Asia Pacific Oil Refining Catalyst Market

Taille du marché en milliards USD

TCAC :

%

USD

3.37 Billion

USD

4.95 Billion

2024

2032

USD

3.37 Billion

USD

4.95 Billion

2024

2032

| 2025 –2032 | |

| USD 3.37 Billion | |

| USD 4.95 Billion | |

|

|

|

|

Segmentation du marché des catalyseurs de raffinage du pétrole en Asie-Pacifique, par type (hydrotraitement, craquage catalytique en lit fluidisé (FCC), craquage catalytique en lit fluidisé résiduel (RFCC), hydrocraquage et autres), catalyseur (zéolites, métaux et produits chimiques ), canal de distribution (vente directe/B2B, distributeurs/distributeurs tiers/négociants, commerce électronique et autres), application (diesel, kérosène, déparaffinage de distillats et autres) - Tendances et prévisions du secteur jusqu'en 2032

Quelle est la taille et le taux de croissance du marché des catalyseurs de raffinage du pétrole en Asie-Pacifique ?

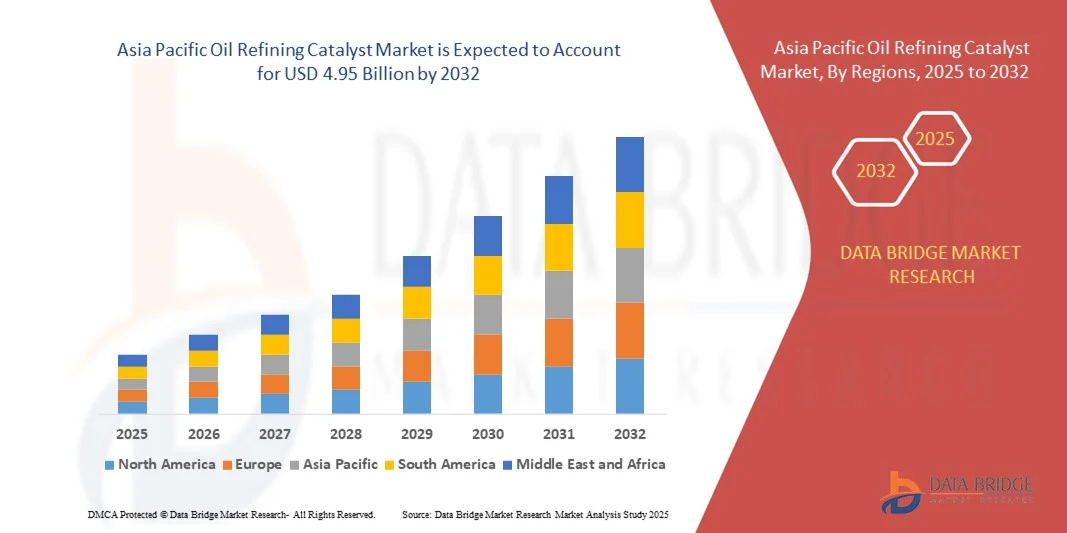

- La taille du marché des catalyseurs de raffinage du pétrole en Asie-Pacifique était évaluée à 3,37 milliards USD en 2024 et devrait atteindre 4,95 milliards USD d'ici 2032 , à un TCAC de 4,9 % au cours de la période de prévision.

- Cette croissance est principalement due à l’urbanisation croissante, à l’évolution des habitudes alimentaires et à une prise de conscience croissante des problèmes de santé dans les économies émergentes comme la Chine, le Japon et l’Inde.

- L’utilisation croissante d’édulcorants hypocaloriques dans les aliments et les boissons, ainsi que l’expansion des applications dans les produits pharmaceutiques et les soins personnels, stimulent encore davantage la demande du marché.

Quels sont les principaux points à retenir du marché des catalyseurs de raffinage du pétrole ?

- La demande croissante de produits sans sucre, la prévalence croissante des maladies liées au mode de vie telles que le diabète et l'obésité, ainsi que l'expansion des efforts de recherche et développement pour les édulcorants artificiels avancés sont des déterminants clés de la croissance du marché.

- Toutefois, les préoccupations en matière de santé concernant les édulcorants artificiels, les normes réglementaires strictes et la disponibilité de substituts naturels tels que la stévia devraient poser des défis à l'expansion du marché au cours de la période de prévision.

- La Chine a dominé le marché des catalyseurs de raffinage du pétrole en Asie-Pacifique en 2024, détenant la plus grande part des revenus de 46,3 %, tirée par une forte demande intérieure pour les boissons, les aliments et les emballages pharmaceutiques.

- Le marché indien des catalyseurs de raffinage du pétrole devrait connaître une croissance annuelle composée (TCAC) record de 8,58 %, portée par la consommation croissante de boissons, d'aliments et de produits pharmaceutiques en zones urbaines et rurales. Les mesures gouvernementales incitatives en faveur de la fabrication, du recyclage et de la production durable accélèrent l'adoption de ces technologies par le marché.

- Le segment du craquage catalytique fluidisé (FCC) a dominé le marché en 2024, représentant une part de marché de 42,6 %, grâce à son utilisation généralisée dans la conversion de fractions de brut lourd en produits plus légers et de grande valeur tels que l'essence et les oléfines.

Portée du rapport et segmentation du marché des catalyseurs de raffinage du pétrole

|

Attributs |

Informations clés sur le marché des catalyseurs de raffinage du pétrole |

|

Segments couverts |

|

|

Pays couverts |

Asie-Pacifique

|

|

Principaux acteurs du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse approfondie des experts, une analyse des prix, une analyse de la part de marque, une enquête auprès des consommateurs, une analyse démographique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire. |

Quelle est la tendance clé du marché des catalyseurs de raffinage du pétrole ?

Vers des catalyseurs durables et performants

- Une tendance clé qui façonne le marché des catalyseurs de raffinage du pétrole est la transition vers des technologies de catalyseurs durables, économes en énergie et performantes, visant à améliorer l'efficacité du raffinage tout en minimisant les émissions de carbone. Cette évolution est largement motivée par des réglementations environnementales strictes et la tendance mondiale vers des carburants plus propres.

- Les fabricants investissent dans des catalyseurs de nouvelle génération dotés d'une activité, d'une sélectivité et d'une capacité de régénération améliorées pour réduire les déchets et optimiser les rendements en carburant.

- De plus, les catalyseurs biosourcés et nanostructurés gagnent en importance, offrant une stabilité accrue et une dépendance réduite aux matières premières non renouvelables.

- Un exemple notable est celui de BASF SE (Allemagne), qui a lancé sa plateforme de catalyseur FortiForm en 2024, conçue pour augmenter le débit des raffineries et réduire les émissions de CO₂.

- Cette évolution continue vers la durabilité et l’efficacité opérationnelle transforme le paysage du raffinage, incitant les entreprises à investir dans la R&D pour des catalyseurs qui répondent à la fois aux objectifs économiques et environnementaux.

Quels sont les principaux moteurs du marché des catalyseurs de raffinage du pétrole ?

- La demande croissante de carburants plus propres, combinée aux normes d'émissions strictes imposées par les gouvernements, constitue un moteur majeur du marché des catalyseurs pour le raffinage du pétrole. Les catalyseurs sont essentiels à la production de carburants à faible teneur en soufre et à l'amélioration des performances globales des raffineries.

- Par exemple, en février 2024, Exxon Mobil Corporation (États-Unis) a agrandi ses installations de R&D sur les catalyseurs de raffinage afin d'accélérer le développement de catalyseurs d'hydrotraitement plus efficaces.

- La consommation croissante d’essence, de diesel et de kérosène dans les économies émergentes comme l’Inde et la Chine stimule encore davantage la demande.

- De plus, les raffineries se modernisent pour se conformer aux normes de soufre 2020 de l'Organisation maritime internationale (OMI), ce qui a entraîné d'importantes mises à niveau des catalyseurs à l'échelle mondiale.

- Ces développements favorisent collectivement l’innovation technologique, l’optimisation des raffineries et la production de carburant durable, propulsant ainsi le marché mondial des catalyseurs de raffinage du pétrole vers l’avant.

Quel facteur freine la croissance du marché des catalyseurs de raffinage du pétrole ?

- Le coût élevé du développement et de la régénération des catalyseurs demeure un défi majeur pour l'expansion du marché. La complexité des procédés de fabrication, la fluctuation des prix des matières premières et la nécessité d'une manipulation spécialisée des métaux rares comme le platine et le palladium contribuent à des coûts d'exploitation élevés.

- Par exemple, en 2024, la volatilité des prix des métaux a considérablement affecté la rentabilité de Clariant (Suisse) et d’autres grands producteurs de catalyseurs

- En outre, les réglementations strictes en matière d’élimination des catalyseurs usagés augmentent les défis opérationnels et les coûts de gestion des déchets pour les raffineries.

- Des entreprises telles qu'Albemarle Corporation (États-Unis) et Johnson Matthey (Royaume-Uni) répondent à ces contraintes en développant des solutions de catalyseurs recyclables et réactivables pour réduire les coûts du cycle de vie.

- Cependant, parvenir à un équilibre optimal entre les performances des catalyseurs, la rentabilité et la conformité environnementale reste un obstacle majeur, nécessitant des investissements et des innovations soutenus dans la technologie des catalyseurs.

Comment le marché des catalyseurs de raffinage du pétrole est-il segmenté ?

Le marché des catalyseurs de raffinage du pétrole est segmenté en fonction du type, du catalyseur, du canal de distribution et de l’application.

- Par type

Le marché des catalyseurs de raffinage du pétrole est segmenté en fonction du type de catalyseur : hydrotraitement, craquage catalytique en lit fluidisé (FCC), craquage catalytique en lit fluidisé résiduel (RFCC), hydrocraquage et autres. En 2024, le segment du craquage catalytique en lit fluidisé (FCC) a dominé le marché, représentant une part de marché de 42,6 %, grâce à son utilisation généralisée pour la conversion de fractions lourdes de brut en produits plus légers et à forte valeur ajoutée, tels que l'essence et les oléfines. Les catalyseurs FCC améliorent la flexibilité des raffineries et le rendement en carburant tout en réduisant les coûts d'exploitation, ce qui les rend indispensables aux raffineries de grande taille.

Le segment de l'hydrocraquage devrait enregistrer le TCAC le plus élevé entre 2025 et 2032, porté par la transition mondiale vers des carburants plus propres et la nécessité de produire du diesel à très faible teneur en soufre. L'augmentation des investissements dans les unités d'hydrocraquage en Asie-Pacifique et au Moyen-Orient accélère encore la croissance de ce segment.

- Par Catalyst

Selon le type de catalyseur, le marché est divisé en zéolites, métaux et produits chimiques. Le segment des zéolites détenait la plus grande part de marché, avec 48,3 % en 2024, principalement grâce à sa sélectivité élevée, sa stabilité thermique et son efficacité dans les réactions de craquage catalytique et d'hydrocraquage. Les zéolites sont largement utilisées dans les raffineries pour augmenter le rendement en carburant et éliminer les impuretés, ce qui en fait le type de catalyseur le plus prisé au monde.

Le segment des métaux devrait connaître son taux de croissance annuel composé le plus élevé entre 2025 et 2032, porté par la demande croissante de catalyseurs d'hydrotraitement et d'hydrogénation utilisant des métaux actifs tels que le nickel, le cobalt et le platine. L'intérêt croissant pour le raffinage économe en énergie et les technologies de régénération des catalyseurs à haute performance renforce encore l'adoption des catalyseurs métalliques.

- Par canal de distribution

En fonction du canal de distribution, le marché des catalyseurs de raffinage du pétrole est segmenté en ventes directes/B2B, distributeurs/distributeurs tiers/négociants, commerce électronique et autres. En 2024, le segment des ventes directes/B2B a dominé le marché, avec une part de marché de 56,4 %, grâce à la préférence des raffineries et des entreprises pétrochimiques pour les contrats d'approvisionnement à long terme et les solutions de catalyseurs personnalisées directement auprès des fabricants. Les partenariats directs garantissent également le support technique, le suivi des performances et l'optimisation des produits.

Le secteur du e-commerce devrait connaître le TCAC le plus rapide entre 2025 et 2032, propulsé par la transformation numérique des chaînes d'approvisionnement industrielles. Les plateformes en ligne proposent de plus en plus d'options d'approvisionnement en catalyseurs raffinés, réduisant les délais et élargissant l'accès aux petites raffineries et aux opérateurs indépendants.

- Par application

En fonction des applications, le marché est segmenté en diesel, kérosène, déparaffinage de distillats et autres. En 2024, le segment diesel a dominé le marché avec une part de marché de 45,7 %, grâce à la demande mondiale croissante de diesel propre et aux réglementations strictes en matière d'émissions exigeant des procédés de raffinage catalytique avancés. L'utilisation de catalyseurs dans la production de diesel améliore la désulfuration et la qualité du carburant, ce qui les rend essentiels au respect des normes environnementales.

Le segment du déparaffinage des distillats devrait enregistrer le TCAC le plus élevé entre 2025 et 2032, porté par la demande croissante de lubrifiants hautes performances et de carburants basse température. La consommation croissante de lubrifiants premium dans les secteurs automobile et industriel favorise l'adoption de catalyseurs de déparaffinage spécialisés dans les raffineries du monde entier.

Quelle région détient la plus grande part du marché des catalyseurs de raffinage du pétrole ?

- La Chine a dominé le marché des catalyseurs de raffinage du pétrole en Asie-Pacifique en 2024, détenant la plus grande part des revenus de 46,3 %, tirée par une forte demande intérieure pour les boissons, les aliments et les emballages pharmaceutiques.

- L'infrastructure industrielle solide du pays, ses capacités de production rentables et l'abondance de matières premières comme la silice et le calcin permettent une production à grande échelle de catalyseurs et de contenants en verre. Les politiques gouvernementales favorisant une fabrication respectueuse de l'environnement, les initiatives de recyclage et les investissements dans les technologies avancées de formage et d'affinage du verre renforcent encore sa domination sur le marché.

- L'orientation croissante de la Chine vers les exportations de boissons alcoolisées, de soins personnels et d'aliments transformés, combinée à une consommation intérieure croissante de produits haut de gamme, renforce sa position de leader sur le marché régional. Globalement, son statut de pôle manufacturier stratégique et ses capacités de R&D consolident son rôle de leader dans le secteur des catalyseurs de raffinage du pétrole en Asie-Pacifique.

Aperçu du marché indien des catalyseurs de raffinage du pétrole

Le marché indien des catalyseurs de raffinage du pétrole devrait connaître une croissance annuelle composée (TCAC) record de 8,58 %, stimulée par la consommation croissante de boissons, d'aliments et de produits pharmaceutiques en milieu urbain et rural. Les mesures gouvernementales incitatives en faveur de la fabrication, du recyclage et de la production durable accélèrent l'adoption de ces produits par le marché. La préférence croissante des entreprises de boissons, de cosmétiques et de transformation alimentaire pour les catalyseurs haut de gamme et écologiques stimule la demande dans tous les secteurs. L'augmentation des exportations d'aliments transformés, de boissons alcoolisées et non alcoolisées, et de produits de soins personnels, renforce la position de l'Inde sur le marché régional. Les investissements dans des installations de production modernes et l'amélioration des technologies de catalyseurs renforcent la compétitivité de l'Inde, faisant du pays un acteur clé de la croissance dans le secteur des catalyseurs de raffinage du pétrole en Asie-Pacifique.

Aperçu du marché vietnamien des catalyseurs de raffinage du pétrole

Le marché vietnamien des catalyseurs de raffinage du pétrole est en pleine expansion grâce à l'industrialisation croissante et à la consommation croissante de boissons, de sauces et de cosmétiques en bouteille. Le pays bénéficie du soutien gouvernemental à la production durable, d'accords commerciaux favorisant les exportations et de collaborations avec des entreprises mondiales d'emballage et de catalyseurs. La croissance de la population urbaine et la consommation croissante de boissons et d'aliments haut de gamme stimulent la demande de produits de haute qualité et esthétiques. Les progrès des technologies de production, de raffinage et de recyclage améliorent l'efficacité opérationnelle. Ensemble, ces facteurs positionnent le Vietnam comme un contributeur croissant au marché des catalyseurs de raffinage du pétrole en Asie-Pacifique.

Aperçu du marché indonésien des catalyseurs de raffinage du pétrole

Le marché indonésien des catalyseurs de raffinage du pétrole connaît une croissance soutenue, soutenue par la hausse de la consommation intérieure de boissons, d'aliments et de produits pharmaceutiques. L'abondance de matières premières, notamment le sable de silice et le calcin, facilite la production locale. Les initiatives gouvernementales en faveur d'une fabrication écologique et durable encouragent les investissements dans les technologies modernes de raffinage et de production de verre. Les industries de transformation des boissons et des aliments, tournées vers l'exportation, stimulent la demande de catalyseurs et de contenants durables et haut de gamme. La sensibilisation croissante des consommateurs à la qualité, à la sécurité et à la durabilité des produits favorise également leur adoption par le marché. Les investissements en R&D pour des catalyseurs fonctionnels et des conceptions innovantes renforcent la compétitivité, faisant de l'Indonésie un contributeur essentiel au marché de la région Asie-Pacifique.

Quelles sont les principales entreprises sur le marché des catalyseurs de raffinage du pétrole ?

L’industrie des catalyseurs de raffinage du pétrole est principalement dirigée par des entreprises bien établies, notamment :

- Royal Dutch Shell plc (Royaume-Uni)

- 3M (États-Unis)

- Dow (États-Unis)

- Exxon Mobil Corporation (États-Unis)

- BASF SE (Allemagne)

- WR Grace & Co.-Conn (États-Unis)

- Anten Chemical Co., Ltd (Chine)

- Johnson Matthey (Royaume-Uni)

- Clariant (Suisse)

- China Petrochemical Corporation (Chine)

- Albemarle Corporation (États-Unis)

- Honeywell International Inc (États-Unis)

- Haldor Topsoe A/S (Danemark)

- Arkema (France)

- Kuwait Catalyst Company (Koweït)

- JGC C&C (Japon)

- Axens (France)

- Gazpromneft-Systèmes catalytiques (Russie)

- UNICAT Catalyst Technologies, LLC (États-Unis)

- TAIYO KOKO Co., Ltd (Japon)

Quels sont les développements récents sur le marché des catalyseurs de raffinage du pétrole en Asie-Pacifique ?

- En janvier 2023, Albemarle Corporation a annoncé le lancement de Ketjen, une filiale à 100 % proposant des solutions de catalyseurs personnalisées et sophistiquées pour les industries de la chimie de spécialité, du raffinage et de la pétrochimie, renforçant ainsi son portefeuille et sa présence sur le marché mondial.

- En février 2021, la filiale de Bharat Petroleum Corporation Limited, Numaligarh Refinery Limited (NRL), a désigné Axens pour fournir des technologies avancées pour le bloc essence de son projet d'extension de la raffinerie de Numaligarh (NREP), visant à augmenter la capacité de raffinage de 9 000 KT par an et à améliorer l'efficacité opérationnelle.

- En septembre 2020, Clariant a annoncé la construction d'une nouvelle usine de production de catalyseurs en Chine, investissant considérablement pour renforcer sa présence locale et mieux soutenir les clients régionaux, tout en produisant des catalyseurs CATOFIN pour la déshydrogénation du propane, augmentant ainsi les capacités de production et la compétitivité du marché.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.