Marché de l'externalisation des affaires réglementaires des DIV en Asie-Pacifique, par service (rédaction et soumissions réglementaires, enregistrement réglementaire et demandes d'essais cliniques, conseil réglementaire, représentation juridique, services de gestion des données, services de fabrication et de contrôle de produits chimiques (CMC) et autres), indication (oncologie, neurologie , cardiologie, chimie clinique et immuno-essais, médecine de précision , maladies infectieuses, diabète, tests génétiques, VIH/sida, hématologie, tests de médicaments/pharmacogénomique, transfusion sanguine, point de service et autres), modèle de déploiement (cloud et sur site), taille de l'organisation (petites et moyennes entreprises (PME) et grandes entreprises), stade (clinique, préclinique et PMA (autorisation post-commercialisation)), classe (classe I, classe II et classe III), utilisateur final (sociétés pharmaceutiques, sociétés de dispositifs médicaux, sociétés de biotechnologie et autres), pays (Chine, Corée du Sud, Japon, Inde, Australie, Singapour, Malaisie, Indonésie, Thaïlande, Philippines et reste de l'Asie-Pacifique) Tendances et prévisions de l'industrie jusqu'en 2029.

Analyse et perspectives du marché : marché de l'externalisation des affaires réglementaires en matière de diagnostic in vitro en Asie-Pacifique

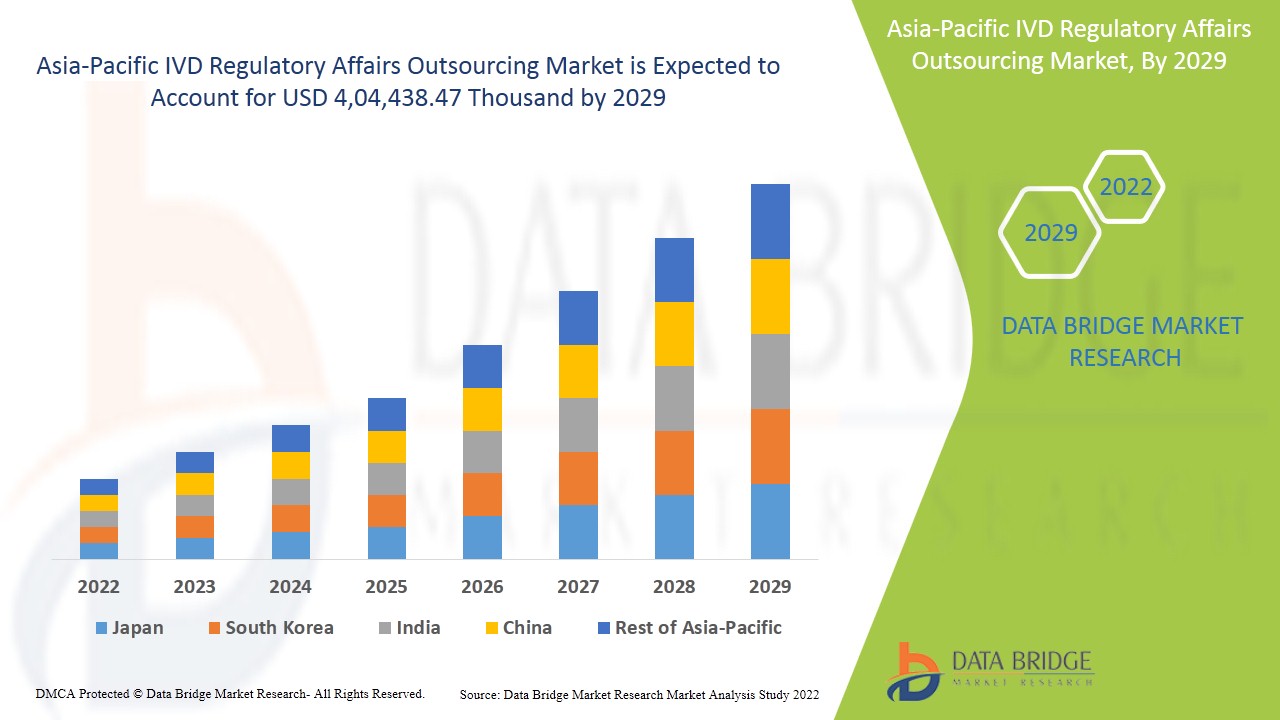

Le marché de l'externalisation des affaires réglementaires IVD en Asie-Pacifique devrait connaître une croissance du marché au cours de la période de prévision de 2022 à 2029. Data Bridge Market Research analyse que le marché croît avec un TCAC de 14,1 % au cours de la période de prévision de 2022 à 2029 et devrait atteindre 4 04 438,47 milliers de dollars d'ici 2029.

- Les produits de diagnostic in vitro sont des réactifs, des dispositifs et des systèmes utilisés pour diagnostiquer une maladie ou d'autres conditions, notamment pour déterminer l'état de santé d'une personne afin de guérir, d'atténuer, de traiter ou de prévenir une maladie. Ces produits sont destinés à être utilisés pour la collecte, la préparation et l'examen d'échantillons du corps humain. Les affaires réglementaires jouent un rôle crucial dans l'industrie des dispositifs de diagnostic in vitro (DIV) et des dispositifs médicaux. Les services d'externalisation des affaires réglementaires impliquent la rédaction médicale et la publication de documents réglementaires par des professionnels qui contribuent à la production de documents de haute qualité pour les projets de recherche clinique. La demande d'externalisation des services réglementaires augmente considérablement dans les études cliniques menées dans les économies émergentes, offrant une plate-forme saine pour la croissance de ce secteur.

Les principaux facteurs à l'origine de la croissance du marché de l'externalisation des affaires réglementaires en matière de diagnostic in vitro sont l'augmentation de la prévalence des maladies chroniques dans la région et les progrès technologiques dans divers dispositifs de diagnostic in vitro. L'augmentation des acquisitions stratégiques et des partenariats entre organisations crée des opportunités pour la croissance du marché. L'évolution des réglementations concernant les dispositifs médicaux dans différentes régions constitue le principal frein au marché de l'externalisation des affaires réglementaires en matière de diagnostic in vitro. Le manque d'infrastructures dans les services de santé constitue un défi majeur pour la croissance du marché.

Ce rapport sur le marché de l'externalisation des affaires réglementaires IVD fournit des détails sur la part de marché, les nouveaux développements et l'analyse du pipeline de produits, l'impact des acteurs du marché national et local, analyse les opportunités en termes de poches de revenus émergentes, de changements dans la réglementation du marché, d'approbations de produits, de décisions stratégiques, de lancements de produits, d'expansions géographiques et d'innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché, contactez-nous pour un briefing d'analyste, notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

Portée et taille du marché de l'externalisation des affaires réglementaires IVD en Asie-Pacifique

Le marché de l'externalisation des affaires réglementaires IVD en Asie-Pacifique est segmenté en sept segments notables qui sont basés sur les services, l'indication, le mode de déploiement, la taille de l'organisation, l'étape, la classe et l'utilisateur final.

- Sur la base des services, le marché de l'externalisation des affaires réglementaires du DIV en Asie-Pacifique est segmenté en rédaction et soumissions réglementaires, enregistrement réglementaire et demandes d'essais cliniques, conseil réglementaire, représentation juridique, services de gestion des données, services de fabrication et de contrôle de produits chimiques (CMC), et autres. En 2022, la rédaction et les soumissions réglementaires devraient dominer le marché à mesure que le nombre d'enregistrements de produits et d'approbations d'essais cliniques augmente dans toute la région.

- Sur la base des indications, le marché de l'externalisation des affaires réglementaires des DIV en Asie-Pacifique est segmenté en oncologie, neurologie, cardiologie, chimie clinique et immuno-essais, médecine de précision, maladies infectieuses, diabète, tests génétiques, VIH/SIDA, hématologie, tests de médicaments/pharmacogénomique, transfusion sanguine, point de service, et autres. En 2022, le segment de l'oncologie devrait dominer, car le portefeuille de technologies et de services de haute qualité lié à l'application réglementaire des DIV suscite une plus grande implication des pairs.

- Sur la base du mode de déploiement, le marché de l'externalisation des affaires réglementaires IVD en Asie-Pacifique est segmenté en cloud et sur site. En 2022, le segment cloud devrait dominer car il est rentable et les caractéristiques flexibles de la technologie de cloud computing dans la réglementation IVD fournissent une infrastructure stable avec un rendement maximal aux organisations traitant des systèmes IVD.

- En fonction de la taille de l'organisation, le marché de l'externalisation des affaires réglementaires du diagnostic in vitro en Asie-Pacifique est segmenté en petites et moyennes entreprises (PME) et grandes entreprises. En 2022, le segment des grandes entreprises devrait dominer car il implique la représentation juridique du produit et, en raison des réglementations strictes qui peuvent varier d'un pays à l'autre, implique une consommation élevée de ressources en raison des besoins élevés en ressources et des changements de politiques.

- Sur la base du stade, le marché de l'externalisation des affaires réglementaires des dispositifs de diagnostic in vitro en Asie-Pacifique est segmenté en clinique, préclinique et PMA (autorisation post-commercialisation). En 2022, le segment clinique devrait dominer le marché. Les acteurs des dispositifs de diagnostic in vitro sur le marché doivent suivre certaines réglementations pour obtenir l'approbation des autorités supérieures, pour le lancement du produit dans une région. Ces directives strictes doivent être respectées et c'est l'une des tâches les plus difficiles parmi toutes les étapes. L'approbation préalable à la mise sur le marché de divers dispositifs médicaux varie d'un pays à l'autre.

- Sur la base de la classe, le marché de l'externalisation des affaires réglementaires des dispositifs médicaux de diagnostic in vitro en Asie-Pacifique est segmenté en classe I, classe II et classe III. En 2022, le segment de classe I devrait dominer le marché car il concerne 47 % des dispositifs médicaux et aucun risque pour la santé publique ou un faible risque personnel avec les réglementations les plus faibles.

- Sur la base de l'utilisateur final, le marché de l'externalisation des affaires réglementaires IVD en Asie-Pacifique est segmenté en sociétés pharmaceutiques, sociétés de dispositifs médicaux, sociétés de biotechnologie et autres. En 2022, les sociétés de dispositifs médicaux devraient se lancer dans la R&D dans toute la région en raison de la demande de réglementation IVD.

Analyse du marché de l'externalisation des affaires réglementaires IVD en Asie-Pacifique au niveau des pays

Le marché de l'externalisation des affaires réglementaires IVD en Asie-Pacifique est analysé et des informations sur la taille du marché sont fournies par pays, services, indication, mode de déploiement, taille de l'organisation, étape, classe et utilisateur final.

Les pays couverts par le rapport sur le marché de l’externalisation des affaires réglementaires IVD en Asie-Pacifique sont la Chine, la Corée du Sud, le Japon, l’Inde, l’Australie, Singapour, la Malaisie, l’Indonésie, la Thaïlande, les Philippines et le reste de l’Asie-Pacifique.

La Chine devrait dominer le marché de la région Asie-Pacifique en raison des développements croissants dans le secteur de la santé et de la disponibilité du plus grand laboratoire clinique de la région Asie-Pacifique.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie des pays, les actes réglementaires et les tarifs d'importation et d'exportation sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques mondiales et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Demande croissante d'externalisation des affaires réglementaires en matière de diagnostic in vitro

Le marché de l'externalisation des affaires réglementaires IVD en Asie-Pacifique vous fournit également une analyse de marché détaillée pour chaque pays, la croissance de l'industrie avec les ventes, les ventes de composants, l'impact du développement technologique dans l'externalisation des affaires réglementaires IVD et les changements dans les scénarios réglementaires avec leur soutien au marché de l'externalisation des affaires réglementaires IVD. Les données sont disponibles pour la période historique de 2011 à 2019.

Analyse du paysage concurrentiel et des parts de marché de l'externalisation des affaires réglementaires IVD en Asie-Pacifique

Le paysage concurrentiel du marché de l'externalisation des affaires réglementaires du diagnostic in vitro en Asie-Pacifique fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence mondiale, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et l'étendue du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liées au marché de l'externalisation des affaires réglementaires du diagnostic in vitro en Asie-Pacifique.

Certains des principaux acteurs opérant dans le rapport sont le marché de l'externalisation des affaires réglementaires IVD, notamment Freyr Solutions, PPD Inc. (une filiale de Thremofisher Scientific Inc.), EMERGO, ICON, Parexel International Corporation, CRITERIUM, INC., Groupe ProductLife SA, Labcorp Drug Development, WuXi AppTec, Genpact, Medpace, Dor Pharmaceutical Services, Qserve, entre autres. Les analystes de DBMR comprennent les atouts concurrentiels et fournissent une analyse concurrentielle pour chaque concurrent séparément.

De nombreux développements de produits sont également initiés par les entreprises du monde entier, ce qui accélère également la croissance du marché de l'externalisation des affaires réglementaires IVD en Asie-Pacifique.

Par exemple,

- En novembre 2021, le magazine USA-9 Technology a classé Freyr parmi les « 10 meilleurs fournisseurs de solutions technologiques de 2021 ». USA-9.com est un magazine technologique qui a classé Freyr Solutions, l'un des principaux fournisseurs mondiaux de solutions et de services réglementaires, parmi les « 10 meilleurs fournisseurs de solutions technologiques de 2021 », car Fryer continue de concevoir des solutions logicielles innovantes et d'aider ses clients à atteindre leurs objectifs de conformité respectifs. Cela a aidé l'entreprise à accroître sa popularité.

- En octobre 2021, le groupe Propharma a acquis Pharmica Consulting. Le groupe ProPharma, une société de portefeuille d'Odyssey Investment Partners, a acquis Pharmica Consulting, une société de conseil en sciences de la vie qui fournit des solutions de conseil en gestion de projet (PM) et des logiciels d'exploitation propriétaires aux sociétés pharmaceutiques et biotechnologiques pour l'exécution d'essais cliniques. Cela a aidé l'entreprise à développer ses activités à l'échelle mondiale.

Les partenariats, les coentreprises et d'autres stratégies permettent d'accroître la part de marché de l'entreprise grâce à une couverture et une présence accrues. Elles offrent également aux organisations l'avantage d'améliorer leur offre en matière d'externalisation des affaires réglementaires en matière de diagnostic in vitro grâce à une gamme élargie de tailles.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC IVD REGULATORY AFFAIRS OUTSOURCING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 SERVICE TIMELINE CURVE

2.1 MARKET END USER COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 ASIA PACIFIC IVD REGULATORY AFFAIRS OUTSOURCING MARKET, REGULATORY SCENARIO

4.1.1 THE U.S.

4.1.2 REGULATIONS IN EUROPE

4.1.3 REGULATIONS IN ASIA

4.1.3.1 CHINA

4.1.3.2 SOUTH KOREA

4.1.3.3 MALAYSIA

4.1.3.4 THAILAND

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISE IN PREVALENCE OF CHRONIC DISEASES ACROSS THE REGION

5.1.2 TECHNOLOGICAL ADVANCEMENT IN DEVELOPING VARIOUS IN VITRO DIAGNOSTIC DEVICES

5.1.3 DEVELOPMENT OF PROJECT-BASED SUPPORT LEADS TO LONG TERM OUTSOURCING AGREEMENT AMONG ORGANIZATION

5.1.4 INCREASE IN PRODUCT REGISTRATION NUMBERS AND CLINICAL TRIAL APPROVALS ACROSS THE REGION

5.2 RESTRAINTS

5.2.1 STRINGENT REGULATIONS REGARDING MEDICAL DEVICES IN DIFFERENT REGIONS

5.2.2 HIGHER COST RELATED TO MAINTENANCE AND OUTSOURCING OF IVD

5.3 OPPORTUNITIES

5.3.1 RISE IN STRATEGIC ACQUISITION & PARTNERSHIP AMONG ORGANIZATION

5.3.2 EMERGENCE OF VARIOUS EFFICIENT TECHNOLOGICAL SERVICES AND STANDARDS

5.3.3 INCREASE IN R&D ACTIVITIES BY COMPANIES ACROSS THE REGION

5.4 CHALLENGES

5.4.1 LACK OF INFRASTRUCTURE IN HEALTHCARE SERVICE

5.4.2 SHORTAGE OF SKILLED PERSONNEL FOR HANDLING IN VITRO DIAGNOSTIC DEVICES

6 ASIA PACIFIC IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE

6.1 OVERVIEW

6.2 REGULATORY WRITING & SUBMISSIONS

6.3 LEGAL REPRESENTATION

6.4 REGULATORY CONSULTING

6.5 REGULATORY REGISTRATION & CLINICAL TRIAL APPLICATIONS

6.6 CHEMISTRY MANUFACTURING AND CONTROLS (CMC) SERVICES

6.7 DATA MANAGEMENT SERVICES

6.8 OTHERS

7 ASIA PACIFIC IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY INDICATION

7.1 OVERVIEW

7.2 CLINICAL CHEMISTRY AND IMMUNOASSAYS

7.3 INFECTIOUS DISEASES

7.3.1 VIROLOGY

7.3.2 MICROBIOLOGY AND MYCOLOGY

7.3.3 BACTERIOLOGY

7.3.4 SEPSIS

7.3.5 HEPATITIS B

7.3.6 HEPATITIS C

7.3.7 MALARIA

7.3.8 TUBERCULOSIS

7.3.9 SYPHILIS

7.3.10 HUMAN PAPILLOMAVIRUS (HPV) INFECTION

7.3.11 OTHERS

7.4 HAEMATOLOGY

7.5 DRUG TESTING/PHARMACOGENOMICS

7.6 PRECISION MEDICINE

7.7 DIABETES

7.8 BLOOD TRANSFUSION

7.9 CARDIOLOGY

7.1 POINT OF CARE

7.10.1 WAIVED TEST

7.10.2 AT HOME TESTS

7.11 ONCOLOGY

7.12 NEUROLOGY

7.13 HIV/AIDS

7.14 GENETIC TESTING

7.15 OTHERS

8 ASIA PACIFIC IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY CLASS

8.1 OVERVIEW

8.2 CLASS I

8.3 CLASS III

8.4 CLASS II

9 ASIA PACIFIC IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY DEPLOYMENT MODE

9.1 OVERVIEW

9.2 CLOUD

9.3 ON-PREMISES

10 ASIA PACIFIC IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE

10.1 OVERVIEW

10.2 LARGE ENTERPRISES

10.3 SMALL & MEDIUM ENTERPRISES (SMES)

11 ASIA PACIFIC IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY STAGE

11.1 OVERVIEW

11.2 CLINICAL

11.3 PRECLINICAL

11.4 PMA (POST MARKET AUTHORIZATION)

12 ASIA PACIFIC IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY END USER

12.1 OVERVIEW

12.2 MEDICAL DEVICE COMPANIES

12.2.1 BY ORGANIZATION SIZE

12.2.1.1 LARGE ENTERPRISES

12.2.1.2 SMALL & MEDIUM ENTERPRISES (SMES)

12.2.2 BY SERVICE

12.2.2.1 REGULATORY WRITING & SUBMISSIONS

12.2.2.2 LEGAL REPRESENTATION

12.2.2.3 REGULATORY CONSULTING

12.2.2.4 REGULATORY REGISTRATION & CLINICAL TRIAL APPLICATIONS

12.2.2.5 CHEMISTRY MANUFACTURING AND CONTROLS (CMC) SERVICES

12.2.2.6 DATA MANAGEMENT SERVICES

12.2.2.7 OTHERS

12.3 PHARMACEUTICAL COMPANIES

12.3.1 BY ORGANIZATION SIZE

12.3.1.1 LARGE ENTERPRISES

12.3.1.2 SMALL & MEDIUM ENTERPRISES (SMES)

12.3.2 BY SERVICE

12.3.2.1 REGULATORY WRITING & SUBMISSIONS

12.3.2.2 LEGAL REPRESENTATION

12.3.2.3 REGULATORY CONSULTING

12.3.2.4 REGULATORY REGISTRATION & CLINICAL TRIAL APPLICATIONS

12.3.2.5 CHEMISTRY MANUFACTURING AND CONTROLS (CMC) SERVICES

12.3.2.6 DATA MANAGEMENT SERVICES

12.3.2.7 OTHERS

12.4 BIOTECHNOLOGY COMPANIES

12.4.1 BY ORGANIZATION SIZE

12.4.1.1 LARGE ENTERPRISES

12.4.1.2 SMALL & MEDIUM ENTERPRISES (SMES)

12.4.2 BY SERVICE

12.4.2.1 REGULATORY WRITING & SUBMISSIONS

12.4.2.2 LEGAL REPRESENTATION

12.4.2.3 REGULATORY CONSULTING

12.4.2.4 REGULATORY REGISTRATION & CLINICAL TRIAL APPLICATIONS

12.4.2.5 CHEMISTRY MANUFACTURING AND CONTROLS (CMC) SERVICES

12.4.2.6 DATA MANAGEMENT SERVICES

12.4.2.7 OTHERS

12.5 OTHERS

13 ASIA PACIFIC IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION

13.1 ASIA-PACIFIC

13.1.1 CHINA

13.1.2 JAPAN

13.1.3 INDIA

13.1.4 SOUTH KOREA

13.1.5 AUSTRALIA

13.1.6 SINGAPORE

13.1.7 THAILAND

13.1.8 MALAYSIA

13.1.9 INDONESIA

13.1.10 PHILIPPINES

13.1.11 REST OF ASIA-PACIFIC

14 ASIA PACIFIC IVD REGULATORY AFFAIRS OUTSOURCING MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 ICON PLC

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 MEDPACE

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 PAREXEL INTERNATIONAL CORPORATION

16.3.1 COMPANY SNAPSHOT

16.3.2 COMPANY SHARE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT DEVELOPMENTS

16.4 LABCORP DRUG DEVELOPMENT

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENT

16.5 PPD INC. (A SUBSIDIARY OF THERMOFISHER SCIENTIFIC INC.)

16.5.1 COMPANY SNAPSHOT

16.5.2 COMPANY SHARE ANALYSIS

16.5.3 PRODUCT PORTFOLIO

16.5.4 RECENT DEVELOPMENTS

16.6 CHARLES RIVER LABORATORIES

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT DEVELOPMENTS

16.7 FREYR

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENTS

16.8 ASSENT COMPLIANCE INC.

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 ANDAMAN MEDICAL

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 ASIA ACTUAL

16.10.1 COMPANY SNAPSHOT

16.10.2 SERVICE PORTFOLIO

16.10.3 RECENT DEVELOPMENTS

16.11 AXSOURCE

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENTS

16.12 CRITERIUM, INC.

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 DOR PHARMACEUTICAL SERVICES

16.13.1 COMPANY SNAPSHOT

16.13.2 SERVICE PORTFOLIO

16.13.3 RECENT DEVELOPMENTS

16.14 EMERGO BY UL

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENTS

16.15 GENPACT

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCT PORTFOLIO

16.15.4 RECENT DEVELOPMENTS

16.16 GROUPE PRODUCTLIFE S.A.

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENTS

16.17 LORENZ LIFE SCIENCES GROUP

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENTS

16.18 MAKROCARE

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENTS

16.19 MARACA INTERNATIONAL BVBA

16.19.1 COMPANY SNAPSHOT

16.19.2 SERVICE PORTFOLIO

16.19.3 RECENT DEVELOPMENTS

16.2 MDICONSULTANTS, INC.

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENTS

16.21 PBC BIOMED

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 RECENT DEVELOPMENT

16.22 PROMEDICA INTERNATIONAL, A CALIFORNIA CORPORATION

16.22.1 COMPANY SNAPSHOT

16.22.2 PRODUCT PORTFOLIO

16.22.3 RECENT DEVELOPMENT

16.23 PROPHARMA GROUP

16.23.1 COMPANY SNAPSHOT

16.23.2 PRODUCT PORTFOLIO

16.23.3 RECENT DEVELOPMENTS

16.24 QSERVE

16.24.1 COMPANY SNAPSHOT

16.24.2 SERVICE PORTFOLIO

16.24.3 RECENT DEVELOPMENTS

16.25 REGULATORY COMPLIANCE ASSOCIATES INC.

16.25.1 COMPANY SNAPSHOT

16.25.2 PRODUCT PORTFOLIO

16.25.3 RECENT DEVELOPMENT

16.26 RMQ+

16.26.1 COMPANY SNAPSHOT

16.26.2 PRODUCT PORTFOLIO

16.26.3 RECENT DEVELOPMENT

16.27 SARACA SOLUTIONS PRIVATE LIMITED

16.27.1 COMPANY SNAPSHOT

16.27.2 PRODUCT PORTFOLIO

16.27.3 RECENT DEVELOPMENT

16.28 VCLS

16.28.1 COMPANY SNAPSHOT

16.28.2 PRODUCT PORTFOLIO

16.28.3 RECENT DEVELOPMENTS

16.29 WUXI APPTEC

16.29.1 COMPANY SNAPSHOT

16.29.2 REVENUE ANALYSIS

16.29.3 PRODUCT PORTFOLIO

16.29.4 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

Liste des tableaux

TABLE 1 ASIA PACIFIC IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 2 ASIA PACIFIC REGULATORY WRITING & SUBMISSIONS IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 3 ASIA PACIFIC LEGAL REPRESENTATION IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 4 ASIA PACIFIC REGULATORY CONSULTING IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 5 ASIA PACIFIC REGULATORY REGISTRATION & CLINICAL TRIAL APPLICATIONS IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 6 ASIA PACIFIC CHEMISTRY MANUFACTURING AND CONTROLS (CMC) SERVICES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 7 ASIA PACIFIC DATA MANAGEMENT SERVICES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 8 ASIA PACIFIC OTHERS IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 9 ASIA PACIFIC IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY INDICATION, 2020-2029 (USD THOUSAND)

TABLE 10 ASIA PACIFIC CLINICAL CHEMISTRY AND IMMUNOASSAYS IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 11 ASIA PACIFIC INFECTIOUS DISEASES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION,2020-2029 (THOUSAND)

TABLE 12 ASIA PACIFIC INFECTIOUS DISEASES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 13 ASIA PACIFIC HAEMATOLOGY IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 14 ASIA PACIFIC DRUG TESTING/PHARMACOGENOMICS IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (THOUSAND)

TABLE 15 ASIA PACIFIC PRECISION MEDICINE IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (THOUSAND)

TABLE 16 ASIA PACIFIC DIABETES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (THOUSAND)

TABLE 17 ASIA PACIFIC BLOOD TRANSFUSION IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (THOUSAND)

TABLE 18 ASIA PACIFIC CARDIOLOGY IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (THOUSAND)

TABLE 19 ASIA PACIFIC POINT OF CARE IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (THOUSAND)

TABLE 20 ASIA PACIFIC POINT OF CARE IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 21 ASIA PACIFIC ONCOLOGY IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (THOUSAND)

TABLE 22 ASIA PACIFIC NEUROLOGY IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (THOUSAND)

TABLE 23 ASIA PACIFIC HIV/AIDS IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (THOUSAND)

TABLE 24 ASIA PACIFIC GENETIC TESTING IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (THOUSAND)

TABLE 25 ASIA PACIFIC OTHERS IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (THOUSAND)

TABLE 26 ASIA PACIFIC IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY CLASS, 2020-2029 (USD THOUSAND)

TABLE 27 ASIA PACIFIC CLASS I IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 28 ASIA PACIFIC CLASS III IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (THOUSAND)

TABLE 29 ASIA PACIFIC CLASS II IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 30 ASIA PACIFIC IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD THOUSAND)

TABLE 31 ASIA PACIFIC CLOUD IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 32 ASIA PACIFIC ON-PREMISES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 33 ASIA PACIFIC IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD THOUSAND)

TABLE 34 ASIA PACIFIC LARGE ENTERPRISES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 35 ASIA PACIFIC SMALL & MEDIUM ENTERPRISES (SMES) IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 36 ASIA PACIFIC IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY STAGE, 2020-2029 (USD THOUSAND)

TABLE 37 ASIA PACIFIC CLINICAL IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 38 ASIA PACIFIC PRECLINICAL IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 39 ASIA PACIFIC PMA (POST MARKET AUTHORIZATION) IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 40 ASIA PACIFIC IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 41 ASIA PACIFIC MEDICAL DEVICE COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 42 ASIA PACIFIC MEDICAL DEVICE COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 43 ASIA PACIFIC MEDICAL DEVICE COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 44 ASIA PACIFIC PHARMACEUTICAL COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 45 ASIA PACIFIC PHARMACEUTICAL COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 46 ASIA PACIFIC PHARMACEUTICAL COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 47 ASIA PACIFIC BIOTECHNOLOGY COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 48 ASIA PACIFIC BIOTECHNOLOGY COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 49 ASIA PACIFIC BIOTECHNOLOGY COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 50 ASIA PACIFIC OTHERS IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 51 ASIA-PACIFIC IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 52 ASIA-PACIFIC IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 53 ASIA-PACIFIC IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY INDICATION, 2020-2029 (USD THOUSAND)

TABLE 54 ASIA-PACIFIC INFECTIOUS DISEASES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 55 ASIA-PACIFIC POINT OF CARE IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 56 ASIA-PACIFIC IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD THOUSAND)

TABLE 57 ASIA-PACIFIC IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 58 ASIA-PACIFIC IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY STAGE, 2020-2029 (USD THOUSAND)

TABLE 59 ASIA-PACIFIC IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY CLASS, 2020-2029 (USD THOUSAND)

TABLE 60 ASIA-PACIFIC IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 61 ASIA-PACIFIC MEDICAL DEVICE COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 62 ASIA-PACIFIC MEDICAL DEVICE COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 63 ASIA-PACIFIC PHARMACEUTICAL COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 64 ASIA-PACIFIC PHARMACEUTICAL COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 65 ASIA-PACIFIC BIOTECHNOLOGY COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 66 ASIA-PACIFIC BIOTECHNOLOGY COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 67 CHINA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 68 CHINA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY INDICATION, 2020-2029 (USD THOUSAND)

TABLE 69 CHINA INFECTIOUS DISEASES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 70 CHINA POINT OF CARE IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 71 CHINA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD THOUSAND)

TABLE 72 CHINA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 73 CHINA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY STAGE, 2020-2029 (USD THOUSAND)

TABLE 74 CHINA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY CLASS, 2020-2029 (USD THOUSAND)

TABLE 75 CHINA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 76 CHINA MEDICAL DEVICE COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 77 CHINA MEDICAL DEVICE COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 78 CHINA PHARMACEUTICAL COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 79 CHINA PHARMACEUTICAL COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 80 CHINA BIOTECHNOLOGY COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 81 CHINA BIOTECHNOLOGY COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 82 JAPAN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 83 JAPAN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY INDICATION, 2020-2029 (USD THOUSAND)

TABLE 84 JAPAN INFECTIOUS DISEASES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 85 JAPAN POINT OF CARE IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 86 JAPAN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD THOUSAND)

TABLE 87 JAPAN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 88 JAPAN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY STAGE, 2020-2029 (USD THOUSAND)

TABLE 89 JAPAN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY CLASS, 2020-2029 (USD THOUSAND)

TABLE 90 JAPAN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 91 JAPAN MEDICAL DEVICE COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 92 JAPAN MEDICAL DEVICE COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 93 JAPAN PHARMACEUTICAL COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 94 JAPAN PHARMACEUTICAL COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 95 JAPAN BIOTECHNOLOGY COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 96 JAPAN BIOTECHNOLOGY COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 97 INDIA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 98 INDIA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY INDICATION, 2020-2029 (USD THOUSAND)

TABLE 99 INDIA INFECTIOUS DISEASES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 100 INDIA POINT OF CARE IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 101 INDIA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD THOUSAND)

TABLE 102 INDIA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 103 INDIA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY STAGE, 2020-2029 (USD THOUSAND)

TABLE 104 INDIA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY CLASS, 2020-2029 (USD THOUSAND)

TABLE 105 INDIA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 106 INDIA MEDICAL DEVICE COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 107 INDIA MEDICAL DEVICE COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 108 INDIA PHARMACEUTICAL COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 109 INDIA PHARMACEUTICAL COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 110 INDIA BIOTECHNOLOGY COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 111 INDIA BIOTECHNOLOGY COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 112 SOUTH KOREA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 113 SOUTH KOREA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY INDICATION, 2020-2029 (USD THOUSAND)

TABLE 114 SOUTH KOREA INFECTIOUS DISEASES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 115 SOUTH KOREA POINT OF CARE IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 116 SOUTH KOREA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD THOUSAND)

TABLE 117 SOUTH KOREA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 118 SOUTH KOREA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY STAGE, 2020-2029 (USD THOUSAND)

TABLE 119 SOUTH KOREA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY CLASS, 2020-2029 (USD THOUSAND)

TABLE 120 SOUTH KOREA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 121 SOUTH KOREA MEDICAL DEVICE COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 122 SOUTH KOREA MEDICAL DEVICE COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 123 SOUTH KOREA PHARMACEUTICAL COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 124 SOUTH KOREA PHARMACEUTICAL COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 125 SOUTH KOREA BIOTECHNOLOGY COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 126 SOUTH KOREA BIOTECHNOLOGY COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 127 AUSTRALIA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 128 AUSTRALIA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY INDICATION, 2020-2029 (USD THOUSAND)

TABLE 129 AUSTRALIA INFECTIOUS DISEASES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 130 AUSTRALIA POINT OF CARE IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 131 AUSTRALIA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD THOUSAND)

TABLE 132 AUSTRALIA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 133 AUSTRALIA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY STAGE, 2020-2029 (USD THOUSAND)

TABLE 134 AUSTRALIA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY CLASS, 2020-2029 (USD THOUSAND)

TABLE 135 AUSTRALIA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 136 AUSTRALIA MEDICAL DEVICE COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 137 AUSTRALIA MEDICAL DEVICE COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 138 AUSTRALIA PHARMACEUTICAL COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 139 AUSTRALIA PHARMACEUTICAL COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 140 AUSTRALIA BIOTECHNOLOGY COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 141 AUSTRALIA BIOTECHNOLOGY COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 142 SINGAPORE IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 143 SINGAPORE IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY INDICATION, 2020-2029 (USD THOUSAND)

TABLE 144 SINGAPORE INFECTIOUS DISEASES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 145 SINGAPORE POINT OF CARE IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 146 SINGAPORE IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD THOUSAND)

TABLE 147 SINGAPORE IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 148 SINGAPORE IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY STAGE, 2020-2029 (USD THOUSAND)

TABLE 149 SINGAPORE IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY CLASS, 2020-2029 (USD THOUSAND)

TABLE 150 SINGAPORE IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 151 SINGAPORE MEDICAL DEVICE COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 152 SINGAPORE MEDICAL DEVICE COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 153 SINGAPORE PHARMACEUTICAL COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 154 SINGAPORE PHARMACEUTICAL COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 155 SINGAPORE BIOTECHNOLOGY COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 156 SINGAPORE BIOTECHNOLOGY COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 157 THAILAND IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 158 THAILAND IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY INDICATION, 2020-2029 (USD THOUSAND)

TABLE 159 THAILAND INFECTIOUS DISEASES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 160 THAILAND POINT OF CARE IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 161 THAILAND IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD THOUSAND)

TABLE 162 THAILAND IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 163 THAILAND IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY STAGE, 2020-2029 (USD THOUSAND)

TABLE 164 THAILAND IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY CLASS, 2020-2029 (USD THOUSAND)

TABLE 165 THAILAND IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 166 THAILAND MEDICAL DEVICE COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 167 THAILAND MEDICAL DEVICE COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 168 THAILAND PHARMACEUTICAL COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 169 THAILAND PHARMACEUTICAL COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 170 THAILAND BIOTECHNOLOGY COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 171 THAILAND BIOTECHNOLOGY COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 172 MALAYSIA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 173 MALAYSIA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY INDICATION, 2020-2029 (USD THOUSAND)

TABLE 174 MALAYSIA INFECTIOUS DISEASES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 175 MALAYSIA POINT OF CARE IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 176 MALAYSIA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD THOUSAND)

TABLE 177 MALAYSIA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 178 MALAYSIA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY STAGE, 2020-2029 (USD THOUSAND)

TABLE 179 MALAYSIA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY CLASS, 2020-2029 (USD THOUSAND)

TABLE 180 MALAYSIA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 181 MALAYSIA MEDICAL DEVICE COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 182 MALAYSIA MEDICAL DEVICE COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 183 MALAYSIA PHARMACEUTICAL COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 184 MALAYSIA PHARMACEUTICAL COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 185 MALAYSIA BIOTECHNOLOGY COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 186 MALAYSIA BIOTECHNOLOGY COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 187 INDONESIA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 188 INDONESIA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY INDICATION, 2020-2029 (USD THOUSAND)

TABLE 189 INDONESIA INFECTIOUS DISEASES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 190 INDONESIA POINT OF CARE IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 191 INDONESIA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD THOUSAND)

TABLE 192 INDONESIA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 193 INDONESIA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY STAGE, 2020-2029 (USD THOUSAND)

TABLE 194 INDONESIA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY CLASS, 2020-2029 (USD THOUSAND)

TABLE 195 INDONESIA IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 196 INDONESIA MEDICAL DEVICE COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 197 INDONESIA MEDICAL DEVICE COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 198 INDONESIA PHARMACEUTICAL COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 199 INDONESIA PHARMACEUTICAL COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 200 INDONESIA BIOTECHNOLOGY COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 201 INDONESIA BIOTECHNOLOGY COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 202 PHILIPPINES IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 203 PHILIPPINES IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY INDICATION, 2020-2029 (USD THOUSAND)

TABLE 204 PHILIPPINES INFECTIOUS DISEASES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 205 PHILIPPINES POINT OF CARE IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 206 PHILIPPINES IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD THOUSAND)

TABLE 207 PHILIPPINES IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 208 PHILIPPINES IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY STAGE, 2020-2029 (USD THOUSAND)

TABLE 209 PHILIPPINES IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY CLASS, 2020-2029 (USD THOUSAND)

TABLE 210 PHILIPPINES IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 211 PHILIPPINES MEDICAL DEVICE COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 212 PHILIPPINES MEDICAL DEVICE COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 213 PHILIPPINES PHARMACEUTICAL COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 214 PHILIPPINES PHARMACEUTICAL COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 215 PHILIPPINES BIOTECHNOLOGY COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 216 PHILIPPINES BIOTECHNOLOGY COMPANIES IN IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

TABLE 217 REST OF ASIA-PACIFIC IVD REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE, 2020-2029 (USD THOUSAND)

Liste des figures

FIGURE 1 ASIA PACIFIC IVD REGULATORY AFFAIRS OUTSOURCING MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC IVD REGULATORY AFFAIRS OUTSOURCING MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC IVD REGULATORY AFFAIRS OUTSOURCING MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC IVD REGULATORY AFFAIRS OUTSOURCING MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC IVD REGULATORY AFFAIRS OUTSOURCING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC IVD REGULATORY AFFAIRS OUTSOURCING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC IVD REGULATORY AFFAIRS OUTSOURCING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA PACIFIC IVD REGULATORY AFFAIRS OUTSOURCING MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 ASIA PACIFIC IVD REGULATORY AFFAIRS OUTSOURCING MARKET: END USER COVERAGE GRID

FIGURE 10 ASIA PACIFIC IVD REGULATORY AFFAIRS OUTSOURCING MARKET: SEGMENTATION

FIGURE 11 RISE IN THE PREVALENCE OF CHRONIC DISEASES ACROSS IS EXPECTED TO DRIVE ASIA PACIFIC IVD REGULATORY AFFAIRS OUTSOURCING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 SERVICE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF ASIA PACIFIC IVD REGULATORY AFFAIRS OUTSOURCING MARKET IN 2022 & 2029

FIGURE 13 ASIA-PACIFIC IS EXPECTED TO DOMINATE AND IS THE FASTEST GROWING REGION IN THE ASIA PACIFIC IVD REGULATORY AFFAIRS OUTSOURCING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR ASIA PACIFIC IVD REGULATORY AFFAIRS OUTSOURCING MARKET

FIGURE 15 MULTIPLE CHRONIC CONDITIONS AMONG PEOPLE AGED 65 AND ABOVE IN EUROPEAN REGION (2017)

FIGURE 16 ASIA PACIFIC IVD REGULATORY AFFAIRS OUTSOURCING MARKET: BY SERVICE, 2021

FIGURE 17 ASIA PACIFIC IVD REGULATORY AFFAIRS OUTSOURCING MARKET: BY INDICATION, 2021

FIGURE 18 ASIA PACIFIC IVD REGULATORY AFFAIRS OUTSOURCING MARKET: BY CLASS, 2021

FIGURE 19 ASIA PACIFIC IVD REGULATORY AFFAIRS OUTSOURCING MARKET: BY DEPLOYMENT MODE, 2021

FIGURE 20 ASIA PACIFIC IVD REGULATORY AFFAIRS OUTSOURCING MARKET: BY ORGANIZATION SIZE, 2021

FIGURE 21 ASIA PACIFIC IVD REGULATORY AFFAIRS OUTSOURCING MARKET: BY STAGE, 2021

FIGURE 22 ASIA PACIFIC IVD REGULATORY AFFAIRS OUTSOURCING MARKET: BY END USER, 2021

FIGURE 23 ASIA-PACIFIC IVD REGULATORY AFFAIRS OUTSOURCING MARKET: SNAPSHOT (2021)

FIGURE 24 ASIA-PACIFIC IVD REGULATORY AFFAIRS OUTSOURCING MARKET: BY COUNTRY (2021)

FIGURE 25 ASIA-PACIFIC IVD REGULATORY AFFAIRS OUTSOURCING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 26 ASIA-PACIFIC IVD REGULATORY AFFAIRS OUTSOURCING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 27 ASIA-PACIFIC IVD REGULATORY AFFAIRS OUTSOURCING MARKET: BY SERVICE (2022-2029)

FIGURE 28 ASIA PACIFIC IVD REGULATORY AFFAIRS OUTSOURCING MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.