Asia-Pacific Tokenization Market, By Offering (Solutions and Services), Organization Size (Large Organizations and SMES), Deployment (Cloud and On-Premises), Technique (API-Based and Gateway-Based), Technology (Cloud Computing, Internet Of Things (Iot), Blockchain, Machine Learning And Artificial Intelligence, Natural Language Processing (NLP), And Others), Application (Payment Security, Data Processing, Encryption, User Authentication, Compliance Management, And Others), End-User (Banking, Financial Services And Insurance (BSFI), IT & Telecommunications, Media And Entertainment, Retail & E-Commerce, Automotive, Healthcare And Life Sciences, Manufacturing, Energy And Utilities, Aerospace And Defense, Government And Public Sector, And Others)– Industry Trends and Forecast to 2029.

Asia-Pacific Tokenization Market Analysis and Size

Service providers were continuously trying to find out ways to increase the precision of work, enhanced services, safety and work with growing technology. The requirement for these reasons is being fulfilled through the implementation of the tokenization as they are used to provide enhanced, uninterrupted free, and timely services at the industrial operations. The tokenization in various industries is being used widely due to the rising demand for customer experience. It enables industries to enhance their operations and productivity. Tokenization’s help end-users to make better decision regarding payment modes, assets management, safeguard customer data, and others. The global tokenization market is in the growth phase rapidly due to growing digitization in various industries which drives the demand for the tokenization. The companies are even launching new products to gain a larger market share.

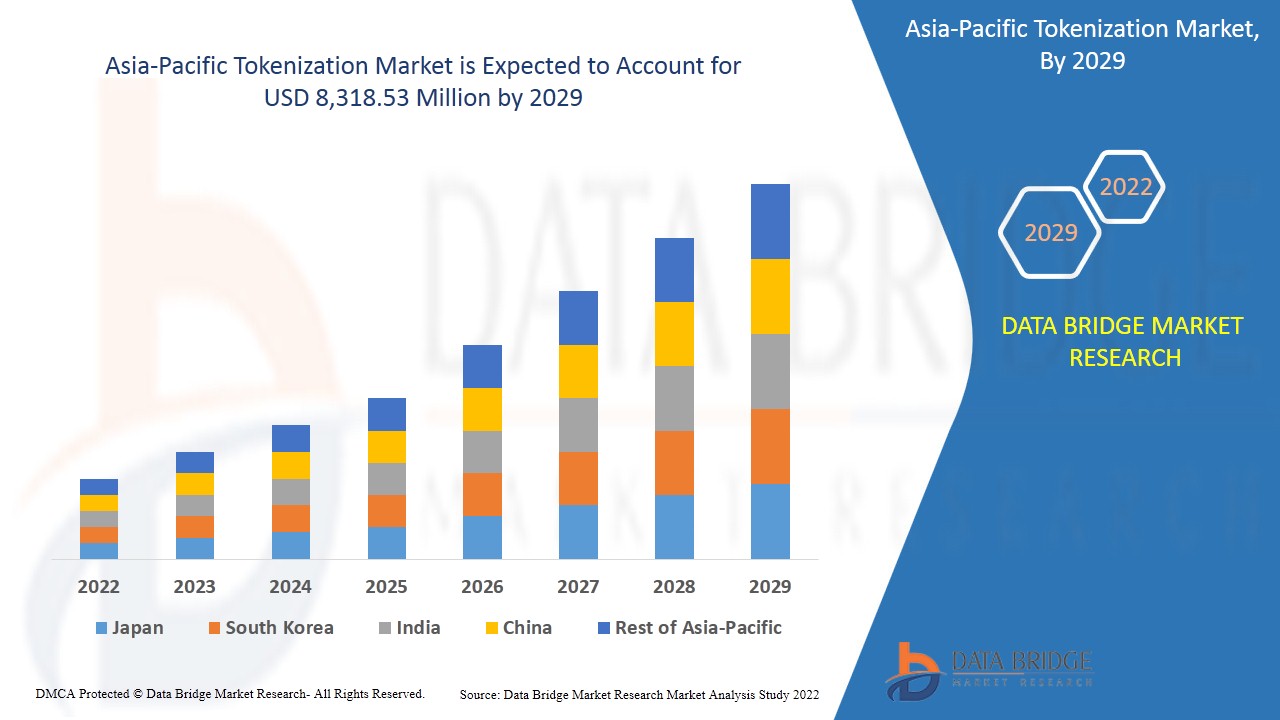

Data Bridge Market Research analyses that the machine control system market is expected to reach the value of USD 8,318.53 million by 2029, at a CAGR of 16.8% during the forecast period. Solutions" accounts for the largest offering segment in the tokenization market. The solutions provide accurate information which is utilized to develop high precision IoT network. The tokenization market report also covers pricing analysis, patent analysis, and technological advancements in depth.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 |

|

Quantitative Units |

Revenue in USD Million, Pricing in USD |

|

Segments Covered |

Par offre (solutions et services), taille de l'organisation (grandes organisations et PME), déploiement (cloud et sur site), technique (basée sur API et basée sur une passerelle), technologie (Internet des objets (IOT), apprentissage automatique et intelligence artificielle, cloud computing, traitement du langage naturel (NLP), chaîne de blocs et autres), application (sécurité des paiements, authentification des utilisateurs, gestion de la conformité, traitement des données, cryptage et autres), utilisateur final (banque, services financiers et assurances, informatique et télécommunications, gouvernement et secteur public, médias et divertissement, vente au détail et commerce électronique, fabrication, énergie et services publics, automobile, aérospatiale et défense et autres) |

|

Pays couverts |

Chine, Japon, Inde, Corée du Sud, Singapour, Malaisie, Australie, Thaïlande, Indonésie, Philippines et reste de l'Asie-Pacifique (APAC) |

|

Acteurs du marché couverts |

Français Fiserv, Inc., Groupe Thales, Broadcom, Futurex, Hewlett Packard Enterprise Development LP, FIS, Lookout, Inc., Protegrity Inc., Visa, Mastercard, Micro Focus, American Express Company, Entrust Corporation, VeriFone, Inc., utimaco GmbH, PaymentVision, Tokeny Solutions, Quantoz NV, HST, Paya, Inc., Baffle, StrongKey, Inc., Prime Factors, Fortanix, AsiaPay Limited, Marqeta, Inc., Open Text Corporation, Randtronics, Bluefin Payment Systems, Sygnum Pte. Ltd., entre autres. |

Définition du marché

La tokenisation est le processus d'échange de données sensibles contre des données non sensibles appelées « tokens » qui peuvent être utilisées dans une base de données ou un système interne sans les inclure dans le champ d'application.

Contrairement aux données chiffrées, les données tokenisées sont indéchiffrables et irréversibles. Cette distinction est particulièrement importante car il n’existe aucune relation mathématique entre le jeton et son numéro d’origine. Les jetons ne peuvent pas retrouver leur forme d’origine sans la présence de données supplémentaires stockées séparément. Les jetons n’ont pratiquement aucune valeur en eux-mêmes : ils ne sont utiles que parce qu’ils représentent quelque chose de plus important, comme un numéro de compte principal de carte de crédit (PAN) ou un numéro de sécurité sociale (SSN). Une bonne analogie est celle d’un jeton de poker. Au lieu de remplir une table avec de l’argent liquide (qui peut être facilement perdu ou volé), les joueurs utilisent des jetons comme espaces réservés.

Il s'agit donc d'une technologie utile dans des institutions telles que les institutions financières, les administrations publiques et les établissements de santé pour la conversion de données en jetons. Actuellement, ce marché a de larges applications dans le monde de l'entreprise pour les collaborations professionnelles et dans les secteurs de l'éducation et de la formation.

Dynamique du marché de la tokenisation

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

- Augmentation du besoin d'expérience client

Les entreprises qui mettent en œuvre avec succès une stratégie d'expérience client sont susceptibles d'atteindre des taux de satisfaction client plus élevés et donc d'améliorer la croissance des revenus. L'amélioration de l'expérience client implique diverses stratégies telles que l'autonomisation des employés pour fournir un meilleur service, des idées de valeur, la cartographie du parcours client, la collecte des commentaires des clients, etc.

- Augmentation des paiements sans contact pour toutes les entreprises

Les paiements sans contact offrent des avantages considérables aux consommateurs et aux entreprises grâce à leur simplicité d'utilisation qui permet des transactions plus rapides avec plus de fiabilité et de sécurité grâce à la technologie de paiement par tap-to-pay, qui confère des avantages de fidélité aux entreprises et améliore les relations avec les clients. Ainsi, les paiements sans contact sont adoptés très rapidement par les consommateurs et les entreprises.

- La multiplication des règles et des normes réglementaires strictes conduit à une sécurité renforcée

La protection des données et la circulation transfrontalière des données sont la principale raison de la mise en place de divers cadres juridiques. De jour en jour, la quantité d'informations ou de données transmises, stockées et collectées à travers le monde augmente en raison de l'augmentation des activités sociales et financières en ligne disponibles via les téléphones portables et de l'amélioration de la connectivité Internet, ce qui permet d'accroître l'importance de la protection des données et de la confidentialité.

La protection et la sécurité des données sont directement liées au commerce de biens et de services dans l'économie numérique et l'absence de protection peut restreindre les activités commerciales, ce qui entraîne des effets économiques négatifs. Par conséquent, la protection des données semble être un droit fondamental avec l'augmentation de l'économie de l'information qui influence de nombreuses opportunités de développement des affaires grâce à l'expérience client. Ainsi, la sécurité des données et l'efficacité transactionnelle rendent la tokenisation de plus en plus populaire auprès des innovateurs, des acteurs du marché et des régulateurs de plus en plus nombreux dans l'économie numérique.

- Augmentation de la complexité de la gestion des données

Les décisions prises pour le processus métier reposent sur l'analyse d'un volume considérable de données. Il est donc nécessaire de gérer très efficacement les données afin d'obtenir facilement les informations pertinentes. Par conséquent, chaque donnée doit être cryptée dans des jetons. Au moment de l'analyse des données, l'utilisateur peut y accéder à l'aide de jetons attribués.

Les jetons créés sont considérés comme des données, qui doivent être gérées de manière systématique, sinon la gestion des données devient une tâche fastidieuse et élabore la culture de travail. De même, la tokenisation du langage semble très facile, mais son extraction ainsi que son intégration avec un autre langage, le langage machine, seraient un facteur difficile à résoudre.

- Augmentation de la demande de solutions et de services basés sur le cloud

Les solutions et services de cloud computing aident les entreprises à fonctionner efficacement avec moins de dépendance aux ressources humaines, ce qui contribue à propulser la croissance du marché avec une plus grande efficacité opérationnelle. La croissance de l'efficacité à des fins commerciales dans de nombreux secteurs verticaux a entraîné l'adoption de divers modèles commerciaux qui stimulent la demande de logiciels tels que les solutions basées sur le logiciel en tant que service (SaaS).

Les entreprises proposant des solutions SaaS sont impliquées dans le domaine des paiements récurrents et des facturations au sein de leurs plateformes, qui ont la capacité de générer des jetons de paiement automatiques en temps réel, garantissant ainsi une transaction fluide pour le client à chaque fois. Les entreprises SaaS fourniront une couche de sécurité supplémentaire pour les paiements grâce à la tokenisation des données sensibles. L'essor des logiciels SaaS devrait donc stimuler la croissance du marché.

Impact post-COVID-19 sur le marché de la tokenisation

La COVID-19 a eu un impact majeur sur le marché de la tokenisation, car presque tous les pays ont opté pour la fermeture de toutes les installations de production, à l'exception de celles qui produisent des biens essentiels. Le gouvernement a pris des mesures strictes telles que l'arrêt de la production et de la vente de biens non essentiels, le blocage du commerce international et bien d'autres pour empêcher la propagation de la COVID-19. Les seules entreprises qui font face à cette situation de pandémie sont les services essentiels qui sont autorisés à ouvrir et à exécuter les processus.

La croissance du marché de la tokenisation est due à la nécessité croissante d'identifier les données de manière unique. Cependant, des facteurs tels que les besoins en espace de stockage de données volumineux freinent la croissance du marché. La fermeture des installations de production pendant la pandémie a eu un impact significatif sur le marché.

Les institutions financières prennent diverses décisions stratégiques pour rebondir après la COVID-19. Les acteurs mènent de nombreuses activités de recherche et développement pour améliorer la technologie impliquée dans la tokenisation. Grâce à cela, les entreprises mettront sur le marché des contrôleurs avancés et précis. En outre, l'utilisation de la tokenisation par les autorités gouvernementales dans la gestion des actifs, la défense et la sécurité a conduit à la croissance du marché.

Développement récent

- En août 2021, Lookout, Inc. a annoncé le lancement d'une nouvelle offre de sécurité mobile pour les petites entreprises. Ce développement aidera l'entreprise à diversifier son portefeuille pour offrir de meilleures solutions à des fins diverses, ce qui pourrait constituer une solution unique pour les clients, ce qui contribue à attirer de nouveaux clients

- En janvier 2022, Visa a annoncé une nouvelle plateforme, Visa Acceptance Cloud (VAC), pour moderniser les capacités des services de paiement. Cette nouvelle plateforme aidera l'entreprise à improviser et à renforcer les capacités des solutions fournies aux clients, ce qui peut améliorer la relation client avec l'entreprise

Portée du marché mondial de la tokenisation

Le marché de la tokenisation est segmenté en fonction des offres, de la taille de l'organisation, de la technique, de la technologie, du déploiement, de l'application et de l'utilisateur final. La croissance parmi ces segments vous aidera à analyser les segments de croissance faibles dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Offre

- Solutions

- Services

Sur la base de l’offre, le marché de la tokenisation est segmenté en solutions et services.

Taille de l'organisation

- Grandes organisations

- PME

Sur la base de la taille de l’organisation, le marché de la tokenisation a été segmenté en grandes organisations et PME.

Déploiement

- Nuage

- Sur site

Sur la base du déploiement, le marché de la tokenisation a été segmenté en cloud et sur site.

Technologie

- Internet des objets (IOT)

- Apprentissage automatique et intelligence artificielle

- Cloud Computing

- Traitement du langage naturel (TLN)

- Chaîne de blocs

- Autres

Sur la base de la technologie, le marché de la tokenisation a été segmenté en cloud computing, Internet des objets (IoT), blockchain, apprentissage automatique et intelligence artificielle, traitement du langage naturel (NLP) et autres.

Technique

- Basé sur API

- Basé sur la passerelle

Sur la base de la technique, le marché mondial de la tokenisation a été segmenté en marché basé sur les API et en marché basé sur les passerelles.

Application

- Sécurité des paiements

- Authentification de l'utilisateur

- Gestion de la conformité

- Informatique

- Cryptage

- Autres

Sur la base des applications, le marché de la tokenisation a été segmenté en sécurité des paiements, traitement des données, cryptage, authentification des utilisateurs, gestion de la conformité et autres.

Utilisateur final

- Banque, services financiers et assurances

- Informatique et télécommunications

- Gouvernement et secteur public

- Médias et divertissement

- Commerce de détail et commerce électronique

- Fabrication

- Énergie et services publics

- Automobile

- Aérospatiale et Défense

- Autres

Sur la base de l'utilisateur final, le marché de la tokenisation a été segmenté en banque, services financiers et assurances (BSFI), informatique et télécommunications, médias et divertissement, vente au détail et commerce électronique, automobile, santé et sciences de la vie, fabrication, énergie et services publics, aérospatiale et défense, gouvernement et secteur public, et autres.

Analyse/perspectives régionales du marché de la tokenisation

Le marché de la tokenisation est analysé et des informations sur la taille et les tendances du marché sont fournies par pays, offre, taille de l'organisation, déploiement, technologie, technique, application et secteur d'activité de l'utilisateur final, comme référencé ci-dessus.

Les pays couverts dans le rapport sur le marché de la tokenisation sont la Chine, le Japon, l'Inde, la Corée du Sud, Singapour, la Malaisie, l'Australie, la Thaïlande, l'Indonésie, les Philippines et le reste de l'Asie-Pacifique (APAC).

La Chine domine la région mondiale car les anciennes infrastructures du pays, telles que les ponts, les autoroutes, les systèmes d'égouts et les tunnels, sont continuellement réparées et améliorées grâce à l'utilisation de divers équipements de contrôle de machines, tels que des excavatrices, des systèmes de pavage et des bulldozers.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques et l'analyse des cinq forces du porteur, les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques d'Asie-Pacifique et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et des routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché de la tokenisation

Le paysage concurrentiel du marché de la tokenisation fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Asie-Pacifique, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liée au marché de la tokenisation.

Français Certains des principaux acteurs opérant sur le marché de la tokenisation sont Fiserv, Inc., Thales Group, Broadcom, Futurex, Hewlett Packard Enterprise Development LP, FIS, Lookout, Inc., Protegrity Inc., Visa, Mastercard, Micro Focus, American Express Company, Entrust Corporation, VeriFone, Inc., utimaco GmbH, PaymentVision, Tokeny Solutions, Quantoz NV, HST, Paya, Inc., Baffle, StrongKey, Inc., Prime Factors, Fortanix, AsiaPay Limited, Marqeta, Inc., Open Text Corporation, Randtronics, Bluefin Payment Systems, Sygnum Pte. Ltd., entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC TOKENIZATION MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 OFFERING TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTERS FIVE FORCE MODEL

4.2 BENEFITS OF TOKENIZATION SOLUTION FOR BUSINESSES

4.3 THE FUTURE OF FINANCIAL MARKETS: TOKENIZATION

4.4 SUPPLY CHAIN ANALYSIS

4.5 CHALLENGE MATRIX

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISE IN DEMAND FOR CUSTOMER EXPERIENCE

5.1.2 UPSURGE OF CONTACTLESS PAYMENTS FOR ALL BUSINESSES

5.1.3 RISE IN INCTANCES OF DATA BREACH

5.1.4 RISE IN THE NEED FOR UNIQUE DATA IDENTIFICATION

5.2 RESTRAINTS

5.2.1 RISE IN COMPLEXITY OF DATA MANAGEMENT

5.2.2 REQUIREMENT OF LARGE VOLUME DATA STORAGE SPACE

5.3 OPPORTUNITIES

5.3.1 UPSURGE OF STRINGENT RULES AND REGULATORY STANDARDS LEAD TO DEVELOPED SECURITY

5.3.2 RISE IN DEMAND FOR DATA SECURITY

5.3.3 RISE IN DEMAND FOR CLOUD-BASED SOLUTIONS AND SERVICES

5.3.4 INCREASE IN DIGITALIZING THE BUSINESS OPERATIONS

5.4 CHALLENGES

5.4.1 LACK OF MANAGING AND ADOPTION PROCESS

5.4.2 RISE OF TECHNICAL COMPLEXITY

6 ASIA PACIFIC TOKENIZATION MARKET, BY OFFERING

6.1 OVERVIEW

6.2 SOLUTIONS

6.2.1 PAYMENT TOKENIZATION

6.2.2 DATA TOKENIZATION

6.2.3 ASSET TOKENIZATION

6.2.4 PLATFORM TOKENIZATION

6.2.5 OTHERS

6.3 SERVICES

6.3.1 PROFESSIONAL

6.3.2 SUPPORT & MAINTENANCE

6.3.3 INTEGRATION & IMPLEMENTATION

6.3.4 TRAINING & CONSULTING

6.3.5 MANAGED

7 ASIA PACIFIC TOKENIZATION MARKET, BY ORGANIZATION SIZE

7.1 OVERVIEW

7.2 LARGE ORGANIZATIONS

7.3 SMES

8 ASIA PACIFIC TOKENIZATION MARKET, BY DEPLOYMENT

8.1 OVERVIEW

8.2 CLOUD

8.2.1 PUBLIC CLOUD

8.2.2 PRIVATE CLOUD

8.2.3 HYBRID CLOUD

8.3 ON-PREMISES

9 ASIA PACIFIC TOKENIZATION MARKET, BY TECHNOLOGY

9.1 OVERVIEW

9.2 CLOUD COMPUTING

9.3 INTERNET OF THINGS (IOT)

9.4 BLOCKCHAIN

9.5 MACHINE LEARNING & ARTIFICIAL INTELLIGENCE

9.6 NATURAL LANGUAGE PROCESSING (NLP)

9.7 OTHERS

10 ASIA PACIFIC TOKENIZATION MARKET, BY TECHNIQUE

10.1 OVERVIEW

10.2 API-BASED

10.3 GATEWAY-BASED

11 ASIA PACIFIC TOKENIZATION MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 PAYMENT SECURITY

11.3 DATA PROCESSING

11.4 ENCRYPTION

11.5 USER AUTHENTICATION

11.6 COMPLIANCE MANAGEMENT

11.7 OTHERS

12 ASIA PACIFIC TOKENIZATION MARKET, BY END USER

12.1 OVERVIEW

12.2 BANKING, FINANCIAL SERVICES & INSURANCE (BFSI)

12.2.1 LARGE ORGANIZATIONS

12.2.2 SMES

12.3 IT & TELECOMMUNICATIONS

12.3.1 LARGE ORGANIZATIONS

12.3.2 SMES

12.4 RETAIL & E-COMMERCE

12.4.1 LARGE ORGANIZATIONS

12.4.2 SMES

12.5 AUTOMOTIVE

12.5.1 LARGE ORGANIZATIONS

12.5.2 SMES

12.6 HEALTHCARE & LIFE SCIENCES

12.6.1 LARGE ORGANIZATIONS

12.6.2 SMES

12.7 MANUFACTURING

12.7.1 LARGE ORGANIZATIONS

12.7.2 SMES

12.8 ENERGY & UTILITIES

12.8.1 LARGE ORGANIZATIONS

12.8.2 SMES

12.9 AEROSPACE & DEFENCE

12.9.1 LARGE ORGANIZATIONS

12.9.2 SMES

12.1 GOVERNMENT & PUBLIC SECTOR

12.10.1 LARGE ORGANIZATIONS

12.10.2 SMES

12.11 MEDIA & ENTERTAINMENT

12.11.1 LARGE ORGANIZATIONS

12.11.2 SMES

12.12 OTHERS

12.12.1 LARGE ORGANIZATIONS

12.12.2 SMES

13 ASIA PACIFIC TOKENIZATION MARKET, BY REGION

13.1 ASIA-PACIFIC

13.1.1 CHINA

13.1.2 JAPAN

13.1.3 INDIA

13.1.4 SOUTH KOREA

13.1.5 SINGAPORE

13.1.6 MALAYSIA

13.1.7 AUSTRALIA

13.1.8 THAILAND

13.1.9 INDONESIA

13.1.10 PHILIPPINES

13.1.11 REST OF ASIA-PACIFIC

14 ASIA PACIFIC TOKENIZATION MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 VISA

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 MASTERCARD

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 AMERICAN EXPRESS COMPANY

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENTS

16.4 VERIFONE, INC.

16.4.1 COMPANY SNAPSHOT

16.4.2 COMPANY SHARE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENT

16.5 HEWLETT PACARD ENTERPRISE DEVELOPMENT LP

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 ASIAPAY LIMITED

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENTS

16.7 BAFFLE

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENT

16.8 BLUEFIN PAYMENT SYSTEMS

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 BROADCOM

16.9.1 COMPANY SNAPSHOT

16.9.2 REVENUE ANALYSIS

16.9.3 PRODUCT PORTFOLIO

16.9.4 RECENT DEVELOPMENTS

16.1 ENTRUST CORPORATION

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENTS

16.11 FIS

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 PRODUCT PORTFOLIO

16.11.4 RECENT DEVELOPMENTS

16.12 FISERVE, INC.

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 RECENT DEVELOPMENTS

16.13 FORTANIX

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENTS

16.14 FUTUREX

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENTS

16.15 HST

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENT

16.16 LOOKOUT, INC.

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENTS

16.17 MARQETA, INC

16.17.1 COMPANY SNAPSHOT

16.17.2 REVENUE ANALYSIS

16.17.3 SOLUTION PORTFOLIO

16.17.4 RECENT DEVELOPMENTS

16.18 MICRO FOCUS

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 PRODUCT PORTFOLIO

16.18.4 RECENT DEVELOPMENTS

16.19 OPEN TEXT CORPORATION

16.19.1 COMPANY SNAPSHOT

16.19.2 REVENUE ANALYSIS

16.19.3 SOLUTION PORTFOLIO

16.19.4 RECENT DEVELOPMENTS

16.2 PAYA, INC.

16.20.1 COMPANY SNAPSHOT

16.20.2 REVENUE ANALYSIS

16.20.3 SOLUTION PORTFOLIO

16.20.4 RECENT DEVELOPMENTS

16.21 PAYMENTVISION

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 RECENT DEVELOPMENTS

16.22 PRIME FACTORS

16.22.1 COMPANY SNAPSHOT

16.22.2 PRODUCT PORTFOLIO

16.22.3 RECENT DEVELOPMENTS

16.23 PROTEGRITY INC.

16.23.1 COMPANY SNAPSHOT

16.23.2 PRODUCT PORTFOLIO

16.23.3 RECENT DEVELOPMENTS

16.24 QUANTOZ NV

16.24.1 COMPANY SNAPSHOT

16.24.2 PRODUCT PORTFOLIO

16.24.3 RECENT DEVELOPMENT

16.25 RANDTRONICS

16.25.1 COMPANY SNAPSHOT

16.25.2 PRODUCT PORTFOLIO

16.25.3 RECENT DEVELOPMENT

16.26 STRONGKEY, INC.

16.26.1 COMPANY SNAPSHOT

16.26.2 PRODUCT PORTFOLIO

16.26.3 RECENT DEVELOPMENT

16.27 SYGNUM PTE. LTD.

16.27.1 COMPANY SNAPSHOT

16.27.2 PRODUCT PORTFOLIO

16.27.3 RECENT DEVELOPMENT

16.28 THALES GROUP

16.28.1 COMPANY SNAPSHOT

16.28.2 REVENUE ANALYSIS

16.28.3 PRODUCT PORTFOLIO

16.28.4 RECENT DEVELOPMENTS

16.29 TOKENY SÀRL

16.29.1 COMPANY SNAPSHOT

16.29.2 PRODUCT PORTFOLIO

16.29.3 RECENT DEVELOPMENTS

16.3 UTIMACO GMBH

16.30.1 COMPANY SNAPSHOT

16.30.2 PRODUCT PORTFOLIO

16.30.3 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

Liste des tableaux

TABLE 1 ASIA PACIFIC TOKENIZATION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 2 ASIA PACIFIC SOLUTIONS IN TOKENIZATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 ASIA PACIFIC SOLUTIONS IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 ASIA PACIFIC SERVICES IN TOKENIZATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 ASIA PACIFIC SERVICES IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 ASIA PACIFIC PROFESSIONAL IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 7 ASIA PACIFIC TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 8 ASIA PACIFIC LARGE ORGANIZATION IN TOKENIZATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 ASIA PACIFIC SMES IN TOKENIZATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 ASIA PACIFIC TOKENIZATION MARKET, BY DEPLOYMENT, 2020-2029 (USD MILLION)

TABLE 11 ASIA PACIFIC CLOUD IN TOKENIZATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 ASIA PACIFIC CLOUD IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 13 ASIA PACIFIC ON-PREMISES IN TOKENIZATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 ASIA PACIFIC TOKENIZATION MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 15 ASIA PACIFIC CLOUD COMPUTING IN TOKENIZATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 ASIA PACIFIC INTERNET OF THINGS (IOT) IN TOKENIZATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 ASIA PACIFIC BLOCKCHAIN IN TOKENIZATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 ASIA PACIFIC MACHINE LEARNING & ARTIFICIAL INTELLIGENCE IN TOKENIZATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 ASIA PACIFIC NATURAL LANGUAGE PROCESSING (NLP) IN TOKENIZATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 ASIA PACIFIC OTHERS IN TOKENIZATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 ASIA PACIFIC TOKENIZATION MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 22 ASIA PACIFIC API-BASED IN TOKENIZATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 ASIA PACIFIC GATEWAY-BASED IN TOKENIZATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 ASIA PACIFIC TOKENIZATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 25 ASIA PACIFIC PAYMENT SECURITY IN TOKENIZATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 ASIA PACIFIC DATA PROCESSING IN TOKENIZATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 ASIA PACIFIC ENCRYPTION IN TOKENIZATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 ASIA PACIFIC USER AUTHENTICATION IN TOKENIZATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 ASIA PACIFIC COMPLIANCE MANAGEMENT IN TOKENIZATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 ASIA PACIFIC OTHERS IN TOKENIZATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 ASIA PACIFIC TOKENIZATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 32 ASIA PACIFIC BANKING, FINANCIAL SERVICES & INSURANCE (BFSI ) IN TOKENIZATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 ASIA PACIFIC BANKING, FINANCIAL SERVICES & INSURANCE (BFSI) IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 34 ASIA PACIFIC IT & TELECOMMUNICATIONS IN TOKENIZATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 ASIA PACIFIC IT & TELECOMMUNICATIONS IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 36 ASIA PACIFIC RETAIL & E-COMMERCE IN TOKENIZATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 ASIA PACIFIC RETAIL & E-COMMERCE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 38 ASIA PACIFIC AUTOMOTIVE IN TOKENIZATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 ASIA PACIFIC AUTOMOTIVE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 40 ASIA PACIFIC HEALTHCARE & LIFE SCIENCES IN TOKENIZATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 ASIA PACIFIC HEALTHCARE & LIFE SCIENCES IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 42 ASIA PACIFIC MANUFACTURING IN TOKENIZATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 ASIA PACIFIC MANUFACTURING IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 44 ASIA PACIFIC ENERGY & UTILITIES IN TOKENIZATION MARKET, BY REGION , 2020-2029 (USD MILLION)

TABLE 45 ASIA PACIFIC ENERGY & UTILITIES IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 46 ASIA PACIFIC AEROSPACE & DEFENCE IN TOKENIZATION MARKET, BY REGION , 2020-2029 (USD MILLION)

TABLE 47 ASIA PACIFIC AEROSPACE & DEFENCE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 48 ASIA PACIFIC GOVERNMENT & PUBLIC SECTOR IN TOKENIZATION MARKET, BY REGION , 2020-2029 (USD MILLION)

TABLE 49 ASIA PACIFIC GOVERNMENT & PUBLIC SECTOR IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 50 ASIA PACIFIC MEDIA & ENTERTAINMENT IN TOKENIZATION MARKET, BY REGION , 2020-2029 (USD MILLION)

TABLE 51 ASIA PACIFIC MEDIA & ENTERTAINMENT IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 52 ASIA PACIFIC OTHERS IN TOKENIZATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 53 ASIA PACIFIC OTHERS IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 54 ASIA-PACIFIC TOKENIZATION MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 55 ASIA-PACIFIC TOKENIZATION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 56 ASIA-PACIFIC SOLUTIONS IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 57 ASIA-PACIFIC SERVICES IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 58 ASIA-PACIFIC PROFESSIONAL IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 59 ASIA-PACIFIC TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 60 ASIA-PACIFIC TOKENIZATION MARKET, BY DEPLOYMENT, 2020-2029 (USD MILLION)

TABLE 61 ASIA-PACIFIC CLOUD IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 62 ASIA-PACIFIC TOKENIZATION MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 63 ASIA-PACIFIC TOKENIZATION MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 64 ASIA-PACIFIC TOKENIZATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 65 ASIA-PACIFIC TOKENIZATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 66 ASIA-PACIFIC BANKING, FINANCIAL SERVICES & INSURANCE (BFSI) IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 67 ASIA-PACIFIC IT & TELECOMMUNICATIONS IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 68 ASIA-PACIFIC RETAIL & E-COMMERCE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 69 ASIA-PACIFIC AUTOMOTIVE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 70 ASIA-PACIFIC HEALTHCARE & LIFE SCIENCES IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 71 ASIA-PACIFIC MANUFACTURING IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 72 ASIA-PACIFIC ENERGY & UTILITIES IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 73 ASIA-PACIFIC AEROSPACE & DEFENCE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 74 ASIA-PACIFIC GOVERNMENT & PUBLIC SECTOR IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 75 ASIA-PACIFIC MEDIA & ENTERTAINMENT IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 76 ASIA-PACIFIC OTHERS IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 77 CHINA TOKENIZATION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 78 CHINA SOLUTIONS IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 79 CHINA SERVICES IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 80 CHINA PROFESSIONAL IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 81 CHINA TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 82 CHINA TOKENIZATION MARKET, BY DEPLOYMENT, 2020-2029 (USD MILLION)

TABLE 83 CHINA CLOUD IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 84 CHINA TOKENIZATION MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 85 CHINA TOKENIZATION MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 86 CHINA TOKENIZATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 87 CHINA TOKENIZATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 88 CHINA BANKING, FINANCIAL SERVICES & INSURANCE (BFSI) IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 89 CHINA IT & TELECOMMUNICATIONS IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 90 CHINA RETAIL & E-COMMERCE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 91 CHINA AUTOMOTIVE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 92 CHINA HEALTHCARE & LIFE SCIENCES IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 93 CHINA MANUFACTURING IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 94 CHINA ENERGY & UTILITIES IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 95 CHINA AEROSPACE & DEFENCE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 96 CHINA GOVERNMENT & PUBLIC SECTOR IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 97 CHINA MEDIA & ENTERTAINMENT IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 98 CHINA OTHERS IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 99 JAPAN TOKENIZATION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 100 JAPAN SOLUTIONS IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 101 JAPAN SERVICES IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 102 JAPAN PROFESSIONAL IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 103 JAPAN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 104 JAPAN TOKENIZATION MARKET, BY DEPLOYMENT, 2020-2029 (USD MILLION)

TABLE 105 JAPAN CLOUD IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 JAPAN TOKENIZATION MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 107 JAPAN TOKENIZATION MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 108 JAPAN TOKENIZATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 109 JAPAN TOKENIZATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 110 JAPAN BANKING, FINANCIAL SERVICES & INSURANCE (BFSI) IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 111 JAPAN IT & TELECOMMUNICATIONS IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 112 JAPAN RETAIL & E-COMMERCE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 113 JAPAN AUTOMOTIVE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 114 JAPAN HEALTHCARE & LIFE SCIENCES IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 115 JAPAN MANUFACTURING IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 116 JAPAN ENERGY & UTILITIES IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 117 JAPAN AEROSPACE & DEFENCE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 118 JAPAN GOVERNMENT & PUBLIC SECTOR IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 119 JAPAN MEDIA & ENTERTAINMENT IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 120 JAPAN OTHERS IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 121 INDIA TOKENIZATION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 122 INDIA SOLUTIONS IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 123 INDIA SERVICES IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 124 INDIA PROFESSIONAL IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 125 INDIA TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 126 INDIA TOKENIZATION MARKET, BY DEPLOYMENT, 2020-2029 (USD MILLION)

TABLE 127 INDIA CLOUD IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 128 INDIA TOKENIZATION MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 129 INDIA TOKENIZATION MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 130 INDIA TOKENIZATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 131 INDIA TOKENIZATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 132 INDIA BANKING, FINANCIAL SERVICES & INSURANCE (BFSI) IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 133 INDIA IT & TELECOMMUNICATIONS IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 134 INDIA RETAIL & E-COMMERCE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 135 INDIA AUTOMOTIVE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 136 INDIA HEALTHCARE & LIFE SCIENCES IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 137 INDIA MANUFACTURING IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 138 INDIA ENERGY & UTILITIES IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 139 INDIA AEROSPACE & DEFENCE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 140 INDIA GOVERNMENT & PUBLIC SECTOR IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 141 INDIA MEDIA & ENTERTAINMENT IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 142 INDIA OTHERS IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 143 SOUTH KOREA TOKENIZATION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 144 SOUTH KOREA SOLUTIONS IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 145 SOUTH KOREA SERVICES IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 146 SOUTH KOREA PROFESSIONAL IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 147 SOUTH KOREA TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 148 SOUTH KOREA TOKENIZATION MARKET, BY DEPLOYMENT, 2020-2029 (USD MILLION)

TABLE 149 SOUTH KOREA CLOUD IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 150 SOUTH KOREA TOKENIZATION MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 151 SOUTH KOREA TOKENIZATION MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 152 SOUTH KOREA TOKENIZATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 153 SOUTH KOREA TOKENIZATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 154 SOUTH KOREA BANKING, FINANCIAL SERVICES & INSURANCE (BFSI) IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 155 SOUTH KOREA IT & TELECOMMUNICATIONS IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 156 SOUTH KOREA RETAIL & E-COMMERCE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 157 SOUTH KOREA AUTOMOTIVE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 158 SOUTH KOREA HEALTHCARE & LIFE SCIENCES IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 159 SOUTH KOREA MANUFACTURING IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 160 SOUTH KOREA ENERGY & UTILITIES IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 161 SOUTH KOREA AEROSPACE & DEFENCE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 162 SOUTH KOREA GOVERNMENT & PUBLIC SECTOR IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 163 SOUTH KOREA MEDIA & ENTERTAINMENT IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 164 SOUTH KOREA OTHERS IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 165 SINGAPORE TOKENIZATION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 166 SINGAPORE SOLUTIONS IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 167 SINGAPORE SERVICES IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 168 SINGAPORE PROFESSIONAL IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 169 SINGAPORE TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 170 SINGAPORE TOKENIZATION MARKET, BY DEPLOYMENT, 2020-2029 (USD MILLION)

TABLE 171 SINGAPORE CLOUD IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 172 SINGAPORE TOKENIZATION MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 173 SINGAPORE TOKENIZATION MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 174 SINGAPORE TOKENIZATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 175 SINGAPORE TOKENIZATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 176 SINGAPORE BANKING, FINANCIAL SERVICES & INSURANCE (BFSI) IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 177 SINGAPORE IT & TELECOMMUNICATIONS IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 178 SINGAPORE RETAIL & E-COMMERCE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 179 SINGAPORE AUTOMOTIVE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 180 SINGAPORE HEALTHCARE & LIFE SCIENCES IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 181 SINGAPORE MANUFACTURING IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 182 SINGAPORE ENERGY & UTILITIES IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 183 SINGAPORE AEROSPACE & DEFENCE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 184 SINGAPORE GOVERNMENT & PUBLIC SECTOR IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 185 SINGAPORE MEDIA & ENTERTAINMENT IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 186 SINGAPORE OTHERS IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 187 MALAYSIA TOKENIZATION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 188 MALAYSIA SOLUTIONS IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 189 MALAYSIA SERVICES IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 190 MALAYSIA PROFESSIONAL IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 191 MALAYSIA TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 192 MALAYSIA TOKENIZATION MARKET, BY DEPLOYMENT, 2020-2029 (USD MILLION)

TABLE 193 MALAYSIA CLOUD IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 194 MALAYSIA TOKENIZATION MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 195 MALAYSIA TOKENIZATION MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 196 MALAYSIA TOKENIZATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 197 MALAYSIA TOKENIZATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 198 MALAYSIA BANKING, FINANCIAL SERVICES & INSURANCE (BFSI) IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 199 MALAYSIA IT & TELECOMMUNICATIONS IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 200 MALAYSIA RETAIL & E-COMMERCE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 201 MALAYSIA AUTOMOTIVE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 202 MALAYSIA HEALTHCARE & LIFE SCIENCES IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 203 MALAYSIA MANUFACTURING IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 204 MALAYSIA ENERGY & UTILITIES IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 205 MALAYSIA AEROSPACE & DEFENCE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 206 MALAYSIA GOVERNMENT & PUBLIC SECTOR IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 207 MALAYSIA MEDIA & ENTERTAINMENT IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 208 MALAYSIA OTHERS IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 209 AUSTRALIA TOKENIZATION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 210 AUSTRALIA SOLUTIONS IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 211 AUSTRALIA SERVICES IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 212 AUSTRALIA PROFESSIONAL IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 213 AUSTRALIA TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 214 AUSTRALIA TOKENIZATION MARKET, BY DEPLOYMENT, 2020-2029 (USD MILLION)

TABLE 215 AUSTRALIA CLOUD IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 216 AUSTRALIA TOKENIZATION MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 217 AUSTRALIA TOKENIZATION MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 218 AUSTRALIA TOKENIZATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 219 AUSTRALIA TOKENIZATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 220 AUSTRALIA BANKING, FINANCIAL SERVICES & INSURANCE (BFSI) IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 221 AUSTRALIA IT & TELECOMMUNICATIONS IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 222 AUSTRALIA RETAIL & E-COMMERCE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 223 AUSTRALIA AUTOMOTIVE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 224 AUSTRALIA HEALTHCARE & LIFE SCIENCES IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 225 AUSTRALIA MANUFACTURING IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 226 AUSTRALIA ENERGY & UTILITIES IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 227 AUSTRALIA AEROSPACE & DEFENCE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 228 AUSTRALIA GOVERNMENT & PUBLIC SECTOR IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 229 AUSTRALIA MEDIA & ENTERTAINMENT IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 230 AUSTRALIA OTHERS IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 231 THAILAND TOKENIZATION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 232 THAILAND SOLUTIONS IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 233 THAILAND SERVICES IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 234 THAILAND PROFESSIONAL IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 235 THAILAND TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 236 THAILAND TOKENIZATION MARKET, BY DEPLOYMENT, 2020-2029 (USD MILLION)

TABLE 237 THAILAND CLOUD IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 238 THAILAND TOKENIZATION MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 239 THAILAND TOKENIZATION MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 240 THAILAND TOKENIZATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 241 THAILAND TOKENIZATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 242 THAILAND BANKING, FINANCIAL SERVICES & INSURANCE (BFSI) IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 243 THAILAND IT & TELECOMMUNICATIONS IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 244 THAILAND RETAIL & E-COMMERCE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 245 THAILAND AUTOMOTIVE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 246 THAILAND HEALTHCARE & LIFE SCIENCES IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 247 THAILAND MANUFACTURING IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 248 THAILAND ENERGY & UTILITIES IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 249 THAILAND AEROSPACE & DEFENCE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 250 THAILAND GOVERNMENT & PUBLIC SECTOR IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 251 THAILAND MEDIA & ENTERTAINMENT IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 252 THAILAND OTHERS IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 253 INDONESIA TOKENIZATION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 254 INDONESIA SOLUTIONS IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 255 INDONESIA SERVICES IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 256 INDONESIA PROFESSIONAL IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 257 INDONESIA TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 258 INDONESIA TOKENIZATION MARKET, BY DEPLOYMENT, 2020-2029 (USD MILLION)

TABLE 259 INDONESIA CLOUD IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 260 INDONESIA TOKENIZATION MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 261 INDONESIA TOKENIZATION MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 262 INDONESIA TOKENIZATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 263 INDONESIA TOKENIZATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 264 INDONESIA BANKING, FINANCIAL SERVICES & INSURANCE (BFSI) IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 265 INDONESIA IT & TELECOMMUNICATIONS IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 266 INDONESIA RETAIL & E-COMMERCE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 267 INDONESIA AUTOMOTIVE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 268 INDONESIA HEALTHCARE & LIFE SCIENCES IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 269 INDONESIA MANUFACTURING IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 270 INDONESIA ENERGY & UTILITIES IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 271 INDONESIA AEROSPACE & DEFENCE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 272 INDONESIA GOVERNMENT & PUBLIC SECTOR IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 273 INDONESIA MEDIA & ENTERTAINMENT IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 274 INDONESIA OTHERS IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 275 PHILIPPINES TOKENIZATION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 276 PHILIPPINES SOLUTIONS IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 277 PHILIPPINES SERVICES IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 278 PHILIPPINES PROFESSIONAL IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 279 PHILIPPINES TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 280 PHILIPPINES TOKENIZATION MARKET, BY DEPLOYMENT, 2020-2029 (USD MILLION)

TABLE 281 PHILIPPINES CLOUD IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 282 PHILIPPINES TOKENIZATION MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 283 PHILIPPINES TOKENIZATION MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 284 PHILIPPINES TOKENIZATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 285 PHILIPPINES TOKENIZATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 286 PHILIPPINES BANKING, FINANCIAL SERVICES & INSURANCE (BFSI) IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 287 PHILIPPINES IT & TELECOMMUNICATIONS IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 288 PHILIPPINES RETAIL & E-COMMERCE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 289 PHILIPPINES AUTOMOTIVE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 290 PHILIPPINES HEALTHCARE & LIFE SCIENCES IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 291 PHILIPPINES MANUFACTURING IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 292 PHILIPPINES ENERGY & UTILITIES IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 293 PHILIPPINES AEROSPACE & DEFENCE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 294 PHILIPPINES GOVERNMENT & PUBLIC SECTOR IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 295 PHILIPPINES MEDIA & ENTERTAINMENT IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 296 PHILIPPINES OTHERS IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 297 REST OF ASIA-PACIFIC TOKENIZATION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 ASIA PACIFIC TOKENIZATION MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC TOKENIZATION MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC TOKENIZATION MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC TOKENIZATION MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC TOKENIZATION MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC TOKENIZATION MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC TOKENIZATION MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA PACIFIC TOKENIZATION MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 ASIA PACIFIC TOKENIZATION MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 ASIA PACIFIC TOKENIZATION MARKET: SEGMENTATION

FIGURE 11 RISE IN DEMAND FOR CUSTOMER EXPERIENCE IS EXPECTED TO DRIVE THE ASIA PACIFIC TOKENIZATION MARKET IN THE FORECAST PERIOD

FIGURE 12 OFFERING SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC TOKENIZATION MARKET IN 2022 & 2029

FIGURE 13 NORTH AMERICA IS EXPECTED TO DOMINATE AND IS THE FASTEST-GROWING REGION IN THE ASIA PACIFIC TOKENIZATION MARKET IN THE FORECAST PERIOD

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA PACIFIC TOKENIZATION MARKET

FIGURE 15 PRIORITIES REQUIRED FOR BUSINESS DEVELOPMENT IN NEXT FIVE YEARS

FIGURE 16 CARD FRAUD WORLDWIDE

FIGURE 17 ASIA PACIFIC TOKENIZATION MARKET: BY OFFERING, 2021

FIGURE 18 ASIA PACIFIC TOKENIZATION MARKET: BY ORGANIZATION SIZE, 2021

FIGURE 19 ASIA PACIFIC TOKENIZATION MARKET: BY DEPLOYMENT , 2021

FIGURE 20 ASIA PACIFIC TOKENIZATION MARKET: BY TECHNOLOGY, 2021

FIGURE 21 ASIA PACIFIC TOKENIZATION MARKET: BY TECHNIQUE, 2021

FIGURE 22 ASIA PACIFIC TOKENIZATION MARKET: BY APPLICATION, 2021

FIGURE 23 ASIA PACIFIC TOKENIZATION MARKET: BY END USER, 2021

FIGURE 24 ASIA-PACIFIC TOKENIZATION MARKET : SNAPSHOT (2021)

FIGURE 25 ASIA-PACIFIC TOKENIZATION MARKET : BY COUNTRY (2021)

FIGURE 26 ASIA-PACIFIC TOKENIZATION MARKET : BY COUNTRY (2022 & 2029)

FIGURE 27 ASIA-PACIFIC TOKENIZATION MARKET : BY COUNTRY (2021 & 2029)

FIGURE 28 ASIA-PACIFIC TOKENIZATION MARKET : BY OFFERING (2022-2029)

FIGURE 29 ASIA PACIFIC TOKENIZATION MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.