Asia Pacific Neem Oil Concentrates Market

Taille du marché en milliards USD

TCAC :

%

USD

476,188.67 Thousand

USD

1,270,566.81 Thousand

2022

2030

USD

476,188.67 Thousand

USD

1,270,566.81 Thousand

2022

2030

| 2023 –2030 | |

| USD 476,188.67 Thousand | |

| USD 1,270,566.81 Thousand | |

|

|

|

|

Marché de l'huile et des concentrés de neem en Asie-Pacifique, par type (extrait de fruit et de graine, extrait de feuille et extrait d'écorce), application (agriculture et élevage, produits pharmaceutiques et nutraceutiques, soins personnels, automobile, alimentation et boissons, et autres) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et taille du marché de l'huile de neem et de ses concentrés en Asie-Pacifique

L'huile de neem est une huile végétale dérivée des graines de l'arbre neem (Azadirachta indica), originaire du sous-continent indien. Elle est utilisée depuis des siècles dans la médecine traditionnelle indienne, l'agriculture et les soins de la peau. L'huile de neem contient une variété de composés biologiquement actifs, notamment l'azadirachtine, la nimbine et la nimbidine, qui sont responsables de ses propriétés médicinales et pesticides. Elle possède des propriétés antifongiques, antibactériennes, antivirales et insecticides, ce qui en fait un remède naturel et un pesticide populaire.

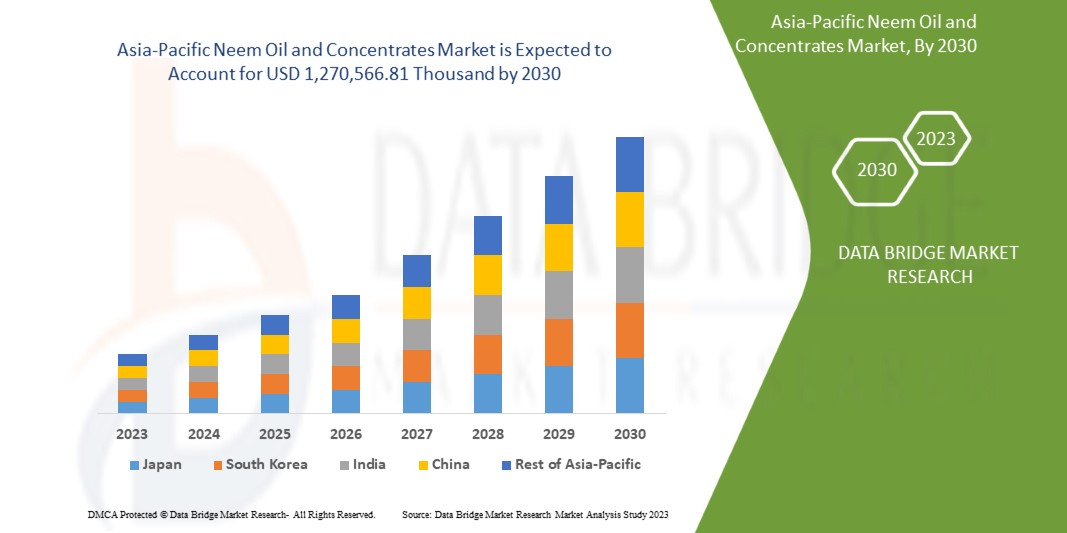

Le marché de l'huile de neem et de ses concentrés en Asie-Pacifique devrait atteindre 1 270 566,81 milliers USD d'ici 2030, contre 476 188,67 milliers USD en 2023, avec un TCAC substantiel de 13,3 % au cours de la période de prévision de 2023 à 2030.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable de 2015 à 2020) |

|

Unités quantitatives |

Chiffre d'affaires en milliers de dollars américains |

|

Segments couverts |

Type (extrait de fruit et de graine, extrait de feuille et extrait d'écorce), application (agriculture et élevage, produits pharmaceutiques et nutraceutiques, soins personnels, automobile, aliments et boissons, et autres) |

|

Pays couverts |

Japon, Chine, Inde, Corée du Sud, Australie et Nouvelle-Zélande, Philippines, Malaisie, Thaïlande, Indonésie, Singapour et reste de l'Asie-Pacifique |

|

Acteurs du marché couverts |

Murugappa Group, SUNSHIV BOTANICS, ConnOils LLC, VedaOils, Ozone Biotech, SPECTRUM BRANDS, INC., Woodstream Corporation, DYNA-GRO, INC, GreenWay Biotech, MYCSA AG, Manorama Industries Limited., SUN BIONATURALS et NOW Foods, entre autres |

Définition du marché

Les graines de l'arbre Neem contiennent de l'huile de neem, un insecticide naturel. Elle est jaune à brune, dégage une odeur d'ail/de soufre et a un goût amer. Elle est utilisée depuis des centaines d'années pour éradiquer les maladies et les parasites. L'huile de neem est encore utilisée aujourd'hui dans de nombreux produits différents sous diverses formes. Il s'agit notamment de shampoings pour animaux de compagnie, de cosmétiques , de savons et de dentifrices. L'huile de neem peut également être utilisée pour fabriquer du biodiesel ou des biocarburants. L'huile de neem est composée de nombreux ingrédients. Le répulsif et tueur d'insectes le plus efficace est l'azadirachtine, dérivée de l'huile de neem. On l'appelle huile de neem hydrophobe clarifiée lorsqu'il en reste.

Dynamique du marché de l'huile de neem et de ses concentrés en Asie-Pacifique

Cette section traite de la compréhension des moteurs, des avantages, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Demande croissante de produits biologiques

Le marché des concentrés d’huile de neem connaît une demande croissante de produits biologiques. L’huile de neem dérivée de l’arbre neem est de plus en plus populaire ces derniers temps. La demande de produits biologiques, tels que les concentrés d’huile de neem, a augmenté à mesure que les clients se soucient de plus en plus de leur santé et de l’environnement. Les clients étant de plus en plus conscients des dangers potentiels pour la santé liés aux produits chimiques et aux pesticides synthétiques, les produits biologiques ont connu une croissance considérable sur le marché. Les concentrés d’huile de neem sont extraits des graines de l’arbre neem et sont appelés biologiques car ils sont produits sans produits chimiques toxiques ni organismes génétiquement modifiés (OGM). Cela rend les concentrés d’huile de neem attrayants pour ceux qui recherchent des solutions naturelles et durables. L’huile de neem a des caractéristiques insecticides et peut traiter divers parasites, notamment les insectes, les acariens et les nématodes. Contrairement aux pesticides synthétiques, l’huile de neem n’est pas toxique pour les humains et les insectes utiles, ce qui en fait une approche de lutte antiparasitaire respectueuse de l’environnement.

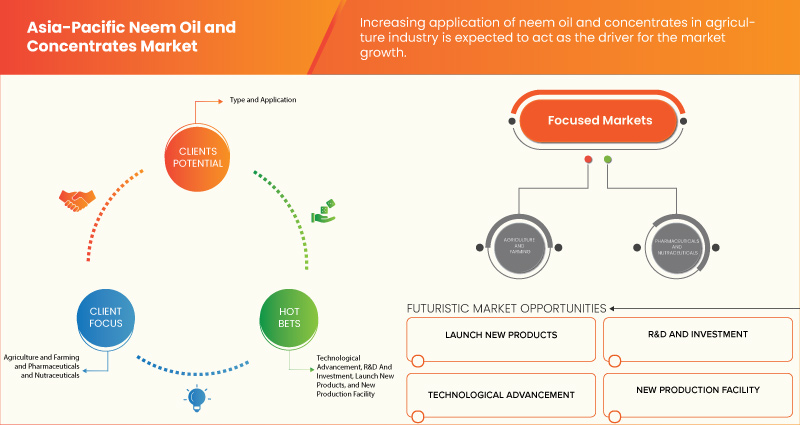

- Utilisation croissante des concentrés d'huile de Neem dans l'industrie agricole

Le marché de l'huile de neem et de ses concentrés en Asie-Pacifique connaît une augmentation de l'utilisation de concentrés d'huile de neem dans l'agriculture. L'huile de neem, dérivée de l'arbre neem (Azadirachta indica), a gagné en popularité dans l'agriculture en raison de sa grande variété d'applications et de ses multiples avantages. La demande de concentrés d'huile de neem augmente à mesure que l'agriculture recherche des alternatives plus durables et plus respectueuses de l'environnement. L'huile de neem a des caractéristiques insecticides et peut traiter divers ravageurs des cultures, tels que les pucerons, les aleurodes, les acariens, les chenilles et les coléoptères. Ses composants actifs empêchent la prolifération et le développement des insectes, ce qui entraîne moins de pertes de récoltes. Contrairement aux pesticides synthétiques, l'huile de neem est considérée comme sûre pour les humains, les insectes utiles et l'environnement.

Opportunités

- Applications potentielles dans l'industrie automobile

La demande croissante de produits respectueux de l'environnement pousse le secteur automobile à rechercher en permanence des solutions innovantes et durables. L'huile de neem naturelle présente des avantages pour diverses applications automobiles. L'industrie des revêtements et des peintures automobiles peut utiliser l'huile de neem comme ingrédient. Ses qualités antibactériennes et insecticides peuvent aider à défendre les surfaces extérieures des voitures contre les agents pathogènes et les parasites dangereux. Les constructeurs automobiles peuvent ajouter de l'huile de neem aux formules de revêtement pour augmenter la ténacité et la longévité de la peinture, ainsi que pour ajouter une protection contre les variables environnementales qui pourraient entraîner la dégradation de la peinture. En raison de ses caractéristiques lubrifiantes exceptionnelles, l'huile de neem peut être utilisée comme lubrifiant ou comme complément aux lubrifiants automobiles. Elle peut réduire la friction et l'usure de divers composants du moteur, ce qui améliore les performances du moteur et prolonge la durée de vie des pièces du moteur. De plus, la composition naturelle de l'huile de neem peut aider à réduire l'impact environnemental de l'utilisation de lubrifiants dans les produits de l'industrie automobile.

- Développement et diversification de nouveaux produits

L'huile de neem est bien connue pour ses nombreux effets bénéfiques, notamment ses propriétés insecticides, antibactériennes et antioxydantes. Ces caractéristiques en font un élément flexible pour une variété d'applications. Les entreprises peuvent explorer de nouvelles formulations et applications de l'huile de neem en investissant dans la recherche et le développement, créant ainsi des produits uniques qui s'adressent à certains segments de marché.

L'huile de neem peut être préparée à différentes concentrations ou combinée à d'autres composants naturels pour augmenter son efficacité et son adaptabilité. Cela peut conduire à la création de produits concentrés à base d'huile de neem qui fournissent des solutions ciblées de lutte antiparasitaire pour certaines cultures ou utilisations. De plus, les produits à base d'huile de neem peuvent être améliorés pour satisfaire les besoins spécifiques d'industries telles que les cosmétiques, les médicaments, les soins personnels et l'automobile.

Contraintes/Défis

- Disponibilité des substituts

Bien que l’huile de neem soit couramment utilisée dans l’agriculture comme biopesticide et insecticide, des produits alternatifs et des produits chimiques synthétiques disponibles sur le marché offrent des qualités similaires de lutte antiparasitaire. Ces substituts peuvent être plus facilement disponibles, moins chers ou avoir une présence sur le marché plus établie, ce qui constitue un défi à l’adoption généralisée de l’huile de neem. De même, certaines alternatives offrent des performances comparables dans l’industrie automobile, où l’huile de neem est utilisée dans les lubrifiants et les revêtements. Les alternatives à l’huile de neem comprennent les lubrifiants synthétiques, les revêtements et d’autres huiles biosourcées. La disponibilité et la compétitivité de ces substituts peuvent limiter l’utilisation de l’huile de neem dans le secteur automobile.

- Obstacles réglementaires et contrôle de la qualité

L'huile de neem, obtenue à partir des graines de l'arbre neem, a récemment suscité beaucoup d'intérêt en raison de ses nombreuses applications dans les domaines de l'agriculture, de la santé et des soins personnels. Cependant, le marché de l'huile de neem doit relever des défis considérables pour négocier le paysage réglementaire complexe et assurer un contrôle qualité cohérent.

Les exigences d’enregistrement et de licence pour les produits à base d’huile de neem constituent l’un des obstacles réglementaires les plus importants. Les fabricants doivent obtenir des autorisations ou des certificats réglementaires dans plusieurs pays avant de faire de la publicité et de vendre légalement des produits à base d’huile de neem. Le processus d’enregistrement peut être long et coûteux et impliquer des procédures de documentation et de test approfondies. Cela peut entraîner des retards dans la mise sur le marché des produits à base d’huile de neem et augmenter le coût de la conformité pour les fabricants, en particulier pour les petites et moyennes entreprises.

- Connaissance limitée de l'huile de Neem et de ses concentrés

Ce manque de compréhension présente divers obstacles pour les acteurs du marché en ce qui concerne la pénétration du marché, l'adoption des produits et la croissance globale du marché. L'un des principaux problèmes auxquels est confrontée l'industrie de l'huile de neem et de ses concentrés est le manque de connaissances des consommateurs. De nombreux consommateurs ne connaissent pas les avantages, les applications et les utilisations potentielles de l'huile de neem en dehors des applications agricoles traditionnelles. Ce manque de sensibilisation limite la demande de produits à base d'huile de neem dans divers secteurs, notamment les soins personnels, les médicaments et le nettoyage ménager.

- Disponibilité limitée et défis liés à la chaîne d'approvisionnement

Le marché de l'huile de neem et de son concentré est confronté à des défis majeurs en raison de la disponibilité limitée et des difficultés de la chaîne d'approvisionnement. La culture et la transformation des arbres de neem, qui peuvent être affectées par divers facteurs tels que le climat, les parasites et les maladies, sont nécessaires à la fabrication de l'huile de neem. Cela peut entraîner des changements dans la disponibilité de l'huile de neem et perturber la chaîne d'approvisionnement. En outre, la demande d'huile de neem n'a cessé d'augmenter dans divers secteurs, notamment l'agriculture, les cosmétiques et les soins de santé. Répondre à cette demande croissante nécessite une chaîne d'approvisionnement bien établie et efficace pour garantir la disponibilité rapide et constante des produits à base d'huile de neem.

Développement récent

- En 2022, à Birkoni, Chhattisgarh, Manorama Industries Limited a ouvert une toute nouvelle usine pour répondre à la forte demande de graisses et de CBE personnalisés. Cela aide les entreprises à développer et à fabriquer de nouveaux articles et à renforcer leurs réseaux d'approvisionnement locaux et mondiaux

Portée du marché de l'huile de neem et de ses concentrés en Asie-Pacifique

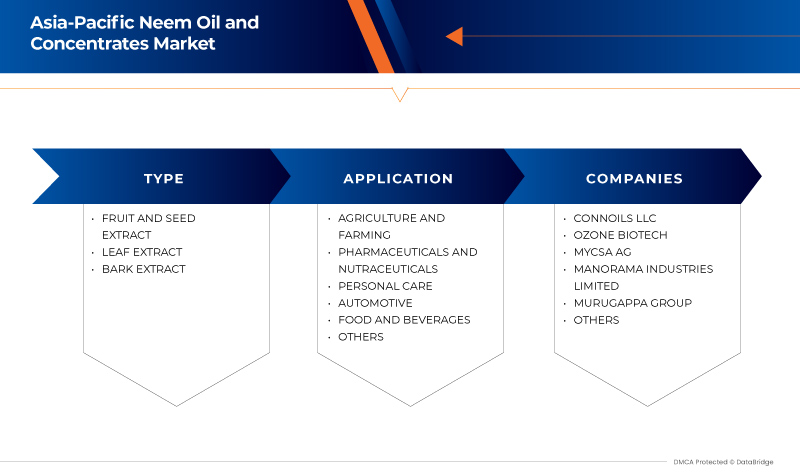

Le marché de l'huile de neem et de ses concentrés en Asie-Pacifique est classé en fonction du type et de l'application. La croissance de ces segments vous aidera à analyser les principaux segments de croissance des industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Taper

- Extrait de fruits et de graines

- Extrait de feuille

- Extrait d'écorce

Sur la base du type, le marché est segmenté en extrait de fruits et de graines, extrait de feuilles et extrait d'écorce.

Application

- Agriculture et élevage

- Produits pharmaceutiques et nutraceutiques

- Soins personnels

- Automobile

- Alimentation et boissons

- Autres

Sur la base des applications, le marché est segmenté en agriculture et élevage, produits pharmaceutiques et nutraceutiques, soins personnels, automobile, alimentation et boissons, et autres.

Analyse/perspectives régionales du marché de l'huile de neem et de ses concentrés en Asie-Pacifique

Le marché de l’huile de neem et de ses concentrés en Asie-Pacifique est segmenté en fonction du type et de l’application.

Les pays du marché de l'huile de neem et de ses concentrés en Asie-Pacifique sont le Japon, la Chine, l'Inde, la Corée du Sud, l'Australie et la Nouvelle-Zélande, les Philippines, la Malaisie, la Thaïlande, l'Indonésie, Singapour et le reste de l'Asie-Pacifique.

La Chine domine le marché de l’huile de neem et de ses concentrés en Asie-Pacifique en raison d’une sensibilisation croissante aux propriétés de l’huile de neem et de ses produits concentrés.

La section pays du rapport fournit également des facteurs individuels d'impact sur le marché et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. L'analyse des points de données en aval et en amont de la chaîne de valeur, l'analyse des tendances techniques des cinq forces de Porter et les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques régionales et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché de l'huile de neem et de ses concentrés en Asie-Pacifique

Le paysage concurrentiel du marché de l'huile de neem et de ses concentrés en Asie-Pacifique fournit des détails par concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et l'étendue du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises par rapport au marché.

Certains des principaux acteurs du marché opérant sur le marché de l'huile de neem et des concentrés d'Asie-Pacifique sont Murugappa Group, SUNSHIV BOTANICS, ConnOils LLC, VedaOils, Ozone Biotech, SPECTRUM BRANDS, INC., Woodstream Corporation, DYNA-GRO, INC, GreenWay Biotech, MYCSA AG, Manorama Industries Limited., SUN BIONATURALS et NOW Foods, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDYD

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA-PACIFIC NEEM OIL AND CONCENTRATES MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING DEMAND FOR ORGANIC PRODUCTS

5.1.2 INCREASING APPLICATION OF NEEM OIL CONCENTRATES IN THE AGRICULTURE INDUSTRY

5.1.3 EXPANSION OF END-USE INDUSTRIES FOR NEEM OIL CONCENTRATES

5.2 RESTRAINTS

5.2.1 AVAILABILITY OF SUBSTITUTES

5.2.2 REGULATORY HURDLES AND QUALITY CONTROL

5.3 OPPORTUNITIES

5.3.1 POTENTIAL APPLICATIONS IN AUTOMOTIVE INDUSTRY

5.3.2 NEW PRODUCT DEVELOPMENT AND DIVERSIFICATION

5.4 CHALLENGES

5.4.1 LIMITED AWARENESS OF NEEM OIL AND CONCENTRATES

5.4.2 LIMITED AVAILABILITY AND SUPPLY CHAIN CHALLENGES

6 ASIA-PACIFIC NEEM OIL AND CONCENTRATES MARKET, BY TYPE

6.1 OVERVIEW

6.2 FRUIT AND SEED EXTRACT

6.3 LEAF EXTRACT

6.4 BARK EXTRACT

7 ASIA-PACIFIC NEEM OIL AND CONCENTRATES MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 AGRICULTURE AND FARMING

7.2.1 BY TYPE

7.2.1.1 FRUIT AND SEED EXTRACT

7.2.1.2 LEAF EXTRACT

7.2.1.3 BARK EXTRACT

7.3 PHARMACEUTICALS AND NUTRACEUTICALS

7.3.1 BY TYPE

7.3.1.1 FRUIT AND SEED EXTRACT

7.3.1.2 LEAF EXTRACT

7.3.1.3 BARK EXTRACT

7.4 PERSONAL CARE

7.4.1 BY TYPE

7.4.1.1 FRUIT AND SEED EXTRACT

7.4.1.2 LEAF EXTRACT

7.4.1.3 BARK EXTRACT

7.5 AUTOMOTIVE

7.5.1 BY TYPE

7.5.1.1 FRUIT AND SEED EXTRACT

7.5.1.2 LEAF EXTRACT

7.5.1.3 BARK EXTRACT

7.6 FOOD AND BEVERAGES

7.6.1 BY TYPE

7.6.1.1 FRUIT AND SEED EXTRACT

7.6.1.2 LEAF EXTRACT

7.6.1.3 BARK EXTRACT

7.7 OTHERS

7.7.1 BY TYPE

7.7.1.1 FRUIT AND SEED EXTRACT

7.7.1.2 LEAF EXTRACT

7.7.1.3 BARK EXTRACT

8 ASIA-PACIFIC NEEM OIL AND CONCENTRATES MARKET, BY REGION

8.1 ASIA-PACIFIC

8.1.1 CHINA

8.1.2 INDIA

8.1.3 AUSTRALIA & NEW ZEALAND

8.1.4 SOUTH KOREA

8.1.5 JAPAN

8.1.6 INDONESIA

8.1.7 THAILAND

8.1.8 PHILIPPINES

8.1.9 MALAYSIA

8.1.10 SINGAPORE

8.1.11 REST OF ASIA-PACIFIC

9 ASIA-PACIFIC NEEM OIL AND CONCENTRATES MARKET: COMPANY LANDSCAPE

9.1 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

9.2 CERTIFICATION

9.3 ACQUISITION

9.4 NEW PLANT

10 SWOT ANALYSIS

11 COMPANY PROFILES

11.1 MURUGAPPA GROUP

11.1.1 COMPANY SNAPSHOT

11.1.2 REVENUE ANALYSIS

11.1.3 PRODUCT PORTFOLIO

11.1.4 RECENT DEVELOPMENT

11.2 CONNOILS LLC

11.2.1 COMPANY SNAPSHOT

11.2.2 PRODUCT PORTFOLIO

11.2.3 RECENT DEVELOPMENT

11.3 MANORAMA INDUSTRIES LIMITED

11.3.1 COMPANY SNAPSHOT

11.3.2 REVENUE ANALYSIS

11.3.3 PRODUCT PORTFOLIO

11.3.4 RECENT DEVELOPMENT

11.4 MYCSA AG

11.4.1 COMPANY SNAPSHOT

11.4.2 PRODUCT PORTFOLIO

11.4.3 RECENT DEVELOPMENT

11.5 OZONE BIOTECH

11.5.1 COMPANY SNAPSHOT

11.5.2 PRODUCT PORTFOLIO

11.5.3 RECENT DEVELOPMENT

11.6 DYNO-GRO, INC

11.6.1 COMPANY SNAPSHOT

11.6.2 PRODUCT PORTFOLIO

11.6.3 RECENT DEVELOPMENT

11.7 GREENWAY BIOTECH

11.7.1 COMPANY SNAPSHOT

11.7.2 PRODUCT PORTFOLIO

11.7.3 RECENT DEVELOPMENT

11.8 NOW FOODS

11.8.1 COMPANY SNAPSHOT

11.8.2 PRODUCT PORTFOLIO

11.8.3 RECENT DEVELOPMENT

11.9 SPECTRUM BRANDS, INC.

11.9.1 COMPANY SNAPSHOT

11.9.2 REVENUE ANALYSIS

11.9.3 PRODUCT PORTFOLIO

11.9.4 RECENT DEVELOPMENT

11.1 SUN BIONATURALS

11.10.1 COMPANY SNAPSHOT

11.10.2 PRODUCT PORTFOLIO

11.10.3 RECENT DEVELOPMENT

11.11 SUNSHIV BOTANICS

11.11.1 COMPANY SNAPSHOT

11.11.2 PRODUCT PORTFOLIO

11.11.3 RECENT DEVELOPMENT

11.12 VEDAOILS

11.12.1 COMPANY SNAPSHOT

11.12.2 PRODUCT PORTFOLIO

11.12.3 RECENT DEVELOPMENT

11.13 WOODSTREAM CORPORATION

11.13.1 COMPANY SNAPSHOT

11.13.2 PRODUCT PORTFOLIO

11.13.3 RECENT DEVELOPMENT

12 QUESTIONNAIRE

13 RELATED REPORTS

Liste des tableaux

TABLE 1 ASIA-PACIFC NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 2 ASIA-PACIFIC NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 3 ASIA-PACIFIC NEEM OIL AND CONCENTRATES MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 4 ASIA-PACIFIC AGRICULTURE AND FARMING IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 5 ASIA-PACIFIC PHARMACEUTICALS AND NUTRACEUTICALS IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 6 ASIA-PACIFIC PERSONAL CARE IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 7 ASIA-PACIFIC AUTOMOTIVE IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 8 ASIA-PACIFIC FOOD AND BEVERAGES IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 9 ASIA-PACIFIC OTHERS IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 10 ASIA-PACIFIC NEEM OIL AND CONCENTRATES MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 11 ASIA-PACIFIC NEEM OIL AND CONCENTRATES MARKET, BY COUNTRY, 2021-2030 (TONS)

TABLE 12 ASIA-PACIFIC NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 13 ASIA-PACIFIC NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 14 ASIA-PACIFIC NEEM OIL AND CONCENTRATES MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 15 ASIA-PACIFIC AGRICULTURE AND FARMING IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 16 ASIA-PACIFIC PHARMACEUTICALS AND NUTRACEUTICALS IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 17 ASIA-PACIFIC PERSONAL CARE IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 18 ASIA-PACIFIC AUTOMOTIVE IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 19 ASIA-PACIFIC FOOD AND BEVERAGES IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 20 ASIA-PACIFIC OTHERS IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 21 CHINA NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 22 CHINA NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 23 CHINA NEEM OIL AND CONCENTRATES MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 24 CHINA AGRICULTURE AND FARMING IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 25 CHINA PHARMACEUTICALS AND NUTRACEUTICALS IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 26 CHINA PERSONAL CARE IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 27 CHINA AUTOMOTIVE IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 28 CHINA FOOD AND BEVERAGES IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 29 CHINA OTHERS IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 30 INDIA NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 31 INDIA NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 32 INDIA NEEM OIL AND CONCENTRATES MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 33 INDIA AGRICULTURE AND FARMING IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 34 INDIA PHARMACEUTICALS AND NUTRACEUTICALS IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 35 INDIA PERSONAL CARE IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 36 INDIA AUTOMOTIVE IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 37 INDIA FOOD AND BEVERAGES IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 38 INDIA OTHERS IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 39 AUSTRALIA & NEW ZEALAND NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 40 AUSTRALIA & NEW ZEALAND NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 41 AUSTRALIA & NEW ZEALAND NEEM OIL AND CONCENTRATES MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 42 AUSTRALIA & NEW ZEALAND AGRICULTURE AND FARMING IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 43 AUSTRALIA & NEW ZEALAND PHARMACEUTICALS AND NUTRACEUTICALS IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 44 AUSTRALIA & NEW ZEALAND PERSONAL CARE IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 45 AUSTRALIA & NEW ZEALAND AUTOMOTIVE IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 46 AUSTRALIA & NEW ZEALAND FOOD AND BEVERAGES IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 47 AUSTRALIA & NEW ZEALAND OTHERS IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 48 SOUTH KOREA NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 49 SOUTH KOREA NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 50 SOUTH KOREA NEEM OIL AND CONCENTRATES MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 51 SOUTH KOREA AGRICULTURE AND FARMING IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 52 SOUTH KOREA PHARMACEUTICALS AND NUTRACEUTICALS IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 53 SOUTH KOREA PERSONAL CARE IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 54 SOUTH KOREA AUTOMOTIVE IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 55 SOUTH KOREA FOOD AND BEVERAGES IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 56 SOUTH KOREA OTHERS IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 57 JAPAN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 58 JAPAN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 59 JAPAN NEEM OIL AND CONCENTRATES MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 60 JAPAN AGRICULTURE AND FARMING IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 61 JAPAN PHARMACEUTICALS AND NUTRACEUTICALS IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 62 JAPAN PERSONAL CARE IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 63 JAPAN AUTOMOTIVE IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 64 JAPAN FOOD AND BEVERAGES IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 65 JAPAN OTHERS IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 66 INDONESIA NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 67 INDONESIA NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 68 INDONESIA NEEM OIL AND CONCENTRATES MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 69 INDONESIA AGRICULTURE AND FARMING IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 70 INDONESIA PHARMACEUTICALS AND NUTRACEUTICALS IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 71 INDONESIA PERSONAL CARE IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 72 INDONESIA AUTOMOTIVE IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 73 INDONESIA FOOD AND BEVERAGES IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 74 INDONESIA OTHERS IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 75 THAILAND NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 76 THAILAND NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 77 THAILAND NEEM OIL AND CONCENTRATES MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 78 THAILAND AGRICULTURE AND FARMING IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 79 THAILAND PHARMACEUTICALS AND NUTRACEUTICALS IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 80 THAILAND PERSONAL CARE IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 81 THAILAND AUTOMOTIVE IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 82 THAILAND FOOD AND BEVERAGES IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 83 THAILAND OTHERS IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 84 PHILIPPINES NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 85 PHILIPPINES NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 86 PHILIPPINES NEEM OIL AND CONCENTRATES MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 87 PHILIPPINES AGRICULTURE AND FARMING IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 88 PHILIPPINES PHARMACEUTICALS AND NUTRACEUTICALS IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 89 PHILIPPINES PERSONAL CARE IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 90 PHILIPPINES AUTOMOTIVE IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 91 PHILIPPINES FOOD AND BEVERAGES IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 92 PHILIPPINES OTHERS IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 93 MALAYSIA NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 94 MALAYSIA NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 95 MALAYSIA NEEM OIL AND CONCENTRATES MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 96 MALAYSIA AGRICULTURE AND FARMING IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 97 MALAYSIA PHARMACEUTICALS AND NUTRACEUTICALS IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 98 MALAYSIA PERSONAL CARE IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 99 MALAYSIA AUTOMOTIVE IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 100 MALAYSIA FOOD AND BEVERAGES IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 101 MALAYSIA OTHERS IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 102 SINGAPORE NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 103 SINGAPORE NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 104 SINGAPORE NEEM OIL AND CONCENTRATES MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 105 SINGAPORE AGRICULTURE AND FARMING IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 106 SINGAPORE PHARMACEUTICALS AND NUTRACEUTICALS IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 107 SINGAPORE PERSONAL CARE IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 108 SINGAPORE AUTOMOTIVE IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 109 SINGAPORE FOOD AND BEVERAGES IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 110 SINGAPORE OTHERS IN NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 111 REST OF ASIA-PACIFIC NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 112 REST OF ASIA-PACIFIC NEEM OIL AND CONCENTRATES MARKET, BY TYPE, 2021-2030 (TONS)

Liste des figures

FIGURE 1 ASIA-PACIFIC NEEM OIL AND CONCENTRATES MARKET: SEGMENTATION

FIGURE 2 ASIA-PACIFIC NEEM OIL AND CONCENTRATES MARKET: DATA TRIANGULATION

FIGURE 3 ASIA-PACIFIC NEEM OIL AND CONCENTRATES MARKET: DROC ANALYSIS

FIGURE 4 ASIA-PACIFIC NEEM OIL AND CONCENTRATES MARKET: REGIONAL VS COUNTRY ANALYSIS

FIGURE 5 ASIA-PACIFIC NEEM OIL AND CONCENTRATES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA-PACIFIC NEEM OIL AND CONCENTRATES MARKET: TYPE LIFE LINE CURVE

FIGURE 7 ASIA-PACIFIC NEEM OIL AND CONCENTRATES MARKET: MULTIVARIATE MODELLING

FIGURE 8 ASIA-PACIFIC NEEM OIL AND CONCENTRATES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 ASIA-PACIFIC NEEM OIL AND CONCENTRATES MARKET: DBMR MARKET POSITION GRID

FIGURE 10 ASIA-PACIFIC NEEM OIL AND CONCENTRATES MARKET: APPLICATION COVERAGE GRID

FIGURE 11 ASIA-PACIFIC NEEM OIL AND CONCENTRATES MARKET: CHALLENGE MATRIX

FIGURE 12 ASIA-PACIFIC NEEM OIL AND CONCENTRATES MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 ASIA-PACIFIC NEEM OIL AND CONCENTRATES MARKET: SEGMENTATION

FIGURE 14 GROWING DEMAND FOR ORGANIC PRODUCTS IS DRIVING THE ASIA-PACIFIC NEEM OIL AND CONCENTRATES MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 15 FRUIT AND SEED EXTRACT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA-PACIFIC NEEM OIL AND CONCENTRATES MARKET IN 2023 & 2030

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA-PACIFIC NEEM OIL AND CONCENTRATES MARKET

FIGURE 17 ASIA-PACIFIC NEEM OIL AND CONCENTRATES MARKET: BY TYPE, 2022

FIGURE 18 ASIA-PACIFIC NEEM OIL AND CONCENTRATES MARKET: BY APPLICATION, 2022

FIGURE 19 ASIA-PACIFIC NEEM OIL AND CONCENTRATES MARKET: SNAPSHOT (2022)

FIGURE 20 ASIA-PACIFIC NEEM OIL AND CONCENTRATES MARKET: BY COUNTRY (2022)

FIGURE 21 ASIA-PACIFIC NEEM OIL AND CONCENTRATES MARKET: BY COUNTRY (2023 & 2030)

FIGURE 22 ASIA-PACIFIC NEEM OIL AND CONCENTRATES MARKET: BY COUNTRY (2022 & 2030)

FIGURE 23 ASIA-PACIFIC NEEM OIL AND CONCENTRATES MARKET: BY TYPE (2023 - 2030)

FIGURE 24 ASIA-PACIFIC NEEM OIL AND CONCENTRATES MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.