Asia Pacific Rubber Testing Equipment Market

Taille du marché en milliards USD

TCAC :

%

USD

116.54 Million

USD

192.87 Million

2024

2032

USD

116.54 Million

USD

192.87 Million

2024

2032

| 2025 –2032 | |

| USD 116.54 Million | |

| USD 192.87 Million | |

|

|

|

|

Segmentation du marché des équipements d'essai du caoutchouc en Asie-Pacifique, par type d'essai (viscosité, densité, dureté, flexion, épaisseur, stabilité mécanique, impact et vieillissement en étuve), technologie (viscosimètre Mooney, rhéomètre à matrice mobile, densimètre, dureté et analyseur de processus), type de caoutchouc (styrène-butadiène, EPDM, butyle, naturel, silicone, néoprène, nitrile, etc.), plage de fréquences (plus de 4 Hz, 1 à 4 Hz et moins de 1 Hz), application (pneus et pièces automobiles, produits industriels en caoutchouc, joints et joints toriques en caoutchouc, semelles de chaussures, bandes transporteuses, courroies, tapis et moquettes en caoutchouc, articles de sport et de fitness) - Tendances et prévisions du secteur jusqu'en 2032

Taille du marché des équipements d'essai du caoutchouc en Asie-Pacifique

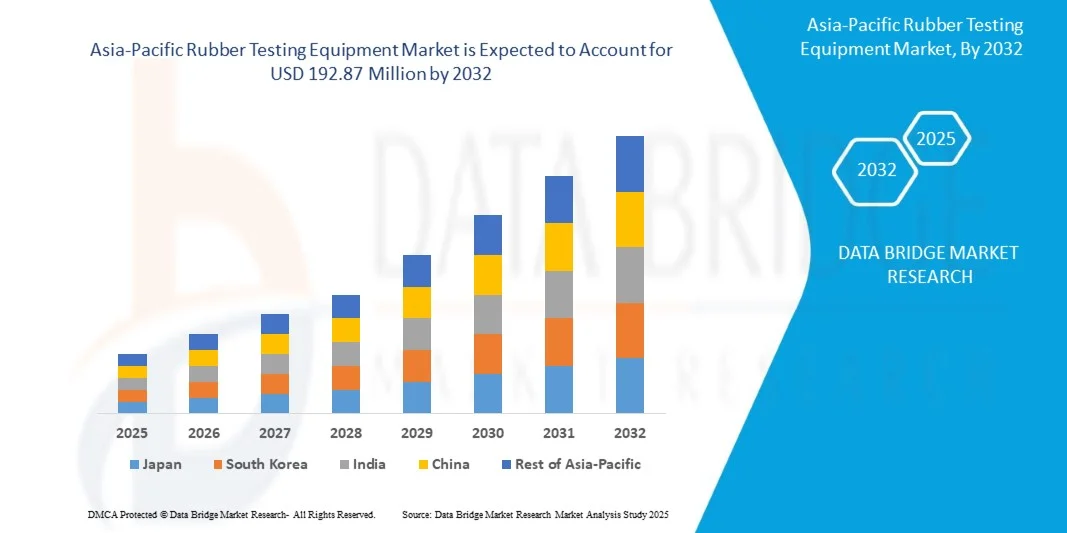

- La taille du marché des équipements de test du caoutchouc en Asie-Pacifique était évaluée à 116,54 millions USD en 2024 et devrait atteindre 192,87 millions USD d'ici 2032 , à un TCAC de 6,5 % au cours de la période de prévision.

- La croissance du marché est largement alimentée par la demande croissante de composants en caoutchouc haute performance dans les secteurs de l'automobile, de l'aérospatiale et de l'industrie, ainsi que par des réglementations strictes en matière de qualité et de sécurité qui favorisent l'adoption de solutions de test avancées.

- En outre, les progrès technologiques dans les équipements de test, tels que l’automatisation, l’analyse des données en temps réel et l’intégration avec les plateformes numériques, améliorent la précision et l’efficacité des tests, soutenant ainsi davantage l’expansion du marché.

Analyse du marché des équipements d'essai du caoutchouc en Asie-Pacifique

- Le marché des équipements de test du caoutchouc connaît une croissance constante, les fabricants se concentrant de plus en plus sur l'assurance qualité pour répondre aux normes de performance dans les applications industrielles.

- L'importance croissante accordée à la cohérence et à la sécurité des produits dans des secteurs tels que l'automobile et la fabrication encourage l'utilisation de solutions de test du caoutchouc précises et automatisées.

- La Chine a dominé le marché des équipements de test du caoutchouc avec la plus grande part de revenus de 38,5 % en 2024, grâce à une industrialisation rapide, une production automobile croissante et des réglementations de qualité strictes.

- Le Japon devrait connaître le taux de croissance annuel composé (TCAC) le plus élevé sur le marché des équipements de test du caoutchouc en Asie-Pacifique en raison de l'augmentation des investissements dans les technologies de test avancées, de la demande croissante de précision et de durabilité dans les produits en caoutchouc automobiles et industriels, et de l'innovation continue dans l'automatisation et les systèmes de test modulaires.

- Le segment des tests de viscosité a représenté la plus grande part de chiffre d'affaires du marché en 2024, grâce à son rôle crucial dans l'évaluation de la transformabilité et des caractéristiques d'écoulement des composés de caoutchouc. Les fabricants s'appuient fortement sur les tests de viscosité pour garantir la régularité de la production et répondre aux exigences de performance des applications finales.

Portée du rapport et segmentation du marché des équipements d'essai du caoutchouc en Asie-Pacifique

|

Attributs |

Analyses clés du marché des équipements d'essai du caoutchouc en Asie-Pacifique |

|

Segments couverts |

|

|

Pays couverts |

Asie-Pacifique

|

|

Principaux acteurs du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse approfondie par des experts, une production et une capacité géographiquement représentées par entreprise, des configurations de réseau de distributeurs et de partenaires, une analyse détaillée et mise à jour des tendances des prix et une analyse des déficits de la chaîne d'approvisionnement et de la demande. |

Tendances du marché des équipements d'essai du caoutchouc en Asie-Pacifique

Adoption croissante de solutions avancées de test du caoutchouc

- L'utilisation croissante d'équipements d'essai de pointe pour le caoutchouc transforme le contrôle qualité en permettant une évaluation précise et fiable des propriétés du caoutchouc, telles que la résistance à la traction, la dureté et l'élasticité. Ces systèmes permettent aux fabricants de garantir des performances constantes et la conformité de leurs produits aux normes industrielles, réduisant ainsi les défauts et améliorant la qualité globale de leurs produits. De plus, l'intégration avec les rapports numériques et l'analyse des données permet aux fabricants de suivre les tendances de production et de prendre des décisions éclairées pour l'amélioration de leurs produits.

- La demande croissante de produits en caoutchouc dans les secteurs automobile, industriel et grand public accélère l'adoption de dispositifs de test automatisés et portables. Ces solutions sont particulièrement efficaces pour identifier les anomalies des matériaux et garantir la conformité des composants en caoutchouc aux exigences de sécurité et de durabilité. Cette tendance est renforcée par le renforcement des réglementations mondiales en matière de qualité et par le besoin de certifications sur les marchés d'exportation.

- La simplicité d'utilisation, la précision et la polyvalence des instruments modernes d'analyse du caoutchouc les rendent attractifs pour les contrôles qualité de routine, aidant ainsi les fabricants à maintenir l'efficacité de leur production et à réduire le gaspillage de matériaux. De plus, ces systèmes sont souvent modulaires et dotés de fonctions de surveillance à distance, permettant un déploiement flexible sur plusieurs lignes de production et installations. Leur adoption contribue également aux objectifs de développement durable en minimisant les défauts de production et le gaspillage de ressources.

- Par exemple, en 2023, plusieurs fabricants de pneus et de caoutchouc industriel de la région ont signalé une amélioration de la régularité de leurs produits et une réduction des défauts de production après l'installation de machines automatisées d'essais de traction et de dureté. Ces améliorations ont renforcé la réputation de la marque et la satisfaction client, tout en réduisant les taux de rappel et les réclamations sous garantie. L'intégration de capteurs intelligents et le retour d'information en temps réel ont permis aux fabricants d'affiner leurs processus et de maintenir une qualité de produit uniforme.

- Si les équipements avancés d'essai du caoutchouc gagnent en popularité, leur impact dépend de l'innovation technologique continue, de la formation des opérateurs et de leur accessibilité financière. Les fabricants doivent se concentrer sur le développement de systèmes modulaires, évolutifs et fiables pour tirer pleinement parti de la croissance du marché. Les mises à jour logicielles continues et la compatibilité avec les solutions IoT émergentes sont également essentielles pour maintenir l'efficacité opérationnelle et répondre aux normes industrielles en constante évolution.

Dynamique du marché des équipements d'essai du caoutchouc en Asie-Pacifique

Conducteur

« Accent croissant sur la qualité, la sécurité et la normalisation des produits »

- L'attention croissante portée à la sécurité des produits et à leur conformité aux normes internationales favorise l'adoption d'équipements de test du caoutchouc. Les entreprises privilégient de plus en plus les solutions de test garantissant durabilité, performance et conformité réglementaire dans les secteurs automobile, industriel et grand public. La sensibilisation croissante à la sécurité des utilisateurs finaux et à la responsabilité des marques incite également les fabricants à adopter des systèmes de test de haute précision.

- Les fabricants recherchent de plus en plus des systèmes de test automatisés, précis et fiables pour optimiser leurs processus de production, réduire les déchets et maintenir une qualité constante d'un lot à l'autre. Des équipements de test avancés permettent une caractérisation détaillée des matériaux, contribuant ainsi à améliorer la conception et les performances des produits. L'utilisation d'objets connectés et d'outils d'analyse assure la traçabilité des processus, facilitant ainsi les audits réglementaires et les initiatives d'assurance qualité interne.

- L'essor de l'industrie du caoutchouc, notamment dans les secteurs des pneus automobiles, des joints industriels et des biens de consommation, stimule la demande du marché. Les solutions de test fournissent des informations cruciales sur les propriétés des matériaux, garantissant ainsi que les produits finis répondent aux attentes de performance et aux exigences des clients. De plus, l'augmentation des exportations vers des régions où les normes de sécurité sont strictes encourage les entreprises à adopter des protocoles de test avancés pour préserver leur accès au marché.

- Par exemple, en 2022, plusieurs fabricants de composants en caoutchouc de la région ont intégré des systèmes automatisés d'essais de dureté et de traction à leurs lignes de production, ce qui a permis d'améliorer l'uniformité des produits et de réduire les taux de défaillance. Cette adoption a également amélioré l'efficacité opérationnelle en réduisant les interventions manuelles et les erreurs humaines, ce qui a permis d'augmenter le rendement et de réduire les coûts.

- Si la qualité et la standardisation des produits sont des moteurs de croissance clés, l'adoption dépend de la rentabilité, de la simplicité d'utilisation et de la disponibilité d'un personnel qualifié pour utiliser des équipements de test sophistiqués. Des programmes de formation continue et des services d'assistance technique deviennent essentiels pour garantir une utilisation optimale et éviter les temps d'arrêt, favorisant ainsi l'expansion du marché à long terme.

Retenue/Défi

« Coût élevé des équipements de test avancés et accessibilité limitée aux opérations à petite échelle »

- Le coût élevé des instruments d'essai du caoutchouc de pointe, notamment les machines d'essai universelles, les duromètres et les rhéomètres, limite leur adoption par les PME. Les contraintes de prix limitent l'accès aux technologies de pointe qui améliorent le contrôle qualité. De plus, les contrats de maintenance coûteux et les exigences d'étalonnage alourdissent les dépenses d'exploitation, dissuadant les petits acteurs d'investir.

- Dans de nombreuses régions, on observe une pénurie de personnel qualifié capable d'utiliser et d'entretenir des équipements de test complexes. Le manque de formation et d'expertise technique entrave leur utilisation efficace, réduisant ainsi les avantages des systèmes avancés. Ce défi est particulièrement marqué dans les marchés émergents, où la formation professionnelle aux équipements de laboratoire de pointe est limitée.

- Les difficultés d'approvisionnement et la disponibilité limitée d'instruments de test spécialisés dans les régions en développement limitent encore davantage la pénétration du marché. Les petits fabricants ont souvent recours à des méthodes de test manuelles ou obsolètes, ce qui peut entraîner une qualité inégale. Les retards dans l'importation d'équipements et de pièces détachées haut de gamme peuvent perturber les calendriers de production et affecter l'efficacité opérationnelle globale.

- Par exemple, en 2023, plusieurs producteurs de composants en caoutchouc d'Asie du Sud-Est ont signalé des retards dans la mise à niveau des équipements de test automatisés en raison de contraintes budgétaires et logistiques, affectant l'efficacité de la production et la fiabilité des produits. Ces difficultés ont entraîné des retards dans le respect des délais et limité leur capacité à respecter les normes de qualité à l'exportation, impactant ainsi leurs revenus et leur compétitivité sur le marché.

- Alors que les technologies de test continuent d'évoluer, il est essentiel de combler les lacunes en matière de coût, d'accessibilité et de compétences pour une adoption plus large et une croissance durable du marché des équipements de test du caoutchouc. Les collaborations sectorielles, le soutien des pouvoirs publics et des options de financement flexibles pourraient permettre aux petits acteurs d'adopter des systèmes de test avancés et d'améliorer les normes globales du marché.

Portée du marché des équipements d'essai du caoutchouc en Asie-Pacifique

Le marché des équipements de test du caoutchouc en Asie-Pacifique est segmenté en fonction du type de test, de la technologie, du type de caoutchouc, de la plage de fréquences et de l'application.

- Par type de test

Selon le type d'essai, le marché est segmenté en essais de viscosité, essais de densité, essais de dureté, essais de flexion, essais d'épaisseur, essais de stabilité mécanique, essais d'impact et essais de vieillissement en étuve. Le segment des essais de viscosité a représenté la plus grande part de chiffre d'affaires du marché en 2024, grâce à son rôle essentiel dans l'évaluation de l'aptitude à la transformation et des caractéristiques d'écoulement des composés de caoutchouc. Les fabricants s'appuient fortement sur les essais de viscosité pour garantir la régularité de la production et répondre aux exigences de performance des applications finales.

Le segment des essais de dureté devrait connaître la croissance la plus rapide entre 2025 et 2032, alimenté par la demande croissante de composants en caoutchouc haute performance dans des secteurs tels que l'automobile, la construction et l'aéronautique. Les essais de dureté permettent d'évaluer avec précision la résistance des matériaux sous pression, garantissant ainsi la durabilité et la fiabilité des pièces en caoutchouc utilisées dans des conditions extrêmes.

- Par technologie

Sur le plan technologique, le marché est segmenté en viscosimètres Mooney, rhéomètres à matrice mobile, densitomètres automatisés, densitomètres automatisés et analyseurs de procédés. Le segment des viscosimètres Mooney détenait la plus grande part de marché en 2024, car il demeure une référence largement reconnue pour la mesure de la viscosité du caoutchouc brut et des composés de caoutchouc. Sa simplicité d'utilisation et ses nombreuses applications en font un outil essentiel pour le contrôle qualité du caoutchouc.

Le segment des analyseurs de procédés devrait connaître la croissance la plus rapide entre 2025 et 2032, porté par la demande croissante de surveillance en temps réel des paramètres de production. Les analyseurs de procédés améliorent l'efficacité opérationnelle en réduisant les temps d'arrêt et en permettant une prise de décision basée sur les données, un élément essentiel dans les environnements de production automatisés et à grande échelle.

- Par type de caoutchouc

Le marché est segmenté en fonction du type de caoutchouc : caoutchouc styrène-butadiène, caoutchouc EPDM, caoutchouc butyle, caoutchouc naturel, caoutchouc silicone, caoutchouc néoprène, caoutchouc nitrile, etc. En 2024, le caoutchouc naturel a dominé le marché grâce à son utilisation intensive dans les applications automobiles, industrielles et grand public, grâce à son élasticité et sa résistance mécanique. Sa compatibilité avec diverses méthodes de test et sa disponibilité sur les marchés mondiaux renforcent encore cette domination du segment.

Le segment du caoutchouc de silicone devrait connaître la croissance la plus rapide entre 2025 et 2032, grâce à son excellente stabilité thermique, ses propriétés d'isolation électrique et son utilisation croissante dans les secteurs de l'électronique et de la santé. Ce matériau nécessite des tests rigoureux pour répondre à des normes de qualité strictes, ce qui alimente la demande d'équipements de test spécialisés pour le caoutchouc.

- Par gamme de fréquences

En termes de gamme de fréquences, le marché est segmenté en plus de 4 Hz, de 1 à 4 Hz et de moins de 1 Hz. Le segment de 1 à 4 Hz a représenté la plus grande part de chiffre d'affaires en 2024 grâce à sa large application dans les analyses mécaniques dynamiques standard et les essais de fatigue. Cette gamme est optimale pour évaluer les performances sous contraintes répétitives dans des secteurs tels que l'automobile et la chaussure.

Le segment des fréquences supérieures à 4 Hz devrait connaître la croissance la plus rapide entre 2025 et 2032, grâce à son utilisation croissante dans les applications avancées d'essais de fatigue et d'impact. Les équipements fonctionnant dans cette gamme permettent des cycles d'essai plus rapides et une précision accrue, essentielles pour les environnements industriels à haut débit.

- Par application

En fonction des applications, le marché est segmenté en pneus et pièces automobiles, produits industriels en caoutchouc, joints et joints toriques en caoutchouc, semelles de chaussures, bandes transporteuses, courroies, tapis et moquettes en caoutchouc, et articles de sport et de fitness. Le segment des pneus et pièces automobiles a représenté la part la plus importante en 2024, grâce aux exigences de qualité et aux réglementations de sécurité strictes du secteur automobile. Les tests garantissent que les composants tels que les pneus et les bagues répondent aux critères de performance en matière de résistance à l'usure, à la pression et à la température.

Le segment des bandes transporteuses devrait connaître la croissance la plus rapide entre 2025 et 2032, soutenu par l'industrialisation croissante et le besoin de matériaux durables dans les secteurs de la logistique et de l'exploitation minière. Des tests rigoureux des propriétés mécaniques et de la résistance au vieillissement sont essentiels pour garantir des performances durables en fonctionnement continu et dans des environnements abrasifs.

Analyse régionale du marché des équipements d'essai du caoutchouc en Asie-Pacifique

- La Chine a dominé le marché des équipements de test du caoutchouc avec la plus grande part de revenus de 38,5 % en 2024, grâce à une industrialisation rapide, une production automobile croissante et des réglementations de qualité strictes.

- Les fabricants adoptent des systèmes de test automatisés et de précision pour garantir des performances constantes des produits et leur conformité aux normes internationales.

- L'adoption généralisée est également soutenue par la demande croissante de pneus, de joints industriels et de produits en caoutchouc destinés aux consommateurs, ce qui stimule les investissements dans les équipements de test avancés.

Analyse du marché japonais des équipements d'essai du caoutchouc

Le marché japonais devrait connaître sa plus forte croissance entre 2025 et 2032, portée par les avancées technologiques, l'adoption massive de systèmes de test automatisés et la demande de produits industriels en caoutchouc haute performance. Les fabricants se concentrent sur l'amélioration de la qualité, l'optimisation des processus et l'intégration de solutions de test IoT, soutenues par des réglementations gouvernementales mettant l'accent sur la sécurité et la normalisation.

Part de marché des équipements d'essai du caoutchouc en Asie-Pacifique

L'industrie des équipements de test du caoutchouc en Asie-Pacifique est principalement dirigée par des entreprises bien établies, notamment :

- Taiwan Semiconductor Manufacturing Company (TSMC) (Taïwan)

- Samsung Electronics (Corée du Sud)

- Toyota Motor Corporation (Japon)

- Reliance Industries Limited (Inde)

- Commonwealth Bank of Australia (CBA) (Australie)

- Singapore Airlines (Singapour)

- PetroChina (Chine)

- Groupe BHP (Australie)

- LG Electronics (Corée du Sud)

- China State Construction Engineering Corporation (CSCEC) (Chine)

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.