Marché du kaolin en Asie et en Europe, par qualité (calciné, hydraté, délaminé, traité en surface et structuré), procédé (lavé à l'eau, flotté à l'air, calciné, délaminé, modifié en surface et non traité), application (papier, céramique , peinture et revêtements, fibre de verre, plastique, caoutchouc, produits pharmaceutiques et médicaux, cosmétiques et autres) - Tendances et prévisions de l'industrie jusqu'en 2030

Analyse et taille du marché du kaolin en Asie et en Europe

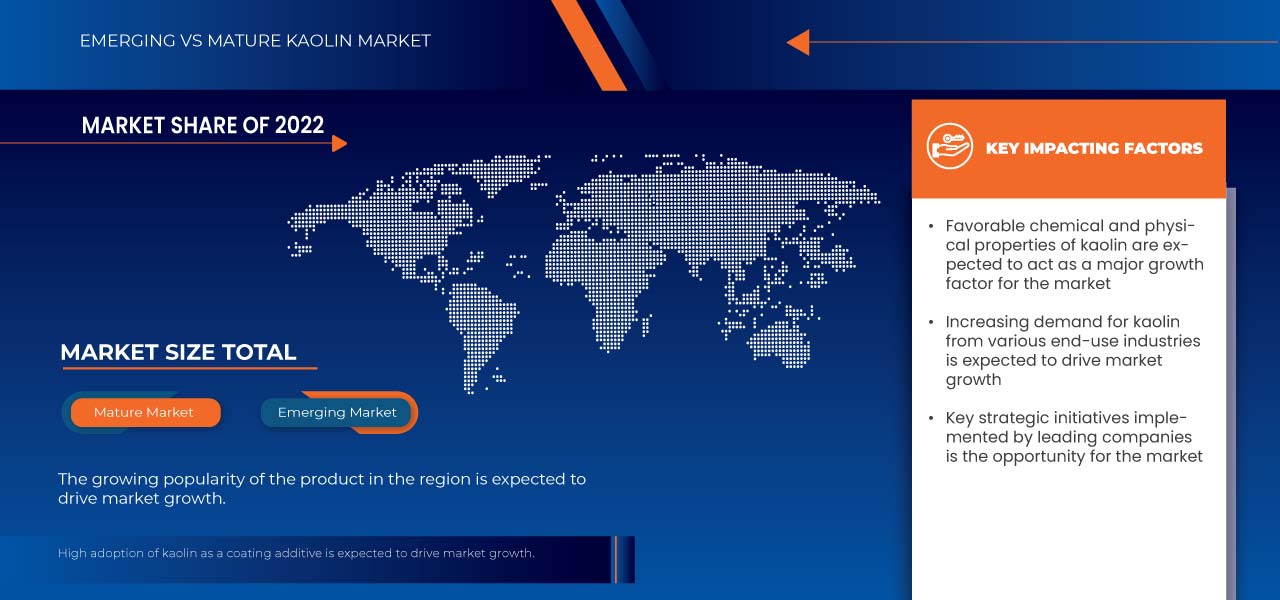

Le marché du kaolin en Asie et en Europe devrait connaître une croissance significative au cours de la période de prévision de 2023 à 2030. Data Bridge Market Research analyse que le marché croît avec un TCAC de 4,7% au cours de la période de prévision de 2023 à 2030 et devrait atteindre 5 072 562,29 milliers USD d'ici 2030. L'utilisation croissante du kaolin dans diverses industries a été le principal moteur du marché du kaolin en Asie et en Europe.

Le rapport sur le marché du kaolin en Asie et en Europe fournit des détails sur la part de marché, les nouveaux développements et l'impact des acteurs du marché national et local, analyse les opportunités en termes de poches de revenus émergentes, de changements dans la réglementation du marché, d'approbations de produits, de décisions stratégiques, de lancements de produits, d'expansions géographiques et d'innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché, contactez-nous pour un briefing d'analyste. Notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable de 2015 à 2020) |

|

Unités quantitatives |

Chiffre d'affaires en milliers de dollars américains |

|

Segments couverts |

Qualité (calciné, hydraté, délaminé, traité en surface et structuré), procédé (lavé à l'eau, flotté à l'air, calciné, délaminé, modifié en surface et non traité), application (papier, céramique, peinture et revêtements, fibre de verre, plastique, caoutchouc, produits pharmaceutiques et médicaux, cosmétiques et autres) |

|

Pays couverts |

Chine, Inde, Japon, Corée du Sud, Thaïlande, Singapour, Indonésie, Philippines, Malaisie, Reste de l'Asie, Allemagne, Royaume-Uni, France, Italie, Espagne, Russie, Suisse, Turquie, Belgique, Pays-Bas et Reste de l'Europe |

|

Acteurs du marché couverts |

Ashapura Group, EICL, LB MINERALS, Ltd, Quartz Works GmbH, Shree Ram Minerals, Jiangxi Sincere Mineral Industry Co., ltd., KaMin LLC. / CADAM, Thiele Kaolin Company, Imerys et SCR-Sibelco NV entre autres. |

Définition du marché

Le kaolin, également appelé kaolin, est une argile blanche molle utilisée comme ingrédient nécessaire à la fabrication du papier, du caoutchouc, des cosmétiques et autres. Le kaolin est utilisé comme agent de remplissage dans l'industrie du papier avec un adhésif qui améliore l'apparence du papier en lui donnant différents niveaux de brillance, de douceur, de luminosité, d'opacité et d'imprimabilité. De plus, le produit contribue à améliorer l'imprimabilité du papier en offrant une absorption d'encre accrue, une meilleure rétention des pigments d'encre et une rugosité accrue. Il est très utilisé dans l'industrie céramique pour la fabrication de porcelaine et de réfractaires. Le kaolin est utilisé pour améliorer la résistance mécanique et la résistance à l'abrasion dans l'industrie du caoutchouc.

Dynamique du marché du kaolin en Asie et en Europe

Cette section traite de la compréhension des moteurs, des opportunités, des défis et des contraintes du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Perspectives optimistes pour le kaolin dans le secteur de la construction

La construction est l'une des industries les plus importantes et les plus anciennes au monde. Aujourd'hui, le secteur de la construction fait partie des industries leaders dans toutes les économies de marché. Le secteur de la construction utilise une variété de matériaux tels que le ciment, le béton, les agrégats, l'argile, le bois, les métaux et les briques. La majorité des pays ont désigné les activités de construction comme des industries essentielles, ouvrant ainsi la demande de matériaux pour des produits tels que les peintures et revêtements, le plastique et la céramique , entre autres.

Le marché du kaolin a montré des signes d'amélioration, en grande partie grâce à la reprise complète des activités industrielles et de construction dans diverses régions. En outre, l'adoption de la loi sur les investissements dans les infrastructures et l'emploi devrait ouvrir de nouvelles perspectives au sein du secteur de la construction du pays, ce qui à son tour stimulera la demande de kaolin et stimulera le marché du kaolin en Asie et en Europe.

- Propriétés chimiques et physiques favorables du kaolin

Le kaolin est un minéral naturel, chimiquement inerte et insoluble dans l'eau, contenant principalement de la kaolinite ainsi que du feldspath, du quartz et de la muscovite en quantités variables. Les propriétés chimiques de l'argile, ajoutées à ses propriétés antimicrobiennes, en font un composant essentiel dans diverses industries d'utilisation finale, notamment l'agriculture et l'industrie pharmaceutique, entre autres.

Le kaolin est un métal de choix dans diverses applications et industries d'utilisation finale en raison de ses propriétés chimiques et physiques souhaitées et favorables. La demande d'argile de kaolin dans l'industrie des plastiques augmente car son utilisation améliore ses performances électriques, sa durabilité et sa résistance. De plus, l'adoption croissante de la céramique est due à l'opacité, à l'inertie chimique, à la texture non abrasive et à la forme plate de l'argile de kaolin. De plus, l'utilisation du kaolin dans les bétons et les mortiers augmente en raison de sa stabilité thermique. Certaines qualités de kaolin ont des tailles de particules fines, une adsorption élevée et des propriétés de suspension.

De plus, le kaolin est un minéral industriel unique en son genre car il est chimiquement inerte sur une plage de pH relativement large, possède un bon pouvoir couvrant ou masquant lorsqu'il est utilisé comme pigment ou agent de charge dans les revêtements et les enduits, est doux et non abrasif et possède une faible conductivité thermique et électrique. Le kaolin a également une faible capacité de rétrécissement-gonflement et une faible capacité d'échange de cations.

Comparé à d'autres minéraux argileux, le kaolin est chimiquement et structurellement simple. De plus, les kaolins présentaient une variété de morphologies cristallines allant des plaques submicroniques, euédriques et hexagonales aux plaques et tubes anédriques. En dehors de cela, l'une des principales utilisations de l'argile kaolin est de faciliter l'adsorption d'autres substances. L'argile kaolin est naturellement hautement adsorbante, elle peut donc aider à extraire et à éliminer les impuretés indésirables, les agents pathogènes ou d'autres substances dans n'importe quel mélange ou application. Toutes ces propriétés du kaolin en font un matériau de choix dans diverses applications, ce qui à son tour stimulera sa demande sous peu et favorisera la croissance du marché.

Opportunité

- Technologies améliorées dans les pratiques d'exploitation du kaolin

Le kaolin est utilisé dans de nombreux produits de consommation et comme additif fonctionnel et activateur de processus dans la fabrication. Il s'agit d'un minéral industriel très polyvalent, extrait et traité pour divers marchés d'utilisation finale. Sa polyvalence découle de sa gamme naturelle de formes cristallines, de tailles et de structures de couches.

Dans le secteur minier, de nombreuses avancées ont été motivées par des principes de développement durable et de responsabilité sociale des entreprises. Ces principes intègrent des considérations sociales, environnementales et économiques à chaque phase du cycle de vie de l’exploitation minière.

Ces mesures comprennent l’amélioration de l’efficacité des mines et de la récupération des processus. L’utilisation efficace de l’énergie et de l’eau est également un aspect essentiel des opérations minières durables.

En général, le kaolin est extrait de mines à ciel ouvert. Le processus d'extraction commence par la conception d'une mine qui prend en compte les aspects géotechniques du site. L'ingénieur minier conçoit les pentes des parois hautes pour réduire le risque de rupture des parois et garantir des conditions de travail sûres. L'étape suivante consiste à enlever les morts-terrains à l'aide de grattoirs, d'excavatrices ou de chargeuses et l'extraction du kaolin commence.

De plus, l'introduction et l'adoption de la technologie de l'Internet des objets (IoT) donnent aux mineurs un meilleur aperçu de l'état de fonctionnement de leur équipement. Les capteurs sur les machines d'extraction de kaolin pilotent la maintenance prédictive qui, à son tour, réduit la probabilité de temps d'arrêt imprévus et non programmés qui épuisent souvent les ressources des sociétés minières, ce qui est la tendance majeure qui devrait offrir des opportunités possibles de croissance du marché.

Retenue

- L'exploitation du kaolin entraîne de nombreux risques pour l'environnement et la santé

Le processus d'extraction du kaolin comporte divers risques pour l'environnement et la santé. Les personnes peuvent être exposées au kaolin sur leur lieu de travail en respirant la poudre ou par contact avec la peau ou les yeux. Du point de vue environnemental, le problème environnemental le plus important est dû au fait que les opérations d'extraction du kaolin créent des surfaces très sensibles au ruissellement et à l'érosion hydrique, avec un potentiel élevé d'effets écologiques sur site et hors site.

Cependant, l'extraction du kaolin a des effets négatifs à très long terme sur l'environnement tels que les déséquilibres écologiques et agricoles, l'érosion, l'envasement des rivières et des lacs et la déforestation. L'enlèvement de la végétation pour le processus d'excavation et d'enlèvement de l'argile, une partie du sol local n'est pas protégée, ce qui provoque des processus de compaction dans certaines situations et des lessivages. Une fois que le sol lessivé devient impropre à l'agriculture, les terres utilisées pour l'extraction de l'argile finissent par être abandonnées par les propriétaires. Par conséquent, l'extraction du kaolin entraîne une dégradation de l'environnement et de la santé humaine, ce qui devrait à son tour freiner la croissance du marché.

Défi

- Disponibilité facile de substituts

La disponibilité facile de substituts rentables du kaolin, tels que les carbonates de calcium broyés (GCC) et les carbonates de calcium précipités (PCC), est l’un des principaux facteurs qui devraient remettre en cause la croissance des revenus du marché.

Les PCC ont une couleur blanche brillante avec une distribution granulométrique étroite. Ils sont disponibles dans différentes tailles et morphologies cristallines qui peuvent être adaptées pour améliorer les propriétés d'impression et optiques du papier, augmenter la productivité des machines à papier et réduire les coûts de fabrication du papier en remplaçant les agents de blanchiment optiques.

De même, les GCC ont une luminosité ISO plus élevée (près de 96 %) que le kaolin (83 %), ce qui devrait également diminuer la préférence pour l’argile kaolin parmi les fabricants de papier.

L'argile bentonite est un autre substitut facilement disponible sur le marché. L'argile bentonite possède de puissantes propriétés d'absorption d'huile et peut absorber plus que sa masse corporelle en eau. Cela en fait un excellent ingrédient pour les personnes ayant une peau extrêmement grasse et favorise son utilisation dans les produits cosmétiques. L'argile bentonite est composée de montmorillonite, un type d'argile smectite. Elle a une teneur en eau élevée et gonfle au contact de l'eau. Cela la rend efficace pour éliminer les impuretés de la peau. Une autre alternative est la terre à foulon, qui est également utilisée pour les soins de la peau et la détoxification. On dit qu'elle est riche en minéraux et qu'elle possède des propriétés nettoyantes et revitalisantes et constitue une excellente alternative à l'argile kaolin.

Dans l'industrie du caoutchouc, les alternatives potentielles au kaolin comprennent le carbonate de calcium, la silice précipitée , le talc, la barytine, la wollastonite, le mica, les silicates précipités, la silice pyrogénée et la diatomite. Tous ces matériaux et minéraux sont utilisés comme charges lors de la composition du caoutchouc et offrent des propriétés similaires à celles offertes par le kaolin.

Dans la production de céramique, destinée à la fabrication de porcelaine, l'halloysite a des propriétés physiques similaires à celles du kaolin. Dans l'industrie de la peinture et du revêtement, la vermiculite sous forme exfoliée est utilisée comme agent opacifiant de peinture, la structure en forme de plaque ayant des propriétés similaires à celles du kaolin. En dehors de cela, les argiles fibreuses et le talc sont des minéraux argileux naturels courants utilisés dans les formulations pharmaceutiques et cosmétiques, outre le kaolin comme excipient ou ingrédient actif en raison de ses excellentes propriétés physiques, chimiques et de surface. La présence de tous ces substituts sur le marché constitue un goulot d'étranglement pour la demande de kaolin dans diverses industries d'utilisation finale, constituant ainsi un défi à la croissance du marché.

Développements récents

- En septembre 2022, KaMin LLC a finalisé l'acquisition de l'activité de minéraux de kaolin de BASF. Cette opération stratégique a transformé KaMin en diversifiant son portefeuille dans des segments de croissance hautement techniques et en renforçant sa position de leader mondial dans le secteur des minéraux industriels. L'acquisition comprend quatre sites de production et des installations connexes dans le centre de la Géorgie, aux États-Unis, élargissant les capacités techniques et le vivier de talents de KaMin. Avec cette fusion, KaMin vise à fournir des solutions de produits innovantes et de la valeur aux clients, aux distributeurs et aux propriétaires de marques du monde entier.

- En août 2022, Thiele a annoncé une augmentation imminente des prix sur toutes ses catégories de produits, effective à compter du 1er octobre 2022. Cette décision fait suite à l'inflation continue des coûts des matières premières, de la main-d'œuvre et de la logistique, qui exerce une pression supplémentaire sur les opérations de l'entreprise.

Portée du marché du kaolin en Asie et en Europe

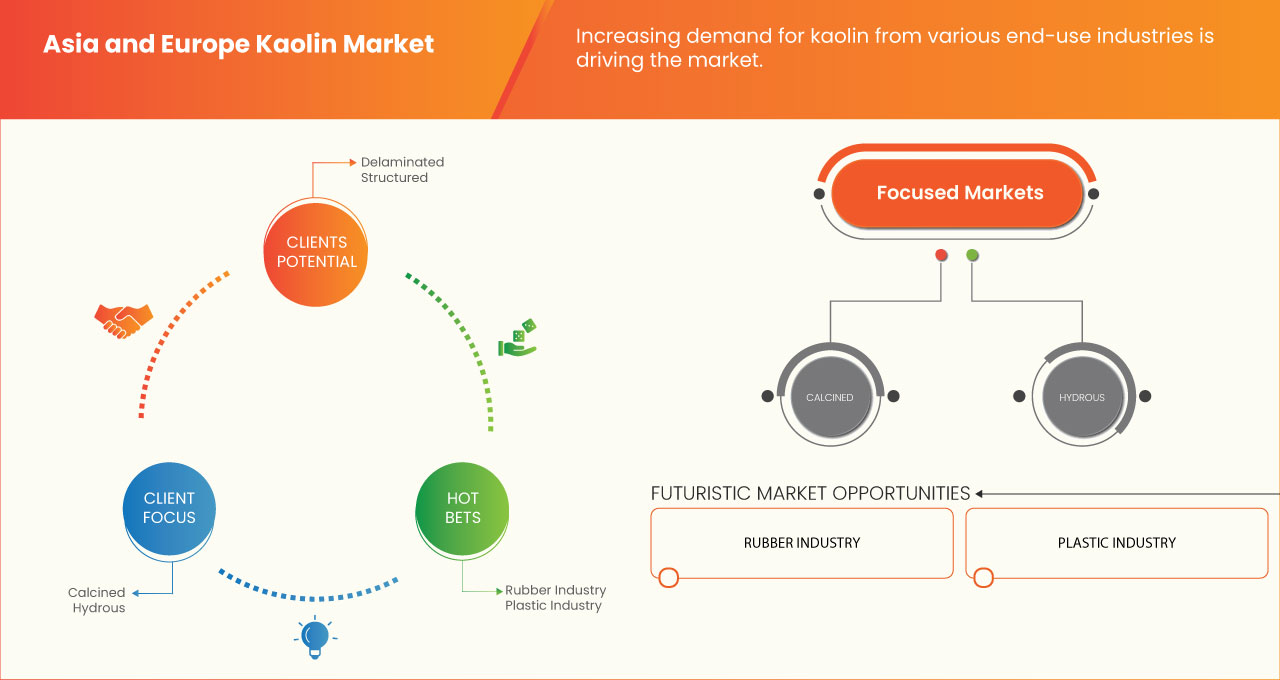

Le marché du kaolin est classé en fonction de la qualité, du processus et des applications. La croissance parmi ces segments vous aidera à analyser les principaux segments de croissance des industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Grade

- Calciné

- hydrique

- Délaminé

- Surface traitée

- Structuré

Sur la base de la qualité, le marché du kaolin d'Asie et d'Europe est segmenté en calciné, hydraté, délaminé, traité en surface et structuré.

Processus

- Lavé à l'eau

- Flotteur d'air

- Calciné

- Délaminé

- Surface modifiée non traitée

Sur la base du processus, le marché du kaolin en Asie et en Europe est segmenté en lavé à l'eau, flotté à l'air, calciné, délaminé, modifié en surface et non traité.

Application

- Papier

- Céramique

- Peinture et revêtements

- Fibre de verre

- Plastique

- Caoutchouc

- Produits pharmaceutiques et médicaux

- Produits de beauté

- Autres

Sur la base des applications, le marché du kaolin en Asie et en Europe est segmenté en papier, céramique, peinture et revêtements, fibre de verre, plastique, caoutchouc, produits pharmaceutiques et médicaux, cosmétiques et autres.

Analyse/perspectives régionales du marché du kaolin en Asie et en Europe

Le marché du kaolin en Asie et en Europe est segmenté sur la base de la classe, de la qualité et de l’application.

Les pays du marché du kaolin en Asie et en Europe sont la Chine, l'Inde, le Japon, la Corée du Sud, la Thaïlande, Singapour, l'Indonésie, les Philippines, la Malaisie, le reste de l'Asie, l'Allemagne, le Royaume-Uni, la France, l'Italie, l'Espagne, la Russie, la Suisse, la Turquie, la Belgique, les Pays-Bas et le reste de l'Europe.

L'Asie devrait dominer le marché du kaolin en Asie et en Europe en raison de la demande de kaolin de diverses industries d'utilisation finale. La Chine devrait dominer le marché du kaolin en Asie en raison de l'adoption élevée du kaolin comme additif de revêtement. L'Allemagne devrait dominer le marché du kaolin en Europe en raison de l'augmentation de la demande de kaolin de diverses industries d'utilisation finale.

La section pays du rapport fournit également des facteurs individuels d'impact sur le marché et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. L'analyse des points de données en aval et en amont de la chaîne de valeur, l'analyse des tendances techniques des cinq forces de Porter et les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques mondiales et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché du kaolin en Asie et en Europe

Le paysage concurrentiel du marché du kaolin fournit des détails par concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et l'étendue du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises par rapport au marché du kaolin.

Certains des principaux acteurs du marché opérant sur le marché sont Ashapura Group, EICL, LB MINERALS, Ltd, Quartz Works GmbH, Shree Ram Minerals, Jiangxi Sincere Mineral Industry Co., ltd., KaMin LLC. / CADAM, Thiele Kaolin Company, Imerys et SCR-Sibelco NV, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE ASIA AND EUROPE KAOLIN MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 GRADE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER’S FIVE FORCES:

4.2.1 THREAT OF NEW ENTRANTS:

4.2.2 THREAT OF SUBSTITUTES:

4.2.3 CUSTOMER BARGAINING POWER:

4.2.4 SUPPLIER BARGAINING POWER:

4.2.5 INTERNAL COMPETITION (RIVALRY):

4.3 IMPORT EXPORT SCENARIO

4.4 PRODUCTION CONSUMPTION ANALYSIS

4.5 VENDOR SELECTION CRITERIA

4.6 CRITICAL SELECTION CRITERIA FOR BUSINESS DECISION

4.7 MANUFACTURING COST SCENARIO AND FUTURE IMPACT

4.8 MANUFACTURING PROCESS: ASIA AND EUROPE KAOLIN MARKET

4.9 MARKET CHANGES / CURRENT EVENTS: ASIA AND EUROPE KAOLIN MARKET

4.1 PRODUCTION CAPACITY OUTLOOK

4.11 SUPPLY CHAIN ANALYSIS- ASIA AND EUROPE KAOLIN MARKET

4.11.1 OVERVIEW

4.11.2 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.12 TECHNOLOGIES OVERVIEW

5 ASIA AND EUROPE KAOLIN MARKET: REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 OPTIMISTIC OUTLOOK FOR KAOLIN IN THE CONSTRUCTION SECTOR

6.1.2 FAVORABLE CHEMICAL AND PHYSICAL PROPERTIES OF KAOLIN

6.1.3 INCREASING DEMAND FOR KAOLIN FROM VARIOUS END-USE INDUSTRIES

6.1.4 HIGH ADOPTION OF KAOLIN AS A COATING ADDITIVE

6.2 RESTRAINT

6.2.1 KAOLIN MINING CAUSES NUMEROUS ENVIRONMENTAL AND HEALTH HAZARDS

6.3 OPPORTUNITIES

6.3.1 KEY STRATEGIC INITIATIVES IMPLEMENTED BY LEADING COMPANIES

6.3.2 IMPROVED TECHNOLOGIES IN MINING PRACTICES OF KAOLIN

6.4 CHALLENGES

6.4.1 EASY AVAILABILITY OF SUBSTITUTES

6.4.2 VOLATILITY IN PRICE OF KAOLIN

7 ASIA AND EUROPE KAOLIN MARKET

7.1 OVERVIEW

7.2 ASIA

7.2.1 CHINA

7.2.2 INDIA

7.2.3 JAPAN

7.2.4 SOUTH KOREA

7.2.5 THAILAND

7.2.6 SINGAPORE

7.2.7 INDONESIA

7.2.8 PHILIPPINES

7.2.9 MALAYSIA

7.2.10 REST OF ASIA

7.3 EUROPE

7.3.1 GERMANY

7.3.2 U.K.

7.3.3 FRANCE

7.3.4 ITALY

7.3.5 SPAIN

7.3.6 RUSSIA

7.3.7 SWITZERLAND

7.3.8 TURKEY

7.3.9 BELGIUM

7.3.10 NETHERLANDS

7.3.11 REST OF EUROPE

8 ASIA AND EUROPE KAOLIN MARKET COMPANY LANDSCAPE

8.1 COMPANY SHARE ANALYSIS: ASIA AND EUROPE

8.2 PRICE INCREASE

8.3 ACQUISITION

9 SWOT ANALYSIS

10 COMPANY PROFILES

10.1 IMERYS

10.1.1 COMPANY SNAPSHOT

10.1.2 REVENUE ANALYSIS

10.1.3 PRODUCT PORTFOLIO

10.1.4 RECENT DEVELOPMENTS

10.2 SCR-SIBELCO NV

10.2.1 COMPANY SNAPSHOT

10.2.2 REVENUE ANALYSIS

10.2.3 PRODUCT PORTFOLIO

10.2.4 RECENT DEVELOPMENTS

10.3 KAMIN LLC. / CADAM

10.3.1 COMPANY SNAPSHOT

10.3.2 PRODUCT PORTFOLIO

10.3.3 RECENT DEVELOPMENTS

10.4 ASHAPURA GROUP

10.4.1 COMPANY SNAPSHOT

10.4.2 REVENUE ANALYSIS

10.4.3 PRODUCT PORTFOLIO

10.4.4 RECENT DEVELOPMENTS

10.5 JIANGXI SINCERE MINERAL INDUSTRY CO., LTD.

10.5.1 COMPANY SNAPSHOT

10.5.2 PRODUCT PORTFOLIO

10.5.3 RECENT DEVELOPMENTS

10.6 EICL

10.6.1 COMPANY SNAPSHOT

10.6.2 REVENUE ANALYSIS

10.6.3 PRODUCT PORTFOLIO

10.6.4 RECENT DEVELOPMENTS

10.7 LB MINERALS, LTD

10.7.1 COMPANY SNAPSHOTS

10.7.2 PRODUCT PORTFOLIO

10.7.3 RECENT DEVELOPMENTS

10.8 QUARTZ WORKS GMBH

10.8.1 COMPANY SNAPSHOT

10.8.2 PRODUCT PORTFOLIO

10.8.3 RECENT DEVELOPMENTS

10.9 SHREE RAM MINERALS

10.9.1 COMPANY SNAPSHOT

10.9.2 PRODUCT PORTFOLIO

10.9.3 RECENT DEVELOPMENTS

10.1 THIELE KAOLIN COMPANY

10.10.1 COMPANY SNAPSHOT

10.10.2 PRODUCT PORTFOLIO

10.10.3 RECENT DEVELOPMENT

11 QUESTIONNAIRE

12 RELATED REPORTS

Liste des tableaux

TABLE 1 COMPANIES - PRODUCTION CAPACITY ANALYSIS

TABLE 2 REGULATORY FRAMEWORK

TABLE 3 ASIA KAOLIN MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 4 ASIA KAOLIN MARKET, BY COUNTRY, 2021-2030 (TONS)

TABLE 5 ASIA KAOLIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 6 ASIA KAOLIN MARKET, BY GRADE, 2021-2030 (TONS)

TABLE 7 ASIA KAOLIN MARKET, BY PROCESS, 2021-2030 (USD THOUSAND)

TABLE 8 ASIA KAOLIN MARKET, BY PROCESS, 2021-2030 (TONS)

TABLE 9 ASIA KAOLIN MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 10 ASIA KAOLIN MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 11 CHINA KAOLIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 12 CHINA KAOLIN MARKET, BY GRADE, 2021-2030 (TONS)

TABLE 13 CHINA KAOLIN MARKET, BY PROCESS, 2021-2030 (USD THOUSAND)

TABLE 14 CHINA KAOLIN MARKET, BY PROCESS, 2021-2030 (TONS)

TABLE 15 CHINA KAOLIN MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 16 CHINA KAOLIN MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 17 INDIA KAOLIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 18 INDIA KAOLIN MARKET, BY GRADE, 2021-2030 (TONS)

TABLE 19 INDIA KAOLIN MARKET, BY PROCESS, 2021-2030 (USD THOUSAND)

TABLE 20 INDIA KAOLIN MARKET, BY PROCESS, 2021-2030 (TONS)

TABLE 21 INDIA KAOLIN MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 22 INDIA KAOLIN MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 23 JAPAN KAOLIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 24 JAPAN KAOLIN MARKET, BY GRADE, 2021-2030 (TONS)

TABLE 25 JAPAN KAOLIN MARKET, BY PROCESS, 2021-2030 (USD THOUSAND)

TABLE 26 JAPAN KAOLIN MARKET, BY PROCESS, 2021-2030 (USD THOUSAND)

TABLE 27 JAPAN KAOLIN MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 28 JAPAN KAOLIN MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 29 SOUTH KOREA KAOLIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 30 SOUTH KOREA KAOLIN MARKET, BY GRADE, 2021-2030 (TONS)

TABLE 31 SOUTH KOREA KAOLIN MARKET, BY PROCESS, 2021-2030 (USD THOUSAND)

TABLE 32 SOUTH KOREA KAOLIN MARKET, BY PROCESS, 2021-2030 (USD THOUSAND)

TABLE 33 SOUTH KOREA KAOLIN MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 34 SOUTH KOREA KAOLIN MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 35 THAILAND KAOLIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 36 THAILAND KAOLIN MARKET, BY GRADE, 2021-2030 (TONS)

TABLE 37 THAILAND KAOLIN MARKET, BY PROCESS, 2021-2030 (USD THOUSAND)

TABLE 38 THAILAND KAOLIN MARKET, BY PROCESS, 2021-2030 (USD THOUSAND)

TABLE 39 THAILAND KAOLIN MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 40 THAILAND KAOLIN MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 41 SINGAPORE KAOLIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 42 SINGAPORE KAOLIN MARKET, BY GRADE, 2021-2030 (TONS)

TABLE 43 SINGAPORE KAOLIN MARKET, BY PROCESS, 2021-2030 (USD THOUSAND)

TABLE 44 SINGAPORE KAOLIN MARKET, BY PROCESS, 2021-2030 (USD THOUSAND)

TABLE 45 SINGAPORE KAOLIN MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 46 SINGAPORE KAOLIN MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 47 INDONESIA KAOLIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 48 INDONESIA KAOLIN MARKET, BY GRADE, 2021-2030 (TONS)

TABLE 49 INDONESIA KAOLIN MARKET, BY PROCESS, 2021-2030 (USD THOUSAND)

TABLE 50 INDONESIA KAOLIN MARKET, BY PROCESS, 2021-2030 (USD THOUSAND)

TABLE 51 INDONESIA KAOLIN MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 52 INDONESIA KAOLIN MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 53 PHILIPPINES KAOLIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 54 PHILIPPINES KAOLIN MARKET, BY GRADE, 2021-2030 (TONS)

TABLE 55 PHILIPPINES KAOLIN MARKET, BY PROCESS, 2021-2030 (USD THOUSAND)

TABLE 56 PHILIPPINES KAOLIN MARKET, BY PROCESS, 2021-2030 (USD THOUSAND)

TABLE 57 PHILIPPINES KAOLIN MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 58 PHILIPPINES KAOLIN MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 59 MALAYSIA KAOLIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 60 MALAYSIA KAOLIN MARKET, BY GRADE, 2021-2030 (TONS)

TABLE 61 MALAYSIA KAOLIN MARKET, BY PROCESS, 2021-2030 (USD THOUSAND)

TABLE 62 MALAYSIA KAOLIN MARKET, BY PROCESS, 2021-2030 (USD THOUSAND)

TABLE 63 MALAYSIA KAOLIN MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 64 MALAYSIA KAOLIN MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 65 REST OF ASIA KAOLIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 66 REST OF ASIA KAOLIN MARKET, BY GRADE, 2021-2030 (TONS)

TABLE 67 EUROPE KAOLIN MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 68 EUROPE KAOLIN MARKET, BY COUNTRY, 2021-2030 (TONS)

TABLE 69 EUROPE KAOLIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 70 EUROPE KAOLIN MARKET, BY GRADE, 2021-2030 (TONS)

TABLE 71 EUROPE KAOLIN MARKET, BY PROCESS, 2021-2030 (USD THOUSAND)

TABLE 72 EUROPE KAOLIN MARKET, BY PROCESS, 2021-2030 (TONS)

TABLE 73 EUROPE KAOLIN MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 74 EUROPE KAOLIN MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 75 GERMANY KAOLIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 76 GERMANY KAOLIN MARKET, BY GRADE, 2021-2030 (TONS)

TABLE 77 GERMANY KAOLIN MARKET, BY PROCESS, 2021-2030 (USD THOUSANDS)

TABLE 78 GERMANY KAOLIN MARKET, BY PROCESS, 2021-2030 (TONS)

TABLE 79 GERMANY KAOLIN MARKET, BY APPLICATION, 2021-2030 (USD THOUSANDS)

TABLE 80 GERMANY KAOLIN MARKET, BY PROCESS, 2021-2030 (TONS)

TABLE 81 U.K. KAOLIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 82 U.K. KAOLIN MARKET, BY GRADE, 2021-2030 (TONS)

TABLE 83 U.K. KAOLIN MARKET, BY PROCESS, 2021-2030 (USD THOUSAND)

TABLE 84 U.K. KAOLIN MARKET, BY PROCESS, 2021-2030 (TONS)

TABLE 85 U.K. KAOLIN MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 86 U.K. KAOLIN MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 87 FRANCE KAOLIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 88 FRANCE KAOLIN MARKET, BY GRADE, 2021-2030 (TONS)

TABLE 89 FRANCE KAOLIN MARKET, BY PROCESS, 2021-2030 (USD THOUSAND)

TABLE 90 FRANCE KAOLIN MARKET, BY PROCESS, 2021-2030 (TONS)

TABLE 91 FRANCE KAOLIN MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 92 FRANCE KAOLIN MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 93 ITALY KAOLIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 94 ITALY KAOLIN MARKET, BY GRADE, 2021-2030 (TONS)

TABLE 95 ITALY KAOLIN MARKET, BY PROCESS, 2021-2030 (USD THOUSAND)

TABLE 96 ITALY KAOLIN MARKET, BY PROCESS, 2021-2030 (TONS)

TABLE 97 ITALY KAOLIN MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 98 ITALY KAOLIN MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 99 SPAIN KAOLIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 100 SPAIN KAOLIN MARKET, BY GRADE, 2021-2030 (TONS)

TABLE 101 SPAIN KAOLIN MARKET, BY PROCESS, 2021-2030 (USD THOUSAND)

TABLE 102 SPAIN KAOLIN MARKET, BY PROCESS, 2021-2030 (TONS)

TABLE 103 SPAIN KAOLIN MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 104 SPAIN KAOLIN MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 105 RUSSIA KAOLIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 106 RUSSIA KAOLIN MARKET, BY GRADE, 2021-2030 (TONS)

TABLE 107 RUSSIA KAOLIN MARKET, BY PROCESS, 2021-2030 (USD THOUSAND)

TABLE 108 RUSSIA KAOLIN MARKET, BY PROCESS, 2021-2030 (TONS)

TABLE 109 RUSSIA KAOLIN MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 110 RUSSIA KAOLIN MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 111 SWITZERLAND KAOLIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 112 SWITZERLAND KAOLIN MARKET, BY GRADE, 2021-2030 (TONS)

TABLE 113 SWITZERLAND KAOLIN MARKET, BY PROCESS, 2021-2030 (USD THOUSAND)

TABLE 114 SWITZERLAND KAOLIN MARKET, BY PROCESS, 2021-2030 (TONS)

TABLE 115 SWITZERLAND KAOLIN MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 116 SWITZERLAND KAOLIN MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 117 TURKEY KAOLIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 118 TURKEY KAOLIN MARKET, BY GRADE, 2021-2030 (TONS)

TABLE 119 TURKEY KAOLIN MARKET, BY PROCESS, 2021-2030 (USD THOUSAND)

TABLE 120 TURKEY KAOLIN MARKET, BY PROCESS, 2021-2030 (TONS)

TABLE 121 TURKEY KAOLIN MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 122 TURKEY KAOLIN MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 123 BELGIUM KAOLIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 124 BELGIUM KAOLIN MARKET, BY GRADE, 2021-2030 (TONS)

TABLE 125 BELGIUM KAOLIN MARKET, BY PROCESS, 2021-2030 (USD THOUSAND)

TABLE 126 BELGIUM KAOLIN MARKET, BY PROCESS, 2021-2030 (TONS)

TABLE 127 BELGIUM KAOLIN MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 128 BELGIUM KAOLIN MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 129 NETHERLANDS KAOLIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 130 NETHERLANDS KAOLIN MARKET, BY GRADE, 2021-2030 (TONS)

TABLE 131 NETHERLANDS KAOLIN MARKET, BY PROCESS, 2021-2030 (USD THOUSAND)

TABLE 132 NETHERLANDS KAOLIN MARKET, BY PROCESS, 2021-2030 (TONS)

TABLE 133 NETHERLANDS KAOLIN MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 134 NETHERLANDS KAOLIN MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 135 REST OF EUROPE KAOLIN MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 136 REST OF EUROPE KAOLIN MARKET, BY GRADE, 2021-2030 (TONS)

Liste des figures

FIGURE 1 ASIA AND EUROPE KAOLIN MARKET

FIGURE 2 ASIA AND EUROPE KAOLIN MARKET: DATA TRIANGULATION

FIGURE 3 ASIA AND EUROPE KAOLIN MARKET: DROC ANALYSIS

FIGURE 4 ASIA KAOLIN MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE KAOLIN MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 6 ASIA KAOLIN MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 7 EUROPE KAOLIN MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 8 ASIA AND EUROPE KAOLIN MARKET: THE GRADE LIFE LINE CURVE

FIGURE 9 ASIA AND EUROPE KAOLIN MARKET: MULTIVARIATE MODELLING

FIGURE 10 ASIA AND EUROPE KAOLIN MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 11 ASIA AND EUROPE KAOLIN MARKET: DBMR MARKET POSITION GRID

FIGURE 12 ASIA AND EUROPE KAOLIN MARKET: APPLICATION COVERAGE GRID

FIGURE 13 ASIA AND EUROPE KAOLIN MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 14 ASIA AND EUROPE KAOLIN MARKET: VENDOR SHARE ANALYSIS

FIGURE 15 ASIA AND EUROPE KAOLIN MARKET: SEGMENTATION

FIGURE 16 OPTIMISTIC OUTLOOK FOR KAOLIN IN THE CONSTRUCTION SECTOR IS EXPECTED TO DRIVE ASIA KAOLIN MARKET IN THE FORECAST PERIOD

FIGURE 17 INCREASING DEMAND FOR KAOLIN FROM VARIOUS END-USE INDUSTRIES TO DRIVE EUROPE KAOLIN MARKET IN THE FORECAST PERIOD

FIGURE 18 CALCINED SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA KAOLIN MARKET IN 2023 & 2030

FIGURE 19 CALCINED SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE KAOLIN MARKET IN 2023 & 2030

FIGURE 20 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 21 VENDOR SELECTION CRITERIA

FIGURE 22 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA AND EUROPE KAOLIN MARKET

FIGURE 23 ASIA AND EUROPE KAOLIN MARKET: SNAPSHOT (2022)

FIGURE 24 ASIA KAOLIN MARKET: SNAPSHOT (2022)

FIGURE 25 EUROPE KAOLIN MARKET: SNAPSHOT (2022)

FIGURE 26 ASIA AND EUROPE KAOLIN MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.