Marché des laboratoires dentaires en Asie-Pacifique, par produits (dispositifs généraux et de diagnostic, dispositifs de traitement et autres), tendances du secteur et prévisions jusqu'en 2029

Analyse et perspectives du marché

L'équipement du laboratoire dentaire comprend toute la gamme des systèmes utilisés pour la fabrication de prothèses dentaires fixes ou amovibles. La tâche du technicien de laboratoire dentaire consiste à fabriquer des couronnes, des ponts, des prothèses dentaires et des appareils orthodontiques sur prescription d'un dentiste. Bon nombre de ces tâches nécessitent une grande précision et la compétence du technicien pèse lourdement sur le succès final du traitement. Les techniciens de laboratoire sont formés sur le tas ou dans le cadre de programmes d'enseignement formel.

L'avancée technologique dans l'industrie dentaire est l'utilisation du processus de conception assistée par ordinateur et de fabrication assistée par ordinateur (CAO/FAO) ; processus, en développant des appareils de numérisation 3D haute définition, des logiciels de conception plus précis, plus rapides et plus simples, et une fabrication soustractive ou additive précise de matériaux innovants.

Définition du marché

Le rôle principal d'un laboratoire dentaire est de fournir des soins de dentisterie restauratrice en reproduisant parfaitement tous les paramètres fonctionnels et esthétiques définis par le dentiste dans une solution restauratrice. Tout au long du processus de restauration, de la consultation initiale du patient, du diagnostic et de la planification du traitement jusqu'à la mise en place de la restauration finale, les voies de communication entre le dentiste et le technicien de laboratoire peuvent désormais assurer un transfert complet d'informations. Les composants fonctionnels, les paramètres occlusaux, la phonétique et les exigences esthétiques ne sont que quelques-uns des types d'informations essentiels dont les techniciens ont besoin pour réaliser des restaurations réussies, fonctionnelles et esthétiques. Aujourd'hui comme par le passé, les outils de communication entre le dentiste et le technicien comprennent la photographie, la documentation écrite et les empreintes de la dentition existante du patient.

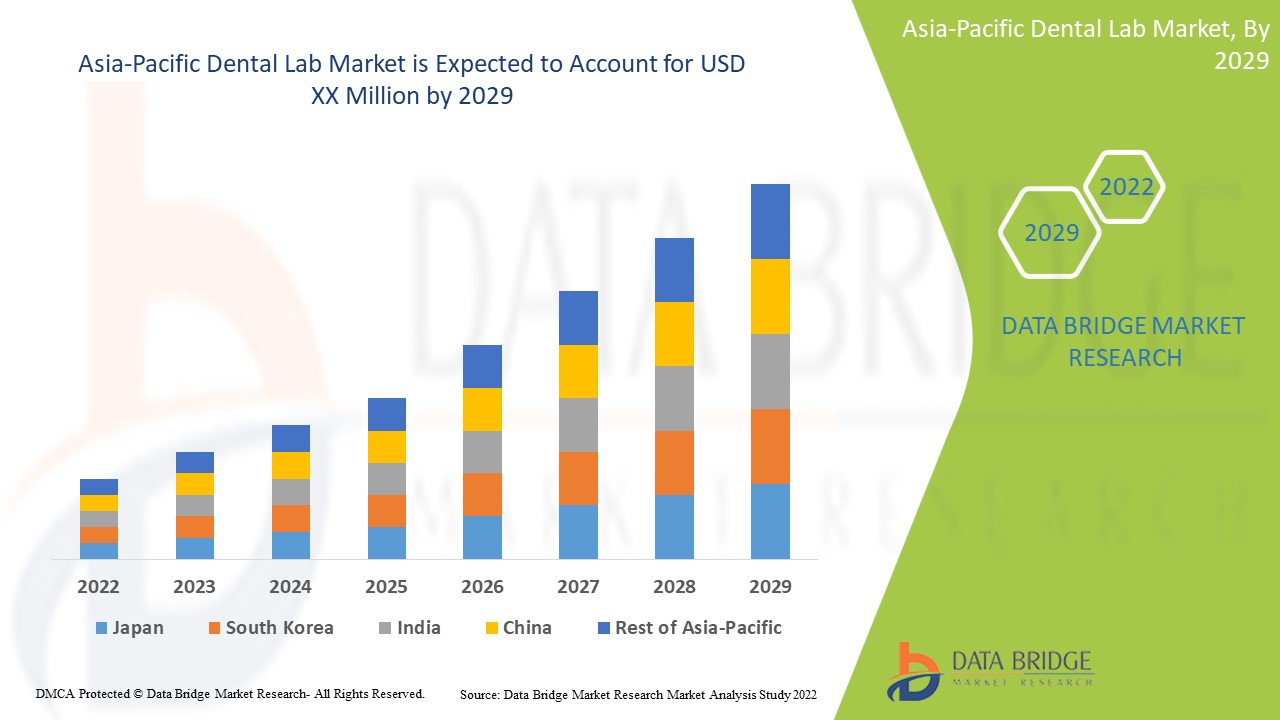

Le laboratoire dentaire de la région Asie-Pacifique est favorable et vise à réduire la gravité des symptômes. Data Bridge Market Research analyse que le marché des laboratoires dentaires connaîtra une croissance de 13,4 % au cours de la période de prévision de 2022 à 2029.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable de 2019 à 2014) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, prix en USD |

|

Segments couverts |

Sous-produits (dispositifs généraux et de diagnostic, dispositifs de traitement et autres) |

|

Pays couverts |

Japon, Inde, Chine, Corée du Sud, Australie, Singapour, Thaïlande, Malaisie, Indonésie, Philippines et reste de l'Asie-Pacifique |

|

Acteurs du marché couverts |

Ultradent Products Inc., A-dec Inc., BioHorizons IPH Inc., Carestream Health, Dentatus, Roland DGA Corporation, 3Shape A/S, Formlabs, PLANMECA OY, Septodont, 3M, BEGO GmbH & Co. KG, VOCO Gmbh, Henry Schein, Inc., GC Corporation, BIOLASE, Inc., Bicon, LLC, Dentsply Sirona, Envista (une filiale de Danaher Corporation), Kulzer GmbH (une filiale de Mitsui Chemicals, Inc), CAMLOG Biotechnologies GmbH, Zimvie Inc. (une filiale de Zimmer Biomet), Institut Straumann AG et OSSTEM UK |

Dynamique du marché des laboratoires dentaires en Asie-Pacifique

Conducteurs

- Forte prévalence des troubles dentaires

La santé bucco-dentaire est l'un des aspects les plus importants du maintien de la santé des gencives, des dents et du système bucco-facial, qui permet de parler, de mâcher et de sourire. Selon le rapport de l'Organisation mondiale de la santé de mars 2022, environ 2 milliards de personnes dans le monde souffrent de caries sur une dent permanente, parmi lesquelles environ 520 millions d'enfants souffrent de caries sur une dent primaire.

Les troubles dentaires les plus courants comprennent la carie dentaire, les maladies parodontales et le cancer de la bouche.

Par exemple,

- En 2021, aux États-Unis, les données du Centre pour le contrôle et la prévention des maladies (CDC) indiquent que plus d'un adulte sur quatre (26 %) aux États-Unis souffre de caries dentaires non traitées. 70,1 % des adultes âgés de 65 ans et plus souffrent d'une maladie parodontale et 47,2 % des adultes âgés de 30 ans et plus souffrent d'une forme de maladie parodontale.

Les entreprises étant constamment engagées dans des activités de recherche et de développement, la connaissance de la prévalence des troubles bucco-dentaires aiderait à trouver de nouvelles solutions et à favoriser davantage de collaborations et de partenariats avec les acteurs du marché dans des pays tels que la région Asie-Pacifique. Ainsi, l'augmentation des cas de troubles dentaires tels que les caries dentaires, la dégradation des dents et les cancers de la bouche devrait stimuler la croissance du marché mondial des laboratoires dentaires.

- Augmentation de l'activité de recherche et développement dans les industries dentaires

La pression sur les prix a entraîné des changements dans la dynamique fondamentale du secteur des implants dentaires. Les innovations ont entraîné une augmentation substantielle du nombre d'acteurs locaux et régionaux impliqués dans la création de produits similaires et leur offre à moindre coût.

Par exemple,

- En 2018, Young Innovations (États-Unis) a annoncé l'acquisition de Johnson-Promidet (États-Unis). L'entreprise se concentre sur les solutions de pièces à main dentaires de haute qualité. Cette acquisition permettra de fournir des produits et des solutions innovants et de haute qualité aux cliniciens et à leurs patients et d'améliorer également leur portefeuille de marques et de produits grâce à une croissance organique et à des acquisitions.

L'augmentation des activités de recherche et développement a rendu les entreprises plus actives dans l'extension de leurs services sur le marché ciblant davantage de clients sur le marché, conduisant à une croissance du marché mondial des laboratoires dentaires.

Opportunités

- Lancement de nouveaux produits

Les principaux acteurs tentent également d’élaborer des stratégies spécifiques, telles que des lancements de produits, des acquisitions, des approbations, des extensions et des partenariats, pour assurer le bon fonctionnement de l’entreprise, éviter les risques et augmenter la croissance à long terme des ventes du marché.

Les entreprises impliquées dans le marché des laboratoires dentaires ont proposé divers nouveaux produits basés sur de nouvelles technologies, les lancements les plus notables parmi ceux-ci dans le domaine des laboratoires dentaires étant dans le domaine de l'imagerie dentaire et de la dentisterie numérique.

Par exemple,

- En 2019, Zimmer Biomet (Indiana, États-Unis) a annoncé le lancement de sa nouvelle gamme de membranes et de sutures non résorbables, spécifiquement conçues pour éliminer l'infiltration bactérienne dans le site chirurgical.

Ces initiatives stratégiques, telles que celles prises par les acteurs du marché, notamment les acquisitions, les conférences et les lancements de produits ciblés, aident les entreprises à se développer et à améliorer leur portefeuille de produits, ce qui conduit finalement à une augmentation de la génération de revenus. Par conséquent, ces initiatives stratégiques des acteurs du marché offrent une opportunité qui les aide à stimuler la croissance du marché.

Contraintes/Défis

- Scénario d'absence de remboursement approprié

Les traitements dentaires, l'assurance dentaire, les taux de remboursement et les règles et réglementations évoluent rapidement. Les services de facturation dentaire s'efforcent de soumettre des demandes de remboursement précises aux payeurs d'assurance et reçoivent un remboursement maximal ; ces demandes sont refusées en raison de nombreux facteurs, notamment des documents non valides. L'enquête menée par Bankers Healthcare Group (BHG) a révélé que la baisse des taux de remboursement est une préoccupation majeure parmi les professionnels dentaires.

La procédure actuelle d'évaluation de la couverture manque de transparence et diffère également selon les différents payeurs, ce qui conduit à des décisions de couverture incohérentes et limite donc l'accès des professionnels de santé et des patients au meilleur traitement. Ce problème d'assurance entrave le marché et crée divers défis pour le secteur, ce qui en fait un frein responsable au marché.

- Manque de techniciens qualifiés

Il existe une pénurie de main d’œuvre qualifiée dans le domaine de la santé dans les pays émergents ou en développement en raison des migrations et de plusieurs autres facteurs.

L'Afrique est le continent qui a le plus de problèmes de santé, en particulier dans les régions d'Afrique subsaharienne, qui ont été gravement touchées par la migration des professionnels de santé. En moyenne, 57 pays souffrent d'une grave pénurie de professionnels de santé, avec un déficit d'environ 2,4 millions de médecins et d'infirmières.

Impact du Covid-19 sur le marché des laboratoires dentaires

Pendant la pandémie, les laboratoires dentaires ont un effet remarquable sur la réduction de la mortalité et de la morbidité des patients atteints de COVID-19. D'autres études à grande échelle sont nécessaires pour valider ces résultats. Un protocole pour les laboratoires dentaires infectés par COVID-19 doit être défini pour obtenir les meilleurs résultats cliniques possibles. Les laboratoires dentaires et les techniciens laissent des niveaux d'extinction en baisse. Selon le Centre national d'information sur la biotechnologie, des études ont montré qu'il existe un niveau élevé de contamination pour les empreintes dentaires arrivant dans un laboratoire dentaire.

Développement récent

- En septembre, Envista a conclu un accord avec Planmeca OY. L'accord stipule qu'Envista vendra sa division d'unités de traitement et d'instruments KaVo à Planmeca OY pour 455 millions USD, avec un paiement de complément de prix potentiel pouvant atteindre 30 millions USD. Cela augmentera le nombre de clients et augmentera la disponibilité des unités de traitement KaVo dans les cliniques dentaires.

Portée du marché des laboratoires dentaires en Asie-Pacifique

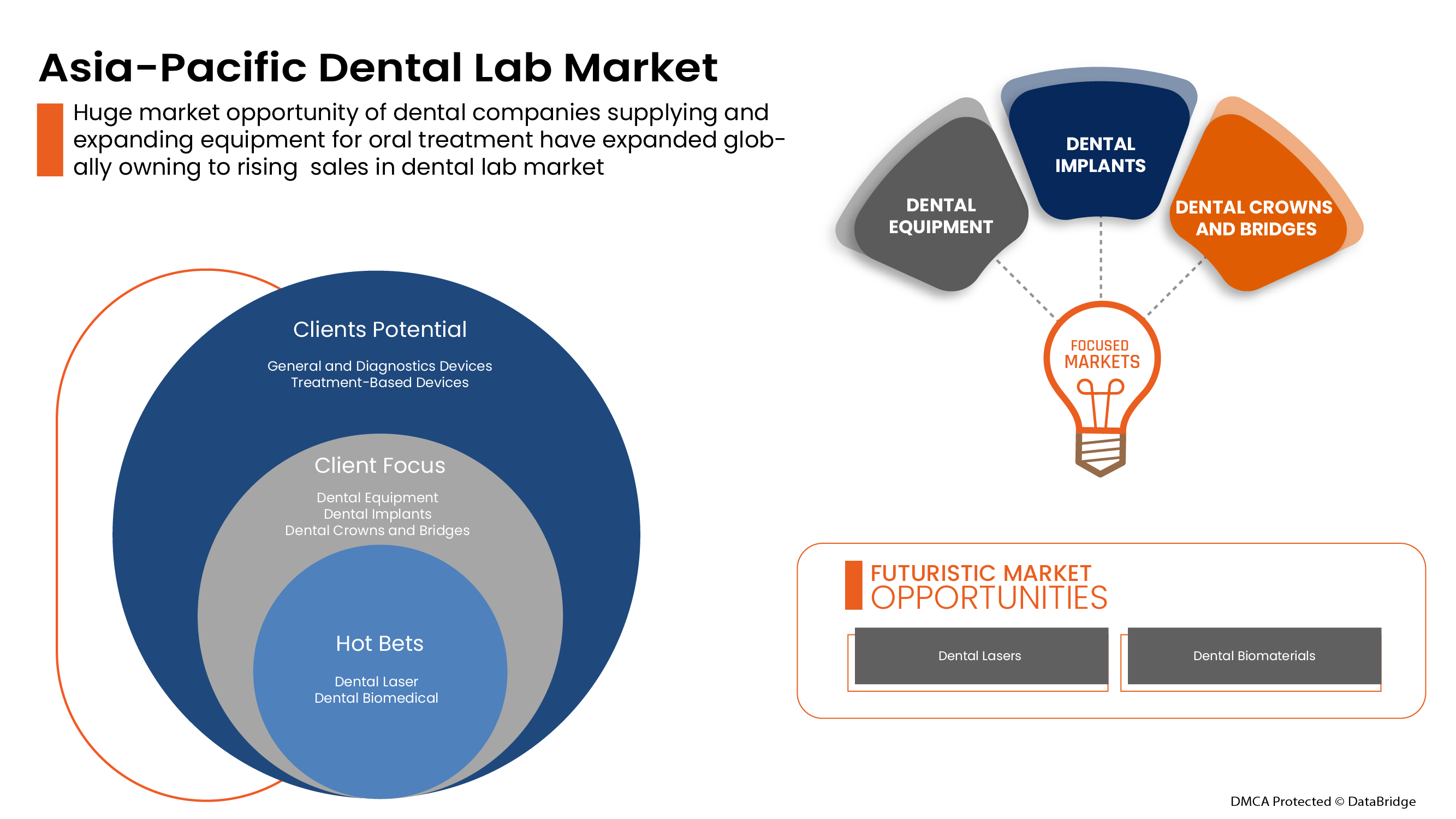

Le marché des laboratoires dentaires est segmenté sur la base d'un seul segment : les produits. La croissance parmi ces segments vous aidera à analyser les segments de croissance faibles dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Produits

- Appareils généraux et de diagnostic

- Dispositifs basés sur le traitement

- Autres

Sur la base des produits, le marché des laboratoires dentaires de la région Asie-Pacifique est segmenté en appareils généraux et de diagnostic, appareils basés sur le traitement et autres.

Analyse de pipeline

Analyse/perspectives régionales du marché des laboratoires dentaires

Le marché des laboratoires dentaires de la région Asie-Pacifique est analysé et des informations sur la taille et les tendances du marché sont fournies par régions et par produit comme référencé ci-dessus.

Les pays couverts dans le rapport sur le marché des laboratoires dentaires sont le Japon, l’Inde, la Chine, la Corée du Sud, l’Australie, Singapour, la Thaïlande, la Malaisie, l’Indonésie, les Philippines et le reste de l’Asie-Pacifique.

La Chine devrait dominer le marché en raison de l'augmentation des cas de troubles parodontaux, de l'augmentation du tourisme médical et de l'augmentation de la population de patients dans les laboratoires dentaires de la région Asie-Pacifique.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie des pays, l'épidémiologie des maladies et les tarifs d'importation et d'exportation sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques mondiales et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des laboratoires dentaires

Le paysage concurrentiel du marché des laboratoires dentaires en Asie-Pacifique fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Asie-Pacifique, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liées au marché des laboratoires dentaires.

Français Certains des principaux acteurs opérant sur le marché des laboratoires dentaires sont Ultradent Products Inc., A-dec Inc., BioHorizons IPH Inc., Carestream Health, Dentatus, Roland DGA Corporation, 3Shape A/S, Formlabs, PLANMECA OY, Septodont, 3M, BEGO GmbH & Co. KG, VOCO Gmbh, Henry Schein, Inc., GC Corporation, BIOLASE, Inc., Bicon, LLC, Dentsply Sirona, Envista (une filiale de Danaher Corporation), Kulzer GmbH (une filiale de Mitsui Chemicals, Inc), CAMLOG Biotechnologies GmbH, Zimvie Inc. (une filiale de Zimmer Biomet), Institut Straumann AG et OSSTEM UK, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE ASIA PACIFIC DENTAL LAB MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 ASIA PACIFIC DENTAL LABMARKET: SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT SEGMENT LIFELINE CURVE

2.8 DBMR MARKET POSITION GRID

2.9 VENDOR SHARE ANALYSIS

2.1 SECONDARY SOURCES

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER'S FIVE FORCES MODEL

5 ASIA PACIFIC DENTAL LAB MARKET: REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RAPID GROWTH IN THE GERIATRIC POPULATION

6.1.2 HIGH PREVALENCE OF DENTAL DISORDERS

6.1.3 RISE IN RESEARCH AND DEVELOPMENT ACTIVITY IN DENTAL INDUSTRIES

6.1.4 INCREASING AWARENESS OF PERIODONTAL DISEASE

6.1.5 GROWING MEDICAL TOURISM FOR DENTAL PROCEDURES

6.2 RESTRAINTS

6.2.1 HIGH COST OF DENTAL EQUIPMENT AND MATERIALS

6.2.2 LACK OF PROPER REIMBURSEMENT SCENARIO

6.2.3 LACK OF DENTAL KNOWLEDGE IN EMERGING COUNTRIES

6.3 OPPORTUNITIES

6.3.1 NEW PRODUCT RELEASES

6.3.2 INCREASED AESTHETIC DENTISTRY IN DENTAL LABS

6.4 CHALLENGES

6.4.1 LACK OF SKILLED TECHNICIANS

6.4.2 DELAYED ADOPTION OF ADVANCED TECHNOLOGIES IN EMERGING ECONOMIES

7 ASIA PACIFIC DENTAL LAB MARKET, BY PRODUCTS

7.1 OVERVIEW

7.2 GENERAL AND DIAGNOSTICS DEVICES

7.2.1 DENTAL EQUIPMENT

7.2.1.1 DENTAL CHAIRS

7.2.1.2 HAND PIECES

7.2.1.3 LIGHT CURE EQUIPMENT

7.2.1.4 SCALING UNITS

7.2.2 DENTAL IMPLANTS

7.2.2.1 TITANIUM DENTAL IMPLANTS

7.2.2.2 ZIRCONIA DENTAL IMPLANTS

7.2.3 DENTAL CROWNS & BRIDGES

7.2.3.1 METAL-FUSED CERAMIC CROWNS

7.2.3.2 CERAMIC CAD/CAM

7.2.3.3 CERAMIC CONVENTIONAL CROWNS & BRIDGES

7.2.4 DENTAL SYSTEMS AND PARTS

7.2.4.1 INSTRUMENT DELIVERY SYSTEMS

7.2.4.2 CONE BEAM CT SCANNING

7.2.4.3 CAD/CAM SYSTEMS

7.2.4.4 3D PRINTERS

7.2.4.5 DENTAL MILLING MACHINE

7.2.5 DENTAL RADIOLOGY EQUIPMENT

7.2.5.1 EXTRA-ORAL RADIOLOGY

7.2.5.1.1 FILM-BASED DEVICES

7.2.5.1.2 DIGITAL DEVICES

7.2.5.2 INTRA-ORAL RADIOLOGY

7.2.5.2.1 BITEWINGS

7.2.5.2.2 PERIAPICALS

7.2.5.2.3 OCCUSAL

7.2.6 DENTAL BIOMATERIALS

7.2.7 DENTAL LASERS

7.2.7.1 DIODE LASERS

7.2.7.2 YTTRIUM LASERS

7.2.7.3 CO2 LASERS

7.3 TREATMENT-BASED DEVICES

7.3.1 ORTHODONTICS

7.3.1.1 REMOVABLE

7.3.1.2 FIXED

7.3.1.2.1 BRACKETS

7.3.1.2.2 ARCHWIRES

7.3.1.2.3 ANCHORAGE APPLIANCES

7.3.1.2.4 LIGATURES

7.3.2 ENDOTONICS

7.3.2.1 PERMANENT ENDODONTIC SEALERS

7.3.2.2 OBTURATORS

7.3.3 PERIODONTICS

7.3.3.1 DENTAL ANESTHETICS

7.3.3.1.1 INJECTABLE ANESTHETICS

7.3.3.1.2 TOPICAL ANESTHETICS

7.3.3.2 DENTAL SUTURES

7.3.3.3 DENTAL HEMOSTATS

7.3.3.3.1 COLLAGEN-BASED HEMOSTATS

7.3.3.3.2 OXIDIZED REGENERATED CELLULOSE-BASED HEMOSTATS

7.3.3.3.3 GELATIN-BASED HEMOSTATS

7.4 OTHERS

7.4.1 OTHER DENTAL LABORATORY MACHINES

7.4.2 HYGIENE MAINTENANCE DEVICES

7.4.3 RETAIL DENTAL CARE ESSENTIALS

7.4.4 OTHER CONSUMABLES

8 ASIA PACIFIC DENTAL LAB MARKET, BY REGION

8.1 ASIA-PACIFIC

8.1.1 CHINA

8.1.2 JAPAN

8.1.3 INDIA

8.1.4 SOUTH KOREA

8.1.5 AUSTRALIA

8.1.6 SINGAPORE

8.1.7 THAILAND

8.1.8 MALAYSIA

8.1.9 INDONESIA

8.1.10 PHILIPPINES

8.1.11 REST OF ASIA-PACIFIC

9 ASIA PACIFIC DENTAL LAB MARKET, COMPANY LANDSCAPE

9.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

10 SWOT ANALYSIS

11 COMPANY PROFILE

11.1 HENRY SCHEIN, INC.(2021)

11.1.1 COMPANY SNAPSHOT

11.1.2 REVENUE ANALYSIS

11.1.3 COMPANY SHARE ANALYSIS

11.1.4 PRODUCT PORTFOLIO

11.1.5 RECENT DEVELOPMENTS

11.2 DENTSPLY SIRONA (2021)

11.2.1 COMPANY SNAPSHOT

11.2.2 REVENUE ANALYSIS

11.2.3 COMPANY SHARE ANALYSIS

11.2.4 PRODUCT PORTFOLIO

11.2.5 RECENT DEVELOPMENTS

11.3 ENVISTA (A SUBSIDIARY OF DANAHER CORPORATION) (2021)

11.3.1 COMPANY SNAPSHOT

11.3.2 REVENUE ANALYSIS

11.3.3 COMPANY SHARE ANALYSIS

11.3.4 PRODUCT PORTFOLIO

11.3.5 RECENT DEVELOPMENTS

11.4 INSTITUT STRAUMANN AG (2021)

11.4.1 COMPANY SNAPSHOT

11.4.2 REVENUE ANALYSIS

11.4.3 COMPANY SHARE ANALTSIS

11.4.4 PRODUCT PORTFOLIO

11.4.5 RECENT DEVELOPMENTS

11.5 PLANMECA OY. (2021)

11.5.1 COMPANY SNAPSHOT

11.5.2 COMPANY SHARE ANALYSIS

11.5.3 PRODUCT PORTFOLIO

11.5.4 RECENT DEVELOPMENTS

11.6 3M (2021)

11.6.1 COMPANY SNAPSHOT

11.6.2 REVENUE ANALYSIS

11.6.3 PRODUCT PORTFOLIO

11.6.4 RECENT DEVELOPMENTS

11.7 A-DEC-IN (2021)

11.7.1 COMPANY SNAPSHOT

11.7.2 PRODUCT PORTFOLIO

11.7.3 RECENT DEVELOPMENTS

11.8 BIOHORIZONS IPH, INC. (2021)

11.8.1 COMPANY SNAPSHOT

11.8.2 PRODUCT PORTFOLIO

11.8.3 RECENT DEVELOPMENTS

11.9 BIOLASE, INC.(2021)

11.9.1 COMPANY SNAPSHOT

11.9.2 REVENUE ANALYSIS

11.9.3 PRODUCT PORTFOLIO

11.9.4 RECENT DEVELOPMENTS

11.1 BEGO GMBH & CO. KG

11.10.1 COMPANY SNAPSHOT

11.10.2 PRODUCT PORTFOLIO

11.10.3 RECENT DEVELOPMENTS

11.11 BICON, LLC

11.11.1 COMPANY SNAPSHOT

11.11.2 PRODUCT PORTFOLIO

11.11.3 RECENT DEVELOPMENTS

11.12 CAMLOG BIOTECHNOLOGIES GMBH

11.12.1 COMPANY SNAPSHOT

11.12.2 PRODUCT PORTFOLIO

11.12.3 RECENT DEVELOPMENTS

11.13 CARESTREAM HEALTH (2021)

11.13.1 COMPANY SNAPSHOT

11.13.2 PRODUCT PORTFOLIO

11.13.3 RECENT DEVELOPMENTS

11.14 DENTATUS (2021)

11.14.1 COMPANY SNAPSHOT

11.14.2 PRODUCT PORTFOLIO

11.14.3 RECENT DEVELOPMENTS

11.15 FORMLABS (2021)

11.15.1 COMPANY SNAPSHOT

11.15.2 PRODUCT PORTFOLIO

11.15.3 RECENT DEVELOPMENTS

11.16 GC CORPORATION

11.16.1 COMPANY SNAPSHOT

11.16.2 PRODUCT PORTFOLIO

11.16.3 RECENT DEVELOPMENTS

11.17 KULZER GMBH (A SUBSIDIARY OF MITSUI CHEMICALS, INC) (2021)

11.17.1 COMPANY SNAPSHOT

11.17.2 REVENUE ANALYSIS

11.17.3 PRODUCT PORTFOLIO

11.17.4 RECENT DEVELOPMENTS

11.18 OSSTEM U.K.(2021)

11.18.1 COMPANY SNAPSHOT

11.18.2 PRODUCT PORTFOLIO

11.18.3 RECENT DEVELOPMENTS

11.19 PINDAN DENTAL LABORATORY

11.19.1 COMPANY SNAPSHOT

11.19.2 PRODUCT PORTFOLIO

11.19.3 RECENT DEVELOPMENTS

11.2 ROLAND DG CORPORATION (2021)

11.20.1 COMPANY SNAPSHOT

11.20.2 REVENUE ANALYSIS

11.20.3 PRODUCT PORTFOLIO

11.20.4 RECENT DEVELOPMENTS

11.21 SEPTODONT (2021)

11.21.1 COMPANY SNAPSHOT

11.21.2 PRODUCT PORTFOLIO

11.21.3 RECENT DEVELOPMENTS

11.22 3 SHAPE A/S (2021)

11.22.1 COMPANY SNAPSHOT

11.22.2 PRODUCT PORTFOLIO

11.22.3 RECENT DEVELOPMENTS

11.23 ULTRADENT PRODUCTS INC (2021)

11.23.1 COMPANY SNAPSHOT

11.23.2 PRODUCT PORTFOLIO

11.23.3 RECENT DEVELOPMENTS

11.24 VOCO GMBH (2021)

11.24.1 COMPANY SNAPSHOT

11.24.2 PRODUCT PORTFOLIO

11.24.3 RECENT DEVELOPMENTS

11.25 YOUNG INNOVATIONS, INC (2021)

11.25.1 COMPANY SNAPSHOT

11.25.2 PRODUCT PORTFOLIO

11.25.3 RECENT DEVELOPMENTS

11.26 ZIMVIE INC. (A SUBSIDIARY OF ZIMMET BIOMET HOLDINGS)(2021)

11.26.1 COMPANY SNAPSHOT

11.26.2 REVENUE ANALYSIS

11.26.3 PRODUCT PORTFOLIO

11.26.4 RECENT DEVELOPMENTS

12 QUESTIONNAIRE

13 RELATED REPORTS

Liste des tableaux

TABLE 1 DENTAL TREATMENT COSTS IN THE U.K.

TABLE 2 AESTHETIC PROCEDURES AND COST RANGES IN THE U.S. (2018)

TABLE 3 ASIA PACIFIC DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 4 ASIA PACIFIC GENERAL & DIAGNOSTICS DEVICES IN DENTAL LAB MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 ASIA PACIFIC GENERAL & DIAGNOSTICS DEVICES IN DENTAL LAB MARKET, BY PRODUCTS ,2020-2029 (USD MILLION)

TABLE 6 ASIA PACIFIC DENTAL EQUIPMENT IN DENTAL LAB MARKET, BY PRODUCTS , 2020-2029 (USD MILLION)

TABLE 7 ASIA PACIFIC DENTAL IMPLANTS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 8 ASIA PACIFIC DENTAL CROWNS & BRIDGES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 9 ASIA PACIFIC DENTAL SYSTEMS AND PARTS IN DENTAL LAB MARKET, BY PRODUCTS , 2020-2029 (USD MILLION)

TABLE 10 ASIA PACIFIC DENTAL RADIOLOGY EQUIPMENT IN DENTAL LAB MARKET, BY PRODUCTS , 2020-2029 (USD MILLION)

TABLE 11 ASIA PACIFIC EXTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS , 2020-2029 (USD MILLION)

TABLE 12 ASIA PACIFIC INTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 13 ASIA PACIFIC DENTAL LASERS IN DENTAL LAB MARKET, BY PRODUCTS , 2020-2029 (USD MILLION)

TABLE 14 ASIA PACIFIC TREATMENT-BASED DEVICES IN DENTAL LAB MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 ASIA PACIFIC TREATMENT-BASED DEVICES IN DENTAL LAB MARKET, BY PRODUCTS , 2020-2029 (USD MILLION)

TABLE 16 ASIA PACIFIC ORTHODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 17 ASIA PACIFIC FIXED IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 18 ASIA PACIFIC ENDODONTICS IN DENTAL LAB MARKET, BY PRODUCTS , 2020-2029 (USD MILLION)

TABLE 19 ASIA PACIFIC PERIODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 20 ASIA PACIFIC DENTAL ANESTHETICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 21 ASIA PACIFIC DENTAL HEMOSTATS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 22 ASIA PACIFIC OTHERS IN DENTAL LAB MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 ASIA PACIFIC OTHERS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 24 ASIA-PACIFIC DENTAL LAB MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 25 ASIA-PACIFIC DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 26 ASIA-PACIFIC GENERAL AND DIAGNOSTIC DEVICES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 27 ASIA-PACIFIC DENTAL EQUIPMENT IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 28 ASIA-PACIFIC DENTAL IMPLANTS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 29 ASIA-PACIFIC DENTAL CROWNS AND BRIDGES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 30 ASIA-PACIFIC DENTAL SYSTEMS AND PARTS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 31 ASIA-PACIFIC DENTAL RADIOLOGY EQUIOMENT IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 32 ASIA-PACIFIC EXTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 33 ASIA-PACIFIC INTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 34 ASIA-PACIFIC DENTAL LASERS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 35 ASIA-PACIFIC TREATMENT-BASED DEVICES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 36 ASIA-PACIFIC ORTHODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 37 ASIA-PACIFIC FIXED IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 38 ASIA-PACIFIC ENDODONTIC IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 39 ASIA-PACIFIC PERIODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 40 ASIA-PACIFIC DENTAL ANESTHETICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 41 ASIA-PACIFIC DENTAL HEMOSTATS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 42 ASIA-PACIFIC OTHERS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 43 CHINA DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 44 CHINA GENERAL AND DIAGNOSTIC DEVICES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 45 CHINA DENTAL EQUIPMENT IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 46 CHINA DENTAL IMPLANTS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 47 CHINA DENTAL CROWNS AND BRIDGES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 48 CHINA DENTAL SYSTEMS AND PARTS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 49 CHINA DENTAL RADIOLOGY EQUIOMENT IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 50 CHINA EXTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 51 CHINA INTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 52 CHINA DENTAL LASERS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 53 CHINA TREATMENT-BASED DEVICES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 54 CHINA ORTHODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 55 CHINA FIXED IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 56 CHINA ENDODONTIC IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 57 CHINA PERIODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 58 CHINA DENTAL ANESTHETICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 59 CHINA DENTAL HEMOSTATS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 60 CHINA OTHERS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 61 JAPAN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 62 JAPAN GENERAL AND DIAGNOSTIC DEVICES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 63 JAPAN DENTAL EQUIPMENT IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 64 JAPAN DENTAL IMPLANTS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 65 JAPAN DENTAL CROWNS AND BRIDGES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 66 JAPAN DENTAL SYSTEMS AND PARTS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 67 JAPAN DENTAL RADIOLOGY EQUIOMENT IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 68 JAPAN EXTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 69 JAPAN INTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 70 JAPAN DENTAL LASERS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 71 JAPAN TREATMENT-BASED DEVICES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 72 JAPAN ORTHODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 73 JAPAN FIXED IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 74 JAPAN ENDODONTIC IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 75 JAPAN PERIODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 76 JAPAN DENTAL ANESTHETICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 77 JAPAN DENTAL HEMOSTATS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 78 JAPAN OTHERS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 79 INDIA DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 80 INDIA GENERAL AND DIAGNOSTIC DEVICES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 81 INDIA DENTAL EQUIPMENT IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 82 INDIA DENTAL IMPLANTS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 83 INDIA DENTAL CROWNS AND BRIDGES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 84 INDIA DENTAL SYSTEMS AND PARTS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 85 INDIA DENTAL RADIOLOGY EQUIOMENT IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 86 INDIA EXTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 87 INDIA INTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 88 INDIA DENTAL LASERS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 89 INDIA TREATMENT-BASED DEVICES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 90 INDIA ORTHODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 91 INDIA FIXED IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 92 INDIA ENDODONTIC IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 93 INDIA PERIODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 94 INDIA DENTAL ANESTHETICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 95 INDIA DENTAL HEMOSTATS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 96 INDIA OTHERS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 97 SOUTH KOREA DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 98 SOUTH KOREA GENERAL AND DIAGNOSTIC DEVICES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 99 SOUTH KOREA DENTAL EQUIPMENT IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 100 SOUTH KOREA DENTAL IMPLANTS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 101 SOUTH KOREA DENTAL CROWNS AND BRIDGES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 102 SOUTH KOREA DENTAL SYSTEMS AND PARTS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 103 SOUTH KOREA DENTAL RADIOLOGY EQUIOMENT IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 104 SOUTH KOREA EXTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 105 SOUTH KOREA INTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 106 SOUTH KOREA DENTAL LASERS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 107 SOUTH KOREA TREATMENT-BASED DEVICES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 108 SOUTH KOREA ORTHODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 109 SOUTH KOREA FIXED IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 110 SOUTH KOREA ENDODONTIC IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 111 SOUTH KOREA PERIODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 112 SOUTH KOREA DENTAL ANESTHETICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 113 SOUTH KOREA DENTAL HEMOSTATS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 114 SOUTH KOREA OTHERS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 115 AUSTRALIA DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 116 AUSTRALIA GENERAL AND DIAGNOSTIC DEVICES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 117 AUSTRALIA DENTAL EQUIPMENT IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 118 AUSTRALIA DENTAL IMPLANTS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 119 AUSTRALIA DENTAL CROWNS AND BRIDGES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 120 AUSTRALIA DENTAL SYSTEMS AND PARTS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 121 AUSTRALIA DENTAL RADIOLOGY EQUIOMENT IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 122 AUSTRALIA EXTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 123 AUSTRALIA INTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 124 AUSTRALIA DENTAL LASERS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 125 AUSTRALIA TREATMENT-BASED DEVICES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 126 AUSTRALIA ORTHODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 127 AUSTRALIA FIXED IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 128 AUSTRALIA ENDODONTIC IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 129 AUSTRALIA PERIODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 130 AUSTRALIA DENTAL ANESTHETICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 131 AUSTRALIA DENTAL HEMOSTATS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 132 AUSTRALIA OTHERS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 133 SINGAPORE DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 134 SINGAPORE GENERAL AND DIAGNOSTIC DEVICES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 135 SINGAPORE DENTAL EQUIPMENT IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 136 SINGAPORE DENTAL IMPLANTS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 137 SINGAPORE DENTAL CROWNS AND BRIDGES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 138 SINGAPORE DENTAL SYSTEMS AND PARTS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 139 SINGAPORE DENTAL RADIOLOGY EQUIOMENT IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 140 SINGAPORE EXTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 141 SINGAPORE INTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 142 SINGAPORE DENTAL LASERS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 143 SINGAPORE TREATMENT-BASED DEVICES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 144 SINGAPORE ORTHODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 145 SINGAPORE FIXED IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 146 SINGAPORE ENDODONTIC IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 147 SINGAPORE PERIODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 148 SINGAPORE DENTAL ANESTHETICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 149 SINGAPORE DENTAL HEMOSTATS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 150 SINGAPORE OTHERS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 151 THAILAND DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 152 THAILAND GENERAL AND DIAGNOSTIC DEVICES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 153 THAILAND DENTAL EQUIPMENT IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 154 THAILAND DENTAL IMPLANTS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 155 THAILAND DENTAL CROWNS AND BRIDGES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 156 THAILAND DENTAL SYSTEMS AND PARTS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 157 THAILAND DENTAL RADIOLOGY EQUIOMENT IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 158 THAILAND EXTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 159 THAILAND INTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 160 THAILAND DENTAL LASERS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 161 THAILAND TREATMENT-BASED DEVICES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 162 THAILAND ORTHODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 163 THAILAND FIXED IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 164 THAILAND ENDODONTIC IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 165 THAILAND PERIODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 166 THAILAND DENTAL ANESTHETICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 167 THAILAND DENTAL HEMOSTATS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 168 THAILAND OTHERS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 169 MALAYSIA DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 170 MALAYSIA GENERAL AND DIAGNOSTIC DEVICES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 171 MALAYSIA DENTAL EQUIPMENT IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 172 MALAYSIA DENTAL IMPLANTS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 173 MALAYSIA DENTAL CROWNS AND BRIDGES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 174 MALAYSIA DENTAL SYSTEMS AND PARTS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 175 MALAYSIA DENTAL RADIOLOGY EQUIOMENT IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 176 MALAYSIA EXTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 177 MALAYSIA INTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 178 MALAYSIA DENTAL LASERS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 179 MALAYSIA TREATMENT-BASED DEVICES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 180 MALAYSIA ORTHODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 181 MALAYSIA FIXED IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 182 MALAYSIA ENDODONTIC IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 183 MALAYSIA PERIODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 184 MALAYSIA DENTAL ANESTHETICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 185 MALAYSIA DENTAL HEMOSTATS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 186 MALAYSIA OTHERS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 187 INDONESIA DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 188 INDONESIA GENERAL AND DIAGNOSTIC DEVICES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 189 INDONESIA DENTAL EQUIPMENT IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 190 INDONESIA DENTAL IMPLANTS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 191 INDONESIA DENTAL CROWNS AND BRIDGES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 192 INDONESIA DENTAL SYSTEMS AND PARTS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 193 INDONESIA DENTAL RADIOLOGY EQUIOMENT IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 194 INDONESIA EXTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 195 INDONESIA INTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 196 INDONESIA DENTAL LASERS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 197 INDONESIA TREATMENT-BASED DEVICES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 198 INDONESIA ORTHODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 199 INDONESIA FIXED IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 200 INDONESIA ENDODONTIC IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 201 INDONESIA PERIODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 202 INDONESIA DENTAL ANESTHETICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 203 INDONESIA DENTAL HEMOSTATS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 204 INDONESIA OTHERS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 205 PHILIPPINES DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 206 PHILIPPINES GENERAL AND DIAGNOSTIC DEVICES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 207 PHILIPPINES DENTAL EQUIPMENT IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 208 PHILIPPINES DENTAL IMPLANTS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 209 PHILIPPINES DENTAL CROWNS AND BRIDGES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 210 PHILIPPINES DENTAL SYSTEMS AND PARTS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 211 PHILIPPINES DENTAL RADIOLOGY EQUIOMENT IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 212 PHILIPPINES EXTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 213 PHILIPPINES INTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 214 PHILIPPINES DENTAL LASERS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 215 PHILIPPINES TREATMENT-BASED DEVICES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 216 PHILIPPINES ORTHODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 217 PHILIPPINES FIXED IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 218 PHILIPPINES ENDODONTIC IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 219 PHILIPPINES PERIODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 220 PHILIPPINES DENTAL ANESTHETICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 221 PHILIPPINES DENTAL HEMOSTATS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 222 PHILIPPINES OTHERS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 223 REST OF ASIA-PACIFIC DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 ASIA PACIFIC DENTAL LAB MARKET : SEGMENTATION

FIGURE 2 ASIA PACIFIC DENTAL LABMARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC DENTAL LABMARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC DENTAL LABMARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC DENTAL LABMARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC DENTAL LABMARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC DENTAL LABMARKET: DBMR POSITION GRID

FIGURE 8 ASIA PACIFIC DENTAL LABMARKET: VENDOR SHARE ANALYSIS

FIGURE 9 ASIA PACIFIC DENTAL LAB MARKET: SEGMENTATION

FIGURE 10 NORTH AMERICA IS ANTICIPATED TO DOMINATE THE ASIA PACIFIC DENTAL LAB MARKET AND ASIA-PACIFIC IS ESTIMATED TO BE GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 INCREASED INCIDENCE OF DENTAL DISEASES, RISE IN PRODUCT LAUNCHES AND MEDICAL TOURISM FOR DENTAL TREATMENT ACROSS THE WORLD IS EXPECTED TO DRIVE THE ASIA PACIFIC DENTAL LAB MARKET FROM 2022 TO 2029

FIGURE 12 PRODUCT TYPE SEGMENT IS EXPECTED TO HAVE THE LARGEST SHARE OF THE ASIA PACIFIC DENTAL LAB MARKET FROM 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA PACIFIC DENTAL LAB MARKET

FIGURE 14 FORECAST GERIATRIC POPULATION 2010-2050 TIME PERIOD (IN MILLIONS)

FIGURE 15 INCREASED INCIDENCE OF PERIODONTAL DISEASE IN THE U.S., 2020

FIGURE 16 ASIA PACIFIC DENTAL LAB MARKET: BY PRODUCTS, 2021

FIGURE 17 ASIA PACIFIC DENTAL LAB MARKET: BY PRODUCTS, 2022-2029 (USD MILLION)

FIGURE 18 ASIA PACIFIC DENTAL LAB MARKET: BY PRODUCTS, CAGR (2022-2029)

FIGURE 19 ASIA PACIFIC DENTAL LAB MARKET: BY PRODUCTS, LIFELINE CURVE

FIGURE 20 ASIA-PACIFIC DENTAL LAB MARKET: SNAPSHOT (2021)

FIGURE 21 ASIA-PACIFIC DENTAL LAB MARKET: BY COUNTRY (2021)

FIGURE 22 ASIA-PACIFIC DENTAL LAB MARKET: BY COUNTRY (2022 & 2029)

FIGURE 23 ASIA-PACIFIC DENTAL LAB MARKET: BY COUNTRY (2021 & 2029)

FIGURE 24 ASIA-PACIFIC DENTAL LAB MARKET: BY PRODUCTS (2022-2029)

FIGURE 25 ASIA PACIFIC DENTAL LAB MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.