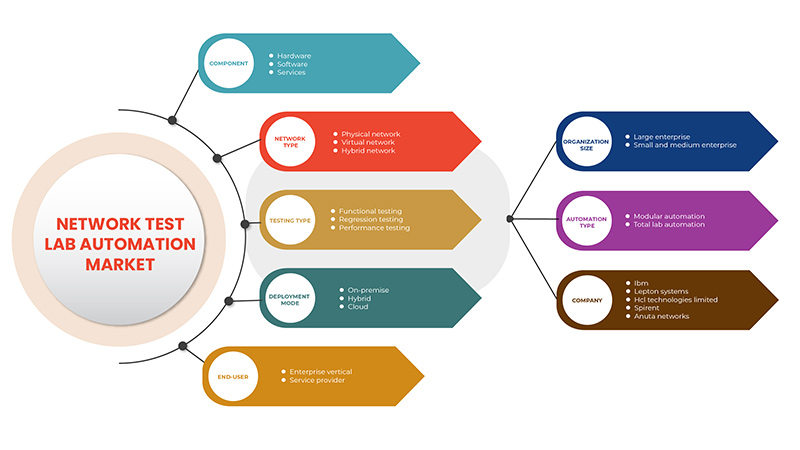

Marché de l’automatisation des laboratoires de test de réseau en Asie-Pacifique, par composant (matériel, logiciel, services), type de réseau (réseau physique, réseau virtuel, réseau hybride), type de test (tests fonctionnels, tests de régression, tests de performance), mode de déploiement (cloud, sur site, hybride), utilisateur final (secteur d’entreprise, fournisseur de services), taille de l’organisation (grande entreprise, petite et moyenne entreprise), type d’automatisation (automatisation modulaire, automatisation totale des laboratoires) – Tendances et prévisions de l’industrie jusqu’en 2029

Analyse et taille du marché

Alors que les industries et les entreprises accélèrent leurs initiatives de transformation numérique , les cycles de nouveaux produits et technologies se raccourcissent. Pour garantir le succès de l'introduction de nouvelles technologies dans les environnements opérationnels existants, il est essentiel de disposer des bonnes ressources pour tester et valider de manière approfondie l'appareil, le produit ou la solution pour la fiabilité, les performances et l'interopérabilité dans le monde réel. Étant donné que les tests sur des environnements simulés introduisent des risques futurs importants, la plupart des entreprises font des investissements considérables dans la construction d'infrastructures et d'expertises de laboratoire ou les font tester par des fournisseurs de services d'automatisation de laboratoire de test de réseau. Étant donné que ces nouvelles technologies et produits des industries et des entreprises sont plus complexes qu'auparavant et que les entreprises sont confrontées à un déficit de compétences en matière de mise en réseau, de tests, de surveillance et d'automatisation, les fournisseurs de services effectuent les tests pour le compte des entreprises. Le fournisseur de services peut utiliser des types de tests tels que fonctionnels, de performances ou de régression pour le produit proposé et s'aider de divers outils de test. L'arrivée de l'intelligence artificielle et son intégration avec les IOT et la 5G augmenteront le taux de produits numériques dans toutes les industries et devront être testés avant leur lancement. Cela fera fleurir le marché de l'automatisation des laboratoires de test de réseau en Asie-Pacifique à l'avenir.

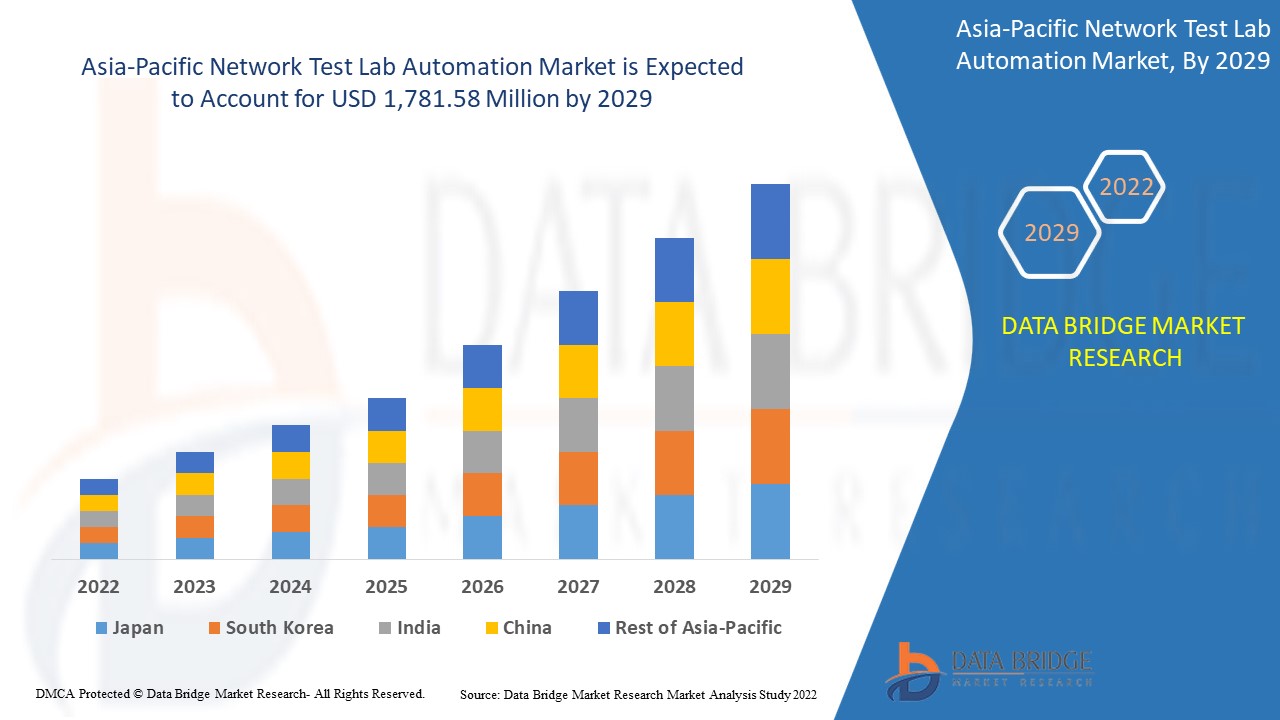

Data Bridge Market Research analyse que le marché de l'automatisation des laboratoires de tests de réseau en Asie-Pacifique devrait atteindre une valeur de 1 781,58 millions USD d'ici 2029. Le rapport sur le marché de l'automatisation des laboratoires de tests de réseau couvre également l'analyse des prix, l'analyse des brevets et les avancées technologiques en profondeur.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Année historique |

2020 |

|

Unités quantitatives |

Chiffre d'affaires en millions USD |

|

Segments couverts |

Par composant (matériel, logiciel, services), type de réseau (réseau physique, réseau virtuel, réseau hybride), type de test (tests fonctionnels, tests de régression, tests de performance), mode de déploiement (cloud, sur site, hybride), utilisateur final (secteur d'entreprise, fournisseur de services), taille de l'organisation (grande entreprise, petite et moyenne entreprise), type d'automatisation (automatisation modulaire, automatisation totale du laboratoire) |

|

Pays couverts |

Chine, Japon, Inde, Corée du Sud, Singapour, Malaisie, Australie, Thaïlande, Indonésie, Philippines, Reste de l'Asie-Pacifique (APAC) dans la région Asie-Pacifique (APAC). |

|

Acteurs du marché couverts |

Qualisystems Ltd., Spirent Communications, Lepton, Pluribus Networks, Polatis, Fiber Smart Networks, Cisco, Sedona Systems, Anuta Networks, Versa Networks, Netbrain, Juniper Networks, Netscout, Keysight Technologies, ZPE Systems, Inc., Danaher, Great Software Laboratory, Accuver, Wipro, Appviewx, HCL Technologies. |

Définition du marché

Le processus d'automatisation de la configuration, de l'exploitation, du déploiement, des tests et de la gestion des périphériques virtuels et physiques d'un réseau est appelé automatisation du réseau. La disponibilité du service réseau augmentera à mesure que les fonctions quotidiennes et les tests réseau, ainsi que les procédures répétitives, seront traités et contrôlés automatiquement. Tout réseau peut bénéficier de l'automatisation du réseau. Les entreprises, les fournisseurs de services et les centres de données peuvent utiliser des solutions logicielles et matérielles pour automatiser leurs réseaux, réduisant ainsi les coûts opérationnels, les erreurs humaines et augmentant la productivité.

Dynamique du marché de l'automatisation des laboratoires de test réseau

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Augmentation de la demande d'automatisation et de solutions pour une expérience client fluide

De nos jours, les laboratoires de recherche et de pathologie ont connu une évolution significative au cours des deux dernières décennies. Dans les laboratoires, la demande d'instruments et de systèmes de laboratoire automatisés à la pointe de la technologie est croissante. Plusieurs innovations, notamment l'automatisation des laboratoires, sont motivées par le désir d'améliorer les diagnostics, la découverte de médicaments et la recherche.

Grâce à l'automatisation des laboratoires, différents scientifiques et professionnels de laboratoire sont en mesure d'atteindre une vitesse, une cohérence et une précision de nouvelle génération dans la recherche et la génération de rapports. De plus, les progrès de l'automatisation des laboratoires ont entraîné la standardisation des processus qui contribuent à réduire le nombre d'erreurs. Par conséquent, l'évaluation croissante des résultats en temps réel à l'aide de techniques automatisées et le nombre croissant de cas de diagnostic ont entraîné une demande importante de logiciels avancés et de systèmes automatisés de pointe.

- Pénétration des options de stockage basées sur le cloud pour diverses applications de laboratoire

Au cours des dernières décennies, 90 % des entreprises ont choisi les solutions basées sur le cloud plutôt que les méthodes traditionnelles de calcul et de stockage de données pour des avantages tels que de meilleures informations, une collaboration plus facile et des coûts réduits pour les organisations. Cependant, l'utilisation accrue du cloud signifie que les entreprises doivent également gérer leur infrastructure cloud plus efficacement afin de gérer l'efficacité opérationnelle et de réduire la complexité. L'automatisation du cloud fait référence à l'utilisation de logiciels et de processus pour automatiser le provisionnement et la gestion des charges de travail et des services de cloud computing tels que la création de réseaux virtuels, le déploiement de machines virtuelles, l'équilibrage de charge et la surveillance des performances. Grâce à l'automatisation du cloud, les administrateurs informatiques peuvent réduire ou éliminer les processus manuels pour réduire les frais administratifs et accélérer la fourniture des ressources.

Opportunités

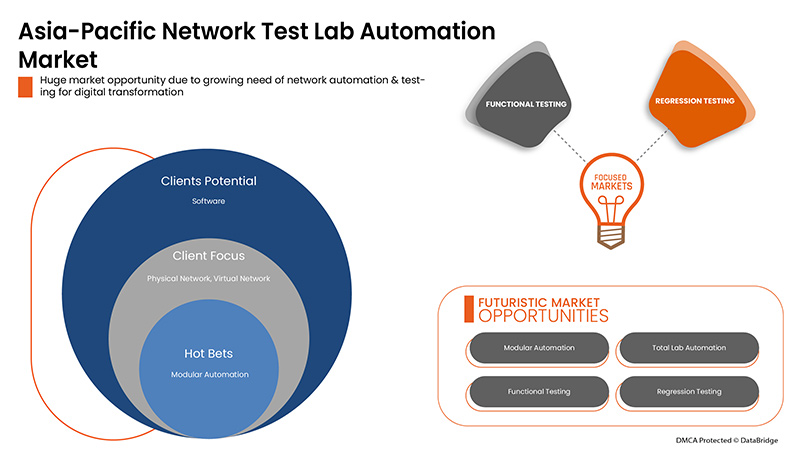

- Besoin croissant d'automatisation et de tests de réseau pour la transformation numérique

La transformation numérique est le processus d’utilisation des technologies numériques pour transformer les processus et services commerciaux traditionnels et non numériques existants, ou en créer de nouveaux, afin de répondre à l’évolution du marché et aux attentes des clients. Ainsi, elle modifie complètement la manière dont les entreprises sont gérées et exploitées, et la manière dont la valeur est délivrée aux clients. La transformation numérique est importante car elle permet aux organisations de s’adapter à des secteurs en constante évolution et d’améliorer continuellement leurs opérations en conséquence. Chaque initiative de transformation numérique aura ses propres objectifs spécifiques. Le principal objectif de toute transformation numérique est d’améliorer les processus actuels. Mais la transformation numérique des organisations nécessite une planification approfondie, une gestion appropriée des ressources, des tests et le développement de produits et de logiciels avec d’énormes investissements en capital. Si cela n’est pas fait, la mise en œuvre du logiciel et du modèle commercial peut prendre beaucoup de temps, ce qui entraîne une perte de capital et de temps pour une organisation. Selon une étude de Bain & Company, seulement 8 % des entreprises mondiales ont été en mesure d’atteindre les résultats commerciaux visés grâce à leurs investissements dans la technologie numérique. Cela rend l’intégration de l’automatisation et des tests du réseau très essentielle pour la réussite de la transformation numérique.

Contraintes/Défis

- Augmentation de la complexité des systèmes d'automatisation des laboratoires et donc augmentation du risque de temps d'arrêt

Les processus d'automatisation des laboratoires en réseau ont été mis en œuvre dans le monde entier pour réduire le besoin de personnel humain et pour effectuer des tâches répétitives en mettant en œuvre des processus de machines automatisés à la place. Mais plus la complexité du système est élevée, plus le risque qu'une défaillance du système ait de graves conséquences sur le fonctionnement du laboratoire est grand. De nombreuses défaillances critiques du système, en particulier celles impliquant les chaînes de montage, nécessiteraient de rétablir les procédures manuelles de gestion des échantillons (c'est-à-dire le tri manuel, la centrifugation). Cependant, dans la plupart des laboratoires, on constate que les ressources constituent un facteur limitant pour le développement et les tests. Une façon traditionnelle de gérer les laboratoires et de coordonner les plannings consiste à utiliser des panneaux de brassage et à modifier les connexions manuellement. Cependant, cette approche n'est pas évolutive et est inefficace dans de nombreux cas.

- Manque de main d’œuvre qualifiée et d’expertise expérimentée

L’intelligence artificielle (IA), l’apprentissage automatique (ML), l’Internet des objets (IoT) et l’automatisation sont de nouvelles technologies qui ont le potentiel de transformer le secteur des tests de réseau au cours de la prochaine décennie. Ces tendances technologiques sont devenues encore plus importantes avec la pandémie de COVID-19 qui a changé le paysage technologique. La pandémie mondiale ayant modifié la dynamique de la main-d’œuvre, la dépendance aux logiciels, au Web et aux applications mobiles de pointe a considérablement augmenté. Pour répondre à cette demande toujours croissante, les entreprises se sont tournées vers la technologie pour accroître le besoin de proposer à leurs utilisateurs finaux des produits et des logiciels entièrement fonctionnels, riches en fonctionnalités et sans faille. En conséquence, l’automatisation des tests a apporté la promesse d’une couverture de test étendue, d’une précision scientifique des tests, de la rationalisation des opérations de test, d’une réduction des coûts et d’une efficacité accrue des ressources. Cela a entraîné le besoin d’une main-d’œuvre qualifiée importante pour que l’industrie puisse répondre à la demande croissante. Un travailleur qualifié est un travailleur qui possède des compétences, une formation ou des connaissances particulières qu’il peut ensuite appliquer à son travail. Les compétences requises pour le secteur des tests de réseau peuvent inclure la maîtrise de divers langages de programmation, la maîtrise des principaux outils de test d'automatisation (y compris ceux sans code), une expérience des tests manuels et une connaissance des outils de gestion des tests avec une compréhension des exigences commerciales. Cette exigence a réduit le nombre de main-d'œuvre qualifiée pour le secteur, de plus, la demande pour ce poste augmente car il y a moins de main-d'œuvre qualifiée dans le secteur.

Impact post-COVID-19 sur le marché de l'automatisation des laboratoires de test réseau

La COVID-19 a eu un impact positif sur le marché de l’automatisation des laboratoires de tests réseau en raison de l’adoption rapide du travail à distance et de l’infrastructure cloud.

La pandémie de COVID-19 a eu un impact positif sur le marché de l'automatisation des laboratoires de test réseau. L'adoption et l'utilisation croissantes de l'intelligence artificielle et de l'apprentissage automatique dans les entreprises ont contribué à la croissance du marché pendant et après la pandémie. En outre, la croissance a été élevée après l'ouverture du marché après la COVID-19, et on s'attend à ce qu'il y ait une croissance considérable dans le secteur en raison de la demande accrue de l'industrie 4.0 et de la technologie d'automatisation.

Les fournisseurs de solutions prennent diverses décisions stratégiques pour rebondir après la COVID-19. Les acteurs mènent de nombreuses activités de recherche et développement pour améliorer la technologie impliquée dans l'automatisation des laboratoires de test réseau. Grâce à cela, les entreprises apporteront des technologies avancées sur le marché. En outre, les initiatives gouvernementales pour l'utilisation de la technologie d'automatisation ont conduit à la croissance du marché

Développement récent

- En avril 2022, Keysight Technologies, Inc. a annoncé que ses solutions de plateforme de test automatisé de dispositifs sur le terrain et en laboratoire ont été sélectionnées par Xiaomi. Xiaomi a choisi les outils de test de Keysight pour vérifier les performances des appareils 5G dans diverses circonstances de signalisation réseau et de canaux radio. Pour développer des solutions de test 5G avancées, Keysight a combiné efficacement les capacités de test en laboratoire et sur le terrain. Cette collaboration renforcera le portefeuille de clients et la présence de l'entreprise.

- En janvier 2022, Spirent acquiert octoScope pour étendre ses capacités de test WiFi. Les solutions de test d'octoScope comprennent des tests Wi-Fi et 5G automatisés dans des environnements émulés de type réel, y compris les dernières technologies WiFi 6 et WiFi 6E. Cette acquisition aidera l'entreprise de solutions de test de réseau sans fil à étendre ses capacités de test WiFi, à améliorer ses services et à réorganiser sa marque à travers le monde.

Portée du marché de l'automatisation des laboratoires de test de réseau en Asie-Pacifique

Le marché de l'automatisation des laboratoires de test réseau est segmenté en fonction du composant, du type de réseau, du type de test, du mode de déploiement, de l'utilisateur final, de la taille de l'organisation et du type d'automatisation. La croissance parmi ces segments vous aidera à analyser les segments de croissance faibles dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Composant

- Matériel

- Logiciel

- Services

Sur la base des composants, le marché de l'automatisation des laboratoires de tests de réseau Asie-Pacifique est segmenté en matériel, logiciels et services.

Type de réseau

- Réseau physique

- Réseau virtuel

- Réseau hybride

Sur la base du type de réseau, le marché de l’automatisation des laboratoires de tests de réseau Asie-Pacifique a été segmenté en réseau physique, réseau virtuel et réseau hybride.

Type de test

- Tests fonctionnels

- Tests de régression

- Tests de performance

Sur la base du type de test, le marché de l'automatisation des laboratoires de tests de réseau Asie-Pacifique a été segmenté en tests fonctionnels, tests de régression et tests de performances.

Mode de déploiement

- Nuage

- Hybride

- Sur site

Sur la base du mode de déploiement, le marché de l'automatisation des laboratoires de tests de réseau en Asie-Pacifique est segmenté en cloud, hybride et sur site.

Utilisateur final

- Secteur d'activité vertical de l'entreprise

- Fournisseur de services

Sur la base de l'utilisateur final, le marché de l'automatisation des laboratoires de tests de réseau Asie-Pacifique a été segmenté en entreprise verticale, fournisseur de services.

Taille de l'organisation

- Grande entreprise

- Petites et moyennes entreprises

Sur la base de la taille de l'organisation, le marché de l'automatisation des laboratoires de tests de réseau Asie-Pacifique est segmenté en grandes entreprises, petites et moyennes entreprises.

Type d'automatisation

- Automatisation modulaire

- Automatisation totale du laboratoire

Sur la base du type d’automatisation, le marché de l’automatisation des laboratoires de tests de réseau Asie-Pacifique est segmenté en automatisation modulaire, automatisation totale des laboratoires.

Analyse/perspectives régionales du marché de l'automatisation des laboratoires de test réseau

Le marché de l’automatisation des laboratoires de tests réseau est analysé et des informations et tendances sur la taille du marché sont fournies par pays, type de matériau, processus de fabrication et industrie d’utilisation finale, comme référencé ci-dessus.

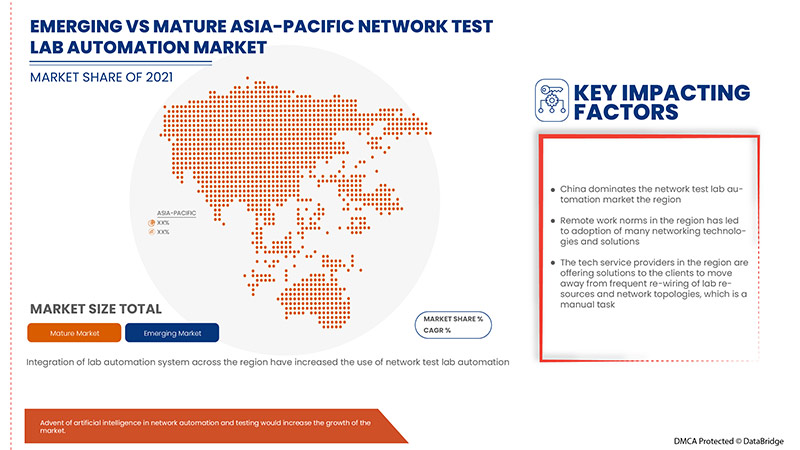

Les pays couverts par le rapport sur le marché de l'automatisation des laboratoires de tests de réseau sont la Chine, le Japon, l'Inde, la Corée du Sud, Singapour, la Malaisie, l'Australie, la Thaïlande, l'Indonésie, les Philippines et le reste de l'Asie-Pacifique (APAC). La Chine domine la région Asie-Pacifique en raison des investissements massifs des entreprises dans la numérisation des opérations commerciales.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques et l'analyse des cinq forces du porteur, les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques mondiales et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché de l'automatisation des laboratoires de tests réseau

Le paysage concurrentiel du marché de l'automatisation des laboratoires de test réseau fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence mondiale, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liée au marché de l'automatisation des laboratoires de test réseau.

Certains des principaux acteurs opérant sur le marché de l'automatisation des laboratoires de tests réseau sont : Qualisystems Ltd., Spirent Communications, Lepton, Pluribus Networks, Polatis, Fiber Smart Networks, Cisco, Sedona Systems, Anuta Networks, Versa Networks, Netbrain, Juniper Networks, Netscout, Keysight Technologies, ZPE Systems, Inc., Danaher, Great Software Laboratory, Accuver, Wipro, Appviewx, HCL Technologies.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC NETWORK TEST LAB AUTOMATION MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MARKET END-USER COVERAGE GRID

2.9 MULTIVARIATE MODELLING

2.1 COMPONENT CURVE

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 TECHNOLOGICAL TRENDS

4.2 CASE STUDIES

4.2.1 AUTOMATION OF API TESTING FOR NETWORK APPLICATION

4.2.2 CIRCUIT SWITCHED CORE NETWORK AUTOMATION

4.3 VALUE CHAIN ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISE IN DEMAND FOR AUTOMATION AND SOLUTION FOR SEAMLESS CUSTOMER EXPERIENCE

5.1.2 INTEGRATION OF LAB AUTOMATION SYSTEM ACROSS THE REGION

5.1.3 PENETRATION OF CLOUD BASED STORAGE OPTIONS FOR VARIOUS LAB APPLICATIONS

5.1.4 HIGHER ACCURACY AND QUALITY OF TESTING ASSOCIATED WITH NETWORK TEST LAB AUTOMATION

5.2 RESTRAINTS

5.2.1 HIGHER COST FOR IMPLEMENTATION OF LAB AUTOMATION SYSTEMS

5.2.2 RISE IN COMPLEXITY OF LAB AUTOMATION SYSTEMS AND THEREBY INCREASING THE RISK OF DOWNTIME

5.3 OPPORTUNITIES

5.3.1 GROWING NEED OF NETWORK AUTOMATION & TESTING FOR DIGITAL TRANSFORMATION

5.3.2 INCREASING ADVANCEMENT OF AUTOMATION IN MEDICAL SEGMENT

5.3.3 ADVENT OF ARTIFICIAL INTELLIGENCE IN NETWORK AUTOMATION AND TESTING

5.3.4 INCREASING STRATEGIC PARTNERSHIP AMONG MAJOR MARKET PLAYERS

5.4 CHALLENGES

5.4.1 LACK OF END USER FRIENDLY TOOLS IN TEST LAB AUTOMATION

5.4.2 LACK OF SKILLED WORKFORCE AND EXPERIENCED EXPERTISE

6 ASIA PACIFIC NETWORK TEST LAB AUTOMATION MARKET, BY COMPONENT

6.1 OVERVIEW

6.2 SOFTWARE

6.2.1 TEST AS A SERVICE

6.2.2 NETWORK AUTOMATION TOOLS

6.2.3 TEST LAB AS A SERVICE (LAAS)

6.2.4 INTENT-BASED NETWORKING

6.3 HARDWARE

6.4 SERVICES

6.4.1 PROFESSIONAL SERVICE

6.4.1.1 DEPLOYMENT AND INTEGRATION SERVICES

6.4.1.2 TRAINING AND SUPPORT SERVICES

6.4.1.3 ADVISORY AND CONSULTING SERVICE

6.4.2 MANAGED SERVICE

7 ASIA PACIFIC NETWORK TEST LAB AUTOMATION MARKET, BY NETWORK TYPE

7.1 OVERVIEW

7.2 VIRTUAL NETWORK

7.3 HYBRID NETWORK

7.4 PHYSICAL NETWORK

8 ASIA PACIFIC NETWORK TEST LAB AUTOMATION MARKET, BY TESTING TYPE

8.1 OVERVIEW

8.2 FUNCTIONAL TESTING

8.3 REGRESSION TESTING

8.4 PERFORMANCE TESTING

9 ASIA PACIFIC NETWORK TEST LAB AUTOMATION MARKET, BY DEPLOYMENT MODE

9.1 OVERVIEW

9.2 CLOUD

9.3 ON-PREMISE

9.4 HYBRID

10 ASIA PACIFIC NETWORK TEST LAB AUTOMATION MARKET, BY END-USER

10.1 OVERVIEW

10.2 ENTERPRISE VERTICAL

10.2.1 INFORMATION TECHNOLOGY

10.2.2 BANKING, FINANCIAL SERVICE AND INSURANCE

10.2.3 MANUFACTURING

10.2.4 HEALTHCARE

10.2.5 EDUCATION

10.2.6 ENERGY AND UTILITIES

10.2.7 OTHERS

10.3 SERVICE PROVIDER

11 ASIA PACIFIC NETWORK TEST LAB AUTOMATION MARKET, BY AUTOMATION TYPE

11.1 OVERVIEW

11.2 MODULAR AUTOMATION

11.3 TOTAL LAB AUTOMATION

12 ASIA PACIFIC NETWORK TEST LAB AUTOMATION MARKET, BY ORGANIZATION SIZE

12.1 OVERVIEW

12.2 LARGE ENTERPRISE

12.3 SMALL AND MEDIUM ENTERPRISE

13 ASIA PACIFIC NETWORK TEST LAB AUTOMATION MARKET, BY REGION

13.1 ASIA-PACIFIC

13.1.1 CHINA

13.1.2 JAPAN

13.1.3 SOUTH KOREA

13.1.4 INDIA

13.1.5 AUSTRALIA

13.1.6 SINGAPORE

13.1.7 INDONESIA

13.1.8 MALAYSIA

13.1.9 THAILAND

13.1.10 PHILIPPINES

13.1.11 REST OF ASIA-PACIFIC

14 ASIA PACIFIC NETWORK TEST LAB AUTOMATION MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 KEYSIGHT TECHNOLOGIES

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 SOLUTION PORTFOLIO

16.1.5 RECENT DEVELOPMENT

16.2 IBM

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 SPIRENT COMMUNICATIONS

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENTS

16.4 CISCO SYSTEMS, INC.

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENTS

16.5 HCL TECHNOLOGIES LIMITED

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 SOLUTIONS PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 ACCUVER

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENT

16.7 ANUTA NETWORKS PVT. LTD.

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENTS

16.8 APPVIEWX

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENTS

16.9 BELL INTEGRATOR

16.9.1 COMPANY SNAPSHOT

16.9.2 SERVICE PORTFOLIO

16.9.3 RECENT DEVELOPMENTS

16.1 CALIENT TECHNOLOGIES

16.10.1 COMPANY SNAPSHOT

16.10.2 SOLUTION PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 DANAHER

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 BRAND PORTFOLIO

16.11.4 RECENT DEVELOPMENT

16.12 FIBER MOUNTAIN

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 FIBER SMART NETWORKS INC.

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENTS

16.14 GREAT SOFTWARE LABORATORY

16.14.1 COMPANY SNAPHSOT

16.14.2 SOLUTION PORTFOLIO

16.14.3 RECENT DEVELOPMENT

16.15 JUNIPER NETWORKS, INC.

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCT PORTFOLIO

16.15.4 RECENT DEVELOPMENTS

16.16 KENTIK

16.16.1 COMPANY SNAPSHOT

16.16.2 SOLUTION PORTFOLIO

16.16.3 RECENT DEVELOPMENTS

16.17 LEPTON SYSTEMS

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENTS

16.18 NETBRAIN TECHNOLOGIES, INC.

16.18.1 COMPANY SNAPSHOT

16.18.2 SERVICE PORTFOLIO

16.18.3 RECENT DEVELOPMENT

16.19 NETSCOUT

16.19.1 COMPANY SNAPSHOT

16.19.2 REVENUE ANALYSIS

16.19.3 PRODUCT PORTFOLIO

16.19.4 RECENT DEVELOPMENTS

16.2 PHOENIX DATACOM LIMITED

16.20.1 COMPANY SNAPSHOT

16.20.2 SOLUTION PORTFOLIO

16.20.3 RECENT DEVELOPMENT

16.21 PLURIBUS NETWORKS

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 RECENT DEVELOPMENTS

16.22 POLATIS, INC.

16.22.1 COMPANY SNAPSHOT

16.22.2 PRODUCT PORTFOLIO

16.22.3 RECENT DEVELOPMENTS

16.23 QUALISYSTEMS LTD

16.23.1 COMPANY SNAPSHOT

16.23.2 PRODUCT PORTFOLIO

16.23.3 RECENT DEVELOPMENTS

16.24 SEGRON AUTOMATION S.R.O

16.24.1 COMPANY SNAPSHOT

16.24.2 PRODUCT PORTFOLIO

16.24.3 RECENT DEVELOPMENTS

16.25 VERSA NETWORKS

16.25.1 COMPANY SNAPSHOT

16.25.2 PRODUCT PORTFOLIO

16.25.3 RECENT DEVELOPMENTS

16.26 WIPRO LIMITED

16.26.1 COMPANY SNAPSHOT

16.26.2 REVENUE ANALYSIS

16.26.3 PRODUCT PORTFOLIO

16.26.4 RECENT DEVELOPMENTS

16.27 ZPE SYSTEMS, INC.

16.27.1 COMPANY SNAPSHOT

16.27.2 SOLUTION PORTFOLIO

16.27.3 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

Liste des tableaux

TABLE 1 ASIA PACIFIC NETWORK TEST LAB AUTOMATION MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 2 ASIA PACIFIC SOFTWARE IN NETWORK TEST LAB AUTOMATION MARKET, BY REGION, 2020-2029, (USD MILLION)

TABLE 3 ASIA PACIFIC SOFTWARE IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 ASIA PACIFIC HARDWARE IN NETWORK TEST LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 ASIA PACIFIC SERVICES IN NETWORK TEST LAB AUTOMATION MARKET, BY REGION, 2020-2029, (USD MILLION)

TABLE 6 ASIA PACIFIC SERVICES IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 7 ASIA PACIFIC PROFESSIONAL SERVICE IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 8 ASIA PACIFIC NETWORK TEST LAB AUTOMATION MARKET, BY NETWORK TYPE, 2020-2029 (USD MILLION)

TABLE 9 ASIA PACIFIC VIRTUAL NETWORK IN NETWORK TEST LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 ASIA PACIFIC HYBRID NETWORK IN NETWORK TEST LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 ASIA PACIFIC PHYSICAL NETWORK IN NETWORK TEST LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 ASIA PACIFIC NETWORK TEST LAB AUTOMATION MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 13 ASIA PACIFIC FUNCTIONAL TESTING IN NETWORK TEST LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 ASIA PACIFIC REGRESSION TESTING IN NETWORK TEST LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 ASIA PACIFIC PERFORMANCE TESTING IN NETWORK TEST LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 ASIA PACIFIC NETWORK TEST LAB AUTOMATION MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 17 ASIA PACIFIC CLOUD IN NETWORK TEST LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 ASIA PACIFIC ON-PREMISE IN NETWORK TEST LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 ASIA PACIFIC HYBRID IN NETWORK TEST LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 ASIA PACIFIC NETWORK TEST LAB AUTOMATION MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 21 ASIA PACIFIC ENTERPRISE VERTICAL IN NETWORK TEST LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 ASIA PACIFIC ENTERPRISE VERTICAL IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 23 ASIA PACIFIC SERVICE PROVIDER IN NETWORK TEST LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 ASIA PACIFIC NETWORK TEST LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 25 ASIA PACIFIC MODULAR AUTOMATION IN NETWORK TEST LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 ASIA PACIFIC TOTAL LAB AUTOMATION IN NETWORK TEST LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 ASIA PACIFIC NETWORK TEST LAB AUTOMATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 28 ASIA PACIFIC LARGE ENTERPRISE IN NETWORK TEST LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 ASIA PACIFIC SMALL AND MEDIUM ENTERPRISE IN NETWORK TEST LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 ASIA-PACIFIC NETWORK TEST LAB AUTOMATION MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 31 ASIA-PACIFIC NETWORK TEST LAB AUTOMATION MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 32 ASIA-PACIFIC SOFTWARE IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 33 ASIA-PACIFIC SERVICES IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 34 ASIA-PACIFIC PROFESSIONAL SERVICE IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 35 ASIA-PACIFIC NETWORK TEST LAB AUTOMATION MARKET, BY NETWORK TYPE, 2020-2029 (USD MILLION)

TABLE 36 ASIA-PACIFIC NETWORK TEST LAB AUTOMATION MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 37 ASIA-PACIFIC NETWORK TEST LAB AUTOMATION MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 38 ASIA-PACIFIC NETWORK TEST LAB AUTOMATION MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 39 ASIA-PACIFIC ENTERPRISE VERTICAL IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 40 ASIA-PACIFIC NETWORK TEST LAB AUTOMATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 41 ASIA-PACIFIC NETWORK TEST LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 42 CHINA NETWORK TEST LAB AUTOMATION MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 43 CHINA SOFTWARE IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 44 CHINA SERVICES IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 45 CHINA PROFESSIONAL SERVICE IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 46 CHINA NETWORK TEST LAB AUTOMATION MARKET, BY NETWORK TYPE, 2020-2029 (USD MILLION)

TABLE 47 CHINA NETWORK TEST LAB AUTOMATION MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 48 CHINA NETWORK TEST LAB AUTOMATION MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 49 CHINA NETWORK TEST LAB AUTOMATION MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 50 CHINA ENTERPRISE VERTICAL IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 51 CHINA NETWORK TEST LAB AUTOMATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 52 CHINA NETWORK TEST LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 53 JAPAN NETWORK TEST LAB AUTOMATION MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 54 JAPAN SOFTWARE IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 55 JAPAN SERVICES IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 56 JAPAN PROFESSIONAL SERVICE IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 57 JAPAN NETWORK TEST LAB AUTOMATION MARKET, BY NETWORK TYPE, 2020-2029 (USD MILLION)

TABLE 58 JAPAN NETWORK TEST LAB AUTOMATION MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 59 JAPAN NETWORK TEST LAB AUTOMATION MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 60 JAPAN NETWORK TEST LAB AUTOMATION MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 61 JAPAN ENTERPRISE VERTICAL IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 62 JAPAN NETWORK TEST LAB AUTOMATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 63 JAPAN NETWORK TEST LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 64 SOUTH KOREA NETWORK TEST LAB AUTOMATION MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 65 SOUTH KOREA SOFTWARE IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 66 SOUTH KOREA SERVICES IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 67 SOUTH KOREA PROFESSIONAL SERVICE IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 SOUTH KOREA NETWORK TEST LAB AUTOMATION MARKET, BY NETWORK TYPE, 2020-2029 (USD MILLION)

TABLE 69 SOUTH KOREA NETWORK TEST LAB AUTOMATION MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 70 SOUTH KOREA NETWORK TEST LAB AUTOMATION MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 71 SOUTH KOREA NETWORK TEST LAB AUTOMATION MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 72 SOUTH KOREA ENTERPRISE VERTICAL IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 73 SOUTH KOREA NETWORK TEST LAB AUTOMATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 74 SOUTH KOREA NETWORK TEST LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 75 INDIA NETWORK TEST LAB AUTOMATION MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 76 INDIA SOFTWARE IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 77 INDIA SERVICES IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 78 INDIA PROFESSIONAL SERVICE IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 79 INDIA NETWORK TEST LAB AUTOMATION MARKET, BY NETWORK TYPE, 2020-2029 (USD MILLION)

TABLE 80 INDIA NETWORK TEST LAB AUTOMATION MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 81 INDIA NETWORK TEST LAB AUTOMATION MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 82 INDIA NETWORK TEST LAB AUTOMATION MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 83 INDIA ENTERPRISE VERTICAL IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 84 INDIA NETWORK TEST LAB AUTOMATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 85 INDIA NETWORK TEST LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 86 AUSTRALIA NETWORK TEST LAB AUTOMATION MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 87 AUSTRALIA SOFTWARE IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 88 AUSTRALIA SERVICES IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 89 AUSTRALIA PROFESSIONAL SERVICE IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 90 AUSTRALIA NETWORK TEST LAB AUTOMATION MARKET, BY NETWORK TYPE, 2020-2029 (USD MILLION)

TABLE 91 AUSTRALIA NETWORK TEST LAB AUTOMATION MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 92 AUSTRALIA NETWORK TEST LAB AUTOMATION MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 93 AUSTRALIA NETWORK TEST LAB AUTOMATION MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 94 AUSTRALIA ENTERPRISE VERTICAL IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 95 AUSTRALIA NETWORK TEST LAB AUTOMATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 96 AUSTRALIA NETWORK TEST LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 97 SINGAPORE NETWORK TEST LAB AUTOMATION MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 98 SINGAPORE SOFTWARE IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 99 SINGAPORE SERVICES IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 100 SINGAPORE PROFESSIONAL SERVICE IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 101 SINGAPORE NETWORK TEST LAB AUTOMATION MARKET, BY NETWORK TYPE, 2020-2029 (USD MILLION)

TABLE 102 SINGAPORE NETWORK TEST LAB AUTOMATION MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 103 SINGAPORE NETWORK TEST LAB AUTOMATION MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 104 SINGAPORE NETWORK TEST LAB AUTOMATION MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 105 SINGAPORE ENTERPRISE VERTICAL IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 SINGAPORE NETWORK TEST LAB AUTOMATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 107 SINGAPORE NETWORK TEST LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 108 INDONESIA NETWORK TEST LAB AUTOMATION MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 109 INDONESIA SOFTWARE IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 110 INDONESIA SERVICES IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 111 INDONESIA PROFESSIONAL SERVICE IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 112 INDONESIA NETWORK TEST LAB AUTOMATION MARKET, BY NETWORK TYPE, 2020-2029 (USD MILLION)

TABLE 113 INDONESIA NETWORK TEST LAB AUTOMATION MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 114 INDONESIA NETWORK TEST LAB AUTOMATION MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 115 INDONESIA NETWORK TEST LAB AUTOMATION MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 116 INDONESIA ENTERPRISE VERTICAL IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 117 INDONESIA NETWORK TEST LAB AUTOMATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 118 INDONESIA NETWORK TEST LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 119 MALAYSIA NETWORK TEST LAB AUTOMATION MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 120 MALAYSIA SOFTWARE IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 121 MALAYSIA SERVICES IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 122 MALAYSIA PROFESSIONAL SERVICE IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 123 MALAYSIA NETWORK TEST LAB AUTOMATION MARKET, BY NETWORK TYPE, 2020-2029 (USD MILLION)

TABLE 124 MALAYSIA NETWORK TEST LAB AUTOMATION MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 125 MALAYSIA NETWORK TEST LAB AUTOMATION MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 126 MALAYSIA NETWORK TEST LAB AUTOMATION MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 127 MALAYSIA ENTERPRISE VERTICAL IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 128 MALAYSIA NETWORK TEST LAB AUTOMATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 129 MALAYSIA NETWORK TEST LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 130 THAILAND NETWORK TEST LAB AUTOMATION MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 131 THAILAND SOFTWARE IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 132 THAILAND SERVICES IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 133 THAILAND PROFESSIONAL SERVICE IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 134 THAILAND NETWORK TEST LAB AUTOMATION MARKET, BY NETWORK TYPE, 2020-2029 (USD MILLION)

TABLE 135 THAILAND NETWORK TEST LAB AUTOMATION MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 136 THAILAND NETWORK TEST LAB AUTOMATION MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 137 THAILAND NETWORK TEST LAB AUTOMATION MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 138 THAILAND ENTERPRISE VERTICAL IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 139 THAILAND NETWORK TEST LAB AUTOMATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 140 THAILAND NETWORK TEST LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 141 PHILIPPINES NETWORK TEST LAB AUTOMATION MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 142 PHILIPPINES SOFTWARE IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 143 PHILIPPINES SERVICES IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 144 PHILIPPINES PROFESSIONAL SERVICE IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 145 PHILIPPINES NETWORK TEST LAB AUTOMATION MARKET, BY NETWORK TYPE, 2020-2029 (USD MILLION)

TABLE 146 PHILIPPINES NETWORK TEST LAB AUTOMATION MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 147 PHILIPPINES NETWORK TEST LAB AUTOMATION MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 148 PHILIPPINES NETWORK TEST LAB AUTOMATION MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 149 PHILIPPINES ENTERPRISE VERTICAL IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 150 PHILIPPINES NETWORK TEST LAB AUTOMATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 151 PHILIPPINES NETWORK TEST LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 152 REST OF ASIA-PACIFIC NETWORK TEST LAB AUTOMATION MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 ASIA PACIFIC NETWORK TEST LAB AUTOMATION MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC NETWORK TEST LAB AUTOMATION MARKET : DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC NETWORK TEST LAB AUTOMATION MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC NETWORK TEST LAB AUTOMATION MARKET:REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC NETWORK TEST LAB AUTOMATION MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC NETWORK TEST LAB AUTOMATION MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC NETWORK TEST LAB AUTOMATION MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA PACIFIC NETWORK TEST LAB AUTOMATION MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 ASIA PACIFIC NETWORK TEST LAB AUTOMATION MARKET: MARKET END-USER COVERAGE GRID

FIGURE 10 ASIA PACIFIC NETWORK TEST LAB AUTOMATION MARKET: SEGMENTATION

FIGURE 11 INTEGRATION OF LAB AUTOMATION ACROSS THE REGION MAGNET IS EXPECTED TO BE KEY DRIVERS THE MARKET FOR ASIA PACIFIC NETWORK TEST LAB AUTOMATION MARKET IN THE FORECAST PERIOD OF 2021 TO 2029

FIGURE 12 SOFTWARE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF ASIA PACIFIC NETWORK TEST LAB AUTOMATION MARKET IN 2022 TO 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES & CHALLENGES OF ASIA PACIFIC NETWORK TEST LAB AUTOMATION MARKET

FIGURE 14 TYPE OF CLOUD COMPUTING SERVICE, BY SERVICE MODEL, 2021 (EUROPE)

FIGURE 15 ASIA PACIFIC NETWORK TEST LAB AUTOMATION MARKET: BY COMPONENT, 2021

FIGURE 16 ASIA PACIFIC NETWORK TEST LAB AUTOMATION MARKET: BY NETWORK TYPE, 2021

FIGURE 17 ASIA PACIFIC NETWORK TEST LAB AUTOMATION MARKET: BY TESTING TYPE, 2021

FIGURE 18 ASIA PACIFIC NETWORK TEST LAB AUTOMATION MARKET: BY DEPLOYMENT MODE, 2021

FIGURE 19 ASIA PACIFIC NETWORK TEST LAB AUTOMATION MARKET: BY END-USER, 2021

FIGURE 20 ASIA PACIFIC NETWORK TEST LAB AUTOMATION MARKET: BY AUTOMATION TYPE, 2021

FIGURE 21 ASIA PACIFIC NETWORK TEST LAB AUTOMATION MARKET: BY ORGANIZATION SIZE, 2021

FIGURE 22 ASIA-PACIFIC NETWORK TEST LAB AUTOMATION MARKET: SNAPSHOT (2021)

FIGURE 23 ASIA-PACIFIC NETWORK TEST LAB AUTOMATION MARKET: BY COUNTRY (2021)

FIGURE 24 ASIA-PACIFIC NETWORK TEST LAB AUTOMATION MARKET: BY COUNTRY (2022 & 2029)

FIGURE 25 ASIA-PACIFIC NETWORK TEST LAB AUTOMATION MARKET: BY COUNTRY (2021 & 2029)

FIGURE 26 ASIA-PACIFIC NETWORK TEST LAB AUTOMATION MARKET: BY COMPONENT (2022-2029)

FIGURE 27 ASIA PACIFIC NETWORK TEST LAB AUTOMATION MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.