Asia Pacific Vaccines Market

Taille du marché en milliards USD

TCAC :

%

USD

9,048.51 Million

USD

18,031.69 Million

2022

2030

USD

9,048.51 Million

USD

18,031.69 Million

2022

2030

| 2023 –2030 | |

| USD 9,048.51 Million | |

| USD 18,031.69 Million | |

|

|

|

Asia-Pacific Vaccines Market, By Composition (Combination Vaccines and Mono Vaccines), Type (Subunit, Recombinant, Polysaccharide, and Conjugate Vaccines, Live-Attenuated Vaccines, Inactivated Vaccines, and Toxoid Vaccines), Kind (Routine Vaccine, Recommended Vaccine, and Required Vaccine), Age of Administration (Pediatric Vaccine and Adult Vaccine), Diseases (Pneumococcal Disease, Measles, Mumps & Varicella, DPT, Hepatitis, Influenza, Typhoid, Meningococcal, Rabies, Japanese Encephalitis, Yellow Fever, and Others), Route of Administration (Injectable, Oral, and Nasal), End User (Community Hospitals, Hospitals, Specialty Centres, Clinics, and Others), Distribution Channel (Hospital Pharmacy, Retail Pharmacy, and Online Pharmacy) - Industry Trends and Forecast to 2030.

Asia-Pacific Vaccines Market Analysis and Insights

The increasing prevalence of infectious diseases, including bacterial and viral diseases, provides the market with lucrative growth. Along with this, increasing government support and launching newer vaccines are also boosting the vaccine market. Another factor boosting the vaccine market growth is increasing vaccination awareness and demand for effective COVID-19 vaccines.

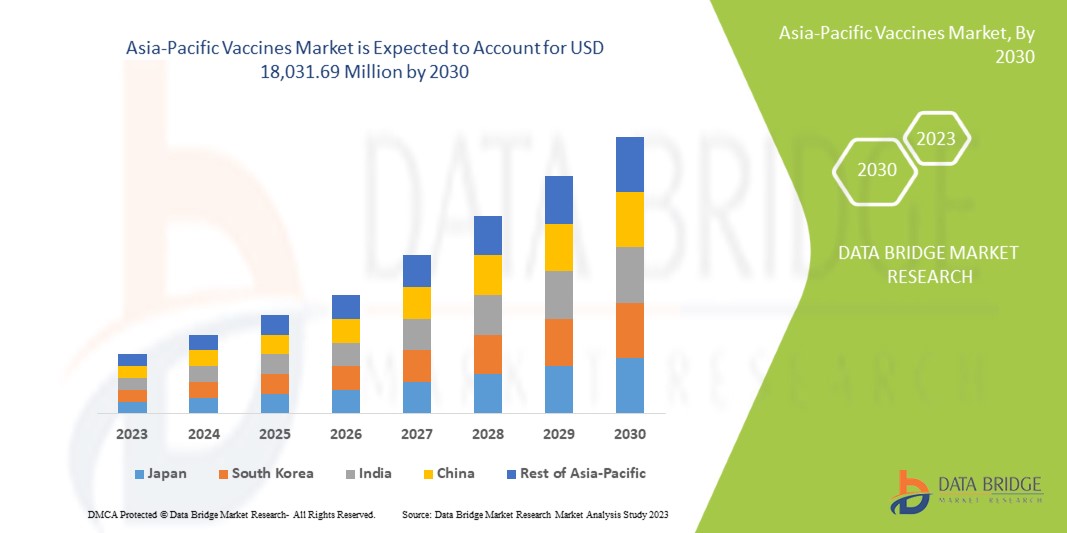

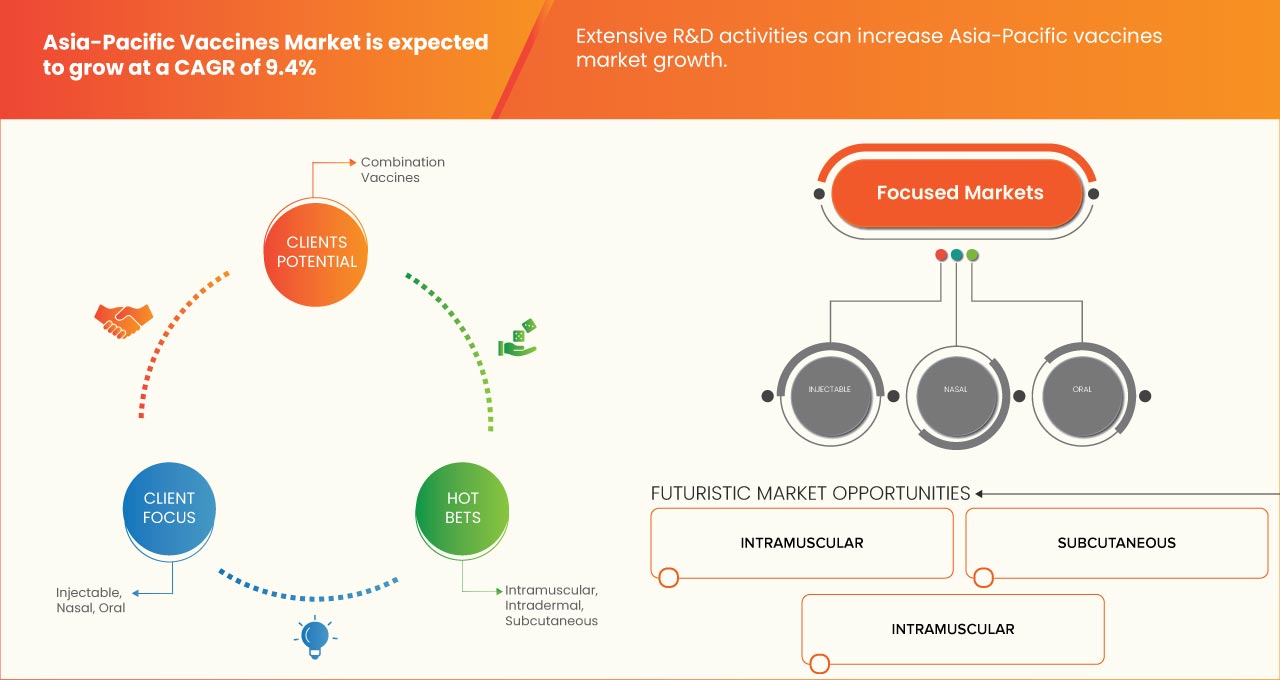

The Asia-Pacific vaccines market is expected to grow in the forecast period of 2023 to 2030. Data Bridge Market Research analyses that the market is growing with a CAGR of 9.4% in the forecast period of 2023 to 2030 and is expected to reach USD 18,031.69 Million by 2030 from USD 9,048.51 million in 2022.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customisable to 2015-2020) |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

By Composition (Combination Vaccines and Mono Vaccines), Type (Subunit, Recombinant, Polysaccharide, and Conjugate Vaccines, Live-Attenuated Vaccines, Inactivated Vaccines, and Toxoid Vaccines), Kind (Routine Vaccine, Recommended Vaccine, and Required Vaccine), Age of Administration (Pediatric Vaccine and Adult Vaccine), Diseases (Pneumococcal Disease, Measles, Mumps & Varicella, DPT, Hepatitis, Influenza, Typhoid, Meningococcal, Rabies, Japanese Encephalitis, Yellow Fever, and Others), Route of Administration (Injectable, Oral, and Nasal), End User (Community Hospitals, Hospitals, Specialty Centres, Clinics, and Others), Distribution Channel (Hospital Pharmacy, Retail Pharmacy, and Online Pharmacy) |

|

Countries Covered |

Japan, China, Australia, India, South Korea, Singapore, Indonesia, Thailand, Malaysia, Philippines, Vietnam, and Rest of Asia-Pacific |

|

Market Players Covered |

Bharat Biotech, Biological E Limited, Bio Farma, Serum Institute of India Pvt. Ltd., Takeda Pharmaceutical Company Limited, Merck Sharp & Dohme Corp. (une filiale de Merck & Co., Inc.), Abbott, AstraZeneca, Sanofi, Pfizer Inc., Janssen Global Services, LLC (une filiale de Johnson & Johnson Services, Inc.), F. Hoffmann-La Roche Ltd, Panacea Biotec Ltd et BAXTER VACCINES (une filiale de Baxter), entre autres |

Définition du marché des vaccins en Asie-Pacifique

Les vaccins sont des produits qui stimulent le système immunitaire d'un individu pour induire une immunité contre une maladie particulière. Les vaccins fonctionnent selon le principe de la mémoire et de la reconnaissance. Lorsque des microbes affaiblis ou tués sont injectés dans un corps, ces microbes incitent les cellules B, les cellules mémoires du système immunitaire, à reconnaître l'agent pathogène. À l'avenir, si le même agent pathogène attaque l'organisme, il agit contre lui. Des vaccins ont été découverts pour les maladies infectieuses, notamment la maladie pneumococcique, la rougeole, les oreillons, la rubéole, l'hépatite, la grippe, la typhoïde, la varicelle et la rage.

Il existe deux types de vaccins : les vaccins combinés (contenant différentes souches de l'agent pathogène) et les monovaccins (contenant une seule souche de l'agent pathogène). Différents types de vaccins ont été développés à partir du matériel extrait de l'agent pathogène, qui peut être une enveloppe polysaccharidique, de l'ADN, de l'ARN et de l'organisme entier, inactivé ou vivant.

Il s'agit des vaccins qui ont permis l'éradication de maladies telles que la polio. Selon la préférence et l'efficacité des vaccins, ceux-ci peuvent être injectés par plusieurs voies d'administration qui peuvent être injectables, orales ou nasales. Cependant, la voie injectable d'administration du vaccin est hautement préférée car elle induit une réponse systémique. La vaccination peut être réalisée dans les hôpitaux, les cliniques communautaires et les cliniques spécialisées, entre autres, par du personnel formé ayant les connaissances appropriées sur les dispositifs d'administration des vaccins.

La prévalence croissante des maladies infectieuses, notamment bactériennes et virales, assure au marché une croissance lucrative. Parallèlement à cela, l'augmentation du soutien gouvernemental et le lancement de nouveaux vaccins stimulent également le marché des vaccins. Un autre facteur qui stimule la croissance du marché des vaccins est la sensibilisation croissante à la vaccination et la demande de vaccins efficaces contre la COVID-19.

Dynamique du marché des vaccins en Asie-Pacifique

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

CONDUCTEURS

CROISSANCE DES PROGRAMMES ET CAMPAGNES DE VACCINATION

Les programmes et campagnes de vaccination se multiplient dans le monde entier en raison de l'augmentation du nombre de maladies chroniques. L'hépatite, la diphtérie, la coqueluche et la polio, entre autres maladies infectieuses, étant répandues dans l'environnement, il est urgent de sensibiliser davantage à la vaccination, ce qui peut être réalisé en lançant plusieurs campagnes et programmes. Il a été signalé que le nombre de programmes de vaccination augmente avec l'augmentation des maladies infectieuses. La couverture vaccinale augmente également dans le monde entier, dans le but de lutter contre les maladies débilitantes.

Pourtant, environ 20 millions de personnes ne sont toujours pas vaccinées ou le sont sous-vaccinées, ce qui accroît la demande de vaccination. La prévalence des maladies chroniques augmente dans le monde entier. Le besoin de se faire vacciner est donc grand. Cela signifie qu'un programme de vaccination en pleine expansion et la campagne de vaccination devraient faire croître le marché des vaccins.

FORTE PRÉVALENCE DE MALADIES CHRONIQUES TELLES QUE LA GRIPPE, LES MALADIES INFECTIEUSES ET VIRALES

La prévalence des maladies infectieuses augmente dans le monde entier, et l'on constate une augmentation rapide de la grippe et des maladies infectieuses bactériennes. Ce taux croissant de maladies infectieuses a créé un besoin de prévention des maladies, qui peut être évité par la vaccination ou l'immunisation. Comme les maladies augmentent considérablement, il est urgent de procéder à une vaccination de masse. Les vaccinations de masse concernent de nombreuses maladies et devraient donc assurer au marché des vaccins une croissance lucrative.

Alors que les cas de maladie augmentent, l'accent est mis sur la vaccination de masse pour éviter une augmentation de la population. De nombreuses personnes qui n'ont pas été vaccinées à un plus jeune âge sont immunisées dans le monde entier. Ainsi, pour répondre à ces besoins, la demande de nouveaux vaccins augmente et devrait donc agir comme un moteur sur le marché des vaccins en Asie-Pacifique.

RETENUE

INDISPONIBILITÉ DES VACCINS ENREGISTRÉS

Les procédures d'approbation réglementaires strictes et les procédures de développement longues des vaccins sont quelques-uns des facteurs responsables de l'indisponibilité des vaccins homologués. Les autorités réglementaires rencontrent des difficultés dans l'évaluation, l'homologation, le contrôle et la surveillance des vaccins. L'approvisionnement mondial en vaccins est retardé en raison de ces réglementations.

Par conséquent, les processus réglementaires et la constitution de documents des entreprises de fabrication dans différents pays peuvent constituer un frein et entraver la croissance du marché des vaccins.

OPPORTUNITÉ

INITIATIVES STRATÉGIQUES DES ACTEURS DU MARCHÉ

Les acteurs du marché adoptent diverses initiatives stratégiques sur le marché des vaccins qui impliquent l'expansion, la collaboration et l'acquisition. Ces initiatives leur permettent d'augmenter le portefeuille de produits de l'entreprise, ce qui conduit à l'expansion du marché et à l'augmentation de la demande de produits parmi les clients, ce qui permet en fin de compte aux acteurs du marché de générer un revenu maximal.

Alors que la demande de vaccins efficaces et innovants augmente dans le monde entier, ces initiatives stratégiques prises par les principaux acteurs du marché visent à améliorer les opérations commerciales et à accroître la rentabilité du marché.

Les différentes initiatives stratégiques adoptées par les acteurs du marché leur ont permis d'étendre leur présence dans le secteur des vaccins et de bénéficier d'une plus grande croissance sur le marché. Ainsi, les acteurs du marché opérant dans le secteur des vaccins adoptent plusieurs initiatives stratégiques qui devraient constituer une opportunité pour la croissance du marché des vaccins.

DÉFI

EFFETS SECONDAIRES CAUSÉS PAR LES VACCINS

Le vaccin est un produit médical qui aide à prévenir différentes maladies. Mais parfois, des effets secondaires surviennent en raison de l'utilisation des vaccins. Certains d'entre eux sont des effets secondaires légers qui se traduisent par une rougeur, une douleur ou un gonflement au point d'injection. Mais les effets secondaires indésirables des vaccins sont rares mais peuvent mettre la vie en danger.

Les effets secondaires potentiellement mortels peuvent susciter la peur dans l'esprit de la population. De plus, ils affectent la crédibilité des fabricants de vaccins, affectant ainsi les ventes de ces derniers. Cela suggère donc que les effets secondaires causés par les vaccins peuvent freiner la croissance du marché des vaccins.

Développements récents

- En octobre 2022, l'Indonésie a lancé son premier vaccin local contre la COVID-19. Le vaccin IndoVac a été développé conjointement par la société pharmaceutique publique indonésienne Bio Farma et le Baylor College of Medicine, un centre indépendant des sciences de la santé à Houston, au Texas.

- En novembre 2020, Merck Sharp & Dohme Corp., une filiale de Merck & Co., Inc., a signé un accord pour acquérir OncoImmune, une société biopharmaceutique en phase clinique. La société OncoImmune est fortement axée sur le développement d'options de traitement contre la COVID-19. Grâce à cet accord, la société prévoit de développer de nouveaux candidats vaccins

- En septembre 2020, Sanofi et GSK ont signé un accord avec le gouvernement canadien pour la fourniture de 72 millions de doses de vaccins contre la COVID-19. La demande de vaccins contre la COVID-19 est élevée et augmente avec la pandémie. Cet accord a permis à l'entreprise de garantir son potentiel futur

Portée du marché des vaccins en Asie-Pacifique

Le marché des vaccins en Asie-Pacifique est segmenté en composition, type, genre, âge d'administration, maladies, voie d'administration, utilisateur final et canal de distribution. La croissance parmi ces segments vous aidera à analyser les segments de croissance faibles dans les industries et fournira aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

COMPOSITION

- Vaccins combinés

- Vaccins mono

Sur la base de la composition, le marché des vaccins de la région Asie-Pacifique est segmenté en vaccins combinés et monovaccins.

TAPER

- Vaccins sous-unitaires, recombinants, polysaccharidiques et conjugués

- Vaccins vivants atténués

- Vaccins inactivés

- Vaccins à base d'anatoxines

Sur la base du type, le marché des vaccins de l'Asie-Pacifique est segmenté en vaccins sous-unitaires, recombinants, polysaccharidiques et conjugués, vaccins vivants atténués, vaccins inactivés et vaccins toxoïdes.

GENTIL

- Vaccin de routine

- Vaccin recommandé

- Vaccin obligatoire

Sur la base du type, le marché des vaccins de la région Asie-Pacifique est segmenté en vaccin de routine, vaccin recommandé et vaccin obligatoire.

ÂGE D'ADMINISTRATION

- Vaccin pédiatrique

- Vaccin pour adultes

Sur la base de l'âge d'administration, le marché des vaccins de la région Asie-Pacifique est segmenté en vaccins pédiatriques et vaccins pour adultes.

MALADIES

- Maladie pneumococcique

- Rougeole, oreillons et varicelle

- DPT

- Hépatite

- Grippe

- Typhoïde

- Méningocoque

- Varicelle

- Rage

- Encéphalite japonaise

- Fièvre jaune

- Autres

Sur la base des maladies, le marché des vaccins de l'Asie-Pacifique est segmenté en maladies pneumococciques, rougeole, oreillons et varicelle, DTP, hépatite, grippe, typhoïde, méningocoque, rage, encéphalite japonaise, fièvre jaune et autres.

VOIE D'ADMINISTRATION

- Injectable

- Nasale

- Oral

Sur la base de la voie d’administration, le marché des vaccins de l’Asie-Pacifique est segmenté en vaccins injectables, oraux et nasaux.

UTILISATEUR FINAL

- Hôpitaux communautaires

- Hôpitaux

- Centres spécialisés

- Cliniques

- Autres

Sur la base de l’utilisateur final, le marché des vaccins de l’Asie-Pacifique est segmenté en hôpitaux communautaires, hôpitaux, centres spécialisés, cliniques et autres.

CANAL DE DISTRIBUTION

- Pharmacie hospitalière

- Pharmacie de détail

- Pharmacie en ligne

Sur la base du canal de distribution, le marché des vaccins en Asie-Pacifique est segmenté en pharmacie hospitalière, pharmacie de détail et pharmacie en ligne.

Analyse/perspectives régionales du marché des vaccins en Asie-Pacifique

Le marché des vaccins en Asie-Pacifique est analysé et des informations sur la taille et les tendances du marché sont fournies par pays, composition, type, nature, âge d'administration, maladies, voie d'administration, utilisateur final et canal de distribution, comme référencé ci-dessus.

Les pays couverts dans ce rapport de marché sont le Japon, la Chine, la Corée du Sud, l’Inde, l’Australie, Singapour, la Thaïlande, la Malaisie, l’Indonésie, les Philippines, le Vietnam et le reste de l’Asie-Pacifique.

Le Japon devrait dominer le marché des vaccins en Asie-Pacifique en termes de parts de marché et de revenus et devrait continuer à accroître sa domination au cours de la période de prévision. Cela est dû à une préférence croissante pour les examens de santé préventifs.

La section pays du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Les points de données, tels que les ventes de produits neufs et de remplacement, la démographie des pays, l'épidémiologie des maladies et les tarifs d'importation et d'exportation, sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques mondiales et les défis auxquels elles sont confrontées en raison de la concurrence des marques locales et nationales et l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des vaccins en Asie-Pacifique

Le paysage concurrentiel du marché des vaccins fournit des détails sur un concurrent. Les détails comprennent la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence mondiale, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit et la domination des applications. Les points de données ci-dessus ne concernent que l'orientation des entreprises vers le marché des vaccins.

Français Certains des principaux acteurs opérant sur le marché des vaccins en Asie-Pacifique sont Bharat Biotech, Biological E Limited, Bio Farma, Serum Institute of India Pvt. Ltd., Takeda Pharmaceutical Company Limited, Merck Sharp & Dohme Corp. (une filiale de Merck & Co., Inc.), Abbott, AstraZeneca, Sanofi, Pfizer Inc., Janssen Global Services, LLC (une filiale de Johnson & Johnson Services, Inc.), F. Hoffmann-La Roche Ltd, Panacea Biotec Ltd et BAXTER VACCINES (une filiale de Baxter), entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE ASIA-PACIFIC VACCINES MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 COMPOSITION LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 PESTEL MODEL

4.2 PORTER'S FIVE FORCES

4.3 EPIDEMIOLOGY

4.4 INDUSTRIAL INSIGHTS:

4.5 PIPELINE ANALYSIS

4.6 ASIA-PACIFIC VACCINES MARKET: SUPPLY CHAIN MANAGEMENT OF VACCINES

4.6.1 COLD CHAIN STORAGE:

4.6.2 PROCESS OF LOGISTICS

5 REGULATORY FRAMEWORK

5.1 JAPAN

5.2 CHINA

5.3 SOUTH KOREA

5.4 INDIA

5.5 AUSTRALIA

5.6 SINGAPORE

5.7 THAILAND

5.8 MALAYSIA

5.9 INDONESIA

5.1 VIETNAM

5.11 PHILIPPINES

5.12 REST OF ASIA-PACIFIC

5.12.1 TAIWAN

5.12.2 CAMBODIA

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING IMMUNIZATION PROGRAMS AND CAMPAIGNS

6.1.2 HIGH PREVALENCE OF CHRONIC CONDITIONS SUCH AS FLU, INFECTIOUS AND VIRAL DISEASES

6.1.3 IMPROVEMENT IN TREATMENT

6.1.4 LAUNCH OF NEWER VACCINES

6.1.5 INCREASING GOVERNMENT SUPPORT

6.2 RESTRAINTS

6.2.1 UNAVAILABILITY OF REGISTERED VACCINES

6.2.2 DIFFICULTIES ASSOCIATED WITH THE TRANSPORT AND PRODUCTION OF VACCINES

6.3 OPPORTUNITIES

6.3.1 STRATEGIC INITIATIVES BY THE MARKET PLAYERS

6.3.2 PRESENCE OF PIPELINE PRODUCTS

6.3.3 RISE IN EXPENDITURE IN THE HEALTHCARE SECTOR

6.3.4 INCREASING AWARENESS FOR VACCINATION

6.4 CHALLENGES

6.4.1 SIDE EFFECTS CAUSED BY VACCINES

6.4.2 FEAR AMONG PATIENTS RELATED TO INJECTIONS AND NEEDLE STICKS

6.4.3 PRODUCT RECALL

7 ASIA-PACIFIC VACCINES MARKET, BY COMPOSITION

7.1 OVERVIEW

7.2 COMBINATION VACCINES

7.3 MONO VACCINES

8 ASIA-PACIFIC VACCINES MARKET, BY TYPE

8.1 OVERVIEW

8.2 SUBUNIT, RECOMBINANT, POLYSACCHARIDE, AND CONJUGATE VACCINES

8.2.1 PNEUMOCOCCAL DISEASE

8.2.2 HIB (HAEMOPHILUS INFLUENZA TYPE B) DISEASE

8.2.3 HPV (HUMAN PAPILLOMA VIRUS)

8.2.4 HEPATITIS B

8.2.5 MENINGOCOCCAL

8.2.6 SHINGLES

8.2.7 WHOOPING COUGH

8.2.8 OTHERS

8.3 LIVE-ATTENUTAED VACCINES

8.3.1 ROTAVIRUS

8.3.2 MEASLES

8.3.3 MUMPS

8.3.4 RUBELLA

8.3.5 SMALLPOX

8.3.6 YELLOW FEVER

8.3.7 OTHERS

8.4 INACTIVATED VACCINES

8.4.1 FLU (SHOT ONLY)

8.4.2 POLIO (SHOT ONLY)

8.4.3 HEPATITIS A

8.4.4 RABIES

8.4.5 OTHERS

8.5 TOXOID VACCINES

8.5.1 DIPHTHERIA, TETANUS & PERTUSSIS (DTP)

8.5.2 OTHERS

9 ASIA-PACIFIC VACCINES MARKET, BY KIND

9.1 OVERVIEW

9.2 ROUTINE VACCINES

9.2.1 PNEUMOCOCCAL DISEASES

9.3 DIPTHERIA, TETANUS & PERTUSIS(DPT)

9.3.1 HIB (HAEMOPHILUS INFLUENZA TYPE B) DISEASE

9.3.2 MEASLES

9.3.3 MUMPS

9.3.4 HEPATITIS B

9.3.5 RUBELLA

9.3.6 POLIO

9.3.7 OTHERS

9.4 RECOMMENDED VACCINE

9.4.1 TYPHOID FEVER VACCINE

9.5 HEPATITIS A

9.5.1 RABIES

9.5.2 JAPANESE ENCEPHALITIS

9.5.3 TICK-BORNE ENCEPHALITIS

9.5.4 CHOLERA

9.5.5 OTHERS

9.6 REQUIRED VACCINE

9.6.1 MENINGOCOCCAL

9.7 YELLOW FEVER

9.7.1 OTHERS

10 ASIA-PACIFIC VACCINES MARKET, BY AGE OF ADMINISTRATION

10.1 OVERVIEW

10.2 PEDIATRIC VACCINE

10.2.1 PNEUMOCOCCAL DISEASES

10.3 MEASLES, MUMPS & RUBELLA

10.3.1 DIPTHERIA, TETANUS & PERTUSIS (DPT)

10.3.2 ROTAVIRUS

10.3.3 MENINGOCOCCAL

10.3.4 VARICELLA

10.3.5 POLIO

10.3.6 TUBERCULOSIS

10.3.7 MALARIA

10.3.8 OTHERS

10.4 ADULT VACCINE

10.4.1 INFLUENZA

10.5 HPV (HUMAN PAPILLOMA VIRUS)

10.5.1 TYPHOID

10.5.2 HEPATITIS B

10.5.3 JAPANESE ENCEPHALITIS

10.5.4 YELLOW FEVER

10.5.5 CANCER

10.5.6 OTHERS

11 ASIA-PACIFIC VACCINES MARKET, BY DISEASES

11.1 OVERVIEW

11.2 PNEUMOCCOCAL DISEASE

11.3 MEASLES, MUMPS & RUBELLA

11.4 DPT

11.5 HEPATITIS

11.6 INFLUENZA

11.7 TYPHOID

11.8 MENINGOCOCCAL

11.9 VARICELLA

11.1 RABIES

11.11 JAPANESE ENCEPHALITIS

11.12 YELLOW FEVER

11.13 OTHERS

12 ASIA-PACIFIC VACCINES MARKET, BY ROUTE OF ADMINISTRATION

12.1 OVERVIEW

12.2 INJECTABLE

12.2.1 INTRAMUSCULAR

12.2.2 SUBCUTANEOUS

12.2.3 INTRADERMAL

12.3 ORAL

12.4 NASAL

13 ASIA-PACIFIC VACCINES MARKET, BY END USER

13.1 OVERVIEW

13.2 COMMUNITY HOSPITALS

13.3 HOSPITALS

13.4 SPECIALTY CENTERS

13.5 CLINICS

13.6 OTHERS

14 ASIA-PACIFIC VACCINES MARKET, BY DISTRIBUTION CHANNEL

14.1 OVERVIEW

14.2 HOSPITAL PHARMACY

14.3 RETAIL PHARMACY

14.4 ONLINE PHARMACY

15 ASIA-PACIFIC VACCINE MARKET

15.1 ASIA-PACIFIC

15.1.1 JAPAN

15.1.2 CHINA

15.1.3 AUSTRALIA

15.1.4 INDIA

15.1.5 SOUTH KOREA

15.1.6 SINGAPORE

15.1.7 MALAYSIA

15.1.8 THAILAND

15.1.9 INDONESIA

15.1.10 PHILIPPINES

15.1.11 VIETNAM

15.1.12 REST OF ASIA PACIFIC

16 ASIA-PACIFIC VACCINES MARKET: COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

16.2 DISEASE SHARE ANALYSIS: PFIZER, INC.

16.3 COUNTRY SHARE ANALYSIS: PFIZER, INC.

16.4 DISEASE SHARE ANALYSIS: MERCK SHARP & DOHME CORP. (A SUBSIDIARY OF MERCK & CO., INC.)

16.5 COUNTRY SHARE ANALYSIS: MERCK SHARP & DOHME CORP. (A SUBSIDIARY OF MERCK & CO., INC.)

16.6 DISEASE SHARE ANALYSIS: GLAXOSMITHKLINE PLC

16.7 COUNTRY SHARE ANALYSIS: GLAXOSMITHKLINE PLC.

16.8 DISEASE SHARE ANALYSIS: SANOFI

16.9 COUNTRY SHARE ANALYSIS: SANOFI

16.1 DISEASE SHARE ANALYSIS: SERUM INSTITUTE OF INDIA PVT. LTD.

16.11 COUNTRY SHARE ANALYSIS: SERUM INSTITUTE OF INDIA PVT. LTD.

17 SWOT ANALYSIS

18 COMPANY PROFILE

18.1 PFIZER INC.

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 PRODUCT PORTFOLIO

18.1.4 RECENT DEVELOPMENTS

18.2 MERCK SHARP & DOHME CORP. (A SUBSIDIARY OF MERCK & CO., INC.)

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 COMPANY WEBSITE AND PRESS RELEASES

18.2.4 PRODUCT PORTFOLIO

18.2.5 RECENT DEVELOPMENTS

18.3 GLAXOSMITHKLINE PLC.

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 PRODUCT PORTFOLIO

18.3.4 RECENT DEVELOPMENTS

18.4 SANOFI

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 PRODUCT PORTFOLIO

18.4.4 RECENT DEVELOPMENTS

18.5 SERUM INSTITUTE OF INDIA PVT. LTD.

18.5.1 COMPANY SNAPSHOT

18.5.2 PRODUCT PORTFOLIO

18.5.3 RECENT DEVELOPMENTS

18.6 ABBOTT

18.6.1 COMPANY SNAPSHOT

18.6.2 REVENUE ANALYSIS

18.6.3 PRODUCT PORTFOLIO

18.6.4 RECENT DEVELOPMENTS

18.7 ASTRAZENECA (2022)

18.7.1 COMPANY SNAPSHOT

18.7.2 REVENUE ANALYSIS

18.7.3 PRODUCT PORTFOLIO

18.7.4 RECENT DEVELOPMENTS

18.8 ALK

18.8.1 COMPANY SNAPSHOT

18.8.2 REVENUE ANALYSIS

18.8.3 PRODUCT PORTFOLIO

18.8.4 RECENT DEVELOPMENTS

18.9 BAXTER VACCINES (A SUBSIDIARY OF BAXTER)

18.9.1 COMPANY SNAPSHOT

18.9.2 REVENUE ANALYSIS

18.9.3 PRODUCT PORTFOLIO

18.9.4 RECENT DEVELOPMENT

18.1 BHARAT BIOTECH

18.10.1 COMPANY SNAPSHOT

18.10.2 PRODUCT PORTFOLIO

18.10.3 RECENT DEVELOPMENTS

18.11 BIO FARMA

18.11.1 COMPANY SNAPSHOT

18.11.2 PRODUCT PORTFOLIO

18.11.3 RECENT DEVELOPMENTS

18.12 BIOLOGICAL E LIMITED

18.12.1 COMPANY SNAPSHOT

18.12.2 PRODUCT PORTFOLIO

18.12.3 RECENT DEVELOPMENTS

18.13 DAIICHI SANKYO COMPANY, LIMITED

18.13.1 COMPANY SNAPSHOT

18.13.2 REVENUE ANALYSIS

18.13.3 PRODUCT PORTFOLIO

18.13.4 RECENT DEVELOPMENTS

18.14 F. HOFFMANN-LA ROCHE LTD

18.14.1 COMPANY SNAPSHOT

18.14.2 REVENUE ANALYSIS

18.14.3 PRODUCT PORTFOLIO

18.14.4 RECENT DEVELOPMENT

18.15 JANSSEN GLOBAL SERVICES, LLC (A SUBSIDIARY OF JOHNSON & JOHNSON SERVICES, INC.)

18.15.1 COMPANY SNAPSHOT

18.15.2 REVENUE ANALYSIS

18.15.3 PRODUCT PORTFOLIO

18.15.4 RECENT DEVELOPMENTS

18.16 LANZHOU BIOLOGICAL PRODUCTS RESEARCH INSTITUTE CO., LTD.,

18.16.1 COMPANY SNAPSHOT

18.16.2 PRODUCT PORTFOLIO

18.16.3 RECENT DEVELOPMENTS

18.17 PANACEA BIOTEC LTD

18.17.1 COMPANY SNAPSHOT

18.17.2 REVENUE ANALYSIS

18.17.3 PRODUCT PORTFOLIO

18.17.4 RECENT DEVELOPMENTS

18.18 SEQIRUS (A SUBSIDIARY OF CSL LIMITED)

18.18.1 COMPANY SNAPSHOT

18.18.2 REVENUE ANALYSIS

18.18.3 PRODUCT PORTFOLIO

18.18.4 RECENT DEVELOPMENTS

18.19 TAKEDA PHARMACEUTICAL COMPANY LIMITED

18.19.1 COMPANY SNAPSHOT

18.19.2 REVENUE ANALYSIS

18.19.3 COMPANY WEBSITE AND PRESS RELEASES

18.19.4 PRODUCT PORTFOLIO

18.19.5 RECENT DEVELOPMENTS

19 QUESTIONNAIRE

20 RELATED REPORTS

Liste des tableaux

TABLE 1 ASIA-PACIFIC VACCINES MARKET, PIPELINE ANALYSIS

TABLE 2 RECOMMENDED TEMPERATURE AND STORAGE LENGTH AT VARIOUS LEVELS OF THE COLD CHAIN.

TABLE 3 LOGISTICS PROCESS ACROSS DIFFERENT REGIONS.

TABLE 4 LAWS AND REGULATIONS IN TAIWAN

TABLE 5 VACCINES UNDER CLINICAL TRIAL

TABLE 6 THE SIDE EFFECTS RELATED TO THE VACCINES

TABLE 7 ASIA-PACIFIC VACCINES MARKET, BY COMPOSITION, 2021-2030 (USD MILLION)

TABLE 8 ASIA-PACIFIC VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 9 ASIA-PACIFIC SUBUNIT, RECOMBINANT, POLYSACCHARIDE & CONJUGATED VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 10 ASIA-PACIFIC LIVE-ATTENUATED VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 11 ASIA-PACIFIC INACTIVATED VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 12 ASIA-PACIFIC TOXOID VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 13 ASIA-PACIFIC VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 14 ASIA-PACIFIC ROUTINE VACCINES IN VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 15 ASIA-PACIFIC RECOMMENDED VACCINE IN VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 16 ASIA-PACIFIC REQUIRED VACCINE IN VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 17 ASIA-PACIFIC VACCINES MARKET, BY AGE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 18 ASIA-PACIFIC PEDIATRIC VACCINE IN VACCINES MARKET, BY AGE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 19 ASIA-PACIFIC ADULT VACCINE IN VACCINES MARKET, BY AGE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 20 ASIA-PACIFIC VACCINES MARKET, BY DISEASE, 2021-2030 (USD MILLION)

TABLE 21 ASIA-PACIFIC VACCINES MARKET, BY ROUTE OF ADMINISTRATION, 2022-2030 (USD MILLION)

TABLE 22 ASIA-PACIFIC INJECTABLE IN VACCINES MARKET, BY ROUTE OF ADMINISTRATION, 2022-2030 (USD MILLION)

TABLE 23 ASIA-PACIFIC VACCINES MARKET, BY END USER, 2022-2030 (USD MILLION)

TABLE 24 ASIA-PACIFIC VACCINES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 25 ASIA-PACIFIC KNEE CARTILAGE REPAIR MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 26 JAPAN VACCINES MARKET, BY COMPOSITION, 2021-2030 (USD MILLION)

TABLE 27 JAPAN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 28 JAPAN SUBUNIT, RECOMBINANT, POLYSACCHARIDE & CONJUGATED VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 29 JAPAN LIVE-ATTENUATED VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 30 JAPAN INACTIVATED VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 31 JAPAN TOXOID VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 32 JAPAN VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 33 JAPAN ROUTINE VACCINE IN VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 34 JAPAN RECOMMENDED VACCINE IN VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 35 JAPAN REQUIRED VACCINE IN VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 36 JAPAN VACCINES MARKET, BY AGE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 37 JAPAN PEDIATRIC VACCINE IN VACCINES MARKET, BY AGE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 38 JAPAN ADULT IN VACCINES MARKET, BY AGE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 39 JAPAN VACCINES MARKET, BY DISEASE, 2021-2030 (USD MILLION)

TABLE 40 JAPAN VACCINES MARKET, BY ROUTE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 41 JAPAN INJECTABLE IN VACCINES MARKET, BY ROUTE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 42 JAPAN VACCINES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 43 JAPAN VACCINES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 44 CHINA VACCINES MARKET, BY COMPOSITION, 2021-2030 (USD MILLION)

TABLE 45 CHINA VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 46 CHINA SUBUNIT, RECOMBINANT, POLYSACCHARIDE & CONJUGATED VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 47 CHINA LIVE-ATTENUATED VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 48 CHINA INACTIVATED VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 49 CHINA TOXOID VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 50 CHINA VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 51 CHINA ROUTINE VACCINE IN VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 52 CHINA RECOMMENDED VACCINE IN VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 53 CHINA REQUIRED VACCINE IN VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 54 CHINA VACCINES MARKET, BY AGE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 55 CHINA PEDIATRIC VACCINE IN VACCINES MARKET, BY AGE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 56 CHINA ADULT IN VACCINES MARKET, BY AGE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 57 CHINA VACCINES MARKET, BY DISEASE, 2021-2030 (USD MILLION)

TABLE 58 CHINA VACCINES MARKET, BY ROUTE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 59 CHINA INJECTABLE IN VACCINES MARKET, BY ROUTE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 60 CHINA VACCINES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 61 CHINA VACCINES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 62 AUSTRALIA VACCINES MARKET, BY COMPOSITION, 2021-2030 (USD MILLION)

TABLE 63 AUSTRALIA VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 64 AUSTRALIA SUBUNIT, RECOMBINANT, POLYSACCHARIDE & CONJUGATED VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 65 AUSTRALIA LIVE-ATTENUATED VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 66 AUSTRALIA INACTIVATED VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 67 AUSTRALIA TOXOID VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 68 AUSTRALIA VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 69 AUSTRALIA ROUTINE VACCINE IN VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 70 AUSTRALIA RECOMMENDED VACCINE IN VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 71 AUSTRALIA REQUIRED VACCINE IN VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 72 AUSTRALIA VACCINES MARKET, BY AGE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 73 AUSTRALIA PEDIATRIC VACCINE IN VACCINES MARKET, BY AGE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 74 AUSTRALIA ADULT IN VACCINES MARKET, BY AGE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 75 AUSTRALIA VACCINES MARKET, BY DISEASE, 2021-2030 (USD MILLION)

TABLE 76 AUSTRALIA VACCINES MARKET, BY ROUTE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 77 AUSTRALIA INJECTABLE IN VACCINES MARKET, BY ROUTE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 78 AUSTRALIA VACCINES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 79 INDIA VACCINES MARKET, BY COMPOSITION, 2021-2030 (USD MILLION)

TABLE 80 INDIA VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 81 INDIA SUBUNIT, RECOMBINANT, POLYSACCHARIDE & CONJUGATED VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 82 INDIA LIVE-ATTENUATED VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 83 INDIA INACTIVATED VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 84 INDIA TOXOID VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 85 INDIA VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 86 INDIA ROUTINE VACCINE IN VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 87 INDIA RECOMMENDED VACCINE IN VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 88 INDIA REQUIRED VACCINE IN VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 89 INDIA VACCINES MARKET, BY AGE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 90 INDIA PEDIATRIC VACCINE IN VACCINES MARKET, BY AGE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 91 INDIA ADULT IN VACCINES MARKET, BY AGE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 92 INDIA VACCINES MARKET, BY DISEASE, 2021-2030 (USD MILLION)

TABLE 93 INDIA VACCINES MARKET, BY ROUTE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 94 INDIA INJECTABLE IN VACCINES MARKET, BY ROUTE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 95 INDIA VACCINES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 96 INDIA VACCINES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 97 SOUTH KOREA VACCINES MARKET, BY COMPOSITION, 2021-2030 (USD MILLION)

TABLE 98 SOUTH KOREA VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 99 SOUTH KOREA SUBUNIT, RECOMBINANT, POLYSACCHARIDE & CONJUGATED VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 100 SOUTH KOREA LIVE-ATTENUATED VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 101 SOUTH KOREA INACTIVATED VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 102 SOUTH KOREA VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 103 SOUTH KOREA ROUTINE VACCINE IN VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 104 SOUTH KOREA RECOMMENDED VACCINE IN VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 105 SOUTH KOREA REQUIRED VACCINE IN VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 106 SOUTH KOREA VACCINES MARKET, BY AGE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 107 SOUTH KOREA PEDIATRIC VACCINE IN VACCINES MARKET, BY AGE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 108 SOUTH KOREA ADULT IN VACCINES MARKET, BY AGE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 109 SOUTH KOREA VACCINES MARKET, BY DISEASE, 2021-2030 (USD MILLION)

TABLE 110 SOUTH KOREA VACCINES MARKET, BY ROUTE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 111 SOUTH KOREA INJECTABLE IN VACCINES MARKET, BY ROUTE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 112 SOUTH KOREA VACCINES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 113 SOUTH KOREA VACCINES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 114 SINGAPORE VACCINES MARKET, BY COMPOSITION, 2021-2030 (USD MILLION)

TABLE 115 SINGAPORE SUBUNIT, RECOMBINANT, POLYSACCHARIDE & CONJUGATED VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 116 SINGAPORE LIVE-ATTENUATED VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 117 SINGAPORE INACTIVATED VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 118 SINGAPORE TOXOID VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 119 SINGAPORE VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 120 SINGAPORE ROUTINE VACCINE IN VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 121 SINGAPORE RECOMMENDED VACCINE IN VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 122 SINGAPORE REQUIRED VACCINE IN VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 123 SINGAPORE VACCINES MARKET, BY AGE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 124 SINGAPORE PEDIATRIC VACCINE IN VACCINES MARKET, BY AGE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 125 SINGAPORE ADULT IN VACCINES MARKET, BY AGE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 126 SINGAPORE VACCINES MARKET, BY DISEASE, 2021-2030 (USD MILLION)

TABLE 127 SINGAPORE VACCINES MARKET, BY ROUTE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 128 SINGAPORE INJECTABLE IN VACCINES MARKET, BY ROUTE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 129 SINGAPORE VACCINES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 130 SINGAPORE VACCINES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 131 MALAYSIA VACCINES MARKET, BY COMPOSITION, 2021-2030 (USD MILLION)

TABLE 132 MALAYSIA VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 133 MALAYSIA SUBUNIT, RECOMBINANT, POLYSACCHARIDE & CONJUGATED VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 134 MALAYSIA LIVE-ATTENUATED VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 135 MALAYSIA INACTIVATED VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 136 MALAYSIA TOXOID VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 137 MALAYSIA VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 138 MALAYSIA ROUTINE VACCINE IN VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 139 MALAYSIA RECOMMENDED VACCINE IN VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 140 MALAYSIA REQUIRED VACCINE IN VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 141 MALAYSIA VACCINES MARKET, BY AGE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 142 MALAYSIA PEDIATRIC VACCINE IN VACCINES MARKET, BY AGE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 143 MALAYSIA ADULT IN VACCINES MARKET, BY AGE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 144 MALAYSIA VACCINES MARKET, BY DISEASE, 2021-2030 (USD MILLION)

TABLE 145 MALAYSIA VACCINES MARKET, BY ROUTE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 146 MALAYSIA INJECTABLE IN VACCINES MARKET, BY ROUTE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 147 MALAYSIA VACCINES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 148 MALAYSIA VACCINES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 149 THAILAND VACCINES MARKET, BY COMPOSITION, 2021-2030 (USD MILLION)

TABLE 150 THAILAND VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 151 THAILAND SUBUNIT, RECOMBINANT, POLYSACCHARIDE & CONJUGATED VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 152 THAILAND LIVE-ATTENUATED VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 153 THAILAND INACTIVATED VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 154 THAILAND TOXOID VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 155 THAILAND VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 156 THAILAND RECOMMENDED VACCINE IN VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 157 THAILAND REQUIRED VACCINE IN VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 158 THAILAND VACCINES MARKET, BY AGE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 159 THAILAND PEDIATRIC VACCINE IN VACCINES MARKET, BY AGE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 160 THAILAND ADULT IN VACCINES MARKET, BY AGE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 161 THAILAND VACCINES MARKET, BY DISEASE, 2021-2030 (USD MILLION)

TABLE 162 THAILAND VACCINES MARKET, BY ROUTE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 163 THAILAND INJECTABLE IN VACCINES MARKET, BY ROUTE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 164 THAILAND VACCINES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 165 THAILAND VACCINES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 166 INDONESIA VACCINES MARKET, BY COMPOSITION, 2021-2030 (USD MILLION)

TABLE 167 INDONESIA VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 168 INDONESIA SUBUNIT, RECOMBINANT, POLYSACCHARIDE & CONJUGATED VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 169 INDONESIA LIVE-ATTENUATED VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 170 INDONESIA INACTIVATED VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 171 INDONESIA TOXOID VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 172 INDONESIA VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 173 INDONESIA ROUTINE VACCINE IN VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 174 INDONESIA RECOMMENDED VACCINE IN VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 175 INDONESIA REQUIRED VACCINE IN VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 176 INDONESIA VACCINES MARKET, BY AGE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 177 INDONESIA PEDIATRIC VACCINE IN VACCINES MARKET, BY AGE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 178 INDONESIA ADULT IN VACCINES MARKET, BY AGE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 179 INDONESIA VACCINES MARKET, BY DISEASE, 2021-2030 (USD MILLION)

TABLE 180 INDONESIA VACCINES MARKET, BY ROUTE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 181 INDONESIA INJECTABLE IN VACCINES MARKET, BY ROUTE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 182 INDONESIA VACCINES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 183 INDONESIA VACCINES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 184 PHILIPPINES VACCINES MARKET, BY COMPOSITION, 2021-2030 (USD MILLION)

TABLE 185 PHILIPPINES VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 186 PHILIPPINES SUBUNIT, RECOMBINANT, POLYSACCHARIDE & CONJUGATED VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 187 PHILIPPINES LIVE-ATTENUATED VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 188 PHILIPPINES INACTIVATED VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 189 PHILIPPINES TOXOID VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 190 PHILIPPINES VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 191 PHILIPPINES ROUTINE VACCINE IN VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 192 PHILIPPINES RECOMMENDED VACCINE IN VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 193 PHILIPPINES REQUIRED VACCINE IN VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 194 PHILIPPINES VACCINES MARKET, BY AGE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 195 PHILIPPINES PEDIATRIC VACCINE IN VACCINES MARKET, BY AGE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 196 PHILIPPINES ADULT IN VACCINES MARKET, BY AGE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 197 PHILIPPINES VACCINES MARKET, BY DISEASE, 2021-2030 (USD MILLION)

TABLE 198 PHILIPPINES VACCINES MARKET, BY ROUTE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 199 PHILIPPINES INJECTABLE IN VACCINES MARKET, BY ROUTE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 200 PHILIPPINES VACCINES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 201 PHILIPPINES VACCINES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 202 VIETNAM VACCINES MARKET, BY COMPOSITION, 2021-2030 (USD MILLION)

TABLE 203 VIETNAM VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 204 VIETNAM SUBUNIT, RECOMBINANT, POLYSACCHARIDE & CONJUGATED VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 205 VIETNAM LIVE-ATTENUATED VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 206 VIETNAM INACTIVATED VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 207 VIETNAM TOXOID VACCINES IN VACCINES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 208 VIETNAM VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 209 VIETNAM ROUTINE VACCINE IN VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 210 VIETNAM RECOMMENDED VACCINE IN VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 211 VIETNAM REQUIRED VACCINE IN VACCINES MARKET, BY KIND, 2021-2030 (USD MILLION)

TABLE 212 VIETNAM VACCINES MARKET, BY AGE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 213 VIETNAM PEDIATRIC VACCINE IN VACCINES MARKET, BY AGE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 214 VIETNAM ADULT IN VACCINES MARKET, BY AGE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 215 VIETNAM VACCINES MARKET, BY DISEASE, 2021-2030 (USD MILLION)

TABLE 216 VIETNAM VACCINES MARKET, BY ROUTE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 217 VIETNAM INJECTABLE IN VACCINES MARKET, BY ROUTE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 218 VIETNAM VACCINES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 219 VIETNAM VACCINES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 220 REST OF ASIA-PACIFIC VACCINES MARKET, BY COMPOSITION, 2021-2030 (USD MILLION)

Liste des figures

FIGURE 1 ASIA-PACIFIC VACCINES MARKET: SEGMENTATION

FIGURE 2 ASIA-PACIFIC VACCINES MARKET: DATA TRIANGULATION

FIGURE 3 ASIA-PACIFIC VACCINES MARKET: DROC ANALYSIS

FIGURE 4 ASIA-PACIFIC VACCINES MARKET: ASIA-PACIFIC VS COUNTRY MARKET ANALYSIS

FIGURE 5 ASIA-PACIFIC VACCINES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA-PACIFIC VACCINES MARKET: MULTIVARIATE MODELLING

FIGURE 7 ASIA-PACIFIC VACCINES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 ASIA-PACIFIC VACCINES MARKET: DBMR MARKET POSITION GRID

FIGURE 9 ASIA-PACIFIC VACCINES MARKET: SEGMENTATION

FIGURE 10 GROWING IMMUNIZATION PROGRAMS AND CAMPAIGNS AND THE HIGH PREVALENCE OF CHRONIC CONDITIONS SUCH AS FLU AND BACTERIAL INFECTIOUS DISEASES ARE DRIVING THE ASIA-PACIFIC VACCINES MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 11 THE COMBINATION VACCINES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA-PACIFIC VACCINES MARKET IN 2023 & 2030

FIGURE 12 FDA REGULATORY REVIEW PROCESS OF VACCINES

FIGURE 13 PROCESS OF SPECIAL APPROVAL ON VACCINES DURING THE 2019 H1N1PDM PANDEMIC

FIGURE 14 REGULATION OVERVIEW FOR THERAPEUTICS IN SINGAPORE

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF THE ASIA-PACIFIC VACCINES MARKET

FIGURE 16 ASIA-PACIFIC VACCINES MARKET: BY COMPOSITION, 2022

FIGURE 17 ASIA-PACIFIC VACCINES MARKET: BY COMPOSITION, 2023-2030 (USD MILLION)

FIGURE 18 ASIA-PACIFIC VACCINES MARKET: BY COMPOSITION, CAGR (2023-2030)

FIGURE 19 ASIA-PACIFIC VACCINES MARKET: BY COMPOSITION, LIFELINE CURVE

FIGURE 20 ASIA-PACIFIC VACCINES MARKET: BY TYPE, 2022

FIGURE 21 ASIA-PACIFIC VACCINES MARKET: BY TYPE, 2023-2030 (USD MILLION)

FIGURE 22 ASIA-PACIFIC VACCINES MARKET: BY TYPE, CAGR (2023-2030)

FIGURE 23 ASIA-PACIFIC VACCINES MARKET: BY TYPE, LIFELINE CURVE

FIGURE 24 ASIA-PACIFIC VACCINES MARKET: BY KIND, 2022

FIGURE 25 ASIA-PACIFIC VACCINES MARKET: BY KIND, 2023-2030 (USD MILLION)

FIGURE 26 ASIA-PACIFIC VACCINES MARKET: BY KIND, CAGR (2023-2030)

FIGURE 27 ASIA-PACIFIC VACCINES MARKET: BY KIND, LIFELINE CURVE

FIGURE 28 ASIA-PACIFIC VACCINES MARKET: BY AGE OF ADMINISTRATION, 2022

FIGURE 29 ASIA-PACIFIC VACCINES MARKET: BY AGE OF ADMINISTRATION, 2023-2030 (USD MILLION)

FIGURE 30 ASIA-PACIFIC VACCINES MARKET: BY AGE OF ADMINISTRATION, CAGR (2023-2030)

FIGURE 31 ASIA-PACIFIC VACCINES MARKET: BY AGE OF ADMINISTRATION, LIFELINE CURVE

FIGURE 32 ASIA-PACIFIC VACCINES MARKET: BY DISEASES, 2022

FIGURE 33 ASIA-PACIFIC VACCINES MARKET: BY DISEASES, 2023-2030 (USD MILLION)

FIGURE 34 ASIA-PACIFIC VACCINES MARKET: BY DISEASES, CAGR (2023-2030)

FIGURE 35 ASIA-PACIFIC VACCINES MARKET: BY DISEASES, LIFELINE CURVE

FIGURE 36 ASIA-PACIFIC VACCINES MARKET: BY ROUTE OF ADMINISTRATION, 2022

FIGURE 37 ASIA-PACIFIC VACCINES MARKET: BY ROUTE OF ADMINISTRATION, 2023-2030 (USD MILLION)

FIGURE 38 ASIA-PACIFIC VACCINES MARKET: BY ROUTE OF ADMINISTRATION, CAGR (2023-2030)

FIGURE 39 ASIA-PACIFIC VACCINES MARKET: BY ROUTE OF ADMINISTRATION, LIFELINE CURVE

FIGURE 40 ASIA-PACIFIC VACCINES MARKET: BY END USER, 2022

FIGURE 41 ASIA-PACIFIC VACCINES MARKET: BY END USER, 2023-2030 (USD MILLION)

FIGURE 42 ASIA-PACIFIC VACCINES MARKET: BY END USER, CAGR (2023-2030)

FIGURE 43 ASIA-PACIFIC VACCINES MARKET: BY END USER, LIFELINE CURVE

FIGURE 44 ASIA-PACIFIC VACCINES MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 45 ASIA-PACIFIC VACCINES MARKET: BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

FIGURE 46 ASIA-PACIFIC VACCINES MARKET: BY DISTRIBUTION CHANNEL, CAGR (2023-2030)

FIGURE 47 ASIA-PACIFIC VACCINES MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 48 ASIA-PACIFIC VACCINE MARKET: SNAPSHOT (2022)

FIGURE 49 ASIA-PACIFIC VACCINE MARKET: BY COUNTRY (2022)

FIGURE 50 ASIA-PACIFIC VACCINE MARKET: BY COUNTRY (2023 & 2030)

FIGURE 51 ASIA-PACIFIC VACCINE MARKET: BY COUNTRY (2022 & 2030)

FIGURE 52 ASIA-PACIFIC VACCINE MARKET: BY COMPOSITION (2023-2030)

FIGURE 53 ASIA-PACIFIC VACCINES MARKET: COMPANY SHARE 2022 (%)

FIGURE 54 PFIZER, INC., ASIA-PACIFIC VACCINES MARKET: DISEASE SHARE 2022 (%)

FIGURE 55 PFIZER, INC., ASIA-PACIFIC VACCINES MARKET: COUNTRY SHARE 2022 (%)

FIGURE 56 MERCK SHARP & DOHME CORP. (A SUBSIDIARY OF MERCK & CO., INC.) ASIA-PACIFIC VACCINES MARKET: DISEASE SHARE 2022 (%)

FIGURE 57 MERCK SHARP & DOHME CORP. (A SUBSIDIARY OF MERCK & CO., INC.) ASIA-PACIFIC VACCINES MARKET: COUNTRY SHARE 2022 (%)

FIGURE 58 GLAXOSMITHKLINE PLC, ASIA-PACIFIC VACCINES MARKET: DISEASE SHARE 2022 (%)

FIGURE 59 GLAXOSMITHKLINE PLC, ASIA-PACIFIC VACCINES MARKET: COMPANY SHARE 2022 (%)

FIGURE 60 SANOFI, ASIA-PACIFIC VACCINES MARKET: DISEASE SHARE 2022 (%)

FIGURE 61 SANOFI ASIA-PACIFIC VACCINES MARKET: COUNTRY SHARE 2022 (%)

FIGURE 62 SERUM INSTITUTE OF INDIA PVT. LTD., ASIA-PACIFIC VACCINES MARKET: DISEASE SHARE 2022 (%)

FIGURE 63 SERUM INSTITUTE OF INDIA PVT. LTD. ASIA-PACIFIC VACCINES MARKET: COUNTRY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.