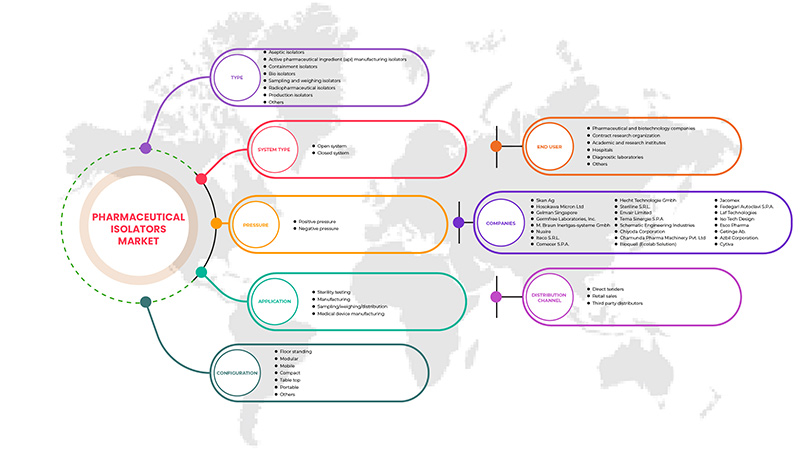

Marché des isolateurs pharmaceutiques en Asie-Pacifique, par type (isolateurs aseptiques, isolateurs de confinement, isolateurs biologiques, isolateurs d'échantillonnage et de pesée, isolateurs de fabrication d'ingrédients pharmaceutiques actifs (API), isolateurs radiopharmaceutiques, isolateurs de production, autres), type de système (système fermé, système ouvert), pression (pression positive, pression négative), configuration (au sol, modulaire, mobile, compact, de table, portable, autres), application ( test de stérilité , fabrication, échantillonnage/pesée/distribution, fabrication de dispositifs médicaux), utilisateur final (hôpitaux, laboratoires de diagnostic, instituts universitaires et de recherche, sociétés pharmaceutiques et biotechnologiques, organismes de recherche sous contrat, autres), canal de distribution (appel d'offres direct, vente au détail, distributeurs tiers) Tendances et prévisions de l'industrie jusqu'en 2029.

Analyse et perspectives du marché des isolateurs pharmaceutiques en Asie-Pacifique

Les isolateurs pharmaceutiques sont utilisés dans l'industrie pharmaceutique comme système de barrière sans contamination. Les tests microbiologiques, le traitement de thérapie cellulaire, la fabrication pharmaceutique avancée (ATMP) et le pesage, l'emballage et la distribution de produits injectables stériles ne sont que quelques-unes des applications des isolateurs pharmaceutiques. L'utilisation d'isolateurs pharmaceutiques est alimentée par la croissance continue du marché pharmaceutique dans les pays en développement et développés et par l'augmentation des dépenses de R&D pour produire des traitements innovants. Les isolateurs médicaux avancés et les exigences de l'industrie pharmaceutique ont conduit les principaux fabricants à développer l'industrie des isolateurs médicaux. L'utilisation croissante de composés dangereux, le coût croissant de la non-conformité et l'augmentation des laboratoires de recherche sont des moteurs importants du marché des isolateurs pharmaceutiques au cours de la période de prévision.

Cependant, la plupart des experts ne sont pas d’accord pour dire que les entités réglementaires ne font plus obstacle à des avancées technologiques telles que le développement d’isolants pharmaceutiques.

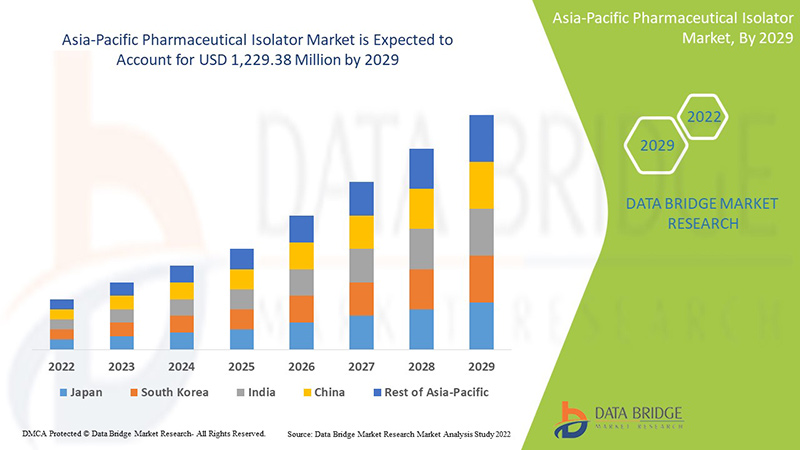

Data Bridge Market Research analyse que le marché des isolateurs pharmaceutiques en Asie-Pacifique devrait atteindre la valeur de 1 229,38 millions USD d'ici 2029, à un TCAC de 15,7 % au cours de la période de prévision. Le type représente le segment de type le plus important du marché en raison de la demande rapide d'isolateurs pharmaceutiques à l'échelle mondiale. Ce rapport de marché couvre également en profondeur l'analyse des prix, l'analyse des brevets et les avancées technologiques.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable de 2019 à 2014) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, volumes en unités, prix en USD |

|

Segments couverts |

By Type (Aseptic Isolators, Containment Isolators, Bio Isolators, Sampling And Weighing Isolators, Active Pharmaceutical Ingredient (API) Manufacturing Isolators, Radiopharmaceutical Isolators, Production Isolators, Others), System Type (Closed System, Open System), Pressure (Positive Pressure, Negative Pressure), Configuration (Floor Standing, Modular, Mobile, Compact, Table Top, Portable, Others), Application (Sterility Testing, Manufacturing, Sampling/ Weighing/ Distribution, Medical Device Manufacturing), End User (Hospitals, Diagnostic Laboratories, Academic And Research Institutes, Pharmaceutical And Biotechnology Companies, Contract Research Organizations, Others), Distribution Channel (Direct Tender, Retail Sales, Third Party Distributors). |

|

Countries Covered |

China, Japan, India, South Korea, Singapore, Thailand, Malaysia, Australia, Philippines, Indonesia and rest of Asia-Pacific. |

|

Market Players Covered |

Getinge, SKAN AG, Hosokawa micron ltd, Gelman Singapore, Azbil Corporation, Germfree Laboratories, Inc., M. Braun Inertgas-Systeme Gmbh, Nuaire, Iteco S.R.L., Comecer S.P.A., Hecht Technologie Gmbh, Steriline S.R.L., Envair Limited, Tema Sinergie S.P.A, Schematic Engineering Industries, Chiyoda Corporation, Chamunda Pharma Machinery Pvt. Ltd, Bioquell (Ecolab Solution), Jacomex, Fedegari Autoclavi S.p.A., LAF Technologies, ISO Tech Design, Cytiva, Esco Pharma among others. |

Asia-Pacific Pharmaceutical Isolator Market Definition

The isolation concept protects the process from the operator and or the operator from the process, while protecting the environment. The key to containment, is minimal exposure. By controlling the exposure range below the hazard level set for the compound, the Operator and the environment are properly protected. Hence, the product is protected and therefore a key regulatory issue is addressed. A pharmaceutical isolator is a sealed bacterial enclosure used in the pharmaceutical surrounding for aseptic filling and toxic process. It is made of a perfectly sterile main isolator where the products are handled, stored or packaged using shoulder-high gloves placed on one of the walls. The pharmaceutical isolator enables the control and containment of pharmaceutical processes. The conditions required for working of a pharmaceutical isolator are sterile environment and free of viable microorganisms. A pharmaceutical isolator ensures that production area and aseptic environment are placed in separate positions. A pharmaceutical industry isolator is cost effective and efficient, in comparison to cleanrooms for the pharmaceutical industry in an aseptic environment. It creates a controlled atmosphere during the microbial and drug production process by adjusting with the different standards certification standard required for isolators and restricted access barriers. It ensures the protection of the product, the operators and the environment at the same time.

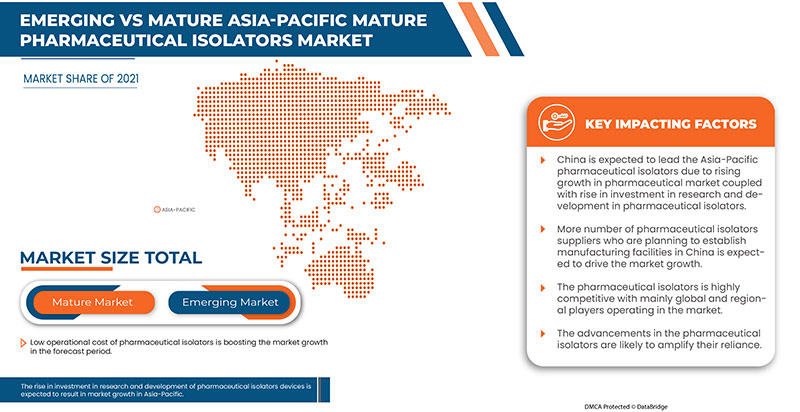

The abundant applications of pharmaceutical isolators, vary for production and control purposes. It is used while handling, transferring or packing solid semi-solid or powder pharma drugs, handling and filing solutions and infusions. The pharmaceutical isolators are applied in sterility testing, aseptic handling of tissues or biological production systems or pathogenic samples, etc. It can be used for the production and control of drugs and pharmaceutical products. The surge in demand for the isolators across pharmaceutical and biotechnology industry, along with low operational cost, high maintenance of aseptic condition in the production of pharmaceutical products and growing demand of biopharmaceutical industry are the factors expected to drive the market growth, in the forecast period.

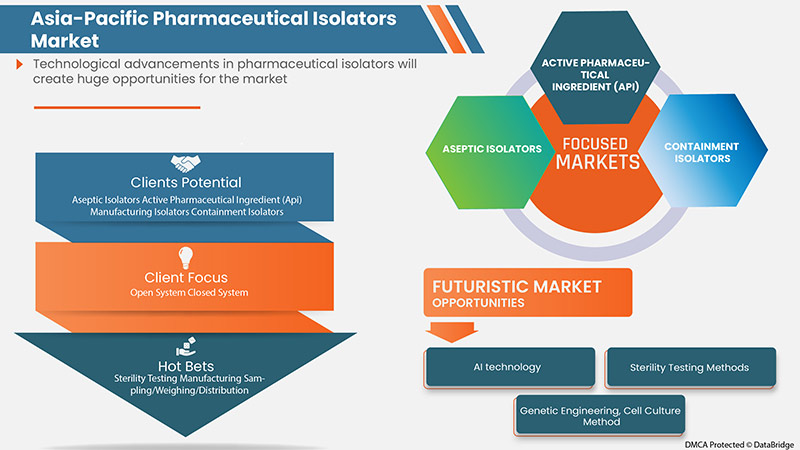

Also, strategic initiatives by market players, technological progressions in pharmaceutical isolators, high sterility assurance and increasing investment for healthcare infrastructure increase the growth of the pharmaceutical isolators market.

Asia-Pacific Pharmaceutical Isolator Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

Growing demand for the pharmaceutical isolators across booming pharmaceutical

Pharmaceutical isolator is a separative device that divides a pharmaceutical procedure or activity from the operator and the adjacent environment. It is used for various purposes such as:

- Providing a categorized aseptic environment for an activity or procedure and guarding it from microbial and non-microbial contamination rising from the operator and adjacent environment which is referred to product protection.

- Protective product from contamination produced by other product and procedure, moreover at the same time or during earlier operations. This is referred to as safeguard against method generated contamination or cross- contamination.

The Increasing contamination problems in the manufacturing unit in which comes isolator that create a demand for Pharmaceutical isolator that helps in contamination and de-contamination.

- Low operational cost of pharmaceutical isolators

Enclosures that are sealed to some standard of leak tightness that comprises inside qualified controlled environment, at modification with the surrounding conditions isolator application reaches from R&D by the production of pharmaceuticals to laboratory use, especially for the microbiological quality control. Whereas pharmaceutical aseptic production has extremely high standards of cleanness almost completely particle free and germ free environments for the aseptic production.

Due to growth in the pharma industry and the widening product range more and more manufacturers and suppliers needs to think about investments in latest added technologies of the clean room technology.

Aseptic processing of the pharmaceutical drugs is the major factor need to be included in good manufacturing practices meeting the government regulations. The high cost of the maintenance of the aseptic condition by clean room technology which is around 62% higher than the pharmaceutical isolators, shifting the manufacturers to acquire isolator’s technology and constraining the overall manufacturing cost of the pharmaceutical products.

Restraint

Stringent governmental regulations

Active Pharmaceutical Ingredients (API) and intermediates for pharmaceutical use (for instance biological, radiopharmaceutical, and pharmaceutical) and those used to production drugs for clinical trials are regulated under the Divisions 1A and 2, Part C of the Food and Drug Regulations.

- Division 1A, Part C of the Food and Drug Regulations describes activities for which Good Manufacturing Practices (GMP) compliance is required and must be demonstrated prior to the issuance of an API establishment license (EL).

- Division 2, Part C of the Food and Drug Regulations defines the requirements for the GMP of APIs and API intermediates, which are interpreted in the present guidance document.

Due to this strict regulation by the government that has to be followed for the production by the Good Manufacturing Practices (GMP) Guidelines for Active Pharmaceutical Ingredients (API) - (GUI-0104) which constraining the market growth rate.

Opportunity

-

Strategic initiatives by market players

The rise in the pharmaceutical isolators market increases the need for strategic business ideas. It includes a partnership, business expansion, and other development. The rising demand for pharmaceuticals is significantly increasing the demand for excipient and to cope with this demand companies are building new manufacturing sites among other strategic initiatives.

These strategic initiatives such as product launches, agreement and business expansion by the major market player will boost the pharmaceutical isolators market growth and is expected to act as an opportunity for the Asia-Pacific medical display market.

Challenge

Lack of skilled expertise

The shortage of skilled expertise would challenge the pace of recovery and growth in one place. Often, the people who are unemployed in one place have skills that are in short supply elsewhere. Moreover, rapid technological advancement in this field also leads to lack of expertise.

Lack of skilled professionals while handling the pharmaceutical isolators poses a major challenge while selecting and developing the pharmaceutical isolators. The data by the Phys.org 2003 mentions the medical display industries are facing a shortage of workers due to increase demand of pharmaceutical isolators in Asia-Pacific region and severe scarcity of micro chips used in LED and LCD display, which increases the price lead times of LCD production.

As skill demands are too high, it has manifested as a challenge to retain and manage skill-specified professionals. Moreover, technological advancement is another aspect that leads to the increased demand for skilled professionals. Neurologists report significant unmet supportive care needs and barriers in their centers with only a small minority rating themselves as competently providing supportive care. There is an urgent need for education of neurologists and professionals for treatment of dementia and procuring available supportive care resources. Lack of trained and experienced professionals and persistent skill gaps limit the employability prospects and access to quality jobs. It is therefore apparent that availability of professionals equipped with adequate skills is expected to challenge the market growth.

Post-COVID-19 Impact on Asia-Pacific Pharmaceutical Isolator Market

The COVID-19 pandemic has become the world's most serious threat. It wreaked havoc in many stores and businesses around the world. The pandemic, on the other hand, has provided many opportunities for pharmaceutical and biopharmaceutical companies to expand their research and development activities to develop new vaccines against the new coronavirus. Companies are conducting clinical trials to try to stop the spread of the COVID-19 virus. Pharmaceutical insulator suppliers to biopharmaceutical organizations have more opportunities as the number of clinical trials increases.

Manufacturers are making various strategic decisions to bounce back post-COVID-19. The players are conducting multiple R&D activities and product launch and strategic partnerships to improve the technology and test results involved in the pharmaceutical medical display market.

Recent Developments

- In June 2022, the company announced a partnership with Medical Supply Company (MSC) to market and service Jacomex equipment to the pharmaceutical and pharmaceutical industries in Ireland. MSC has many years of recognized expertise in the market with field teams closest to customers and company’s commercial team currently working abroad had the pleasure of welcoming Cian Murphy and finalizing the agreement between Jacomex and MSC. The beginning of a long and fruitful collaboration. This has helped the company to expand their business.

- In January 2022, Clario partnered with XingImaging, a radiopharmaceutical production and positron emission tomography (PET) acquisition company, to deliver PET imaging clinical trials for testing novel therapeutics in China. The partnership offers to share the joint resources and neuroscience experts of Clario and XingImaging to expedite the startup of clinical trials and drug discovery in China.

Asia-Pacific Pharmaceutical isolator market Scope

Asia-Pacific pharmaceutical isolator market is segmented into type, pressure, application, configuration, system type, end user and distribution channel. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

ASIA-PACIFIC PHARMACEUTICAL ISOLATOR MARKET, BY TYPE

- ASEPTIC ISOLATORS

- CONTAINMENT ISOLATORS

- BIO ISOLATORS

- SAMPLING AND WEIGHING ISOLATORS

- ACTIVE PHARMACEUTICAL INGREDIENT (API) MANUFACTURING ISOLATORS

- RADIOPHARMACEUTICAL ISOLATORS

- PRODUCTION ISOLATORS

- OTHERS

On the basis of type, the Asia-Pacific pharmaceutical isolator market is segmented into aseptic isolators, containment isolators, bio isolators, sampling and weighing isolators, active pharmaceutical ingredient (API) manufacturing isolators, radiopharmaceutical isolators, production isolators, others.

ASIA-PACIFIC PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE

- CLOSED SYSTEM

- OPEN SYSTEM

On the basis of system type, the Asia-Pacific pharmaceutical isolator market is segmented into closed system, open system.

ASIA-PACIFIC PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE

- POSITIVE PRESSURE

- NEGATIVE PRESSURE

On the basis of pressure, the Asia-Pacific pharmaceutical isolator market is segmented into positive pressure and negative pressure.

ASIA-PACIFIC PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION

- FLOOR STANDING

- MODULAR

- MOBILE

- COMPACT

- TABLE TOP

- PORTABLE

- OTHERS

On the basis of configuration, the Asia-Pacific pharmaceutical isolator market is segmented into floor standing, modular, mobile, compact, table top, portable, others.

ASIA-PACIFIC PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION

- STERILITY TESTING

- MANUFACTURING

- SAMPLING/ WEIGHING/ DISTRIBUTION

- MEDICAL DEVICE MANUFACTURING

- OTHERS

On the basis of application, the Asia-Pacific pharmaceutical isolator market is segmented into sterility testing, manufacturing, sampling/ weighing/ distribution, medical device manufacturing, others.

ASIA-PACIFIC PHARMACEUTICAL ISOLATOR MARKET, BY END USER

- HOSPITALS

- DIAGNOSTIC LABORATORIES

- ACADEMIC AND RESEARCH INSTITUTES

- PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES

- CONTRACT RESEARCH ORGANIZATIONS

- OTHERS

On the basis of end user, the Asia-Pacific pharmaceutical isolator market is segmented into hospitals, diagnostic laboratories, academic and research institutes, pharmaceutical and biotechnology companies, contract research organizations, others.

ASIA-PACIFIC PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL

- DIRECT TENDER

- RETAIL SALES

- THIRD PARTY DISTRIBUTORS

On the basis of distribution channel, the Asia-Pacific pharmaceutical isolator market is segmented into direct tender, retail sales, third party distributors.

Asia-Pacific Pharmaceutical Isolator Market Regional Analysis/Insights

The Asia-Pacific pharmaceutical isolator market is analyzed and market size information is provided type, pressure, application, configuration, system type, end user, and distribution channel.

The countries covered in this market report are China, Japan, India, South Korea, Singapore, Thailand, Malaysia, Australia, Philippines, Indonesia and rest of Asia-Pacific. In 2022, China is dominating due to increasing investments in R&D.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of Asia-Pacific brands and their challenges faced due to large or scarce competition from local and domestic brands, and impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Asia-Pacific Pharmaceutical Isolator Market Share Analysis

Asia-Pacific pharmaceutical isolator market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in R&D, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breath, application dominance, technology lifeline curve. The above data points provided are only related to the company’s focus on the Asia-Pacific pharmaceutical isolator market.

Some of the major players operating in the Asia-Pacific pharmaceutical isolator market are Getinge, SKAN AG, Hosokawa micron ltd, Gelman Singapore, Azbil Corporation, Germfree Laboratories, Inc., M. Braun Inertgas-Systeme Gmbh, Nuaire, Iteco S.R.L., Comecer S.P.A., Hecht Technologie Gmbh, Steriline S.R.L., Envair Limited, Tema Sinergie S.P.A, Schematic Engineering Industries, Chiyoda Corporation, Chamunda Pharma Machinery Pvt. Ltd, Bioquell (Ecolab Solution), Jacomex, Fedegari Autoclavi S.p.A., LAF Technologies, ISO Tech Design, Cytiva, Esco Pharma.

Research Methodology: Asia-Pacific Pharmaceutical Isolator Market

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, Asia-Pacific vs Regional, and Vendor Share Analysis. Please request analyst call in case of further inquiry.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 SOURCE LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES

4.3 INDUSTRIAL INSIGHTS:

5 ASIA PACIFIC PHARMACEUTICAL ISOLATORS MARKET: REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING DEMAND FOR THE PHARMACEUTICAL ISOLATORS ACROSS BOOMING PHARMACEUTICAL

6.1.2 LOW OPERATIONAL COST OF PHARMACEUTICAL ISOLATORS

6.1.3 HIGH MAINTENANCE OF ASEPTIC CONDITIONS IN THE PRODUCTION OF PHARMACEUTICAL PRODUCTS

6.1.4 LOW OPERATING COST OF PHARMACEUTICAL ISOLATORS & GROWING DEMAND IN THE BIOPHARMACEUTICAL INDUSTRY

6.2 RESTRAINTS

6.2.1 STRINGENT GOVERNMENTAL REGULATIONS

6.2.2 HIGH COST OF INSTALLATION & LIMITED ADOPTION OF RABS

6.3 OPPORTUNITIES

6.3.1 STRATEGIC INITIATIVES BY MARKET PLAYERS

6.3.2 TECHNOLOGICAL ADVANCEMENTS IN PHARMACEUTICAL ISOLATORS

6.3.3 HIGH STERILITY ASSURANCE

6.4 CHALLENGES

6.4.1 LACK OF SKILLED EXPERTISE

6.4.2 ENGINEERING CHALLENGES FACED WHILE DESIGNING THE PHARMACEUTICAL ISOLATORS

7 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET, BY TYPE

7.1 OVERVIEW

7.2 ASEPTIC ISOLATOR

7.3 ACTIVE PHARMACEUTICAL INGREDIENT (API) MANUFACTURING ISOLATORS

7.4 CONTAINMENT ISOLATORS

7.5 BIO ISOLATORS

7.6 SAMPLING AND WEIGHING ISOLATORS

7.7 RADIOPHARMACEUTICAL ISOLATORS

7.8 PRODUCTION ISOLATORS

7.9 OTHERS

8 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE

8.1 OVERVIEW

8.2 OPEN SYSTEM

8.3 CLOSED SYSTEM

9 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE

9.1 OVERVIEW

9.2 POSITIVE PRESSURE

9.3 NEGATIVE PRESSURE

10 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION

10.1 OVERVIEW

10.2 FLOOR STANDING

10.3 MODULAR

10.4 MOBILE

10.5 COMPACT

10.6 TABLE TOP

10.7 PORTABLE

10.8 OTHERS

11 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 STERILITY TESTING

11.3 MANUFACTURING

11.4 SAMPLING/WEIGHING/DISTRIBUTION

11.5 MEDICAL DEVICE MANUFACTURING

12 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 DIRECT TENDER

12.3 RETAIL SALES

12.4 THIRD PARTY DISTRIBUTORS

13 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET, BY END USER

13.1 OVERVIEW

13.2 PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES

13.2.1 STERILE FILTERING

13.2.2 AMPULE FILLING

13.2.3 SYRINGE FILLING

13.2.4 SAMPLING

13.2.5 SAMPLE TESTING

13.2.6 STERILITY TESTING

13.2.7 PACKAGING

13.2.8 OTHERS

13.3 CONTRACT RESEARCH ORGANIZATION

13.3.1 STERILE FILTERING

13.3.2 AMPULE FILLING

13.3.3 SYRINGE FILLING

13.3.4 SAMPLING

13.3.5 SAMPLE TESTING

13.3.6 STERILITY TESTING

13.3.7 PACKAGING

13.3.8 OTHERS

13.4 ACADEMIC AND RESEARCH INSTITUTES

13.4.1 STERILE FILTERING

13.4.2 AMPULE FILLING

13.4.3 SYRINGE FILLING

13.4.4 SAMPLING

13.4.5 SAMPLE TESTING

13.4.6 STERILITY TESTING

13.4.7 PACKAGING

13.4.8 OTHERS

13.5 HOSPITALS

13.5.1 STERILE FILTERING

13.5.2 AMPULE FILLING

13.5.3 SYRINGE FILLING

13.5.4 SAMPLING

13.5.5 SAMPLE TESTING

13.5.6 STERILITY TESTING

13.5.7 PACKAGING

13.5.8 OTHERS

13.6 DIAGNOSTIC LABORATORIES

13.6.1 STERILE FILTERING

13.6.2 AMPULE FILLING

13.6.3 SYRINGE FILLING

13.6.4 SAMPLING

13.6.5 SAMPLE TESTING

13.6.6 STERILITY TESTING

13.6.7 PACKAGING

13.6.8 OTHERS

13.7 OTHERS

14 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET, BY REGION

14.1 ASIA-PACIFIC

14.1.1 CHINA

14.1.2 JAPAN

14.1.3 SOUTH KOREA

14.1.4 INDIA

14.1.5 AUSTRALIA

14.1.6 SINGAPORE

14.1.7 THAILAND

14.1.8 MALAYSIA

14.1.9 INDONESIA

14.1.10 PHILIPPINES

14.1.11 REST OF ASIA-PACIFIC

15 ASIA PACIFIC PHARMACEUTICAL ISOLATORS MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 GETINGE AB

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENT

17.2 CYTIVA (A SUBSIDIARY OF DANAHER CORPORATION)

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENT

17.3 AZBIL CORPORATION

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENTS

17.4 CHIYODA CORPORATION

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENT

17.5 HOSOKAWA MICRON LTD

17.5.1 COMPANY SNAPSHOT

17.5.2 COMPANY SHARE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT DEVELOPMENTS

17.6 BIOQUELL, AN ECOLAB SOLUTION (A SUBSIDIARY OF ECOLAB)

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT DEVELOPMENT

17.7 CHAMUNDA PHARMA MACHNIERY

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENTS

17.8 COMECER S.P.A. (A SUBSIDIARY OF ATS AUTOMATION TOOLS) (2021)

17.8.1 COMPANY SNAPSHOT

17.8.2 REVENUE ANALYSIS

17.8.3 PRODUCT PORTFOLIO

17.8.4 RECENT DEVELOPMENT

17.9 ENVAIR TECHNOLOGY

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENTS

17.1 ESCO MICRO PTE. LTD

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENT

17.11 FEDEGARI AUTOCLAVI S.P.A

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENTS

17.12 GERMFREE LABORATORIES, INC.

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENT

17.13 GELMAN SINGAPORE

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENTS

17.14 HECT TECHNOLOGIE GMBH (2021)

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENT

17.15 ISO TECH DESIGN

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENTS

17.16 ITECO SRL

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENT

17.17 JACOMEX

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENT

17.18 LAF TECHNOLOGIES

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENTS

17.19 MBRAUN.(2021)

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENT

17.2 NUAIRE (A SUBSIDIARY OF GENUIT GROUP PLC)

17.20.1 COMPANY SNAPSHOT

17.20.2 REVENUE ANALYSIS

17.20.3 PRODUCT PORTFOLIO

17.20.4 RECENT DEVELOPMENTS

17.21 STERILINE (2021)

17.21.1 COMPANY SNAPSHOT

17.21.2 PRODUCT PORTFOLIO

17.21.3 RECENT DEVELOPMENTS

17.22 SCHEMATIC ENGINEERING INDUSTRY

17.22.1 COMPANY SNAPSHOT

17.22.2 PRODUCT PORTFOLIO

17.22.3 RECENT DEVELOPMENTS

17.23 SKAN AG

17.23.1 COMPANY SNAPSHOT

17.23.2 REVENUE ANALYSIS

17.23.3 PRODUCT PORTFOLIO

17.23.4 RECENT DEVELOPMENT

17.24 TEMA SINERGIE S.P.A

17.24.1 COMPANY SNAPSHOT

17.24.2 PRODUCT PORTFOLIO

17.24.3 RECENT DEVELOPMENTS

18 QUESTIONNAIRE

19 RELATED REPORTS

Liste des tableaux

TABLE 1 OPERATING COSTS FOR ASEPTIC PRODUCTION UNDER RABS OR ISOLATOR

TABLE 2 APPLICATION OF GUI-0104 TO API MANUFACTURING

TABLE 3 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 ASIA PACIFIC ASEPTIC ISOLATOR IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 ASIA PACIFIC ACTIVE PHARMACEUTICAL INGREDIENT (API) MANUFACTURING ISOLATORS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 ASIA PACIFIC CONTAINMENT ISOLATORS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 ASIA PACIFIC BIO ISOLATORS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 ASIA PACIFIC SAMPLING AND WEIGHING ISOLATORS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 ASIA PACIFIC RADIOPHARMACEUTICAL ISOLATORS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 ASIA PACIFIC PRODUCTION ISOLATORS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 ASIA PACIFIC OTHERS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 13 ASIA PACIFIC OPEN SYSTEM IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 ASIA PACIFIC CLOSED SYSTEM IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 16 ASIA PACIFIC POSITIVE PRESSURE IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 ASIA PACIFIC NEGATIVE PRESSURE IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 19 ASIA PACIFIC FLOOR STANDING IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 ASIA PACIFIC MODULAR IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 ASIA PACIFIC MOBILE IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 ASIA PACIFIC COMPACT IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 ASIA PACIFIC TABLE TOP IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 ASIA PACIFIC PORTABLE IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 ASIA PACIFIC OTHERS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 27 ASIA PACIFIC STERILITY TESTING IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 ASIA PACIFIC MANUFACTURING IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 ASIA PACIFIC SAMPLING/WEIGHING/DISTRIBUTION IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 ASIA PACIFIC MEDICAL DEVICE MANUFACTURING IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 32 ASIA PACIFIC DIRECT TENDER IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 ASIA PACIFIC RETAIL SALES INPHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 ASIA PACIFIC THIRD PARTY DISTRIBUTORS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 36 ASIA PACIFIC PHARMACEUTICAL AND BIOTECHNOLOGICAL COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 ASIA PACIFIC PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 38 ASIA PACIFIC CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 ASIA PACIFIC CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 40 ASIA PACIFIC ACADEMIC AND RESEARCH INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 ASIA PACIFIC ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 42 ASIA PACIFIC HOSPITALS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 ASIA PACIFIC HOSPITALS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 44 ASIA PACIFIC DIAGNOSTIC LABARATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 ASIA PACIFIC DIAGNOSTICS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 46 ASIA PACIFIC OTHERS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 47 ASIA-PACIFIC PHARMACEUTICAL ISOLATOR MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 48 ASIA-PACIFIC PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 ASIA-PACIFIC PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 50 ASIA-PACIFIC PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 51 ASIA-PACIFIC PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 52 ASIA-PACIFIC PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 53 ASIA-PACIFIC PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 54 ASIA-PACIFIC PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 55 ASIA-PACIFIC CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 56 ASIA-PACIFIC ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 57 ASIA-PACIFIC HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 58 ASIA-PACIFIC DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 59 ASIA-PACIFIC PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 60 CHINA PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 61 CHINA PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 62 CHINA PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 63 CHINA PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 64 CHINA PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 65 CHINA PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 66 CHINA PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 67 CHINA CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 68 CHINA ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 69 CHINA HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 70 CHINA DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 71 CHINA PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 72 JAPAN PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 73 JAPAN PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 74 JAPAN PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 75 JAPAN PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 76 JAPAN PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 77 JAPAN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 78 JAPAN PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 79 JAPAN CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 80 JAPAN ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 81 JAPAN HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 82 JAPAN DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 83 JAPAN PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 84 SOUTH KOREA PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 85 SOUTH KOREA PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 86 SOUTH KOREA PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 87 SOUTH KOREA PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 88 SOUTH KOREA PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 89 SOUTH KOREA PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 90 SOUTH KOREA PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 91 SOUTH KOREA CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 92 SOUTH KOREA ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 93 SOUTH KOREA HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 94 SOUTH KOREA DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 95 SOUTH KOREA PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 96 INDIA PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 97 INDIA PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 98 INDIA PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 99 INDIA PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 100 INDIA PHARMACEUTICAL ISOLATOR MARKET, BY END USERS, 2020-2029 (USD MILLION)

TABLE 101 INDIA PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 102 INDIA CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 103 INDIA ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 104 INDIA HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 105 INDIA DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 106 INDIA PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 107 AUSTRALIA PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 108 AUSTRALIA PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 109 AUSTRALIA PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 110 AUSTRALIA PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 111 AUSTRALIA PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 112 AUSTRALIA PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 113 AUSTRALIA PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 114 AUSTRALIA CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 115 AUSTRALIA ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 116 AUSTRALIA HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 117 AUSTRALIA DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 118 AUSTRALIA PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 119 SINGAPORE PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 120 SINGAPORE PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 121 SINGAPORE PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 122 SINGAPORE PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 123 SINGAPORE PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 124 SINGAPORE PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 125 SINGAPORE PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 126 SINGAPORE CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 127 SINGAPORE ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 128 SINGAPORE HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 129 SINGAPORE DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 130 SINGAPORE PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 131 THAILAND PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 132 THAILAND PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 133 THAILAND PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 134 THAILAND PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 135 THAILAND PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 136 THAILAND PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 137 THAILAND ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 138 THAILAND HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 139 THAILAND DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 140 THAILAND PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 141 MALAYSIA PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 142 MALAYSIA PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 143 MALAYSIA PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 144 MALAYSIA PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 145 MALAYSIA PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 146 MALAYSIA PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 147 MALAYSIA CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 148 MALAYSIA HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 149 MALAYSIA DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 150 MALAYSIA PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 151 INDONESIA PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 152 INDONESIA PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 153 INDONESIA PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 154 INDONESIA PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 155 INDONESIA PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 156 INDONESIA PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 157 INDONESIA PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 158 INDONESIA CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 159 INDONESIA ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 160 INDONESIA HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 161 INDONESIA DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 162 INDONESIA PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 163 PHILIPPINES PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 164 PHILIPPINES PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 165 PHILIPPINES PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 166 PHILIPPINES PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 167 PHILIPPINES PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 168 PHILIPPINES PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 169 PHILIPPINES PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 170 PHILIPPINES CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 171 PHILIPPINES ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 172 PHILIPPINES HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 173 PHILIPPINES DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 174 PHILIPPINES PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 175 REST OF ASIA-PACIFIC PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET: DBMR MARKET POSITION GRID

FIGURE 9 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET: SEGMENTATION

FIGURE 11 INCREASING USE OF PHARMACEUTICAL ISOLATORS IS EXPECTED TO DRIVE THE ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 ASEPTIC ISOLATORS IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET

FIGURE 14 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET: BY TYPE, 2021

FIGURE 15 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET: BY TYPE, 2022-2029 (USD MILLION)

FIGURE 16 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET: BY TYPE, CAGR (2022-2029)

FIGURE 17 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET: BY TYPE, LIFELINE CURVE

FIGURE 18 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET: BY SYSTEM TYPE, 2021

FIGURE 19 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET: BY SYSTEM TYPE, 2022-2029 (USD MILLION)

FIGURE 20 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET: BY SYSTEM TYPE, CAGR (2022-2029)

FIGURE 21 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET: BY SYSTEM TYPE, LIFELINE CURVE

FIGURE 22 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET: BY PRESSURE, 2021

FIGURE 23 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET: BY PRESSURE, 2022-2029 (USD MILLION)

FIGURE 24 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET: BY PRESSURE, CAGR (2022-2029)

FIGURE 25 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET: BY PRESSURE, LIFELINE CURVE

FIGURE 26 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET: BY CONFIGURATION, 2021

FIGURE 27 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET: BY CONFIGURATION, 2022-2029 (USD MILLION)

FIGURE 28 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET: BY CONFIGURATION, CAGR (2022-2029)

FIGURE 29 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET: BY CONFIGURATION, LIFELINE CURVE

FIGURE 30 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET: BY APPLICATION, 2021

FIGURE 31 ASIA PACIFICPHARMACEUTICAL ISOLATOR MARKET: BY APPLICATION, 2022-2029 (USD MILLION)

FIGURE 32 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 33 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 34 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 35 ASIA PACIFICPHARMACEUTICAL ISOLATOR MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 36 ASIA PACIFICPHARMACEUTICAL ISOLATOR MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 37 ASIA PACIFICPHARMACEUTICAL ISOLATOR MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 38 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET : BY END USER, 2021

FIGURE 39 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET : BY END USER, 2022-2029 (USD MILLION)

FIGURE 40 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET : BY END USER, CAGR (2022-2029)

FIGURE 41 ASIA PACIFIC PHARMACEUTICAL ISOLATOR MARKET : BY END USER, LIFELINE CURVE

FIGURE 42 ASIA-PACIFIC PHARMACEUTICAL ISOLATOR MARKET: SNAPSHOT (2021)

FIGURE 43 ASIA-PACIFIC PHARMACEUTICAL ISOLATOR MARKET: BY COUNTRY (2021)

FIGURE 44 ASIA-PACIFIC PHARMACEUTICAL ISOLATOR MARKET: BY COUNTRY (2022 & 2029)

FIGURE 45 ASIA-PACIFIC PHARMACEUTICAL ISOLATOR MARKET: BY COUNTRY (2021 & 2029)

FIGURE 46 ASIA-PACIFIC PHARMACEUTICAL ISOLATOR MARKET: TYPE (2022-2029)

FIGURE 47 ASIA PACIFIC PHARMACEUTICAL ISOLATORS MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.