Asia Pacific Medical Transport Boxes Market

Taille du marché en milliards USD

TCAC :

%

USD

187.51 Million

USD

305.70 Million

2024

2032

USD

187.51 Million

USD

305.70 Million

2024

2032

| 2025 –2032 | |

| USD 187.51 Million | |

| USD 305.70 Million | |

|

|

|

|

Segmentation du marché des boîtes de transport médical en Asie-Pacifique, par type de produit (boîtes médicales traditionnelles et boîtes médicales de stockage à froid), matériau (boîtes en plastique, en métal et en carton ondulé), application (médicaments, échantillons de test, vaccins, sang, organes, dispositifs médicaux, déchets médicaux, etc.), conception (boîtes standard et personnalisées), utilisateur final (laboratoires de diagnostic, banques du sang, hôpitaux et cliniques, centres de chirurgie ambulatoire, instituts universitaires et de recherche, etc.), canal de distribution (appel d'offres direct, vente au détail, etc.) - Tendances et prévisions du secteur jusqu'en 2032

Taille du marché des boîtes de transport médical en Asie-Pacifique

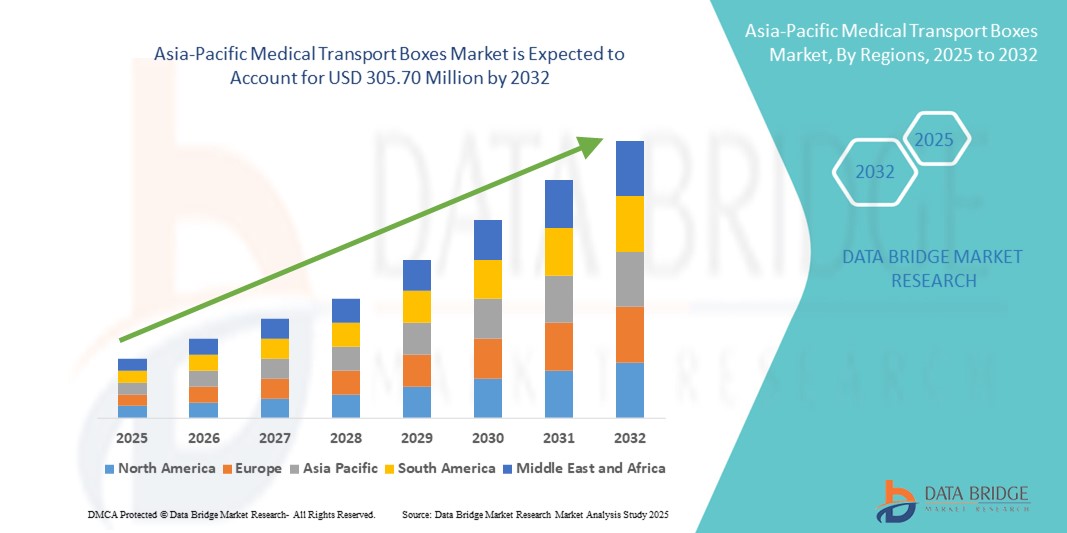

- La taille du marché des boîtes de transport médical en Asie-Pacifique était évaluée à 187,51 millions USD en 2024 et devrait atteindre 305,70 millions USD d'ici 2032 , à un TCAC de 6,3 % au cours de la période de prévision.

- La croissance du marché est principalement tirée par la demande croissante de transport sûr et à température contrôlée d'échantillons médicaux, de vaccins et de produits pharmaceutiques dans les établissements de santé et les centres de recherche.

- De plus, le développement croissant des infrastructures de santé, la sensibilisation croissante à l'intégrité des échantillons médicaux et les avancées des technologies d'emballage isotherme favorisent leur adoption. Ces facteurs contribuent à l'essor des boîtes de transport médical, stimulant ainsi considérablement la croissance du marché dans la région.

Analyse du marché des boîtes de transport médical en Asie-Pacifique

- Les boîtes de transport médicales, conçues pour assurer un transport sécurisé et à température contrôlée des produits pharmaceutiques, des échantillons biologiques, des vaccins et d'autres matériels médicaux, sont de plus en plus cruciales dans la logistique des soins de santé dans les hôpitaux, les laboratoires de diagnostic et les instituts de recherche en raison de réglementations strictes et du besoin d'intégrité des échantillons.

- La demande croissante de boîtes de transport médical est principalement motivée par l'expansion des infrastructures de soins de santé, l'augmentation des essais cliniques, l'augmentation des programmes de vaccination et le besoin critique de gestion de la chaîne du froid dans les chaînes d'approvisionnement médicales.

- La Chine a dominé le marché des boîtes de transport médical en Asie-Pacifique avec la plus grande part de revenus de 39 % en 2024, soutenue par une urbanisation rapide, des initiatives gouvernementales en matière de santé et un écosystème de fabrication robuste pour les solutions d'emballage médical.

- L'Inde devrait être le pays connaissant la croissance la plus rapide sur le marché des boîtes de transport médical en Asie-Pacifique au cours de la période de prévision, alimentée par l'augmentation des dépenses de santé, l'amélioration des capacités de la chaîne d'approvisionnement et une plus grande adoption de technologies avancées de stockage à froid.

- Le segment des boîtes médicales de stockage à froid a dominé le marché des boîtes de transport médical en Asie-Pacifique avec une part de marché de 62,8 % en 2024, en raison du rôle essentiel que jouent ces boîtes dans le maintien des produits médicaux sensibles à la température tels que les vaccins et le sang pendant le transport.

Portée du rapport et segmentation du marché des boîtes de transport médical en Asie-Pacifique

|

Attributs |

Informations clés sur le marché des conteneurs de transport médical en Asie-Pacifique |

|

Segments couverts |

|

|

Pays couverts |

Asie-Pacifique

|

|

Principaux acteurs du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse approfondie des experts, une analyse des prix, une analyse de la part de marque, une enquête auprès des consommateurs, une analyse démographique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire. |

Tendances du marché des boîtes de transport médical en Asie-Pacifique

Progrès dans les technologies de contrôle et de suivi de la température

- Une tendance significative et croissante sur le marché des conteneurs de transport médical en Asie-Pacifique est l'intégration de systèmes avancés de contrôle de la température associés à des technologies de suivi et de surveillance en temps réel basées sur l'IoT. Cette convergence améliore la fiabilité et la sécurité du transport des échantillons médicaux dans les établissements de santé et de recherche.

- Par exemple, des entreprises telles que Cryopak et Thermo Fisher Scientific proposent des boîtes isothermes équipées de capteurs de température qui transmettent des données en temps réel aux plateformes cloud, garantissant ainsi une surveillance continue des expéditions sensibles telles que les vaccins et les échantillons biologiques.

- Les innovations comprennent des boîtes intelligentes capables d'ajuster la température interne de manière dynamique, d'alerter immédiatement les parties prenantes en cas d'écarts et de fournir des rapports détaillés sur l'état du transport pour se conformer aux exigences réglementaires strictes.

- Ces solutions de transport intelligentes facilitent une plus grande transparence et une plus grande responsabilité au sein de la logistique de la chaîne du froid, réduisant ainsi les risques associés aux variations de température qui peuvent compromettre l'efficacité du produit.

- Cette tendance vers des emballages de transport plus intelligents et connectés répond aux demandes croissantes d'intégrité de la chaîne d'approvisionnement médicale, en particulier dans un contexte de campagnes de vaccination et d'activités de recherche clinique accrues dans la région.

- L’adoption de ces technologies augmente rapidement parmi les hôpitaux, les laboratoires et les sociétés pharmaceutiques cherchant à améliorer la conservation des échantillons et la conformité réglementaire.

Dynamique du marché des conteneurs de transport médical en Asie-Pacifique

Conducteur

Une demande croissante stimulée par l'expansion des soins de santé et la distribution de vaccins

- L'expansion rapide des infrastructures de santé, le nombre croissant d'essais cliniques et les programmes de vaccination à grande échelle dans des pays comme la Chine, l'Inde et l'Asie du Sud-Est entraînent une demande croissante de boîtes de transport médical fiables.

- Par exemple, l’augmentation des efforts de vaccination contre la COVID-19 et des initiatives de vaccination de routine a souligné le besoin crucial de solutions de transport à température contrôlée pour maintenir l’efficacité du vaccin tout au long de la distribution.

- La prise de conscience croissante de l’importance de l’intégrité de la chaîne du froid et les exigences réglementaires plus strictes pour le transport de matières biologiques stimulent davantage la croissance du marché.

- L’évolution vers les diagnostics ambulatoires et les services de santé décentralisés augmente également le besoin de transport d’échantillons sûr et efficace, ce qui stimule la demande des laboratoires de diagnostic et des centres chirurgicaux ambulatoires.

- Les investissements accrus dans les infrastructures logistiques des soins de santé et les programmes de soutien gouvernementaux axés sur l’accessibilité et la sécurité des soins de santé amplifient cette trajectoire de croissance.

Retenue/Défi

Coûts élevés et limitations des infrastructures dans les zones reculées

- Le coût relativement élevé des boîtes de transport médical à température contrôlée avancées et la nécessité d'une maintenance spécialisée posent des défis pour une adoption généralisée, en particulier parmi les petits prestataires de soins de santé et dans les zones rurales en développement.

- Les infrastructures limitées de la chaîne du froid et l'approvisionnement en électricité peu fiable dans les régions éloignées ou sous-développées entravent l'utilisation efficace des solutions de transport de haute technologie, limitant ainsi la pénétration du marché.

- Par exemple, dans certaines régions rurales de l'Inde et de l'Asie du Sud-Est, les pannes de courant fréquentes et les réseaux de transport médiocres rendent difficile le maintien de températures constantes, ce qui entraîne la détérioration des échantillons malgré l'utilisation de boîtes de transport avancées.

- En outre, la fragmentation des chaînes d’approvisionnement des soins de santé et l’absence de protocoles normalisés entre les pays compliquent la mise en œuvre de pratiques de transport cohérentes.

- Pour relever ces défis, il faut des innovations de produits abordables, des investissements améliorés dans les infrastructures et des programmes de formation et de sensibilisation accrus pour les professionnels de la santé afin de garantir une gestion appropriée des expéditions médicales.

- La collaboration entre les gouvernements, les fabricants et les prestataires de soins de santé est essentielle pour surmonter les obstacles logistiques et élargir l’accès à des solutions de transport médical de qualité dans les zones mal desservies.

Portée du marché des boîtes de transport médical en Asie-Pacifique

Le marché est segmenté en fonction du type de produit, du matériau, de l’application, de la conception, de l’utilisateur final et du canal de distribution.

- Par type de produit

En fonction du type de produit, le marché des boîtes de transport médical en Asie-Pacifique se divise en boîtes médicales traditionnelles et boîtes médicales réfrigérées. Le segment des boîtes médicales réfrigérées a dominé le marché avec une part de chiffre d'affaires de 62,8 % en 2024, grâce à la nécessité impérieuse de maintenir une température précise pour les produits médicaux sensibles tels que les vaccins, le sang et les échantillons biologiques pendant leur transport. Le développement des programmes de vaccination et l'intensification des essais cliniques en Asie-Pacifique renforcent la demande de solutions de stockage réfrigéré.

Le segment des boîtes médicales traditionnelles devrait connaître la croissance la plus rapide au cours de la période de prévision, car il s'adresse aux articles médicaux non sensibles à la température tels que les dispositifs médicaux et les déchets, offrant une option plus rentable et largement accessible pour les petits prestataires de soins de santé et les marchés émergents.

- Par matériau

En fonction du matériau, le marché des boîtes de transport médical en Asie-Pacifique est segmenté en boîtes en plastique, en métal et en carton ondulé. En 2024, le segment des boîtes en plastique dominait le marché avec 55 % de parts de marché. Il est plébiscité pour sa légèreté, sa durabilité et ses excellentes propriétés isolantes, idéales pour une utilisation répétée en logistique médicale. Les boîtes en plastique offrent également un bon rapport coût-performance, favorisant leur adoption généralisée dans les hôpitaux et les laboratoires de diagnostic.

Le segment des boîtes en carton ondulé devrait connaître la croissance la plus rapide au cours de la période de prévision, grâce à sa rentabilité, sa biodégradabilité et sa facilité de personnalisation. Ce matériau est particulièrement apprécié pour le transport courte distance et les applications jetables dans les zones rurales et aux ressources limitées, ce qui s'inscrit dans le cadre des initiatives croissantes en matière de développement durable dans la région.

- Par application

En fonction des applications, le marché des boîtes de transport médical en Asie-Pacifique est segmenté en médicaments, échantillons de test, vaccins, sang, organes, dispositifs médicaux, déchets médicaux, etc. Le segment des vaccins dominait avec une part de marché de 40 % en 2024, grâce à des campagnes de vaccination intensives, notamment dans des pays très peuplés comme la Chine et l'Inde. Les exigences strictes en matière de chaîne du froid pour garantir l'efficacité des vaccins font de ce segment un élément essentiel du marché.

Le segment du transport d'organes devrait connaître la croissance la plus rapide au cours de la période de prévision, en raison de l'augmentation du nombre d'opérations de transplantation d'organes et des progrès de la médecine de transplantation. Le transport d'organes exige des solutions d'emballage à température contrôlée hautement spécialisées, rapides et sécurisées, de plus en plus adoptées par les professionnels de santé pour garantir le succès des transplantations.

- Par conception

En termes de conception, le marché des boîtes de transport médical en Asie-Pacifique est segmenté en boîtes standard et boîtes sur mesure. Le segment des boîtes standard dominait le marché avec 70 % de parts de marché en 2024 grâce à leur taille standardisée, leur large applicabilité et leur rentabilité, répondant ainsi à la majorité des besoins de transport médical des établissements de santé.

Le segment des boîtes personnalisées devrait connaître la croissance la plus rapide au cours de la période de prévision, les prestataires de soins de santé et les laboratoires pharmaceutiques recherchant des solutions d'emballage sur mesure. Les boîtes personnalisées offrent une isolation renforcée, des mécanismes de verrouillage sécurisés et des dimensions spécifiques pour répondre à des exigences de transport spécifiques, notamment pour les organes fragiles, les échantillons biologiques rares ou les matériaux d'essais cliniques de grande valeur.

- Par utilisateur final

En fonction de l'utilisateur final, le marché des boîtes de transport médical en Asie-Pacifique est segmenté entre laboratoires de diagnostic, banques de sang, hôpitaux et cliniques, centres de chirurgie ambulatoire, instituts universitaires et de recherche, etc. Le segment des hôpitaux et cliniques dominait avec environ 45 % de parts de marché en 2024, reflétant le volume et la fréquence élevés des transports d'échantillons et de produits médicaux dans ces établissements. Le développement des infrastructures de santé et la fréquentation croissante des patients expliquent cette domination.

Le segment des centres chirurgicaux ambulatoires devrait enregistrer la croissance la plus rapide au cours de la période de prévision, en raison de la décentralisation de la prestation de soins de santé et de la popularité croissante des procédures ambulatoires, qui nécessitent des solutions de transport efficaces, sécurisées et rapides pour les échantillons et dispositifs médicaux.

- Par canal de distribution

En fonction du canal de distribution, le marché des boîtes de transport médical en Asie-Pacifique est segmenté en appels d'offres directs, ventes au détail et autres. Le segment des appels d'offres directs détenait la part la plus importante, soit 60 % en 2024, principalement en raison des achats en gros effectués par les services de santé publics, les grands hôpitaux et les acheteurs institutionnels en quête de rentabilité et de contrats d'approvisionnement à long terme.

Le segment des ventes au détail devrait connaître la croissance la plus rapide au cours de la période de prévision, soutenu par la demande croissante des petites cliniques, des centres de diagnostic privés et des prestataires de soins de santé spécialisés qui préfèrent acheter de plus petites quantités de boîtes de transport médicales prêtes à l'emploi via les canaux de vente au détail ou de commerce électronique pour maintenir la flexibilité opérationnelle.

Analyse régionale du marché des boîtes de transport médical en Asie-Pacifique

- La Chine a dominé le marché des boîtes de transport médical en Asie-Pacifique avec la plus grande part de revenus de 39 % en 2024, soutenue par une urbanisation rapide, des initiatives gouvernementales en matière de santé et un écosystème de fabrication robuste pour les solutions d'emballage médical.

- L'augmentation des initiatives gouvernementales visant à améliorer la logistique de la chaîne du froid, associée à une sensibilisation croissante à l'importance d'un transport sûr pour les vaccins, le sang et les échantillons biologiques, a considérablement stimulé la demande en Chine.

- L'urbanisation croissante du pays, l'amélioration de l'accessibilité aux soins de santé et l'accent mis sur la recherche et le développement favorisent l'adoption généralisée de boîtes de transport médical avancées dans les hôpitaux, les laboratoires de diagnostic et les instituts de recherche.

Aperçu du marché chinois des boîtes de transport médical

En 2024, le marché chinois des boîtes de transport médical a représenté la plus grande part de chiffre d'affaires de la région Asie-Pacifique, grâce à des investissements importants dans les infrastructures de santé, à des campagnes de vaccination à grande échelle et au soutien gouvernemental à la logistique de la chaîne du froid. La solide base industrielle du pays permet la production de boîtes de transport médical innovantes et rentables, conformes à des normes réglementaires strictes. L'urbanisation croissante et l'augmentation des dépenses de santé stimulent également la demande des hôpitaux, des laboratoires de diagnostic et des instituts de recherche. Les progrès constants des technologies de surveillance de la température et de l'intégration de l'IoT accélèrent encore l'expansion du marché en Chine.

Aperçu du marché indien des boîtes de transport médical

Le marché indien des conteneurs de transport médical occupe une part importante du marché Asie-Pacifique, porté par l'urbanisation rapide du pays, la croissance de la classe moyenne et l'expansion des services de santé. La mission « Villes intelligentes » du gouvernement et les campagnes nationales de vaccination contribuent significativement à la demande de solutions de transport médical fiables. L'accessibilité financière et la sensibilisation croissante à la gestion de la chaîne du froid favorisent l'adoption de ces solutions dans les secteurs de la santé, tant public que privé. De plus, l'essor des centres de diagnostic et des structures de chirurgie ambulatoire dans les villes de deuxième et troisième rangs favorise la croissance du marché.

Aperçu du marché japonais des boîtes de transport médical

Le marché japonais des boîtes de transport médical connaît une croissance constante, soutenu par l'infrastructure sanitaire avancée du pays et par des normes élevées en matière de logistique médicale. L'importance accordée au maintien de l'intégrité des produits et à la conformité réglementaire stimule la demande de solutions d'emballage sophistiquées à température contrôlée. Le vieillissement de la population accroît également le besoin d'un transport fiable des échantillons médicaux et des produits pharmaceutiques. L'intégration de technologies intelligentes telles que la surveillance de la température en temps réel et l'enregistrement des données se généralise, renforçant la position du Japon comme marché clé dans la région Asie-Pacifique.

Aperçu du marché des boîtes de transport médical en Corée du Sud

Le marché sud-coréen des boîtes de transport médical connaît une croissance constante, portée par un système de santé à la pointe de la technologie et une forte concentration sur la recherche et le développement. Le leadership du pays dans les domaines biotechnologique et pharmaceutique exige des solutions de transport fiables pour les matières biologiques sensibles. Le soutien gouvernemental aux initiatives de santé intelligente et à l'amélioration de la chaîne du froid renforce la demande du marché. Par ailleurs, l'intégration de systèmes de surveillance IoT dans le transport médical est de plus en plus adoptée par les hôpitaux et les laboratoires.

Part de marché des boîtes de transport médical en Asie-Pacifique

L'industrie des boîtes de transport médical en Asie-Pacifique est principalement dirigée par des entreprises bien établies, notamment :

- Paragonix Technologies (États-Unis)

- B Medical Systems (France)

- Envirotainer AB (Suède)

- Cryopak Industries (États-Unis)

- Pelican BioThermal (États-Unis)

- Sonoco ThermoSafe (États-Unis)

- va-Q-tec AG (Allemagne)

- Technologies de la chaîne du froid (États-Unis)

- GSK plc (Royaume-Uni)

- Sensitech Inc. (États-Unis)

- Systèmes Softbox (Royaume-Uni)

- Thermo Fisher Scientific Inc. (États-Unis)

- Groupe Biocair (Royaume-Uni)

- DHL Supply Chain (Allemagne)

- UPS Healthcare (États-Unis)

- Courrier mondial (États-Unis)

- Marques (États-Unis)

- Cryoport, Inc. (États-Unis)

- Schott AG (Allemagne)

Quels sont les développements récents sur le marché des boîtes de transport médical en Asie-Pacifique ?

- En juillet 2025, TransMedics a reçu l'approbation de la FDA pour un essai clinique en deux phases portant sur son système de soins d'organes (OCS) dans le cadre de transplantations cardiaques. Cet essai vise à évaluer des temps de perfusion plus longs et la viabilité des organes provenant de donneurs en état de mort cérébrale, devenant ainsi potentiellement le plus grand essai clinique consacré à la préservation cardiaque. Ce développement souligne l'importance croissante des technologies avancées de transport médical en transplantation d'organes.

- En août 2024, Paragonix Technologies a annoncé une collaboration avec la Nationwide Organ Recovery Transport Alliance (NORA) afin de mettre en place un service de transport d'organes de donneurs rentable. Cette initiative s'appuie sur une technologie de préservation avancée et utilise le transport aérien commercial, visant à améliorer l'accessibilité et la fiabilité du transport d'organes aux États-Unis.

- En avril 2024, le réfrigérateur et congélateur à vaccins à énergie solaire directe de B Medical Systems, le TCW 40 SDD, a reçu le label ACT décerné par My Green Lab. Cette reconnaissance souligne l'engagement de l'entreprise en faveur du développement durable, faisant du TCW 40 SDD le premier réfrigérateur et congélateur à vaccins à énergie solaire à recevoir ce prestigieux label.

- En octobre 2022, le groupe Secop et B Medical Systems ont annoncé un accord de développement conjoint pour créer une nouvelle génération de conteneurs de transport médical. Cette collaboration vise à exploiter leur expertise combinée pour développer des unités de transport actif équipées de systèmes de compresseurs en cascade capables d'atteindre et de maintenir des températures ultra-basses pour les vaccins, les échantillons biologiques et autres produits sensibles, même à des températures ambiantes allant jusqu'à 43 °C.

- En janvier 2021, Blackfrog Technologies, une start-up soutenue par le Département de biotechnologie, a développé et lancé « Emvolio », un appareil de réfrigération portable alimenté par batterie. Cette innovation a été conçue pour résoudre le problème de la livraison des vaccins au dernier kilomètre en garantissant un environnement à température contrôlée stricte pendant 12 heures, ce qui représente une amélioration significative par rapport aux glacières traditionnelles.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.