Asia Pacific Vertical Farming Market

Taille du marché en milliards USD

TCAC :

%

| 2024 –2030 | |

|

|

|

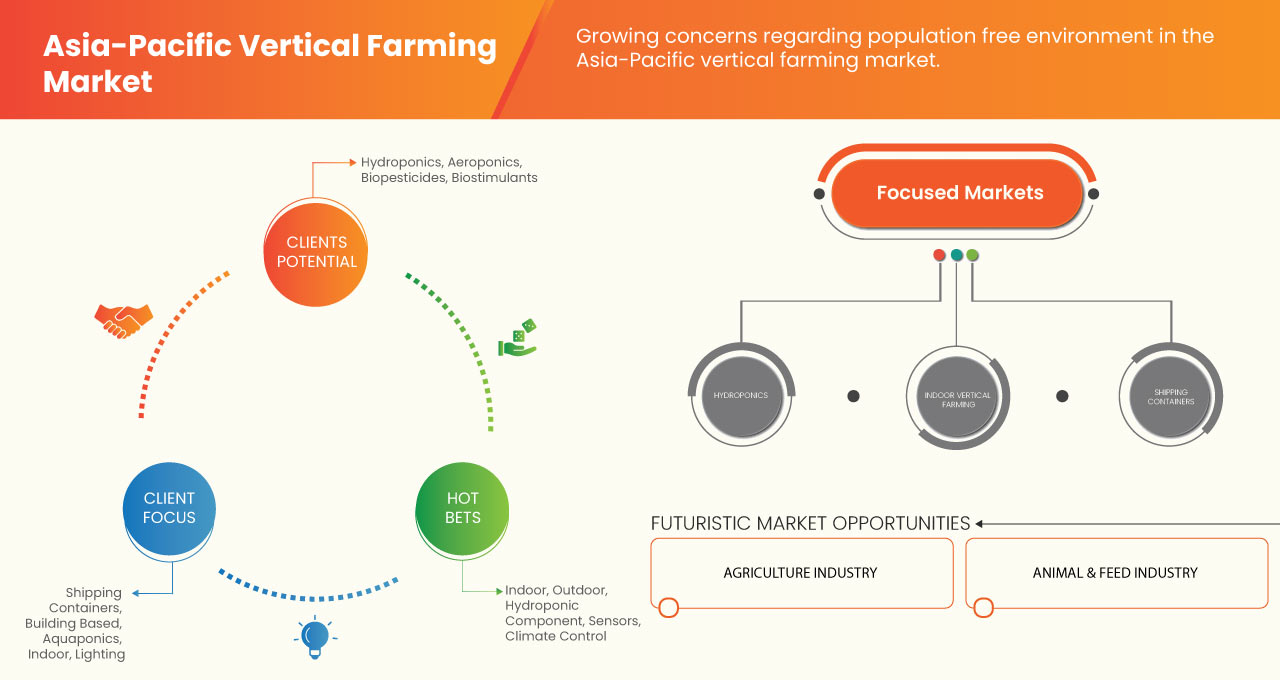

>Marché de l'agriculture verticale en Asie-Pacifique, par mécanisme de croissance (hydroponie, aéroponie et aquaponie), structure (conteneurs d'expédition et bâtiment), type ( biopesticides , biofertilisants et biostimulants), type de culture (feuilles vertes, plantes pollinisées et plantes nutraceutiques), application (intérieure et extérieure), composant (éclairage, composant hydroponique, contrôle climatique et capteurs) Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et perspectives du marché de l'agriculture verticale en Asie-Pacifique

Les fermes verticales sont modulaires et peuvent être adaptées à n'importe quelle structure. Comme elles produisent 75 fois plus de nourriture par mètre carré qu'une ferme conventionnelle, les fermes verticales peuvent également nourrir plus de personnes que l'agriculture standard. Les fermes verticales n'utilisent pas non plus de pesticides ni de fongicides pour rendre les aliments meilleurs et plus propres. Les fermes verticales minimisent souvent l'utilisation d'eau car les fermes intérieures nécessitent 90 % d'eau de moins que les fermes extérieures, donc peu importe que vous ayez une saison des pluies ou une saison sèche. L'agriculture intérieure régule également la fertilisation des nutriments par les plantes, de sorte que la nourriture fournie soit très nutritive. Cultivez une grande quantité de nourriture et utilisez moins d'eau dans une pièce relativement petite. 6 500 mètres carrés = une récolte de 900 000 kilos. Les stratégies d'agriculture verticale peuvent aider à préserver les terres agricoles et les forêts tropicales et également donner le temps de régénérer et de reconstituer la couche arable d'autres terres et également aider à minimiser la consommation de carburant.

Data Bridge Market Research analyse que le marché de l'agriculture verticale en Asie-Pacifique connaîtra un TCAC de 27,5 % au cours de la période de prévision de 2023 à 2030.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable de 2020 à 2016) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, prix en USD |

|

Segments couverts |

Par mécanisme de croissance (hydroponie, aéroponie et aquaponie), structure (conteneurs d'expédition et bâtiments), type (biopesticides, biofertilisants et biostimulants), type de culture (feuilles vertes, plantes pollinisées et plantes nutraceutiques), application (intérieure et extérieure), composant (éclairage, composant hydroponique, contrôle climatique et capteurs). |

|

Pays couverts |

Japon, Chine, Corée du Sud, Inde, Australie, Singapour, Thaïlande, Indonésie, Malaisie, Philippines, reste de l'Asie-Pacifique. |

|

Acteurs du marché couverts |

Français Signify Holding, CubicFarm Systems Corp., InFarm, Gills N Claws Pte Ltd, Sky Greens, SPREAD Co., Ltd., Triton Foodworks, SANANBIO, EVERLIGHT, OSRAM GmbH, Valoya, Heliospectra AB, Jain Irrigation Systems Ltd, Glenorie Hydroponics, Sino Opto Technology Co., Ltd entre autres. |

Définition du marché

Vertical farming is the method of processing food such as in a skyscraper, used factory, or shipping container done in vertically stacked layers. Indoor farming methods and controlled-environment agriculture (CEA) technologies are used for modern vertical farming concepts, where all environmental conditions can be controlled. Artificial regulation of illumination, environmental control (humidity, temperature, gases and among others) and fertigation are utilised for these services. Few vertical farms use methods similar to greenhouses, where artificial lighting and metal reflectors can be used to maximise natural sunlight.

Asia-Pacific Vertical Farming Market Dynamics

This section deals with understanding the market drivers, opportunities, restraints, and challenges. All of this is discussed in detail as below:

Drivers

INCREASING DEMAND FOR ORGANIC FOOD

As crops are grown without the use of chemical pesticides in a well-controlled indoor environment, vertical farming enables us to grow pesticide-free and organic crops. Organic food applies to goods produced through the agriculture sector that do not require industrial fertilizers, chemicals and development regulators. Today, consumers around the world have become more mindful of the origins of food they eat on a regular basis and have moved from crops that are processed with additives and pesticides to organic foods. Moreover, the rising purchasing power of people and changing consumer preference over the organic or pollution free food is augmenting the growth towards health consciousness.

All countries with relatively high organic food intake have high per capita income levels, such as China, which has adopted "green" foods to bring organic foods into the country. Japan, in Asia represents the single largest organic food market. Per capita spending on organic foods is marginally correlated favourably with per capita income levels, but Japan is a significant exception. Broadly speaking, organic goods tend to be premium goods in the sense that their consumption is higher in high per capita income countries. In several middle-income countries, piecemeal knowledge about organic food markets shows that supermarket markets are still in the early stages of growth. Around 50 different organic items are sold in major supermarkets in major countries.

Imported organic foods and beverages as well as domestically produced organic fruit, vegetables, rice, and tea are sold primarily in specialty stores in Taiwan. Organic foods are available on a limited basis in Hong Kong. The market for organic foods is just beginning to be evident only at a single store, stores stocked locally produced organic foods like vegetables, eggs, and cheese. Some middle income countries will likely have larger shares of organic products in the future but current sales appear to be very modest in absolute terms.

Principles of minimization of the chemical inputs in the agriculture and hence is environment friendly. Thus, vertical farming techniques can be utilized to increase the production and productivity to meet the growing food demands. The increasing demand for the organic food is driving the growth of the Asia-pacific vertical farming market.

GROWING CONCERNS REGARDING POLLUTION FREE ENVIRONMENT

Air pollution is the world’s single greatest environmental risk to health. Some 6.5 million people across the world die prematurely every year from exposure to outdoor and indoor air pollution. Pollution is not a modern phenomenon; it can be largely regulated and sometimes avoided, but it is greatly ignored. Land and soil pollution is largely the product of poor agricultural practices, inefficient irrigation, improper solid waste management – including unsafe storage of obsolete stockpiles of hazardous chemicals and nuclear waste – and a range of industrial, military and extractive activities. Better awareness, new forms of consumption and development, as well as creative technical methods, mean that many nations, cities and industries are now effectively solving significant problems with emissions. Indoor vertical farming can significantly lessen the occupational hazards associated with traditional farming. Farmers are not exposed to hazards related to heavy farming equipment, diseases like malaria, poisonous chemicals and so on. As it does not disturb animals and trees inland areas, it is good for biodiversity as well. The workplace risks associated with conventional farming can be greatly minimised by indoor vertical farming. Farmers are not exposed to risks associated with heavy agricultural machines, pathogens such as malaria, hazardous substances, etc. Since inland areas do not disturb animals and vegetation, it is also ideal for biodiversity. In 2019, humans emitted 54 billion tonnes of carbon dioxide equivalent (CO2eq), of which 17 billion tonnes (31%) came from agrifood systems.

Pollution can have negative impacts and disproportionate burdens on women and men, and particularly on the poor and the vulnerable such as the elderly, children and the disabled, affecting their rights to health, water, food, life, housing and development. Many toxic dumpsites are located in poor areas, leading to environmental injustice. Pollution has significant economic costs from the point of view of health, productivity losses, health-care costs and ecosystem damages. Vertical farming can save large amount of water usage and minimize the effect of greenhouse effect.

Hence, the growing concerns regarding pollution free environment is driving the growth of the vertical farming market.

Opportunities

INCREASING UTILIZATION OF IOT SENSORS IN CROP PRODUCTION

Smart farming offers awareness to growers who want to stay clear of problems and intervene before profits are affected by small or big problems through connected devices, the Internet of Things. It comes into play that tells farmers what they need to know about soil, humidity, water levels, and other important metrics. When practicing vertical farming, most of the farmers would like to monitor the farming conditions, and yet limited knowledge on data management have forced them to investigate plant conditions with naked eyes. Therefore, vertical farming monitoring system with Internet of Thing (IoT) is introduced as a platform to collect data and visualize it through a web-based applications. It is a more convenient way to keep track on the vertical farming performance, and contribute to the research and development on agriculture field with real case data analysis. With the help of the system, a reliable environment for farming activities could be formed. Consequently, crops are grown under a controlled surrounding, and get rid of the dangers caused by extreme weather such as droughts and floods.

Even the government is starting to embrace new smart farming opportunities. At its Beltsville Area Research Facility, the United States Department of Agriculture (USDA) recently turned a 7,000-acre farm into a testbed for IoT technology and related advancements, such as Artificial Intelligence (AI). Reportedly, this initiative will help thousands of data scientists gather information faster.

IoT sensors can provide information about crop health in real time and display the existence of pests clearly. For evaluating crops over a wide area, low-resolution image sensors are suitable. These instruments take photos of pests that cannot be observed with the human eye.

The Internet of Things (IoT) is a successful technology that offers efficient and reliable solutions. Solutions to the modernisation of multiple domains. Solutions based on IoT are being created to Maintain and monitor agricultural farms automatically with minimal human involvement.

Hence, the increasing utilization of IoT sensors in crop production has provided with the ample opportunities for the growth of Asia-Pacific vertical farming market.

Restraints/Challenges

HIGH INITIAL INVESTMENTS IN VERTICAL FARMING

The biggest hurdle to the introduction of vertical farming are the high upfront costs. High capital costs are the product of both the higher per square metre land prices in urban centres and the facilities required to manage plant development. Vertical cultivation happens without the involvement of insects in a controlled climate. As such, the method of pollination has to be performed manually, which would be labour intensive and expensive. As high as energy prices are in vertical farming, due to their concentration in urban centres where incomes are higher, as well as the need for more skilled workers, labour costs may be much higher. However, automation at vertical farms can contribute to the need for fewer employees. In vertical farms, manual pollination can become one of the more labor-intensive functions. Although the start-up costs of vertical farming are high, the long-term advantages are gradually being understood and accepted by all - even retailers - participating in the food supply chain. The reality that the upfront capital needed to build and develop a vertical farm is significant is no running away. The prospective long-term potential growth and benefits offered by being at the forefront of this emerging industry, however, make it an enticing investment proposal for those with funds. A vertical farm instead of automation relies more on manual labour for watering and harvesting. The cost of powering LED grow lights is one of the biggest hurdles a vertical farm must overcome for its produce to be competitive with fruits and vegetables from a traditional farm. As businesses contend with the energy costs of keeping a regulated atmosphere 24/7 and the challenge of coordinating the labour-intensive method of operating a vertical farm, the industry is riddled with bankruptcies.

Hence, high initial investments in vertical farming is retarding the growth of the Asia-Pacific vertical farming market.

Recent Developments

- In May 2022, Signify the world leader in lighting, has completed the acquisition of Fluence from ams OSRAM. The transaction strengthens our Asia-Pacific Agriculture lighting growth platform and extends our position in the attractive North American horticultural lighting market.

- In June 2022, Jain Irrigation Systems Limited., India (Jain Irrigation) and Temasek-owned Rivulis Pte Ltd., Singapore (Rivulis) are pleased to announce that Jain International Trading B.V. (a wholly owned subsidiary of Jain Irrigation) and Rivulis have entered into definitive transaction agreements.

Asia-Pacific Vertical Farming Market Scope

The Asia-Pacific vertical farming market is segmented based on growth mechanism, structure, type, crop type, application and component. .The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Growth Mechanism

- Hydroponics

- Aeroponics

- Aquaponics

Sur la base du mécanisme de croissance, le marché de l’agriculture verticale Asie-Pacifique est segmenté en hydroponie, aéroponie et aquaponie.

Structure

- Conteneurs d'expédition

- Basé sur le bâtiment

Sur la base de la structure, le marché de l'agriculture verticale de la région Asie-Pacifique est segmenté en conteneurs d'expédition et en bâtiments.

Taper

- Biopesticides

- Biofertilisant

- Biostimulants

Sur la base du type, le marché de l’agriculture verticale Asie-Pacifique est segmenté en biopesticides, biofertilisants et biostimulants.

Type de culture

- Feuilles vertes

- Plantes pollinisées

- Plante nutraceutique

Sur la base du type de culture, le marché de l'agriculture verticale de la région Asie-Pacifique est segmenté en plantes à feuilles vertes, plantes pollinisées et plantes nutraceutiques.

Application

- Intérieur

- De plein air

Sur la base des applications, le marché de l'agriculture verticale en Asie-Pacifique est segmenté en intérieur et en extérieur.

- Éclairage

- Composante hydroponique

- Contrôle du climat

- Capteurs

Sur la base des composants, le marché de l'agriculture verticale Asie-Pacifique est segmenté en éclairage, composants hydroponiques, contrôle climatique et capteurs.

Analyse/perspectives régionales du marché de l'agriculture verticale en Asie-Pacifique

Le marché de l’agriculture verticale en Asie-Pacifique est analysé et des informations sur la taille et les tendances du marché sont fournies sur la base des références ci-dessus.

Les pays couverts dans le rapport sur le marché de l’agriculture verticale en Asie-Pacifique sont le Japon, la Chine, la Corée du Sud, l’Inde, l’Australie, Singapour, la Thaïlande, l’Indonésie, la Malaisie, les Philippines et le reste de l’Asie-Pacifique.

La Chine devrait dominer le marché de l'agriculture verticale en Asie-Pacifique en termes de part de marché et de chiffre d'affaires. Elle devrait maintenir sa domination au cours de la période de prévision en raison de la puissance des acteurs du marché et de la forte demande d'agriculture verticale dans la région chinoise.

La section régionale du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché qui ont un impact sur les tendances actuelles et futures du marché. Les points de données, tels que les ventes de produits neufs et de remplacement, la démographie des pays, l'épidémiologie des maladies et les tarifs d'importation et d'exportation, sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques d'Asie-Pacifique et les défis auxquels elles sont confrontées en raison de la forte concurrence des marques locales et nationales et de l'impact des canaux de vente sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché de l'agriculture verticale en Asie-Pacifique

Le marché de l'agriculture verticale fournit des détails sur les concurrents. Les détails comprennent un aperçu de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives de marché, la présence en Asie-Pacifique, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit et la domination des applications. Les points de données ci-dessus ne concernent que l'accent mis par les entreprises sur le marché de l'agriculture verticale.

Certains des principaux acteurs opérant sur le marché de l'agriculture verticale en Asie-Pacifique sont Signify Holding, CubicFarm Systems Corp., InFarm, Gills N Claws Pte Ltd, Sky Greens, SPREAD Co., Ltd., Triton Foodworks, SANANBIO, EVERLIGHT, OSRAM GmbH, Valoya, Heliospectra AB, Jain Irrigation Systems Ltd, Glenorie Hydroponics, Sino Opto Technology Co., Ltd, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA-PACIFIC VERTICAL FARMING MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 GROWTH MECHANISM LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING DEMAND FOR ORGANIC FOOD

5.1.2 LIMITED LAND AVAILABILITY FOR TRADITIONAL AGRICULTURE

5.1.3 GROWING CONCERNS REGARDING POLLUTION FREE ENVIRONMENT

5.1.4 RISING ADOPTION OF ADVANCED TECHNOLOGIES FOR FOOD PRODUCTION

5.2 RESTRAINTS

5.2.1 HIGH INITIAL INVESTMENTS IN VERTICAL FARMING

5.2.2 LIMITED VARIETY OF CROPS RESULTS IN ECONOMICAL FEASIBILITY

5.2.3 HIGHER ENERGY CONSUMPTION OF LIGHT AND AIR CONDITIONING

5.3 OPPORTUNITIES

5.3.1 INCREASING UTILIZATION OF IOT SENSORS IN CROP PRODUCTION

5.3.2 GROWING PRODUCTION OF BIOPHARMACEUTICAL PRODUCTS

5.3.3 GROWING ADOPTION OF LED LIGHTING

5.4 CHALLENGES

5.4.1 COMPLEXITY OF HORTICULTURE LIGHTING

5.4.2 MAINTENANCE OF AIR CIRCULATION IN VERTICAL FARMING

5.4.3 VERTICAL FARMING DONE ON LARGE SCALE

6 IMPACT ANALYSIS OF COVID-19

7 APAC VERTICAL FARMING MARKET, BY GROWTH MECHANISM

7.1 OVERVIEW

7.2 HYDROPONICS

7.3 AEROPONICS

7.4 AQUAPONICS

8 APAC VERTICAL FARMING MARKET, BY STRUCTURE

8.1 OVERVIEW

8.2 SHIPPING CONTAINERS

8.3 BUILDING BASED

9 APAC VERTICAL FARMING MARKET, BY TYPE

9.1 OVERVIEW

9.2 BIOPESTICIDES

9.2.1 MICROBIALS

9.2.2 PHEROMONES

9.2.3 PLANT EXTRACTS

9.3 BIOFERTILIZER

9.3.1 NITROGEN FIXING

9.3.2 PHOSPHATE-SOLUBILIZING

9.3.3 POTASH-MOBILIZING

9.4 BIOSTIMULANTS

9.4.1 LIQUID

9.4.2 DRY

10 APAC VERTICAL FARMING MARKET, BY CROP TYPE

10.1 OVERVIEW

10.2 LEAFY GREEN

10.3 POLLINATED PLANTS

10.4 NUTRACEUTICAL PLANT

11 APAC VERTICAL FARMING MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 INDOOR

11.3 OUTDOOR

12 APAC VERTICAL FARMING MARKET, BY COMPONENT

12.1 OVERVIEW

12.2 LIGHTING

12.2.1 GROW LIGHT

12.2.2 GROW BALLAST

12.2.3 GROW REFLECTORS

12.3 HYDROPONIC COMPONENT

12.3.1 PUMP & IRRIGATION

12.3.2 WATER FILTRATION

12.3.3 METERS & SOLUTIONS

12.3.4 OTHERS

12.4 CLIMATE CONTROL

12.4.1 VENTILATION FANS

12.4.2 AIR PURIFICATION/CONTROL

12.5 SENSORS

12.5.1 CO2 SENSORS

12.5.2 TEMPERATURE SENSORS

12.5.3 NUTRIENT SENSORS

12.5.4 CROP SENSORS

12.5.5 PH SENSORS

12.5.6 OTHERS

13 APAC VERTICAL FARMING MARKET, BY COUNTRY

13.1 CHINA

13.2 JAPAN

13.3 SOUTH KOREA

13.4 SINGAPORE

13.5 AUSTRALIA

13.6 INDIA

13.7 THAILAND

13.8 INDONESIA

13.9 MALAYSIA

13.1 PHILIPPINES

13.11 REST OF APAC

14 COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 OSRAM GMBH

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 PRODUCT PORTFOLIO

16.1.4 RECENT DEVELOPMENTS

16.2 SIGNIFY HOLDING

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 BRAND PORTFOLIO

16.2.4 RECENT DEVELOPMENTS

16.3 EVERLIGHT

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT DEVELOPMENT

16.4 JAIN IRRIGATION SYSTEMS LTD

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENT

16.5 INFARM

16.5.1 COMPANY SNAPSHOT

16.5.2 TECHNOLOGY PORTFOLIO

16.5.3 RECENT DEVELOPMENT

16.6 CUBICFARM SYSTEMS CORP.

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT DEVELOPMENTS

16.7 GILLS N CLAWS PTE LTD

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENTS

16.8 GLENORIE HYDROPONICS

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.9 HELIOSPECTRA AB

16.9.1 COMPANY SNAPSHOT

16.9.2 REVENUE ANALYSIS

16.9.3 PRODUCT PORTFOLIO

16.9.4 RECENT DEVELOPMENTS

16.1 SANANBIO

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 SINO OPTO TECHNOLOGY CO., LTD

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENTS

16.12 SKY GREENS

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENTS

16.13 SPREAD CO., LTD.

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENT

16.14 TRITON FOODWORKS

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENTS

16.15 VALOYA

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

Liste des tableaux

TABLE 1 APAC VERTICAL FARMING MARKET, BY GROWTH MECHANISM, 2021-2030 (USD MILLION)

TABLE 2 APAC VERTICAL FARMING MARKET, BY STRUCTURE, 2021-2030 (USD MILLION)

TABLE 3 APAC VERTICAL FARMING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 4 APAC BIOPESTICIDES IN VERTICAL FARMING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 5 APAC BIOFERTILIZER IN VERTICAL FARMING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 6 APAC BIOSTIMULANTS IN VERTICAL FARMING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 7 APAC VERTICAL FARMING MARKET, BY CROP TYPE, 2021-2030 (USD MILLION)

TABLE 8 APAC VERTICAL FARMING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 9 APAC VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 10 APAC LIGHTING IN VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 11 APAC HYDROPONIC COMPONENT IN VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 12 APAC CLIMATE CONTROL IN VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 13 APAC SENSORS IN VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 14 APAC VERTICAL FARMING MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 15 CHINA VERTICAL FARMING MARKET, BY GROWTH MECHANISM, 2021-2030 (USD MILLION)

TABLE 16 CHINA VERTICAL FARMING MARKET, BY STRUCTURE, 2021-2030 (USD MILLION)

TABLE 17 CHINA VERTICAL FARMING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 18 CHINA BIOPESTICIDES IN VERTICAL FARMING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 19 CHINA BIOFERTILIZER IN VERTICAL FARMING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 20 CHINA BIOSTIMULANTS IN VERTICAL FARMING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 21 CHINA VERTICAL FARMING MARKET, BY CROP TYPE, 2021-2030 (USD MILLION)

TABLE 22 CHINA VERTICAL FARMING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 23 CHINA VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 24 CHINA LIGHTING IN VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 25 CHINA HYDROPONIC COMPONENT IN VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 26 CHINA CLIMATE CONTROL IN VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 27 CHINA SENSORS IN VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 28 JAPAN VERTICAL FARMING MARKET, BY GROWTH MECHANISM, 2021-2030 (USD MILLION)

TABLE 29 JAPAN VERTICAL FARMING MARKET, BY STRUCTURE, 2021-2030 (USD MILLION)

TABLE 30 JAPAN VERTICAL FARMING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 31 JAPAN BIOPESTICIDES IN VERTICAL FARMING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 32 JAPAN BIOFERTILIZER IN VERTICAL FARMING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 33 JAPAN BIOSTIMULANTS IN VERTICAL FARMING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 34 JAPAN VERTICAL FARMING MARKET, BY CROP TYPE, 2021-2030 (USD MILLION)

TABLE 35 JAPAN VERTICAL FARMING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 36 JAPAN VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 37 JAPAN LIGHTING IN VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 38 JAPAN HYDROPONIC COMPONENT IN VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 39 JAPAN CLIMATE CONTROL IN VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 40 JAPAN SENSORS IN VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 41 SOUTH KOREA VERTICAL FARMING MARKET, BY GROWTH MECHANISM, 2021-2030 (USD MILLION)

TABLE 42 SOUTH KOREA VERTICAL FARMING MARKET, BY STRUCTURE, 2021-2030 (USD MILLION)

TABLE 43 SOUTH KOREA VERTICAL FARMING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 44 SOUTH KOREA BIOPESTICIDES IN VERTICAL FARMING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 45 SOUTH KOREA BIOFERTILIZER IN VERTICAL FARMING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 46 SOUTH KOREA BIOSTIMULANTS IN VERTICAL FARMING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 47 SOUTH KOREA VERTICAL FARMING MARKET, BY CROP TYPE, 2021-2030 (USD MILLION)

TABLE 48 SOUTH KOREA VERTICAL FARMING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 49 SOUTH KOREA VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 50 SOUTH KOREA LIGHTING IN VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 51 SOUTH KOREA HYDROPONIC COMPONENT IN VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 52 SOUTH KOREA CLIMATE CONTROL IN VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 53 SOUTH KOREA SENSORS IN VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 54 SINGAPORE VERTICAL FARMING MARKET, BY GROWTH MECHANISM, 2021-2030 (USD MILLION)

TABLE 55 SINGAPORE VERTICAL FARMING MARKET, BY STRUCTURE, 2021-2030 (USD MILLION)

TABLE 56 SINGAPORE VERTICAL FARMING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 57 SINGAPORE BIOPESTICIDES IN VERTICAL FARMING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 58 SINGAPORE BIO FERTILIZER IN VERTICAL FARMING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 59 SINGAPORE BIOSTIMULANTS IN VERTICAL FARMING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 60 SINGAPORE VERTICAL FARMING MARKET, BY CROP TYPE, 2021-2030 (USD MILLION)

TABLE 61 SINGAPORE VERTICAL FARMING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 62 SINGAPORE VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 63 SINGAPORE LIGHTING IN VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 64 SINGAPORE HYDROPONIC COMPONENT IN VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 65 SINGAPORE CLIMATE CONTROL IN VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 66 SINGAPORE SENSORS IN VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 67 AUSTRALIA VERTICAL FARMING MARKET, BY GROWTH MECHANISM, 2021-2030 (USD MILLION)

TABLE 68 AUSTRALIA VERTICAL FARMING MARKET, BY STRUCTURE, 2021-2030 (USD MILLION)

TABLE 69 AUSTRALIA VERTICAL FARMING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 70 AUSTRALIA BIOPESTICIDES IN VERTICAL FARMING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 71 AUSTRALIA BIOFERTILIZER IN VERTICAL FARMING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 72 AUSTRALIA BIOSTIMULANTS IN VERTICAL FARMING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 73 AUSTRALIA VERTICAL FARMING MARKET, BY CROP TYPE, 2021-2030 (USD MILLION)

TABLE 74 AUSTRALIA VERTICAL FARMING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 75 AUSTRALIA VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 76 AUSTRALIA LIGHTING IN VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 77 AUSTRALIA HYDROPONIC COMPONENT IN VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 78 AUSTRALIA CLIMATE CONTROL IN VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 79 AUSTRALIA SENSORS IN VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 80 INDIA VERTICAL FARMING MARKET, BY GROWTH MECHANISM, 2021-2030 (USD MILLION)

TABLE 81 INDIA VERTICAL FARMING MARKET, BY STRUCTURE, 2021-2030 (USD MILLION)

TABLE 82 INDIA VERTICAL FARMING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 83 INDIA BIOPESTICIDES IN VERTICAL FARMING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 84 INDIA BIOFERTILIZER IN VERTICAL FARMING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 85 INDIA BIOSTIMULANTS IN VERTICAL FARMING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 86 INDIA VERTICAL FARMING MARKET, BY CROP TYPE, 2021-2030 (USD MILLION)

TABLE 87 INDIA VERTICAL FARMING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 88 INDIA VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 89 INDIA LIGHTING IN VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 90 INDIA HYDROPONIC COMPONENT IN VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 91 INDIA CLIMATE CONTROL IN VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 92 INDIA SENSORS IN VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 93 THAILAND VERTICAL FARMING MARKET, BY GROWTH MECHANISM, 2021-2030 (USD MILLION)

TABLE 94 THAILAND VERTICAL FARMING MARKET, BY STRUCTURE, 2021-2030 (USD MILLION)

TABLE 95 THAILAND VERTICAL FARMING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 96 THAILAND BIOPESTICIDES IN VERTICAL FARMING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 97 THAILAND BIOFERTILIZER IN VERTICAL FARMING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 98 THAILAND BIOSTIMULANTS IN VERTICAL FARMING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 99 THAILAND VERTICAL FARMING MARKET, BY CROP TYPE, 2021-2030 (USD MILLION)

TABLE 100 THAILAND VERTICAL FARMING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 101 THAILAND VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 102 THAILAND LIGHTING IN VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 103 THAILAND HYDROPONIC COMPONENT IN VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 104 THAILAND CLIMATE CONTROL IN VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 105 THAILAND SENSORS IN VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 106 INDONESIA VERTICAL FARMING MARKET, BY GROWTH MECHANISM, 2021-2030 (USD MILLION)

TABLE 107 INDONESIA VERTICAL FARMING MARKET, BY STRUCTURE, 2021-2030 (USD MILLION)

TABLE 108 INDONESIA VERTICAL FARMING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 109 INDONESIA BIOPESTICIDES IN VERTICAL FARMING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 110 INDONESIA BIOFERTILIZER IN VERTICAL FARMING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 111 INDONESIA BIOSTIMULANTS IN VERTICAL FARMING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 112 INDONESIA VERTICAL FARMING MARKET, BY CROP TYPE, 2021-2030 (USD MILLION)

TABLE 113 INDONESIA VERTICAL FARMING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 114 INDONESIA VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 115 INDONESIA LIGHTING IN VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 116 INDONESIA HYDROPONIC COMPONENT IN VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 117 INDONESIA CLIMATE CONTROL IN VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 118 INDONESIA SENSORS IN VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 119 MALAYSIA VERTICAL FARMING MARKET, BY GROWTH MECHANISM, 2021-2030 (USD MILLION)

TABLE 120 MALAYSIA VERTICAL FARMING MARKET, BY STRUCTURE, 2021-2030 (USD MILLION)

TABLE 121 MALAYSIA VERTICAL FARMING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 122 MALAYSIA BIOPESTICIDES IN VERTICAL FARMING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 123 MALAYSIA BIOFERTILIZER IN VERTICAL FARMING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 124 MALAYSIA BIOSTIMULANTS IN VERTICAL FARMING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 125 MALAYSIA VERTICAL FARMING MARKET, BY CROP TYPE, 2021-2030 (USD MILLION)

TABLE 126 MALAYSIA VERTICAL FARMING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 127 MALAYSIA VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 128 MALAYSIA LIGHTING IN VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 129 MALAYSIA HYDROPONIC COMPONENT IN VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 130 MALAYSIA CLIMATE CONTROL IN VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 131 MALAYSIA SENSORS IN VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 132 PHILIPPINES VERTICAL FARMING MARKET, BY GROWTH MECHANISM, 2021-2030 (USD MILLION)

TABLE 133 PHILIPPINES VERTICAL FARMING MARKET, BY STRUCTURE, 2021-2030 (USD MILLION)

TABLE 134 PHILIPPINES VERTICAL FARMING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 135 PHILIPPINES BIOPESTICIDES IN VERTICAL FARMING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 136 PHILIPPINES BIOFERTILIZER IN VERTICAL FARMING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 137 PHILIPPINES BIOSTIMULANTS IN VERTICAL FARMING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 138 PHILIPPINES VERTICAL FARMING MARKET, BY CROP TYPE, 2021-2030 (USD MILLION)

TABLE 139 PHILIPPINES VERTICAL FARMING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 140 PHILIPPINES VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 141 PHILIPPINES LIGHTING IN VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 142 PHILIPPINES HYDROPONIC COMPONENT IN VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 143 PHILIPPINES CLIMATE CONTROL IN VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 144 PHILIPPINES SENSORS IN VERTICAL FARMING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 145 REST OF APAC VERTICAL FARMING MARKET, BY GROWTH MECHANISM, 2021-2030 (USD MILLION)

Liste des figures

FIGURE 1 ASIA-PACIFIC VERTICAL FARMING MARKET: SEGMENTATION

FIGURE 2 ASIA-PACIFIC VERTICAL FARMING MARKET: DATA TRIANGULATION

FIGURE 3 ASIA-PACIFIC VERTICAL FARMING MARKET : DROC ANALYSIS

FIGURE 4 ASIA-PACIFIC VERTICAL FARMING MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA-PACIFIC VERTICAL FARMING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA-PACIFIC VERTICAL FARMING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA-PACIFIC VERTICAL FARMING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA-PACIFIC VERTICAL FARMING MARKET: SEGMENTATION

FIGURE 9 THE GROWING PRODUCTION OF BIOPHARMACEUTICAL PRODUCTS IS DRIVING THE GROWTH OF ASIA-PACIFIC VERTICAL FARMING MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 10 HYDROPONICS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA-PACIFIC VERTICAL FARMING MARKET IN 2023 & 2030

FIGURE 11 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF ASIA-PACIFIC VERTICAL FARMING MARKET

FIGURE 12 APAC VERTICAL FARMING MARKET: BY GROWTH MECHANISM, 2022

FIGURE 13 APAC VERTICAL FARMING MARKET: BY STRUCTURE, 2022

FIGURE 14 APAC VERTICAL FARMING MARKET: BY TYPE, 2022

FIGURE 15 APAC VERTICAL FARMING MARKET: BY CROP TYPE, 2022

FIGURE 16 APAC VERTICAL FARMING MARKET: BY APPLICATION, 2022

FIGURE 17 APAC VERTICAL FARMING MARKET: BY COMPONENT, 2022

FIGURE 18 APAC VERTICAL FARMING MARKET: SNAPSHOT (2022)

FIGURE 19 APAC VERTICAL FARMING MARKET: BY COUNTRY (2022)

FIGURE 20 APAC VERTICAL FARMING MARKET: BY COUNTRY (2023 & 2030)

FIGURE 21 APAC VERTICAL FARMING MARKET: BY COUNTRY (2022 & 2030)

FIGURE 22 APAC VERTICAL FARMING MARKET: BY GROWTH MECHANISM (2023 - 2030)

FIGURE 23 ASIA-PACIFIC VERTICAL FARMING MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.