L'expansion du secteur de la distribution souligne le besoin crucial d'intégrer les systèmes d'identification par radiofréquence (RFID) et de surveillance électronique des articles (EAS). L'association de la RFID, qui facilite la gestion des stocks en temps réel et améliore l'efficacité opérationnelle, et de l'EAS, qui offre une protection antivol, garantit des solutions complètes de suivi des actifs et de sécurité . Cette intégration optimise la visibilité des stocks, réduit les ruptures de stock, minimise les pertes dues aux vols et simplifie les processus de paiement. En exploitant la RFID pour un suivi précis des stocks et l'EAS pour la prévention des vols, les détaillants peuvent améliorer la satisfaction client, augmenter leurs ventes et conserver leur avantage concurrentiel dans un marché de la distribution dynamique.

Accéder au rapport complet sur https://www.databridgemarketresearch.com/reports/mexico-rfid-and-electronic-article-surveillance-systems-market

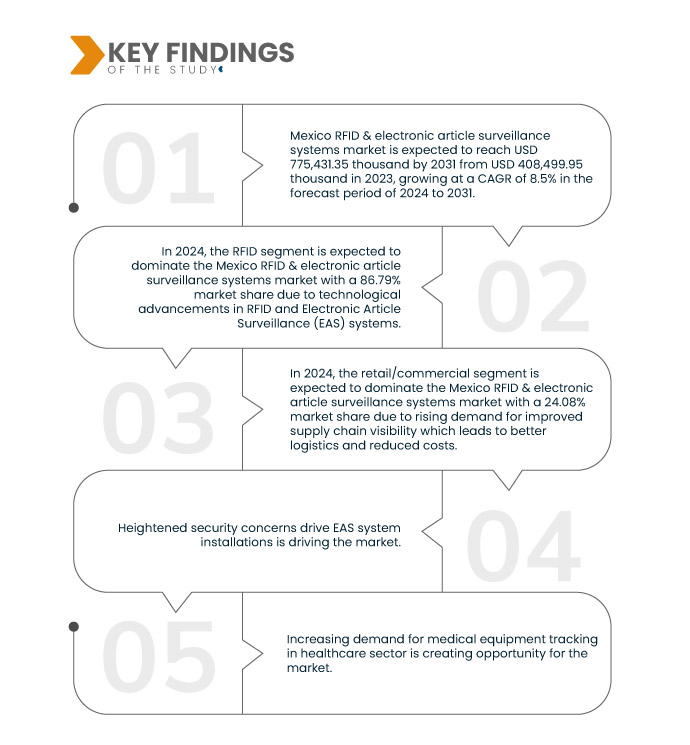

Data Bridge Market Research analyse que le marché mexicain des systèmes de surveillance électronique des articles et RFID devrait atteindre une valeur de 775 431,35 milliers USD d'ici 2031, contre 408 499,95 milliers USD en 2023, avec un TCAC de 8,5 % au cours de la période de prévision 2024 à 2031.

Le besoin d'une gestion des stocks et de mesures de sécurité renforcées dans des secteurs tels que la vente au détail, la logistique et la santé favorise l'adoption des technologies RFID et EAS. Les exigences réglementaires incitent les entreprises à investir dans ces systèmes afin de garantir la transparence et la traçabilité de leurs opérations. Par ailleurs, la prévalence croissante des vols et des contrefaçons alimente la demande de solutions antivol robustes, notamment les systèmes EAS. De plus, les avancées technologiques, telles que l'intégration de la RFID à l'IoT et aux plateformes cloud, élargissent les capacités et les applications de ces systèmes, stimulant ainsi la croissance du marché.

Principales conclusions de l'étude

Sensibilisation croissante à la sécurité et à la prévention des pertes

La sensibilisation croissante à la sécurité et à la prévention des pertes représente une opportunité majeure pour le marché des systèmes RFID et de surveillance électronique des articles (EAS). Les entreprises et les organisations étant de plus en plus conscientes des risques liés au vol, à la démarque inconnue et aux accès non autorisés, la demande de solutions de sécurité efficaces augmente. La technologie RFID, avec sa capacité à suivre et à surveiller les actifs en temps réel, joue un rôle crucial dans le renforcement des mesures de sécurité. En mettant en œuvre des systèmes RFID, les entreprises peuvent améliorer la visibilité des stocks, prévenir le vol et rationaliser les processus de sécurité, réduisant ainsi les pertes et protégeant leurs actifs de valeur.

Par ailleurs, le marché des systèmes de surveillance électronique des articles (EAS) devrait bénéficier de l'importance croissante accordée à la prévention des pertes. Ces systèmes, qui utilisent des étiquettes et des systèmes de détection pour prévenir le vol dans les commerces de détail, deviennent des outils indispensables pour les détaillants souhaitant protéger leurs marchandises. Face à l'essor du crime organisé et des vols internes, le besoin de solutions EAS robustes, capables de dissuader efficacement les vols à l'étalage et les démarques, se fait de plus en plus sentir. Par conséquent, la demande de technologies EAS avancées, notamment les systèmes RFID, devrait augmenter, offrant aux acteurs du marché de formidables opportunités d'innovation et de réponse aux besoins de sécurité en constante évolution des détaillants et des entreprises.

Portée du rapport et segmentation du marché

Rapport métrique

|

Détails

|

Période de prévision

|

2024 à 2031

|

Année de base

|

2023

|

Années historiques

|

2022 (personnalisable pour 2016-2021)

|

Unités quantitatives

|

Chiffre d'affaires en milliers de dollars américains

|

Segments couverts

|

Offres (matériel, logiciel et service), type (systèmes de surveillance électronique des articles et RFID), taille de l'organisation (grande organisation et petite et moyenne organisation), application (contrôle d'accès, suivi des actifs, suivi du personnel, gestion de bijoux et autres), utilisateurs finaux (vente au détail/commerce, logistique et transport, automobile, industrie, santé, aérospatiale, technologies de l'information (TI), défense, éducation, bétail, sports, faune et autres), canal de vente (indirect et direct)

|

États couverts

|

Jalisco, Oaxaca, Chihuahua, Coahuila de Zaragoza, Sonora, Zacatecas et le reste du Mexique

|

Acteurs du marché couverts

|

Checkpoint Systems, Inc (États-Unis), AVERY DENNISON CORPORATION (États-Unis), Johnson Controls (États-Unis), Zebra Technologies Corp (États-Unis), HID Global Corporation, une partie d'ASSA ABLOY (États-Unis), Honeywell International Inc. (États-Unis), Dahua Technology (Chine), Amersec sro (République tchèque), Datalogic SpA (Italie) et Gunnebo AB (Suède), entre autres.

|

Points de données couverts dans le rapport

|

Outre les informations sur le marché telles que la valeur marchande, le taux de croissance, les segments de marché, la couverture géographique, les acteurs du marché et le scénario du marché, le rapport de marché organisé par l'équipe de recherche sur le marché de Data Bridge comprend une analyse approfondie des experts, une analyse des importations/exportations, une analyse des prix, une analyse de la consommation de production et une analyse du pilon.

|

Analyse des segments

Le marché mexicain des systèmes de surveillance d'articles RFID et électroniques est classé en six segments notables basés sur l'offre, le type, la taille de l'organisation, l'application, les utilisateurs finaux et le canal de vente.

- Sur la base des offres, le marché mexicain des systèmes de surveillance électronique et RFID des articles est segmenté en matériel, logiciel et service.

En 2024, le segment du matériel devrait dominer le marché mexicain des systèmes RFID et de surveillance électronique des articles

En 2024, le segment du matériel devrait dominer le marché mexicain des systèmes de surveillance d'articles électroniques et RFID avec 49,36 % en raison des composants matériels tels que les étiquettes RFID, les lecteurs, les antennes et les systèmes EAS qui constituent l'épine dorsale de ces technologies, servant d'infrastructure fondamentale pour la mise en œuvre .

- Le marché mexicain des systèmes de surveillance électronique des articles et RFID est segmenté en deux catégories : RFID et systèmes de surveillance électronique des articles. En 2024, le segment RFID devrait dominer le marché mexicain avec une part de marché de 86,79 %.

- Selon la taille des organisations, le marché mexicain des systèmes de surveillance électronique des articles et RFID est segmenté en grandes organisations, petites et moyennes. En 2024, le segment des grandes organisations devrait dominer le marché mexicain des systèmes de surveillance électronique des articles et RFID avec une part de marché de 62,66 %.

- En fonction des applications, le marché mexicain des systèmes RFID et de surveillance électronique des articles est segmenté en contrôle d'accès, suivi des biens, suivi du personnel et gestion des bijoux, entre autres. En 2024, le segment du contrôle d'accès devrait dominer le marché mexicain des systèmes RFID et de surveillance électronique des articles avec une part de marché de 44,85 %.

- Sur la base des utilisateurs finaux, le marché mexicain des systèmes de surveillance électronique des articles et RFID est segmenté en commerce de détail/commercial, logistique et transport, automobile, industriel, santé, aérospatiale, technologies de l'information (TI), défense, éducation, élevage, sports, faune et autres.

En 2024, le segment de la vente au détail/commercial devrait dominer le marché mexicain des systèmes RFID et de surveillance électronique des articles.

En 2024, le segment de la vente au détail/commercial devrait dominer le marché mexicain des systèmes de surveillance électronique des articles RFID avec une part de marché de 24,08 %.

- En fonction du canal de vente, le marché mexicain des systèmes de surveillance électronique et RFID des articles est segmenté en deux segments : indirect et direct. En 2024, le segment indirect devrait dominer le marché mexicain des systèmes de surveillance électronique et RFID des articles avec une part de marché de 56,07 %.

Acteurs majeurs

Data Bridge Market Research analyse Checkpoint Systems, Inc. – A Division of CCL Industries Inc (US), AVERY DENNISON CORPORATION (US), Johnson Controls (US), Zebra Technologies Corp (US), HID Global Corporation, part of ASSA ABLOY (US) comme les principaux acteurs opérant sur le marché.

Développement du marché

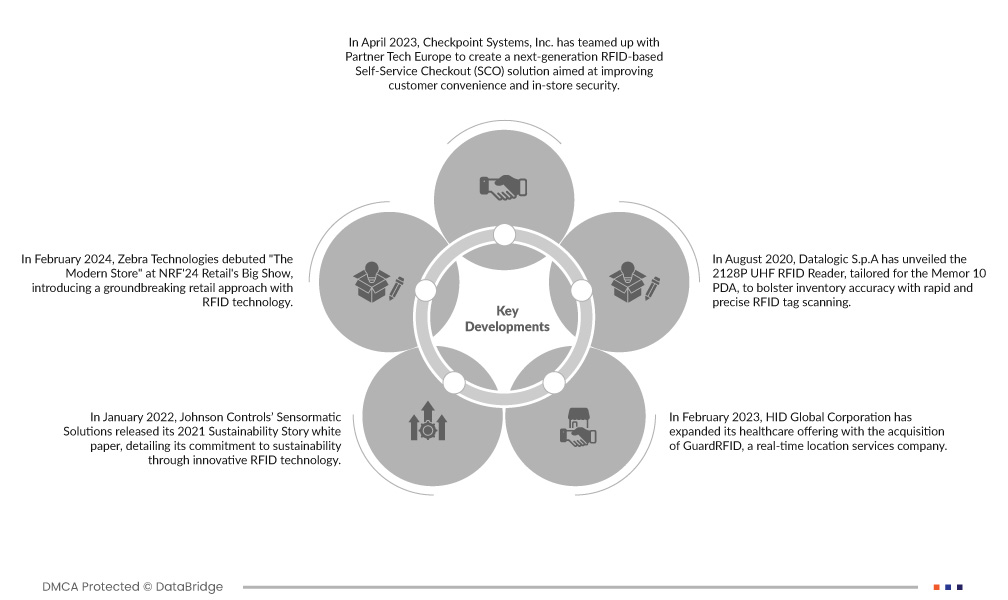

- En avril 2023, Checkpoint Systems, Inc. s'est associé à Partner Tech Europe pour créer une solution de caisse libre-service (SCO) nouvelle génération basée sur la RFID, visant à améliorer le confort des clients et la sécurité en magasin. Cette collaboration renforce la présence de Checkpoint Systems, Inc. sur le marché de la RFID en intégrant sa technologie à des systèmes SCO avancés. Cette nouvelle solution améliore l'expérience client, renforce la prévention des pertes et fournit des données d'achat précises, dynamisant ainsi les ventes et l'efficacité opérationnelle des détaillants.

- En février 2024, Zebra Technologies a présenté « The Modern Store » au NRF'24 Retail's Big Show, présentant une approche innovante du commerce de détail grâce à la technologie RFID. Cette innovation optimise la gestion des stocks, personnalise les interactions clients et simplifie les opérations en magasin grâce à des fonctionnalités telles que le libre-service et la personnalisation des profils utilisateurs. En intégrant la RFID dans les environnements de vente, Zebra consolide sa réputation de fournisseur de solutions avancées qui améliorent l'efficacité opérationnelle, la précision et l'expérience client. Le succès de « The Modern Store » renforce la position de Zebra sur le marché et élargit son influence dans le secteur des technologies du commerce de détail.

- En janvier 2022, Sensormatic Solutions de Johnson Controls a publié son livre blanc « Sustainability Story 2021 », détaillant son engagement en faveur du développement durable grâce à une technologie RFID innovante. Ses systèmes de surveillance électronique des articles (EAS) consomment désormais 50 % d'énergie en moins, et la solution d'intelligence des stocks, exploitant la RFID, réduit les déchets et les émissions de carbone dans la chaîne d'approvisionnement. Cette priorité accordée au développement durable profite aux détaillants comme aux consommateurs, garantissant des opérations efficaces, une consommation d'énergie réduite et des expériences d'achat fluides.

- En février 2023, HID Global Corporation a élargi son offre de soins de santé avec l'acquisition de GuardRFID, une société de services de localisation en temps réel. Cette acquisition renforce la présence de HID dans les domaines de la RFID active et de la RTLS, lui permettant de proposer des solutions innovantes pour la sécurité des nourrissons, la gestion de la contrainte du personnel, la localisation des biens et la gestion des patients errants. Cette acquisition renforce la capacité de HID à protéger les patients et le personnel des établissements de santé, positionnant l'entreprise comme un leader du secteur.

- En août 2020, Datalogic SpA a dévoilé le lecteur RFID UHF 2128P, conçu pour le PDA Memor 10, afin d'optimiser la précision des stocks grâce à une lecture rapide et précise des étiquettes RFID. Cette avancée renforce les capacités RFID de Datalogic SPA, offrant des performances supérieures en lecture d'étiquettes. Avec le lancement du lecteur RFID UHF 2128P, Datalogic améliore la précision et l'efficacité des stocks pour ses clients. Des fonctionnalités clés telles qu'une puissance de sortie maximale, une portée de lecture étendue et un logiciel de déduplication des étiquettes simplifient les processus de gestion des stocks, positionnant Datalogic comme un fournisseur leader de solutions RFID de pointe pour des secteurs tels que la vente au détail, le transport et la logistique, l'industrie manufacturière et la santé.

Analyse régionale

Géographiquement, les États couverts par le rapport sur le marché des systèmes de surveillance électronique et RFID des articles au Mexique sont Jalisco, Oaxaca, Chihuahua, Coahuila de Zaragoza, Sonora, Zacatecas et le reste du Mexique.

Selon l'analyse de Data Bridge Market Research :

Jalisco devrait être l'État dominant et à la croissance la plus rapide sur le marché mexicain des systèmes RFID et de surveillance électronique des articles.

L'État de Jalisco domine le marché mexicain des systèmes RFID et de surveillance électronique des articles grâce à son important pôle technologique et d'innovation. L'État abrite un écosystème florissant d'entreprises technologiques, d'instituts de recherche et de main-d'œuvre qualifiée, favorisant ainsi un environnement propice au développement et à l'adoption des systèmes RFID et EAS.

Pour plus d'informations sur le marché mexicain des systèmes de surveillance électronique des articles et RFID, cliquez ici : https://www.databridgemarketresearch.com/reports/mexico-rfid-and-electronic-article-surveillance-systems-market