Asia Pacific Wound Debridement Devices Market

Taille du marché en milliards USD

TCAC :

%

USD

101.59 Million

USD

155.91 Million

2024

2032

USD

101.59 Million

USD

155.91 Million

2024

2032

| 2025 –2032 | |

| USD 101.59 Million | |

| USD 155.91 Million | |

|

|

|

|

Segmentation du marché des dispositifs de débridement des plaies en Asie-Pacifique, par produit (hydrochirurgical, ultrasons basse fréquence, mécanique, larvothérapie et autres), méthode (autolytique, chirurgicale, enzymatique, mécanique et par asticot), type de plaie (plaies chirurgicales, ulcères diabétiques, brûlures, escarres, ulcères veineux et autres), utilisateur final (hôpitaux, centres de soins des plaies, centres ambulatoires, soins à domicile, cliniques et soins de santé communautaires) - Tendances et prévisions du secteur jusqu'en 2032

Taille du marché des dispositifs de débridement des plaies en Asie-Pacifique

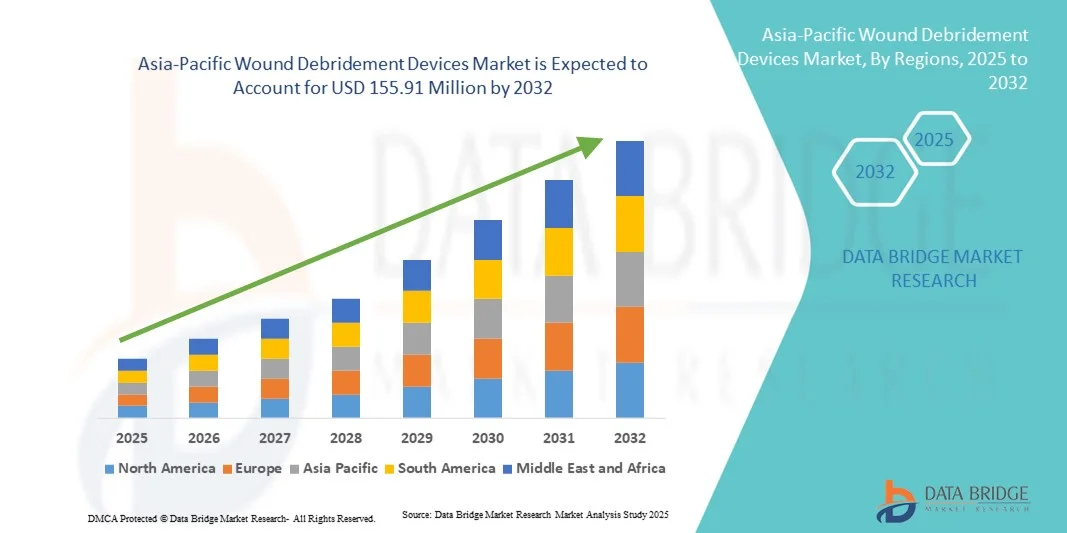

- La taille du marché des dispositifs de débridement des plaies en Asie-Pacifique était évaluée à 101,59 millions USD en 2024 et devrait atteindre 155,91 millions USD d'ici 2032 , à un TCAC de 5,50 % au cours de la période de prévision.

- La croissance du marché est largement alimentée par la prévalence croissante des plaies chroniques, des ulcères diabétiques et des escarres, qui stimulent la demande de solutions avancées de soins des plaies.

- En outre, les progrès réalisés dans les technologies de débridement des plaies, notamment les dispositifs à ultrasons, hydrochirurgicaux et mécaniques, associés à une adoption croissante dans les hôpitaux, les cliniques spécialisées et les établissements de soins à domicile, accélèrent l'adoption de solutions de dispositifs de débridement des plaies, stimulant ainsi considérablement la croissance du secteur.

Analyse du marché des dispositifs de débridement des plaies en Asie-Pacifique

- Les dispositifs de débridement des plaies, notamment les outils mécaniques, enzymatiques, autolytiques et chirurgicaux, sont des éléments de plus en plus essentiels de la gestion moderne des soins des plaies dans les hôpitaux, les cliniques et les établissements de soins à domicile en raison de leur efficacité à éliminer les tissus nécrotiques, à prévenir les infections et à favoriser une guérison plus rapide.

- La demande croissante de dispositifs de débridement des plaies est principalement alimentée par la prévalence croissante des plaies chroniques, du diabète et des escarres, l'adoption croissante de technologies avancées de soins des plaies et la sensibilisation croissante des prestataires de soins de santé aux résultats des patients et au contrôle des infections.

- La Chine a dominé le marché des dispositifs de débridement des plaies en Asie-Pacifique avec la plus grande part de revenus de 41,8 % en 2024, grâce à une infrastructure de soins de santé en expansion rapide, un afflux élevé de patients et des initiatives gouvernementales visant à améliorer la gestion des soins des plaies dans les hôpitaux et les cliniques spécialisées.

- L'Inde devrait être le marché à la croissance la plus rapide dans le secteur des dispositifs de débridement des plaies au cours de la période de prévision, avec un TCAC projeté de 9,5 % de 2025 à 2032, en raison de la prévalence croissante des plaies chroniques, du diabète et des escarres.

- Le segment hydrochirurgical a dominé le marché des dispositifs de débridement des plaies en Asie-Pacifique avec la plus grande part de chiffre d'affaires du marché de 41,6 % en 2024, grâce à sa précision dans l'élimination des tissus nécrotiques tout en préservant les tissus sains, la réduction des saignements pendant les procédures et la compatibilité avec les protocoles avancés de soins des plaies.

Portée du rapport et segmentation du marché des dispositifs de débridement des plaies

|

Attributs |

Informations clés sur le marché des dispositifs de débridement des plaies |

|

Segments couverts |

|

|

Pays couverts |

Asie-Pacifique

|

|

Principaux acteurs du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse approfondie des experts, une analyse des prix, une analyse de la part de marque, une enquête auprès des consommateurs, une analyse démographique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire. |

Tendances du marché des dispositifs de débridement des plaies en Asie-Pacifique

Demande croissante de solutions avancées de soins des plaies

- Une tendance significative et croissante sur le marché des dispositifs de débridement des plaies est l'adoption croissante de technologies avancées de soins des plaies, notamment les outils de débridement mécanisés, les dispositifs à ultrasons et les systèmes hydrochirurgicaux. Ces innovations améliorent significativement les résultats cliniques, réduisent la durée des interventions et améliorent le confort des patients.

- Par exemple, les dispositifs mécanisés de débridement des plaies permettent une élimination précise des tissus nécrotiques tout en minimisant les dommages aux tissus sains environnants, favorisant ainsi une cicatrisation plus rapide et réduisant les risques d'infection. De même, les dispositifs de débridement des plaies par ultrasons assurent une élimination efficace des tissus, tout en favorisant un flux sanguin localisé et en stimulant la régénération tissulaire.

- L'intégration de ces dispositifs aux protocoles hospitaliers de soins des plaies et aux services de soins à domicile améliore l'efficacité globale du traitement et les taux de guérison des patients. La tendance vers des solutions de débridement mini-invasives, conviviales et hautement efficaces redéfinit les attentes en matière de prise en charge des plaies.

- Des entreprises telles que Smith & Nephew, Medline et Mölnlycke lancent des dispositifs innovants dotés d'une ergonomie, d'une portabilité et d'une précision améliorées, accélérant encore leur adoption dans les hôpitaux, les cliniques et les établissements de soins à domicile.

- La demande en dispositifs de débridement des plaies plus avancés, plus efficaces et plus polyvalents augmente rapidement dans les secteurs des soins aigus et de la gestion des plaies chroniques, car les prestataires de soins de santé cherchent à réduire les complications, à améliorer les résultats des patients et à optimiser l'efficacité opérationnelle.

Dynamique du marché des dispositifs de débridement des plaies en Asie-Pacifique

Conducteur

Prévalence croissante des plaies chroniques et augmentation des dépenses de santé

- La prévalence croissante des plaies chroniques, des ulcères diabétiques et des escarres à l'échelle mondiale contribue fortement à la demande croissante de dispositifs de débridement des plaies. Le vieillissement de la population, combiné à une incidence accrue du diabète et des maladies vasculaires, accroît le besoin de solutions efficaces pour le traitement des plaies.

- Par exemple, en avril 2024, Smith & Nephew a lancé un système de débridement hydrochirurgical de nouvelle génération conçu pour un nettoyage rapide et précis des plaies, témoignant de l'investissement croissant d'entreprises clés dans les technologies innovantes. Ces initiatives devraient stimuler la croissance du marché au cours de la période de prévision.

- Les prestataires de soins de santé adoptent de plus en plus de dispositifs de débridement mécanisés et avancés pour réduire les temps de guérison, minimiser les séjours à l'hôpital et améliorer la qualité de vie des patients.

- En outre, l’augmentation des dépenses de santé dans les marchés développés et émergents, ainsi que l’expansion des réseaux hospitaliers et des centres de soins des plaies, favorisent une adoption accrue des dispositifs de débridement des plaies.

- La commodité, l'efficacité clinique et la sécurité offertes par ces dispositifs pour le traitement des plaies complexes sont des facteurs clés de leur adoption dans les hôpitaux, les cliniques spécialisées et les services de soins à domicile. La tendance actuelle vers des pratiques de prise en charge des plaies fondées sur des données probantes soutient la croissance du marché.

Retenue/Défi

Coûts élevés et sensibilisation limitée dans les régions en développement

- Le coût relativement élevé des dispositifs avancés de débridement des plaies par rapport aux méthodes conventionnelles de soins des plaies constitue un frein à leur adoption, notamment dans les régions sensibles aux prix. Ce facteur de coût peut limiter leur déploiement généralisé dans les petites cliniques ou les établissements de santé à faibles ressources.

- La sensibilisation et la formation limitées des professionnels de la santé concernant l’utilisation appropriée des dispositifs de débridement mécanisés et hydrochirurgicaux constituent un autre défi, affectant les taux d’adoption sur certains marchés.

- Relever ces défis grâce à des programmes de formation complets, des campagnes de sensibilisation et le développement de dispositifs plus économiques est essentiel pour développer le marché. Des entreprises leaders comme Medline et Mölnlycke privilégient les initiatives de formation et la simplification de la conception des dispositifs afin d'améliorer l'accessibilité et la convivialité.

- Bien que les prix de certains dispositifs diminuent progressivement, la prime perçue pour la technologie avancée de débridement des plaies peut encore entraver l’adoption, en particulier lorsque les méthodes manuelles traditionnelles sont profondément ancrées.

- Surmonter ces obstacles grâce au soutien au remboursement, aux programmes de sensibilisation et à l’innovation technologique sera essentiel pour une croissance soutenue du marché des dispositifs de débridement des plaies, garantissant une plus grande accessibilité et de meilleurs résultats pour les patients à l’échelle mondiale.

Portée du marché des dispositifs de débridement des plaies en Asie-Pacifique

Le marché est segmenté en fonction du produit, de la méthode, du type de plaie et de l’utilisateur final.

- Par produit

En termes de produits, le marché des dispositifs de débridement des plaies en Asie-Pacifique est segmenté en dispositifs hydrochirurgicaux, à ultrasons basse fréquence, mécaniques, à thérapie larvaire, etc. En 2024, le segment hydrochirurgical a dominé la plus grande part de marché, avec 41,6 %, grâce à sa précision dans l'élimination des tissus nécrotiques tout en préservant les tissus sains, à la réduction des saignements pendant les interventions et à sa compatibilité avec les protocoles avancés de soins des plaies. Les dispositifs hydrochirurgicaux sont largement adoptés dans les hôpitaux et les centres spécialisés en soins des plaies grâce à leur polyvalence dans le traitement des plaies chirurgicales, des brûlures et des ulcères chroniques. Ce segment bénéficie de solides programmes de formation des cliniciens, de recommandations de santé établies et de cadres de remboursement favorables en Asie-Pacifique. La sensibilisation croissante aux techniques mini-invasives de prise en charge des plaies, les améliorations technologiques continues, notamment l'ergonomie, la portabilité améliorée et l'efficacité accrue des procédures, ont renforcé sa position de leader sur le marché. Le segment hydrochirurgical bénéficie également d'un taux d'adoption élevé en raison de son intégration avec les systèmes de dossiers médicaux électroniques et les programmes multidisciplinaires de soins des plaies, ce qui en fait le choix privilégié des cliniciens traitant des cas de plaies complexes dans toute la région Asie-Pacifique.

Le segment de la larothérapie devrait connaître le TCAC le plus rapide, soit 8,5 % entre 2025 et 2032, grâce à l'acceptation croissante de la larothérapie pour le traitement des plaies chroniques et diabétiques résistantes aux thérapies conventionnelles. La larothérapie offre un débridement sélectif, des avantages antimicrobiens et une accélération de la cicatrisation des plaies complexes, ce qui la rend particulièrement adaptée aux soins ambulatoires et à domicile. L'augmentation des preuves cliniques étayant son efficacité, conjuguée à la multiplication des autorisations réglementaires et à la mobilisation des médecins, favorise son adoption. La sensibilisation croissante des patients, la rentabilité de la prise en charge des plaies à long terme et l'intégration dans les parcours de soins multidisciplinaires confortent la larothérapie comme le segment de produits à la croissance la plus rapide en Asie-Pacifique. Cette croissance est également soutenue par des initiatives de formation destinées aux cliniciens, une couverture d'assurance élargie pour les thérapies alternatives et le développement de nouveaux produits améliorant la convivialité et le confort des patients, accélérant ainsi son adoption dans de nombreux contextes de soins.

- Par méthode

En Asie-Pacifique, le marché des dispositifs de débridement des plaies est segmenté en trois catégories : autolytique, chirurgical, enzymatique, mécanique et par asticot. Le segment des méthodes chirurgicales dominait avec une part de marché de 38,9 % en 2024, grâce à son efficacité à éliminer rapidement les tissus dévitalisés des plaies aiguës et complexes. Le débridement chirurgical est privilégié dans les hôpitaux et les centres de soins des plaies en raison de ses résultats immédiats, de son adaptation à divers types de plaies et de son intégration à des outils chirurgicaux de pointe. Sa forte adoption dans les programmes multidisciplinaires de prise en charge des plaies, le respect des recommandations cliniques de la région Asie-Pacifique et la grande confiance des cliniciens contribuent à sa prédominance. Les progrès constants en matière d'instruments de précision, de mesures de sécurité, d'options chirurgicales mini-invasives et de programmes de formation ont renforcé sa position de leader. De plus, le débridement chirurgical bénéficie de résultats rapides, de taux d'infection réduits et d'un meilleur rétablissement des patients, ce qui en fait la méthode privilégiée pour les plaies aiguës et les cas post-chirurgicaux en Asie-Pacifique.

Le segment des méthodes autolytiques devrait connaître le TCAC le plus rapide, soit 7,8 %, entre 2025 et 2032, grâce à son approche non invasive qui utilise les enzymes naturelles de l'organisme pour liquéfier les tissus nécrosés. Le débridement autolytique est privilégié en soins à domicile et en ambulatoire en raison de sa facilité d'utilisation, de sa douleur minimale et de son risque réduit de complications. La sensibilisation croissante des patients et des soignants, ainsi que le développement de pansements avancés optimisant les processus autolytiques, stimulent son adoption. La demande croissante de soins des plaies rentables, sûrs et conviviaux, ainsi que l'intégration à la télémédecine et au suivi à domicile, accélèrent encore la croissance de ce segment. L'intérêt croissant pour les soins préventifs, l'intervention précoce pour les plaies chroniques et les programmes de formation dispensés par des cliniciens favorisent l'adoption du débridement autolytique en Asie-Pacifique.

- Par type de plaie

En fonction du type de plaie, le marché des dispositifs de débridement des plaies en Asie-Pacifique est segmenté en plaies chirurgicales, ulcères diabétiques, brûlures, escarres, ulcères veineux, etc. Le segment des ulcères diabétiques dominait le marché avec une part de 36,7 % en 2024, en raison de la forte prévalence du diabète en Asie-Pacifique et de la complexité de ces plaies chroniques. Les ulcères diabétiques nécessitent des approches de débridement spécialisées, une surveillance fréquente et une prise en charge multidisciplinaire. Les hôpitaux et les centres de soins des plaies jouent un rôle clé dans le traitement des ulcères diabétiques, soutenus par les initiatives gouvernementales en matière de santé, les recommandations cliniques et la couverture des assurances. Ce segment bénéficie également de technologies de pointe telles que les appareils hydrochirurgicaux et à ultrasons basse fréquence adaptés aux plaies diabétiques. La formation continue des cliniciens, les programmes d'éducation des patients et les stratégies proactives de prise en charge des plaies renforcent la prédominance des ulcères diabétiques. De plus, les innovations en matière de pansements et de surveillance en temps réel contribuent à l'efficacité des soins et à la réduction des risques de complications, maintenant ainsi le leadership du segment.

Le segment des escarres devrait connaître le TCAC le plus rapide, soit 8,1 %, entre 2025 et 2032, sous l'effet du vieillissement de la population, de la prolongation des séjours hospitaliers et d'une sensibilisation croissante à la prévention et à la prise en charge des escarres. L'adoption de techniques de débridement avancées, l'intégration de dispositifs de soulagement de la pression et les programmes de soins multidisciplinaires contribuent à la croissance rapide du marché. L'augmentation des dépenses de santé, la demande croissante de solutions de soins à domicile et les protocoles hospitaliers privilégiant l'intervention précoce accélèrent encore l'expansion de ce segment. Ce segment bénéficie également de la télésurveillance et des outils numériques d'évaluation des plaies qui facilitent les interventions rapides et améliorent les résultats des patients, ce qui en fait le segment des plaies à la croissance la plus rapide en Asie-Pacifique.

- Par utilisateur final

En fonction de l'utilisateur final, le marché des dispositifs de débridement des plaies en Asie-Pacifique est segmenté en hôpitaux, centres de soins des plaies, centres ambulatoires, soins à domicile, cliniques et soins de proximité. Le segment hospitalier dominait avec une part de marché de 42,9 % en 2024, grâce à la disponibilité de technologies de débridement avancées, à la compétence des cliniciens et à un afflux important de patients pour les plaies complexes et aiguës. Les hôpitaux restent les principaux centres de débridement chirurgical et hydrochirurgical grâce à des infrastructures robustes, au respect des recommandations cliniques et à l'intégration dans des programmes de soins multidisciplinaires. Le développement des unités de soins des plaies avancées, la formation de personnel spécialisé et les initiatives gouvernementales en matière de santé renforcent encore la domination des hôpitaux. Les hôpitaux bénéficient également d'équipes dédiées à la prise en charge des plaies, d'un accès aux dispositifs les plus récents et de chaînes d'approvisionnement bien établies, ce qui maintient une satisfaction élevée des patients et des taux de réutilisation.

Le segment des soins à domicile devrait connaître le TCAC le plus rapide, soit 9,0 % entre 2025 et 2032, grâce à la demande croissante de soins ambulatoires des plaies, à la prévalence croissante des plaies chroniques et à la rentabilité des interventions à domicile. La disponibilité d'appareils de débridement portables, l'éducation des patients et la télémédecine permettent une gestion efficace des soins à domicile. La préférence croissante des patients pour des soins des plaies personnalisés et pratiques, associée aux politiques de remboursement et aux technologies de télésurveillance, accélère l'adoption, faisant des soins à domicile le segment d'utilisateurs finaux connaissant la croissance la plus rapide en Asie-Pacifique. Le développement des prestataires de services de soins à domicile et l'intégration aux plateformes numériques soutiennent également cette croissance.

Analyse régionale du marché des dispositifs de débridement des plaies en Asie-Pacifique

- La Chine a dominé le marché des dispositifs de débridement des plaies en Asie-Pacifique avec la plus grande part de revenus de 41,8 % en 2024, grâce à une infrastructure de soins de santé en expansion rapide, un afflux élevé de patients et des initiatives gouvernementales visant à améliorer la gestion des soins des plaies dans les hôpitaux et les cliniques spécialisées.

- L'Inde devrait être le marché à la croissance la plus rapide dans le secteur des dispositifs de débridement des plaies au cours de la période de prévision, avec un TCAC projeté de 9,5 % de 2025 à 2032, en raison de la prévalence croissante des plaies chroniques, du diabète et des escarres.

- L'accessibilité financière des dispositifs de pointe, les initiatives gouvernementales pour la prise en charge des maladies chroniques et la numérisation des soins de santé favorisent l'expansion du marché. L'afflux croissant de patients, la hausse des dépenses de santé et l'expansion des réseaux de soins privés contribuent à cette croissance rapide.

Aperçu du marché chinois des dispositifs de débridement des plaies

Le marché chinois des dispositifs de débridement des plaies a dominé le marché avec une part de chiffre d'affaires de 41,8 % en 2024, portée par une infrastructure de santé en pleine expansion, un afflux important de patients et des initiatives gouvernementales visant à améliorer la gestion des plaies dans les hôpitaux et les cliniques spécialisées. La prévalence croissante des plaies chroniques, des ulcères diabétiques, des brûlures et des escarres nécessite une utilisation généralisée de dispositifs de traitement des plaies avancés. Les fabricants chinois sont leaders dans la production de dispositifs hydrochirurgicaux, à ultrasons basse fréquence et de débridement mécanique, rendant ainsi des solutions de haute qualité largement accessibles. Le développement des réseaux hospitaliers, des centres spécialisés dans le traitement des plaies et des services de soins à domicile favorise une adoption robuste. La sensibilisation croissante des professionnels de santé, l'intégration des dispositifs dans les protocoles cliniques et les programmes gouvernementaux de prise en charge des maladies chroniques renforcent la domination du marché. De plus, les investissements en recherche et développement, ainsi que la disponibilité de dispositifs rentables, stimulent davantage la croissance du marché. L'accent mis par la Chine sur la modernisation des infrastructures de santé, l'augmentation des capacités hospitalières et l'amélioration des protocoles de traitement des plaies consolide sa position de premier marché en Asie-Pacifique.

Aperçu du marché indien des dispositifs de débridement des plaies

Le marché indien des dispositifs de débridement des plaies devrait connaître la croissance la plus rapide, avec un TCAC prévu de 9,5 % entre 2025 et 2032, porté par la prévalence croissante des plaies chroniques, des ulcères diabétiques, des brûlures et des escarres. Le développement des infrastructures hospitalières, la multiplication des centres de soins des plaies et le développement des services de soins à domicile sont des moteurs clés de l'adoption de ces dispositifs. Les initiatives gouvernementales visant à améliorer la prise en charge des maladies chroniques et le soutien aux dispositifs médicaux modernes accélèrent encore la croissance. La sensibilisation croissante des professionnels de santé et des patients aux technologies avancées de traitement des plaies, telles que les appareils hydrochirurgicaux et à ultrasons basse fréquence, favorise la pénétration du marché. La disponibilité croissante de solutions rentables proposées par les fabricants nationaux facilite leur adoption. Les services de soins ambulatoires des plaies et les solutions de télémédecine contribuent à la commodité et à l'efficacité de la prise en charge des patients. Les programmes de formation des cliniciens, ainsi que les collaborations entre les hôpitaux et les fournisseurs de dispositifs, garantissent des soins de haute qualité. Par ailleurs, l'urbanisation, la hausse des revenus disponibles et le développement du secteur privé de la santé soutiennent la croissance rapide du marché indien, en faisant le segment à la croissance la plus rapide en Asie-Pacifique.

Part de marché des dispositifs de débridement des plaies en Asie-Pacifique

L’industrie des dispositifs de débridement des plaies est principalement dirigée par des entreprises bien établies, notamment :

- Smith+Neveu (Royaume-Uni)

- Medtronic (Irlande)

- Zimmer Biomet (États-Unis)

- Integra LifeSciences Corporation (États-Unis)

- Abbott (États-Unis)

- B. Braun SE (Allemagne)

- Mölnlycke Health Care AB (Suède)

- Groupe Coloplast (Danemark)

- Organogenesis Inc. (États-Unis)

- Bioventus LLC. (États-Unis)

- Hollister Incorporated (États-Unis)

- Lohmann & Rauscher GmbH & Co. KG (Allemagne)

- Essity Aktiebolag (Suède)

- Advanced Medical Solutions Group plc (Royaume-Uni)

- DeRoyal Industries, Inc. (États-Unis)

- Italia Medica SRL (Italie)

- Söring GmbH (Allemagne)

- Olympus Corporation (Japon)

Derniers développements sur le marché des dispositifs de débridement des plaies en Asie-Pacifique

- En octobre 2022, Reprise Biomedical a annoncé le lancement aux États-Unis de Miro3D, une matrice résorbable tridimensionnelle conçue pour le traitement des plaies profondes et tunnelisées. Cette matrice biologique vise à améliorer la cicatrisation en apportant un soutien structurel et en favorisant la régénération tissulaire des plaies complexes.

- En février 2023, des chercheurs ont mis au point le premier bandage électronique flexible et extensible capable d'accélérer la cicatrisation de 30 %. Ce bandage délivre l'électrothérapie directement sur la plaie et se biodégrade une fois la cicatrisation terminée, ce qui représente une avancée majeure dans le traitement des plaies.

- En septembre 2024, Solventum a lancé le pansement VAC Peel and Place, un pansement et un champ opératoire intégrés, applicables en moins de deux minutes et portés jusqu'à sept jours. Cette innovation vise à simplifier l'application et à améliorer le confort du patient lors du traitement des plaies par pression négative.

- En mai 2025, Summit Products Group a officiellement lancé son activité et annoncé une alliance stratégique avec NovaBone Products, leader dans le développement de biomatériaux pour la médecine régénérative. Cette collaboration vise à transformer les soins chirurgicaux et régénératifs des plaies en offrant aux professionnels de santé de nouvelles options chirurgicales conçues pour favoriser la précision et la régénération au bloc opératoire.

- En septembre 2025, le projet WOTAD (Woundcare Offloading Through Automated Debridement) a été lancé au Danemark. Ce projet vise à développer, produire et tester un robot pour le débridement entièrement automatique des plaies chroniques. Le robot Flash-Clean offrira un traitement à l'eau et au laser, offrant une alternative plus douce au débridement chirurgical et potentiellement accélérant la cicatrisation.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.