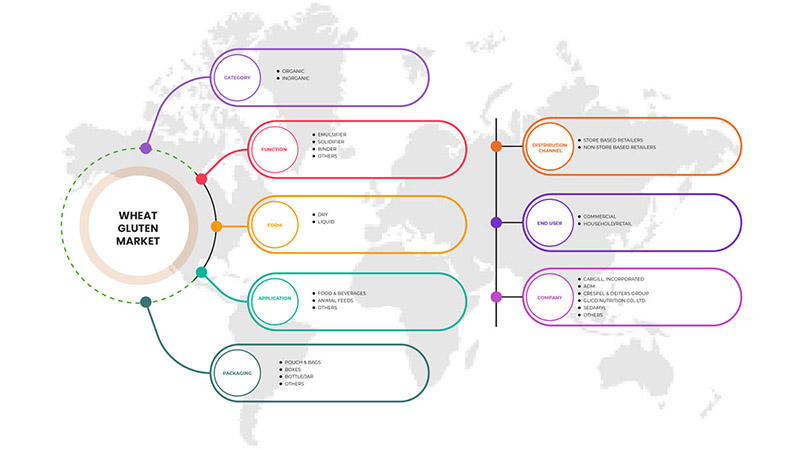

Marché du gluten de blé en Asie-Pacifique, par catégorie (biologique et inorganique), fonction (émulsifiant, solidifiant, liant et autres), forme (liquide et sec), application ( aliments et boissonsaliments pour animaux et autres), emballage (bouteille/pot, pochette et sacs, boîtes et autres), canal de distribution (détaillants en magasin et détaillants hors magasin), utilisateur final (ménage/détail et commercial) - Tendances et prévisions de l'industrie jusqu'en 2029.

Analyse et perspectives du marché du gluten de blé en Asie-Pacifique

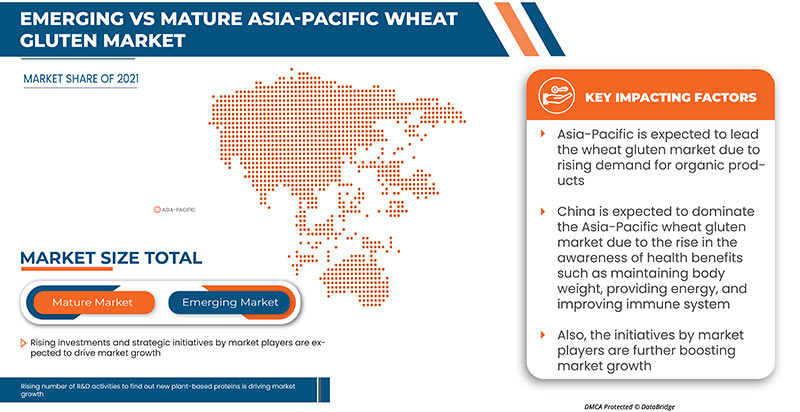

La prise de conscience croissante des bienfaits des protéines végétales, la demande croissante de produits biologiques et les initiatives des acteurs du marché offrent des opportunités au marché. Cependant, l'augmentation des coûts de production et de fabrication, la sensibilité au gluten et les réactions auto-immunes chez les personnes constituent les principaux défis à la croissance du marché.

Le marché du gluten de blé en Asie-Pacifique connaît une croissance au cours de l'année de prévision en raison de l'augmentation du nombre d'acteurs sur le marché et de la disponibilité de diverses alternatives à la viande à base de plantes sur le marché. Parallèlement à cela, le nombre d'activités de R&D visant à découvrir de nouvelles protéines à base de plantes a augmenté sur le marché, ce qui stimule encore davantage la croissance du marché. Cependant, l'augmentation des cas de troubles héréditaires et chroniques dus à l'intolérance au gluten pourrait entraver la croissance du marché au cours de la période de prévision.

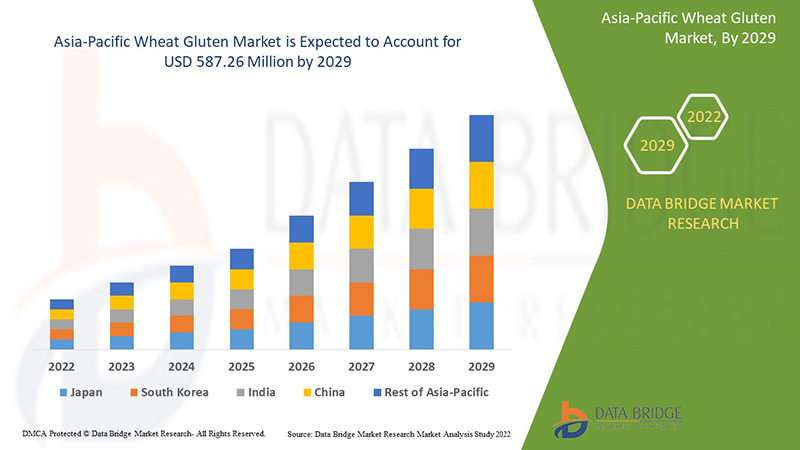

Le marché du gluten de blé en Asie-Pacifique devrait connaître une croissance du marché au cours de la période de prévision de 2022 à 2029. Data Bridge Market Research analyse que le marché croît avec un TCAC de 6,5 % au cours de la période de prévision de 2022 à 2029 et devrait atteindre 587,26 millions USD d'ici 2029.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Année historique |

2020 (personnalisable de 2014 à 2019) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD |

|

Segments couverts |

Par catégorie (organique et inorganique), fonction (émulsifiant, solidifiant, liant et autres), forme (liquide et sec), application (aliments et boissons, aliments pour animaux et autres), emballage (bouteille/pot, sachet et sacs, boîtes et autres), canal de distribution (détaillants en magasin et détaillants hors magasin), utilisateur final (ménage/détail et commercial) |

|

Pays couverts |

Chine, Japon, Inde, Corée du Sud, Australie, Singapour, Thaïlande, Malaisie, Indonésie, Philippines, Vietnam, Nouvelle-Zélande et reste de l'Asie-Pacifique |

|

Acteurs du marché couverts |

Cargill, Incorporated, ADM, Crespel & Deiters Group, Glico Nutrition Co., Ltd., Sedamyl, Manildra Group, MGP, Roquette Frères, CropEnergies AG, Anhui Ante Food Co., Ltd., ARDENT MILLS, Bryan W Nash and Sons, Pioneer Industries Private Limited, Henan Tianguan Group Co. Ltd, Permolex, Meelunie BV, Mühlenchemie GmbH & Co. KG, Royal Ingredients Group, Kröner Stärke et z&f sungold corporation, entre autres |

Définition du marché

Le gluten de blé est également connu sous le nom de seitan, viande de blé, viande de gluten ou gluten. Le gluten de blé est une protéine naturellement présente dans le blé ou la farine de blé. Il est fabriqué en lavant la pâte de farine de blé dans de l'eau jusqu'à ce que tous les grains d'amidon soient éliminés. La poudre de gluten de blé est fabriquée en hydratant la farine de blé dur pour activer le gluten. Après cela, la masse hydratée est traitée pour éliminer l'amidon tout en laissant le gluten derrière. Enfin, le gluten est séché et réduit en poudre. Certaines variétés de gluten ont une texture filandreuse ou moelleuse semblable à celle de la viande.

Dynamique du marché du gluten de blé en Asie-Pacifique

Conducteurs

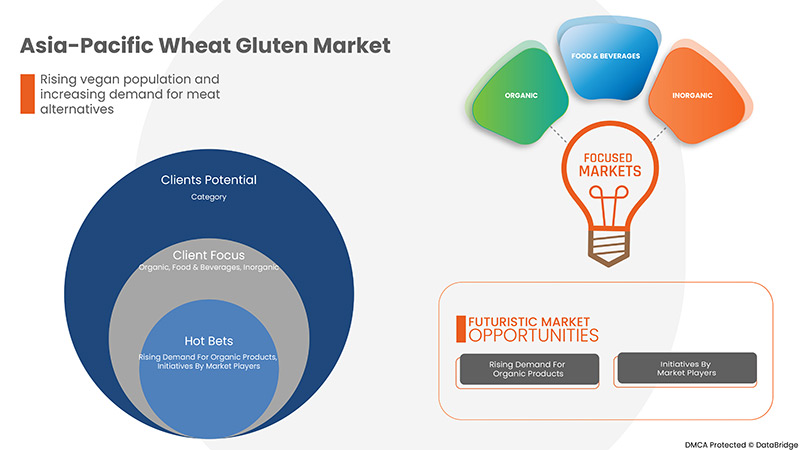

- Augmentation de la population végétalienne et demande croissante d'alternatives à la viande

Le gluten est une protéine naturellement présente dans certaines céréales comme le blé, l'orge et le seigle. Les glutens de blé sont constitués de fractions protéiques de gliadines et de gluténines. Les gliadines contiennent une chaîne polypeptidique unique associée à des liaisons hydrogène, des liaisons hydrophobes et des interactions disulfures intramoléculaires tandis que les gluténines contiennent des interactions disulfures intermoléculaires. Le gluten de blé et l'amidon de blé sont des coproduits économiquement importants produits lors du traitement humide de la farine de blé. Le gluten de blé est un ingrédient alimentaire de base et ses applications se situent principalement dans les produits de boulangerie et les produits carnés transformés. Il possède des propriétés uniques telles que, lorsqu'il est hydraté et mélangé, il forme une structure très extensible et élastique qui est responsable de la capacité de rétention de gaz de la pâte à pain. Il peut être utilisé en combinaison avec de la farine de blé et d'autres additifs pour produire un produit texturé sans soja.

La population végétalienne augmente dans le monde entier et la demande d'alternatives à la viande augmente également. Les gens sont de plus en plus conscients des bienfaits des protéines végétales pour la santé et se tournent vers un mode de vie végétalien où le gluten de blé peut servir d'alternative à la viande.

- Préférence croissante des consommateurs pour les régimes riches en protéines

La plupart des consommateurs préfèrent les régimes riches en protéines pour plusieurs raisons. En voici quelques-unes : les protéines sont les éléments constitutifs du corps humain et des muscles ; elles sont vitales pour les activités du corps et du cerveau ; elles sont importantes pour une vie saine et active. Le gluten est l'un des aliments riches en protéines qui peuvent être extraits du blé. Le gluten a une teneur élevée en protéines ainsi qu'en vitamines et minéraux tels que des antioxydants, des fibres, de la vitamine B, de la vitamine E, du magnésium, du fer, de l'acide folique et d'autres.

En outre, ces dernières années, les régimes et produits riches en protéines ont eu un impact réel sur la nutrition et ont transformé l'attitude des consommateurs à l'égard des protéines dans leur alimentation, car une alimentation adéquate est un aspect important d'un mode de vie sain pour tous les individus. Diverses études ont montré les bienfaits des protéines végétales pour la santé et la sensibilisation du public s'est accrue. En conséquence, les consommateurs préfèrent les régimes riches en protéines.

- Augmentation du nombre d'activités de R&D pour découvrir de nouvelles protéines végétales

La demande de régimes riches en protéines augmente de plus en plus chez les gens et, par conséquent, le nombre de recherches visant à découvrir les protéines a augmenté. Les protéines d'origine animale étant à l'origine de la plupart des risques pour la santé, les gens se tournent progressivement vers un mode de vie végétalien, partout dans le monde. Les protéines d'origine végétale sont riches en vitamines et en minéraux et présentent de grands avantages pour la santé, selon des études récentes. Le gluten de blé est l'une des protéines végétales utilisées comme alternative à la viande et comme régime riche en protéines par la plupart des gens dans le monde.

La majorité de la population humaine préfère les régimes riches en protéines d'origine végétale en raison de plusieurs avantages pour la santé et pour surmonter les maladies causées par la consommation de régimes à base de protéines animales. Ainsi, le nombre de recherches et développements augmente pour découvrir de nouvelles protéines végétales de diverses manières pour répondre à la demande.

Opportunités

-

Prise de conscience croissante des bienfaits des protéines végétales

Divers produits à base de protéines végétales sont disponibles sur le marché en raison de l'évolution des préférences gustatives des consommateurs. L'un d'entre eux est le gluten de blé et ses produits, qui sont très demandés. Le marché des protéines végétales telles que le gluten de blé connaît une forte demande et une forte croissance dans les boulangeries, les boissons fonctionnelles et autres aliments. Les protéines végétales sont facilement disponibles en raison de leur large utilisation dans diverses industries. Le gluten de blé est utilisé dans divers produits tels que les produits d'alimentation animale qui aident à minimiser la dépendance des agriculteurs aux sources traditionnelles de protéines. Le gluten de blé et les produits à base de protéines végétales contiennent plusieurs nutriments et sont infusés de protéines et d'arômes. La sensibilisation croissante aux modes de vie sains et à la gestion de la perte de poids, ainsi que la demande de barres protéinées à base de plantes parmi les consommateurs.

Par conséquent, la demande de gluten de blé dans divers produits constituera une opportunité de croissance du marché. Parallèlement, le gluten de blé est utilisé dans les produits gazeux pour rehausser les saveurs ajoutées.

-

Demande croissante de produits biologiques

La demande de produits biologiques augmente à grande vitesse. Les ingrédients alimentaires biologiques tels que les protéines végétales constituent une alternative protéinée parfaite à la viande ou à d’autres produits non végétariens que les consommateurs peuvent consommer quotidiennement. Tous les acides aminés essentiels et les fibres élevées présents dans les produits biologiques en font un substitut idéal aux protéines animales.

La demande d'ingrédients biologiques dans le gluten de blé et ses produits est due aux régimes alimentaires car ils présentent divers avantages pour la santé tels qu'un faible risque de diabète, une digestibilité facile, une bonne santé cardiovasculaire et d'autres. La sensibilisation croissante des consommateurs aux avantages pour la santé offerts par les ingrédients biologiques tels que les protéines végétales a augmenté la demande de produits alimentaires et de boissons.

Contraintes/Défis

- Augmentation des coûts de production et de fabrication

Le gluten de blé a ouvert la voie à l'amélioration et au soutien de la santé, ce qui joue un rôle majeur dans l'industrie alimentaire et des boissons. Mais d'un autre côté, il a entraîné des coûts importants liés à sa production et à sa fabrication.

Dans certains pays du monde, le gluten de blé est considéré comme une solution au problème du maintien d'un mode de vie sain. Cependant, sa fabrication et sa production sont confrontées à une multitude de défis tels qu'une main-d'œuvre intensive, une quantité croissante de matières premières et la nécessité d'une production plus rapide en raison de la demande accrue. Ces exigences doivent être satisfaites de manière efficace et efficiente. Le gluten de blé nécessite un investissement en capital élevé pour maintenir la R&D. Les nouvelles machines et équipements comprennent de nombreux essais pour tester le fonctionnement, ce qui entraîne des investissements en capital élevés pour les petites et moyennes entreprises.

- Augmentation des cas de maladies héréditaires et chroniques dues à l'intolérance au gluten

Le gluten est un type de protéine extraite du blé et d’autres céréales. Il existe de nombreux cas d’intolérance au gluten. Il existe plusieurs causes potentielles d’intolérance au gluten, notamment la maladie cœliaque, la sensibilité au gluten non cœliaque et l’allergie au blé. Ces trois formes d’intolérance au gluten peuvent provoquer des symptômes généralisés. La maladie cœliaque est la forme la plus grave d’intolérance au gluten. Il s’agit d’une maladie auto-immune qui touche environ 1 % de la population et peut entraîner des lésions du système digestif. Elle peut provoquer un large éventail de symptômes, notamment des problèmes de peau, des problèmes gastro-intestinaux, des changements d’humeur, etc. Les symptômes courants associés à la maladie non cœliaque sont les ballonnements, les maux de tête, les douleurs d’estomac, la fatigue, la diarrhée et la constipation, entre autres. De même, les symptômes associés à l’allergie au blé sont les éruptions cutanées, les problèmes digestifs, la congestion nasale et l’anaphylaxie, entre autres.

En raison de l’impact de l’intolérance au gluten, plusieurs troubles, notamment la maladie cœliaque, la maladie non cœliaque et les allergies au blé, sont causés, et sont chroniques et héréditaires dans certains cas.

Impact post-COVID-19 sur le marché du gluten de blé en Asie-Pacifique

La COVID-19 a eu un impact négatif sur le marché du gluten de blé en Asie-Pacifique. Les confinements et l'isolement pendant la pandémie ont entraîné la fermeture de la plupart des magasins et l'approvisionnement en protéines végétales a été davantage affecté. Les achats en ligne d'alternatives à la viande végétale ont augmenté. La COVID-19 a donc eu un impact négatif sur le marché.

Développements récents

- En janvier 2022, ADM a annoncé l'ouverture de son premier centre scientifique et technologique en Chine pour établir son développement de haute qualité dans le secteur de la nutrition et de la santé. Cela a aidé l'entreprise à fournir de meilleurs services aux consommateurs grâce à de telles innovations au sein de l'organisation.

- En avril 2021, MGP a annoncé l'acquisition de Luxco Printers. L'acquisition englobe le portefeuille de sociétés de boissons alcoolisées dans diverses catégories. Cette acquisition a aidé l'entreprise à élargir son segment et son portefeuille de produits.

Portée du marché du gluten de blé en Asie-Pacifique

Le marché du gluten de blé en Asie-Pacifique est segmenté en sept segments notables en fonction de la catégorie, de la fonction, de la forme, de l'application, de l'emballage, du canal de distribution et de l'utilisateur final. La croissance parmi ces segments vous aidera à analyser les segments de croissance limités dans les industries et fournira aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Par catégorie

- Organique

- Inorganique

En fonction de la catégorie, le marché est segmenté en organique et inorganique

Par fonction

- Émulsifiant

- Solidifiant

- Liant

- Autres

En fonction de la fonction, le marché est segmenté en émulsifiant, solidifiant, liant et autres

Par formulaire

- Liquide

- Sec

En fonction de la forme, le marché est segmenté en liquide et sec

Par application

- Alimentation et boissons

- Alimentation animale

- Autres

En fonction des applications, le marché est segmenté en aliments et boissons, aliments pour animaux et autres

Par emballage

- Bouteille/Pot

- Pochettes et sacs

- Boîtes

- Autres

En fonction de l'emballage, le marché est segmenté en bouteilles/pots, sachets et sacs, boîtes et autres

Par canal de distribution

- Détaillants en magasin

- Détaillants non basés dans des magasins

En fonction du canal de distribution, le marché est segmenté en détaillants en magasin et en détaillants hors magasin.

Par utilisateur final

- Ménage/Commerce de détail

- Commercial

En fonction de l'utilisateur final, le marché est segmenté en ménages/vente au détail et commerce

Analyse/perspectives régionales du marché du gluten de blé en Asie-Pacifique

Le marché du gluten de blé en Asie-Pacifique est analysé et des informations sur la taille du marché et les tendances sont fournies par pays, catégorie, fonction, forme, application, emballage, canal de distribution et utilisateur final.

Le marché du gluten de blé de la région Asie-Pacifique comprend la Chine, le Japon, l'Inde, la Corée du Sud, l'Australie, Singapour, la Thaïlande, la Malaisie, l'Indonésie, les Philippines, le Vietnam, la Nouvelle-Zélande et le reste de la région Asie-Pacifique. La Chine domine le marché du gluten de blé de la région Asie-Pacifique en termes de part de marché et de chiffre d'affaires et continuera à accroître sa domination au cours de la période de prévision.

La prise de conscience croissante des bienfaits des protéines végétales alimente encore davantage la croissance du marché. En outre, la demande croissante de produits biologiques et les initiatives des acteurs du marché stimulent également la croissance du marché.

Analyse du paysage concurrentiel et des parts de marché du gluten de blé en Asie-Pacifique

Le paysage concurrentiel du marché du gluten de blé en Asie-Pacifique fournit des détails par concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements en R&D, les nouvelles initiatives du marché, la présence en Asie-Pacifique, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit et la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises sur le marché.

Certains des principaux acteurs opérant sur le marché du gluten de blé en Asie-Pacifique sont Cargill, Incorporated, ADM, Crespel & Deiters Group, Glico Nutrition Co., Ltd., Sedamyl, Manildra Group, MGP, Roquette Frères, CropEnergies AG, Anhui Ante Food Co., Ltd., ARDENT MILLS, Bryan W Nash and Sons, Pioneer Industries Private Limited, Henan Tianguan Group Co. Ltd, Permolex, Meelunie BV, Mühlenchemie GmbH & Co. KG, Royal Ingredients Group, Kröner Stärke et z&f sungold corporation, entre autres.

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. Les données du marché sont analysées et estimées à l'aide de modèles statistiques et cohérents du marché. En outre, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. La principale méthodologie de recherche utilisée par l'équipe de recherche DBMR est la triangulation des données, qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). En dehors de cela, les modèles de données comprennent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement de l'entreprise, l'analyse des parts de marché des entreprises, les normes de mesure, l'Asie-Pacifique par rapport à la région et l'analyse des parts des fournisseurs. Veuillez demander un appel d'analyste en cas de demande de renseignements supplémentaires.

Personnalisation disponible

Data Bridge Market Research est un leader dans la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, le marché des produits remis à neuf et une analyse de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC WHEAT GLUTEN MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 CATEGORY LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PATENT ANALYSIS OF ASIA PACIFIC WHEAT GLUTEN MARKET

4.2 CONSUMER BUYING BEHAVIOR

4.3 BRAND ANALYSIS

4.4 ASIA PACIFIC WHEAT GLUTEN MARKET SUPPLY CHAIN ANALYSIS

4.4.1 RAW MATERIAL PROCUREMENT

4.4.2 MANUFACTURING

4.4.3 TRANSPORTATION OR LOGISTICS

4.4.4 MARKETING AND DISTRIBUTION

4.4.5 END-USER

4.5 ASIA PACIFIC WHEAT GLUTEN MARKET UPCOMING TECHNOLOGIES AND TRENDS

4.5.1 CRISPR/CAS9 GENE EDITING OF GLUTEN IN WHEAT

4.5.2 RNA INTERFERENCE IN WHEAT GLUTEN

4.5.3 COLD ETHANOL TECHNOLOGY

5 REGULATORY FRAMEWORK

5.1 FDA

5.1.1 REGULATIONS ON ALLERGEN LABELING

5.2 EUROPEAN UNION (EU)

5.3 REGULATIONS IN INDIA

5.3.1 FSSAI PROPOSES STANDARDS RELATING TO GLUTEN AND NON-GLUTEN FOODS

5.4 REGULATIONS IN CHINA

5.5 REGULATIONS IN THE U.S.

5.6 REGULATIONS IN CANADA

5.7 REGULATIONS IN THAILAND

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING VEGAN POPULATION AND INCREASING DEMAND FOR MEAT-ALTERNATIVES

6.1.2 RISING PREFERENCE OF CONSUMERS TOWARDS HIGH PROTEIN-RICH DIETS

6.1.3 RISING NUMBER OF RESEARCH AND DEVELOPMENT ACTIVITIES TO FIND OUT NEW PLANT-BASED PROTEINS

6.2 RESTRAINTS

6.2.1 RISING CASES OF HEREDITARY AND CHRONIC DISORDERS DUE TO GLUTEN INTOLERANCE

6.2.2 HIGHER COST OF PLANT-BASED PROTEINS

6.3 OPPORTUNITIES

6.3.1 GROWING AWARENESS REGARDING THE BENEFITS OF PLANT-BASED PROTEINS

6.3.2 RISING DEMAND FOR ORGANIC PRODUCTS

6.3.3 INITIATIVES BY MARKET PLAYERS

6.4 CHALLENGES

6.4.1 INCREASED COST OF PRODUCTION AND MANUFACTURING

6.4.2 RISING PREVALENCE OF DISEASES

6.4.3 GLUTEN SENSITIVITY AND AUTOIMMUNE REACTIONS IN PEOPLE

7 ASIA PACIFIC WHEAT GLUTEN MARKET, BY CATEGORY

7.1 OVERVIEW

7.2 ORGANIC

7.3 INORGANIC

8 ASIA PACIFIC WHEAT GLUTEN MARKET, BY FUNCTION

8.1 OVERVIEW

8.2 BINDER

8.3 EMULSIFIER

8.4 SOLIDIFIER

8.5 OTHERS

9 ASIA PACIFIC WHEAT GLUTEN, BY FORM

9.1 OVERVIEW

9.2 DRY

9.3 LIQUID

10 ASIA PACIFIC WHEAT GLUTEN MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 FOOD & BEVERAGES

10.2.1 BAKERY & CONFECTIONARY PRODUCTS

10.2.1.1 CAKES, MUFFINS & DOUGHNUTS

10.2.1.2 BREADS

10.2.1.3 COOKIES, CRACKERS

10.2.1.4 PIE CRUSTS & PIZZA DOUGH

10.2.1.5 BATTER

10.2.1.6 OTHERS

10.2.2 CONVENIENCE FOOD

10.2.2.1 NOODLES AND PASTA

10.2.2.2 SOUPS & SAUCES

10.2.2.3 SEASONING & DRESSING

10.2.2.4 SNACKS & EXTRUDED SNACKS

10.2.2.5 READY TO EAT MEALS

10.2.2.6 OTHERS

10.2.3 MEAT ANALOGUES

10.2.4 SPORTS NUTRITION

10.2.5 BREAKFAST CEREALS

10.2.6 MEAT & POULTRY PRODUCTS

10.2.7 NUTRITIONAL BARS

10.2.8 BEVERAGES

10.2.9 OTHERS

10.3 ANIMAL FEED

10.3.1 PET FOOD

10.3.2 RUMINANT

10.3.3 SWINE

10.3.4 POULTRY

10.3.5 OTHERS

10.4 OTHERS

11 ASIA PACIFIC WHEAT GLUTEN MARKET, BY PACKAGING

11.1 OVERVIEW

11.2 POUCH & BAGS

11.3 BOXES

11.4 BOTTLE/JAR

11.4.1 PLASTIC

11.4.2 GLASS

11.4.3 METAL

11.4.4 PAPER

11.5 OTHERS

12 ASIA PACIFIC WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 STORE BASED RETAILERS

12.2.1 HYPERMARKETS/SUPER MARKETS

12.2.2 CONVENIENCE STORES

12.2.3 GROCERY STORES

12.2.4 SPECIALITY STORES

12.2.5 OTHERS

12.3 NON-STORE BASED RETAILERS

13 ASIA PACIFIC WHEAT GLUTEN MARKET, BY END USER

13.1 OVERVIEW

13.2 COMMERCIAL

13.2.1 BAKERY STORES

13.2.2 RESTAURANTS AND CAFES

13.2.3 HOTELS

13.2.4 CLOUD KITCHEN

13.2.5 OTHERS

13.3 HOUSEHOLD/RETAIL

14 ASIA PACIFIC WHEAT GLUTEN MARKET, BY REGION

14.1 ASIA-PACIFIC

14.1.1 CHINA

14.1.2 AUSTRALIA

14.1.3 INDIA

14.1.4 JAPAN

14.1.5 SOUTH KOREA

14.1.6 THAILAND

14.1.7 VIETNAM

14.1.8 MALAYSIA

14.1.9 SINGAPORE

14.1.10 INDONESIA

14.1.11 PHILIPPINES

14.1.12 NEW ZEALAND

14.1.13 REST OF ASIA-PACIFIC

15 ASIA PACIFIC WHEAT GLUTEN MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 CARGILL, INCORPORATED

17.1.1 COMPANY SNAPSHOT

17.1.2 COMPANY SHARE ANALYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT DEVELOPMENT

17.2 ADM

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENT

17.3 CRESPEL & DEITERS GROUP

17.3.1 COMPANY SNAPSHOT

17.3.2 COMPANY SHARE ANALYSIS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT DEVELOPMENT

17.4 GLICO NUTRITION CO., LTD.

17.4.1 COMPANY SNAPSHOT

17.4.2 COMPANY SHARE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT DEVELOPMENT

17.5 SEDAMYL

17.5.1 COMPANY SNAPSHOT

17.5.2 PRODUCT PORTFOLIO

17.5.3 RECENT DEVELOPMENT

17.6 ANHUI ANTE FOOD CO.,LTD.

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENT

17.7 ARDENT MILLS

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENTS

17.8 BRYAN W NASH AND SONS

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENT

17.9 CROPENERGIES AG

17.9.1 COMPANY SNAPSHOT

17.9.2 REVENUE ANALYSIS

17.9.3 PRODUCT PORTFOLIO

17.9.4 RECENT DEVELOPMENT

17.1 HENAN TIANGUAN GROUP CO., LTD.

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENT

17.11 KRÖNER-STÄRKE GMBH

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENT

17.12 MANILDRA GROUP

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENT

17.13 MEELUNIE B.V.

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENT

17.14 MGP

17.14.1 COMPANY SNAPSHOT

17.14.2 REVENUE ANALYSIS

17.14.3 PRODUCT PORTFOLIO

17.14.4 RECENT DEVELOPMENT

17.15 MUHLENCHEMIE GMBH & CO. KG

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENT

17.16 PERMOLEX

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENT

17.17 PIONEER INDUSTRIES PRIVATE LIMITED

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENT

17.18 ROQUETTE FRÈRES

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENT

17.19 ROYAL INGREDIENTS GROUP

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENT

17.2 Z&F SUNGOLD CORPORATION

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENT

18 QUESTIONNAIRE

19 RELATED REPORTS

Liste des tableaux

TABLE 1 ASIA PACIFIC WHEAT GLUTEN MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 2 ASIA PACIFIC ORGANIC IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 ASIA PACIFIC INORGANIC IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 ASIA PACIFIC WHEAT GLUTEN MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 5 ASIA PACIFIC BINDER IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 ASIA PACIFIC EMULSIFIER IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 ASIA PACIFIC SOLIDIFIER IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 ASIA PACIFIC OTHERS IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 ASIA PACIFIC WHEAT GLUTEN MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 10 ASIA PACIFIC DRY IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 ASIA PACIFIC LIQUID IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 ASIA PACIFIC WHEAT GLUTEN MARKET, APPLICATION, 2020-2029 (USD MILLION)

TABLE 13 ASIA PACIFIC FOOD & BEVERAGES IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 ASIA PACIFIC BAKERY & CONFECTIONERY PRODUCTS IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 15 ASIA PACIFIC CONVENIENCE FOOD IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 16 ASIA PACIFIC ANIMAL FEED IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 ASIA PACIFIC ANIMAL FEED IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 18 ASIA PACIFIC OTHERS IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 ASIA PACIFIC WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 20 ASIA PACIFIC POUCH & BAGS IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 ASIA PACIFIC BOXES IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 ASIA PACIFIC BOTTLE/JAR IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 ASIA PACIFIC BOTTLE/JAR IN WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 24 ASIA PACIFIC OTHERS IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 ASIA PACIFIC WHEAT GLUTEN MARKET, DISTRIBUTION CHANNEL 2020-2029 (USD MILLION)

TABLE 26 ASIA PACIFIC STORE-BASED RETAILERS IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 ASIA PACIFIC STORE BASED RETAILERS IN WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION

TABLE 28 ASIA PACIFIC NON-STORE BASED RETAILERS IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 ASIA PACIFIC WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 30 ASIA PACIFIC COMMERCIAL IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 ASIA PACIFIC COMMERCIAL IN WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 32 ASIA PACIFIC HOUSEHOLD/RETAIL IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 ASIA-PACIFIC ELECTRONIC WHEAT GLUTEN MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 34 ASIA-PACIFIC WHEAT GLUTEN MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 35 ASIA-PACIFIC WHEAT GLUTEN MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 36 ASIA-PACIFIC WHEAT GLUTEN MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 37 ASIA-PACIFIC WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 38 ASIA-PACIFIC FOOD & BEVERAGES IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 39 ASIA-PACIFIC BAKERY & CONFECTIONERY PRODUCTS IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 40 ASIA-PACIFIC CONVENIENCE FOOD IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 41 ASIA-PACIFIC ANIMAL FEED IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 42 ASIA-PACIFIC WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 43 ASIA-PACIFIC BOTTLE/JAR IN WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 44 ASIA-PACIFIC WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 45 ASIA-PACIFIC STORE BASED RETAILERS IN WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 46 ASIA-PACIFIC WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 47 ASIA-PACIFIC COMMERCIAL IN WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 48 CHINA WHEAT GLUTEN MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 49 CHINA WHEAT GLUTEN MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 50 CHINA WHEAT GLUTEN MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 51 CHINA WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 52 CHINA FOOD & BEVERAGES IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 53 CHINA BAKERY & CONFECTIONERY PRODUCTS IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 54 CHINA CONVENIENCE FOOD IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 55 CHINA ANIMAL FEED IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 56 CHINA WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 57 CHINA BOTTLE/JAR IN WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 58 CHINA WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 59 CHINA STORE BASED RETAILERS IN WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 60 CHINA WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 61 CHINA COMMERCIAL IN WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 62 AUSTRALIA WHEAT GLUTEN MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 63 AUSTRALIA WHEAT GLUTEN MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 64 AUSTRALIA WHEAT GLUTEN MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 65 AUSTRALIA WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 66 AUSTRALIA FOOD & BEVERAGES IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 67 AUSTRALIA BAKERY & CONFECTIONERY PRODUCTS IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 68 AUSTRALIA CONVENIENCE FOOD IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 69 AUSTRALIA ANIMAL FEED IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 70 AUSTRALIA WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 71 AUSTRALIA BOTTLE/JAR IN WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 72 AUSTRALIA WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 73 AUSTRALIA STORE BASED RETAILERS IN WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 74 AUSTRALIA WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 75 AUSTRALIA COMMERCIAL IN WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 76 INDIA WHEAT GLUTEN MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 77 INDIA WHEAT GLUTEN MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 78 INDIA WHEAT GLUTEN MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 79 INDIA WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 80 INDIA FOOD & BEVERAGES IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 81 INDIA BAKERY & CONFECTIONERY PRODUCTS IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 82 INDIA CONVENIENCE FOOD IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 83 INDIA ANIMAL FEED IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 84 INDIA WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 85 INDIA BOTTLE/JAR IN WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 86 INDIA WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 87 INDIA STORE BASED RETAILERS IN WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 88 INDIA WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 89 INDIA COMMERCIAL IN WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 90 JAPAN WHEAT GLUTEN MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 91 JAPAN WHEAT GLUTEN MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 92 JAPAN WHEAT GLUTEN MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 93 JAPAN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 94 JAPAN FOOD & BEVERAGES IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 95 JAPAN BAKERY & CONFECTIONERY PRODUCTS IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 96 JAPAN CONVENIENCE FOOD IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 97 JAPAN ANIMAL FEED IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 98 JAPAN WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 99 JAPAN BOTTLE/JAR IN WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 100 JAPAN WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 101 JAPAN STORE BASED RETAILERS IN WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 102 JAPAN WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 103 JAPAN COMMERCIAL IN WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 104 SOUTH KOREA WHEAT GLUTEN MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 105 SOUTH KOREA WHEAT GLUTEN MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 106 SOUTH KOREA WHEAT GLUTEN MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 107 SOUTH KOREA WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 108 SOUTH KOREA FOOD & BEVERAGES IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 109 SOUTH KOREA BAKERY & CONFECTIONERY PRODUCTS IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 110 SOUTH KOREA CONVENIENCE FOOD IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 111 SOUTH KOREA ANIMAL FEED IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 112 SOUTH KOREA WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 113 SOUTH KOREA WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 114 SOUTH KOREA WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 115 SOUTH KOREA STORE BASED RETAILERS IN WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 116 SOUTH KOREA WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 117 SOUTH KOREA COMMERCIAL IN WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 118 THAILAND WHEAT GLUTEN MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 119 THAILAND WHEAT GLUTEN MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 120 THAILAND WHEAT GLUTEN MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 121 THAILAND WHEAT GLUTEN MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 122 THAILAND FOOD & BEVERAGES IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 123 THAILAND BAKERY & CONFECTIONERY PRODUCTS IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 124 THAILAND CONVENIENCE FOOD IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 125 THAILAND ANIMAL FEED IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 126 THAILAND WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 127 THAILAND BOTTLE/JAR IN WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 128 THAILAND WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 129 THAILAND STORE BASED RETAILERS IN WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 130 THAILAND WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 131 THAILAND COMMERCIAL IN WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 132 VIETNAM WHEAT GLUTEN MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 133 VIETNAM WHEAT GLUTEN MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 134 VIETNAM WHEAT GLUTEN MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 135 VIETNAM WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 136 VIETNAM FOOD & BEVERAGES IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 137 VIETNAM BAKERY & CONFECTIONERY PRODUCTS IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 138 VIETNAM CONVENIENCE FOOD IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 139 VIETNAM ANIMAL FEED IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 140 VIETNAM WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 141 VIETNAM BOTTLE/JAR IN WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 142 VIETNAM WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 143 VIETNAM STORE BASED RETAILERS IN WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 144 VIETNAM WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 145 VIETNAM COMMERCIAL IN WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 146 MALAYSIA WHEAT GLUTEN MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 147 MALAYSIA WHEAT GLUTEN MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 148 MALAYSIA WHEAT GLUTEN MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 149 MALAYSIA WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 150 MALAYSIA WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 151 MALAYSIA BAKERY & CONFECTIONERY PRODUCTS IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 152 MALAYSIA CONVENIENCE FOOD IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 153 MALAYSIA ANIMAL FEED IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 154 MALAYSIA WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 155 MALAYSIA BOTTLE/JAR IN WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 156 MALAYSIA WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 157 MALAYSIA STORE BASED RETAILERS IN WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 158 MALAYSIA WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 159 MALAYSIA COMMERCIAL IN WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 160 SINGAPORE WHEAT GLUTEN MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 161 SINGAPORE WHEAT GLUTEN MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 162 SINGAPORE WHEAT GLUTEN MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 163 SINGAPORE WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 164 SINGAPORE FOOD & BEVERAGES IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 165 SINGAPORE BAKERY & CONFECTIONARY PRODUCTS IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 166 SINGAPORE CONVENIENCE FOOD IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 167 SINGAPORE ANIMAL FEED IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 168 SINGAPORE WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 169 SINGAPORE BOTTLE/JAR IN WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 170 SINGAPORE WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 171 SINGAPORE STORE BASED RETAILERS IN WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 172 SINGAPORE WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 173 SINGAPORE COMMERCIAL IN WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 174 INDONESIA COMMERCIAL IN WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 175 INDONESIA WHEAT GLUTEN MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 176 INDONESIA WHEAT GLUTEN MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 177 INDONESIA WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 178 INDONESIA FOOD & BEVERAGES IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 179 INDONESIA BAKERY & CONFECTIONERY PRODUCTS IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 180 INDONESIA CONVENIENCE FOOD IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 181 INDONESIA ANIMAL FEED IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 182 INDONESIA WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 183 INDONESIA BOTTLE/JAR IN WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 184 INDONESIA WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 185 INDONESIA STORE BASED RETAILERS IN WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 186 INDONESIA WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 187 INDONESIA COMMERCIAL IN WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 188 PHILIPPINES WHEAT GLUTEN MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 189 PHILIPPINES WHEAT GLUTEN MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 190 PHILIPPINES WHEAT GLUTEN MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 191 PHILIPPINES WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 192 PHILIPPINES FOOD & BEVERAGES IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 193 PHILIPPINES BAKERY & CONFECTIONERY PRODUCTS IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 194 PHILIPPINES CONVENIENCE FOOD IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 195 PHILIPPINES ANIMAL FEED IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 196 PHILIPPINES WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 197 PHILIPPINES BOTTLE/JAR IN WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 198 PHILIPPINES WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 199 PHILIPPINES STORE BASED RETAILERS IN WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 200 PHILIPPINES WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 201 PHILIPPINES WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 202 NEW ZEALAND WHEAT GLUTEN MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 203 NEW ZEALAND WHEAT GLUTEN MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 204 NEW ZEALAND WHEAT GLUTEN MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 205 NEW ZEALAND WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 206 NEW ZEALAND FOOD & BEVERAGES IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 207 NEW ZEALAND BAKERY & CONFECTIONARY PRODUCTS IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 208 NEW ZEALAND CONVENIENCE FOOD IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 209 NEW ZEALAND ANIMAL FEED IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 210 NEW ZEALAND WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 211 NEW ZEALAND BOTTLE/JAR IN WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 212 NEW ZEALAND WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 213 NEW ZEALAND STORE BASED RETAILERS IN WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 214 NEW ZEALAND WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 215 NEW ZEALAND COMMERCIAL IN WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 216 REST OF ASIA-PACIFIC WHEAT GLUTEN MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 ASIA PACIFIC WHEAT GLUTEN MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC WHEAT GLUTEN MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC WHEAT GLUTEN MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC WHEAT GLUTEN MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC WHEAT GLUTEN MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC WHEAT GLUTEN MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC WHEAT GLUTEN MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA PACIFIC WHEAT GLUTEN MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 ASIA PACIFIC WHEAT GLUTEN MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 ASIA PACIFIC WHEAT GLUTEN MARKET: SEGMENTATION

FIGURE 11 THE GROWING EXPENDITURE ON WHEAT GLUTEN TECHNOLOGY IS EXPECTED TO DRIVE THE ASIA PACIFIC WHEAT GLUTEN MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 ORGANIC SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC WHEAT GLUTEN MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA PACIFIC WHEAT GLUTEN MARKET

FIGURE 14 ASIA PACIFIC WHEAT GLUTEN MARKET: BY CATEGORY, 2021

FIGURE 15 ASIA PACIFIC WHEAT GLUTEN MARKET: BY CATEGORY, 2022-2029 (USD MILLION)

FIGURE 16 ASIA PACIFIC WHEAT GLUTEN MARKET: BY CATEGORY, CAGR (2022-2029)

FIGURE 17 ASIA PACIFIC WHEAT GLUTEN MARKET: BY CATEGORY, LIFELINE CURVE

FIGURE 18 ASIA PACIFIC WHEAT GLUTEN MARKET: BY FUNCTION, 2021

FIGURE 19 ASIA PACIFIC WHEAT GLUTEN MARKET: BY FUNCTION, 2022-2029 (USD MILLION)

FIGURE 20 ASIA PACIFIC WHEAT GLUTEN MARKET: BY FUNCTION, CAGR (2022-2029)

FIGURE 21 ASIA PACIFIC WHEAT GLUTEN MARKET: BY FUNCTION, LIFELINE CURVE

FIGURE 22 ASIA PACIFIC WHEAT GLUTEN MARKET: BY FORM, 2021

FIGURE 23 ASIA PACIFIC WHEAT GLUTEN MARKET: BY FORM, 2022-2029 (USD MILLION)

FIGURE 24 ASIA PACIFIC WHEAT GLUTEN MARKET: BY FORM, CAGR (2022-2029)

FIGURE 25 ASIA PACIFIC WHEAT GLUTEN MARKET: BY FORM, LIFELINE CURVE

FIGURE 26 ASIA PACIFIC WHEAT GLUTEN MARKET: APPLICATION, 2021

FIGURE 27 ASIA PACIFIC WHEAT GLUTEN MARKET: APPLICATION, 2022-2029 (USD MILLION)

FIGURE 28 ASIA PACIFIC WHEAT GLUTEN MARKET: APPLICATION, CAGR (2022-2029)

FIGURE 29 ASIA PACIFIC WHEAT GLUTEN MARKET: BY FORM, LIFELINE CURVE

FIGURE 30 ASIA PACIFIC WHEAT GLUTEN MARKET: BY PACKAGING, 2021

FIGURE 31 ASIA PACIFIC WHEAT GLUTEN MARKET: BY PACKAGING, 2022-2029 (USD MILLION)

FIGURE 32 ASIA PACIFIC WHEAT GLUTEN MARKET: BY PACKAGING, CAGR (2022-2029)

FIGURE 33 ASIA PACIFIC WHEAT GLUTEN MARKET: BY PACKAGING, LIFELINE CURVE

FIGURE 34 ASIA PACIFIC WHEAT GLUTEN MARKET: DISTRIBUTION CHANNEL, 2021

FIGURE 35 ASIA PACIFIC WHEAT GLUTEN MARKET: DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 36 ASIA PACIFIC WHEAT GLUTEN MARKET: DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 37 ASIA PACIFIC WHEAT GLUTEN MARKET: DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 38 ASIA PACIFIC WHEAT GLUTEN MARKET: BY END USER, 2021

FIGURE 39 ASIA PACIFIC WHEAT GLUTEN MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 40 ASIA PACIFIC WHEAT GLUTEN MARKET: BY END USER, CAGR (2022-2029)

FIGURE 41 ASIA PACIFIC WHEAT GLUTEN MARKET: BY END USER, LIFELINE CURVE

FIGURE 42 ASIA-PACIFIC WHEAT GLUTEN MARKET: SNAPSHOT (2021)

FIGURE 43 ASIA-PACIFIC WHEAT GLUTEN MARKET: BY COUNTRY (2021)

FIGURE 44 ASIA-PACIFIC WHEAT GLUTEN MARKET: BY COUNTRY (2022 & 2029)

FIGURE 45 ASIA-PACIFIC WHEAT GLUTEN MARKET: BY COUNTRY (2021 & 2029)

FIGURE 46 ASIA-PACIFIC WHEAT GLUTEN MARKET: CATEGORY (2022-2029)

FIGURE 47 ASIA PACIFIC WHEAT GLUTEN MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.