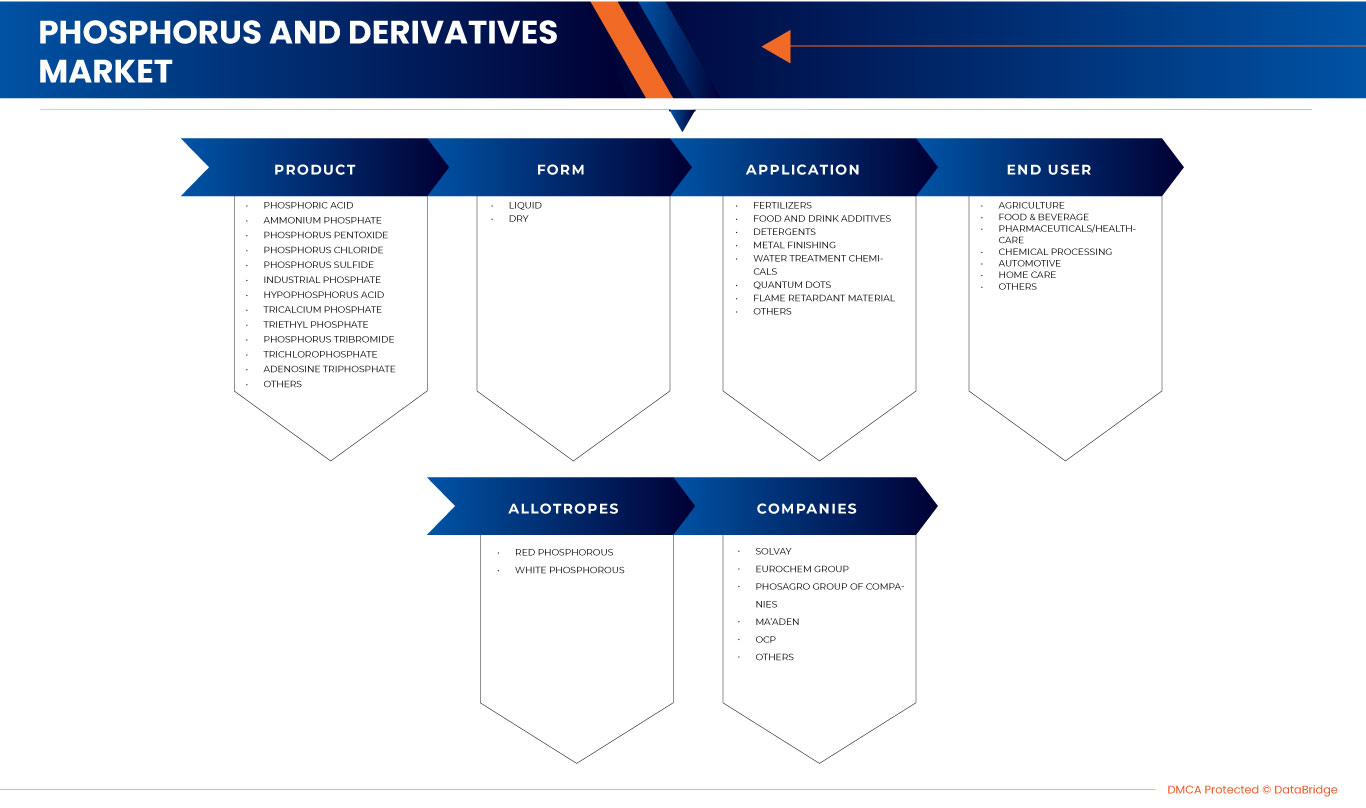

Marché du phosphore et des dérivés en Asie-Pacifique, par produit ( acide phosphorique , phosphate d'ammonium, pentoxyde de phosphore, chlorure de phosphore, sulfure de phosphore, phosphate industriel, acide hypophosphoreux, phosphate tricalcique, phosphate de triéthyle, tribromure de phosphore, trichlorophosphate, adénosine triphosphate et autres), forme (sec et liquide), application (engrais, additifs alimentaires et boissons, détergents, finition des métaux, produits chimiques de traitement de l'eau, points quantiques, matériau ignifuge et autres), utilisateur final (agriculture, alimentation et boissons, produits pharmaceutiques/soins de santé, traitement chimique, automobile, soins à domicile et autres), allotropes (phosphore rouge et phosphore blanc) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et perspectives du marché du phosphore et des produits dérivés en Asie-Pacifique

Le phosphore et l'acide phosphorique désignent des acides cristallins généralement faibles, incolores et inodores. Ces matières inorganiques sont corrosives pour les métaux ferreux et leurs alliages et possèdent une bonne solubilité dans l'eau. Elles ont tendance à se décomposer à haute température. Elles peuvent former des fumées toxiques lorsqu'elles sont combinées à de l'alcool. Elles confèrent aux boissons gazeuses une saveur acidulée et empêchent la croissance de moisissures et de bactéries, qui peuvent se multiplier facilement dans une solution sucrée. La majeure partie de l'acidité du soda provient également de l'acide phosphorique.

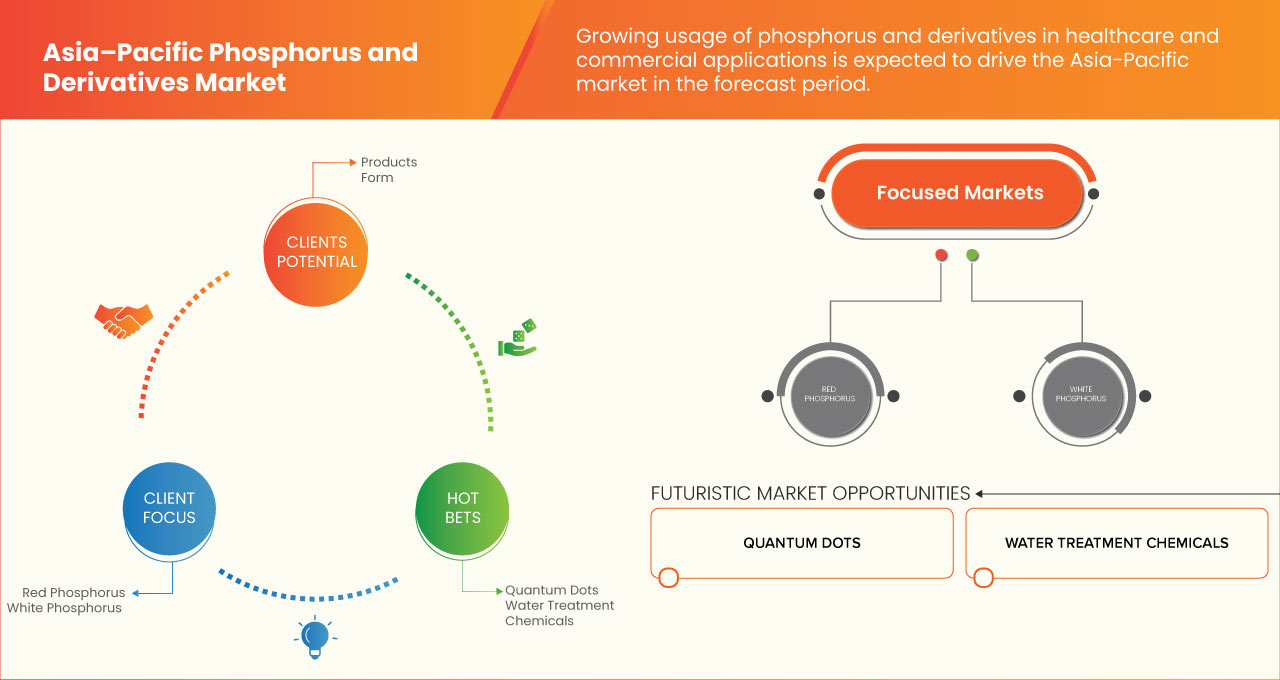

Les facteurs déterminants susceptibles d'être responsables de la croissance du marché du phosphore et de ses dérivés en Asie-Pacifique sont la croissance rapide du secteur de l'agriculture, de l'alimentation et des boissons. Cependant, les réglementations gouvernementales strictes sur l'utilisation du phosphore et de ses dérivés devraient restreindre le marché.

D'autre part, les initiatives stratégiques des acteurs du marché et l'essor du secteur agricole et des industries agroalimentaires peuvent constituer une opportunité de croissance pour le marché du phosphore et des dérivés de la région Asie-Pacifique. Les risques associés à la surutilisation de produits à base de phosphate peuvent créer des défis pour le marché du phosphore et des dérivés de la région Asie-Pacifique. Il existe quelques développements récents liés au marché du phosphore et des dérivés de la région Asie-Pacifique.

Toutefois, les effets nocifs du phosphore et de ses dérivés sur l’environnement devraient entraver la croissance du marché du phosphore et de ses dérivés en Asie-Pacifique au cours de la période de prévision.

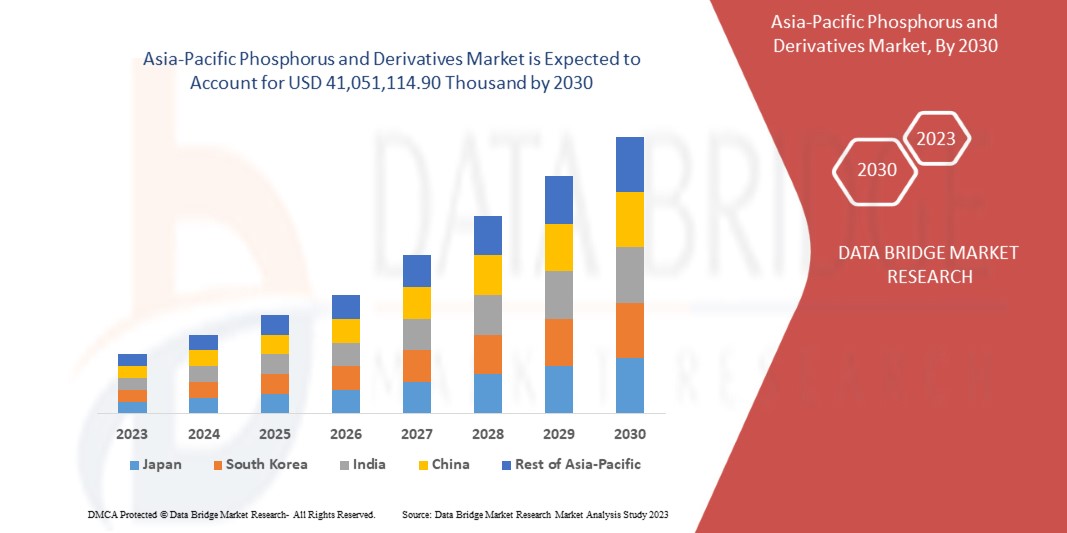

Data Bridge Market Research analyse que le marché du phosphore et des dérivés de la région Asie-Pacifique devrait atteindre la valeur de 41 051 114,90 milliers USD d'ici 2030, à un TCAC de 4,34 % au cours de la période de prévision. L'acide phosphorique est le segment de produit le plus important du marché en raison de l'utilisation croissante du phosphore dans le phosphore et les dérivés de la région Asie-Pacifique.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (2015 -2020) |

|

Unités quantitatives |

Chiffre d'affaires en milliers de dollars américains |

|

Segments couverts |

Produit (acide phosphorique, phosphate d'ammonium, pentoxyde de phosphore, chlorure de phosphore, sulfure de phosphore, phosphate industriel, acide hypophosphoreux, phosphate tricalcique, phosphate de triéthyle, tribromure de phosphore, trichlorophosphate, adénosine triphosphate et autres), forme (sec et liquide), application (engrais, additifs alimentaires et boissons, détergents, finition des métaux, produits chimiques de traitement de l'eau, points quantiques, matériau ignifuge et autres), utilisateur final (agriculture, alimentation et boissons, produits pharmaceutiques/soins de santé, traitement chimique, automobile, soins à domicile et autres), allotropes (phosphore rouge et phosphore blanc) |

|

Pays couverts |

Japon, Chine, Corée du Sud, Inde, Australie, Singapour, Thaïlande, Taïwan, Hong Kong, Nouvelle-Zélande, Malaisie, Indonésie, Philippines, Reste de l'Asie-Pacifique |

|

Acteurs du marché couverts |

ANEXIB Chemicals, Nippon Chemical Industrial CO., LTD., Mosaic Company, LANXESS, Solvay, Ma'aden, ICL, Xuzhou JianPing Chemical Co., Ltd. et Sekisui Diagnostics, entre autres |

Définition du marché du phosphore et des produits dérivés en Asie-Pacifique

Le phosphore est un élément non métallique combustible généralement présent sous deux formes allotropiques : le phosphore blanc et le phosphore rouge. L'acide phosphorique, l'acide phosphoreux, l'oxychlorure de phosphore, le pentachlorure de phosphore, le tribromure de phosphore, l'hypophosphite de sodium, le phosphate de tributyle et le phosphate de triéthyle sont de tels dérivés du phosphore. L'acide phosphorique, un dérivé du phosphore, est un acide cristallin généralement faible, incolore et inodore. Ces matières inorganiques sont corrosives pour le métal ferreux et ses alliages et possèdent une bonne solubilité dans l'eau. Elles ont tendance à se décomposer à haute température. Elles peuvent former des fumées toxiques lorsqu'elles sont combinées à l'alcool. Il donne aux boissons gazeuses une saveur acidulée et empêche la croissance de moisissures et de bactéries, qui peuvent se multiplier facilement dans une solution sucrée. La majeure partie de l'acidité du soda provient également de l'acide phosphorique.

Le phosphore est d'abord transformé en pentoxyde de phosphore par un procédé de fabrication chimique. Il est ensuite traité à nouveau pour devenir de l'acide phosphorique.

Dynamique du marché du phosphore et des produits dérivés en Asie-Pacifique

Cette section traite de la compréhension des moteurs, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Demande croissante d'engrais dans l'industrie agricole

L'acide phosphorique produit plusieurs engrais, notamment le DAP, le MAP, les NPK et le SSP.

Le phosphate diammonique (DAP) est l'engrais phosphaté le plus populaire en raison de ses propriétés physiques. La composition du DAP est de N-18% et de P2O5 -46%. Les engrais DAP sont parfaits pour toutes les cultures agricoles pour fournir une nutrition complète en phosphore tout au long de la croissance et du développement des cultures et une dose de démarrage d'azote et de faible teneur en soufre. Il peut être appliqué en automne pour le labourage et au printemps pendant le semis et la culture avant le semis. La dissolution dans le sol permet une alcalinisation temporaire du pH de la solution du sol autour du granulé d'engrais, stimulant ainsi une meilleure absorption du phosphore des engrais sur les sols acides. Le soufre des engrais contribue également à une meilleure absorption de l'azote et du phosphore par les plantes.

Ainsi, les multiples utilisations de l’acide phosphorique pour produire des engrais phosphatés devraient stimuler la croissance du marché de l’acide phosphorique en Asie-Pacifique.

- Demande croissante dans le secteur pharmaceutique

L'acide phosphorique est principalement utilisé dans de nombreuses applications médicales, telles que le ciment dentaire, pour préparer des dérivés d'albumine, acidifier l'urine, éliminer les débris nécrotiques (cellules ou tissus morts), les médicaments anti-nausées, les blanchisseurs de dents et les liquides de bain de bouche.

L'acide phosphorique utilisé dans le blanchiment des dents peut altérer la surface des dents. L'utilisation d'acide phosphorique à 37 % après le blanchiment peut augmenter considérablement l'effet décalcifiant de l'acide sur la surface de l'émail, créant une surface gravée irrégulière. De plus, il peut créer une sensibilité au niveau des dents.

Ainsi, l’utilisation croissante de l’acide phosphorique dans les applications médicales devrait stimuler la croissance du marché de l’acide phosphorique en Asie-Pacifique.

Retenue

- Réglementation gouvernementale stricte sur l'utilisation du phosphore et de ses dérivés

Il existe de nombreuses réglementations émanant de différents organismes de réglementation gouvernementaux concernant l’utilisation et la production d’acide phosphorique.

La FDA protège la santé publique en garantissant la sécurité, l'efficacité et la sûreté des médicaments à usage humain et vétérinaire, des produits biologiques, des produits chimiques et autres. L'USFDA a édicté certaines réglementations concernant l'utilisation de l'acide phosphorique dans les aliments et des réglementations concernant la manipulation de l'acide phosphorique. Vous trouverez ci-dessous certains des paramètres définis par la FDA à des fins de protection

Ainsi, en raison des réglementations gouvernementales strictes sur l’acide phosphorique, il existe des limitations sur l’utilisation de l’acide phosphorique, ce qui peut entraver la croissance du marché au cours de la période de prévision.

Opportunité

Accroître l'innovation et le lancement de nouveaux produits

Les principaux acteurs du marché ont lancé de nouveaux produits présentant des capacités améliorées. Les fabricants ont pris les mesures nécessaires pour améliorer la précision des nouveaux produits et la fonctionnalité globale.

Les acteurs du marché se concentrent davantage sur la production d’acide phosphorique au niveau national et opèrent en exportant vers d’autres régions pour développer leurs activités.

Ainsi, les innovations croissantes et les lancements de nouveaux produits devraient offrir une opportunité pour le marché de l’acide phosphorique en Asie-Pacifique.

Défi

Risques associés à la surconsommation de produits à base de phosphate

Aux niveaux étatique, provisoire et national, l’approvisionnement en acide phosphorique est réglementé par diverses règles gouvernementales, car plusieurs risques peuvent avoir un impact sur l’utilisation des engrais, et il existe plusieurs impacts environnementaux lors de la production d’acide phosphorique.

La production d’engrais phosphatés utilise généralement comme matière première de la roche phosphatée sédimentaire, qui contient des concentrations accrues de radionucléides de la série U environ 10 à 100 fois supérieures à celles des sols non perturbés.

Ainsi, en raison des effets nocifs de l’acide phosphorique sur l’air, l’eau, le sol et la santé humaine, de nombreux organismes gouvernementaux ont mené la mise en œuvre de plusieurs réglementations, de systèmes de certification de haut niveau et d’enregistrements d’entreprises pour l’utilisation de l’acide phosphorique, ce qui peut constituer un défi pour le marché de l’acide phosphorique en Asie-Pacifique.

Développements récents

- En mars 2023, Solvay a annoncé avoir été reconnu comme l'un des 60 meilleurs fournisseurs de 2022 dans le réseau Asie-Pacifique de Northrop Grumman Corporation, qui compte plus de 10 000 fournisseurs. Cela renforcera notamment l'image de marque de l'entreprise.

- En mars 2023, le groupe Airedale a annoncé que l'entreprise poursuivrait sa croissance en acquérant McCann Chemicals. Cela contribuera à accroître la croissance et la diversification du portefeuille de produits de l'entreprise.

Portée du marché du phosphore et des produits dérivés en Asie-Pacifique

Le marché du phosphore et des dérivés de la région Asie-Pacifique est segmenté en cinq segments notables tels que le produit, la forme, l'application, l'utilisateur final et les allotropes. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles.

Produit

- Acide phosphorique

- Phosphate d'ammonium

- Pentoxyde de phosphore

- Chlorure de phosphore

- Sulfure de phosphore

- Phosphate industriel

- Acide hypophosphoreux

- Phosphate tricalcique

- Phosphate de triéthyle

- Tribromure de phosphore

- Trichlorophosphate

- Adénosine triphosphate

- Autres

Sur la base du produit, le marché du phosphore et des dérivés de la région Asie-Pacifique est segmenté en acide phosphorique, phosphate d'ammonium, pentoxyde de phosphore, chlorure de phosphore, sulfure de phosphore, phosphate industriel, acide hypophosphoreux, phosphate tricalcique, phosphate de triéthyle, tribromure de phosphore, trichlorophosphate, adénosine triphosphate et autres.

Formulaire

- Sec

- Liquide

Sur la base de la forme, le marché du phosphore et des dérivés de la région Asie-Pacifique est segmenté en sec et liquide.

Application

- Engrais

- Additifs alimentaires et boissons

- Détergents

- Finition des métaux

- Produits chimiques pour le traitement de l'eau

- Points quantiques

- Matériau ignifuge

- Autres

Sur la base de l'application, le marché du phosphore et des dérivés de la région Asie-Pacifique est segmenté en engrais, additifs alimentaires et boissons, détergents, finition des métaux, produits chimiques de traitement de l'eau, points quantiques, matériaux ignifuges et autres.

Utilisateur final

- Agriculture

- Alimentation et boissons

- Produits pharmaceutiques/Soins de santé

- Traitement chimique

- Automobile

- Soins à domicile

- Autres

Sur la base de l'utilisateur final, le marché du phosphore et des dérivés de la région Asie-Pacifique est segmenté en agriculture, alimentation et boissons, produits pharmaceutiques/soins de santé, traitement chimique, automobile, soins ménagers et autres.

Allotropes

- Phosphore rouge

- Phosphore blanc

Sur la base des allotropes, le marché du phosphore et des dérivés de la région Asie-Pacifique est segmenté en phosphore rouge et phosphore blanc.

Analyse/perspectives régionales du marché du phosphore et des produits dérivés de la région Asie-Pacifique

Le marché du phosphore et des dérivés de la région Asie-Pacifique est segmenté en cinq segments notables tels que le produit, la forme, l’application, l’utilisateur final et les allotropes.

Les pays couverts dans ce rapport de marché sur le marché du phosphore et des dérivés de la région Asie-Pacifique sont le Japon, la Chine, la Corée du Sud, l'Inde, l'Australie, Singapour, la Nouvelle-Zélande, la Malaisie, l'Indonésie, les Philippines et le reste de l'Asie-Pacifique.

La section par pays du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements de réglementation nationale qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie des pays, les actes réglementaires et les tarifs d'importation et d'exportation sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité du phosphore et de ses dérivés ainsi que les défis liés à des réglementations strictes sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché du phosphore et des produits dérivés en Asie-Pacifique

Le paysage concurrentiel du marché du phosphore et des dérivés en Asie-Pacifique fournit des détails sur un concurrent. Les détails comprennent un aperçu de l'entreprise, les données financières, les revenus générés, le potentiel du marché, l'expansion commerciale, les installations de service, le partenariat, le développement stratégique, la domination des applications et la courbe de survie technologique. Les points de données ci-dessus ne concernent que l'orientation de l'entreprise vers le marché du phosphore et des dérivés en Asie-Pacifique.

Certains des principaux acteurs opérant sur le marché du phosphore et des dérivés de la région Asie-Pacifique sont ANEXIB Chemicals, Nippon Chemical Industrial CO., LTD., Mosaic Company, LANXESS, Solvay, Ma'aden, ICL, Xuzhou JianPing Chemical Co., Ltd., Sekisui Diagnostics et d'autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE EUROPE PHOSPHORUS AND DERIVATIVES MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT LIFELINE CURVE

2.7 MULTIVARIATE MODELLING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 MARKET APPLICATION COVERAGE GRID

2.12 DBMR MARKET CHALLENGE MATRIX

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ENVIRONMENTAL FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 ECONOMICAL FACTORS

4.1.6 LEGAL FACTORS

4.2 PORTER'S FIVE FORCES

4.3 RAW MATERIAL COVERAGE

4.4 PRODUCTION CONSUMPTION ANALYSIS

4.5 IMPORT-EXPORT SCENARIO

4.6 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURES

4.7 VENDOR SELECTION CRITERIA

4.8 PRODUCTION CAPACITY OUTLOOK

5 REGULATION COVERAGE

6 CLIMATE CHANGE SCENARIO

6.1 ENVIRONMENTAL CONCERNS

6.2 INDUSTRY RESPONSE

6.3 GOVERNMENT'S ROLE

6.4 ANALYST RECOMMENDATION

7 PRICING ANALYSIS OF PHOSPHORUS

8 SUPPLY CHAIN ANALYSIS

9 REGIONAL SUMMARIES

10 MARKET OVERVIEW

10.1 DRIVERS

10.1.1 INCREASING DEMAND FOR FERTILIZERS IN THE AGRICULTURE INDUSTRY

10.1.2 GROWING AWARENESS ABOUT THE BENEFITS OF PHOSPHORUS AND DERIVATIVES AMONG CONSUMERS

10.1.3 INCREASING DEMAND IN THE PHARMACEUTICAL SECTOR

10.1.4 RISING APPLICATIONS OF PHOSPHORUS AND DERIVATIVES IN SEVERAL INDUSTRIES

10.2 RESTRAINTS

10.2.1 STRINGENT GOVERNMENT REGULATIONS ON PHOSPHORUS AND DERIVATIVES USAGE

10.2.2 HARMFUL EFFECTS OF PHOSPHORUS AND DERIVATIVES ON THE ENVIRONMENT

10.3 OPPORTUNITIES

10.3.1 INCREASING USE OF PHOSPHORUS AND DERIVATIVES IN THE FOOD & BEVERAGE INDUSTRY

10.3.2 INCREASING INNOVATION AND NEW PRODUCT LAUNCHES

10.3.3 GROWING USE OF PHOSPHORUS AND DERIVATIVES IN FUEL CELLS

10.4 CHALLENGES

10.4.1 RISKS ASSOCIATED WITH OVER USAGE OF PHOSPHATE-BASED PRODUCTS

10.4.2 INCREASING ADOPTION OF GENETICALLY MODIFIED SEEDS

11 EUROPE PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT

11.1 OVERVIEW:

11.2 PHOSPHORIC ACID

11.3 AMMONIUM PHOSPHATE

11.4 PHOSPHORUS PENTOXIDE

11.5 PHOSPHORUS CHLORIDE

11.6 PHOSPHORUS SULPHIDE

11.7 INDUSTRIAL PHOSPHATE

11.8 HYPHOSPHORUS ACID

11.9 TRICALCIUM PHOSPHATE

11.1 TRIETHYL PHOSPHATE

11.11 PHOSPHORUS TRIBROMIDE

11.12 TRICHLOROPHOSPHATE

11.13 ADENOSINE TRIPHOSPHATE

11.14 OTHERS

12 EUROPE PHOSPHORUS AND DERIVATIVES MARKET, BY FORM

12.1 OVERVIEW

12.2 DRY

12.3 LIQUID

13 EUROPE PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION

13.1 OVERVIEW:

13.2 FERTILIZERS

13.3 FOOD AND DRINK ADDITIVES

13.4 DETERGENTS

13.5 METAL FINISHING

13.6 WATER TREATMENT CHEMICALS

13.7 QUANTUM DOTS

13.8 FLAME RETARDANT MATERIAL

13.9 OTHERS

14 EUROPE PHOSPHORUS AND DERIVATIVES MARKET, BY END USER

14.1 OVERVIEW:

14.2 AGRICULTURE

14.3 FOOD AND BEVERAGES

14.4 PHARMACEUTICALS/HEALTHCARE

14.5 CHEMICAL PROCESSING

14.6 AUTOMOTIVE

14.7 HOMECARE

14.8 OTHERS

15 EUROPE PHOSPHOROUS AND DERIVATIVES MARKET, BY ALLOTROPES

15.1 OVERVIEW

15.2 RED PHOSPHOROUS

15.3 WHITE PHOSPHOROUS

16 EUROPE PHOSPHORUS AND DERIVATIVES MARKET, BY REGION

16.1 EUROPE

16.1.1 RUSSIA

16.1.2 U.K.

16.1.3 GERMANY

16.1.4 FRANCE

16.1.5 ITALY

16.1.6 SPAIN

16.1.7 NETHERLANDS

16.1.8 POLAND

16.1.9 SWEDEN

16.1.10 BELGIUM

16.1.11 IRELAND

16.1.12 AUSTRIA

16.1.13 DENMARK

16.1.14 FINLAND

16.1.15 ROMANIA

16.1.16 CZECH REPUBLIC

16.1.17 PORTUGAL

16.1.18 GREECE

16.1.19 HUNGARY

16.1.20 SLOVAKIA

16.1.21 LUXEMBOURG

16.1.22 BULGARIA

16.1.23 CROATIA

16.1.24 LITHUANIA

16.1.25 SLOVENIA

16.1.26 LATVIA

16.1.27 ESTONIA

16.1.28 REPUBLIC OF CYPRUS

16.1.29 MALTA

17 EUROPE PHOSPHORUS AND DERIVATIVES MARKET: COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS: EUROPE

17.2 EXPANSIONS

17.3 AGREEMENTS

17.4 RECOGNITIONS

17.5 COLLABORATION

17.6 NEW LAUNCHES/PRODUCTS

17.7 ACQUISITIONS

17.8 PRESENTATION

17.9 NEW PRODUCTION BUILDING

17.1 INVESTMENT

18 COMPANY PROFILE

18.1 SOLVAY

18.1.1 COMPANY SNAPSHOT

18.1.2 PRODUCTION CAPACITY

18.1.3 SWOT

18.1.4 REVENUE ANALYSIS

18.1.5 COMPANY SHARE ANALYSIS

18.1.6 PRODUCT PORTFOLIO

18.1.7 RECENT DEVELOPMENT

18.2 EUROCHEM GROUP

18.2.1 COMPANY SNAPSHOT

18.2.2 PRODUCTION CAPACITY

18.2.3 SWOT

18.2.4 COMPANY SHARE ANALYSIS

18.2.5 PRODUCT PORTFOLIO

18.2.6 RECENT DEVELOPMENT

18.3 PHOSAGRO GROUP OF COMPANIES

18.3.1 COMPANY SNAPSHOT

18.3.2 PRODUCTION CAPACITY

18.3.3 SWOT

18.3.4 REVENUE ANALYSIS

18.3.5 COMPANY SHARE ANALYSIS

18.3.6 PRODUCT PORTFOLIO

18.3.7 RECENT DEVELOPMENT

18.4 MA'ADEN

18.4.1 COMPANY SNAPSHOT

18.4.2 PRODUCTION CAPACITY

18.4.3 SWOT

18.4.4 REVENUE ANALYSIS

18.4.5 COMPANY SHARE ANALYSIS

18.4.6 PRODUCT PORTFOLIO

18.4.7 RECENT DEVELOPMENTS

18.5 OCP

18.5.1 COMPANY SNAPSHOT

18.5.2 PRODUCTION CAPACITY

18.5.3 SWOT

18.5.4 COMPANY SHARE ANALYSIS

18.5.5 PRODUCT PORTFOLIO

18.5.6 RECENT DEVELOPMENT

18.6 ADITYA BIRLA MANAGEMENT CORPORATION PVT. LTD.

18.6.1 COMPANY SNAPSHOT

18.6.2 SWOT

18.6.3 REVENUE ANALYSIS

18.6.4 PRODUCT PORTFOLIO

18.6.5 RECENT DEVELOPMENT

18.7 AIREDALE CHEMICAL COMPANY LIMITED

18.7.1 COMPANY SNAPSHOT

18.7.2 SWOT

18.7.3 PRODUCT PORTFOLIO

18.7.4 RECENT DEVELOPMENT

18.8 ANEXIB CHEMICALS

18.8.1 COMPANY SNAPSHOT

18.8.2 SWOT

18.8.3 PRODUCT PORTFOLIO

18.8.4 RECENT DEVELOPMENT

18.9 ANHUI GUANGXIN AGROCHEMICAL CO., LTD.

18.9.1 COMPANY SNAPSHOT

18.9.2 SWOT

18.9.3 PRODUCT PORTFOLIO

18.9.4 RECENT DEVELOPMENTS

18.1 EXCEL INDUSTRIES LTD. (2022)

18.10.1 COMPANY SNAPSHOT

18.10.2 SWOT

18.10.3 REVENUE ANALYSIS

18.10.4 PRODUCT PORTFOLIO

18.10.5 RECENT DEVELOPMENT

18.11 FUTONG CHEMICAL CO., LTD

18.11.1 COMPANY SNAPSHOT

18.11.2 SWOT

18.11.3 PRODUCT PORTFOLIO

18.11.4 RECENT DEVELOPMENT

18.12 ICL

18.12.1 COMPANY SNAPSHOT

18.12.2 SWOT

18.12.3 REVENUE ANALYSIS

18.12.4 PRODUCT PORTFOLIO

18.12.5 RECENT DEVELOPMENTS

18.13 INNOPHOS

18.13.1 COMPANY SNAPSHOT

18.13.2 SWOT

18.13.3 PRODUCT PORTFOLIO

18.13.4 RECENT DEVELOPMENT

18.14 JORDAN PHOSPHATE MINES COMPANY (PLC)

18.14.1 COMPANY SNAPSHOT

18.14.2 SWOT

18.14.3 REVENUE ANALYSIS

18.14.4 PRODUCT PORTFOLIO

18.14.5 RECENT DEVELOPMENT

18.15 KAZPHOSPHATE LLC

18.15.1 COMPANY SNAPSHOT

18.15.2 SWOT

18.15.3 PRODUCT PORTFOLIO

18.15.4 RECENT DEVELOPMENT

18.16 LANXESS

18.16.1 COMPANY SNAPSHOT

18.16.2 SWOT

18.16.3 REVENUE ANALYSIS

18.16.4 PRODUCT PORTFOLIO

18.16.5 RECENT DEVELOPMENTS

18.17 MOSAIC

18.17.1 COMPANY SNAPSHOT

18.17.2 SWOT

18.17.3 REVENUE ANALYSIS

18.17.4 PRODUCT PORTFOLIO

18.17.5 RECENT DEVELOPMENT

18.18 NIPPON CHEMICAL INDUSTRIAL CO., LTD.

18.18.1 COMPANY SNAPSHOT

18.18.2 SWOT

18.18.3 REVENUE ANALYSIS

18.18.4 PRODUCT PORTFOLIO

18.18.5 RECENT DEVELOPMENTS

18.19 NUTRIEN LTD. (2022)

18.19.1 COMPANY SNAPSHOT

18.19.2 SWOT

18.19.3 REVENUE ANALYSIS

18.19.4 PRODUCT PORTFOLIO

18.19.5 RECENT DEVELOPMENT

18.2 PCC ROKITA SPÓŁKA AKCYJNA. (A SUBSIDIARY OF PCC GROUP)

18.20.1 COMPANY SNAPSHOT

18.20.2 SWOT

18.20.3 REVENUE ANALYSIS

18.20.4 PRODUCT PORTFOLIO

18.20.5 RECENT DEVELOPMENT

18.21 SANDHYA GROUP

18.21.1 COMPANY SNAPSHOT

18.21.2 SWOT

18.21.3 PRODUCT PORTFOLIO

18.21.4 RECENT DEVELOPMENT

18.22 SEKISUI DIAGNOSTICS

18.22.1 COMPANY SNAPSHOT

18.22.2 SWOT

18.22.3 PRODUCT PORTFOLIO

18.22.4 RECENT DEVELOPMENT

18.23 SMC EUROPE

18.23.1 COMPANY SNAPSHOT

18.23.2 SWOT

18.23.3 PRODUCT PORTFOLIO

18.23.4 RECENT DEVELOPMENT

18.24 STREM (A SUBSIDIARY OF ASCENSUS)

18.24.1 COMPANY SNAPSHOT

18.24.2 SWOT

18.24.3 PRODUCT PORTFOLIO

18.24.4 RECENT DEVELOPMENTS

18.25 XUZHOU JIANPING CHEMICAL CO., LTD.

18.25.1 COMPANY SNAPSHOT

18.25.2 SWOT

18.25.3 PRODUCT PORTFOLIO

18.25.4 RECENT DEVELOPMENTS

19 QUESTIONNAIRE

20 RELATED REPORTS

Liste des tableaux

TABLE 1 ASIA PACIFIC PHOSPHORUS AND DERIVATIVES MARKET, BY REGION, 2019-2022 (AVERAGE SELLING PRICE (USD) PER KG)

TABLE 2 THE RECOMMENDED DIETARY ALLOWANCE (RDA) FOR PHOSPHORUS IS THE FOLLOWING:

TABLE 3 ASIA-PACIFIC PHOSPHORUS AND DERIVATIVES MARKET, BY COUNTRY, 2016-2030 (USD THOUSAND)

TABLE 4 ASIA-PACIFIC PHOSPHORUS AND DERIVATIVES MARKET, BY COUNTRY, 2016-2030 (TONS)

TABLE 5 ASIA-PACIFIC PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (USD THOUSAND)

TABLE 6 ASIA-PACIFIC PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (TONS)

TABLE 7 ASIA-PACIFIC PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 8 ASIA-PACIFIC PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 9 ASIA-PACIFIC AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 10 ASIA-PACIFIC AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 11 ASIA-PACIFIC PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 12 ASIA-PACIFIC PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 13 ASIA-PACIFIC PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 14 ASIA-PACIFIC PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 15 ASIA-PACIFIC PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (USD THOUSAND)

TABLE 16 ASIA-PACIFIC PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (TONS)

TABLE 17 ASIA-PACIFIC PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (USD THOUSAND)

TABLE 18 ASIA-PACIFIC PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (TONS)

TABLE 19 ASIA-PACIFIC PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (USD THOUSAND)

TABLE 20 ASIA-PACIFIC PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (TONS)

TABLE 21 ASIA-PACIFIC PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (USD THOUSAND)

TABLE 22 ASIA-PACIFIC PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (TONS)

TABLE 23 CHINA PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (USD THOUSAND)

TABLE 24 CHINA PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (TONS)

TABLE 25 CHINA PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 26 CHINA PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 27 CHINA AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 28 CHINA AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 29 CHINA PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 30 CHINA PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 31 CHINA PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 32 CHINA PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 33 CHINA PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (USD THOUSAND)

TABLE 34 CHINA PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (TONS)

TABLE 35 CHINA PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (USD THOUSAND)

TABLE 36 CHINA PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (TONS)

TABLE 37 CHINA PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (USD THOUSAND)

TABLE 38 CHINA PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (TONS)

TABLE 39 CHINA PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (USD THOUSAND)

TABLE 40 CHINA PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (TONS)

TABLE 41 INDIA PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (USD THOUSAND)

TABLE 42 INDIA PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (TONS)

TABLE 43 INDIA PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 44 INDIA PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 45 INDIA AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 46 INDIA AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 47 INDIA PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 48 INDIA PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 49 INDIA PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 50 INDIA PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 51 INDIA PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (USD THOUSAND)

TABLE 52 INDIA PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (TONS)

TABLE 53 INDIA PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (USD THOUSAND)

TABLE 54 INDIA PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (TONS)

TABLE 55 INDIA PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (USD THOUSAND)

TABLE 56 INDIA PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (TONS)

TABLE 57 INDIA PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (USD THOUSAND)

TABLE 58 INDIA PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (TONS)

TABLE 59 JAPAN PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (USD THOUSAND)

TABLE 60 JAPAN PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (TONS)

TABLE 61 JAPAN PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 62 JAPAN PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 63 JAPAN AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 64 JAPAN AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 65 JAPAN PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 66 JAPAN PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 67 JAPAN PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 68 JAPAN PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 69 JAPAN PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (USD THOUSAND)

TABLE 70 JAPAN PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (TONS)

TABLE 71 JAPAN PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (USD THOUSAND)

TABLE 72 JAPAN PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (TONS)

TABLE 73 JAPAN PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (USD THOUSAND)

TABLE 74 JAPAN PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (TONS)

TABLE 75 JAPAN PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (USD THOUSAND)

TABLE 76 JAPAN PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (TONS)

TABLE 77 SOUTH KOREA PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (USD THOUSAND)

TABLE 78 SOUTH KOREA PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (TONS)

TABLE 79 SOUTH KOREA PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 80 SOUTH KOREA PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 81 SOUTH KOREA AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 82 SOUTH KOREA AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 83 SOUTH KOREA PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 84 SOUTH KOREA PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 85 SOUTH KOREA PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 86 SOUTH KOREA PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 87 SOUTH KOREA PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (USD THOUSAND)

TABLE 88 SOUTH KOREA PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (TONS)

TABLE 89 SOUTH KOREA PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (USD THOUSAND)

TABLE 90 SOUTH KOREA PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (TONS)

TABLE 91 SOUTH KOREA PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (USD THOUSAND)

TABLE 92 SOUTH KOREA PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (TONS)

TABLE 93 SOUTH KOREA PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (USD THOUSAND)

TABLE 94 SOUTH KOREA PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (TONS)

TABLE 95 INDONESIA PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (USD THOUSAND)

TABLE 96 INDONESIA PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (TONS)

TABLE 97 INDONESIA PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 98 INDONESIA PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 99 INDONESIA AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 100 INDONESIA AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 101 INDONESIA PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 102 INDONESIA PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 103 INDONESIA PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 104 INDONESIA PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 105 INDONESIA PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (USD THOUSAND)

TABLE 106 INDONESIA PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (TONS)

TABLE 107 INDONESIA PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (USD THOUSAND)

TABLE 108 INDONESIA PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (TONS)

TABLE 109 INDONESIA PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (USD THOUSAND)

TABLE 110 INDONESIA PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (TONS)

TABLE 111 INDONESIA PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (USD THOUSAND)

TABLE 112 INDONESIA PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (TONS)

TABLE 113 AUSTRALIA PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (USD THOUSAND)

TABLE 114 AUSTRALIA PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (TONS)

TABLE 115 AUSTRALIA PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 116 AUSTRALIA AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 117 AUSTRALIA AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 118 AUSTRALIA PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 119 AUSTRALIA PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 120 AUSTRALIA PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 121 AUSTRALIA PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 122 AUSTRALIA PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (USD THOUSAND)

TABLE 123 AUSTRALIA PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (TONS)

TABLE 124 AUSTRALIA PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (USD THOUSAND)

TABLE 125 AUSTRALIA PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (TONS)

TABLE 126 AUSTRALIA PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (USD THOUSAND)

TABLE 127 AUSTRALIA PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (TONS)

TABLE 128 AUSTRALIA PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (USD THOUSAND)

TABLE 129 AUSTRALIA PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (TONS)

TABLE 130 SINGAPORE PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (USD THOUSAND)

TABLE 131 SINGAPORE PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (TONS)

TABLE 132 SINGAPORE PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 133 SINGAPORE PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 134 SINGAPORE AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 135 SINGAPORE AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 136 SINGAPORE PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 137 SINGAPORE PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 138 SINGAPORE PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 139 SINGAPORE PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 140 SINGAPORE PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (USD THOUSAND)

TABLE 141 SINGAPORE PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (TONS)

TABLE 142 SINGAPORE PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (USD THOUSAND)

TABLE 143 SINGAPORE PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (TONS)

TABLE 144 SINGAPORE PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (USD THOUSAND)

TABLE 145 SINGAPORE PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (TONS)

TABLE 146 SINGAPORE PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (USD THOUSAND)

TABLE 147 SINGAPORE PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (TONS)

TABLE 148 PHILIPPINES PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (USD THOUSAND)

TABLE 149 PHILIPPINES PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (TONS)

TABLE 150 PHILIPPINES PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 151 PHILIPPINES PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 152 PHILIPPINES AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 153 PHILIPPINES AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 154 PHILIPPINES PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 155 PHILIPPINES PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 156 PHILIPPINES PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 157 PHILIPPINES PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 158 PHILIPPINES PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (USD THOUSAND)

TABLE 159 PHILIPPINES PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (TONS)

TABLE 160 PHILIPPINES PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (USD THOUSAND)

TABLE 161 PHILIPPINES PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (TONS)

TABLE 162 PHILIPPINES PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (USD THOUSAND)

TABLE 163 PHILIPPINES PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (TONS)

TABLE 164 PHILIPPINES PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (USD THOUSAND)

TABLE 165 PHILIPPINES PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (TONS)

TABLE 166 THAILAND PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (USD THOUSAND)

TABLE 167 THAILAND PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (TONS)

TABLE 168 THAILAND PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 169 THAILAND PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 170 THAILAND AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 171 THAILAND AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 172 THAILAND PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 173 THAILAND PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 174 THAILAND PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 175 THAILAND PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 176 THAILAND PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (USD THOUSAND)

TABLE 177 THAILAND PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (TONS)

TABLE 178 THAILAND PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (USD THOUSAND)

TABLE 179 THAILAND PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (TONS)

TABLE 180 THAILAND PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (USD THOUSAND)

TABLE 181 THAILAND PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (TONS)

TABLE 182 THAILAND PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (USD THOUSAND)

TABLE 183 THAILAND PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (TONS)

TABLE 184 MALAYSIA PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (USD THOUSAND)

TABLE 185 MALAYSIA PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (TONS)

TABLE 186 MALAYSIA PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 187 MALAYSIA PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 188 MALAYSIA AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 189 MALAYSIA AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 190 MALAYSIA PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 191 MALAYSIA PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 192 MALAYSIA PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 193 MALAYSIA PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 194 MALAYSIA PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (USD THOUSAND)

TABLE 195 MALAYSIA PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (TONS)

TABLE 196 MALAYSIA PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (USD THOUSAND)

TABLE 197 MALAYSIA PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (TONS)

TABLE 198 MALAYSIA PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (USD THOUSAND)

TABLE 199 MALAYSIA PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (TONS)

TABLE 200 MALAYSIA PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (USD THOUSAND)

TABLE 201 MALAYSIA PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (TONS)

TABLE 202 NEW ZEALAND PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (USD THOUSAND)

TABLE 203 NEW ZEALAND PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (TONS)

TABLE 204 NEW ZEALAND PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 205 NEW ZEALAND PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 206 NEW ZEALAND AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 207 NEW ZEALAND AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 208 NEW ZEALAND PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 209 NEW ZEALAND PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 210 NEW ZEALAND PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 211 NEW ZEALAND PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 212 NEW ZEALAND PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (USD THOUSAND)

TABLE 213 NEW ZEALAND PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (TONS)

TABLE 214 NEW ZEALAND PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (USD THOUSAND)

TABLE 215 NEW ZEALAND PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (TONS)

TABLE 216 NEW ZEALAND PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (USD THOUSAND)

TABLE 217 NEW ZEALAND PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (TONS)

TABLE 218 NEW ZEALAND PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (USD THOUSAND)

TABLE 219 NEW ZEALAND PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (TONS)

TABLE 220 HONG KONG PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (USD THOUSAND)

TABLE 221 HONG KONG PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (TONS)

TABLE 222 HONG KONG PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 223 HONG KONG PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 224 HONG KONG AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 225 HONG KONG AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 226 HONG KONG PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 227 HONG KONG PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 228 HONG KONG PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 229 HONG KONG PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 230 HONG KONG PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (USD THOUSAND)

TABLE 231 HONG KONG PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (TONS)

TABLE 232 HONG KONG PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (USD THOUSAND)

TABLE 233 HONG KONG PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (TONS)

TABLE 234 HONG KONG PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (USD THOUSAND)

TABLE 235 HONG KONG PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (TONS)

TABLE 236 HONG KONG PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (USD THOUSAND)

TABLE 237 HONG KONG PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (TONS)

TABLE 238 TAIWAN PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (USD THOUSAND)

TABLE 239 TAIWAN PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (TONS)

TABLE 240 TAIWAN PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 241 TAIWAN PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 242 TAIWAN AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 243 TAIWAN AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 244 TAIWAN PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 245 TAIWAN PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 246 TAIWAN PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 247 TAIWAN PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 248 TAIWAN PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (USD THOUSAND)

TABLE 249 TAIWAN PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (TONS)

TABLE 250 TAIWAN PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (USD THOUSAND)

TABLE 251 TAIWAN PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (TONS)

TABLE 252 TAIWAN PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (USD THOUSAND)

TABLE 253 TAIWAN PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (TONS)

TABLE 254 TAIWAN PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (USD THOUSAND)

TABLE 255 TAIWAN PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (TONS)

TABLE 256 REST OF ASIA-PACIFIC PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (USD THOUSAND)

TABLE 257 REST OF ASIA-PACIFIC PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (TONS)

Liste des figures

FIGURE 1 ASIA PACIFIC PHOSPHORUS AND DERIVATIVES MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC PHOSPHORUS AND DERIVATIVES MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC PHOSPHORUS AND DERIVATIVES MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC PHOSPHORUS AND DERIVATIVES MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC PHOSPHORUS AND DERIVATIVES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC PHOSPHORUS AND DERIVATIVES MARKET: PRODUCT LIFELINE CURVE

FIGURE 7 ASIA PACIFIC PHOSPHORUS AND DERIVATIVES MARKET: MULTIVARIATE MODELLING

FIGURE 8 ASIA PACIFIC PHOSPHORUS AND DERIVATIVES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 ASIA PACIFIC PHOSPHORUS AND DERIVATIVES MARKET: DBMR MARKET POSITION GRID

FIGURE 10 ASIA PACIFIC PHOSPHORUS AND DERIVATIVES MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 ASIA PACIFIC PHOSPHORUS AND DERIVATIVES MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 12 ASIA PACIFIC PHOSPHORUS AND DERIVATIVES: THE MARKET CHALLENGE MATRIX

FIGURE 13 ASIA PACIFIC PHOSPHORUS AND DERIVATIVES MARKET: SEGMENTATION

FIGURE 14 RISING APPLICATIONS OF PHOSPHORUS AND DERIVATIVES IN SEVERAL INDUSTRIES ARE DRIVING THE GROWTH OF THE ASIA PACIFIC PHOSPHORUS AND DERIVATIVES MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 15 THE PHOSPHORIC ACID SEGMENT IN THE PRODUCT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC PHOSPHORUS AND DERIVATIVES MARKET IN 2023 & 2030

FIGURE 16 PRODUCTION PROCESS OF PHOSPHORUS AND ITS DERIVATIVES

FIGURE 17 UNITED STATES CONSUMPTION OF PHOSPHATE ROCK (2019 – 2022)

FIGURE 18 IMPORT EXPORT SCENARIO OF PHOSPHORUS

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA PACIFIC PHOSPHORUS AND DERIVATIVES MARKET

FIGURE 20 FERTILIZER CONSUMPTION IN EUROPEAN COUNTRIES (2019) (KILOGRAMS PER HECTARE OF LAND)

FIGURE 21 ASIA PACIFIC PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2022

FIGURE 22 ASIA PACIFIC PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2022

FIGURE 23 ASIA PACIFIC PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2022

FIGURE 24 ASIA PACIFIC PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2022

FIGURE 25 ASIA PACIFIC PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2022

FIGURE 26 ASIA-PACIFIC PHOSPHORUS AND DERIVATIVES MARKET: SNAPSHOT (2022)

FIGURE 27 ASIA-PACIFIC PHOSPHORUS AND DERIVATIVES MARKET: BY COUNTRY (2022)

FIGURE 28 ASIA-PACIFIC PHOSPHORUS AND DERIVATIVES MARKET: BY COUNTRY (2023 & 2030)

FIGURE 29 ASIA-PACIFIC PHOSPHORUS AND DERIVATIVES MARKET: BY COUNTRY (2022 & 2030)

FIGURE 30 ASIA-PACIFIC PHOSPHORUS AND DERIVATIVES MARKET: BY PRODUCT (2022 - 2030)

FIGURE 31 ASIA PACIFIC PHOSPHORUS AND DERIVATIVES MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.