Marché des logiciels de trésorerie en Asie-Pacifique, par système d'exploitation (Windows, Linux, IOS, Android, MAC), application (gestion des liquidités et de la trésorerie, gestion des investissements, gestion de la dette, gestion des risques financiers, gestion de la conformité, planification fiscale, autres), mode de déploiement (sur site, cloud), taille de l'organisation (grandes entreprises et petites et moyennes entreprises), vertical (banque, services financiers et assurances, gouvernement, fabrication, soins de santé, biens de consommation, produits chimiques , énergie et autres) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et taille du marché des logiciels de trésorerie en Asie-Pacifique

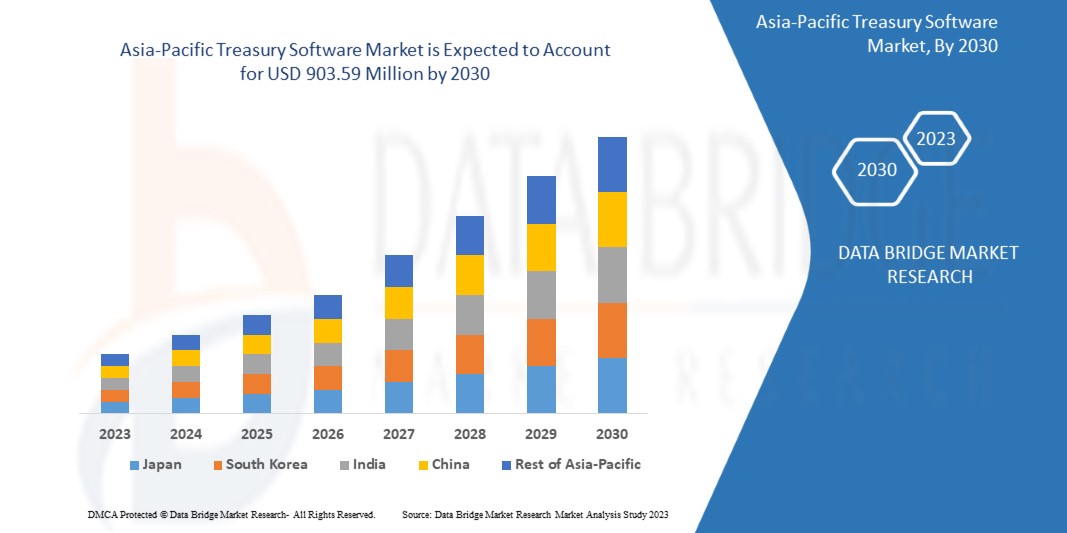

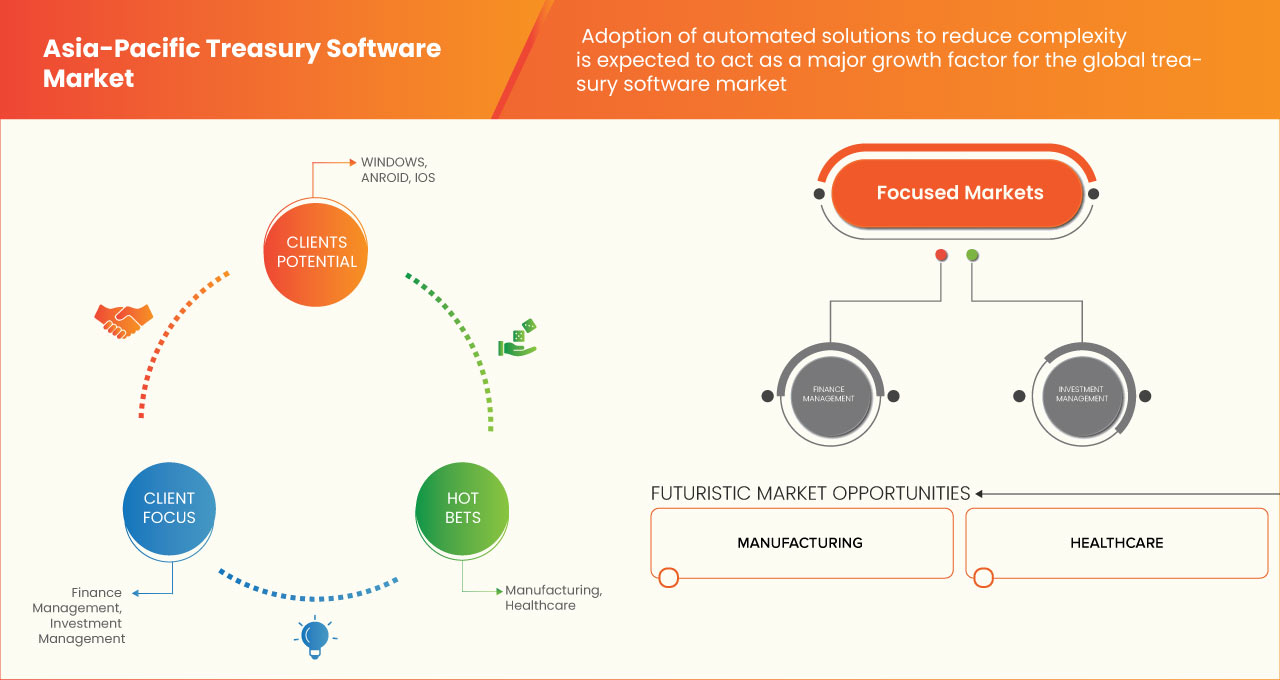

Le marché des logiciels de trésorerie de la région Asie-Pacifique devrait connaître une croissance du marché au cours de la période de prévision de 2023 à 2030. Data Bridge Market Research analyse que le marché croît avec un TCAC de 3,6 % au cours de la période de prévision de 2023 à 2030 et devrait atteindre 903,59 millions USD d'ici 2030. L'augmentation de l'exigence d'un processus de prise de décision rapide dans la biotechnologie devrait stimuler considérablement la croissance du marché.

Le rapport sur le marché des logiciels de trésorerie en Asie-Pacifique fournit des détails sur les parts de marché, les nouveaux développements et l'analyse du pipeline de produits, l'impact des acteurs du marché national et localisé, les opportunités d'analyse en termes de poches de revenus émergentes, les changements dans la réglementation du marché, les approbations de produits, les décisions stratégiques, les lancements de produits, les expansions géographiques et les innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché, contactez Data Bridge Market Research pour un briefing d'analyste, notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable pour 2020-2016) |

|

Unités quantitatives |

Chiffre d'affaires en milliers de dollars américains, prix en dollars américains |

|

Segments couverts |

Système d'exploitation (Windows, Linux, IOS, Android, MAC), application (gestion des liquidités et de la trésorerie, gestion des investissements, gestion de la dette, gestion des risques financiers, gestion de la conformité, planification fiscale, autres), mode de déploiement (sur site, cloud), taille de l'organisation (grandes entreprises et petites et moyennes entreprises), secteur vertical (banque, services financiers et assurances, gouvernement, fabrication, soins de santé, biens de consommation, produits chimiques, énergie et autres) |

|

Pays couverts |

Chine, Inde, Japon, Corée du Sud, Australie, Indonésie, Malaisie, Thaïlande, Singapour, Philippines et le reste de l'Asie-Pacifique |

|

Acteurs du marché couverts |

Finastra, ZenTreasury Ltd, Emphasys Software, SS&C Technologies, Inc., CAPIX, Adenza, Coupa Software Inc., DataLog Finance, FIS, Access Systems (UK) Limited, Treasury Software Corp., MUREX SAS, EdgeVerve Systems Limited (une filiale à 100 % d'Infosys), Financial Sciences Corp., Broadridge Financial Solutions, Inc., CashAnalytics, Oracle, Fiserv, Inc, ION, SAP, Solomon Software, ABM CLOUD et entre autres |

Définition du marché

Le logiciel de trésorerie est une application qui automatise les activités financières d'une entreprise telles que les flux de trésorerie, les actifs et les investissements. Il fournit un système de gestion de trésorerie qui suit la capacité d'une entreprise à convertir des actifs en espèces pour faire face à une obligation financière. Les gestionnaires financiers et les comptes utilisent le logiciel de gestion de trésorerie pour surveiller la liquidité et la capacité à convertir des actifs en espèces pour faire face aux obligations financières. Le logiciel automatise et rationalise les fonctions de gestion de trésorerie, réduisant les risques financiers et de réputation, réduisant les coûts et améliorant l'efficacité et l'efficience opérationnelles. La visibilité, les analyses et les prévisions accrues fournies par le système de gestion de trésorerie améliorent la prise de décision et aident à créer des stratégies financières organisationnelles.

Dynamique du marché des logiciels de trésorerie en Asie-Pacifique

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Demande croissante de systèmes avancés de gestion de trésorerie pour améliorer l'expérience client

Les systèmes de gestion de trésorerie (TMS) sont des logiciels qui permettent d'automatiser les processus manuels de trésorerie. En offrant une meilleure visibilité sur la trésorerie et les liquidités tout en prenant le contrôle des comptes bancaires, en maintenant la conformité et en gérant les transactions financières, la satisfaction des clients s'est améliorée. Le système de gestion de trésorerie offre essentiellement sept avantages fondamentaux à l'organisation qui peuvent améliorer les capacités, notamment :

- Augmenter la productivité

- Disponibilité des données précises et en temps réel

- Réduction des erreurs de saisie manuelle et de calcul

- Limitez les coûts bancaires et de change redondants

- Suivi détaillé de l'activité

- Flexibilité bancaire et connectivité

- Conformité réglementaire et atténuation des risques

Selon Coupa Software Inc., l'adoption de solutions TMS peut être affectée par divers facteurs tels que la volatilité des devises de 52 %, l'exposition aux risques de trésorerie et financiers de 43 %, le rapatriement de fonds de 40 %, l'infrastructure de trésorerie inadéquate de 30 %, les impacts de la réforme fiscale en Asie-Pacifique de 24 %, le risque opérationnel et de fraude dû aux méthodes traditionnelles de 20 %, le coût opérationnel de la trésorerie de 12 % et d'autres facteurs de 12 %.

- Adoption rapide de l'intelligence artificielle dans la gestion de trésorerie

L’intelligence artificielle a récemment joué un rôle essentiel dans le renforcement et la transformation des industries du monde entier. Des organismes gouvernementaux aux grandes organisations en passant par les petites entreprises en ligne, l’intelligence artificielle (IA) est utilisée par de nombreuses entités sur de multiples plateformes à travers le monde.

En 2020, selon l’enquête menée par NewVantage, 91,5 % des grandes entreprises ont investi massivement dans l’IA. Bien que les entreprises ayant investi dans l’IA utilisent les technologies de l’IA à un rythme modeste, seulement 14,6 % d’entre elles utilisent largement la technologie de l’IA au sein de leur organisation. Parmi elles, plus de la moitié, soit 51,2 %, ont déployé l’IA en production limitée et 26,8 % la pilotent. Cela témoigne du nombre croissant de technologies de l’IA et de la forte volonté des entreprises de les adopter.

L’intelligence artificielle (IA) a déjà démontré son incroyable potentiel en matière de gestion de trésorerie et de prévision. L’IA tente de résoudre des problèmes que l’on pensait auparavant pouvoir résoudre uniquement par une intervention humaine.

Opportunités

- Pénétration des solutions d'analyse avancées dans le secteur bancaire

De nos jours, les banques ont de plus en plus recours à l'analyse pour obtenir un avantage concurrentiel et pour tirer des conclusions et des informations sur la base des informations et des données collectées. L'analyse avancée peut être utilisée pour prédire le comportement et les préférences des clients et pour améliorer l'évaluation des risques. Parfois, les données générées par les secteurs bancaire et financier sont de grande ampleur, et il n'est pas possible pour les banques de les gérer avec leur base de données traditionnelle. Par conséquent, l'analyse a ouvert la voie aux secteurs financiers pour traiter une grande quantité de données à la fois.

De plus, le monde numérique a révolutionné le secteur bancaire. La plupart des solutions d’analyse avancées pour le secteur bancaire sont composées de quatre composants différents : le reporting, l’analyse descriptive, l’analyse prédictive et l’analyse prescriptive. Les institutions financières peuvent désormais cibler et engager les clients de manière continue, et pas seulement lorsqu’ils se rendent dans une agence. Leur portée comprend désormais les clients qui utilisent des applications mobiles, des distributeurs automatiques de billets et des applications bancaires en ligne. Les banques peuvent également utiliser l’analyse pour proposer des produits, des services et des offres personnalisés aux clients en fonction de leurs profils et de leurs historiques. De plus, l’analyse dans le monde bancaire permet également d’identifier et de prévenir la fraude. Les banques utilisent l’analyse avancée pour comparer les habitudes d’utilisation des clients à leurs propres indicateurs de fraude et peuvent immédiatement prendre des mesures lorsqu’une activité potentiellement frauduleuse est détectée. La pénétration globale de l’analyse dans le secteur bancaire est encore relativement faible par rapport à son utilisation dans d’autres secteurs. Cependant, la pénétration de l’analyse dans le secteur bancaire crée de nombreuses opportunités de croissance pour le marché des logiciels de trésorerie.

Contraintes/Défis

- Augmentation des cybermenaces et des violations de données

En raison du COVID-19, la cybercriminalité et les problèmes de cybersécurité ont augmenté de 600 % en 2020. Les failles de sécurité du réseau sont exploitées par les pirates pour effectuer des actions non autorisées au sein d'un système.

Selon Purple Sec LLC, en 2018, les variantes de malwares mobiles ont augmenté de 54 %, dont 98 % ciblent divers appareils Android intelligents. On estime que 25 % des entreprises ont été victimes de crypto-jacking. Les entreprises concernées comprennent le secteur bancaire et les équipes de gestion financière de diverses entreprises/secteurs.

Ces derniers temps, les entreprises et les secteurs d'activité ont adopté massivement la numérisation. Les secteurs bancaire, commercial, touristique et autres évoluent vers des modèles numériques pour améliorer l'expérience client. La numérisation génère une énorme quantité de données et d'informations sur les clients. Cela soulève des problèmes de sécurité, et ces données ont toujours été plus exposées aux cyberattaques et aux violations de données. Grâce à ces informations et à ces données, il devient facile pour les fraudeurs et les cyberattaquants d'imiter ou de voler l'identité d'un individu, qui peut être utilisée pour divers crimes.

Selon une étude S&P Asie-Pacifique sur la part des incidents de cyberattaques en Asie-Pacifique dans les différents secteurs au cours des cinq dernières années, de 2016 à 2021, les institutions financières sont en tête de liste avec 26 % d'incidents de cybersécurité, suivies par les soins de santé avec 11 %, les logiciels et les services technologiques avec 7 % et le commerce de détail avec 6 %.

Impact post-COVID-19 sur le marché des logiciels de trésorerie en Asie-Pacifique

La pandémie de COVID-19 a eu un impact considérable sur le marché des logiciels de trésorerie de la région Asie-Pacifique. La pandémie a provoqué des perturbations majeures dans les chaînes d’approvisionnement, les marchés financiers et les activités économiques de la région Asie-Pacifique, entraînant un changement dans les priorités et les stratégies des services de trésorerie du monde entier.

L’un des impacts les plus significatifs de la pandémie sur le marché des logiciels de trésorerie a été la demande accrue de solutions basées sur le cloud. La pandémie a forcé de nombreuses organisations à passer rapidement au travail à distance, ce qui a mis en évidence l’importance de disposer de solutions de trésorerie basées sur le cloud sécurisées, accessibles et évolutives. En conséquence, la demande de solutions logicielles de trésorerie basées sur le cloud a considérablement augmenté.

Un autre impact de la pandémie sur le marché des logiciels de trésorerie est l’attention accrue portée aux prévisions de trésorerie et à la gestion des liquidités. La pandémie a créé des incertitudes et des risques importants pour les entreprises, rendant les prévisions de trésorerie et la gestion des liquidités précises essentielles à leur survie. Les solutions logicielles de trésorerie capables de fournir des prévisions de trésorerie, une gestion des liquidités et une évaluation des risques précises et en temps réel sont devenues de plus en plus essentielles.

Dans l’ensemble, la pandémie de COVID-19 a accéléré l’adoption de solutions de trésorerie numériques, entraînant une croissance significative du marché des logiciels de trésorerie en Asie-Pacifique. La demande de solutions basées sur le cloud, de prévision de trésorerie et de gestion des liquidités, ainsi que de capacités avancées d’automatisation et d’intégration devrait se poursuivre dans le monde post-pandémique, les organisations cherchant à améliorer leur agilité, leur résilience et leur efficacité.

Développements récents

- En mars 2022, ZenTreasury et son partenaire local MCA ont fourni à Redington Gulf un logiciel de comptabilité des contrats de location pour IFRS-16. Désormais, les clients ne sont plus obligés d'importer des données provenant de nombreuses sources et de les stocker sur différentes plateformes. Tout est réalisé avec un seul logiciel

- En septembre 2022, TIS et Delega ont collaboré pour offrir aux clients une gestion automatisée des droits de signature multi-bancaire de nouvelle génération. Les clients de TIS et Delega peuvent profiter de la gestion électronique des comptes bancaires NextGen grâce à l'accord (eBAM)

Portée du marché des logiciels de trésorerie en Asie-Pacifique

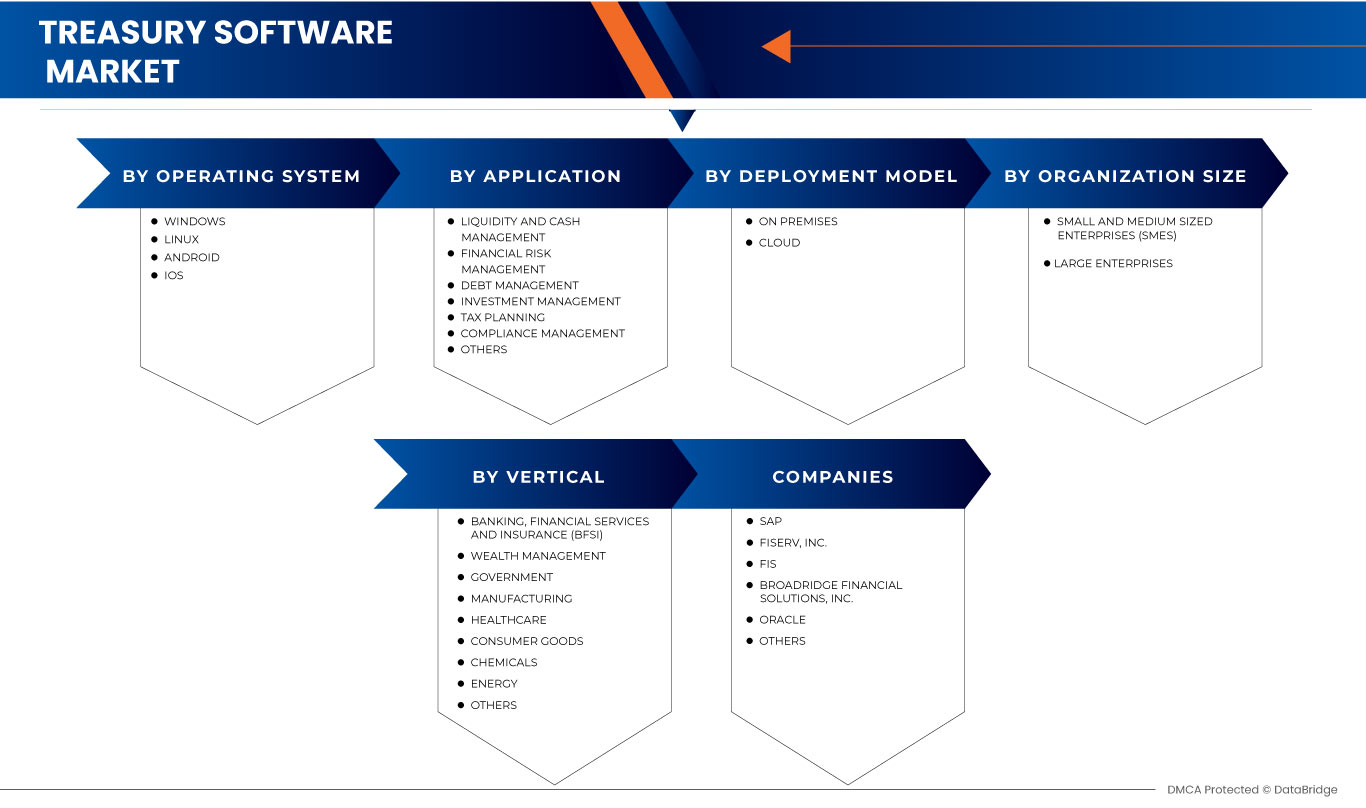

Le marché des logiciels de trésorerie de la région Asie-Pacifique est segmenté en fonction du système d'exploitation, de l'application, du modèle de déploiement, de la taille de l'organisation et du secteur vertical. La croissance de ces segments vous aidera à analyser les segments de faible croissance dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

MARCHÉ DES LOGICIELS DE TRÉSORERIE EN ASIE-PACIFIQUE, PAR SYSTÈME D'EXPLOITATION

- MAC

- FENÊTRES

- IOS

- ANDROÏDE

- LINUX

Sur la base du système d'exploitation, le marché des logiciels de trésorerie de la région Asie-Pacifique est segmenté en Windows, Linux, MAC, Android et iOS.

MARCHÉ DES LOGICIELS DE TRÉSORERIE EN ASIE-PACIFIQUE, PAR APPLICATION

- GESTION DE LA LIQUIDITÉ ET DE LA TRÉSORERIE

- GESTION DES RISQUES FINANCIERS

- GESTION DE LA DETTE

- GESTION DES INVESTISSEMENTS

- PLANIFICATION FISCALE

- GESTION DE LA CONFORMITÉ

- AUTRES

Sur la base des applications, le marché des logiciels de trésorerie de la région Asie-Pacifique est segmenté en gestion des liquidités et de la trésorerie, gestion des investissements, gestion de la dette, gestion des risques financiers, gestion de la conformité, planification fiscale et autres.

MARCHÉ DES LOGICIELS DE TRÉSORERIE EN ASIE-PACIFIQUE, PAR MODÈLE DE DÉPLOIEMENT

- SUR PLACE

- NUAGE

Sur la base du mode de déploiement, le marché des logiciels de trésorerie de la région Asie-Pacifique est segmenté en cloud et sur site.

MARCHÉ DES LOGICIELS DE TRÉSORERIE EN ASIE-PACIFIQUE, PAR TAILLE D'ORGANISATION

- PETITES ET MOYENNES ENTREPRISES (PME)

- GRANDES ENTREPRISES

Sur la base de la taille de l’organisation, le marché des logiciels de trésorerie de la région Asie-Pacifique est segmenté en grandes entreprises et en petites et moyennes entreprises.

MARCHÉ DES LOGICIELS DE TRÉSORERIE EN ASIE-PACIFIQUE, PAR VERTICAL

- BANQUE, SERVICES FINANCIERS ET ASSURANCES (BFSI)

- GESTION DE PATRIMOINE

- GOUVERNEMENT

- FABRICATION

- SOINS DE SANTÉ

- BIENS DE CONSOMMATION

- PRODUITS CHIMIQUES

- ÉNERGIE

- AUTRES

Sur la base de la verticale, le marché des logiciels de trésorerie de la région Asie-Pacifique est segmenté en banque, services financiers et assurances (BFSI), gouvernement, fabrication, soins de santé, biens de consommation, produits chimiques, énergie et autres.

Analyse/perspectives régionales du marché des logiciels de trésorerie de la région Asie-Pacifique

Le marché des logiciels de trésorerie de la région Asie-Pacifique est analysé et des informations et tendances sur la taille du marché sont fournies par pays, système d'exploitation, application, modèle de déploiement, taille de l'organisation et secteur vertical, comme indiqué ci-dessus.

Les pays couverts dans le rapport sur le marché des logiciels de trésorerie de la région Asie-Pacifique sont la Chine, l’Inde, l’Australie, le Japon, la Corée du Sud, la Malaisie, la Thaïlande, Singapour, l’Indonésie, les Philippines et le reste de l’Asie-Pacifique.

La Chine devrait dominer le marché des logiciels de trésorerie de la région Asie-Pacifique en raison du nombre élevé de développeurs de logiciels et de la technologie la plus récente pour développer les logiciels.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques et l'analyse des cinq forces du porteur, les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques d'Asie-Pacifique et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et des routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des logiciels de trésorerie en Asie-Pacifique

Le paysage concurrentiel du marché des logiciels de trésorerie en Asie-Pacifique fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Asie-Pacifique, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liées au marché des logiciels de trésorerie en Asie-Pacifique.

Certains des principaux acteurs opérant sur le marché des logiciels de trésorerie de la région Asie-Pacifique sont Finastra, ZenTreasury Ltd, Emphasys Software, SS&C Technologies, Inc., CAPIX, Adenza, Coupa Software Inc., DataLog Finance, FIS, Access Systems (UK) Limited, Treasury Software Corp., MUREX SAS, EdgeVerve Systems Limited (une filiale à 100 % d'Infosys), Financial Sciences Corp., Broadridge Financial Solutions, Inc., CashAnalytics, Oracle, Fiserv, Inc, ION, SAP, Solomon Software, ABM CLOUD et entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC TREASURY SOFTWARE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 MULTIVARIATE MODELING

2.8 OPERATING SYSTEM TIMELINE CURVE

2.9 MARKET APPLICATION COVERAGE GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 KEY PRIMARY INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING ADOPTION OF SMART ELECTRONIC PAYMENT MANAGEMENT TOOLS

5.1.2 GROWING DEMAND FOR ADVANCED TREASURY MANAGEMENT SYSTEM FOR ENHANCING CUSTOMER EXPERIENCE

5.1.3 HEAVING ADOPTION OF ARTIFICIAL INTELLIGENCE IN TREASURY MANAGEMENT

5.1.4 ADOPTION OF CLOUD BASED SOLUTION IN TREASURY MANAGEMENT

5.2 RESTRAINTS

5.2.1 INCREASING CYBER THREATS AND DATA BREACHES

5.2.2 HIGH COST ASSOCIATED WITH TREASURY MANAGEMENT SYSTEMS

5.2.3 CONTINUOUS CHANGES IN REGULATORY FRAMEWORK IN TREASURER MANAGEMENT

5.3 OPPORTUNITIES

5.3.1 PENETRATION OF ADVANCED ANALYTICS SOLUTIONS IN THE BANKING SECTOR

5.3.2 ADOPTION OF AUTOMATED SOLUTIONS TO REDUCE COMPLEXITY

5.3.3 RISE IN STRATEGIC PARTNERSHIP & COLLABORATION AMONG THE ORGANIZATION

5.4 CHALLENGES

5.4.1 LACK OF AWARENESS AMONG CONSUMERS REGARDING THE BENEFITS OF TREASURY SOFTWARE

5.4.2 FACTORS LIKE COMPLEXITIES, INADEQUATE INFRASTRUCTURE, AND FX VOLATILITY HAMPERS TMS EFFICIENCY

6 IMPACT OF COVID-19 ON THE ASIA PACIFIC TREASURY SOFTWARE MARKET

7 ASIA PACIFIC TREASURY SOFTWARE MARKET, BY OPERATING SYSTEM

7.1 OVERVIEW

7.2 WINDOWS

7.3 LINUX

7.4 MAC

7.5 ANDROID

7.6 IOS

8 ASIA PACIFIC TREASURY SOFTWARE MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 LIQUIDITY AND CASH MANAGEMENT

8.3 INVESTMENT MANAGEMENT

8.4 DEBT MANAGEMENT

8.5 FINANCIAL RISK MANAGEMENT

8.6 COMPLIANCE MANAGEMENT

8.7 TAX PLANNING MANAGEMENT

8.8 OTHERS

9 ASIA PACIFIC TREASURY SOFTWARE MARKET, BY ORGANIZATION SIZE

9.1 OVERVIEW

9.2 LARGE ENTERPRISES

9.3 SMALL AND MEDIUM-SIZED ENTERPRISES (SMES)

10 ASIA PACIFIC TREASURY SOFTWARE MARKET, BY DEPLOYMENT MODEL

10.1 OVERVIEW

10.2 CLOUD

10.2.1 PUBLIC

10.2.2 HYBRID

10.2.3 PRIVATE

10.3 ON-PREMISES

11 ASIA PACIFIC TREASURY SOFTWARE MARKET, BY VERTICAL

11.1 OVERVIEW

11.2 BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI)

11.2.1 WEALTH MANAGEMENT

11.2.2 BANKING

11.2.3 CAPITAL MARKET

11.2.4 OTHERS

11.3 GOVERNMENT

11.4 MANUFACTURING

11.5 HEALTHCARE

11.6 CONSUMER GOODS

11.7 CHEMICALS

11.8 ENERGY

11.9 OTHERS

12 ASIA PACIFIC TREASURY SOFTWARE MARKET , BY REGION

12.1 ASIA PACIFIC

12.1.1 CHINA

12.1.2 JAPAN

12.1.3 SOUTH KOREA

12.1.4 INDIA

12.1.5 AUSTRALIA

12.1.6 SINGAPORE

12.1.7 THAILAND

12.1.8 INDONESIA

12.1.9 MALAYSIA

12.1.10 PHILIPPINES

12.1.11 REST OF ASIA-PACIFIC

13 ASIA PACIFIC TREASURY SOFTWARE MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

14 SWOT ANALYSIS

15 COMPANY PROFILING

15.1 SAP

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 APPLICATION PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 FISERV, INC.

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 FIS

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 SOLUTION PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 BROADRIDGE FINANCIAL SOLUTIONS, INC.

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 SOLUTION PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.5 ORACLE

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENTS

15.6 ABM CLOUD

15.6.1 COMPANY SNAPSHOT

15.6.2 SERVICE PORTFOLIO

15.6.3 RECENT DEVELOPMENTS

15.7 ACCESS SYSTEMS (UK) LIMITED

15.7.1 COMPANY SNAPSHOT

15.7.2 SOLUTION PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 ADENZA

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENTS

15.9 CAPIX

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENTS

15.1 CASHANALYTICS

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENTS

15.11 COUPA SOFTWARE INC.

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT DEVELOPMENTS

15.12 DATALOG FINANCE

15.12.1 COMPANY SNAPSHOT

15.12.2 SOLUTION PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 EDGEVERVE SYSTEMS LIMITED (A WHOLLY OWNED SUBSIDIARY OF INFOSYS)

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENTS

15.14 EMPHASYS SOFTWARE

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENTS

15.15 ERNST & YOUNG

15.15.1 COMPANY SNAPSHOT

15.15.2 SERVICE PORTFOLIO

15.15.3 RECENT DEVELOPMENTS

15.16 FINASTRA

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENTS

15.17 FINANCIAL SCIENCES CORP.

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENTS

15.18 ION

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENTS

15.19 MUREX S.A.S

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENTS

15.2 NOMENTIA

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENTS

15.21 SOLOMON SOFTWARE

15.21.1 COMPANY SNAPSHOT

15.21.2 PRODUCT PORTFOLIO

15.21.3 RECENT DEVELOPMENT

15.22 SS&C TECHNOLOGIES, INC.

15.22.1 COMPANY SNAPSHOT

15.22.2 REVENUE ANALYSIS

15.22.3 PRODUCT PORTFOLIO

15.22.4 RECENT DEVELOPMENTS

15.23 TREASURY INTELLIGENCE SOLUTIONS

15.23.1 COMPANY SNAPSHOT

15.23.2 SERVICE PORTFOLIO

15.23.3 RECENT DEVELOPMENTS

15.24 TREASURY SOFTWARE CORP

15.24.1 COMPANY SNAPSHOT

15.24.2 PRODUCT PORTFOLIO

15.24.3 RECENT DEVELOPMENTS

15.25 ZENTREASURY LTD

15.25.1 COMPANY SNAPSHOT

15.25.2 SOLUTION PORTFOLIO

15.25.3 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

Liste des tableaux

TABLE 1 ASIA PACIFIC TREASURY SOFTWARE MARKET, BY OPERATING SYSTEM, 2021-2030 (USD MILLION)

TABLE 2 ASIA PACIFIC WINDOWS IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 3 ASIA PACIFIC LINUX IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 4 ASIA PACIFIC MAC IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 5 ASIA PACIFIC ANDROID IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 6 ASIA PACIFIC IOS IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 7 ASIA PACIFIC TREASURY SOFTWARE MARKET, APPLICATION, 2021-2030 (USD MILLION)

TABLE 8 ASIA PACIFIC LIQUIDITY AND CASH MANAGEMENT IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 9 ASIA PACIFIC INVESTMENT MANAGEMENT IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 10 ASIA PACIFIC DEBT MANAGEMENT IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 11 ASIA PACIFIC FINANCIAL RISK MANAGEMENT IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 12 ASIA PACIFIC COMPLIANCE MANAGEMENT IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 13 ASIA PACIFIC TAX PLANNING MANAGEMENT IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 14 ASIA PACIFIC OTHERS IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 15 ASIA PACIFIC TREASURY SOFTWARE MARKET, BY ORGANIZATION SIZE, 2021-2030 (USD MILLION)

TABLE 16 ASIA PACIFIC LARGE ENTERPRISES IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 17 ASIA PACIFIC SMALL AND MEDIUM SIZED ENTERPRISES (SMES) IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 18 ASIA PACIFIC TREASURY SOFTWARE MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD MILLION)

TABLE 19 ASIA PACIFIC CLOUD IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 20 ASIA PACIFIC CLOUD IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 21 ASIA PACIFIC ON-PREMISES IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 22 ASIA PACIFIC TREASURY SOFTWARE MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 23 ASIA PACIFIC BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 24 ASIA PACIFIC BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 25 ASIA PACIFIC GOVERNMENT IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 26 ASIA PACIFIC MANUFACTURING IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 27 ASIA PACIFIC HEALTHCARE IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 28 ASIA PACIFIC CONSUMER GOODS IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 29 ASIA PACIFIC CHEMICALS IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 30 ASIA PACIFIC ENERGY IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 31 ASIA PACIFIC OTHERS IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 32 ASIA-PACIFIC TREASURY SOFTWARE MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 33 ASIA-PACIFIC TREASURY SOFTWARE MARKET, BY OPERATING SYSTEM, 2021-2030 (USD MILLION)

TABLE 34 ASIA-PACIFIC TREASURY SOFTWARE MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 35 ASIA-PACIFIC TREASURY SOFTWARE MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD MILLION)

TABLE 36 ASIA-PACIFIC CLOUD IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 37 ASIA-PACIFIC TREASURY SOFTWARE MARKET, BY ORGANIZATION SIZE, 2021-2030 (USD MILLION)

TABLE 38 ASIA-PACIFIC TREASURY SOFTWARE MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 39 ASIA-PACIFIC BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 40 CHINA TREASURY SOFTWARE MARKET, BY OPERATING SYSTEM, 2021-2030 (USD MILLION)

TABLE 41 CHINA TREASURY SOFTWARE MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 42 CHINA TREASURY SOFTWARE MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD MILLION)

TABLE 43 CHINA CLOUD IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 44 CHINA TREASURY SOFTWARE MARKET, BY ORGANIZATION SIZE, 2021-2030 (USD MILLION)

TABLE 45 CHINA TREASURY SOFTWARE MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 46 CHINA BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 47 JAPAN TREASURY SOFTWARE MARKET, BY OPERATING SYSTEM, 2021-2030 (USD MILLION)

TABLE 48 JAPAN TREASURY SOFTWARE MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 49 JAPAN TREASURY SOFTWARE MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD MILLION)

TABLE 50 JAPAN CLOUD IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 51 JAPAN TREASURY SOFTWARE MARKET, BY ORGANIZATION SIZE, 2021-2030 (USD MILLION)

TABLE 52 JAPAN TREASURY SOFTWARE MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 53 JAPAN BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 54 SOUTH KOREA TREASURY SOFTWARE MARKET, BY OPERATING SYSTEM, 2021-2030 (USD MILLION)

TABLE 55 SOUTH KOREA TREASURY SOFTWARE MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 56 SOUTH KOREA TREASURY SOFTWARE MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD MILLION)

TABLE 57 SOUTH KOREA CLOUD IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 58 SOUTH KOREA TREASURY SOFTWARE MARKET, BY ORGANIZATION SIZE, 2021-2030 (USD MILLION)

TABLE 59 SOUTH KOREA TREASURY SOFTWARE MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 60 SOUTH KOREA BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 61 INDIA TREASURY SOFTWARE MARKET, BY OPERATING SYSTEM, 2021-2030 (USD MILLION)

TABLE 62 INDIA TREASURY SOFTWARE MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 63 INDIA TREASURY SOFTWARE MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD MILLION)

TABLE 64 INDIA CLOUD IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 65 INDIA TREASURY SOFTWARE MARKET, BY ORGANIZATION SIZE, 2021-2030 (USD MILLION)

TABLE 66 INDIA TREASURY SOFTWARE MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 67 INDIA BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 68 AUSTRALIA TREASURY SOFTWARE MARKET, BY OPERATING SYSTEM, 2021-2030 (USD MILLION)

TABLE 69 AUSTRALIA TREASURY SOFTWARE MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 70 AUSTRALIA TREASURY SOFTWARE MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD MILLION)

TABLE 71 AUSTRALIA CLOUD IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 72 AUSTRALIA TREASURY SOFTWARE MARKET, BY ORGANIZATION SIZE, 2021-2030 (USD MILLION)

TABLE 73 AUSTRALIA TREASURY SOFTWARE MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 74 AUSTRALIA BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 75 SINGAPORE TREASURY SOFTWARE MARKET, BY OPERATING SYSTEM, 2021-2030 (USD MILLION)

TABLE 76 SINGAPORE TREASURY SOFTWARE MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 77 SINGAPORE TREASURY SOFTWARE MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD MILLION)

TABLE 78 SINGAPORE CLOUD IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 79 SINGAPORE TREASURY SOFTWARE MARKET, BY ORGANIZATION SIZE, 2021-2030 (USD MILLION)

TABLE 80 SINGAPORE TREASURY SOFTWARE MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 81 SINGAPORE BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 82 THAILAND TREASURY SOFTWARE MARKET, BY OPERATING SYSTEM, 2021-2030 (USD MILLION)

TABLE 83 THAILAND TREASURY SOFTWARE MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 84 THAILAND TREASURY SOFTWARE MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD MILLION)

TABLE 85 THAILAND CLOUD IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 86 THAILAND TREASURY SOFTWARE MARKET, BY ORGANIZATION SIZE, 2021-2030 (USD MILLION)

TABLE 87 THAILAND TREASURY SOFTWARE MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 88 THAILAND BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 89 INDONESIA TREASURY SOFTWARE MARKET, BY OPERATING SYSTEM, 2021-2030 (USD MILLION)

TABLE 90 INDONESIA TREASURY SOFTWARE MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 91 INDONESIA TREASURY SOFTWARE MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD MILLION)

TABLE 92 INDONESIA CLOUD IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 93 INDONESIA TREASURY SOFTWARE MARKET, BY ORGANIZATION SIZE, 2021-2030 (USD MILLION)

TABLE 94 INDONESIA TREASURY SOFTWARE MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 95 INDONESIA BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 96 MALAYSIA TREASURY SOFTWARE MARKET, BY OPERATING SYSTEM, 2021-2030 (USD MILLION)

TABLE 97 MALAYSIA TREASURY SOFTWARE MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 98 MALAYSIA TREASURY SOFTWARE MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD MILLION)

TABLE 99 MALAYSIA CLOUD IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 100 MALAYSIA TREASURY SOFTWARE MARKET, BY ORGANIZATION SIZE, 2021-2030 (USD MILLION)

TABLE 101 MALAYSIA TREASURY SOFTWARE MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 102 MALAYSIA BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 103 PHILIPPINES TREASURY SOFTWARE MARKET, BY OPERATING SYSTEM, 2021-2030 (USD MILLION)

TABLE 104 PHILIPPINES TREASURY SOFTWARE MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 105 PHILIPPINES TREASURY SOFTWARE MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD MILLION)

TABLE 106 PHILIPPINES CLOUD IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 107 PHILIPPINES TREASURY SOFTWARE MARKET, BY ORGANIZATION SIZE, 2021-2030 (USD MILLION)

TABLE 108 PHILIPPINES TREASURY SOFTWARE MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 109 PHILIPPINES BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 110 REST OF ASIA-PACIFIC TREASURY SOFTWARE MARKET, BY OPERATING SYSTEM, 2021-2030 (USD MILLION)

Liste des figures

FIGURE 1 ASIA PACIFIC TREASURY SOFTWARE MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC TREASURY SOFTWARE MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC TREASURY SOFTWARE MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC TREASURY SOFTWARE MARKET: ASIA PACIFIC VS REGIONAL ANALYSIS

FIGURE 5 ASIA PACIFIC TREASURY SOFTWARE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC TREASURY SOFTWARE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC TREASURY SOFTWARE MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA PACIFIC TREASURY SOFTWARE MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 ASIA PACIFIC TREASURY SOFTWARE MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 ASIA PACIFIC TREASURY SOFTWARE MARKET: SEGMENTATION

FIGURE 11 SURGING UTILITY IN THE MILITARY AND DEFENSE SECTOR IS EXPECTED TO DRIVE THE ASIA PACIFIC TREASURY SOFTWARE MARKET IN THE FORECAST PERIOD

FIGURE 12 TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC TREASURY SOFTWARE MARKET IN 2023 & 2030

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF ASIA PACIFIC TREASURY SOFTWARE MARKET

FIGURE 14 MOBILE PAYMENTS SHARE (%) BY COUNTRY

FIGURE 15 FACTORS AFFECTING THE TMS AND CUSTOMER EXPERIENCE

FIGURE 16 THREE WAYS ARTIFICIAL INTELLIGENCE IS TRANSFORMING TREASURY

FIGURE 17 CYBER-ATTACKS INCIDENTS ACROSS INDUSTRIES FROM 2016 TO 2021

FIGURE 18 CYBER-ATTACKS INCIDENTS BY COUNTRY AND REGION IN 2020

FIGURE 19 TREASURY DEPARTMENT CURRENTLY USING

FIGURE 20 ANALYTICS ADOPTION BY SECTOR, FROM THE YEAR 2019 TO 2021 AT INDIAN FIRMS

FIGURE 21 ASIA PACIFIC TREASURY SOFTWARE MARKET: BY OPERATING SYSTEM, 2022

FIGURE 22 ASIA PACIFIC TREASURY SOFTWARE MARKET: BY APPLICATION, 2022

FIGURE 23 ASIA PACIFIC TREASURY SOFTWARE MARKET: BY ORGANIZATION SIZE, 2022

FIGURE 24 ASIA PACIFIC TREASURY SOFTWARE MARKET: BY DEPLOYMENT MODEL, 2022

FIGURE 25 ASIA PACIFIC TREASURY SOFTWARE MARKET: BY VERTICAL, 2022

FIGURE 26 ASIA-PACIFIC TREASURY SOFTWARE MARKET: SNAPSHOT (2022)

FIGURE 27 ASIA-PACIFIC TREASURY SOFTWARE MARKET: BY COUNTRY (2022)

FIGURE 28 ASIA-PACIFIC TREASURY SOFTWARE MARKET: BY COUNTRY (2023 & 2030)

FIGURE 29 ASIA-PACIFIC TREASURY SOFTWARE MARKET: BY COUNTRY (2022 & 2030)

FIGURE 30 ASIA-PACIFIC TREASURY SOFTWARE MARKET: BY OPERATING SYSTEM (2023 & 2030)

FIGURE 31 ASIA PACIFIC TREASURY SOFTWARE MARKET: COMPANY SHARE 2022(%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.