Asia Pacific Vegan Protein Market

Taille du marché en milliards USD

TCAC :

%

USD

2.71 Billion

USD

4.85 Billion

2024

2032

USD

2.71 Billion

USD

4.85 Billion

2024

2032

| 2025 –2032 | |

| USD 2.71 Billion | |

| USD 4.85 Billion | |

|

|

|

|

Segmentation du marché des protéines végétaliennes en Asie-Pacifique, par source (protéines de soja, de pois, de riz, de chanvre, de spiruline, de quinoa, de lin, de chia, de canola, de courge, etc.), type de protéines (isolats, concentrés et hydrolysats), degré d'hydrolyse (intactes, légèrement hydrolysées et fortement hydrolysées), forme (sèche et liquide), nature (conventionnelle et biologique), fonction (solubilité, émulsification, gélification, rétention d'eau, moussage, etc.), application (aliments, boissons, nutraceutiques et compléments alimentaires, cosmétiques et soins personnels, alimentation animale, produits pharmaceutiques, etc.) - Tendances et prévisions du secteur jusqu'en 2032

Taille du marché des protéines végétaliennes en Asie-Pacifique

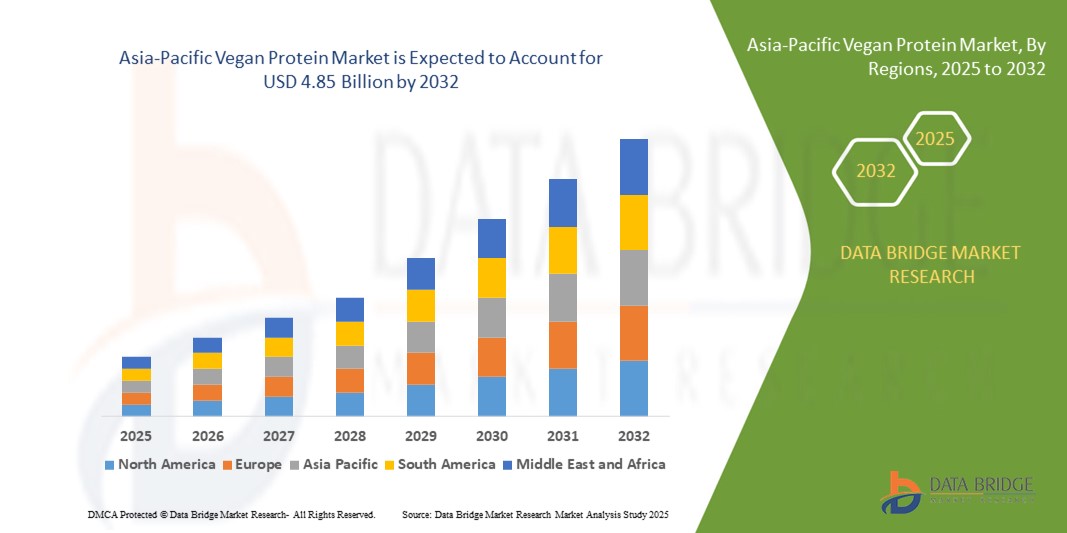

- La taille du marché des protéines végétaliennes en Asie-Pacifique était évaluée à 2,71 milliards USD en 2024 et devrait atteindre 4,85 milliards USD d'ici 2032 , à un TCAC de 7,50 % au cours de la période de prévision.

- La croissance du marché est largement alimentée par l’adoption croissante de régimes à base de plantes, l’attention croissante des consommateurs à la santé et au bien-être et la sensibilisation croissante à l’environnement et à l’éthique.

- La forte demande d’aliments fonctionnels, de boissons et de compléments alimentaires enrichis en protéines stimule encore davantage l’expansion du marché.

Analyse du marché des protéines végétaliennes en Asie-Pacifique

- L'adoption croissante des régimes à base de plantes et la prise de conscience croissante des consommateurs en matière de santé stimulent la demande de produits protéinés végétaliens. La prise de conscience croissante des bienfaits environnementaux et éthiques des protéines végétales stimule encore la croissance du marché.

- L'essor des tendances en matière de fitness et de bien-être, ainsi que l'utilisation croissante de protéines végétaliennes dans les aliments fonctionnels, les nutraceutiques et les compléments alimentaires, contribuent à l'expansion du marché.

- Le marché chinois des protéines végétales a dominé la région Asie-Pacifique en 2024, porté par l'urbanisation, la sensibilisation croissante aux questions de santé et l'adoption croissante des régimes végétaliens par les consommateurs. Les consommateurs intègrent activement des aliments, boissons et compléments enrichis en protéines à leur alimentation quotidienne, soutenant une croissance soutenue.

- Le Japon devrait connaître le taux de croissance annuel composé (TCAC) le plus élevé du marché des protéines végétaliennes en Asie-Pacifique, grâce à la préférence croissante des consommateurs pour les aliments fonctionnels et enrichis, à l'adoption rapide de formules végétales innovantes et à la forte demande du secteur des nutraceutiques et des compléments alimentaires. L'accent mis par le pays sur les produits de santé pratiques et les tendances « clean label » accélère également l'expansion du marché.

- Le segment des protéines de soja a représenté la plus grande part de marché en 2024, grâce à son utilisation répandue dans les produits alimentaires, les boissons et les compléments alimentaires. La protéine de soja est plébiscitée pour sa haute valeur nutritionnelle, ses applications polyvalentes et sa chaîne d'approvisionnement bien établie dans les pays d'Asie-Pacifique.

Portée du rapport et segmentation du marché des protéines végétaliennes en Asie-Pacifique

|

Attributs |

Informations clés sur le marché des protéines végétaliennes en Asie-Pacifique |

|

Segments couverts |

|

|

Pays couverts |

Asie-Pacifique

|

|

Principaux acteurs du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse approfondie des experts, une analyse des prix, une analyse de la part de marque, une enquête auprès des consommateurs, une analyse démographique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire. |

Tendances du marché des protéines végétaliennes en Asie-Pacifique

Adoption croissante de solutions à base de protéines végétales

- La tendance croissante vers les produits protéinés végétaliens transforme le paysage alimentaire et nutraceutique en proposant des alternatives protéinées végétales et durables. Ces produits permettent aux consommateurs de couvrir leurs besoins quotidiens en protéines tout en réduisant leur dépendance aux sources animales, contribuant ainsi à la fois à la santé et à l'environnement. L'intérêt croissant des consommateurs pour des options alimentaires éthiques et écologiques renforce leur acceptation par le marché.

- La demande croissante de protéines en poudre, barres et compléments alimentaires pratiques accélère l'adoption de solutions protéinées végétaliennes. Ces produits sont particulièrement efficaces dans les secteurs du fitness et du bien-être, où les consommateurs recherchent des options rapides et nutritives. La disponibilité de produits prêts à l'emploi et aromatisés améliore la commodité et encourage une utilisation fréquente.

- L'accessibilité, la variété et la facilité d'intégration des protéines végétales dans l'alimentation quotidienne rendent ces produits attractifs pour les ménages, les salles de sport et les restaurants. Une consommation fréquente améliore la diversité alimentaire et favorise les tendances globales en matière de santé et de bien-être. De plus, la tendance aux protéines végétales fonctionnelles et enrichies élargit les possibilités d'utilisation en nutrition quotidienne.

- Par exemple, ces dernières années, plusieurs marques de nutrition ont enregistré une forte hausse de leurs ventes après le lancement de nouvelles protéines en poudre à base de pois, de riz et de soja destinées aux consommateurs végétaliens et flexitariens. Ces lancements ont permis une adoption plus large et un meilleur engagement des consommateurs. Les efforts marketing mettant en avant la durabilité, la nutrition et la polyvalence ont encore accru la portée des produits.

- Si les protéines véganes favorisent une consommation saine et une alimentation durable, leur croissance dépend de l'innovation continue des produits, de l'optimisation du goût et de leur accessibilité. Les fabricants doivent privilégier des formulations innovantes, un approvisionnement de qualité et un marketing stratégique pour tirer pleinement parti de cette demande croissante. Des emballages optimisés, des formats longue conservation et des mélanges de protéines multifonctionnels contribuent également à la dynamique du marché.

Dynamique du marché des protéines végétaliennes en Asie-Pacifique

Conducteur

Sensibilisation accrue à la santé et transition vers une alimentation à base de plantes

- La croissance des consommateurs soucieux de leur santé incite fabricants et distributeurs à privilégier les protéines végétales. Les consommateurs recherchent de plus en plus des alternatives aux protéines animales traditionnelles pour leur santé cardiovasculaire, leur gestion du poids et leur bien-être digestif. Cette évolution est également confortée par la popularité croissante des produits alimentaires clean label et naturels.

- La prise de conscience croissante de l'impact environnemental de l'élevage incite les consommateurs à se tourner vers des protéines végétales. Cette tendance incite les marques à proposer des formules végétales plus diversifiées et à investir dans des pratiques d'approvisionnement durables. L'accent mis sur la réduction de l'empreinte carbone et les emballages écologiques renforce également la préférence des consommateurs pour les protéines végétales.

- Les gouvernements, les organismes de nutrition et les programmes de bien-être promeuvent les régimes alimentaires à base de plantes dans le cadre de campagnes de santé publique. Les initiatives éducatives et le soutien des influenceurs du fitness et de la santé stimulent encore davantage l'adoption par les consommateurs. Les initiatives mettant en avant les bienfaits de la nutrition préventive et des aliments fonctionnels contribuent à la croissance constante du marché.

- Par exemple, plusieurs marques ont récemment lancé des campagnes de sensibilisation mettant en avant les bienfaits nutritionnels et environnementaux des protéines végétaliennes, ce qui a accru la visibilité des produits et l'intérêt des consommateurs. Des campagnes promotionnelles croisées avec des plateformes de fitness, de lifestyle et de bien-être ont permis d'élargir la portée du marché.

- Si la sensibilisation à la santé et le développement durable stimulent la croissance, l'innovation produit, l'optimisation des saveurs et l'élargissement de la distribution restent essentiels à la poursuite de l'expansion du marché. De plus, le développement de protéines hybrides et de mélanges enrichis renforce l'attrait fonctionnel des produits protéinés végétaliens.

Retenue/Défi

Coût élevé des formules de protéines premium et préférences gustatives

- Les protéines végétales en poudre, isolats et mélanges premium sont souvent plus chers que les sources de protéines traditionnelles, ce qui limite leur adoption par les consommateurs sensibles au prix. Cela limite leur utilisation généralisée sur les marchés émergents et chez les consommateurs occasionnels. La rentabilité de la production et l'approvisionnement en ingrédients restent des défis majeurs pour les fabricants.

- Dans de nombreuses régions, les consommateurs peuvent percevoir les protéines végétales comme moins appétissantes ou moins efficaces que les protéines animales. Les difficultés de goût, de texture et de digestibilité continuent d'influencer les comportements d'achat répétés. Les marques investissent dans le masquage des saveurs, l'amélioration des textures et les associations de protéines pour surmonter ces obstacles.

- Les contraintes de la chaîne d'approvisionnement, telles que l'approvisionnement en soja, pois, riz ou autres ingrédients riches en protéines de haute qualité, peuvent entraîner des goulots d'étranglement dans la production et une hausse des prix de détail, affectant ainsi l'accessibilité. Les retards dans la disponibilité des matières premières et les fluctuations de l'offre mondiale peuvent également perturber la stabilité du marché.

- Par exemple, plusieurs marques de protéines végétaliennes ont récemment révisé leurs emballages, leur étiquetage et leurs allégations nutritionnelles afin d'en garantir l'exactitude et la transparence, renforçant ainsi la confiance des consommateurs et encourageant les achats répétés. Ces initiatives comprenaient également des campagnes de sensibilisation visant à clarifier la qualité et les bienfaits des protéines.

- Alors que les protéines végétales continuent d'évoluer en termes de formulation et de goût, il reste crucial de répondre aux enjeux de coût, de préférences sensorielles et de chaîne d'approvisionnement. Les acteurs doivent privilégier des solutions abordables, de haute qualité et savoureuses pour soutenir le potentiel de croissance à long terme. Investir dans la recherche, la production évolutive et les sources de protéines alternatives peut améliorer l'accessibilité et la rentabilité.

Portée du marché des protéines végétaliennes en Asie-Pacifique

Le marché est segmenté en fonction de la source, du type de protéine, du niveau d’hydrolyse, de la forme, de la nature, de la fonction et de l’application.

- Par source

En fonction de la provenance, le marché des protéines végétaliennes en Asie-Pacifique est segmenté en protéines de soja, de pois, de riz, de chanvre, de spiruline, de quinoa, de lin, de chia, de colza et de graines de courge, entre autres. En 2024, le segment des protéines de soja détenait la plus grande part de chiffre d'affaires, grâce à son utilisation répandue dans les produits alimentaires, les boissons et les compléments alimentaires. La protéine de soja est plébiscitée pour sa haute valeur nutritionnelle, ses applications polyvalentes et sa chaîne d'approvisionnement bien établie dans les pays d'Asie-Pacifique.

Le segment des protéines de pois devrait connaître la croissance la plus rapide entre 2025 et 2032, porté par la préférence croissante des consommateurs pour les sources de protéines végétales sans allergènes. La protéine de pois est particulièrement populaire dans les poudres protéinées, les snacks et les aliments fonctionnels en raison de son goût neutre, de sa grande digestibilité et de son adéquation aux formulations clean label.

- Par type de protéines

En fonction du type de protéines, le marché des protéines végétaliennes en Asie-Pacifique est segmenté en isolats, concentrés et hydrolysats. Le segment des isolats a représenté la plus grande part de chiffre d'affaires en 2024 grâce à sa teneur élevée en protéines, sa pureté et ses propriétés fonctionnelles adaptées aux boissons et aux compléments alimentaires.

Le segment des hydrolysats devrait connaître la croissance la plus rapide entre 2025 et 2032, grâce à une digestibilité accrue, une absorption rapide et une adéquation à la nutrition sportive et aux applications cliniques. Les hydrolysats sont très prisés des consommateurs en quête d'une utilisation rapide et efficace des protéines.

- Par niveau d'hydrolyse

En fonction du niveau d'hydrolyse, le marché des protéines végétaliennes en Asie-Pacifique est segmenté en protéines intactes, légèrement hydrolysées et fortement hydrolysées. Le segment intact a dominé en 2024 grâce à son profil nutritionnel équilibré et à son rapport coût-efficacité pour une consommation alimentaire régulière.

Le segment des protéines légèrement hydrolysées devrait connaître le taux de croissance le plus rapide entre 2025 et 2032, grâce à une solubilité, des performances fonctionnelles et une digestibilité améliorées, ce qui le rend idéal pour les boissons enrichies et les formulations de protéines spécialisées.

- Par formulaire

En termes de forme, le marché des protéines végétaliennes en Asie-Pacifique est segmenté en protéines sèches et liquides. Le segment sec a représenté la plus grande part de marché en 2024, grâce à sa facilité de stockage, sa longue durée de conservation et son applicabilité aux protéines en poudre, aux barres et aux produits de boulangerie.

Le segment des liquides devrait connaître le taux de croissance le plus rapide entre 2025 et 2032, alimenté par la demande croissante de boissons prêtes à boire, de smoothies et de boissons fonctionnelles enrichies en protéines parmi les consommateurs soucieux de leur santé.

- Par nature

Fondé sur la nature, le marché des protéines végétaliennes en Asie-Pacifique est segmenté en protéines conventionnelles et biologiques. Le segment conventionnel a dominé le marché en 2024, soutenu par une infrastructure de production solide et un prix abordable.

Le segment biologique devrait connaître le taux de croissance le plus rapide entre 2025 et 2032, grâce à la préférence croissante des consommateurs pour les protéines végétales propres, sans OGM et issues de sources durables dans toute la région Asie-Pacifique.

- Par fonction

En fonction de leur fonction, le marché des protéines végétaliennes en Asie-Pacifique est segmenté en trois catégories : solubilité, émulsification, gélification, rétention d'eau, moussage, etc. Le segment de la solubilité détenait la plus grande part de marché en 2024 en raison de son importance dans les boissons, les shakes et les aliments fonctionnels.

Les segments de l'émulsification et de la gélification devraient connaître le taux de croissance le plus rapide de 2025 à 2032, grâce à l'utilisation croissante de protéines végétaliennes dans la boulangerie, les alternatives aux produits laitiers et les applications alimentaires transformées pour améliorer la texture et la stabilité.

- Par application

En fonction des applications, le marché des protéines végétales en Asie-Pacifique est segmenté en produits alimentaires, boissons, nutraceutiques et compléments alimentaires, cosmétiques et soins personnels, alimentation animale, produits pharmaceutiques, etc. En 2024, le segment des produits alimentaires a dominé grâce à la forte incorporation de protéines végétales dans les produits de boulangerie, les snacks et la confiserie.

Le segment des produits nutraceutiques et des compléments alimentaires devrait connaître le taux de croissance le plus rapide entre 2025 et 2032, grâce à l’adoption croissante d’aliments fonctionnels enrichis en protéines, de compléments de bien-être et de boissons enrichies.

Analyse régionale du marché des protéines végétaliennes en Asie-Pacifique

- Le marché chinois des protéines végétales a dominé la région Asie-Pacifique en 2024, porté par l'urbanisation, la sensibilisation croissante aux questions de santé et l'adoption croissante des régimes végétaliens par les consommateurs. Les consommateurs intègrent activement des aliments, boissons et compléments enrichis en protéines à leur alimentation quotidienne, soutenant une croissance soutenue.

- Les capacités de production nationales et la solidité des réseaux de distribution contribuent à l'expansion du marché. La popularité croissante des boissons prêtes à boire, des protéines en poudre et des aliments fonctionnels enrichis favorise leur adoption.

- Les consommateurs sont également influencés par une sensibilisation croissante à la durabilité environnementale et aux produits clean label. Les campagnes marketing et l'innovation produit améliorent la visibilité et accélèrent la croissance du marché.

Aperçu du marché japonais des protéines végétaliennes

Le marché japonais des protéines végétales devrait connaître sa plus forte croissance entre 2025 et 2032, porté par un intérêt croissant pour la santé, le bien-être et la nutrition fonctionnelle. Les consommateurs recherchent des solutions protéinées végétales pratiques, notamment des poudres, des barres et des boissons, pour soutenir leur apport quotidien en protéines. L'adoption de snacks enrichis en protéines et de formules prêtes à boire progresse rapidement. La forte notoriété des produits clean label et sans allergènes contribue à la croissance de la demande. Le développement du commerce de détail et du e-commerce améliore l'accessibilité, tandis que le développement de produits innovants et les campagnes marketing mettant en avant les avantages nutritionnels et environnementaux soutiennent une croissance accélérée.

Part de marché des protéines végétaliennes en Asie-Pacifique

L'industrie des protéines végétaliennes en Asie-Pacifique est principalement dirigée par des entreprises bien établies, notamment :

- Titan Biotech Ltd. (Inde)

- Sunwarrior (Chine)

- Wilmar International Ltd. (Singapour)

- Entobel (Singapour)

- Proeon (Chine)

- Groupe Shandong Jianyuan (Chine)

- Australian Plant Proteins Pty. Ltd. (Australie)

- ETChem (Chine)

- Vegemil Co., Ltd. (Corée du Sud)

- Journée parfaite (Australie)

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.