Marché de la lutte antiparasitaire pour le bétail en Asie-Pacifique, par méthode de contrôle ( chimique , biologique, mécanique, logiciels et services, et autres), mode d'application (sprays, poudre, granulés, pièges, appâts, et autres), type de ravageur (insectes, rongeurs, oiseaux, faune, reptiles, arachnides, termites, mollusques, et autres), utilisation finale (fermes bovines, fermes avicoles, fermes porcines, fermes ovines, fermes équestres, fermes caprines, résidentiel/ménager, et autres) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et taille du marché de la lutte antiparasitaire pour le bétail en Asie-Pacifique

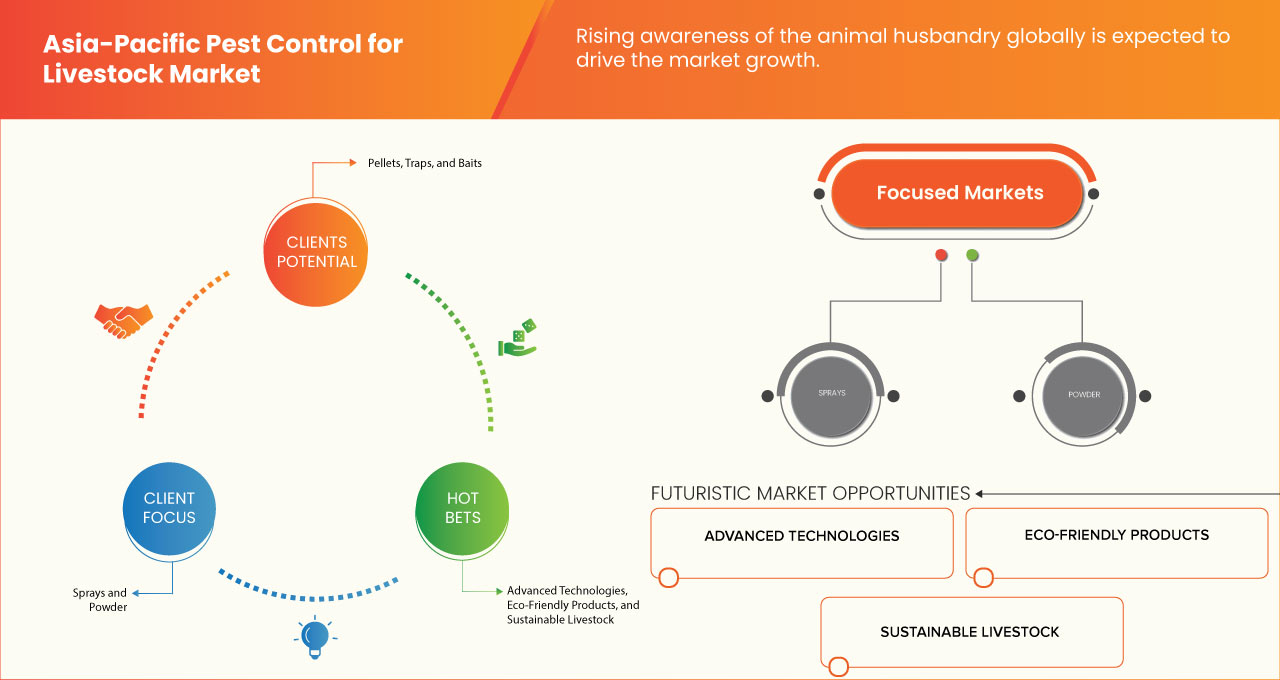

Le principal facteur à l’origine de la croissance du marché est la sensibilisation croissante à l’élevage, les initiatives gouvernementales visant à promouvoir la santé et le bien-être des animaux, la sensibilisation croissante aux approches de lutte antiparasitaire respectueuses de l’environnement constitueront une opportunité pour la croissance du marché.

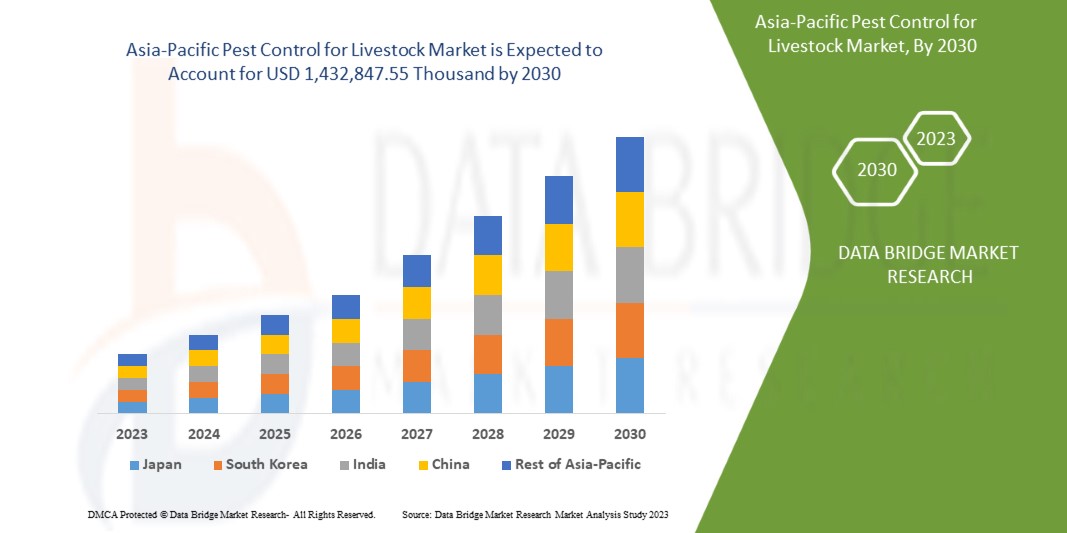

Le marché de la lutte antiparasitaire pour le bétail en Asie-Pacifique devrait connaître une croissance significative au cours de la période de prévision de 2023 à 2030. Data Bridge Market Research analyse que le marché croît avec un TCAC de 4,8 % au cours de la période de prévision de 2023 à 2030 et devrait atteindre 1 432 847,55 milliers de dollars d'ici 2030.

Le rapport sur le marché de la lutte antiparasitaire pour le bétail en Asie-Pacifique fournit des détails sur la part de marché, les nouveaux développements et l'impact des acteurs du marché national et local, analyse les opportunités en termes de poches de revenus émergentes, de changements dans la réglementation du marché, d'approbations de produits, de décisions stratégiques, de lancements de produits, d'expansions géographiques et d'innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché, contactez-nous pour un briefing d'analyste. Notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable de 2015 à 2020) |

|

Unités quantitatives |

Chiffre d'affaires en milliers de dollars américains |

|

Segments couverts |

Méthode de contrôle (chimique, biologique, mécanique, logiciels et services, et autres), mode d'application (sprays, poudre, granulés, pièges, appâts, et autres), type d'organisme nuisible (insectes, rongeurs, oiseaux, faune, reptiles, arachnides, termites, mollusques, et autres), utilisation finale (élevages de bovins, élevages de volailles, élevages de porcs, élevages de moutons, élevages de chevaux, élevages de chèvres, résidentiels/domestiques, et autres) |

|

Pays couverts |

Chine, Inde, Indonésie, Vietnam, Thaïlande, Japon, Malaisie, Philippines, Corée du Sud, Singapour, Australie, Nouvelle-Zélande, Taïwan, Hong Kong et reste de l'Asie-Pacifique |

|

Acteurs du marché couverts |

Elanco, BASF SE, Central Garden & Pet Company, Neogen Corporation, Vetoquinol, FMC Corporation, LANXESS et Bell Labs, entre autres |

Définition du marché

La lutte antiparasitaire pour le bétail fait référence à la gestion et à l'atténuation de divers ravageurs et parasites qui peuvent avoir un impact négatif sur la santé, le bien-être et la productivité des animaux domestiques, tels que les bovins, les moutons, les chèvres, les porcs, la volaille et d'autres animaux d'élevage. Ces ravageurs et parasites peuvent inclure des insectes, des tiques, des acariens, des vers et d'autres organismes qui peuvent provoquer des maladies, de l'inconfort et des pertes économiques dans l'industrie de l'élevage. L'objectif principal de la lutte antiparasitaire pour le bétail est de préserver la santé animale, d'améliorer leur bien-être et d'optimiser la productivité en gérant et en atténuant l'impact des ravageurs et des parasites.

Dynamique du marché de la lutte antiparasitaire pour le bétail en Asie-Pacifique

Cette section traite de la compréhension des moteurs, des opportunités, des défis et des contraintes du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Sensibilisation croissante à l'élevage

La demande croissante de viande, de lait et d'autres produits dérivés du bétail et de l'élevage est un élément crucial du système agricole dans le monde entier. Les infestations de mouches représentent de graves risques pour la santé des animaux, entraînant des maladies et une baisse de la productivité. Les experts travaillant dans l'élevage du monde entier sont de plus en plus conscients de l'importance d'une lutte efficace contre les nuisibles. L'industrie de la lutte antiparasitaire de la région Asie-Pacifique est stimulée par cette prise de conscience croissante, avec un accent particulier sur la lutte contre les problèmes liés aux mouches chez le bétail, en particulier les vaches et les chevaux.

La prise de conscience croissante de la nécessité d'une gestion efficace des nuisibles dans l'élevage, notamment en ce qui concerne les infestations de mouches chez les vaches et les chevaux, parmi les spécialistes de l'élevage du monde entier, constitue un moteur important pour le secteur de la lutte antiparasitaire en Asie-Pacifique. Ainsi, la prise de conscience croissante de l'élevage dans le monde entier devrait stimuler la croissance du marché.

- Demande croissante de produits laitiers

La demande de produits laitiers augmente en raison de facteurs tels que la croissance démographique, l'évolution des habitudes alimentaires et la connaissance croissante des bienfaits des produits laitiers pour la santé par les consommateurs. Cependant, le secteur bovin, qui est en charge de la production de produits laitiers, continue d'être confronté à des infestations de parasites, en particulier de mouches. En plus de causer des problèmes aux bovins, les mouches peuvent également affecter la qualité et la sécurité des produits laitiers. Le marché de la lutte antiparasitaire en Asie-Pacifique connaît donc une expansion rapide, avec une concentration sur la lutte contre les mouches chez les bovins en particulier.

La demande croissante de produits laitiers dans le monde entier constitue un moteur de marché important pour la lutte antiparasitaire, notamment en ce qui concerne la gestion des mouches dans le bétail. L'industrie de l'élevage doit trouver un moyen pratique de contrôler les infestations de mouches, car les gens du monde entier continuent d'apprécier les avantages nutritionnels des produits laitiers et d'inclure ces aliments dans leur régime alimentaire.

Opportunité

- Sensibilisation accrue aux approches de lutte antiparasitaire respectueuses de l'environnement

L'industrie de l'élevage est confrontée à un défi croissant dans la lutte contre les nuisibles, en particulier les mouches, qui peuvent nuire au bien-être et à la productivité des animaux. Les méthodes conventionnelles de lutte contre les nuisibles impliquent souvent l'utilisation d'insecticides chimiques, qui peuvent avoir des conséquences environnementales et sanitaires. Cependant, une opportunité importante émerge sur le marché de la lutte contre les nuisibles dans la région Asie-Pacifique en raison de l'enthousiasme croissant pour les approches de lutte contre les nuisibles respectueuses de l'environnement.

Les éleveurs et les consommateurs sont de plus en plus conscients de l’impact environnemental des méthodes de lutte contre les nuisibles. L’utilisation d’insecticides chimiques peut entraîner une contamination des sols et des eaux, nuire aux espèces non ciblées et favoriser la résistance aux pesticides. Cette prise de conscience accrue entraîne une demande d’alternatives plus respectueuses de l’environnement.

Contraintes/Défis

- Adaptabilité des mouches aux méthodes de lutte conventionnelles

La lutte contre les mouches nuisibles dans le domaine de la gestion du bétail est une lutte constante pour les agriculteurs et les éleveurs du monde entier. En plus de gêner les animaux, les mouches posent de graves problèmes de santé car elles peuvent propager des maladies et réduire la productivité du bétail. Différentes stratégies de lutte contre les nuisibles, notamment des traitements chimiques, biologiques et physiques, ont été développées pour résoudre ce problème. Cependant, la résistance et l'adaptabilité extraordinaires des mouches aux mesures de contrôle conventionnelles constituent un obstacle majeur sur le marché de la lutte contre les nuisibles dans le bétail en Asie-Pacifique.

Les fabricants et les éleveurs doivent s'adapter à ces défis en adoptant des stratégies de lutte intégrée contre les ravageurs et en explorant les technologies émergentes pour assurer la santé et le bien-être du bétail et la durabilité de l'industrie. Ainsi, l'adaptabilité des mouches aux méthodes de lutte conventionnelles devrait freiner la croissance du marché au cours de la période de prévision.

- Préoccupations environnementales liées aux pesticides chimiques

Les infestations de mouches sont confrontées à un défi de taille en raison des préoccupations environnementales croissantes liées aux pesticides chimiques. Ces préoccupations sont motivées par l'impact écologique reconnu de ces pesticides. De nombreux pesticides conventionnels utilisés pour lutter contre les mouches et autres nuisibles contiennent des produits chimiques toxiques qui peuvent persister dans l'environnement, nuisant à des espèces non ciblées telles que les insectes utiles, les organismes aquatiques et même la faune sauvage. Par exemple, l'utilisation de pesticides organophosphorés peut entraîner la contamination des plans d'eau, affectant ainsi les écosystèmes aquatiques.

En conclusion, les préoccupations environnementales liées aux pesticides chimiques représentent un défi de taille pour la lutte antiparasitaire sur le marché du bétail en Asie-Pacifique. Ces défis englobent l'impact écologique, la sécurité alimentaire, la résistance aux pesticides, la contamination des sols et de l'eau et la conformité réglementaire. Pour répondre à ces préoccupations, il faut adopter des pratiques de lutte antiparasitaire durables et respectueuses de l'environnement, ce qui présente à la fois des défis et des opportunités pour l'industrie. Par conséquent, il est prévu que les préoccupations environnementales liées aux pesticides chimiques pourraient entraver l'expansion du marché.

Développements récents

- En septembre 2022, la National Pest Management Association (NPMA) a annoncé que McLaughlin Gormley King Company avait rejoint l'organisation en tant que partenaire stratégique. McLaughlin Gormley King Company a joué un rôle crucial dans l'innovation du secteur en tant que pionnier dans la fourniture de solutions de lutte antiparasitaire sûres et efficaces à base de plantes et de synthèse. Cela permet à l'organisation de chérir son lien de longue date et d'assurer l'avenir du secteur professionnel de la lutte antiparasitaire.

- En juin 2022, Neogen Corporation a élargi sa gamme de produits Prozap avec une nouvelle option de lutte antiparasitaire pour les éleveurs de volailles. Prozap Gamma-Defense est un pesticide microencapsulé à libération lente utilisé pour éliminer les coléoptères de la litière, les mouches, les puces, les tiques et d'autres parasites spécifiés dans et autour des poulaillers et autres bâtiments et structures pour animaux. Cela a permis à l'entreprise d'augmenter sa production et d'augmenter ses revenus.

- En avril 2022, Neogen Corporation a annoncé l'ajout d'un nouveau produit à sa célèbre gamme de produits de lutte contre les insectes Prozap. L'insecticide à verser Prozap Protectus - IGR est un mélange triplement actif prêt à l'emploi qui tue les poux broyeurs et suceurs, les mouches des cornes, les mouches des étables, les mouches des chevaux et des cerfs et d'autres insectes sur les bovins et les veaux. La solution est développée avec un mélange unique de produits chimiques actifs, dont un régulateur de croissance des insectes (IGR), un adulticide et un synergiste, qui soulage les infestations et détruit les œufs de poux avant leur éclosion, permettant ainsi de lutter contre les poux tout au long de la saison en un seul traitement. Cette composition de produit innovante a aidé l'organisation à gagner plus de clients.

- En mars 2022, Elanco a annoncé la croissance de son empreinte de valeur partagée à travers l'Afrique subsaharienne, réalisant ainsi son objectif 2030 de générer des solutions de développement durable pour les communautés dépendantes de l'élevage. Elanco fournit aux éleveurs locaux une gamme complète d'acaricides en petits conditionnements bon marché, ainsi que des connaissances en matière de lutte contre les tiques. Elanco avait l'intention de livrer sa gamme complète de produits pour le bétail et la volaille au Nigéria, entrant ainsi sur un nouveau marché.

- En avril 2021, le groupe français Theseo, fabricant majeur de produits de santé animale et de biosécurité, a été acquis par LANXESS. LANXESS élargit considérablement son portefeuille de produits pour le secteur en pleine croissance de l'élevage, offrant actuellement une gamme complète de solutions de désinfection et d'hygiène.

Champ d'application du marché de la lutte antiparasitaire pour le bétail en Asie-Pacifique

Le marché de la lutte antiparasitaire pour le bétail en Asie-Pacifique est classé en fonction de la méthode de lutte, du mode d'application, du type d'organisme nuisible et de l'utilisation finale. La croissance de ces segments vous aidera à analyser les principaux segments de croissance des industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Méthode de contrôle

- Chimique

- Biologique

- Mécanique

- Logiciels et services

- Autres

Sur la base de la méthode de contrôle, le marché est segmenté en produits chimiques, biologiques, mécaniques, logiciels et services, et autres.

Mode d'application

- Sprays

- Poudre

- Granulés

- Pièges

- Appâts

- Autres

Sur la base du mode d'application, le marché est segmenté en sprays, poudres, granulés, pièges, appâts et autres.

Type de ravageur

- Insectes

- Rongeurs

- Oiseaux

- Faune

- Reptiles

- Arachnides

- Termite

- Mollusques

- Autres

Sur la base du type de ravageur, le marché est segmenté en insectes, rongeurs, oiseaux, animaux sauvages, reptiles, arachnides, termites, mollusques et autres.

Utilisation finale

- Fermes d'élevage

- Fermes avicoles

- Élevage de porcs

- Fermes d'élevage de moutons

- Fermes équestres

- Fermes d'élevage de chèvres

- Résidentiel / Ménage

- Autres

Sur la base de l'utilisation finale, le marché est segmenté en fermes avicoles, fermes bovines, fermes ovines, fermes caprines, fermes équestres, fermes porcines, résidentielles/domestiques et autres.

Analyse/perspectives régionales du marché de la lutte antiparasitaire pour le bétail en Asie-Pacifique

Le marché de la lutte antiparasitaire pour le bétail en Asie-Pacifique est segmenté en fonction de la méthode de contrôle, du mode d'application, du type de parasite et de l'utilisation finale.

Les pays couverts par le marché de la lutte antiparasitaire pour le bétail en Asie-Pacifique sont la Chine, l'Inde, l'Indonésie, le Vietnam, la Thaïlande, le Japon, la Malaisie, les Philippines, la Corée du Sud, Singapour, l'Australie, la Nouvelle-Zélande, Taïwan, Hong Kong et le reste de l'Asie-Pacifique.

La Chine devrait dominer le marché de la lutte antiparasitaire pour le bétail en Asie-Pacifique en raison de l'importante population de bétail et des préoccupations croissantes concernant les parasites.

La section pays du rapport fournit également des facteurs individuels d'impact sur le marché et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. L'analyse des points de données en aval et en amont de la chaîne de valeur, l'analyse des tendances techniques des cinq forces de Porter et les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques d'Asie-Pacifique et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et régionales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché de la lutte antiparasitaire pour le bétail en Asie-Pacifique

Le paysage concurrentiel du marché de la lutte antiparasitaire pour le bétail en Asie-Pacifique fournit des détails par concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et l'ampleur du produit, la domination de l'utilisation finale, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises par rapport au marché.

Certains des principaux acteurs du marché opérant sur le marché sont Elanco, BASF SE, Central Garden & Pet Company, Neogen Corporation, Vetoquinol, FMC Corporation, LANXESS et Bell Labs, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE ASIA-PACIFIC PEST CONTROL FOR LIVESTOCK MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET END USE COVERAGE GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING AWARENESS OF ANIMAL HUSBANDRY

5.1.2 GOVERNMENT INITIATIVES TO PROMOTE ANIMAL HEALTH AND WELFARE

5.1.3 INCREASING DEMAND FOR DAIRY ITEMS

5.2 RESTRAINTS

5.2.1 ADAPTABILITY OF FLIES TO CONVENTIONAL CONTROL METHODS

5.2.2 HIGH MAINTENANCE COST ASSOCIATED WITH PEST CONTROL

5.3 OPPORTUNITIES

5.3.1 INCREASING AWARENESS OF ENVIRONMENTALLY SUSTAINABLE PEST CONTROL APPROACHES

5.3.2 RISING ADVANCEMENTS IN PEST CONTROL

5.4 CHALLENGE

5.4.1 CREATION AND ADOPTION OF ENVIRONMENT-FRIENDLY PEST CONTROL SOLUTIONS

6 ASIA-PACIFIC PEST CONTROL FOR LIVESTOCK MARKET, BY CONTROL METHOD

6.1 OVERVIEW

6.2 CHEMICAL

6.2.1 CHEMICAL, BY TYPE

6.2.1.1 INSECTICIDES

6.2.1.2 RODENTICIDES

6.2.1.3 OTHERS

6.3 BIOLOGICAL

6.3.1 BIOLOGICAL, BY TYPE

6.3.1.1 PREDATORY INSECTS

6.3.1.2 MICROBIAL

6.3.1.3 PLANT-EXTRACTS

6.3.1.4 OTHERS

6.4 MECHANICAL

6.4.1 MECHANICAL, BY TYPE

6.4.1.1 TRAPS

6.4.1.2 MESH SCREENS

6.4.1.3 LIGHT TRAPS

6.4.1.4 ADHESIVE TRAPS

6.4.1.5 ULTRASONIC VIBRATIONS

6.4.1.6 UV RADIATION DEVICES

6.4.1.7 MALAISE TRAPS

6.4.1.8 OTHERS

6.5 SOFTWARE & SERVICES

6.6 OTHERS

7 ASIA-PACIFIC PEST CONTROL FOR LIVESTOCK MARKET, BY PEST TYPE

7.1 OVERVIEW

7.2 INSECTS

7.2.1 INSECTS, BY TYPE

7.2.1.1 FLY

7.2.1.1.1 FLY, BY FLY CONTROL PRODUCTS TYPE

7.2.1.1.1.1 FLY SPRAYS

7.2.1.1.1.2 FLY TRAPS

7.2.1.1.1.3 FLY BAITS

7.2.1.1.1.4 FLY REPELLENTS

7.2.1.1.1.5 FLY CONTROL ACCESSORIES

7.2.1.1.1.6 FLY LIGHT

7.2.1.1.1.7 FLY KILLER DEVICES

7.2.1.1.1.8 FLY BAGS

7.2.1.1.1.9 OTHERS

7.2.1.1.2 FLY, BY TYPE

7.2.1.1.2.1 STABLE FLY

7.2.1.1.2.2 HORN FLY

7.2.1.1.2.3 HOUSE FLY

7.2.1.1.2.4 FACE FLY

7.2.1.1.2.5 HORSE FLIES

7.2.1.1.2.6 DEER FLY

7.2.1.1.2.7 INVASIVE FLIES

7.2.1.1.2.8 BITING FLIES

7.2.1.1.2.9 NONBITING FLIES

7.2.1.2 LICE

7.2.1.2.1 LICE, BY TYPE

7.2.1.2.1.1 BITING LICE

7.2.1.2.1.2 SUCKING LICE

7.2.1.3 COCKROACHES

7.2.1.4 BEDBUGS

7.2.1.5 MOSQUITOS

7.2.1.6 ANTS

7.2.1.7 BEES AND WASPS

7.2.1.8 OTHERS

7.3 RODENTS

7.4 BIRDS

7.5 WILDLIFE

7.5.1 WILDLIFE, BY TYPE

7.5.1.1 RACCOONS

7.5.1.2 SQUIRRELS

7.5.1.3 OPOSSUMS

7.5.1.4 BATS

7.5.1.5 CHIPMUNKS

7.5.1.6 MOLES

7.5.1.7 OTHERS

7.6 REPTILES

7.7 ARACHNIDA

7.7.1 ARACHNIDA, BY TYPE

7.7.1.1 TICKS

7.7.1.1.1 TICKS, BY TYPE

7.7.1.1.1.1 CATTLE FEVER TICK

7.7.1.1.1.2 LONE STAR TICK

7.7.1.1.1.3 GULF COAST TICK

7.7.1.1.1.4 AMERICAN DOG TICK

7.7.1.1.1.5 SPINOSE EAR TICK

7.7.1.2 MITES

7.7.2 OTHERS

7.8 TERMITE

7.9 MOLLUSKS

7.1 OTHERS

8 ASIA-PACIFIC PEST CONTROL FOR LIVESTOCK MARKET, BY MODE OF APPLICATION

8.1 OVERVIEW

8.2 SPRAYS

8.3 POWDER

8.4 PELLETS

8.5 TRAPS

8.6 BAITS

8.7 OTHERS

9 ASIA-PACIFIC PEST CONTROL FOR LIVESTOCK MARKET, BY END USE

9.1 OVERVIEW

9.2 CATTLE FARMS

9.3 POULTRY FARMS

9.4 PIG FARMS

9.5 SHEEP FARMS

9.6 HORSE FARMS

9.7 GOAT FARMS

9.8 RESIDENTIAL / HOUSEHOLD

9.9 OTHERS

10 ASIA-PACIFIC PEST CONTROL FOR LIVESTOCK MARKET, BY COUNTRY

10.1 ASIA-PACIFIC

10.1.1 CHINA

10.1.2 INDIA

10.1.3 INDONESIA

10.1.4 VIETNAM

10.1.5 THAILAND

10.1.6 JAPAN

10.1.7 MALAYSIA

10.1.8 PHILIPPINES

10.1.9 SOUTH KOREA

10.1.10 SINGAPORE

10.1.11 AUSTRALIA

10.1.12 NEW ZEALAND

10.1.13 TAIWAN

10.1.14 HONG KONG

10.1.15 REST OF ASIA-PACIFIC

11 ASIA-PACIFIC PEST CONTROL FOR LIVESTOCK MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

12 COMPANY PROFILES

12.1 ELANCO

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 PRODUCT PORTFOLIO

12.1.4 RECENT DEVELOPMENT

12.2 BASF SE

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 PRODUCT PORTFOLIO

12.2.4 RECENT DEVELOPMENT

12.3 FMC CORPORATION

12.3.1 COMPANY SNAPSHOT

12.3.2 REVENUE ANALYSIS

12.3.3 PRODUCT PORTFOLIO

12.3.4 RECENT DEVELOPMENT

12.4 LANXESS

12.4.1 COMPANY SNAPSHOT

12.4.2 REVENUE ANALYSIS

12.4.3 PRODUCT PORTFOLIO

12.4.4 RECENT DEVELOPMENT

12.5 CENTRAL GARDEN & PET COMPANY

12.5.1 COMPANY SNAPSHOT

12.5.2 REVENUE ANALYSIS

12.5.3 PRODUCT PORTFOLIO

12.5.4 RECENT DEVELOPMENT

12.6 BELL LABS.

12.6.1 COMPANY SNAPSHOT

12.6.2 PRODUCT PORTFOLIO

12.6.3 RECENT DEVELOPMENT

12.7 NEOGEN CORPORATION

12.7.1 COMPANY SNAPSHOT

12.7.2 REVENUE ANALYSIS

12.7.3 PRODUCT PORTFOLIO

12.7.4 RECENT DEVELOPMENTS

12.8 VETOQUINOL

12.8.1 COMPANY SNAPSHOT

12.8.2 REVENUE ANALYSIS

12.8.3 PRODUCT PORTFOLIO

12.8.4 RECENT DEVELOPMENT

13 QUESTIONNAIRE

14 RELATED REPORTS

Liste des tableaux

TABLE 1 ASIA-PACIFIC PEST CONTROL FOR LIVESTOCK MARKET, BY CONTROL METHOD, 2021-2030 (USD THOUSAND)

TABLE 2 ASIA-PACIFIC CHEMICAL IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 3 ASIA-PACIFIC MECHANICAL IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 4 ASIA-PACIFIC PEST CONTROL FOR LIVESTOCK MARKET, BY PEST TYPE, 2021-2030 (USD THOUSAND)

TABLE 5 ASIA-PACIFIC INSECTS IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 6 ASIA-PACIFIC FLY IN PEST CONTROL FOR LIVESTOCK MARKET, BY FLY CONTROL PRODUCTS TYPE, 2021-2030 (USD THOUSAND)

TABLE 7 ASIA-PACIFIC FLY IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 8 ASIA-PACIFIC LICE IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 9 ASIA-PACIFIC WILDLIFE IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 10 ASIA-PACIFIC ARACHNIDA IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 11 ASIA-PACIFIC TICKS IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 12 ASIA-PACIFIC PEST CONTROL FOR LIVESTOCK MARKET, BY MODE OF APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 13 ASIA-PACIFIC PEST CONTROL FOR LIVESTOCK MARKET, BY END USE, 2021-2030 (USD THOUSAND)

TABLE 14 ASIA-PACIFIC PEST CONTROL FOR LIVESTOCK MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 15 CHINA PEST CONTROL FOR LIVESTOCK MARKET, BY CONTROL METHOD, 2021-2030 (USD THOUSAND)

TABLE 16 CHINA CHEMICAL IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 17 CHINA BIOLOGICAL IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 18 CHINA MECHANICAL IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 19 CHINA PEST CONTROL FOR LIVESTOCK MARKET, BY MODE OF APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 20 CHINA PEST CONTROL FOR LIVESTOCK MARKET, BY PEST TYPE, 2021-2030 (USD THOUSAND)

TABLE 21 CHINA INSECTS IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 22 CHINA FLY IN PEST CONTROL FOR LIVESTOCK MARKET, BY FLY CONTROL PRODUCTS TYPE, 2021-2030 (USD THOUSAND)

TABLE 23 CHINA FLY IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 24 CHINA LICE IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 25 CHINA WILDLIFE IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 26 CHINA ARACHNIDA IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 27 CHINA TICKS IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 28 CHINA PEST CONTROL FOR LIVESTOCK MARKET, BY END USE, 2021-2030 (USD THOUSAND)

TABLE 29 INDIA PEST CONTROL FOR LIVESTOCK MARKET, BY CONTROL METHOD, 2021-2030 (USD THOUSAND)

TABLE 30 INDIA CHEMICAL IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 31 INDIA BIOLOGICAL IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 32 INDIA MECHANICAL IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 33 INDIA PEST CONTROL FOR LIVESTOCK MARKET, BY MODE OF APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 34 INDIA PEST CONTROL FOR LIVESTOCK MARKET, BY PEST TYPE, 2021-2030 (USD THOUSAND)

TABLE 35 INDIA INSECTS IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 36 INDIA FLY IN PEST CONTROL FOR LIVESTOCK MARKET, BY FLY CONTROL PRODUCTS TYPE, 2021-2030 (USD THOUSAND)

TABLE 37 INDIA FLY IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 38 INDIA LICE IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 39 INDIA WILDLIFE IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 40 INDIA ARACHNIDA IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 41 INDIA TICKS IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 42 INDIA PEST CONTROL FOR LIVESTOCK MARKET, BY END USE, 2021-2030 (USD THOUSAND)

TABLE 43 INDONESIA PEST CONTROL FOR LIVESTOCK MARKET, BY CONTROL METHOD, 2021-2030 (USD THOUSAND)

TABLE 44 INDONESIA CHEMICAL IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 45 INDONESIA BIOLOGICAL IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 46 INDONESIA MECHANICAL IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 47 INDONESIA PEST CONTROL FOR LIVESTOCK MARKET, BY MODE OF APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 48 INDONESIA PEST CONTROL FOR LIVESTOCK MARKET, BY PEST TYPE, 2021-2030 (USD THOUSAND)

TABLE 49 INDONESIA INSECTS IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 50 INDONESIA FLY IN PEST CONTROL FOR LIVESTOCK MARKET, BY FLY CONTROL PRODUCTS TYPE, 2021-2030 (USD THOUSAND)

TABLE 51 INDONESIA FLY IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 52 INDONESIA LICE IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 53 INDONESIA WILDLIFE IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 54 INDONESIA ARACHNIDA IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 55 INDONESIA TICKS IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 56 INDONESIA PEST CONTROL FOR LIVESTOCK MARKET, BY END USE, 2021-2030 (USD THOUSAND)

TABLE 57 VIETNAM PEST CONTROL FOR LIVESTOCK MARKET, BY CONTROL METHOD, 2021-2030 (USD THOUSAND)

TABLE 58 VIETNAM CHEMICAL IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 59 VIETNAM BIOLOGICAL IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 60 VIETNAM MECHANICAL IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 61 VIETNAM PEST CONTROL FOR LIVESTOCK MARKET, BY MODE OF APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 62 VIETNAM PEST CONTROL FOR LIVESTOCK MARKET, BY PEST TYPE, 2021-2030 (USD THOUSAND)

TABLE 63 VIETNAM INSECTS IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 64 VIETNAM FLY IN PEST CONTROL FOR LIVESTOCK MARKET, BY FLY CONTROL PRODUCTS TYPE, 2021-2030 (USD THOUSAND)

TABLE 65 VIETNAM FLY IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 66 VIETNAM LICE IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 67 VIETNAM WILDLIFE IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 68 VIETNAM ARACHNIDA IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 69 VIETNAM TICKS IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 70 VIETNAM PEST CONTROL FOR LIVESTOCK MARKET, BY END USE, 2021-2030 (USD THOUSAND)

TABLE 71 THAILAND PEST CONTROL FOR LIVESTOCK MARKET, BY CONTROL METHOD, 2021-2030 (USD THOUSAND)

TABLE 72 THAILAND CHEMICAL IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 73 THAILAND BIOLOGICAL IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 74 THAILAND MECHANICAL IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 75 THAILAND PEST CONTROL FOR LIVESTOCK MARKET, BY MODE OF APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 76 THAILAND PEST CONTROL FOR LIVESTOCK MARKET, BY PEST TYPE, 2021-2030 (USD THOUSAND)

TABLE 77 THAILAND INSECTS IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 78 THAILAND FLY IN PEST CONTROL FOR LIVESTOCK MARKET, BY FLY CONTROL PRODUCTS TYPE, 2021-2030 (USD THOUSAND)

TABLE 79 THAILAND FLY IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 80 THAILAND LICE IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 81 THAILAND WILDLIFE IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 82 THAILAND ARACHNIDA IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 83 THAILAND TICKS IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 84 THAILAND PEST CONTROL FOR LIVESTOCK MARKET, BY END USE, 2021-2030 (USD THOUSAND)

TABLE 85 JAPAN PEST CONTROL FOR LIVESTOCK MARKET, BY CONTROL METHOD, 2021-2030 (USD THOUSAND)

TABLE 86 JAPAN CHEMICAL IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 87 JAPAN BIOLOGICAL IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 88 JAPAN MECHANICAL IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 89 JAPAN PEST CONTROL FOR LIVESTOCK MARKET, BY MODE OF APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 90 JAPAN PEST CONTROL FOR LIVESTOCK MARKET, BY PEST TYPE, 2021-2030 (USD THOUSAND)

TABLE 91 JAPAN INSECTS IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 92 JAPAN FLY IN PEST CONTROL FOR LIVESTOCK MARKET, BY FLY CONTROL PRODUCTS TYPE, 2021-2030 (USD THOUSAND)

TABLE 93 JAPAN FLY IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 94 JAPAN LICE IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 95 JAPAN WILDLIFE IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 96 JAPAN ARACHNIDA IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 97 JAPAN TICKS IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 98 JAPAN PEST CONTROL FOR LIVESTOCK MARKET, BY END USE, 2021-2030 (USD THOUSAND)

TABLE 99 MALAYSIA PEST CONTROL FOR LIVESTOCK MARKET, BY CONTROL METHOD, 2021-2030 (USD THOUSAND)

TABLE 100 MALAYSIA CHEMICAL IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 101 MALAYSIA BIOLOGICAL IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 102 MALAYSIA MECHANICAL IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 103 MALAYSIA PEST CONTROL FOR LIVESTOCK MARKET, BY MODE OF APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 104 MALAYSIA PEST CONTROL FOR LIVESTOCK MARKET, BY PEST TYPE, 2021-2030 (USD THOUSAND)

TABLE 105 MALAYSIA INSECTS IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 106 MALAYSIA FLY IN PEST CONTROL FOR LIVESTOCK MARKET, BY FLY CONTROL PRODUCTS TYPE, 2021-2030 (USD THOUSAND)

TABLE 107 MALAYSIA FLY IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 108 MALAYSIA LICE IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 109 MALAYSIA WILDLIFE IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 110 MALAYSIA ARACHNIDA IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 111 MALAYSIA TICKS IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 112 MALAYSIA PEST CONTROL FOR LIVESTOCK MARKET, BY END USE, 2021-2030 (USD THOUSAND)

TABLE 113 PHILIPPINES PEST CONTROL FOR LIVESTOCK MARKET, BY CONTROL METHOD, 2021-2030 (USD THOUSAND)

TABLE 114 PHILIPPINES CHEMICAL IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 115 PHILIPPINES BIOLOGICAL IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 116 PHILIPPINES MECHANICAL IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 117 PHILIPPINES PEST CONTROL FOR LIVESTOCK MARKET, BY MODE OF APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 118 PHILIPPINES PEST CONTROL FOR LIVESTOCK MARKET, BY PEST TYPE, 2021-2030 (USD THOUSAND)

TABLE 119 PHILIPPINES INSECTS IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 120 PHILIPPINES FLY IN PEST CONTROL FOR LIVESTOCK MARKET, BY FLY CONTROL PRODUCTS TYPE, 2021-2030 (USD THOUSAND)

TABLE 121 PHILIPPINES FLY IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 122 PHILIPPINES LICE IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 123 PHILIPPINES WILDLIFE IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 124 PHILIPPINES ARACHNIDA IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 125 PHILIPPINES TICKS IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 126 PHILIPPINES PEST CONTROL FOR LIVESTOCK MARKET, BY END USE, 2021-2030 (USD THOUSAND)

TABLE 127 SOUTH KOREA PEST CONTROL FOR LIVESTOCK MARKET, BY CONTROL METHOD, 2021-2030 (USD THOUSAND)

TABLE 128 SOUTH KOREA CHEMICAL IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 129 SOUTH KOREA BIOLOGICAL IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 130 SOUTH KOREA MECHANICAL IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 131 SOUTH KOREA PEST CONTROL FOR LIVESTOCK MARKET, BY MODE OF APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 132 SOUTH KOREA PEST CONTROL FOR LIVESTOCK MARKET, BY PEST TYPE, 2021-2030 (USD THOUSAND)

TABLE 133 SOUTH KOREA INSECTS IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 134 SOUTH KOREA FLY IN PEST CONTROL FOR LIVESTOCK MARKET, BY FLY CONTROL PRODUCTS TYPE, 2021-2030 (USD THOUSAND)

TABLE 135 SOUTH KOREA FLY IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 136 SOUTH KOREA LICE IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 137 SOUTH KOREA WILDLIFE IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 138 SOUTH KOREA ARACHNIDA IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 139 SOUTH KOREA TICKS IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 140 SOUTH KOREA PEST CONTROL FOR LIVESTOCK MARKET, BY END USE, 2021-2030 (USD THOUSAND)

TABLE 141 SINGAPORE PEST CONTROL FOR LIVESTOCK MARKET, BY CONTROL METHOD, 2021-2030 (USD THOUSAND)

TABLE 142 SINGAPORE CHEMICAL IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 143 SINGAPORE BIOLOGICAL IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 144 SINGAPORE MECHANICAL IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 145 SINGAPORE PEST CONTROL FOR LIVESTOCK MARKET, BY MODE OF APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 146 SINGAPORE PEST CONTROL FOR LIVESTOCK MARKET, BY PEST TYPE, 2021-2030 (USD THOUSAND)

TABLE 147 SINGAPORE INSECTS IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 148 SINGAPORE FLY IN PEST CONTROL FOR LIVESTOCK MARKET, BY FLY CONTROL PRODUCTS TYPE, 2021-2030 (USD THOUSAND)

TABLE 149 SINGAPORE FLY IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 150 SINGAPORE LICE IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 151 SINGAPORE WILDLIFE IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 152 SINGAPORE ARACHNIDA IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 153 SINGAPORE TICKS IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 154 SINGAPORE PEST CONTROL FOR LIVESTOCK MARKET, BY END USE, 2021-2030 (USD THOUSAND)

TABLE 155 AUSTRALIA PEST CONTROL FOR LIVESTOCK MARKET, BY CONTROL METHOD, 2021-2030 (USD THOUSAND)

TABLE 156 AUSTRALIA CHEMICAL IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 157 AUSTRALIA BIOLOGICAL IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 158 AUSTRALIA MECHANICAL IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 159 AUSTRALIA PEST CONTROL FOR LIVESTOCK MARKET, BY MODE OF APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 160 AUSTRALIA PEST CONTROL FOR LIVESTOCK MARKET, BY PEST TYPE, 2021-2030 (USD THOUSAND)

TABLE 161 AUSTRALIA INSECTS IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 162 AUSTRALIA FLY IN PEST CONTROL FOR LIVESTOCK MARKET, BY FLY CONTROL PRODUCTS TYPE, 2021-2030 (USD THOUSAND)

TABLE 163 AUSTRALIA FLY IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 164 AUSTRALIA LICE IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 165 AUSTRALIA WILDLIFE IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 166 AUSTRALIA ARACHNIDA IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 167 AUSTRALIA TICKS IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 168 AUSTRALIA PEST CONTROL FOR LIVESTOCK MARKET, BY END USE, 2021-2030 (USD THOUSAND)

TABLE 169 NEW ZEALAND PEST CONTROL FOR LIVESTOCK MARKET, BY CONTROL METHOD, 2021-2030 (USD THOUSAND)

TABLE 170 NEW ZEALAND CHEMICAL IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 171 NEW ZEALAND BIOLOGICAL IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 172 NEW ZEALAND MECHANICAL IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 173 NEW ZEALAND PEST CONTROL FOR LIVESTOCK MARKET, BY MODE OF APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 174 NEW ZEALAND PEST CONTROL FOR LIVESTOCK MARKET, BY PEST TYPE, 2021-2030 (USD THOUSAND)

TABLE 175 NEW ZEALAND INSECTS IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 176 NEW ZEALAND FLY IN PEST CONTROL FOR LIVESTOCK MARKET, BY FLY CONTROL PRODUCTS TYPE, 2021-2030 (USD THOUSAND)

TABLE 177 NEW ZEALAND FLY IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 178 NEW ZEALAND LICE IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 179 NEW ZEALAND WILDLIFE IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 180 NEW ZEALAND ARACHNIDA IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 181 NEW ZEALAND TICKS IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 182 NEW ZEALAND PEST CONTROL FOR LIVESTOCK MARKET, BY END USE, 2021-2030 (USD THOUSAND)

TABLE 183 TAIWAN PEST CONTROL FOR LIVESTOCK MARKET, BY CONTROL METHOD, 2021-2030 (USD THOUSAND)

TABLE 184 TAIWAN CHEMICAL IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 185 TAIWAN BIOLOGICAL IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 186 TAIWAN MECHANICAL IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 187 TAIWAN PEST CONTROL FOR LIVESTOCK MARKET, BY MODE OF APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 188 TAIWAN PEST CONTROL FOR LIVESTOCK MARKET, BY PEST TYPE, 2021-2030 (USD THOUSAND)

TABLE 189 TAIWAN INSECTS IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 190 TAIWAN FLY IN PEST CONTROL FOR LIVESTOCK MARKET, BY FLY CONTROL PRODUCTS TYPE, 2021-2030 (USD THOUSAND)

TABLE 191 TAIWAN FLY IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 192 TAIWAN LICE IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 193 TAIWAN WILDLIFE IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 194 TAIWAN ARACHNIDA IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 195 TAIWAN TICKS IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 196 TAIWAN PEST CONTROL FOR LIVESTOCK MARKET, BY END USE, 2021-2030 (USD THOUSAND)

TABLE 197 HONG KONG PEST CONTROL FOR LIVESTOCK MARKET, BY CONTROL METHOD, 2021-2030 (USD THOUSAND)

TABLE 198 HONG KONG CHEMICAL IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 199 HONG KONG BIOLOGICAL IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 200 HONG KONG MECHANICAL IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 201 HONG KONG PEST CONTROL FOR LIVESTOCK MARKET, BY MODE OF APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 202 HONG KONG PEST CONTROL FOR LIVESTOCK MARKET, BY PEST TYPE, 2021-2030 (USD THOUSAND)

TABLE 203 HONG KONG INSECTS IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 204 HONG KONG FLY IN PEST CONTROL FOR LIVESTOCK MARKET, BY FLY CONTROL PRODUCTS TYPE, 2021-2030 (USD THOUSAND)

TABLE 205 HONG KONG FLY IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 206 HONG KONG LICE IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 207 HONG KONG WILDLIFE IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 208 HONG KONG ARACHNIDA IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 209 HONG KONG TICKS IN PEST CONTROL FOR LIVESTOCK MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 210 HONG KONG PEST CONTROL FOR LIVESTOCK MARKET, BY END USE, 2021-2030 (USD THOUSAND)

TABLE 211 REST OF ASIA-PACIFIC PEST CONTROL FOR LIVESTOCK MARKET, BY CONTROL METHOD, 2021-2030 (USD THOUSAND)

Liste des figures

FIGURE 1 ASIA-PACIFIC PEST CONTROL FOR LIVESTOCK MARKET: SEGMENTATION

FIGURE 2 ASIA-PACIFIC PEST CONTROL FOR LIVESTOCK MARKET: DATA TRIANGULATION

FIGURE 3 ASIA-PACIFIC PEST CONTROL FOR LIVESTOCK MARKET: DROC ANALYSIS

FIGURE 4 ASIA-PACIFIC PEST CONTROL FOR LIVESTOCK MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 ASIA-PACIFIC PEST CONTROL FOR LIVESTOCK MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA-PACIFIC PEST CONTROL FOR LIVESTOCK MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA-PACIFIC PEST CONTROL FOR LIVESTOCK MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA-PACIFIC PEST CONTROL FOR LIVESTOCK MARKET: MARKET END USE COVERAGE GRID

FIGURE 9 ASIA-PACIFIC PEST CONTROL FOR LIVESTOCK MARKET: SEGMENTATION

FIGURE 10 RISING AWARENESS REGARDING ANIMAL HUSBANDRY IS DRIVING THE GROWTH OF THE ASIA-PACIFIC PEST CONTROL FOR LIVESTOCK MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 11 CHEMICAL SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA-PACIFIC PEST CONTROL FOR LIVESTOCK MARKET IN 2023 AND 2030

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA-PACIFIC PEST CONTROL FOR LIVESTOCK MARKET

FIGURE 13 ASIA-PACIFIC PEST CONTROL FOR LIVESTOCK MARKET: BY CONTROL METHOD, 2022

FIGURE 14 ASIA-PACIFIC PEST CONTROL FOR LIVESTOCK MARKET: BY PEST TYPE, 2022

FIGURE 15 ASIA-PACIFIC PEST CONTROL FOR LIVESTOCK MARKET: BY MODE OF APPLICATION, 2022

FIGURE 16 ASIA-PACIFIC PEST CONTROL FOR LIVESTOCK MARKET: BY END USE, 2022

FIGURE 17 ASIA-PACIFIC PEST CONTROL FOR LIVESTOCK MARKET: SNAPSHOT (2022)

FIGURE 18 ASIA-PACIFC PEST CONTROL FOR LIVESTOCK MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.