Asia Pacific Maltitol In Chocolate Market

Taille du marché en milliards USD

TCAC :

%

USD

31,088.61 Thousand

USD

53,016.68 Thousand

2021

2029

USD

31,088.61 Thousand

USD

53,016.68 Thousand

2021

2029

| 2022 –2029 | |

| USD 31,088.61 Thousand | |

| USD 53,016.68 Thousand | |

|

|

|

Marché du maltitol dans le chocolat en Asie-Pacifique , par forme ( poudre de cristal et sirops), catégorie de chocolat ( chocolat blancchocolat au lait et chocolat noir ), application ( boulangerie , chocolats de détail, inclusions de chocolat ), pays (Japon, Chine, Corée du Sud, Inde, Australie, Singapour, Nouvelle-Zélande, Malaisie, Indonésie, Philippines, Thaïlande et reste de l'Asie-Pacifique) Tendances et prévisions de l'industrie jusqu'en 2029.

Analyse et perspectives du marché : Marché du maltitol dans le chocolat en Asie-Pacifique

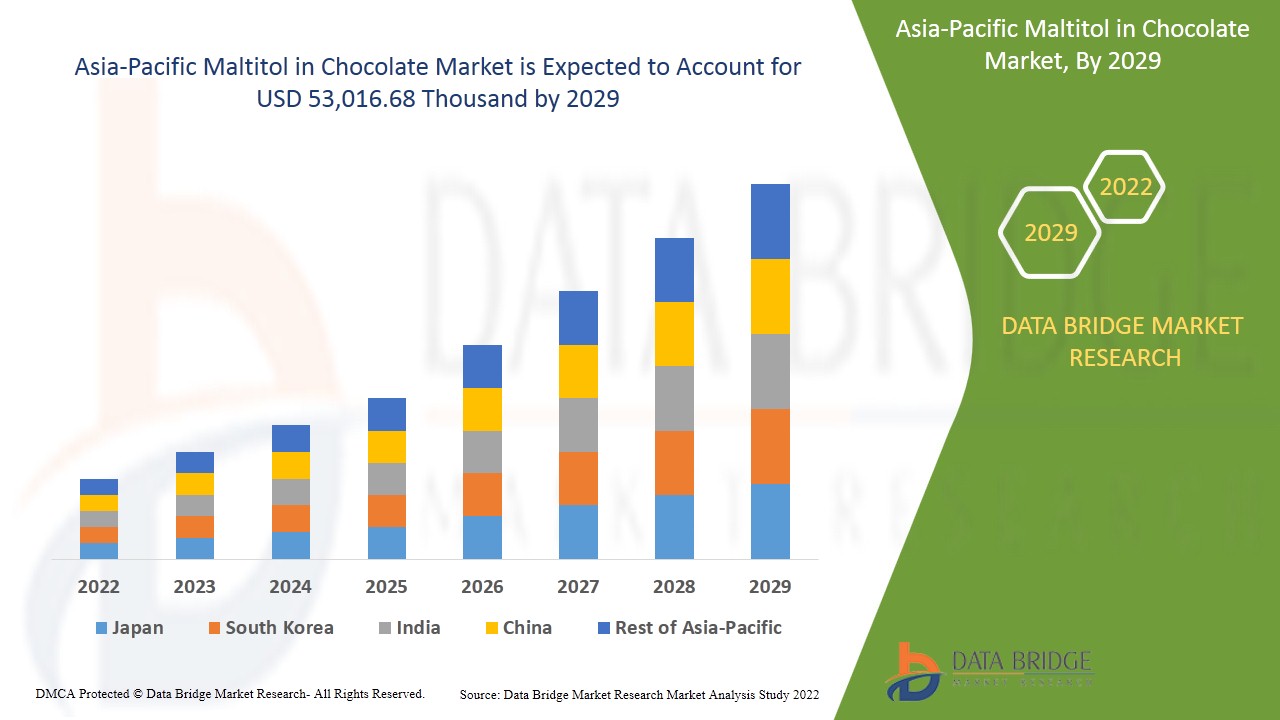

Le marché du maltitol dans le chocolat devrait croître au cours de la période de prévision de 2022 à 2029. Data Bridge Market Research analyse que le marché croît avec un TCAC de 7,0 % au cours de la période de prévision de 2022 à 2029 et devrait atteindre 53 016,68 milliers USD d'ici 2029 contre 31 088,61 milliers USD en 2021.

Le maltitol est un glucide appelé alcool de sucre ou polyol. Le maltitol est un composé hydrosoluble que l'on trouve naturellement dans de nombreux fruits et légumes. À grande échelle, le maltitol est produit à partir d'amidons riches en sucre de maltose. Les principales applications du maltitol dans l'industrie alimentaire sont les produits de boulangerie, les chocolats sans sucre, les chewing-gums, les bonbons durs et les enrobages de chocolat. Le maltitol est sans danger pour la consommation humaine car sa sécurité a été examinée et confirmée par les autorités sanitaires du monde entier, telles que l'Union européenne, l'Organisation mondiale de la santé et des pays comme l'Australie et le Canada. Le maltitol a le même goût que le sucre normal. Il a environ 90 % de sucrosité similaire à celle du sucre et contient près de la moitié des calories par gramme du sucre (2,1 calories pour le maltitol contre quatre calories pour le sucre).

Le maltitol est un alcool de sucre obtenu à partir de diverses matières premières telles que les fruits, les légumes et les amidons. Le sucre maltose issu des amidons est la source du maltitol et il est utilisé comme édulcorant hypocalorique dans divers produits alimentaires et boissons tels que les chocolats sans sucre, les bonbons durs, les produits de boulangerie, les enrobages de chocolat et les chewing-gums. La demande d'édulcorants hypocaloriques augmente à mesure que les gens deviennent plus soucieux de leur santé et que la population diabétique du monde augmente également. Ainsi, la demande de maltitol dans les chocolats hypocaloriques et les chocolats sans sucre augmente également dans le monde entier. Les facteurs à l'origine de la croissance du marché sont la demande croissante de produits à base de chocolat hypocaloriques et sans sucre, un nombre croissant de problèmes de santé causés par les ingrédients sucrés ordinaires, l'adoption croissante du maltitol comme alternative au saccharose et des sources abondantes de matières premières. Les facteurs qui freinent la croissance du marché sont les effets secondaires du maltitol, le coût élevé du maltitol par rapport aux autres édulcorants et le nombre de substituts disponibles sur le marché. De nombreuses entreprises agrandissent leurs installations de fabrication pour répondre à la demande croissante de chocolats contenant du maltitol.

Le rapport sur le marché du maltitol dans le chocolat fournit des détails sur la part de marché, les nouveaux développements et l'analyse du pipeline de produits, l'impact des acteurs du marché national et localisé, analyse les opportunités en termes de poches de revenus émergentes, les changements dans la réglementation du marché, les approbations de produits, les décisions stratégiques, les lancements de produits, les expansions géographiques et les innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché mondial du maltitol dans le chocolat, contactez Data Bridge Market Research pour un briefing d'analyste ; notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

Portée et taille du marché du maltitol dans le chocolat

Le marché du maltitol dans le chocolat est segmenté en trois segments notables qui sont basés sur la forme, la catégorie de chocolat et l'application. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles.

- Sur la base de la forme, le marché du maltitol dans le chocolat est segmenté en cristaux, en poudre et en sirop. En 2022, le segment du sirop devrait dominer la part de marché en raison de facteurs tels que le faible coût du sirop par rapport aux autres formes.

- Sur la base de la catégorie de chocolat, le marché du maltitol dans le chocolat est segmenté en chocolat blanc, chocolat au lait et chocolat noir. En 2022, le segment du chocolat blanc devrait dominer la part de marché en raison de facteurs tels que la forte demande de chocolat blanc chez les parents de jeunes enfants.

- En fonction des applications, le marché du maltitol dans le chocolat est segmenté en produits de boulangerie, chocolats de détail et inclusions de chocolat. En 2022, le segment des chocolats de détail devrait dominer le marché en raison de la forte demande de produits à base de chocolat hypocaloriques.

Analyse du marché du maltitol dans le chocolat au niveau des pays

Le marché du maltitol dans le chocolat est segmenté en trois segments notables qui sont basés sur la forme, la catégorie de chocolat et l'application.

Les pays couverts par le rapport sur le marché du maltitol dans le chocolat sont le Japon, la Chine, la Corée du Sud, l'Inde, l'Australie, Singapour, la Nouvelle-Zélande, la Malaisie, l'Indonésie, les Philippines, la Thaïlande et le reste de l'Asie-Pacifique.

La Chine est en tête de la croissance du marché Asie-Pacifique et le segment des applications domine dans ce pays en raison des avantages pour la santé associés à la consommation de maltitol.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie des pays, les actes réglementaires et les tarifs d'importation et d'exportation sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques mondiales et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des canaux de vente sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Les activités stratégiques croissantes des principaux acteurs du marché visant à accroître la notoriété du maltitol dans le chocolat stimulent la croissance du marché du maltitol dans le chocolat

Le marché du maltitol dans le chocolat vous fournit également une analyse de marché détaillée de la croissance de chaque pays sur un marché particulier. En outre, il fournit des informations détaillées sur la stratégie des acteurs du marché et leur présence géographique. Les données sont disponibles pour la période historique de 2012 à 2020.

Analyse du paysage concurrentiel et des parts de marché du maltitol dans le chocolat

Le paysage concurrentiel du marché du maltitol dans le chocolat fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement du produit, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et l'étendue du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus ne concernent que l'accent mis par l'entreprise sur le marché du maltitol dans le chocolat.

Français Certains des principaux acteurs opérant sur le marché du maltitol dans le chocolat sont Zhejiang Huakang Pharmaceutical Co. Ltd., Roquette Frères, Ingredion, Mitsubishi Corporation Life Sciences Limited, ADM, Brenntag, Merck KGaA, Shandong Futaste Co., Cargill, Incorporated, B Food Science Co., Ltd., Hangzhou Verychem Science And Technology Co.Ltd, Haihang Industry, Sosa, Foodchem International Corporation, PT. Ecogreen Oleochemicals, Mitushi Biopharma, MUBY CHEMICALS, Hylen Co., Ltd, Nutra Food Ingredients, entre autres.

Par exemple,

- En décembre 2020, Merck KGaA a agrandi ses installations de production aux États-Unis pour les activités des sciences de la vie, qui incluent la production de maltitol. Ces agrandissements augmenteront considérablement la capacité et la production de ces installations d'ici fin 2021 et 2022, respectivement, et créeront près de 700 nouveaux postes de fabrication. Cette expansion a permis à l'entreprise d'élargir sa présence géographique.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC MALTITOL IN CHOCOLATE MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 INGREDIENT TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 IMPORT & EXPORT ANALYSIS OF ASIA PACIFIC MALTITOL IN CHOCOLATE MARKET

4.1.1 IMPORT-EXPORT ANALYSIS

5 LIST OF SUBSTITUTES

6 ASIA PACIFIC MALTITOL IN CHOCOLATE MARKET: MARKETING STRATEGIES

7 ASIA PACIFIC MALTITOL IN CHOCOLATE MARKET: REGULATIONS

7.1 REGULATIONS ON THE MALTITOL BY EUROPEAN UNIONS

7.2 REGULATIONS ON THE USE OF FOOD ADDITIVES

7.3 REGULATIONS ON MALTITOL BY THE U.S. FDA

8 ASIA PACIFIC MALTITOL IN CHOCOLATE MARKET: SUPPLY CHAIN ANALYSIS

8.1 RAW MATERIAL PROCUREMENT

8.2 MANUFACTURING

8.3 MARKETING AND DISTRIBUTION

8.4 END USERS

9 MARKET OVERVIEW

9.1 DRIVERS

9.1.1 INCREASING DEMAND FOR LOW CALORIE AND SUGAR-FREE CHOCOLATE PRODUCTS

9.1.2 GROWING NUMBER OF HEALTH ISSUES CAUSED BY REGULAR SUGAR INGREDIENT

9.1.3 GROWING ADOPTION OF MALTITOL AS SUCROSE ALTERNATIVE

9.1.4 ABUNDANT SOURCES OF RAW MATERIAL

9.2 RESTRAINTS

9.2.1 SIDE EFFECTS OF MALTITOL

9.2.2 HIGH COST OF MALTITOL AS COMPARED TO OTHER SWEETENERS

9.2.3 NUMBER OF SUBSTITUTES AVAILABLE IN THE MARKET

9.3 OPPORTUNITIES

9.3.1 MALTITOL IS AN IMPORTANT INGREDIENT IN CHOCOLATES TO PREVENT DENTAL CARIES IN CHILDREN AND ADULTS

9.3.2 HEALTH BENEFITS ASSOCIATED WITH CONSUMPTION OF MALTITOL

9.4 CHALLENGES

9.4.1 HIGH COST OF CHOCOLATES CONTAINING MALTITOL

9.4.2 STRINGENT GOVERNMENT REGULATIONS

10 COVID-19 IMPACT ON ASIA PACIFIC MALTITOL IN CHOCOLATE MARKET

10.1 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVES TO BOOST THE ASIA PACIFIC MALTITOL IN CHOCOLATE MARKET

10.2 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

10.3 IMPACT ON PRICE

10.4 IMPACT ON DEMAND

10.5 IMPACT ON SUPPLY CHAIN

10.6 CONCLUSION

11 ASIA PACIFIC MALTITOL IN CHOCOLATE MARKET, BY FORM

11.1 OVERVIEW

11.2 SYRUP

11.2.1 HIGH MALTOSE SYRUP

11.2.2 EXTRA HIGH MALTOSE SYRUP

11.3 CRYSTAL

11.4 POWDER

12 ASIA PACIFIC MALTITOL IN CHOCOLATE MARKET, BY CHOCOLATE CATEGORY

12.1 OVERVIEW

12.2 MILK CHOCOLATE

12.3 DARK CHOCOLATE

12.4 WHITE CHOCOLATE

13 ASIA PACIFIC MALTITOL IN CHOCOLATE MARKET, BY APPLICATION

13.1 OVERVIEW

13.2 RETAIL CHOCOLATES

13.2.1 CHOCOLATE BARS

13.2.2 CANDIES

13.2.3 ASSORTMENT CHOCOLATES

13.2.4 BITES

13.2.5 CHOCOLATE WAFFERS

13.2.6 OTHERS

13.3 BAKERY

13.3.1 CAKES & PASTRIES

13.3.2 BREADS & ROLLS

13.3.3 BISCUIT

13.3.4 COOKIES & CRACKERS

13.3.5 OTHERS

13.4 CHOCOLATE INCLUSIONS

13.4.1 CHOCOLATE SHAPES

13.4.2 JIMMIES

13.4.3 DRAGEES

13.4.3.1 OVAL DRAGEES

13.4.3.2 PEARL DRAGEES

13.4.4 CHOCOLATE SYRUPS

13.4.5 CHOCOLATE FLAKES

13.4.6 QUINS

13.4.7 NONPAREILS

13.4.8 CHOCOLATE CHUNKS

13.4.9 CHOCOLATE SHELLS

13.4.10 CHOCOLATE CUPS

13.4.11 OTHERS

14 ASIA PACIFIC MALTITOL IN CHOCOLATE MARKET, BY REGION

14.1 ASIA-PACIFIC

14.1.1 CHINA

14.1.2 JAPAN

14.1.3 INDIA

14.1.4 SOUTH KOREA

14.1.5 AUSTRALIA

14.1.6 SINGAPORE

14.1.7 MALAYSIA

14.1.8 THAILAND

14.1.9 INDONESIA

14.1.10 PHILIPPINES

14.1.11 REST OF ASIA-PACIFIC

15 ASIA PACIFIC MALTITOL IN CHOCOLATE MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

16 SWOT ANALYSIS

17 COMPANY PROFILES

17.1 INGREDION

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENTS

17.2 CARGILL, INCORPORATED

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENT

17.3 MERCK KGAA

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENTS

17.4 ROQUETTE FRÈRES

17.4.1 COMPANY SNAPSHOT

17.4.2 COMPANY SHARE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT DEVELOPMENT

17.5 ADM

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 COMPANY SHARE ANALYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENTS

17.6 SHANDONG FUTASTE CO.

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENTS

17.7 BRENNTAG

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 PRODUCT PORTFOLIO

17.7.4 RECENT DEVELOPMENTS

17.8 B FOOD SCIENCE CO., LTD.

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENTS

17.9 FOODCHEM INTERNATIONAL CORPORATION

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENTS

17.1 HANGZHOU VERYCHEM SCIENCE AND TECHNOLOGY CO.LTD

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENTS

17.11 HAIHANG INDUSTRY

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENT

17.12 HYLEN CO., LTD

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENT

17.13 MITSUBISHI CORPORATION LIFE SCIENCES LIMITED

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENTS

17.14 MITUSHI BIOPHARMA

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENT

17.15 MUBY CHEMICALS

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENT

17.16 NUTRA FOOD INGREDIENTS

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENTS

17.17 PT. ECOGREEN OLEOCHEMICALS

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENTS

17.18 SOSA

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENT

17.19 ZHEJIANG HUAKANG PHARMACEUTICAL CO., LTD.

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENTS

18 QUESTIONNAIRE

19 RELATED REPORTS

Liste des tableaux

TABLE 1 IMPORT DATA OF PRODUCT: 1107 MALT (USD THOUSAND)

TABLE 2 EXPORT DATA OF PRODUCT: 1107 MALT (USD THOUSAND)

TABLE 3 LIST OF MALTITOL SUBSTITUTES

TABLE 4 A COMPARISON OF SOME PHYSICO-CHEMICAL PROPERTIES FOR SUCROSE AND MALTITOL

TABLE 5 FREQUENCY AND MEAN SCORE OF INTOLERANCE SYMPTOMS INTENSITY AFTER REGULAR CONSUMPTION OF INCREASING DOSES OF MALTITOL IN 12 HEALTHY VOLUNTEERS

TABLE 6 PRICES INDICATION OF DIFFERENT SWEETENERS

TABLE 7 ASIA PACIFIC MALTITOL IN CHOCOLATE MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 8 ASIA PACIFIC SYRUP IN MALTITOL IN CHOCOLATE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 9 ASIA PACIFIC SYRUP IN MALTITOL IN CHOCOLATE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 10 ASIA PACIFIC CRYSTAL IN MALTITOL IN CHOCOLATE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 11 ASIA PACIFIC POWDER IN MALTITOL IN CHOCOLATE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 12 ASIA PACIFIC MALTITOL IN CHOCOLATE MARKET, BY CHOCOLATE CATEGORY, 2020-2029 (USD THOUSAND)

TABLE 13 ASIA PACIFIC MILK CHOCOLATE IN MALTITOL IN CHOCOLATE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 14 ASIA PACIFIC DARK CHOCOLATE IN MALTITOL IN CHOCOLATE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 15 ASIA PACIFIC WHITE CHOCOLATE IN MALTITOL IN CHOCOLATE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 16 ASIA PACIFIC MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 17 ASIA PACIFIC RETAIL CHOCOLATES IN MALTITOL IN CHOCOLATE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 18 ASIA PACIFIC RETAIL CHOCOLATES IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 19 ASIA PACIFIC BAKERY IN MALTITOL IN CHOCOLATE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 20 ASIA PACIFIC BAKERY IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 21 ASIA PACIFIC CHOCOLATE INCLUSIONS IN MALTITOL IN CHOCOLATE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 22 ASIA PACIFIC CHOCOLATE INCLUSIONS IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 23 ASIA PACIFIC DRAGEES IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 24 ASIA-PACIFIC MALTITOL IN CHOCOLATE MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 25 ASIA-PACIFIC MALTITOL IN CHOCOLATE MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 26 ASIA-PACIFIC SYRUP IN MALTITOL IN CHOCOLATE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 27 ASIA-PACIFIC MALTITOL IN CHOCOLATE MARKET, BY CHOCOLATE CATEGORY, 2020-2029 (USD THOUSAND)

TABLE 28 ASIA-PACIFIC MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 29 ASIA-PACIFIC BAKERY IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 30 ASIA-PACIFIC RETAIL CHOCOLATES IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 31 ASIA-PACIFIC CHOCOLATE INCLUSIONS IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 32 ASIA-PACIFIC DRAGEES IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 33 CHINA MALTITOL IN CHOCOLATE MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 34 CHINA SYRUP IN MALTITOL IN CHOCOLATE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 35 CHINA MALTITOL IN CHOCOLATE MARKET, BY CHOCOLATE CATEGORY, 2020-2029 (USD THOUSAND)

TABLE 36 CHINA MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 37 CHINA BAKERY IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 38 CHINA RETAIL CHOCOLATES IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 39 CHINA CHOCOLATE INCLUSIONS IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 40 CHINA DRAGEES IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 41 JAPAN MALTITOL IN CHOCOLATE MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 42 JAPAN SYRUP IN MALTITOL IN CHOCOLATE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 43 JAPAN MALTITOL IN CHOCOLATE MARKET, BY CHOCOLATE CATEGORY, 2020-2029 (USD THOUSAND)

TABLE 44 JAPAN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 45 JAPAN BAKERY IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 46 JAPAN RETAIL CHOCOLATES IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 47 JAPAN CHOCOLATE INCLUSIONS IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 48 JAPAN DRAGEES IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 49 INDIA MALTITOL IN CHOCOLATE MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 50 INDIA SYRUP IN MALTITOL IN CHOCOLATE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 51 INDIA MALTITOL IN CHOCOLATE MARKET, BY CHOCOLATE CATEGORY, 2020-2029 (USD THOUSAND)

TABLE 52 INDIA MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 53 INDIA BAKERY IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 54 INDIA RETAIL CHOCOLATES IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 55 INDIA CHOCOLATE INCLUSIONS IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 56 INDIA DRAGEES IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 57 SOUTH KOREA MALTITOL IN CHOCOLATE MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 58 SOUTH KOREA SYRUP IN MALTITOL IN CHOCOLATE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 59 SOUTH KOREA MALTITOL IN CHOCOLATE MARKET, BY CHOCOLATE CATEGORY, 2020-2029 (USD THOUSAND)

TABLE 60 SOUTH KOREA MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 61 SOUTH KOREA BAKERY IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 62 SOUTH KOREA RETAIL CHOCOLATES IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 63 SOUTH KOREA CHOCOLATE INCLUSIONS IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 64 SOUTH KOREA DRAGEES IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 65 AUSTRALIA MALTITOL IN CHOCOLATE MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 66 AUSTRALIA SYRUP IN MALTITOL IN CHOCOLATE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 67 AUSTRALIA MALTITOL IN CHOCOLATE MARKET, BY CHOCOLATE CATEGORY, 2020-2029 (USD THOUSAND)

TABLE 68 AUSTRALIA MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 69 AUSTRALIA BAKERY IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 70 AUSTRALIA RETAIL CHOCOLATES IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 71 AUSTRALIA CHOCOLATE INCLUSIONS IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 72 AUSTRALIA DRAGEES IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 73 SINGAPORE MALTITOL IN CHOCOLATE MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 74 SINGAPORE SYRUP IN MALTITOL IN CHOCOLATE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 75 SINGAPORE MALTITOL IN CHOCOLATE MARKET, BY CHOCOLATE CATEGORY, 2020-2029 (USD THOUSAND)

TABLE 76 SINGAPORE MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 77 SINGAPORE BAKERY IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 78 SINGAPORE RETAIL CHOCOLATES IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 79 SINGAPORE CHOCOLATE INCLUSIONS IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 80 SINGAPORE DRAGEES IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 81 MALAYSIA MALTITOL IN CHOCOLATE MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 82 MALAYSIA SYRUP IN MALTITOL IN CHOCOLATE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 83 MALAYSIA MALTITOL IN CHOCOLATE MARKET, BY CHOCOLATE CATEGORY, 2020-2029 (USD THOUSAND)

TABLE 84 MALAYSIA MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 85 MALAYSIA BAKERY IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 86 MALAYSIA RETAIL CHOCOLATES IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 87 MALAYSIA CHOCOLATE INCLUSIONS IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 88 MALAYSIA DRAGEES IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 89 THAILAND MALTITOL IN CHOCOLATE MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 90 THAILAND SYRUP IN MALTITOL IN CHOCOLATE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 91 THAILAND MALTITOL IN CHOCOLATE MARKET, BY CHOCOLATE CATEGORY, 2020-2029 (USD THOUSAND)

TABLE 92 THAILAND MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 93 THAILAND BAKERY IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 94 THAILAND RETAIL CHOCOLATES IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 95 THAILAND CHOCOLATE INCLUSIONS IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 96 THAILAND DRAGEES IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 97 INDONESIA MALTITOL IN CHOCOLATE MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 98 INDONESIA SYRUP IN MALTITOL IN CHOCOLATE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 99 INDONESIA MALTITOL IN CHOCOLATE MARKET, BY CHOCOLATE CATEGORY, 2020-2029 (USD THOUSAND)

TABLE 100 INDONESIA MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 101 INDONESIA BAKERY IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 102 INDONESIA RETAIL CHOCOLATES IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 103 INDONESIA CHOCOLATE INCLUSIONS IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 104 INDONESIA DRAGEES IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 105 PHILIPPINES MALTITOL IN CHOCOLATE MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 106 PHILIPPINES SYRUP IN MALTITOL IN CHOCOLATE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 107 PHILIPPINES MALTITOL IN CHOCOLATE MARKET, BY CHOCOLATE CATEGORY, 2020-2029 (USD THOUSAND)

TABLE 108 PHILIPPINES MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 109 PHILIPPINES BAKERY IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 110 PHILIPPINES RETAIL CHOCOLATES IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 111 PHILIPPINES CHOCOLATE INCLUSIONS IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 112 PHILIPPINES DRAGEES IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 113 REST OF ASIA-PACIFIC MALTITOL IN CHOCOLATE MARKET, BY FORM, 2020-2029 (USD THOUSAND)

Liste des figures

FIGURE 1 ASIA PACIFIC MALTITOL IN CHOCOLATE MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC MALTITOL IN CHOCOLATE MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC MALTITOL IN CHOCOLATE MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC MALTITOL IN CHOCOLATE MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC MALTITOL IN CHOCOLATE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC MALTITOL IN CHOCOLATE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC MALTITOL IN CHOCOLATE MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA PACIFIC MALTITOL IN CHOCOLATE: MARKET APPLICATION GRID

FIGURE 9 ASIA PACIFIC MALTITOL IN CHOCOLATE MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 ASIA PACIFIC MALTITOL IN CHOCOLATE MARKET: SEGMENTATION

FIGURE 11 NORTH AMERICA IS EXPECTED TO DOMINATE THE ASIA PACIFIC MALTITOL IN CHOCOLATE MARKET AND GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 INCREASING DEMAND FOR LOW CALORIE AND SUGAR-FREE CHOCOLATE PRODUCTS ARE LEADING TO THE GROWTH OF THE ASIA PACIFIC MALTITOL IN CHOCOLATE MARKET IN THE FORECAST PERIOD

FIGURE 13 SYRUP SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC MALTITOL IN CHOCOLATE MARKET IN 2022 & 2029

FIGURE 14 SUPPLY CHAIN OF ASIA PACIFIC MALTITOL IN CHOCOLATE MARKET

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF ASIA PACIFIC MALTITOL IN CHOCOLATE MARKET

FIGURE 16 ASIA PACIFIC MALTITOL IN CHOCOLATE MARKET, BY FORM, 2021

FIGURE 17 ASIA PACIFIC MALTITOL IN CHOCOLATE MARKET, BY CHOCOLATE CATEGORY, 2021

FIGURE 18 ASIA PACIFIC MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2021

FIGURE 19 ASIA-PACIFIC MALTITOL IN CHOCOLATE MARKET: SNAPSHOT (2021)

FIGURE 20 ASIA-PACIFIC MALTITOL IN CHOCOLATE MARKET: BY COUNTRY (2021)

FIGURE 21 ASIA-PACIFIC MALTITOL IN CHOCOLATE MARKET: BY COUNTRY (2022 & 2029)

FIGURE 22 ASIA-PACIFIC MALTITOL IN CHOCOLATE MARKET: BY COUNTRY (2021 & 2029)

FIGURE 23 ASIA-PACIFIC MALTITOL IN CHOCOLATE MARKET: BY FORM (2022 & 2029)

FIGURE 24 ASIA PACIFIC MALTITOL IN CHOCOLATE MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.