Marché du chocolat haut de gamme en Asie-Pacifique, par type ( chocolat au lait , chocolat noir et chocolat blanc), type de produit (chocolat ordinaire/nature et chocolat fourré), inclusion (chocolats avec inclusions et chocolats ordinaires/sans inclusions), nature (conventionnelle et biologique), catégorie (standard premium et super premium), teneur en cacao (50-60 %, 71-80 %, 61-70 %, 81-90 % et 91-100 %), saveur (saveur, classique/régulière), emballage (emballage plastique, boîtes-cadeaux/assorties, pochettes, boîte en carton, sachets et autres), canal de distribution (détaillants en magasin et détaillants hors magasin) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et taille du marché du chocolat haut de gamme en Asie-Pacifique

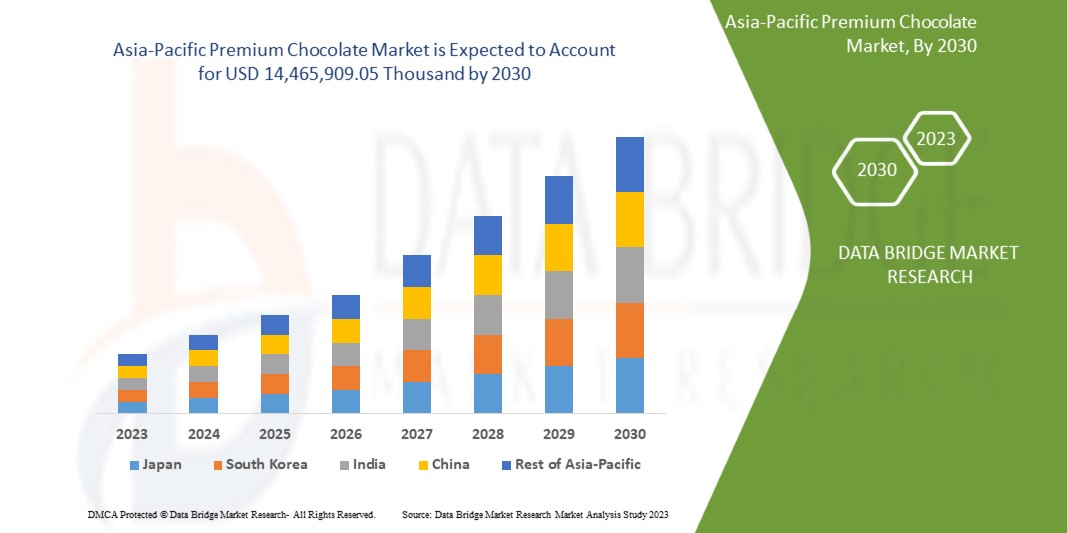

Le marché du chocolat haut de gamme de l'Asie-Pacifique devrait connaître une croissance significative au cours de la période de prévision de 2023 à 2030. Data Bridge Market Research analyse que le marché croît avec un TCAC de 4,6 % au cours de la période de prévision de 2023 à 2040 et devrait atteindre 14 465 909,05 milliers de dollars d'ici 2030. Le principal facteur à l'origine de la croissance du marché du chocolat haut de gamme de l'Asie-Pacifique est l'augmentation de la demande de chocolats très luxueux.

Les chocolats haut de gamme sont connus pour avoir une teneur en cacao plus élevée que les chocolats ordinaires. Ils sont disponibles dans des variétés infusées de noix, de fruits et parfois d'alcool. La présence de tous ces ingrédients confère aux chocolats haut de gamme une sensation plus agréable et plus luxueuse. Les clients peuvent obtenir un goût plus doux et plus riche.

Le rapport sur le marché du chocolat haut de gamme en Asie-Pacifique fournit des détails sur la part de marché, les nouveaux développements et l'impact des acteurs du marché national et local, analyse les opportunités en termes de poches de revenus émergentes, de changements dans la réglementation du marché, d'approbations de produits, de décisions stratégiques, de lancements de produits, d'expansions géographiques et d'innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché, contactez-nous pour un briefing d'analyste. Notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable de 2015 à 2020) |

|

Unités quantitatives |

Chiffre d'affaires en milliers et prix en USD |

|

Segments couverts |

Type (chocolat au lait, chocolat noir et chocolat blanc), type de produit (chocolat ordinaire/nature et chocolat fourré), inclusion (chocolats avec inclusions et chocolats ordinaires/sans inclusions), nature (conventionnel et biologique), catégorie (standard, premium et super premium), teneur en cacao (50-60 %, 71-80 %, 61-70 %, 81-90 %, et 91-100 %), saveur (saveur, classique/ordinaire), emballage (emballage plastique, boîtes cadeaux/assorties, pochettes, boîte en carton, sachets et autres), canal de distribution (détaillants en magasin et détaillants hors magasin) |

|

Pays couverts |

Chine, Inde, Japon, Indonésie, Corée du Sud, Australie, Philippines, Thaïlande, Malaisie, Singapour et reste de l'Asie-Pacifique |

|

Acteurs du marché couverts |

Mars, Incorporated et ses sociétés affiliées (Virginie), Mondelēz International (États-Unis), THE HERSHEY COMPANY (États-Unis), Ferrero (Italie), Nestlé (Suisse), General Mills, Inc. (États-Unis), Meiji Holdings Co., Ltd. (Japon), Chocoladefabriken Lindt & Sprüngli AG (Suisse), Barry Callebaut (Suisse), The Kraft Heinz Company (États-Unis), Cargill, Incorporated. (États-Unis), Cloetta AB (Suède), ORION CORP. (Corée), Ghirardelli Chocolate Company (une filiale de Lindt & Sprüngli AG) (États-Unis), Ezaki Glico Co., Ltd. (Japon), MORINAGA & CO., LTD (Japon) et Arcor (Argentine), entre autres. |

|

Points de données abordés dans le rapport |

En plus des informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse approfondie des experts, l'épidémiologie des patients, l'analyse du pipeline, l'analyse des prix et le cadre réglementaire. |

Définition du marché

Le chocolat de qualité supérieure est un type de chocolat qui contient un pourcentage de cacao plus élevé que le lait au chocolat ordinaire. Cela peut faire référence à plusieurs choses, comme la grande quantité de cacao utilisée dans la barre ; si le chocolat est issu du commerce équitable et de sources durables ; s'il combine d'autres ingrédients, comme des morceaux de framboise ou de l'alcool ; et si l'emballage a une sensation plus sophistiquée. Il est également fabriqué avec du lait entier au lieu de lait écrémé et a une teneur en matières grasses plus élevée. Le lait au chocolat de qualité supérieure a une saveur plus riche et une consistance plus épaisse que le lait au chocolat ordinaire.

Dynamique du marché du chocolat haut de gamme en Asie-Pacifique

CONDUCTEURS

- Augmentation de la popularité des chocolats végétaliens, biologiques et sans gluten.

La prise de conscience de la consommation de chocolats végétaliens, biologiques et sans gluten a lentement évolué parmi les consommateurs du monde entier. Le chocolat végétalien aide à améliorer les fonctions cérébrales et est considéré comme bien meilleur pour la santé que le chocolat standard. Il est fabriqué à partir d'ingrédients d'origine végétale au lieu de produits laitiers, d'œufs et de gélatine , ce qui signifie qu'il contient moins de matières grasses, moins de calories et pas de cholestérol.

La consommation de produits à base de cacao a entraîné des bénéfices majeurs pour la santé, ce qui devrait stimuler la croissance du marché des produits à base de chocolat haut de gamme. Les bénéfices pour la santé comprennent notamment une diminution de l'hypertension , une réduction du syndrome de fatigue chronique et une protection contre les coups de soleil. Le cacao est également riche en polyphénols qui aident à protéger les tissus de l'organisme contre le stress oxydatif et les pathologies associées telles que les cancers et l'inflammation.

La poudre de cacao est utilisée dans la fabrication de chocolats végétaliens qui proviennent de fèves de cacao qui n'ont pas été torréfiées. Comme ces fèves ne sont pas chauffées à haute température pendant la transformation, cela permet de conserver intactes toutes leurs vitamines et minéraux. De plus, les chocolats végétaliens ne contiennent pas de lait, ils contiennent donc beaucoup de fibres, de protéines et d'antioxydants.

Les chocolats végétaliens contiennent de l'anandamide et du cacao brut, qui se lient aux récepteurs de votre cerveau et vous procurent une sensation de bonheur et de paix. Le chocolat végétalien aide à réduire la tension artérielle. En plus de réduire la tension artérielle, le chocolat végétalien a d'autres propriétés qui peuvent réduire votre risque de crise cardiaque et d'accident vasculaire cérébral. Outre l'impact positif du cacao sur la dégénérescence mentale liée à l'âge, son effet sur le cerveau peut également améliorer l'humeur et les symptômes de la dépression.

Un régime sans gluten est une alternative pour les personnes atteintes de la maladie cœliaque . Manger du gluten provoque une inflammation et des dommages aux intestins, ce qui entraîne divers problèmes de santé, notamment des carences en vitamines, de l'anémie et de l'ostéoporose. Le chocolat noir pur, non sucré et dérivé de fèves de cacao torréfiées, ne contient pas naturellement de gluten. Par conséquent, la préférence pour le chocolat sans gluten est une alternative savoureuse et saine au chocolat ordinaire en raison de ses bienfaits pour la santé.

La consommation de produits à base de chocolat végétaliens, biologiques et sans gluten peut aider à contrôler les maladies cardiaques et la tension artérielle. Ainsi, la sensibilisation accrue aux produits à base de cacao pour la santé devrait stimuler le marché du chocolat haut de gamme en Asie-Pacifique.

- Forte demande de chocolats haut de gamme pendant les périodes de fêtes.

La demande saisonnière joue un rôle important dans les ventes de chocolats haut de gamme. Sur le marché de l'Asie-Pacifique, les cadeaux de chocolats jouent un rôle majeur, ce qui entraîne une augmentation des fêtes de fin d'année, notamment à Pâques, à la Saint-Valentin, à Noël et autres. L'influence croissante de la vente au détail en ligne est également considérée comme l'une des principales raisons de l'augmentation des ventes de chocolats saisonniers. L'occidentalisation de la culture a permis aux milléniaux de prendre conscience de la culture des cadeaux.

Lors de ces occasions spéciales, de nombreux acteurs du secteur du chocolat saisonnier lancent une large gamme de chocolats artisanaux aux saveurs et aux emballages inédits. Ils mettent également en place une communication marketing intégrée en utilisant divers autres modes de plateformes de médias sociaux pour accroître la popularité de leurs offres de chocolat saisonnier. Cela contribue à faire connaître les chocolats saisonniers à l'échelle mondiale

L'évolution des préférences et de l'acceptation du chocolat et de son emballage attrayant, l'adoption de la culture du cadeau, la cohérence de la qualité, la richesse de l'urbanisation chez les jeunes et le revenu disponible élevé stimulent le marché de la culture du chocolat haut de gamme.

Les facteurs tels que le pouvoir d'achat des milléniaux, l'essor du commerce électronique, l'essor du marché des cadeaux et l'influence de l'occidentalisation et des approches non conventionnelles des marques de vente au détail se sont multipliés, ce qui devrait stimuler le marché du chocolat haut de gamme en Asie-Pacifique.

OPPORTUNITÉS

- Une attention continue portée au développement de nouveaux chocolats aromatisés et uniques

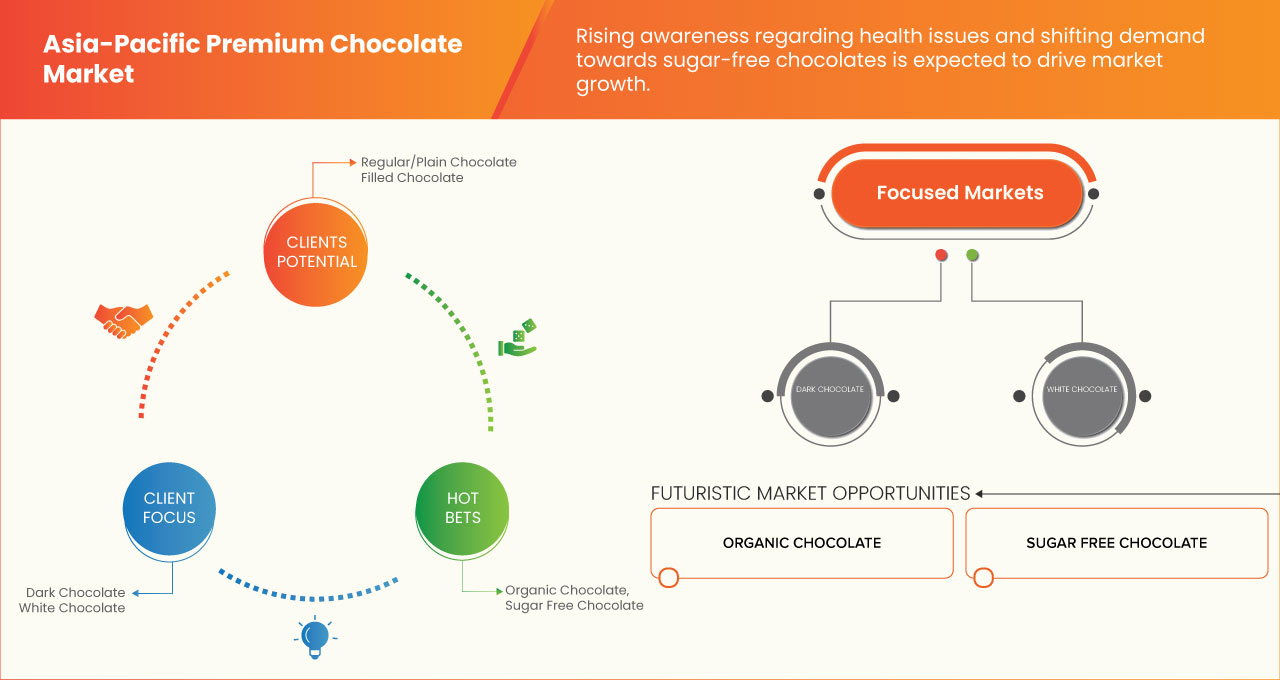

La tendance émergente des produits clean-label et biologiques pour maintenir la santé et le bien-être général a conduit à une augmentation rapide de la demande de chocolats haut de gamme ou de spécialité. L'introduction de goûts et de saveurs uniques est considérée comme un facteur clé qui a attiré l'attention des clients.

De plus, les entreprises lancent leurs produits avec des idées innovantes pour sécuriser leur position sur le marché du chocolat haut de gamme de la région Asie-Pacifique.

Ainsi, pour accroître la base de consommateurs, l’introduction de chocolats aromatisés et aux textures améliorées créera des opportunités potentielles pour les producteurs de chocolat haut de gamme. Les entreprises devraient introduire des saveurs locales et saisonnières pour attirer les consommateurs du monde entier, en mettant l’accent à la fois sur la santé et le goût. Cela pourrait ouvrir un tout nouveau domaine d’innovation en matière de saveurs, ce qui devrait créer une opportunité pour le marché.

- Tendance croissante de la distribution en ligne

Le commerce électronique redéfinit les activités commerciales dans le monde entier. Au fil des ans, le commerce électronique a évolué de manière profonde. Le chocolat présente de nombreux avantages pour la santé, ainsi que le fort désir d'ajouter des saveurs innovantes au chocolat qui stimulent les ventes de chocolats. Le canal de distribution était auparavant uniquement les magasins qui fonctionnaient principalement sans aucun recours aux médias électroniques, mais avec l'utilisation accrue d'Internet, les canaux de distribution ont changé. Étant donné qu'Internet continue d'influencer la vie quotidienne, le commerce électronique est nécessaire à la croissance de tout marché et permet d'étendre une entreprise au-delà de son emplacement physique.

Le canal de distribution en ligne profite au fabricant en exploitant l'empressement des clients en ligne à essayer de nouveaux produits. Des campagnes publicitaires et marketing efficaces pour les chocolats végétaliens, sans gluten et à faible teneur en sucre sur les sites en ligne augmenteront les ventes de chocolats. Le commerce électronique est également un succès auprès des consommateurs en raison des multiples offres proposées par les plateformes en ligne sur les festivals et les clients réguliers, et même sur les commandes en gros.

La numérisation accrue et la migration des consommateurs vers les canaux de distribution en ligne continueront de stimuler la croissance du commerce électronique, ce qui constitue une tendance croissante du canal de distribution en ligne, ce qui devrait créer des opportunités pour le marché.

RESTRICTIONS/DÉFIS

- Fluctuations des prix des matières premières

Le prix du chocolat a changé, mais la plupart des consommateurs l'ignorent. La volatilité des prix du chocolat est principalement influencée par l'offre de chocolat. Le principal composant de la production de chocolat est le cacao, qui est utilisé dans une variété de produits. Pour fabriquer du chocolat, d'autres ingrédients comme le sucre, les produits laitiers, les noix, les édulcorants à base de maïs et l'énergie sont également nécessaires. Le marché des matières premières, qui fixe le prix en fonction des niveaux d'offre et de demande et peut entraîner des niveaux variables de volatilité des prix des matières premières, est le principal responsable des prix de ces matières premières.

La poudre de cacao et le beurre de cacao sont les deux composants du cacao utilisés pour fabriquer le chocolat. Étant donné qu'il produit les chocolats les plus riches et qu'il est utilisé dans les confiseries au chocolat fin, le beurre de cacao est de loin le plus recherché des deux. Cependant, comme il est le plus difficile et le plus cher à produire, toute interruption de l'approvisionnement en cacao finira par se répercuter et faire augmenter les prix à la consommation. La fluctuation du prix de la matière première utilisée pour la production devrait freiner la croissance du chocolat haut de gamme sur le marché.

- Augmentation du coût de la chaîne d'approvisionnement

La volatilité des prix du chocolat est principalement influencée par l'offre de chocolat. Le principal composant de la production de chocolat est le cacao, qui est utilisé dans une variété de produits. Les autres ingrédients nécessaires à la production de produits à base de chocolat comprennent le sucre, les produits laitiers, les noix, les édulcorants à base de maïs et l'énergie. Les prix sont basés sur les niveaux de l'offre et de la demande et peuvent entraîner des niveaux variables de volatilité des prix, ce qui est principalement responsable des prix de ces matières premières. Le processus par lequel le cacao devient les ingrédients des produits vendus dans les rayons des supermarchés est complexe. À différentes étapes du cycle de production, le cacao cultivé par un certain nombre d'agriculteurs, principalement des petits exploitants, est mélangé. Étant donné que la plupart des risques liés à la chaîne d'approvisionnement proviennent de chaque exploitation, il est difficile de retracer le cacao jusqu'à ces endroits en raison de ce mélange. De plus, la complexité de cette chaîne d'approvisionnement crée des inégalités tout au long de la chaîne de valeur.

Les problèmes les plus importants dans les chaînes d’approvisionnement du cacao sont l’expansion de la production dans les réserves forestières protégées et le recours au travail des enfants. En raison de l’augmentation prévue de la fréquence des ravageurs, des maladies et des sécheresses, le changement climatique constitue également une menace pour la viabilité à long terme de l’industrie du cacao.

La perturbation de la chaîne d'approvisionnement entraîne une augmentation du prix de la chaîne d'approvisionnement, ce qui devrait remettre en cause la croissance du marché au cours de la période de prévision

Développements récents

- Le 10 février 2023, Morinaga Nutritional Foods, Inc. (une filiale) a annoncé l'acquisition de Turtle Island Foods Holdings, Inc. Turtle Island Foods est un fabricant de produits alimentaires à base de plantes. À la suite de cette acquisition, Turtle Islands Foods deviendra une filiale à part entière de Morinaga Nutritional Foods, Inc. Cela créera une opportunité de développer des chocolats nutritionnels pour le marché du chocolat haut de gamme

- En 2021, Lindt et Sprüngli ont investi environ 80,95 millions de dollars pour agrandir leur usine de pâte de cacao à Olten. Elle est considérée comme la plus grande et la plus importante usine de pâte de cacao du réseau de production de la région Asie-Pacifique.

Portée du marché du chocolat haut de gamme en Asie-Pacifique

Le marché du chocolat haut de gamme d'Asie-Pacifique est segmenté en neuf segments notables en fonction du type, du type de produit, de l'inclusion, de la nature, de la catégorie, de la teneur en cacao, de la saveur, de l'emballage et du canal de distribution. La croissance parmi ces segments vous aidera à analyser les principaux segments de croissance des industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

TAPER

- Chocolat au lait

- Chocolat noir

- Chocolat blanc

Sur la base du type, le marché est segmenté en chocolat au lait, chocolat noir et chocolat blanc.

TYPE DE PRODUIT

- Régulier/uni

- Rempli

En fonction du type de produit, le marché est segmenté en produits ordinaires/plats et remplis.

INCLUSION

- Avec inclusion de chocolats et de produits réguliers

- Chocolat sans inclusions

Sur la base de l'inclusion, le marché est segmenté en chocolats avec inclusion et chocolats ordinaires sans inclusion.

NATURE

- Conventionnel

- Organique

Sur la base de la nature, le marché est segmenté en conventionnel et biologique.

CATÉGORIE

- Standard Premium

- Super Premium

Sur la base de la catégorie, le marché est segmenté en premium standard et super premium.

TENEUR EN CACAO

- 50-60%

- 71-80%

- 61-70%

- 81-90%

- 91-100%

Sur la base de la teneur en cacao, le marché est segmenté en 50-60 %, 71-80 %, 61-70 %, 81-90 % et 91-100 %.

SAVEUR

- Saveur

- Classique/Régulier

Sur la base de la saveur, le marché est segmenté en saveur, classique/régulier.

CONDITIONNEMENT

- Film plastique

- Coffrets cadeaux/Assortiment

- Pochettes

- Boîte à cartes

- Sachets

- Autres

Sur la base de l'emballage, le marché est segmenté en film plastique, boîtes cadeaux/assorties, pochettes, boîtes en carton, sachets et autres.

CANAL DE DISTRIBUTION

- Détaillant en magasin

- Détaillants hors magasin

Sur la base du canal de distribution, le marché est segmenté en détaillants en magasin et en détaillants hors magasin.

Analyse/perspectives régionales du marché du chocolat haut de gamme en Asie-Pacifique

Le marché du chocolat haut de gamme de la région Asie-Pacifique est segmenté en fonction du type, du type de produit, de l'inclusion, de la nature, de la catégorie, de la teneur en cacao, de la saveur, de l'emballage et du canal de distribution.

Les pays du marché du chocolat haut de gamme de la région Asie-Pacifique sont le Japon, la Chine, la Corée du Sud, l’Inde, Singapour, la Thaïlande, l’Indonésie, la Malaisie, les Philippines, l’Australie, la Nouvelle-Zélande et le reste de la région Asie-Pacifique.

La Chine domine le marché du chocolat haut de gamme de la région Asie-Pacifique en termes de part de marché et de chiffre d'affaires en raison de la sensibilisation croissante aux propriétés des technologies d'alkylation dans cette région.

La section par pays du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. L'analyse des points de données en aval et en amont de la chaîne de valeur, les tendances techniques, l'analyse des cinq forces du porteur et les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques d'Asie-Pacifique et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données par pays.

Analyse du paysage concurrentiel et des parts de marché du chocolat haut de gamme en Asie-Pacifique

Le paysage concurrentiel du marché du chocolat haut de gamme en Asie-Pacifique fournit des détails par concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et l'ampleur du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liées au marché du chocolat haut de gamme en Asie-Pacifique.

Certains des principaux acteurs opérant sur le marché du chocolat haut de gamme de la région Asie-Pacifique sont Mars, Incorporated et ses filiales, Mondelēz International, THE HERSHEY COMPANY, Ferrero, Nestlé, General Mills, Inc., Meiji Holdings Co., Ltd., Lindt & Sprungli AG, Barry Callebaut, The Kraft Heinz Company, Cargill, Incorporated. , Cloetta AB, ORION CORP., Ghirardelli Chocolate Company (une filiale de Lindt & Sprüngli AG), Ezaki Glico Co., Ltd., MORINAGA & CO., LTD et Arcor, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE ASIA PACIFIC PREMIUM CHOCOLATE MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 GRADE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 ANALYSIS OF HAZELNUT CONTENT FOR TOP ASIA PACIFIC PREMIUM CHOCOLATE BRANDS

4.2 BRAND COMPARATIVE ANALYSIS

4.2.1 FERRERO

4.2.2 NESTLE

4.2.3 CHOCOLADEFABRIKEN LINDT & SPRÜNGLI AG

4.3 FACTORS INFLUENCING BUYING DECISION

4.3.1 PACKAGING FACTOR

4.3.2 TASTE

4.3.3 HEALTH

4.3.4 BRAND LOYALTY

4.3.5 GENDER AND AGE

4.3.6 INCOME

4.4 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

4.4.1 RISING CONSUMER PREFERENCE TOWARD DARK AND VEGAN CHOCOLATE

4.4.2 CONSUMERS ARE INTERESTED IN NEW INNOVATIVE FLAVOURS AND TEXTURE

4.4.3 RISING DEMAND FOR PREMIUM CHOCOLATES FOR GIFTING PURPOSES

4.4.4 FUTURE PERSPECTIVE

4.5 MEETING CONSUMER REQUIREMENT

4.6 SUPPLY CHAIN ANALYSIS

4.6.1 RAW MATERIAL PROCUREMENT & MANUFACTURING

4.6.2 DISTRIBUTION

4.6.3 END-USERS

4.7 SHOPPING BEHAVIOR AND DYNAMICS

4.7.1 RECOMMENDATIONS FROM FAMILY AND FRIENDS

4.7.2 RESEARCH

4.7.3 IMPULSIVE

4.7.4 ADVERTISEMENT

4.7.5 TELEVISION ADVERTISEMENT

4.7.6 ONLINE ADVERTISEMENT

4.7.7 IN-STORE ADVERTISEMENT

4.7.8 OUTDOOR ADVERTISEMENT

4.8 NEW PRODUCT LAUNCH STRATEGY

4.8.1 NUMBER OF PRODUCT LAUNCHES

4.8.2 LINE EXTENSION

4.8.3 NEW PACKAGING

4.8.4 RE-LAUNCHED

4.8.5 NEW FORMULATION

4.8.6 DIFFERENTIAL PRODUCT OFFERING

4.8.7 PACKAGE DESIGNING

4.8.8 PRICING ANALYSIS

4.9 REGULATION COVERAGE

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISE IN THE POPULARITY OF VEGAN, ORGANIC, AND GLUTEN FREE CHOCOLATES

5.1.2 HIGH DEMAND FOR PREMIUM CHOCOLATES IN FESTIVE SEASONS

5.1.3 DEMAND FOR PREMIUM CHOCOLATES OWING TO THE SHIFT TOWARDS A HEALTHY LIFESTYLE

5.1.4 USE OF PREMIUM CHOCOLATE IN THE BAKING INDUSTRY

5.2 RESTRAINTS

5.2.1 FLUCTUATING PRICES OF RAW MATERIALS

5.2.2 AVAILABILITY OF VARIOUS SUBSTITUTE

5.3 OPPORTUNITIES

5.3.1 CONTINUOUS FOCUS ON DEVELOPING NEW FLAVORED AND UNIQUE CHOCOLATES

5.3.2 RISING TREND OF ONLINE DISTRIBUTION

5.4 CHALLENGES

5.4.1 RISING COST OF SUPPLY CHAIN

5.4.2 RULES AND REGULATIONS ASSOCIATED WITH PREMIUM CHOCOLATES

6 ASIA PACIFIC PREMIUM CHOCOLATE MARKET, BY REGION

6.1 ASIA-PACIFIC

6.1.1 CHINA

6.1.2 INDIA

6.1.3 JAPAN

6.1.4 INDONESIA

6.1.5 SOUTH KOREA

6.1.6 AUSTRALIA

6.1.7 PHILIPPINES

6.1.8 THAILAND

6.1.9 MALAYSIA

6.1.10 SINGAPORE

6.1.11 REST OF ASIA-PACIFIC

7 ASIA PACIFIC PREMIUM CHOCOLATE MARKET: COMPANY LANDSCAPE

7.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

7.2 ACQUISITION

7.3 NEW PRODUCT DEVELOPMENT

7.4 FACILITY EXPANSION

7.5 NEW APPOINTMENT

8 SWOT ANALYSIS

9 COMPANY PROFILES

9.1 MARS, INCORPORATED AND ITS AFFILIATES

9.1.1 COMPANY SNAPSHOT

9.1.2 COMPANY SHARE ANALYSIS

9.1.3 PRODUCT PORTFOLIO

9.1.4 RECENT UPDATES

9.2 MONDELĒZ INTERNATIONAL

9.2.1 COMPANY SNAPSHOT

9.2.2 REVENUE ANALYSIS

9.2.3 COMPANY SHARE ANALYSIS

9.2.4 PRODUCT PORTFOLIO

9.2.5 RECENT DEVELOPMENT

9.3 THE HERSHEY COMPANY

9.3.1 COMPANY SNAPSHOT

9.3.2 REVENUE ANALYSIS

9.3.3 COMPANY SHARE ANALYSIS

9.3.4 PRODUCT PORTFOLIO

9.3.5 RECENT DEVELOPMENT

9.4 FERRERO

9.4.1 COMPANY SNAPSHOT

9.4.2 COMPANY SHARE ANALYSIS

9.4.3 PRODUCT PORTFOLIO

9.4.4 RECENT UPDATES

9.5 NESTLÉ

9.5.1 COMPANY SNAPSHOT

9.5.2 REVENUE ANALYSIS

9.5.3 COMPANY SHARE ANALYSIS

9.5.4 PRODUCT PORTFOLIO

9.5.5 RECENT DEVELOPMENT

9.6 ARCOR

9.6.1 COMPANY SNAPSHOT

9.6.2 REVENUE ANALYSIS

9.6.3 PRODUCT PORTFOLIO

9.6.4 RECENT DEVELOPMENT

9.7 BARRY CALLEBAUT

9.7.1 COMPANY SNAPSHOT

9.7.2 REVENUE ANALYSIS

9.7.3 PRODUCT PORTFOLIO

9.7.4 RECENT UPDATES

9.8 CARGILL, INCORPORATED

9.8.1 COMPANY SNAPSHOT

9.8.2 PRODUCT PORTFOLIO

9.8.3 RECENT UPDATES

9.9 CHOCOLADEFABRIKEN LINDT & SPRÜNGLI AG (2022)

9.9.1 COMPANY SNAPSHOT

9.9.2 REVENUE ANALYSIS

9.9.3 PRODUCT PORTFOLIO

9.9.4 RECENT DEVELOPMENT

9.1 CLOETTA AB

9.10.1 COMPANY SNAPSHOT

9.10.2 REVENUE ANALYSIS

9.10.3 PRODUCT PORTFOLIO

9.10.4 RECENT DEVELOPMENT

9.11 EZAKI GLICO CO., LTD.

9.11.1 COMPANY SNAPSHOT

9.11.2 REVENUE ANALYSIS

9.11.3 PRODUCT PORTFOLIO

9.11.4 RECENT DEVELOPMENT

9.12 GENERAL MILLS, INC.

9.12.1 COMPANY SNAPSHOT

9.12.2 REVENUE ANALYSIS

9.12.3 PRODUCT PORTFOLIO

9.12.4 RECENT DEVELOPMENT

9.13 GHIRARDELLI CHOCOLATE COMPANY

9.13.1 COMPANY SNAPSHOT

9.13.2 PRODUCT PORTFOLIO

9.13.3 RECENT DEVELOPMENT

9.14 MEIJI HOLDINGS CO., LTD.

9.14.1 COMPANY SNAPSHOT

9.14.2 REVENUE ANALYSIS

9.14.3 PRODUCT PORTFOLIO

9.14.4 RECENT DEVELOPMENT

9.15 MORINAGA & CO., LTD.

9.15.1 COMPANY SNAPSHOT

9.15.2 REVENUE ANALYSIS

9.15.3 PRODUCT PORTFOLIO

9.15.4 RECENT DEVELOPMENT

9.16 ORION CORP.

9.16.1 COMPANY SNAPSHOT

9.16.2 REVENUE ANALYSIS

9.16.3 PRODUCT PORTFOLIO

9.16.4 RECENT DEVELOPMENTS

9.17 THE KRAFT HEINZ COMPANY

9.17.1 COMPANY SNAPSHOT

9.17.2 REVENUE ANALYSIS

9.17.3 PRODUCT PORTFOLIO

9.17.4 RECENT DEVELOPMENT

10 QUESTIONNAIRE

11 RELATED REPORTS

Liste des tableaux

TABLE 1 ESTIMATED HAZELNUT CONTENT FOR TOP ASIA PACIFIC PREMIUM CHOCOLATE COMPANIES

TABLE 2 REGULATORY COVERAGE

TABLE 3 ASIA-PACIFIC PREMIUM CHOCOLATE MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 4 ASIA-PACIFIC PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 5 ASIA-PACIFIC PREMIUM CHOCOLATE MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 6 ASIA-PACIFIC PREMIUM CHOCOLATE MARKET, BY INCLUSION, 2021-2030 (USD THOUSAND)

TABLE 7 ASIA-PACIFIC WITH INCLUSIONS CHOCOLATES IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 8 ASIA-PACIFIC INFUSED NUTS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 9 ASIA-PACIFIC ALMOND IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 10 ASIA-PACIFIC ALMOND IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 11 ASIA-PACIFIC HAZELNUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 12 ASIA-PACIFIC HAZELNUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 13 ASIA-PACIFIC PEANUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 14 ASIA-PACIFIC PEANUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 15 ASIA-PACIFIC CASHEW IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 16 ASIA-PACIFIC CASHEW IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 17 ASIA-PACIFIC RAISINS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 18 ASIA-PACIFIC RAISINS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 19 ASIA-PACIFIC PISTACHIOS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 20 ASIA-PACIFIC PISTACHIOS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 21 ASIA-PACIFIC OTHER NUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 22 ASIA-PACIFIC OTHER NUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 23 ASIA-PACIFIC INFUSED FRUITS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 24 ASIA-PACIFIC PREMIUM CHOCOLATE MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 25 ASIA-PACIFIC PREMIUM CHOCOLATE MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 26 ASIA-PACIFIC PREMIUM CHOCOLATE MARKET, BY COCOA CONTENT, 2021-2030 (USD THOUSAND)

TABLE 27 ASIA-PACIFIC PREMIUM CHOCOLATE MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 28 ASIA-PACIFIC FLAVOR IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 29 ASIA-PACIFIC PREMIUM CHOCOLATE MARKET, BY PACKAGING, 2021-2030 (USD THOUSAND)

TABLE 30 ASIA-PACIFIC PREMIUM CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 31 ASIA-PACIFIC STORE BASED RETAILERS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 32 ASIA-PACIFIC NON-STORE RETAILERS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 33 CHINA PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 34 CHINA PREMIUM CHOCOLATE MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 35 CHINA PREMIUM CHOCOLATE MARKET, BY INCLUSION, 2021-2030 (USD THOUSAND)

TABLE 36 CHINA WITH INCLUSIONS CHOCOLATES IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 37 CHINA INFUSED NUTS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 38 CHINA ALMOND IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 39 CHINA ALMOND IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 40 CHINA HAZELNUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 41 CHINA HAZELNUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 42 CHINA PEANUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 43 CHINA PEANUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 44 CHINA CASHEW IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 45 CHINA CASHEW IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 46 CHINA RAISINS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 47 CHINA RAISINS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 48 CHINA PISTACHIOS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 49 CHINA PISTACHIOS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 50 CHINA OTHER NUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 51 CHINA OTHER NUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 52 CHINA INFUSED FRUITS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 53 CHINA PREMIUM CHOCOLATE MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 54 CHINA PREMIUM CHOCOLATE MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 55 CHINA PREMIUM CHOCOLATE MARKET, BY COCOA CONTENT, 2021-2030 (USD THOUSAND)

TABLE 56 CHINA PREMIUM CHOCOLATE MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 57 CHINA FLAVOR IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 58 CHINA PREMIUM CHOCOLATE MARKET, BY PACKAGING, 2021-2030 (USD THOUSAND)

TABLE 59 CHINA PREMIUM CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 60 CHINA STORE BASED RETAILERS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 61 CHINA NON-STORE RETAILERS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 62 INDIA PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 63 INDIA PREMIUM CHOCOLATE MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 64 INDIA PREMIUM CHOCOLATE MARKET, BY INCLUSION, 2021-2030 (USD THOUSAND)

TABLE 65 INDIA WITH INCLUSIONS CHOCOLATES IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 66 INDIA INFUSED NUTS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 67 INDIA ALMOND IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 68 INDIA ALMOND IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 69 INDIA HAZELNUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 70 INDIA HAZELNUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 71 INDIA PEANUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 72 INDIA PEANUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 73 INDIA CASHEW IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 74 INDIA CASHEW IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 75 INDIA RAISINS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 76 INDIA RAISINS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 77 INDIA PISTACHIOS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 78 INDIA PISTACHIOS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 79 INDIA OTHER NUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 80 INDIA OTHER NUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 81 INDIA INFUSED FRUITS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 82 INDIA PREMIUM CHOCOLATE MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 83 INDIA PREMIUM CHOCOLATE MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 84 INDIA PREMIUM CHOCOLATE MARKET, BY COCOA CONTENT, 2021-2030 (USD THOUSAND)

TABLE 85 INDIA PREMIUM CHOCOLATE MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 86 INDIA FLAVOR IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 87 INDIA PREMIUM CHOCOLATE MARKET, BY PACKAGING, 2021-2030 (USD THOUSAND)

TABLE 88 INDIA PREMIUM CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 89 INDIA STORE BASED RETAILERS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 90 INDIA NON-STORE RETAILERS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 91 JAPAN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 92 JAPAN PREMIUM CHOCOLATE MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 93 JAPAN PREMIUM CHOCOLATE MARKET, BY INCLUSION, 2021-2030 (USD THOUSAND)

TABLE 94 JAPAN WITH INCLUSIONS CHOCOLATES IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 95 JAPAN INFUSED NUTS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 96 JAPAN ALMOND IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 97 JAPAN ALMOND IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 98 JAPAN HAZELNUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 99 JAPAN HAZELNUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 100 JAPAN PEANUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 101 JAPAN PEANUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 102 JAPAN CASHEW IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 103 JAPAN CASHEW IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 104 JAPAN RAISINS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 105 JAPAN RAISINS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 106 JAPAN PISTACHIOS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 107 JAPAN PISTACHIOS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 108 JAPAN OTHER NUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 109 JAPAN OTHER NUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 110 JAPAN INFUSED FRUITS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 111 JAPAN PREMIUM CHOCOLATE MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 112 JAPAN PREMIUM CHOCOLATE MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 113 JAPAN PREMIUM CHOCOLATE MARKET, BY COCOA CONTENT, 2021-2030 (USD THOUSAND)

TABLE 114 JAPAN PREMIUM CHOCOLATE MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 115 JAPAN FLAVOR IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 116 JAPAN PREMIUM CHOCOLATE MARKET, BY PACKAGING, 2021-2030 (USD THOUSAND)

TABLE 117 JAPAN PREMIUM CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 118 JAPAN STORE BASED RETAILERS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 119 JAPAN NON-STORE RETAILERS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 120 INDONESIA PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 121 INDONESIA PREMIUM CHOCOLATE MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 122 INDONESIA PREMIUM CHOCOLATE MARKET, BY INCLUSION, 2021-2030 (USD THOUSAND)

TABLE 123 INDONESIA WITH INCLUSIONS CHOCOLATES IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 124 INDONESIA INFUSED NUTS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 125 INDONESIA ALMOND IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 126 INDONESIA ALMOND IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 127 INDONESIA HAZELNUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 128 INDONESIA HAZELNUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 129 INDONESIA PEANUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 130 INDONESIA PEANUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 131 INDONESIA CASHEW IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 132 INDONESIA CASHEW IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 133 INDONESIA RAISINS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 134 INDONESIA RAISINS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 135 INDONESIA PISTACHIOS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 136 INDONESIA PISTACHIOS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 137 INDONESIA OTHER NUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 138 INDONESIA OTHER NUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 139 INDONESIA PREMIUM CHOCOLATE MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 140 INDONESIA PREMIUM CHOCOLATE MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 141 INDONESIA PREMIUM CHOCOLATE MARKET, BY COCOA CONTENT, 2021-2030 (USD THOUSAND)

TABLE 142 INDONESIA PREMIUM CHOCOLATE MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 143 INDONESIA FLAVOR IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 144 INDONESIA PREMIUM CHOCOLATE MARKET, BY PACKAGING, 2021-2030 (USD THOUSAND)

TABLE 145 INDONESIA PREMIUM CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 146 INDONESIA STORE BASED RETAILERS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 147 INDONESIA NON-STORE RETAILERS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 148 SOUTH KOREA PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 149 SOUTH KOREA PREMIUM CHOCOLATE MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 150 SOUTH KOREA PREMIUM CHOCOLATE MARKET, BY INCLUSION, 2021-2030 (USD THOUSAND)

TABLE 151 SOUTH KOREA WITH INCLUSIONS CHOCOLATES IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 152 SOUTH KOREA INFUSED NUTS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 153 SOUTH KOREA ALMOND IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 154 SOUTH KOREA ALMOND IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 155 SOUTH KOREA HAZELNUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 156 SOUTH KOREA HAZELNUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 157 SOUTH KOREA PEANUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 158 SOUTH KOREA PEANUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 159 SOUTH KOREA CASHEW IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 160 SOUTH KOREA CASHEW IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 161 SOUTH KOREA RAISINS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 162 SOUTH KOREA RAISINS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 163 SOUTH KOREA PISTACHIOS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 164 SOUTH KOREA PISTACHIOS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 165 SOUTH KOREA OTHER NUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 166 SOUTH KOREA OTHER NUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 167 SOUTH KOREA INFUSED FRUITS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 168 SOUTH KOREA PREMIUM CHOCOLATE MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 169 SOUTH KOREA PREMIUM CHOCOLATE MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 170 SOUTH KOREA PREMIUM CHOCOLATE MARKET, BY COCOA CONTENT, 2021-2030 (USD THOUSAND)

TABLE 171 SOUTH KOREA PREMIUM CHOCOLATE MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 172 SOUTH KOREA FLAVOR IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 173 SOUTH KOREA PREMIUM CHOCOLATE MARKET, BY PACKAGING, 2021-2030 (USD THOUSAND)

TABLE 174 SOUTH KOREA PREMIUM CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 175 SOUTH KOREA STORE BASED RETAILERS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 176 SOUTH KOREA NON-STORE RETAILERS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 177 AUSTRALIA PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 178 AUSTRALIA PREMIUM CHOCOLATE MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 179 AUSTRALIA PREMIUM CHOCOLATE MARKET, BY INCLUSION, 2021-2030 (USD THOUSAND)

TABLE 180 AUSTRALIA WITH INCLUSIONS CHOCOLATES IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 181 AUSTRALIA INFUSED NUTS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 182 AUSTRALIA ALMOND IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 183 AUSTRALIA ALMOND IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 184 AUSTRALIA HAZELNUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 185 AUSTRALIA HAZELNUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 186 AUSTRALIA PEANUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 187 AUSTRALIA PEANUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 188 AUSTRALIA CASHEW IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 189 AUSTRALIA CASHEW IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 190 AUSTRALIA RAISINS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 191 AUSTRALIA RAISINS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 192 AUSTRALIA PISTACHIOS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 193 AUSTRALIA PISTACHIOS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 194 AUSTRALIA OTHER NUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 195 AUSTRALIA OTHER NUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 196 AUSTRALIA INFUSED FRUITS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 197 AUSTRALIA PREMIUM CHOCOLATE MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 198 AUSTRALIA PREMIUM CHOCOLATE MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 199 AUSTRALIA PREMIUM CHOCOLATE MARKET, BY COCOA CONTENT, 2021-2030 (USD THOUSAND)

TABLE 200 AUSTRALIA PREMIUM CHOCOLATE MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 201 AUSTRALIA FLAVOR IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 202 AUSTRALIA PREMIUM CHOCOLATE MARKET, BY PACKAGING, 2021-2030 (USD THOUSAND)

TABLE 203 AUSTRALIA PREMIUM CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 204 AUSTRALIA STORE BASED RETAILERS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 205 AUSTRALIA NON-STORE RETAILERS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 206 PHILIPPINES PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 207 PHILIPPINES PREMIUM CHOCOLATE MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 208 PHILIPPINES PREMIUM CHOCOLATE MARKET, BY INCLUSION, 2021-2030 (USD THOUSAND)

TABLE 209 PHILIPPINES WITH INCLUSIONS CHOCOLATES IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 210 PHILIPPINES INFUSED NUTS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 211 PHILIPPINES ALMOND IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 212 PHILIPPINES ALMOND IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 213 PHILIPPINES HAZELNUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 214 PHILIPPINES HAZELNUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 215 PHILIPPINES PEANUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 216 PHILIPPINES PEANUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 217 PHILIPPINES CASHEW IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 218 PHILIPPINES CASHEW IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 219 PHILIPPINES RAISINS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 220 PHILIPPINES RAISINS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 221 PHILIPPINES PISTACHIOS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 222 PHILIPPINES PISTACHIOS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 223 PHILIPPINES OTHER NUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 224 PHILIPPINES OTHER NUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 225 PHILIPPINES INFUSED FRUITS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 226 PHILIPPINES PREMIUM CHOCOLATE MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 227 PHILIPPINES PREMIUM CHOCOLATE MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 228 PHILIPPINES PREMIUM CHOCOLATE MARKET, BY COCOA CONTENT, 2021-2030 (USD THOUSAND)

TABLE 229 PHILIPPINES PREMIUM CHOCOLATE MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 230 PHILIPPINES FLAVOR IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 231 PHILIPPINES PREMIUM CHOCOLATE MARKET, BY PACKAGING, 2021-2030 (USD THOUSAND)

TABLE 232 PHILIPPINES PREMIUM CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 233 PHILIPPINES STORE BASED RETAILERS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 234 PHILIPPINES NON-STORE RETAILERS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 235 THAILAND PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 236 THAILAND PREMIUM CHOCOLATE MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 237 THAILAND PREMIUM CHOCOLATE MARKET, BY INCLUSION, 2021-2030 (USD THOUSAND)

TABLE 238 THAILAND WITH INCLUSIONS CHOCOLATES IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 239 THAILAND INFUSED NUTS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 240 THAILAND ALMOND IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 241 THAILAND ALMOND IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 242 THAILAND HAZELNUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 243 THAILAND HAZELNUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 244 THAILAND PEANUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 245 THAILAND PEANUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 246 THAILAND CASHEW IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 247 THAILAND CASHEW IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 248 THAILAND RAISINS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 249 THAILAND RAISINS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 250 THAILAND PISTACHIOS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 251 THAILAND PISTACHIOS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 252 THAILAND OTHER NUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 253 THAILAND OTHER NUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 254 THAILAND INFUSED FRUITS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 255 THAILAND PREMIUM CHOCOLATE MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 256 THAILAND PREMIUM CHOCOLATE MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 257 THAILAND PREMIUM CHOCOLATE MARKET, BY COCOA CONTENT, 2021-2030 (USD THOUSAND)

TABLE 258 THAILAND PREMIUM CHOCOLATE MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 259 THAILAND FLAVOR IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 260 THAILAND PREMIUM CHOCOLATE MARKET, BY PACKAGING, 2021-2030 (USD THOUSAND)

TABLE 261 THAILAND PREMIUM CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 262 THAILAND STORE BASED RETAILERS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 263 THAILAND NON-STORE RETAILERS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 264 MALAYSIA PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 265 MALAYSIA PREMIUM CHOCOLATE MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 266 MALAYSIA PREMIUM CHOCOLATE MARKET, BY INCLUSION, 2021-2030 (USD THOUSAND)

TABLE 267 MALAYSIA WITH INCLUSIONS CHOCOLATES IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 268 MALAYSIA INFUSED NUTS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 269 MALAYSIA ALMOND IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 270 MALAYSIA ALMOND IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 271 MALAYSIA HAZELNUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 272 MALAYSIA HAZELNUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 273 MALAYSIA PEANUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 274 MALAYSIA PEANUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 275 MALAYSIA CASHEW IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 276 MALAYSIA CASHEW IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 277 MALAYSIA RAISINS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 278 MALAYSIA RAISINS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 279 MALAYSIA PISTACHIOS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 280 MALAYSIA PISTACHIOS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 281 MALAYSIA OTHER NUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 282 MALAYSIA OTHER NUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 283 MALAYSIA INFUSED FRUITS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 284 MALAYSIA PREMIUM CHOCOLATE MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 285 MALAYSIA PREMIUM CHOCOLATE MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 286 MALAYSIA PREMIUM CHOCOLATE MARKET, BY COCOA CONTENT, 2021-2030 (USD THOUSAND)

TABLE 287 MALAYSIA PREMIUM CHOCOLATE MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 288 MALAYSIA FLAVOR IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 289 MALAYSIA PREMIUM CHOCOLATE MARKET, BY PACKAGING, 2021-2030 (USD THOUSAND)

TABLE 290 MALAYSIA PREMIUM CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 291 MALAYSIA STORE BASED RETAILERS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 292 MALAYSIA NON-STORE RETAILERS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 293 SINGAPORE PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 294 SINGAPORE PREMIUM CHOCOLATE MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 295 SINGAPORE PREMIUM CHOCOLATE MARKET, BY INCLUSION, 2021-2030 (USD THOUSAND)

TABLE 296 SINGAPORE WITH INCLUSIONS CHOCOLATES IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 297 SINGAPORE INFUSED NUTS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 298 SINGAPORE ALMOND IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 299 SINGAPORE ALMOND IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 300 SINGAPORE HAZELNUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 301 SINGAPORE HAZELNUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 302 SINGAPORE PEANUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 303 SINGAPORE PEANUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 304 SINGAPORE CASHEW IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 305 SINGAPORE CASHEW IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 306 SINGAPORE RAISINS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 307 SINGAPORE RAISINS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 308 SINGAPORE PISTACHIOS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 309 SINGAPORE PISTACHIOS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 310 SINGAPORE OTHER NUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 311 SINGAPORE OTHER NUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 312 SINGAPORE INFUSED FRUITS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 313 SINGAPORE PREMIUM CHOCOLATE MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 314 SINGAPORE PREMIUM CHOCOLATE MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 315 SINGAPORE PREMIUM CHOCOLATE MARKET, BY COCOA CONTENT, 2021-2030 (USD THOUSAND)

TABLE 316 SINGAPORE PREMIUM CHOCOLATE MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 317 SINGAPORE FLAVOR IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 318 SINGAPORE PREMIUM CHOCOLATE MARKET, BY PACKAGING, 2021-2030 (USD THOUSAND)

TABLE 319 SINGAPORE PREMIUM CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 320 SINGAPORE STORE BASED RETAILERS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 321 SINGAPORE NON-STORE RETAILERS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 322 REST OF ASIA-PACIFIC PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

Liste des figures

FIGURE 1 ASIA PACIFIC PREMIUM CHOCOLATE MARKET

FIGURE 2 ASIA PACIFIC PREMIUM CHOCOLATE MARKET : DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC PREMIUM CHOCOLATE MARKET : DROC ANALYSIS

FIGURE 4 ASIA PACIFIC PREMIUM CHOCOLATE MARKET : ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC PREMIUM CHOCOLATE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC PREMIUM CHOCOLATE MARKET: THE GRADE LIFE LINE CURVE

FIGURE 7 ASIA PACIFIC PREMIUM CHOCOLATE MARKET: MULTIVARIATE MODELLING

FIGURE 8 ASIA PACIFIC PREMIUM CHOCOLATE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 ASIA PACIFIC PREMIUM CHOCOLATE MARKET: DBMR MARKET POSITION GRID

FIGURE 10 ASIA PACIFIC PREMIUM CHOCOLATE MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 ASIA PACIFIC PREMIUM CHOCOLATE MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 ASIA PACIFIC PREMIUM CHOCOLATE MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 ASIA PACIFIC PREMIUM CHOCOLATE MARKET : SEGMENTATION

FIGURE 14 THE RISE IN POPULARITY OF VEGAN, ORGANIC, AND GLUTEN FREE CHOCOLATE ACROSS THE GLOBE IS EXPECTED TO DRIVE THE ASIA PACIFIC PREMIUM CHOCOLATE MARKET IN THE FORECAST PERIOD

FIGURE 15 THE MILK CHOCOLATE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC PREMIUM CHOCOLATE MARKET IN 2023 & 2030

FIGURE 16 SUPPLY CHAIN OF THE ASIA PACIFIC PREMIUM CHOCOLATE MARKET

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA PACIFIC PREMIUM CHOCOLATE MARKET

FIGURE 18 ASIA-PACIFIC PREMIUM CHOCOLATE MARKET: SNAPSHOT (2022)

FIGURE 19 ASIA-PACIFIC PREMIUM CHOCOLATE MARKET: BY COUNTRY (2022)

FIGURE 20 ASIA-PACIFIC PREMIUM CHOCOLATE MARKET: BY COUNTRY (2023 & 2030)

FIGURE 21 ASIA-PACIFIC PREMIUM CHOCOLATE MARKET: BY COUNTRY (2022 & 2030)

FIGURE 22 ASIA-PACIFIC PREMIUM CHOCOLATE MARKET: BY TYPE (2023 - 2030)

FIGURE 23 ASIA PACIFIC PREMIUM CHOCOLATE MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.