Asia Pacific Class B Bench Top Dental Autoclaves Market

Taille du marché en milliards USD

TCAC :

%

USD

12.52 Billion

USD

17.22 Billion

2021

2029

USD

12.52 Billion

USD

17.22 Billion

2021

2029

| 2022 –2029 | |

| USD 12.52 Billion | |

| USD 17.22 Billion | |

|

|

|

Marché des autoclaves dentaires de paillasse de classe B en Asie-Pacifique, par produit (systèmes, accessoires), matériau ( acier inoxydable , cuivre), type de charge (matériaux poreux, matériaux solides, autres), capacité (24L), utilisateur final ( hôpitaux et cliniques dentaires, laboratoires dentaires, instituts universitaires et de recherche , autres) Tendances et prévisions de l'industrie jusqu'en 2029.

Analyse et perspectives du marché des autoclaves dentaires de paillasse de classe B en Asie-Pacifique

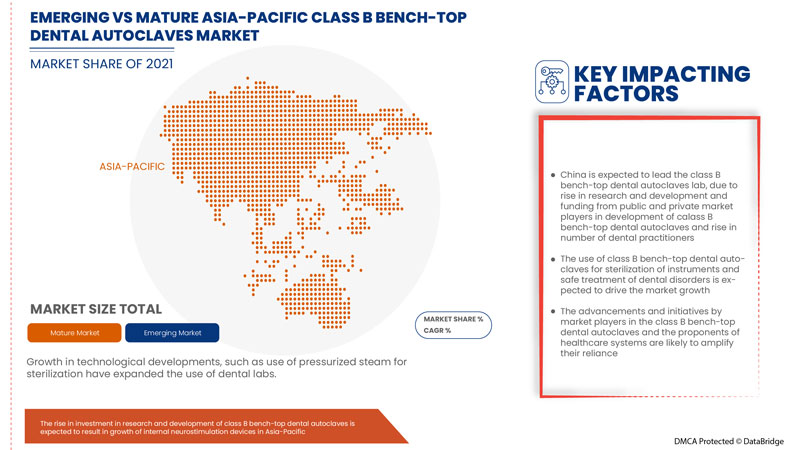

Les facteurs responsables de la croissance du marché sont l'augmentation de la prévalence des troubles dentaires, l'augmentation du nombre de praticiens et de cliniques dentaires, l'augmentation de la demande de procédures dentaires esthétiques et la prévalence des infections contractées à l'hôpital. Cependant, des réglementations strictes et des scénarios de remboursement inappropriés devraient freiner la croissance du marché.

D'un autre côté, les initiatives stratégiques des acteurs du marché, la prévalence croissante des problèmes de santé dentaire, la sensibilisation accrue de tous les groupes d'âge et l'augmentation des dépenses de santé peuvent constituer une opportunité de croissance du marché. Cependant, le besoin d'expertise qualifiée, les défis liés à la mise en œuvre des autoclaves dentaires de paillasse de classe B dans les laboratoires dentaires et l'approbation réglementaire peuvent créer des défis pour le marché.

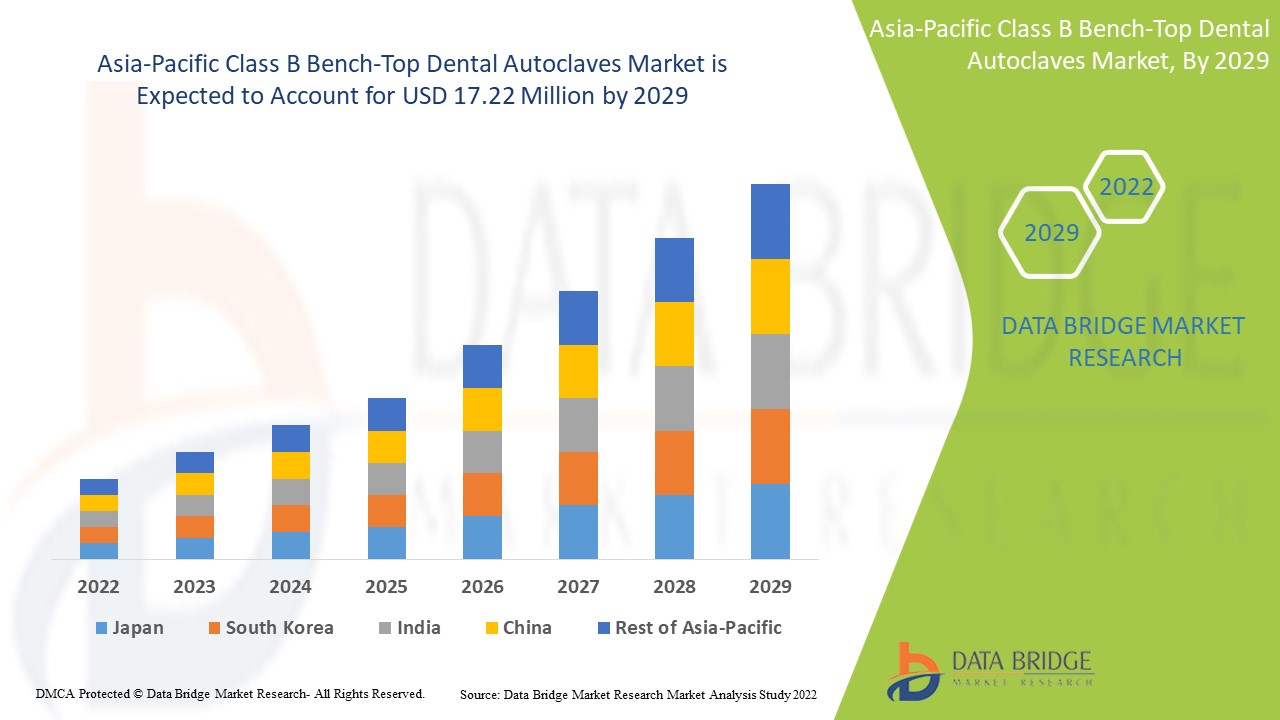

Le marché des autoclaves dentaires de paillasse de classe B en Asie-Pacifique devrait connaître une croissance du marché au cours de la période de prévision de 2022 à 2029. Data Bridge Market Research analyse que le marché croît avec un TCAC de 4,0 % au cours de la période de prévision de 2022 à 2029 et devrait atteindre 17,22 millions USD d'ici 2029 contre 12,52 millions USD en 2021.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable jusqu'en 2019-2014) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, volumes en unités |

|

Segments couverts |

Produit (systèmes, accessoires), matériau ( acier inoxydable , cuivre), type de charge (matériaux poreux, matériaux solides, autres), capacité (< 10 L, 10 L-16 L, 16 L-18 L, 18 L-24 L, > 24 L), utilisateur final ( hôpitaux et cliniques dentaires, laboratoires dentaires, instituts universitaires et de recherche , autres) |

|

Pays couverts |

Chine, Japon, Corée du Sud, Australie, Singapour, Thaïlande, Malaisie, Indonésie et reste de l'Asie-Pacifique |

|

Acteurs du marché couverts |

NSK/Nakanishi Inc., W&H DENTALWERK INTERNATIONAL, Dentsply Sirona, Celitron Medical Technologies Kft, MELAG Medizintechnik GmbH & Co. KG, STURDY INDUSTRIAL CO., LTD., ZEALWAY Instrument Inc., LTE Scientific Ltd, 2022, FONA srl, Tuttnauer, Tecno-Gaz SpA, NEWMED, entre autres |

Définition du marché

Les autoclaves dentaires de paillasse de classe B sont définis par un cycle de vide de pré-stérilisation. La classe B est considérée comme la classe d'autoclave la plus élevée et peut être utilisée pour stériliser toutes les charges, y compris les solides, les instruments creux de type A, les instruments creux de type B, les charges poreuses et les instruments emballés. Les autoclaves de paillasse de classe B doivent réussir le test Helix conformément à la norme EN 13060 décrite par la norme EN 867-5:2001. Cela ne peut être réalisé qu'en utilisant un vide fractionné de pré-stérilisation. Le séchage sous vide après stérilisation assure un séchage complet de toutes les charges après l'ensemble du processus de stérilisation. Un stérilisateur de classe B est un autoclave indispensable dans chaque clinique dentaire. Il permet une stérilisation très efficace et sûre des instruments. Les autoclaves de classe B STERICOX sont conformes à la norme EN13060 et sont disponibles en capacité de 23 litres, ce qui en fait la marque la plus appréciée à un prix économique. Les stérilisateurs dentaires de classe B sont largement utilisés en médecine et en dentisterie pour garantir la sécurité des médecins, du personnel et des patients. Différents types de charges telles que des matériaux poreux, des textiles, des produits en sachets, des turbines, des baguettes et des pointes peuvent être efficacement stérilisés dans un autoclave dentaire de classe B.

Dynamique du marché des autoclaves dentaires de paillasse de classe B en Asie-Pacifique

Conducteurs

-

PRÉVALENCE AUGMENTÉE DES TROUBLES DENTAIRES

La santé bucco-dentaire fait référence à la santé des gencives, des dents et du système buccal et facial qui permet de parler, de mâcher et de sourire. Les troubles dentaires les plus courants comprennent la carie dentaire, les maladies parodontales et le cancer de la bouche , entre autres. Selon le rapport de l'Organisation mondiale de la santé, environ 2,3 milliards de personnes dans le monde souffrent de caries sur une dent permanente, parmi lesquelles environ 530 millions d'enfants souffrent de caries sur une dent primaire.

La carie dentaire résulte d'une interaction complexe de variables, notamment les bactéries, la sensibilité de l'hôte, le temps, l'alimentation et d'autres facteurs. Des pratiques non hygiéniques, comme une mauvaise hygiène bucco-dentaire, peuvent provoquer une carie dentaire qui aura un impact sur la croissance et la maturité des dents permanentes, et la consommation généralisée d'aliments sucrés provoque la cavitation des dents. La stérilisation est une étape essentielle pour les instruments dentaires réutilisables qui ont été contaminés par tous les fluides biologiques.

À mesure que le nombre de troubles dentaires augmente, le risque d'infection ou de contamination croisée par le biais du matériel dentaire augmente également. Ainsi, la disponibilité et l'utilisation d'autoclaves dentaires de paillasse de classe B devraient stimuler l'expansion du marché en raison de l'augmentation des troubles dentaires.

Ainsi, l’augmentation des cas de troubles dentaires tels que les caries dentaires , la dégradation des dents et les cancers de la bouche devrait stimuler la croissance du marché des autoclaves dentaires de paillasse de classe B en Asie-Pacifique.

-

AUGMENTATION DU NOMBRE DE PRATICIENS DENTAIRES ET DE CLINIQUES DENTAIRES

Le nombre de problèmes dentaires augmentant à l'échelle mondiale, le besoin de professionnels et de cliniques dentaires augmente également. L'utilisation d'instruments de pointe exigeant des professionnels dentaires qualifiés, le nombre de praticiens dentaires augmente dans les pays en développement et développés.

Ainsi, l’augmentation de la population de dentistes et du nombre de laboratoires dentaires devrait stimuler la croissance du marché au cours de la période prévue.

-

DEMANDE AUGMENTÉE DE PROCÉDURES DENTAIRES ESTHÉTIQUES

La dentisterie esthétique améliore l'idée de santé bucco-dentaire en produisant une sensation complète de bien-être qui comprend à la fois une sensation et une apparence excellentes. De nouveaux matériaux dentaires donnent des résultats supérieurs, car la dentisterie esthétique a progressé au fil du temps. Le développement de la dentisterie esthétique a ouvert la voie à des changements plus importants et plus durables du visage qui vont bien au-delà de la simple correction des dents. Ainsi, la demande de procédures dentaires esthétiques a augmenté la croissance du marché des autoclaves de paillasse de classe B car ils comprennent une puissante pompe à vide pour éliminer tout l'air de leur chambre, ce qui leur permet de stériliser efficacement chaque partie des instruments nécessaires aux procédures dentaires. Sa rapidité et son interface conviviale ont augmenté sa demande parmi les praticiens de la santé.

Opportunités

-

PRÉVALENCE AUGMENTANTE DES PROBLÈMES DE SANTÉ DENTAIRE ET SENSIBILISATION À CEUX-CI DANS TOUS LES GROUPES D'ÂGE

Les problèmes dentaires sont parfois négligés, ce qui conduit à des problèmes dentaires majeurs. Les cas d'infections buccales ou dentaires sont de plus en plus fréquents selon les groupes d'âge. Par conséquent, les organismes gouvernementaux ont imposé diverses directives liées à la santé dentaire. De plus, les organismes gouvernementaux et les organisations de soins de santé sensibilisent au contrôle des infections par le biais de diverses résolutions et programmes de santé.

Le développement des programmes de santé dentaire a un impact considérable sur le développement de produits dentaires de meilleure qualité et plus avancés sur le marché. Par conséquent, l'augmentation des problèmes dentaires et la sensibilisation de tous les groupes d'âge constituent une plus grande opportunité pour la croissance du marché des autoclaves dentaires de paillasse de classe B en Asie-Pacifique.

Contraintes/Défis

-

MANQUE DE SENSIBILISATION À L'HYGIÈNE DENTAIRE

Le développement du marché mondial des autoclaves dentaires devrait être entravé par le manque de sensibilisation à l’hygiène dentaire des pays en développement.

Par exemple, les troubles bucco-dentaires sont courants dans le monde entier et ont un impact négatif sur la santé des populations et sur l’économie mondiale.

La majorité des pays continuent de constater une augmentation de la prévalence des maladies bucco-dentaires, qui résulte principalement du faible accès des populations aux établissements de soins de santé bucco-dentaire et du manque de connaissances en matière d’hygiène dentaire (ce qui conduit les populations à ne pas être conscientes de l’importance de l’hygiène dentaire).

-

SCÉNARIO DE REMBOURSEMENT INAPPROPRIÉ

Le remboursement est l'un des scénarios cruciaux pour l'expansion de ce marché. Divers organismes interviennent dans le cadre de ce remboursement.

Toutefois, certains problèmes subsistent, comme une couverture inadaptée et un manque de transparence dans les procédures de remboursement. Ces limitations empêchent les professionnels dentaires d'accéder à des produits à des coûts abordables, ce qui réduit les incitations des développeurs de produits.

Par exemple,

- En avril 2019, Endeavor Business Media LLC. a signalé que le taux de remboursement des soins dentaires était en baisse. Rechercher des remboursements, comprendre les subtilités des exclusions, des périodes d'attente et des préapprobations, soumettre la documentation appropriée et déposer des demandes de remboursement ne sont que quelques-unes des nombreuses responsabilités requises pour chaque visite de patient, ce qui rend difficile le bon déroulement des processus de remboursement.

- Selon l'article du NCBI, les obstacles inclus dans la couverture dentaire tels que le manque de couverture, la couverture insuffisante, l'incapacité de trouver un dentiste qui accepte l'assurance, la mauvaise qualité des soins pour les non assurés et l'obligation d'attendre que la couverture prenne effet, entre autres

La procédure actuelle d’évaluation de la couverture manque de transparence et diffère selon les différents payeurs, ce qui conduit à des décisions de couverture incohérentes et limite l’accès des professionnels de la santé aux meilleurs instruments.

Ces limitations entraînent des retards dans le développement et l'investissement dans de nouveaux dispositifs. Selon la publication du NCBI, il a été projeté que le manque de remboursement des soins dentaires constitue un obstacle important à la recherche de soins dentaires, ce qui devrait freiner la croissance du marché.

Développement récent

- En octobre 2021, W&H a annoncé qu'elle pourrait couvrir l'ensemble du flux de travail de la chirurgie buccale mini-invasive avec une solution modulaire qui simplifiera le travail clinique et ouvrira de nouvelles perspectives de traitement. Ainsi, cela aidera l'entreprise à générer plus de revenus

Portée du marché des autoclaves dentaires de paillasse de classe B en Asie-Pacifique

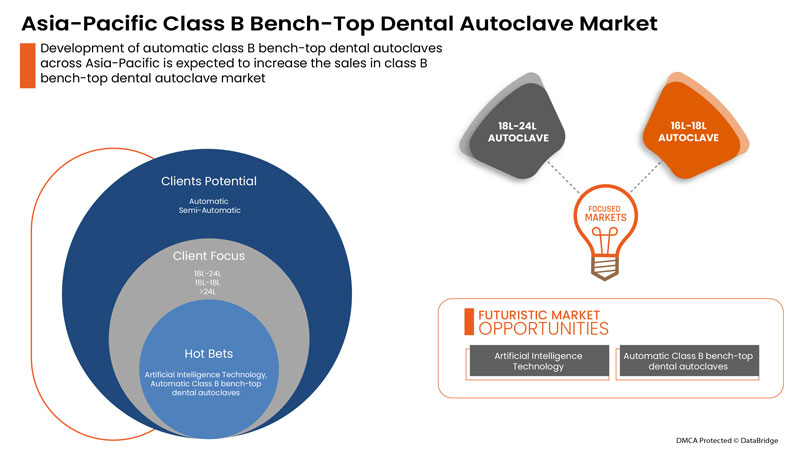

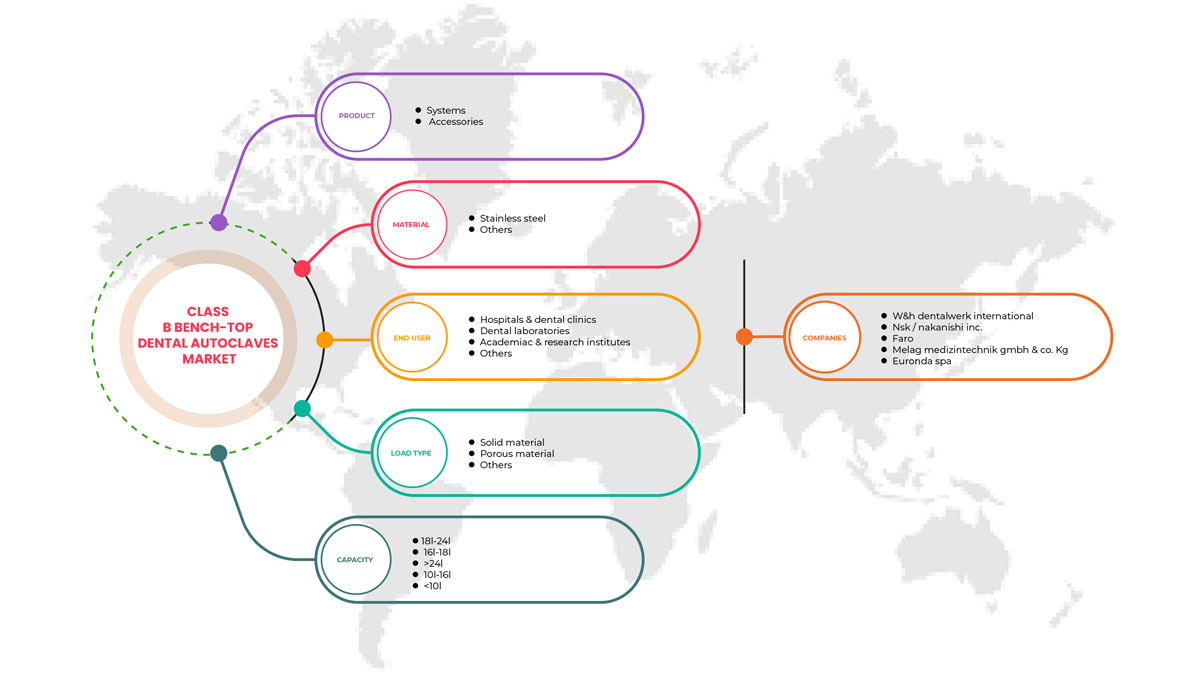

Le marché des autoclaves dentaires de paillasse de classe B en Asie-Pacifique est segmenté en produits, matériaux, types de charge, capacités et utilisateurs finaux. La croissance parmi ces segments vous aidera à analyser les segments de croissance limités dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Produit

- Systèmes

- Accessoires

Sur la base des produits, le marché des autoclaves dentaires de paillasse de classe B de la région Asie-Pacifique est segmenté en systèmes et accessoires.

Matériel

- Acier inoxydable

- Cuivre

Sur la base du matériau, le marché des autoclaves dentaires de paillasse de classe B de la région Asie-Pacifique est segmenté en acier inoxydable et en cuivre.

Type de charge

- Matériaux solides

- Matériaux poreux

- Autres

Sur la base du type de charge, le marché des autoclaves dentaires de paillasse de classe B de la région Asie-Pacifique est segmenté en matériaux solides, matériaux poreux et autres.

Capacité

- <10L

- 10L-16L

- 16L-18L

- 18L-24L

- >24L

Sur la base de la capacité, le marché des autoclaves dentaires de paillasse de classe B de la région Asie-Pacifique est segmenté en <10L, 10L-16L, 16L-18L, 18L-24L et >24L.

Utilisateur final

- Hôpitaux et cliniques dentaires

- Laboratoires dentaires

- Instituts universitaires et de recherche

- Autres

Sur la base de l'utilisateur final, le marché des autoclaves dentaires de paillasse de classe B de la région Asie-Pacifique est segmenté en hôpitaux et cliniques dentaires, laboratoires dentaires, instituts universitaires et de recherche, et autres.

Analyse/perspectives régionales du marché des autoclaves dentaires de paillasse de classe B en Asie-Pacifique

Le marché des autoclaves dentaires de paillasse de classe B en Asie-Pacifique est analysé et des informations et tendances sur la taille du marché sont fournies par pays, produit, matériau, type de charge, capacité et utilisateur final.

Le marché des autoclaves dentaires de paillasse de classe B de la région Asie-Pacifique est divisé en Chine, Japon, Corée du Sud, Australie, Singapour, Thaïlande, Malaisie, Indonésie et reste de la région Asie-Pacifique.

La Chine devrait être le leader du laboratoire d'autoclaves dentaires de paillasse de classe B en raison d'une augmentation de la recherche et du développement et du financement des acteurs du marché public et privé dans le développement d'autoclaves dentaires de paillasse de classe B et d'une augmentation du nombre de praticiens dentaires

La section par pays du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données, tels que les ventes de produits neufs et de remplacement, la démographie des pays, l'épidémiologie des maladies et les tarifs d'importation et d'exportation, sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques d'Asie-Pacifique, les défis rencontrés en raison de la forte concurrence des marques locales et nationales et l'impact des canaux de vente sont pris en compte lors de la fourniture d'une analyse prévisionnelle des données par pays.

Analyse du paysage concurrentiel et des parts de marché des autoclaves dentaires de paillasse de classe B en Asie-Pacifique

Le paysage concurrentiel du marché des autoclaves dentaires de paillasse de classe B en Asie-Pacifique fournit des détails par concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence mondiale, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit et la domination des applications. Les points de données ci-dessus ne concernent que les entreprises se concentrant sur le marché des autoclaves dentaires de paillasse de classe B en Asie-Pacifique.

Français Certains des principaux acteurs opérant sur le marché des autoclaves dentaires de paillasse de classe B en Asie-Pacifique sont NSK/Nakanishi Inc., W&H DENTALWERK INTERNATIONAL, Dentsply Sirona, Celitron Medical Technologies Kft, MELAG Medizintechnik GmbH & Co. KG, STURDY INDUSTRIAL CO., LTD., ZEALWAY Instrument Inc., LTE Scientific Ltd, 2022, FONA srl, Tuttnauer, Tecno-Gaz SpA, NEWMED, entre autres.

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. Les données du marché sont analysées et estimées à l'aide de modèles statistiques et cohérents du marché. En outre, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. La principale méthodologie de recherche utilisée par l'équipe de recherche DBMR est la triangulation des données, qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). En dehors de cela, les modèles de données comprennent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement de l'entreprise, l'analyse des parts de marché des entreprises, les normes de mesure, l'Asie-Pacifique par rapport à la région et l'analyse des parts des fournisseurs. Veuillez demander un appel d'analyste en cas de demande de renseignements supplémentaires.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHIC SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 RESEARCH METHODOLOGY

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT SEGMENT LIFELINE CURVE

2.8 DBMR MARKET POSITION GRID

2.9 MARKET APPLICATION COVERAGE GRID

2.1 THE CATEGORY VS TIME GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES

5 ASIA PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASED PREVALENCE OF DENTAL DISORDERS

6.1.2 INCREASED NUMBER OF DENTAL PRACTITIONERS AND DENTAL CLINICS

6.1.3 INCREASED DEMAND FOR COSMETIC DENTAL PROCEDURES

6.1.4 INCREASED PREVALENCE OF HOSPITAL-ACQUIRED INFECTION

6.2 RESTRAINTS

6.2.1 STRINGENT GOVERNMENT REGULATIONS

6.2.2 INAPPROPRIATE REIMBURSEMENT SCENARIO

6.2.3 INSUFFICIENT ATTENTION TO PROCESS

6.3 OPPORTUNITIES

6.3.1 RISING PREVALENCE OF DENTAL HEALTH ISSUES AND AWARENESS ACROSS ALL AGE GROUPS

6.3.2 STRATEGIC INITIATIVES OF KEY PLAYERS

6.3.3 RISING HEALTHCARE EXPENDITURE

6.4 CHALLENGES

6.4.1 HIGH COST OF BENCH-TOP DENTAL AUTOCLAVES

6.4.2 LACK OF AWARENESS ABOUT DENTAL HYGIENE

7 ASIA PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 SYSTEMS

7.2.1 AUTOMATIC

7.2.2 SEMI-AUTOMATIC

7.2.3 MANUAL

7.3 ACCESSORIES

8 ASIA PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY MATERIAL

8.1 OVERVIEW

8.2 STAINLESS STEEL

8.3 OTHERS

9 ASIA PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY LOAD TYPE

9.1 OVERVIEW

9.2 SOLID MATERIAL

9.2.1 TYPE A SOLID LOADS WITH HOLLOW SECTIONS

9.2.2 TYPE B SOLID LOADS WITH HOLLOW SECTIONS

9.3 POROUS MATERIAL

9.4 OTHERS

10 ASIA PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY CAPACITY

10.1 OVERVIEW

10.2 18L-24L

10.3 16L-18L

10.4 >24L

10.5 >10L-16L

10.6 <10L

11 ASIA PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY END USER

11.1 OVERVIEW

11.2 HOSPITALS & DENTAL CLINICS

11.3 DENTAL LABORATORIES

11.4 ACADEMIC & RESEARCH INSTITUTES

11.5 OTHERS

12 ASIA PACIFIC CLASS B BENCH TOP DENTAL AUTOCLAVE MARKET BY COUNTRY

12.1 ASIA-PACIFIC

12.1.1 CHINA

12.1.2 JAPAN

12.1.3 SOUTH KOREA

12.1.4 AUSTRALIA

12.1.5 SINGAPORE

12.1.6 THAILAND

12.1.7 MALAYSIA

12.1.8 INDONESIA

12.1.9 REST OF ASIA-PACIFIC

13 ASIA PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: COMPANY LANDSCAPE

14 ASIA-PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 W&H DENTALWERK INTERNATIONAL

16.1.1 COMPANY SNAPSHOT

16.1.2 PRODUCT PORTFOLIO

16.1.3 RECENT DEVELOPMENT

16.2 NSK/NAKANISHI INC.

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT DEVELOPMENT

16.3 MELAG MEDIZINTECHNIK GMBH & CO. KG

16.3.1 COMPANY SNAPSHOT

16.3.2 1.3.2 PRODUCT PORTFOLIO

16.3.3 RECENT DEVELOPMENTS

16.4 FARO

16.4.1 COMPANY SNAPSHOT

16.4.2 PRODUCT PORTFOLIO

16.4.3 RECENT DEVELOPMENT

16.5 EURONDA SPA

16.5.1 COMPANY SNAPSHOT

16.5.2 PRODUCT PORTFOLIO

16.5.3 RECENT DEVELOPMENTS

16.6 CELITRON MEDICAL TECHNOLOGIES KFT

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENT

16.7 DENTSPLY SIRONA

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT DEVELOPMENT

16.8 FLIGHT DENTAL SYSTEM

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENTS

16.9 FONA

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENTS

16.1 LTE SCIENTIFIC LTD, 2022

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENTS

16.11 LABOMIZ SCIENTIFIC

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENTS

16.12 MEDICAL TRADING S.R.L.

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 MATACHANA

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENTS

16.14 NEU-TEC GROUP INC.

16.15 COMPANY SNAPSHOT

16.15.1 PRODUCT PORTFOLIO

16.15.2 RECENT DEVELOPMENT

16.16 NEWMED

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENT

16.17 PRIORCAVE LTD.

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENTS

16.18 STURDY INDUSTRIAL CO., LTD.

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENTS

16.19 TUTTNAUER

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENT

16.2 TECNO-GAZ S.P.A.

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENTS

16.21 ZEALWAY INSTRUMENT INC.

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

Liste des tableaux

TABLE 1 ASIA-PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 2 ASIA-PACIFIC SYSTEMS IN CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 3 ASIA-PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 4 ASIA-PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY LOAD TYPE, 2020-2029 (USD MILLION)

TABLE 5 ASIA-PACIFIC SOLID MATERIAL IN CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY LOAD TYPE, 2020-2029 (USD MILLION)

TABLE 6 ASIA-PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 7 ASIA-PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 8 ASIA-PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 9 ASIA-PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY COUNTRY, BY VOLUME 2020-2029 (UNITS)

TABLE 10 CHINA CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 11 CHINA SYSTEMS IN CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 12 CHINA CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 13 CHINA CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY LOAD TYPE, 2020-2029 (USD MILLION)

TABLE 14 CHINA SOLID MATERIAL IN CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY LOAD TYPE, 2020-2029 (USD MILLION)

TABLE 15 CHINA CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 16 CHINA CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 17 JAPAN CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 18 JAPAN SYSTEMS IN CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 19 JAPAN CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 20 JAPAN CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY LOAD TYPE, 2020-2029 (USD MILLION)

TABLE 21 JAPAN SOLID MATERIAL IN CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY LOAD TYPE, 2020-2029 (USD MILLION)

TABLE 22 JAPAN CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 23 JAPAN CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 24 SOUTH KOREA CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 25 SOUTH KOREA SYSTEMS IN CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 26 SOUTH KOREA CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 27 SOUTH KOREA CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY LOAD TYPE, 2020-2029 (USD MILLION)

TABLE 28 SOUTH KOREA SOLID MATERIAL IN CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY LOAD TYPE, 2020-2029 (USD MILLION)

TABLE 29 SOUTH KOREA CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 30 SOUTH KOREA CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 31 AUSTRALIA CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 32 AUSTRALIA SYSTEMS IN CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 33 AUSTRALIA CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 34 AUSTRALIA CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY LOAD TYPE, 2020-2029 (USD MILLION)

TABLE 35 AUSTRALIA SOLID MATERIAL IN CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY LOAD TYPE, 2020-2029 (USD MILLION)

TABLE 36 AUSTRALIA CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 37 AUSTRALIA CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 38 SINGAPORE CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 39 SINGAPORE SYSTEMS IN CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 40 SINGAPORE CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 41 SINGAPORE CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY LOAD TYPE, 2020-2029 (USD MILLION)

TABLE 42 SINGAPORE SOLID MATERIAL IN CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY LOAD TYPE, 2020-2029 (USD MILLION)

TABLE 43 SINGAPORE CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 44 SINGAPORE CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 45 THAILAND CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 46 THAILAND SYSTEMS IN CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 47 THAILAND CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 48 THAILAND CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY LOAD TYPE, 2020-2029 (USD MILLION)

TABLE 49 THAILAND SOLID MATERIAL IN CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY LOAD TYPE, 2020-2029 (USD MILLION)

TABLE 50 THAILAND CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 51 THAILAND CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 52 MALAYSIA CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 53 MALAYSIA SYSTEMS IN CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 MALAYSIA CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 55 MALAYSIA CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY LOAD TYPE, 2020-2029 (USD MILLION)

TABLE 56 MALAYSIA SOLID MATERIAL IN CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY LOAD TYPE, 2020-2029 (USD MILLION)

TABLE 57 MALAYSIA CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 58 MALAYSIA CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 59 INDONESIA CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 60 INDONESIA SYSTEMS IN CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 61 INDONESIA CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 62 INDONESIA CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY LOAD TYPE, 2020-2029 (USD MILLION)

TABLE 63 INDONESIA SOLID MATERIAL IN CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY LOAD TYPE, 2020-2029 (USD MILLION)

TABLE 64 INDONESIA CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 65 INDONESIA CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 66 REST OF ASIA-PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 ASIA PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: GEOGRAPHIC SCOPE

FIGURE 3 ASIA PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: DATA TRIANGULATION

FIGURE 4 ASIA PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: SNAPSHOT

FIGURE 5 ASIA PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: GLOBAL VS REGIONAL ANALYSIS

FIGURE 6 ASIA PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 7 ASIA PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: INTERVIEWS: BY REGION AND DESIGNATION

FIGURE 8 ASIA PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: DBMR MARKET POSITION GRID

FIGURE 9 ASIA PACIFIC, CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: END USER COVERAGE GRID

FIGURE 10 ASIA PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: THE CATEGORY VS TIME GRID

FIGURE 11 ASIA PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET SEGMENTATION

FIGURE 12 GROWING APPLICATIONS OF CLASS B BENCH-TOP DENTAL AUTOCLAVES, RISE IN PREVALENCE OF DENTAL DISORDERS AND RISE IN DENTAL PRACTITIONERS, AND INCREASED SAFETY OF HYGIENE AND MAINTENANCE ARE EXPECTED TO DRIVE THE MARKET FOR ASIA PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 13 THE SYSTEMS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET IN 2019 AND 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE CLASS B BENCH-TOP DENTAL AUTOCLAVE MARKET

FIGURE 15 ASIA-PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY PRODUCT, 2021

FIGURE 16 ASIA-PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY PRODUCT, 2022-2029 (USD MILLION)

FIGURE 17 ASIA-PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY PRODUCT, CAGR (2022-2029)

FIGURE 18 ASIA-PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY PRODUCT, LIFELINE CURVE

FIGURE 19 ASIA-PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY MATERIAL, 2021

FIGURE 20 ASIA-PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY MATERIAL, 2022-2029 (USD MILLION)

FIGURE 21 ASIA-PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY MATERIAL, CAGR (2022-2029)

FIGURE 22 ASIA-PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY MATERIAL, LIFELINE CURVE

FIGURE 23 ASIA-PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY LOAD TYPE, 2021

FIGURE 24 ASIA-PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY LOAD TYPE, 2022-2029 (USD MILLION)

FIGURE 25 ASIA-PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY LOAD TYPE, CAGR (2022-2029)

FIGURE 26 ASIA-PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY LOAD TYPE, LIFELINE CURVE

FIGURE 27 ASIA-PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY CAPACITY, 2021

FIGURE 28 ASIA-PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY CAPACITY, 2022-2029 (USD MILLION)

FIGURE 29 ASIA-PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY CAPACITY, CAGR (2022-2029)

FIGURE 30 ASIA-PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY CAPACITY, LIFELINE CURVE

FIGURE 31 ASIA-PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY END USER, 2021

FIGURE 32 ASIA-PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 33 ASIA-PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY END USER, CAGR (2022-2029)

FIGURE 34 ASIA-PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: BY END USER, LIFELINE CURVE

FIGURE 35 ASIA-PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET : SNAPSHOT (2021)

FIGURE 36 ASIA-PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET : BY COUNTRY (2021)

FIGURE 37 ASIA-PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET : BY COUNTRY (2022 & 2029)

FIGURE 38 ASIA-PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET : BY COUNTRY (2021 & 2029)

FIGURE 39 ASIA-PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET : BY PRODUCT (2022-2029)

FIGURE 40 ASIA-PACIFIC CLASS B BENCH-TOP DENTAL AUTOCLAVES MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.