Marché du glyphosate en Asie-Pacifique, par type (sels de glyphosate et acides de glyphosate), forme (sec et liquide), fonction (solution de gestion des mauvaises herbes, amélioration de la santé du sol, amélioration de l'efficacité de la plantation et autres), couleur (blanc et incolore), durée de conservation (moins de 1 an, 1 an, 2 ans, 3 ans et plus de 3 ans), application aux cultures (oléagineux, légumineuses, céréales et grains, fruits, légumes, horticulture et tours et ornements), canal de distribution (direct et indirect), tendances de l'industrie et prévisions jusqu'en 2029.

Analyse et perspectives du marché du glyphosate en Asie-Pacifique

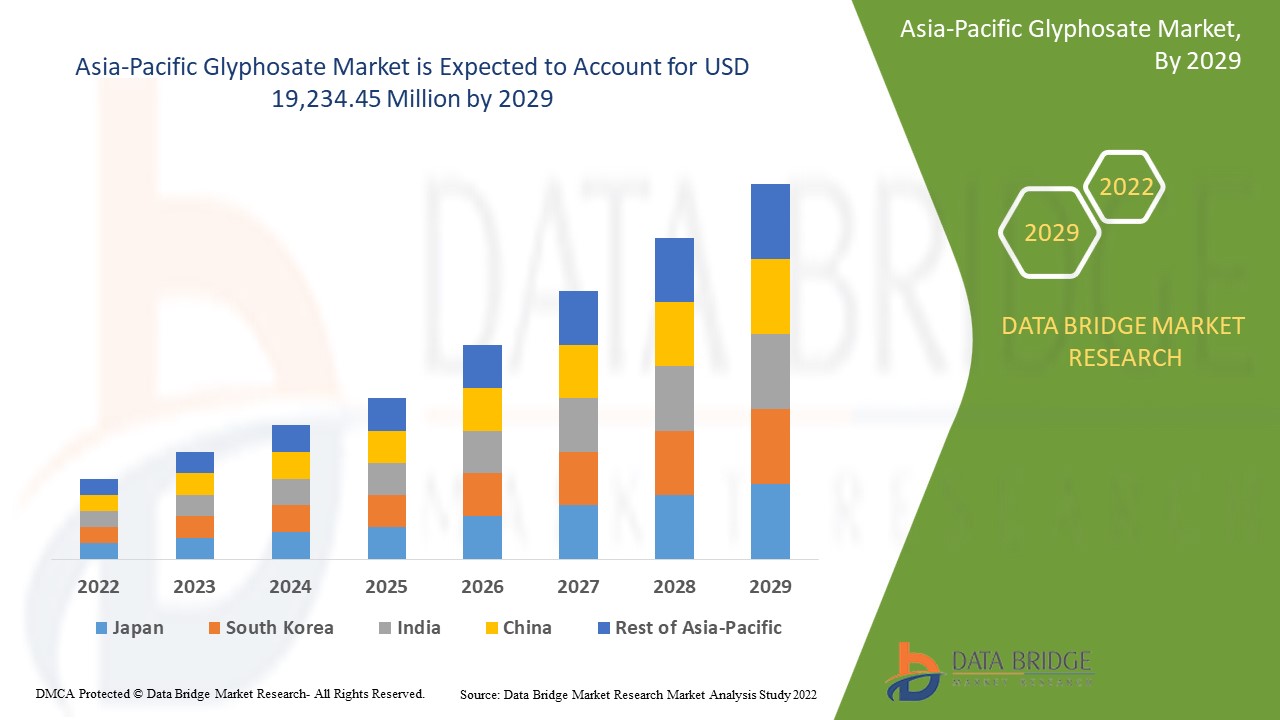

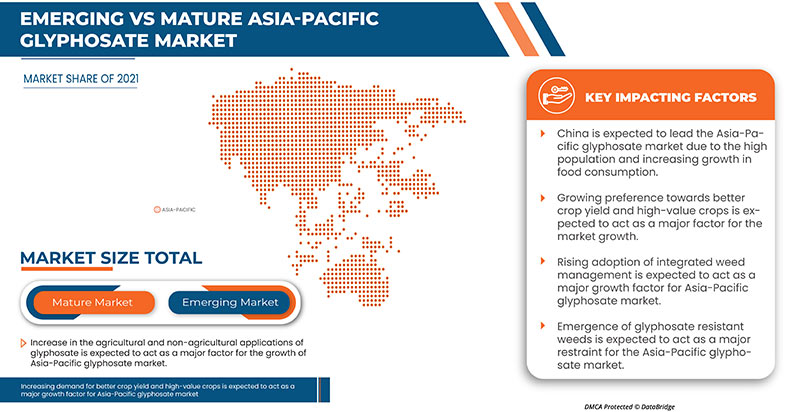

Le marché du glyphosate en Asie-Pacifique devrait connaître une croissance significative au cours de la période de prévision de 2022 à 2029. Data Bridge Market Research analyse que le marché croît avec un TCAC de 6,1 % au cours de la période de prévision de 2022 à 2029 et devrait atteindre 19 234,45 millions USD d'ici 2029. Le principal facteur à l'origine de la croissance du marché du glyphosate est l'essor du secteur agricole, l'adoption croissante de la gestion intégrée des mauvaises herbes, la commercialisation croissante de cultures à haute valeur ajoutée et l'augmentation des applications agricoles et non agricoles du glyphosate.

L'augmentation des applications agricoles et non agricoles du glyphosate à travers le monde est l'un des principaux facteurs de croissance du marché du glyphosate. L'utilisation du glyphosate pour tuer les mauvaises herbes telles que la morgeline, le pied-de-coq, le pissenlit et d'autres mauvaises herbes et l'augmentation du remplacement du désherbage mécanique dans de nombreuses cultures accélèrent la croissance du marché. L'augmentation de l'approbation de la technologie de tolérance aux herbicides pour les cultures à croissance inorganique avec une adoption rapide par les agriculteurs et les avantages du produit par rapport aux systèmes de travail du sol mécanique, tels que le faible coût, moins de sol et la dégradation de l'environnement, influencent le marché. En outre, une augmentation de la demande de cultures de qualité améliorée et l'expansion du secteur agricole ont un effet positif sur le marché du glyphosate.

Le rapport sur le marché du glyphosate en Asie-Pacifique fournit des détails sur la part de marché, les nouveaux développements et l'impact des acteurs du marché national et local, analyse les opportunités en termes de poches de revenus émergentes, de changements dans la réglementation du marché, d'approbations de produits, de décisions stratégiques, de lancements de produits, d'expansions géographiques et d'innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché, contactez-nous pour un briefing d'analyste. Notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable de 2019 à 2014) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD |

|

Segments couverts |

Par type (sels de glyphosate et acides de glyphosate), forme (sèche et liquide), fonction (solution de gestion des mauvaises herbes, amélioration de la santé du sol, amélioration de l'efficacité de la plantation et autres), couleur (blanc et incolore), durée de conservation (moins de 1 an, 1 an, 2 ans, 3 ans et plus de 3 ans), application aux cultures ( graines oléagineuses , légumineuses, céréales et grains, fruits, légumes, horticulture et plantes ornementales), canal de distribution (direct et indirect), |

|

Pays couverts |

Japon, Chine, Corée du Sud, Inde, Singapour, Thaïlande, Indonésie, Malaisie, Philippines, Australie, reste de l'Asie-Pacifique. |

|

Acteurs du marché couverts |

SinoHarvest, Syngenta, AgroStar, Novus Biologicals, Bayer AG, Nufarm, UPL, ADAMA, OCI COMPANY Ltd., Excel Crop Care Ltd., Merck KGaA, BASF SE |

Définition du marché

Le glyphosate est l'un des herbicides les plus couramment utilisés et est classé comme un herbicide systémique de post-levée, non sélectif, capable de tuer les mauvaises herbes à feuillage vert. Ces pesticides sont utilisés pour prévenir et contrôler la croissance des champignons et des maladies à spores. C'est un herbicide appliqué sur les feuilles des plantes pour tuer à la fois les plantes à feuilles larges et les graminées. Il est utilisé dans l'agriculture et la foresterie, les pelouses et les jardins, et pour les mauvaises herbes dans les zones industrielles. Il est également utilisé pour contrôler la croissance des plantes aquatiques. 2 types de glyphosate sont les sels de glyphosate et les acides de glyphosate. C'est une solution de gestion des mauvaises herbes pour améliorer la santé des sols, l'efficacité de la plantation et autres.

Dynamique du marché du glyphosate en Asie-Pacifique

Conducteurs

- Hausse du secteur agricole

L'agriculture joue un rôle majeur dans la croissance économique et le développement des pays. Elle contribue au développement en garantissant la sécurité alimentaire et en améliorant la nutrition. La transformation économique signifie qu'un pays modifie la contribution relative de sa technologie et de ses secteurs à son produit intérieur brut (PIB) global, où le secteur agricole joue un rôle crucial. Elle stimule la productivité du travail, accroît les excédents agricoles pour accumuler du capital et augmente les devises étrangères via les exportations.

- Adoption croissante de la gestion intégrée des mauvaises herbes

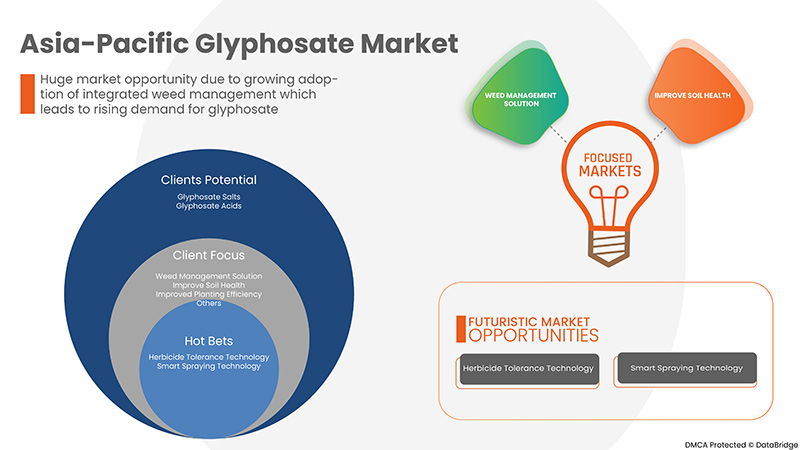

L'adoption croissante de systèmes et de solutions efficaces et intégrés de lutte contre les mauvaises herbes est le principal facteur qui devrait accélérer la croissance du marché du glyphosate en Asie-Pacifique au cours de la période de prévision. Le glyphosate gagne en popularité pour la gestion des mauvaises herbes dans divers plans d'eau et terres afin de contrôler la croissance inutile des mauvaises herbes indésirables. Le glyphosate est largement utilisé dans les eaux agricoles, les canaux, les eaux d'irrigation, les fermes, les pépinières, etc.

- Commercialisation croissante de cultures à haute valeur ajoutée

Les cultures à forte valeur ajoutée sont des cultures de base telles que les légumes, les fruits, les fleurs, les plantes ornementales, les condiments et les épices. Elles offrent à l’agriculteur un rendement net par hectare plus élevé que les cultures de base ou d’autres cultures largement cultivées. L’introduction de pratiques et de solutions innovantes dans les exploitations agricoles contribue à la commercialisation des cultures à forte valeur ajoutée. Ces systèmes et technologies aideront les agriculteurs à bénéficier de la transformation agricole en cours. La production agricole en Asie s’oriente vers des cultures à forte valeur ajoutée telles que les légumes et les fruits, soutenues par de nouvelles pratiques et technologies. L’agriculture contractuelle a le potentiel de bénéficier à la fois aux agriculteurs et aux entrepreneurs en permettant la spécialisation des produits, mais nécessite la capacité des agences gouvernementales locales à surveiller et à faire respecter les contrats. De même, les technologies numériques peuvent promouvoir un développement inclusif en aidant les agriculteurs des zones reculées à accéder aux informations techniques et commerciales, mais cela nécessitera un meilleur accès à la technologie mobile. Pour soutenir la transformation agricole en cours, la politique agricole devrait faciliter une plus grande orientation vers le marché par la recherche et le développement.

- Augmentation des applications agricoles et non agricoles du glyphosate

Le glyphosate est un herbicide largement utilisé et appliqué/pulvérisé en agriculture et en foresterie, sur les pelouses et les jardins, et contre les mauvaises herbes dans les zones industrielles. Il tue les mauvaises herbes, en particulier les mauvaises herbes annuelles à feuilles larges et les graminées qui concurrencent les cultures. La forme de sel de sodium du glyphosate régule la croissance des plantes et fait mûrir certaines cultures. Il empêche les plantes de fabriquer certaines protéines pour arrêter la croissance des plantes. Cet herbicide non sélectif se déplace du feuillage traité vers d'autres parties de la plante, y compris les racines. De cette façon, le glyphosate tue les mauvaises herbes annuelles et vivaces. Il est utilisé dans diverses applications de cultures telles que les graines oléagineuses, les légumineuses, les céréales et les grains, les fruits, les légumes et l'horticulture.

Opportunité

- Hausse de l'approbation des technologies de tolérance aux herbicides

Les glyphosates sont des pesticides qui protègent et contrôlent les maladies fongiques et les maladies à spores. Les glyphosates peuvent contrôler des maladies fongiques spécifiques ainsi que celles provenant de sources multiples. Les hybrides de cultures tolérantes aux herbicides sont génétiquement modifiés pour résister aux herbicides non sélectifs, tels que le glyphosate. Afin de développer une tolérance au glyphosate, de nombreux efforts de recherche et développement se concentrent sur l'évaluation du glyphosate, l'herbicide le plus efficace qui peut contrôler toutes les plantes quelle que soit l'espèce. Plusieurs entreprises mènent continuellement des recherches approfondies et lancent de nouveaux produits sur le marché.

Contraintes/Défis

- Émergence de mauvaises herbes résistantes au glyphosate

La résistance au glyphosate est apparue pour la première fois chez Lolium rigidum dans un verger de pommiers en Australie en 1996, et la même année, la première culture résistante au glyphosate (le soja) a été introduite aux États-Unis. Plus de trente espèces de mauvaises herbes ont désormais développé une résistance au glyphosate, qui sont réparties dans 37 pays et dans 34 cultures différentes et six situations non cultivées. De plus, des mauvaises herbes résistantes au glyphosate ont été identifiées dans des vergers, des vignobles, des plantations, des céréales et des situations de jachère et de non-culture. Les mauvaises herbes résistantes au glyphosate représentent la plus grande menace pour la lutte durable contre les mauvaises herbes dans les principales cultures agronomiques, car cet herbicide est utilisé pour lutter contre les mauvaises herbes résistantes aux herbicides ayant d'autres sites d'action, et aucun nouveau site d'action d'herbicide n'a été introduit depuis très longtemps. Cependant, l'industrie réagit en développant des traits de résistance aux herbicides dans les principales cultures qui permettent d'utiliser les herbicides existants d'une nouvelle manière. Cependant, une dépendance excessive à ces caractéristiques entraîne une résistance multiple chez les mauvaises herbes.

- Réglementation gouvernementale stricte concernant le glyphosate

L’adoption de réglementations strictes, notamment dans la région Asie-Pacifique, devrait limiter l’expansion du marché du glyphosate dans cette région. Les organismes de réglementation des pays de la région Asie-Pacifique suivent des réglementations strictes sur la culture de cultures génétiquement modifiées. Leur adoption rapide a conduit à une utilisation intensive d’herbicides, provoquant ainsi l’évolution de mauvaises herbes résistantes au glyphosate. Par conséquent, l’un des facteurs limitant l’industrie est la législation rigoureuse régissant l’utilisation du glyphosate en raison de plusieurs préoccupations environnementales et sanitaires. Une surexposition au glyphosate peut entraîner le cancer et des problèmes de santé connexes.

- Impact nocif des glyphosates sur l’environnement et la population humaine

Les inquiétudes concernant les effets dangereux du glyphosate sur la population humaine et l'environnement devraient remettre en cause le marché du glyphosate. Plusieurs effets environnementaux du glyphosate ont été documentés et enregistrés dans les environnements terrestres et aquatiques et contre la santé humaine. Les fuites d'herbicides au glyphosate dans les plans d'eau affectent négativement les organismes aquatiques tels que les têtards et les poissons, qui sont tués. En plus de tuer les plantes dans les zones où le glyphosate est distribué, il tue également les plantes dans leur environnement. Que ce soit sur terre ou dans l'eau, la mort de ces organismes vivants peut avoir des effets néfastes. Ce type d'impact environnemental menace le marché et remet en cause sa croissance.

Développement récent

En septembre 2022, Merck KGaA a ouvert un laboratoire de clairance virale (VC) dans le cadre de la première phase de construction de son nouveau centre de tests biologiques en Chine, d'une valeur de 29 millions d'euros. Ce nouveau centre de 5 000 mètres carrés est le premier du genre pour Merck KGaA en Chine. Le laboratoire VC permet aux clients de mener des études de clairance virale localement, du développement préclinique à la commercialisation, et répondra à la demande à deux chiffres de services de tests VC en Chine. Cela aidera l'entreprise à améliorer ses opérations dans la région Asie-Pacifique.

Portée du marché du glyphosate en Asie-Pacifique

Le marché du glyphosate en Asie-Pacifique est classé en fonction du type, de la forme, de la fonction, de la couleur, de la durée de conservation, de l'application et du canal de distribution. La croissance de ces segments vous aidera à analyser les principaux segments de croissance des industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Taper

- Sels de glyphosate

- Acides de glyphosate

En fonction du type, le marché du glyphosate en Asie-Pacifique est classé en deux segments : les sels de glyphosate et les acides de glyphosate.

Formulaire

- Liquide

- Sec

Sur la base d'une forme, le marché du glyphosate en Asie-Pacifique est classé en deux segments : sec et liquide.

Fonction

- Solution de gestion des mauvaises herbes

- Améliorer la santé des sols

- Amélioration de l'efficacité de la plantation

- Autres

En fonction de la fonction, le marché du glyphosate en Asie-Pacifique est classé en quatre segments : solutions de gestion des mauvaises herbes, amélioration de la santé des sols, amélioration de l'efficacité de la plantation et autres.

Couleur

- Blanc

- Incolore

En fonction de la couleur, le marché du glyphosate en Asie-Pacifique est classé en trois segments : blanc et incolore.

Durée de conservation

- Plus de 3 ans

- 3 ans

- 2 ans

- 1 an

- Moins d'un an

Sur la base de la durée de conservation, le marché du glyphosate en Asie-Pacifique est classé en cinq segments : moins d’un an, 1 an, 2 ans, 3 ans et plus de 3 ans.

Application aux cultures

- Céréales et grains

- Graines oléagineuses

- Légumineuses

- Légumes

- Fruits

- Tour et ornements

- Horticulture

En fonction de l'application des cultures, le marché du glyphosate en Asie-Pacifique est classé en sept segments avec les graines oléagineuses, les légumineuses, les céréales et grains, les fruits, les légumes, l'horticulture et les plants et ornements.

Canal de distribution

- Direct

- Indirect

En fonction du canal de distribution, le marché du glyphosate en Asie-Pacifique est classé en deux segments : direct et indirect.

Analyse/perspectives régionales du marché du glyphosate en Asie-Pacifique

Le marché du glyphosate en Asie-Pacifique est segmenté en fonction du type, de la forme, de la fonction, de la couleur, de la durée de conservation, de l’application et du canal de distribution.

Les pays du marché du glyphosate en Asie-Pacifique sont le Japon, la Chine, la Corée du Sud, l'Inde, Singapour, la Thaïlande, l'Indonésie, la Malaisie, les Philippines, l'Australie et le reste de l'Asie-Pacifique. La Chine domine le marché du glyphosate en Asie-Pacifique en termes de part de marché et de chiffre d'affaires en raison de la forte présence des acteurs du marché dans la région.

La section par pays du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. L'analyse des points de données en aval et en amont de la chaîne de valeur, les tendances techniques, l'analyse des cinq forces du porteur et les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques européennes et les défis rencontrés en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché du glyphosate en Asie-Pacifique

Le paysage concurrentiel du marché du glyphosate en Asie-Pacifique fournit des détails par concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et l'étendue du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que les entreprises se concentrant sur le marché du glyphosate en Asie-Pacifique.

Certains des principaux acteurs opérant sur le marché du glyphosate en Asie-Pacifique sont SinoHarvest, Syngenta, AgroStar, Novus Biologicals, Bayer AG, Nufarm, UPL, ADAMA, OCI COMPANY Ltd., Excel Crop Care Ltd., Merck KGaA, BASF SE.

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des tailles d'échantillon importantes. Les données du marché sont analysées et estimées à l'aide de modèles statistiques et cohérents du marché. En outre, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. La principale méthodologie de recherche utilisée par l'équipe de recherche DBMR est la triangulation des données, qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). En dehors de cela, les modèles de données comprennent des grilles de positionnement des fournisseurs, une analyse de la chronologie du marché, un aperçu et un guide du marché, des grilles de positionnement des entreprises, une analyse des parts de marché des entreprises, des normes de mesure, une analyse des parts de marché Europe vs. Région et des fournisseurs. Veuillez demander un appel d'analyste en cas de demande de renseignements supplémentaires.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE ASIA-PACIFIC GLYPHOSATE MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 BRAND OUTLOOK

4.1.1 COMPARATIVE BRAND ANALYSIS

4.1.2 PRODUCT VS BRAND OVERVIEW

4.2 CONSUMER-LEVEL TRENDS

4.3 FACTORS INFLUENCING PURCHASING DECISION OF CUSTOMER

4.4 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.5 IMPORT EXPORT SCENERIO

4.6 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

4.7 MEETING CONSUMER REQUIREMENT

4.8 NEW PRODUCT LAUNCH STRATEGY

4.8.1 NUMBER OF PRODUCT LAUNCHES

4.8.1.1 LINE EXTENSION

4.8.1.2 NEW PACKAGING

4.8.1.3 RE-LAUNCHED

4.8.1.4 NEW FORMULATION

4.9 OVERVIEW OF TECHNOLOGICAL INNOVATIONS

4.1 CONSUMER DISPOSABLE INCOME DYNAMICS/SPEND DYNAMICS

4.10.1 OVERVIEW

4.10.2 SOCIAL FACTORS

4.10.3 CULTURAL FACTORS

4.10.4 PSYCHOLOGICAL FACTORS

4.10.5 PERSONAL FACTORS

4.10.6 ECONOMIC FACTORS

4.10.7 PRODUCT TRAITS

4.10.8 MARKET ATTRIBUTES

4.10.9 CONCLUSION

4.11 IMPACT OF ECONOMIC SLOWDOWN

4.12 PORTER’S FIVE FORCES:

4.12.1 THREAT OF NEW ENTRANTS:

4.12.2 THREAT OF SUBSTITUTES:

4.12.3 CUSTOMER BARGAINING POWER:

4.12.4 SUPPLIER BARGAINING POWER:

4.12.5 INTERNAL COMPETITION (RIVALRY):

4.13 PRICING INDEX

4.14 PROMOTIONAL ACTIVITIES

4.15 RAW MATERIAL SOURCING ANALYSIS

4.16 SHOPPING BEHAVIOUR AND DYNAMICS

4.17 SUPPLY CHAIN ANALYSIS

4.17.1 OVERVIEW

4.17.2 LOGISTIC COST SCENARIO

4.17.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.18 VALUE CHAIN ANALYSIS

5 PRODUCTION CAPACITY OF KEY MANUFACTURERS

6 REGULATORY FRAMEWORK AND GUIDELINES

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 RISE IN THE AGRICULTURAL SECTOR

7.1.2 RISING ADOPTION OF INTEGRATED WEED MANAGEMENT

7.1.3 GROWING COMMERCIALIZATION OF HIGH-VALUE CROPS

7.1.4 INCREASE IN THE AGRICULTURAL AND NON-AGRICULTURAL APPLICATIONS OF GLYPHOSATE

7.2 RESTRAINTS

7.2.1 EMERGENCE OF GLYPHOSATE-RESISTANT WEEDS

7.2.2 STRINGENT GOVERNMENT REGULATION REGARDING GLYPHOSATE

7.3 OPPORTUNITIES

7.3.1 RISE IN THE APPROVAL OF HERBICIDE-TOLERANCE TECHNOLOGY

7.4 CHALLENGES

7.4.1 HARMFUL IMPACT OF GLYPHOSATES ON THE ENVIRONMENT AND HUMAN POPULATION

8 ASIA-PACIFIC GLYPHOSATE MARKET, BY TYPE

8.1 OVERVIEW

8.2 GLYPHOSATE SALTS

8.2.1 ISOPROPYLAMINE SALT

8.2.2 MONOAMMONIUM SALT

8.2.3 POTASSIUM SALT

8.2.4 DIAMMONIUM SALT

8.2.5 OTHERS

8.3 GLYPHOSATE ACIDS

9 ASIA-PACIFIC GLYPHOSATE MARKET, BY FORM

9.1 OVERVIEW

9.2 LIQUID

9.3 DRY

9.3.1 GRANULAR

9.3.2 POWDER

9.3.3 OTHERS

10 ASIA-PACIFIC GLYPHOSATE MARKET, BY FUNCTION

10.1 OVERVIEW

10.2 WEED MANAGEMENT SOLUTION

10.3 IMPROVE SOIL HEALTH

10.4 IMPROVED PLANTING EFFICIENCY

10.5 OTHERS

11 ASIA-PACIFIC GLYPHOSATE MARKET, BY COLOR

11.1 OVERVIEW

11.2 WHITE

11.3 COLORLESS

12 ASIA-PACIFIC GLYPHOSATE MARKET, BY SHELF LIFE

12.1 OVERVIEW

12.2 MORE THAN 3 YEARS

12.3 3 YEARS

12.4 2 YEARS

12.5 1 YEAR

12.6 LESS THAN 1 YEAR

13 ASIA-PACIFIC GLYPHOSATE MARKET, BY CROP APPLICATION

13.1 OVERVIEW

13.2 CEREALS AND GRAINS

13.2.1 CEREALS AND GRAINS, BY TYPE

13.2.1.1 WHEAT

13.2.1.2 RICE

13.2.1.3 BARLEY

13.2.1.4 MILLET

13.2.1.5 OAT

13.2.1.6 SORGHUM

13.2.1.7 RYE

13.2.1.8 OTHERS

13.2.2 CEREALS AND GRAINS, BY GLYPHOSATE TYPE

13.2.2.1 GLYPHOSATE SALTS

13.2.2.2 GLYPHOSATE ACIDS

13.3 OIL SEEDS

13.3.1 OIL SEEDS, BY TYPE

13.3.1.1 SOYBEAN

13.3.1.2 COTTONSEED

13.3.1.3 SUNFLOWER

13.3.1.4 CORN

13.3.1.5 PEANUT

13.3.1.6 FLAXSEEDS

13.3.1.7 OTHERS

13.3.2 OIL SEEDS, BY GLYPHOSATE TYPE

13.3.2.1 GLYPHOSATE SALTS

13.3.2.2 GLYPHOSATE ACIDS

13.4 PULSES

13.4.1 PULSES, BY TYPE

13.4.1.1 CHICKPEAS

13.4.1.2 BLACK BEANS

13.4.1.3 PEAS

13.4.1.4 OTHERS

13.4.2 PULSES, BY GLYPHOSATE TYPE

13.4.2.1 GLYPHOSATE SALTS

13.4.2.2 GLYPHOSATE ACIDS

13.5 VEGETABLES

13.5.1 VEGETABLES, BY TYPE

13.5.1.1 LEAFY GREENS

13.5.1.2 CRUCIFEROUS VEGETABLES

13.5.1.3 MARROW VEGETABLES

13.5.1.4 ROOT VEGETABLES

13.5.1.5 ONION

13.5.1.6 GARLIC

13.5.1.7 OTHERS

13.5.2 VEGETABLES, BY GLYPHOSATE TYPE

13.5.2.1 GLYPHOSATE SALTS

13.5.2.2 GLYPHOSATE ACIDS

13.6 FRUITS

13.6.1 FRUITS, BY TYPE

13.6.1.1 APPLE & PEARS

13.6.1.2 CITRUS FRUITS

13.6.1.3 TROPICAL FRUITS

13.6.1.4 BERRIES

13.6.1.5 MELONS

13.6.1.6 OTHERS

13.6.2 FRUITS, BY GLYPHOSATE TYPE

13.6.2.1 GLYPHOSATE SALTS

13.6.2.2 GLYPHOSATE ACIDS

13.7 TURN AND ORNAMENTS

13.7.1 TURN AND ORNAMENTS, BY GLYPHOSATE TYPE

13.7.1.1 GLYPHOSATE SALTS

13.7.1.2 GLYPHOSATE ACIDS

13.8 HORTICULTURE

13.8.1 HORTICULTURE, BY GLYPHOSATE TYPE

13.8.1.1 GLYPHOSATE SALTS

13.8.1.2 GLYPHOSATE ACIDS

14 ASIA-PACIFIC GLYPHOSATE MARKET, BY DISTRIBUTION CHANNEL

14.1 OVERVIEW

14.2 DIRECT

14.3 INDIRECT

15 ASIA-PACIFIC GLYPHOSATE MARKET, BY COUNTRY

15.1 CHINA

15.2 INDIA

15.3 AUSTRALIA

15.4 JAPAN

15.5 SOUTH KOREA

15.6 INDONESIA

15.7 THAILAND

15.8 SINGAPORE

15.9 MALAYSIA

15.1 PHILIPPINES

15.11 REST OF ASIA-PACIFIC

16 ASIA-PACIFIC GLYPHOSATE MARKET, COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

16.1.1 COLLABORATION

16.1.2 FACILITY EXPANSIONS

16.1.3 EVENT

16.1.4 ACQUISITION

17 SWOT ANALYSIS

18 COMPANY PROFILES

18.1 BAYER AG

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 PRODUCT PORTFOLIO

18.1.4 RECENT UPDATES

18.2 BASF SE

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 PRODUCT PORTFOLIO

18.2.4 RECENT UPDATES

18.3 MERCK KGAA

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 PRODUCT PORTFOLIO

18.3.4 RECENT UPDATES

18.4 SYNGENTA

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 PRODUCT PORTFOLIO

18.4.4 RECENT UPDATES

18.5 OCI COMPANY LTD.

18.5.1 COMPANY SNAPSHOT

18.5.2 REVENUE ANALYSIS

18.5.3 PRODUCT PORTFOLIO

18.5.4 RECENT UPDATES

18.6 ADAMA

18.6.1 COMPANY SNAPSHOT

18.6.2 REVENUE ANALYSIS

18.6.3 PRODUCT PORTFOLIO

18.6.4 RECENT UPDATES

18.7 AGROSTAR

18.7.1 COMPANY SNAPSHOT

18.7.2 PRODUCT PORTFOLIO

18.7.3 RECENT UPDATES

18.8 EXCEL CROP CARE LTD.

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 RECENT DEVELOPMENTS

18.9 NOVUS BIOLOGICALS

18.9.1 COMPANY SNAPSHOT

18.9.2 PRODUCT PORTFOLIO

18.9.3 RECENT DEVELOPMENTS

18.1 NUFARM

18.10.1 COMPANY SNAPSHOT

18.10.2 REVENUE ANALYSIS

18.10.3 PRODUCT PORTFOLIO

18.10.4 RECENT UPDATES

18.11 SINOHARVEST

18.11.1 COMPANY SNAPSHOT

18.11.2 PRODUCT PORTFOLIO

18.11.3 RECENT UPDATES

18.12 UPL

18.12.1 COMPANY SNAPSHOT

18.12.2 REVENUE ANALYSIS

18.12.3 PRODUCT PORTFOLIO

18.12.4 RECENT UPDATES

19 QUESTIONNAIRE

20 RELATED REPORTS

Liste des tableaux

TABLE 1 IMPORT DATA OF HERBICIDES, ANTI-SPROUTING PRODUCTS, AND PLANT-GROWTH REGULATORS, PUT UP IN FORMS OR PACKINGS FOR RETAIL SALE OR AS PREPARATIONS OR ARTICLES (EXCL. GOODS OF SUBHEADING 3808.59); HS CODE - 380893 (USD THOUSAND)

TABLE 2 EXPORT DATA OF HERBICIDES, ANTI-SPROUTING PRODUCTS, AND PLANT-GROWTH REGULATORS, PUT UP IN FORMS OR PACKINGS FOR RETAIL SALE OR AS PREPARATIONS OR ARTICLES (EXCL. GOODS OF SUBHEADING 3808.59); HS CODE - 380893 (USD THOUSAND)

TABLE 3 REGULATORY FRAMEWORK

TABLE 4 ASIA-PACIFIC GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 5 ASIA-PACIFIC GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 6 ASIA-PACIFIC GLYPHOSATE SALTS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 7 ASIA-PACIFIC GLYPHOSATE SALTS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 8 ASIA-PACIFIC GLYPHOSATE MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 9 ASIA-PACIFIC GLYPHOSATE MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 10 ASIA-PACIFIC DRY IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 11 ASIA-PACIFIC DRY IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 12 ASIA-PACIFIC GLYPHOSATE MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 13 ASIA-PACIFIC GLYPHOSATE MARKET, BY FUNCTION, 2020-2029 (KILO TONS)

TABLE 14 ASIA-PACIFIC GLYPHOSATE MARKET, BY COLOR, 2020-2029 (USD MILLION)

TABLE 15 ASIA-PACIFIC GLYPHOSATE MARKET, BY COLOR, 2020-2029 (KILO TONS)

TABLE 16 ASIA-PACIFIC GLYPHOSATE MARKET, BY SHELF LIFE, 2020-2029 (USD MILLION)

TABLE 17 ASIA-PACIFIC GLYPHOSATE MARKET, BY SHELF LIFE, 2020-2029 (KILO TONS)

TABLE 18 ASIA-PACIFIC GLYPHOSATE MARKET, BY CROP APPLICATION, 2020-2029 (USD MILLION)

TABLE 19 ASIA-PACIFIC GLYPHOSATE MARKET, BY CROP APPLICATION, 2020-2029 (KILO TONS)

TABLE 20 ASIA-PACIFIC CEREAL AND GRAINS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 21 ASIA-PACIFIC CEREALS AND GRAINS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 22 ASIA-PACIFIC CEREALS AND GRAINS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 23 ASIA-PACIFIC CEREALS AND GRAINS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 24 ASIA-PACIFIC OIL SEEDS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 25 ASIA-PACIFIC OIL SEEDS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 26 ASIA-PACIFIC OIL SEEDS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 27 ASIA-PACIFIC OIL SEEDS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 28 ASIA-PACIFIC PULSES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 29 ASIA-PACIFIC PULSES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 30 ASIA-PACIFIC PULSES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 31 ASIA-PACIFIC PULSES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 32 ASIA-PACIFIC VEGETABLE IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 33 ASIA-PACIFIC VEGETABLE IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 34 ASIA-PACIFIC VEGETABLE IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 35 ASIA-PACIFIC VEGETABLE GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 36 ASIA-PACIFIC FRUITS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 37 ASIA-PACIFIC FRUITS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 38 ASIA-PACIFIC FRUITS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 39 ASIA-PACIFIC FRUITS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 40 ASIA-PACIFIC TURN AND ORNAMENTS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 41 ASIA-PACIFIC TURN AND ORNAMENTS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 42 ASIA-PACIFIC HORTICULTURE IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 43 ASIA-PACIFIC HORTICULTURE IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 44 ASIA-PACIFIC GLYPHOSATE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 45 ASIA-PACIFIC GLYPHOSATE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (KILO TONS)

TABLE 46 ASIA-PACIFIC GLYPHOSATE MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 47 ASIA-PACIFIC GLYPHOSATE MARKET, BY COUNTRY, 2020-2029 (KILO TONS)

TABLE 48 CHINA GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 CHINA GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 50 CHINA GLYPHOSATE SALTS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 51 CHINA GLYPHOSATE SALTS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 52 CHINA GLYPHOSATE MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 53 CHINA GLYPHOSATE MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 54 CHINA DRY IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 55 CHINA DRY IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 56 CHINA GLYPHOSATE MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 57 CHINA GLYPHOSATE MARKET, BY FUNCTION, 2020-2029 (KILO TONS)

TABLE 58 CHINA GLYPHOSATE MARKET, BY COLOR, 2020-2029 (USD MILLION)

TABLE 59 CHINA GLYPHOSATE MARKET, BY COLOR, 2020-2029 (KILO TONS)

TABLE 60 CHINA GLYPHOSATE MARKET, BY SHELF LIFE, 2020-2029 (USD MILLION)

TABLE 61 CHINA GLYPHOSATE MARKET, BY SHELF LIFE, 2020-2029 (KILO TONS)

TABLE 62 CHINA GLYPHOSATE MARKET, BY CROP APPLICATION, 2020-2029 (USD MILLION)

TABLE 63 CHINA GLYPHOSATE MARKET, BY CROP APPLICATION, 2020-2029 (KILO TONS)

TABLE 64 CHINA OIL SEEDS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 65 CHINA OIL SEEDS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 66 CHINA OIL SEEDS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 67 CHINA OIL SEEDS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 68 CHINA PULSES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 CHINA PULSES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 70 CHINA PULSES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 71 CHINA PULSES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 72 CHINA CEREALS & GRAINS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 73 CHINA CEREALS & GRAINS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 74 CHINA CEREALS & GRAINS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 75 CHINA CEREALS & GRAINS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 76 CHINA FRUITS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 77 CHINA FRUITS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 78 CHINA FRUITS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 79 CHINA FRUITS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 80 CHINA VEGETABLES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 81 CHINA VEGETABLES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 82 CHINA VEGETABLES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 83 CHINA VEGETABLES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 84 CHINA HORTICULTURE IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 85 CHINA HORTICULTURE IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 86 CHINA TURN & ORNAMENTS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 87 CHINA TURN & ORNAMENTS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 88 CHINA GLYPHOSATE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 89 CHINA GLYPHOSATE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (KILO TONS)

TABLE 90 INDIA GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 91 INDIA GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 92 INDIA GLYPHOSATE SALTS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 93 INDIA GLYPHOSATE SALTS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 94 INDIA GLYPHOSATE MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 95 INDIA GLYPHOSATE MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 96 INDIA DRY IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 97 INDIA DRY IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 98 INDIA GLYPHOSATE MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 99 INDIA GLYPHOSATE MARKET, BY FUNCTION, 2020-2029 (KILO TONS)

TABLE 100 INDIA GLYPHOSATE MARKET, BY COLOR, 2020-2029 (USD MILLION)

TABLE 101 INDIA GLYPHOSATE MARKET, BY COLOR, 2020-2029 (KILO TONS)

TABLE 102 INDIA GLYPHOSATE MARKET, BY SHELF LIFE, 2020-2029 (USD MILLION)

TABLE 103 INDIA GLYPHOSATE MARKET, BY SHELF LIFE, 2020-2029 (KILO TONS)

TABLE 104 INDIA GLYPHOSATE MARKET, BY CROP APPLICATION, 2020-2029 (USD MILLION)

TABLE 105 INDIA GLYPHOSATE MARKET, BY CROP APPLICATION, 2020-2029 (KILO TONS)

TABLE 106 INDIA OIL SEEDS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 107 INDIA OIL SEEDS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 108 INDIA OIL SEEDS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 109 INDIA OIL SEEDS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 110 INDIA PULSES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 111 INDIA PULSES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 112 INDIA PULSES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 113 INDIA PULSES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 114 INDIA CEREALS & GRAINS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 115 INDIA CEREALS & GRAINS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 116 INDIA CEREALS & GRAINS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 117 INDIA CEREALS & GRAINS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 118 INDIA FRUITS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 119 INDIA FRUITS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 120 INDIA FRUITS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 121 INDIA FRUITS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 122 INDIA VEGETABLES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 123 INDIA VEGETABLES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 124 INDIA VEGETABLES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 125 INDIA VEGETABLES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 126 INDIA HORTICULTURE IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 127 INDIA HORTICULTURE IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 128 INDIA TURN & ORNAMENTS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 129 INDIA TURN & ORNAMENTS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 130 INDIA GLYPHOSATE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 131 INDIA GLYPHOSATE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (KILO TONS)

TABLE 132 AUSTRALIA GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 133 AUSTRALIA GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 134 AUSTRALIA GLYPHOSATE SALTS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 135 AUSTRALIA GLYPHOSATE SALTS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 136 AUSTRALIA GLYPHOSATE MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 137 AUSTRALIA GLYPHOSATE MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 138 AUSTRALIA DRY IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 139 AUSTRALIA DRY IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 140 AUSTRALIA GLYPHOSATE MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 141 AUSTRALIA GLYPHOSATE MARKET, BY FUNCTION, 2020-2029 (KILO TONS)

TABLE 142 AUSTRALIA GLYPHOSATE MARKET, BY COLOR, 2020-2029 (USD MILLION)

TABLE 143 AUSTRALIA GLYPHOSATE MARKET, BY COLOR, 2020-2029 (KILO TONS)

TABLE 144 AUSTRALIA GLYPHOSATE MARKET, BY SHELF LIFE, 2020-2029 (USD MILLION)

TABLE 145 AUSTRALIA GLYPHOSATE MARKET, BY SHELF LIFE, 2020-2029 (KILO TONS)

TABLE 146 AUSTRALIA GLYPHOSATE MARKET, BY CROP APPLICATION, 2020-2029 (USD MILLION)

TABLE 147 AUSTRALIA GLYPHOSATE MARKET, BY CROP APPLICATION, 2020-2029 (KILO TONS)

TABLE 148 AUSTRALIA OIL SEEDS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 149 AUSTRALIA OIL SEEDS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 150 AUSTRALIA OIL SEEDS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 151 AUSTRALIA OIL SEEDS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 152 AUSTRALIA PULSES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 153 AUSTRALIA PULSES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 154 AUSTRALIA PULSES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 155 AUSTRALIA PULSES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 156 AUSTRALIA CEREALS & GRAINS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 157 AUSTRALIA CEREALS & GRAINS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 158 AUSTRALIA CEREALS & GRAINS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 159 AUSTRALIA CEREALS & GRAINS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 160 AUSTRALIA FRUITS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 161 AUSTRALIA FRUITS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 162 AUSTRALIA FRUITS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 163 AUSTRALIA FRUITS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 164 AUSTRALIA VEGETABLES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 165 AUSTRALIA VEGETABLES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 166 AUSTRALIA VEGETABLES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 167 AUSTRALIA VEGETABLES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 168 AUSTRALIA HORTICULTURE IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 169 AUSTRALIA HORTICULTURE IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 170 AUSTRALIA TURN & ORNAMENTS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 171 AUSTRALIA TURN & ORNAMENTS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 172 AUSTRALIA GLYPHOSATE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 173 AUSTRALIA GLYPHOSATE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (KILO TONS)

TABLE 174 JAPAN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 175 JAPAN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 176 JAPAN GLYPHOSATE SALTS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 177 JAPAN GLYPHOSATE SALTS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 178 JAPAN GLYPHOSATE MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 179 JAPAN GLYPHOSATE MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 180 JAPAN DRY IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 181 JAPAN DRY IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 182 JAPAN GLYPHOSATE MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 183 JAPAN GLYPHOSATE MARKET, BY FUNCTION, 2020-2029 (KILO TONS)

TABLE 184 JAPAN GLYPHOSATE MARKET, BY COLOR, 2020-2029 (USD MILLION)

TABLE 185 JAPAN GLYPHOSATE MARKET, BY COLOR, 2020-2029 (KILO TONS)

TABLE 186 JAPAN GLYPHOSATE MARKET, BY SHELF LIFE, 2020-2029 (USD MILLION)

TABLE 187 JAPAN GLYPHOSATE MARKET, BY SHELF LIFE, 2020-2029 (KILO TONS)

TABLE 188 APAN GLYPHOSATE MARKET, BY CROP APPLICATION, 2020-2029 (USD MILLION)

TABLE 189 JAPAN GLYPHOSATE MARKET, BY CROP APPLICATION, 2020-2029 (KILO TONS)

TABLE 190 JAPAN OIL SEEDS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 191 JAPAN OIL SEEDS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 192 JAPAN OIL SEEDS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 193 JAPAN OIL SEEDS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 194 JAPAN PULSES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 195 JAPAN PULSES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 196 JAPAN PULSES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 197 JAPAN PULSES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 198 JAPAN CEREALS & GRAINS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 199 JAPAN CEREALS & GRAINS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 200 JAPAN CEREALS & GRAINS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 201 JAPAN CEREALS & GRAINS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 202 JAPAN FRUITS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 203 JAPAN FRUITS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 204 JAPAN FRUITS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 205 JAPAN FRUITS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 206 JAPAN VEGETABLES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 207 JAPAN VEGETABLES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 208 JAPAN VEGETABLES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 209 JAPAN VEGETABLES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 210 JAPAN HORTICULTURE IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 211 JAPAN HORTICULTURE IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 212 JAPAN TURN & ORNAMENTS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 213 JAPAN TURN & ORNAMENTS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 214 JAPAN GLYPHOSATE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 215 JAPAN GLYPHOSATE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (KILO TONS)

TABLE 216 SOUTH KOREA GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 217 SOUTH KOREA GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 218 SOUTH KOREA GLYPHOSATE SALTS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 219 SOUTH KOREA GLYPHOSATE SALTS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 220 SOUTH KOREA GLYPHOSATE MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 221 SOUTH KOREA GLYPHOSATE MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 222 SOUTH KOREA DRY IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 223 SOUTH KOREA DRY IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 224 SOUTH KOREA GLYPHOSATE MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 225 SOUTH KOREA GLYPHOSATE MARKET, BY FUNCTION, 2020-2029 (KILO TONS)

TABLE 226 SOUTH KOREA GLYPHOSATE MARKET, BY COLOR, 2020-2029 (USD MILLION)

TABLE 227 SOUTH KOREA GLYPHOSATE MARKET, BY COLOR, 2020-2029 (KILO TONS)

TABLE 228 SOUTH KOREA GLYPHOSATE MARKET, BY SHELF LIFE, 2020-2029 (USD MILLION)

TABLE 229 SOUTH KOREA GLYPHOSATE MARKET, BY SHELF LIFE, 2020-2029 (KILO TONS)

TABLE 230 SOUTH KOREA GLYPHOSATE MARKET, BY CROP APPLICATION, 2020-2029 (USD MILLION)

TABLE 231 SOUTH KOREA GLYPHOSATE MARKET, BY CROP APPLICATION, 2020-2029 (KILO TONS)

TABLE 232 SOUTH KOREA OIL SEEDS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 233 SOUTH KOREA OIL SEEDS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 234 SOUTH KOREA OIL SEEDS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 235 SOUTH KOREA OIL SEEDS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 236 SOUTH KOREA PULSES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 237 SOUTH KOREA PULSES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 238 SOUTH KOREA PULSES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 239 SOUTH KOREA PULSES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 240 SOUTH KOREA CEREALS & GRAINS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 241 SOUTH KOREA CEREALS & GRAINS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 242 SOUTH KOREA CEREALS & GRAINS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 243 SOUTH KOREA CEREALS & GRAINS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 244 SOUTH KOREA FRUITS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 245 SOUTH KOREA FRUITS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 246 SOUTH KOREA FRUITS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 247 SOUTH KOREA FRUITS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 248 SOUTH KOREA VEGETABLES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 249 SOUTH KOREA VEGETABLES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 250 SOUTH KOREA VEGETABLES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 251 SOUTH KOREA VEGETABLES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 252 SOUTH KOREA HORTICULTURE IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 253 SOUTH KOREA HORTICULTURE IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 254 SOUTH KOREA TURN & ORNAMENTS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 255 SOUTH KOREA TURN & ORNAMENTS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 256 SOUTH KOREA GLYPHOSATE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 257 SOUTH KOREA GLYPHOSATE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (KILO TONS)

TABLE 258 INDONESIA GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 259 INDONESIA GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 260 INDONESIA GLYPHOSATE SALTS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 261 INDONESIA GLYPHOSATE SALTS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 262 INDONESIA GLYPHOSATE MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 263 INDONESIA GLYPHOSATE MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 264 INDONESIA DRY IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 265 INDONESIA DRY IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 266 INDONESIA GLYPHOSATE MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 267 INDONESIA GLYPHOSATE MARKET, BY FUNCTION, 2020-2029 (KILO TONS)

TABLE 268 INDONESIA GLYPHOSATE MARKET, BY COLOR, 2020-2029 (USD MILLION)

TABLE 269 INDONESIA GLYPHOSATE MARKET, BY COLOR, 2020-2029 (KILO TONS)

TABLE 270 INDONESIA GLYPHOSATE MARKET, BY SHELF LIFE, 2020-2029 (USD MILLION)

TABLE 271 INDONESIA GLYPHOSATE MARKET, BY SHELF LIFE, 2020-2029 (KILO TONS)

TABLE 272 INDONESIA GLYPHOSATE MARKET, BY CROP APPLICATION, 2020-2029 (USD MILLION)

TABLE 273 INDONESIA GLYPHOSATE MARKET, BY CROP APPLICATION, 2020-2029 (KILO TONS)

TABLE 274 INDONESIA OIL SEEDS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 275 INDONESIA OIL SEEDS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 276 INDONESIA OIL SEEDS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 277 INDONESIA OIL SEEDS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 278 INDONESIA PULSES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 279 INDONESIA PULSES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 280 INDONESIA PULSES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 281 INDONESIA PULSES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 282 INDONESIA CEREALS & GRAINS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 283 INDONESIA CEREALS & GRAINS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 284 INDONESIA CEREALS & GRAINS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 285 INDONESIA CEREALS & GRAINS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 286 INDONESIA FRUITS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 287 INDONESIA FRUITS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 288 INDONESIA FRUITS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 289 INDONESIA FRUITS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 290 INDONESIA VEGETABLES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 291 INDONESIA VEGETABLES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 292 INDONESIA VEGETABLES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 293 INDONESIA VEGETABLES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 294 INDONESIA HORTICULTURE IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 295 INDONESIA HORTICULTURE IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 296 INDONESIA TURN & ORNAMENTS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 297 INDONESIA TURN & ORNAMENTS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 298 INDONESIA GLYPHOSATE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 299 INDONESIA GLYPHOSATE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (KILO TONS)

TABLE 300 THAILAND GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 301 THAILAND GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 302 THAILAND GLYPHOSATE SALTS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 303 THAILAND GLYPHOSATE SALTS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 304 THAILAND GLYPHOSATE MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 305 THAILAND GLYPHOSATE MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 306 THAILAND DRY IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 307 THAILAND DRY IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 308 THAILAND GLYPHOSATE MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 309 THAILAND GLYPHOSATE MARKET, BY FUNCTION, 2020-2029 (KILO TONS)

TABLE 310 THAILAND GLYPHOSATE MARKET, BY COLOR, 2020-2029 (USD MILLION)

TABLE 311 THAILAND GLYPHOSATE MARKET, BY COLOR, 2020-2029 (KILO TONS)

TABLE 312 THAILAND GLYPHOSATE MARKET, BY SHELF LIFE, 2020-2029 (USD MILLION)

TABLE 313 THAILAND GLYPHOSATE MARKET, BY SHELF LIFE, 2020-2029 (KILO TONS)

TABLE 314 THAILAND GLYPHOSATE MARKET, BY CROP APPLICATION, 2020-2029 (USD MILLION)

TABLE 315 THAILAND GLYPHOSATE MARKET, BY CROP APPLICATION, 2020-2029 (KILO TONS)

TABLE 316 THAILAND OIL SEEDS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 317 THAILAND OIL SEEDS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 318 THAILAND OIL SEEDS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 319 THAILAND OIL SEEDS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 320 THAILAND PULSES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 321 THAILAND PULSES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 322 THAILAND PULSES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 323 THAILAND PULSES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 324 THAILAND CEREALS & GRAINS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 325 THAILAND CEREALS & GRAINS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 326 THAILAND CEREALS & GRAINS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 327 THAILAND CEREALS & GRAINS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 328 THAILAND FRUITS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 329 THAILAND FRUITS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 330 THAILAND FRUITS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 331 THAILAND FRUITS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 332 THAILAND VEGETABLES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 333 THAILAND VEGETABLES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 334 THAILAND VEGETABLES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 335 THAILAND VEGETABLES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 336 THAILAND HORTICULTURE IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 337 THAILAND HORTICULTURE IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 338 THAILAND TURN & ORNAMENTS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 339 THAILAND TURN & ORNAMENTS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 340 THAILAND GLYPHOSATE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 341 THAILAND GLYPHOSATE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (KILO TONS)

TABLE 342 SINGAPORE GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 343 SINGAPORE GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 344 SINGAPORE GLYPHOSATE SALTS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 345 SINGAPORE GLYPHOSATE SALTS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 346 SINGAPORE GLYPHOSATE MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 347 SINGAPORE GLYPHOSATE MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 348 SINGAPORE DRY IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 349 SINGAPORE DRY IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 350 SINGAPORE GLYPHOSATE MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 351 SINGAPORE GLYPHOSATE MARKET, BY FUNCTION, 2020-2029 (KILO TONS)

TABLE 352 SINGAPORE GLYPHOSATE MARKET, BY COLOR, 2020-2029 (USD MILLION)

TABLE 353 SINGAPORE GLYPHOSATE MARKET, BY COLOR, 2020-2029 (KILO TONS)

TABLE 354 SINGAPORE GLYPHOSATE MARKET, BY SHELF LIFE, 2020-2029 (USD MILLION)

TABLE 355 SINGAPORE GLYPHOSATE MARKET, BY SHELF LIFE, 2020-2029 (KILO TONS)

TABLE 356 SINGAPORE GLYPHOSATE MARKET, BY CROP APPLICATION, 2020-2029 (USD MILLION)

TABLE 357 SINGAPORE GLYPHOSATE MARKET, BY CROP APPLICATION, 2020-2029 (KILO TONS)

TABLE 358 SINGAPORE OIL SEEDS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 359 SINGAPORE OIL SEEDS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 360 SINGAPORE OIL SEEDS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 361 SINGAPORE OIL SEEDS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 362 SINGAPORE PULSES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 363 SINGAPORE PULSES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 364 SINGAPORE PULSES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 365 SINGAPORE PULSES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 366 SINGAPORE CEREALS & GRAINS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 367 SINGAPORE CEREALS & GRAINS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 368 SINGAPORE CEREALS & GRAINS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 369 SINGAPORE CEREALS & GRAINS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 370 SINGAPORE FRUITS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 371 SINGAPORE FRUITS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 372 SINGAPORE FRUITS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 373 SINGAPORE FRUITS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 374 SINGAPORE VEGETABLES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 375 SINGAPORE VEGETABLES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 376 SINGAPORE VEGETABLES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 377 SINGAPORE VEGETABLES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 378 SINGAPORE HORTICULTURE IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 379 SINGAPORE HORTICULTURE IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 380 SINGAPORE TURN & ORNAMENTS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 381 SINGAPORE TURN & ORNAMENTS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 382 SINGAPORE GLYPHOSATE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 383 SINGAPORE GLYPHOSATE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (KILO TONS)

TABLE 384 MALAYSIA GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 385 MALAYSIA GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 386 MALAYSIA GLYPHOSATE SALTS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 387 MALAYSIA GLYPHOSATE SALTS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 388 MALAYSIA GLYPHOSATE MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 389 MALAYSIA GLYPHOSATE MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 390 MALAYSIA DRY IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 391 MALAYSIA DRY IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 392 MALAYSIA GLYPHOSATE MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 393 MALAYSIA GLYPHOSATE MARKET, BY FUNCTION, 2020-2029 (KILO TONS)

TABLE 394 MALAYSIA GLYPHOSATE MARKET, BY COLOR, 2020-2029 (USD MILLION)

TABLE 395 MALAYSIA GLYPHOSATE MARKET, BY COLOR, 2020-2029 (KILO TONS)

TABLE 396 MALAYSIA GLYPHOSATE MARKET, BY SHELF LIFE, 2020-2029 (USD MILLION)

TABLE 397 MALAYSIA GLYPHOSATE MARKET, BY SHELF LIFE, 2020-2029 (KILO TONS)

TABLE 398 MALAYSIA GLYPHOSATE MARKET, BY CROP APPLICATION, 2020-2029 (USD MILLION)

TABLE 399 MALAYSIA GLYPHOSATE MARKET, BY CROP APPLICATION, 2020-2029 (KILO TONS)

TABLE 400 MALAYSIA OIL SEEDS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 401 MALAYSIA OIL SEEDS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 402 MALAYSIA OIL SEEDS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 403 MALAYSIA OIL SEEDS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 404 MALAYSIA PULSES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 405 MALAYSIA PULSES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 406 MALAYSIA PULSES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 407 MALAYSIA PULSES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 408 MALAYSIA CEREALS & GRAINS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 409 MALAYSIA CEREALS & GRAINS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 410 MALAYSIA CEREALS & GRAINS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 411 MALAYSIA CEREALS & GRAINS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 412 MALAYSIA FRUITS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 413 MALAYSIA FRUITS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 414 MALAYSIA FRUITS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 415 MALAYSIA FRUITS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 416 MALAYSIA VEGETABLES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 417 MALAYSIA VEGETABLES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 418 MALAYSIA VEGETABLES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 419 MALAYSIA VEGETABLES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 420 MALAYSIA HORTICULTURE IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 421 MALAYSIA HORTICULTURE IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 422 MALAYSIA TURN & ORNAMENTS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 423 MALAYSIA TURN & ORNAMENTS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 424 MALAYSIA GLYPHOSATE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 425 MALAYSIA GLYPHOSATE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (KILO TONS)

TABLE 426 PHILIPPINES GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 427 PHILIPPINES GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 428 PHILIPPINES GLYPHOSATE SALTS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 429 PHILIPPINES GLYPHOSATE SALTS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 430 PHILIPPINES GLYPHOSATE MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 431 PHILIPPINES GLYPHOSATE MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 432 PHILIPPINES DRY IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 433 PHILIPPINES DRY IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 434 PHILIPPINES GLYPHOSATE MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 435 PHILIPPINES GLYPHOSATE MARKET, BY FUNCTION, 2020-2029 (KILO TONS)

TABLE 436 PHILIPPINES GLYPHOSATE MARKET, BY COLOR, 2020-2029 (USD MILLION)

TABLE 437 PHILIPPINES GLYPHOSATE MARKET, BY COLOR, 2020-2029 (KILO TONS)

TABLE 438 PHILIPPINES GLYPHOSATE MARKET, BY SHELF LIFE, 2020-2029 (USD MILLION)

TABLE 439 PHILIPPINES GLYPHOSATE MARKET, BY SHELF LIFE, 2020-2029 (KILO TONS)

TABLE 440 PHILIPPINES GLYPHOSATE MARKET, BY CROP APPLICATION, 2020-2029 (USD MILLION)

TABLE 441 PHILIPPINES GLYPHOSATE MARKET, BY CROP APPLICATION, 2020-2029 (KILO TONS)

TABLE 442 PHILIPPINES OIL SEEDS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 443 PHILIPPINES OIL SEEDS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 444 PHILIPPINES OIL SEEDS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 445 PHILIPPINES OIL SEEDS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 446 PHILIPPINES PULSES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 447 PHILIPPINES PULSES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 448 PHILIPPINES PULSES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 449 PHILIPPINES PULSES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 450 PHILIPPINES CEREALS & GRAINS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 451 PHILIPPINES CEREALS & GRAINS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 452 PHILIPPINES CEREALS & GRAINS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 453 PHILIPPINES CEREALS & GRAINS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 454 PHILIPPINES FRUITS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 455 PHILIPPINES FRUITS IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 456 PHILIPPINES FRUITS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 457 PHILIPPINES FRUITS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 458 PHILIPPINES VEGETABLES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 459 PHILIPPINES VEGETABLES IN GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 460 PHILIPPINES VEGETABLES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 461 PHILIPPINES VEGETABLES IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 462 PHILIPPINES HORTICULTURE IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 463 PHILIPPINES HORTICULTURE IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 464 PHILIPPINES TURN & ORNAMENTS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (USD MILLION)

TABLE 465 PHILIPPINES TURN & ORNAMENTS IN GLYPHOSATE MARKET, BY GLYPHOSATE TYPE, 2020-2029 (KILO TONS)

TABLE 466 PHILIPPINES GLYPHOSATE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 467 PHILIPPINES GLYPHOSATE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (KILO TONS)

TABLE 468 REST OF ASIA-PACIFIC GLYPHOSATE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 469 REST OF ASIA-PACIFIC GLYPHOSATE MARKET, BY TYPE, 2020-2029 (KILO TONS)

Liste des figures

FIGURE 1 ASIA-PACIFIC GLYPHOSATE MARKET: SEGMENTATION

FIGURE 2 ASIA-PACIFIC GLYPHOSATE MARKET: DATA TRIANGULATION

FIGURE 3 ASIA-PACIFIC GLYPHOSATE MARKET: DROC ANALYSIS

FIGURE 4 ASIA-PACIFIC GLYPHOSATE MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA-PACIFIC GLYPHOSATE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA-PACIFIC GLYPHOSATE MARKET: THE DISTRIBUTION CHANNEL LIFE LINE CURVE

FIGURE 7 ASIA-PACIFIC GLYPHOSATE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 ASIA-PACIFIC GLYPHOSATE MARKET: DBMR MARKET POSITION GRID

FIGURE 9 ASIA-PACIFIC GLYPHOSATE MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 ASIA-PACIFIC GLYPHOSATE MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 11 ASIA-PACIFIC GLYPHOSATE MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 ASIA-PACIFIC GLYPHOSATE MARKET: SEGMENTATION

FIGURE 13 RISE IN THE AGRICULTURAL SECTOR EXPECTED TO DRIVE THE ASIA-PACIFIC GLYPHOSATE MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 THE GLYPHOSATE SALTS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA-PACIFIC GLYPHOSATE MARKET IN 2022 & 2029

FIGURE 15 ASIA-PACIFIC GLYPHOSATE MARKET: FACTORS AFFECTING DISPOSABLE INCOME OR SPEND DYNAMICS OF THE CONSUMERS

FIGURE 16 PRICE ANALYSIS FOR THE ASIA-PACIFIC GLYPHOSATE MARKET (USD/KG)

FIGURE 17 VALUE CHAIN OF THE ASIA-PACIFIC GLYPHOSATE MARKET

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA-PACIFIC GLYPHOSATE MARKET

FIGURE 19 ASIA-PACIFIC GLYPHOSATE MARKET: BY TYPE, 2021

FIGURE 20 ASIA-PACIFIC GLYPHOSATE MARKET: BY FORM, 2021

FIGURE 21 ASIA-PACIFIC GLYPHOSATE MARKET: BY FUNCTION, 2021

FIGURE 22 ASIA-PACIFIC GLYPHOSATE MARKET: BY COLOR, 2021

FIGURE 23 ASIA-PACIFIC GLYPHOSATE MARKET: BY SHELF LIFE 2021

FIGURE 24 ASIA-PACIFIC GLYPHOSATE MARKET: BY CROP APPLICATION, 2021

FIGURE 25 ASIA-PACIFIC GLYPHOSATE MARKET: BY DISTRIBUTION CHANNEL 2021

FIGURE 26 ASIA-PACIFIC GLYPHOSATE MARKET: SNAPSHOT (2021)

FIGURE 27 ASIA-PACIFIC GLYPHOSATE MARKET: BY COUNTRY (2021)

FIGURE 28 ASIA-PACIFIC GLYPHOSATE MARKET: BY COUNTRY (2022 & 2029)

FIGURE 29 ASIA-PACIFIC GLYPHOSATE MARKET: BY COUNTRY (2021 & 2029)

FIGURE 30 ASIA-PACIFIC GLYPHOSATE MARKET: BY TYPE (2022 - 2029)

FIGURE 31 ASIA-PACIFIC GLYPHOSATE MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.