Les panneaux décoratifs sont des éléments architecturaux conçus pour rehausser l'esthétique des espaces intérieurs ou extérieurs. Fabriqués à partir de matériaux variés tels que le bois, le métal, le verre ou les composites, ces panneaux présentent des motifs, des textures ou des designs complexes qui ajoutent caractère et élégance à tout environnement. Ils remplissent diverses fonctions, comme revêtement mural, cloison ou décoration de façade, alliant ainsi esthétique et fonctionnalité. Outre leur fonction décorative, certains panneaux offrent également une isolation acoustique ou thermique, contribuant ainsi au confort et à la fonctionnalité d'un espace. Largement utilisés dans les bâtiments résidentiels, commerciaux et publics, les panneaux décoratifs offrent une solution polyvalente et élégante aux besoins architecturaux modernes.

Accéder au rapport complet sur https://www.databridgemarketresearch.com/reports/dubai-and-saudi-arabia-decorative-panels-market

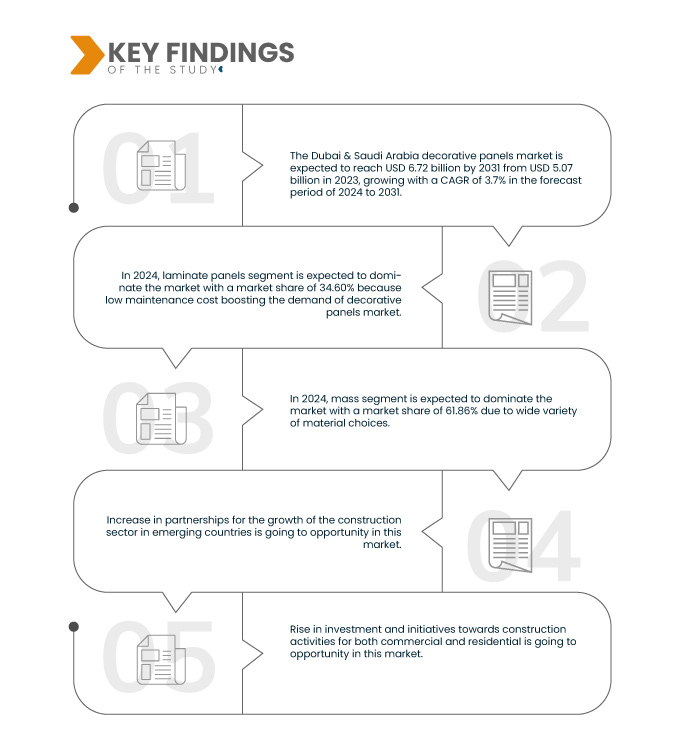

Data Bridge Market Research analyse que le marché des panneaux décoratifs de Dubaï et d'Arabie saoudite devrait atteindre 6,72 milliards USD d'ici 2031, contre 5,07 milliards USD en 2023, avec un TCAC de 3,7 % au cours de la période de prévision de 2024 à 2031.

Principales conclusions de l'étude

Flexibilité dans les options de conception augmentant la demande du marché des panneaux décoratifs

Le marché des panneaux décoratifs à Dubaï et en Arabie saoudite connaît une croissance significative, portée par la flexibilité de conception offerte par ces panneaux. Cette adaptabilité transforme l'aménagement intérieur et la construction, permettant une personnalisation et une innovation poussées dans les espaces résidentiels et commerciaux. Contrairement aux éléments de design traditionnels, les panneaux décoratifs modernes se déclinent en une variété de matériaux, de finitions, de tailles et de formes, répondant à diverses préférences esthétiques. Leur capacité à s'adapter à des caractéristiques architecturales uniques et à faciliter les mises à jour les rend particulièrement attractifs dans ces régions. Les fabricants peuvent exploiter cette flexibilité en présentant des possibilités de conception, en collaborant avec des designers et en proposant des options de personnalisation pour répondre à la demande croissante de solutions personnalisées et adaptées aux tendances.

Portée du rapport et segmentation du marché

Rapport métrique

|

Détails

|

Période de prévision

|

2024 à 2031

|

Année de base

|

2023

|

Années historiques

|

2022 (personnalisable de 2016 à 2021)

|

Unités quantitatives

|

Chiffre d'affaires en milliards USD

|

Segments couverts

|

Type de produit (panneaux stratifiés, panneaux à base de bois, panneaux à base de verre, panneaux à base de métal et autres), gamme de prix (masse et premium), application (revêtement mural, meubles, armoires de cuisine, portes d'armoires, comptoirs, portes, revêtements de sol, plafonds, étagères, agencements de magasins, tendances en matière d'escaliers, terrasses résidentielles et autres), utilisateur final (résidentiel, commercial et industriel)

|

Pays couverts

|

Arabie saoudite et Dubaï

|

Acteurs du marché couverts

|

Finsa (Espagne), Akinco.ae (EAU), Bawan (Arabie saoudite), Sonae Arauco (filiale de Sonae Industria) (Royaume-Uni), Kronoplus Limited (Autriche), EGGER (Autriche), mopatech (Arabie saoudite), FAZZA (Arabie saoudite), SONTEXT P/L (Australie), Bluespace Workspace (EAU), Workspace (EAU). (EAU), Royal Shades Curtains LLC (EAU), PFLEIDERER Group BV & Co KG (Allemagne), PERI SE (Allemagne).

|

Points de données couverts dans le rapport

|

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research incluent également une analyse approfondie des experts, une épidémiologie des patients, une analyse du pipeline, une analyse des prix et un cadre réglementaire.

|

Analyse des segments :

Le marché des panneaux décoratifs de Dubaï et d'Arabie saoudite est segmenté en quatre segments notables en fonction du type de produit, de la gamme de prix, de l'application et de l'utilisateur final.

- Sur la base du type de produit, le marché est segmenté en panneaux stratifiés, panneaux à base de bois, panneaux à base de verre, panneaux à base de métal et autres.

En 2024, le segment des panneaux stratifiés devrait dominer le marché des panneaux décoratifs de Dubaï et d'Arabie saoudite

En 2024, le segment des panneaux stratifiés devrait dominer le marché avec une part de marché de 34,60 % grâce à leur rentabilité, leur durabilité et leur large éventail d'options de conception. Abordables et esthétiques, les panneaux stratifiés constituent un choix attractif pour les intérieurs résidentiels et commerciaux. De plus, faciles d'entretien et résistants aux rayures et à l'humidité, ils sont parfaitement adaptés aux climats rigoureux de la région.

- Sur la base de la gamme de prix, le marché est segmenté en masse et premium

En 2024, le segment des panneaux stratifiés devrait dominer le marché des panneaux décoratifs de Dubaï et d'Arabie saoudite

En 2024, le segment grand public devrait dominer le marché avec une part de marché de 61,86 %, grâce à son prix abordable et à son attrait général. Les panneaux décoratifs grand public offrent des designs attrayants à des prix plus bas, les rendant accessibles à un plus grand nombre de clients.

- En fonction des applications, le marché est segmenté en revêtements muraux, meubles, armoires de cuisine, portes d'armoires, plans de travail, portes, revêtements de sol , plafonds, étagères, agencements de magasins, tendances en matière d'escaliers, terrasses, etc. En 2024, le segment des revêtements muraux devrait dominer le marché avec une part de marché de 22,24 %.

- En fonction de l'utilisateur final, le marché est segmenté en résidentiel, commercial et industriel. En 2024, le segment des sols devrait dominer le marché avec une part de marché maximale de 36,84 %.

Acteurs majeurs

Data Bridge Market Research analyse Bawan (Arabie saoudite), EGGER (Autriche), Sonae Arauco (filiale de Sonae Industria) (Royaume-Uni), PFLEIDERER Group BV & Co. KG (Allemagne), PERI SE (Allemagne) comme les principaux acteurs du marché sur ce marché.

Développement du marché

- En mai 2024, le groupe PERI, fabricant leader de systèmes de coffrage et d'échafaudage basé en Allemagne, a acquis Mabey Hire, société britannique leader sur le marché des solutions de construction d'infrastructures et de rénovation. Mabey Hire, qui compte 400 employés répartis sur 16 sites au Royaume-Uni, conservera sa direction, sa marque et son nom actuels, mais en tant qu'entreprise indépendante sous PERI UK. Cette acquisition vise à exploiter les synergies en matière d'ingénierie et de professionnalisme, à enrichir l'offre de services et à élargir la portée commerciale. David Adams, PDG de Mabey Hire, et Ian Hayes, directeur général de PERI UK, soulignent le potentiel de ventes croisées et d'amélioration du service client. Christian Schwörer, PDG du groupe PERI, souligne que cette acquisition constitue une étape importante dans la stratégie de croissance de PERI sur les marchés du génie civil et de la rénovation.

- En août 2021, les produits HPL haut de gamme de Pfleiderer ont obtenu la certification Ange Bleu. Pfleiderer est un pionnier du développement durable dans la construction et l'ameublement, en phase avec la conscience écologique des consommateurs. Ses produits HPL certifiés, dotés de surfaces et de plans de travail anti-traces de doigts, marquent une avancée majeure en matière d'options éco-responsables. Grâce à une durabilité vérifiable et à une qualité haut de gamme, Pfleiderer est une référence dans le secteur, obtenant le prestigieux label Ange Bleu.

- En juin 2018, Finsa est fière d'annoncer le lancement de sa nouvelle gamme de produits spécialement conçue pour le secteur de la vente au détail. Alors que les magasins, restaurants et centres commerciaux rouvrent leurs portes après la crise de la Covid-19, sa gamme complète de solutions bois est accessible aux architectes, décorateurs d'intérieur et professionnels du design travaillant sur des projets de vente au détail. Ce nouveau portefeuille présente 20 projets mettant en valeur la polyvalence de ses matériaux dans divers environnements, notamment les restaurants, les boutiques, les salles de sport, les cliniques et les centres commerciaux. Qu'il s'agisse de concevoir des établissements luxueux ou des espaces plus modestes, leur large gamme de supports et de surfaces décoratives offre des possibilités infinies d'expression créative.

- En mars 2023, SHANDONG YIYIJIA DECOR CO., LTD. a récemment lancé un nouveau panneau mural insonorisant composé d'une surface en MDF et d'une base en polyuréthane. Disponibles en plusieurs coloris, ces panneaux sûrs et non polluants ont connu un succès considérable grâce à leurs excellentes performances. Ils sont populaires en Europe, en Amérique et en Asie. Les panneaux mesurent 60 cm, 28 cm ou 30 cm de largeur et 2,4 mètres ou 3 mètres de longueur, avec des dimensions personnalisables. D'une épaisseur de 21 mm, ils sont conformes à la norme CARB P2 et offrent un coefficient d'atténuation du bruit de 0,3 en pose directe et de 0,9 en pose avec une quille. Leur entretien est facile, avec un simple aspirateur ou un chiffon sec.

- En mai 2024, Sontext est fier de présenter les panneaux acoustiques en bois DecraSound, le dernier-né de sa vaste gamme. DecraSlat associe des lattes de placage bois à un support acoustique en polyester (PET), pour une installation facile et une disponibilité dans plus de 35 placages bois et 25 stratifiés décoratifs. Idéal pour ceux qui recherchent un panneau mural acoustique aspect bois, léger et économique, DecraSlat est un choix de premier ordre. Pour présenter les différentes options de réduction du bruit et de création d'environnements dynamiques, DecraSlat a créé un ensemble de magnifiques catalogues à l'occasion du lancement de la gamme DecraSound.

Analyse régionale

Sur la base de la géographie, le marché est segmenté en Arabie saoudite et à Dubaï.

Selon l'analyse de Data Bridge Market Research :

L'Arabie saoudite devrait dominer le marché des panneaux décoratifs de Dubaï et d'Arabie saoudite

L'Arabie saoudite devrait dominer le marché car la facilité d'installation stimule la demande d'utilisation de panneaux décoratifs dans les secteurs résidentiel et de la construction.

Pour plus d'informations sur le marché des panneaux décoratifs de Dubaï et d'Arabie saoudite , cliquez ici : https://www.databridgemarketresearch.com/reports/dubai-and-saudi-arabia-decorative-panels-market