Asia Pacific E Commerce Packaging Market

Taille du marché en milliards USD

TCAC :

%

USD

41.69 Billion

USD

86.16 Billion

2025

2033

USD

41.69 Billion

USD

86.16 Billion

2025

2033

| 2026 –2033 | |

| USD 41.69 Billion | |

| USD 86.16 Billion | |

|

|

|

|

Segmentation du marché des emballages pour le e-commerce en Asie-Pacifique : par type d’emballage (cartons ondulés, sacs, enveloppes d’expédition, étiquettes, emballages de protection, caisses-palettes, rubans adhésifs, emballages postaux, films rétractables), par matériau (fibres, plastiques recyclés et post-consommation, matériaux biosourcés, plastiques conventionnels, autres), par utilisateur final (vêtements et accessoires, électronique et électrique, textile, articles ménagers, soins personnels, alimentation et boissons, produits pharmaceutiques, automobile, produits métalliques, produits chimiques, agriculture, mobilier, bois et produits dérivés, cuir et articles en cuir, matériaux de construction, produits du tabac, autres), par canal de distribution (direct, indirect) – Tendances du secteur et prévisions jusqu’en 2033

Taille du marché des emballages pour le commerce électronique en Asie-Pacifique

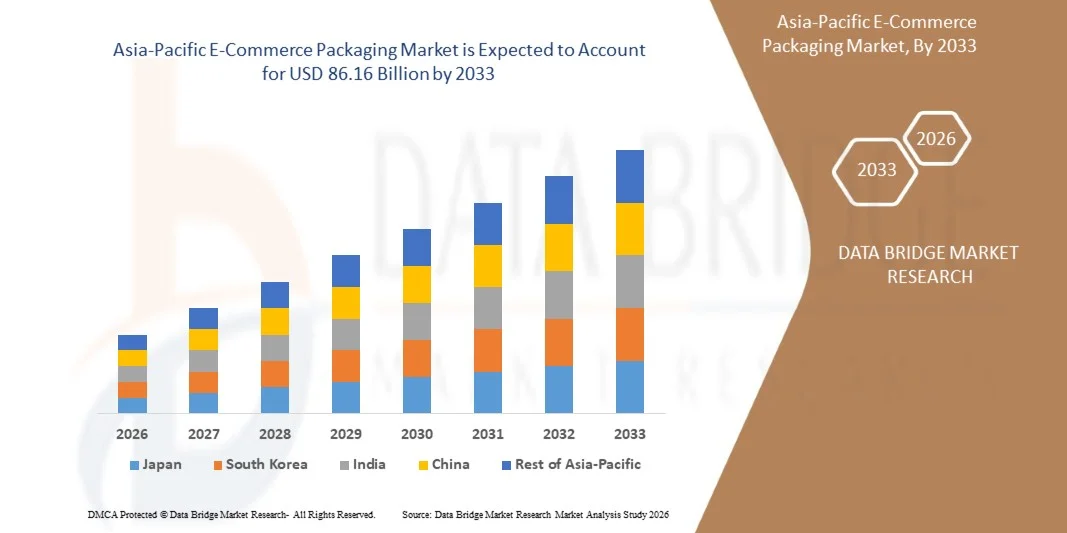

- Le marché des emballages pour le commerce électronique en Asie-Pacifique était évalué à 41,69 milliards de dollars en 2025 et devrait atteindre 86,16 milliards de dollars d'ici 2033 , avec un TCAC de 9,5 % au cours de la période de prévision.

- La croissance du marché des emballages pour le e-commerce en Asie-Pacifique est principalement tirée par l'essor rapide des achats en ligne, la préférence croissante des consommateurs pour la livraison à domicile et le besoin de solutions d'emballage protectrices, durables et légères. L'adoption croissante du numérique, l'amélioration des réseaux logistiques et l'essor du commerce omnicanal renforcent encore la demande du marché.

- Par ailleurs, les progrès réalisés dans le domaine des technologies d'emballage durables, l'augmentation des investissements dans les matériaux écologiques et le renforcement des réglementations sur les déchets plastiques influencent considérablement le développement du marché. Des innovations telles que les emballages biodégradables, les matériaux recyclables et les solutions d'emballage intelligentes favorisent l'adoption des produits et accélèrent la croissance globale du secteur.

Analyse du marché des emballages pour le commerce électronique en Asie-Pacifique

- Le marché des emballages pour le e-commerce en Asie-Pacifique englobe la production, la transformation et l'application de solutions d'emballage utilisées pour l'expédition de biens de consommation, d'électronique, de produits d'hygiène et de soins personnels, ainsi que de produits industriels. La croissance de ce marché est alimentée par l'essor rapide du commerce en ligne, la pénétration croissante du numérique et la demande grandissante d'emballages protecteurs, légers et personnalisables, indispensables au développement des activités e-commerce à grande échelle dans toute la région.

- L'adoption des emballages pour le e-commerce s'accélère sous l'effet d'un besoin croissant en matériaux d'emballage durables, recyclables et économiques, ainsi que d'investissements de plus en plus importants dans les technologies de fabrication avancées et d'automatisation. L'évolution vers des formats d'emballage écologiques, des solutions de conception plus efficaces et une meilleure compatibilité logistique permettent aux fabricants de répondre aux exigences régionales changeantes en matière de durabilité, de performance et de réduction de l'impact environnemental.

- La Chine domine le marché de l'emballage pour le e-commerce en Asie-Pacifique avec une part de marché de 21,53 % en 2025 et devrait également enregistrer le taux de croissance annuel composé (TCAC) le plus élevé au cours de la période de prévision. Ce leadership s'appuie sur un écosystème e-commerce en pleine expansion, un développement important des infrastructures logistiques et de distribution, ainsi que des investissements croissants dans des solutions d'emballage durables. Par ailleurs, les partenariats stratégiques entre les fournisseurs d'emballage internationaux et les géants chinois du e-commerce renforcent encore la capacité de production et l'influence régionale de la Chine.

- Le segment des boîtes en carton ondulé devrait représenter la plus grande part de marché (36,21 %) en 2025, grâce à son rapport coût-efficacité, sa recyclabilité, sa grande durabilité et son adéquation à l'expédition en vrac dans le secteur du e-commerce. La demande croissante de matériaux en carton ondulé renforcés et légers, conjuguée à l'expansion des capacités de production dans la région Asie-Pacifique, continue de consolider la position dominante de ce segment sur le marché de l'emballage pour le e-commerce.

Portée du rapport et segmentation du marché de l'emballage pour le commerce électronique en Asie-Pacifique

|

Attributs |

Principaux enseignements du marché de l'emballage pour le commerce électronique en Asie-Pacifique |

|

Segments couverts |

|

|

Pays couverts |

Asie-Pacifique

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

Adoption de l'automatisation et de systèmes d'optimisation des processus de traitement des commandes Premiumisation grâce à l'impression numérique et à la personnalisation de la marque |

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur du marché, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché élaborés par Data Bridge Market Research comprennent également une analyse des importations et des exportations, un aperçu de la capacité de production, une analyse de la consommation de production, une analyse des tendances des prix, un scénario de changement climatique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, les critères de sélection des fournisseurs, une analyse PESTLE, une analyse de Porter et le cadre réglementaire. |

Tendances du marché de l'emballage pour le commerce électronique en Asie-Pacifique

« Durabilité et matériaux écologiques »

- On observe une forte tendance industrielle à remplacer les emballages plastiques traditionnels par du papier, du carton et d'autres matériaux à base de fibres, facilement recyclables et plus respectueux de l'environnement. Cette évolution est motivée par la demande croissante d'un impact environnemental moindre, d'une recyclabilité facilitée et d'une meilleure adéquation aux principes de l'économie circulaire.

- L'utilisation de matériaux biodégradables, de films compostables et de plastiques d'origine végétale (par exemple, issus de la canne à sucre, de l'amidon ou d'autres sources renouvelables) est en forte croissance dans les emballages du e-commerce. Ces matériaux contribuent à réduire les déchets plastiques, à diminuer l'empreinte carbone et séduisent les consommateurs soucieux de l'environnement, ce qui en fait un segment en pleine expansion.

- Face à la prise de conscience croissante des consommateurs concernant les enjeux environnementaux, nombreux sont ceux qui privilégient les marques utilisant des emballages écologiques. Ces emballages durables sont devenus un indicateur visible des valeurs et de la responsabilité des marques. Ce phénomène incite les marques à adopter des emballages écologiques pour fidéliser leur clientèle, instaurer la confiance et se démarquer sur les marchés concurrentiels du e-commerce.

- Partout dans le monde, les gouvernements réglementent de plus en plus les plastiques à usage unique, encouragent la réduction des déchets et promeuvent le recyclage, incitant ainsi les fournisseurs d'emballages pour le commerce électronique à se tourner vers des matériaux durables. Le respect des normes et réglementations environnementales encourage les fabricants et les marques à investir dans des solutions d'emballage compostables, recyclables et écologiques.

Dynamique du marché de l'emballage pour le commerce électronique en Asie-Pacifique

Conducteur

« Pénétration régionale d’Internet et des smartphones dans les marchés émergents »

- Avec l'accès croissant à Internet et aux smartphones à prix abordable dans les pays émergents, une part plus importante de la population peut faire des achats en ligne. Cela augmente le volume des commandes de commerce électronique, ce qui, par ricochet, stimule la demande en matériaux et solutions d'emballage.

- Grâce à un accès facilité aux appareils mobiles et à Internet, les consommateurs passent commande plus fréquemment (petits articles, achats courants). Ce comportement entraîne une augmentation globale des envois de colis, stimulant ainsi la demande d'emballages spécifiques au commerce électronique (cartons, enveloppes matelassées, films de protection, etc.).

- Les économies émergentes bénéficiant d'une infrastructure internet en plein essor et d'une pénétration croissante des smartphones (comme certaines régions d'Asie-Pacifique) connaissent une forte croissance du commerce électronique. Avec le développement du commerce électronique, le besoin en solutions d'emballage sûres, efficaces et évolutives s'accroît également.

- Avec la généralisation de la connectivité numérique, de plus en plus de marques et de détaillants des marchés émergents privilégient le commerce en ligne plutôt que de s'appuyer uniquement sur les magasins physiques. Il en résulte une augmentation du nombre de marchandises expédiées directement aux consommateurs, ce qui accroît la demande d'emballages adaptés à la logistique, à la protection et à l'expérience de déballage.

- L'amélioration de la connectivité internet et l'accès aux smartphones s'accompagnent souvent d'une hausse des revenus disponibles et d'une urbanisation croissante dans les marchés émergents. Cela élargit la clientèle potentielle du commerce en ligne, augmentant ainsi les volumes et la variété des produits expédiés et, par conséquent, la demande en emballages diversifiés.

Retenue/Défi

« La volatilité des prix des matières premières (papier, résines, adhésifs) »

- La volatilité des prix des matières premières essentielles telles que le papier, les résines et les adhésifs constitue un frein structurel au marché mondial des emballages pour le commerce électronique. Les coûts de production du papier kraft, du carton ondulé et de la pâte à papier ont subi de fortes fluctuations depuis 2021, sous l'effet des chocs sur les prix de l'énergie, de la demande à l'exportation et des changements de politique, ce qui a entraîné une instabilité des coûts des emballages en carton ondulé et en papier.

- Dans le même temps, les matières premières de résine et de film telles que le polyéthylène, le polypropylène, le PET et le film BOPP ont connu des cycles marqués d'escalade rapide et de corrections ultérieures, rendant la tarification contractuelle des enveloppes et pochettes souples pour le commerce électronique très incertaine.

- Les matières premières adhésives et de mastic, liées aux chaînes pétrochimiques et à la disponibilité des monomères, ont également connu des hausses de prix répétées et des tensions sur l'approvisionnement, amplifiant encore le risque de marge pour les transformateurs d'emballages fournissant les marques de commerce électronique.

- Par exemple, en août 2025, le magazine Adhesives and Sealants Industry a indiqué dans son rapport annuel 2025 sur les matières premières et les produits chimiques que l'environnement des coûts des principaux intrants adhésifs et chimiques restait influencé par l'évolution des prix des matières premières, les contraintes logistiques et les facteurs géopolitiques, ce qui montre que la volatilité des coûts des matières premières demeurait une préoccupation majeure pour les fournisseurs d'adhésifs de l'industrie de l'emballage.

- De ce fait, les producteurs d'emballages pour le commerce électronique et les plateformes logistiques ont été exposés à des réévaluations fréquentes des prix, à des durées contractuelles plus courtes et à des tensions sur leur fonds de roulement, ce qui limite leur capacité à offrir des solutions d'emballage stables et à long terme aux détaillants et aux places de marché.

Portée du marché de l'emballage pour le commerce électronique en Asie-Pacifique

Le marché des emballages pour le commerce électronique en Asie-Pacifique est segmenté en quatre catégories en fonction de l'emballage, du matériau, de l'utilisateur final et du canal de distribution.

- Par emballage

Le marché mondial des emballages pour le commerce électronique en Asie-Pacifique est segmenté selon le type d'emballage : boîtes en carton ondulé, sacs, enveloppes d'expédition, étiquettes, emballages de protection, caisses-palettes, rubans adhésifs, emballages postaux et films rétractables. Les sacs sont eux-mêmes subdivisés selon leur type : sacs en polyéthylène, sacs de messagerie, sacs tissés, sacs en mousse, sacs inviolables, sacs à fermeture hermétique et autres. Les rubans adhésifs sont subdivisés selon leur type : rubans BOPP auto-adhésifs, rubans imprimés, rubans en papier renforcé, rubans d'emballage en PVC, rubans adhésifs de scellage, rubans de scellage pour sacs refermables et autres. Les emballages de protection sont eux-mêmes subdivisés selon leur type (rouleaux de film à bulles, rouleaux de carton ondulé et autres) et selon leur unité de conditionnement (rouleaux de film à bulles, rouleaux de carton ondulé et autres).

Le segment des boîtes en carton ondulé devrait dominer le marché mondial de l'emballage e-commerce avec une part de marché de 36,21 %, affichant le TCAC le plus élevé (10,2 %). Cette croissance est due à la demande croissante de solutions d'emballage flexibles, légères et économiques pour les expéditions en ligne. Le sous-segment des sacs en polyéthylène devrait connaître une croissance significative, portée par l'adoption croissante de matériaux biodégradables et recyclables et l'essor des livraisons e-commerce à l'échelle mondiale. Le segment des rubans adhésifs devrait également enregistrer une croissance substantielle, stimulée par les exigences croissantes en matière d'emballages sécurisés et inviolables. Les rubans BOPP auto-adhésifs et les rubans imprimés devraient se distinguer grâce à leurs performances de scellage élevées et aux opportunités de personnalisation qu'ils offrent aux vendeurs en ligne. Le segment des emballages de protection devrait croître de manière constante, notamment celui des rouleaux de bulles d'air, les détaillants en ligne privilégiant de plus en plus l'expédition sécurisée des marchandises fragiles et des solutions de protection économiques.

- Par matériaux

Le marché mondial des emballages e-commerce en Asie-Pacifique est segmenté, selon le matériau, en emballages à base de fibres, en plastiques recyclés et plastiques PCR (recyclés post-consommation), en matériaux biosourcés, en plastiques conventionnels (plastiques vierges) et autres. Les emballages à base de fibres sont eux-mêmes subdivisés en carton ondulé et en papier/carton. Le carton ondulé est ensuite segmenté en simple cannelure, double cannelure, simple face, triple cannelure et autres.

Le segment des emballages à base de fibres devrait dominer le marché mondial des emballages de commerce électronique en Asie-Pacifique avec une part de marché de 50,74 % et une croissance annuelle composée de 9,6 % en raison de sa forte demande de solutions d'emballage durables, recyclables et économiques.

- Par l'utilisateur final

Le marché mondial des emballages pour le commerce électronique en Asie-Pacifique est segmenté, selon l'utilisateur final, en vêtements et accessoires (hors cuir), électronique et électrique, textile, articles ménagers, soins personnels, alimentation et boissons, produits pharmaceutiques, automobile, produits métalliques, produits chimiques, agriculture, mobilier, bois et produits dérivés (hors mobilier), cuir et articles en cuir, matériaux de construction, produits du tabac et autres. Le segment « Vêtements et accessoires » est lui-même segmenté par canal de distribution (détail et gros) et par type d'emballage (cartons ondulés, sacs, enveloppes, étiquettes, emballages de protection, caisses-palettes, rubans adhésifs, emballages postaux et films rétractables). Le segment « Électronique et électrique » est segmenté par canal de distribution (détail et gros), par type d'emballage (cartons ondulés, sacs, enveloppes, étiquettes, emballages de protection, caisses-palettes, rubans adhésifs, emballages postaux et films rétractables) et par type de produit (ordinateurs, produits électroniques et optiques, équipements électriques et autres). Le segment « Textile » est segmenté par canal de distribution (détail et gros) et par type d'emballage (cartons ondulés, sacs, enveloppes, étiquettes, emballages de protection, caisses-palettes, rubans adhésifs, emballages postaux et films rétractables). Les produits ménagers, d'hygiène personnelle, alimentaires et de boissons, pharmaceutiques, automobiles, produits métalliques ouvrés, produits chimiques, agricoles, meubles, bois et produits dérivés, cuir et articles en cuir, matériaux de construction, produits du tabac et autres sont segmentés de manière similaire par type de canal de distribution (détail et gros), avec une segmentation supplémentaire par emballage pour les catégories concernées. Les produits alimentaires et de boissons sont segmentés par type (aliments et boissons), les produits automobiles par type de produit (pièces détachées et pièces de modification), et les produits agricoles par type (engrais, produits de la pêche et de l'aquaculture, plantes, semences et autres).

Le segment des vêtements et accessoires devrait dominer le marché mondial de l'emballage pour le commerce électronique en Asie-Pacifique, avec une part de marché de 14,30 % et une croissance annuelle composée de 10,1 %, grâce à l'essor rapide de la vente de mode en ligne et à la demande croissante de solutions d'emballage économiques, légères et esthétiques. Le segment de l'emballage pour l'électronique et l'électronique devrait connaître une croissance significative, portée par le besoin d'emballages sécurisés et protecteurs pour les produits fragiles et de grande valeur. Les segments de l'alimentation et des boissons, des produits pharmaceutiques et des soins personnels devraient également enregistrer une forte croissance, grâce à l'augmentation des ventes en ligne de produits alimentaires et de santé.

- Par canal de distribution

Le marché mondial des emballages pour le commerce électronique en Asie-Pacifique est segmenté, selon le canal de distribution, en canaux directs et indirects. Les ventes directes sont elles-mêmes segmentées en sites web appartenant aux entreprises, agents commerciaux et contrats directs, tandis que les ventes indirectes sont segmentées en distributeurs/grossistes, revendeurs à valeur ajoutée (VAR) et places de marché en ligne tierces.

Le canal de vente directe devrait dominer le marché mondial des emballages pour le commerce électronique en Asie-Pacifique avec une part de marché de 68,66 % et une croissance annuelle composée de 9,7 % en raison de la tendance croissante des fabricants et des marques à vendre des solutions d'emballage directement aux entreprises de commerce électronique via leurs propres sites web et leurs équipes de vente dédiées.

Analyse régionale du marché des emballages pour le commerce électronique en Asie-Pacifique

- La région Asie-Pacifique devrait représenter 50,42 % du marché régional en 2025, grâce à une demande industrielle bien établie et à des applications émergentes dans les secteurs de l'isolation des bâtiments, des composants automobiles et de la chimie de spécialité. Elle affiche également le taux de croissance annuel composé (TCAC) le plus élevé, à 9,5 %, témoignant d'une croissance rapide par rapport aux autres régions. Cette expansion est alimentée par le développement croissant des infrastructures, l'adoption de matériaux de construction à haute performance énergétique et l'augmentation des investissements dans la fabrication de véhicules et d'appareils électroménagers, qui utilisent des produits en polyuréthane dérivés du MDI.

- La région bénéficie de la présence de grands fabricants de produits chimiques nationaux et régionaux, de politiques commerciales favorables et de conditions réglementaires et tarifaires avantageuses, autant d'éléments qui facilitent la pénétration du marché et garantissent un approvisionnement constant aux consommateurs industriels. De plus, les initiatives visant à promouvoir des matériaux durables et performants dans les secteurs de la construction et de l'automobile renforcent les perspectives de croissance à long terme du marché de l'emballage pour le commerce électronique en Asie-Pacifique.

Analyse du marché de l'emballage pour le commerce électronique en Chine et en Asie-Pacifique

Le marché chinois des emballages pour le commerce électronique en Asie-Pacifique connaît une croissance rapide, alimentée par l'essor du commerce en ligne, la demande croissante des consommateurs pour des emballages durables et écologiques, et d'importants investissements dans les industries chimiques et manufacturières. L'émergence de solutions d'emballage innovantes et le développement des infrastructures favorisent l'adoption du marché et l'efficacité dans tous les secteurs.

Analyse du marché de l'emballage pour le commerce électronique en Inde et en Asie-Pacifique

Le marché de l'emballage pour le commerce électronique en Inde et en Asie-Pacifique connaît une croissance rapide, portée par l'essor du commerce en ligne, la pénétration croissante des smartphones et la préférence des consommateurs pour des emballages sûrs et durables. La demande de solutions d'emballage innovantes, écologiques et protectrices est en hausse, notamment dans des secteurs comme l'électronique, l'habillement et les biens de consommation courante, ce qui devrait orienter l'expansion du marché jusqu'en 2025 et au-delà.

Analyse du marché de l'emballage pour le commerce électronique au Japon et en Asie-Pacifique

Le marché de l'emballage pour le commerce électronique en Asie-Pacifique, au Japon, connaît une croissance soutenue, portée par l'essor du commerce en ligne, la demande croissante des consommateurs pour des emballages écologiques et durables, et les progrès technologiques en matière de solutions d'emballage. Les investissements dans les infrastructures de production et de logistique contribuent à améliorer l'efficacité et favorisent l'adoption de ces solutions dans les secteurs de l'électronique, de la mode et des biens de consommation courante.

Analyse du marché de l'emballage pour le commerce électronique en Corée du Sud et en Asie-Pacifique

Le marché de l'emballage pour le commerce électronique en Asie-Pacifique, en Corée du Sud, est en croissance soutenue, porté par l'essor du commerce en ligne et la préférence croissante des consommateurs pour des emballages durables et résistants. Les investissements dans les technologies de pointe en matière de fabrication et de logistique, associés à des solutions d'emballage innovantes, améliorent l'efficacité opérationnelle et favorisent leur adoption dans des secteurs clés tels que l'électronique, la mode et les biens de consommation courante.

Part de marché des emballages pour le commerce électronique en Asie-Pacifique

Le secteur de l'emballage pour le commerce électronique est principalement dominé par des entreprises bien établies, notamment :

- fInternational Paper Company (États-Unis)

- Amcor PLC (Suisse)

- DS Smith PLC (Royaume-Uni)

- Smurfit WestRock (Irlande)

- Packaging Corporation of America (PCA) (États-Unis)

- Mondi PLC (Royaume-Uni)

- Klabin SA (Brésil)

- Société Oji Holdings (Japon)

- Sealed Air Corporation (États-Unis)

- Nine Dragons Paper Holdings Ltd. (Chine)

- Société 3M (États-Unis)

- Avery Dennison Corporation ((États-Unis)

- Green Bay Packaging Inc. (États-Unis)

- Cosmo Films (Inde)

- Georgia-Pacific LLC (États-Unis)

- Ranpak Holdings Corp. (États-Unis)

- Boxon Group AB (Suède)

- Stora Enso Oyj (Finlande)

- Pratt Industries (États-Unis)

- Intertape Polymer Group Inc. (IPG) (Canada)

- Pregis LLC (États-Unis))

- Prem Industries India Limited (Inde)

- Packhelp (Pologne)

- Elite Custom Boxes (États-Unis)

- Emballage e-commerce (Inde)

- Blue Box Packaging (New York)

- Packman Packaging Private Limited (Inde) Filmar Group (Italie)

- Packtek (Inde)

- Altpac (Inde)

Dernières évolutions du marché de l'emballage pour le commerce électronique en Asie-Pacifique

- En février 2024, Smurfit Westrock a publié son premier « Rapport de développement durable 2024 », mettant en avant ses solutions d'emballage durables et son approche de l'économie circulaire. Ce rapport témoigne de son engagement en faveur du développement durable et des emballages recyclables, des enjeux de plus en plus importants pour les clients du e-commerce et la conformité aux réglementations environnementales à l'échelle mondiale ; il valorise également son offre d'emballages pour les détaillants en ligne.

- En décembre 2024, Amcor a présenté à l'IPPE 2025 des équipements d'emballage innovants dotés de technologies de dimensionnement d'emballage pilotées par l'IA et d'emballage sous vide qui devraient réduire la consommation de film jusqu'à 30 %, conformément aux objectifs de durabilité et d'efficacité opérationnelle.

- En janvier 2025, International Paper a souligné la tendance actuelle à la « patricisation », soit le passage des emballages plastiques aux emballages papier, motivé par des préoccupations environnementales. L’entreprise promeut des emballages réutilisables et la transparence en matière de développement durable afin de répondre à l’évolution des préférences des consommateurs.

- En février 2023, la boîte sécurisée e-commerce d'International Paper a remporté le prestigieux prix WorldStar of Packaging pour sa conception inviolable qui prévient le vol et favorise le développement durable. Fabriquée à 100 % à partir de carton ondulé recyclé, elle élimine le besoin de ruban adhésif plastique.

- En octobre 2025, Klabin a reçu le prix Sesi SDG 2025 dans la catégorie « Social – Grandes entreprises » pour son initiative « Klabin transforme en semant l’éducation », qui renforce l’éducation publique dans les régions où elle est implantée. Ce programme, actif depuis 2019, s’est étendu à 20 municipalités réparties dans quatre États brésiliens et bénéficie à près de 30 000 élèves, enseignants et personnels administratifs scolaires. Cette distinction souligne l’engagement de Klabin en faveur du développement régional durable et son alignement sur les Objectifs de développement durable des Nations Unies grâce à des actions concrètes d’éducation communautaire.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 COMPANY EVALUATION QUADRANT

4.3 PATENT ANALYSIS

4.3.1 PATENT FILING DISTRIBUTION BY COUNTRY

4.3.2 KEY APPLICANTS (TOP INNOVATORS)

4.3.3 TECHNOLOGY SEGMENTATION BY IPC CODES

4.3.4 PATENT TREND OVER TIME (2016–2025)

4.4 PRICING ANALYSIS

4.5 PRODUCTION CAPACITY OF KEY MANUFACTURERS

4.6 BRAND OUTLOOK

4.7 CLIMATE CHANGE SCENARIO

4.7.1 ENVIRONMENTAL CONCERNS

4.7.1.1 Packaging waste volumes and landfill pressure

4.7.1.2 Plastic pollution & microplastics

4.7.1.3 Deforestation and pulp supply stress

4.7.1.4 Greenhouse gas (GHG) emissions across the lifecycle

4.7.1.5 Water and chemical pollution

4.7.1.6 Supply chain vulnerability to extreme weather

4.7.1.7 Regulatory and consumer pressure

4.7.2 INDUSTRY RESPONSE

4.7.2.1 Material substitution and lightweighting

4.7.2.2 Design for recycling & circularity

4.7.2.3 Adoption of recycled and bio-based feedstocks

4.7.2.4 Investment in recycling & recovery partnerships

4.7.2.5 Supply-chain optimization & right-sizing

4.7.2.6 Process & energy efficiency at converters

4.7.2.7 Certification & eco-labeling

4.7.2.8 Innovation in protective solutions

4.7.3 GOVERNMENT’S ROLE

4.7.3.1 Regulation & mandates

4.7.3.2 Standards, labelling & transparency

4.7.3.3 Fiscal instruments & incentives

4.7.3.4 Infrastructure investment

4.7.3.5 Public procurement leadership

4.7.3.6 R&D & standards support

4.7.4 ANALYST RECOMMENDATIONS

4.8 CONSUMER BUYING BEHAVIOR

4.8.1 DEMAND FOR SUSTAINABLE AND ECO-FRIENDLY PACKAGING

4.8.2 PREFERENCE FOR SECURE AND DAMAGE-RESISTANT PACKAGING

4.8.3 RISING IMPORTANCE OF CONVENIENCE AND EASE OF UNBOXING

4.8.4 INFLUENCE OF AESTHETIC APPEAL AND BRAND IDENTITY

4.8.5 INCREASING CONSUMER NEED FOR TRANSPARENCY AND INFORMATION

4.8.6 SHIFT TOWARD PERSONALIZED PACKAGING EXPERIENCES

4.8.7 CONCERNS ABOUT PACKAGING WASTE AND RECYCLING CONVENIENCE

4.8.8 WILLINGNESS TO PAY FOR PREMIUM PACKAGING IN CERTAIN CATEGORIES

4.8.9 CONCLUSION

4.9 COST ANALYSIS BREAKDOWN

4.9.1 TOP-LEVEL COST BUCKETS

4.9.1.1 Raw Materials

4.9.1.2 Manufacturing & Converting

4.9.1.3 Protective Inserts & Cushioning

4.9.1.4 Labour & Fulfilment Handling

4.9.1.5 Packaging Design / Customization / Printing

4.9.1.6 Logistics & Dimensional Weight Impact

4.9.1.7 Returns & Reverse Logistics

4.9.1.8 Sustainability Premium & Compliance Costs

4.9.1.9 Overheads & CAPEX Amortization

4.9.1.10 Supplier Margin / Distributor Markup

4.9.2 TYPICAL COST SHARES

4.9.2.1 Raw Materials + Converting: 50-65% of Total Packaging Cost

4.9.2.2 Labour & Fulfilment Handling: 10-20%

4.9.2.3 Protective Inserts & Void Fill: 5-15%

4.9.2.4 Design / Printing / Customization: 3-10%

4.9.2.5 Sustainability Premium / Compliance: 5-15%

4.9.2.6 Packaging as % of Fulfilment Cost: 15-20%

4.1 INDUSTRY ECOSYSTEM ANALYSIS

4.10.1 PROMINENT COMPANIES

4.10.2 SMALL & MEDIUM-SIZED COMPANIES

4.10.3 END USERS

4.11 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.11.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

4.11.2 NUMBER OF PRODUCTS IN DEVELOPMENT

4.11.3 STAGE OF DEVELOPMENT

4.11.4 TIMELINES AND MILESTONES

4.11.5 INNOVATION STRATEGIES AND METHODOLOGIES

4.11.6 17.6 RISK ASSESSMENT AND MITIGATION

4.11.7 FUTURE OUTLOOK

4.12 PROFIT MARGIN OUTLOOK AND SCENARIO ASSESSMENT

4.12.1 INTRODUCTION

4.12.2 EXPECTED MARGIN PERFORMANCE (BASE CASE)

4.12.3 MARGIN UPSIDE POTENTIAL (FAVOURABLE MARKET ENVIRONMENT)

4.12.4 MARGIN COMPRESSION RISKS (ADVERSE MARKET CONDITIONS)

4.12.5 EXPOSURE TO RAW MATERIAL PRICE VOLATILITY

4.12.6 MARGIN VARIATION BY PRODUCT CATEGORY

4.12.7 INFLUENCE OF SCALE AND AUTOMATION ON COST EFFICIENCY

4.12.8 SENSITIVITY TO DEMAND CYCLICALITY AND PRICING DYNAMICS

4.12.9 FINANCIAL IMPACT OF SUSTAINABILITY REQUIREMENTS

4.12.10 COMPETITIVE INTENSITY AND ITS EFFECT ON MARGIN STRUCTURE

4.12.11 STRATEGIC MARGIN ENHANCEMENT OPPORTUNITIES

4.12.12 CONCLUSION

4.13 RAW MATERIAL COVERAGE

4.13.1 PAPER AND PAPERBOARD: THE DOMINANT RAW MATERIAL

4.13.2 PLASTICS: FLEXIBLE, PROTECTIVE, AND LIGHTWEIGHT

4.13.3 BIODEGRADABLE AND COMPOSTABLE MATERIALS

4.13.4 MOLDED FIBER AND PULP-BASED MATERIALS

4.13.5 FOAMS AND CUSHIONING MATERIALS

4.13.6 ADHESIVES, COATINGS, AND INKS

4.13.7 EMERGING RAW MATERIALS FOR SMARTER PACKAGING

4.13.8 CONCLUSION

4.14 SUPPLY CHAIN ANALYSIS

4.14.1 OVERVIEW

4.14.2 LOGISTIC COST SCENARIO

4.14.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.15 TECHNOLOGICAL ADVANCEMENTS

4.15.1 SMART PACKAGING AND IOT INTEGRATION

4.15.2 AUTOMATION AND ROBOTICS IN FULFILMENT CENTRES

4.15.3 RIGHT-SIZING AND ON-DEMAND PACKAGING TECHNOLOGIES

4.15.4 SUSTAINABLE AND ADVANCED MATERIAL INNOVATIONS

4.15.5 ARTIFICIAL INTELLIGENCE AND DATA-DRIVEN DESIGN

4.15.6 ANTI-COUNTERFEIT AND SECURITY TECHNOLOGIES

4.15.7 ENHANCED CUSTOMIZATION AND DIGITAL PRINTING

4.15.8 CONCLUSION

4.16 VALUE CHAIN ANALYSIS

4.16.1 OVERVIEW

4.16.2 RAW MATERIAL SUPPLY

4.16.3 COMPONENT MANUFACTURING AND PROCESSING

4.16.4 EQUIPMENT & TECHNOLOGY PROVIDERS

4.16.5 DISTRIBUTION AND LOGISTICS

4.16.6 END-USERS

4.16.7 CONCLUSION

4.17 VENDOR SELECTION CRITERIA

4.17.1 PRODUCT QUALITY, DURABILITY, AND COMPLIANCE

4.17.2 SUSTAINABILITY AND ENVIRONMENTAL CERTIFICATIONS

4.17.3 TECHNOLOGICAL CAPABILITIES AND INNOVATION

4.17.4 CUSTOMIZATION, BRANDING, AND CONSUMER EXPERIENCE

4.17.5 COST EFFICIENCY AND TOTAL COST OF OWNERSHIP (TCO)

4.17.6 SUPPLY CHAIN STRENGTH AND ASIA-PACIFIC REACH

4.17.7 CERTIFICATIONS, SAFETY STANDARDS, AND INDUSTRY EXPERTISE

4.17.8 AFTER-SALES SUPPORT AND TECHNICAL ASSISTANCE

4.17.9 CONCLUSION

5 TARIFFS AND IMPACT ANALYSIS

5.1 CURRENT TARIFF RATE(S) IN TOP-5 COUNTRY MARKETS

5.2 OUTLOOK: LOCAL PRODUCTION VS IMPORT RELIANCE

5.3 VENDOR SELECTION CRITERIA DYNAMICS

5.4 IMPACT ON SUPPLY CHAIN

5.4.1 RAW MATERIAL PROCUREMENT

5.4.2 MANUFACTURING AND PRODUCTION

5.4.3 LOGISTICS AND DISTRIBUTION

5.4.4 PRICE PITCHING AND POSITION OF MARKET

5.5 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

5.5.1 SUPPLY CHAIN OPTIMIZATION

5.5.2 JOINT VENTURE ESTABLISHMENTS

5.6 IMPACT ON PRICES

5.7 REGULATORY INCLINATION

5.7.1 GEOPOLITICAL SITUATION

5.7.2 TRADE PARTNERSHIPS BETWEEN COUNTRIES

5.7.2.1 FREE TRADE AGREEMENTS

5.7.2.2 ALLIANCES ESTABLISHMENTS

5.7.3 STATUS ACCREDITATION (INCLUDING MFN)

5.7.4 DOMESTIC COURSE OF CORRECTION

5.7.4.1 INCENTIVE SCHEMES TO BOOST PRODUCTION OUTPUTS

5.7.4.2 ESTABLISHMENT OF SEZs/INDUSTRIAL PARKS

6 REGULATORY COVERAGE

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 REGIONAL INTERNET & SMARTPHONE PENETRATION IN EMERGING MARKETS

7.1.2 RISING CONSUMER EXPECTATIONS FOR PRODUCT PROTECTION AND DELIVERY EXPERIENCE

7.1.3 RAPID GROWTH OF ONLINE RETAIL AND FULFILLMENT NETWORKS

7.1.4 SUSTAINABILITY SHIFT TOWARD RECYCLABLE AND FIBER-BASED FORMATS

7.2 RESTRAINS

7.2.1 VOLATILITY IN RAW MATERIAL PRICES (PAPER, RESINS, ADHESIVES)

7.2.2 PACKAGING WASTE REGULATIONS AND COMPLIANCE COSTS

7.3 OPPORTUNITY

7.3.1 ADOPTION OF AUTOMATION AND RIGHT-SIZING SYSTEMS IN FULFILLMENT

7.3.2 PREMIUMIZATION VIA DIGITAL PRINTING AND BRAND PERSONALIZATION

7.4 CHALLENGES

7.4.1 BALANCING PROTECTION WITH MATERIAL REDUCTION TARGETS

7.4.2 REVERSE LOGISTICS AND RETURNS PACKAGING OPTIMIZATION

8 ASIA-PACIFIC E-COMMERCE PACKAGING MARKET, BY PACKAGING.

8.1 OVERVIEW

8.2 ASIA-PACIFIC E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

8.2.1 CORRUGATED BOXES

8.2.2 BAGS

8.2.3 MAILER

8.2.4 LABELS

8.2.5 PROTECTIVE PACKAGING

8.2.6 PALLET BOXES

8.2.7 TAPES

8.2.8 POSTAL PACKAGING

8.2.9 SHRINK FILM

8.3 ASIA-PACIFIC E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (THOUSAND UNITS)

8.3.1 CORRUGATED BOXES

8.3.2 BAGS

8.3.3 MAILER

8.3.4 LABELS

8.3.5 PROTECTIVE PACKAGING

8.3.6 PALLET BOXES

8.3.7 TAPES

8.3.8 POSTAL PACKAGING

8.3.9 SHRINK FILM

8.4 ASIA-PACIFIC CORRUGATED BOXES IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.4.1 ASIA-PACIFIC

8.4.2 NORTH AMERICA

8.4.3 EUROPE

8.4.4 SOUTH AMERICA

8.4.5 MIDDLE EAST & AFRICA

8.5 ASIA-PACIFIC CORRUGATED BOXES IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

8.5.1 ASIA-PACIFIC

8.5.2 NORTH AMERICA

8.5.3 EUROPE

8.5.4 SOUTH AMERICA

8.5.5 MIDDLE EAST & AFRICA

8.6 ASIA-PACIFIC BAGS IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.6.1 POLYTHENE BAGS

8.6.2 COURIER BAGS

8.6.3 WOVEN SACK BAGS

8.6.4 FOAM BAGS

8.6.5 TEMPER PROOF BAGS

8.6.6 LOCK BAGS

8.6.7 OTHERS

8.7 ASIA-PACIFIC BAGS IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (THOUSAND UNITS)

8.7.1 POLYTHENE BAGS

8.7.2 COURIER BAGS

8.7.3 WOVEN SACK BAGS

8.7.4 FOAM BAGS

8.7.5 TEMPER PROOF BAGS

8.7.6 LOCK BAGS

8.7.7 OTHERS

8.8 ASIA-PACIFIC BAGS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.8.1 ASIA-PACIFIC

8.8.2 NORTH AMERICA

8.8.3 EUROPE

8.8.4 SOUTH AMERICA

8.8.5 MIDDLE EAST & AFRICA

8.9 ASIA-PACIFIC BAGS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

8.9.1 ASIA-PACIFIC

8.9.2 NORTH AMERICA

8.9.3 EUROPE

8.9.4 SOUTH AMERICA

8.9.5 MIDDLE EAST & AFRICA

8.1 ASIA-PACIFIC MAILER IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.10.1 ASIA-PACIFIC

8.10.2 NORTH AMERICA

8.10.3 EUROPE

8.10.4 SOUTH AMERICA

8.10.5 MIDDLE EAST & AFRICA

8.11 ASIA-PACIFIC MAILER IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

8.11.1 ASIA-PACIFIC

8.11.2 NORTH AMERICA

8.11.3 EUROPE

8.11.4 SOUTH AMERICA

8.11.5 MIDDLE EAST & AFRICA

8.12 ASIA-PACIFIC LABELS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.12.1 ASIA-PACIFIC

8.12.2 NORTH AMERICA

8.12.3 EUROPE

8.12.4 SOUTH AMERICA

8.12.5 MIDDLE EAST & AFRICA

8.13 ASIA-PACIFIC LABELS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

8.13.1 ASIA-PACIFIC

8.13.2 NORTH AMERICA

8.13.3 EUROPE

8.13.4 SOUTH AMERICA

8.13.5 MIDDLE EAST & AFRICA

8.14 ASIA-PACIFIC TAPES IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.14.1 SELF-ADHESIVE BOPP TAPES

8.14.2 PRINTED TAPES

8.14.3 REINFORCED PAPER TAPES

8.14.4 PVC PACKING TAPES

8.14.5 PACKAGING SEALING ADHESIVE TAPES

8.14.6 RESEALABLE BAG SEALING TAPES

8.14.7 OTHERS

8.15 ASIA-PACIFIC TAPES IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (THOUSAND UNITS)

8.15.1 SELF-ADHESIVE BOPP TAPES

8.15.2 PRINTED TAPES

8.15.3 REINFORCED PAPER TAPES

8.15.4 PVC PACKING TAPES

8.15.5 PACKAGING SEALING ADHESIVE TAPES

8.15.6 RESEALABLE BAG SEALING TAPES

8.15.7 OTHERS

8.16 ASIA-PACIFIC TAPES IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.16.1 ASIA-PACIFIC

8.16.2 NORTH AMERICA

8.16.3 EUROPE

8.16.4 SOUTH AMERICA

8.16.5 MIDDLE EAST & AFRICA

8.17 ASIA-PACIFIC TAPES IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

8.17.1 ASIA-PACIFIC

8.17.2 NORTH AMERICA

8.17.3 EUROPE

8.17.4 SOUTH AMERICA

8.17.5 MIDDLE EAST & AFRICA

8.18 ASIA-PACIFIC PROTECTIVE PACKAGING IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.18.1 AIR BUBBLE ROLLS

8.18.2 CORRUGATED ROLLS

8.18.3 OTHERS

8.19 ASIA-PACIFIC PROTECTIVE PACKAGING IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (THOUSAND UNITS )

8.19.1 AIR BUBBLE ROLLS

8.19.2 CORRUGATED ROLLS

8.19.3 OTHERS

8.2 ASIA-PACIFIC PROTECTIVE PACKAGING IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.20.1 ASIA-PACIFIC

8.20.2 NORTH AMERICA

8.20.3 EUROPE

8.20.4 SOUTH AMERICA

8.20.5 MIDDLE EAST & AFRICA

8.21 ASIA-PACIFIC PROTECTIVE PACKAGING IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

8.21.1 ASIA-PACIFIC

8.21.2 NORTH AMERICA

8.21.3 EUROPE

8.21.4 SOUTH AMERICA

8.21.5 MIDDLE EAST & AFRICA

8.22 ASIA-PACIFIC PALLET BOXES IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.22.1 ASIA-PACIFIC

8.22.2 NORTH AMERICA

8.22.3 EUROPE

8.22.4 SOUTH AMERICA

8.22.5 MIDDLE EAST & AFRICA

8.23 ASIA-PACIFIC PALLET BOXES IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

8.23.1 ASIA-PACIFIC

8.23.2 NORTH AMERICA

8.23.3 EUROPE

8.23.4 SOUTH AMERICA

8.23.5 MIDDLE EAST & AFRICA

8.24 ASIA-PACIFIC POSTAL PACKAGING IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.24.1 ASIA-PACIFIC

8.24.2 NORTH AMERICA

8.24.3 EUROPE

8.24.4 SOUTH AMERICA

8.24.5 MIDDLE EAST & AFRICA

8.25 ASIA-PACIFIC POSTAL PACKAGING IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

8.25.1 ASIA-PACIFIC

8.25.2 NORTH AMERICA

8.25.3 EUROPE

8.25.4 SOUTH AMERICA

8.25.5 MIDDLE EAST & AFRICA

8.26 ASIA-PACIFIC SHRINK FILM IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.26.1 ASIA-PACIFIC

8.26.2 NORTH AMERICA

8.26.3 EUROPE

8.26.4 SOUTH AMERICA

8.26.5 MIDDLE EAST & AFRICA

8.27 ASIA-PACIFIC SHRINK FILMING E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

8.27.1 ASIA-PACIFIC

8.27.2 NORTH AMERICA

8.27.3 EUROPE

8.27.4 SOUTH AMERICA

8.27.5 MIDDLE EAST & AFRICA

9 ASIA-PACIFIC E-COMMERCE PACKAGING MARKET, BY MATERIAL.

9.1 OVERVIEW

9.2 ASIA-PACIFIC E-COMMERCE PACKAGING MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

9.2.1 FIBER-BASED

9.2.2 RECYCLED CONTENT & POST-CONSUMER RECYCLED (PCR) PLASTICS

9.2.3 BIO-BASED MATERIALS

9.2.4 CONVENTIONAL PLASTICS (VIRGIN PLASTICS)

9.2.5 OTHERS

9.3 ASIA-PACIFIC FIBER-BASED IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.3.1 CORRUGATED BOARD

9.3.2 PAPER & PAPERBOARD

9.4 ASIA-PACIFIC CORRUGATED BOARD IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.4.1 SINGLE WALL

9.4.2 DOUBLE WALL

9.4.3 SINGLE FACE

9.4.4 TRIPLE WALL

9.4.5 OTHERS

9.5 ASIA-PACIFIC FIBER-BASED IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.5.1 ASIA-PACIFIC

9.5.2 NORTH AMERICA

9.5.3 EUROPE

9.5.4 SOUTH AMERICA

9.5.5 MIDDLE EAST & AFRICA

9.6 ASIA-PACIFIC RECYCLED CONTENT & POST-CONSUMER RECYCLED (PCR) PLASTICS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.6.1 ASIA-PACIFIC

9.6.2 NORTH AMERICA

9.6.3 EUROPE

9.6.4 SOUTH AMERICA

9.6.5 MIDDLE EAST & AFRICA

9.7 ASIA-PACIFIC BIO-BASED MATERIALS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.7.1 ASIA-PACIFIC

9.7.2 NORTH AMERICA

9.7.3 EUROPE

9.7.4 SOUTH AMERICA

9.7.5 MIDDLE EAST & AFRICA

9.8 ASIA-PACIFIC CONVENTIONAL PLASTICS (VIRGIN PLASTICS) IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.8.1 ASIA-PACIFIC

9.8.2 NORTH AMERICA

9.8.3 EUROPE

9.8.4 SOUTH AMERICA

9.8.5 MIDDLE EAST & AFRICA

9.9 ASIA-PACIFIC OTHERS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.9.1 ASIA-PACIFIC

9.9.2 NORTH AMERICA

9.9.3 EUROPE

9.9.4 SOUTH AMERICA

9.9.5 MIDDLE EAST & AFRICA

10 ASIA-PACIFIC E-COMMERCE PACKAGING MARKET, BY END-USER.

10.1 OVERVIEW

10.2 ASIA-PACIFIC E-COMMERCE PACKAGING MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

10.2.1 APPARELS AND ACCESSORIES (EX. LEATHER BASED) (0001)

10.2.2 ELECTRONICS & ELECTRICAL (2500)

10.2.3 TEXTILE (0001)

10.2.4 HOUSEHOLD (2000,0001)

10.2.5 PERSONAL CARE (2000,0001)

10.2.6 FOOD AND BEVERAGES (1000,1100)

10.2.7 PHARMACEUTICALS (2100)

10.2.8 AUTOMOTIVE (4600)

10.2.9 FABRICATED METAL PRODUCTS (2500)

10.2.10 CHEMICAL PRODUCTS (2000)

10.2.11 AGRICULTURE (0100)

10.2.12 FURNITURE (0001)

10.2.13 WOOD AND WOOD PRODUCTS (EX. FURNITURE) (0001)

10.2.14 LEATHER AND LEATHER GOODS (0001)

10.2.15 CONSTRUCTION MATERIALS (2000,0001)

10.2.16 TOBACCO PRODUCTS (0001)

10.3 ASIA-PACIFIC APPAREL & ACCESSORIES IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

10.3.1 RETAIL

10.3.2 WHOLESALE

10.4 ASIA-PACIFIC APPAREL & ACCESSORIES IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

10.4.1 CORRUGATED BOXES

10.4.2 BAGS

10.4.3 MAILER

10.4.4 LABELS

10.4.5 PROTECTIVE PACKAGING

10.4.6 PALLET BOXES

10.4.7 TAPES

10.4.8 POSTAL PACKAGING

10.4.9 SHRINK FILM

10.5 ASIA-PACIFIC APPAREL & ACCESSORIES IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.5.1 ASIA-PACIFIC

10.5.2 NORTH AMERICA

10.5.3 EUROPE

10.5.4 SOUTH AMERICA

10.5.5 MIDDLE EAST & AFRICA

10.6 ASIA-PACIFIC ELECTRONICS & ELECTRICAL IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

10.6.1 RETAIL

10.6.2 WHOLESALE

10.7 ASIA-PACIFIC ELECTRONICS & ELECTRICAL IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

10.7.1 CORRUGATED BOXES

10.7.2 BAGS

10.7.3 MAILER

10.7.4 LABELS

10.7.5 PROTECTIVE PACKAGING

10.7.6 PALLET BOXES

10.7.7 TAPES

10.7.8 POSTAL PACKAGING

10.7.9 SHRINK FILM

10.8 ASIA-PACIFIC ELECTRONICS & ELECTRICAL IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

10.8.1 COMPUTERS, ELECTRONIC AND OPTICAL PRODUCTS

10.8.2 ELECTRICAL EQUIPMENT

10.8.3 OTHERS

10.9 ASIA-PACIFIC ELECTRONICS & ELECTRICAL IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.9.1 ASIA-PACIFIC

10.9.2 NORTH AMERICA

10.9.3 EUROPE

10.9.4 SOUTH AMERICA

10.9.5 MIDDLE EAST & AFRICA

10.1 ASIA-PACIFIC TEXTILE IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

10.10.1 RETAIL

10.10.2 WHOLESALE

10.11 ASIA-PACIFIC TEXTILE IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

10.11.1 CORRUGATED BOXES

10.11.2 BAGS

10.11.3 MAILER

10.11.4 LABELS

10.11.5 PROTECTIVE PACKAGING

10.11.6 PALLET BOXES

10.11.7 TAPES

10.11.8 POSTAL PACKAGING

10.11.9 SHRINK FILM

10.12 ASIA-PACIFIC TEXTILE IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.12.1 ASIA-PACIFIC

10.12.2 NORTH AMERICA

10.12.3 EUROPE

10.12.4 SOUTH AMERICA

10.12.5 MIDDLE EAST & AFRICA

10.13 ASIA-PACIFIC HOUSEHOLD IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

10.13.1 RETAIL

10.13.2 WHOLESALE

10.14 ASIA-PACIFIC HOUSEHOLD IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

10.14.1 CORRUGATED BOXES

10.14.2 BAGS

10.14.3 MAILER

10.14.4 LABELS

10.14.5 PROTECTIVE PACKAGING

10.14.6 PALLET BOXES

10.14.7 TAPES

10.14.8 POSTAL PACKAGING

10.14.9 SHRINK FILM

10.15 ASIA-PACIFIC HOUSEHOLD IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.15.1 ASIA-PACIFIC

10.15.2 NORTH AMERICA

10.15.3 EUROPE

10.15.4 SOUTH AMERICA

10.15.5 MIDDLE EAST & AFRICA

10.16 ASIA-PACIFIC PERSONAL CARE IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

10.16.1 RETAIL

10.16.2 WHOLESALE

10.17 ASIA-PACIFIC PERSONAL CARE IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

10.17.1 CORRUGATED BOXES

10.17.2 BAGS

10.17.3 MAILER

10.17.4 LABELS

10.17.5 PROTECTIVE PACKAGING

10.17.6 PALLET BOXES

10.17.7 TAPES

10.17.8 POSTAL PACKAGING

10.17.9 SHRINK FILM

10.18 ASIA-PACIFIC PERSONAL CARE IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.18.1 ASIA-PACIFIC

10.18.2 NORTH AMERICA

10.18.3 EUROPE

10.18.4 SOUTH AMERICA

10.18.5 MIDDLE EAST & AFRICA

10.19 ASIA-PACIFIC FOOD AND BEVERAGES IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

10.19.1 RETAIL

10.19.2 WHOLESALE

10.2 ASIA-PACIFIC FOOD AND BEVERAGES IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

10.20.1 CORRUGATED BOXES

10.20.2 BAGS

10.20.3 MAILER

10.20.4 LABELS

10.20.5 PROTECTIVE PACKAGING

10.20.6 PALLET BOXES

10.20.7 TAPES

10.20.8 POSTAL PACKAGING

10.20.9 SHRINK FILM

10.21 ASIA-PACIFIC FOOD AND BEVERAGES IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

10.21.1 FOOD

10.21.2 BEVERAGES

10.22 ASIA-PACIFIC FOOD AND BEVERAGES IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.22.1 ASIA-PACIFIC

10.22.2 NORTH AMERICA

10.22.3 EUROPE

10.22.4 SOUTH AMERICA

10.22.5 MIDDLE EAST & AFRICA

10.23 ASIA-PACIFIC PHARMACEUTICALS IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

10.23.1 RETAIL

10.23.2 WHOLESALE

10.24 ASIA-PACIFIC PHARMACEUTICALS IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

10.24.1 CORRUGATED BOXES

10.24.2 BAGS

10.24.3 MAILER

10.24.4 LABELS

10.24.5 PROTECTIVE PACKAGING

10.24.6 PALLET BOXES

10.24.7 TAPES

10.24.8 POSTAL PACKAGING

10.24.9 SHRINK FILM

10.25 ASIA-PACIFIC PHARMACEUTICALS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.25.1 ASIA-PACIFIC

10.25.2 NORTH AMERICA

10.25.3 EUROPE

10.25.4 SOUTH AMERICA

10.25.5 MIDDLE EAST & AFRICA

10.26 ASIA-PACIFIC AUTOMOTIVE IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

10.26.1 RETAIL

10.26.2 WHOLESALE

10.27 ASIA-PACIFIC AUTOMOTIVE IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

10.27.1 CORRUGATED BOXES

10.27.2 BAGS

10.27.3 MAILER

10.27.4 LABELS

10.27.5 PROTECTIVE PACKAGING

10.27.6 PALLET BOXES

10.27.7 TAPES

10.27.8 POSTAL PACKAGING

10.27.9 SHRINK FILM

10.28 ASIA-PACIFIC AUTOMOTIVE IN E-COMMERCE PACKAGING MARKET, BY COMMODITY TYPE, 2018-2033 (USD THOUSAND)

10.28.1 SPARE PARTS

10.28.2 VEHICLE MODIFICATION PARTS

10.29 ASIA-PACIFIC AUTOMOTIVE IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.29.1 ASIA-PACIFIC

10.29.2 NORTH AMERICA

10.29.3 EUROPE

10.29.4 SOUTH AMERICA

10.29.5 MIDDLE EAST & AFRICA

10.3 ASIA-PACIFIC FABRICATED METAL PRODUCTS IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

10.30.1 RETAIL

10.30.2 WHOLESALE

10.31 ASIA-PACIFIC FABRICATED METAL PRODUCTS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.32 ASIA-PACIFIC

10.32.1 NORTH AMERICA

10.32.2 EUROPE

10.32.3 SOUTH AMERICA

10.32.4 MIDDLE EAST & AFRICA

10.33 ASIA-PACIFIC CHEMICAL PRODUCTS IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

10.33.1 RETAIL

10.33.2 WHOLESALE

10.34 ASIA-PACIFIC CHEMICAL PRODUCTS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.34.1 ASIA-PACIFIC

10.34.2 NORTH AMERICA

10.34.3 EUROPE

10.34.4 SOUTH AMERICA

10.34.5 MIDDLE EAST & AFRICA

10.35 ASIA-PACIFIC AGRICULTURE IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

10.35.1 RETAIL

10.35.2 WHOLESALE

10.36 ASIA-PACIFIC AGRICULTURE IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

10.36.1 FERTILIZERS

10.36.2 FISHING AND AQUACULTURE PRODUCTS

10.36.3 PLANTS

10.36.4 SEEDS

10.36.5 OTHERS

10.37 ASIA-PACIFIC AGRICULTURE IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.37.1 ASIA-PACIFIC

10.37.2 NORTH AMERICA

10.37.3 EUROPE

10.37.4 SOUTH AMERICA

10.37.5 MIDDLE EAST & AFRICA

10.38 ASIA-PACIFIC FURNITURE IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

10.38.1 RETAIL

10.38.2 WHOLESALE

10.39 ASIA-PACIFIC FURNITURE IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.39.1 ASIA-PACIFIC

10.39.2 NORTH AMERICA

10.39.3 EUROPE

10.39.4 SOUTH AMERICA

10.39.5 MIDDLE EAST & AFRICA

10.4 ASIA-PACIFIC WOOD AND WOOD PRODUCTS (EX. FURNITURE) IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

10.40.1 RETAIL

10.40.2 WHOLESALE

10.41 ASIA-PACIFIC WOOD AND WOOD PRODUCTS (EX. FURNITURE) IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.41.1 ASIA-PACIFIC

10.41.2 NORTH AMERICA

10.41.3 EUROPE

10.41.4 SOUTH AMERICA

10.41.5 MIDDLE EAST & AFRICA

10.42 ASIA-PACIFIC LEATHER AND LEATHER GOODS PRODUCTS IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

10.42.1 RETAIL

10.42.2 WHOLESALE

10.43 ASIA-PACIFIC LEATHER AND LEATHER GOODS PRODUCTS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.43.1 ASIA-PACIFIC

10.43.2 NORTH AMERICA

10.43.3 EUROPE

10.43.4 SOUTH AMERICA

10.43.5 MIDDLE EAST & AFRICA

10.44 ASIA-PACIFIC CONSTRUCTION MATERIALS IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

10.44.1 RETAIL

10.44.2 WHOLESALE

10.45 ASIA-PACIFIC CONSTRUCTION MATERIALS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.45.1 ASIA-PACIFIC

10.45.2 NORTH AMERICA

10.45.3 EUROPE

10.45.4 SOUTH AMERICA

10.45.5 MIDDLE EAST & AFRICA

10.46 ASIA-PACIFIC TOBACCO PRODUCTS IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

10.46.1 RETAIL

10.46.2 WHOLESALE

10.47 ASIA-PACIFIC TOBACCO PRODUCTS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.47.1 ASIA-PACIFIC

10.47.2 NORTH AMERICA

10.47.3 EUROPE

10.47.4 SOUTH AMERICA

10.47.5 MIDDLE EAST & AFRICA

10.48 ASIA-PACIFIC OTHERS IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

10.48.1 CORRUGATED BOXES

10.48.2 BAGS

10.48.3 MAILER

10.48.4 LABELS

10.48.5 PROTECTIVE PACKAGING

10.48.6 PALLET BOXES

10.48.7 TAPES

10.48.8 POSTAL PACKAGING

10.48.9 SHRINK FILM

10.49 ASIA-PACIFIC OTHERS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.49.1 ASIA-PACIFIC

10.49.2 NORTH AMERICA

10.49.3 EUROPE

10.49.4 SOUTH AMERICA

10.49.5 MIDDLE EAST & AFRICA

11 ASIA-PACIFIC E-COMMERCE PACKAGING MARKET, BY DISTRIBUTION CHANNEL.

11.1 OVERVIEW

11.2 ASIA-PACIFIC E-COMMERCE PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

11.2.1 DIRECT

11.2.2 INDIRECT

11.3 ASIA-PACIFIC DIRECT SALES IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.3.1 COMPANY OWNED WEBSITES

11.3.2 FIELD AGENTS

11.3.3 DIRECT CONTRACTS

11.4 ASIA-PACIFIC INDIRECT SALES IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.4.1 DISTRIBUTORS / WHOLESALERS

11.4.2 VALUE-ADDED RESELLERS (VARS)

11.4.3 THIRD-PARTY ONLINE MARKETPLACES

11.5 ASIA-PACIFIC DIRECT SALE IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.5.1 ASIA-PACIFIC

11.5.2 NORTH AMERICA

11.5.3 EUROPE

11.5.4 SOUTH AMERICA

11.5.5 MIDDLE EAST & AFRICA

11.6 ASIA-PACIFIC INDIRECT SALE IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.6.1 ASIA-PACIFIC

11.6.2 NORTH AMERICA

11.6.3 EUROPE

11.6.4 SOUTH AMERICA

11.6.5 MIDDLE EAST & AFRICA

12 ASIA-PACIFIC E-COMMERCE PACKAGING MARKET, BY GEOGRAPHY

12.1 ASIA-PACIFIC

12.1.1 CHINA

12.1.2 INDIA

12.1.3 JAPAN

12.1.4 SOUTH KOREA

12.1.5 AUSTRALIA

12.1.6 INDONESIA

12.1.7 THAILAND

12.1.8 TAIWAN

12.1.9 SINGAPORE

12.1.10 MALAYSIA

12.1.11 PHILIPPINES

12.1.12 HONG KONG

12.1.13 NEW ZEALAND

12.1.14 REST OF ASIA-PACIFIC

13 ASIA-PACIFIC E-COMMERCE PACKAGING MARKET: COMPANY LANDSCAPE

13.1 MANUFACTURER COMPANY SHARE ANALYSIS: GLOBAL

14 SWOT ANALYSIS

15 MANUFACTURERS COMPANY PROFILE

15.1 INTERNATIONAL PAPER

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENT

15.2 AMCOR PLC

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.3 DS SMITH

15.3.1 COMPANY SNAPSHOT

15.3.2 COMPANY SHARE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENT

15.4 SMURFIT WESTROCK

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENT

15.5 PACKAGING CORPORATION OF AMERICA.

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENT

15.6 3M

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENT

15.7 ALTPAC

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 AVERY DENNISON CORPORATION

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENT

15.9 BLUE BOX PACKAGING

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 BOXON AB

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 COSMO FILMS

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT DEVELOPMENT

15.12 ECOM PACKAGING

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 ECB

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 FILMAR GROUP

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 GEORGIA-PACIFIC LLC

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 GREEN BAY PACKAGING INC

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 IPG

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

15.18 KLABIN S.A

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 PRODUCT PORTFOLIO

15.18.4 RECENT DEVELOPMENT

15.19 MONDI

15.19.1 COMPANY SNAPSHOT

15.19.2 REVENUE ANALYSIS

15.19.3 PRODUCT PORTFOLIO

15.19.4 RECENT DEVELOPMENT

15.2 NINE DRAGONS WORLDWIDE (CHINA) INVESTMENT GROUP CO., LTD.

15.20.1 COMPANY SNAPSHOT

15.20.2 REVENUE ANALYSIS

15.20.3 PRODUCT PORTFOLIO

15.20.4 RECENT DEVELOPMENT

15.21 OJI HOLDINGS CORPORATION.

15.21.1 COMPANY SNAPSHOT

15.21.2 REVENUE ANALYSIS

15.21.3 PRODUCT PORTFOLIO

15.21.4 RECENT DEVELOPMENT

15.22 PACKHELP

15.22.1 COMPANY SNAPSHOT

15.22.2 PRODUCT PORTFOLIO

15.22.3 RECENT DEVELOPMENT

15.23 PACKMAN PACKAGING PRIVATE LIMITED.

15.23.1 COMPANY SNAPSHOT

15.23.2 PRODUCT PORTFOLIO

15.23.3 RECENT DEVELOPMENT

15.24 PACKTEK

15.24.1 COMPANY SNAPSHOT

15.24.2 PRODUCT PORTFOLIO

15.24.3 RECENT DEVELOPMENT

15.25 PRATT INDUSTRIES INC.

15.25.1 COMPANY SNAPSHOT

15.25.2 PRODUCT PORTFOLIO

15.25.3 RECENT DEVELOPMENT

15.26 PREGIS LLC

15.26.1 COMPANY SNAPSHOT

15.26.2 PRODUCT PORTFOLIO

15.26.3 RECENT DEVELOPMENT

15.27 PREM INDUSTRIES INDIA LIMITED

15.27.1 COMPANY SNAPSHOT

15.27.2 PRODUCT PORTFOLIO

15.27.3 RECENT DEVELOPMENT

15.28 RANPAK

15.28.1 COMPANY SNAPSHOT

15.28.2 REVENUE ANALYSIS

15.28.3 PRODUCT PORTFOLIO

15.28.4 RECENT DEVELOPMENT

15.29 SEALED AIR

15.29.1 COMPANY SNAPSHOT

15.29.2 REVENUE ANALYSIS

15.29.3 PRODUCT PORTFOLIO

15.29.4 RECENT DEVELOPMENT

15.3 STORA ENSO

15.30.1 COMPANY SNAPSHOT

15.30.2 REVENUE ANALYSIS

15.30.3 PRODUCT PORTFOLIO

15.30.4 RECENT DEVELOPMENT

16 DISTRIBUTOR COMPANY PROFILE

16.1 BUNZL PLC

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 PRODUCT PORTFOLIO

16.1.4 RECENT DEVELOPMENT

16.2 MACFARLANE PACKAGING (A SUBSIDIARY COMPANY OF MACFARLANE GROUP PLC)

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT DEVELOPMENT

16.3 RAJAPACK LTD

16.3.1 COMPANY SNAPSHOT

16.3.2 PRODUCT PORTFOLIO

16.3.3 RECENT DEVELOPMENT

16.4 ULINE

16.4.1 COMPANY SNAPSHOT

16.4.2 PRODUCT PORTFOLIO

16.4.3 RECENT DEVELOPMENT

16.5 VERITIV OPERATING COMPANY

16.5.1 COMPANY SNAPSHOT

16.5.2 PRODUCT PORTFOLIO

16.5.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

Liste des tableaux

TABLE 1 PRODUCTION CAPACITY OF KEY MANUFACTURERS

TABLE 2 BRAND COMPARATIVE ANALYSIS

TABLE 3 CONSUMER PREFERENCE MATRIX

TABLE 4 REGULATORY COVERAGE

TABLE 5 ASIA-PACIFIC E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 6 ASIA-PACIFIC E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (THOUSAND UNITS)

TABLE 7 ASIA-PACIFIC CORRUGATED BOXES IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 8 ASIA-PACIFIC CORRUGATED BOXES IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

TABLE 9 ASIA-PACIFIC BAGS IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 10 ASIA-PACIFIC BAGS IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (THOUSAND UNITS)

TABLE 11 ASIA-PACIFIC BAGS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 12 ASIA-PACIFIC BAGS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

TABLE 13 ASIA-PACIFIC MAILER IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 14 ASIA-PACIFIC MAILER IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

TABLE 15 ASIA-PACIFIC LABELS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 16 ASIA-PACIFIC LABELS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

TABLE 17 ASIA-PACIFIC TAPES IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 18 ASIA-PACIFIC TAPES IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (THOUSAND UNITS)

TABLE 19 ASIA-PACIFIC TAPES IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 20 ASIA-PACIFIC TAPES IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

TABLE 21 ASIA-PACIFIC PROTECTIVE PACKAGING IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 22 ASIA-PACIFIC PROTECTIVE PACKAGING IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (THOUSAND UNITS )

TABLE 23 ASIA-PACIFIC PROTECTIVE PACKAGING IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 24 ASIA-PACIFIC PROTECTIVE PACKAGING IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

TABLE 25 ASIA-PACIFIC PALLET BOXES IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 26 ASIA-PACIFIC PALLET BOXES IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

TABLE 27 ASIA-PACIFIC POSTAL PACKAGING IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 28 ASIA-PACIFIC POSTAL PACKAGING IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

TABLE 29 ASIA-PACIFIC SHRINK FILM IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 30 ASIA-PACIFIC SHRINK FILMING E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

TABLE 31 ASIA-PACIFIC E-COMMERCE PACKAGING MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 32 ASIA-PACIFIC FIBER-BASED IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 33 ASIA-PACIFIC CORRUGATED BOARD IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 34 ASIA-PACIFIC FIBER-BASED IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 35 ASIA-PACIFIC RECYCLED CONTENT & POST-CONSUMER RECYCLED (PCR) PLASTICS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 36 ASIA-PACIFIC BIO-BASED MATERIALS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 37 ASIA-PACIFIC CONVENTIONAL PLASTICS (VIRGIN PLASTICS) IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 38 ASIA-PACIFIC OTHERS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 39 ASIA-PACIFIC E-COMMERCE PACKAGING MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 40 ASIA-PACIFIC APPAREL & ACCESSORIES IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 41 ASIA-PACIFIC APPAREL & ACCESSORIES IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 42 ASIA-PACIFIC APPAREL & ACCESSORIES IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 43 ASIA-PACIFIC ELECTRONICS & ELECTRICAL IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 44 ASIA-PACIFIC ELECTRONICS & ELECTRICAL IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 45 ASIA-PACIFIC ELECTRONICS & ELECTRICAL IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 46 ASIA-PACIFIC ELECTRONICS & ELECTRICAL IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 47 ASIA-PACIFIC TEXTILE IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 48 ASIA-PACIFIC TEXTILE IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 49 ASIA-PACIFIC TEXTILE IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 50 ASIA-PACIFIC HOUSEHOLD IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 51 ASIA-PACIFIC HOUSEHOLD IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 52 ASIA-PACIFIC HOUSEHOLD IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 53 ASIA-PACIFIC PERSONAL CARE IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 54 ASIA-PACIFIC PERSONAL CARE IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 55 ASIA-PACIFIC PERSONAL CARE IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 56 ASIA-PACIFIC FOOD AND BEVERAGES IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 57 ASIA-PACIFIC FOOD AND BEVERAGES IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 58 ASIA-PACIFIC FOOD AND BEVERAGES IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 59 ASIA-PACIFIC FOOD AND BEVERAGES IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 60 ASIA-PACIFIC PHARMACEUTICALS IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 61 ASIA-PACIFIC PHARMACEUTICALS IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 62 ASIA-PACIFIC PHARMACEUTICALS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 63 ASIA-PACIFIC AUTOMOTIVE IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 64 ASIA-PACIFIC AUTOMOTIVE IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 65 ASIA-PACIFIC AUTOMOTIVE IN E-COMMERCE PACKAGING MARKET, BY COMMODITY TYPE, 2018-2033 (USD THOUSAND)

TABLE 66 ASIA-PACIFIC AUTOMOTIVE IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 67 ASIA-PACIFIC FABRICATED METAL PRODUCTS IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 68 ASIA-PACIFIC FABRICATED METAL PRODUCTS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 69 ASIA-PACIFIC CHEMICAL PRODUCTS IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 70 ASIA-PACIFIC CHEMICAL PRODUCTS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 71 ASIA-PACIFIC AGRICULTURE IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 72 ASIA-PACIFIC AGRICULTURE IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 73 ASIA-PACIFIC AGRICULTURE IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 74 ASIA-PACIFIC FURNITURE IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 75 ASIA-PACIFIC FURNITURE IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 76 ASIA-PACIFIC WOOD AND WOOD PRODUCTS (EX. FURNITURE) IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 77 ASIA-PACIFIC WOOD AND WOOD PRODUCTS (EX. FURNITURE) IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 78 ASIA-PACIFIC LEATHER AND LEATHER GOODS PRODUCTS IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 79 ASIA-PACIFIC LEATHER AND LEATHER GOODS PRODUCTS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 80 ASIA-PACIFIC CONSTRUCTION MATERIALS IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 81 ASIA-PACIFIC CONSTRUCTION MATERIALS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 82 ASIA-PACIFIC TOBACCO PRODUCTS IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 83 ASIA-PACIFIC TOBACCO PRODUCTS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 84 ASIA-PACIFIC OTHERS IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 85 ASIA-PACIFIC OTHERS IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 86 ASIA-PACIFIC OTHERS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 87 ASIA-PACIFIC E-COMMERCE PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 88 ASIA-PACIFIC DIRECT SALES IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 89 ASIA-PACIFIC INDIRECT SALES IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 90 ASIA-PACIFIC DIRECT SALE IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 91 ASIA-PACIFIC INDIRECT SALE IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 92 ASIA-PACIFIC

TABLE 93 ASIA-PACIFIC E-COMMERCE PACKAGING MARKET, BY COUNTRY, 2018-2033 (USD THOUSAND)

TABLE 94 ASIA-PACIFIC

TABLE 95 ASIA-PACIFIC E-COMMERCE PACKAGING MARKET, BY COUNTRY, 2018-2033 (THOUSAND UNITS)

TABLE 96 THOUSAND

TABLE 97 ASIA-PACIFIC E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 98 ASIA-PACIFIC E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (THOUSAND UNITS)

TABLE 99 ASIA-PACIFIC BAGS IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 100 ASIA-PACIFIC BAGS IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (THOUSAND UNITS)

TABLE 101 ASIA-PACIFIC TAPES IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 102 ASIA-PACIFIC TAPES IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (THOUSAND UNITS)

TABLE 103 ASIA-PACIFIC PROTECTIVE PACKAGING IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 104 ASIA-PACIFIC PROTECTIVE PACKAGING IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (THOUSAND UNITS )

TABLE 105 ASIA-PACIFIC E-COMMERCE PACKAGING MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 106 ASIA-PACIFIC FIBER-BASED IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 107 ASIA-PACIFIC CORRUGATED BOARD IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 108 ASIA-PACIFIC E-COMMERCE PACKAGING MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 109 ASIA-PACIFIC APPAREL & ACCESSORIES IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 110 ASIA-PACIFIC APPAREL & ACCESSORIES IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 111 ASIA-PACIFIC ELECTRONICS & ELECTRICAL IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 112 ASIA-PACIFIC ELECTRONICS & ELECTRICAL IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 113 ASIA-PACIFIC ELECTRONICS & ELECTRICAL IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 114 ASIA-PACIFIC TEXTILE IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 115 ASIA-PACIFIC TEXTILE IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 116 ASIA-PACIFIC HOUSEHOLD IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 117 ASIA-PACIFIC HOUSEHOLD IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 118 ASIA-PACIFIC PERSONAL CARE IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 119 ASIA-PACIFIC PERSONAL CARE IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 120 ASIA-PACIFIC FOOD AND BEVERAGES IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 121 ASIA-PACIFIC FOOD AND BEVERAGES IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 122 ASIA-PACIFIC FOOD AND BEVERAGES IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 123 ASIA-PACIFIC PHARMACEUTICALS IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 124 ASIA-PACIFIC PHARMACEUTICALS IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 125 ASIA-PACIFIC AUTOMOTIVE IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 126 ASIA-PACIFIC AUTOMOTIVE IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 127 ASIA-PACIFIC AUTOMOTIVE IN E-COMMERCE PACKAGING MARKET, BY COMMODITY TYPE, 2018-2033 (USD THOUSAND)

TABLE 128 ASIA-PACIFIC FABRICATED METAL PRODUCTS IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 129 ASIA-PACIFIC CHEMICAL PRODUCTS IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 130 ASIA-PACIFIC AGRICULTURE IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 131 ASIA-PACIFIC AGRICULTURE IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 132 ASIA-PACIFIC FURNITURE IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 133 ASIA-PACIFIC WOOD AND WOOD PRODUCTS (EX. FURNITURE) IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 134 ASIA-PACIFIC LEATHER AND LEATHER GOODS PRODUCTS IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 135 ASIA-PACIFIC CONSTRUCTION MATERIALS IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 136 ASIA-PACIFIC TOBACCO PRODUCTS IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 137 ASIA-PACIFIC OTHERS IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 138 ASIA-PACIFIC OTHERS IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 139 ASIA-PACIFIC E-COMMERCE PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 140 ASIA-PACIFIC DIRECT SALES IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 141 ASIA-PACIFIC INDIRECT SALES IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 142 CHINA E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 143 CHINA E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (THOUSAND UNITS)

TABLE 144 CHINA BAGS IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 145 CHINA BAGS IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (THOUSAND UNITS)

TABLE 146 CHINA TAPES IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 147 CHINA TAPES IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (THOUSAND UNITS)

TABLE 148 CHINA PROTECTIVE PACKAGING IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)