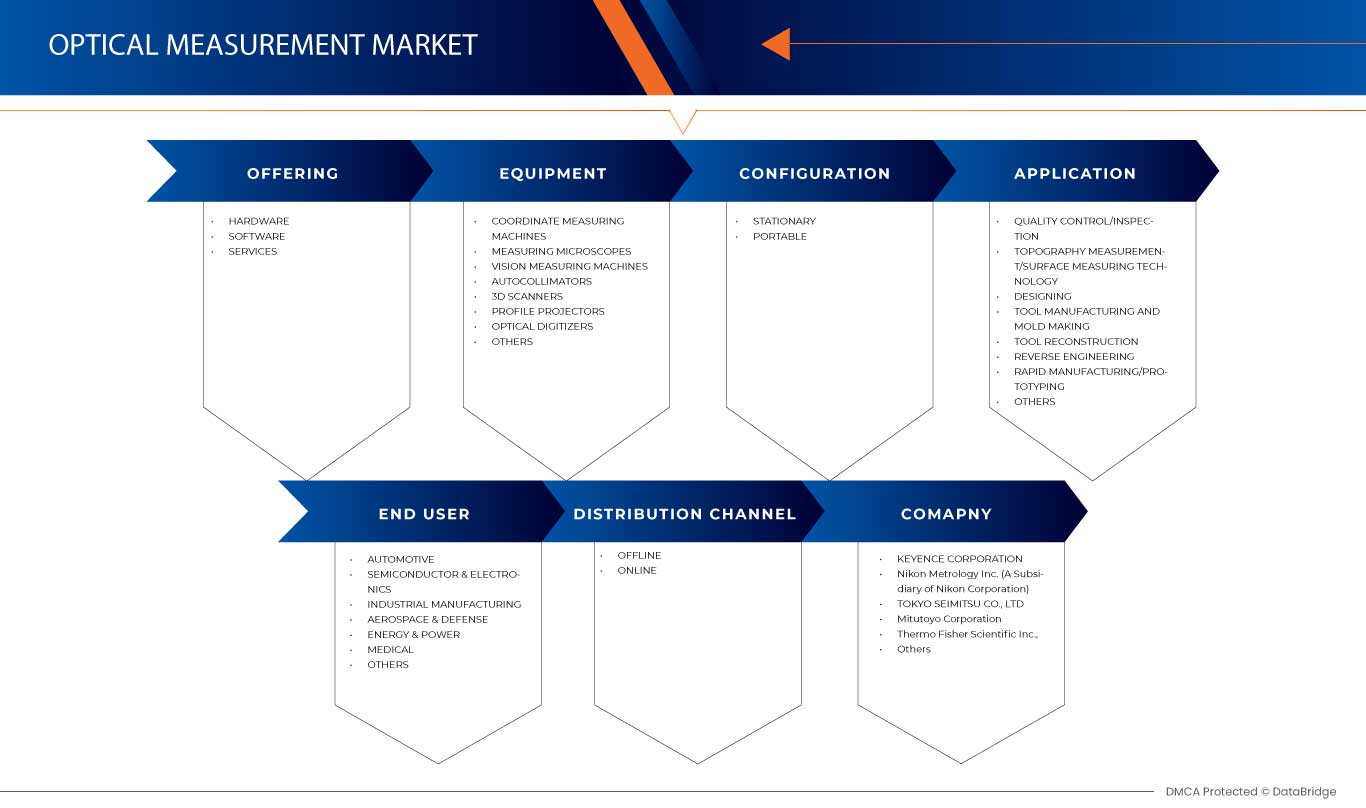

Marché de la mesure optique APAC et SEA, par offre (matériel, logiciels et services), équipement (machines de mesure tridimensionnelle, microscopes de mesure, machines de mesure de vision, autocollimateurs, scanners 3D, projecteurs de profil, numériseurs optiques et autres), configuration (stationnaire et portable), application (contrôle qualité/inspection, mesure topographique/technologie de mesure de surface, conception, fabrication d'outils et fabrication de moules, reconstruction d'outils, rétro-ingénierie, fabrication rapide/prototypage et autres), utilisateur final (automobile, semi-conducteurs et électronique, fabrication industrielle, aérospatiale et défense, énergie et électricité, médical et autres), canal de distribution (hors ligne et en ligne) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et perspectives du marché des mesures optiques en Asie-Pacifique et en Asie du Sud-Est

La mesure optique est une technologie avancée utilisée pour les tests et l'inspection non destructifs d'objets et de matériaux. Elle utilise le rayonnement X pour générer des images détaillées des structures internes de divers objets, permettant la détection de défauts, de contaminants ou de menaces sans avoir besoin de contact physique ou de démontage. Les mesures optiques se composent d'une source de rayons X, d'un détecteur, d'un système de convoyeur , d'une unité de contrôle et d'un logiciel de traitement d'images. Elles trouvent des applications dans des secteurs tels que la fabrication, le contrôle qualité, la sécurité et la protection douanière et frontalière, fournissant une imagerie haute résolution et une analyse précise pour des inspections efficaces et fiables. L'importance croissante accordée à la qualité et à la sécurité des produits dans tous les secteurs stimule la demande de mesures optiques. Ces systèmes permettent des inspections approfondies, aidant les entreprises à garantir le respect des normes de qualité, à détecter les défauts et à prévenir les rappels de produits, préservant ainsi leur réputation et la confiance des clients.

Data Bridge Market Research estime que le marché de la mesure optique de la région APAC et SEA devrait atteindre une valeur de 2 454 807,92 milliers USD d'ici 2030, à un TCAC de 8,3 % au cours de la période de prévision. Le rapport sur le marché de la mesure optique de la région APAC et SEA couvre également de manière exhaustive l'analyse des prix, l'analyse des brevets et les avancées technologiques.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable de 2015 à 2020) |

|

Unités quantitatives |

Chiffre d'affaires en milliers de dollars américains, volumes en unités, prix en dollars américains |

|

Segments couverts |

Par offre (matériel, logiciel et services), équipement ( machines de mesure tridimensionnelle , microscopes de mesure, machines de mesure de vision, autocollimateurs, scanners 3D, projecteurs de profil, numériseurs optiques et autres), configuration (fixe et portable), application (contrôle/inspection de la qualité, mesure topographique/technologie de mesure de surface, conception, fabrication d'outils et fabrication de moules, reconstruction d'outils, rétro-ingénierie, fabrication rapide/prototypage et autres), utilisateur final (automobile, semi-conducteurs et électronique, fabrication industrielle, aérospatiale et défense, énergie et électricité, médical et autres), canal de distribution (hors ligne et en ligne) |

|

Pays couverts |

Chine, Japon, Corée du Sud, Inde, Taïwan, Australie, Nouvelle-Zélande, Singapour, Thaïlande, Malaisie, Indonésie, Philippines, Vietnam, Myanmar, Cambodge, Laos et reste de l'Asie du Sud-Est |

|

Acteurs du marché couverts |

KEYENCE CORPORATION, Nikon Metrology Inc. (une filiale de Nikon Corporation), TOKYO SEIMITSU CO., LTD., JEOL Ltd., Mitutoyo Corporation, Thermo Fisher Scientific Inc., NOVA, Carl Zeiss AG, Hexagon AB, Bruker, Mahr GmbH, FARO, JENOPTIK AG, Quality Vision International, Micro-Vu, Leica Microsystems, Zygo Corporation, Third Dimension Software Ltd., SCANTECH (HANGZHOU) CO., LTD., ZG Technology Co., Ltd., Holon 3D, Radical Scientific Equipment Pvt Ltd., Vision Engineering Ltd., Sinowon Innovation Metrology Manufacture Limited |

Définition du marché

Les appareils de mesure optique sont des instruments sans contact qui utilisent des images pour effectuer des mesures. Les instruments utilisent une technologie de traitement d'image pour effectuer automatiquement des mesures rapides et précises. Les appareils de mesure optique sont appréciés pour leurs mesures précises et leur capacité à détecter les pièces défectueuses sur les lignes de fabrication. De plus, les appareils récents utilisent des caméras CCD qui permettent une détection précise des images en couleur. De plus, les avancées dans les solutions logicielles ont permis une détection variée des contours et la prise en charge de calculs complexes.

Les industries utilisent des instruments de mesure optique pour les environnements de recherche et développement comme outil de mesure pour développer des prototypes d'ingénierie ou des produits finis pour les lignes de production et évaluer les défauts des produits ou matériaux existants. Dans l'industrie des sciences de la vie, les appareils sont utilisés pour valider l'utilisabilité des prothèses ou détecter l'exactitude des produits de diagnostic. Les mesures optiques utilisent l'œil humain pour comparer certaines caractéristiques d'échantillons à des normes ; il s'agit de l'une des nombreuses techniques d'évaluation utilisées dans les installations, y compris d'autres techniques de test, d'inspection et d'étalonnage.

Dynamique du marché des mesures optiques en Asie-Pacifique et en Asie du Sud-Est

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Demande croissante d'automatisation dans le secteur manufacturier

Les industries de la région s'efforcent d'améliorer la productivité, l'efficacité et le contrôle de la qualité. L'automatisation est devenue une stratégie clé. Les systèmes de mesure optique jouent un rôle crucial dans l'automatisation en fournissant des données de mesure précises et fiables pour divers processus de fabrication. L'automatisation nécessite des mesures précises et en temps réel pour l'inspection dimensionnelle, l'alignement, l'analyse de surface et l'assurance qualité. Les systèmes de mesure optique offrent des capacités avancées pour répondre à ces exigences. Ils utilisent des technologies telles que la numérisation laser, la vision artificielle et la photogrammétrie pour capturer et analyser les données avec précision et rapidité. Par conséquent, la demande croissante d'automatisation dans la fabrication est un moteur important de la croissance du marché

- Une attention croissante portée au contrôle de la qualité

L’importance croissante accordée au contrôle qualité est un facteur important dans l’adoption de systèmes de mesure optique dans les régions Asie-Pacifique (APAC) et Asie du Sud-Est (SEA). Les solutions de métrologie optique sont devenues des outils essentiels dans la mesure où les industries cherchent à fournir des produits répondant aux normes de qualité les plus élevées. La capacité des systèmes de mesure optique, tels que la numérisation à lumière structurée et les applications basées sur la vision industrielle, à mesurer et inspecter avec précision les objets en temps réel joue un rôle crucial dans la garantie de la qualité des produits. Ces systèmes offrent des capacités de mesure non destructives de haute précision, et l’intégration de l’intelligence artificielle (IA) améliore encore la précision de la détection des défauts. En réduisant les déchets et en minimisant le besoin d’inspection manuelle en utilisant la métrologie optique, les fabricants peuvent identifier et rectifier rapidement les défauts. Dans les régions APAC et SEA, où l’automobile, l’électronique et l’ingénierie de précision sont prédominantes, la demande de systèmes de mesure optique a augmenté à mesure que les entreprises accordent la priorité au contrôle qualité pour obtenir un avantage concurrentiel. Nous pouvons anticiper l’adoption et l’expansion continues des systèmes de mesure optique dans ces régions pour soutenir l’accent croissant mis sur le contrôle qualité dans la fabrication.

Opportunité

- Augmenter les investissements dans la recherche et le développement

L’augmentation des investissements dans la recherche et le développement (R&D) des systèmes de mesure optique présente une opportunité significative pour le marché des systèmes de mesure optique APAC (Asie-Pacifique) et SEA (Asie du Sud-Est).

La R&D joue un rôle crucial dans l'avancement des technologies et l'innovation. Elle conduit au développement de nouveaux systèmes de mesure optique améliorés à mesure que les investissements en R&D augmentent. Ces systèmes peuvent offrir une précision accrue, une plus grande précision et des fonctionnalités accrues, répondant aux besoins en constante évolution de diverses industries.

Retenue/Défi

- Investissement initial élevé pour la configuration et l'exploitation des systèmes de mesure optique

L’investissement initial élevé requis pour mettre en place et exploiter des systèmes de mesure optique constitue un frein important pour le marché. Ces systèmes impliquent des technologies avancées, des équipements sophistiqués et des logiciels spécialisés, ce qui peut entraîner des coûts initiaux substantiels pour les entreprises. L’investissement initial comprend l’achat d’appareils de mesure optique de haute qualité, tels que des scanners laser, des interféromètres, des spectromètres et des systèmes d’imagerie. En outre, la mise en place peut nécessiter une infrastructure de soutien, telle que des platines de précision, des systèmes d’isolation des vibrations et des équipements d’étalonnage. De plus, les entreprises doivent investir dans du personnel qualifié formé à l’exploitation et à la maintenance de ces systèmes complexes.

Développements récents

- En juin 2023, la division Métrologie industrielle de Nikon a amélioré l'opérabilité de son logiciel AutoMeasure, utilisé dans la série de machines de mesure vidéo NEXIV, en introduisant la recherche automatique des contours dans la version 13.2. En activant la fonction de réglage automatique des contours, les opérateurs peuvent rapidement programmer une routine de mesure avant l'inspection. Cette fonction améliore la précision des mesures, réduit les variations, garantit la répétabilité des résultats et simplifie la création de programmes, ce qui se traduit par une efficacité accrue et des gains de temps dans les tâches d'inspection effectuées à l'aide des systèmes de mesure vidéo NEXIV. Cette amélioration a amélioré la fonctionnalité et la compétitivité des systèmes de mesure vidéo NEXIV de Nikon. En offrant des capacités de recherche automatique des contours, Nikon fournit aux clients une solution de mesure plus efficace et plus précise

- En mars 2023, KEYENCE CORPORATION a présenté le système de mesure multicapteur LM-X, qui offre des mesures optiques, laser et par palpeur tactile dans une seule unité compacte. Le système LM-X permet une mesure de haute précision par simple pression sur un bouton, éliminant ainsi le positionnement fastidieux des pièces. Avec des fonctionnalités telles que la détection automatique de la position et de l'orientation des pièces, une sonde tactile à basse pression pour les caractéristiques optiquement difficiles et une grande platine à faible vibration pour les mesures à grande vitesse, le système LM-X offre des mesures rapides et précises sans variations entre les résultats des opérateurs. Le lancement du système de mesure multicapteur LM-X a élargi l'offre de produits de Keyence, offrant une solution complète pour les mesures de haute précision et renforçant la position de l'entreprise sur le marché de la technologie de mesure multicapteur

Portée du marché des mesures optiques en Asie-Pacifique et en Asie du Sud-Est

Le marché de la mesure optique APAC et SEA est segmenté en six segments notables sur la base de l'offre, de l'équipement, de la source, de la configuration, de l'application, de l'utilisateur final et du canal de distribution. La croissance parmi ces segments vous aidera à analyser les segments de croissance maigres dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

En offrant un million de dollars américains)

- Matériel

- Logiciel

- Services

Sur la base de l’offre, le marché est segmenté en matériel, logiciels et services.

Par équipement

- Autocollimateurs

- Microscopes de mesure

- Scanners 3D

- Projecteurs de profils

- Machines à mesurer tridimensionnelles

- Machines de mesure de vision

- Numériseurs optiques

- Autres

Sur la base de l'équipement, le marché est segmenté en autocollimateurs, microscopes de mesure, scanners 3D , projecteurs de profil, machines de mesure de coordonnées, machines de mesure de vision, numériseurs optiques et autres.

Par configuration

- Stationnaire

- Portable

Sur la base de la configuration, le marché est segmenté en stationnaire et portable

Par application

- Contrôle de la qualité/Inspection

- Mesure de la topographie/Technologie de mesure de surface

- Fabrication d'outils et de moules

- Reconstruction d'outils

- Conception

- Fabrication rapide/Prototypage

- Ingénierie inverse

- Autres

Sur la base de l'application, le marché est segmenté en contrôle/inspection de la qualité, mesure de la topographie/technologie de mesure de surface, fabrication d'outils et de moules, reconstruction d'outils, conception, fabrication rapide/prototypage, rétro-ingénierie, et autres.

Par utilisateur final

- Automobile

- Semi-conducteurs et électronique

- Aérospatiale et Défense

- Fabrication industrielle

- Énergie et électricité

- Médical

- Autres

Sur la base de l'utilisateur final, le marché est segmenté en automobile, semi-conducteurs et électronique, aérospatiale et défense, fabrication industrielle, énergie et électricité, médical et autres.

Par canal de distribution

- Hors ligne

- En ligne

Sur la base du canal de distribution, le marché est segmenté en hors ligne et en ligne.

Analyse/perspectives du marché des mesures optiques dans les pays de la région APAC et SEA

Le marché des mesures optiques APAC et SEA est analysé et des informations et tendances sur la taille du marché sont fournies par pays, composant, type, source, type de produit, poids, application, utilisateur final et canal de distribution, comme référencé ci-dessus.

Les pays couverts dans le rapport sur le marché de la mesure optique APAC et SEA sont la Chine, le Japon, la Corée du Sud, l'Inde, Taïwan, l'Australie, la Nouvelle-Zélande, Singapour, la Thaïlande, la Malaisie, l'Indonésie, les Philippines, le Vietnam, le Myanmar, le Cambodge, le Laos et le reste de l'ASEAN.

En 2023, la Chine devrait dominer la région APAC et SEA en raison de la forte demande de mesures optiques dans la région. Le pays dispose d'un secteur manufacturier vaste et diversifié qui englobe des industries telles que l'automobile, l'électronique, l'aérospatiale, les biens de consommation, etc. À mesure que les processus de fabrication deviennent plus avancés et soucieux de la qualité, la demande de systèmes de mesure optique a considérablement augmenté.

Le Japon devrait connaître une croissance au cours de la période de prévision en raison de sa réputation de longue date en matière d'innovation technologique et d'ingénierie de précision. Les entreprises japonaises sont à l'avant-garde du développement de systèmes de mesure optique avancés, offrant une grande précision, une grande fiabilité et des fonctionnalités de pointe.

La section pays du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques et l'analyse des cinq forces de Porter, ainsi que des études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour chaque pays. En outre, la présence et la disponibilité des marques APAC et SEA et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des mesures optiques en Asie-Pacifique et en Asie du Sud-Est

Le paysage concurrentiel du marché de la mesure optique APAC & SEA fournit des détails sur le concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence APAC & SEA, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit et la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liée au marché de la mesure optique APAC & SEA.

Certains des principaux acteurs du marché opérant sur le marché de la mesure optique APAC et SEA sont :

KEYENCE CORPORATION, Nikon Metrology Inc. (une filiale de Nikon Corporation), TOKYO SEIMITSU CO., LTD., JEOL Ltd., Mitutoyo Corporation, Thermo Fisher Scientific Inc., NOVA, Carl Zeiss AG, Hexagon AB, Bruker, Mahr GmbH, FARO, JENOPTIK AG, Quality Vision International, Micro-Vu, Leica Microsystems, Zygo Corporation, Third Dimension Software Ltd., SCANTECH (HANGZHOU) CO., LTD., ZG Technology Co., Ltd., Holon 3D, Radical Scientific Equipment Pvt Ltd., Vision Engineering Ltd., Sinowon Innovation Metrology Manufacture Limited

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE APAC & SEA OPTICAL MEASUREMENT MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELLING

2.9 OFFERING TIMELINE CURVE

2.1 APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 TECHNOLOGICAL TRENDS

4.2 PATENT ANALYSIS

4.3 REGULATORY STANDARDS

4.4 CASE STUDIES

4.4.1 OPTICAL METHODS FOR MEASURING THICKNESS OF LIQUID SHEETS

4.4.2 METHODOLOGY FOR THE DEVELOPMENT OF IN-LINE OPTICAL SURFACE MEASURING INSTRUMENTS WITH A CASE STUDY FOR ADDITIVE SURFACE FINISHING

4.4.3 FAST OPTICAL SENSING OF METALS: A CASE STUDY OF CU2+ ASSESSMENT IN SOILS

4.5 VALUE CHAIN ANALYSIS

4.6 PORTER’S FIVE FORCE ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING DEMAND FOR AUTOMATION IN MANUFACTURING

5.1.2 GROWING FOCUS ON QUALITY CONTROL

5.1.3 INCREASING GOVERNMENT INITIATIVES TO BOOST MANUFACTURING AND AUTOMATION

5.1.4 INCREASING USE OF OPTICAL MEASUREMENT SYSTEMS IN VARIOUS INDUSTRIES

5.1.5 INTRODUCTION OF HYBRID MEASUREMENT TECHNOLOGY

5.2 RESTRAINTS

5.2.1 HIGH INITIAL INVESTMENT FOR SETUP AND OPERATION OF OPTICAL MEASUREMENT SYSTEMS

5.2.2 TECHNOLOGICAL LIMITATIONS OF OPTICAL MEASUREMENT SYSTEM

5.3 OPPORTUNITIES

5.3.1 INCREASING INVESTMENT IN RESEARCH AND DEVELOPMENT

5.3.2 ADVANCEMENT IN MACHINE VISION FOR AUTOMATED OPTICAL MEASUREMENT SYSTEM

5.3.3 STRATEGIC INITIATIVES BY KEY MARKET PLAYERS

5.4 CHALLENGES

5.4.1 ECONOMIC SLOWDOWN IN THE REGION

5.4.2 SYSTEM COMPLEXITY ALONG WITH HIGH INVESTMENT IN SKILLED LABOR

6 APAC & SEA OPTICAL MEASUREMENT MARKET, BY OFFERING

6.1 OVERVIEW

6.2 HARDWARE

6.3 SOFTWARE

6.4 SERVICES

7 APAC & SEA OPTICAL MEASUREMENT MARKET, BY EQUIPMENT

7.1 OVERVIEW

7.2 COORDINATE MEASURING MACHINES

7.3 MEASURING MICROSCOPES

7.4 VISION MEASURING MACHINES

7.5 AUTOCOLLIMATORS

7.6 3D SCANNERS

7.7 PROFILE PROJECTORS

7.8 OPTICAL DIGITIZERS

7.9 OTHERS

8 APAC & SEA OPTICAL MEASUREMENT MARKET, BY CONFIGURATION

8.1 OVERVIEW

8.2 STATIONARY

8.3 PORTABLE

9 APAC & SEA OPTICAL MEASUREMENT MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 QUALITY CONTROL/INSPECTION

9.3 TOPOGRAPHY MEASUREMENT/SURFACE MEASURING TECHNOLOGY

9.4 DESIGNING

9.5 TOOL MANUFACTURING AND MOLD MAKING

9.6 TOOL RECONSTRUCTION

9.7 REVERSE ENGINEERING

9.8 RAPID MANUFACTURING/PROTOTYPING

9.9 OTHERS

10 APAC & SEA OPTICAL MEASUREMENT MARKET, BY END USER

10.1 OVERVIEW

10.2 AUTOMOTIVE

10.2.1 COORDINATE MEASURING MACHINES

10.2.2 MEASURING MICROSCOPES

10.2.3 VISION MEASURING MACHINES

10.2.4 AUTOCOLLIMATORS

10.2.5 3D SCANNERS

10.2.6 PROFILE PROJECTORS

10.2.7 OPTICAL DIGITIZERS

10.2.8 OTHERS

10.3 SEMICONDUCTOR & ELECTRONICS

10.3.1 COORDINATE MEASURING MACHINES

10.3.2 MEASURING MICROSCOPES

10.3.3 VISION MEASURING MACHINES

10.3.4 AUTOCOLLIMATORS

10.3.5 3D SCANNERS

10.3.6 PROFILE PROJECTORS

10.3.7 OPTICAL DIGITIZERS

10.3.8 OTHERS

10.4 INDUSTRIAL MANUFACTURING

10.4.1 COORDINATE MEASURING MACHINES

10.4.2 MEASURING MICROSCOPES

10.4.3 VISION MEASURING MACHINES

10.4.4 AUTOCOLLIMATORS

10.4.5 3D SCANNERS

10.4.6 PROFILE PROJECTORS

10.4.7 OPTICAL DIGITIZERS

10.4.8 OTHERS

10.5 AEROSPACE & DEFENSE

10.5.1 COORDINATE MEASURING MACHINES

10.5.2 MEASURING MICROSCOPES

10.5.3 VISION MEASURING MACHINES

10.5.4 AUTOCOLLIMATORS

10.5.5 3D SCANNERS

10.5.6 PROFILE PROJECTORS

10.5.7 OPTICAL DIGITIZERS

10.5.8 OTHERS

10.6 ENERGY & POWER

10.6.1 COORDINATE MEASURING MACHINES

10.6.2 MEASURING MICROSCOPES

10.6.3 VISION MEASURING MACHINES

10.6.4 AUTOCOLLIMATORS

10.6.5 3D SCANNERS

10.6.6 PROFILE PROJECTORS

10.6.7 OPTICAL DIGITIZERS

10.6.8 OTHERS

10.7 MEDICAL

10.7.1 COORDINATE MEASURING MACHINES

10.7.2 MEASURING MICROSCOPES

10.7.3 VISION MEASURING MACHINES

10.7.4 AUTOCOLLIMATORS

10.7.5 3D SCANNERS

10.7.6 PROFILE PROJECTORS

10.7.7 OPTICAL DIGITIZERS

10.7.8 OTHERS

10.8 OTHERS

11 APAC & SEA OPTICAL MEASUREMENT MARKET, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.1.1 OFFLINE

11.1.1.1 DISTRIBUTORS & WHOLESALE

11.1.1.2 DEALERS SPECIALTY STORES

11.1.1.3 OTHERS

11.1.2 ONLINE

11.1.2.1 COMPANY WEBSITE

11.1.2.2 THIRD PART E-COMMERCE

12 APAC & SEA OPTICAL MEASUREMENT MARKET, BY COUNTRY

12.1 OVERVIEW

12.2 CHINA

12.3 JAPAN

12.4 SOUTH KOREA

12.5 INDIA

12.6 TAIWAN

12.7 AUSTRALIA

12.8 NEW ZEALAND

12.9 SEA

12.9.1 SINGAPORE

12.9.2 THAILAND

12.9.3 MALAYSIA

12.9.4 INDONESIA

12.9.5 PHILIPPINES

12.9.6 VIETNAM

12.9.7 MYANMAR

12.9.8 CAMBODIA

12.9.9 LAOS

12.9.10 REST OF SEA

13 APAC & SEA OPTICAL MEASUREMENT MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: APAC

13.2 COMPANY SHARE ANALYSIS: SEA

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 KEYENCE CORPORATION

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENTS

15.1.5 SWOT ANALYSIS

15.2 NIKON METROLOGY INC

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENTS

15.2.5 SWOT ANALYSIS

15.3 THERMO FISHER SCIENTIFIC INC.

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 BRAND PORTFOLIO

15.3.4 RECENT DEVELOPMENTS

15.3.5 SWOT ANALYSIS

15.4 TOKYO SEIMITSU CO., LTD

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENTS

15.4.5 SWOT ANALYSIS

15.5 JEOL LTD.

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENTS

15.5.5 SWOT ANALYSIS

15.6 BRUKER

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 BRAND PORTFOLIO

15.6.4 RECENT DEVELOPMENTS

15.7 CARL ZEISS AG

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENTS

15.8 FARO

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 BRAND PORTFOLIO

15.8.4 RECENT DEVELOPMENTS

15.9 HEXAGON AB

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENTS

15.1 HOLON 3D

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 JENOPTIK AG

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT DEVELOPMENTS

15.12 LEICA MICROSYSTEMS

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENTS

15.13 MAHR GMBH

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENTS

15.14 MICRO-VU

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENTS

15.15 MITUTOYO CORPORATION

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENTS

15.16 NOVA

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT DEVELOPMENTS

15.17 QUALITY VISION INTERNATIONAL

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENTS

15.18 RADICAL SCIENTIFIC EQUIPMENT PVT LTD.

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENT

15.19 SCANTECH (HANGZHOU) CO., LTD.

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENTS

15.2 SINOWON INNOVATION METROLOGY MANUFACTURE LIMITED

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENTS

15.21 THIRD DIMENSION SOFTWARE LTD.

15.21.1 COMPANY SNAPSHOT

15.21.2 PRODUCT PORTFOLIO

15.21.3 RECENT DEVELOPMENTS

15.22 VISION ENGINEERING LTD

15.22.1 COMPANY SNAPSHOT

15.22.2 PRODUCT PORTFOLIO

15.22.3 RECENT DEVELOPMENTS

15.23 ZG TECHNOLOGY CO., LTD.

15.23.1 COMPANY SNAPSHOT

15.23.2 PRODUCT PORTFOLIO

15.23.3 RECENT DEVELOPMENTS

15.24 ZYGO CORPORATION

15.24.1 COMPANY SNAPSHOT

15.24.2 PRODUCT PORTFOLIO

15.24.3 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

Liste des tableaux

TABLE 1 OPTICAL MEASUREMENT SYSTEMS AND COST ASSOCIATED (USD)

TABLE 2 ADVANTAGES AND DISADVANTAGES OF EACH TYPE OF MEASUREMENT SYSTEM

TABLE 3 APAC & SEA OPTICAL MEASUREMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 4 APAC & SEA OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 5 APAC & SEA OPTICAL MEASUREMENT MARKET, BY CONFIGURATION, 2021-2030 (USD THOUSAND)

TABLE 6 APAC & SEA OPTICAL MEASUREMENT MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 7 APAC & SEA OPTICAL MEASUREMENT MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 8 APAC & SEA AUTOMOTIVE IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 9 APAC & SEA SEMICONDUCTOR & ELECTRONICS IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 10 APAC & SEA INDUSTRIAL MANUFACTURING IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 11 APAC & SEA AEROSPACE & DEFENSE IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 12 APAC & SEA ENERGY & POWER IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 13 APAC & SEA MEDICAL IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 14 APAC & SEA OPTICAL MEASUREMENT MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 15 APAC & SEA OFFLINE IN OPTICAL MEASUREMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 16 APAC & SEA ONLINE IN OPTICAL MEASUREMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 17 APAC & SEA OPTICAL MEASUREMENT MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 18 APAC & SEA OPTICAL MEASUREMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 19 APAC & SEA OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 20 APAC & SEA OPTICAL MEASUREMENT MARKET, BY CONFIGURATION, 2021-2030 (USD THOUSAND)

TABLE 21 APAC & SEA OPTICAL MEASUREMENT MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 22 APAC & SEA OPTICAL MEASUREMENT MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 23 APAC & SEA AUTOMOTIVE IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 24 APAC & SEA SEMICONDUCTOR & ELECTRONICS IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 25 APAC & SEA INDUSTRIAL MANUFACTURING IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 26 APAC & SEA AEROSPACE & DEFENSE IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 27 APAC & SEA ENERGY & POWER IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 28 APAC & SEA MEDICAL IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 29 APAC & SEA OPTICAL MEASUREMENT MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 30 APAC & SEA OFFLINE IN OPTICAL MEASUREMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 31 APAC & SEA ONLINE IN OPTICAL MEASUREMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 32 CHINA OPTICAL MEASUREMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 33 CHINA OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 34 CHINA OPTICAL MEASUREMENT MARKET, BY CONFIGURATION, 2021-2030 (USD THOUSAND)

TABLE 35 CHINA OPTICAL MEASUREMENT MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 36 CHINA OPTICAL MEASUREMENT MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 37 CHINA AUTOMOTIVE IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 38 CHINA SEMICONDUCTOR & ELECTRONICS IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 39 CHINA INDUSTRIAL MANUFACTURING IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 40 CHINA AEROSPACE & DEFENSE IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 41 CHINA ENERGY & POWER IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 42 CHINA MEDICAL IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 43 CHINA OPTICAL MEASUREMENT MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 44 CHINA OFFLINE IN OPTICAL MEASUREMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 45 CHINA ONLINE IN OPTICAL MEASUREMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 46 JAPAN OPTICAL MEASUREMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 47 JAPAN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 48 JAPAN OPTICAL MEASUREMENT MARKET, BY CONFIGURATION, 2021-2030 (USD THOUSAND)

TABLE 49 JAPAN OPTICAL MEASUREMENT MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 50 JAPAN OPTICAL MEASUREMENT MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 51 JAPAN AUTOMOTIVE IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 52 JAPAN SEMICONDUCTOR & ELECTRONICS IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 53 JAPAN INDUSTRIAL MANUFACTURING IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 54 JAPAN AEROSPACE & DEFENSE IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 55 JAPAN ENERGY & POWER IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 56 JAPAN MEDICAL IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 57 JAPAN OPTICAL MEASUREMENT MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 58 JAPAN OFFLINE IN OPTICAL MEASUREMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 59 JAPAN ONLINE IN OPTICAL MEASUREMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 60 SOUTH KOREA OPTICAL MEASUREMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 61 SOUTH KOREA OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 62 SOUTH KOREA OPTICAL MEASUREMENT MARKET, BY CONFIGURATION, 2021-2030 (USD THOUSAND)

TABLE 63 SOUTH KOREA OPTICAL MEASUREMENT MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 64 SOUTH KOREA OPTICAL MEASUREMENT MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 65 SOUTH KOREA AUTOMOTIVE IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 66 SOUTH KOREA SEMICONDUCTOR & ELECTRONICS IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 67 SOUTH KOREA INDUSTRIAL MANUFACTURING IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 68 SOUTH KOREA AEROSPACE & DEFENSE IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 69 SOUTH KOREA ENERGY & POWER IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 70 SOUTH KOREA MEDICAL IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 71 SOUTH KOREA OPTICAL MEASUREMENT MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 72 SOUTH KOREA OFFLINE IN OPTICAL MEASUREMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 73 SOUTH KOREA ONLINE IN OPTICAL MEASUREMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 74 INDIA OPTICAL MEASUREMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 75 INDIA OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 76 INDIA OPTICAL MEASUREMENT MARKET, BY CONFIGURATION, 2021-2030 (USD THOUSAND)

TABLE 77 INDIA OPTICAL MEASUREMENT MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 78 INDIA OPTICAL MEASUREMENT MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 79 INDIA AUTOMOTIVE IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 80 INDIA SEMICONDUCTOR & ELECTRONICS IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 81 INDIA INDUSTRIAL MANUFACTURING IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 82 INDIA AEROSPACE & DEFENSE IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 83 INDIA ENERGY & POWER IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 84 INDIA MEDICAL IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 85 INDIA OPTICAL MEASUREMENT MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 86 INDIA OFFLINE IN OPTICAL MEASUREMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 87 INDIA ONLINE IN OPTICAL MEASUREMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 88 TAIWAN OPTICAL MEASUREMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 89 TAIWAN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 90 TAIWAN OPTICAL MEASUREMENT MARKET, BY CONFIGURATION, 2021-2030 (USD THOUSAND)

TABLE 91 TAIWAN OPTICAL MEASUREMENT MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 92 TAIWAN OPTICAL MEASUREMENT MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 93 TAIWAN AUTOMOTIVE IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 94 TAIWAN SEMICONDUCTOR & ELECTRONICS IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 95 TAIWAN INDUSTRIAL MANUFACTURING IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 96 TAIWAN AEROSPACE & DEFENSE IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 97 TAIWAN ENERGY & POWER IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 98 TAIWAN MEDICAL IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 99 TAIWAN OPTICAL MEASUREMENT MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 100 TAIWAN OFFLINE IN OPTICAL MEASUREMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 101 TAIWAN ONLINE IN OPTICAL MEASUREMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 102 AUSTRALIA OPTICAL MEASUREMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 103 AUSTRALIA OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 104 AUSTRALIA OPTICAL MEASUREMENT MARKET, BY CONFIGURATION, 2021-2030 (USD THOUSAND)

TABLE 105 AUSTRALIA OPTICAL MEASUREMENT MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 106 AUSTRALIA OPTICAL MEASUREMENT MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 107 AUSTRALIA AUTOMOTIVE IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 108 AUSTRALIA SEMICONDUCTOR & ELECTRONICS IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 109 AUSTRALIA INDUSTRIAL MANUFACTURING IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 110 AUSTRALIA AEROSPACE & DEFENSE IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 111 AUSTRALIA ENERGY & POWER IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 112 AUSTRALIA MEDICAL IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 113 AUSTRALIA OPTICAL MEASUREMENT MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 114 AUSTRALIA OFFLINE IN OPTICAL MEASUREMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 115 AUSTRALIA ONLINE IN OPTICAL MEASUREMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 116 NEW ZEALAND OPTICAL MEASUREMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 117 NEW ZEALAND OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 118 NEW ZEALAND OPTICAL MEASUREMENT MARKET, BY CONFIGURATION, 2021-2030 (USD THOUSAND)

TABLE 119 NEW ZEALAND OPTICAL MEASUREMENT MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 120 NEW ZEALAND OPTICAL MEASUREMENT MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 121 NEW ZEALAND AUTOMOTIVE IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 122 NEW ZEALAND SEMICONDUCTOR & ELECTRONICS IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 123 NEW ZEALAND INDUSTRIAL MANUFACTURING IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 124 NEW ZEALAND AEROSPACE & DEFENSE IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 125 NEW ZEALAND ENERGY & POWER IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 126 NEW ZEALAND MEDICAL IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 127 NEW ZEALAND OPTICAL MEASUREMENT MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 128 NEW ZEALAND OFFLINE IN OPTICAL MEASUREMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 129 NEW ZEALAND ONLINE IN OPTICAL MEASUREMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 130 SEA OPTICAL MEASUREMENTS MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 131 SEA OPTICAL MEASUREMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 132 SEA OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 133 SEA OPTICAL MEASUREMENT MARKET, BY CONFIGURATION, 2021-2030 (USD THOUSAND)

TABLE 134 SEA OPTICAL MEASUREMENT MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 135 SEA OPTICAL MEASUREMENT MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 136 SEA AUTOMOTIVE IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 137 SEA SEMICONDUCTOR & ELECTRONICS IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 138 SEA INDUSTRIAL MANUFACTURING IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 139 SEA AEROSPACE & DEFENSE IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 140 SEA ENERGY & POWER IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 141 SEA MEDICAL IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 142 SEA OPTICAL MEASUREMENT MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 143 SEA OFFLINE IN OPTICAL MEASUREMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 144 SEA ONLINE IN OPTICAL MEASUREMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 145 SINGAPORE OPTICAL MEASUREMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 146 SINGAPORE OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 147 SINGAPORE OPTICAL MEASUREMENT MARKET, BY CONFIGURATION, 2021-2030 (USD THOUSAND)

TABLE 148 SINGAPORE OPTICAL MEASUREMENT MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 149 SINGAPORE OPTICAL MEASUREMENT MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 150 SINGAPORE AUTOMOTIVE IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 151 SINGAPORE SEMICONDUCTOR & ELECTRONICS IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 152 SINGAPORE INDUSTRIAL MANUFACTURING IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 153 SINGAPORE AEROSPACE & DEFENSE IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 154 SINGAPORE ENERGY & POWER IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 155 SINGAPORE MEDICAL IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 156 SINGAPORE OPTICAL MEASUREMENT MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 157 SINGAPORE OFFLINE IN OPTICAL MEASUREMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 158 SINGAPORE ONLINE IN OPTICAL MEASUREMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 159 THAILAND OPTICAL MEASUREMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 160 THAILAND OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 161 THAILAND OPTICAL MEASUREMENT MARKET, BY CONFIGURATION, 2021-2030 (USD THOUSAND)

TABLE 162 THAILAND OPTICAL MEASUREMENT MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 163 THAILAND OPTICAL MEASUREMENT MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 164 THAILAND AUTOMOTIVE IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 165 THAILAND SEMICONDUCTOR & ELECTRONICS IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 166 THAILAND INDUSTRIAL MANUFACTURING IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 167 THAILAND AEROSPACE & DEFENSE IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 168 THAILAND ENERGY & POWER IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 169 THAILAND MEDICAL IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 170 THAILAND OPTICAL MEASUREMENT MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 171 THAILAND OFFLINE IN OPTICAL MEASUREMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 172 THAILAND ONLINE IN OPTICAL MEASUREMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 173 MALAYSIA OPTICAL MEASUREMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 174 MALAYSIA OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 175 MALAYSIA OPTICAL MEASUREMENT MARKET, BY CONFIGURATION, 2021-2030 (USD THOUSAND)

TABLE 176 MALAYSIA OPTICAL MEASUREMENT MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 177 MALAYSIA OPTICAL MEASUREMENT MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 178 MALAYSIA AUTOMOTIVE IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 179 MALAYSIA SEMICONDUCTOR & ELECTRONICS IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 180 MALAYSIA INDUSTRIAL MANUFACTURING IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 181 MALAYSIA AEROSPACE & DEFENSE IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 182 MALAYSIA ENERGY & POWER IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 183 MALAYSIA MEDICAL IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 184 MALAYSIA OPTICAL MEASUREMENT MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 185 MALAYSIA OFFLINE IN OPTICAL MEASUREMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 186 MALAYSIA ONLINE IN OPTICAL MEASUREMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 187 INDONESIA OPTICAL MEASUREMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 188 INDONESIA OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 189 INDONESIA OPTICAL MEASUREMENT MARKET, BY CONFIGURATION, 2021-2030 (USD THOUSAND)

TABLE 190 INDONESIA OPTICAL MEASUREMENT MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 191 INDONESIA OPTICAL MEASUREMENT MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 192 INDONESIA AUTOMOTIVE IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 193 INDONESIA SEMICONDUCTOR & ELECTRONICS IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 194 INDONESIA INDUSTRIAL MANUFACTURING IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 195 INDONESIA AEROSPACE & DEFENSE IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 196 INDONESIA ENERGY & POWER IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 197 INDONESIA MEDICAL IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 198 INDONESIA OPTICAL MEASUREMENT MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 199 INDONESIA OFFLINE IN OPTICAL MEASUREMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 200 INDONESIA ONLINE IN OPTICAL MEASUREMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 201 PHILIPPINES OPTICAL MEASUREMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 202 PHILIPPINES OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 203 PHILIPPINES OPTICAL MEASUREMENT MARKET, BY CONFIGURATION, 2021-2030 (USD THOUSAND)

TABLE 204 PHILIPPINES OPTICAL MEASUREMENT MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 205 PHILIPPINES OPTICAL MEASUREMENT MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 206 PHILIPPINES AUTOMOTIVE IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 207 PHILIPPINES SEMICONDUCTOR & ELECTRONICS IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 208 PHILIPPINES INDUSTRIAL MANUFACTURING IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 209 PHILIPPINES AEROSPACE & DEFENSE IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 210 PHILIPPINES ENERGY & POWER IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 211 PHILIPPINES MEDICAL IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 212 PHILIPPINES OPTICAL MEASUREMENT MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 213 PHILIPPINES OFFLINE IN OPTICAL MEASUREMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 214 PHILIPPINES ONLINE IN OPTICAL MEASUREMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 215 VIETNAM OPTICAL MEASUREMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 216 VIETNAM OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 217 VIETNAM OPTICAL MEASUREMENT MARKET, BY CONFIGURATION, 2021-2030 (USD THOUSAND)

TABLE 218 VIETNAM OPTICAL MEASUREMENT MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 219 VIETNAM OPTICAL MEASUREMENT MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 220 VIETNAM AUTOMOTIVE IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 221 VIETNAM SEMICONDUCTOR & ELECTRONICS IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 222 VIETNAM INDUSTRIAL MANUFACTURING IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 223 VIETNAM AEROSPACE & DEFENSE IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 224 VIETNAM ENERGY & POWER IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 225 VIETNAM MEDICAL IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 226 VIETNAM OPTICAL MEASUREMENT MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 227 VIETNAM OFFLINE IN OPTICAL MEASUREMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 228 VIETNAM ONLINE IN OPTICAL MEASUREMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 229 MYANMAR OPTICAL MEASUREMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 230 MYANMAR OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 231 MYANMAR OPTICAL MEASUREMENT MARKET, BY CONFIGURATION, 2021-2030 (USD THOUSAND)

TABLE 232 MYANMAR OPTICAL MEASUREMENT MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 233 MYANMAR OPTICAL MEASUREMENT MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 234 MYANMAR AUTOMOTIVE IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 235 MYANMAR SEMICONDUCTOR & ELECTRONICS IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 236 MYANMAR INDUSTRIAL MANUFACTURING IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 237 MYANMAR AEROSPACE & DEFENSE IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 238 MYANMAR ENERGY & POWER IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 239 MYANMAR MEDICAL IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 240 MYANMAR OPTICAL MEASUREMENT MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 241 MYANMAR DISTRIBUTION CHANNEL IN OPTICAL MEASUREMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 242 MYANMAR DISTRIBUTION CHANNEL IN OPTICAL MEASUREMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 243 CAMBODIA OPTICAL MEASUREMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 244 CAMBODIA OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 245 CAMBODIA OPTICAL MEASUREMENT MARKET, BY CONFIGURATION, 2021-2030 (USD THOUSAND)

TABLE 246 CAMBODIA OPTICAL MEASUREMENT MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 247 CAMBODIA OPTICAL MEASUREMENT MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 248 CAMBODIA AUTOMOTIVE IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 249 CAMBODIA SEMICONDUCTOR & ELECTRONICS IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 250 CAMBODIA INDUSTRIAL MANUFACTURING IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 251 CAMBODIA AEROSPACE & DEFENSE IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 252 CAMBODIA ENERGY & POWER IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 253 CAMBODIA MEDICAL IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 254 CAMBODIA OPTICAL MEASUREMENT MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 255 CAMBODIA DISTRIBUTION CHANNEL IN OPTICAL MEASUREMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 256 CAMBODIA DISTRIBUTION CHANNEL IN OPTICAL MEASUREMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 257 LAOS OPTICAL MEASUREMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 258 LAOS OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 259 LAOS OPTICAL MEASUREMENT MARKET, BY CONFIGURATION, 2021-2030 (USD THOUSAND)

TABLE 260 LAOS OPTICAL MEASUREMENT MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 261 LAOS OPTICAL MEASUREMENT MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 262 LAOS AUTOMOTIVE IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 263 LAOS SEMICONDUCTOR & ELECTRONICS IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 264 LAOS INDUSTRIAL MANUFACTURING IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 265 LAOS AEROSPACE & DEFENSE IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 266 LAOS ENERGY & POWER IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 267 LAOS MEDICAL IN OPTICAL MEASUREMENT MARKET, BY EQUIPMENT, 2021-2030 (USD THOUSAND)

TABLE 268 LAOS OPTICAL MEASUREMENT MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 269 LAOS DISTRIBUTION CHANNEL IN OPTICAL MEASUREMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 270 LAOS DISTRIBUTION CHANNEL IN OPTICAL MEASUREMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 271 REST OF SEA OPTICAL MEASUREMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

Liste des figures

FIGURE 1 APAC & SEA OPTICAL MEASUREMENT MARKET: SEGMENTATION

FIGURE 2 APAC & SEA OPTICAL MEASUREMENT MARKET: DATA TRIANGULATION

FIGURE 3 APAC & SEA OPTICAL MEASUREMENT MARKET: DROC ANALYSIS

FIGURE 4 APAC & SEA OPTICAL MEASUREMENT MARKET: REGIONAL MARKET ANALYSIS

FIGURE 5 APAC & SEA OPTICAL MEASUREMENT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 APAC & SEA OPTICAL MEASUREMENT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 APAC & SEA OPTICAL MEASUREMENT MARKET: DBMR MARKET POSITION GRID

FIGURE 8 APAC & SEA OPTICAL MEASUREMENT MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 APAC & SEA OPTICAL MEASUREMENT MARKET: MULTIVARIATE MODELLING

FIGURE 10 APAC & SEA OPTICAL MEASUREMENT MARKET: OFFERING TIMELINE CURVE

FIGURE 11 APAC & SEA OPTICAL MEASUREMENT MARKET: APPLICATION COVERAGE GRID

FIGURE 12 APAC & SEA OPTICAL MEASUREMENT MARKET: SEGMENTATION

FIGURE 13 GROWING FOCUS ON QUALITY CONTROL IS EXPECTED TO BE KEY DRIVER FOR APAC & SEA OPTICAL MEASUREMENT MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 14 HARDWARE IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF APAC & SEA OPTICAL MEASUREMENT MARKET FROM 2023 TO 2030

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE APAC & SEA OPTICAL MEASUREMENT SYSTEMS MARKET

FIGURE 16 INCREASING AUTOMATION IN INDIA (IN %)

FIGURE 17 VARIOUS GOVERNMENT INITIATIVES

FIGURE 18 USE OF OPTICAL METROLOGY IN VARIOUS INDUSTRIES

FIGURE 19 STRATEGIC INITIATIVES BY KEY MARKET PLAYERS

FIGURE 20 APAC & SEA OPTICAL MEASUREMENT MARKET: BY OFFERING, 2022

FIGURE 21 APAC & SEA OPTICAL MEASUREMENT MARKET: BY EQUIPMENT, 2022

FIGURE 22 APAC & SEA OPTICAL MEASUREMENT MARKET: BY CONFIGURATION, 2022

FIGURE 23 APAC & SEA OPTICAL MEASUREMENT MARKET: BY APPLICATION, 2022

FIGURE 24 APAC & SEA OPTICAL MEASUREMENT MARKET: BY END USER, 2022

FIGURE 25 APAC & SEA OPTICAL MEASUREMENT MARKET: BY DISTRIBUTION CHANNEL

FIGURE 26 APAC & SEA OPTICAL MEASUREMENTS MARKET: SNAPSHOT (2022)

FIGURE 27 APAC & SEA OPTICAL MEASUREMENTS MARKET: BY COUNTRY (2022)

FIGURE 28 APAC & SEA OPTICAL MEASUREMENTS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 29 APAC & SEA OPTICAL MEASUREMENTS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 30 APAC & SEA OPTICAL MEASUREMENTS MARKET: BY OFFERING (2023-2030)

FIGURE 31 APAC OPTICAL MEASUREMENT MARKET: COMPANY SHARE 2022 (%)

FIGURE 32 SEA OPTICAL MEASUREMENT MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.