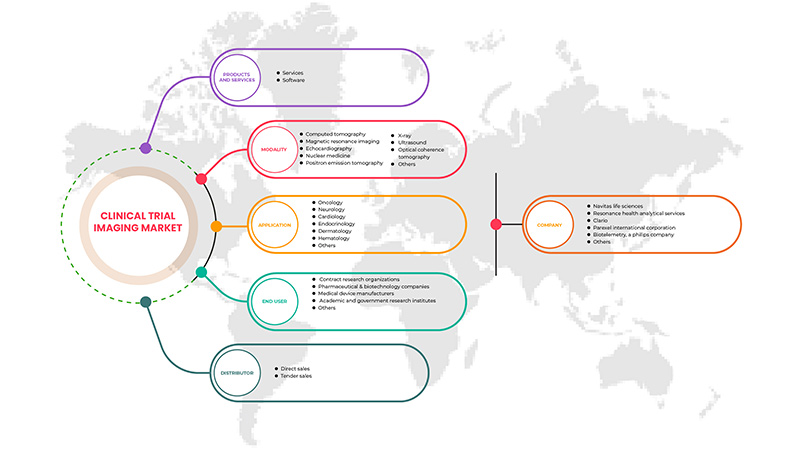

Marché de l'imagerie des essais cliniques en Asie-Pacifique, par produit et services (services et logiciels), modalité ( tomodensitométrie , imagerie par résonance magnétique, échocardiographie, médecine nucléaire, tomographie par émission de positons , rayons X, ultrasons, tomographie par cohérence optique et autres), application (oncologie, neurologie, endocrinologie, cardiologie, dermatologie, hématologie et autres), utilisateur final (sociétés pharmaceutiques et biotechnologiques, organismes de recherche sous contrat, fabricants de dispositifs médicaux, instituts de recherche universitaires et gouvernementaux et autres), distributeur (ventes directes et ventes par appel d'offres) - Tendances et prévisions de l'industrie jusqu'en 2029.

Analyse et perspectives du marché de l'imagerie des essais cliniques en Asie-Pacifique

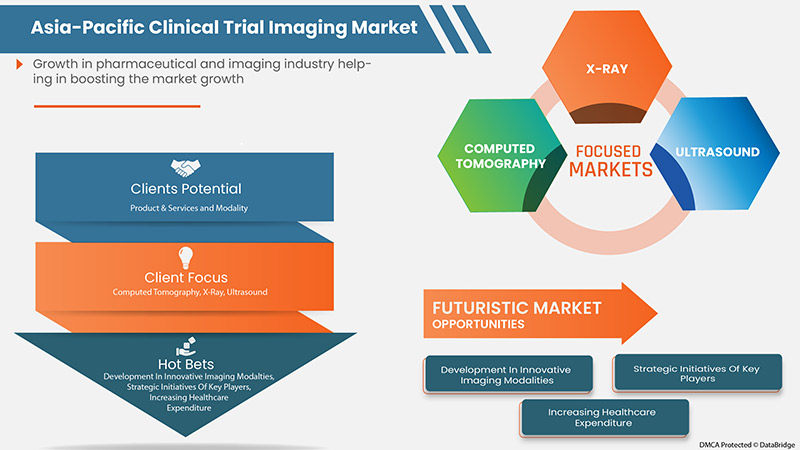

La demande croissante en technologie d'imagerie, suivie de l'augmentation de la prévalence des maladies chroniques en raison de l'augmentation de la population âgée et des initiatives stratégiques des acteurs du marché telles que le lancement de produits, l'avancement, l'acquisition et les accords sont les facteurs qui devraient stimuler la croissance du marché.

Toutefois, des scénarios de remboursement inappropriés et défavorables pour les appareils d’imagerie et l’absence de normes bien définies dans les instruments d’imagerie des essais cliniques devraient freiner la croissance du marché.

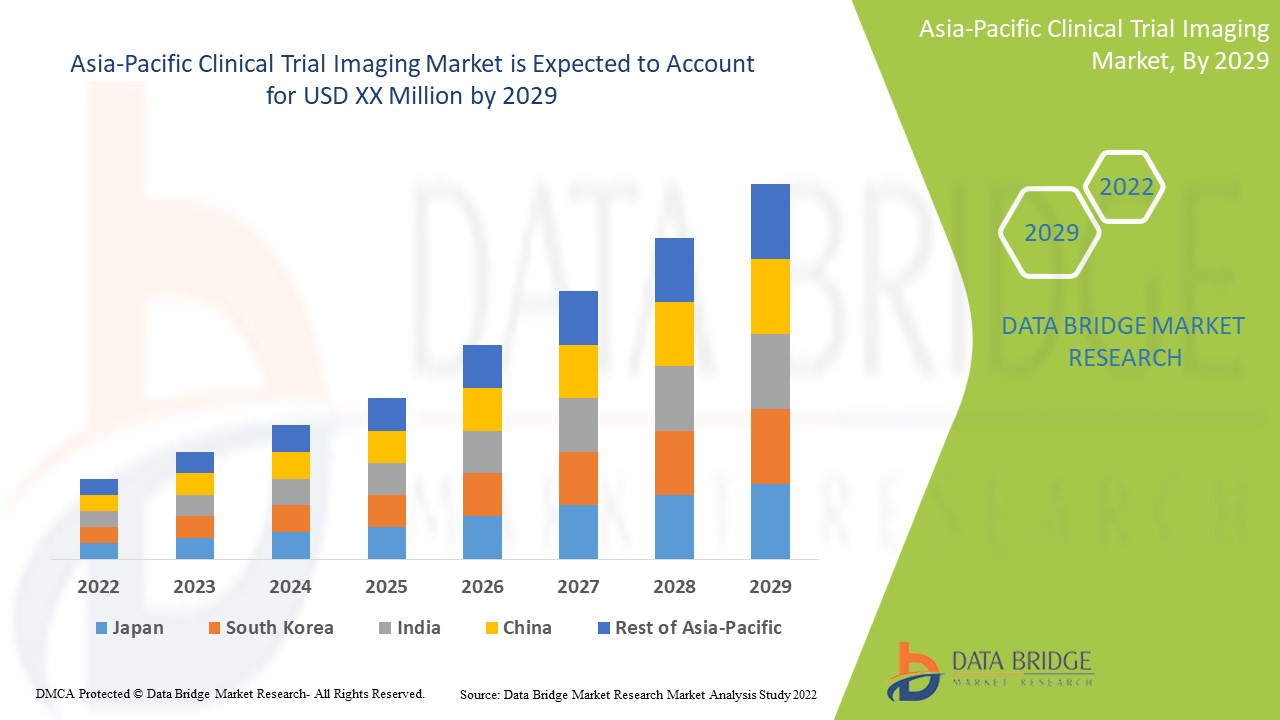

Les progrès technologiques croissants dans l'imagerie des essais cliniques pour le diagnostic et le traitement des maladies chroniques devraient stimuler la croissance du marché. Data Bridge Market Research analyse que le marché de l'imagerie des essais cliniques en Asie-Pacifique connaîtra un TCAC de 8,8 % au cours de la période de prévision de 2022 à 2029.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable jusqu'en 2019-2014) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD et prix en USD |

|

Segments couverts |

Par produit et services (services et logiciels), modalité (tomodensitométrie, imagerie par résonance magnétique, échocardiographie, médecine nucléaire, tomographie par émission de positons, rayons X, ultrasons, tomographie par cohérence optique et autres), application (oncologie, neurologie, endocrinologie, cardiologie, dermatologie, hématologie et autres), utilisateur final (sociétés pharmaceutiques et biotechnologiques, organismes de recherche sous contrat, fabricants de dispositifs médicaux, instituts de recherche universitaires et gouvernementaux et autres), distributeur (ventes directes et ventes par appel d'offres) |

|

Pays couverts |

Chine, Japon, Corée du Sud, Inde, Australie, Singapour, Thaïlande, Malaisie, Indonésie, Philippines et reste de l'Asie-Pacifique |

|

Acteurs du marché couverts |

Navitas Life Sciences, Resonance Health Analytical Services, ICON plc, Image Core Lab, Radiant Sage LLC, WORLDCARE CLINICAL, Clario, Paraxel International Corporation, Median Technologies, Perspectum, Calyx, WIRB-Copernicus Group et Invicro.LLC, entre autres |

Définition du marché

L'essai clinique est un processus de développement de nouveaux médicaments. Il est conçu pour évaluer un traitement potentiel et ses effets sur l'homme. Avant la commercialisation de nouveaux médicaments, des tests cliniques approfondis sont effectués pour identifier les composés prometteurs et des tests de sécurité sont effectués pour déterminer les risques possibles.

Dans les essais cliniques, l'imagerie médicale joue un rôle important pour obtenir des résultats plus précis et plus efficaces. Différentes technologies d'imagerie peuvent être utilisées pour élucider et démontrer les actions mécanistes des médicaments. L'imagerie des essais cliniques est le processus d'analyse clinique et d'intervention médicale par la création de représentations d'images des parties internes du corps. Elle dispose de plusieurs technologies différentes qui sont utilisées pour visualiser le corps humain afin de surveiller, de traiter et de diagnostiquer des conditions médicales.

Dans un avenir proche, les décisions importantes liées à l’imagerie des essais cliniques sur la découverte de médicaments seront prises par des personnes qui non seulement comprennent la biopsie, mais peuvent également utiliser les outils d’imagerie des essais cliniques et les connaissances qu’ils libèrent pour développer des hypothèses et identifier des cibles de qualité.

Dynamique du marché de l'imagerie des essais cliniques en Asie-Pacifique

Conducteurs

- Augmentation des dépenses en recherche et développement

Les entreprises d'imagerie et pharmaceutiques investissent en permanence dans la R&D pour proposer des services innovants en matière d'imagerie d'essais cliniques à leurs clients et renforcer leur présence sur le marché. L'imagerie médicale joue un rôle dynamique dans le développement clinique. Alors que le secteur de l'imagerie médicale est en constante fluctuation en raison de la mise en œuvre de nouvelles technologies sur le marché, les industries pharmaceutiques et d'imagerie continuent de croître. Cela est dû à l'augmentation des investissements dans les entreprises d'imagerie médicale ainsi qu'aux fusions et acquisitions, ainsi qu'à l'adoption d'innovations dans les technologies d'imagerie pour soutenir les essais cliniques des dispositifs médicaux. L'augmentation des dépenses en R&D dans les entreprises pharmaceutiques et biotechnologiques alimente la croissance du marché.

Cela a encouragé le développement de nouveaux produits et de programmes de recherche de haut niveau organisés dans les industries biopharmaceutiques et une forte préférence pour les études du génome humain. L'augmentation des dépenses consacrées aux activités de R&D permet également de développer de nouveaux médicaments et thérapies pour traiter les maladies chroniques, ce qui stimule la croissance du marché. Cela aide les sociétés pharmaceutiques et biotechnologiques à développer de nouvelles technologies dans la catégorie des essais cliniques d'imagerie. Par conséquent, l'augmentation des dépenses en R&D devrait stimuler la croissance du marché.

- Nombre croissant d'organismes de recherche sous contrat (CRO)

Une organisation de recherche sous contrat (CRO) est une organisation qui apporte son soutien aux essais cliniques et autres services de recherche aux industries de l'imagerie et pharmaceutiques sous la forme de services de recherche pharmaceutique externalisés en termes de médicaments et de dispositifs médicaux. La CRO aide les industries de l'imagerie et pharmaceutiques dans le processus de développement de médicaments pour réduire les coûts et lancer le processus d'essais cliniques pour développer le médicament pour un segment de maladie particulier en utilisant l'imagerie des essais cliniques et d'autres processus pour combler les lacunes de capacité de l'équipe de recherche interne pour la recherche pharmaceutique et clinique.

Un grand nombre de CRO sont engagés dans le suivi du processus de développement de médicaments, comme PAREXEL (États-Unis), PRA Health Sciences (États-Unis), Labcorp (États-Unis), PPD (États-Unis), Syneos Health (États-Unis), ICON plc (Irlande), Envigo (Royaume-Uni), Charles River (États-Unis) et SGS (Suisse), entre autres. Il s'agit de quelques CRO qui sont engagés pour apporter un soutien aux essais cliniques et à d'autres services de recherche pour les industries de l'imagerie et pharmaceutique. Le nombre croissant de CRO devrait stimuler la croissance du marché.

Opportunités

- Hausse des dépenses de santé

Les dépenses de santé ont augmenté dans le monde entier en raison de l'augmentation du revenu disponible des citoyens dans divers pays. De plus, pour répondre aux besoins de la population, les organismes gouvernementaux et les organisations de santé prennent des initiatives en accélérant les dépenses de santé.

Par exemple,

- Les comptes nationaux des dépenses de santé (NHEA) ont publié un rapport indiquant que les dépenses de santé aux États-Unis ont augmenté de 4,6 % en 2019. Cela représente 3,80 billions USD pour l'ensemble de la population américaine rapportée par les centres américains pour Medicare (CMS) et le PIB pour la santé, les dépenses aux États-Unis devraient atteindre 17,7 %.

L'augmentation des dépenses de santé est également bénéfique pour la croissance future du secteur économique et de la santé et elle est particulièrement fructueuse car elle affecte considérablement le développement de produits médicaux meilleurs et avancés sur le marché. Par conséquent, l'augmentation des dépenses de santé devrait créer une plus grande opportunité pour le marché.

- Initiatives stratégiques des acteurs du marché

La demande d'imagerie d'essais cliniques augmente sur le marché en raison des niveaux accrus de R&D ainsi que de la croissance du marché de l'imagerie d'essais cliniques aidée par le désir de médicaments innovants. Ainsi, les principaux acteurs du marché ont mis en œuvre une nouvelle stratégie en développant de nouveaux produits et en collaborant avec d'autres acteurs du marché pour améliorer les opérations commerciales et la rentabilité.

Par exemple,

- En février 2020, ICON plc a acquis MedPass International, une société européenne de recherche sous contrat (CRO) spécialisée dans les dispositifs médicaux et le conseil en matière de remboursement et de réglementation. Cette acquisition aurait contribué à l'expansion des services de recherche sur les dispositifs médicaux et les diagnostics d'ICON en Europe.

Ces initiatives stratégiques des acteurs du marché, notamment les acquisitions, les conférences et les lancements de produits ciblés, les aident à développer et à améliorer le portefeuille de produits de l'entreprise, ce qui conduit finalement à une augmentation de la génération de revenus. Par conséquent, ces initiatives stratégiques des acteurs du marché peuvent constituer une opportunité de croissance du marché.

Contraintes/Défis

- Maladies à haut risque causées par les radiations

En imagerie médicale clinique, les radiations sont absorbées par le corps, ce qui peut endommager les structures moléculaires à l'intérieur du corps du patient. De fortes doses de radiations peuvent affecter les cellules humaines, notamment en provoquant la perte de cheveux, des brûlures cutanées et une incidence accrue de cancer. Le risque estimé de développer un cancer mortel est de 1 sur 2000 après avoir été exposé à une dose de radiation de 10 mSv lors d'un scanner.

Par exemple,

- Selon la Radiological Society of America (RSNA), 1 à 2 % de tous les cancers aux États-Unis sont causés par des tomodensitogrammes et l'American Cancer Society a identifié les tomodensitogrammes et les rayons X comme l'une des causes du cancer du sein, du cancer du cerveau et d'autres cancers.

- Selon le Centre de contrôle et de prévention des maladies (Center for Disease Control and Prevention), l'exposition à des niveaux élevés de radiations provoque un syndrome d'irradiation aiguë. La quantité de radiation absorbée par le corps d'une personne est appelée dose de radiation.

Les radiations à haut risque qui en résultent pourraient réduire l'utilisation et la vente d'appareils d'imagerie pour essais cliniques, affectant ainsi la crédibilité des fabricants impliqués dans ce marché. Par conséquent, les maladies à haut risque provoquant des radiations devraient freiner la croissance du marché.

- Politiques réglementaires strictes

Le secteur de la santé est réglementé par une structure de lois, de règles et de réglementations vaste et complexe.

Par exemple,

- En avril 2018, la FDA américaine a publié des directives mises à jour sur les normes de processus d'imagerie des essais cliniques pour l'industrie, qui incluent la qualité des données d'imagerie obtenues dans les essais cliniques.

- Les industries biotechnologiques et pharmaceutiques doivent obtenir l'approbation préalable de la FDA pour le processus de développement de médicaments. Elles doivent soumettre une demande d'IND (Investigational New Drug) à la FDA avant de commencer les recherches cliniques.

Impact du COVID-19 sur le marché de l'imagerie des essais cliniques en Asie-Pacifique

Les services d’imagerie diagnostique ont pris du temps et ont été compliqués par la nécessité de mettre en place des pratiques strictes de contrôle et de prévention des infections pour contenir le risque de transmission et protéger le personnel de santé. Par conséquent, la décision d’imager des patients suspects ou des patients positifs à la COVID-19 est basée sur leur impact sur l’amélioration de l’état du patient. Les volumes dans les cliniques d’imagerie médicale ambulatoires ont certainement diminué en raison des réglementations de distanciation sociale et des confinements dans la région Asie-Pacifique. Cela a réduit le nombre de rendez-vous disponibles, ce qui a entraîné des listes d’attente plus longues pour des examens tels que l’échographie et les procédures interventionnelles.

Développements récents

- En janvier 2022, Clario s'est associé à XingImaging, une société de production de produits radiopharmaceutiques et d'acquisition de tomographie par émission de positons (TEP), pour réaliser des essais cliniques d'imagerie TEP afin de tester de nouvelles thérapies en Chine. Le partenariat propose de partager les ressources communes et les experts en neurosciences de Clario et de XingImaging pour accélérer le démarrage des essais cliniques et la découverte de médicaments en Chine.

- En novembre 2021, Clario a été créée. ERT et Bioclinica ont fusionné pour former Clario. La création d'une nouvelle société a donné lieu à la distribution de logiciels et de services d'imagerie clinique et à une augmentation des ventes.

Portée du marché de l'imagerie des essais cliniques en Asie-Pacifique

Le marché de l'imagerie des essais cliniques en Asie-Pacifique est segmenté en cinq segments en fonction des produits et services, des modalités, des applications, des utilisateurs finaux et des distributeurs. La croissance de ces segments vous aidera à analyser les segments de croissance limités dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Produits et services

- Services

- Logiciel

En fonction des produits et des services, le marché est segmenté en services et logiciels.

Modalité

- Tomodensitométrie

- Imagerie par résonance magnétique

- Échocardiographie

- Médecine nucléaire

- Tomographie par émission de positons

- radiographie

- Ultrason

- Tomographie par cohérence optique

- Autres

En fonction de la modalité, le marché est segmenté en tomodensitométrie , imagerie par résonance magnétique , échocardiographie, médecine nucléaire, tomographie par émission de positons, rayons X, ultrasons, tomographie par cohérence optique et autres.

Application

- Oncologie

- Neurologie

- Cardiologie

- Endocrinologie

- Dermatologie

- Hématologie

- Autres

En fonction des applications, le marché est segmenté en oncologie , neurologie, cardiologie, endocrinologie, dermatologie, hématologie et autres.

Utilisateur final

- Organismes de recherche sous contrat

- Sociétés pharmaceutiques et biotechnologiques

- Fabricants de dispositifs médicaux

- Instituts de recherche universitaires et gouvernementaux

- Autres

En fonction de l'utilisateur final, le marché est segmenté en organismes de recherche sous contrat , sociétés pharmaceutiques et biotechnologiques, fabricants de dispositifs médicaux, instituts de recherche universitaires et gouvernementaux et autres.

Distributeur

- Vente directe

- Ventes par appel d'offres

En fonction du distributeur, le marché est segmenté en ventes directes et ventes par appel d'offres.

Analyse/perspectives régionales du marché de l'imagerie des essais cliniques en Asie-Pacifique

Le marché de l’imagerie des essais cliniques en Asie-Pacifique est analysé et des informations sur la taille du marché et les tendances sont fournies par régions, produits et services, modalité, application, utilisateur final et distributeur comme référencé ci-dessus.

Les pays couverts par ce rapport de marché sont la Chine, le Japon, la Corée du Sud, l'Inde, l'Australie, Singapour, la Thaïlande, la Malaisie, l'Indonésie, les Philippines et le reste de l'Asie-Pacifique. La Chine devrait dominer le marché car l'imagerie clinique est sûre et pratique à utiliser. Le rôle vital du gouvernement chinois dans la mise en place et l'établissement de fournisseurs nationaux dans le domaine de l'imagerie diagnostique en Chine est l'un des principaux facteurs qui devraient stimuler la croissance du marché.

La section par pays du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements dans la réglementation du marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie du pays, l'épidémiologie des maladies et les tarifs d'importation et d'exportation sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario du marché pour les différents pays. En outre, la présence et la disponibilité des marques d'Asie-Pacifique et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales sur les canaux de vente sont prises en compte lors de l'analyse prévisionnelle des données par pays.

Analyse du paysage concurrentiel et des parts de marché de l'imagerie des essais cliniques en Asie-Pacifique

Le paysage concurrentiel du marché de l'imagerie des essais cliniques en Asie-Pacifique fournit des détails sur le concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements en R&D, les nouvelles initiatives du marché, la présence en Asie-Pacifique, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit et la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liées au marché de l'imagerie des essais cliniques en Asie-Pacifique.

Certains des principaux acteurs opérant sur le marché sont Navitas Life Sciences, Resonance Health Analytical Services, ICON plc, Image Core Lab, Radiant Sage LLC, WORLDCARE CLINICAL, Clario, Paraxel International Corporation, Median Technologies, Perspectum, Calyx, WIRB-Copernicus Group et Invicro.LLC entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCTS AND SERVICES LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES

5 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING R&D EXPENDITURE

6.1.2 INCREASING NUMBER OF CONTRACT RESEARCH ORGANIZATIONS (CROS)

6.1.3 INCREASING INCIDENCE OF CHRONIC DISEASES

6.1.4 GROWTH IN THE PHARMACEUTICAL AND IMAGING INDUSTRIES

6.2 RESTRAINTS

6.2.1 HIGH-RISK RADIATION CAUSING DISEASES

6.2.2 HIGH IMPLEMENTATION COST OF IMAGING SYSTEMS

6.3 OPPORTUNITIES

6.3.1 RISE IN HEALTHCARE EXPENDITURE

6.3.2 STRATEGIC INITIATIVES BY KEY PLAYERS

6.3.3 DEVELOPMENT OF INNOVATIVE IMAGING MODALITIES AND CONTRAST AGENTS

6.4 CHALLENGES

6.4.1 STRICT REGULATORY POLICIES

6.4.2 COST OF CLINICAL TRIALS

7 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET, BY PRODUCTS & SERVICES

7.1 OVERVIEW

7.2 SERVICES

7.2.1 OPERATIONAL IMAGING SERVICES

7.2.2 READ ANALYSIS SERVICES

7.2.3 TRIAL DESIGN CONSULTING SERVICES

7.2.4 SYSTEM AND TECHNICAL SUPPORT SERVICES

7.3 SOFTWARE

8 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET, BY MODALITY

8.1 OVERVIEW

8.2 COMPUTED TOMOGRAPHY

8.3 MAGENTIC RESONANCE IMAGING

8.4 ECHOCARDIOGRAPHY

8.5 NUCLEAR MEDICINE

8.6 POSITRON EMISSION TOMOGRAPHY

8.7 X-RAY

8.8 ULTRASOUND

8.9 OPTICAL COHERENCE TOMOGRAPHY

8.1 OTHERS

9 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 ONCOLOGY

9.2.1 X-RAY

9.2.2 ULTRASOUND

9.2.3 COMPUTED TOMOGRAPHY

9.2.4 MAGNETIC RESONANCE IMAGING

9.2.5 NUCLEAR MEDICINE

9.2.6 POSITRON EMISSION TOMOGRAPHY

9.2.7 OPTICAL COHERENCE TOMOGRAPHY

9.2.8 ECHOCARDIOGRAPHY

9.2.9 OTHERS

9.3 NEUROLOGY

9.3.1 COMPUTED TOMOGRAPHY

9.3.2 MAGNETIC RESONANCE IMAGING

9.3.3 POSITRON EMISSION TOMOGRAPHY

9.3.4 NUCLEAR MEDICINE

9.3.5 X-RAY

9.3.6 ULTRASOUND

9.3.7 OPTICAL COHERENCE TOMOGRAPHY

9.3.8 ECHOCARDIOGRAPHY

9.3.9 OTHERS

9.4 CARDIOLOGY

9.4.1 ECHOCARDIOGRAPHY

9.4.2 MAGNETIC RESONANCE IMAGING

9.4.3 COMPUTED TOMOGRAPHY

9.4.4 POSITRON EMISSION TOMOGRAPHY

9.4.5 NUCLEAR MEDICINE

9.4.6 X-RAY

9.4.7 ULTRASOUND

9.4.8 OPTICAL COHERENCE TOMOGRAPHY

9.4.9 OTHERS

9.5 ENDOCRINOLOGY

9.5.1 COMPUTED TOMOGRAPHY

9.5.2 MAGNETIC RESONANCE IMAGING

9.5.3 ECHOCARDIOGRAPHY

9.5.4 POSITRON EMISSION TOMOGRAPHY

9.5.5 NUCLEAR MEDICINE

9.5.6 X-RAY

9.5.7 ULTRASOUND

9.5.8 OPTICAL COHERENCE TOMOGRAPHY

9.5.9 OTHERS

9.6 DERMATOLOGY

9.6.1 ULTRASOUND

9.6.2 X-RAY

9.6.3 MAGNETIC RESONANCE IMAGING

9.6.4 COMPUTED TOMOGRAPHY

9.6.5 OPTICAL COHERENCE TOMOGRAPHY

9.6.6 POSITRON EMISSION TOMOGRAPHY

9.6.7 NUCLEAR MEDICINE

9.6.8 ECHOCARDIOGRAPHY

9.6.9 OTHERS

9.7 HEMATOLOGY

9.7.1 ULTRASOUND

9.7.2 COMPUTED TOMOGRAPHY

9.7.3 MAGNETIC RESONANCE IMAGING

9.7.4 X-RAY

9.7.5 POSITRON EMISSION TOMOGRAPHY

9.7.6 NUCLEAR MEDICINE

9.7.7 OPTICAL COHERENCE TOMOGRAPHY

9.7.8 ECHOCARDIOGRAPHY

9.7.9 OTHERS

9.8 OTHERS

10 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET, BY END USER

10.1 OVERVIEW

10.2 CONTRACT RESEARCH ORGANIZATION

10.3 PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES

10.4 MEDICAL DEVICE MANUFACTURERS

10.5 ACADEMIC AND GOVERNMENT RESEARCH INSTITUTES

10.6 OTHERS

11 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET, BY DISTRIBUTOR

11.1 OVERVIEW

11.2 DIRECT SALES

11.3 TENDER SALES

12 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET, BY REGION

12.1 ASIA-PACIFIC

12.1.1 CHINA

12.1.2 JAPAN

12.1.3 SOUTH KOREA

12.1.4 INDIA

12.1.5 AUSTRALIA

12.1.6 SINGAPORE

12.1.7 THAILAND

12.1.8 MALAYSIA

12.1.9 INDONESIA

12.1.10 PHILIPPINES

12.1.11 REST OF ASIA-PACIFIC

13 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 NAVITAS LIFE SCIENCES

15.1.1 COMPANY SNAPSHOT

15.1.2 COMPANY SHARE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENTS

15.2 RESONANCE HEALTH ANALYTICAL SERVICES

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.3 CLARIO

15.3.1 COMPANY SNAPSHOT

15.3.2 COMPANY SHARE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENTS

15.4 PARAXEL

15.4.1 COMPANY SNAPSHOT

15.4.2 COMPANY SHARE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENT

15.5 BIOTELEMETRY, A PHILIPS COMPANY

15.5.1 COMPANY SNAPSHOT

15.5.2 COMPANY SHARE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENT

15.6 ICON PLC

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENTS

15.7 MEDIAN TECHNOLOGIES

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENT

15.8 PERSPECTUM

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENTS

15.9 ANAGRAM 4 CLINICAL TRIALS

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 CALYX

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 IMAGE CORE LAB

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 INVICRO. LLC. (A SUBSIDIARY OF KONICA MINOLTA)

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENTS

15.13 IXICO PLC

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENTS

15.14 QUOTIENT SCIENCES

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 RADIANT SAGE LLC

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 WIRB-COPERNICUS GROUP

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 WORLDCARE CLINICAL

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

Liste des tableaux

TABLE 1 COST OF CLINICAL TRIAL PHASE 2 AND PHASE 3

TABLE 2 HUGE R&D COST IN THE U.S. FOR DIFFERENT PHASES

TABLE 3 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET, BY PRODUCTS & SERVICES, 2020-2029 (USD MILLION)

TABLE 4 ASIA PACIFIC SERVICES IN CLINICAL TRIAL IMAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 ASIA PACIFIC SERVICES IN CLINICAL TRIAL IMAGING MARKET, BY PRODUCTS & SERVICES, 2020-2029 (USD MILLION)

TABLE 6 ASIA PACIFIC SOFTWARE IN CLINICAL TRIAL IMAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET, BY MODALITY, 2020-2029 (USD MILLION)

TABLE 8 ASIA PACIFIC COMPUTED TOMOGRAPHY IN CLINICAL TRIAL IMAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 ASIA PACIFIC MAGNETIC RESONANCE IMAGING IN CLINICAL TRIAL IMAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 ASIA PACIFIC ECHOCARDIOGRAPHY IN CLINICAL TRIAL IMAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 ASIA PACIFIC NUCLEAR MEDICINE IN CLINICAL TRIAL IMAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 ASIA PACIFIC POSITRON EMISSION TOMOGRAPHY IN CLINICAL TRIAL IMAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 ASIA PACIFIC X-RAY IN CLINICAL TRIAL IMAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 ASIA PACIFIC ULTRASOUND IN CLINICAL TRIAL IMAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 ASIA PACIFIC OPTICAL COHERENCE TOMOGRAPHY IN CLINICAL TRIAL IMAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 ASIA PACIFIC OTHERS IN CLINICAL TRIAL IMAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 18 ASIA PACIFIC ONCOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 ASIA PACIFIC ONCOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 20 ASIA PACIFIC NEUROLOGY IN CLINICAL TRIAL IMAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 ASIA PACIFIC NEUROLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 22 ASIA PACIFIC CARDIOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 ASIA PACIFIC CARDIOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 24 ASIA PACIFIC ENDOCRINOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 ASIA PACIFIC ENDOCRINOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 26 ASIA PACIFIC DERMATOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 ASIA PACIFIC DERMATOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 28 ASIA PACIFIC HEMATOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 ASIA PACIFIC HEMATOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 30 ASIA PACIFIC OTHERS IN CLINICAL TRIAL IMAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 32 ASIA PACIFIC CONTRACT RESEARCH ORGANIZATION IN CLINICAL TRIAL IMAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 ASIA PACIFIC PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN CLINICAL TRIAL IMAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 ASIA PACIFIC MEDICAL DEVICE MANUFACTURERS IN CLINICAL TRIAL IMAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 ASIA PACIFIC ACADEMIC AND GOVERNMENT RESEARCH INSTITUTES IN CLINICAL TRIAL IMAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 ASIA PACIFIC OTHERS IN CLINICAL TRIAL IMAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET, BY DISTRIBUTOR, 2020-2029 (USD MILLION)

TABLE 38 ASIA PACIFIC DIRECT SALES IN CLINICAL TRIAL IMAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 ASIA PACIFIC TENDER SALES IN CLINICAL TRIAL IMAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 ASIA-PACIFIC CLINICAL TRIAL IMAGING MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 41 ASIA-PACIFIC CLINICAL TRIAL IMAGING MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 42 ASIA-PACIFIC SERVICES IN CLINICAL TRIAL IMAGING MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 43 ASIA-PACIFIC CLINICAL TRIAL IMAGING MARKET, BY MODALITY, 2020-2029 (USD MILLION)

TABLE 44 ASIA-PACIFIC CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 45 ASIA-PACIFIC ONCOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 46 ASIA-PACIFIC NEUROLOGY CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 47 ASIA-PACIFIC ENDOCRINOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION,2020-2029 (USD MILLION)

TABLE 48 ASIA-PACIFIC CARDIOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 49 ASIA-PACIFIC DERMATOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 50 ASIA-PACIFIC HEMATOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 51 ASIA-PACIFIC CLINICAL TRIAL IMAGING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 52 ASIA-PACIFIC CLINICAL TRIAL IMAGING MARKET, BY DISTRIBUTOR, 2020-2029 (USD MILLION)

TABLE 53 CHINA CLINICAL TRIAL IMAGING MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 54 CHINA SERVICES IN CLINICAL TRIAL IMAGING MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 55 CHINA CLINICAL TRIAL IMAGING MARKET, BY MODALITY, 2020-2029 (USD MILLION)

TABLE 56 CHINA CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 57 CHINA ONCOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 58 CHINA NEUROLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 59 CHINA ENDOCRINOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 60 CHINA CARDIOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 61 CHINA DERMATOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 62 CHINA HEMATOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 63 CHINA CLINICAL TRIAL IMAGING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 64 CHINA CLINICAL TRIAL IMAGING MARKET, BY DISTRIBUTOR, 2020-2029 (USD MILLION)

TABLE 65 JAPAN CLINICAL TRIAL IMAGING MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 66 JAPAN SERVICES IN CLINICAL TRIAL IMAGING MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 67 JAPAN CLINICAL TRIAL IMAGING MARKET, BY MODALITY, 2020-2029 (USD MILLION)

TABLE 68 JAPAN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 69 JAPAN ONCOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 70 JAPAN NEUROLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 71 JAPAN ENDOCRINOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 72 JAPAN CARDIOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 73 JAPAN DERMATOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 74 JAPAN HEMATOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 75 JAPAN CLINICAL TRIAL IMAGING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 76 JAPAN CLINICAL TRIAL IMAGING MARKET, BY DISTRIBUTOR, 2020-2029 (USD MILLION)

TABLE 77 SOUTH KOREA CLINICAL TRIAL IMAGING MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 78 SOUTH KOREA SERVICES IN CLINICAL TRIAL IMAGING MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 79 SOUTH KOREA CLINICAL TRIAL IMAGING MARKET, BY MODALITY, 2020-2029 (USD MILLION)

TABLE 80 SOUTH KOREA CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 81 SOUTH KOREA ONCOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 82 SOUTH KOREA NEUROLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 83 SOUTH KOREA ENDOCRINOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 84 SOUTH KOREA CARDIOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 85 SOUTH KOREA DERMATOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 86 SOUTH KOREA HEMATOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 87 SOUTH KOREA CLINICAL TRIAL IMAGING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 88 SOUTH KOREA CLINICAL TRIAL IMAGING MARKET, BY DISTRIBUTOR, 2020-2029 (USD MILLION)

TABLE 89 INDIA CLINICAL TRIAL IMAGING MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 90 INDIA SERVICES IN CLINICAL TRIAL IMAGING MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 91 INDIA CLINICAL TRIAL IMAGING MARKET, BY MODALITY, 2020-2029 (USD MILLION)

TABLE 92 INDIA CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 93 INDIA ONCOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 94 INDIA NEUROLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 95 INDIA ENDOCRINOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 96 INDIA CARDIOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 97 INDIA DERMATOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 98 INDIA HEMATOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 99 INDIA CLINICAL TRIAL IMAGING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 100 INDIA CLINICAL TRIAL IMAGING MARKET, BY DISTRIBUTOR, 2020-2029 (USD MILLION)

TABLE 101 AUSTRALIA CLINICAL TRIAL IMAGING MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 102 AUSTRALIA SERVICES IN CLINICAL TRIAL IMAGING MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 103 AUSTRALIA CLINICAL TRIAL IMAGING MARKET, BY MODALITY, 2020-2029 (USD MILLION)

TABLE 104 AUSTRALIA CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 105 AUSTRALIA ONCOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 106 AUSTRALIA NEUROLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 107 AUSTRALIA ENDOCRINOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 108 AUSTRALIA CARDIOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 109 AUSTRALIA DERMATOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 110 AUSTRALIA HEMATOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 111 AUSTRALIA CLINICAL TRIAL IMAGING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 112 AUSTRALIA CLINICAL TRIAL IMAGING MARKET, BY DISTRIBUTOR, 2020-2029 (USD MILLION)

TABLE 113 SINGAPORE CLINICAL TRIAL IMAGING MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 114 SINGAPORE SERVICES IN CLINICAL TRIAL IMAGING MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 115 SINGAPORE CLINICAL TRIAL IMAGING MARKET, BY MODALITY, 2020-2029 (USD MILLION)

TABLE 116 SINGAPORE CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 117 SINGAPORE ONCOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 118 SINGAPORE NEUROLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 119 SINGAPORE ENDOCRINOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 120 SINGAPORE CARDIOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 121 SINGAPORE DERMATOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 122 SINGAPORE HEMATOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 123 SINGAPORE CLINICAL TRIAL IMAGING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 124 SINGAPORE CLINICAL TRIAL IMAGING MARKET, BY DISTRIBUTOR, 2020-2029 (USD MILLION)

TABLE 125 THAILAND CLINICAL TRIAL IMAGING MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 126 THAILAND SERVICES IN CLINICAL TRIAL IMAGING MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 127 THAILAND CLINICAL TRIAL IMAGING MARKET, BY MODALITY, 2020-2029 (USD MILLION)

TABLE 128 THAILAND CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 129 THAILAND ONCOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 130 THAILAND NEUROLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 131 THAILAND ENDOCRINOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 132 THAILAND CARDIOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 133 THAILAND DERMATOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 134 THAILAND HEMATOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 135 THAILAND CLINICAL TRIAL IMAGING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 136 THAILAND CLINICAL TRIAL IMAGING MARKET, BY DISTRIBUTOR, 2020-2029 (USD MILLION)

TABLE 137 MALAYSIA CLINICAL TRIAL IMAGING MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 138 MALAYSIA SERVICES IN CLINICAL TRIAL IMAGING MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 139 MALAYSIA CLINICAL TRIAL IMAGING MARKET, BY MODALITY, 2020-2029 (USD MILLION)

TABLE 140 MALAYSIA CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 141 MALAYSIA ONCOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 142 MALAYSIA NEUROLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 143 MALAYSIA ENDOCRINOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 144 MALAYSIA CARDIOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 145 MALAYSIA DERMATOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 146 MALAYSIA HEMATOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 147 MALAYSIA CLINICAL TRIAL IMAGING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 148 MALAYSIA CLINICAL TRIAL IMAGING MARKET, BY DISTRIBUTOR, 2020-2029 (USD MILLION)

TABLE 149 INDONESIA CLINICAL TRIAL IMAGING MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 150 INDONESIA SERVICES IN CLINICAL TRIAL IMAGING MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 151 INDONESIA CLINICAL TRIAL IMAGING MARKET, BY MODALITY, 2020-2029 (USD MILLION)

TABLE 152 INDONESIA CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 153 INDONESIA ONCOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 154 INDONESIA NEUROLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 155 INDONESIA ENDOCRINOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 156 INDONESIA CARDIOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 157 INDONESIA DERMATOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 158 INDONESIA HEMATOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 159 INDONESIA CLINICAL TRIAL IMAGING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 160 INDONESIA CLINICAL TRIAL IMAGING MARKET, BY DISTRIBUTOR, 2020-2029 (USD MILLION)

TABLE 161 PHILIPPINES CLINICAL TRIAL IMAGING MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 162 PHILIPPINES SERVICES IN CLINICAL TRIAL IMAGING MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 163 PHILIPPINES CLINICAL TRIAL IMAGING MARKET, BY MODALITY, 2020-2029 (USD MILLION)

TABLE 164 PHILIPPINES CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 165 PHILIPPINES ONCOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 166 PHILIPPINES NEUROLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 167 PHILIPPINES ENDOCRINOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 168 PHILIPPINES CARDIOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 169 PHILIPPINES DERMATOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 170 PHILIPPINES HEMATOLOGY IN CLINICAL TRIAL IMAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 171 PHILIPPINES CLINICAL TRIAL IMAGING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 172 PHILIPPINES CLINICAL TRIAL IMAGING MARKET, BY DISTRIBUTOR, 2020-2029 (USD MILLION)

TABLE 173 REST OF ASIA-PACIFIC CLINICAL TRIAL IMAGING MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: SEGMENTATION

FIGURE 11 THE INCREASING NUMBER OF CONTRACT RESEARCH ORGANIZATION AND RISING R&D EXPENDITURE ARE EXPECTED TO DRIVE THE ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 SERVICES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET

FIGURE 14 WORLDWIDE BIOPHARMA COMPANIES R&D EXPENDITURE (IN USD MILLION)

FIGURE 15 THE MARKET GROWTH IN CLINICAL CRO (IN USD MILLIONS)

FIGURE 16 THE FUNCTION OF CRO

FIGURE 17 ESTIMATED NEW CANCER CASES, 2022

FIGURE 18 VALUE OF THE PHARMACEUTICAL SECTOR, WORLDWIDE, 2021 BY COUNTRY (IN MILLION U.S. DOLLARS)

FIGURE 19 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: BY PRODUCTS & SERVICES, 2021

FIGURE 20 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: BY PRODUCTS & SERVICES, 2022-2029 (USD MILLION)

FIGURE 21 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: BY PRODUCTS & SERVICES, CAGR (2022-2029)

FIGURE 22 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: BY PRODUCTS & SERVICES, LIFELINE CURVE

FIGURE 23 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: BY MODALITY, 2021

FIGURE 24 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: BY MODALITY, 2022-2029 (USD MILLION)

FIGURE 25 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: BY MODALITY, CAGR (2022-2029)

FIGURE 26 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: BY MODALITY, LIFELINE CURVE

FIGURE 27 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: BY APPLICATION, 2021

FIGURE 28 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: BY APPLICATION, 2022-2029 (USD MILLION)

FIGURE 29 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 30 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 31 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: BY END USER, 2021

FIGURE 32 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 33 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: BY END USER, CAGR (2022-2029)

FIGURE 34 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: BY END USER, LIFELINE CURVE

FIGURE 35 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: BY DISTRIBUTOR, 2021

FIGURE 36 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: BY DISTRIBUTOR, 2022-2029 (USD MILLION)

FIGURE 37 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: BY DISTRIBUTOR, CAGR (2022-2029)

FIGURE 38 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: BY DISTRIBUTOR, LIFELINE CURVE

FIGURE 39 ASIA-PACIFIC CLINICAL TRIAL IMAGING MARKET SNAPSHOT (2021)

FIGURE 40 ASIA-PACIFIC CLINICAL TRIAL IMAGING MARKET: BY COUNTRY (2021)

FIGURE 41 ASIA-PACIFIC CLINICAL TRIAL IMAGING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 42 ASIA-PACIFIC CLINICAL TRIAL IMAGING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 43 ASIA-PACIFIC CLINICAL TRIAL IMAGING MARKET: BY PRODUCT & SERVICES (2022-2029)

FIGURE 44 ASIA PACIFIC CLINICAL TRIAL IMAGING MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.