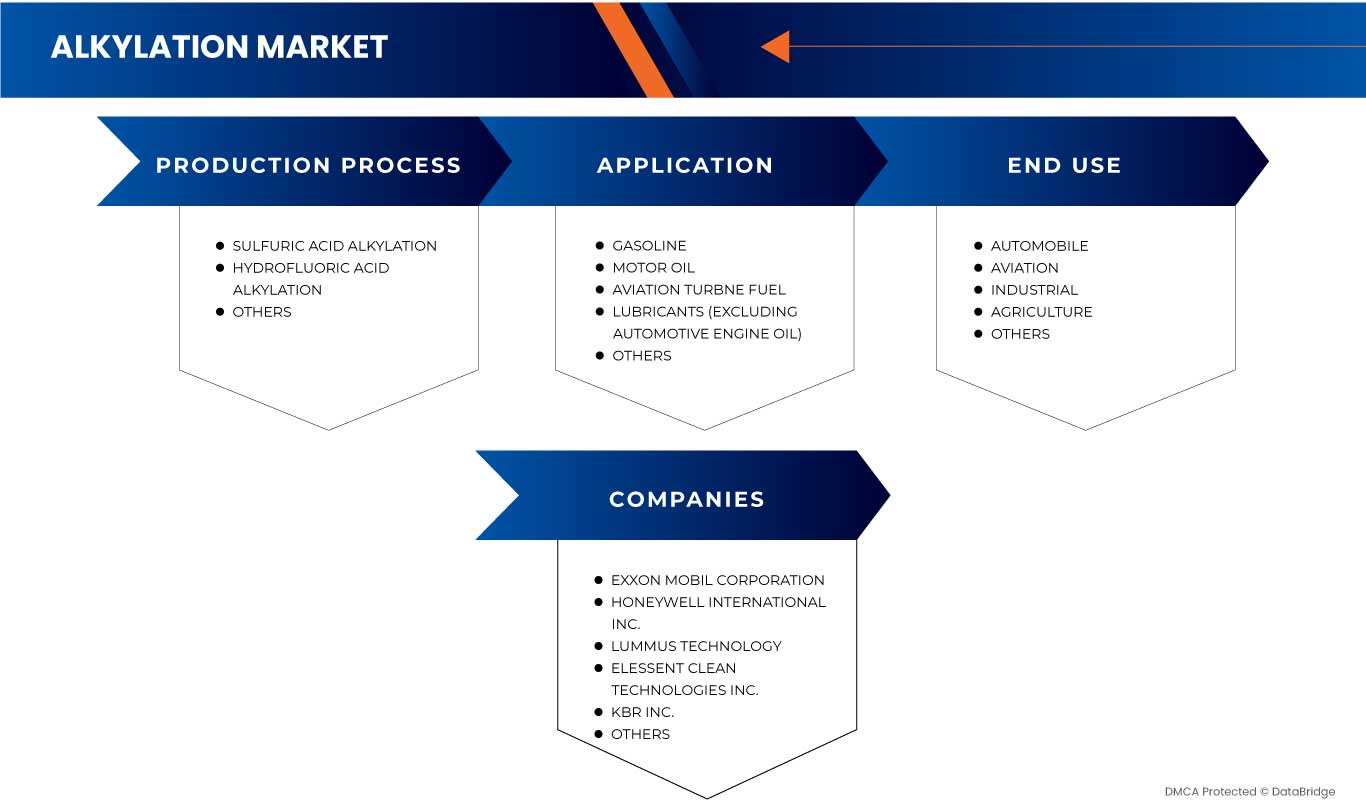

Marché de l'alkylation en Asie-Pacifique, par procédé de production (alkylation à l'acide sulfurique, alkylation à l'acide fluorhydrique et autres), application (huile moteur, carburant pour turbines d'aviation, lubrifiants (à l'exclusion de l'huile moteur automobile), essence et autres), utilisation finale (automobile, aviation, agriculture, industrie et autres) - Tendances et prévisions de l'industrie jusqu'en 2040.

Analyse et taille du marché de l'alkylation en Asie-Pacifique

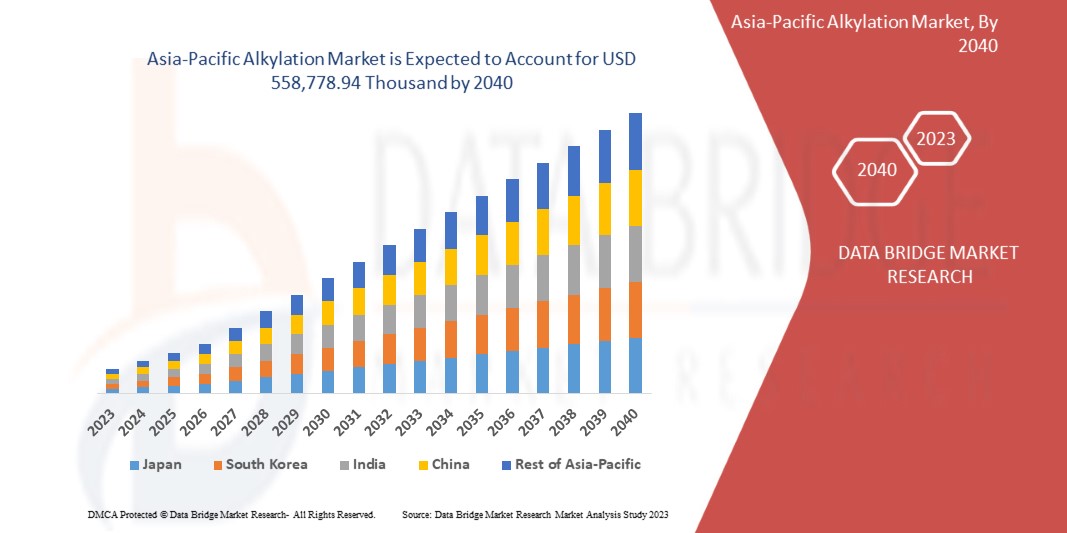

Le marché de l'alkylation en Asie-Pacifique devrait connaître une croissance significative au cours de la période de prévision de 2023 à 2040. Data Bridge Market Research analyse que le marché croît avec un TCAC de 3,8 % au cours de la période de prévision de 2023 à 2040 et devrait atteindre 558 778,94 milliers de dollars d'ici 2040. La demande d'essence hautement efficace est le principal facteur de croissance du marché de l'alkylation.

La réaction des oléfines avec une isoparaffine pour créer une paraffine de poids moléculaire plus élevé est connue sous le nom d'alkylation et est couramment utilisée dans le secteur du raffinage du pétrole. En particulier, la méthode produit une paraffine à chaîne ramifiée dans la plage d'ébullition de l'essence en faisant réagir du propylène et des butylènes avec de l'isobutane. L'alkylate a des indices d'octane élevés et une faible sensibilité, ce qui en fait un mélange d'essence de qualité supérieure.

Le rapport sur le marché de l'alkylation en Asie-Pacifique fournit des détails sur la part de marché, les nouveaux développements et l'impact des acteurs du marché national et local, analyse les opportunités en termes de poches de revenus émergentes, de changements dans la réglementation du marché, d'approbations de produits, de décisions stratégiques, de lancements de produits, d'expansions géographiques et d'innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché, contactez-nous pour un briefing d'analyste. Notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2040 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable de 2015 à 2020) |

|

Unités quantitatives |

Chiffre d'affaires en milliers de dollars américains |

|

Segments couverts |

Procédé de production (alkylation à l'acide sulfurique, alkylation à l'acide fluorhydrique et autres), application (huile moteur, carburant pour turbines d'aviation, lubrifiants (à l'exclusion de l'huile moteur automobile), essence et autres), utilisation finale (automobile, aviation, agriculture, industrie et autres) |

|

Pays couverts |

Japon, Chine, Corée du Sud, Inde, Singapour, Thaïlande, Indonésie, Malaisie, Philippines, Australie et Nouvelle-Zélande, et le reste de l'Asie-Pacifique |

|

Acteurs du marché couverts |

Exxon Mobil Corporation, Honeywell International Inc., Lummus Technology, Elessent Clean Technologies Inc., Sulzer Ltd, KBR Inc. et Well Resources Inc., entre autres |

Définition du marché

L'alkylation produit des hydrocarbures ramifiés plus longs à partir de l'alkylation d'oléfines, telles que le propylène, le butylène et l'isobutène. Les hydrocarbures à indice d'octane élevé produits par alkylation sont appelés alkylats. Le mélange de ces alkylats avec de l'essence a été introduit pour améliorer l'efficacité des performances des machines. Le principal facteur qui a un impact sur l'alkylation est l'utilisation d'un catalyseur approprié. L'acide sulfurique et l'acide fluorhydrique sont les catalyseurs d'alkylation les plus utilisés.

Dynamique du marché de l'alkylation en Asie-Pacifique

Cette section traite de la compréhension des moteurs, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Augmentation de la demande d'essence à haut rendement

Le secteur automobile, indicateur économique important, est à la veille de nouvelles technologies et de nouveaux développements. En outre, le besoin des clients de disposer de caractéristiques distinctives et coûteuses stimule actuellement le secteur automobile. Les consommateurs d'aujourd'hui utilisent des véhicules polyvalents à l'échelle de l'Asie-Pacifique, ce qui stimule les ventes d'automobiles dans le monde entier. La plupart des automobiles sont construites autour d'un moteur à combustion interne qui fonctionne uniquement au diesel ou à l'essence. Par conséquent, la demande d'essence augmente considérablement et les groupes motopropulseurs basés sur des moteurs à combustion continueront de dominer dans un avenir prévisible.

- Croissance des applications des produits dérivés, notamment de l'essence et des lubrifiants

Plusieurs produits de raffinage sont générés à partir du pétrole brut dans le raffinage du pétrole. L'alkylation est un procédé de raffinage secondaire que de nombreuses raffineries du monde entier utilisent pour ajouter des hydrocarbures à indice d'octane élevé à l'essence automobile et aviation. Il s'agit du processus d'ajout de groupes alkyles à une molécule de substrat et il est utile dans plusieurs applications. L'alkylation produit de l'essence à indice d'octane élevé en transformant les isoparaffines et les alcènes de faible poids moléculaire en alkylat. Les hydrocarbures à indice d'octane élevé sont nécessaires pour éviter l'auto-inflammation de l'essence (cliquetis) dans un moteur et pour respecter les normes d'octane du moteur.

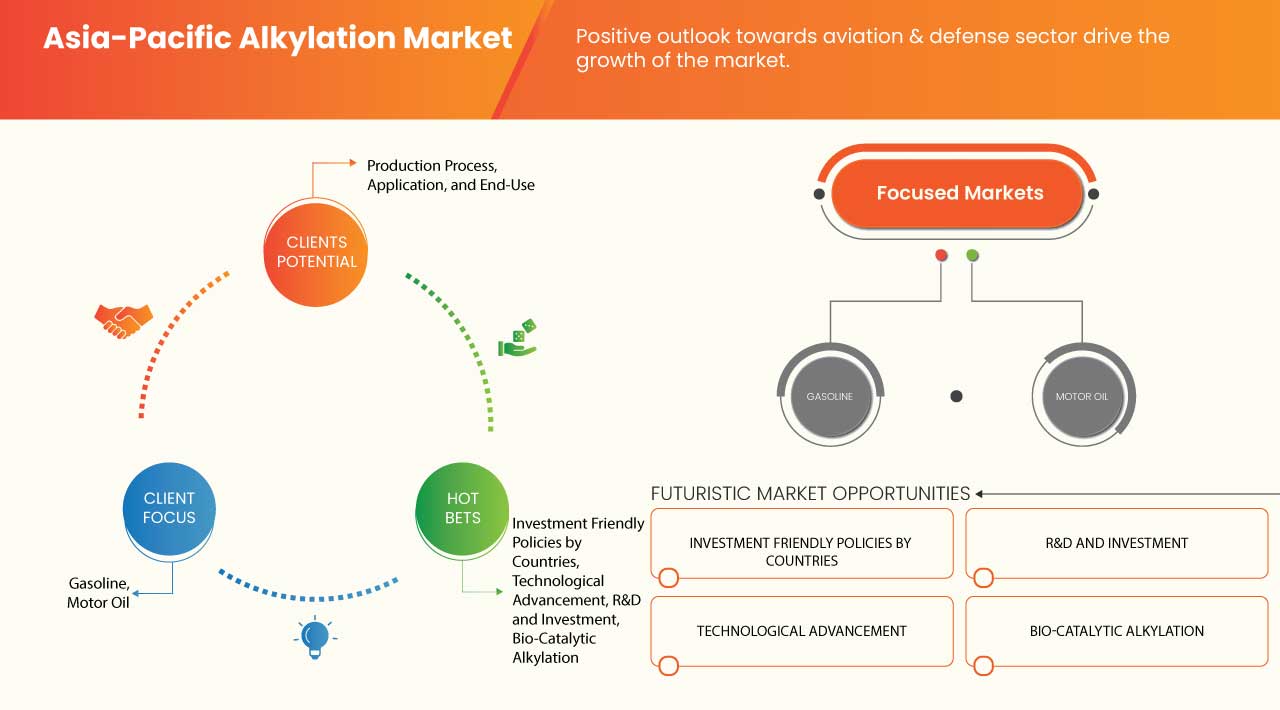

Opportunités

- Mise en œuvre de politiques favorables à l’investissement dans les pays, notamment la Chine et l’Inde

L'alkylation est devenue un procédé de raffinage essentiel en raison du besoin croissant de composants de mélange d'essence à indice d'octane élevé et à faible pression de vapeur. Elle sera beaucoup plus importante pour satisfaire aux lois et exigences strictes du gouvernement. Les pressions commerciales et réglementaires exercent une pression sur les raffineurs pour qu'ils utilisent des techniques sûres et durables afin de fournir des carburants propres et respectueux de l'environnement. Ainsi, les raffineries établies sur le marché de l'alkylation peuvent profiter de cette opportunité pour investir davantage dans de nouvelles capacités de production. En revanche, les nouveaux entrants peuvent investir davantage dans l'intégration d'unités d'alkylation pour contribuer à la croissance de l'industrie.

- Progrès technologique pour améliorer les procédés d'alkylation

La demande à long terme en essence de haute qualité dans la région Asie-Pacifique est stimulée par des facteurs macroéconomiques tels qu’une clientèle en constante augmentation et l’avènement des moteurs à compression élevée nécessitant une faible pression de vapeur. Dans le même temps, des critères plus stricts en matière de carburant et d’émissions, tels que les exigences en matière de teneur en soufre faible ou ultra-faible, augmentent la dépendance aux mélanges augmentant l’indice d’octane, comme l’alkylat. Les raffineries utilisent plusieurs technologies pour créer l’alkylat, et toutes les raffineries doivent utiliser une technique d’alkylation innovante, sûre et durable.

Contraintes/Défis

- Problèmes de sécurité liés à l’utilisation de la technologie d’alkylation

La technologie d'alkylation à base d'acide convertit les matières premières d'oléfines mélangées en alkylats à indice d'octane élevé pour le mélange d'essence en utilisant du fluorure d'hydrogène ou de l'acide sulfurique comme catalyseur. Cependant, la nature hautement corrosive des catalyseurs acides forts rend les réactions d'alkylation au fluorure d'hydrogène et à l'acide sulfurique dangereuses. Les raffineurs qui utilisent la technologie d'alkylation à base d'acide utilisent divers métaux pour l'équipement de la technologie d'alkylation et nécessitent également des systèmes de sécurité coûteux pour protéger les employés de la raffinerie, l'infrastructure et l'environnement extérieur. Les exploitants et les propriétaires sont très préoccupés par la sécurité du processus d'alkylation et surveillent régulièrement la sécurité de leurs unités. Cependant, comme tout processus industriel comporte des risques, le processus d'alkylation sera probablement confronté à des problèmes de sécurité potentiels.

- Problèmes environnementaux associés à la technologie d’alkylation

L'alkylate est produit par la technologie d'alkylation à partir d'oléfines légères et d'isobutène en présence de catalyseurs chimiques. Il est essentiel à la production d'essence, de sorte que divers problèmes environnementaux sont associés à la technologie d'alkylation. La fabrication d'alkylate nécessite l'utilisation de procédés catalysés par des acides liquides, par exemple des catalyseurs chimiques à base d'acide fluorhydrique ou d'acide sulfurique. Les catalyseurs sont dangereux, corrosifs et toxiques par nature. La température augmente et le volume de vapeur d'air augmente lorsque l'acide fluorhydrique entre en contact avec l'eau. L'acide fluorhydrique déversé s'évapore rapidement, mais une partie reste dans l'environnement du sol et peut avoir de graves répercussions sur la qualité du sol et les eaux souterraines.

Développement récent

- En juin 2021, Sinopec a lancé avec succès deux autres unités spécialisées d'alkylation STRATCO d'Elessent Clean Technologies Inc. La société étend sa capacité d'alkylation en ajoutant une cinquième et une sixième unité d'alkylation STRATCO à son réseau de raffinage.

- En mars 2023, ExxonMobil a annoncé le démarrage réussi de son projet d'extension de la raffinerie de Beaumont, qui augmentera la capacité de l'un des plus grands complexes pétrochimiques et de raffinage de la côte américaine du golfe du Mexique de 250 000 barils par jour. La plus grande expansion de raffinerie depuis plus de dix ans est soutenue par la production croissante de brut de l'entreprise dans le bassin permien, qui contribuera à répondre au besoin croissant d'énergie abordable et fiable. La raffinerie de Beaumont, où l'entreprise produit des produits finis, notamment du diesel, de l'essence et du kérosène, grâce au pétrole brut du Permien

Portée du marché de l'alkylation en Asie-Pacifique

Le marché de l'alkylation en Asie-Pacifique est classé en fonction du processus de production, de l'application et de l'utilisation finale. La croissance de ces segments vous aidera à analyser les principaux segments de croissance des industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Processus de production

- Alkylation de l'acide sulfurique

- Alkylation de l'acide fluorhydrique

- Autres

Sur la base du processus de production, le marché de l'alkylation Asie-Pacifique est classé en alkylation à l'acide sulfurique, alkylation à l'acide fluorhydrique, autres.

Application

- Huile moteur

- Carburant pour turbines d'aviation

- Lubrifiants (à l'exclusion des huiles pour moteurs automobiles)

- Essence

- Autres

Sur la base de l'application, le marché de l'alkylation de l'Asie-Pacifique est classé en huile moteur, carburant pour turbines d'aviation, lubrifiants (à l'exclusion de l'huile moteur automobile), essence et autres .

Utilisation finale

- Automobile

- Aviation

- Agriculture

- Industriel

- Autres

Sur la base de l’utilisation finale, le marché de l’alkylation Asie-Pacifique est classé en automobile, aviation, agriculture, industrie et autres.

Analyse/perspectives régionales du marché de l'alkylation en Asie-Pacifique

Le marché de l’alkylation en Asie-Pacifique est segmenté en fonction du processus de production, de l’application et de l’utilisation finale.

Les pays du marché de l'alkylation en Asie-Pacifique sont le Japon, la Chine, la Corée du Sud, l'Inde, Singapour, la Thaïlande, l'Indonésie, la Malaisie, les Philippines, l'Australie et la Nouvelle-Zélande, ainsi que le reste de l'Asie-Pacifique. La Chine domine le marché de l'alkylation en Asie-Pacifique en termes de part de marché et de chiffre d'affaires en raison de la sensibilisation croissante aux propriétés des technologies d'alkylation dans cette région.

La section par pays du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. L'analyse des points de données en aval et en amont de la chaîne de valeur, les tendances techniques, l'analyse des cinq forces du porteur et les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques d'Asie-Pacifique et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données par pays.

Analyse du paysage concurrentiel et des parts de marché de l'alkylation en Asie-Pacifique

Le paysage concurrentiel du marché de l'alkylation en Asie-Pacifique fournit des détails par concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et l'étendue du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liées au marché de l'alkylation en Asie-Pacifique.

Certains des principaux acteurs opérant sur le marché de l'alkylation en Asie-Pacifique sont Exxon Mobil Corporation, Honeywell International Inc., Lummus Technology, Elessent Clean Technologies Inc., Sulzer Ltd, KBR Inc. et Well Resources Inc. entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 APPLICATION LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER’S FIVE FORCES:

4.2.1 THREAT OF NEW ENTRANTS:

4.2.2 THE THREAT OF SUBSTITUTES:

4.2.3 CUSTOMER BARGAINING POWER:

4.2.4 SUPPLIER BARGAINING POWER:

4.2.5 INTERNAL COMPETITION (RIVALRY):

4.3 LIST OF FEW ALKYLATION SERVICE PROVIDERS

4.4 CLIMATE CHANGE SCENARIO

4.4.1 ENVIRONMENTAL CONCERNS

4.4.2 INDUSTRY RESPONSE

4.4.3 GOVERNMENT’S ROLE

4.4.4 ANALYST RECOMMENDATION

4.5 SUPPLY CHAIN ANALYSIS

4.5.1 OVERVIEW

4.5.2 LOGISTIC COST SCENARIO

4.5.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.6 VENDOR SELECTION CRITERIA

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISE IN DEMAND FOR HIGHLY EFFICIENT GASOLINE

6.1.2 APPLICATION GROWTH OF DERIVATIVES, NAMELY GASOLINE, AND LUBRICANTS

6.1.3 POSITIVE OUTLOOK TOWARDS AVIATION AND DEFENSE SECTOR

6.1.4 GROWING IMPORTANCE OF IMPROVING REFINING MARGINS

6.2 RESTRAINTS

6.2.1 SAFETY CONCERNS RELATED TO THE USE OF ALKYLATION TECHNOLOGY

6.2.2 CREDIBLE THREAT FROM ALTERNATIVE FUEL SOURCES

6.3 OPPORTUNITIES

6.3.1 IMPLEMENTATION OF INVESTMENT-FRIENDLY POLICIES IN COUNTRIES, NAMELY CHINA AND INDIA

6.3.2 TECHNOLOGICAL ADVANCEMENT TO IMPROVISE ALKYLATION PROCESSES

6.4 CHALLENGES

6.4.1 ENVIRONMENTAL ISSUES ASSOCIATED WITH ALKYLATION TECHNOLOGY

6.4.2 STRINGENT RULES AND REGULATIONS

6.4.3 VOLATILITY IN RAW MATERIAL PRICES

7 ASIA PACIFIC ALKYLATION MARKET, BY PRODUCTION PROCESS

7.1 OVERVIEW

7.2 SULFURIC ACID ALKYLATION

7.3 HYDROFLUORIC ACID ALKYLATION

7.4 OTHERS

8 ASIA PACIFIC ALKYLATION MARKET, BY END-USE

8.1 OVERVIEW

8.2 AUTOMOBILE

8.3 AVIATION

8.4 AGRICULTURE

8.5 INDUSTRIAL

8.6 OTHERS

9 ASIA PACIFIC ALKYLATION MARKET BY APPLICATION

9.1 OVERVIEW

9.2 MOTOR OIL

9.3 AVIATION TURBINE FUEL

9.4 GASOLINE

9.5 OTHERS

10 ASIA PACIFIC ALKYLATION MARKET, BY REGION

10.1 ASIA-PACIFIC

10.1.1 CHINA

10.1.2 INDIA

10.1.3 SOUTH KOREA

10.1.4 JAPAN

10.1.5 THAILAND

10.1.6 AUSTRALIA & NEW ZEALAND

10.1.7 INDONESIA

10.1.8 SINGAPORE

10.1.9 PHILIPPINES

10.1.10 MALAYSIA

10.1.11 REST OF ASIA-PACIFIC

11 ASIA PACIFIC ALKYLATION MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

11.2 EXPANSION

11.3 NEW PROJECT

11.4 COLLABORATION

11.5 NEW UNIT

12 COMPANY PROFILES

12.1 EXXON MOBIL CORPORATION

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 COMPANY SHARE ANALYSIS

12.1.4 SWOT ANALYSIS

12.1.5 PRODUCT PORTFOLIO

12.1.6 RECENT DEVELOPMENT

12.2 HONEYWELL INTERNATIONAL INC.

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 COMPANY SHARE ANALYSIS

12.2.4 SWOT ANALYSIS

12.2.5 PRODUCT PORTFOLIO

12.2.6 RECENT DEVELOPMENTS

12.3 LUMMUS TECHNOLOGY

12.3.1 COMPANY SNAPSHOT

12.3.2 COMPANY SHARE ANALYSIS

12.3.3 SWOT ANALYSIS

12.3.4 PRODUCT PORTFOLIO

12.3.5 RECENT DEVELOPMENTS

12.4 KBR INC.

12.4.1 COMPANY SNAPSHOT

12.4.2 REVENUE ANALYSIS

12.4.3 COMPANY SHARE ANALYSIS

12.4.4 PRODUCT PORTFOLIO

12.4.5 SWOT ANALYSIS

12.4.6 RECENT DEVELOPMENT

12.5 ELESSENT CLEAN TECHNOLOGIES INC.

12.5.1 COMPANY SNAPSHOT

12.5.2 COMPANY SHARE ANALYSIS

12.5.3 PRODUCT PORTFOLIO

12.5.4 SWOT ANALYSIS

12.5.5 RECENT DEVELOPMENTS

12.6 SULZER LTD

12.6.1 COMPANY SNAPSHOT

12.6.2 REVENUE ANALYSIS

12.6.3 PRODUCT PORTFOLIO

12.6.4 SWOT ANALYSIS

12.6.5 RECENT DEVELOPMENT

12.7 WELL RESOURCES INC.

12.7.1 COMPANY SNAPSHOT

12.7.2 SWOT ANALYSIS

12.7.3 PRODUCT PORTFOLIO

12.7.4 RECENT DEVELOPMENTS

13 QUESTIONNAIRE

14 RELATED REPORTS

Liste des tableaux

TABLE 1 REGULATORY COVERAGE

TABLE 2 ASIA-PACIFIC ALKYLATION MARKET, BY COUNTRY, 2021-2040 (USD THOUSAND)

TABLE 3 ASIA-PACIFIC ALKYLATION MARKET, BY PRODUCTION PROCESS, 2021-2040 (USD THOUSAND)

TABLE 4 ASIA-PACIFIC ALKYLATION MARKET, BY APPLICATION, 2021-2040 (USD THOUSAND)

TABLE 5 ASIA-PACIFIC ALKYLATION MARKET, BY END USE, 2021-2040 (USD THOUSAND)

TABLE 6 ASIA-PACIFIC AUTOMOBILE IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 7 ASIA-PACIFIC AVIATION IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 8 ASIA-PACIFIC AGRICULTURE IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 9 CHINA ALKYLATION MARKET, BY PRODUCTION PROCESS, 2021-2040 (USD THOUSAND)

TABLE 10 CHINA ALKYLATION MARKET, BY APPLICATION, 2021-2040 (USD THOUSAND)

TABLE 11 CHINA ALKYLATION MARKET, BY END USE, 2021-2040 (USD THOUSAND)

TABLE 12 CHINA AUTOMOBILE IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 13 CHINA AVIATION IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 14 CHINA AGRICULTURE IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 15 INDIA ALKYLATION MARKET, BY PRODUCTION PROCESS, 2021-2040 (USD THOUSAND)

TABLE 16 INDIA ALKYLATION MARKET, BY APPLICATION, 2021-2040 (USD THOUSAND)

TABLE 17 INDIA ALKYLATION MARKET, BY END USE, 2021-2040 (USD THOUSAND)

TABLE 18 INDIA AUTOMOBILE IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 19 INDIA AVIATION IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 20 INDIA AGRICULTURE IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 21 SOUTH KOREA ALKYLATION MARKET, BY PRODUCTION PROCESS, 2021-2040 (USD THOUSAND)

TABLE 22 SOUTH KOREA ALKYLATION MARKET, BY APPLICATION, 2021-2040 (USD THOUSAND)

TABLE 23 SOUTH KOREA ALKYLATION MARKET, BY END USE, 2021-2040 (USD THOUSAND)

TABLE 24 SOUTH KOREA AUTOMOBILE IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 25 SOUTH KOREA AVIATION IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 26 SOUTH KOREA AGRICULTURE IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 27 JAPAN ALKYLATION MARKET, BY PRODUCTION PROCESS, 2021-2040 (USD THOUSAND)

TABLE 28 JAPAN ALKYLATION MARKET, BY APPLICATION, 2021-2040 (USD THOUSAND)

TABLE 29 JAPAN ALKYLATION MARKET, BY END USE, 2021-2040 (USD THOUSAND)

TABLE 30 JAPAN AUTOMOBILE IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 31 JAPAN AVIATION IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 32 JAPAN AGRICULTURE IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 33 THAILAND ALKYLATION MARKET, BY PRODUCTION PROCESS, 2021-2040 (USD THOUSAND)

TABLE 34 THAILAND ALKYLATION MARKET, BY APPLICATION, 2021-2040 (USD THOUSAND)

TABLE 35 THAILAND ALKYLATION MARKET, BY END USE, 2021-2040 (USD THOUSAND)

TABLE 36 THAILAND AUTOMOBILE IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 37 THAILAND AVIATION IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 38 THAILAND AGRICULTURE IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 39 AUSTRALIA AND NEW ZEALAND ALKYLATION MARKET, BY PRODUCTION PROCESS, 2021-2040 (USD THOUSAND)

TABLE 40 AUSTRALIA AND NEW ZEALAND ALKYLATION MARKET, BY APPLICATION, 2021-2040 (USD THOUSAND)

TABLE 41 AUSTRALIA AND NEW ZEALAND ALKYLATION MARKET, BY END USE, 2021-2040 (USD THOUSAND)

TABLE 42 AUSTRALIA AND NEW ZEALAND AUTOMOBILE IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 43 AUSTRALIA AND NEW ZEALAND AVIATION IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 44 AUSTRALIA AND NEW ZEALAND AGRICULTURE IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 45 INDONESIA ALKYLATION MARKET, BY PRODUCTION PROCESS, 2021-2040 (USD THOUSAND)

TABLE 46 INDONESIA ALKYLATION MARKET, BY APPLICATION, 2021-2040 (USD THOUSAND)

TABLE 47 INDONESIA ALKYLATION MARKET, BY END USE, 2021-2040 (USD THOUSAND)

TABLE 48 INDONESIA AUTOMOBILE IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 49 INDONESIA AVIATION IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 50 INDONESIA AGRICULTURE IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 51 SINGAPORE ALKYLATION MARKET, BY PRODUCTION PROCESS, 2021-2040 (USD THOUSAND)

TABLE 52 SINGAPORE ALKYLATION MARKET, BY APPLICATION, 2021-2040 (USD THOUSAND)

TABLE 53 SINGAPORE ALKYLATION MARKET, BY END USE, 2021-2040 (USD THOUSAND)

TABLE 54 SINGAPORE AUTOMOBILE IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 55 SINGAPORE AVIATION IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 56 SINGAPORE AGRICULTURE IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 57 PHILIPPINES ALKYLATION MARKET, BY PRODUCTION PROCESS, 2021-2040 (USD THOUSAND)

TABLE 58 PHILIPPINES ALKYLATION MARKET, BY APPLICATION, 2021-2040 (USD THOUSAND)

TABLE 59 PHILIPPINES ALKYLATION MARKET, BY END USE, 2021-2040 (USD THOUSAND)

TABLE 60 PHILIPPINES AUTOMOBILE IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 61 PHILIPPINES AVIATION IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 62 PHILIPPINES AGRICULTURE IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 63 MALAYSIA ALKYLATION MARKET, BY PRODUCTION PROCESS, 2021-2040 (USD THOUSAND)

TABLE 64 MALAYSIA ALKYLATION MARKET, BY APPLICATION, 2021-2040 (USD THOUSAND)

TABLE 65 MALAYSIA ALKYLATION MARKET, BY END USE, 2021-2040 (USD THOUSAND)

TABLE 66 MALAYSIA AUTOMOBILE IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 67 MALAYSIA AVIATION IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 68 MALAYSIA AGRICULTURE IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 69 REST OF ASIA-PACIFIC ALKYLATION MARKET, BY PRODUCTION PROCESS, 2021-2040 (USD THOUSAND)

Liste des figures

FIGURE 1 ASIA PACIFIC ALKYLATION MARKET

FIGURE 2 ASIA PACIFIC ALKYLATION MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC ALKYLATION MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC ALKYLATION MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC ALKYLATION MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC ALKYLATION MARKET: THE APPLICATION LIFE LINE CURVE

FIGURE 7 ASIA PACIFIC ALKYLATION MARKET: MULTIVARIATE MODELLING

FIGURE 8 ASIA PACIFIC ALKYLATION MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 ASIA PACIFIC ALKYLATION MARKET: DBMR MARKET POSITION GRID

FIGURE 10 ASIA PACIFIC ALKYLATION MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 ASIA PACIFIC ALKYLATION MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 ASIA PACIFIC ALKYLATION MARKET: SEGMENTATION

FIGURE 13 RISE IN DEMAND FOR HIGHLY EFFICIENT GASOLINE IS EXPECTED TO DRIVE THE ASIA PACIFIC ALKYLATION MARKET IN THE FORECAST PERIOD

FIGURE 14 THE SULFURIC ACID ALKYLATION SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC ALKYLATION MARKET IN 2023 AND 2040

FIGURE 15 VENDOR SELECTION CRITERIA

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA PACIFIC ALKYLATION MARKET

FIGURE 17 NUMBER OF CAR SALES IN U.S. 2018 TO 2022 (IN MILLION)

FIGURE 18 CONSUMPTION OF REFINERY PRODUCTS FROM 2018 TO 2021 IN INDIA (IN ‘000 METRIC TONS)

FIGURE 19 U.S. JET FUEL CONSUMPTION 2017 TO 2021 (IN THOUSAND BARRELS PER DAY)

FIGURE 20 ASIA PACIFIC ALKYLATION MARKET: BY PRODUCTION PROCESS, 2022

FIGURE 21 ASIA PACIFIC ALKYLATION MARKET: BY END-USE, 2022

FIGURE 22 ASIA PACIFIC ALKYLATION MARKET: BY APPLICATION, 2022

FIGURE 23 ASIA-PACIFIC ALKYLATION MARKET: SNAPSHOT (2022)

FIGURE 24 ASIA-PACIFIC ALKYLATION MARKET: BY COUNTRY (2022)

FIGURE 25 ASIA-PACIFIC ALKYLATION MARKET: BY COUNTRY (2023 & 2040)

FIGURE 26 ASIA-PACIFIC ALKYLATION MARKET: BY COUNTRY (2022 & 2040)

FIGURE 27 ASIA-PACIFIC ALKYLATION MARKET: BY PRODUCTION PROCESS (2023 - 2040)

FIGURE 28 ASIA PACIFIC ALKYLATION MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.