Asia Pacific Compressed Natural Gas Cng Market

Taille du marché en milliards USD

TCAC :

%

USD

41.10 Billion

USD

55.47 Billion

2024

2032

USD

41.10 Billion

USD

55.47 Billion

2024

2032

| 2025 –2032 | |

| USD 41.10 Billion | |

| USD 55.47 Billion | |

|

|

|

|

Segmentation du marché du gaz naturel comprimé (GNC) en Asie-Pacifique, par source (gaz associé et gaz non associé), kits (séquentiels et Venturi), type de distribution (bouteilles/réservoirs, accumulateurs, collecteurs composites et autres), utilisation finale (véhicules automobiles légers, véhicules automobiles moyens et véhicules automobiles lourds) – Tendances et prévisions du secteur jusqu'en 2032

Taille du marché du gaz naturel comprimé en Asie-Pacifique

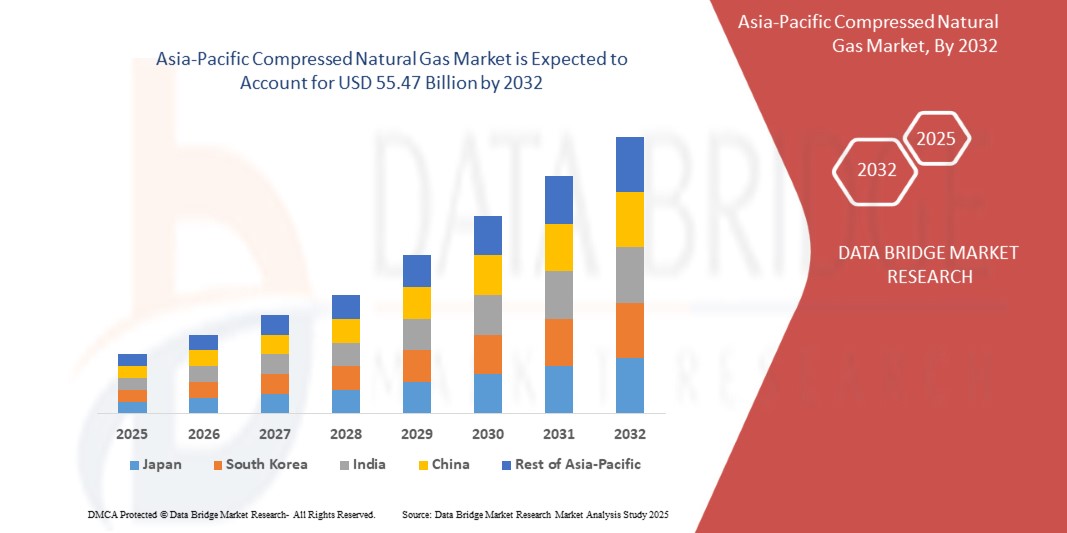

- La taille du marché du gaz naturel comprimé (GNC) en Asie-Pacifique était évaluée à 41,1 milliards USD en 2024 et devrait atteindre 55,47 milliards USD d'ici 2032 , enregistrant un TCAC de 3,8 % au cours de la période de prévision.

- La croissance du marché est largement alimentée par l'urbanisation rapide, la demande croissante de carburants propres et les initiatives gouvernementales visant à réduire les émissions de gaz à effet de serre. Des pays comme la Chine, l'Inde et le Pakistan sont en tête de l'adoption du gaz naturel comprimé grâce à un soutien politique fort et à la croissance de leur parc automobile.

- De plus, l'augmentation du coût des carburants conventionnels tels que l'essence et le diesel a encouragé les consommateurs individuels et les exploitants de flottes à se tourner vers le gaz naturel comprimé comme alternative plus économique et plus respectueuse de l'environnement.

- Collectivement, ces moteurs positionnent le gaz naturel comprimé comme un carburant essentiel dans la transition énergétique propre de la région Asie-Pacifique, en particulier dans le secteur des transports où la demande de solutions de mobilité abordables et durables continue d'augmenter.

Analyse du marché du gaz naturel comprimé en Asie-Pacifique

- Le marché du gaz naturel comprimé en Asie-Pacifique connaît une forte croissance en raison de la forte dépendance de la région au transport routier, combinée aux initiatives de carburant propre soutenues par le gouvernement et aux incitations financières pour les consommateurs et les fabricants.

- La Chine et l'Inde dominent collectivement le marché régional, avec des investissements à grande échelle dans les réseaux de distribution de gaz naturel comprimé, des programmes de conversion de véhicules et des politiques imposant l'utilisation de carburants propres dans les flottes de transports publics.

- L'adoption croissante de véhicules automobiles légers fonctionnant au gaz naturel comprimé (LMV), tels que les voitures particulières et les véhicules à trois roues, est un moteur de croissance clé, soutenu par l'accessibilité financière, des coûts de fonctionnement inférieurs et une disponibilité croissante des stations-service.

- L'Inde est le marché qui connaît la croissance la plus rapide, avec une croissance prévue de 8,9 % du gaz naturel comprimé (2025-2032), soutenue par une expansion rapide des infrastructures de ravitaillement, des subventions pour les véhicules au GNC et une demande croissante des flottes de véhicules de tourisme et commerciaux.

- La Chine domine le marché du gaz naturel comprimé de la région Asie-Pacifique en 2024, évalué à 13,6 milliards de dollars, en raison de ses vastes réserves de gaz naturel, de son adoption à grande échelle dans les transports publics et des politiques de réduction des émissions soutenues par le gouvernement.

- Le segment du gaz non associé a dominé le marché en 2024, détenant la plus grande part de revenus, soutenu par de vastes réserves dans des pays comme la Chine, l'Inde et l'Indonésie.

Portée du rapport et segmentation du marché du gaz naturel comprimé en Asie-Pacifique

|

Attributs |

Informations clés sur le marché du gaz naturel comprimé en Asie-Pacifique |

|

Segments couverts |

|

|

Pays couverts |

Asie-Pacifique

|

|

Principaux acteurs du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre la valeur marchande, le taux de croissance, la segmentation, la couverture régionale et les principaux acteurs, le rapport comprend une analyse approfondie des experts, une analyse des prix et des coûts, les modèles de demande des consommateurs, le cadre politique et réglementaire, les tendances d'adoption de la technologie, les informations sur la chaîne d'approvisionnement et la chaîne de valeur, ainsi que l'analyse des cinq forces de PESTLE & Porter. |

Tendances du marché du gaz naturel comprimé en Asie-Pacifique

Adoption croissante des véhicules au GNC grâce aux initiatives en matière d'énergie propre

- Une tendance significative sur le marché du gaz naturel comprimé en Asie-Pacifique est l'adoption croissante de véhicules fonctionnant au gaz naturel comprimé, soutenue par des initiatives gouvernementales en matière d'énergie propre, des normes d'émission plus strictes et des avantages croissants en matière de coût du carburant par rapport à l'essence et au diesel.

- Par exemple, l'Inde et la Chine développent rapidement leurs réseaux de stations-service en gaz naturel comprimé. Les sociétés indiennes GAIL et Indraprastha Gas Limited investissent massivement dans les corridors urbains et autoroutiers. De même, les sociétés chinoises CNPC et Sinopec développent leurs infrastructures de gaz naturel comprimé afin de respecter leurs objectifs de réduction des émissions de carbone.

- Les constructeurs automobiles lancent davantage de véhicules compatibles avec le gaz naturel comprimé (GNC) dans les catégories des véhicules légers, moyens et lourds afin de répondre à la demande croissante, notamment dans les flottes de transports publics urbains et les secteurs de la logistique commerciale. Des entreprises comme Maruti Suzuki en Inde et Hyundai en Corée du Sud renforcent leur portefeuille de véhicules au GNC.

- Les avantages environnementaux tels que la réduction des émissions de gaz à effet de serre et des particules fines bénéficient d'un soutien important de la part des autorités réglementaires, faisant du gaz naturel comprimé un combustible de transition privilégié dans la transition énergétique de la région Asie-Pacifique.

- De plus, l'accessibilité du gaz naturel comprimé par rapport aux carburants conventionnels stimule la demande auprès des consommateurs et des entreprises sensibles aux coûts. Les subventions, les avantages fiscaux et les incitations pour les gestionnaires de flottes accélèrent encore son adoption.

- L'accent croissant mis sur le transport durable, soutenu par les avancées technologiques dans les kits de gaz naturel comprimé séquentiel et les systèmes de stockage de grande capacité, remodèle les préférences des consommateurs et favorise un déploiement à grande échelle dans toute la région.

Dynamique du marché du gaz naturel comprimé en Asie-Pacifique

Conducteur

Les incitations gouvernementales et l'expansion des infrastructures favorisent l'adoption du GNC

- Le marché du gaz naturel comprimé en Asie-Pacifique est fortement stimulé par un soutien gouvernemental important sous forme de subventions, d'incitations et de politiques favorables visant à réduire la dépendance aux combustibles fossiles conventionnels et à diminuer les émissions de carbone. Des pays comme l'Inde, la Chine et le Pakistan investissent massivement dans les infrastructures de ravitaillement en gaz naturel comprimé, facilitant ainsi l'accès au gaz naturel comprimé pour les consommateurs et les exploitants de flottes.

- Par exemple, les projets d'expansion du réseau national de gaz et de distribution de gaz de ville (CGD) en Inde favorisent l'adoption généralisée du gaz naturel comprimé dans les véhicules légers et lourds. De même, la Chine privilégie le gaz naturel dans le cadre de sa transition énergétique propre, grâce à des investissements massifs dans les pipelines et les infrastructures de stockage.

- L'accessibilité du gaz naturel comprimé par rapport à l'essence et au diesel constitue un autre facteur déterminant. Face à la hausse des prix mondiaux du pétrole brut, les consommateurs soucieux des coûts et les exploitants de flottes commerciales se tournent de plus en plus vers les véhicules fonctionnant au gaz naturel comprimé afin de réduire leurs coûts d'exploitation.

- De plus, la faible empreinte carbone du gaz naturel comprimé s'aligne sur les objectifs climatiques mondiaux et régionaux. Ses avantages environnementaux, notamment la réduction des émissions de gaz à effet de serre et des particules fines, stimulent son adoption dans les transports publics, la logistique et la mobilité individuelle.

- Les progrès technologiques dans les kits de gaz naturel comprimé séquentiel, le stockage en bouteilles composites et les systèmes à double carburant améliorent encore les performances et la sécurité, augmentant la confiance des consommateurs et l'adoption sur le marché de l'Asie-Pacifique.

Retenue/Défi

Lacunes en matière d'infrastructures et coûts de conversion initiaux élevés

- Malgré de solides perspectives de croissance, le marché du gaz naturel comprimé en Asie-Pacifique est confronté à des difficultés en raison de l'insuffisance des infrastructures dans plusieurs économies émergentes. Alors que les grandes villes connaissent une expansion rapide des stations-service en gaz naturel comprimé, l'accessibilité reste limitée dans les zones rurales et semi-urbaines, ce qui freine son adoption généralisée.

- Par exemple, les coûts initiaux élevés de conversion des véhicules équipés de kits de gaz naturel comprimé constituent également un frein, notamment sur les marchés sensibles aux prix. Pour de nombreux consommateurs, les économies de carburant à long terme sont compensées par l'investissement initial important nécessaire à la conversion.

- Les préoccupations en matière de sécurité liées au stockage et à la manutention des bouteilles de gaz naturel comprimé demeurent un obstacle dans certaines régions. Bien que les progrès technologiques aient réduit les risques, la perception du public et le manque de sensibilisation continuent d'influencer les hésitations des consommateurs.

- De plus, les fluctuations des prix du gaz naturel et les incertitudes liées à la chaîne d'approvisionnement peuvent impacter l'accessibilité et la disponibilité du gaz, limitant ainsi le potentiel du marché. Les pays fortement dépendants des importations de gaz naturel sont confrontés à des risques de volatilité, susceptibles de freiner les stratégies d'adoption à long terme.

- Surmonter ces défis nécessite des efforts coordonnés de la part des gouvernements et des acteurs de l'industrie pour développer les infrastructures, fournir des subventions pour la modernisation et investir dans des campagnes de sensibilisation qui mettent l'accent à la fois sur les économies de coûts et les avantages environnementaux du gaz naturel comprimé.

Portée du marché du gaz naturel comprimé en Asie-Pacifique

Le marché est segmenté en fonction de la source, des kits, du type de distribution et de l’utilisation finale.

• Par source

En fonction de la source, le marché du gaz naturel comprimé en Asie-Pacifique est segmenté en gaz associé, gaz non associé et sources non conventionnelles. Le segment du gaz non associé a dominé le marché en 2024, détenant la plus grande part de revenus, soutenu par d'importantes réserves dans des pays comme la Chine, l'Inde et l'Indonésie. Une production abondante, associée à des politiques gouvernementales visant à optimiser l'utilisation des réserves nationales, a fait du gaz non associé le principal contributeur à l'approvisionnement en GNC de la région.

Le segment des sources non conventionnelles devrait connaître la croissance la plus rapide entre 2025 et 2032, alimenté par l'augmentation des investissements dans les projets de gaz de schiste et de méthane de houille, notamment en Chine et en Australie. Les progrès des technologies d'extraction, conjugués à la demande croissante de sources de gaz naturel diversifiées, accélèrent l'adoption des gaz non conventionnels pour la production de GNC.

• Par kits

En termes de kits, le marché du gaz naturel comprimé en Asie-Pacifique est segmenté en kits montés par les constructeurs d'origine et en kits rétrofités. Le segment des kits montés par les constructeurs d'origine a représenté la plus grande part de chiffre d'affaires en 2024, grâce à l'adoption croissante des véhicules GNC montés en usine par des constructeurs automobiles de premier plan tels que Maruti Suzuki, Hyundai et Toyota. La préférence croissante des consommateurs pour des solutions fiables et garanties a renforcé la domination de ce segment.

Le segment des kits de modernisation devrait connaître le TCAC le plus élevé entre 2025 et 2032, soutenu par une accessibilité financière croissante, un volume important de véhicules à essence existants et une forte demande dans les pays en développement comme l'Inde, le Pakistan et le Bangladesh. Les kits de modernisation deviennent une solution rentable pour les particuliers et les gestionnaires de flottes, en particulier sur les marchés où les prix des carburants sont très volatils.

• Par type de distribution

En termes de distribution, le marché du gaz naturel comprimé en Asie-Pacifique est segmenté entre la distribution par pipeline et la livraison en cascade/par camion. En 2024, le segment de la distribution par pipeline a dominé le marché, représentant la plus grande part grâce à d'importants investissements dans les réseaux de gazoducs en Chine, en Inde et en Australie. La connectivité des pipelines assure un approvisionnement fiable et rentable pour les stations-service urbaines, favorisant ainsi l'adoption à grande échelle du GNC.

Le segment des livraisons par cascades et par camions devrait connaître sa plus forte croissance entre 2025 et 2032, porté par la demande croissante dans les zones rurales et reculées où les infrastructures de pipelines restent sous-développées. Le déploiement croissant de cascades mobiles et de pipelines virtuels comble les lacunes en matière d'infrastructures, rendant le gaz naturel comprimé plus accessible aux régions mal desservies.

• Par utilisation finale

En fonction de son utilisation finale, le marché du gaz naturel comprimé en Asie-Pacifique est segmenté entre les secteurs du transport, de l'industrie et de la production d'électricité. En 2024, le secteur des transports a dominé le marché, détenant plus de 70 % de la part de marché totale, grâce à l'adoption massive du gaz naturel comprimé dans les voitures particulières, les taxis, les bus et les flottes logistiques. De fortes incitations gouvernementales, des programmes de réduction de la pollution urbaine et une prise de conscience croissante des économies de coûts ont renforcé le transport comme principal secteur d'utilisation finale.

Le secteur de la production d'électricité devrait connaître le TCAC le plus élevé entre 2025 et 2032, notamment au Pakistan et au Bangladesh, où les gouvernements encouragent activement la production d'électricité à partir du gaz naturel. La demande croissante de sources d'énergie propres, fiables et abordables, conjuguée aux efforts visant à réduire la dépendance aux combustibles importés, accélère la transition vers le GNC dans le secteur de l'électricité.

Analyse régionale du marché du gaz naturel comprimé en Asie-Pacifique

- L'Asie-Pacifique a dominé le marché mondial du gaz naturel comprimé avec la plus grande part de revenus de plus de 55 % en 2024, soutenue par une forte demande de carburants alternatifs dans les transports et les applications industrielles, et par de fortes initiatives gouvernementales visant à réduire les émissions de carbone.

- Les vastes réserves de gaz naturel de la région, l'expansion rapide des infrastructures de ravitaillement en gaz naturel comprimé et l'adoption à grande échelle du gaz naturel comprimé dans les flottes de transport public et de logistique accélèrent la pénétration du marché.

- L'urbanisation croissante, la rentabilité du gaz naturel comprimé par rapport aux carburants conventionnels et les politiques de soutien telles que les subventions et les incitations fiscales stimulent une forte consommation dans les économies clés, notamment la Chine, l'Inde, le Pakistan et la Thaïlande.

- L'augmentation des investissements dans les projets de gaz naturel bio-comprimé et de gaz naturel renouvelable, associée à la présence d'acteurs majeurs de l'industrie et à des flottes de véhicules en croissance rapide, renforce encore la position dominante de l'Asie-Pacifique sur le marché mondial du gaz naturel comprimé.

Aperçu du marché chinois du gaz naturel comprimé

La Chine détient une part significative de 13,6 milliards de dollars sur le marché du gaz naturel comprimé en Asie-Pacifique, grâce à sa volonté de réduire ses émissions de carbone et sa dépendance aux importations de pétrole. Les importants secteurs de la logistique et des transports publics du pays sont à l'avant-garde de l'adoption du gaz naturel comprimé, avec des bus, des taxis et des camions de plus en plus alimentés au gaz naturel. Les gouvernements régionaux encouragent la conversion des flottes, tandis que les constructeurs nationaux intensifient leur production de véhicules et leurs infrastructures de ravitaillement. De plus, les investissements de la Chine dans des systèmes avancés de stockage et de distribution de gaz naturel comprimé, associés à ses vastes ressources nationales en gaz naturel, garantissent un approvisionnement constant et des prix compétitifs.

Aperçu du marché indien du gaz naturel comprimé

L'Inde est l'un des marchés du gaz naturel comprimé les plus importants et à la croissance la plus rapide en Asie-Pacifique, avec un TCAC de 8,9 %. L'engagement ferme du gouvernement en faveur du développement de la mobilité propre, notamment en subventionnant les véhicules au gaz naturel comprimé et en déployant rapidement des couloirs de ravitaillement en gaz naturel comprimé, stimule l'expansion du marché. La hausse de la pollution atmosphérique urbaine et du coût croissant du carburant incite également les consommateurs et les gestionnaires de flottes à se tourner vers des alternatives abordables au gaz naturel comprimé. Les constructeurs automobiles nationaux tels que Maruti Suzuki, Tata Motors et Hyundai élargissent leur gamme de véhicules au gaz naturel comprimé montés en usine, démocratisant ainsi l'adoption de ce gaz. Le marché indien bénéficie du développement continu des infrastructures de pipelines et de l'intensification des partenariats entre acteurs publics et privés pour répondre à la demande croissante.

Aperçu du marché japonais du gaz naturel comprimé

Le marché japonais du gaz naturel comprimé, bien que plus restreint que celui de l'Inde et de la Chine, connaît une croissance progressive grâce à l'accent mis par le pays sur le développement durable et la réduction des émissions de gaz à effet de serre. Le gouvernement japonais encourage l'adoption de carburants alternatifs, parallèlement à l'hydrogène et à la mobilité électrique. L'adoption du GNC est particulièrement forte dans certaines flottes commerciales, telles que les transports municipaux et la logistique. Le marché japonais se caractérise par une technologie de bouteilles avancée, des dispositifs de sécurité et une intégration avec des systèmes de ravitaillement intelligents, reflétant son approche axée sur l'innovation.

Aperçu du marché du gaz naturel comprimé en Corée du Sud

La Corée du Sud s'est imposée comme un acteur actif sur le marché du GNC en Asie-Pacifique, notamment dans le secteur des transports publics. Le gouvernement a encouragé l'utilisation de bus et de taxis au gaz naturel comprimé pour remédier aux problèmes de qualité de l'air urbain. Les constructeurs locaux, dont Hyundai et Kia, développent leur offre de véhicules au gaz naturel comprimé, ce qui renforce l'adoption nationale. La Corée du Sud bénéficie également d'infrastructures solides et de la confiance des consommateurs dans les solutions de mobilité propre.

Part de marché du gaz naturel comprimé en Asie-Pacifique

L'industrie du gaz naturel comprimé en Asie-Pacifique est principalement dirigée par des entreprises bien établies, notamment :

- Indraprastha Gas Limited (Inde)

- GAIL (Inde) Limited (Inde)

- China National Petroleum Corporation (Chine)

- Sinopec (Chine)

- PTT Public Company Limited (Thaïlande)

- Tokyo Gas Co., Ltd. (Japon)

- SK E&S (Corée du Sud)

- ENN Energy Holdings Limited (Chine)

- Petronas (Malaisie)

- Osaka Gas Co., Ltd. (Japon)

Derniers développements sur le marché du gaz naturel comprimé en Asie-Pacifique

- En mars 2024, Indraprastha Gas Limited (Inde) a annoncé l'expansion de plus de 150 nouvelles stations-service GNC dans les principales villes indiennes afin de répondre à la forte demande des véhicules particuliers et utilitaires. Cette initiative s'inscrit dans l'objectif de l'Inde d'accroître la pénétration du GNC à l'échelle nationale.

- En janvier 2024, la China National Petroleum Corporation (CNPC) a modernisé sa plateforme de ravitaillement en GNC à grande échelle à Pékin afin de soutenir ses flottes de véhicules lourds. Cette expansion s'inscrit dans la stratégie globale de diversification énergétique de la Chine et dans son engagement à réduire les émissions du secteur des transports.

- En décembre 2023, PT Pertamina (Indonésie) a lancé un partenariat public-privé visant à déployer des installations de stockage et de distribution de GNC de pointe. Ce projet vise à accroître l'adoption du GNC dans les flottes logistiques tout en réduisant la dépendance aux carburants importés.

- En octobre 2023, Korea Gas Corporation (KOGAS) s'est associée au groupe Hyundai Motor pour améliorer l'infrastructure GNC des bus publics et des flottes municipales. Cette collaboration porte sur le déploiement de bouteilles composites et de systèmes de ravitaillement de nouvelle génération, plus sûrs.

- En septembre 2023, Tokyo Gas Co., Ltd. (Japon) a lancé un programme pilote de stations de ravitaillement en GNC intelligentes équipées de systèmes de paiement numérique et de surveillance en temps réel pour améliorer la commodité et la sécurité des consommateurs.

- En août 2023, PTT Public Company Limited (Thaïlande) a annoncé un investissement dans la construction de nouvelles stations de vente au détail de GNC à Bangkok et dans les régions environnantes, visant une plus grande adoption dans les taxis et les flottes de covoiturage.

- En juillet 2023, la Philippine National Oil Company (PNOC) a annoncé un plan stratégique visant à établir des couloirs de bus au GNC dans la métropole de Manille dans le cadre de ses efforts pour lutter contre la détérioration de la qualité de l'air urbain et la hausse des coûts du diesel.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.