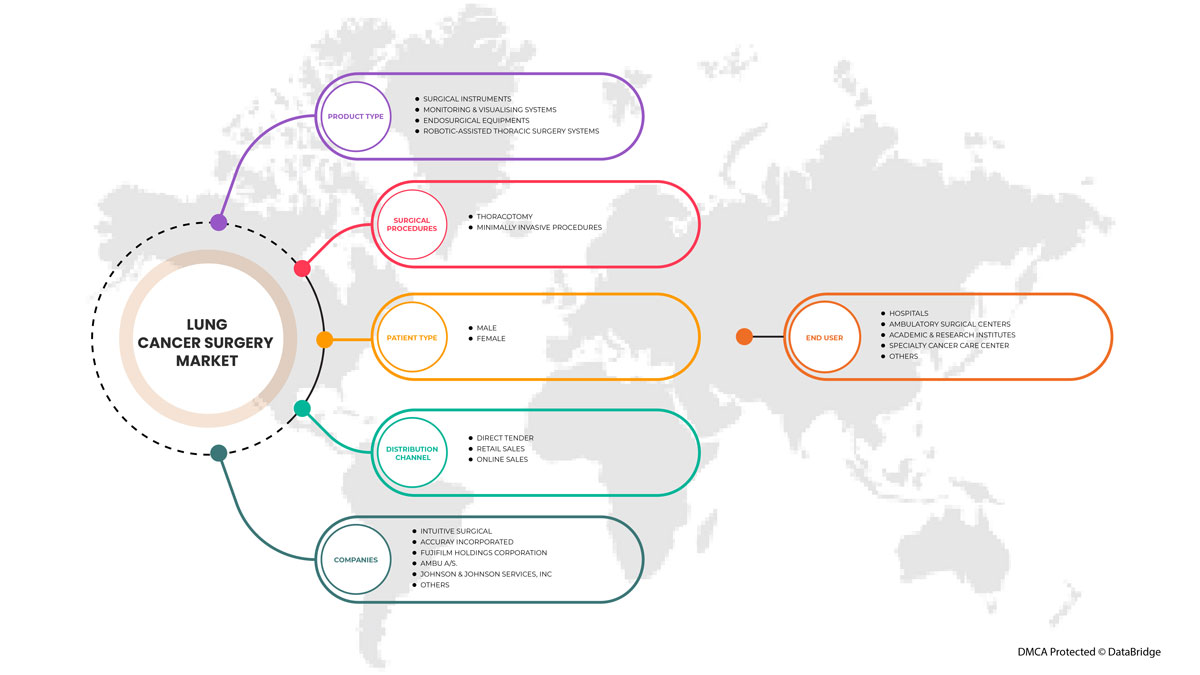

Marché de la chirurgie du cancer du poumon en Asie-Pacifique, par type de produit ( instruments chirurgicaux , système de surveillance et de visualisation, équipement endochirurgical, systèmes de chirurgie thoracique assistée par robot et autres), procédure chirurgicale (thoracotomie et chirurgie mini-invasive ), type de patient (homme et femme), utilisateur final (hôpitaux, centres de chirurgie ambulatoire , laboratoires universitaires et de recherche, centres spécialisés de soins contre le cancer et autres), canal de distribution (appel d'offres direct, ventes au détail, ventes en ligne et autres) - Tendances et prévisions de l'industrie jusqu'en 2029.

Analyse et perspectives du marché de la chirurgie du cancer du poumon en Asie-Pacifique

La chirurgie en coin est une procédure utilisée pour retirer le cancer du poumon ainsi qu'une petite quantité de tissu sain. La résection segmentaire fait référence à l'ablation d'une plus grande partie des poumons. Une lobectomie est une procédure visant à retirer l'un des cinq lobes des poumons. La pneumonectomie est l'ablation chirurgicale de l'ensemble des poumons.

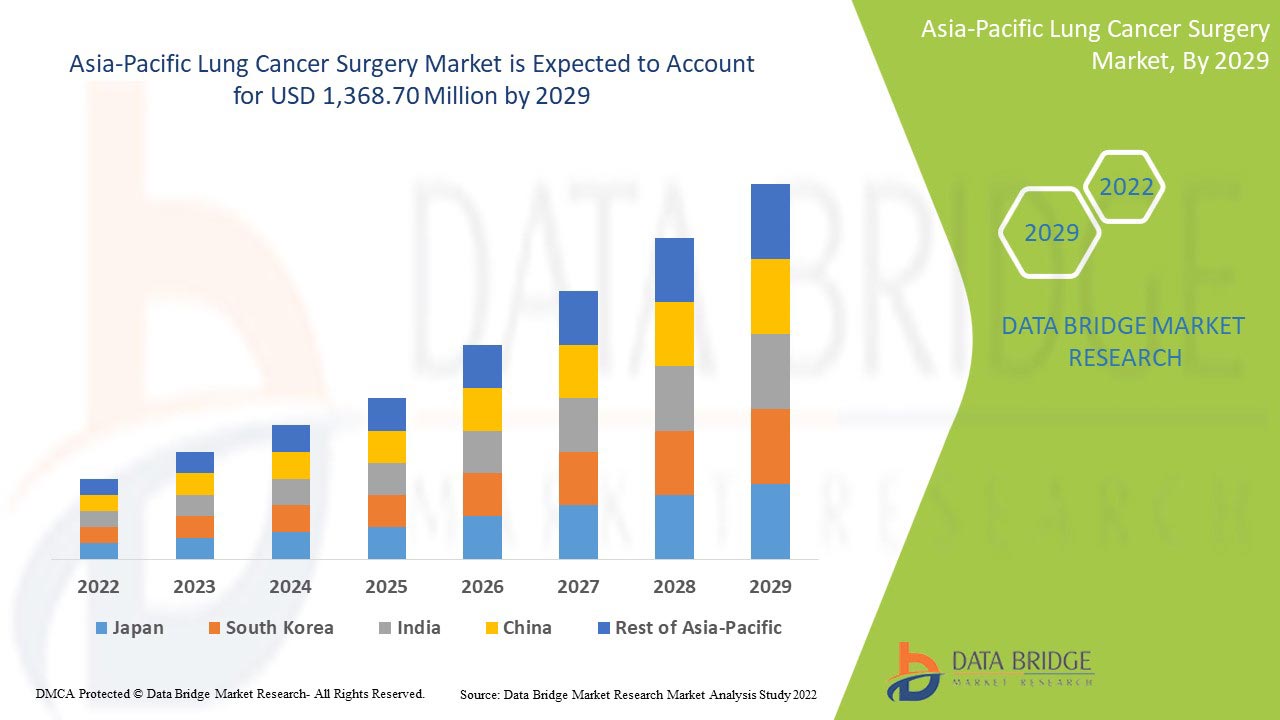

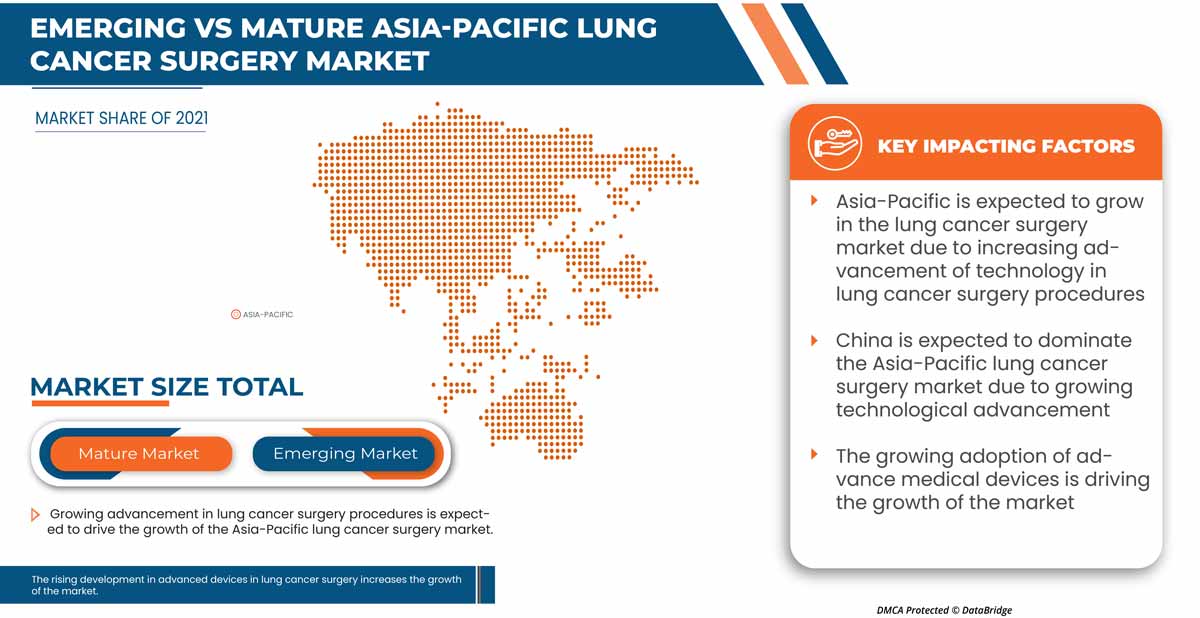

Le marché de la chirurgie du cancer du poumon en Asie-Pacifique devrait connaître une croissance significative au cours de la période de prévision de 2022 à 2029. Data Bridge Market Research analyse que le marché croît avec un TCAC de 6,0 % au cours de la période de prévision de 2022 à 2029 et devrait atteindre 1 368,70 millions USD d'ici 2029.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (Personnalisable 2019-2014) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD |

|

Segments couverts |

Par type de produit (instruments chirurgicaux, système de surveillance et de visualisation, équipement endochirurgical, systèmes de chirurgie thoracique assistée par robot et autres), procédure chirurgicale (thoracotomie et chirurgie mini-invasive), type de patient (homme et femme), utilisateur final (hôpitaux, centres de chirurgie ambulatoire, laboratoires universitaires et de recherche, centres spécialisés dans le traitement du cancer et autres), canal de distribution (appel d'offres direct, vente au détail, vente en ligne et autres) |

|

Pays couverts |

Chine, Japon, Inde, Corée du Sud, Australie, Singapour, Thaïlande, Malaisie, Indonésie, Philippines, Reste de l'Asie-Pacifique |

|

Acteurs du marché couverts |

Les principales entreprises présentes sur le marché sont Ackermann, Scanlan International, KLS Martin Group, Wexler Surgical, Lepu Medical Technology (Beijing) Co, Ltd., Intuitive Surgical, FusionKraft, Accuray Incorporated, Teleflex Incorporated, KARL STORZ SE & Co. KG, TROKAMED GmbH, Richard Wolf GmbH entre autres. |

Définition du marché

Selon le type, la localisation et le stade du cancer du poumon, ainsi que d’autres problèmes médicaux, certaines personnes peuvent être candidates à une chirurgie du cancer du poumon. Ce type de chirurgie est utilisé pour traiter le cancer du poumon. Elle consiste à retirer la tumeur, une partie du tissu pulmonaire qui l’entoure et souvent aussi certains ganglions lymphatiques. Lorsque le cancer du poumon est limité et qu’on ne s’attend pas à ce qu’il se propage, la chirurgie pour retirer la tumeur est considérée comme la meilleure option. Cela inclut les tumeurs carcinoïdes et le cancer du poumon non à petites cellules à ses premiers stades.

Dynamique du marché de la chirurgie du cancer du poumon

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

-

Augmentation de la prévalence du cancer du poumon

Le cancer du poumon est la cause de décès la plus fréquente chez les hommes et les femmes dans le monde. L'incidence et la mortalité du cancer du poumon augmentent à l'échelle mondiale en raison du début de l'épidémie de tabagisme dans divers pays et populations du monde en développement. Le cancer du poumon, notamment le cancer de la trachée et des bronches, est largement considéré comme une menace pour la santé dans la région Asie-Pacifique, entraînant un lourd fardeau pour les individus et les familles. Le cancer du poumon est une tumeur maligne caractérisée par la croissance incontrôlée de tissus cellulaires dans le poumon. Il est le deuxième cancer le plus fréquemment diagnostiqué et présente le taux de mortalité le plus élevé de tous les cancers, tant chez les hommes que chez les femmes. Selon GLOBOCAN, le cancer du poumon est la tumeur maligne la plus fréquemment diagnostiquée dans le monde, avec un taux d'incidence standardisé selon l'âge de 22,5 pour 100 000 personnes-années. Les hommes ont plus de risques de développer un cancer du poumon que les femmes. Cependant, depuis le milieu des années 1990, les taux d'incidence chez les patients masculins ont diminué dans la plupart des pays développés, tandis que les taux d'incidence chez les patientes féminines ont régulièrement augmenté.

-

Progrès technologiques dans le domaine de la santé

Les progrès technologiques sont d'une importance capitale dans la chirurgie du cancer du poumon. Ils touchent désormais presque tous les aspects de notre vie. Cependant, les avantages les plus significatifs sont dus aux avancées technologiques dans le domaine des soins de santé. En développant de nouvelles méthodes de traitement, la technologie du système de santé devient plus efficace. Les avancées technologiques récentes ont permis de sauver des millions de vies et d'améliorer la qualité de vie.

Le cancer du poumon est une maladie bien connue et répandue chez les personnes de tous âges. La technologie de pointe permet d'offrir de meilleures options de dépistage de la maladie. Ainsi, l'introduction de produits technologiques avancés pour le traitement du cancer du poumon agit comme un moteur de croissance du marché

-

Sensibilisation accrue aux avantages

Les programmes de sensibilisation au cancer du poumon menés par des organisations à but non lucratif, privées et publiques, contribuent à stimuler la croissance du marché. Ces initiatives visent à réduire la stigmatisation et les préjugés, à prévenir les maladies et à promouvoir la recherche.

La déclaration ci-dessus montre que la sensibilisation de la population au cancer du poumon a augmenté grâce à de nombreux programmes de sensibilisation mis en place par différentes organisations. Les gens savent que le cancer du poumon peut être guéri s'il est diagnostiqué à un stade précoce. Ainsi, la sensibilisation des populations agit comme un moteur pour le marché de la chirurgie du cancer du poumon en Asie-Pacifique.

Opportunités

-

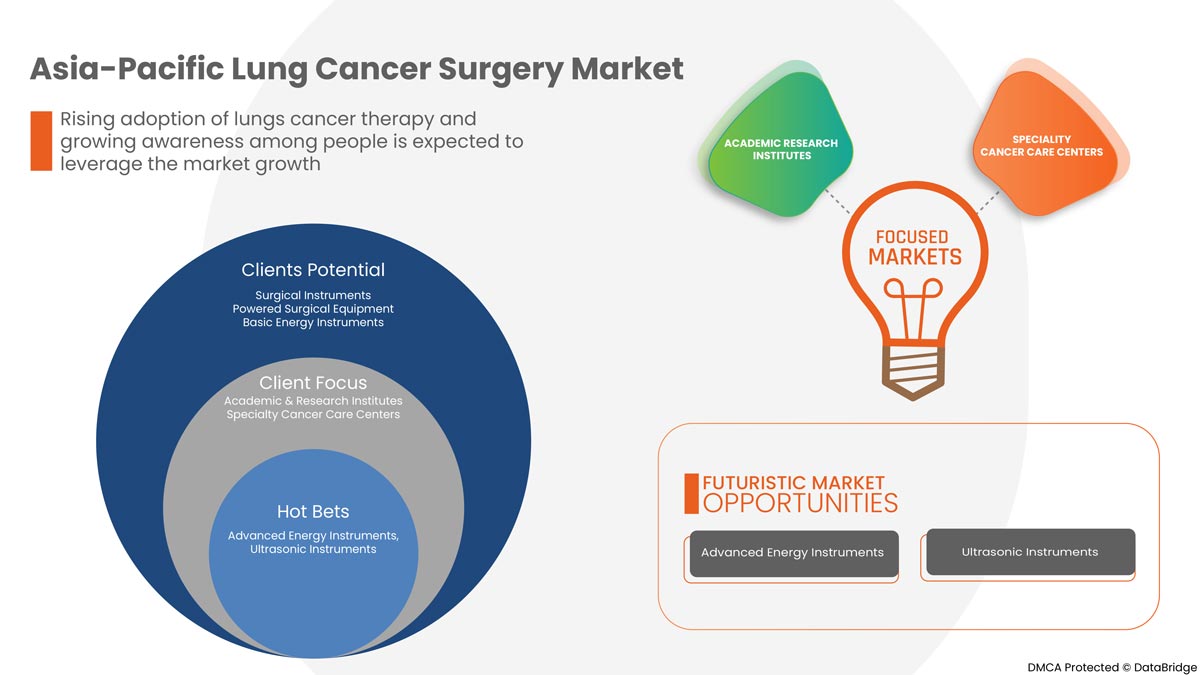

L'essor des techniques mini-invasives dans la chirurgie du cancer du poumon

La chirurgie est le traitement standard du cancer du poumon non à petites cellules (CPNPC) à un stade précoce. La chirurgie mini-invasive (CMI) est désormais préférée à la chirurgie ouverte conventionnelle. Il a été démontré que les procédures CMI telles que la chirurgie thoracoscopique assistée par vidéo (VATS) et la chirurgie thoracoscopique assistée par robot (RATS) réduisent les problèmes postopératoires et la durée d'hospitalisation. Par conséquent, de nouvelles techniques mini-invasives sont lancées.

La demande croissante de techniques mini-invasives est également bénéfique pour la croissance économique et la croissance du secteur de la santé. Elle est particulièrement fructueuse car elle affecte considérablement le développement de techniques médicales meilleures et avancées sur le marché. Ainsi, l'essor des techniques mini-invasives dans la chirurgie du cancer du poumon constitue une opportunité plus importante pour le marché de la chirurgie du cancer du poumon en Asie-Pacifique.

Contraintes/Défis

Cependant, les obstacles aux techniques de chirurgie du cancer du poumon et le coût élevé du processus de chirurgie du cancer du poumon dans certaines régions peuvent entraver la croissance de la chirurgie du cancer du poumon, ce qui freine la croissance du marché. De plus, la forte concurrence dans les industries de technologie médicale et les longs délais d'obtention de la qualification à l'étranger peuvent constituer des facteurs difficiles à la croissance du marché

Ce rapport sur le marché de la chirurgie du cancer du poumon fournit des détails sur les nouveaux développements récents, les réglementations commerciales, l'analyse des importations et des exportations, l'analyse de la production, l'optimisation de la chaîne de valeur, la part de marché, l'impact des acteurs du marché national et local, les opportunités d'analyse en termes de poches de revenus émergentes, les changements dans la réglementation du marché, l'analyse stratégique de la croissance du marché, la taille du marché, la croissance du marché des catégories, les niches d'application et la domination, les approbations de produits, les lancements de produits, les expansions géographiques, les innovations technologiques sur le marché. Pour obtenir plus d'informations sur le marché de la chirurgie du cancer du poumon, contactez Data Bridge Market Research pour un briefing d'analyste, notre équipe vous aidera à prendre une décision de marché éclairée pour atteindre la croissance du marché.

Impact du COVID-19 sur le marché de la chirurgie du cancer du poumon

Tous les secteurs, y compris les soins de santé, les services de dispositifs médicaux, l'automobile, les produits pharmaceutiques et bien d'autres, ont été gravement perturbés par le nouveau coronavirus. L'épidémie a provoqué des perturbations de la chaîne d'approvisionnement et des arrêts de fabrication à grande échelle, ce qui a eu un effet sur l'économie de presque tous les pays du monde. Le secteur du diagnostic du cancer du poumon non à petites cellules a également été touché par la pandémie. Les patients choisissent de rester chez eux plutôt que de recevoir un diagnostic et un traitement par peur de contracter le virus. Le système de santé a changé d'orientation pour contenir le COVID-19 à mesure que les cas augmentaient, retardant ainsi le diagnostic et le traitement d'autres maladies chroniques comme le cancer. En conséquence, le scénario de pandémie devrait avoir un effet négatif sur l'industrie du diagnostic du cancer du poumon. En conséquence, les patients atteints de COVID-19 ont occupé tous les lits disponibles dans les hôpitaux et les cliniques, tandis que les patients atteints de cancer du poumon ont reçu moins d'attention. En outre, la croissance du marché a été affectée par les problèmes d'accessibilité aux cliniques, l'exclusion sociale et le confinement de la population, qui ralentissent tous les renvois et le flux de patients.

Le marché de la chirurgie du cancer du poumon pourrait toutefois connaître une croissance en raison d’une légère diminution des cas de COVID-19, ce qui entraînera une augmentation de la demande de diagnostic et de chirurgie du cancer du poumon, les patients se présentant dans les cliniques et les hôpitaux pour se faire soigner. Le nombre de cas de COVID-19 diminue et la vaccination contre cette maladie augmente dans toute la région Asie-Pacifique.

Développement récent

- En mai 2021, Olympus a annoncé aujourd'hui le lancement sur le marché du bronchoscope à ultrasons endobronchiques (EBUS) BF-UC190F approuvé par la FDA 510(k), le dernier ajout à sa solide gamme d'appareils EBUS pour le diagnostic et la stadification du cancer du poumon mini-invasif par biopsie à l'aiguille.

Portée du marché de la chirurgie du cancer du poumon en Asie-Pacifique

Le marché de la chirurgie du cancer du poumon en Asie-Pacifique est segmenté en type de produit, procédure chirurgicale, type de patient, utilisateur final et canal de distribution. La croissance parmi ces segments vous aidera à analyser les segments de croissance faibles dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Type de produit

- Instruments chirurgicaux

- Système de surveillance et de visualisation

- Équipement endochirurgical

- Systèmes de chirurgie thoracique assistée par robot

- Autres

Sur la base du type de produit, le marché de la chirurgie du cancer du poumon en Asie-Pacifique est segmenté en instruments chirurgicaux, systèmes de surveillance et de visualisation, équipements endochirurgicaux, systèmes de chirurgie thoracique assistée par robot et autres.

Procédure chirurgicale

- Thoracotomie

- Chirurgie mini-invasive

Sur la base de la procédure chirurgicale, le marché de la chirurgie du cancer du poumon en Asie-Pacifique est segmenté en thoracotomie et chirurgie mini-invasive.

Type de patient

- Mâle

- Femelle

Sur la base du type de patient, le marché de la chirurgie du cancer du poumon en Asie-Pacifique est segmenté en hommes et femmes.

Utilisateur final

- Hôpitaux

- Centres ambulatoires et chirurgicaux

- Instituts universitaires et de recherche

- Centre de soins spécialisés contre le cancer

- Autres

Sur la base de l'utilisateur final, le marché de la chirurgie du cancer du poumon en Asie-Pacifique est segmenté en hôpitaux, centres ambulatoires et chirurgicaux, instituts universitaires et de recherche, centres spécialisés dans les soins contre le cancer et autres.

Canal de distribution

- Appel d'offres direct

- Ventes au détail

- Ventes en ligne

- Autres

Sur la base du canal de distribution, le marché de la chirurgie du cancer du poumon en Asie-Pacifique est segmenté en appels d'offres directs, ventes au détail, ventes en ligne et autres.

Analyse/perspectives régionales du marché de la chirurgie du cancer du poumon

Le marché de la chirurgie du cancer du poumon est analysé et des informations et tendances sur la taille du marché sont fournies par pays, type de produit, procédure chirurgicale, type de patient, utilisateur final et canal de distribution comme référencé ci-dessus.

Le marché de la chirurgie du cancer du poumon en Asie-Pacifique comprend les pays suivants : Chine, Japon, Inde, Corée du Sud, Australie, Singapour, Thaïlande, Malaisie, Indonésie, Philippines et reste de l'Asie-Pacifique.

La Chine domine le marché de la chirurgie du cancer du poumon en Asie-Pacifique en termes de part de marché et de chiffre d'affaires et continuera de renforcer sa domination au cours de la période de prévision. Cela est dû au besoin croissant de vérification et de validation des processus chirurgicaux oncologiques dans le pays et au développement rapide de la recherche.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données, tels que les ventes de produits neufs et de remplacement, la démographie des pays, l'épidémiologie des maladies et les tarifs d'importation et d'exportation, sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques d'Asie-Pacifique et les défis auxquels elles sont confrontées en raison de la forte concurrence des marques locales et nationales, ainsi que l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché de la chirurgie du cancer du poumon

Le paysage concurrentiel du marché de la chirurgie du cancer du poumon fournit des détails par concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Asie-Pacifique, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit et la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises sur le marché de la chirurgie du cancer du poumon.

Français Certains des principaux acteurs opérant sur le marché de la chirurgie du cancer du poumon sont AngioDynamics, Ackermann, Scanlan International, KLS Martin Group, Wexler Surgical, Lepu Medical Technology(Beijing) Co., Ltd., Intuitive Surgical, FusionKraft, Surgical Holdings, GerMedUSA, Medtronic, Accuray Incorporated, Teleflex Incorporated, KARL STORZ SE & Co. KG, TROKAMED GmbH, Richard Wolf GmbH, Sontec Instruments, Inc., asap endoscopic products GmbH, FUJIFILM Holdings America Corporation, Ambu A/S., Johnson & Johnson Services, Inc., Olympus Corporation et entre autres.

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. Les données du marché sont analysées et estimées à l'aide de modèles statistiques et cohérents du marché. En outre, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. La principale méthodologie de recherche utilisée par l'équipe de recherche DBMR est la triangulation des données, qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). En dehors de cela, les modèles de données comprennent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement de l'entreprise, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse de la part de marché Asie-Pacifique par rapport à la région et des fournisseurs. Veuillez demander un appel d'analyste en cas de demande de renseignements supplémentaires.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE ASIA PACIFIC LUNG CANCER SURGERY MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHIC SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.7 MULTIVARIATE MODELLING

2.8 PRODUCT TYPE LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 MARKET APPLICATION COVERAGE GRID

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL

4.2 PORTER'S FIVE FORCES MODEL

5 EPIDEMIOLOGY

5.1 INCIDENCE OF LUNG CANCER, BY COUNTRY

5.2 TREATMENT RATE BY GENDER

5.3 MORTALITY BY GENDER

6 REGULATIONS OF THE ASIA PACIFIC LUNG CANCER SURGERY MARKET

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 INCREASED PREVALENCE OF LUNG CANCER DISEASES

7.1.2 TECHNOLOGICAL ADVANCEMENTS IN THE FIELD OF HEALTHCARE

7.1.3 INCREASED AWARENESS REGARDING THE BENEFITS

7.1.4 GOVERNMENT INITIATIVES TO IMPLEMENT SCREENING PROGRAMS FOR VARIOUS DISEASES

7.1.5 RISE IN AIR POLLUTION AND SURGE IN SMOKING

7.2 RESTRAINTS

7.2.1 HIGH COST OF LUNG CANCER SURGERY

7.2.2 INSUFFICIENT FUNDING FOR CANCER AND ASSOCIATED DISORDERS

7.2.3 STRINGENT REGULATORY FRAMEWORKS

7.3 OPPORTUNITIES

7.3.1 RISE OF MINIMALLY INVASIVE TECHNIQUES IN LUNG CANCER SURGERY

7.3.2 STRATEGIC INITIATIVES OF KEY PLAYERS

7.3.3 INCREASE IN RESEARCH AND DEVELOPMENT EFFORTS IN THE HEALTHCARE INDUSTRY

7.4 CHALLENGES

7.4.1 DEARTH OF SKILLED ONCOLOGISTS

7.4.2 HEALTH RISK OF LUNG CANCER SURGERIES

8 ASIA PACIFIC LUNG CANCER SURGERY MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 SURGICAL INSTRUMENTS

8.2.1 HAND INSTRUMENTS

8.2.1.1 STAPLER

8.2.1.2 FORCEPS

8.2.1.3 ELECTRIC HOOK

8.2.1.4 RETRACTORS

8.2.1.5 CLAMPS

8.2.1.6 SCISSORS

8.2.1.7 ELEVATORS

8.2.1.8 HEMOCLIP APPLIERS

8.2.1.9 ULTRASOUND SCALPEL

8.2.1.10 RIB SHEARS

8.2.1.11 CUTTERS

8.2.1.12 NEEDLE HOLDER

8.2.1.13 TROCAR

8.2.1.14 OTHERS

8.2.2 POWERED SURGICAL EQUIPMENT

8.2.2.1 ADVANCED ENERGY INSTRUMENTS

8.2.2.1.1 ADVANCED BIPOLAR INSTRUMENTS

8.2.2.1.2 OTHERS

8.2.2.2 BASIC ENERGY INSTRUMENTS

8.2.2.2.1 BIPOLAR INSTRUMENTS

8.2.2.2.2 MONOPOLAR INSTRUMENTS

8.3 MONITORING & VISUALISING SYSTEM

8.3.1 CAMERAS & VIDEO SUPPORT

8.3.2 BRONCHOSCOPES

8.3.3 ENDOSCOPIC TROCARS WITH OPTICAL VIEWS

8.3.4 THORACOSCOPES

8.3.5 MEDIASTINOSCOPES

8.3.6 OTHERS

8.4 ENDOSURGICAL EQUIPMENTS

8.5 ROBOTIC ASSISTED SURGERY SYSTEMS

8.6 OTHERS

9 ASIA PACIFIC LUNG CANCER SURGERY MARKET, BY SURGICAL PROCEDURE

9.1 OVERVIEW

9.2 THORACOTOMY

9.2.1 LOBECTOMY

9.2.1.1 SURGICAL INSTRUMENTS

9.2.1.2 MONITORING & VISUALISING SYSTEMS

9.2.1.3 ENDOSURGICAL EQUIPMENT

9.2.1.4 ROBOTIC-ASSISTED THORACIC SURGERY SYSTEMS

9.2.1.5 OTHERS

9.2.2 SLEEVE RESECTION

9.2.2.1 SURGICAL INSTRUMENTS

9.2.2.2 MONITORING & VISUALISING SYSTEMS

9.2.2.3 ENDOSURGICAL EQUIPMENT

9.2.2.4 ROBOTIC-ASSISTED THORACIC SURGERY SYSTEMS

9.2.2.5 OTHERS

9.2.3 SEGMENTECTOMY

9.2.3.1 SURGICAL INSTRUMENTS

9.2.3.2 MONITORING & VISUALISING SYSTEMS

9.2.3.3 ENDOSURGICAL EQUIPMENT

9.2.3.4 ROBOTIC-ASSISTED THORACIC SURGERY SYSTEMS

9.2.3.5 OTHERS

9.2.4 PNEUMONECTOMY

9.2.4.1 SURGICAL INSTRUMENTS

9.2.4.2 MONITORING & VISUALISING SYSTEMS

9.2.4.3 ENDOSURGICAL EQUIPMENT

9.2.4.4 ROBOTIC-ASSISTED THORACIC SURGERY SYSTEMS

9.2.4.5 OTHERS

9.2.5 OTHERS

9.3 MINIMALLY INVASIVE SURGERIES

9.3.1 VIDEO-ASSISTED THORACIC SURGERY (VATS)

9.3.1.1 SURGICAL INSTRUMENTS

9.3.1.2 MONITORING & VISUALISING SYSTEMS

9.3.1.3 ENDOSURGICAL EQUIPMENT

9.3.1.4 ROBOTIC-ASSISTED THORACIC SURGERY SYSTEMS

9.3.1.5 OTHERS

9.3.2 ROBOTICALLY-ASSISTED THORACIC SURGERY (RATS)

9.3.2.1 SURGICAL INSTRUMENTS

9.3.2.2 MONITORING & VISUALISING SYSTEMS

9.3.2.3 ENDOSURGICAL EQUIPMENT

9.3.2.4 ROBOTIC-ASSISTED THORACIC SURGERY SYSTEMS

9.3.2.5 OTHERS

10 ASIA PACIFIC LUNG CANCER SURGERY MARKET, BY PATIENT TYPE

10.1 OVERVIEW

10.2 MALE

10.2.1 GERIATRIC

10.2.1.1 THORACOTOMY

10.2.1.2 MINIMALLY INVASIVE SURGERIES

10.2.2 ADULTS

10.2.2.1 THORACOTOMY

10.2.2.2 MINIMALLY INVASIVE SURGERIES

10.2.3 PEDIATRIC

10.2.3.1 THORACOTOMY

10.2.3.2 MINIMALLY INVASIVE SURGERIES

10.3 FEMALE

10.3.1 GERIATRIC

10.3.1.1 THORACOTOMY

10.3.1.2 MINIMALLY INVASIVE SURGERIES

10.3.2 ADULTS

10.3.2.1 THORACOTOMY

10.3.2.2 MINIMALLY INVASIVE SURGERIES

10.3.3 PEDIATRIC

10.3.3.1 THORACOTOMY

10.3.3.2 MINIMALLY INVASIVE SURGERIES

11 ASIA PACIFIC LUNG CANCER SURGERY MARKET, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 DIRECT TENDER

11.3 RETAIL SALES

11.4 ONLINE SALES

11.5 OTHERS

12 ASIA PACIFIC LUNG CANCER SURGERY MARKET, BY END USER

12.1 OVERVIEW

12.2 HOSPITALS

12.2.1 PUBLIC HOSPITALS

12.2.2 PRIVATE HOSPITALS

12.3 AMBULATORY SURGICAL CENTERS

12.4 SPECIALTY CANCER CARE CENTERS

12.5 ACADEMIC AND RESEARCH LABORATORIES

12.6 OTHERS

13 ASIA PACIFIC LUNG CANCER SURGERY MARKET, BY REGION

13.1 ASIA-PACIFIC

13.1.1 CHINA

13.1.2 JAPAN

13.1.3 INDIA

13.1.4 SOUTH KOREA

13.1.5 AUSTRALIA

13.1.6 SINGAPORE

13.1.7 THAILAND

13.1.8 MALAYSIA

13.1.9 INDONESIA

13.1.10 PHILIPPINES

13.1.11 REST OF ASIA-PACIFIC

14 ASIA PACIFIC LUNG CANCER SURGERY MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

15 SWOT ANALYSIS

16 COMPANY PROFILES

16.1 JOHNSON & JOHNSON SERVICES, INC.

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 ACCURAY INCORPORATED

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 INTUITIVE SURGICAL

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENTS

16.4 FUJIFILM HOLDINGS CORPORATION

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENTS

16.5 AMBU A/S.

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 ANGIODYNAMICS

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT DEVELOPMENT

16.7 ACKERMANN

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENTS

16.8 ASAP ENDOSCOPIC PRODUCTS GMBH

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCTPORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 FUSIONKRAFT

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENTS

16.1 GERMED USA

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENTS

16.11 KLS MARTIN GROUP

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENTS

16.12 KARL STORZ SE & CO. KG

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 LEPU MEDICAL TECHNOLOGY (BEIJING) CO., LTD.

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENT

16.14 MEDTRONICS (2021)

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT DEVELOPMENT

16.15 OLYMPUS CORPORATION

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCTPORTFOLIO

16.15.4 RECENT DEVELOPMENTS

16.16 RICHARD WOLF GMBH.

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENTS

16.17 SURGICAL HOLDINGS

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENTS

16.18 SONTEC INSTRUMENTS, INC.

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENT

16.19 SCANLAN INTERNATIONAL

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENTS

16.2 TELEFLEX INCORPORATED

16.20.1 COMPANY SNAPSHOT

16.20.2 REVENUE ANALYSIS

16.20.3 PRODUCTPORTFOLIO

16.20.4 RECENT DEVELOPMENT

16.21 TROKAMED GMBH.

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 RECENT DEVELOPMENT

16.22 WEXLER SURGICAL

16.22.1 COMPANY SNAPSHOT

16.22.2 PRODUCT PORTFOLIO

16.22.3 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

Liste des tableaux

TABLE 1 THE BELOW TABLE SHOWS REGION-SPECIFIC INCIDENCE AGE-STANDARDIZED RATES PER 100,000 BY SEX FOR LUNG CANCER AMONG MEN AND WOMEN IN 2020

TABLE 2 ASIA PACIFIC LUNG CANCER SURGERY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 3 ASIA PACIFIC SURGICAL INSTRUMENTS IN LUNG CANCER SURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 ASIA PACIFIC SURGICAL INSTRUMENTS IN LUNG CANCER SURGERY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 5 ASIA PACIFIC HAND INSTRUMENTS IN LUNG CANCER SURGERY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 6 ASIA PACIFIC HAND INSTRUMENTS IN LUNG CANCER SURGERY MARKET, BY PRODUCT TYPE, 2020-2029 (VOLUME IN THOUSAND UNITS)

TABLE 7 ASIA PACIFIC POWERED SURGICAL EQUIPMENTS IN LUNG CANCER SURGERY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 8 ASIA PACIFIC ADVANCED ENERGY INSTRUMENTS IN LUNG CANCER SURGERY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 9 ASIA PACIFIC BASIC ENERGY INSTRUMENTS IN LUNG CANCER SURGERY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 10 ASIA PACIFIC BASIC ENERGY INSTRUMENTS IN LUNG CANCER SURGERY MARKET, BY TYPE, 2020-2029 (VOLUME IN THOUSAND UNITS)

TABLE 11 ASIA PACIFIC MONITORING & VISUALISING SYSTEMS IN LUNG CANCER SURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 ASIA PACIFIC MONITORING & VISUALISING SYSTEMS IN LUNG CANCER SURGERY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 13 ASIA PACIFIC MONITORING & VISUALISING SYSTEMS IN LUNG CANCER SURGERY MARKET, BY PRODUCT TYPE, 2020-2029 (VOLUME IN THOUSAND UNITS)

TABLE 14 ASIA PACIFIC ENDOSURGICAL EQUIPMENT IN LUNG CANCER SURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 ASIA PACIFIC ROBOTIC-ASSISTED THORACIC SURGERY SYSTEMS IN LUNG CANCER SURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 ASIA PACIFIC OTHERS IN LUNG CANCER SURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 ASIA PACIFIC LUNG CANCER SURGERY MARKET, BY SURGICAL PROCEDURE, 2020-2029 (USD MILLION)

TABLE 18 ASIA PACIFIC THORACOTOMY IN LUNG CANCER SURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 ASIA PACIFIC THORACOTOMY IN LUNG CANCER SURGERY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 20 ASIA PACIFIC LOBECTOMY IN LUNG CANCER SURGERY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 21 ASIA PACIFIC SLEEVE RESECTION IN LUNG CANCER SURGERY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 22 ASIA PACIFIC SEGMENTECTOMY IN LUNG CANCER SURGERY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 23 ASIA PACIFIC PNEUMONECTOMY IN LUNG CANCER SURGERY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 24 ASIA PACIFIC MINIMALLY INVASIVE SURGERIES IN LUNG CANCER SURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 ASIA PACIFIC MINIMALLY INVASIVE SURGERIES IN LUNG CANCER SURGERY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 26 ASIA PACIFIC VIDEO-ASSISTED THORACIC SURGERY (VATS) IN LUNG CANCER SURGERY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 27 ASIA PACIFIC ROBOTICALLY-ASSISTED THORACIC SURGERY (RATS) IN LUNG CANCER SURGERY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 28 ASIA PACIFIC LUNG CANCER SURGERY MARKET, BY PATIENT TYPE, 2020-2029 (USD MILLION)

TABLE 29 ASIA PACIFIC MALE IN LUNG CANCER SURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 ASIA PACIFIC MALE IN LUNG CANCER SURGERY MARKET, BY PATIENT TYPE, 2020-2029 (USD MILLION)

TABLE 31 ASIA PACIFIC GERIATRIC IN LUNG CANCER SURGERY MARKET, BY SURGICAL PROCEDURE, 2020-2029 (USD MILLION)

TABLE 32 ASIA PACIFIC ADULTS IN LUNG CANCER SURGERY MARKET, BY SURGICAL PROCEDURE, 2020-2029 (USD MILLION)

TABLE 33 ASIA PACIFIC PEDIATRIC IN LUNG CANCER SURGERY MARKET, BY SURGICAL PROCEDURE, 2020-2029 (USD MILLION)

TABLE 34 ASIA PACIFIC FEMALE IN LUNG CANCER SURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 ASIA PACIFIC FEMALE IN LUNG CANCER SURGERY MARKET, BY PATIENT TYPE, 2020-2029 (USD MILLION)

TABLE 36 ASIA PACIFIC GERIATRIC IN LUNG CANCER SURGERY MARKET, BY SURGICAL PROCEDURE, 2020-2029 (USD MILLION)

TABLE 37 ASIA PACIFIC ADULTS IN LUNG CANCER SURGERY MARKET, BY SURGICAL PROCEDURE, 2020-2029 (USD MILLION)

TABLE 38 ASIA PACIFIC PEDIATRIC IN LUNG CANCER SURGERY MARKET, BY SURGICAL PROCEDURE, 2020-2029 (USD MILLION)

TABLE 39 ASIA PACIFIC LUNG CANCER SURGERY MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 40 ASIA PACIFIC DIRECT TENDER IN LUNG CANCER SURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 ASIA PACIFIC RETAIL SALES IN LUNG CANCER SURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 ASIA PACIFIC ONLINE SALES IN LUNG CANCER SURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 ASIA PACIFIC ONLINE SALES IN LUNG CANCER SURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 ASIA PACIFIC LUNG CANCER SURGERY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 45 ASIA PACIFIC HOSPITALS IN LUNG CANCER SURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 46 ASIA PACIFIC HOSPITALS IN LUNG CANCER SURGERY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 47 ASIA PACIFIC AMBULATORY SURGICAL CENTERS IN LUNG CANCER SURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 48 ASIA PACIFIC SPECIALTY CANCER CARE CENTERS IN LUNG CANCER SURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 49 ASIA PACIFIC ACADEMIC AND RESEARCH LABORATORIES IN LUNG CANCER SURGERY MARKET, BY REGION, 2020-2029 (USD MILLION))

TABLE 50 ASIA PACIFIC OTHERS IN LUNG CANCER SURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 51 ASIA-PACIFIC LUNG CANCER SURGERY MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 ASIA PACIFIC LUNG CANCER SURGERYMARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC LUNG CANCER SURGERY MARKET: GEOGRAPHIC SCOPE

FIGURE 3 ASIA PACIFIC LUNG CANCER SURGERYMARKET: DATA TRIANGULATION

FIGURE 4 ASIA PACIFIC LUNG CANCER SURGERY MARKET: SNAPSHOT

FIGURE 5 ASIA PACIFIC LUNG CANCER SURGERY MARKET: BOTTOM UP APPROACH

FIGURE 6 ASIA PACIFIC LUNG CANCER SURGERY MARKET: TOP DOWN APPROACH

FIGURE 7 ASIA PACIFIC LUNG CANCER SURGERY MARKET: INTERVIEWS BY REGION AND DESIGNATION

FIGURE 8 ASIA PACIFIC LUNG CANCER SURGERY MARKET: DBMR MARKET POSITION GRID

FIGURE 9 ASIA PACIFIC LUNG CANCER SURGERY MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 ASIA PACIFIC LUNG CANCER SURGERY MARKET: END USER COVERAGE GRID

FIGURE 11 ASIA PACIFIC LUNG CANCER SURGERY MARKET SEGMENTATION

FIGURE 12 GROWING PREVALENCE OF CANCER DISEASES, RISE IN AIR POLLUTION, AND SURGE IN SMOKING HABIT IS EXPECTED TO DRIVE THE ASIA PACIFIC LUNG CANCER SURGERY MARKET GROWTH IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 13 SURGICAL INSTRUMENT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC LUNG CANCER SURGERY MARKET IN 2022 & 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF ASIA PACIFIC LUNG CANCER SURGERY MARKET

FIGURE 15 ASIA PACIFIC LUNG CANCER SURGERY MARKET: BY PRODUCT TYPE, 2021

FIGURE 16 ASIA PACIFIC LUNG CANCER SURGERY MARKET: BY PRODUCT TYPE, 2022-2029 (USD MILLION)

FIGURE 17 ASIA PACIFIC LUNG CANCER SURGERY MARKET: BY PRODUCT TYPE, CAGR (2022-2029)

FIGURE 18 ASIA PACIFIC LUNG CANCER SURGERY MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 19 ASIA PACIFIC LUNG CANCER SURGERY MARKET: BY SURGICAL PROCEDURE, 2021

FIGURE 20 ASIA PACIFIC LUNG CANCER SURGERY MARKET: BY SURGICAL PROCEDURE, 2022-2029 (USD MILLION)

FIGURE 21 ASIA PACIFIC LUNG CANCER SURGERY MARKET: BY SURGICAL PROCEDURE, CAGR (2022-2029)

FIGURE 22 ASIA PACIFIC LUNG CANCER SURGERY MARKET: BY SURGICAL PROCEDURE, LIFELINE CURVE

FIGURE 23 ASIA PACIFIC LUNG CANCER SURGERY MARKET: BY PATIENT TYPE, 2021

FIGURE 24 ASIA PACIFIC LUNG CANCER SURGERY MARKET: BY PATIENT TYPE, 2022-2029 (USD MILLION)

FIGURE 25 ASIA PACIFIC LUNG CANCER SURGERY MARKET: BY PATIENT TYPE, CAGR (2022-2029)

FIGURE 26 ASIA PACIFIC LUNG CANCER SURGERY MARKET: BY PATIENT TYPE, LIFELINE CURVE

FIGURE 27 ASIA PACIFIC LUNG CANCER SURGERY MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 28 ASIA PACIFIC LUNG CANCER SURGERY MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 29 ASIA PACIFIC LUNG CANCER SURGERY MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 30 ASIA PACIFIC LUNG CANCER SURGERY MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 31 ASIA PACIFIC LUNG CANCER SURGERY MARKET: BY END USER, 2021

FIGURE 32 ASIA PACIFIC LUNG CANCER SURGERY MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 33 ASIA PACIFIC LUNG CANCER SURGERY MARKET: BY END USER, CAGR (2022-2029)

FIGURE 34 ASIA PACIFIC LUNG CANCER SURGERY MARKET: BY END USER, LIFELINE CURVE

FIGURE 35 ASIA-PACIFIC LUNG CANCER SURGERY MARKET: SNAPSHOT (2021)

FIGURE 36 ASIA-PACIFIC LUNG CANCER SURGERY MARKET: BY COUNTRY (2021)

FIGURE 37 ASIA-PACIFIC LUNG CANCER SURGERY MARKET: BY COUNTRY (2022 & 2029)

FIGURE 38 ASIA-PACIFIC LUNG CANCER SURGERY MARKET: BY COUNTRY (2021 & 2029)

FIGURE 39 ASIA-PACIFIC LUNG CANCER SURGERY MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 40 ASIA PACIFIC LUNG CANCER SURGERY MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.