L'essor des investisseurs particuliers sur les marchés financiers a considérablement stimulé la croissance du marché des options. Avec la démocratisation de l'information financière et l'accès à des plateformes de trading sophistiquées, de plus en plus d'investisseurs particuliers se lancent dans le trading d'options. Ces investisseurs sont attirés par les options pour leur capacité à mobiliser de petits montants de capital et à générer potentiellement des rendements substantiels. La participation accrue des investisseurs particuliers a accru la liquidité et les volumes de transactions du marché des options, le rendant ainsi plus dynamique et attractif pour un plus large éventail d'acteurs.

Accéder au rapport complet sur https://www.databridgemarketresearch.com/reports/north-america-and-europe-options-trading-platform-market

Data Bridge Market Research analyse que le marché des plateformes de trading d'options en Amérique du Nord et en Europe devrait atteindre 2,60 milliards de dollars d'ici 2031, contre 1,41 milliard en 2023, avec un TCAC de 8,1 % sur la période de prévision 2024-2031. La démocratisation de l'information financière et les plateformes de trading avancées ont donné plus de pouvoir aux investisseurs individuels, augmentant la liquidité et les volumes de transactions. Les ressources pédagogiques et les outils conviviaux fournis par ces plateformes ont rendu le trading d'options plus accessible, tandis que les réseaux sociaux et les communautés en ligne ont stimulé la participation des particuliers. Cette forte activité de détail a élargi la clientèle, encouragé l'innovation et introduit de nouveaux produits et services de trading, rendant le marché des options plus dynamique et attractif.

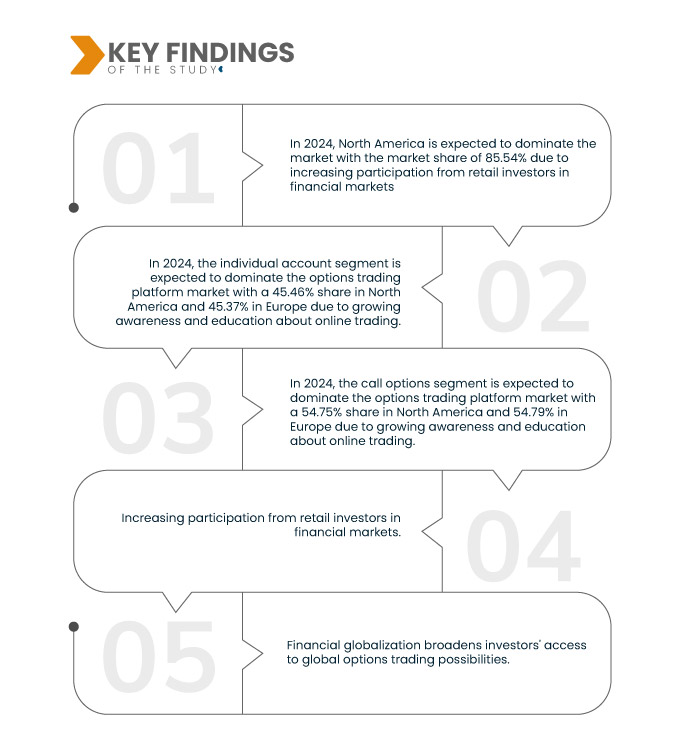

Principales conclusions de l'étude

Sensibilisation et éducation croissantes au trading en ligne

La sensibilisation et l'éducation croissantes au trading en ligne ont eu un impact significatif sur le marché des options. À mesure que de plus en plus de personnes accèdent aux ressources d'éducation financière, elles sont mieux armées pour comprendre les complexités et les avantages potentiels du trading d'options. Des initiatives éducatives, allant des cours en ligne aux webinaires et aux plateformes interactives, fournissent aux investisseurs particuliers les connaissances nécessaires pour prendre des décisions éclairées. Cette meilleure compréhension réduit les risques perçus associés au trading d'options, le rendant plus accessible à un public plus large. Par conséquent, une base d'investisseurs plus informés est susceptible de s'engager activement dans le trading d'options, stimulant ainsi la croissance du marché. La prolifération des plateformes de trading en ligne proposant un contenu éducatif complet a encore renforcé cette tendance. Ces plateformes incluent souvent des tutoriels, des guides stratégiques et des outils de simulation permettant aux utilisateurs de s'entraîner au trading dans un environnement sans risque. En démystifiant le trading d'options et en proposant des expériences d'apprentissage pratiques et concrètes, ces plateformes permettent aux investisseurs particuliers de développer et d'affiner leurs stratégies de trading. Ainsi, davantage d'investisseurs se sentent en confiance pour participer au marché des options, ce qui se traduit par des volumes de transactions plus importants et une liquidité accrue du marché. La possibilité d’accéder à ces ressources à tout moment et en tout lieu joue également un rôle crucial pour attirer un groupe diversifié d’investisseurs, des novices aux traders chevronnés.

Portée du rapport et segmentation du marché

Rapport métrique

|

Détails

|

Période de prévision

|

2024 à 2031

|

Année de base

|

2023

|

Années historiques

|

2022 (personnalisable pour 2016-2021)

|

Unités quantitatives

|

Chiffre d'affaires en milliards USD

|

Segments couverts

|

(Compte individuel, compte IRA, compte d'entité et compte conjoint), type d'options (options d'achat et options de vente), type de plateforme ( application mobile , ordinateur de bureau et Web), niveau d'autorisation de négociation (niveau 1, niveau 2, niveau 3 et niveau 4), modèle de tarification (gratuit et par abonnement), nombre de styles (option de style américain et options de style européen)

|

Pays couverts

|

États-Unis, Canada, Mexique, Royaume-Uni, Allemagne, France, Italie, Espagne, Russie, Turquie, Belgique, Pays-Bas, Norvège, Finlande, Suisse, Danemark, Suède, Pologne et reste de l'Europe

|

Acteurs du marché couverts

|

Ally Financial Inc (États-Unis), Bank of America Corporation (États-Unis), Charles Schwab & Co., Inc. (États-Unis), Interactive Brokers LLC (États-Unis), Robinhood (États-Unis), E*TRADE de Morgan Stanley (États-Unis), ETORO USA LLC.(États-Unis), IG Group Holdings plc (Royaume-Uni), Saxo Capital Markets Pte Ltd (Singapour), Ava Trade Markets Ltd. (Canada), TradeStation (États-Unis), tastytrade, Inc., Social Finance, LLC (États-Unis), Tickmill (Afrique), FMR LLC (États-Unis), Webull Financial LLC (États-Unis), Moomoo Financial Inc (États-Unis) et Public Holdings, Inc.(États-Unis) entre autres.

|

Points de données couverts dans le rapport

|

Outre les informations sur le marché telles que la valeur marchande, le taux de croissance, les segments de marché, la couverture géographique, les acteurs du marché et le scénario du marché, le rapport de marché organisé par l'équipe de recherche sur le marché de Data Bridge comprend une analyse approfondie des experts, une analyse des importations/exportations, une analyse des prix, une analyse de la consommation de production et une analyse du pilon.

|

Analyse des segments

Le marché des plateformes de trading d'options en Amérique du Nord et en Europe est classé en six segments notables qui sont basés sur le type de compte, le type d'option, le type de plateforme, le niveau d'autorisation de trading, le modèle de tarification et le nombre de styles.

- Sur la base du type de compte, le marché est segmenté en compte individuel, compte IRA, compte d'entité et compte joint

En 2024, le segment des comptes individuels devrait dominer le marché des plateformes de trading d'options en Amérique du Nord et en Europe

En 2024, le segment des comptes individuels devrait dominer le marché avec une part de 45,46 % en Amérique du Nord et de 45,37 % en Europe en raison de la flexibilité d'utiliser des avoirs à long terme comme actions pour le trading d'options, permettant des positions importantes sans investissement important en espèces.

- Sur la base du type d’option, le marché est segmenté en options d’achat et options de vente.

En 2024, le segment des options d'achat devrait dominer le marché des plateformes de négociation d'options en Amérique du Nord et en Europe

En 2024, le segment des options d'achat devrait dominer le marché avec une part de 54,75 % en Amérique du Nord et de 54,79 % en Europe en raison de la participation croissante des investisseurs particuliers sur les marchés financiers.

- Selon le type de plateforme, le marché est segmenté en applications mobiles, ordinateurs et web. En 2024, le segment des applications mobiles devrait dominer le marché avec une part de marché de 48,47 % en Amérique du Nord et de 49,26 % en Europe.

- Sur la base du niveau d'autorisation de négociation, le marché est segmenté en niveau 1, niveau 2, niveau 3 et niveau 4. En 2024, le segment de niveau 1 devrait dominer le marché avec une part de 41,65 % en Amérique du Nord et de 40,82 % en Europe.

- Selon le modèle de tarification, le marché est segmenté en offres gratuites et par abonnement. En 2024, le segment gratuit devrait dominer le marché avec une part de marché de 55,37 % en Amérique du Nord et de 55,40 % en Europe.

- En fonction du nombre de styles, le marché est segmenté en options de style américain et options de style européen. En 2024, le segment des options de style américain devrait dominer le marché avec une part de marché de 61,25 % en Amérique du Nord et de 62,35 % en Europe.

Acteurs majeurs

Data Bridge Market Research analyse Ally Financial Inc (États-Unis), Bank of America Corporation (États-Unis), E*TRADE de Morgan Stanley (États-Unis), Charles Schwab & Co., Inc. (États-Unis), Robinhood (États-Unis), comme les principaux acteurs opérant sur le marché des plateformes de trading d'options en Amérique du Nord.

Data Bridge Market Research analyse Interactive Brokers LLC (États-Unis), IG Group Holdings plc (Royaume-Uni), Bank of America Corporation (États-Unis), Charles Schwab & Co., Inc. (États-Unis), Robinhood (États-Unis), comme les principaux acteurs opérant sur le marché des plateformes de trading d'options en Europe.

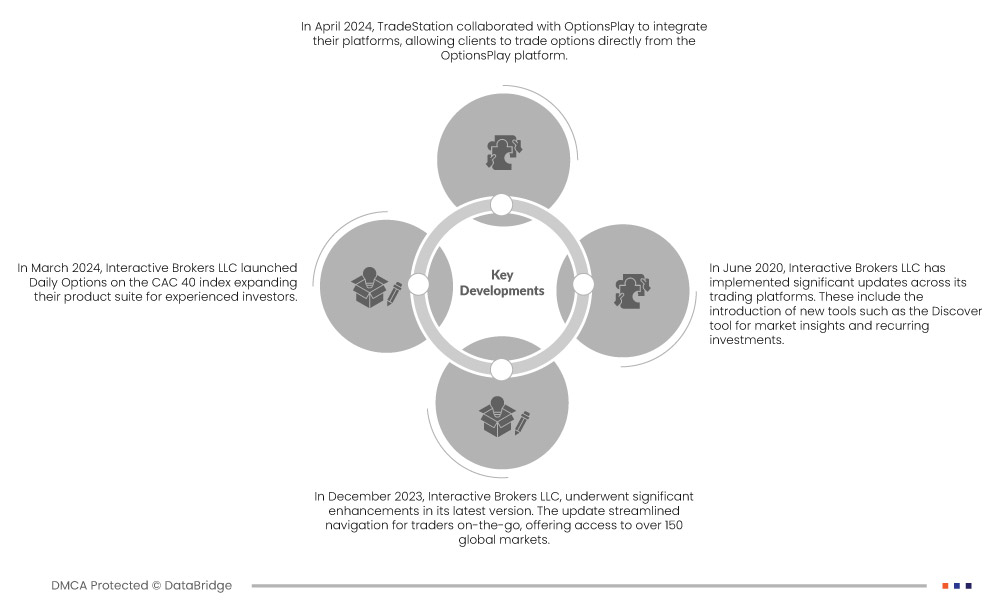

Développement du marché

- En avril 2024, Charles Schwab a été nommé meilleure plateforme d'investissement par US News & World Report pour la deuxième année consécutive. Schwab a également été reconnu comme la meilleure plateforme d'investissement pour le trading d'actions, d'options et de devises. Cette reconnaissance renforce la position de Schwab comme plateforme de référence pour les investisseurs, attirant potentiellement davantage d'utilisateurs, notamment ceux intéressés par le trading d'options, et renforçant sa réputation dans le secteur.

- En mars 2024, Interactive Brokers LLC a lancé les Options Quotidiennes sur l'indice CAC 40, élargissant ainsi sa gamme de produits destinée aux investisseurs expérimentés. Cette offre permet aux traders d'exécuter des stratégies à court terme et de gérer efficacement leur exposition au marché boursier français. Avec une gamme complète de marchés d'options dans le monde entier, des outils de trading avancés, des tarifs compétitifs et de nombreuses ressources pédagogiques, Interactive Brokers continue d'offrir aux traders des solutions complètes.

- En février 2024, ETRADE de Morgan Stanley a été reconnu comme le meilleur courtier en ligne pour l'investissement mobile et le trading en ligne par StockBrokers.com, remportant 15 distinctions « Best in Class ». Cette reconnaissance renforce la réputation et la crédibilité d'ETRADE, et pourrait attirer davantage de traders et d'investisseurs sur sa plateforme. Les avis positifs soulignent la facilité d'utilisation, la profondeur de la recherche et la gamme d'outils d'investissement et de trading d'E*TRADE, ce qui pourrait optimiser l'engagement client et l'activité de trading.

- En décembre 2023, eToro USA LLC a élargi son offre américaine en ajoutant près de 700 nouvelles actions, portant son actif total à 4 790 actions. Cette initiative enrichit les options d'investissement des utilisateurs et permet une plus grande diversification de leur portefeuille. La politique zéro commission d'eToro sur les actions nouvellement ajoutées permet aux utilisateurs de trader sans frais supplémentaires, améliorant ainsi leur rentabilité. Le partenariat de l'entreprise avec Bridgewise pour le lancement de Fundamental-AI, une solution d'analyse boursière avancée, témoigne de son engagement à mettre la technologie au service des investisseurs.

- En juillet 2023, Public Holdings Inc. a annoncé sa décision révolutionnaire de partager 50 % des revenus du trading d'options directement avec ses membres, visant à révolutionner le secteur du trading. En privilégiant la transparence et en proposant des options à faible coût, Public Holdings se positionne comme une plateforme incontournable pour les investisseurs. Cette initiative offre aux clients un aperçu des coûts et des avantages du trading, tout en leur proposant des ressources pédagogiques complètes et des analyses avancées.

Analyse régionale

Géographiquement, les pays couverts dans le rapport sur le marché des plateformes de trading d'options en Amérique du Nord et en Europe sont les États-Unis, le Canada, le Mexique, le Royaume-Uni, l'Allemagne, la France, l'Italie, l'Espagne, la Russie, la Turquie, la Belgique, les Pays-Bas, la Norvège, la Finlande, la Suisse, le Danemark, la Suède, la Pologne et le reste de l'Europe.

Selon l'analyse de Data Bridge Market Research :

L'Amérique du Nord devrait dominer et être la région à la croissance la plus rapide sur le marché des plateformes de trading d'options.

L'Amérique du Nord domine le marché des plateformes de négociation d'options grâce à sa plus forte capitalisation boursière, à une réglementation bien structurée et à un nombre total plus élevé de contrats à terme et d'options négociés en bourse. Ces facteurs contribuent à la solidité et au développement de l'infrastructure de négociation d'options en Amérique du Nord, attirant davantage de traders et d'investissements qu'en Europe.

Pour plus d'informations sur le marché des plateformes de trading d'options en Amérique du Nord et en Europe, cliquez ici : https://www.databridgemarketresearch.com/reports/north-america-and-europe-options-trading-platform-market