Asia Pacific Ice Cream Dry Mixes Market

Taille du marché en milliards USD

TCAC :

%

USD

354,604.08 Thousand

USD

495,138.89 Thousand

2022

2030

USD

354,604.08 Thousand

USD

495,138.89 Thousand

2022

2030

| 2023 –2030 | |

| USD 354,604.08 Thousand | |

| USD 495,138.89 Thousand | |

|

|

|

Marché des mélanges secs pour glaces en Asie-Pacifique, par saveur (mélange de crème glacée sèche au chocolat, mélange de crème glacée sèche à la vanille, mélange de crème glacée sèche à la fraise, mélange de crème glacée sèche aux pépites de chocolat à la menthe, mélange de crème glacée sèche aux biscuits et à la crème, mélange de crème glacée sèche aux noix, mélange de crème glacée sèche au café, mélange de crème glacée sèche aux fruits et autres), catégorie (à base de produits laitiers et non laitiers), matériau d'emballage (plastique, papier/carton et autres), type d'emballage (sachets et sacs, boîtes et autres), canal de distribution (B2B et B2C), utilisation finale (restaurants et cafés, fabricants de crème glacée, glaciers et magasins, fabricants de crème glacée à domicile, entreprises de restauration et détaillants d'aliments spécialisés) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et perspectives du marché des mélanges secs pour glaces en Asie-Pacifique

Le marché des mélanges secs pour crème glacée de la région Asie-Pacifique est défini comme l'industrie engagée dans la production et la distribution d'ingrédients pré-mélangés utilisés dans la préparation de crème glacée. Le mélange pour crème glacée comprend généralement une combinaison de solides du lait, d'édulcorants, de stabilisants, d'émulsifiants et d'arômes.

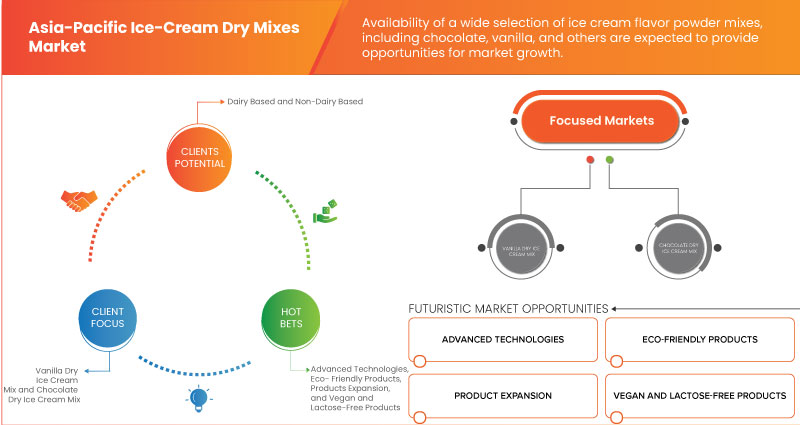

La demande croissante de mélanges de crème glacée sèche à domicile et la disponibilité d'une large sélection de mélanges de poudres aromatisées pour crème glacée, notamment au chocolat, à la vanille et autres, sont quelques-uns des facteurs moteurs de la croissance du marché. L'un des principaux obstacles susceptibles d'avoir un impact négatif sur la croissance du marché est la présence d'ingrédients artificiels dans les mélanges secs pour crème glacée, entre autres. Le développement de mélanges secs pour crème glacée végétaliens et sans lactose devrait offrir des opportunités de croissance du marché. Cependant, les fluctuations des prix des matières premières devraient remettre en cause la croissance du marché.

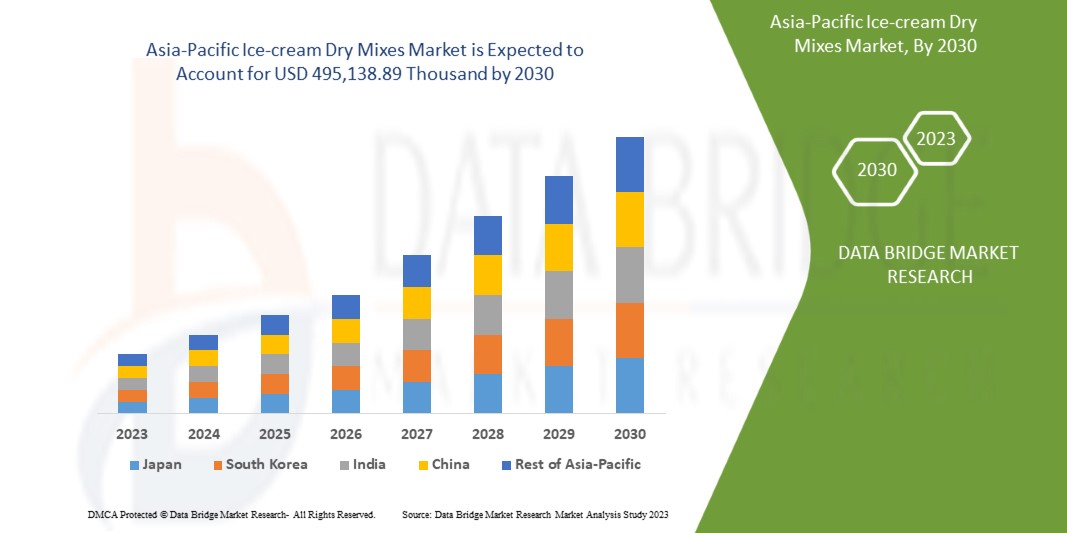

Data Bridge Market Research analyse que le marché des mélanges secs de crème glacée en Asie-Pacifique devrait atteindre 495 138,89 milliers USD d'ici 2030, contre 354 604,08 milliers USD en 2022, avec un TCAC de 4,3 % au cours de la période de prévision de 2023 à 2030.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable de 2015 à 2020) |

|

Unités quantitatives |

Chiffre d'affaires en milliers de dollars américains, volume en tonnes et prix de vente moyen en dollars américains par kg |

|

Segments couverts |

Saveur (mélange de crème glacée sèche au chocolat, mélange de crème glacée sèche à la vanille, mélange de crème glacée sèche à la fraise, mélange de crème glacée sèche aux pépites de chocolat à la menthe, mélange de crème glacée sèche aux biscuits et à la crème, mélange de crème glacée sèche aux noix, mélange de crème glacée sèche au café, mélange de crème glacée sèche aux fruits et autres), catégorie (à base de produits laitiers et non laitiers), matériau d'emballage (plastique, papier/carton et autres), type d'emballage (sachets et sacs, boîtes et autres), canal de distribution (B2B et B2C), utilisation finale (restaurants et cafés, fabricants de crème glacée, glaciers et magasins de crème glacée, fabricants de crème glacée à domicile, entreprises de restauration et détaillants d'aliments spécialisés) |

|

Pays couverts |

Chine, Inde, Japon, Corée du Sud, Indonésie, Thaïlande, Malaisie, Philippines, Singapour, Australie et reste de l'Asie-Pacifique |

|

Acteurs du marché couverts |

Skyline Food Products LLP, TOP Creamery, Amba Enterprise, Wholefarm Australia Pty Ltd, Nimje Industries, Cookwellfoods, Phoon Huat Pte Ltd., KWALITY, Keliff's et Amrut International, entre autres |

Définition du marché

Les mélanges de crème glacée comprennent généralement une combinaison de solides du lait, d'édulcorants , de stabilisants, d'émulsifiants et d'arômes. Ces mélanges sont produits par les fabricants pour simplifier le processus de production de crème glacée pour les établissements commerciaux tels que les glaciers, les restaurants et les fournisseurs de services alimentaires. Différents types de mélanges de crème glacée, y compris des options laitières et non laitières, sont couverts par le marché, répondant aux diverses préférences des consommateurs. Il joue un rôle essentiel dans la fourniture des composants fondamentaux nécessaires à la création d'une large gamme de saveurs et de variétés de crème glacée, offrant commodité et cohérence aux producteurs de crème glacée du monde entier.

Le marché des mélanges secs pour crème glacée de la région Asie-Pacifique est défini comme l'industrie engagée dans la production et la distribution d'ingrédients pré-mélangés utilisés dans la préparation de crème glacée.

Dynamique du marché des mélanges secs pour glaces en Asie-Pacifique

Cette section traite de la compréhension des moteurs, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Disponibilité d'une grande variété de mélanges de poudres aromatisées pour crème glacée

Les fabricants peuvent offrir aux amateurs de glaces une expérience unique de diverses manières. Différentes saveurs, notamment le chocolat, la vanille, le caramel, la mangue , le milkshake, la fraise, le kesar pista, les biscuits et la crème, les pépites de chocolat à la menthe, le café, le beurre de noix de pécan, le rocky road, la pâte à biscuits, le tourbillon de caramel, la pistache, le brownie au fudge, la noix de coco, le butterfinger, le red velvet et d'autres peuvent être incluses dans les variantes de produits.

Les producteurs de mélanges secs pour crème glacée peuvent servir une plus large gamme de clients en répondant à une variété de goûts et de préférences en offrant un choix de saveurs. Cette variété peut attirer plus de clients, ce qui peut stimuler les ventes. Chaque lot de crème glacée fabriqué avec des ingrédients secs a des goûts et des textures cohérents. Les clients bénéficieront de la même qualité à chaque achat grâce à cela, ce qui augmentera la fidélité à la marque. Les fabricants mélangent plusieurs goûts de mélanges secs ou ajoutent des ingrédients et des garnitures pour créer des saveurs personnalisées, produisant des produits distinctifs qui les distinguent de leurs concurrents. Les fabricants répondent rapidement aux tendances changeantes du marché et aux attentes des consommateurs avec une variété de saveurs de mélanges secs. De nouveaux goûts sont également introduits en fonction de la mode ou des préférences saisonnières. La création de saveurs de marque contribue à créer une identité de marque et à distinguer la crème glacée produite par l'entreprise sur le marché. En général, les saveurs de mélanges secs pour crème glacée offrent aux clients la liberté de profiter d'une large gamme de sélections de crème glacée confortablement, à moindre coût et en fonction de leurs goûts uniques et de leurs préoccupations alimentaires, améliorant ainsi toute leur expérience de la crème glacée. Il s’avère ainsi être un élément clé de l’expansion du marché, qui stimule sa croissance.

- Demande croissante pour l'utilisation de mélanges de crème glacée sèche à domicile

Il n'est pas nécessaire d'avoir une sorbetière spécifique pour utiliser de la poudre à glace pour créer de la glace à la maison à l'aide d'un mixeur. Pour une expérience à domicile, la poudre à glace est la meilleure option. Les utilisateurs n'ont besoin que d'eau, d'un mixeur électrique et d'un congélateur pour préparer une délicieuse glace en sélectionnant le parfum, en suivant les instructions et en lisant la recette.

Les mélanges de crème glacée sèche sont un moyen pratique et rapide de préparer des glaces maison sans utiliser de recettes compliquées ou d'équipement spécialisé. L'achat de mélanges de poudre pour crème glacée plutôt que de crème glacée préfabriquée en magasin peut être plus économique. Les utilisateurs peuvent expérimenter différentes saveurs et textures pour créer des compositions uniques en ajoutant leurs propres composants au mélange de poudre. Étant donné que les mélanges de poudre pour crème glacée ont une durée de conservation plus longue, ils constituent un choix pratique pour les occasions spéciales ou les envies soudaines de dessert.

En conséquence, les mélanges secs pour crème glacée deviennent un choix populaire pour les ménages à la recherche d'une option de dessert rapide et personnalisable qui peut être préparée avec un minimum d'effort. Ainsi, il s'avère être un facteur contribuant majeur à la croissance du marché.

Restrictions

- Sensibilité des mélanges secs de crème glacée au rancissement oxydatif

Étant donné que le mélange de crème glacée séchée contient une grande quantité de matière grasse du lait, le rancissement oxydatif est une préoccupation majeure. Lorsque les graisses et les huiles sont exposées à l'oxygène pendant qu'elles sont chauffées, éclairées ou en présence de certains catalyseurs , un processus chimique appelé rancissement oxydatif se produit. Ce processus entraîne la décomposition des lipides en produits chimiques indésirables, conférant au produit fini des goûts et des odeurs désagréables.

Les acides gras insaturés présents dans les graisses végétales ou laitières, qui sont contenus dans les mélanges de crème glacée sèche, les rendent plus sensibles à l'oxydation. La qualité des graisses et des huiles utilisées dans le mélange sec peut affecter sa sensibilité au rancissement oxydatif, et celui-ci peut se produire plus rapidement si des huiles de mauvaise qualité ou de qualité inférieure sont utilisées. Si le mélange sec n'est pas correctement scellé et exposé à l'air, l'oxygène peut réagir avec les graisses, favorisant l'oxydation. Le trempage du mélange de crème glacée sèche dans des conditions chaudes et humides peut accélérer le taux de réactions oxydatives, entraînant le rancissement.

Bien que le rancissement oxydatif puisse avoir un impact sur la saveur et la qualité des mélanges de crème glacée sèche, il ne s'agit peut-être pas d'un problème aussi grave que le rancissement des produits de crème glacée finis, car les graisses du mélange sec n'ont pas encore été disséminées dans la phase aqueuse. Les lipides sont exposés à plus d'air après avoir été combinés avec de l'eau et transformés en crème glacée, ce qui augmente la sensibilité du produit final au rancissement et pourrait limiter son expansion commerciale

- Présence d'ingrédients artificiels dans les mélanges secs pour crème glacée

Selon la marque et la composition exacte du produit, la quantité d'additifs artificiels dans les mélanges secs pour crème glacée peut varier. Des substances artificielles peuvent être incluses dans certains mélanges secs pour crème glacée pour améliorer la saveur, la texture et la durée de conservation. Les ingrédients artificiels courants que l'on peut retrouver dans les mélanges secs pour crème glacée comprennent les arômes artificiels (vanille artificielle, chocolat, fraise, menthe, fruits, noix, café, caramel, beurre et autres), les colorants artificiels (jaune coucher de soleil, rouge allura, bleu brillant, carmin indigo, érythrosine, vert S, tartrazine et autres), les édulcorants artificiels (aspartame, acésulfame de potassium (Ace-K), sucralose, saccharine, néotame, advantame et autres), les émulsifiants (polysorbate 80, mono- et diglycérides, carraghénane, gomme de guar et autres), les stabilisants (gomme de cellulose, gomme de xanthane, gomme de guar , gomme de caroube, alginate de sodium , alginate de propylène glycol (PGA) et autres), les conservateurs (sorbate de potassium, benzoate de sodium , propionate de calcium , propylparabène et autres) et les antioxydants (butylhydroxyanisole). (BHA), hydroxytoluène butylé (BHT), gallate de propyle, éthoxyquine et autres).

Les consommateurs peuvent souhaiter des produits contenant moins d'additifs artificiels, et certaines personnes peuvent décider de renoncer à l'utilisation de certaines substances artificielles en raison de leurs convictions personnelles, de leurs choix alimentaires ou de problèmes de santé. Les mélanges secs pour crème glacée avec des options clean label ou ceux créés avec des arômes, des colorants et des édulcorants naturels peuvent être une meilleure option pour les personnes à la recherche de substituts plus naturels. L'expansion du marché peut être limitée par les effets indésirables croissants associés à de telles situations, ce qui freine la croissance du marché.

Opportunités

- Élargissement de la variété des produits grâce à l'introduction de saveurs exotiques

Des saveurs inhabituelles sont ajoutées pour augmenter la variété des produits et différencier les mélanges secs pour crème glacée des alternatives plus courantes et facilement disponibles. Elles offrent des sensations gustatives distinctives qui peuvent attirer les clients à la recherche de quelque chose de frais et d'intéressant. L'ajout de saveurs exotiques aux mélanges secs pour crème glacée témoigne d'un dévouement à l'originalité et à l'ingéniosité. Cela permet aux producteurs d'expérimenter des saveurs conventionnelles et de satisfaire une variété de palais.

Les saveurs exotiques attirent une clientèle plus large et plus variée, notamment les personnes d'origines diverses ou celles qui aiment découvrir les cuisines d'autres cultures. Elles sont parfaites pour les mélanges secs de crème glacée en édition limitée ou à thème saisonnier, car elles peuvent être influencées par les fruits de saison, les ingrédients locaux ou les événements culturels. Le bouche-à-oreille et le buzz sur les réseaux sociaux sont souvent générés par des goûts distinctifs et inhabituels. La probabilité que les clients parlent de leurs expériences passionnantes en matière de crème glacée peut augmenter, ce qui renforce le produit. On peut vivre une expérience gastronomique en essayant des cuisines nouvelles et uniques. Le mélange sec de crème glacée peut inciter les clients à essayer de nouvelles associations, ce qui en fait un produit intrigant et captivant. Ces goûts peuvent servir des consommateurs de niche, comme ceux qui recherchent de véritables saveurs exotiques ou des alternatives qui respectent certaines exigences alimentaires telles que le véganisme ou les régimes sans gluten.

Bien que les saveurs traditionnelles soient toujours populaires, l'ajout de saveurs inhabituelles aux mélanges secs de crème glacée peut accroître la diversité des produits, stimuler le palais des clients et promouvoir l'amour de la nourriture et le sentiment d'aventure culinaire. Les fabricants peuvent profiter de la popularité de ces saveurs pour offrir à leurs consommateurs des expériences de crème glacée mémorables et satisfaisantes. En conséquence, ils ont désormais plusieurs chances de tirer profit du marché, ce qui devrait offrir des opportunités de croissance du marché.

- Développement de mélanges secs pour crème glacée végétaliens et sans lactose

La population a récemment adopté le mode de vie végétalien. Les gens adoptent ce mode de vie pour améliorer leur bien-être général et pour le bien-être de leur corps, à l'intérieur comme à l'extérieur. Ces progrès sont également observés dans la production de crème glacée. Pour des raisons éthiques, environnementales ou de santé, de plus en plus de personnes se tournent vers des régimes végétaliens ou à base de plantes. En conséquence, les alternatives végétaliennes sont plus demandées dans de nombreuses catégories d'aliments, y compris les glaces. Les glaces traditionnelles à base de produits laitiers ne conviennent pas à de nombreuses personnes en raison d'une intolérance au lactose ou d'allergies aux produits laitiers. Les mélanges secs pour glaces sans lactose ou végétaliennes offrent un substitut délicieux exempt de tout composant provenant des produits laitiers. Les mélanges secs pour glaces végétaliennes contiennent souvent des composants à base de plantes, qui sont considérés comme de meilleures options.

Les mélanges secs pour glaces végétaliennes remplacent le lait végétal comme le lait de coco , le lait d'amande , le lait de soja , le lait d'avoine ou le lait de cajou par des composants laitiers tels que le lait, la crème et le beurre. Certains mélanges secs pour glaces végétaliennes contiennent des édulcorants naturels comme le sirop d'agave, le sirop d'érable ou le sucre de coco à la place du sucre conventionnel. Les mélanges secs pour glaces végétaliennes peuvent contenir des stabilisants et des émulsifiants d'origine végétale comme la gomme de guar, la gomme xanthane ou la carraghénine pour préserver une texture lisse. Dans les mélanges secs pour glaces végétaliennes, des extraits de fruits naturels, de la poudre de chocolat ou d'autres arômes sont fréquemment utilisés. Les produits laitiers, les œufs et le gluten ne sont généralement pas présents, ce qui le rend idéal pour les personnes ayant des besoins alimentaires variés. Un mélange de crème glacée sèche à base de plantes a moins d'impact sur l'environnement qu'un mélange à base de produits laitiers car il utilise moins d'eau et de terres.

La création de mélanges secs pour glaces végétaliennes permet aux producteurs de satisfaire les demandes et les goûts d'un large éventail de clients tout en profitant des perspectives de croissance offertes par l'acceptation croissante des régimes végétaliens et à base de plantes. Cela a créé un potentiel de développement attrayant dans l'industrie de la crème glacée, ce qui devrait créer des opportunités de croissance du marché.

Défi

- Problèmes de santé liés à la consommation de crème glacée

Même si la crème glacée est un dessert apprécié et satisfaisant, sa consommation peut comporter des risques pour la santé. Il est essentiel de consommer de la crème glacée avec modération et de faire attention à sa santé. La teneur élevée en calories et en sucre de la crème glacée peut entraîner une prise de poids et augmenter le risque de diabète de type 2, d'obésité et d'autres problèmes de santé chroniques. Lorsqu'elle est consommée en excès, la teneur élevée en graisses saturées de la crème glacée peut augmenter le taux de cholestérol et le risque de maladie cardiaque.

Le lactose, un sucre naturel présent dans les produits laitiers, peut être présent dans les glaces traditionnelles. Après avoir mangé de la glace, les personnes intolérantes au lactose peuvent ressentir des troubles digestifs, tels que des ballonnements, des gaz et de la diarrhée. Les personnes allergiques ou sensibles à certains aliments, comme le lait, les amandes, le soja et le blé, peuvent ressentir des effets indésirables si la glace contient ces allergènes. La crème glacée contient beaucoup de sucre, ce qui peut entraîner une augmentation rapide du taux de sucre dans le sang, en particulier chez les personnes diabétiques ou résistantes à l’insuline.

Il est important de noter que la modération est de mise en matière de crème glacée, sans quoi la santé des individus est en danger. Ainsi, les problèmes de santé associés à la consommation de crème glacée devraient constituer un défi important pour la croissance du marché.

Portée du marché des mélanges secs pour glaces en Asie-Pacifique

Le marché des mélanges secs pour glaces en Asie-Pacifique est segmenté en six segments notables en fonction de la saveur, de la catégorie, du matériau d'emballage, du type d'emballage, du canal de distribution et de l'utilisation finale. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et les différences entre vos marchés cibles.

Saveur

- Mélange de crème glacée sèche au chocolat

- Mélange de crème glacée sèche à la vanille

- Mélange de crème glacée sèche à la fraise

- Mélange de crème glacée sèche à la menthe et aux pépites de chocolat

- Mélange de crème glacée sèche aux biscuits et à la crème

- Mélange de crème glacée sèche aux noix

- Mélange de crème glacée sèche au café

- Mélange de crème glacée sèche aux fruits

- Autres

Sur la base de la saveur, le marché est segmenté en mélange de crème glacée sèche au chocolat, mélange de crème glacée sèche à la vanille, mélange de crème glacée sèche à la fraise, mélange de crème glacée sèche aux pépites de chocolat à la menthe, mélange de crème glacée sèche aux biscuits et à la crème, mélange de crème glacée sèche aux noix, mélange de crème glacée sèche au café, mélange de crème glacée sèche aux fruits, et autres.

Catégorie

- À base de produits laitiers

- Produits non laitiers

Sur la base de la catégorie, le marché est segmenté en produits laitiers et non laitiers.

Matériau d'emballage

- Plastique

- Papier/carton

- Autres

Sur la base du matériau d’emballage, le marché est segmenté en plastique, papier/carton et autres.

Type d'emballage

- Pochettes et sacs

- Boîtes

- Autres

Sur la base du type d’emballage, le marché est segmenté en sachets et sacs, boîtes et autres.

Canal de distribution

- B2B

- B2C

Sur la base du canal de distribution, le marché est segmenté en B2C et B2B.

Utilisation finale

- Restaurants et cafés

- Fabricants de glaces

- Glaciers et boutiques

- Sorbetières pour la maison

- Entreprises de restauration

- Détaillants en alimentation spécialisée

Sur la base de l'utilisation finale, le marché est segmenté en restaurants et cafés, fabricants de glaces, glaciers et magasins de glaces, fabricants de glaces à domicile, entreprises de restauration et détaillants d'aliments spécialisés.

Analyse régionale du marché des mélanges secs pour glaces en Asie-Pacifique

Le marché des mélanges secs de crème glacée en Asie-Pacifique est analysé et des informations sur la taille du marché sont fournies par saveur, catégorie, matériau d’emballage, type d’emballage, canal de distribution et utilisation finale, comme référencé ci-dessus.

Les pays couverts dans ce rapport de marché sont la Chine, l’Inde, le Japon, la Corée du Sud, l’Indonésie, la Thaïlande, la Malaisie, les Philippines, le Vietnam, Singapour, l’Australie et le reste de l’Asie-Pacifique.

La Chine devrait dominer le marché en raison de la disponibilité d'une large sélection de mélanges de poudres aromatisées pour crème glacée, ce qui devrait offrir des opportunités dans la région. La Chine est également le pays qui connaît la croissance la plus rapide de la région en raison de la tendance croissante des petits fabricants de crème glacée à utiliser des mélanges de crème glacée sèche.

La section par pays du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements dans la réglementation du marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie du pays, les actes réglementaires et les tarifs douaniers d'import-export sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario du marché pour les différents pays. En outre, la présence et la disponibilité des marques régionales et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, ainsi que l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des mélanges secs pour glaces en Asie-Pacifique

Le paysage concurrentiel du marché des mélanges secs pour glaces en Asie-Pacifique fournit des détails sur les concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence régionale, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais cliniques, l'analyse de la marque, les approbations de produits, les brevets, la largeur et l'ampleur du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation de l'entreprise par rapport au marché.

Certains des principaux acteurs du marché opérant sur le marché des mélanges secs de crème glacée en Asie-Pacifique sont Skyline Food Products LLP, TOP Creamery, Amba Enterprise, Wholefarm Australia Pty Ltd, Nimje Industries, Cookwellfoods, Phoon Huat Pte Ltd., KWALITY, Keliff's et Amrut International, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET END USE COVERAGE GRID

2.1 DBMR VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PRICING ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 AVAILABILITY OF A WIDE VARIETY OF ICE CREAM FLAVOR POWDER MIXES

5.1.2 INCREASING DEMAND FOR THE USE OF DRY ICE CREAM MIXES AT HOME

5.1.3 EXPANDING TENDENCY AMONG SMALL-SCALE ICE CREAM MANUFACTURERS

5.2 RESTRAINTS

5.2.1 SUSCEPTIBILITY OF ICE-CREAM DRY MIXES TO OXIDATIVE RANCIDITY

5.2.2 PRESENCE OF ARTIFICIAL INGREDIENTS IN ICE CREAM DRY MIXES

5.3 OPPORTUNITIES

5.3.1 EXPANSION OF PRODUCT VARIETY BY INTRODUCING EXOTIC FLAVORS

5.3.2 DEVELOPMENT OF VEGAN AND LACTOSE-FREE ICE-CREAM DRY MIXES

5.4 CHALLENGES

5.4.1 HEALTH ISSUES ASSOCIATED WITH ICE CREAM CONSUMPTION

5.4.2 FLUCTUATIONS IN RAW MATERIAL PRICES

6 ASIA-PACIFIC ICE-CREAM DRY MIXES MARKET, BY FLAVOR

6.1 OVERVIEW

6.2 VANILLA DRY ICE CREAM MIX

6.3 CHOCOLATE DRY ICE CREAM MIX

6.4 STRAWBERRY DRY ICE CREAM MIX

6.5 MINT CHOCOLATE CHIP DRY ICE CREAM MIX

6.6 COOKIES AND CREAM DRY ICE CREAM MIX

6.7 NUTTY DRY ICE CREAM MIX

6.8 COFFEE DRY ICE CREAM MIX

6.9 FRUIT DRY ICE CREAM MIX

6.1 OTHERS

7 ASIA-PACIFIC ICE-CREAM DRY MIXES MARKET, BY CATEGORY

7.1 OVERVIEW

7.2 DAIRY BASED

7.3 NON-DAIRY BASED

8 ASIA-PACIFIC ICE-CREAM DRY MIXES MARKET, BY END USE

8.1 OVERVIEW

8.2 ICE CREAM PARLORS AND SHOPS

8.3 RESTAURANTS AND CAFES

8.4 ICE CREAM MANUFACTURERS

8.5 HOME ICE CREAM MAKERS

8.6 CATERING BUSINESSES

8.7 SPECIALTY FOOD RETAILERS

9 ASIA-PACIFIC ICE-CREAM DRY MIXES MARKET, BY PACKAGING MATERIAL

9.1 OVERVIEW

9.2 PLASTIC

9.3 PAPER/PAPERBOARD

9.4 OTHERS

10 ASIA-PACIFIC ICE-CREAM DRY MIXES MARKET, BY PACKAGING TYPE

10.1 OVERVIEW

10.2 POUCHES & BAGS

10.3 BOXES

10.4 OTHERS

11 ASIA-PACIFIC ICE-CREAM DRY MIXES MARKET, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 B2B

11.3 B2C

11.3.1 STORE-BASED RETAILING

11.3.1.1 SUPERMARKETS/HYPERMARKETS

11.3.1.2 CONVENIENCE STORES

11.3.1.3 SPECIALTY STORES

11.3.1.4 OTHERS

11.3.2 NON-STORE RETAILING

11.3.2.1 E-COMMERCE RETAILER

11.3.2.2 COMPANY-OWNED WEBSITES

12 ASIA PACIFIC ICE-CREAM DRY MIXES MARKET,BY COUNTRY

12.1 ASIA-PACIFIC

12.1.1 CHINA

12.1.2 INDIA

12.1.3 JAPAN

12.1.4 SOUTH KOREA

12.1.5 AUSTRALIA

12.1.6 INDONESIA

12.1.7 THAILAND

12.1.8 VIETNAM

12.1.9 PHILIPPINES

12.1.10 MALAYSIA

12.1.11 SINGAPORE

12.1.12 REST OF ASIA-PACIFIC

13 ASIA-PACIFIC ICE-CREAM DRY MIXES MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 SKYLINE FOOD PRODUCTS LLP

15.1.1 COMPANY SNAPSHOT

15.1.2 PRODUCT PORTFOLIO

15.1.3 RECENT DEVELOPMENT

15.2 TOP CREAMERY

15.2.1 COMPANY SNAPSHOT

15.2.2 PRODUCT PORTFOLIO

15.2.3 RECENT DEVELOPMENT

15.3 AMBA ENTERPRISE

15.3.1 COMPANY SNAPSHOT

15.3.2 PRODUCT PORTFOLIO

15.3.3 RECENT DEVELOPMENT

15.4 WHOLEFARM AUSTRALIA PTY LTD

15.4.1 COMPANY SNAPSHOT

15.4.2 PRODUCT PORTFOLIO

15.4.3 RECENT DEVELOPMENT

15.5 NIMJE INDUSTRIES

15.5.1 COMPANY SNAPSHOT

15.5.2 PRODUCT PORTFOLIO

15.5.3 RECENT DEVELOPMENT

15.6 AMRUT INTERNATIONAL

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 COOKWELLFOODS

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 KELIFF'S

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 KWALITY

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 PHOON HUAT PTE LTD

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

Liste des tableaux

TABLE 1 ASIA-PACIFIC ICE-CREAM DRY MIXES MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 2 ASIA-PACIFIC ICE-CREAM DRY MIXES MARKET, BY FLAVOR, 2021-2030 (TONS)

TABLE 3 ASIA-PACIFIC ICE-CREAM DRY MIXES MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 4 ASIA-PACIFIC ICE-CREAM DRY MIXES MARKET, BY END USE, 2021-2030 (USD THOUSAND)

TABLE 5 ASIA-PACIFIC ICE-CREAM DRY MIXES MARKET, BY PACKAGING MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 6 ASIA-PACIFIC ICE-CREAM DRY MIXES MARKET, BY PACKAGING TYPE, 2021-2030 (USD THOUSAND)

TABLE 7 ASIA-PACIFIC ICE-CREAM DRY MIXES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 8 ASIA-PACIFIC B2C IN ICE-CREAM DRY MIXES MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 9 ASIA-PACIFIC STORE-BASED RETAILING IN ICE-CREAM DRY MIXES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 10 ASIA-PACIFIC NON-STORE RETAILING IN ICE-CREAM DRY MIXES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 11 ASIA-PACIFIC ICE-CREAM DRY MIXES MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 12 ASIA-PACIFIC ICE-CREAM DRY MIXES MARKET, BY COUNTRY, 2021-2030 (TONS)

TABLE 13 CHINA ICE-CREAM DRY MIXES MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 14 CHINA ICE-CREAM DRY MIXES MARKET, BY FLAVOR, 2021-2030 (TONS)

TABLE 15 CHINA ICE-CREAM DRY MIXES MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 16 CHINA ICE-CREAM DRY MIXES MARKET, BY END USE, 2021-2030 (USD THOUSAND)

TABLE 17 CHINA ICE-CREAM DRY MIXES MARKET, BY PACKAGING MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 18 CHINA ICE-CREAM DRY MIXES MARKET, BY PACKAGING TYPE, 2021-2030 (USD THOUSAND)

TABLE 19 CHINA ICE-CREAM DRY MIXES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 20 CHINA B2C IN ICE-CREAM DRY MIXES MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 21 CHINA STORE-BASED RETAILING IN ICE-CREAM DRY MIXES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 22 CHINA NON-STORE RETAILING IN ICE-CREAM DRY MIXES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 23 INDIA ICE-CREAM DRY MIXES MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 24 INDIA ICE-CREAM DRY MIXES MARKET, BY FLAVOR, 2021-2030 (TONS)

TABLE 25 INDIA ICE-CREAM DRY MIXES MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 26 INDIA ICE-CREAM DRY MIXES MARKET, BY END USE, 2021-2030 (USD THOUSAND)

TABLE 27 INDIA ICE-CREAM DRY MIXES MARKET, BY PACKAGING MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 28 INDIA ICE-CREAM DRY MIXES MARKET, BY PACKAGING TYPE, 2021-2030 (USD THOUSAND)

TABLE 29 INDIA ICE-CREAM DRY MIXES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 30 INDIA B2C IN ICE-CREAM DRY MIXES MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 31 INDIA STORE-BASED RETAILING IN ICE-CREAM DRY MIXES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 32 INDIA NON-STORE RETAILING IN ICE-CREAM DRY MIXES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 33 JAPAN ICE-CREAM DRY MIXES MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 34 JAPAN ICE-CREAM DRY MIXES MARKET, BY FLAVOR, 2021-2030 (TONS)

TABLE 35 JAPAN ICE-CREAM DRY MIXES MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 36 JAPAN ICE-CREAM DRY MIXES MARKET, BY END USE, 2021-2030 (USD THOUSAND)

TABLE 37 JAPAN ICE-CREAM DRY MIXES MARKET, BY PACKAGING MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 38 JAPAN ICE-CREAM DRY MIXES MARKET, BY PACKAGING TYPE, 2021-2030 (USD THOUSAND)

TABLE 39 JAPAN ICE-CREAM DRY MIXES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 40 JAPAN B2C IN ICE-CREAM DRY MIXES MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 41 JAPAN STORE-BASED RETAILING IN ICE-CREAM DRY MIXES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 42 JAPAN NON-STORE RETAILING IN ICE-CREAM DRY MIXES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 43 SOUTH KOREA ICE-CREAM DRY MIXES MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 44 SOUTH KOREA ICE-CREAM DRY MIXES MARKET, BY FLAVOR, 2021-2030 (TONS)

TABLE 45 SOUTH KOREA ICE-CREAM DRY MIXES MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 46 SOUTH KOREA ICE-CREAM DRY MIXES MARKET, BY END USE, 2021-2030 (USD THOUSAND)

TABLE 47 SOUTH KOREA ICE-CREAM DRY MIXES MARKET, BY PACKAGING MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 48 SOUTH KOREA ICE-CREAM DRY MIXES MARKET, BY PACKAGING TYPE, 2021-2030 (USD THOUSAND)

TABLE 49 SOUTH KOREA ICE-CREAM DRY MIXES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 50 SOUTH KOREA B2C IN ICE-CREAM DRY MIXES MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 51 SOUTH KOREA STORE-BASED RETAILING IN ICE-CREAM DRY MIXES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 52 SOUTH KOREA NON-STORE RETAILING IN ICE-CREAM DRY MIXES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 53 AUSTRALIA ICE-CREAM DRY MIXES MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 54 AUSTRALIA ICE-CREAM DRY MIXES MARKET, BY FLAVOR, 2021-2030 (TONS)

TABLE 55 AUSTRALIA ICE-CREAM DRY MIXES MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 56 AUSTRALIA ICE-CREAM DRY MIXES MARKET, BY END USE, 2021-2030 (USD THOUSAND)

TABLE 57 AUSTRALIA ICE-CREAM DRY MIXES MARKET, BY PACKAGING MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 58 AUSTRALIA ICE-CREAM DRY MIXES MARKET, BY PACKAGING TYPE, 2021-2030 (USD THOUSAND)

TABLE 59 AUSTRALIA ICE-CREAM DRY MIXES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 60 AUSTRALIA B2C IN ICE-CREAM DRY MIXES MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 61 AUSTRALIA STORE-BASED RETAILING IN ICE-CREAM DRY MIXES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 62 AUSTRALIA NON-STORE RETAILING IN ICE-CREAM DRY MIXES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 63 INDONESIA ICE-CREAM DRY MIXES MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 64 INDONESIA ICE-CREAM DRY MIXES MARKET, BY FLAVOR, 2021-2030 (TONS)

TABLE 65 INDONESIA ICE-CREAM DRY MIXES MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 66 INDONESIA ICE-CREAM DRY MIXES MARKET, BY END USE, 2021-2030 (USD THOUSAND)

TABLE 67 INDONESIA ICE-CREAM DRY MIXES MARKET, BY PACKAGING MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 68 INDONESIA ICE-CREAM DRY MIXES MARKET, BY PACKAGING TYPE, 2021-2030 (USD THOUSAND)

TABLE 69 INDONESIA ICE-CREAM DRY MIXES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 70 INDONESIA B2C IN ICE-CREAM DRY MIXES MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 71 INDONESIA STORE-BASED RETAILING IN ICE-CREAM DRY MIXES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 72 INDONESIA NON-STORE RETAILING IN ICE-CREAM DRY MIXES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 73 THAILAND ICE-CREAM DRY MIXES MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 74 THAILAND ICE-CREAM DRY MIXES MARKET, BY FLAVOR, 2021-2030 (TONS)

TABLE 75 THAILAND ICE-CREAM DRY MIXES MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 76 THAILAND ICE-CREAM DRY MIXES MARKET, BY END USE, 2021-2030 (USD THOUSAND)

TABLE 77 THAILAND ICE-CREAM DRY MIXES MARKET, BY PACKAGING MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 78 THAILAND ICE-CREAM DRY MIXES MARKET, BY PACKAGING TYPE, 2021-2030 (USD THOUSAND)

TABLE 79 THAILAND ICE-CREAM DRY MIXES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 80 THAILAND B2C IN ICE-CREAM DRY MIXES MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 81 THAILAND STORE-BASED RETAILING IN ICE-CREAM DRY MIXES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 82 THAILAND NON-STORE RETAILING IN ICE-CREAM DRY MIXES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 83 VIETNAM ICE-CREAM DRY MIXES MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 84 VIETNAM ICE-CREAM DRY MIXES MARKET, BY FLAVOR, 2021-2030 (TONS)

TABLE 85 VIETNAM ICE-CREAM DRY MIXES MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 86 VIETNAM ICE-CREAM DRY MIXES MARKET, BY END USE, 2021-2030 (USD THOUSAND)

TABLE 87 VIETNAM ICE-CREAM DRY MIXES MARKET, BY PACKAGING MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 88 VIETNAM ICE-CREAM DRY MIXES MARKET, BY PACKAGING TYPE, 2021-2030 (USD THOUSAND)

TABLE 89 VIETNAM ICE-CREAM DRY MIXES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 90 VIETNAM B2C IN ICE-CREAM DRY MIXES MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 91 VIETNAM STORE-BASED RETAILING IN ICE-CREAM DRY MIXES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 92 VIETNAM NON-STORE RETAILING IN ICE-CREAM DRY MIXES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 93 PHILIPPINES ICE-CREAM DRY MIXES MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 94 PHILIPPINES ICE-CREAM DRY MIXES MARKET, BY FLAVOR, 2021-2030 (TONS)

TABLE 95 PHILIPPINES ICE-CREAM DRY MIXES MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 96 PHILIPPINES ICE-CREAM DRY MIXES MARKET, BY END USE, 2021-2030 (USD THOUSAND)

TABLE 97 PHILIPPINES ICE-CREAM DRY MIXES MARKET, BY PACKAGING MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 98 PHILIPPINES ICE-CREAM DRY MIXES MARKET, BY PACKAGING TYPE, 2021-2030 (USD THOUSAND)

TABLE 99 PHILIPPINES ICE-CREAM DRY MIXES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 100 PHILIPPINES B2C IN ICE-CREAM DRY MIXES MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 101 PHILIPPINES STORE-BASED RETAILING IN ICE-CREAM DRY MIXES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 102 PHILIPPINES NON-STORE RETAILING IN ICE-CREAM DRY MIXES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 103 MALAYSIA ICE-CREAM DRY MIXES MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 104 MALAYSIA ICE-CREAM DRY MIXES MARKET, BY FLAVOR, 2021-2030 (TONS)

TABLE 105 MALAYSIA ICE-CREAM DRY MIXES MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 106 MALAYSIA ICE-CREAM DRY MIXES MARKET, BY END USE, 2021-2030 (USD THOUSAND)

TABLE 107 MALAYSIA ICE-CREAM DRY MIXES MARKET, BY PACKAGING MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 108 MALAYSIA ICE-CREAM DRY MIXES MARKET, BY PACKAGING TYPE, 2021-2030 (USD THOUSAND)

TABLE 109 MALAYSIA ICE-CREAM DRY MIXES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 110 MALAYSIA B2C IN ICE-CREAM DRY MIXES MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 111 MALAYSIA STORE-BASED RETAILING IN ICE-CREAM DRY MIXES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 112 MALAYSIA NON-STORE RETAILING IN ICE-CREAM DRY MIXES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 113 SINGAPORE ICE-CREAM DRY MIXES MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 114 SINGAPORE ICE-CREAM DRY MIXES MARKET, BY FLAVOR, 2021-2030 (TONS)

TABLE 115 SINGAPORE ICE-CREAM DRY MIXES MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 116 SINGAPORE ICE-CREAM DRY MIXES MARKET, BY END USE, 2021-2030 (USD THOUSAND)

TABLE 117 SINGAPORE ICE-CREAM DRY MIXES MARKET, BY PACKAGING MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 118 SINGAPORE ICE-CREAM DRY MIXES MARKET, BY PACKAGING TYPE, 2021-2030 (USD THOUSAND)

TABLE 119 SINGAPORE ICE-CREAM DRY MIXES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 120 SINGAPORE B2C IN ICE-CREAM DRY MIXES MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 121 SINGAPORE STORE-BASED RETAILING IN ICE-CREAM DRY MIXES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 122 SINGAPORE NON-STORE RETAILING IN ICE-CREAM DRY MIXES MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 123 REST OF ASIA-PACIFIC ICE-CREAM DRY MIXES MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 124 REST OF ASIA-PACIFIC ICE-CREAM DRY MIXES MARKET, BY FLAVOR, 2021-2030 (TONS)

Liste des figures

FIGURE 1 ASIA-PACIFIC ICE-CREAM DRY MIXES MARKET

FIGURE 2 ASIA-PACIFIC ICE-CREAM DRY MIXES MARKET: DATA TRIANGULATION

FIGURE 3 ASIA-PACIFIC ICE-CREAM DRY MIXES MARKET : DROC ANALYSIS

FIGURE 4 ASIA-PACIFIC ICE-CREAM DRY MIXES MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 ASIA-PACIFIC ICE-CREAM DRY MIXES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA-PACIFIC ICE-CREAM DRY MIXES MARKET: MULTIVARIATE MODELLING

FIGURE 7 ASIA-PACIFIC ICE-CREAM DRY MIXES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 ASIA-PACIFIC ICE-CREAM DRY MIXES MARKET: DBMR MARKET POSITION GRID

FIGURE 9 ASIA-PACIFIC ICE-CREAM DRY MIXES MARKET: MARKET END USE COVERAGE GRID

FIGURE 10 ASIA-PACIFIC ICE-CREAM DRY MIXES MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 ASIA-PACIFIC ICE-CREAM DRY MIXES MARKET: SEGMENTATION

FIGURE 12 AVAILABILITY OF A WIDE VARIETY OF ICE CREAM FLAVOR POWDER MIXES, INCLUDING CHOCOLATE, VANILLA, AND OTHERS IS DRIVING THE GROWTH OF THE ASIA-PACIFIC ICE-CREAM DRY MIXES MARKET IN THE FORECAST PERIOD

FIGURE 13 THE VANILLA DRY ICE CREAM MIX IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA-PACIFIC ICE-CREAM DRY MIXES MARKET IN 2023 AND 2030

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA-PACIFIC ICE-CREAM DRY MIXES MARKET

FIGURE 15 ASIA-PACIFIC ICE-CREAM DRY MIXES MARKET: BY FLAVOR, 2022

FIGURE 16 ASIA-PACIFIC ICE-CREAM DRY MIXES MARKET: BY CATEGORY, 2022

FIGURE 17 ASIA-PACIFIC ICE-CREAM DRY MIXES MARKET: BY END USE, 2022

FIGURE 18 ASIA-PACIFIC ICE-CREAM DRY MIXES MARKET: BY PACKAGING MATERIAL, 2022

FIGURE 19 ASIA-PACIFIC ICE-CREAM DRY MIXES MARKET: BY PACKAGING TYPE, 2022

FIGURE 20 ASIA-PACIFIC ICE-CREAM DRY MIXES MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 21 ASIA-PACIFIC ICE-CREAM DRY MIXES MARKET: SNAPSHOT (2022)

FIGURE 22 ASIA-PACIFIC ICE-CREAM DRY MIXES MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.