Marché de la chimie médicinale pour la découverte de médicaments en Asie-Pacifique, par processus ( sélection de cible , validation de cible, identification de la correspondance, optimisation de la piste et validation du candidat), conception (variation basée sur les fragments, conception de médicaments basée sur la structure, synthèse orientée vers la diversité, chimiogénomique, produits naturels et autres), type de médicament (petites molécules et produits biologiques), domaine thérapeutique ( oncologie , neurologie, maladies infectieuses et immunitaires , maladies cardiovasculaires, maladies du système digestif et autres), utilisateur final (organisme de recherche sous contrat, sociétés pharmaceutiques et biotechnologiques , instituts universitaires et de recherche et autres), pays (Japon, Chine, Australie, Inde, Corée du Sud, Singapour, Indonésie, Thaïlande, Malaisie, Philippines, Vietnam, reste de l'Asie-Pacifique) Tendances et prévisions de l'industrie jusqu'en 2029

Analyse et perspectives du marché : marché de la chimie médicinale pour la découverte de médicaments en Asie-Pacifique

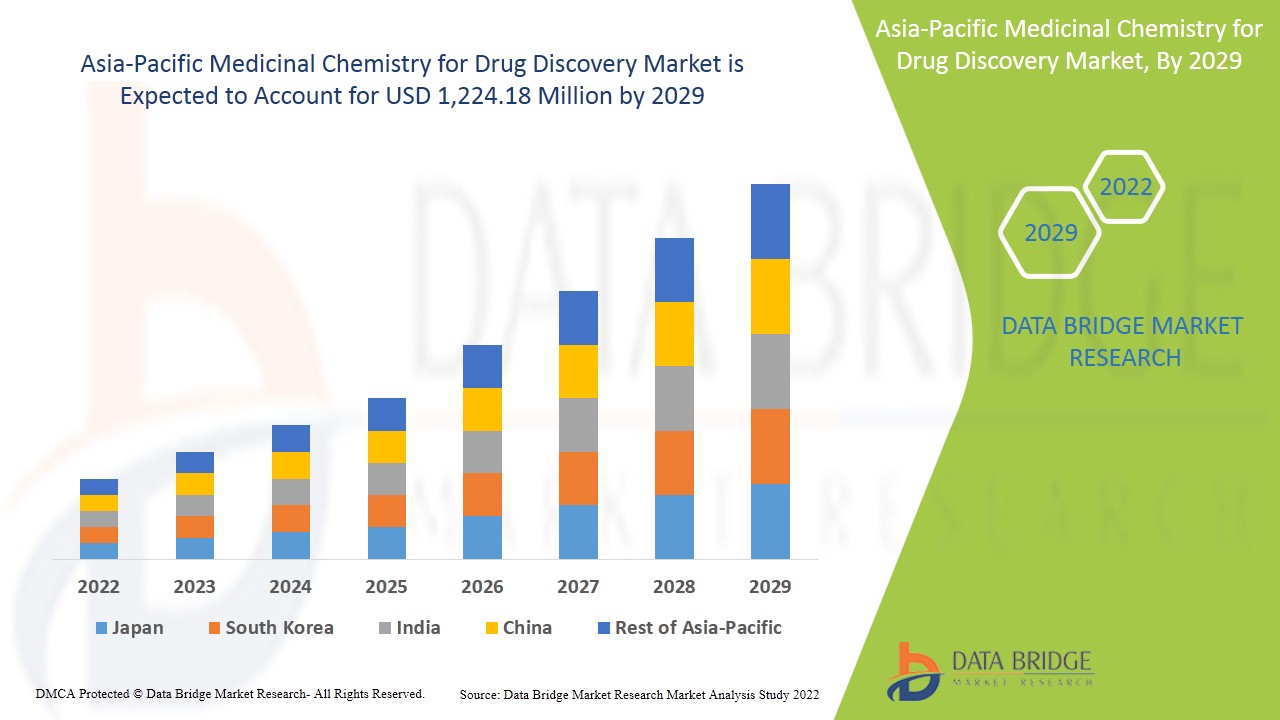

Le marché de la chimie médicinale pour la découverte de médicaments devrait connaître une croissance du marché au cours de la période de prévision de 2022 à 2029. Data Bridge Market Research analyse que le marché croît avec un TCAC de 11,8 % au cours de la période de prévision de 2022 à 2029 et devrait atteindre 1 224,18 millions USD d'ici 2029. Le fardeau croissant de diverses maladies chroniques et la croissance des produits biologiques sont les principaux moteurs qui ont propulsé la demande du marché au cours de la période de prévision.

La chimie médicinale est un domaine scientifique interdisciplinaire qui implique une équipe de scientifiques (dont des chimistes organiques synthétiques, des chimistes analytiques, des biologistes, des toxicologues, des pharmacologues, des microbiologistes et des biopharmaciens) travaillant ensemble à la découverte, à la conception, au développement et à la synthèse de nouveaux médicaments. De plus, la contribution de la chimie médicinale ne se limite pas à la phase de découverte. Elle poursuit son objectif tout au long du développement clinique. Chaque étape du développement clinique implique des quantités excédentaires de médicaments formulés pour étudier les avantages potentiels dans les essais sur l'homme. Au fil du temps, les méthodes chimiques adoptées pour la découverte des molécules ont également subi des changements conduisant au développement de technologies telles que la chimie combinatoire (combichem), la synthèse organique assistée par micro-ondes (MAOS) et le criblage biologique à haut débit (HTS).

La chimie médicinale pour la découverte de médicaments comprend des caractéristiques telles que le besoin croissant de médicaments sûrs et efficaces qui aura un impact sur le lancement de nouveaux produits par les fabricants sur le marché, ce qui augmentera sa demande ainsi que l'augmentation des investissements en recherche et développement pour la découverte et le développement de nouvelles molécules médicamenteuses conduisant à la croissance du marché. Actuellement, diverses études de recherche sont en cours qui devraient offrir diverses autres opportunités sur le marché de la chimie médicinale pour la découverte de médicaments. Cependant, les risques techniques liés à la découverte de médicaments et le manque de professionnels qualifiés devraient freiner la croissance du marché au cours de la période de prévision.

Le rapport sur le marché de la chimie médicinale pour la découverte de médicaments fournit des détails sur la part de marché, les nouveaux développements et l'analyse du pipeline de produits, l'impact des acteurs du marché national et local, analyse les opportunités en termes de poches de revenus émergentes, de changements dans la réglementation du marché , d'approbations de produits, de décisions stratégiques, de lancements de produits, d'expansions géographiques et d'innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché, contactez-nous pour un briefing d'analyste, notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

Étendue et taille du marché de la chimie médicinale pour la découverte de médicaments en Asie-Pacifique

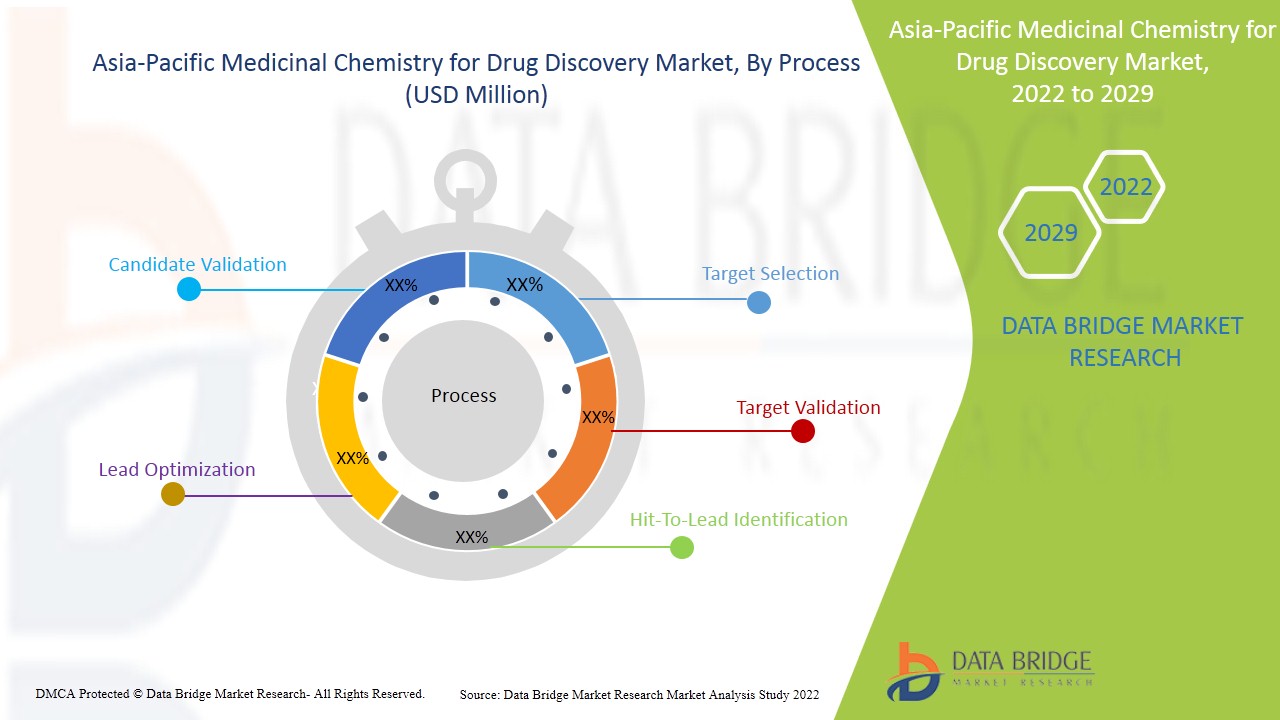

Le marché de la chimie médicinale pour la découverte de médicaments est segmenté en fonction du processus, de la conception, du type de médicament, du domaine thérapeutique et de l'utilisateur final. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence dans vos marchés cibles.

- Sur la base du processus, le marché de la chimie médicinale pour la découverte de médicaments est segmenté en sélection de cibles, validation de cibles, identification de leads, optimisation de leads et validation de candidats. En 2022, le segment de la sélection de cibles devrait dominer le marché mondial de la chimie médicinale pour la découverte de médicaments, car il s'agit du premier processus à partir duquel la découverte de médicaments commence et où les cibles biologiques sont sélectionnées dans un domaine de besoins médicaux non satisfaits. Avant la validation de la cible, l'efficacité, la sécurité et la variation génétique potentielle de la cible sont étudiées dans le cadre du processus de sélection de cibles.

- Sur la base de la conception, le marché de la chimie médicinale pour la découverte de médicaments est segmenté en variation basée sur les fragments, conception de médicaments basée sur la structure, synthèse orientée vers la diversité, chimiogénomique, produits naturels et autres. En 2022, le segment de la variation basée sur les fragments devrait dominer le marché mondial de la chimie médicinale pour la découverte de médicaments en raison du fait que de nombreux composés/inhibiteurs puissants de diverses cibles ont été développés à l'aide de cette méthode. De plus, il s'agit d'une méthode puissante pour développer des composés à petites molécules à partir de fragments se liant faiblement aux cibles. Un autre avantage des méthodes de chimie médicinale basées sur les fragments est qu'elles permettent de réduire les coûts expérimentaux, offrent des résultats divers et jouent un rôle important dans la découverte de médicaments basée sur des cibles.

- Sur la base du type de médicament, le marché de la chimie médicinale pour la découverte de médicaments est segmenté en petites molécules et en produits biologiques. En 2022, le segment des petites molécules devrait dominer le marché en raison du fait que, selon l'étude de marché, la plupart des organisations de découverte de médicaments sont fortement axées sur la découverte de petites molécules et moins sur les produits biologiques, notamment les protéines et les peptides, entre autres.

- Sur la base du domaine thérapeutique, le marché de la chimie médicinale pour la découverte de médicaments est segmenté en oncologie, maladies infectieuses et du système immunitaire, neurologie, maladies cardiovasculaires, maladies du système digestif et autres. En 2022, le segment de l'oncologie devrait dominer le marché en raison de la prévalence croissante du cancer et du nombre croissant d'essais cliniques et d'activités de recherche et développement pour le développement de nouvelles thérapies.

- Sur la base de l'utilisateur final, le marché de la chimie médicinale pour la découverte de médicaments est segmenté en organismes de recherche sous contrat, instituts universitaires et de recherche, sociétés pharmaceutiques et biotechnologiques et autres. En 2022, les organismes de recherche sous contrat devraient dominer le marché mondial de la chimie médicinale pour la découverte de médicaments, car la majeure partie du marché est occupée par des organismes de recherche sous contrat, qui devraient dominer le marché. De plus, les principaux acteurs du marché signent des accords de collaboration avec des organismes de recherche sous contrat pour les essais cliniques en cours afin d'obtenir un développement et une approbation précoces des médicaments.

Analyse du marché de la chimie médicinale pour la découverte de médicaments au niveau des pays

Le marché de la chimie médicinale pour la découverte de médicaments est analysé et des informations sur la taille du marché sont fournies sur la base du processus, de la conception, du type de médicament, du domaine thérapeutique et de l'utilisateur final.

Les pays couverts par le rapport sur le marché de la chimie médicinale pour la découverte de médicaments sont le Japon, la Chine, l'Australie, l'Inde, la Corée du Sud, Singapour, l'Indonésie, la Thaïlande, la Malaisie, les Philippines, le Vietnam et le reste de l'Asie-Pacifique.

La Chine devrait dominer le marché en raison des efforts croissants déployés pour promouvoir la découverte de médicaments locaux et de la demande croissante de services spécialisés qui alimentent l'innovation pharmaceutique.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie des pays, les actes réglementaires et les tarifs d'importation et d'exportation sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques mondiales et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

L'augmentation des dépenses de santé et l'augmentation des maladies chroniques stimulent la croissance du marché de la chimie médicinale pour la découverte de médicaments

Le marché de la chimie médicinale pour la découverte de médicaments vous fournit également une analyse détaillée du marché pour chaque pays, la croissance de l'industrie de la chimie médicinale pour la découverte de médicaments avec les ventes de chimie médicinale pour la découverte de médicaments, l'impact des progrès de la technologie de la chimie médicinale pour la découverte de médicaments et les changements dans les scénarios réglementaires avec leur soutien au marché de la chimie médicinale pour la découverte de médicaments. Les données sont disponibles pour la période historique de 2011 à 2019.

Analyse du paysage concurrentiel et des parts de marché de la chimie médicinale pour la découverte de médicaments

Le paysage concurrentiel du marché de la chimie médicinale pour la découverte de médicaments fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement du produit, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et l'ampleur du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation de l'entreprise liée au marché de la chimie médicinale pour la découverte de médicaments.

Français Certains des principaux acteurs opérant sur le marché de la chimie médicinale pour la découverte de médicaments sont Eurofins Scientific, Covance Inc. (maintenant partie du groupe LabCorp), WuXi Apptec, Charles River, Thermo Fisher Scientific, Inc., Evotec SE, Piramal Pharma Solutions, Pfizer, Inc., Certara, USA, Sygnature Discovery Limited, Malvern Panalytical Ltd (société mère Spectris PLC), Jubilant Biosys Ltd. (une société Jubilant Pharmova Limited), Taros Chemicals GmbH & Co. KG, Genscript Biotech Corporation, Nereid Therapeutics Inc., BioBlocks, Inc., Charnwood Molecular LTD, Domainex, Aurigene Pharmaceutical Services Ltd. (une filiale de Dr. Reddy's Laboratories Ltd.), Selvita, Nanosyn et Drug Discovery Alliances Inc. entre autres.

Différents acteurs du marché fournissent les dernières technologies de chimie médicinale pour la découverte de médicaments, ce qui accélère également le marché de la chimie médicinale pour la découverte de médicaments.

Par exemple,

- En novembre 2021, Jubilant Biosys Limited a agrandi ses installations afin de soutenir les services de chimie de découverte de médicaments et les services ADME in vitro. De plus, la société fournit des services à Turning Point Therapeutics Inc. pour les programmes de recherche en oncologie à petites molécules. Grâce à cette expansion, la société a tiré parti de son offre qui lui a permis de pénétrer ses racines dans la chimie médicinale mondiale pour le marché de la découverte de médicaments.

- En février 2021, Eurofins a acquis Beacon Discovery pour ses années d'expérience dans la découverte et le développement de médicaments et son approche innovante. Beacon Discovery est également bien connue pour sa profonde expertise dans la recherche sur les récepteurs couplés aux protéines G (GPCR). Grâce à cette acquisition, la société a renforcé sa présence sur le marché mondial de la chimie médicinale pour la découverte de médicaments.

La collaboration, le lancement de produits, l'expansion commerciale, les récompenses et la reconnaissance, les coentreprises et d'autres stratégies des acteurs du marché améliorent le marché de l'entreprise dans la chimie médicinale pour la découverte de médicaments, ce qui offre également l'avantage à l'organisation d'améliorer son offre pour la bronchectasie.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET END USER COVERAGE GRID

2.8 PROCESS LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 POTERS FIVE FORCES

5 ASIA PACIFIC MEDICINAL CHEMISTRY IN DRUG DISCOVERY MARKET: REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASE IN R&D FOR DISCOVERY AND DEVELOPMENT OF NOVEL DRUG MOLECULES

6.1.2 RISE IN CHRONIC DISEASES

6.1.3 INITIATIVES FOR RESEARCH ON RARE DISEASES AND ORPHAN DRUGS

6.1.4 GROWTH IN BIOLOGICS

6.1.5 COLLABORATIONS AMONG RESEARCHERS AND PHARMACEUTICAL INDUSTRIES

6.2 RESTRAINTS

6.2.1 RISE IN COST OF FORMULATED DRUG

6.2.2 TECHNICAL RISKS IN MEDICINAL CHEMISTRY FOR DRUG DISCOVERY

6.2.3 BIOETHICAL ISSUES IN MEDICINAL CHEMISTRY FOR DRUG DISCOVERY

6.3 OPPORTUNITIES

6.3.1 ADVANCEMENTS IN BIOCHEMICAL, TRANSLATIONAL, AND MOLECULAR STUDIES

6.3.2 RISE IN HEALTHCARE EXPENDITURE

6.3.3 USE OF ARTIFICIAL INTELLIGENCE IN MEDICINAL CHEMISTRY FOR DRUG DISCOVERY

6.4 CHALLENGES

6.4.1 BIOLOGICS NEED SPECIALIST TESTING SERVICES

6.4.2 STRINGENT REGULATIONS

7 IMPACT OF COVID-19 ON ASIA PACIFIC MEDICINAL CHEMISTRY IN DRUG DISCOVERY MARKET

7.1 IMPACT ON PRICE

7.2 IMPACT ON DEMAND

7.3 IMPACT ON SUPPLY CHAIN

7.4 STRATEGIC DECISIONS BY MANUFACTURERS

7.5 CONCLUSION

8 ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY PROCESS

8.1 OVERVIEW

8.2 TARGET SELECTION

8.3 TARGET VALIDATION

8.4 HIT-TO-LEAD IDENTIFICATION

8.5 LEAD OPTIMIZATION

8.6 CANDIDATE VALIDATION

9 ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY DESIGN

9.1 OVERVIEW

9.2 FRAGMENT-BASED VARIATION

9.3 STRUCTURE BASED DRUG DESIGN

9.4 DIVERSITY ORIENTED SYNTHESIS

9.5 CHEMOGENOMICS

9.6 NATURAL PRODUCTS

9.7 OTHERS

10 ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY DRUG TYPE

10.1 OVERVIEW

10.2 SMALL MOLECULES

10.3 BIOLOGICS

11 ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY THERAPEUTIC AREA

11.1 OVERVIEW

11.2 ONCOLOGY

11.3 NEUROLOGY

11.4 INFECTIOUS AND IMMUNE SYSTEM DISEASES

11.5 CARDIOVASCULAR DISEASES

11.6 DIGESTIVE SYSTEM DISEASES

11.7 OTHERS

12 ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY END USER

12.1 OVERVIEW

12.2 CONTRACT RESEARCH ORGANIZATION

12.3 PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES

12.4 ACADEMIC AND RESEARCH INSTITUTES

12.5 OTHERS

13 ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY REGION

13.1 ASIA-PACIFIC

13.1.1 CHINA

13.1.2 JAPAN

13.1.3 INDIA

13.1.4 SOUTH KOREA

13.1.5 AUSTRALIA

13.1.6 SINGAPORE

13.1.7 THAILAND

13.1.8 PHILIPPINES

13.1.9 MALAYSIA

13.1.10 INDONESIA

13.1.11 VIETNAM

13.1.12 REST OF ASIA-PACIFIC

14 ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 EUROFINS SCIENTIFIC

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 SERVICE PORTFOLIO

16.1.5 RECENT DEVELOPMENT

16.2 LABCORP DRUG DEVELOPMENT

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 SERVICE PORTFOLIO

16.2.5 RECENT DEVELOPMENT

16.3 CHARLES RIVER

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 SERVICE PORTFOLIO

16.3.5 RECENT DEVELOPMENTS

16.4 WUXI APPTEC

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 SERVICE PORTFOLIO

16.4.5 RECENT DEVELOPMENTS

16.5 EVOTEC SE

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 SERVICE PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 PIRAMAL PHARMA SOLUTIONS

16.6.1 COMPANY SNAPSHOT

16.6.2 SERVICE PORTFOLIO

16.6.3 RECENT DEVELOPMENTS

16.7 THERMO FISHER SCIENTIFIC INC.

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 SERVICE PORTFOLIO

16.7.4 RECENT DEVELOPMENT

16.7.4.1 ACQUISITION

16.8 AURIGENE PHARMACEUTICAL SERVICES (A SUBSIDIARY OF DR. REDDY'S LABORATORIES)

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 SERVICE PORTFOLIO

16.8.4 RECENT DEVELOPMENT

16.9 AURELIA BIOSCIENCES

16.9.1 COMPANY SNAPSHOT

16.9.2 SERVICE PORTFOLIO

16.9.3 RECENT DEVELOPMENTS

16.1 BIOBLOCKS INC

16.10.1 COMPANY SNAPSHOT

16.10.2 SERVICE PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 CERTARA INC

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 SERVICE PORTFOLIO

16.11.4 RECENT DEVELOPMENTS

16.12 DOMAINEX

16.12.1 COMPANY SNAPSHOT

16.12.2 SERVICE PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 DRUG DISCOVERY ALLIANCES

16.13.1 COMPANY SNAPSHOT

16.13.2 SERVICE PORTFOLIO

16.13.3 RECENT DEVELOPMENT

16.14 GENSCRIPT BIOTECH

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 SERVICE PORTFOLIO

16.14.4 RECENT DEVELOPMENT

16.15 JUBILANT BIOSYS

16.15.1 COMPANY SNAPSHOT

16.15.2 SERVICE PORTFOLIO

16.15.3 RECENT DEVELOPMENTS

16.16 NANOSYN

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENT

16.17 NEREID THERAPEUTICS

16.17.1 COMPANY SNAPSHOT

16.17.2 SERVICE PORTFOLIO

16.17.3 RECENT DEVELOPMENT

16.18 PFIZER INC.

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 SERVICE PORTFOLIO

16.18.4 RECENT DEVELOPMENTS

16.19 SELVITA

16.19.1 COMPANY SNAPSHOT

16.19.2 REVENUE ANALYSIS

16.19.3 SERVICE PORTFOLIO

16.19.4 RECENT DEVELOPMENTS

16.19.4.1 ACQUISITION

16.2 SPECTRIS PLC

16.20.1 COMPANY SNAPSHOT

16.20.2 REVENUE ANALYSIS

16.20.3 SERVICE PORTFOLIO

16.20.4 RECENT DEVELOPMENT

16.21 SYGNATURE DISCOVERY

16.21.1 COMPANY SNAPSHOT

16.21.2 SERVICE PORTFOLIO

16.21.3 RECENT DEVELOPMENTS

16.22 TAROS CHEMICAL GMBH

16.22.1 COMPANY SNAPSHOT

16.22.2 SERVICE PORTFOLIO

16.22.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

Liste des tableaux

TABLE 1 ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 2 ASIA PACIFIC TARGET SELECTION IN MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 ASIA PACIFIC TARGET VALIDATION IN MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 ASIA PACIFIC HIT-TO-LEAD IDENTIFICATION IN MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 ASIA PACIFIC LEAD OPTIMIZATION IN MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 ASIA PACIFIC CANDIDATE VALIDATION IN MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY DESIGN, 2020-2029 (USD MILLION)

TABLE 8 ASIA PACIFIC FRAGMENT-BASED VARIATION IN MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 ASIA PACIFIC STRUCTURE BASED DRUG DESIGN IN MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 ASIA PACIFIC DIVERSITY ORIENTED SYNTHESIS IN MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 ASIA PACIFIC CHEMOGENOMICS IN MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 ASIA PACIFIC NATURAL PRODUCTS IN MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 ASIA PACIFIC OTHERS IN MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 15 ASIA PACIFIC SMALL MOLECULES IN MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 ASIA PACIFIC BIOLOGICS IN MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY THERAPEUTIC AREA, 2020-2029 (USD MILLION)

TABLE 18 ASIA PACIFIC ONCOLOGY IN MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 ASIA PACIFIC NEUROLOGY IN MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 ASIA PACIFIC INFECTIOUS AND IMMUNE SYSTEM DISEASES IN MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 ASIA PACIFIC CARDIOVASCULAR DISEASES IN MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 ASIA PACIFIC DIGESTIVE SYSTEM DISEASES IN MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 ASIA PACIFIC OTHERS IN MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 25 ASIA PACIFIC CONTRACT RESEARCH ORGANIZATION IN MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 ASIA PACIFIC PHARMACEUTIAL AND BIOTECHNOLOGY COMPANIES IN MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 ASIA PACIFIC ACADEMIC AND RESEARCH INSTITUTES DISEASES IN MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 ASIA PACIFIC OTHERS IN MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 ASIA-PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 30 ASIA-PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 31 ASIA-PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY DESIGN, 2020-2029 (USD MILLION)

TABLE 32 ASIA-PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 33 ASIA-PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY THERAPEUTIC AREA, 2020-2029 (USD MILLION)

TABLE 34 ASIA-PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 35 CHINA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 36 CHINA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY DESIGN, 2020-2029 (USD MILLION)

TABLE 37 CHINA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 38 CHINA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY THERAPEUTIC AREA, 2020-2029 (USD MILLION)

TABLE 39 CHINA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 40 JAPAN MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 41 JAPAN MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY DESIGN, 2020-2029 (USD MILLION)

TABLE 42 JAPAN MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 43 JAPAN MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY THERAPEUTIC AREA, 2020-2029 (USD MILLION)

TABLE 44 JAPAN MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 45 INDIA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 46 INDIA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY DESIGN, 2020-2029 (USD MILLION)

TABLE 47 INDIA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 48 INDIA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY THERAPEUTIC AREA, 2020-2029 (USD MILLION)

TABLE 49 INDIA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 50 SOUTH KOREA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 51 SOUTH KOREA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY DESIGN, 2020-2029 (USD MILLION)

TABLE 52 SOUTH KOREA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 53 SOUTH KOREA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY THERAPEUTIC AREA, 2020-2029 (USD MILLION)

TABLE 54 SOUTH KOREA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 55 AUSTRALIA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 56 AUSTRALIA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY DESIGN, 2020-2029 (USD MILLION)

TABLE 57 AUSTRALIA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 58 AUSTRALIA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY THERAPEUTIC AREA, 2020-2029 (USD MILLION)

TABLE 59 AUSTRALIA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 60 SINGAPORE MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 61 SINGAPORE MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY DESIGN, 2020-2029 (USD MILLION)

TABLE 62 SINGAPORE MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 63 SINGAPORE MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY THERAPEUTIC AREA, 2020-2029 (USD MILLION)

TABLE 64 SINGAPORE MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 65 THAILAND MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 66 THAILAND MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY DESIGN, 2020-2029 (USD MILLION)

TABLE 67 THAILAND MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 68 THAILAND MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY THERAPEUTIC AREA, 2020-2029 (USD MILLION)

TABLE 69 THAILAND MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 70 PHILIPPINES MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 71 PHILIPPINES MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY DESIGN, 2020-2029 (USD MILLION)

TABLE 72 PHILIPPINES MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 73 PHILIPPINES MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY THERAPEUTIC AREA, 2020-2029 (USD MILLION)

TABLE 74 PHILIPPINES MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 75 MALAYSIA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 76 MALAYSIA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY DESIGN, 2020-2029 (USD MILLION)

TABLE 77 MALAYSIA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 78 MALAYSIA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY THERAPEUTIC AREA, 2020-2029 (USD MILLION)

TABLE 79 MALAYSIA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 80 INDONESIA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 81 INDONESIA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY DESIGN, 2020-2029 (USD MILLION)

TABLE 82 INDONESIA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 83 INDONESIA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY THERAPEUTIC AREA, 2020-2029 (USD MILLION)

TABLE 84 INDONESIA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 85 VIETNAM MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 86 VIETNAM MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY DESIGN, 2020-2029 (USD MILLION)

TABLE 87 VIETNAM MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 88 VIETNAM MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY THERAPEUTIC AREA, 2020-2029 (USD MILLION)

TABLE 89 VIETNAM MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 90 REST OF ASIA-PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY PROCESS, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: DROC ANALYSIS

FIGURE 4 MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: END USER COVERAGE GRID

FIGURE 8 ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: DBMR MARKET POSITION GRID

FIGURE 9 ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: SEGMENTATION

FIGURE 11 NORTH AMERICA IS ANTICIPATED TO DOMINATE THE ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET AND IS ESTIMATED TO BE GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 GROWTH IN BIOLOGICS DISCOVERY AND COLLABORATION AMONG RESEARCHERS AND PHARMACEUTICAL INDUSTRY IS EXPECTED TO DRIVE THE ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 13 PROCESS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET IN 2022 & 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET

FIGURE 15 ESTIMATED NEW CANCER CASES IN 2021, IN THE U.S.

FIGURE 16 ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY PROCESS, 2021

FIGURE 17 ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY PROCESS, 2020-2029 (USD MILLION)

FIGURE 18 ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY PROCESS, CAGR (2022-2029)

FIGURE 19 ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY PROCESS, LIFELINE CURVE

FIGURE 20 ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY DESIGN, 2021

FIGURE 21 ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY DESIGN, 2020-2029 (USD MILLION)

FIGURE 22 ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY DESIGN, CAGR (2022-2029)

FIGURE 23 ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY DESIGN, LIFELINE CURVE

FIGURE 24 ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY DRUG TYPE, 2021

FIGURE 25 ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY DRUG TYPE, 2020-2029 (USD MILLION)

FIGURE 26 ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY DRUG TYPE, CAGR (2022-2029)

FIGURE 27 ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY DRUG TYPE, LIFELINE CURVE

FIGURE 28 ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY THERAPEUTIC AREA, 2021

FIGURE 29 ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY THERAPEUTIC AREA, 2020-2029 (USD MILLION)

FIGURE 30 ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY THERAPEUTIC AREA, CAGR (2022-2029)

FIGURE 31 ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY THERAPEUTIC AREA, LIFELINE CURVE

FIGURE 32 ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY END USER, 2021

FIGURE 33 ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY END USER, 2020-2029 (USD MILLION)

FIGURE 34 ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY END USER, CAGR (2022-2029)

FIGURE 35 ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY END USER, LIFELINE CURVE

FIGURE 36 ASIA-PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: SNAPSHOT (2021)

FIGURE 37 ASIA-PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY COUNTRY (2021)

FIGURE 38 ASIA-PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY COUNTRY (2022 & 2029)

FIGURE 39 ASIA-PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY COUNTRY (2021 & 2029)

FIGURE 40 ASIA-PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY PROCESS (2022-2029)

FIGURE 41 ASIA PACIFIC MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.