Les dispositifs de santé maternelle désignent une catégorie spécialisée d'outils et d'équipements médicaux conçus pour surveiller, diagnostiquer et améliorer le bien-être des femmes enceintes et de leur fœtus. Ces dispositifs englobent divers produits, notamment des dispositifs de surveillance fœtale, des instruments obstétricaux, des lits d'accouchement, des chaises d'accouchement et des fournitures jetables. L'objectif principal des dispositifs de santé maternelle est d'assurer une prise en charge complète tout au long de la grossesse, de l'accouchement et du post-partum, contribuant ainsi à la sécurité et à la santé de la mère et du nouveau-né.

Accéder au rapport complet sur https://www.databridgemarketresearch.com/reports/us-maternal-health-devices-market

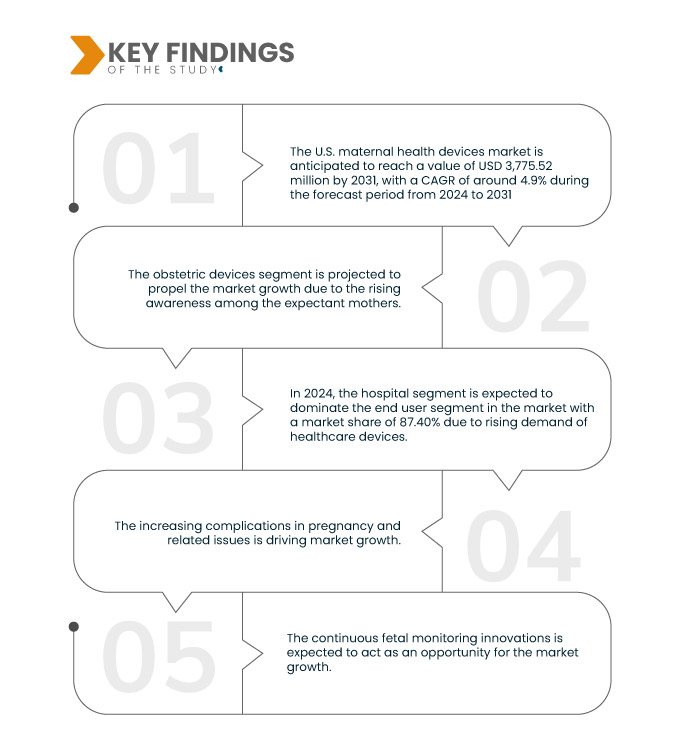

Data Bridge Market Research analyse que le marché américain des dispositifs de santé maternelle devrait atteindre 3 775,52 millions USD d'ici 2031, contre 2 618,06 millions USD en 2023, avec un TCAC de 4,9 % au cours de la période de prévision de 2024 à 2031. Le segment des dispositifs obstétricaux devrait propulser la croissance du marché en raison de la sensibilisation croissante des femmes enceintes.

Principales conclusions de l'étude

Augmentation des complications liées à la grossesse

Le besoin d'équipements modernes permettant de surveiller et de gérer efficacement les complications liées à la grossesse ou à la grossesse est croissant, car un nombre croissant de grossesses sont compliquées par des pathologies allant des maladies chroniques aux préoccupations prénatales. Une surveillance accrue et des mesures d'intervention agressives sont nécessaires en raison de l'incidence croissante de complications telles que le diabète gestationnel, la prééclampsie et l'hypertension maternelle. La détection et la prise en charge précoces de ces problèmes dépendent de plus en plus d'équipements de santé maternelle qui surveillent les signes vitaux, la glycémie et la santé fœtale. L'innovation et le développement substantiels sont stimulés par le besoin de technologies plus avancées, plus précises et plus conviviales pour répondre aux différents besoins des professionnels de santé et des femmes enceintes. Le marché des dispositifs de santé maternelle connaît une innovation stimulée par la demande croissante d'appareils capables de gérer les problèmes et de surveiller les grossesses à risque. Des technologies innovantes, notamment des capteurs portables, des systèmes de surveillance à distance et des analyses basées sur l'IA, sont développées pour répondre à ces problèmes et, à terme, améliorer les résultats des soins maternels. Ainsi, l'augmentation des complications liées à la grossesse nécessite des appareils plus sophistiqués, ce qui stimule la croissance du marché.

Portée du rapport et segmentation du marché

Rapport métrique

|

Détails

|

Période de prévision

|

2024 à 2031

|

Année de base

|

2023

|

Année historique

|

2022 (personnalisable de 2016 à 2021)

|

Unités quantitatives

|

Chiffre d'affaires en millions USD, volume et prix en ASP

|

Segments couverts

|

Type de produit (dispositifs obstétricaux, dispositifs de surveillance fœtale, lits d'accouchement, chaises d'accouchement, fournitures et consommables jetables et autres), modalité (portable, autonome, portatif, portable et autres), stade (stade parental et stade d'accouchement), type (dispositifs de point de service et traditionnels), utilisateur final (hôpital, maternités, établissements de soins infirmiers, cliniques spécialisées, établissements de soins à domicile et autres), canal de distribution (appel d'offres direct, vente au détail, vente en ligne et autres)

|

Pays couvert

|

POU

|

Acteurs du marché couverts

|

Medtronic (Irlande), Stryker (États-Unis), GE HealthCare (États-Unis), Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (Chine), Hill-Rom Holdings Inc. (filiale de Baxter) (États-Unis), FUJIFILM Corporation (Japon), Siemens Healthineers AG (Allemagne), Koninklijke Philips NV (Pays-Bas), CooperSurgical Inc. (États-Unis), CANON MEDICAL SYSTEMS CORPORATION (Japon), Cook (États-Unis), Olympus Corporation (Japon), ESAOTE SPA (Italie), KARL-STORZ SE & CO. KG (Allemagne), Hologic, Inc. (États-Unis), MEDGYN PRODUCTS, INC. (États-Unis) et Healcerion Co., Ltd. (Corée du Sud), entre autres

|

Points de données couverts dans le rapport

|

En plus des informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse approfondie des experts, une épidémiologie des patients, une analyse du pipeline, une analyse des prix et un cadre réglementaire.

|

Analyse des segments

Le marché américain des dispositifs de santé maternelle est classé en six segments notables en fonction du type de produit, de la modalité, de l'étape, du type, de l'utilisateur final et du canal de distribution.

- Sur la base du type de produit, le marché est segmenté en dispositifs de surveillance fœtale, dispositifs obstétriques, lits d'accouchement, chaises d'accouchement et fournitures et consommables jetables.

En 2024, le segment des dispositifs obstétricaux du segment des types de produits devrait dominer le marché

En 2024, le segment des dispositifs obstétricaux devrait dominer le marché en raison de la sensibilisation croissante aux soins de santé avec une part de marché de 31,49 %.

- Sur la base de la modalité, le marché est segmenté en appareils portables, portables, autonomes, portables et autres

En 2024, le segment des appareils portables devrait dominer le marché.

En 2024, le segment des appareils portables devrait dominer le marché en raison de l'augmentation des activités de recherche et développement du secteur de la santé avec une part de marché de 34,16 %.

- En fonction du stade de développement, le marché est segmenté en phase prénatale et phase d'accouchement. En 2024, le segment de la phase prénatale devrait dominer le marché avec une part de marché de 59,75 %.

- En fonction du type de dispositif, le marché est segmenté en dispositifs délocalisés et dispositifs traditionnels. En 2024, le segment des dispositifs délocalisés devrait dominer le marché avec une part de marché de 62,96 %.

- En fonction de l'utilisateur final, le marché est segmenté en hôpitaux, maternités, maisons de retraite, cliniques spécialisées, services de soins à domicile, etc. En 2024, le segment hospitalier devrait dominer le marché avec une part de marché de 87,40 %.

- En fonction des canaux de distribution, le marché est segmenté en appels d'offres directs, ventes au détail, ventes en ligne et autres. En 2024, le segment des appels d'offres directs devrait dominer le marché avec une part de marché de 40,32 %.

Acteurs majeurs

Data Bridge Market Research analyse Medtronic (Irlande), Stryker (États-Unis), GE HealthCare (États-Unis), Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (Chine) et Hill-Rom Holdings Inc. (une filiale de Baxter) (États-Unis) comme les principales entreprises du marché américain des dispositifs de santé maternelle.

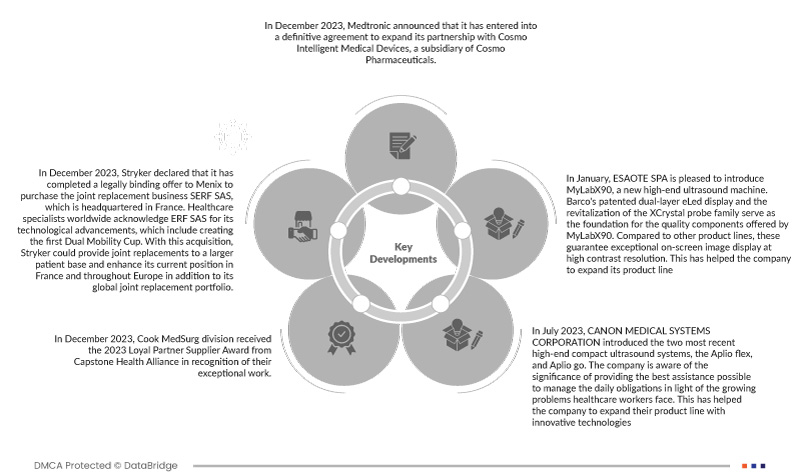

Développement du marché

- En décembre 2023, Medotronic a annoncé la conclusion d'un accord définitif visant à étendre son partenariat avec Cosmo Intelligent Medical Devices, filiale de Cosmo Pharmaceuticals. Ce partenariat, basé sur l'IA, capitalisera sur les avancées déjà réalisées avec le module d'endoscopie intelligent GI Genius, offrant une innovation continue et des avancées évolutives en matière de soins de santé aux patients et aux soignants du monde entier. Grâce à ce partenariat mondial exclusif, Medtronic et Cosmo Pharmaceuticals maintiennent leur engagement à révolutionner l'endoscopie en exploitant la puissance de l'IA pour améliorer les résultats des patients. Cette alliance stratégique renforce la position de Medtronic dans les solutions de santé intégrées à l'IA et représente une avancée significative dans l'intégration de l'IA aux soins endoscopiques.

- En décembre 2023, Stryker a annoncé avoir finalisé une offre ferme auprès de Menix pour l'acquisition de SERF SAS, une entreprise spécialisée dans les prothèses articulaires, dont le siège social est en France. Les spécialistes de la santé du monde entier reconnaissent ERF SAS pour ses avancées technologiques, notamment la création de la première cupule à double mobilité. Grâce à cette acquisition, Stryker pourrait proposer des prothèses articulaires à un plus large public et renforcer sa position actuelle en France et en Europe, en complément de son portefeuille mondial de prothèses articulaires.

- En décembre 2023, la division Cook MedSurg a reçu le prix du Fournisseur Partenaire Fidèle 2023 de Capstone Health Alliance, en reconnaissance de son travail exceptionnel. Cook est ravi de recevoir cette distinction, qui s'ajoute à un nouveau contrat de fournitures urologiques.

- En juillet 2023, CANON MEDICAL SYSTEMS CORPORATION a présenté ses deux derniers échographes compacts haut de gamme : l'Aplio Flex et l'Aplio Go. Consciente de l'importance d'offrir la meilleure assistance possible pour gérer les obligations quotidiennes des professionnels de santé face aux difficultés croissantes, l'entreprise a pu élargir sa gamme de produits grâce à des technologies innovantes.

- En janvier, ESAOTE SPA a le plaisir de présenter MyLabX90, un nouvel échographe haut de gamme. L'écran eLed double couche breveté de Barco et la revitalisation de la gamme de sondes XCrystal constituent la base des composants de qualité proposés par MyLabX90. Comparés à d'autres gammes de produits, ils garantissent un affichage exceptionnel des images à l'écran avec une résolution à contraste élevé. Cela a permis à l'entreprise d'élargir sa gamme de produits.

Pour plus d'informations sur le rapport sur le marché américain des dispositifs de santé maternelle, cliquez ici : https://www.databridgemarketresearch.com/reports/us-maternal-health-devices-market