Marché du polybutadiène à terminaison hydroxyle (HTPB) en Asie-Pacifique, par produit (polybutadiènes à terminaison hydroxyle conventionnels et polybutadiènes à terminaison hydroxyle de faible poids moléculaire), application (carburant pour fusée, matériau en caoutchouc, peinture, polyuréthane et autres), utilisation finale (bâtiment et construction, aérospatiale et défense, automobile, électricité et électronique, construction, emballage et autres), tendances de l'industrie et prévisions jusqu'en 2029.

Analyse et taille du marché

Le polybutadiène à terminaison hydroxyle (HTPB) est le polyol le plus couramment utilisé ces derniers temps. En raison de ses excellentes propriétés physiques, telles que sa résistance élevée à la traction et à la déchirure et sa bonne résistance chimique, il agit comme liant combustible pour le propulseur PU. Le HTPB contient de l'hydrogène et du carbone comme principaux constituants lors de la combustion. Il devient chimiquement et physiquement compatible avec les oxydants conventionnels et d'autres ingrédients.

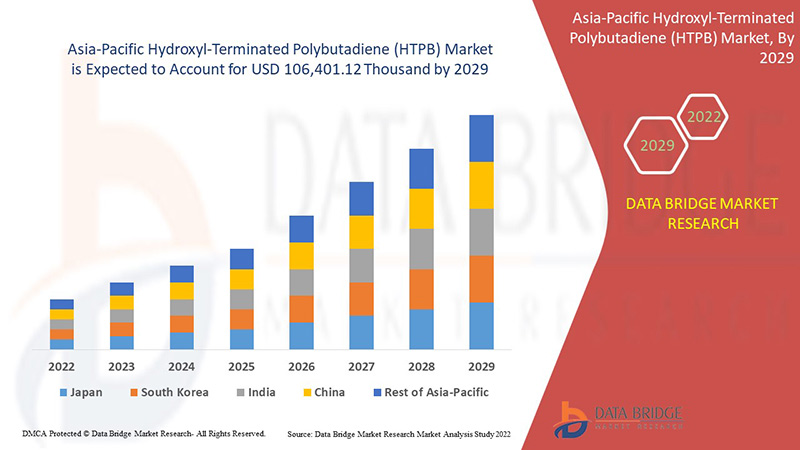

Français La demande croissante de composants aérospatiaux innovants a un impact significatif sur l'expansion du marché du polybutadiène à terminaison hydroxyle (HTPB). Dans ce contexte, la popularité croissante du polybutadiène à terminaison hydroxyle (HTPB) dans l'industrie automobile et la demande croissante de produits électroniques grand public sont des déterminants clés favorisant la croissance du marché du polybutadiène à terminaison hydroxyle (HTPB) au cours de la période de prévision. Data Bridge Market Research analyse que le marché du polybutadiène à terminaison hydroxyle (HTPB) devrait atteindre 106 401,12 milliers USD d'ici 2029, à un TCAC de 7,2 % au cours de la période de prévision. « Aérospatiale et défense » représente le segment d'utilisation finale le plus important sur le marché respectif en raison de la demande d'adhésifs et de liants HTPB dans diverses industries telles que l'automobile, la construction et d'autres industries. Le rapport de marché élaboré par l’équipe de recherche sur le marché de Data Bridge comprend une analyse approfondie par des experts, une analyse des importations/exportations, une analyse des prix, une analyse de la consommation de production et un scénario de chaîne climatique.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable de 2019 à 2014) |

|

Unités quantitatives |

Chiffre d'affaires en milliers de dollars américains, volume en kilotonnes, prix en dollars américains |

|

Segments couverts |

Sous-produit (polybutadiènes à terminaison hydroxyle classiques et polybutadiènes à terminaison hydroxyle de faible poids moléculaire), application (carburant pour fusée, matériau en caoutchouc, peinture, polyuréthane et autres), utilisation finale (bâtiment et construction, aérospatiale et défense, automobile, électricité et électronique, construction, emballage et autres) |

|

Pays couverts |

Chine, Japon, Inde, Corée du Sud, Singapour, Malaisie, Australie et Nouvelle-Zélande, Thaïlande, Indonésie, Philippines, Reste de l'Asie-Pacifique (APAC) dans la région Asie-Pacifique (APAC) |

|

Acteurs du marché couverts |

Evonik Industries AG (Rhénanie-du-Nord-Westphalie, Allemagne), Idemitsu Kosan Co., Ltd. (Tokyo, Japon), Cray Valley (une filiale de TotalEnergies) (Pennsylvanie, États-Unis), Polymer Source. Inc. (Québec, Canada), NIPPON SODA CO., LTD. (Tokyo, Japon) et Island Pyrochemical Industries (IPI) (New York, États-Unis), entre autres. |

Définition du marché

Le polybutadiène à terminaison hydroxyle (HTPB) est un oligomère du composé chimique butadiène avec des groupes fonctionnels hydroxyles complétés à l'extrémité individuelle. Les polymères de polyuréthane sont produits par la réaction du polybutadiène à terminaison hydroxyle avec des isocyanates . Il s'agit d'un liquide translucide dont la couleur est semblable à celle du papier ciré et la texture visqueuse à celle du sirop de maïs. Le principal domaine d'application des composés HTPB est le propulseur solide pour fusées. En raison de leurs propriétés telles qu'une excellente hydrophobicité, de faibles températures de transition vitreuse et une faible teneur en matières volatiles, ces polybutadiènes sont principalement utilisés dans les industries aérospatiales et de défense.

Cadre réglementaire

Agence de protection de l'environnement (EPA) : tous les composants du HTPB sont répertoriés ou exclus de la liste de l'inventaire de la loi sur le contrôle des substances toxiques (TSCA) de l'Agence de protection de l'environnement des États-Unis. Ce produit ne contient aucun produit chimique toxique en concentration supérieure à la concentration de minimis applicable, sous réserve des exigences de déclaration de la section 313 du titre III de la loi Superfund Amendments and Reauthorization Act de 1986 et de la partie 372 du 40 CFR.

La dynamique du marché du polybutadiène à terminaison hydroxyle (HTPB) en Asie-Pacifique comprend :

Facteurs moteurs/opportunités sur le marché du polybutadiène à terminaison hydroxyle (HTPB) en Asie-Pacifique

- Demande croissante de composants aérospatiaux innovants

Les composants aérospatiaux sont généralement fabriqués à partir de matériaux avancés, notamment du polybutadiène à terminaison hydroxyle, des alliages de titane, des superalliages à base de nickel et d'autres céramiques . Les fabricants d'avions ont grandement bénéficié des progrès de la science des matériaux. Par conséquent, l'efficacité du polybutadiène à terminaison hydroxyle dans la technologie aérospatiale améliore les ailes des avions et rend les avions plus légers et plus économes en carburant.

- Le polybutadiène à terminaison hydroxyle (HTPB) gagne en popularité dans l'industrie automobile

Avec l’augmentation des revenus disponibles dans les principales économies du monde, la demande d’automobiles a explosé. Cette augmentation de la production automobile peut également être attribuée à la disponibilité facile des prêts et à la préférence continue pour la mobilité personnelle, en particulier après la pandémie. La demande de véhicules commerciaux a également augmenté en raison des activités commerciales.

- Utilisation du polybutadiène à terminaison hydroxyle (HTPB) dans les propulseurs solides pour fusées

La participation active et l'intérêt croissants des gouvernements pour le renforcement de leurs capacités spatiales. Les efforts et les initiatives des agences spatiales, des centres de recherche et même des entreprises privées dans certaines parties du globe pour lancer des véhicules spatiaux sans pilote. Les lancements de satellites à des fins de communication sont en augmentation. Ce sont les principaux moteurs de la croissance de la demande en systèmes de propulsion de fusées. Cette croissance de l'industrie aérospatiale de la région Asie-Pacifique a un impact direct sur la croissance du marché du polybutadiène à terminaison hydroxyle.

- Perspectives positives à l’égard des produits électroniques grand public

Les appareils électroniques grand public ou domestiques sont des appareils électriques conçus pour une utilisation quotidienne, généralement dans les maisons privées. L'électronique grand public englobe une variété de gadgets utilisés pour le divertissement, la communication et les loisirs, notamment les téléphones portables, les téléviseurs et les circuits imprimés. Le marché des services de fabrication électronique (EMS) reste un marché très actif, principalement porté par les industries de l'électronique grand public et des communications. En réponse à une concurrence de plus en plus féroce dans l'industrie, les fournisseurs d'EMS adoptent de plus en plus des modèles commerciaux innovants et stratégiques ainsi qu'une demande accrue de polybutadiène à terminaison hydroxyle (HTPB).

Contraintes/défis rencontrés par le marché du polybutadiène à terminaison hydroxyle (HTPB) en Asie-Pacifique

- Taux de déformation élevé et propriétés de choc du polybutadiène à terminaison hydroxyle (HTPB)

Le polybutadiène à terminaison hydroxyle (HTPB) est un liant polymère utilisé dans les explosifs à liaison polymère (PBX) et les propulseurs solides pour fusées. Même s'il est utilisé en petites fractions, le liant élastomère absorbe une grande partie de l'énergie d'impact. Il nécessite donc une modélisation minutieuse de son comportement mécanique pour simuler avec précision la réponse des PBX lorsqu'ils sont soumis à des déformations et des taux de déformation importants.

- Les grains de polybutadiène à terminaison hydroxyle (HTPB) ne peuvent pas être remodelés, réutilisés ou recyclés

Le carburant de fusée hybride le plus couramment utilisé, le polybutadiène à terminaison hydroxyle (HTPB), est un matériau polymère thermodurcissable traditionnel fréquemment utilisé comme liant pour les grains de propergol solide pour fusées. Le polybutadiène à terminaison hydroxyle (HTPB) reste le polymère principal pour les grains de carburant hybride en raison de sa connaissance de l'industrie avec ses propriétés chimiques et structurelles.

Le COVID-19 a eu un impact minimal sur le marché du polybutadiène à terminaison hydroxyle (HTPB) en Asie-Pacifique

La COVID-19 a eu un impact sur diverses industries manufacturières et de services au cours de l'année 2020-2021, car elle a entraîné la fermeture de lieux de travail, la perturbation des chaînes d'approvisionnement et des restrictions sur les transports. Cependant, le déséquilibre entre l'offre et la demande et son impact sur les prix sont considérés comme à court terme et devraient se rétablir à la fin de cette pandémie. En raison de l'épidémie de Covid-19 dans le monde entier, la demande de polybutadiène à terminaison hydroxyle (HTPB) a diminué. Ainsi, les industries de l'automobile, de l'électricité et de l'électronique, du bâtiment et de la construction ont beaucoup souffert pendant l'épidémie de Covid-19. L'industrie du polybutadiène à terminaison hydroxyle (HTPB) devrait croître avec la suppression des restrictions dans divers pays.

Développements récents

- En juillet 2019, Entegris a annoncé l'acquisition de MPD Chemicals, la société mère de Monomer-Polymer & Dajac Labs. Cette acquisition a contribué à développer et à diversifier le portefeuille de matériaux techniques d'Entegris.

- En novembre 2014, Evonik Industries AG a inauguré une nouvelle usine de polybutadiène à terminaison hydroxyle (HTPB) à Marl. Evonik a commercialisé le HTPB sous la marque POLYVEST HT et a ainsi élargi sa gamme de produits de polybutadiènes avec une nouvelle qualité fonctionnalisée. Ce développement a permis à l'entreprise de créer une bonne réputation.

Portée du marché du polybutadiène à terminaison hydroxyle (HTPB) en Asie-Pacifique

Le marché du polybutadiène à terminaison hydroxyle (HTPB) de la région Asie-Pacifique est segmenté en fonction du produit, de l'application et de l'utilisation finale. La croissance parmi ces segments vous aidera à analyser les segments de croissance faibles dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Produit

- Polybutadiènes à terminaison hydroxyle de faible poids moléculaire

- Polybutadiènes conventionnels à terminaison hydroxyle

Sur la base du produit, le marché du polybutadiène à terminaison hydroxyle (HTPB) de la région Asie-Pacifique est segmenté en polybutadiènes à terminaison hydroxyle conventionnels et en polybutadiènes à terminaison hydroxyle de faible poids moléculaire.

Application

- Carburant pour fusée

- Polyuréthane

- Peinture

- Matériau en caoutchouc

- Autres

Sur la base de l'application, le marché du polybutadiène à terminaison hydroxyle (HTPB) de la région Asie-Pacifique est segmenté en carburant de fusée, matériau en caoutchouc, peinture, polyuréthane et autres.

Utilisation finale

- Aérospatiale et Défense

- Automobile

- Bâtiment et construction

- Électricité et électronique

- Conditionnement

- Autres

Sur la base de l'utilisation finale, le marché du polybutadiène à terminaison hydroxyle (HTPB) de la région Asie-Pacifique est segmenté en bâtiment et construction, aérospatiale et défense, automobile, électricité et électronique, construction, emballage et autres.

Analyse/perspectives régionales du marché du polybutadiène à terminaison hydroxyle (HTPB) en Asie-Pacifique

Le marché du polybutadiène à terminaison hydroxyle (HTPB) de la région Asie-Pacifique est analysé et des informations et tendances sur la taille du marché sont fournies par pays, produit, application et utilisation finale, comme indiqué ci-dessus.

Les pays couverts dans le rapport sur le marché du polybutadiène à terminaison hydroxyle (HTPB) sont la Chine, le Japon, l'Inde, la Corée du Sud, Singapour, la Malaisie, l'Australie et la Nouvelle-Zélande, la Thaïlande, l'Indonésie, les Philippines et le reste de l'Asie-Pacifique (APAC) dans l'Asie-Pacifique (APAC).

La Chine domine le marché du polybutadiène à terminaison hydroxyle (HTPB) en raison de la demande accrue de HTPB dans l'industrie automobile. La Chine est suivie par l'Inde et devrait connaître une croissance significative au cours de la période de prévision de 2022 à 2029 en raison de la demande croissante de polybutadiène à terminaison hydroxyle (HTPB) de l'industrie aérospatiale et de la défense dans la région. L'Inde est suivie par le Japon et devrait connaître une croissance significative en raison de l'application croissante du HTPB dans diverses applications industrielles telles que la peinture, le carburant pour fusée et les adhésifs.

La section par pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques, l'analyse des cinq forces de Porter et les études de cas sont quelques indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques d'Asie-Pacifique et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché du polybutadiène à terminaison hydroxyle (HTPB) en Asie-Pacifique

Le paysage concurrentiel du marché du polybutadiène à terminaison hydroxyle (HTPB) fournit des détails sur le concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Asie-Pacifique, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises sur le marché du polybutadiène à terminaison hydroxyle (HTPB).

Français Certains des principaux acteurs du marché engagés sur le marché du polybutadiène à terminaison hydroxyle (HTPB) de l'Asie-Pacifique sont Evonik Industries AG, Idemitsu Kosan Co., Ltd., Cray Valley (une filiale de TotalEnergies), Polymer Source. Inc., NIPPON SODA CO., LTD., Island Pyrochemical Industries (IPI), entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 THE PRODUCT LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USE COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER'S FIVE FORCES:

4.1.1 THREAT OF NEW ENTRANTS:

4.1.2 THREAT OF SUBSTITUTES:

4.1.3 CUSTOMER BARGAINING POWER:

4.1.4 SUPPLIER BARGAINING POWER:

4.1.5 INTERNAL COMPETITION (RIVALRY):

4.2 PESTLE ANALYSIS

4.2.1 OVERVIEW

4.2.2 POLITICAL FACTORS

4.2.3 ENVIRONMENTAL FACTORS

4.2.4 SOCIAL FACTORS

4.2.5 TECHNOLOGICAL FACTORS

4.2.6 ECONOMICAL FACTORS

4.2.7 LEGAL FACTORS

4.2.8 CONCLUSION

4.3 IMPORT EXPORT SCENARIO

4.4 POTENTIAL BUYERS’ LIST

4.5 CLIMATE CHANGE SCENARIO

4.6 RAW MATERIALS PRODUCTION COVERAGE

4.7 SUPPLY CHAIN ANALYSIS

4.7.1 OVERVIEW

4.7.2 LOGISTIC COST SCENARIO

4.7.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.8 PRODUCTION AND CONSUMPTION ANALYSIS

4.9 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.1 VENDOR SELECTION CRITERIA

4.11 REGULATORY FRAMEWORK

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING DEMAND FOR INNOVATIVE AEROSPACE COMPONENTS

5.1.2 GAINING POPULARITY OF HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) IN THE AUTOMOTIVE INDUSTRY

5.1.3 USE OF HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) IN SOLID ROCKET PROPELLANT

5.1.4 POSITIVE OUTLOOK TOWARD CONSUMER ELECTRONIC GOODS

5.1.5 GROWING USE OF HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) IN ADHESIVES USED FOR CONSTRUCTION

5.1.6 INCREASING INVESTMENT IN THE SPACE TECHNOLOGIES AROUND THE WORLD

5.2 RESTRAINTS

5.2.1 HIGH STRAIN RATE AND SHOCK PROPERTIES OF HYDROXYL-TERMINATED POLYBUTADIENE (HTPB)

5.2.2 HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) GRAIN CANNOT BE RESHAPED, REUSED, OR RECYCLED

5.3 OPPORTUNITIES

5.3.1 TECHNOLOGICAL PROGRESS IN PROPELLANTS USING HYDROXYL-TERMINATED POLYBUTADIENE

5.3.2 RISING GOVERNMENT INITIATIVES FOR EMERGING NATIONS

5.4 CHALLENGES

5.4.1 DIFFICULTIES IN HANDLING THE RESINS

5.4.2 PRESENCE OF SUBSTITUTE PRODUCTS

6 ASIA PACIFIC HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT

6.1 OVERVIEW

6.2 LOW MOLECULAR WEIGHT HYDROXYL TERMINATED POLYBUTADIENES

6.3 CONVENTIONAL HYDROXYL TERMINATED POLYBUTADIENES

7 ASIA PACIFIC HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 ROCKET FUEL

7.3 POLYURETHANE

7.3.1 ADHESIVES AND SEALANTS

7.3.2 MEMBRANES

7.3.3 SURFACE COATINGS

7.3.4 POTTING AND ENCAPSULATION

7.3.5 OTHERS

7.4 PAINT

7.5 RUBBER MATERIAL

7.6 OTHERS

8 ASIA PACIFIC HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY END USE

8.1 OVERVIEW

8.2 AEROSPACE & DEFENCE

8.2.1 LOW MOLECULAR WEIGHT HYDROXYL TERMINATED POLYBUTADIENES

8.2.2 CONVENTIONAL HYDROXYL TERMINATED POLYBUTADIENES

8.3 AUTOMOTIVE

8.3.1 LOW MOLECULAR WEIGHT HYDROXYL TERMINATED POLYBUTADIENES

8.3.2 CONVENTIONAL HYDROXYL TERMINATED POLYBUTADIENES

8.4 BUILDING AND CONSTRUCTION

8.4.1 LOW MOLECULAR WEIGHT HYDROXYL TERMINATED POLYBUTADIENES

8.4.2 CONVENTIONAL HYDROXYL TERMINATED POLYBUTADIENES

8.5 ELECTRICAL & ELECTRONICS

8.5.1 LOW MOLECULAR WEIGHT HYDROXYL TERMINATED POLYBUTADIENES

8.5.2 CONVENTIONAL HYDROXYL TERMINATED POLYBUTADIENES

8.6 PACKAGING

8.6.1 LOW MOLECULAR WEIGHT HYDROXYL TERMINATED POLYBUTADIENES

8.6.2 CONVENTIONAL HYDROXYL TERMINATED POLYBUTADIENES

8.7 OTHERS

8.7.1 LOW MOLECULAR WEIGHT HYDROXYL TERMINATED POLYBUTADIENES

8.7.2 CONVENTIONAL HYDROXYL TERMINATED POLYBUTADIENES

9 ASIA PACIFIC HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY GEOGRAPHY

9.1 ASIA-PACIFIC

9.1.1 CHINA

9.1.2 INDIA

9.1.3 JAPAN

9.1.4 AUSTRALIA & NEW ZEALAND

9.1.5 SOUTH KOREA

9.1.6 SINGAPORE

9.1.7 THAILAND

9.1.8 INDONESIA

9.1.9 MALAYSIA

9.1.10 PHILIPPINES

9.1.11 REST OF ASIA-PACIFIC

10 ASIA PACIFIC HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

10.2 MERGERS & ACQUISITIONS

10.3 EXPANSIONS

10.4 NEW PRODUCT DEVELOPMENT

11 SWOT ANALYSIS

12 COMPANY PROFILES

12.1 EVONIK INDUSTRIES AG

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 COMPANY SHARE ANALYSIS

12.1.4 PRODUCT PORTFOLIO

12.1.5 RECENT UPDATES

12.2 CRAY VALLEY (A SUBSIDIARY OF TOTALENERGIES)

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 COMPANY SHARE ANALYSIS

12.2.4 PRODUCT PORTFOLIO

12.2.5 RECENT UPDATES

12.3 IDEMITSU KOSAN CO., LTD.

12.3.1 COMPANY SNAPSHOT

12.3.2 REVENUE ANALYSIS

12.3.3 COMPANY SHARE ANALYSIS

12.3.4 PRODUCT PORTFOLIO

12.3.5 RECENT UPDATES

12.4 NIPPON SODA CO., LTD.

12.4.1 COMPANY SNAPSHOT

12.4.2 REVENUE ANALYSIS

12.4.3 COMPANY SHARE ANALYSIS

12.4.4 PRODUCT PORTFOLIO

12.4.5 RECENT UPDATE

12.5 CRS CHEMICALS

12.5.1 COMPANY SNAPSHOT

12.5.2 PRODUCT PORTFOLIO

12.5.3 RECENT UPDATE

12.6 ISLAND PYROCHEMICAL INDUSTRIES (IPI)

12.6.1 COMPANY SNAPSHOT

12.6.2 PRODUCT PORTFOLIO

12.6.3 RECENT UPDATE

12.7 MONOMER-POLYMER & DAJAC LABS (A SUBSIDIARY OF ENTEGRIS)

12.7.1 COMPANY SNAPSHOT

12.7.2 REVENUE ANALYSIS

12.7.3 PRODUCT PORTFOLIO

12.7.4 RECENT UPDATE

12.8 POLYMER SOURCE. INC.

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 RECENT UPDATE

13 QUESTIONNAIRES

14 RELATED REPORTS

Liste des tableaux

TABLE 1 EXPORT DATA OF POLYMERS OF PROPYLENE OR OF OTHER OLEFINS, IN PRIMARY FORMS (EXCLUDING POLYPROPYLENE, POLYISOBUTYLENE AND PROPYLENE COPOLYMERS) , HS CODE - 390290 (USD THOUSAND)

TABLE 2 IMPORT DATA OF POLYMERS OF PROPYLENE OR OF OTHER OLEFINS, IN PRIMARY FORMS (EXCLUDING POLYPROPYLENE, POLYISOBUTYLENE AND PROPYLENE COPOLYMERS) , HS CODE - 390290 (USD THOUSAND)

TABLE 3 BUYERS’ LIST ASIA PACIFICLY (POTENTIAL BUYERS/CURRENT BUYERS)

TABLE 4 ASIA PACIFIC HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 5 ASIA PACIFIC HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (KILO TONS)

TABLE 6 ASIA PACIFIC LOW MOLECULAR WEIGHT HYDROXYL TERMINATED POLYBUTADIENES IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 7 ASIA PACIFIC LOW MOLECULAR WEIGHT HYDROXYL TERMINATED POLYBUTADIENES IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 8 ASIA PACIFIC CONVENTIONAL HYDROXYL TERMINATED POLYBUTADIENES IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 9 ASIA PACIFIC CONVENTIONAL HYDROXYL TERMINATED POLYBUTADIENES IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 10 ASIA PACIFIC HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 11 ASIA PACIFIC ROCKET FUEL IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 12 ASIA PACIFIC POLYURETHANE IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 13 ASIA PACIFIC POLYURETHANE IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 14 ASIA PACIFIC PAINT IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 15 ASIA PACIFIC RUBBER MATERIAL IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 16 ASIA PACIFIC OTHERS IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 17 ASIA PACIFIC HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY END USE, 2020-2029 (USD THOUSAND)

TABLE 18 ASIA PACIFIC AEROSPACE & DEFENCE IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 19 ASIA PACIFIC AEROSPACE & DEFENCE IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 20 ASIA PACIFIC AUTOMOTIVE IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 21 ASIA PACIFIC AUTOMOTIVE IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 22 ASIA PACIFIC BUILDING AND CONSTRUCTION IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 23 ASIA PACIFIC BUILDING AND CONSTRUCTION IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 24 ASIA PACIFIC ELECTRICAL & ELECTRONICS IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 25 ASIA PACIFIC ELECTRICAL & ELECTRONICS IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 26 ASIA PACIFIC PACKAGING IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 27 ASIA PACIFIC PACKAGING IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 28 ASIA PACIFIC OTHERS IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 29 ASIA PACIFIC OTHERS IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 30 ASIA-PACIFIC HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 31 ASIA-PACIFIC HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY COUNTRY, 2020-2029 (KILO TONS)

TABLE 32 ASIA-PACIFIC HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 33 ASIA-PACIFIC HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (KILO TONS)

TABLE 34 ASIA-PACIFIC HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 35 ASIA-PACIFIC POLYURETHANE IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 36 ASIA-PACIFIC HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY END USE, 2020-2029 (USD THOUSAND)

TABLE 37 ASIA-PACIFIC AEROSPACE & DEFENCE IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 38 ASIA-PACIFIC AUTOMOTIVE IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 39 ASIA-PACIFIC BUILDING AND CONSTRUCTION IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 40 ASIA-PACIFIC ELECTRICAL & ELECTRONICS IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 41 ASIA-PACIFIC PACKAGING IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 42 ASIA-PACIFIC OTHERS IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 43 CHINA HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 44 CHINA HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (KILO TONS)

TABLE 45 CHINA HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 46 CHINA POLYURETHANE IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 47 CHINA HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY END USE, 2020-2029 (USD THOUSAND)

TABLE 48 CHINA AEROSPACE & DEFENCE IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 49 CHINA AUTOMOTIVE IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 50 CHINA BUILDING AND CONSTRUCTION IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 51 CHINA ELECTRICAL & ELECTRONICS IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 52 CHINA PACKAGING IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 53 CHINA OTHERS IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 54 INDIA HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 55 INDIA HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (KILO TONS)

TABLE 56 INDIA HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 57 INDIA POLYURETHANE IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 58 INDIA HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY END USE, 2020-2029 (USD THOUSAND)

TABLE 59 INDIA AEROSPACE & DEFENCE IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 60 INDIA AUTOMOTIVE IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 61 INDIA BUILDING AND CONSTRUCTION IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 62 INDIA ELECTRICAL & ELECTRONICS IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 63 INDIA PACKAGING IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 64 INDIA OTHERS IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 65 JAPAN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 66 JAPAN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (KILO TONS)

TABLE 67 JAPAN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 68 JAPAN POLYURETHANE IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 69 JAPAN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY END USE, 2020-2029 (USD THOUSAND)

TABLE 70 JAPAN AEROSPACE & DEFENCE IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 71 JAPAN AUTOMOTIVE IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 72 JAPAN BUILDING AND CONSTRUCTION IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 73 JAPAN ELECTRICAL & ELECTRONICS IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 74 JAPAN PACKAGING IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 75 JAPAN OTHERS IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 76 AUSTRALIA & NEW ZEALAND HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 77 AUSTRALIA & NEW ZEALAND HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (KILO TONS)

TABLE 78 AUSTRALIA & NEW ZEALAND HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 79 AUSTRALIA & NEW ZEALAND POLYURETHANE IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 80 AUSTRALIA & NEW ZEALAND HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY END USE, 2020-2029 (USD THOUSAND)

TABLE 81 AUSTRALIA & NEW ZEALAND AEROSPACE & DEFENCE IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 82 AUSTRALIA & NEW ZEALAND AUTOMOTIVE IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 83 AUSTRALIA & NEW ZEALAND BUILDING AND CONSTRUCTION IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 84 AUSTRALIA & NEW ZEALAND ELECTRICAL & ELECTRONICS IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 85 AUSTRALIA & NEW ZEALAND PACKAGING IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 86 AUSTRALIA & NEW ZEALAND OTHERS IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 87 SOUTH KOREA HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 88 SOUTH KOREA HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (KILO TONS)

TABLE 89 SOUTH KOREA HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 90 SOUTH KOREA POLYURETHANE IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 91 SOUTH KOREA HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY END USE, 2020-2029 (USD THOUSAND)

TABLE 92 SOUTH KOREA AEROSPACE & DEFENCE IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 93 SOUTH KOREA AUTOMOTIVE IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 94 SOUTH KOREA BUILDING AND CONSTRUCTION IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 95 SOUTH KOREA ELECTRICAL & ELECTRONICS IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 96 SOUTH KOREA PACKAGING IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 97 SOUTH KOREA OTHERS IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 98 SINGAPORE HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 99 SINGAPORE HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (KILO TONS)

TABLE 100 SINGAPORE HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 101 SINGAPORE POLYURETHANE IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 102 SINGAPORE HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY END USE, 2020-2029 (USD THOUSAND)

TABLE 103 SINGAPORE AEROSPACE & DEFENCE IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 104 SINGAPORE AUTOMOTIVE IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 105 SINGAPORE BUILDING AND CONSTRUCTION IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 106 SINGAPORE ELECTRICAL & ELECTRONICS IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 107 SINGAPORE PACKAGING IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 108 SINGAPORE OTHERS IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 109 THAILAND HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 110 THAILAND HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (KILO TONS)

TABLE 111 THAILAND HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 112 THAILAND POLYURETHANE IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 113 THAILAND HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY END USE, 2020-2029 (USD THOUSAND)

TABLE 114 THAILAND AEROSPACE & DEFENCE IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 115 THAILAND AUTOMOTIVE IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 116 THAILAND BUILDING AND CONSTRUCTION IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 117 THAILAND ELECTRICAL & ELECTRONICS IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 118 THAILAND PACKAGING IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 119 THAILAND OTHERS IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 120 INDONESIA HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 121 INDONESIA HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (KILO TONS)

TABLE 122 INDONESIA HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 123 INDONESIA POLYURETHANE IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 124 INDONESIA HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY END USE, 2020-2029 (USD THOUSAND)

TABLE 125 INDONESIA AEROSPACE & DEFENCE IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 126 INDONESIA AUTOMOTIVE IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 127 INDONESIA BUILDING AND CONSTRUCTION IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 128 INDONESIA ELECTRICAL & ELECTRONICS IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 129 INDONESIA PACKAGING IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 130 INDONESIA OTHERS IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 131 MALAYSIA HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 132 MALAYSIA HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (KILO TONS)

TABLE 133 MALAYSIA HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 134 MALAYSIA POLYURETHANE IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 135 MALAYSIA HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY END USE, 2020-2029 (USD THOUSAND)

TABLE 136 MALAYSIA AEROSPACE & DEFENCE IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 137 MALAYSIA AUTOMOTIVE IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 138 MALAYSIA BUILDING AND CONSTRUCTION IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 139 MALAYSIA ELECTRICAL & ELECTRONICS IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 140 MALAYSIA PACKAGING IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 141 MALAYSIA OTHERS IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 142 PHILIPPINES HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 143 PHILIPPINES HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (KILO TONS)

TABLE 144 PHILIPPINES HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 145 PHILIPPINES POLYURETHANE IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 146 PHILIPPINES HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY END USE, 2020-2029 (USD THOUSAND)

TABLE 147 PHILIPPINES AEROSPACE & DEFENCE IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 148 PHILIPPINES AUTOMOTIVE IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 149 PHILIPPINES BUILDING AND CONSTRUCTION IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 150 PHILIPPINES ELECTRICAL & ELECTRONICS IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 151 PHILIPPINES PACKAGING IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 152 PHILIPPINES OTHERS IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 153 REST OF ASIA-PACIFIC HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 154 REST OF ASIA-PACIFIC HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2020-2029 (KILO TONS)

Liste des figures

FIGURE 1 ASIA PACIFIC HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET: THE PRODUCT LIFE LINE CURVE

FIGURE 7 ASIA PACIFIC HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET: MULTIVARIATE MODELLING

FIGURE 8 ASIA PACIFIC HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 ASIA PACIFIC HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET: DBMR MARKET POSITION GRID

FIGURE 10 ASIA PACIFIC HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET: MARKET END USE COVERAGE GRID

FIGURE 11 ASIA PACIFIC HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 ASIA PACIFIC HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 ASIA PACIFIC HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET: SEGMENTATION

FIGURE 14 ASIA-PACIFIC IS EXPECTED TO DOMINATE THE ASIA PACIFIC HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKETAND AND IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 15 GAINING POPULARITY OF HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) IN THE AUTOMOTIVE INDUSTRY IS EXPECTED TO DRIVE THE ASIA PACIFIC HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 16 ACRYLIC SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET IN 2022 & 2029

FIGURE 17 ASIA PACIFIC HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET: PESTEL ANALYSIS

FIGURE 18 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 19 ASIA PACIFIC HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET - SUPPLY CHAIN ANALYSIS

FIGURE 20 ASIA PACIFIC HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET: PRODUCTION AND CONSUMPTION ANALYSIS, 2020-2022 (USD THOUSAND)

FIGURE 21 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA PACIFIC HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET

FIGURE 22 ASIA PACIFIC CONSTRUCTION PERSPECTIVES IN PERCENTAGE, BY COUNTRY, IN 2017

FIGURE 23 ACTIVE SATELLITES CURRENTLY ORBITING THE EARTH, BY COUNTRY, TILL 2018

FIGURE 24 ASIA PACIFIC HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2021

FIGURE 25 ASIA PACIFIC HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY APPLICATION, 2021

FIGURE 26 ASIA PACIFIC HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY END USE, 2021

FIGURE 27 ASIA-PACIFIC HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET: SNAPSHOT (2021)

FIGURE 28 ASIA-PACIFIC HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET: BY COUNTRY (2021)

FIGURE 29 ASIA-PACIFIC HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 30 ASIA-PACIFIC HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET: BY COUNTRY (2021 & 2029)

FIGURE 31 ASIA-PACIFIC HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET: BY PRODUCT (2022 & 2029)

FIGURE 32 ASIA PACIFIC HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.