Europe Uv Filter Market

Taille du marché en milliards USD

TCAC :

%

| 2024 –2031 | |

| USD 331.00 Million | |

| USD 430.46 Million | |

|

|

|

>Marché européen des filtres UV, par produit (organique, inorganique et hybride), application (soins personnels et cosmétiques, plastique, emballage, revêtements industriels, construction, lentilles optiques, textiles, agriculture, électronique grand public et autres) – Tendances et prévisions de l'industrie jusqu'en 2031.

Analyse du marché des filtres UV

Les filtres UV connaissent une croissance rapide et l'industrie des soins de la peau a répondu à cette prise de conscience accrue en innovant et en améliorant les formulations de filtres UV. Les entreprises investissent dans la recherche et le développement pour créer des produits de protection UV plus efficaces, durables et faciles à utiliser. L'industrie cosmétique évolue rapidement, avec un accent particulier sur le développement de produits offrant des avantages supplémentaires au-delà des soins de base de la peau. Les filtres UV sont désormais intégrés dans une large gamme de produits, notamment les crèmes hydratantes, les fonds de teint et les baumes à lèvres, pour offrir une protection solaire complète. Cette tendance est particulièrement marquée dans les régions à forte exposition aux UV, où les consommateurs sont plus susceptibles de rechercher des produits avec protection UV intégrée, stimulant ainsi la croissance du marché.

Taille du marché des filtres UV

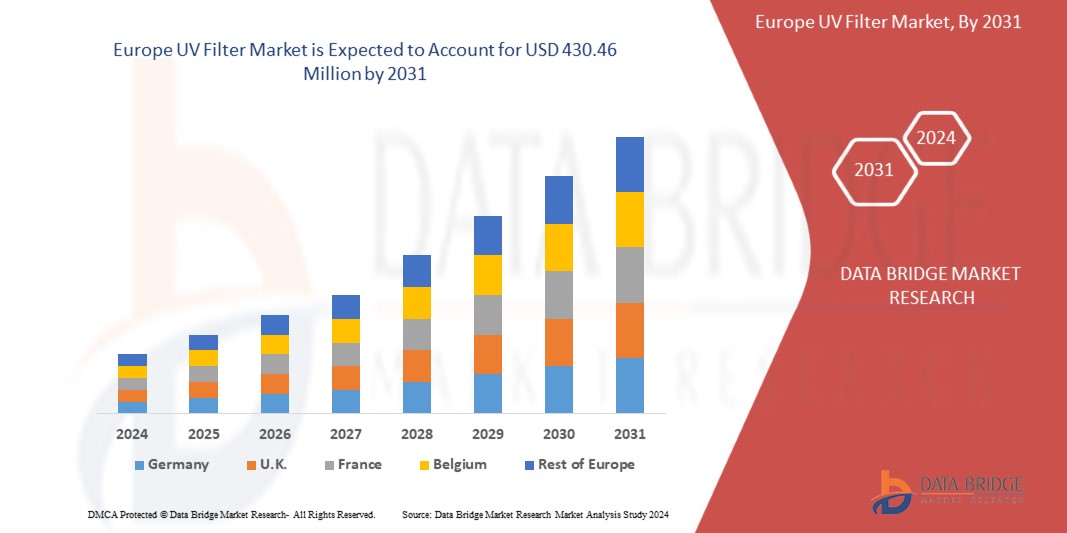

La taille du marché européen des filtres UV a été évaluée à 331,00 millions USD en 2023 et devrait atteindre 430,46 millions USD d'ici 2031, avec un TCAC de 3,39 % au cours de la période de prévision de 2024 à 2031.

Tendances du marché des filtres UV

« Applications croissantes des filtres UV dans les revêtements industriels »

Les filtres UV sont de plus en plus utilisés dans les revêtements industriels pour protéger les surfaces des rayons ultraviolets (UV), qui peuvent provoquer une dégradation, une décoloration et une réduction de la durée de vie des revêtements. Les industries cherchant à améliorer la durabilité et la longévité de leurs produits, la demande de filtres UV a augmenté. Ces filtres sont essentiels pour fournir une barrière protectrice qui empêche les dommages induits par les UV, ce qui en fait un composant essentiel dans la formulation de revêtements haute performance.

L’industrie de la construction contribue également à la demande croissante de filtres UV dans les revêtements. Les revêtements architecturaux utilisés sur les extérieurs des bâtiments sont exposés à des conditions climatiques variables, notamment à un rayonnement UV intense. En incorporant des filtres UV dans ces revêtements, les fabricants peuvent proposer des produits qui résistent à la décoloration et conservent leurs qualités protectrices sur de longues périodes. Cette application de filtres UV devient de plus en plus cruciale, car les propriétaires et les promoteurs immobiliers privilégient les solutions durables et nécessitant peu d’entretien. En outre, le secteur des biens de consommation, notamment l’électronique et les appareils électroménagers, bénéficie des filtres UV dans les revêtements. Les appareils électroniques et électroménagers sont souvent dotés de revêtements qui protègent contre les dommages causés par les UV, garantissant ainsi que leur apparence et leur fonctionnalité restent intactes. À mesure que le marché des biens de consommation durables et esthétiques se développe, le besoin de filtres UV dans ces revêtements augmente. Cette demande est soutenue par les avancées technologiques et les attentes croissantes des consommateurs en matière de produits de haute qualité.

Portée du rapport et segmentation du marché

|

Attributs |

Informations clés sur le marché des filtres UV |

|

Segments couverts |

Par produit : organique, inorganique et hybride Par application : soins personnels et cosmétiques, plastique, emballage, revêtements industriels, construction, lentilles optiques, textiles, agriculture, électronique grand public et autres |

|

Pays couverts |

Allemagne, France, Royaume-Uni, Italie, Russie, Espagne, Pays-Bas, Belgique, Suède, Suisse, Pologne, Norvège, Danemark, Turquie, Finlande et reste de l'Europe. |

|

Principaux acteurs du marché |

BASF SE (Allemagne), DSM (Pays-Bas), Ashland (États-Unis), MFCI CO., LTD (Chine), SUNJIN BEAUTY SCIENCE (Corée du Sud), EverCare (États-Unis), Sarex (Inde), UNIPROMA Hot Products (Royaume-Uni), Omega Optical, LLC. (États-Unis) et IRA Istituto Ricerche Applicate SpA (Italie) |

|

Opportunités de marché |

|

|

Ensembles d'informations sur les données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse des importations et des exportations, un aperçu de la capacité de production, une analyse de la consommation de production, une analyse des tendances des prix, un scénario de changement climatique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire. |

Définition du marché des filtres UV

Les filtres UV sont des composés utilisés pour bloquer ou absorber les rayons ultraviolets (UV). On les retrouve couramment dans les crèmes solaires, les cosmétiques et divers produits de soin de la peau. Ces filtres protègent la peau des rayons UV nocifs, qui peuvent provoquer des coups de soleil, un vieillissement prématuré et un cancer de la peau. Les filtres UV sont classés en deux types principaux : les absorbeurs chimiques et les bloqueurs physiques. Les absorbeurs chimiques absorbent les rayons UV et les convertissent en chaleur inoffensive. Les bloqueurs physiques, comme l'oxyde de zinc et le dioxyde de titane, réfléchissent et dispersent les rayons UV loin de la peau. Leur utilisation est essentielle pour maintenir la santé de la peau et prévenir les dommages induits par les UV.

Dynamique du marché des filtres UV

Conducteurs

- Sensibilisation accrue à la protection de la peau et aux affections cutanées

The skincare industry has responded to this heightened awareness by innovating and improving UV filter formulations. Companies are investing in research and development to create more effective, long-lasting, and user-friendly UV protection products. These advancements are crucial as consumers look for products that not only provide high SPF protection but also cater to different skin types and preferences, such as water-resistant and non-greasy formulations. This innovation is driving the market forward, as more consumers integrate UV protection into their daily skincare routines. Moreover, regulatory bodies worldwide are implementing stricter guidelines for UV protection in skincare products, ensuring that products on the market are both safe and effective. These regulations are compelling manufacturers to enhance their UV filter offerings, thereby boosting market growth. The increasing scrutiny and demand for transparency in product formulations are pushing companies to use high-quality, compliant ingredients, which further fuels the expansion of the UV filter market.

For instance,

- In July 2024, in according to an article published by MJH Life Sciences, World Skin Health Day was inaugurated by the International League of Dermatological Societies (ILDS) and the International Society of Dermatology (ISD). The event aimed to promote "Skin Health for All" with Europe activities. CeraVe, the first official corporate partner, supported initiatives worldwide to enhance skin health education and access. Events included free consultations in Malta, a skin cancer program in Tanzania, and educational sessions in Canada and Australia. The day marked a significant step towards addressing barriers to dermatological care Europe.

Growing Demand for Personal Care and Cosmetic Products

The cosmetic industry is rapidly evolving, with a strong focus on developing products that offer additional benefits beyond basic skincare. UV filters are now being incorporated into a wide range of products, including moisturizers, foundations, and lip balms, to provide comprehensive sun protection. This trend is particularly prominent in regions with high UV exposure, where consumers are more likely to seek out products with built-in UV protection. Advancements in UV filter technology are also playing a crucial role in market growth. Manufacturers are investing in research and development to create more efficient and stable UV filters that provide broad-spectrum protection. These innovations not only enhance the efficacy of personal care and cosmetic products but also address consumer concerns about potential side effects and environmental impact.

For instance,

- In July 2024, according to article published by Cision US Inc., A new study by Veylinx revealed consumer preferences for sunscreen, highlighting increased demand for products with added benefits like anti-aging (+49%), hydration (+33%), and vitamin C (+23%). Consumers showed a willingness to pay more for these enhanced features. The study also noted rising "sunxiety," with 38% feeling uneasy in the sun and a significant percentage burning easily. Usage trends indicated 30% applied sunscreen daily in summer, while 65% preferred SPF greater than 40.

Opportunities

- Rising Demand for Natural and Organic UV Filter Products

Consumers are increasingly seeking products made with natural ingredients due to growing awareness about the potential health and environmental impacts of synthetic chemicals. This shift in consumer preference is driven by a desire for safer, eco-friendly, and sustainable products. Natural and organic UV filters often use plant-based or mineral ingredients like zinc oxide and titanium dioxide, which are perceived as safer and more environmentally friendly.

For instance,

- In July 2024, according to an article published by UL LLC, consumers are placing greater emphasis on transparency and clean beauty in their skincare products. In response, sunscreen brands are removing problematic ingredients such as oxybenzone and octinoxate, which have been associated with environmental and health issues. Clean formulations focus on natural and organic ingredients that are safe for both skin and the environment, in line with the clean beauty trend.

- Advancements And Innovations In Formulation Technology

Improved formulation techniques enhance the effectiveness, stability, and sensory attributes of UV filters, making them more attractive to both manufacturers and consumers. New technologies enable the development of UV filters that offer better protection against a broader spectrum of UV radiation. Innovations such as encapsulation techniques help improve the stability and longevity of UV filters in various products, ensuring they remain effective throughout their intended use.

For instance,

- In July 2024, according to a blog published by Let's Make Beauty by Presperse, encapsulation technology offers excellent flexibility, enabling its use in various cosmetic products to improve their performance, stability, and user experience. Encapsulating UV filters can boost a product's photo stability and comfort, minimize potential skin irritation, and enhance protection against harmful sun exposure

Restraints/Challenges

- Potential Health and Environmental Concerns

Certain UV filters, such as oxybenzone and octocrylene, have raised concerns due to their potential health impacts. Research has indicated that these compounds may have endocrine-disrupting effects, which can interfere with hormonal systems in humans. This has led to increased scrutiny and regulation, as consumers become more aware of the potential risks associated with these chemicals. Consequently, the demand for UV filters is impacted by the growing preference for products with safer, more natural ingredients.

Environmental issues also contribute to the restraint on the UV filter market. Many UV filters have been found to have harmful effects on marine ecosystems. For example, some chemicals can contribute to coral reef bleaching and disrupt aquatic life, leading to adverse environmental impacts. This has led to stricter regulations and bans on certain UV filters in various regions, particularly in places with sensitive marine environments. These ecological concerns result in increased regulatory compliance costs and limit the market's ability to use certain UV filters, impacting overall market growth.

For instances

- In September 2021, According to an article published by Environmental Working Group, the FDA proposed updating sunscreen regulations, determining only zinc oxide and titanium dioxide as “generally recognized as safe and effective” (GRASE). Other ingredients, including oxybenzone and octinoxate, faced scrutiny for safety and were not classified as GRASE due to insufficient data. Concerns arose over systemic absorption, hormone disruption, and potential health risks. European standards differed, proposing stricter limits for some non-mineral UV filters. The FDA requested more safety data for these ingredients while allowing their continued use in the U.S. market.

High Cost of High-Quality UV Filters

For industrial applications, such as in automotive and architectural coatings, the cost of high-quality UV filters can be a significant barrier. These filters are crucial for enhancing the durability and performance of coatings by preventing UV-induced degradation. However, the high cost can lead to increased production costs for manufacturers, which might deter them from using premium filters. As a result, the market may see slower growth in sectors where cost constraints are a critical factor. Additionally, the high cost of advanced UV filters can restrict innovation and the development of new products within the market. Manufacturers might be hesitant to invest in research and development of novel UV filter technologies if the high costs make it challenging to achieve a return on investment. This reluctance can slow down the introduction of new and improved UV filters, further stalling market progress.

Climate Change Scenario

The Europe UV filter market faces significant environmental concerns, particularly regarding the impact of certain UV filters on marine ecosystems. Ingredients such as oxybenzone and octocrylene have been linked to coral reef degradation, harming coral health and disrupting aquatic life due to their toxic effects. In response to environmental and health concerns, the Europe UV filter market is undergoing significant changes. The industry is shifting towards safer, eco-friendly alternatives to traditional UV filters like oxybenzone and octocrylene, which have been linked to coral reef damage and other environmental issues. Governments play a pivotal role in shaping the Europe UV filter market through regulation, policy-making, and enforcement. They establish regulations and safety standards for UV filters to protect consumers, setting limits on concentrations and defining efficacy and safety profiles, as seen with agencies like the U.S. FDA and the European Commission. Analysts recommend several strategic approaches for the Europe UV filter market to address current challenges and leverage emerging opportunities. Firstly, shifting towards eco-friendly alternatives is crucial due to increasing environmental concerns about traditional UV filters like oxybenzone and octocrylene, which have been linked to coral reef damage. Adopting biodegradable and reef-safe ingredients can help companies align with regulatory trends and meet consumer demand for sustainable products

Regulatory Framework content

Regulations play a crucial role in the UV Filter market, ensuring product quality, safety, and environmental compliance throughout the manufacturing process, For UV systems used in water treatment, adherence to Environmental Protection Agency (EPA) guidelines ensures that the UV systems effectively inactivate pathogens and meet safety standards. Regulations on waste disposal and recycling vary by region, requiring manufacturers to implement proper waste management practices to minimize environmental impact.

Below is a detailed coverage of regulations and standards affecting the Europe UV Filter market:

Europe

Regulation (EC) No 1223/2009

- UV filters used in cosmetics must be approved and listed in Annex VI of Regulation (EC) No 1223/2009. This annex specifies which UV filters can be used, their maximum allowable concentrations, and any specific conditions of use.

- Before a UV filter can be included in Annex VI, it must undergo rigorous safety evaluations. This includes toxicological testing to ensure it does not pose a risk to human health when used as intended.

- Products containing UV filters must demonstrate their effectiveness in protecting against UV radiation. This typically involves standardized testing methods for SPF (Sun Protection Factor) and UVA protection.

- Sunscreens and other products containing UV filters must include appropriate labeling, which includes:

SPF Value: Indicates the level of UVB protection.

UVA Protection: Must include a UVA logo or statement if the product offers UVA protection.

Directions for Use: Instructions on how to apply the product effectively.

Warnings: Any specific warnings related to sun exposure and use of the product.

United States

21 CFR Part 352 :

- It includes a list of UV filters that are generally recognized as safe and effective for use in sunscreens. These filters are categorized into two types:

Chemical UV Filters: These include ingredients like:

- Avobenzone (Butyl Methoxydibenzoylmethane): Provides broad-spectrum UVA protection.

- Octocrylene: Used to stabilize other UV filters and provides UVB protection.

- Octinoxate (Ethylhexyl Methoxycinnamate): Absorbs UVB rays.

- Oxybenzone: Provides UVB and some UVA protection.

- Homosalate: Absorbs UVB rays.

Physical (Mineral) UV Filters: These include ingredients like:

- Titanium Dioxide: Provides broad-spectrum protection, including UVA and UVB.

- Zinc Oxide: Also provides broad-spectrum protection.

The UV energy required to produce an MED on protected skin divided by the UV energy required to produce an MED on unprotected skin, which may also be defined by the following ratio: SPF value = MED (protected skin (PS))/MED (unprotected skin (US)), where MED (PS) is the minimal erythema dose for protected skin after application of 2 milligrams per square centimeter of the final formulation of the sunscreen product, and MED (US) is the minimal erythema dose for unprotected skin, e., skin to which no sunscreen product has been applied. In effect, the SPF value is the reciprocal of the effective transmission of the product viewed as a UV radiation filter.

Production Cost Scenario

As per our analysis the average production of UV Filters is 19,011.47 Tons in the year 2023, and it is expected to reach 22,384.32 Tons in 2031. The average consumption is 17,469.64 Tons in the year 2023 and it is expected to reach 21,267.34 Tons in 2031.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Impact attendu du ralentissement économique sur les prix et la disponibilité des produits

Lorsque l'activité économique ralentit, les industries commencent à souffrir. Les effets prévus du ralentissement économique sur les prix et l'accessibilité des produits sont pris en compte dans les rapports d'analyse du marché et les services de renseignements fournis par DBMR. Grâce à cela, nos clients peuvent généralement garder une longueur d'avance sur leurs concurrents, projeter leurs ventes et leurs revenus et estimer leurs dépenses de profits et pertes.

Portée du marché européen des filtres UV

Le marché est segmenté en fonction du produit et de l'application. La croissance parmi ces segments vous aidera à analyser les segments de croissance faibles dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Produit

- Organique

- Avobenzone

- Octinoxate

- Octocrylène

- Oxybenzone

- Homosalate

- Octisalate

- Ensulizole

- Bis-éthylhexyloxyphénol méthoxyphényl triazine (bémotrizinol)

- Méthylène bis-benzotriazolyl tétraméthylbutylphénol (bisoctrizole)

- Drométrizole Trisiloxane

- Méradimate (anthranilate de menthyle)

- Octyltriazone (éthylhexyl triazone)

- Polysilicone-15

- Acide aminobenzoïque

- Octyl diméthyl Paba

- Autres

- Inorganique

- Dioxyde de titane (TIO2)

- Oxyde de zinc (ZNO)

- Oxyde de fer (FE2O3)

- Oxyde de silicone (SIO2)

- Oxyde de tantale

- Autres

- Hybride

Application

- Soins personnels et cosmétiques

- Crème solaire

- Crème BB et CC

- Fondation

- Crème pour le visage

- Lotion

- Baume à lèvres

- Rouge à lèvres

- Shampoings

- Conditionneur

- Autres

- Plastique, Emballage

- Emballage alimentaire

- Emballage pharmaceutique

- Revêtements industriels

- Revêtements protecteurs

- Machinerie

- Pipelines

- Equipement industriel

- Autres

- Revêtements automobiles

- Couche transparente

- Peintures

- Phares

- Fenêtres

- Pare-brise

- Pare-chocs

- Rétroviseurs latéraux

- Garniture

- Autres

- Construction

- Lentilles optiques

- Lunettes de soleil

- Lunettes

- Lentilles de contact

- Textiles

- Vêtements de sport

- Maillots de bain

- Autres

- Agriculture

- Films de serre

- Toiles d'ombrage

- Couvertures de cultures

- Autres

- Électronique grand public

- Smartphones

- Moniteurs

- Téléviseurs

- Autres

- Autres

- Revêtements protecteurs

Analyse régionale du marché européen des filtres UV

Le marché est segmenté en fonction du produit et de l’application .

Les pays couverts sur le marché sont l'Allemagne, la France, le Royaume-Uni, l'Italie, la Russie, l'Espagne, les Pays-Bas, la Belgique, la Suède, la Suisse, la Pologne, la Norvège, le Danemark, la Turquie, la Finlande et le reste de l'Europe.

L’Allemagne devrait dominer le marché en raison de sa population importante et croissante, de sa sensibilisation croissante à la protection de la peau et de l’augmentation des revenus disponibles.

La France devrait connaître la croissance la plus rapide en raison de l'essor de l'industrie régionale des cosmétiques et des soins personnels, qui stimule également la demande de filtres UV dans les produits de protection solaire et de soins de la peau.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques et l'analyse des cinq forces du porteur, les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques européennes et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et des routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Part de marché des filtres UV en Europe

Le paysage concurrentiel du marché fournit des détails par concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Europe, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises par rapport au marché.

Les leaders du marché des filtres UV opérant sur le marché sont :

- BASF SE (Allemagne)

- DSM (Pays-Bas)

- Ashland (États-Unis)

- MFCI CO., LTD (Chine)

- SUNJIN BEAUTY SCIENCE (Corée du Sud)

- EverCare (États-Unis)

- Sarex (Inde)

- Produits phares UNIPROMA (Royaume-Uni)

- Omega Optical, LLC. (États-Unis)

- IRA Istituto Ricerche Applicate SpA (Italie)

Dernières évolutions sur le marché des filtres UV

- En septembre 2023, BASF a encore élargi son empreinte de production de sa gamme de filtres UV modernes dans la région Asie-Pacifique. Uvinul A Plus est l'un des rares filtres UVA photostables disponibles sur le marché aujourd'hui qui filtre de manière fiable les rayons UVA nocifs du soleil et offre une protection contre les radicaux libres et les dommages cutanés

- En mars 2023, DSM élargit la gamme PARSOL avec le lancement de PARSOL DHHB. PARSOL DHHB offre aux formulateurs la flexibilité nécessaire pour créer des produits multifonctionnels avec une protection UVA adéquate et des formulations de haute classe écologique (conformément au DSM Sunscreen Optimizer™ 2.0). Son excellente solubilité et sa large compatibilité de formulation font que PARSOL DHHB se démarque des autres et convient à une gamme complète d'applications, notamment les écrans solaires, les soins du visage et les cosmétiques de couleur

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET APPLICATION COVERAGE GRID

2.1 DBMR VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 ENVIRONMENTAL FACTORS

4.1.6 LEGAL FACTORS

4.2 PORTER’S FIVE FORCES

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 BARGAINING POWER OF SUPPLIERS

4.2.3 BARGAINING POWER OF BUYERS

4.2.4 THREAT OF SUBSTITUTES

4.2.5 INDUSTRIAL RIVALRY

4.3 CLIMATE CHANGE SCENARIO

4.3.1 ENVIRONMENTAL CONCERNS

4.3.2 INDUSTRY RESPONSE

4.3.3 GOVERNMENT'S ROLE

4.3.4 ANALYST'S RECOMMENDATIONS

4.4 DETAILED INFORMATION FOR UV FILTERS MANUFACTURERS

4.5 EUROPE VS CHINA UV FILTER MARKET

4.5.1 OVERVIEW

4.5.2 EUROPE UV FILTER MARKET OVERVIEW

4.5.3 CHINA UV FILTER MARKET OVERVIEW

4.5.4 EUROPE VS CHINA UV FILTER MARKET

4.6 OVERVIEW ON HISTORICAL, PRESENT AND FUTURE OUTLOOK OF UV FILTER AT EUROPE LEVEL

4.6.1 HISTORICAL OVERVIEW

4.6.2 PRESENT SCENARIO

4.6.3 FUTURE OUTLOOK

4.7 PRODUCTION COST SCENARIO BY MANUFACTURERS

4.7.1 RAW MATERIAL COSTS

4.7.2 MANUFACTURING COSTS

4.7.3 REGULATORY COMPLIANCE

4.7.4 DISTRIBUTION AND LOGISTICS

4.7.5 RESEARCH AND DEVELOPMENT

4.7.6 ENVIRONMENTAL AND SUSTAINABILITY INITIATIVES

4.8 RAW MATERIAL COVERAGE

4.8.1 TITANIUM DIOXIDE(TIO2)

4.8.2 ZINC OXIDE

4.8.3 AVOBENZONE

4.8.4 OCTINOXATE

4.8.5 OXYBENZONE

4.8.6 HOMOSALATE

4.8.7 OCTOCRYLENE

4.8.8 OCTISALATE

4.8.9 RAW MATERIAL SUPPLY CHAIN CONSIDERATIONS

4.9 SUPPLY CHAIN ANALYSIS

4.9.1 OVERVIEW

4.9.2 LOGISTIC COST SCENARIO

4.9.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.1 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.10.1 BROAD-SPECTRUM PROTECTION:

4.10.2 ENHANCED STABILITY AND EFFICACY:

4.10.3 MINERAL AND HYBRID FILTERS:

4.10.4 SKIN COMPATIBILITY:

4.10.5 SUSTAINABILITY:

4.11 VENDOR SELECTION CRITERIA

4.11.1 QUALITY AND CONSISTENCY OF SUPPLY

4.11.2 RELIABILITY AND TIMELINESS

4.11.3 COST COMPETITIVENESS

4.11.4 TECHNICAL CAPABILITY AND INNOVATION

4.11.5 REGULATORY COMPLIANCE AND SUSTAINABILITY

4.11.6 FINANCIAL STABILITY

4.11.7 CUSTOMER SERVICE AND SUPPORT

4.12 PRICING ANALYSIS

4.12.1 RAW MATERIAL COSTS

4.12.2 MANUFACTURING PROCESSES

4.12.3 TECHNOLOGICAL ADVANCEMENTS

4.12.4 MARKET DEMAND

4.12.5 WHOLESALE MARGINS

4.12.5.1 Raw Material Costs

4.12.5.2 Production Costs

4.12.5.3 Regulatory Compliance

4.12.5.4 Market Demand

4.12.5.5 Competition and Market Saturation

4.13 PRODUCTION CONSUMPTION ANALYSIS

4.14 TOP 10 COUNTRIES DATA

4.15 REGULATION COVERAGE

4.15.1 QUALITY STANDARDS AND CERTIFICATION

4.15.2 ENVIRONMENTAL REGULATIONS

4.15.3 OCCUPATIONAL HEALTH AND SAFETY

4.15.4 EXPORT CONTROLS AND INTERNATIONAL TRADE

4.15.5 INTELLECTUAL PROPERTY RIGHTS (IPR)

4.15.6 COMPLIANCE CHALLENGES AND CONSIDERATIONS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING AWARENESS OF SKIN PROTECTION AND SKIN CONDITIONS

5.1.2 GROWING DEMAND FOR PERSONAL CARE AND COSMETIC PRODUCTS

5.1.3 INCREASING APPLICATION OF UV FILTERS IN POLYMER STABILIZATION AND DURABILITY

5.1.4 RISING APPLICATIONS OF UV FILTERS IN INDUSTRIAL COATINGS

5.2 RESTRAINTS

5.2.1 POTENTIAL HEALTH AND ENVIRONMENTAL CONCERNS

5.2.2 HIGH COST OF HIGH-QUALITY UV FILTERS

5.3 OPPORTUNITIES

5.3.1 RISING DEMAND FOR NATURAL AND ORGANIC UV FILTER PRODUCTS

5.3.2 ADVANCEMENTS AND INNOVATIONS IN FORMULATION TECHNOLOGY

5.3.3 STRINGENT REGULATIONS AND GUIDELINES FOR UV PROTECTION

5.4 CHALLENGES

5.4.1 HARMFUL ENVIRONMENTAL EFFECTS OF UV FILTERS IN VARIOUS PRODUCTS

5.4.2 COMPLEX REGULATORY LANDSCAPE AND COMPLIANCE WITH DIFFERENT STANDARDS

6 EUROPE UV FILTER MARKET, BY PRODUCT

6.1 OVERVIEW

6.2 ORGANIC

6.3 INORGANIC

6.4 HYBRID

7 EUROPE UV FILTER MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 PERSONAL CARE AND COSMETICS

7.3 PLASTIC

7.3.1 PACKAGING

7.3.2 INDUSTRIAL COATINGS

7.3.3 CONSTRUCTION

7.4 OPTICAL LENSES

7.4.1 TEXTILES

7.5 AGRICULTURE

7.6 CONSUMER ELECTRONICS

7.7 OTHERS

8 EUROPE UV FILTER MARKET, BY REGION

8.1 EUROPE

8.1.1 GERMANY

8.1.2 FRANCE

8.1.3 U.K.

8.1.4 ITALY

8.1.5 RUSSIA

8.1.6 SPAIN

8.1.7 NETHERLANDS

8.1.8 BELGIUM

8.1.9 SWEDEN

8.1.10 SWITZERLAND

8.1.11 POLAND

8.1.12 NORWAY

8.1.13 DENMARK

8.1.14 TURKEY

8.1.15 FINLAND

8.1.16 REST OF EUROPE

9 EUROPE UV FILTER MARKET: COMPANY LANDSCAPE

9.1 COMPANY SHARE ANALYSIS: EUROPE

10 SWOT ANALYSIS

11 COMPANY PROFILE

11.1 BASF SE

11.1.1 COMPANY SNAPSHOT

11.1.2 REVENUE ANALYSIS

11.1.3 COMPANY SHARE ANALYSIS

11.1.4 PRODUCT PORTFOLIO

11.1.5 RECENT DEVELOPMENTS

11.2 DSM

11.2.1 COMPANY SNAPSHOT

11.2.2 REVENUE ANALYSIS

11.2.3 COMPANY SHARE ANALYSIS

11.2.4 PRODUCT PORTFOLIO

11.2.5 RECENT DEVELOPMENTS

11.3 ASHLAND

11.3.1 COMPANY SNAPSHOT

11.3.2 REVENUE ANALYSIS

11.3.3 COMPANY SHARE ANALYSIS

11.3.4 PRODUCT PORTFOLIO

11.3.5 RECENT UPDATES

11.4 MFCI CO.,LTD

11.4.1 COMPANY SNAPSHOT

11.4.2 COMPANY SHARE ANALYSIS

11.4.3 PRODUCT PORTFOLIO

11.4.4 1.4.3 RECENT DEVELOPMENT

11.5 SUNJIN BEAUTY SCIENCE

11.5.1 COMPANY SNAPSHOT

11.5.2 REVENUE ANALYSIS

11.5.3 COMPANY SHARE ANALYSIS

11.5.4 PRODUCT PORTFOLIO

11.5.5 RECENT DEVELOPMENT

11.6 EVERCARE

11.6.1 COMPANY SNAPSHOT

11.6.2 PRODUCT PORTFOLIO

11.6.3 RECENT DEVELOPMENT

11.7 IRA ISTITUTO RICERCHE APPLICATE

11.7.1 COMPANY SNAPSHOT

11.7.2 PRODUCT PORTFOLIO

11.7.3 RECENT DEVELOPMENT

11.8 OMEGA OPTICAL LLC.

11.8.1 COMPANY SNAPSHOT

11.8.2 PRODUCT PORTFOLIO

11.8.3 RECENT UPDATES

11.9 SAREX

11.9.1 COMPANY SNAPSHOT

11.9.2 PRODUCT PORTFOLIO

11.9.3 RECENT DEVELOPMENT

11.1 UNIPROMA HOT PRODUCTS

11.10.1 COMPANY SNAPSHOT

11.10.2 PRODUCT PORTFOLIO

11.10.3 RECENT DEVELOPMENT

12 QUESTIONNAIRE

13 RELATED REPORTS

Liste des tableaux

TABLE 1 LISTS OF TOP 10 MANUFACTURERS, AND THEIR ESTIMATED PRODUCTION COST AND AVERAGE SELLING PRICE ARE LISTED BELOW:

TABLE 2 EUROPE VS CHINA UV FILTER MARKET DEMAND ANALYSIS (USD THOUSAND)

TABLE 3 EUROPE UV FILTER MARKET, WHOLESALE MARGINS

TABLE 4 TOP 10 COUNTRIES DATA, (USD THOUSAND, TONS AND AVERAGE SELLIN GPRICE (USD/KG): EUROPE UV FILTER MARKET

TABLE 5 REGULATIONS ACROSS VARIOUS REGIONS AND COUNTRIES

TABLE 6 EUROPE UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 7 EUROPE UV FILTER MARKET, BY PRODUCT, 2022-2031 (TONS)

TABLE 8 EUROPE UV FILTER MARKET, AVERAGE SELLING PRICE, BY PRODUCT, 2022-2031 (USD/KG)

TABLE 9 EUROPE ORGANIC IN UV FILTER MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 10 EUROPE ORGANIC IN UV FILTER MARKET, BY REGION, 2022-2031 (TONS)

TABLE 11 EUROPE ORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 12 EUROPE INORGANIC IN UV FILTER MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 13 EUROPE INORGANIC IN UV FILTER MARKET, BY REGION, 2022-2031 (TONS)

TABLE 14 EUROPE INORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 15 EUROPE HYBRID IN UV FILTER MARKET, BY REGION 2022-2031 (USD THOUSAND)

TABLE 16 EUROPE HYBRID IN UV FILTER MARKET, BY REGION 2022-2031 (TONS)

TABLE 17 EUROPE UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 18 EUROPE PERSONAL CARE AND COSMETICS IN UV FILTER MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 19 EUROPE PERSONAL CARE AND COSMETICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 20 EUROPE PLASTIC IN UV FILTER MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 21 EUROPE PLASTIC IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 22 EUROPE PACKAGING IN UV FILTER MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 23 EUROPE PACKAGING IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 24 EUROPE INDUSTRIAL COATINGS IN UV FILTER MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 25 EUROPE INDUSTRIAL COATINGS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 26 EUROPE PROTECTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 27 EUROPE AUTOMOTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 28 EUROPE CONSTRUCTION IN UV FILTER MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 29 EUROPE CONSTRUCTION IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 30 EUROPE OPTICAL LENSES IN UV FILTER MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 31 EUROPE OPTICAL LENSES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 32 EUROPE TEXTILES IN UV FILTER MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 33 EUROPE TEXTILES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 34 EUROPE AGRICULTURE IN UV FILTER MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 35 EUROPE AGRICULTURE IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 36 EUROPE CONSUMER ELECTRONICS IN UV FILTER MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 37 EUROPE CONSUMER ELECTRONICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 38 EUROPE OTHERS IN UV FILTER MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 39 EUROPE UV FILTER MARKET, BY COUNTRY, 2022-2031 (USD THOUSAND)

TABLE 40 EUROPE UV FILTER MARKET, BY COUNTRY, 2022-2031 (TONS)

TABLE 41 EUROPE UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 42 EUROPE UV FILTER MARKET, BY PRODUCT, 2022-2031 (TONS)

TABLE 43 EUROPE ORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 44 EUROPE INORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 45 EUROPE UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 46 EUROPE PERSONAL CARE AND COSMETICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 47 EUROPE PLASTIC IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 48 EUROPE PACKAGING IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 49 EUROPE INDUSTRIAL COATINGS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 50 EUROPE PROTECTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 51 EUROPE AUTOMOTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 52 EUROPE CONSTRUCTION IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 53 EUROPE OPTICAL LENSES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 54 EUROPE TEXTILES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 55 EUROPE AGRICULTURE IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 56 EUROPE CONSUMER ELECTRONICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 57 GERMANY UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 58 GERMANY UV FILTER MARKET, BY PRODUCT, 2022-2031 (TONS)

TABLE 59 GERMANY ORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 60 GERMANY INORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 61 GERMANY UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 62 GERMANY PERSONAL CARE AND COSMETICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 63 GERMANY PLASTIC IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 64 GERMANY PACKAGING IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 65 GERMANY INDUSTRIAL COATINGS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 66 GERMANY PROTECTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 67 GERMANY AUTOMOTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 68 GERMANY CONSTRUCTION IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 69 GERMANY OPTICAL LENSES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 70 GERMANY TEXTILES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 71 GERMANY AGRICULTURE IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 72 GERMANY CONSUMER ELECTRONICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 73 FRANCE UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 74 FRANCE UV FILTER MARKET, BY PRODUCT, 2022-2031 (TONS)

TABLE 75 FRANCE ORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 76 FRANCE INORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 77 FRANCE UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 78 FRANCE PERSONAL CARE AND COSMETICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 79 FRANCE PLASTIC IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 80 FRANCE PACKAGING IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 81 FRANCE INDUSTRIAL COATINGS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 82 FRANCE PROTECTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 83 FRANCE AUTOMOTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 84 FRANCE CONSTRUCTION IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 85 FRANCE OPTICAL LENSES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 86 FRANCE TEXTILES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 87 FRANCE AGRICULTURE IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 88 FRANCE CONSUMER ELECTRONICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 89 U.K. UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 90 U.K. UV FILTER MARKET, BY PRODUCT, 2022-2031 (TONS)

TABLE 91 U.K. ORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 92 U.K. INORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 93 U.K. UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 94 U.K. PERSONAL CARE AND COSMETICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 95 U.K. PLASTIC IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 96 U.K. PACKAGING IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 97 U.K. INDUSTRIAL COATINGS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 98 U.K. PROTECTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 99 U.K. AUTOMOTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 100 U.K. CONSTRUCTION IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 101 U.K. OPTICAL LENSES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 102 U.K. TEXTILES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 103 U.K. AGRICULTURE IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 104 U.K. CONSUMER ELECTRONICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 105 ITALY UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 106 ITALY UV FILTER MARKET, BY PRODUCT, 2022-2031 (TONS)

TABLE 107 ITALY ORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 108 ITALY INORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 109 ITALY UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 110 ITALY PERSONAL CARE AND COSMETICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 111 ITALY PLASTIC IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 112 ITALY PACKAGING IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 113 ITALY INDUSTRIAL COATINGS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 114 ITALY PROTECTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 115 ITALY AUTOMOTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 116 ITALY CONSTRUCTION IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 117 ITALY OPTICAL LENSES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 118 ITALY TEXTILES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 119 ITALY AGRICULTURE IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 120 ITALY CONSUMER ELECTRONICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 121 RUSSIA UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 122 RUSSIA UV FILTER MARKET, BY PRODUCT, 2022-2031 (TONS)

TABLE 123 RUSSIA ORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 124 RUSSIA INORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 125 RUSSIA UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 126 RUSSIA PERSONAL CARE AND COSMETICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 127 RUSSIA PLASTIC IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 128 RUSSIA PACKAGING IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 129 RUSSIA INDUSTRIAL COATINGS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 130 RUSSIA PROTECTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 131 RUSSIA AUTOMOTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 132 RUSSIA CONSTRUCTION IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 133 RUSSIA OPTICAL LENSES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 134 RUSSIA TEXTILES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 135 RUSSIA AGRICULTURE IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 136 RUSSIA CONSUMER ELECTRONICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 137 SPAIN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 138 SPAIN UV FILTER MARKET, BY PRODUCT, 2022-2031 (TONS)

TABLE 139 SPAIN ORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 140 SPAIN INORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 141 SPAIN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 142 SPAIN PERSONAL CARE AND COSMETICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 143 SPAIN PLASTIC IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 144 SPAIN PACKAGING IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 145 SPAIN INDUSTRIAL COATINGS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 146 SPAIN PROTECTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 147 SPAIN AUTOMOTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 148 SPAIN CONSTRUCTION IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 149 SPAIN OPTICAL LENSES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 150 SPAIN TEXTILES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 151 SPAIN AGRICULTURE IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 152 SPAIN CONSUMER ELECTRONICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 153 NETHERLANDS UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 154 NETHERLANDS UV FILTER MARKET, BY PRODUCT, 2022-2031 (TONS)

TABLE 155 NETHERLANDS ORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 156 NETHERLANDS INORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 157 NETHERLANDS UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 158 NETHERLANDS PERSONAL CARE AND COSMETICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 159 NETHERLANDS PLASTIC IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 160 NETHERLANDS PACKAGING IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 161 NETHERLANDS INDUSTRIAL COATINGS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 162 NETHERLANDS PROTECTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 163 NETHERLANDS AUTOMOTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 164 NETHERLANDS CONSTRUCTION IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 165 NETHERLANDS OPTICAL LENSES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 166 NETHERLANDS TEXTILES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 167 NETHERLANDS AGRICULTURE IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 168 NETHERLANDS CONSUMER ELECTRONICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 169 BELGIUM UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 170 BELGIUM UV FILTER MARKET, BY PRODUCT, 2022-2031 (TONS)

TABLE 171 BELGIUM ORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 172 BELGIUM INORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 173 BELGIUM UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 174 BELGIUM PERSONAL CARE AND COSMETICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 175 BELGIUM PLASTIC IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 176 BELGIUM PACKAGING IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 177 BELGIUM INDUSTRIAL COATINGS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 178 BELGIUM PROTECTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 179 BELGIUM AUTOMOTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 180 BELGIUM CONSTRUCTION IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 181 BELGIUM OPTICAL LENSES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 182 BELGIUM TEXTILES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 183 BELGIUM AGRICULTURE IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 184 BELGIUM CONSUMER ELECTRONICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 185 SWEDEN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 186 SWEDEN UV FILTER MARKET, BY PRODUCT, 2022-2031 (TONS)

TABLE 187 SWEDEN ORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 188 SWEDEN INORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 189 SWEDEN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 190 SWEDEN PERSONAL CARE AND COSMETICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 191 SWEDEN PLASTIC IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 192 SWEDEN PACKAGING IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 193 SWEDEN INDUSTRIAL COATINGS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 194 SWEDEN PROTECTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 195 SWEDEN AUTOMOTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 196 SWEDEN CONSTRUCTION IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 197 SWEDEN OPTICAL LENSES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 198 SWEDEN TEXTILES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 199 SWEDEN AGRICULTURE IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 200 SWEDEN CONSUMER ELECTRONICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 201 SWITZERLAND UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 202 SWITZERLAND UV FILTER MARKET, BY PRODUCT, 2022-2031 (TONS)

TABLE 203 SWITZERLAND ORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 204 SWITZERLAND INORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 205 SWITZERLAND UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 206 SWITZERLAND PERSONAL CARE AND COSMETICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 207 SWITZERLAND PLASTIC IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 208 SWITZERLAND PACKAGING IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 209 SWITZERLAND INDUSTRIAL COATINGS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 210 SWITZERLAND PROTECTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 211 SWITZERLAND AUTOMOTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 212 SWITZERLAND CONSTRUCTION IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 213 SWITZERLAND OPTICAL LENSES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 214 SWITZERLAND TEXTILES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 215 SWITZERLAND AGRICULTURE IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 216 SWITZERLAND CONSUMER ELECTRONICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 217 POLAND UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 218 POLAND UV FILTER MARKET, BY PRODUCT, 2022-2031 (TONS)

TABLE 219 POLAND ORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 220 POLAND INORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 221 POLAND UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 222 POLAND PERSONAL CARE AND COSMETICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 223 POLAND PLASTIC IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 224 POLAND PACKAGING IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 225 POLAND INDUSTRIAL COATINGS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 226 POLAND PROTECTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 227 POLAND AUTOMOTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 228 POLAND CONSTRUCTION IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 229 POLAND OPTICAL LENSES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 230 POLAND TEXTILES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 231 POLAND AGRICULTURE IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 232 POLAND CONSUMER ELECTRONICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 233 NORWAY UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 234 NORWAY UV FILTER MARKET, BY PRODUCT, 2022-2031 (TONS)

TABLE 235 NORWAY ORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 236 NORWAY INORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 237 NORWAY UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 238 NORWAY PERSONAL CARE AND COSMETICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 239 NORWAY PLASTIC IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 240 NORWAY PACKAGING IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 241 NORWAY INDUSTRIAL COATINGS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 242 NORWAY PROTECTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 243 NORWAY AUTOMOTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 244 NORWAY CONSTRUCTION IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 245 NORWAY OPTICAL LENSES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 246 NORWAY TEXTILES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 247 NORWAY AGRICULTURE IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 248 NORWAY CONSUMER ELECTRONICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 249 DENMARK UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 250 DENMARK UV FILTER MARKET, BY PRODUCT, 2022-2031 (TONS)

TABLE 251 DENMARK ORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 252 DENMARK INORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 253 DENMARK UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 254 DENMARK PERSONAL CARE AND COSMETICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 255 DENMARK PLASTIC IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 256 DENMARK PACKAGING IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 257 DENMARK INDUSTRIAL COATINGS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 258 DENMARK PROTECTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 259 DENMARK AUTOMOTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 260 DENMARK CONSTRUCTION IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 261 DENMARK OPTICAL LENSES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 262 DENMARK TEXTILES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 263 DENMARK AGRICULTURE IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 264 DENMARK CONSUMER ELECTRONICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 265 TURKEY UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 266 TURKEY UV FILTER MARKET, BY PRODUCT, 2022-2031 (TONS)

TABLE 267 TURKEY ORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 268 TURKEY INORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 269 TURKEY UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 270 TURKEY PERSONAL CARE AND COSMETICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 271 TURKEY PLASTIC IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 272 TURKEY PACKAGING IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 273 TURKEY INDUSTRIAL COATINGS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 274 TURKEY PROTECTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 275 TURKEY AUTOMOTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 276 TURKEY CONSTRUCTION IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 277 TURKEY OPTICAL LENSES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 278 TURKEY TEXTILES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 279 TURKEY AGRICULTURE IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 280 TURKEY CONSUMER ELECTRONICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 281 FINLAND UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 282 FINLAND UV FILTER MARKET, BY PRODUCT, 2022-2031 (TONS)

TABLE 283 FINLAND ORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 284 FINLAND INORGANIC IN UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 285 FINLAND UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 286 FINLAND PERSONAL CARE AND COSMETICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 287 FINLAND PLASTIC IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 288 FINLAND PACKAGING IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 289 FINLAND INDUSTRIAL COATINGS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 290 FINLAND PROTECTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 291 FINLAND AUTOMOTIVE COATINGS IN UV FILTER MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 292 FINLAND CONSTRUCTION IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 293 FINLAND OPTICAL LENSES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 294 FINLAND TEXTILES IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 295 FINLAND AGRICULTURE IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 296 FINLAND CONSUMER ELECTRONICS IN UV FILTER MARKET, BY PRODUCT TYPE, 2022-2031 (USD THOUSAND)

TABLE 297 REST OF EUROPE UV FILTER MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 298 REST OF EUROPE UV FILTER MARKET, BY PRODUCT, 2022-2031 (TONS)

Liste des figures

FIGURE 1 EUROPE UV FILTER MARKET

FIGURE 2 EUROPE UV FILTER MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE UV FILTER MARKET: DROC ANALYSIS

FIGURE 4 EUROPE UV FILTER MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE UV FILTER MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE UV FILTER MARKET: MULTIVARIATE MODELLING

FIGURE 7 EUROPE UV FILTER MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 EUROPE UV FILTER MARKET: DBMR MARKET POSITION GRID

FIGURE 9 EUROPE UV FILTER MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 EUROPE UV FILTER MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 EUROPE UV FILTER MARKET: SEGMENTATION

FIGURE 12 THREE SEGMENTS COMPRISE THE EUROPE UV FILTER MARKET, BY PRODUCT

FIGURE 13 EUROPE UV FILTER MARKET: OVERVIEW

FIGURE 14 STRATEGIC DECISIONS

FIGURE 15 GROWING DEMAND FOR PERSONAL CARE AND COSMETIC PRODUCTS IS EXPECTED TO DRIVE THE EUROPE UV FILTER MARKET IN THE FORECAST PERIOD

FIGURE 16 THE ORGANIC SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE UV FILTER MARKET IN 2024 AND 2031

FIGURE 17 PESTEL ANALYSIS

FIGURE 18 PORTER’S FIVE FORCES

FIGURE 19 VENDOR SELECTION CRITERIA

FIGURE 20 EUROPE UV FILTER MARKET, 2022-2031, AVERAGE SELLING PRICE (USD/KG)

FIGURE 21 PRODUCTION CONSUMPTION ANALYSIS: EUROPE UV FILTER MARKET

FIGURE 22 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF EUROPE UV FILTER MARKET

FIGURE 23 EUROPE UV FILTER MARKET: BY PRODUCT, 2023

FIGURE 24 EUROPE UV FILTER MARKET: BY APPLICATION, 2023

FIGURE 25 EUROPE UV FILTER MARKET: SNAPSHOT (2023)

FIGURE 26 EUROPE UV FILTER MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.