Asia Pacific Deodorant Market

Taille du marché en milliards USD

TCAC :

%

USD

34.75 Billion

USD

54.97 Billion

2024

2032

USD

34.75 Billion

USD

54.97 Billion

2024

2032

| 2025 –2032 | |

| USD 34.75 Billion | |

| USD 54.97 Billion | |

|

|

|

Segmentation du marché des déodorants en Asie-Pacifique, par type de produit (spray, crèmes, roll-on, autres), canal de distribution (supermarchés/hypermarchés, supérettes, pharmacies et parapharmacies, vente au détail en ligne, autres), matériau d'emballage (métal, plastique, autres), utilisateur final (hommes, femmes, autres) – Tendances et prévisions de l'industrie jusqu'en 2032

Analyse du marché des déodorants

Avec l'augmentation de la participation des femmes au marché du travail, la demande de produits de soins personnels a connu une croissance considérable au fil des ans. En outre, les opérations promotionnelles actives des fabricants sur diverses plateformes de médias sociaux contribueront considérablement à l'expansion du marché. Par conséquent, tout au long de la période prévue, le marché devrait augmenter considérablement.

Taille du marché des déodorants

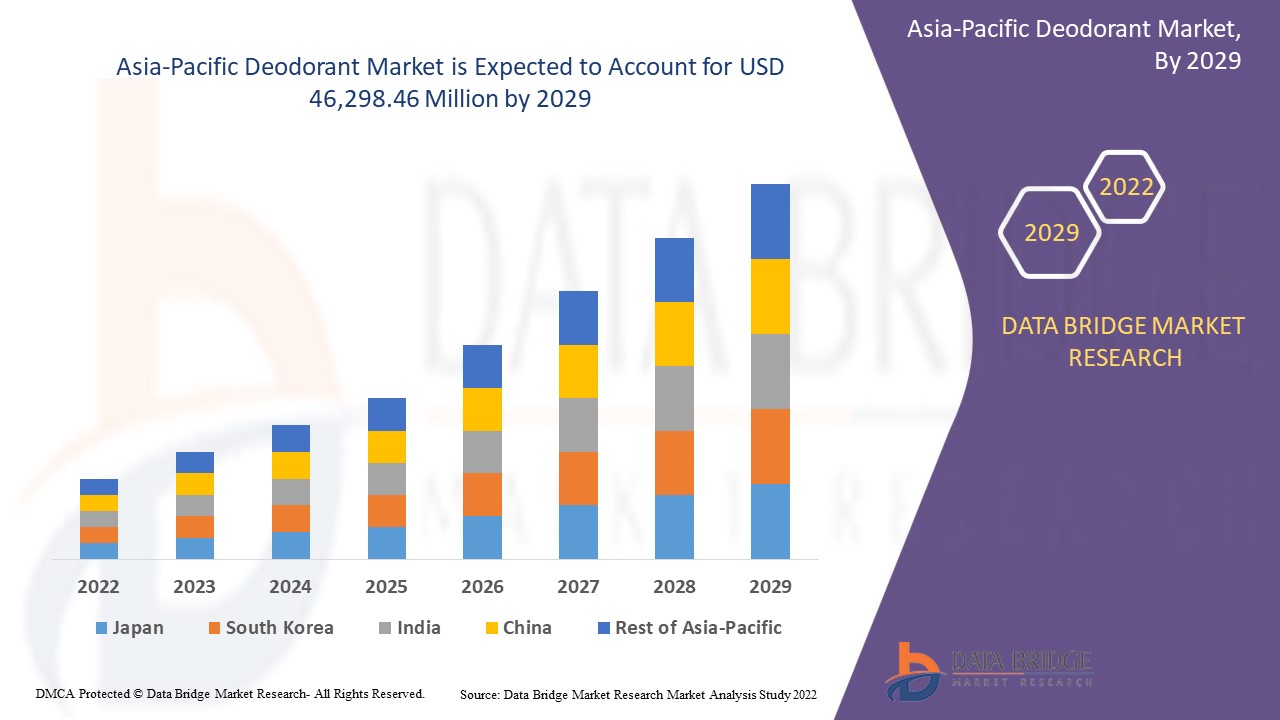

La taille du marché des déodorants en Asie-Pacifique était évaluée à 34,75 milliards USD en 2024 et devrait atteindre 54,97 milliards USD d'ici 2032, avec un TCAC de 5,90 % au cours de la période de prévision de 2025 à 2032.

Portée du rapport et segmentation du marché

|

Attributs |

Informations clés sur le marché des déodorants |

|

Segmentation |

|

|

Pays couverts |

Japon, Chine, Inde, Corée du Sud, Australie, Singapour, Malaisie, Thaïlande, Indonésie, Philippines, Reste de l'Asie-Pacifique |

|

Principaux acteurs du marché |

Unilever (Royaume-Uni), Procter & Gamble (États-Unis), Henkel AG & Co. KGaA (Allemagne), L'Oréal (France), Beiersdorf (Allemagne), group.loccitane (France), AVON PRODUCTS (Royaume-Uni), Elsa's Skincare (États-Unis), SPEICK Natural Cosmetics (Allemagne), Weleda (Suisse), Laverana GmbH & Co. KG (Allemagne), EO Products (États-Unis), Indus Valley (Inde), Lavanila (États-Unis), Sebapharma GmbH & CO. KG (Allemagne), Calvin Klein (États-Unis), Burberry plc (Royaume-Uni), REVLON (États-Unis), Dior (France) et Giorgio Armani SpA (Italie) |

|

Opportunités de marché |

|

Définition du marché des déodorants

Un déodorant est un produit chimique appliqué sur le corps pour prévenir ou masquer les odeurs causées par la dégradation bactérienne de la sueur au niveau des aisselles, de l'aine et des pieds, ainsi que par les sécrétions vaginales dans certaines situations. Ils sont très utilisés par les hommes et les femmes. Ils sont généralement à base d'alcool. Lorsque nous les utilisons, ils acidifient notre peau, ce qui rend les germes moins attirés par elle. De plus, ils deviennent populaires parmi la population du millénaire, ce qui entraîne une utilisation élevée.

Dynamique du marché des déodorants

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs :

- Forte demande de déodorants parmi la population

L'utilisation croissante de déodorants non aérosols et les facteurs démographiques, l'augmentation de la population active passant beaucoup de temps à l'extérieur exigent des déodorants pour garder leur corps frais, qui sont les principaux facteurs qui devraient créer une demande exceptionnelle pour le marché des déodorants au cours de la période prévue.

La popularité croissante des produits en stick et biologiques va encore accélérer le taux de croissance du marché des déodorants . En outre, la demande croissante de produits de soins personnels, ainsi que l'augmentation de la participation des femmes au marché du travail, stimuleront également la croissance de la valeur marchande au cours de la période prévue. En outre, les activités promotionnelles agressives des fabricants via diverses plateformes de médias sociaux, associées à la prolifération des canaux de vente au détail en ligne, stimulent également la croissance globale du marché.

Opportunités

- Innovations et sensibilisation

En outre, l'innovation dans de nouveaux formats et parfums tels que le développement de déodorants naturels et sans aluminium ainsi que le nombre croissant d'activités de marketing et de promotion via les médias sociaux étendent encore les opportunités rentables aux acteurs du marché au cours de la période de prévision de 2025 à 2032. De plus, la sensibilisation croissante des consommateurs concernant le contenu du produit augmentera encore la croissance future du marché des déodorants.

Contraintes/Défis

- Effets indésirables du déodorant

Les déodorants contiennent une variété d'ingrédients qui peuvent induire des réactions allergiques, tels que des composés d'aluminium, de la cyclométhicone et d'autres, qui constitueront probablement un facteur de limitation du marché pour la croissance des déodorants dans le délai prévu. Ce facteur créera des obstacles à la croissance du marché des déodorants.

- Coûts élevés

En outre, le prix élevé du produit devrait freiner la croissance du marché auprès des consommateurs soucieux des prix, limitant ainsi l'expansion du marché des déodorants. Ce facteur devrait remettre en cause le taux de croissance du marché des déodorants.

- Disponibilité des produits contrefaits

La disponibilité de produits contrefaits devrait entraver la croissance au cours de la période de prévision.

Ce rapport sur le marché des déodorants fournit des détails sur les nouveaux développements récents, les réglementations commerciales, l'analyse des importations et des exportations, l'analyse de la production, l'optimisation de la chaîne de valeur, la part de marché, l'impact des acteurs du marché national et local, les opportunités d'analyse en termes de poches de revenus émergentes, les changements dans la réglementation du marché, l'analyse stratégique de la croissance du marché, la taille du marché, la croissance du marché des catégories, les niches d'application et la domination, les approbations de produits, les lancements de produits, les expansions géographiques, les innovations technologiques sur le marché. Pour obtenir plus d'informations sur le marché des déodorants, contactez Data Bridge Market Research pour un briefing d'analyste, notre équipe vous aidera à prendre une décision de marché éclairée pour atteindre la croissance du marché.

Portée du marché des déodorants

Le marché des déodorants est segmenté en fonction du type de produit, du canal de distribution, du matériau d'emballage et de l'utilisateur final. La croissance parmi ces segments vous aidera à analyser les segments de croissance faibles dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Type de produit

- Pulvérisation

- Crèmes

- Roll-on

- Autres

Canal de distribution

- Supermarchés/Hypermarchés

- Dépanneurs

- Pharmacies et parapharmacies

- Vente au détail en ligne

- Autres

Matériau d'emballage

- Métal

- Plastique

- Autres

Utilisateur final

- Hommes

- Femmes

- Autres

Analyse régionale du marché des déodorants

Le marché des déodorants est analysé et des informations sur la taille du marché et les tendances sont fournies par pays, type de produit, canal de distribution, matériau d'emballage et utilisateur final, comme référencé ci-dessus.

Les pays couverts dans le rapport sur le marché des déodorants sont la Chine, le Japon, l'Inde, la Corée du Sud, Singapour, la Malaisie, l'Australie, la Thaïlande, l'Indonésie, les Philippines et le reste de l'Asie-Pacifique (APAC) dans la région Asie-Pacifique (APAC).

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques et l'analyse des cinq forces du porteur, les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques mondiales et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Part de marché des déodorants

Le paysage concurrentiel du marché des déodorants fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence mondiale, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination de l'application. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liée au marché des déodorants.

Les leaders du marché des déodorants opérant sur le marché sont :

- Unilever (Royaume-Uni)

- Procter & Gamble (États-Unis)

- Henkel AG & Co. KGaA (Allemagne)

- L'Oréal (France)

- Beiersdorf (Allemagne)

- groupe.loccitane (France)

- PRODUITS AVON (Royaume-Uni)

- Soins de la peau d'Elsa (États-Unis)

- SPEICK Cosmétiques Naturels (Allemagne)

- Weleda (Suisse)

- Laverana GmbH & Co. KG (Allemagne)

- Produits EO (États-Unis)

- Vallée de l'Indus (Inde)

- Lavanila (États-Unis)

- Sebapharma GmbH & CO. KG (Allemagne)

- Calvin Klein (États-Unis)

- Burberry plc (Royaume-Uni)

- REVLON (États-Unis)

- Dior (France)

- Giorgio Armani SpA (Italie)

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.