Asia Pacific Courier Market

Taille du marché en milliards USD

TCAC :

%

USD

172.37 Billion

USD

312.03 Billion

2025

2033

USD

172.37 Billion

USD

312.03 Billion

2025

2033

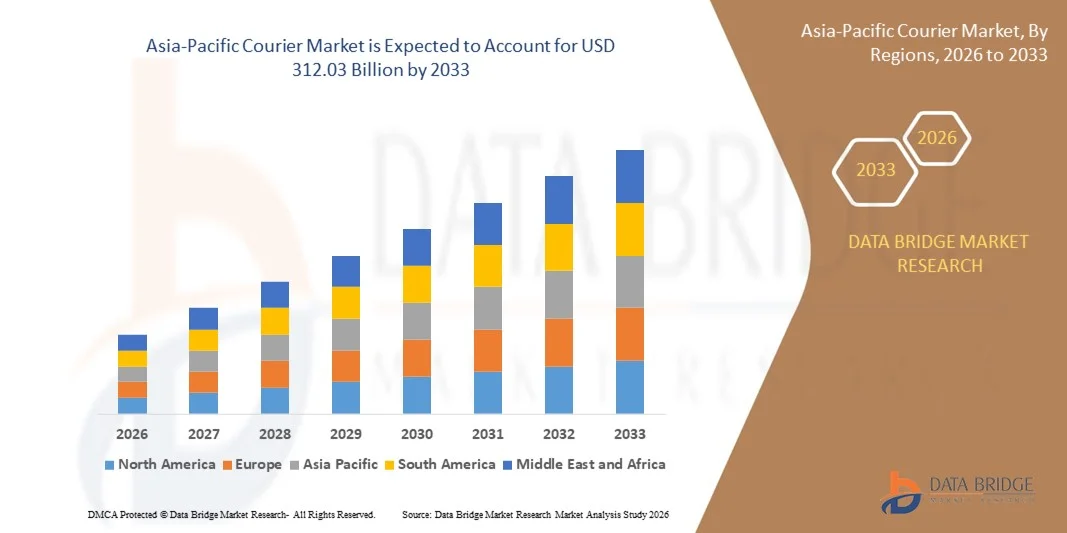

| 2026 –2033 | |

| USD 172.37 Billion | |

| USD 312.03 Billion | |

|

|

|

|

Segmentation du marché des services de messagerie express en Asie-Pacifique, par type (envois sortants et entrants), mode de livraison (livraison standard et express), type de client (B2B, B2C et C2C), destination (nationale et internationale/transfrontalière), utilisateur final (commerce de gros et de détail (e-commerce), messagerie médicale, industrie manufacturière, services (BFSI), construction, services publics et industries primaires) - Tendances et prévisions du secteur jusqu'en 2033

Taille du marché des services de messagerie en Asie-Pacifique

- Le marché des services de messagerie en Asie-Pacifique était évalué à 172,37 milliards de dollars américains en 2025 et devrait atteindre 312,03 milliards de dollars américains d'ici 2033 , avec un taux de croissance annuel composé (TCAC) de 7,7 % au cours de la période de prévision.

- La croissance du marché est largement alimentée par l'expansion rapide du commerce électronique et des plateformes de vente au détail en ligne, ce qui entraîne une demande accrue de services de livraison rapides, fiables et basés sur la technologie, tant dans les zones urbaines que rurales.

- De plus, les attentes croissantes des consommateurs en matière de livraisons le jour même, le lendemain et sans contact, conjuguées à l'adoption de technologies avancées de suivi, d'optimisation des itinéraires et de tri automatisé, font des services de messagerie des composantes essentielles du commerce moderne. Ces facteurs convergents accélèrent l'adoption des solutions de messagerie et de logistique, stimulant ainsi considérablement la croissance du secteur.

Analyse du marché des services de messagerie en Asie-Pacifique

- Les services de messagerie, qui assurent une livraison rapide et fiable de colis, de documents et de marchandises, constituent des éléments de plus en plus essentiels des chaînes d'approvisionnement et des opérations de commerce électronique en raison de leur efficacité, de leur flexibilité et de leur intégration aux plateformes numériques.

- La demande croissante de services de messagerie est principalement alimentée par la croissance du commerce électronique, l'urbanisation croissante, la pénétration accrue des smartphones et d'Internet, ainsi que par la préférence des consommateurs pour des options de livraison pratiques, porte-à-porte.

- La Chine a dominé le marché de la messagerie en 2025, grâce à son infrastructure logistique étendue, à la croissance rapide du commerce électronique et à la demande croissante des consommateurs pour des services de livraison rapides et fiables.

- L'Inde devrait connaître la croissance la plus rapide sur le marché de la messagerie express au cours de la période de prévision, grâce à l'essor du commerce électronique, à l'urbanisation croissante et à la pénétration grandissante des smartphones et d'Internet.

- Le segment des expéditions sortantes a dominé le marché avec une part de 61,3 % en 2025, grâce au volume important d'envois effectués par les entreprises, les plateformes de commerce électronique, les fabricants et les prestataires de services vers les clients finaux. La croissance du commerce de détail en ligne, du commerce transfrontalier et des modèles commerciaux de vente directe au consommateur continue d'alimenter le flux de colis sortants à l'échelle mondiale. Les entreprises de messagerie concentrent leurs efforts sur l'optimisation de la logistique sortante afin de garantir des livraisons ponctuelles, une rentabilité optimale et la satisfaction client.

Portée du rapport et segmentation du marché des services de messagerie

|

Attributs |

Principaux enseignements du marché des services de messagerie |

|

Segments couverts |

|

|

Pays couverts |

Asie-Pacifique

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur du marché, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché élaborés par Data Bridge Market Research comprennent également une analyse des importations et des exportations, un aperçu de la capacité de production, une analyse de la consommation de production, une analyse des tendances des prix, un scénario de changement climatique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, les critères de sélection des fournisseurs, une analyse PESTLE, une analyse de Porter et le cadre réglementaire. |

Tendances du marché des services de messagerie en Asie-Pacifique

Évolution croissante vers des services de messagerie numérisés, rapides et axés sur la technologie

- Une tendance majeure du marché de la livraison express est le recours croissant à des solutions de livraison rapides et optimisées par la technologie, sous l'impulsion de l'essor rapide du commerce électronique et de la vente au détail en ligne, ainsi que des attentes croissantes des consommateurs en matière de service rapide et fiable. Les entreprises investissent massivement dans les plateformes numériques, l'automatisation et les systèmes de suivi afin de rationaliser leurs opérations et d'améliorer l'expérience client dans les zones urbaines et périurbaines.

- Par exemple, DHL a mis en place des centres de tri automatisés et un logiciel d'optimisation des itinéraires avancé afin d'améliorer la rapidité de livraison et de réduire les inefficacités opérationnelles. Ces solutions technologiques renforcent la fiabilité du service et permettent un suivi en temps réel des colis, de leur expédition à leur livraison.

- L'adoption des plateformes logistiques basées sur l'IA est en hausse, permettant de prévoir les délais de livraison, d'optimiser les itinéraires et d'améliorer la connectivité du dernier kilomètre. Les services de messagerie deviennent ainsi des acteurs essentiels au bon fonctionnement de la chaîne d'approvisionnement et à la satisfaction client.

- Les secteurs de la santé et de l'industrie pharmaceutique font de plus en plus appel aux services de messagerie pour la livraison rapide de médicaments essentiels, de vaccins et d'échantillons de laboratoire. Des entreprises comme FedEx et UPS proposent des solutions de livraison à température contrôlée et prioritaires qui garantissent un transport sûr et rapide.

- Les détaillants étendent leur utilisation des réseaux de messagerie numériques pour proposer des livraisons le jour même et le lendemain, en s'appuyant sur des systèmes de suivi, des applications mobiles et l'automatisation des expéditions afin de répondre à la demande croissante des consommateurs. Cette tendance accélère l'adoption par le marché des services de livraison intégrant les technologies numériques.

- Le marché connaît une forte croissance des services de livraison express internationale et de logistique transfrontalière, où les plateformes numériques, l'automatisation du dédouanement et les solutions de suivi intégrées sont essentielles. L'essor du commerce mondial, des achats en ligne transfrontaliers et la demande de livraisons internationales rapides renforcent la transition générale vers des services de messagerie numérisés et axés sur la technologie.

Dynamique du marché des services de messagerie en Asie-Pacifique

Conducteur

Croissance rapide du commerce électronique et demande croissante de livraison rapide

- L'expansion rapide des plateformes de commerce électronique, la pénétration croissante des achats en ligne et les attentes grandissantes des consommateurs en matière de livraisons rapides stimulent fortement la demande de services de messagerie. Les solutions technologiques, le suivi en temps réel et les options de livraison flexibles créent des opportunités de croissance pour ce marché.

- Par exemple, Amazon Logistics exploite une intelligence artificielle sophistiquée, la robotique et l'analyse prédictive pour gérer des volumes importants de livraisons et fournir des services de livraison du dernier kilomètre rapides et fiables. Ces capacités permettent à l'entreprise de répondre à la demande croissante de livraisons le jour même et le lendemain dans de nombreuses régions.

- L'urbanisation croissante, l'utilisation accrue des smartphones et d'Internet, ainsi que la préférence des consommateurs pour la commodité accélèrent encore l'adoption des services de messagerie. Les entreprises de tous les secteurs s'appuient de plus en plus sur des réseaux logistiques numérisés pour garantir des livraisons ponctuelles et une efficacité opérationnelle optimale.

- L'importance croissante de la fiabilité de la chaîne d'approvisionnement, notamment pour les produits de grande valeur et périssables, renforce le besoin de services de messagerie performants. Les entreprises intègrent le suivi dans le cloud, le tri automatisé et l'optimisation des itinéraires pour maintenir leurs performances et la confiance de leurs clients.

- L'essor des plateformes de commerce électronique et des modèles de vente directe au consommateur intensifie la demande de solutions de livraison évolutives et performantes. Cette dépendance soutenue à l'égard de services de livraison rapides et fiables assure au marché une croissance continue.

Retenue/Défi

Coûts opérationnels élevés et contraintes d'infrastructure

- Le marché de la messagerie est confronté à des défis liés au coût élevé des infrastructures, des flottes de véhicules, des centres de tri automatisés et des investissements technologiques nécessaires pour répondre à la demande croissante de livraisons. Ces facteurs augmentent les dépenses opérationnelles globales et limitent les marges bénéficiaires des prestataires.

- Par exemple, Blue Dart et FedEx doivent faire face à des coûts importants liés à la livraison du dernier kilomètre, à l'automatisation des entrepôts et à l'intégration des systèmes de suivi numérique. Maintenir la qualité de service tout en maîtrisant les coûts demeure un défi opérationnel majeur.

- Le manque d'infrastructures logistiques dans les régions semi-urbaines et rurales engendre des goulets d'étranglement dans les livraisons, impactant la rapidité et l'efficacité. L'expansion dans ces zones nécessite des investissements importants dans les réseaux de transport et les systèmes de livraison numériques.

- La hausse des prix du carburant, la pénurie de main-d'œuvre et la fluctuation des coûts d'entretien accentuent les difficultés opérationnelles des prestataires de services de messagerie. Trouver un équilibre entre la maîtrise des coûts et la fiabilité du service est essentiel pour maintenir sa compétitivité sur le marché.

- Le marché continue de se heurter à des contraintes pour déployer à grande échelle des réseaux de distribution à haut débit et axés sur la technologie, tout en préservant leur accessibilité et leur efficacité. Ces défis nécessitent collectivement des solutions innovantes, des partenariats et des investissements dans les infrastructures afin de répondre aux attentes croissantes des consommateurs.

Portée du marché des services de messagerie en Asie-Pacifique

Le marché est segmenté en fonction du type, du mode de livraison, du type de client, de la destination et de l'utilisateur final .

- Par type

Le marché du transport express se segmente en deux catégories : les services d’expédition et les services de réception. Le segment des expéditions a dominé le marché en 2025, avec une part de marché estimée à 61,3 %, grâce au volume important d’envois effectués par les entreprises, les plateformes de commerce électronique, les fabricants et les prestataires de services à destination des consommateurs finaux. La croissance du commerce en ligne, du commerce transfrontalier et des modèles commerciaux de vente directe aux consommateurs continue d’alimenter le flux de colis à l’échelle mondiale. Les entreprises de transport express accordent une grande importance à l’optimisation de leur logistique d’expédition afin de garantir des livraisons ponctuelles, une maîtrise des coûts et la satisfaction de leurs clients.

Le segment des expéditions entrantes devrait connaître la croissance annuelle composée la plus rapide entre 2026 et 2033, portée par l'augmentation des retours de marchandises, de la logistique inverse, des livraisons des fournisseurs et du réapprovisionnement des stocks. L'accent mis sur une gestion efficace de la chaîne d'approvisionnement et l'optimisation des stocks stimule la demande de services de messagerie pour les expéditions entrantes.

- Par mode de livraison

Selon le mode de livraison, le marché du transport express se divise en livraison standard et livraison express. En 2025, la livraison standard détenait la plus grande part de marché (54,8 %), grâce à son rapport coût-efficacité et à son utilisation généralisée pour les envois non urgents dans les secteurs du commerce de détail, de l'industrie et des services. Les entreprises continuent de privilégier les options de livraison standard pour maîtriser leurs coûts logistiques tout en bénéficiant d'un service fiable.

Le segment de la livraison express devrait enregistrer le taux de croissance le plus rapide entre 2026 et 2033, porté par la demande croissante des consommateurs pour des livraisons le jour même, le lendemain et à heure fixe. L'essor du commerce électronique, de la livraison de repas, de la logistique médicale et des services haut de gamme contribue fortement à l'adoption des solutions de messagerie express.

- Par type de client

Le marché du transport express est segmenté selon le type de client en B2B (commerce interentreprises), B2C (commerce de détail) et C2C (vente entre particuliers). Le segment B2B dominait le marché en 2025 avec une part de 46,5 %, grâce à des volumes d'expédition élevés dans les secteurs de la fabrication, du commerce de gros, de l'industrie pharmaceutique, de la banque, de la finance et de l'assurance, ainsi que dans les chaînes d'approvisionnement industrielles. La fiabilité, la régularité et la flexibilité des services de transport express, proposés sous contrat, continuent de stimuler une forte demande B2B.

Le segment B2C devrait connaître la croissance annuelle composée la plus rapide entre 2026 et 2033, portée par l'essor fulgurant du e-commerce, des places de marché numériques et des marques de vente directe aux consommateurs. Les attentes croissantes des consommateurs en matière de livraison rapide, traçable et flexible accélèrent la croissance des services de messagerie B2C.

- Par destination

Selon la destination, le marché de la messagerie se divise en livraisons nationales et internationales/transfrontalières. Le segment national représentait la plus grande part de marché (63,9 %) en 2025, porté par des volumes importants de colis à l'intérieur du pays, les livraisons urbaines et le développement des réseaux nationaux de commerce électronique et de vente au détail. Des infrastructures performantes pour le dernier kilomètre et des réseaux de messagerie locaux soutiennent une forte demande intérieure.

Le segment international/transfrontalier devrait connaître la croissance annuelle composée la plus rapide entre 2026 et 2033, porté par l'essor du commerce mondial, du commerce électronique transfrontalier et de l'expédition internationale de documents et de colis. Les progrès réalisés en matière de dédouanement, de documentation numérique et de réseaux logistiques internationaux accélèrent la croissance du secteur du transport express transfrontalier.

- Par l'utilisateur final

Le marché de la messagerie express est segmenté, selon l'utilisateur final, en commerce de gros et de détail (e-commerce), messagerie médicale, industrie manufacturière, services (banque, finance et assurance), construction, services publics et industries primaires. Le segment du commerce de gros et de détail (e-commerce) dominait le marché avec une part de 49,2 % en 2025, grâce aux volumes considérables de colis générés par les plateformes d'achat en ligne, le commerce omnicanal et les places de marché numériques. La croissance continue des dépenses de consommation en ligne soutient une demande soutenue.

Le segment du transport express médical devrait connaître la plus forte croissance annuelle composée entre 2026 et 2033, porté par la demande croissante de livraisons urgentes de produits pharmaceutiques, d'échantillons de diagnostic, d'équipements médicaux et de fournitures de santé. L'importance accrue accordée à la fiabilité et à la conformité de la logistique des soins de santé favorise l'adoption de ce service.

Analyse régionale du marché des services de messagerie en Asie-Pacifique

- La Chine a dominé le marché de la messagerie en 2025, détenant la plus grande part de revenus, grâce à son infrastructure logistique étendue, à la croissance rapide du commerce électronique et à la demande croissante des consommateurs pour des services de livraison rapides et fiables.

- Des investissements publics importants dans des plateformes logistiques intelligentes, le réseau ferroviaire à grande vitesse et des politiques commerciales favorables renforcent le leadership de la Chine sur le marché régional.

- La présence d'entreprises de messagerie nationales de premier plan, les partenariats avec des acteurs mondiaux du commerce électronique et l'introduction de solutions de livraison innovantes continuent de consolider la position dominante de la Chine au cours de la période prévisionnelle. L'urbanisation croissante, la pénétration grandissante du commerce en ligne et la préférence accrue des consommateurs pour les livraisons le jour même et le lendemain renforcent encore la présence du marché dans les villes de premier et deuxième rangs.

Analyse du marché japonais des services de messagerie

Le marché japonais devrait connaître une croissance soutenue entre 2026 et 2033, grâce à ses technologies logistiques de pointe, à un taux de pénétration élevé des smartphones et aux fortes attentes des consommateurs en matière de livraisons ponctuelles. Les consommateurs japonais privilégient de plus en plus les services de messagerie haut de gamme offrant des options à valeur ajoutée telles que le suivi en temps réel et la livraison sans contact. La demande de solutions de livraison compactes pour le dernier kilomètre est en hausse en raison de la densité urbaine et de la réduction des espaces de vie. L'innovation continue dans les domaines de l'automatisation, de la robotique et des plateformes logistiques numériques, ainsi que les collaborations entre les prestataires de messagerie japonais et internationaux, renforcent les perspectives de croissance stable du marché. L'accent mis par le Japon sur la fiabilité, le progrès technologique et la confiance des consommateurs est le gage de sa position régionale solide.

Analyse du marché indien du courrier express

L'Inde devrait enregistrer le taux de croissance annuel composé (TCAC) le plus rapide du marché de la messagerie express en Asie-Pacifique entre 2026 et 2033, portée par l'essor du commerce électronique, l'urbanisation croissante et la pénétration grandissante des smartphones et d'Internet. La sensibilisation accrue aux services de livraison à domicile et la préférence grandissante des consommateurs pour des options d'expédition rapides et abordables accélèrent l'adoption de ces services. La demande de solutions de messagerie express économiques et performantes est particulièrement forte auprès des petites entreprises et des nouveaux acheteurs en ligne. La croissance rapide des plateformes de commerce électronique, l'expansion des réseaux de livraison du dernier kilomètre et les partenariats entre les acteurs logistiques nationaux et internationaux améliorent l'accessibilité des services. Les initiatives gouvernementales telles que « Digital India » et des politiques commerciales favorables garantissent l'émergence de l'Inde comme le marché à la croissance la plus rapide de la région.

Part de marché des services de messagerie en Asie-Pacifique

Le secteur du transport express est principalement dominé par des entreprises bien établies, notamment :

- FedEx (États-Unis)

- Deutsche Post AG (Allemagne)

- United Parcel Service of America, Inc. (UPS) (États-Unis)

- SF Express (Chine)

- Royal Mail Group Limited (Royaume-Uni)

- Yamato Transport Co., Ltd. (Japon)

- Koninklijke PostNL (Pays-Bas)

- Aramex (Émirats arabes unis)

- Singapore Post Limited (Singapour)

- Sagawa Express Co., Ltd. (Japon)

- Qantas Airways Limited (Australie)

- Allied Express (Australie)

- Unique Air Express (Inde)

- Gati-Kintetsu Express Private Limited (Inde)

- DTDC Express Limited (Inde)

- Hermès Europe GmbH (Allemagne)

- GO! Express & Logistics (Deutschland) GmbH (Allemagne)

- GEODIS (France)

- Delhivery Pvt Ltd (Inde)

- LaserShip Inc (États-Unis)

Dernières évolutions du marché du transport express en Asie-Pacifique

- En juin 2025, JD.com a lancé son premier service express international en propre afin de renforcer sa présence logistique mondiale et de concurrencer directement les leaders du secteur de la messagerie. Cette initiative témoigne de l'ambition de JD.com d'étendre ses capacités de livraison transfrontalières et d'améliorer sa maîtrise des chaînes d'approvisionnement internationales.

- En mai 2025, DHL eCommerce UK a fusionné avec Evri pour créer un vaste réseau de livraison gérant plus d'un milliard de colis par an à travers le pays. Cette fusion illustre la consolidation du secteur visant à améliorer l'efficacité du dernier kilomètre, la rapidité de livraison et la couverture nationale.

- En février 2024, Emirates Post Group, rebaptisé 7X, a lancé EMX, une nouvelle filiale dédiée à la transformation du secteur du courrier express et des colis aux Émirats arabes unis grâce à des technologies de pointe et des solutions logistiques centrées sur le client. Cette initiative illustre la stratégie du groupe visant à moderniser ses services de messagerie express et à renforcer sa compétitivité régionale.

- En mai 2023, Interroll a lancé sa plateforme de convoyage haute performance, conçue spécifiquement pour les opérations de messagerie, de livraison express et de colis. Cette plateforme intègre des modules de déviation intelligents et des capacités de tri à haut débit. Ce développement témoigne de l'importance croissante de l'automatisation et de l'efficacité dans les environnements de traitement de colis à grande échelle.

- En novembre 2022, DHL Express a inauguré un point de service entièrement automatisé et numérique au Dubai Digital Park, une première au Moyen-Orient et au sein du réseau mondial de DHL. Ce lancement a établi une nouvelle référence en matière de service client automatisé et a renforcé le leadership de DHL dans l'innovation logistique.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.