Asia Pacific Biologics Market

Taille du marché en milliards USD

TCAC :

%

USD

73.52 Billion

USD

175.63 Billion

2024

2032

USD

73.52 Billion

USD

175.63 Billion

2024

2032

| 2025 –2032 | |

| USD 73.52 Billion | |

| USD 175.63 Billion | |

|

|

|

|

Segmentation du marché des produits biologiques en Asie-Pacifique, par classe (inhibiteurs du facteur de nécrose tumorale Α (TNF), inhibiteurs des lymphocytes B, inhibiteurs de l'interleukine, modulateurs sélectifs de la co-stimulation (abatacept) et autres), type (anticorps monoclonaux (MAB), protéines thérapeutiques, vaccins, produits biologiques cellulaires, produits biologiques génétiques et autres), voie d'administration (injection et perfusion), application (oncologie, maladies auto-immunes, diabète, maladies infectieuses, maladies cardiovasculaires, affections ophtalmologiques, maladies dermatologiques et autres), matière première (humaine, culture cellulaire aviaire, levure, bactérie, culture cellulaire d'insectes, transgénique et autres), utilisateur final (hôpitaux, cliniques spécialisées, universités et instituts de recherche et autres), canal de distribution (appel d'offres direct, vente au détail et distribution par des tiers) - Tendances et prévisions du secteur jusqu'en 2032

Taille du marché des produits biologiques en Asie-Pacifique

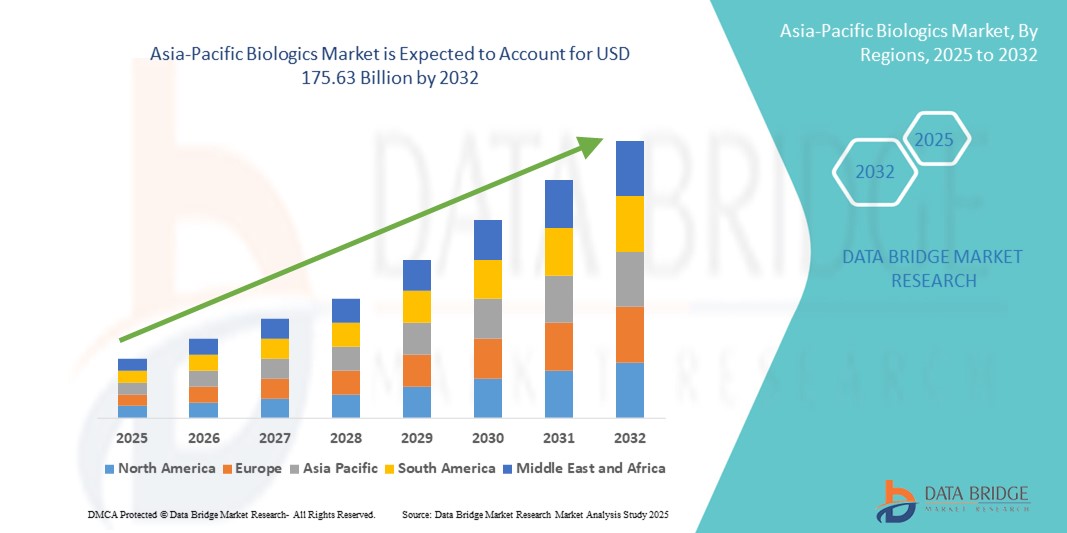

- La taille du marché des produits biologiques en Asie-Pacifique était évaluée à 73,52 milliards USD en 2024 et devrait atteindre 175,63 milliards USD d'ici 2032 , à un TCAC de 11,5 % au cours de la période de prévision.

- La croissance du marché est en grande partie tirée par l'augmentation des investissements dans la recherche biopharmaceutique , la prévalence croissante des maladies chroniques et l'expansion des infrastructures de soins de santé dans les économies émergentes de la région.

- De plus, le soutien croissant des gouvernements aux biotechnologies , l'adoption croissante de la médecine personnalisée et les avancées technologiques dans le développement de médicaments biologiques contribuent à l'expansion rapide du marché des produits biologiques en Asie-Pacifique. Ces facteurs, combinés, améliorent la disponibilité et l'acceptation des thérapies biologiques, accélérant ainsi la croissance du marché.

Analyse du marché des produits biologiques en Asie-Pacifique

- Les produits biologiques, qui englobent des médicaments complexes dérivés de cellules vivantes pour le traitement des maladies chroniques et rares, deviennent des composants essentiels du secteur des soins de santé en Asie-Pacifique en raison des progrès biotechnologiques rapides et de la demande croissante de thérapies ciblées.

- La prévalence croissante des maladies chroniques, l’expansion des infrastructures de santé et la croissance des dépenses de santé dans les économies émergentes entraînent une forte demande de produits biologiques dans la région.

- La Chine a dominé le marché des produits biologiques en Asie-Pacifique avec une part de revenus de 39,2 % en 2024, soutenue par des initiatives gouvernementales solides, une base de patients en expansion et une adoption croissante de produits biologiques et biosimilaires innovants.

- L'Inde devrait être le pays connaissant la croissance la plus rapide sur le marché des produits biologiques en Asie-Pacifique au cours de la période de prévision, en raison de l'intensification des activités de recherche clinique, de l'amélioration des environnements réglementaires et de la croissance des capacités de fabrication biopharmaceutique.

- Le segment des anticorps monoclonaux a dominé le marché des produits biologiques en Asie-Pacifique avec une part de 46,1 % en 2024, grâce à de nombreuses applications en oncologie, dans les maladies auto-immunes et à une innovation continue pour améliorer l'efficacité et la sécurité des traitements.

Portée du rapport et segmentation du marché des produits biologiques en Asie-Pacifique

|

Attributs |

Informations clés sur le marché des produits biologiques en Asie-Pacifique |

|

Segments couverts |

|

|

Pays couverts |

Asie-Pacifique

|

|

Principaux acteurs du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse approfondie des experts, une analyse des prix, une analyse de la part de marque, une enquête auprès des consommateurs, une analyse démographique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire. |

Tendances du marché des produits biologiques en Asie-Pacifique

Une expansion rapide portée par l'innovation biotechnologique et la médecine personnalisée

- Une tendance importante et croissante sur le marché des produits biologiques en Asie-Pacifique est la montée en puissance des innovations biotechnologiques combinée à l'adoption croissante d'approches de médecine personnalisée adaptées aux profils génétiques et moléculaires des patients.

- Par exemple, des entreprises telles que Biocon (Inde) et Shanghai Fosun Pharmaceutical développent des biosimilaires et de nouveaux produits biologiques ciblant le cancer, les maladies auto-immunes et les maladies rares, améliorant ainsi l'accessibilité et l'efficacité des traitements dans toute la région.

- Les progrès des thérapies cellulaires et géniques, soutenus par des capacités de fabrication améliorées et des collaborations entre les entreprises de biotechnologie locales et les sociétés pharmaceutiques mondiales, stimulent les pipelines d'innovation et élargissent les portefeuilles de produits biologiques.

- Les organismes de réglementation de la région Asie-Pacifique, notamment la PMDA du Japon et la NMPA de la Chine, rationalisent les processus d'approbation des produits biologiques et biosimilaires, facilitant ainsi une entrée et une adoption plus rapides sur le marché.

- Cette tendance vers les thérapies de précision et les produits biologiques avancés remodèle les modèles de soins aux patients, avec une intégration croissante dans les programmes nationaux de santé et les régimes de remboursement des assurances, en particulier en Chine, au Japon et en Corée du Sud.

- La demande de traitements biologiques de pointe augmente rapidement en raison de leurs profils de sécurité et d'efficacité supérieurs à ceux des médicaments traditionnels à petites molécules, ce qui alimente une forte expansion du marché dans les pays développés et émergents de la région Asie-Pacifique.

Dynamique du marché des produits biologiques en Asie-Pacifique

Conducteur

Augmentation du fardeau des maladies chroniques et expansion des infrastructures de santé

- La prévalence croissante des maladies chroniques telles que le cancer, le diabète et les maladies auto-immunes en Asie-Pacifique, associée à l'expansion des infrastructures de soins de santé et à l'amélioration des taux de diagnostic des maladies, est un moteur clé de la croissance du marché des produits biologiques.

- Par exemple, en mars 2024, Samsung Biologics a annoncé une augmentation significative de sa capacité en Corée du Sud, visant à répondre à la demande croissante de services de fabrication biopharmaceutique, soulignant l'engagement de l'industrie envers les besoins du marché.

- La sensibilisation croissante des patients et l’amélioration de l’accès aux soins de santé ont accéléré l’adoption des produits biologiques, soutenue par des initiatives gouvernementales et des améliorations de la couverture d’assurance dans des pays comme la Chine et l’Inde.

- De plus, les investissements dans la R&D et la fabrication par des entreprises locales et multinationales améliorent la disponibilité et l'accessibilité des thérapies biologiques, favorisant ainsi la pénétration du marché.

- Les collaborations et partenariats croissants entre les entreprises de biotechnologie de la région Asie-Pacifique et les sociétés pharmaceutiques mondiales accélèrent l’innovation, le transfert de technologie et la commercialisation des produits biologiques dans la région.

- L'expansion des marchés biosimilaires crée des alternatives rentables aux produits biologiques de marque, augmentant ainsi l'accessibilité aux traitements et stimulant la croissance globale du marché.

Retenue/Défi

Coûts de traitement élevés et environnement réglementaire complexe

- Le coût relativement élevé des thérapies biologiques reste un obstacle important à leur adoption généralisée sur les marchés d'Asie-Pacifique sensibles aux prix, limitant l'accessibilité parmi les segments de patients à faible revenu.

- Par exemple, bien que les biosimilaires offrent des économies de coûts, les exigences réglementaires strictes et variées selon les pays créent des retards et augmentent les coûts de conformité pour l'entrée sur le marché.

- La variabilité des protections de la propriété intellectuelle et le manque de réglementations harmonisées posent des défis supplémentaires aux fabricants et entravent une disponibilité plus rapide des biosimilaires.

- En outre, les complexités logistiques liées au stockage et à la distribution des produits biologiques, en particulier dans les zones rurales ou sous-développées, ont un impact sur la continuité et l’évolutivité du traitement.

- La main-d'œuvre qualifiée limitée et les infrastructures inadéquates dans certains pays émergents d'Asie-Pacifique ralentissent les essais cliniques et l'intensification de la fabrication de produits biologiques.

- Les inquiétudes concernant l’immunogénicité et les profils de sécurité à long terme des nouveaux produits biologiques contribuent également à une adoption prudente parmi les prestataires de soins de santé et les patients.

Portée du marché des produits biologiques en Asie-Pacifique

Le marché est segmenté sur la base de la classe, du type, de la voie d’administration, de l’application, du matériel source, de l’utilisateur final et du canal de distribution.

- Par classe

Sur la base de leur classe, le marché des produits biologiques en Asie-Pacifique est segmenté en inhibiteurs du facteur de nécrose tumorale α (TNF), inhibiteurs des lymphocytes B, inhibiteurs de l'interleukine, modulateurs sélectifs de la co-stimulation (Abatacept), entre autres. Le segment des inhibiteurs du facteur de nécrose tumorale α (TNF) a dominé le marché avec la plus grande part de chiffre d'affaires (37,5 %) en 2024, principalement en raison de son rôle bien établi dans le traitement des maladies auto-immunes telles que la polyarthrite rhumatoïde et les maladies inflammatoires chroniques de l'intestin. Ce segment bénéficie d'une forte adoption clinique et d'une grande connaissance des médecins.

En revanche, le segment des inhibiteurs de l'interleukine devrait connaître le TCAC le plus rapide de 22,3 % entre 2025 et 2032, propulsé par l'expansion des indications thérapeutiques dans les affections dermatologiques telles que le psoriasis et d'autres maladies auto-immunes, soutenues par l'innovation continue et les approbations réglementaires.

- Par type

Le marché des produits biologiques en Asie-Pacifique est segmenté selon le type de produit : anticorps monoclonaux (mAbs), protéines thérapeutiques, vaccins, produits biologiques cellulaires, produits biologiques génétiques, etc. Le segment des anticorps monoclonaux a dominé le marché avec une part de 46,1 % en 2024, grâce à leur large application en oncologie et dans les maladies auto-immunes, ainsi qu'aux avancées technologiques continues améliorant la spécificité et la sécurité.

Dans le même temps, le segment des produits biologiques à base cellulaire devrait enregistrer la croissance la plus rapide avec un TCAC de 23,1 %, suivi de près par les produits biologiques à base de gènes avec une croissance de 24,5 %, tous deux stimulés par les avancées en matière de thérapie génique et de médecine personnalisée, ainsi que par l'augmentation des approbations d'essais cliniques dans la région Asie-Pacifique.

- Par voie d'administration

En fonction de la voie d'administration, le marché des produits biologiques en Asie-Pacifique est segmenté en injection et en perfusion. Le segment des injections a dominé avec 62,8 % de parts de chiffre d'affaires en 2024, privilégiant sa commodité et sa compatibilité avec les traitements ambulatoires et l'auto-administration, notamment dans les maladies chroniques.

Le segment des perfusions, bien que plus petit, devrait connaître une croissance régulière au cours de la période de prévision, car il reste essentiel pour l'administration en milieu hospitalier de produits biologiques complexes tels que la chimiothérapie et les immunothérapies nécessitant une administration contrôlée, en particulier dans les indications oncologiques et auto-immunes.

- Par application

En fonction des applications, le marché des produits biologiques en Asie-Pacifique est segmenté en oncologie, maladies auto-immunes, diabète, maladies infectieuses, maladies cardiovasculaires, affections ophtalmologiques et dermatologiques, entre autres. L'oncologie a dominé le marché avec 39,7 % de parts de marché en 2024, grâce à la prévalence croissante du cancer et à la disponibilité de produits biologiques ciblés ciblant divers types de tumeurs.

Le segment des maladies auto-immunes devrait connaître le taux de croissance le plus rapide avec un TCAC de 21,4 % au cours de la période de prévision, en raison de l'augmentation des taux de diagnostic des maladies et de la préférence croissante pour les produits biologiques par rapport aux traitements conventionnels en raison de meilleurs profils d'efficacité et de sécurité.

- Par source matérielle

Sur la base des matières premières, le marché des produits biologiques en Asie-Pacifique est segmenté en produits humains, cultures cellulaires aviaires, levures, bactéries, cultures cellulaires d'insectes, produits transgéniques, etc. Les produits biologiques d'origine humaine ont dominé le marché avec 41,3 % de parts de marché en 2024, privilégiés pour leur innocuité prouvée et leur compatibilité avec la physiologie humaine.

Les systèmes d'expression de levures et de bactéries devraient enregistrer les taux de croissance les plus rapides avec des TCAC de 19,8 % et 18,5 % respectivement au cours de la période de prévision, grâce à leur rentabilité et à leur évolutivité dans la fabrication de biosimilaires et de nouveaux produits biologiques sur les marchés émergents de l'Asie-Pacifique.

- Utilisateur final

En fonction de l'utilisateur final, le marché des produits biologiques en Asie-Pacifique est segmenté en hôpitaux, cliniques spécialisées, instituts universitaires et de recherche, entre autres. Les hôpitaux ont dominé le marché avec 52,1 % de parts de marché en 2024, en raison de leur rôle de centres principaux pour l'administration de thérapies biologiques complexes et la conduite d'essais cliniques.

Les cliniques spécialisées devraient connaître la croissance la plus rapide avec un TCAC de 20,3 % au cours de la période de prévision, grâce à une accessibilité accrue aux produits biologiques en milieu ambulatoire et à la préférence croissante des patients pour des options de traitement pratiques.

- Par canal de distribution

En fonction du canal de distribution, le marché des produits biologiques en Asie-Pacifique est segmenté en appels d'offres directs, ventes au détail et distribution par des tiers. Les appels d'offres directs ont dominé le marché avec une part de 48,6 % en 2024, grâce aux achats en gros des hôpitaux publics et privés, garantissant un approvisionnement régulier en produits biologiques.

Les ventes au détail devraient enregistrer le TCAC le plus rapide, soit 18,7 %, au cours de la période de prévision, grâce à l'expansion des réseaux de pharmacies, à l'augmentation de l'auto-administration par les patients et à une sensibilisation accrue. La distribution par des tiers reste essentielle pour pénétrer les régions éloignées et mal desservies, facilitant ainsi une plus grande pénétration du marché.

Analyse régionale du marché des produits biologiques en Asie-Pacifique

- La Chine a dominé le marché des produits biologiques en Asie-Pacifique avec une part de revenus de 39,2 % en 2024, soutenue par des initiatives gouvernementales solides, une base de patients en expansion et une adoption croissante de produits biologiques et biosimilaires innovants.

- Le pays bénéficie de politiques de soutien favorisant la fabrication de produits biopharmaceutiques, d’approbations réglementaires plus rapides et d’une adoption croissante de produits biologiques et biosimilaires innovants.

- La prévalence croissante des maladies chroniques, l'augmentation des dépenses de santé et l'expansion des activités de recherche clinique en Chine accélèrent encore la croissance du marché, faisant du pays le leader régional du développement et de la consommation de produits biologiques.

Aperçu du marché chinois des produits biologiques

Le marché chinois des produits biologiques a dominé la région Asie-Pacifique avec une part de marché de 42,5 % en 2024, porté par de fortes initiatives gouvernementales favorisant l'innovation biotechnologique, la simplification des procédures d'approbation réglementaire et l'augmentation des dépenses de santé. La croissance de la population chinoise et la demande croissante de biosimilaires rentables contribuent significativement à la croissance du marché. La Chine s'impose également comme un pôle de production de produits biologiques, attirant des entreprises locales et multinationales désireuses de développer leurs capacités de R&D et de production.

Aperçu du marché japonais des produits biologiques

Le marché japonais des produits biologiques connaît une croissance constante grâce à son système de santé avancé, à ses investissements importants en R&D et au vieillissement de sa population, qui entraîne une demande accrue de thérapies biologiques ciblant les maladies chroniques et liées à l'âge. Le pays bénéficie d'un solide soutien réglementaire et d'une adoption précoce de produits biologiques innovants, notamment les thérapies cellulaires et géniques. L'intégration des produits biologiques dans les régimes nationaux d'assurance maladie facilite l'accès des patients, favorisant ainsi une expansion soutenue du marché.

Aperçu du marché des produits biologiques en Corée du Sud

Le marché sud-coréen des produits biologiques s'impose rapidement comme un acteur clé sur le marché des produits biologiques en Asie-Pacifique, grâce à un soutien gouvernemental fort, à des investissements importants en R&D et à un secteur de fabrication biopharmaceutique en pleine croissance. Le pays se concentre fortement sur le développement de produits biologiques et biosimilaires innovants, avec un nombre croissant d'essais cliniques et d'autorisations. L'infrastructure de pointe et la main-d'œuvre qualifiée de la Corée du Sud renforcent sa compétitivité, stimulant la croissance du marché tant sur le marché intérieur qu'à l'exportation.

Aperçu du marché indien des produits biologiques

Le marché indien des produits biologiques occupe une part importante du marché des produits biologiques en Asie-Pacifique, porté par une population nombreuse, une classe moyenne en pleine croissance et des dépenses de santé en hausse. Ce marché bénéficie de l'augmentation de la production de biosimilaires par les entreprises nationales, ce qui améliore l'accès aux thérapies biologiques à des prix plus abordables. Les initiatives gouvernementales en faveur des start-ups biotechnologiques et du développement des infrastructures favorisent l'innovation et la commercialisation de nouveaux produits biologiques, accélérant ainsi la croissance du marché.

Aperçu du marché australien des produits biologiques

Le marché australien des produits biologiques connaît une croissance constante, soutenu par une infrastructure de santé solide et des investissements croissants dans la recherche biopharmaceutique. L'incidence croissante des maladies chroniques et la sensibilisation croissante des patients aux thérapies innovantes encouragent leur adoption. Le cadre réglementaire du pays évolue pour permettre une approbation plus rapide des biosimilaires et des nouveaux produits biologiques, contribuant ainsi à la croissance du marché dans les secteurs de la santé publique et privée.

Part de marché des produits biologiques en Asie-Pacifique

L'industrie des produits biologiques de la région Asie-Pacifique est principalement dirigée par des entreprises bien établies, notamment :

- Biocon Limited (Inde)

- Samsung Biologics (Corée du Sud)

- Celltrion, Inc. (Corée du Sud)

- Takeda Pharmaceutical Company Limited (Japon)

- AstraZeneca (Royaume-Uni)

- Fujifilm Diosynth Biotechnologies (Japon)

- Wuxi Biologics (Chine)

- GenScript Biotech Corporation (Chine)

- Zhejiang Hisun Pharmaceutical Co., Ltd. (Chine)

- Suzhou Hengrui Pharmaceuticals Co., Ltd. (Chine)

- Laboratoires du Dr Reddy (Inde)

- LG Chem Life Sciences (Corée du Sud)

- Lilly (États-Unis)

- Chugai Pharmaceutical Co., Ltd. (Japon)

- Jubilant Life Sciences Limited (Inde)

- Harbin Pharmaceutical Group Co., Ltd. (Chine)

- Mabpharm Inc. (Corée du Sud)

- Hualan Biological Engineering Inc. (Chine)

- Groupe pharmaceutique Shanghai Fosun (Chine)

- Sino Biopharmaceutical Limited (Chine)

Quels sont les développements récents sur le marché des produits biologiques en Asie-Pacifique ?

- En août 2025, l'Inde a approuvé la version sous-cutanée de l'atezolizumab, un médicament anticancéreux commercialisé par Roche sous le nom de Tecentriq. Cette nouvelle méthode permet une administration plus rapide (sept minutes seulement), offrant une alternative plus pratique aux perfusions intraveineuses traditionnelles. L'approbation a été accordée par un comité technique supervisant les essais cliniques de nouvelles molécules. Elle est toutefois conditionnée à la réalisation d'un essai de phase IV en Inde, qui évalue généralement l'efficacité et la sécurité du médicament après sa mise sur le marché.

- En août 2025, Biocon Biologics a annoncé son intention de se concentrer sur les thérapies amaigrissantes à base de GLP-1, un domaine clé de sa croissance future. L'entreprise perçoit un potentiel important dans le marché en pleine croissance des thérapies à base de GLP-1, qui suscitent un intérêt mondial pour leur efficacité dans la gestion du poids. Ce changement stratégique suggère que Biocon s'aligne sur les tendances émergentes en matière de soins de santé et de traitement de l'obésité afin de diversifier et d'enrichir son portefeuille de produits.

- En août 2025, Agilent Technologies a inauguré un nouveau centre d'expérience biopharmaceutique à Hyderabad, en Inde. Ce centre est conçu pour accélérer le développement de médicaments vitaux grâce à des technologies de pointe en chromatographie, spectrométrie de masse, analyse cellulaire et informatique de laboratoire. Il vise à favoriser la collaboration entre l'industrie et le monde universitaire, à simuler des environnements de laboratoire réels et à accélérer la recherche et le développement, tout en respectant les normes réglementaires internationales.

- En juillet 2025, la Corée du Sud a annoncé son intention d'investir 100 milliards de wons sur les 3 à 5 prochaines années pour accélérer le développement de médicaments basés sur l'IA. Cette initiative vise à accélérer la découverte et le développement de nouvelles thérapies biologiques, positionnant ainsi la Corée du Sud comme leader de la recherche biopharmaceutique innovante.

- En juillet 2025, Aragen a annoncé son intention de lancer une production conforme aux Bonnes Pratiques de Fabrication (BPF) dans son usine de produits biologiques de Bangalore. L'usine utilisera une plateforme de production par lots alimentés (feed-batch) renforcée, avec une productivité supérieure à 25 g/L. Cette initiative vise à soutenir une production flexible avec des bioréacteurs 2-KL à usage unique et des capacités intégrées en aval pour des projets de mise à l'échelle rapide ou multi-clients, répondant ainsi à la demande mondiale croissante de produits biologiques.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.