La demande croissante d'automatisation dans divers secteurs est un moteur essentiel de la croissance du marché des bras robotisés. Dans le secteur manufacturier, les bras robotisés sont largement adoptés pour améliorer l'efficacité et la précision de tâches telles que l'assemblage, le soudage et la manutention. Ces robots permettent aux fabricants de répondre à la demande croissante des consommateurs en améliorant leurs capacités de production tout en garantissant une qualité constante des produits. La capacité des bras robotisés à exécuter des tâches répétitives avec une grande précision minimise les erreurs humaines et améliore l'efficacité opérationnelle globale, ce qui les rend essentiels dans les environnements de production contemporains.

Accéder au rapport complet sur https://www.databridgemarketresearch.com/reports/india-robotic-arm-market

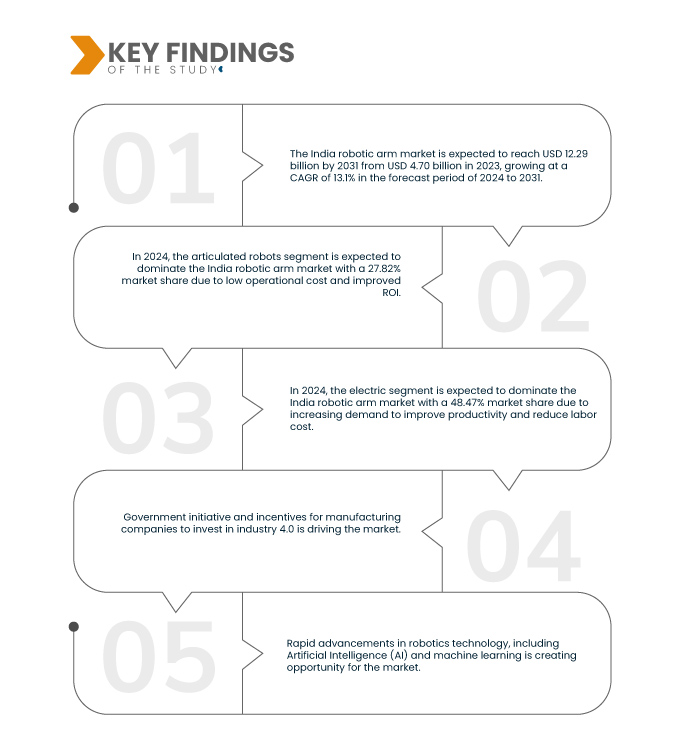

Data Bridge Market Research analyse que le marché indien des bras robotisés devrait atteindre 12,29 milliards USD d'ici 2031, contre 4,70 milliards USD en 2023, avec un taux de croissance annuel composé (TCAC) de 13,1 % sur la période de prévision 2024-2031. Au-delà des secteurs manufacturiers, des industries telles que la santé, la logistique et l'agriculture intègrent également des bras robotisés pour rationaliser leurs opérations. Dans le secteur de la santé, les bras robotisés assistent les interventions chirurgicales et les processus de laboratoire, améliorant la précision et allégeant la charge de travail des professionnels de santé. Les entreprises de logistique utilisent des bras robotisés pour le tri, l'emballage et la palettisation, ce qui améliore l'efficacité de la chaîne d'approvisionnement et réduit les coûts de main-d'œuvre. Dans l'agriculture, les bras robotisés facilitent des tâches telles que la récolte et la plantation, répondant ainsi aux pénuries de main-d'œuvre et augmentant la productivité. L'adoption de bras robotisés dans ces divers secteurs souligne la tendance croissante à l'automatisation, motivée par la nécessité d'améliorer l'efficacité, de réduire les coûts et de maintenir la compétitivité dans un monde de plus en plus automatisé.

Principales conclusions de l'étude

Initiative gouvernementale et mesures incitatives pour les entreprises manufacturières qui investissent dans l'industrie 4.0

Le gouvernement indien encourage activement l'adoption des technologies de l'industrie 4.0, notamment la robotique, par le biais de diverses initiatives et mesures incitatives. Parmi les initiatives notables figure le programme d'incitation à la production (PLI), qui subventionne les entreprises investissant dans des capacités de production dans des secteurs tels que l'automobile, la métallurgie, la pharmacie et l'agroalimentaire, principaux utilisateurs de bras robotisés. Ce programme vise à renforcer la compétitivité de ces industries et à attirer davantage d'investissements, stimulant ainsi la demande de bras robotisés sur le marché.

Par ailleurs, les efforts du gouvernement pour faciliter les affaires et créer un environnement propice à l'adoption de technologies avancées comme la robotique par les entreprises manufacturières constituent un autre moteur important. Grâce à des réformes politiques, au développement des infrastructures et à des programmes de développement des compétences, le gouvernement favorise un écosystème favorable à l'adoption des technologies de l'industrie 4.0, ce qui devrait accélérer encore la demande de bras robotisés.

Portée du rapport et segmentation du marché

Rapport métrique

|

Détails

|

Période de prévision

|

2024 à 2031

|

Année de base

|

2023

|

Années historiques

|

2022 (personnalisable pour 2016-2021)

|

Unités quantitatives

|

Chiffre d'affaires en milliards USD

|

Segments couverts

|

Type de robot (robots articulés, robots cartésiens, robots collaboratifs , robots SCARA, robots parallèles , robots cylindriques et autres), type (électrique, hydraulique et pneumatique), capacité de charge utile (100 kg à 500 kg, 500 kg à 1 000 kg, moins de 100 kg, de 1 000 kg à 3 000 kg et plus de 3 000 kg), type d’axe (6 axes, 7 axes, 5 axes, 4 axes, 3 axes, 2 axes et 1 axe), application (manutention, assemblage et démontage, soudage et brasage, distribution, inspection et tests de qualité, traitement, tri, collage et scellage, et autres), utilisateurs finaux (automobile, électricité et électronique, métaux et machines, alimentation et boissons, plastique et emballage, produits chimiques, soins de santé et produits pharmaceutiques , aérospatiale et défense, logistique et Transports, constructions, pétrole et gaz, gestion des déchets et recyclage, vente au détail, agriculture et autres)

|

Pays couvert

|

Inde

|

Acteurs du marché couverts

|

ABB (Suisse), Kawasaki Heavy Industries (Japon), DENSO CORPORATION (Japon), YASKAWA ELECTRIC CORPORATION (Japon) et FANUC CORPORATION (Japon) Mitsubishi Electric Corporation (Japon), MCI Robotics (Inde), Seiko Epson Corporation (Japon), Mecademic (Canada), Asimov Robotics (Inde), Systemantics (Inde), Svaya Robotics Pvt. Ltd (Inde), Gridbots Technologies Private Limited. (Inde), JanyuTech, Universal Robots A/S (Inde), OMRON Corporation (Japon) et KUKA AG (Allemagne) entre autres

|

Points de données couverts dans le rapport

|

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse approfondie par des experts, une production et une capacité géographiquement représentées par entreprise, des configurations de réseau de distributeurs et de partenaires, une analyse détaillée et mise à jour des tendances des prix et une analyse des déficits de la chaîne d'approvisionnement et de la demande.

|

Analyse des segments

Le marché indien des bras robotisés est classé en six segments notables en fonction du type de robot, du type, de la capacité de charge utile, du type d'axe, de l'application et des utilisateurs finaux.

- En fonction du type de robot, le marché indien des bras robotisés est segmenté en robots articulés, robots cartésiens, robots collaboratifs, robots SCARA , robots parallèles, robots cylindriques, etc. En 2024, le segment des robots articulés devrait dominer le marché indien des bras robotisés avec une part de marché de 27,82 %.

- En Inde, le marché des bras robotisés est segmenté en trois catégories : électrique, hydraulique et pneumatique. En 2024, le segment électrique devrait dominer le marché indien des bras robotisés avec une part de marché de 48,47 %.

- Sur la base de la capacité de charge utile, le marché indien des bras robotisés est segmenté en 100 kg-500 kg, 500 kg-1000 kg, 1000 kg à 3000 kg, moins de 100 kg et plus de 3000 kg.

En 2024, le segment de 100 à 500 kg devrait dominer le marché indien des bras robotisés

En 2024, le segment 100 kg-500 kg devrait dominer le marché avec une part de marché de 35,32 % en raison de son équilibre optimal entre capacité de charge utile et polyvalence.

- En fonction du type d'axe, le marché indien des bras robotisés est segmenté en 6 axes, 7 axes, 5 axes, 4 axes, 3 axes, 2 axes et 1 axe. En 2024, le segment 6 axes devrait dominer le marché indien des bras robotisés avec une part de marché de 29,45 %.

- En fonction des applications, le marché indien des bras robotisés est segmenté en : manutention, assemblage et démontage, soudage et brasage, distribution, inspection et contrôle qualité, traitement, tri, collage et scellage, etc. En 2024, le segment de la manutention devrait dominer le marché indien des bras robotisés avec une part de marché de 23,89 %.

- Sur la base des utilisateurs finaux, le marché indien des bras robotisés est segmenté en automobile, électricité et électronique, métaux et machines, aliments et boissons, plastique et emballage, produits chimiques, soins de santé et produits pharmaceutiques, aérospatiale et défense, logistique et transports, constructions, pétrole et gaz, gestion des déchets et recyclage, vente au détail, agriculture et autres.

En 2024, l'automobile devrait dominer le marché indien des bras robotisés

En 2024, le segment automobile devrait dominer le marché avec 25,66 % de parts de marché en raison de faibles coûts opérationnels et d'un meilleur retour sur investissement.

Acteurs majeurs

Data Bridge Market Research analyse ABB (Suisse), Kawasaki Heavy Industries, Ltd. (Japon), DENSO CORPORATION (Japon), YASKAWA ELECTRIC CORPORATION (Japon) et FANUC CORPORATION (Japon) comme les principaux acteurs opérant sur le marché indien des bras robotisés.

Développement du marché

- En mai 2024, ABB a élargi sa gamme de bras robotisés industriels modulaires avec le lancement des IRB 7710 et IRB 7720. Ces modèles proposent 16 nouvelles variantes, destinées principalement aux constructeurs automobiles et aux fournisseurs de premier rang, ainsi qu'aux applications dans les domaines de la logistique, de la fonderie, de la fabrication de machines, de la construction et de l'agriculture. Leur conception modulaire standardisée simplifie l'installation, améliorant ainsi la flexibilité et la rentabilité. Avec une précision de trajectoire de 0,6 mm et des charges utiles allant jusqu'à 620 kg, ces robots excellent dans les tâches de haute précision, soulignant l'engagement d'ABB en faveur de l'innovation et de la satisfaction client.

- En janvier 2024, ABB et Simpliforge Creations ont collaboré pour développer les capacités d'impression 3D du secteur de la construction en Inde. Ensemble, ils ont développé la plus grande imprimante 3D robotisée à béton d'Asie du Sud, qui a déjà servi à créer le premier lieu de culte et un pont imprimés en 3D en Inde. Cette collaboration vise à révolutionner la construction en permettant des méthodes de construction plus rapides, plus durables et plus sûres.

- En septembre 2023, YASKAWA ELECTRIC CORPORATION a excellé au salon WeldfabMeet Pune 2023, présentant des solutions d'automatisation de soudage de pointe et soulignant l'importance d'un soudage de qualité en ingénierie et en fabrication. Grâce à sa présence remarquée et à son engagement en faveur de l'innovation, Yaskawa India a consolidé son leadership dans le secteur de l'automatisation du soudage et est bien positionnée pour continuer à fournir des solutions de pointe répondant aux besoins d'automatisation de ses clients.

- En février 2022, YASKAWA ELECTRIC CORPORATION a inauguré une nouvelle usine de solutions robotiques à Manesar, Gurugram, visant à améliorer l'automatisation robotique industrielle. L'usine présentait des technologies de pointe pour diverses applications telles que le soudage à l'arc, la palettisation et la surveillance des machines, favorisant ainsi une collaboration plus étroite avec les clients. Dotée d'un atelier ultramoderne de 4 200 m², l'usine assurait la fabrication, l'assemblage, les tests et l'intégration de systèmes robotisés personnalisés.

- En août 2023, FANUC CORPORATION India a inauguré son nouveau centre technologique à Chennai. Ce centre renforce l'engagement de FANUC CORPORATION à servir le pays avec des solutions d'automatisation industrielle de pointe. Doté d'infrastructures essentielles, le centre vise à fournir des services améliorés au pôle industriel en pleine croissance de Chennai, en proposant une maintenance à vie et en favorisant le progrès technologique. Sa conception écologique souligne l'engagement de FANUC CORPORATION en faveur du développement durable, tout en répondant aux besoins du marché indien et en promouvant les initiatives « Made in India ».

Pour plus d'informations sur le marché indien des bras robotisés, cliquez ici : https://www.databridgemarketresearch.com/reports/india-robotic-arm-market