L'Arabie saoudite connaît une croissance et un développement industriels considérables, avec de nombreux projets d'infrastructures, des activités de construction et l'expansion de secteurs industriels. Dans un tel contexte, une alimentation électrique fiable est essentielle pour assurer la continuité des opérations. Les générateurs diesel servent de sources d'alimentation de secours, permettant aux industries de continuer à fonctionner même en cas de panne de réseau. Les pannes de courant peuvent avoir des conséquences économiques et opérationnelles importantes. En Arabie saoudite, où les températures extrêmes sont fréquentes, une alimentation électrique fiable est d'autant plus cruciale. Les générateurs diesel constituent une solution de secours fiable en cas de coupure de courant, prévenant ainsi les perturbations des services et opérations essentiels. Les installations critiques telles que les centres de données, les hôpitaux et les installations militaires nécessitent une alimentation électrique continue et sécurisée pour maintenir leurs activités. Les générateurs diesel sont déployés comme solutions d'alimentation de secours afin de fournir une source d'électricité immédiate et fiable en cas de panne de courant. L'Arabie saoudite est un acteur majeur de l'industrie pétrolière et gazière mondiale. Par conséquent, des sources d'énergie fiables sont essentielles à l'extraction du pétrole, aux processus de raffinage et au fonctionnement global du secteur. Les générateurs diesel sont utilisés pour fournir une alimentation de secours dans les zones reculées et assurer la continuité des opérations.

Accéder au rapport complet sur https://www.databridgemarketresearch.com/reports/saudi-arabia-diesel-generators-market

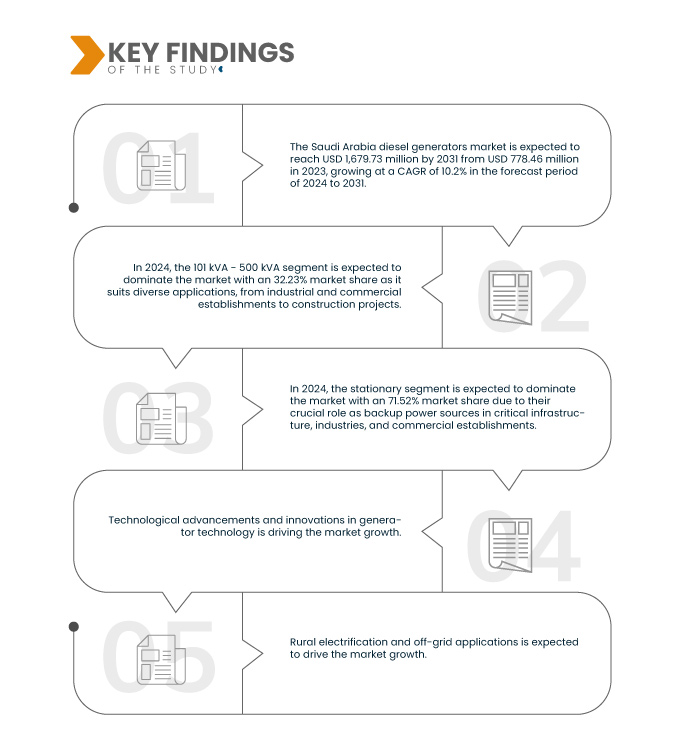

Data Bridge Market Research analyse que le marché des générateurs diesel en Arabie saoudite devrait atteindre 1 679,73 millions USD d'ici 2031, contre 778,46 millions USD en 2023, avec un TCAC de 10,2 % au cours de la période de prévision de 2024 à 2031.

Principales conclusions de l'étude

Demande croissante de générateurs diesel en raison de l'approvisionnement continu en énergie et en électricité dans divers secteurs

L'expansion des industries dans des secteurs tels que l'industrie manufacturière, la construction et le pétrole et le gaz souligne le besoin crucial d'une alimentation électrique fiable et constante. Dans ces secteurs, la continuité des opérations est primordiale pour maintenir la productivité, garantir la sécurité et atteindre les objectifs de production. Les processus de fabrication fonctionnent souvent 24 heures sur 24, et toute interruption de l'alimentation électrique peut entraîner des temps d'arrêt et des pertes importantes. Les générateurs diesel sont mobiles et peuvent être facilement transportés d'un site à l'autre sur un chantier, offrant ainsi une flexibilité pour fournir de l'électricité là où elle est le plus nécessaire à différentes étapes du projet. La croissance démographique et l'urbanisation entraînent une augmentation de la demande d'électricité dans les zones résidentielles et commerciales. Les générateurs diesel peuvent être déployés rapidement pour répondre aux pics soudains de demande d'électricité ou aux régions dont l'infrastructure réseau est inadéquate. Les opérations pétrolières et gazières sont souvent situées dans des zones reculées ou offshore, avec une connectivité réseau limitée. Les générateurs diesel offrent une solution d'alimentation autonome, garantissant la poursuite des opérations quelles que soient les contraintes géographiques. Les processus d'exploration, d'extraction et de raffinage du pétrole et du gaz impliquent des machines et des systèmes complexes qui nécessitent une alimentation électrique constante. Les générateurs diesel constituent une solution de secours fiable pour assurer le fonctionnement continu des opérations critiques, évitant ainsi les risques potentiels et les temps d'arrêt. La croissance du secteur des télécommunications, portée par la demande croissante de connectivité, notamment suite aux avancées technologiques telles que la 5G, a entraîné l'implantation de davantage de stations de base. Les générateurs diesel sont essentiels pour assurer le fonctionnement continu et fiable de ces réseaux de communication.

Portée du rapport et segmentation du marché

Rapport métrique

|

Détails

|

Période de prévision

|

2024 à 2031

|

Année de base

|

2023

|

Années historiques

|

2022 (personnalisable pour 2016-2021)

|

Unités quantitatives

|

Chiffre d'affaires en millions USD et volume en unités

|

Segments couverts

|

Puissance nominale (101 kVA - 500 kVA, 30 kVA - 100 kVA, moins de 30 kVA, 501 kVA - 1 000 kVA et 1 001 kVA - 4 000 kVA), portabilité (fixe et portable), fréquence (60 Hz et 50 Hz), application (alimentation de secours, alimentation principale ou continue, écrêtement des pointes et démarrage à froid), utilisateur final (industriel, commercial et résidentiel), offre de produits (neufs et locatifs), canal de vente (ventes indirectes et ventes directes)

|

Pays couvert

|

Arabie Saoudite

|

Acteurs du marché couverts

|

YANMAR HOLDINGS CO., LTD. (Japon), AJMAJD POWER (Arabie saoudite), Kohler Co. (États-Unis), Atlas Copco (Suède), KUBOTA Corporation (Japon), DEUTZ AG (Allemagne), MAHINDRA POWEROL (Inde), JC Bamford Excavators Ltd. (Royaume-Uni), Cummins Inc. (États-Unis), MITSUBISHI HEAVY INDUSTRIES, LTD. (Japon), Saudi Diesel Equipment Co. Ltd. (Arabie saoudite), Caterpillar (États-Unis), Doosan Corporation (Corée du Sud), Rolls Royce (Royaume-Uni) et AB Volvo Penta (Suède), entre autres.

|

Points de données couverts dans le rapport

|

En plus des informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse approfondie des experts, une production et une capacité géographiquement représentées par entreprise, des configurations de réseau de distributeurs et de partenaires, une analyse détaillée et mise à jour des tendances des prix et une analyse des déficits de la chaîne d'approvisionnement et de la demande.

|

Analyse des segments

Le marché des générateurs diesel en Arabie saoudite est segmenté en sept segments notables en fonction de la puissance nominale, de la portabilité, de la fréquence, de l'application, de l'utilisateur final, de l'offre de produits et du canal de vente.

- Sur la base de la puissance nominale, le marché est segmenté en 101 kVA - 500 kVA, 30 kVA - 100 kVA, moins de 30 kVA, 501 kVA - 1 000 kVA et 1 001 kVA - 4 000 kVA.

En 2024, le segment 101 kVA - 500 kVA devrait dominer le marché avec une part de marché de 32,23 % car il convient à diverses applications, des établissements industriels et commerciaux aux projets de construction.

- Sur la base de la portabilité, le marché est segmenté en stationnaire et portable

En 2024, le segment stationnaire devrait dominer le marché

En 2024, le segment stationnaire devrait dominer le marché avec une part de marché de 71,52 % en raison de son rôle crucial en tant que sources d'alimentation de secours dans les infrastructures critiques, les industries et les établissements commerciaux.

- En termes de fréquence, le marché est segmenté en 60 Hz et 50 Hz. En 2024, le segment 60 Hz devrait dominer le marché avec une part de marché de 90,11 %.

- En fonction des applications, le marché est segmenté en énergie de secours, énergie principale ou continue, écrêtement des pointes de consommation et redémarrage autonome. En 2024, le segment de l'énergie de secours devrait dominer le marché avec une part de marché de 41,23 %.

- En fonction de l'utilisateur final, le marché est segmenté en secteurs industriel, commercial et résidentiel. En 2024, le segment industriel devrait dominer le marché avec une part de marché de 46,69 %.

- En fonction de l'offre produit, le marché est segmenté entre le neuf et la location. En 2024, le segment du neuf devrait dominer le marché avec une part de marché de 76,27 %.

- En fonction du canal de vente, le marché est segmenté en ventes indirectes et ventes directes. En 2024, le segment des ventes indirectes devrait dominer le marché avec une part de marché de 64,60 %.

Acteurs majeurs

Data Bridge Market Research Saudi Arabia diesel generators analyse YANMAR HOLDINGS CO., LTD. (Japon), AB Volvo Penta (Suède), Caterpillar (États-Unis), Saudi Diesel Equipment Co. Ltd. (Arabie saoudite) et DEUTZ AG (Allemagne) comme les principales entreprises du marché des générateurs diesel en Arabie saoudite.

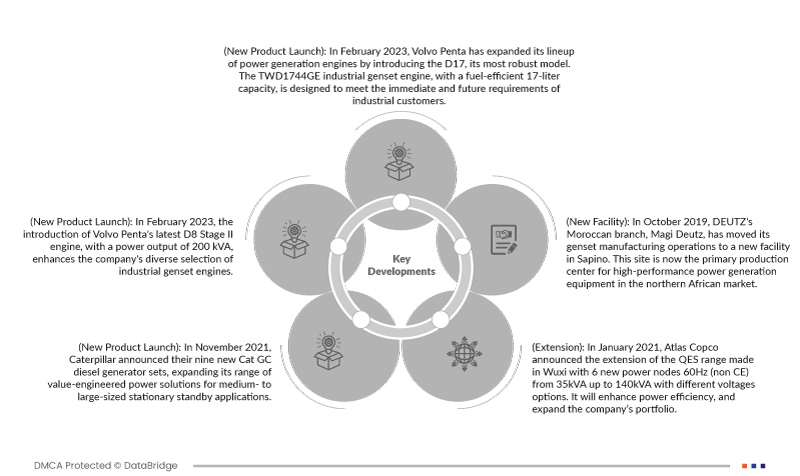

Évolution du marché

- En février 2023, Volvo Penta a élargi sa gamme de moteurs de production d'énergie avec le lancement du D17, son modèle le plus robuste. Le moteur pour groupe électrogène industriel TWD1744GE, d'une cylindrée de 17 litres à faible consommation, est conçu pour répondre aux besoins immédiats et futurs des clients industriels. Outre sa capacité à répondre aux besoins actuels, le D17, comme l'ensemble de sa gamme de moteurs de production d'énergie, devrait évoluer pour faciliter la transition vers des émissions nettement plus faibles grâce à l'adoption de carburants alternatifs.

- En février 2023, le lancement du dernier moteur D8 Stage II de Volvo Penta, d'une puissance de 200 kVA, enrichit la gamme diversifiée de moteurs pour groupes électrogènes industriels de l'entreprise. Ce nouveau modèle offre une réduction impressionnante de la consommation de carburant par kWh, jusqu'à 8 % par rapport à son prédécesseur, le D7. Le D8 est désormais proposé en quatre puissances : 200, 253, 303 et 326 kVA à 1 500 tr/min (50 Hz) en fonctionnement à puissance maximale, pour répondre à diverses configurations d'application. Cela permettra à l'entreprise d'enrichir son portefeuille de produits.

- En novembre 2021, Caterpillar a annoncé le lancement de neuf nouveaux groupes électrogènes diesel Cat GC, élargissant ainsi sa gamme de solutions d'alimentation à valeur ajoutée pour les applications de secours stationnaires de moyenne à grande taille. Ces nouveautés comprennent trois modèles (de 1 250 à 1 500 kVA) pour les applications 50 Hz dans le monde entier, trois modèles (de 800 à 1 250 kW) pour les applications 60 Hz en Amérique du Nord et trois modèles (de 800 à 1 250 kW) pour les applications 60 Hz hors Amérique du Nord. Cet élargissement de l'offre de groupes électrogènes diesel Caterpillar devrait renforcer la compétitivité et la présence de l'entreprise sur le marché.

- En janvier 2021, Atlas Copco a annoncé l'extension de sa gamme QES fabriquée à Wuxi avec six nouveaux nœuds de puissance 60 Hz (non CE) de 35 kVA à 140 kVA, avec différentes options de tension. Cela permettra d'améliorer l'efficacité énergétique et d'élargir le portefeuille de l'entreprise.

- En octobre 2019, Magi Deutz, filiale marocaine de DEUTZ, a transféré ses activités de fabrication de groupes électrogènes vers une nouvelle usine à Sapino. Ce site est désormais le principal centre de production d'équipements de production d'électricité haute performance sur le marché nord-africain. L'usine a entièrement restructuré ses processus de fabrication, établissant de nouvelles normes en matière de qualité, de productivité et de normes de santé et de sécurité. Cela permettra à l'entreprise de renforcer sa présence mondiale.

Selon l'analyse de Data Bridge Market Research :

Pour plus d'informations sur le marché des générateurs diesel en Arabie saoudite, cliquez ici : https://www.databridgemarketresearch.com/reports/saudi-arabia-diesel-generators-market