1.1 BOTTLES

9.2.1.1.2 VIALS AND AMPOULES

9.2.1.1.3 CARTRIDGES AND SYRINGES

9.2.1.1.4 POUCHES AND BAGS

9.2.1.1.5 BLISTER PACKS

9.2.1.1.6 TUBES

9.2.1.1.7 PAPER BOARD BOXES

9.2.1.1.8 CAPS AND CLOSURES

9.2.1.1.9 LABELS

9.2.1.1.10 OTHERS

9.2.1.2 INVESTIGATIONAL MEDICINES

9.2.1.3 HOSPITAL SUPPLIES

9.2.1.3.1 DIAGNOSTIC SUPPLIES

9.2.1.3.2 INJECTABLE SUPPLIES

9.2.1.3.3 MEDICAL EQUIPMENT AND DEVICES

9.2.1.3.4 PERSONAL PROTECTIVE EQUIPMENT

9.2.1.3.5 DISINFECTANTS

9.2.1.3.6 WOUND CARE CONSUMABLE

9.2.1.3.7 INFUSION & DIALYSIS CONSUMABLES

9.2.1.3.8 OTHERS

9.2.1.4 LABORATORY SPECIMENS

9.2.1.4.1 REAGENTS AND CONSUMABLES

9.2.1.4.2 TEST SPECIMENS

9.2.1.5 TISSUE AND ORGAN

9.2.1.5.1 HEART

9.2.1.5.2 LUNGS

9.2.1.5.3 KIDNEY

9.2.1.5.4 LIVER

9.2.1.5.5 OTHERS

9.2.1.6 OTHERS

9.2.2 NON-COLD CHAIN

9.2.2.1 PHARMACEUTICS

9.2.2.2 INVESTIGATIONAL MEDICINES

9.2.2.3 HOSPITAL SUPPLIES

9.2.2.4 LABORATORY SPECIMENS

9.2.2.5 TISSUE AND ORGAN

9.2.2.6 OTHERS

9.3 PACKAGING

9.3.1 PHARMACEUTICALS

9.3.2 MEDICAL DEVICES

9.3.3 LABORATORY SPECIMENS

9.4 STORAGE AND WAREHOUSING

9.4.1 RAW MATERIALS

9.4.2 MEDICINES

9.4.3 MEDICAL DEVICES

9.4.4 CONSUMABLES

9.4.5 BIOLOGICAL MATERIALS

9.4.6 CONTAINERS

9.4.7 OTHERS

9.5 MONITORING

9.6 OTHERS

10 AUSTRALIA AND NEW ZEALAND HEALTHCARE LOGISTICS MARKET, BY TEMPERATURE TYPE

10.1 OVERVIEW

10.2 AMBIENTS

10.3 CHILLED/REFRIGERATED

10.4 FROZEN

10.5 CRYOGENIC

11 AUSTRALIA AND NEW ZEALAND HEALTHCARE LOGISTICS MARKET, BY LOGISTICS TYPE

11.1 OVERVIEW

11.2 OVERLAND LOGISTICS

11.3 SEA FREIGHT LOGISTICS

11.4 AIR FREIGHT LOGISTICS

12 AUSTRALIA AND NEW ZEALAND HEALTHCARE LOGISTICS MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 MEDICINES

12.3 BULK DRUG HANDLERS

12.4 PATIENT LOGISTICS

12.5 VACCINE

12.6 BIOLOGICAL MATERIAL AND ORGANS

12.7 HAZARDOUS CARGO

12.8 OTHERS

13 AUSTRALIA AND NEW ZEALAND HEALTHCARE LOGISTICS MARKET, BY END USER

13.1 OVERVIEW

13.2 BIOPHARMACEUTICAL COMPANIES

13.3 MEDICAL DEVICES COMPANIES

13.4 REFERENCE AND DIAGNOSTIC LABORATORIES

13.5 HOSPITAL & CLINICS

13.6 ACADEMIC AND RESEARCH INSTITUTES

13.7 EMERGENCY MEDICAL SERVICES COMPANIES

13.8 OTHERS

14 AUSTRALIA AND NEW ZEALAND HEALTHCARE LOGISTICS MARKET, BY DISTRIBUTION CHANNEL

14.1 OVERVIEW

14.2 THIRD PARTY

14.3 CONVENTIONAL LOGISTICS

15 AUSTRALIA HEALTHCARE LOGISTICS MARKET, COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: AUSTRALIA

15.2 COMPANY SHARE ANALYSIS: NEW ZEALAND

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 ACFS PORT LOGISTICS PTY LTD.

17.1.1 COMPANY SNAPSHOT

17.1.2 PRODUCT PORTFOLIO

17.1.3 RECENT DEVELOPMENTS

17.2 UNITED PARCEL SERVICE OF AMERICA, INC.

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 PRODUCT PORTFOLIO

17.2.4 RECENT DEVELOPMENT

17.3 LOGISTICS BUREAU PTY LTD.

17.3.1 COMPANY SNAPSHOT

17.3.2 PRODUCT PORTFOLIO

17.3.3 RECENT DEVELOPMENT

17.4 LINFOX PTY LTD.

17.4.1 COMPANY SNAPSHOT

17.4.2 PRODUCT PORTFOLIO

17.4.3 RECENT DEVELOPMENT

17.5 DSV

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT DEVELOPMENTS

17.6 A.P. MOLLER - MAERSK

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT DEVELOPMENT

17.7 C.H. ROBINSON WORLDWIDE, INC.

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 SERVICE PORTFOLIO

17.7.4 RECENT DEVELOPMENTS

17.8 CEVA LOGISTICS

17.8.1 COMPANY SNAPSHOT

17.8.2 REVENUE ANALYSIS

17.8.3 PRODUCT PORTFOLIO

17.8.4 RECENT DEVELOPMENTS

17.9 CRYOPDP

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENTS

17.1 DB SCHENKER

17.10.1 COMPANY SNAPSHOT

17.10.2 REVENUE ANALYSIS

17.10.3 PRODUCT PORTFOLIO

17.10.4 RECENT DEVELOPMENT

17.11 DEUTSCHE POST AG

17.11.1 COMPANY SNAPSHOT

17.11.2 REVENUE ANALYSIS

17.11.3 PRODUCT PORTFOLIO

17.11.4 RECENT DEVELOPMENT

17.12 EBOS GROUP LIMITED

17.12.1 COMPANY SNAPSHOT

17.12.2 REVENUE ANALYSIS

17.12.3 PRODUCT PORTFOLIO

17.12.4 RECENT DEVELOPMENT

17.13 FEDEX

17.13.1 COMPANY SNAPSHOT

17.13.2 REVENUE ANALYSIS

17.13.3 SERVICE PORTFOLIO

17.13.4 RECENT DEVELOPMENTS

17.14 KERRY LOGISTICS NETWORK LIMITED

17.14.1 COMPANY SNAPSHOT

17.14.2 REVENUE ANALYSIS

17.14.3 SERVICE PORTFOLIO

17.14.4 RECENT DEVELOPMENTS

17.15 KUEHNE+NAGEL

17.15.1 COMPANY SNAPSHOT

17.15.2 REVENUE ANALYSIS

17.15.3 PRODUCT PORTFOLIO

17.15.4 RECENT DEVELOPMENT

17.16 MTF LOGISTICS PTY LTD

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENT

17.17 PIK PAK.

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENT

17.18 RHENUS GROUP

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENTS

17.19 TOLL HOLDINGS LIMITED.

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENT

17.2 YUSEN LOGISTICS CO., LTD.

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENTS

18 QUESTIONNAIRE

19 RELATED REPORTS

Liste des tableaux

TABLE 1 AUSTRALIA & NEW ZEALAND HEALTHCARE LOGISTICS MARKET, PATENT ANALYSIS

TABLE 2 GLOBAL HEALTHCARE LOGISTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 3 AUSTRALIA HEALTHCARE LOGISTICS MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 4 NEW ZEALAND HEALTHCARE LOGISTICS MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 5 AUSTRALIA TRANSPORTATION IN HEALTHCARE LOGISTICS MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 6 NEW ZEALAND TRANSPORTATION IN HEALTHCARE LOGISTICS MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 7 AUSTRALIA COLD CHAIN IN HEALTHCARE LOGISTICS MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 8 NEW ZEALAND COLD CHAIN IN HEALTHCARE LOGISTICS MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 9 AUSTRALIA PHARMACEUTICS IN HEALTHCARE LOGISTICS MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 10 NEW ZEALAND PHARMACEUTICS IN HEALTHCARE LOGISTICS MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 11 AUSTRALIA HOSPITAL SUPPLIES IN HEALTHCARE LOGISTICS MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 12 NEW ZEALAND HOSPITAL SUPPLIES IN HEALTHCARE LOGISTICS MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 13 AUSTRALIA LABORATORY SPECIMENS IN HEALTHCARE LOGISTICS MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 14 NEW ZEALAND LABORATORY SPECIMENS IN HEALTHCARE LOGISTICS MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 15 AUSTRALIA TISSUES AND ORGANS IN HEALTHCARE LOGISTICS MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 16 NEW ZEALAND TISSUES AND ORGANS IN HEALTHCARE LOGISTICS MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 17 AUSTRALIA NON- COLD CHAIN IN HEALTHCARE LOGISTICS MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 18 NEW ZEALAND NON- COLD CHAIN IN HEALTHCARE LOGISTICS MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 19 AUSTRALIA PACKAGING IN HEALTHCARE LOGISTICS MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 20 NEW ZEALAND HEALTHCARE LOGISTICS MARKET, BY SERVICES, 2021-2030 (USD MILLION)

TABLE 21 AUSTRALIA PACKAGING IN HEALTHCARE LOGISTICS MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 22 NEW ZEALAND STORAGE AND WAREHOUSING IN HEALTHCARE LOGISTICS MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 23 AUSTRALIA HEALTHCARE LOGISTICS MARKET, BY TEMPERATURE TYPE, 2021-2030 (USD MILLION)

TABLE 24 NEW ZEALAND HEALTHCARE LOGISTICS MARKET, BY TEMPERATURE TYPE, 2021-2030 (USD MILLION)

TABLE 25 AUSTRALIA HEALTHCARE LOGISTICS MARKET, BY LOGISTICS TYPE, 2021-2030 (USD MILLION)

TABLE 26 NEW ZEALAND HEALTHCARE LOGISTICS MARKET, BY LOGISTICS TYPE, 2021-2030 (USD MILLION)

TABLE 27 AUSTRALIA HEALTHCARE LOGISTICS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 28 NEW ZEALAND HEALTHCARE LOGISTICS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 29 AUSTRALIA HEALTHCARE LOGISTICS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 30 NEW ZEALAND HEALTHCARE LOGISTICS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 31 AUSTRALIA HEALTHCARE LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 32 NEW ZEALAND HEALTHCARE LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

Liste des figures

FIGURE 1 AUSTRALIA AND NEW ZEALAND HEALTHCARE LOGISTICS MARKET: SEGMENTATION

FIGURE 2 AUSTRALIA AND NEW ZEALAND HEALTHCARE LOGISTICS MARKET: DATA TRIANGULATION

FIGURE 3 AUSTRALIA AND NEW ZEALAND HEALTHCARE LOGISTICS MARKET: DROC ANALYSIS

FIGURE 4 AUSTRALIA AND NEW ZEALAND HEALTHCARE LOGISTICS MARKET: GLOBAL VS. REGIONAL MARKET ANALYSIS

FIGURE 5 AUSTRALIA AND NEW ZEALAND HEALTHCARE LOGISTICS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 AUSTRALIA AND NEW ZEALAND HEALTHCARE LOGISTICS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 AUSTRALIA AND NEW ZEALAND HEALTHCARE LOGISTICS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 AUSTRALIA AND NEW ZEALAND HEALTHCARE LOGISTICS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 AUSTRALIA HEALTHCARE LOGISTICS MARKET: END USER COVERAGE GRID

FIGURE 10 NEW ZEALAND HEALTHCARE LOGISTICS MARKET: END USER COVERAGE GRID

FIGURE 11 AUSTRALIA AND NEW ZEALAND HEALTHCARE LOGISTICS MARKET: SEGMENTATION

FIGURE 12 INCREASING GROWTH IN GLOBALIZATION LEADING TO HIGH FREIGHT TRANSPORTATION IS EXPECTED TO DRIVE AUSTRALIA HEALTHCARE LOGISTICS MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 13 INCREASING GROWTH IN GLOBALIZATION LEADING TO HIGH FREIGHT TRANSPORTATION IS EXPECTED TO DRIVE NEW ZEALAND HEALTHCARE LOGISTICS MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 14 TRANSPORTATION MODE IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF AUSTRALIA HEALTHCARE LOGISTICS MARKET FROM 2023 TO 2030

FIGURE 15 TRANSPORTATION MODE IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF NEW ZEALAND HEALTHCARE LOGISTICS MARKET FROM 2023 TO 2030

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF AUSTRALIA AND NEW ZEALAND HEALTHCARE LOGISTICS MARKET

FIGURE 17 AUSTRALIA HEALTHCARE LOGISTICS MARKET: BY SERVICE, 2022

FIGURE 18 AUSTRALIA HEALTHCARE LOGISTICS MARKET: BY SERVICE, 2023-2030 (USD MILLION)

FIGURE 19 AUSTRALIA HEALTHCARE LOGISTICS MARKET: BY SERVICE, CAGR (2023-2030)

FIGURE 20 AUSTRALIA HEALTHCARE LOGISTICS MARKET: BY SERVICE, LIFELINE CURVE

FIGURE 21 NEW ZEALAND HEALTHCARE LOGISTICS MARKET: BY SERVICE, 2022

FIGURE 22 NEW ZEALAND HEALTHCARE LOGISTICS MARKET: BY SERVICE, 2023-2030 (USD MILLION)

FIGURE 23 NEW ZEALAND HEALTHCARE LOGISTICS MARKET: BY SERVICE, CAGR (2023-2030)

FIGURE 24 NEW ZEALAND HEALTHCARE LOGISTICS MARKET: BY SERVICE, LIFELINE CURVE

FIGURE 25 AUSTRALIA HEALTHCARE LOGISTICS MARKET: BY TEMPERATURE TYPE, 2022

FIGURE 26 AUSTRALIA HEALTHCARE LOGISTICS MARKET: BY TEMPERATURE TYPE, 2023-2030 (USD MILLION)

FIGURE 27 AUSTRALIA HEALTHCARE LOGISTICS MARKET: BY TEMPERATURE TYPE, CAGR (2023-2030)

FIGURE 28 AUSTRALIA HEALTHCARE LOGISTICS MARKET: BY TEMPERATURE TYPE, LIFELINE CURVE

FIGURE 29 NEW ZEALAND HEALTHCARE LOGISTICS MARKET: BY TEMPERATURE TYPE, 2022

FIGURE 30 NEW ZEALAND HEALTHCARE LOGISTICS MARKET: BY TEMPERATURE TYPE, 2023-2030 (USD MILLION)

FIGURE 31 NEW ZEALAND HEALTHCARE LOGISTICS MARKET: BY TEMPERATURE TYPE, CAGR (2023-2030)

FIGURE 32 NEW ZEALAND HEALTHCARE LOGISTICS MARKET: BY TEMPERATURE TYPE, LIFELINE CURVE

FIGURE 33 AUSTRALIA HEALTHCARE LOGISTICS MARKET: BY LOGISTICS TYPE, 2022

FIGURE 34 AUSTRALIA HEALTHCARE LOGISTICS MARKET: BY LOGISTICS TYPE, 2023-2030 (USD MILLION)

FIGURE 35 AUSTRALIA HEALTHCARE LOGISTICS MARKET: BY LOGISTICS TYPE, CAGR (2023-2030)

FIGURE 36 AUSTRALIA HEALTHCARE LOGISTICS MARKET: BY LOGISTICS TYPE, LIFELINE CURVE

FIGURE 37 NEW ZEALAND HEALTHCARE LOGISTICS MARKET: BY LOGISTICS TYPE, 2022

FIGURE 38 NEW ZEALAND HEALTHCARE LOGISTICS MARKET: BY LOGISTICS TYPE, 2023-2030 (USD MILLION)

FIGURE 39 NEW ZEALAND HEALTHCARE LOGISTICS MARKET: BY LOGISTICS TYPE, CAGR (2023-2030)

FIGURE 40 NEW ZEALAND HEALTHCARE LOGISTICS MARKET: BY LOGISTICS TYPE, LIFELINE CURVE

FIGURE 41 AUSTRALIA HEALTHCARE LOGISTICS MARKET: BY APPLICATION, 2022

FIGURE 42 AUSTRALIA HEALTHCARE LOGISTICS MARKET: BY APPLICATION, 2023-2030 (USD MILLION)

FIGURE 43 AUSTRALIA HEALTHCARE LOGISTICS MARKET: BY APPLICATION, CAGR (2023-2030)

FIGURE 44 AUSTRALIA HEALTHCARE LOGISTICS MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 45 NEW ZEALAND HEALTHCARE LOGISTICS MARKET: BY APPLICATION, 2022

FIGURE 46 NEW ZEALAND HEALTHCARE LOGISTICS MARKET: BY APPLICATION, 2023-2030 (USD MILLION)

FIGURE 47 NEW ZEALAND HEALTHCARE LOGISTICS MARKET: BY APPLICATION, CAGR (2023-2030)

FIGURE 48 NEW ZEALAND HEALTHCARE LOGISTICS MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 49 AUSTRALIA HEALTHCARE LOGISTICS MARKET: BY END USER, 2022

FIGURE 50 AUSTRALIA HEALTHCARE LOGISTICS MARKET: BY END USER, 2023-2030 (USD MILLION)

FIGURE 51 AUSTRALIA HEALTHCARE LOGISTICS MARKET: BY END USER, CAGR (2023-2030)

FIGURE 52 AUSTRALIA HEALTHCARE LOGISTICS MARKET: BY END USER, LIFELINE CURVE

FIGURE 53 NEW ZEALAND HEALTHCARE LOGISTICS MARKET: BY END USER, 2022

FIGURE 54 NEW ZEALAND HEALTHCARE LOGISTICS MARKET: BY END USER, 2023-2030 (USD MILLION)

FIGURE 55 NEW ZEALAND HEALTHCARE LOGISTICS MARKET: BY END USER, CAGR (2023-2030)

FIGURE 56 NEW ZEALAND HEALTHCARE LOGISTICS MARKET: BY END USER, LIFELINE CURVE

FIGURE 57 AUSTRALIA HEALTHCARE LOGISTICS MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 58 AUSTRALIA HEALTHCARE LOGISTICS MARKET: BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

FIGURE 59 AUSTRALIA HEALTHCARE LOGISTICS MARKET: BY DISTRIBUTION CHANNEL, CAGR (2023-2030)

FIGURE 60 AUSTRALIA HEALTHCARE LOGISTICS MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 61 NEW ZEALAND HEALTHCARE LOGISTICS MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 62 NEW ZEALAND HEALTHCARE LOGISTICS MARKET: BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

FIGURE 63 NEW ZEALAND HEALTHCARE LOGISTICS MARKET: BY DISTRIBUTION CHANNEL, CAGR (2023-2030)

FIGURE 64 NEW ZEALAND HEALTHCARE LOGISTICS MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 65 AUSTRALIA HEALTHCARE LOGISTICS MARKET: COMPANY SHARE 2022 (%)

FIGURE 66 NEW ZEALAND HEALTHCARE LOGISTICS MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.