Asia Pacific Closed System Transfer Devices Market

Taille du marché en milliards USD

TCAC :

%

USD

200.07 Million

USD

746.95 Million

2025

2033

USD

200.07 Million

USD

746.95 Million

2025

2033

| 2026 –2033 | |

| USD 200.07 Million | |

| USD 746.95 Million | |

|

|

|

|

Segmentation du marché des dispositifs de transfert en système clos en Asie-Pacifique, par type (systèmes membrane-membrane et dispositifs de transfert en système clos sans aiguille), composant (dispositifs et accessoires), mécanisme de fermeture (systèmes à pression et rotation, systèmes d'alignement couleur-couleur, systèmes Luer-Lock et systèmes à verrouillage par clic), technologie (dispositifs à diaphragme, dispositifs compartimentés et dispositifs de purification/filtration de l'air), utilisateur final (hôpitaux, centres et cliniques d'oncologie, centres de chirurgie ambulatoire, établissements d'enseignement et de recherche), canal de distribution (appels d'offres directs et vente au détail) - Tendances du secteur et prévisions jusqu'en 2033

Taille du marché des dispositifs de transfert en système fermé en Asie-Pacifique

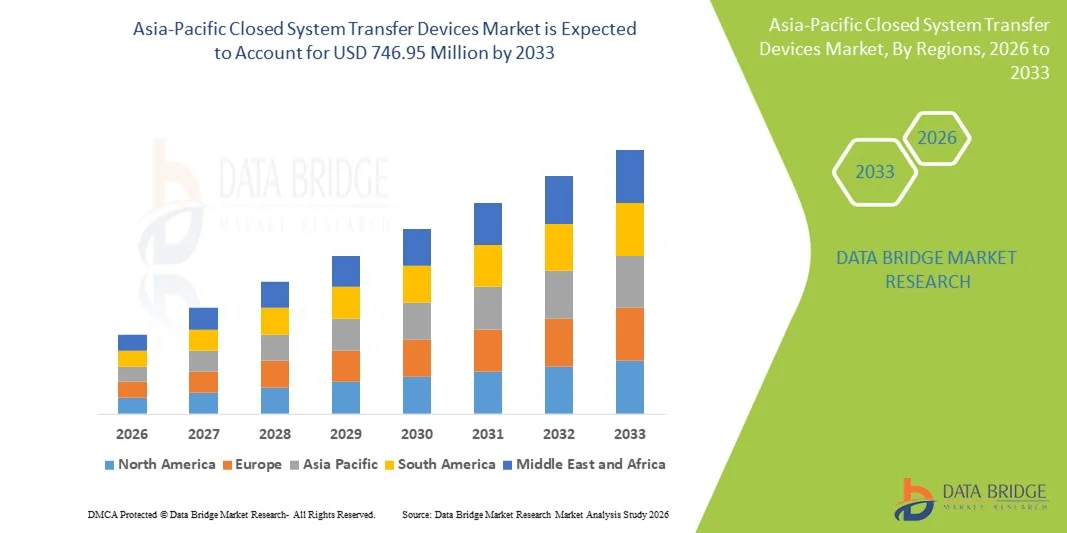

- Le marché des dispositifs de transfert en système fermé en Asie-Pacifique était évalué à 200,07 millions de dollars américains en 2025 et devrait atteindre 746,95 millions de dollars américains d'ici 2033 , avec un TCAC de 17,9 % au cours de la période de prévision.

- La croissance du marché est largement alimentée par l'expansion rapide des infrastructures de santé, l'augmentation de l'incidence du cancer et la sensibilisation croissante à la sécurité au travail lors de la manipulation de médicaments dangereux, ce qui conduit à une adoption plus large des dispositifs de transfert de médicaments en circuit fermé (CSTD) dans les hôpitaux, les centres d'oncologie et les cliniques.

- De plus, les initiatives gouvernementales, les progrès technologiques dans la conception des systèmes de transfert en système clos (CSTD) et le besoin de protocoles de transfert de médicaments plus sûrs stimulent les investissements et la demande dans des pays clés comme la Chine, l'Inde, le Japon et la Corée du Sud. La convergence de ces facteurs fait des systèmes de transfert en système clos des éléments essentiels des pratiques modernes de sécurité des soins de santé, contribuant ainsi de manière significative à la croissance du marché dans la région.

Analyse du marché des dispositifs de transfert en système fermé en Asie-Pacifique

- Les dispositifs de transfert en système clos (CSTD), conçus pour prévenir l'exposition à des médicaments dangereux lors de leur préparation et de leur administration, sont des éléments de plus en plus essentiels des établissements de soins de santé et d'oncologie modernes, dans les hôpitaux, les cliniques et les instituts de recherche, en raison de leur sécurité accrue, de leur conformité réglementaire et de leur intégration transparente dans les flux de travail existants de manipulation des médicaments.

- La demande croissante de dispositifs de transfert en système clos est principalement alimentée par une sensibilisation accrue à la sécurité au travail parmi les professionnels de la santé, l'augmentation de l'incidence du cancer et des directives réglementaires strictes imposant une manipulation sûre des médicaments dangereux.

- La Chine a dominé le marché des dispositifs de transfert en système clos en Asie-Pacifique en 2025, avec la plus grande part de revenus (38,4 %). Cette domination s'explique par une infrastructure de santé bien établie, une forte adoption des protocoles de sécurité avancés dans les hôpitaux et les centres d'oncologie, et une présence importante des principaux acteurs du secteur.

- L'Inde devrait connaître la croissance la plus rapide sur le marché des dispositifs de transfert en système clos en Asie-Pacifique au cours de la période de prévision, en raison du développement rapide de ses infrastructures de santé et de l'augmentation du nombre de patients atteints de cancer.

- Le segment des dispositifs de transfert en système clos sans aiguille a dominé le marché avec une part de marché de 62,5 % en 2025, grâce à sa capacité à minimiser l'exposition aux médicaments dangereux, à réduire les risques de contamination et à simplifier la manipulation sécuritaire des médicaments dans les établissements de soins.

Portée du rapport et segmentation du marché des dispositifs de transfert en système fermé en Asie-Pacifique

|

Attributs |

Dispositifs de transfert en système fermé : principaux enseignements du marché Asie-Pacifique |

|

Segments couverts |

|

|

Pays couverts |

Asie-Pacifique

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur du marché, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché élaborés par Data Bridge Market Research incluent également une analyse approfondie par des experts, des données épidémiologiques sur les patients, une analyse des projets en développement, une analyse des prix et un aperçu du cadre réglementaire. |

Tendances du marché des dispositifs de transfert en système fermé en Asie-Pacifique

Sécurité accrue grâce aux systèmes sans aiguille et à l'automatisation

- Une tendance importante et en accélération sur le marché des systèmes de transfert de médicaments en système clos (CSTD) en Asie-Pacifique est l'adoption croissante de ces dispositifs, qui réduisent l'exposition aux médicaments dangereux et les risques de contamination tout en simplifiant la manipulation dans les hôpitaux, les centres d'oncologie et les instituts de recherche.

- Par exemple, le système BD PhaSeal de transfert de médicaments sans aiguille permet un transfert de médicaments sûr sans aiguille, minimisant ainsi les risques d'exposition et de contamination au travail lors de la préparation et de l'administration de la chimiothérapie.

- Les fonctionnalités d'automatisation des systèmes de transfert de médicaments modernes permettent au personnel soignant de manipuler les médicaments plus efficacement tout en respectant des normes de sécurité strictes, en réduisant les erreurs manuelles et en améliorant le flux de travail global en milieu clinique.

- L'intégration des systèmes de transfert centralisés de médicaments (STCM) aux protocoles de sécurité hospitaliers et aux programmes de formation permet une surveillance centralisée des pratiques de manipulation des médicaments, améliorant ainsi la conformité et réduisant les risques d'exposition accidentelle pour les professionnels de santé.

- Cette tendance vers des systèmes de manipulation de médicaments plus efficaces, intuitifs et sûrs redéfinit les normes opérationnelles en oncologie, et des entreprises comme Equashield développent des dispositifs de transfert de médicaments sans aiguille dotés de mécanismes de sécurité automatisés et d'une étanchéité avancée.

- La demande de dispositifs de transfert de médicaments sans aiguille (CSTD) croît rapidement dans les hôpitaux et les centres d'oncologie en Inde, en Chine, au Japon et en Corée du Sud, les établissements de santé accordant une importance croissante à la sécurité des travailleurs, au respect des réglementations et à l'efficacité opérationnelle.

- Les progrès technologiques, tels que les systèmes de surveillance et de retour d'information en temps réel dans les dispositifs de transfert de médicaments en milieu clos (CSTD), améliorent la facilité d'utilisation et la sécurité, favorisant ainsi une adoption plus large dans les flux de travail cliniques.

Dynamique du marché des dispositifs de transfert en système fermé en Asie-Pacifique

Conducteur

Besoin croissant dû à la sécurité au travail et à la conformité réglementaire

- La prise de conscience croissante des risques liés à l'exposition aux médicaments dangereux parmi les professionnels de la santé, associée à des réglementations gouvernementales et hospitalières strictes, est un facteur clé de la demande accrue de dispositifs de transfert de médicaments en milieu clos (CSTD).

- Par exemple, en mars 2025, BD a annoncé des améliorations apportées à son système de drainage post-transplantation sans aiguille PhaSeal, intégrant une technologie de scellage avancée afin d'améliorer la sécurité du personnel et de réduire les risques de contamination environnementale.

- Alors que les hôpitaux et les centres d'oncologie adoptent des protocoles de sécurité plus stricts, les dispositifs de transfert de médicaments cytotoxiques (CSTD) offrent une protection avancée aux professionnels de santé, minimisant l'exposition aux médicaments cytotoxiques lors de leur préparation et de leur administration.

- De plus, le développement des services d'oncologie et des traitements de chimiothérapie dans des pays comme l'Inde et la Chine favorise l'adoption accrue des dispositifs de transfert de médicaments en milieu clos (CSTD) afin de se conformer aux normes de sécurité au travail.

- Les dispositifs de transfert de médicaments sans aiguille (CSTD) permettent une manipulation des médicaments plus sûre et plus efficace, réduisant les piqûres accidentelles, la contamination et les erreurs de procédure, ce qui favorise leur adoption dans les hôpitaux, les cliniques et les instituts de recherche.

- Les initiatives gouvernementales visant à promouvoir la sécurité au travail et le respect obligatoire des normes de manipulation des médicaments dangereux se généralisent dans les établissements de santé publics et privés.

- Le renforcement des programmes de sensibilisation et des initiatives de formation destinés aux professionnels de la santé met l'accent sur les avantages des dispositifs de transfert de médicaments en milieu clos (CSTD), stimulant ainsi leur acquisition et leur utilisation dans les centres d'oncologie et les hôpitaux.

Retenue/Défi

Coûts élevés et exigences de formation

- Le coût initial relativement élevé des systèmes de transfert de médicaments sans aiguille de pointe, comparé aux méthodes traditionnelles, constitue un obstacle important, notamment pour les petites cliniques et les hôpitaux aux budgets limités dans les pays en développement.

- Par exemple, les nouveaux utilisateurs en Inde et en Asie du Sud-Est peuvent hésiter à adopter les CSTD en raison de l'investissement initial et de la complexité perçue de l'intégration de ces dispositifs dans les flux de travail existants.

- Une formation adéquate des professionnels de santé est essentielle pour garantir une utilisation sûre et correcte des dispositifs de transfert de médicaments en circuit fermé (DTC). Cette formation peut s'avérer longue et nécessiter des ressources supplémentaires pour le personnel.

- Bien que l'automatisation réduise les erreurs manuelles, la nécessité d'un respect et d'un suivi constants des protocoles peut limiter la vitesse d'adoption, en particulier dans les établissements de santé en sous-effectif.

- Surmonter ces défis grâce à des solutions rentables, des conceptions conviviales et des programmes de formation structurés sera essentiel pour une croissance durable du marché et une pénétration plus large dans les établissements de santé de la région Asie-Pacifique.

- Les limitations de la chaîne d'approvisionnement et les retards d'achat, notamment dans les régions éloignées, peuvent entraver l'adoption et la distribution rapides des CSTD, affectant ainsi la croissance du marché.

- Le manque de sensibilisation des petites cliniques et des prestataires de soins de santé aux avantages des systèmes sans aiguille peut ralentir leur adoption, ce qui nécessite des stratégies de formation et de marketing ciblées.

Portée du marché des dispositifs de transfert en système fermé en Asie-Pacifique

Le marché est segmenté en fonction du type, du composant, du mécanisme de fermeture, de la technologie, de l'utilisateur final et du canal de distribution.

- Par type

Le marché des systèmes de transfert de médicaments en système clos (CSTD) en Asie-Pacifique est segmenté, selon le type de système, en systèmes membrane-membrane et dispositifs de transfert en système clos sans aiguille. En 2025, le segment des dispositifs de transfert en système clos sans aiguille dominait le marché avec une part de revenus de 62,5 %, grâce à sa capacité à minimiser l'exposition aux médicaments dangereux, à réduire les risques de contamination et à simplifier la manipulation des médicaments dans les hôpitaux et les centres d'oncologie. Ces dispositifs sont privilégiés pour leur facilité d'utilisation, leur conformité aux normes de sécurité les plus strictes et leur compatibilité avec de nombreux protocoles d'administration de chimiothérapie . Les systèmes sans aiguille contribuent également à des flux de travail plus sûrs pour les professionnels de santé en éliminant les piqûres d'aiguille et en réduisant les erreurs de manipulation. De plus, leur adoption croissante en Chine, en Inde, au Japon et en Corée du Sud contribue à une croissance soutenue du marché. Des fabricants tels que BD et Equashield élargissent leur gamme de produits dans ce segment afin de répondre aux exigences croissantes en matière de sécurité et d'efficacité opérationnelle. La prédominance des systèmes sans aiguille est également confortée par les réglementations qui mettent l'accent sur la sécurité au travail des professionnels de santé.

Le segment des systèmes membrane-membrane devrait connaître la croissance la plus rapide au cours de la période prévisionnelle, grâce à la précision de leurs transferts de médicaments et à leur adéquation aux applications spécialisées des pharmacies hospitalières et des centres d'oncologie. Ces systèmes offrent une étanchéité renforcée et réduisent les risques de contamination, ce qui explique leur popularité croissante dans les pays en développement, comme l'Inde et l'Asie du Sud-Est, où les infrastructures de santé sont en pleine expansion. Leur adoption est également favorisée par des campagnes de sensibilisation axées sur la sécurité au travail et l'amélioration des protocoles de manipulation. Compatibles avec différents types de médicaments, les systèmes membrane-membrane optimisent les flux de travail en milieu clinique. Par ailleurs, les progrès technologiques et la conception économique de ces systèmes incitent les établissements de santé de plus petite taille à les adopter, contribuant ainsi à l'accélération de la croissance de ce segment.

- Par composant

Le marché est segmenté, selon les composants, en dispositifs et accessoires. Le segment des dispositifs a dominé le marché en 2025, les unités CSTD primaires étant essentielles à la sécurité du transfert des médicaments et à la prévention des expositions. Les hôpitaux et les centres d'oncologie investissent massivement dans ces dispositifs afin de garantir la conformité aux réglementations de sécurité et de réduire les risques professionnels. L'adoption de ces dispositifs est favorisée par des caractéristiques technologiques robustes, notamment l'automatisation et les mécanismes de scellage intégrés. De plus, les dispositifs constituent le cœur des protocoles de sécurité hospitaliers, ce qui en fait un élément crucial des flux de travail en oncologie. Les principaux fabricants continuent d'améliorer la fonctionnalité des dispositifs, stimulant ainsi une demande soutenue sur le marché. Enfin, la durabilité et la fiabilité des unités CSTD primaires en font un choix privilégié dans les établissements de santé de la région Asie-Pacifique, consolidant ainsi leur position dominante.

Le segment des accessoires devrait connaître la croissance la plus rapide au cours de la période de prévision, en raison du besoin croissant de composants tels que les tubulures, les bouchons, les connecteurs et les filtres. Ces accessoires améliorent la sécurité, l'efficacité et la polyvalence des systèmes de transfert de médicaments en circuit fermé (CSTD), ce qui les rend essentiels dans les grandes pharmacies hospitalières et les centres d'oncologie. Les fabricants proposent des kits d'accessoires économiques pour répondre aux besoins des petites cliniques et des marchés émergents. La prise de conscience croissante de l'importance des systèmes CSTD complets, accessoires inclus, accélère également leur adoption en Inde et en Asie du Sud-Est. Par ailleurs, les directives réglementaires préconisant l'utilisation de systèmes complets stimulent la demande d'accessoires. La compatibilité de ce segment avec de nombreux types de dispositifs contribue à sa croissance.

- Par mécanisme de fermeture

En fonction du mécanisme de fermeture, le marché se segmente en systèmes à pression et rotation, systèmes d'alignement couleur-à-couleur, systèmes Luer-Lock et systèmes à verrouillage par clic. Le segment des systèmes à pression et rotation dominait le marché en 2025 grâce à sa simplicité d'utilisation, sa fiabilité et sa large compatibilité avec les dispositifs de transfert de médicaments sans aiguille. Les hôpitaux et les centres d'oncologie privilégient ces mécanismes pour leur simplicité et le risque minimal de fermeture incorrecte, réduisant ainsi les risques d'exposition accidentelle. Ce système garantit un transfert de médicament constant et favorise la conformité aux réglementations de sécurité. De plus, les systèmes à pression et rotation sont largement utilisés en Chine, en Inde et au Japon en raison des pratiques d'approvisionnement établies dans les principaux établissements de santé. Les fabricants continuent d'innover en matière d'ergonomie pour améliorer le confort du personnel. Cette position dominante est confortée par de solides homologations réglementaires qui soutiennent son utilisation généralisée.

Le segment des systèmes Luer-Lock devrait connaître la croissance la plus rapide au cours de la période prévisionnelle grâce à sa connexion sécurisée, qui prévient les fuites et la contamination lors du transfert de médicaments. Les systèmes Luer-Lock sont de plus en plus utilisés dans les hôpitaux émergents et les centres d'oncologie en Inde et en Asie du Sud-Est, où les protocoles de sécurité se durcissent. Leur conception offre une grande polyvalence pour différentes applications de transfert de médicaments en circuit fermé (CSTD), prenant en charge de nombreux types de médicaments et de seringues. Par ailleurs, les formations et les actions de sensibilisation du personnel favorisent leur adoption. Les fabricants proposent des versions améliorées du système Luer-Lock, dotées de fonctions d'automatisation et de retour d'information, afin d'optimiser l'utilisation et la sécurité. La croissance de ce segment est également stimulée par son adoption croissante dans les centres de chirurgie ambulatoire et les instituts de recherche.

- Par la technologie

Sur la base de la technologie, le marché est segmenté en dispositifs à membrane, dispositifs compartimentés et dispositifs de purification/filtration de l'air. Le segment des dispositifs à membrane a dominé le marché en 2025 grâce à sa simplicité, sa fiabilité et sa conformité aux normes de sécurité au travail. Ces dispositifs sont largement utilisés dans les hôpitaux et les centres d'oncologie en Chine, au Japon et en Corée du Sud. La technologie à membrane garantit des fuites minimales, un transfert contrôlé du médicament et une intégration aisée aux systèmes CSTD existants. Les fabricants continuent d'innover dans la conception des membranes afin d'en améliorer la durabilité et les performances. L'adoption de ces dispositifs est favorisée par les exigences réglementaires qui mettent l'accent sur la prévention de l'exposition. Les hôpitaux privilégient les systèmes à membrane pour la préparation de chimiothérapie de routine en raison de leur innocuité avérée. De plus, ce segment est privilégié pour les flux de travail à haut volume où l'efficacité et la constance des performances sont essentielles.

Le segment des dispositifs compartimentés devrait connaître la croissance la plus rapide au cours de la période prévisionnelle, grâce à sa capacité à gérer simultanément plusieurs opérations de transfert de médicaments tout en prévenant la contamination croisée. Les systèmes compartimentés sont de plus en plus utilisés en Inde et en Asie du Sud-Est, où les services d'oncologie connaissent une expansion rapide. Les progrès technologiques en matière d'étanchéité et de modularité rendent ces systèmes particulièrement adaptés aux préparations de médicaments multiples. Des programmes de formation et de sensibilisation favorisent leur adoption dans les hôpitaux émergents. Les fabricants s'attachent à concevoir des dispositifs compartimentés économiques pour une plus grande accessibilité. Ce segment bénéficie de la demande croissante d'efficacité et de sécurité des flux de travail.

- Par l'utilisateur final

En fonction de l'utilisateur final, le marché est segmenté en hôpitaux, centres et cliniques d'oncologie, centres de chirurgie ambulatoire et instituts de recherche et d'enseignement. Le segment des hôpitaux a dominé le marché en 2025 grâce à un volume important de patients, une adoption accrue des protocoles de sécurité et le respect des exigences réglementaires. Les hôpitaux en Chine, au Japon et en Corée du Sud investissent massivement dans les dispositifs de transfert de médicaments sans aiguille (CSTD) afin de protéger le personnel soignant et de garantir la sécurité des procédures de manipulation des médicaments. Cette adoption est également encouragée par les directives gouvernementales en matière de sécurité et les politiques institutionnelles. Les hôpitaux privilégient les dispositifs sans aiguille pour les chimiothérapies de routine et la préparation de médicaments à grande échelle. Les principaux fabricants ciblent les contrats hospitaliers pour stimuler leur chiffre d'affaires. Ce segment reste dominant grâce à une intégration rigoureuse des processus d'approvisionnement et d'exploitation.

Le segment des centres et cliniques d'oncologie devrait connaître la croissance la plus rapide au cours de la période prévisionnelle, en raison de l'augmentation de l'incidence du cancer en Inde, en Chine et en Asie du Sud-Est, ce qui engendre une demande accrue de solutions de manipulation de médicaments sécurisées. Les établissements d'oncologie spécialisés privilégient les dispositifs de transfert de médicaments (DTM) sans aiguille et compartimentés afin d'améliorer la sécurité au travail et l'efficacité des flux de travail. Les campagnes de sensibilisation et les initiatives gouvernementales accélèrent encore l'adoption de ces solutions. Les cliniques bénéficient de systèmes portables et faciles à utiliser qui simplifient leurs opérations. Les fabricants se concentrent sur des solutions évolutives pour les petits et moyens centres d'oncologie. L'augmentation du nombre de patients et le développement des services d'oncologie ambulatoires soutiennent la croissance rapide de ce segment.

- Par canal de distribution

En fonction du canal de distribution, le marché est segmenté en appels d'offres et ventes au détail. Le segment des appels d'offres a dominé le marché en 2025, les grands hôpitaux, les établissements de santé publics et les réseaux d'oncologie privilégiant l'achat groupé de dispositifs de transfert de médicaments par voie d'appel d'offres. Ce mode d'achat garantit un approvisionnement régulier, des prix compétitifs et des contrats de service à long terme. Les hôpitaux en Chine, en Inde et au Japon ont recours aux appels d'offres pour se conformer aux normes réglementaires et maintenir leur efficacité opérationnelle. Les fabricants privilégient souvent les appels d'offres pour les ventes en gros volumes. Les achats groupés par appel d'offres garantissent l'application uniforme des protocoles de sécurité dans tous les services. Ce segment bénéficie de l'adoption institutionnelle et des programmes de santé publique.

Le segment des ventes au détail devrait connaître la croissance la plus rapide au cours de la période prévisionnelle, en raison du nombre croissant de petites cliniques, de centres de soins ambulatoires et d'instituts de recherche qui s'approvisionnent en dispositifs de transfert de médicaments par voie intraveineuse (CSTD) directement auprès des distributeurs. Les circuits de distribution offrent une flexibilité aux petites structures et favorisent une adoption rapide dans les régions émergentes telles que l'Inde et l'Asie du Sud-Est. Les fabricants développent leurs réseaux de distribution au détail afin de répondre à la demande croissante. Les ventes au détail permettent également d'accéder à des produits et accessoires complémentaires, améliorant ainsi l'utilisation du système. La croissance de ce segment est par ailleurs stimulée par des campagnes de sensibilisation et des initiatives promotionnelles axées sur la sécurité au travail.

Analyse régionale du marché des dispositifs de transfert en système fermé en Asie-Pacifique

- La Chine a dominé le marché des dispositifs de transfert en système clos en Asie-Pacifique en 2025, avec la plus grande part de revenus (38,4 %). Cette domination s'explique par une infrastructure de santé bien établie, une forte adoption des protocoles de sécurité avancés dans les hôpitaux et les centres d'oncologie, et une présence importante des principaux acteurs du secteur.

- Les établissements de santé de la région apprécient particulièrement la sécurité, l'efficacité et la conformité offertes par les dispositifs de transfert de médicaments sans aiguille (CSTD), qui minimisent l'exposition aux médicaments dangereux et réduisent les risques de contamination lors de la préparation et de l'administration.

- Cette adoption généralisée est également favorisée par l'augmentation de l'incidence du cancer, l'expansion rapide des services de santé et la sensibilisation accrue des autorités réglementaires, faisant des CSTD une solution privilégiée pour les hôpitaux, les centres d'oncologie et les instituts de recherche en Inde, au Japon, en Corée du Sud et en Chine.

Analyse du marché chinois des dispositifs de transfert en système fermé

Le marché chinois des dispositifs de transfert en système clos (DSTC) a généré la plus grande part de revenus en Asie-Pacifique en 2025, grâce à une infrastructure de santé performante, à une large application des protocoles de sécurité et à la forte présence d'acteurs clés du secteur. Les hôpitaux et les centres d'oncologie privilégient de plus en plus les DSTC sans aiguille afin de minimiser l'exposition aux médicaments dangereux et les risques de contamination. L'augmentation du nombre de patients en oncologie et le développement des services de chimiothérapie stimulent l'adoption des DSTC. Par ailleurs, les réglementations gouvernementales axées sur la sécurité au travail et la manipulation sécurisée des médicaments renforcent la demande. L'intégration aux flux de travail automatisés et aux programmes de sécurité hospitaliers améliore l'efficacité et la conformité. L'accent mis par la Chine sur les technologies médicales de pointe et ses stratégies d'approvisionnement centralisées devrait lui permettre de maintenir sa position dominante sur le marché.

Analyse du marché indien des dispositifs de transfert en système fermé

Le marché indien des dispositifs de transfert en système clos devrait connaître la croissance la plus rapide de la région Asie-Pacifique au cours de la période de prévision, porté par une urbanisation rapide, le développement des infrastructures de santé et l'augmentation de l'incidence du cancer. Les hôpitaux, les cliniques et les centres d'oncologie adoptent de plus en plus les dispositifs de transfert en système clos sans aiguille afin de se conformer aux normes de sécurité au travail et d'améliorer l'efficacité de leurs flux de travail. Les initiatives gouvernementales en faveur de la sécurité au travail et les programmes de formation des professionnels de santé accélèrent encore cette adoption. Les solutions de transfert en système clos abordables et portables favorisent leur utilisation dans les petites cliniques et les centres de soins ambulatoires. Par ailleurs, la sensibilisation croissante des professionnels de santé à la sécurité de la manipulation des médicaments stimule la demande. La croissance de la classe moyenne en Inde et l'expansion des services d'oncologie soutiennent la croissance du marché à long terme.

Analyse du marché japonais des dispositifs de transfert en système fermé

Le marché japonais des systèmes de transfert en circuit fermé (STTF) est en plein essor grâce à un système de santé performant, des réglementations de sécurité strictes et une attention accrue portée à la sécurité au travail dans les hôpitaux et les centres d'oncologie. Les STTF sans aiguille sont de plus en plus utilisés pour réduire la contamination et prévenir l'exposition aux médicaments dangereux lors de la préparation et de l'administration des chimiothérapies. L'intégration des STTF aux protocoles de sécurité hospitaliers et aux flux de travail automatisés améliore l'efficacité opérationnelle. La culture japonaise de haute technologie et la préférence pour les dispositifs médicaux de pointe contribuent également à la croissance du marché. Par ailleurs, le vieillissement de la population et la prévalence croissante du cancer stimulent la demande de solutions de manipulation des médicaments plus sûres. Les hôpitaux et les cliniques d'oncologie spécialisées continuent d'investir dans des STTF modernes afin de se conformer aux exigences réglementaires.

Analyse du marché des dispositifs de transfert en système fermé en Corée du Sud

Le marché sud-coréen des dispositifs de transfert en système clos (DSTC) devrait connaître une croissance soutenue au cours de la période prévisionnelle, portée par l'adoption croissante des systèmes sans aiguille et par l'importance accordée à la sécurité et à l'efficacité des soins de santé. Les hôpitaux et les centres d'oncologie privilégient les DSTC afin de minimiser l'exposition professionnelle aux médicaments dangereux. Les réglementations gouvernementales et institutionnelles, qui imposent des normes de manipulation sûres, favorisent leur adoption à grande échelle. La présence d'infrastructures de santé modernes et d'un personnel médical compétent sur le plan technologique facilite l'intégration des DSTC dans les flux de travail courants. Par ailleurs, les campagnes de sensibilisation et les programmes de formation destinés aux professionnels de santé contribuent à l'essor de ce marché. Ce dernier bénéficie à la fois des appels d'offres des hôpitaux publics et des investissements du secteur privé.

Part de marché des dispositifs de transfert en système fermé en Asie-Pacifique

Le secteur des dispositifs de transfert en système clos en Asie-Pacifique est principalement dominé par des entreprises bien établies, notamment :

- EQUASHIELD (États-Unis)

- Simplivia (Israël)

- ICU Medical, Inc. (États-Unis)

- B. Braun SE (Allemagne)

- Vygon (France)

- BD (États-Unis)

- Baxter (États-Unis)

- Terumo Corporation (Japon)

- CODAN Medizinische Geräte GmbH & Co KG (Allemagne)

- Corning Incorporated (États-Unis)

- West Pharmaceutical Services, Inc. (États-Unis)

- Yukon Medical LLC (États-Unis)

- Corvida Medical Inc. (États-Unis)

- Cardinal Health (États-Unis)

- Caragen Ltd. (Irlande)

- JMS Co., Ltd. (Japon)

- Practivet, Inc. (États-Unis)

- Amsino International, Inc. (États-Unis)

- NIPRO CORPORATION (Japon)

- VICTUS Inc. (États-Unis)

Quels sont les développements récents sur le marché des dispositifs de transfert en système fermé en Asie-Pacifique ?

- En mai 2025, ICU Medical, Inc. et Otsuka Pharmaceutical Factory, Inc. ont finalisé une coentreprise stratégique visant à élargir la gamme de produits CSTD, notamment le dispositif de transfert en système clos sans aiguille ChemoLock™ (CSTD) et d'autres solutions de transfert et de sécurité, renforçant ainsi le portefeuille mondial de l'entreprise et favorisant une adoption plus large dans les établissements de santé, y compris en Asie-Pacifique.

- En novembre 2024, ICU Medical a élargi son offre de dispositifs de transfert de médicaments en milieu clos (CSTD) en renforçant son portefeuille de dispositifs sans aiguille ChemoLock et ChemoClave, ainsi que ses solutions de reconstitution et de sécurité de perfusion, répondant ainsi à la demande croissante des hôpitaux en Asie-Pacifique pour des flux de travail plus sûrs concernant les médicaments dangereux.

- En décembre 2023, Equashield a lancé le Mundus Mini HD, un dispositif de transfert en système clos de nouvelle génération conçu pour améliorer le contrôle de la contamination, réduire l'exposition aux médicaments dangereux et optimiser l'efficacité dans les environnements de préparation de médicaments à risque. Ce nouveau dispositif représente une avancée majeure dans la technologie CSTD et offre un potentiel d'application plus large dans les pharmacies hospitalières et les centres d'oncologie de la région Asie-Pacifique.

- En février 2023, BD a annoncé que son système BD PhaSeal™ Optima de nouvelle génération réduisait considérablement la contamination des surfaces par des médicaments dangereux lors de son utilisation clinique, démontrant ainsi une meilleure sécurité pour les professionnels de santé manipulant des médicaments de chimiothérapie – une évolution susceptible d’influencer la pratique clinique et l’adoption dans les principaux centres d’oncologie de la région Asie-Pacifique.

- En avril 2021, Fresenius Kabi a conclu un accord de distribution aux États-Unis avec Corvida Medical pour commercialiser le HALO CSTD, un dispositif de transfert de médicaments en système clos conçu pour améliorer la sécurité de la manipulation des médicaments dangereux. Cet accord témoigne d'un développement des partenariats et de la distribution, susceptible d'influencer les chaînes d'approvisionnement régionales et l'adoption de ce dispositif dans les établissements de santé de la région Asie-Pacifique.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.