Marché de l'acide polyglycolique en Asie-Pacifique dans l'industrie pétrolière et gazière, par forme (poudre/granule, matériaux fibreux, films et autres), application (contrôle du tartre et assainissement, stimulation de puits horizontaux, élimination du gypse , dissolution du naphténate métallique, élimination des matières organiques solubles dans l'eau, fracturation hydraulique, outils de fond de trou, gestion de la pression, contrôle des puits, extraction de pétrole et autres) - Tendances et prévisions de l'industrie jusqu'en 2029.

Analyse et taille du marché

L'acide polyglycolique (PGA) est un polymère biodégradable constitué d'un simple polyester aliphatique linéaire. Le PGA est synthétisé à partir de monomères d'acide glycolique par polycondensation ou polymérisation par ouverture de cycle. Il s'agit d'un polymère dégradable en masse avec une faible solubilité dans l'eau et les solvants organiques en raison de son degré élevé de cristallinité. Le composant est hautement cristallin et présente par conséquent un point de fusion élevé et une faible solubilité dans les solvants organiques.

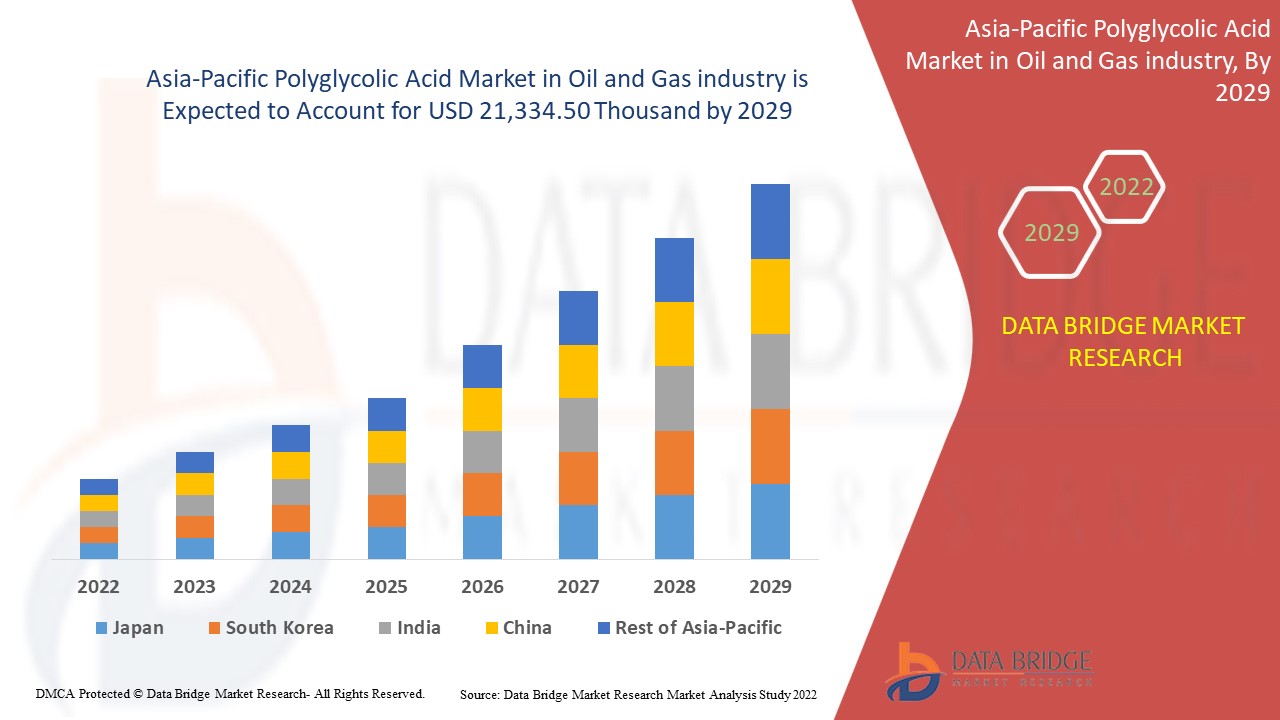

Data Bridge Market Research analyse que le marché de l'acide polyglycolique dans l'industrie pétrolière et gazière devrait atteindre la valeur de 21 334,50 milliers USD d'ici 2029, à un TCAC de 4,5 % au cours de la période de prévision. Les matériaux fibreux « représentent le segment de forme le plus important sur le marché respectif en raison de l'augmentation des activités de forage pétrolier. Le rapport de marché organisé par l'équipe de Data Bridge Market Research comprend une analyse approfondie des experts, une analyse des importations/exportations, une analyse des prix, une analyse de la consommation de production et un scénario de chaîne climatique.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable de 2019 à 2014) |

|

Unités quantitatives |

Chiffre d'affaires en milliers de dollars américains, volumes en milliers de kilomètres, prix en dollars américains |

|

Segments couverts |

Par forme (poudre/granule, matériaux fibreux, films et autres), application (contrôle du tartre et assainissement, stimulation de puits horizontaux, élimination du gypse, dissolution de naphténate métallique, élimination des matières organiques solubles dans l'eau, fracturation hydraulique, outils de fond de puits, gestion de la pression, contrôle de puits, extraction de pétrole et autres) |

|

Pays couvert |

Japon, Chine, Inde, Corée du Sud, Australie et Nouvelle-Zélande, Singapour, Malaisie, Thaïlande, Indonésie, Philippines et reste de l'Asie-Pacifique. |

|

Acteurs du marché couverts |

KUREHA CORPORATION et The Chemours Company |

Définition du marché

L'acide polyglycolique (PGA) a une structure chimique similaire à celle du PLA mais sans le groupe latéral méthyle, ce qui permet aux chaînes polymères de se regrouper étroitement et d'obtenir un degré élevé de cristallinité, une stabilité thermique élevée, une barrière aux gaz exceptionnellement élevée, ainsi qu'une résistance mécanique et une rigidité élevées. Le PGA est rapidement biodégradable et 100 % compostable et possède des caractéristiques intrinsèques telles qu'une hydrophilie élevée, une dégradation rapide et une insolubilité dans la plupart des solvants organiques.

Cadre réglementaire

- US9303118B2 : Procédé de préparation d'un poly(acide glycolique) (PGA) à partir de charges d'alimentation en C1, monoxyde de carbone et formaldéhyde ou son équivalent. En contrôlant les rapports d'alimentation en comonomères et les températures de polymérisation, on peut préparer du PGA de haute qualité. Le procédé est étendu aux copolymères de PGA dans lesquels des oxydes d'alkylène ou des comonomères d'éther cyclique sont inclus dans le mélange de polymérisation avec les monomères en C1 pour produire des thermoplastiques polyester-éther.

Ces normes fournissent une qualification pour la production PGA, des protocoles et des lignes directrices qui garantissent un niveau de sécurité élevé et certifient le matériel à utiliser.

Le COVID-19 a eu un impact minimal sur le marché de l'acide polyglycolique en Asie-Pacifique dans l'industrie pétrolière et gazière

La COVID-19 a eu un impact sur diverses industries manufacturières au cours de l'année 2020-2021, car elle a entraîné la fermeture de lieux de travail, la perturbation des chaînes d'approvisionnement et des restrictions sur les transports. Cependant, un impact significatif a été constaté sur le marché de l'acide polyglycolique. Les opérations et la chaîne d'approvisionnement de l'acide polyglycolique, avec plusieurs installations de fabrication, fonctionnaient toujours dans la région. Les prestataires de services ont continué à proposer de l'acide polyglycolique en suivant les mesures d'hygiène et de sécurité dans le scénario post-COVID.

La dynamique du marché de l'acide polyglycolique en Asie-Pacifique dans l'industrie pétrolière et gazière comprend :

Facteurs moteurs/opportunités rencontrés par le marché de l'acide polyglycolique en Asie-Pacifique dans l'industrie pétrolière et gazière-

- L'utilisation croissante du PGA dans l'exploration du gaz et du pétrole de schiste

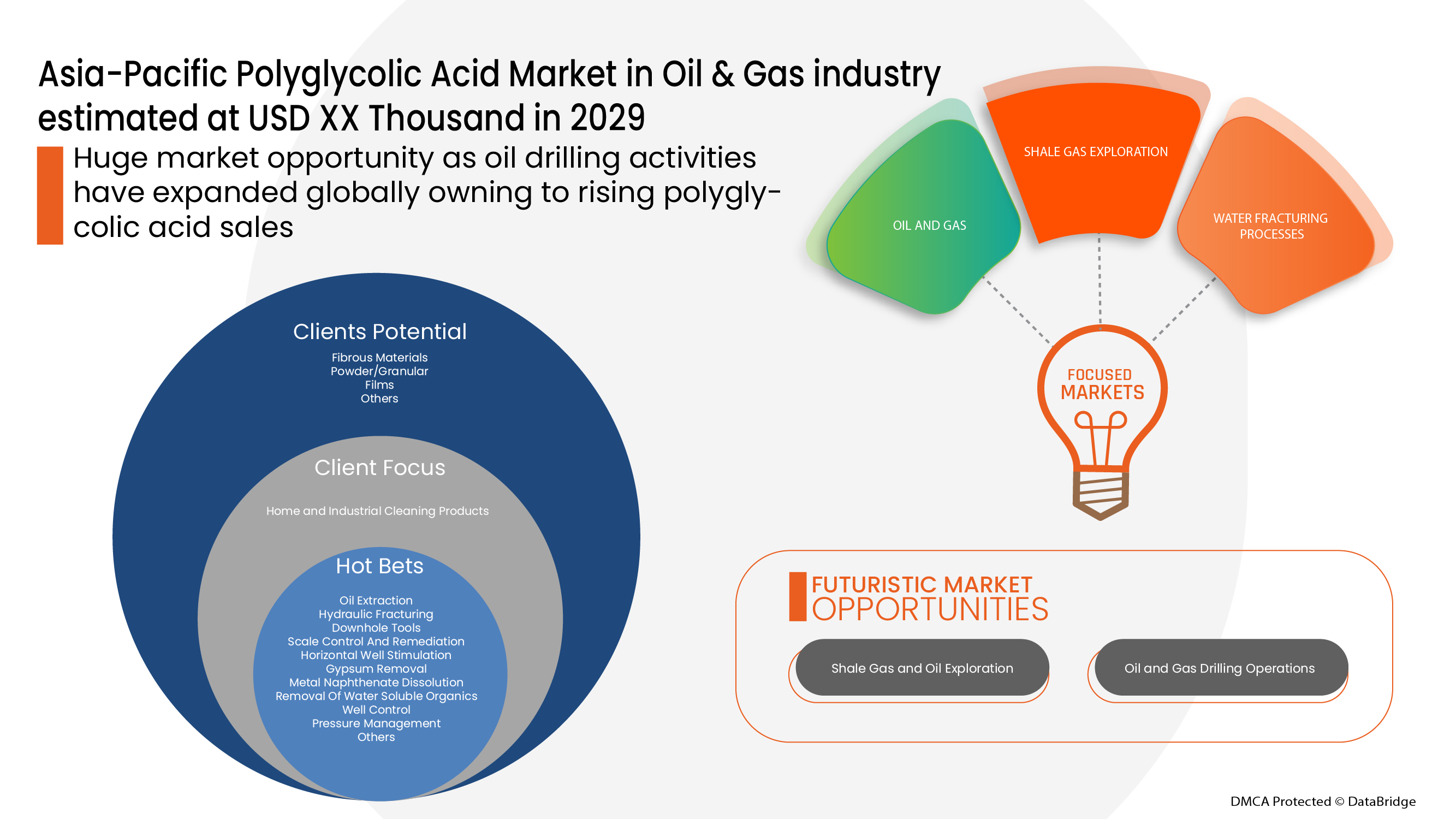

Avec l'avancée de la technologie d'extraction, la production de gaz de schiste a conduit à une nouvelle abondance de l'offre de gaz naturel dans le monde au cours de la dernière décennie, et devrait continuer à le faire dans un avenir prévisible. En général, l'augmentation de la production nationale de ressources énergétiques se traduit souvent par des approvisionnements plus importants et des prix plus bas, une réduction des besoins d'importations et une amélioration de la sécurité énergétique des pays. En conclusion, les unités de production d'exploration gazière se sont fixé un objectif ambitieux d'augmentation de la zone d'exploration et de production avec pour objectif d'augmenter la production nationale de pétrole et de gaz. Cela augmente à son tour la demande de PGA et contribue ainsi à la croissance du marché de l'acide polyglycolique dans l'industrie pétrolière et gazière de la région Asie-Pacifique.

- Augmentation des opérations de forage pétrolier et gazier dans le monde

L'augmentation des activités de forage pétrolier offre des avantages à la fois pour l'économie mondiale et pour l'environnement mondial. Le forage pétrolier nécessite un processus de raffinage qui permet d'utiliser des produits pétroliers utilisables dans le monde entier. Les technologies de forage pétrolier nécessitent du PGA qui est ensuite utilisé pour le contrôle de la pollution de l'air, en particulier pour éliminer les particules nocives des gaz résiduaires des installations industrielles et des centrales électriques. En conclusion, l'utilisation de PGA dans les filtres et précipitateurs industriels peut éliminer un certain nombre d'éléments d'échappement particulaires tels que la fumée de charbon ou de pétrole, le gâteau de sel, les extraits de pulpe chimique et les éléments gazeux. Cela augmente à son tour la demande de PGA et contribue ainsi à la croissance du marché de l'acide polyglycolique en Asie-Pacifique dans l'industrie pétrolière et gazière.

- Utilisation croissante du PGA dans les procédés de fracturation des eaux douces et des eaux à haute salinité

L'essor du pétrole et du gaz produits par fracturation hydraulique est considéré comme une aubaine pour répondre aux besoins énergétiques mondiaux. L'eau produite à partir de puits de combustibles fossiles peut avoir une salinité trois à six fois supérieure à celle de l'eau de mer et ce sel peut être efficacement éliminé par une succession d'étapes d'électrodialyse. En conclusion, le PGA peut également fonctionner comme un acide à libération retardée par dégradation, ce qui permet la décomposition ou l'activation de divers types de fluides de finition. Cela a à son tour créé des opportunités pour le marché de l'acide polyglycolique et donc accéléré la croissance du marché de l'acide polyglycolique en Asie-Pacifique dans l'industrie pétrolière et gazière.

- Augmentation des activités de R&D de PGA

Les opérations pétrolières et gazières menées dans différentes régions améliorent le niveau de vie de la société en favorisant le développement durable des régions souvent marginalisées où se trouvent généralement les unités de production. Ces derniers temps, les gouvernements de différents pays ont investi dans des activités de recherche sur plusieurs fluides utilisés dans la production de gaz, notamment le PGA, pour le développement de la gestion environnementale, tout en se concentrant sur les coûts d'infrastructure pour l'hébergement des opérations pétrolières et gazières dans les régions concernées. En conclusion, les gouvernements des pays en développement accordent également la priorité au développement de réseaux CGD pour améliorer la distribution de gaz domestique vers les segments PNG (domestique) et GNC (transport). Cela a à son tour créé des opportunités pour le marché de l'acide polyglycolique et a donc accéléré la croissance du marché de l'acide polyglycolique en Asie-Pacifique dans l'industrie pétrolière et gazière.

Contraintes/défis rencontrés par le marché de l'acide polyglycolique en Asie-Pacifique dans l'industrie pétrolière et gazière

- Coût de production élevé pour la PGA

L'augmentation de l'efficacité du forage et de la finition et le passage à des puits plus longs pour l'extraction de gaz avec des étapes de finition plus complexes ont tendance à faire grimper les coûts du pétrole et du gaz naturel, ce qui a un impact sur le marché de l'approvisionnement en forage et en finition, affectant les opérations de forage. Comme il est coûteux de posséder des terres pour l'exploration et que le forage est parfois une condition du contrat, les entreprises forent sur le terrain et maintiennent le puits en activité même si les prix baissent. Comme dans toute industrie d'extraction de ressources, la production ne peut pas être ralentie, de sorte que la demande de main-d'œuvre, les coûts d'équipement, les loyers et plus encore continuent de croître même lorsque la production diminue, augmentant ainsi les coûts globaux de l'exploration gazière. En outre, l'implication de différents types d'équipements et de machines utilisant du PGA pour l'extraction de pétrole et de gaz du niveau de la mer profonde comprend des coûts de production énormes. Cela freine à son tour la croissance du marché de l'acide polyglycolique de l'Asie-Pacifique dans l'industrie pétrolière et gazière.

- Fluctuations des prix du gaz naturel

Les fluctuations du prix du gaz naturel sont fonction de l'offre et de la demande du marché. Les alternatives au gaz naturel sont limitées, en particulier à court terme. Cela signifie que tout changement dans l'offre ou la demande de gaz naturel, même sur de courtes périodes, peut entraîner des variations de prix importantes. En raison des contraintes liées aux infrastructures d'approvisionnement en gaz naturel et des limites imposées à la capacité de nombreux consommateurs de gaz naturel à changer rapidement de combustible, des augmentations à court terme de la demande et/ou des réductions de l'offre peuvent entraîner de fortes variations des prix du gaz naturel. En conclusion, les conditions météorologiques typiques obligent les raffineries de gaz naturel à ralentir ou à arrêter leur production pendant les périodes où les événements météorologiques constituent une menace pour les travailleurs et les installations. Cela diminue à son tour la demande d'acide polyglycolique et freine ainsi la croissance du marché de l'acide polyglycolique en Asie-Pacifique dans l'industrie pétrolière et gazière.

Ce rapport sur le marché de l'acide polyglycolique en Asie-Pacifique dans l'industrie pétrolière et gazière fournit des détails sur les nouveaux développements récents, les réglementations commerciales, l'analyse des importations et des exportations, l'analyse de la production, l'optimisation de la chaîne de valeur, la part de marché, l'impact des acteurs du marché national et localisé, les opportunités d'analyse en termes de poches de revenus émergentes, les changements dans la réglementation du marché, l'analyse stratégique de la croissance du marché, la taille du marché, la croissance du marché des catégories, les niches d'application et la domination, les approbations de produits, les lancements de produits, les expansions géographiques, les innovations technologiques sur le marché. Pour obtenir plus d'informations sur le marché des rodenticides, contactez Data Bridge Market Research pour un briefing d'analyste. Notre équipe vous aidera à prendre une décision de marché éclairée pour atteindre la croissance du marché.

Développement récent

- En juillet 2021, KUREHA CORPORATION a construit une nouvelle usine de polyfluorure de vinylidène (« PVDF ») dans sa filiale à 100 %, Kureha Changshu Fluoropolymers Co., en Chine. Cela a permis à l'entreprise de renforcer sa position dans la région Asie-Pacifique.

- En avril 2022, The Chemours Company a annoncé qu'elle organiserait un webinaire destiné aux investisseurs le 16 mai 2022, axé sur le segment des solutions thermiques et spécialisées, mettant en évidence la dynamique séculaire, les principaux moteurs commerciaux et les initiatives stratégiques de croissance. Cela a permis à l'entreprise d'attirer davantage de clients dans le monde entier.

Marché de l'acide polyglycolique en Asie-Pacifique dans l'industrie pétrolière et gazière

Le marché de l'acide polyglycolique de l'Asie-Pacifique dans l'industrie pétrolière et gazière est segmenté en fonction de la forme et de l'application. La croissance parmi ces segments vous aidera à analyser les segments de croissance dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Formulaire

- Matériaux fibreux

- Poudre/granulés

- Films

- Autres

Sur la base de la forme, le marché de l'acide polyglycolique Asie-Pacifique dans l'industrie pétrolière et gazière est segmenté en poudre/granulés, matériaux fibreux, films et autres.

Application

- Extraction de pétrole

- Fracturation hydraulique

- Outils de forage

- Contrôle et assainissement du tartre

- Stimulation de puits horizontaux

- Enlèvement de plâtre

- Dissolution de naphténate métallique

- Élimination des matières organiques solubles dans l'eau

- Contrôle de puits

- Gestion de la pression

- Autres

En fonction des applications, le marché de l'acide polyglycolique de l'Asie-Pacifique dans l'industrie pétrolière et gazière est segmenté en contrôle du tartre et assainissement, stimulation des puits horizontaux, élimination du gypse, dissolution du naphténate métallique, élimination des matières organiques solubles dans l'eau, fracturation hydraulique, outils de fond de trou, gestion de la pression, contrôle des puits, extraction de pétrole et autres.

Marché de l'acide polyglycolique dans l'industrie pétrolière et gazière Analyse/perspectives régionales du marché

Le marché de l’acide polyglycolique de la région Asie-Pacifique dans l’industrie pétrolière et gazière est segmenté sur la base de la forme et de l’application, comme indiqué ci-dessus.

Les pays couverts par le marché de l'acide polyglycolique dans l'industrie pétrolière et gazière de la région Asie-Pacifique sont le Japon, la Chine, l'Inde, la Corée du Sud, l'Australie et la Nouvelle-Zélande, Singapour, la Malaisie, la Thaïlande, l'Indonésie, les Philippines et le reste de l'Asie-Pacifique. La Chine domine le marché en raison de l'augmentation des activités de forage pétrolier dans le pays.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques et l'analyse des cinq forces du porteur, les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques mondiales et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse de la concurrence et des parts de marché du secteur de l'acide polyglycolique en Asie-Pacifique dans le secteur du pétrole et du gaz

Le paysage concurrentiel du marché de l'acide polyglycolique en Asie-Pacifique dans l'industrie pétrolière et gazière fournit des détails par concurrent. Les détails inclus sont l'aperçu de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence mondiale, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liées au marché de l'acide polyglycolique en Asie-Pacifique dans l'industrie pétrolière et gazière.

Les acteurs opérant sur le marché de l'acide polyglycolique dans l'industrie pétrolière et gazière sont KUREHA CORPORATION et The Chemours Company.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE ASIA PACIFIC POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 FORM LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 VENDOR SHARE ANALYSIS

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 CLIMATE CHANGE SCENARI

4.2 ASIA PACIFIC POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, PESTEL ANALYSIS

4.2.1 OVERVIEW

4.2.2 POLITICAL FACTORS

4.2.3 ECONOMIC FACTORS

4.2.4 SOCIAL FACTORS

4.2.5 TECHNOLOGICAL FACTORS

4.2.6 ENVIRONMENTAL FACTORS

4.2.7 LEGAL FACTORS

4.2.8 CONCLUSION

4.3 BUYERS’ LIST

4.4 SUPPLIERS LIST (GLYCOLIC ACID)

4.5 PORTER’S FIVE FORCES:

4.6 ASIA PACIFIC POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, RAW MATERIALS COVERAGE

4.7 ASIA PACIFIC POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, REGULATION COVERAGE

4.8 SUPPLY CHAIN ANALYSIS

4.8.1 OVERVIEW

4.8.2 LOGISTIC COST SCENARIO

4.8.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.9 VENDOR SELECTION CRITERIA

4.1 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS IN PRODUCTION

4.10.1 CONVENTIONAL METHOD/ MELTING OF GLYCOLIC ACID OLIGOMER(GAO)

4.10.2 DEHYDRATING REACTION

4.10.3 RING-OPENING POLYMERIZATION

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING USE OF PGA IN SHALE GAS AND OIL EXPLORATION

5.1.2 INCREASING OIL AND GAS DRILLING OPERATIONS AROUND THE WORLD

5.1.3 APPLICATION OF PGA ENSURES HIGH GAS-BARRIER PERFORMANCE

5.2 RESTRAINTS

5.2.1 HIGH COST OF PRODUCTION FOR PGA

5.2.2 STRICT GOVERNMENT REGULATIONS OF THE OIL AND GAS SECTORS

5.3 OPPORTUNITIES

5.3.1 RISE IN R&D ACTIVITIES OF PGA

5.3.2 GROWING USE OF PGA IN FRESH WATER AND HIGH-SALINITY WATER FRACTURING PROCESSES

5.4 CHALLENGES

5.4.1 FLUCTUATIONS IN THE PRICES OF NATURAL GAS

5.4.2 VOLATILITY OF OIL PRICES

6 ASIA PACIFIC POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY FORM

6.1 OVERVIEW

6.1.1 FIBROUS MATERIALS

6.1.2 POWDER/GRANULAR

6.1.3 FILMS

6.1.4 OTHERS

7 ASIA PACIFIC POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY APPLICATION

7.1 OVERVIEW

7.1.1 OIL EXTRACTION

7.1.2 HYDRAULIC FRACTURING

7.1.3 DOWNHOLE TOOLS

7.1.4 SCALE CONTROL AND REMEDIATION

7.1.5 HORIZONTAL WELL STIMULATION

7.1.6 GYPSUM REMOVAL

7.1.7 METAL NAPHTHENATE DISSOLUTION

7.1.8 REMOVAL OF WATER SOLUBLE ORGANICS

7.1.9 WELL CONTROL

7.1.10 PRESSURE MANAGEMENT

7.1.11 OTHERS

8 ASIA PACIFIC POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY GEOGRAPHY

8.1 ASIA-PACIFIC

8.1.1 CHINA

8.1.2 INDIA

8.1.3 INDONESIA

8.1.4 MALAYSIA

8.1.5 THAILAND

8.1.6 JAPAN

8.1.7 SOUTH KOREA

8.1.8 PHILIPPINES

8.1.9 SINGAPORE

8.1.10 AUSTRALIA AND NEW ZEALAND

8.1.11 REST OF ASIA-PACIFIC

9 ASIA PACIFIC POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, COMPANY LANDSCAPE

9.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

9.1.1 EXPANSIONS

10 SWOT ANALYSIS

11 COMPANY PROFILES

11.1 KUREHA CORPORATION

11.1.1 COMPANY SNAPSHOT

11.1.2 REVENUE ANALYSIS

11.1.3 COMPANY SHARE ANALYSIS

11.1.4 PRODUCT PORTFOLIO

11.1.5 RECENT UPDATES

11.2 THE CHEMOURS COMPANY

11.2.1 COMPANY SNAPSHOT

11.2.2 REVENUE ANALYSIS

11.2.3 COMPANY SHARE ANALYSIS

11.2.4 PRODUCT PORTFOLIO

11.2.5 RECENT UPDATES

12 QUESTIONNAIRE

13 RELATED REPORTS

Liste des tableaux

TABLE 1 BUYERS’ LIST ASIA PACIFICLY (POTENTIONAL BUYERS/CURRENT BUYERS)

TABLE 2 SUPPLIERS LIST (ASIA PACIFICLY)

TABLE 3 ASIA PACIFIC POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 4 ASIA PACIFIC POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY FORM, 2020-2029 (THOUSAND KILO)

TABLE 5 ASIA PACIFIC FIBROUS MATERIALS IN POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 6 ASIA PACIFIC FIBROUS MATERIALS IN POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY REGION, 2020-2029 (THOUSAND KILO)

TABLE 7 ASIA PACIFIC POWDER/GRANULAR IN POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 8 ASIA PACIFIC POWDER/GRANULAR IN POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY REGION, 2020-2029 (THOUSAND KILO)

TABLE 9 ASIA PACIFIC FILMS IN POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 10 ASIA PACIFIC FILMS IN POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY REGION, 2020-2029 (THOUSAND KILO)

TABLE 11 ASIA PACIFIC OTHERS IN POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 12 ASIA PACIFIC OTHERS IN POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY REGION, 2020-2029 (THOUSAND KILO)

TABLE 13 ASIA PACIFIC POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 14 ASIA PACIFIC POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY APPLICATION, 2020-2029 (THOUSAND KILO)

TABLE 15 ASIA PACIFIC OIL EXTRACTION IN POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 16 ASIA PACIFIC OIL EXTRACTION IN POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY REGION, 2020-2029 (THOUSAND KILO)

TABLE 17 ASIA PACIFIC HYDRAULIC FRACTURING IN POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 18 ASIA PACIFIC HYDRAULIC FRACTURING IN POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY REGION, 2020-2029 (THOUSAND KILO)

TABLE 19 ASIA PACIFIC DOWNHOLE TOOLS IN POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 20 ASIA PACIFIC DOWNHOLE TOOLS IN POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY REGION, 2020-2029 (THOUSAND KILO)

TABLE 21 ASIA PACIFIC SCALE CONTROL AND REMEDIATION IN POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 22 ASIA PACIFIC SCALE CONTROL AND REMEDIATION IN POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY REGION, 2020-2029 (THOUSAND KILO)

TABLE 23 ASIA PACIFIC HORIZONTAL WELL STIMULATION IN POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 24 ASIA PACIFIC HORIZONTAL WELL STIMULATION IN POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY REGION, 2020-2029 (THOUSAND KILO)

TABLE 25 ASIA PACIFIC GYPSUM REMOVAL IN POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 26 ASIA PACIFIC GYPSUM REMOVAL IN POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY REGION, 2020-2029 (THOUSAND KILO)

TABLE 27 ASIA PACIFIC METAL NAPHTHENATE DISSOLUTION IN POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 28 ASIA PACIFIC METAL NAPHTHENATE DISSOLUTION IN POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY REGION, 2020-2029 (THOUSAND KILO)

TABLE 29 ASIA PACIFIC REMOVAL OF WATER SOLUBLE ORGANICS IN POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 30 ASIA PACIFIC REMOVAL OF WATER SOLUBLE ORGANICS IN POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY REGION, 2020-2029 (THOUSAND KILO)

TABLE 31 ASIA PACIFIC WELL CONTROL IN POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 32 ASIA PACIFIC WELL CONTROL IN POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY REGION, 2020-2029 (THOUSAND KILO)

TABLE 33 ASIA PACIFIC PRESSURE MANAGEMENT IN POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 34 ASIA PACIFIC PRESSURE MANAGEMENT IN POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY REGION, 2020-2029 (THOUSAND KILO)

TABLE 35 ASIA PACIFIC OTHERS IN POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 36 ASIA PACIFIC OTHERS IN POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY REGION, 2020-2029 (THOUSAND KILO)

TABLE 37 ASIA-PACIFIC POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 38 ASIA-PACIFIC POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY COUNTRY, 2020-2029 (THOUSAND KILO)

TABLE 39 ASIA-PACIFIC POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 40 ASIA-PACIFIC POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY FORM, 2020-2029 (THOUSAND KILO)

TABLE 41 ASIA-PACIFIC POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 42 ASIA-PACIFIC POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY APPLICATION, 2020-2029 (THOUSAND KILO)

TABLE 43 CHINA POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 44 CHINA POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY FORM, 2020-2029 (THOUSAND KILO)

TABLE 45 CHINA POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 46 CHINA POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY APPLICATION, 2020-2029 (THOUSAND KILO)

TABLE 47 INDIA POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 48 INDIA POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY FORM, 2020-2029 (THOUSAND KILO)

TABLE 49 INDIA POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 50 INDIA POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY APPLICATION, 2020-2029 (THOUSAND KILO)

TABLE 51 INDONESIA POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 52 INDONESIA POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY FORM, 2020-2029 (THOUSAND KILO)

TABLE 53 INDONESIA POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 54 INDONESIA POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY APPLICATION, 2020-2029 (THOUSAND KILO)

TABLE 55 MALAYSIA POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 56 MALAYSIA POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY FORM, 2020-2029 (THOUSAND KILO)

TABLE 57 MALAYSIA POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 58 MALAYSIA POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY APPLICATION, 2020-2029 (THOUSAND KILO)

TABLE 59 THAILAND POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 60 THAILAND POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY FORM, 2020-2029 (THOUSAND KILO)

TABLE 61 THAILAND POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 62 THAILAND POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY APPLICATION, 2020-2029 (THOUSAND KILO)

TABLE 63 JAPAN POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 64 JAPAN POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY FORM, 2020-2029 (THOUSAND KILO)

TABLE 65 JAPAN POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 66 JAPAN POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY APPLICATION, 2020-2029 (THOUSAND KILO)

TABLE 67 SOUTH KOREA POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 68 SOUTH KOREA POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY FORM, 2020-2029 (THOUSAND KILO)

TABLE 69 SOUTH KOREA POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 70 SOUTH KOREA POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY APPLICATION, 2020-2029 (THOUSAND KILO)

TABLE 71 PHILIPPINES POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 72 PHILIPPINES POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY FORM, 2020-2029 (THOUSAND KILO)

TABLE 73 PHILIPPINES POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 74 PHILIPPINES POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY APPLICATION, 2020-2029 (THOUSAND KILO)

TABLE 75 SINGAPORE POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 76 SINGAPORE POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY FORM, 2020-2029 (THOUSAND KILO)

TABLE 77 SINGAPORE POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 78 SINGAPORE POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY APPLICATION, 2020-2029 (THOUSAND KILO)

TABLE 79 AUSTRALIA & NEW ZEALAND POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 80 AUSTRALIA & NEW ZEALAND POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY FORM, 2020-2029 (THOUSAND KILO)

TABLE 81 AUSTRALIA & NEW ZEALAND POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 82 AUSTRALIA & NEW ZEALAND POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY APPLICATION, 2020-2029 (THOUSAND KILO)

TABLE 83 REST OF ASIA-PACIFIC POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 84 REST OF ASIA-PACIFIC POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY FORM, 2020-2029 (THOUSAND KILO)

Liste des figures

FIGURE 1 ASIA PACIFIC POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY: SEGMENTATION

FIGURE 2 ASIA PACIFIC POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY: FORM LIFE LINE CURVE

FIGURE 7 ASIA PACIFIC POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY: MULTIVARIATE MODELLING

FIGURE 8 ASIA PACIFIC POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY: INTERVIEW DEMOGRAPHICS

FIGURE 9 ASIA PACIFIC POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY: DBMR MARKET POSITION GRID

FIGURE 10 ASIA PACIFIC POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY: MARKET APPLICATION COVERAGE GRID

FIGURE 11 ASIA PACIFIC POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY: THE MARKET CHALLENGE MATRIX

FIGURE 12 ASIA PACIFIC POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY: VENDOR SHARE ANALYSIS

FIGURE 13 ASIA PACIFIC POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY: SEGMENTATION

FIGURE 14 NORTH AMERICA IS EXPECTED TO DOMINATE THE ASIA PACIFIC POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY AND IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 15 INCREASING OIL AND GAS DRILLING OPERATIONS AROUND THE WORLD IS DRIVING THE ASIA PACIFIC POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 16 FIBROUS MATERIALS IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY IN 2022 & 2029

FIGURE 17 PESTEL ANALYSIS

FIGURE 18 POLYGLYCOLIC ACID MANUFACTURING FOR OIL & GAS INDUSTRY - SUPPLY CHAIN ANALYSIS

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF ASIA PACIFIC POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY

FIGURE 20 NATURAL GAS RESERVES BY COUNTRY (MMCF) IN 2017

FIGURE 21 PERCENTAGE BREAKDOWN OF COST SHARES FOR ONSHORE OIL AND NATURAL GAS DRILLING AND COMPLETION

FIGURE 22 ASIA PACIFIC POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY FORM, 2021

FIGURE 23 ASIA PACIFIC POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY, BY APPLICATION, 2021

FIGURE 24 ASIA-PACIFIC POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY: SNAPSHOT (2021)

FIGURE 25 ASIA-PACIFIC POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY: BY COUNTRY (2021)

FIGURE 26 ASIA-PACIFIC POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY: BY COUNTRY (2022 & 2029)

FIGURE 27 ASIA-PACIFIC POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY: BY COUNTRY (2021 & 2029)

FIGURE 28 ASIA-PACIFIC POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY: BY FORM (2022-2029)

FIGURE 29 ASIA PACIFIC POLYGLYCOLIC ACID MARKET IN OIL & GAS INDUSTRY: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.