La demanda de analizadores de gases de combustión en América, Europa y Asia se ve significativamente influenciada por la creciente aplicación de estrictas normativas ambientales. Los gobiernos de los países desarrollados de estas regiones trabajan para reducir el impacto ambiental de la fabricación, en particular las emisiones. Los organismos reguladores están imponiendo estrictas regulaciones de emisiones a empresas como la producción de electricidad, la manufactura y el transporte para combatir el cambio climático y mejorar la calidad del aire. Esta presión regulatoria está incrementando la demanda de analizadores de gases de combustión modernos para ayudar a la industria a cumplir con las nuevas normativas.

El mayor énfasis en la protección del medio ambiente ha dado lugar a estrictos requisitos de emisiones en diversas industrias, como la energía, la manufactura y el transporte. En respuesta, los gobiernos exigen requisitos de cumplimiento más estrictos, exigiendo a las empresas el uso de nuevas tecnologías para monitorear y gestionar sus emisiones. Los analizadores de gases de combustión, diseñados para examinar adecuadamente la composición de los gases de escape, ayudan a la industria a cumplir con estas regulaciones cambiantes. Las empresas utilizan analizadores de gases de combustión para detectar mejoras operativas, aumentar la eficiencia del combustible y reducir el impacto ambiental.

Acceda al informe completo en https://www.databridgemarketresearch.com/reports/us-central-america-south-america-europe-and-asia-flue-gas-analyzer-market

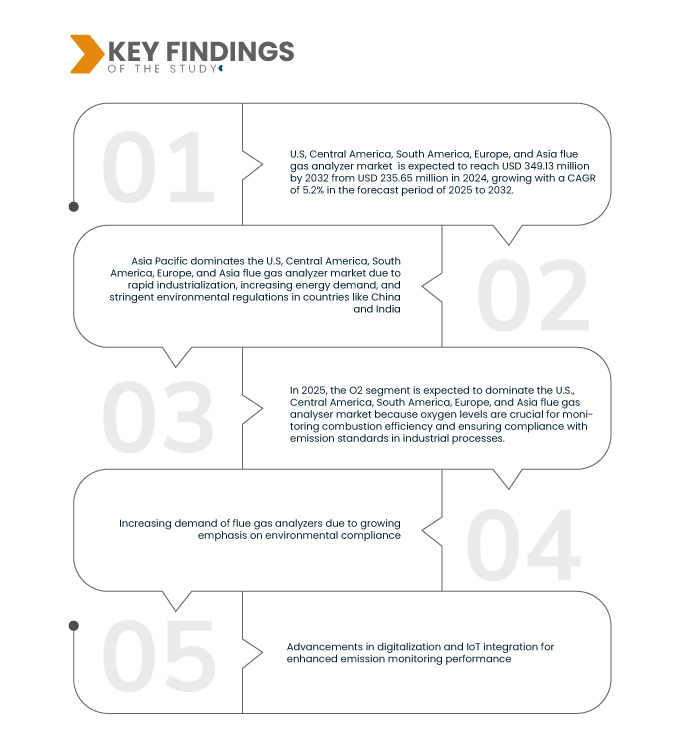

Data Bridge Market Research analiza que se espera que el mercado de analizadores de gases de combustión de EE. UU., América Central, América del Sur, Europa y Asia alcance los USD 349,13 millones para 2032 desde USD 235,65 millones en 2024, creciendo con una CAGR del 5,2% en el período de pronóstico de 2025 a 2032.

Principales hallazgos del estudio

Expansión de la industrialización en los mercados emergentes

El rápido ritmo de industrialización en los mercados emergentes de América, Europa y Asia ha incrementado significativamente la demanda de analizadores de gases de combustión. Industrias como la manufactura, la energía y el procesamiento químico están expandiendo sus operaciones para satisfacer la creciente demanda global y nacional. Estas industrias dependen en gran medida de los procesos de combustión, lo que requiere un monitoreo avanzado de gases de combustión para garantizar el cumplimiento de las normas ambientales, optimizar el uso de combustible y reducir las emisiones. La integración de tecnologías modernas en los procesos industriales impulsa aún más la necesidad de soluciones de análisis de gases precisas y eficientes.

Además, los gobiernos de las economías emergentes están implementando estrictas regulaciones sobre emisiones para combatir la contaminación atmosférica y promover la sostenibilidad. Este impulso regulatorio, sumado a la creciente concienciación sobre el impacto ambiental de las emisiones industriales, ha hecho que los analizadores de gases de combustión sean indispensables tanto para instalaciones nuevas como existentes. A medida que la industrialización se acelera en estas regiones, se prevé un aumento en la adopción de analizadores de gases de combustión, lo que ofrece importantes oportunidades para que los actores del mercado satisfagan esta creciente demanda.

Alcance del informe y segmentación del mercado

Métrica del informe

|

Detalles

|

Período de pronóstico

|

2025 a 2032

|

Año base

|

2024

|

Años históricos

|

2023 (personalizable para 2018-2022)

|

Unidades cuantitativas

|

Ingresos en millones de USD

|

Segmentos cubiertos

|

Oferta (producto y servicios), componente de gas (O₂ CO₂), instalación (nueva y existente), aplicación (plantas de generación de energía, petróleo y gas, pulpa y papel , e incineración de residuos), canal de venta (venta directa e indirecta)

|

Países cubiertos

|

EE. UU., Alemania, Francia, Reino Unido, Italia, España, Rusia, Turquía, Bélgica, Países Bajos, Suiza, Dinamarca, Polonia, Suecia, Noruega, Finlandia, Resto de Europa, China, Japón, India, Corea del Sur, Singapur, Malasia, Tailandia, Indonesia, Filipinas, Taiwán, Vietnam, Resto de Asia, Panamá, Costa Rica, Guatemala, Resto de Centroamérica, Brasil, Argentina, Chile, Colombia, Perú, Paraguay y Resto de Sudamérica.

|

Actores del mercado cubiertos

|

ABB (Suiza), Emerson Electric Co. (EE. UU.), Fuji Electric Co., Ltd. (Japón), Teledyne Technologies Incorporated (EE. UU.), AMETEK Land (Reino Unido), SICK AG (Alemania), Opsis Aktiebolag (Suecia), MSA (EE. UU.), ADEV (Suiza), Process Insights, Inc. (EE. UU.), Siemens (Alemania), Yokogawa Electric Corporation (Japón), Servomex (Reino Unido), Esegas.com (Portugal), Nova Analytical Systems (EE. UU.) y Horiba Group (Japón), entre otros.

|

Puntos de datos cubiertos en el informe

|

Además de los conocimientos sobre escenarios de mercado como el valor de mercado, la tasa de crecimiento, la segmentación, la cobertura geográfica y los principales actores, los informes de mercado seleccionados por Data Bridge Market Research también incluyen un análisis profundo de expertos, producción y capacidad por empresa representadas geográficamente, diseños de red de distribuidores y socios, análisis detallado y actualizado de tendencias de precios y análisis deficitario de la cadena de suministro y la demanda.

|

Análisis de segmentos

El mercado de analizadores de gases de combustión de EE. UU., América Central, América del Sur, Europa y Asia está segmentado en cinco segmentos notables según la oferta, el componente de gas, la instalación, la aplicación y el canal de ventas.

- En función de la oferta, el mercado se segmenta en productos y servicios.

Se espera que en 2025, el segmento de productos domine el mercado de analizadores de gases de combustión de EE. UU., América Central, América del Sur, Europa y Asia.

Se espera que en 2025, el segmento de productos domine el mercado de analizadores de gases de combustión de EE. UU., América Central, América del Sur, Europa y Asia con una participación de mercado del 75,34 % en EE. UU., 73,80 % en América Central, 74,51 % en América del Sur, 73,78 % en Europa y 74,31 % en Asia debido a la creciente demanda de monitoreo preciso de emisiones y cumplimiento normativo en industrias como la generación de energía, la fabricación y la automotriz.

- Sobre la base del componente de gas, el mercado de analizadores de gases de combustión de EE. UU., América Central, América del Sur, Europa y Asia está segmentado en O2 y CO2.

Se espera que en 2025, el segmento O2 domine el mercado de analizadores de gases de combustión de EE. UU., América Central, América del Sur, Europa y Asia.

Se espera que en 2025, el segmento de O2 domine el mercado de analizadores de gases de combustión de EE. UU., América Central, América del Sur, Europa y Asia con una participación de mercado del 57,44 % en EE. UU., 56,97 % en América Central, 57,67 % en América del Sur, 57,11 % en Europa y 57,39 % en Asia porque la medición de oxígeno es esencial para evaluar la eficiencia de la combustión y controlar las emisiones en varios procesos industriales.

- Según la instalación, el mercado estadounidense de analizadores de gases de combustión se segmenta en nuevos y existentes. Para 2025, se prevé que este nuevo segmento domine el mercado de analizadores de gases de combustión en EE. UU., Centroamérica, Sudamérica, Europa y Asia, con una cuota de mercado del 66,04 % en EE. UU., el 64,90 % en Centroamérica, el 66,22 % en Sudamérica, el 64,65 % en Europa y el 66,12 % en Asia.

- Según su aplicación, el mercado estadounidense de analizadores de gases de combustión se segmenta en plantas de generación de energía, petróleo y gas, pulpa y papel, incineración de residuos, entre otros. Para 2025, se prevé que el segmento de plantas de generación de energía domine el mercado de analizadores de gases de combustión en EE. UU., Centroamérica, Sudamérica, Europa y Asia, con una cuota de mercado del 38,57 % en EE. UU., el 38,03 % en Centroamérica, el 39,41 % en Sudamérica, el 38,85 % en Europa y el 38,61 % en Asia.

- Según el canal de venta, el mercado estadounidense de analizadores de gases de combustión se segmenta en ventas directas e indirectas. En 2025, se prevé que el segmento de ventas directas domine el mercado de analizadores de gases de combustión en EE. UU., Centroamérica, Sudamérica, Europa y Asia, con una cuota de mercado del 64,48 % en EE. UU., el 63,49 % en Centroamérica, el 64,60 % en Sudamérica, el 65,83 % en Europa y el 64,55 % en Asia.

Actores principales

Data Bridge Market Research analiza a ABB (Suiza), Emerson Electric Co. (EE. UU.), Fuji Electric Co., Ltd. (Japón), Teledyne Technologies Incorporated (EE. UU.) y AMETEK Land (Reino Unido) como los principales actores que operan en el mercado.

Desarrollo del mercado

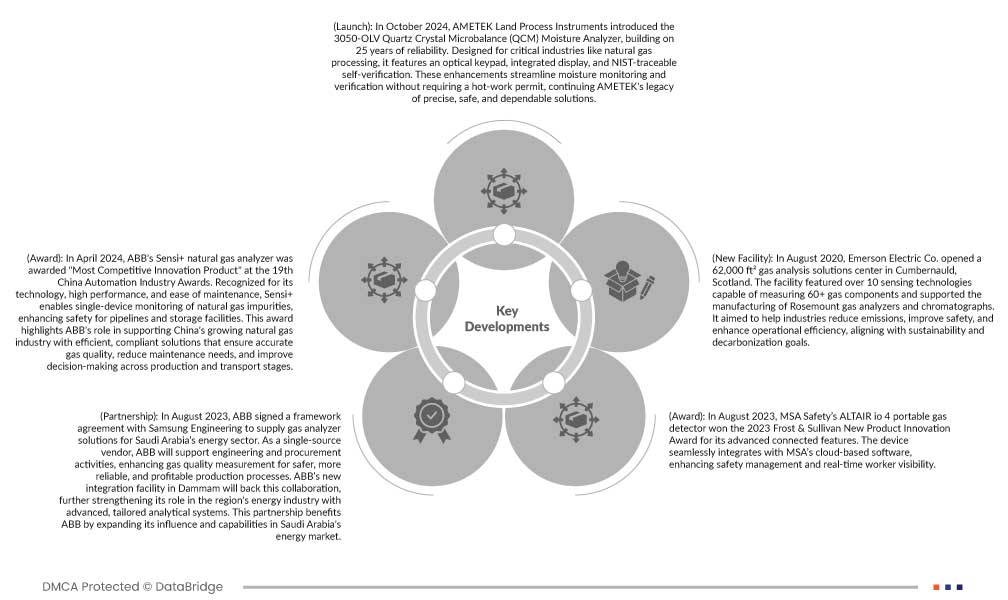

- En octubre de 2024, AMETEK Land Process Instruments presentó el analizador de humedad de microbalanza de cristal de cuarzo (QCM) 3050-OLV, basado en 25 años de fiabilidad. Diseñado para industrias críticas como el procesamiento de gas natural, cuenta con un teclado óptico, pantalla integrada y autoverificación trazable al NIST. Estas mejoras optimizan el monitoreo y la verificación de la humedad sin necesidad de un permiso de trabajo en caliente, continuando la tradición de AMETEK de soluciones precisas, seguras y fiables.

- En abril de 2024, el analizador de gas natural Sensi+ de ABB recibió el premio al "Producto de Innovación Más Competitivo" en la 19.ª edición de los Premios de la Industria de Automatización de China. Reconocido por su tecnología, alto rendimiento y facilidad de mantenimiento, Sensi+ permite la monitorización de impurezas de gas natural con un solo dispositivo, mejorando la seguridad de tuberías e instalaciones de almacenamiento. Este premio destaca el papel de ABB en el apoyo a la creciente industria del gas natural en China con soluciones eficientes y conformes que garantizan una calidad precisa del gas, reducen las necesidades de mantenimiento y optimizan la toma de decisiones en las etapas de producción y transporte.

- En agosto de 2023, ABB firmó un acuerdo marco con Samsung Engineering para suministrar soluciones de análisis de gases al sector energético de Arabia Saudí. Como proveedor integral, ABB apoyará las actividades de ingeniería y compras, optimizando la medición de la calidad del gas para lograr procesos de producción más seguros, fiables y rentables. La nueva planta de integración de ABB en Dammam respaldará esta colaboración, reforzando aún más su papel en la industria energética de la región con sistemas analíticos avanzados y personalizados. Esta colaboración beneficia a ABB al ampliar su influencia y capacidades en el mercado energético de Arabia Saudí.

- En agosto de 2023, el detector de gas portátil ALTAIR io 4 de MSA Safety ganó el Premio a la Innovación de Nuevo Producto Frost & Sullivan 2023 por sus avanzadas funciones de conexión. El dispositivo se integra a la perfección con el software en la nube de MSA, lo que mejora la gestión de la seguridad y la visibilidad de los trabajadores en tiempo real.

- En agosto de 2020, Emerson Electric Co. inauguró un centro de soluciones de análisis de gases de 62.000 pies cuadrados en Cumbernauld, Escocia. Las instalaciones contaban con más de 10 tecnologías de detección capaces de medir más de 60 componentes de gases y respaldaban la fabricación de analizadores de gases y cromatógrafos Rosemount. Su objetivo era ayudar a las industrias a reducir las emisiones, mejorar la seguridad y optimizar la eficiencia operativa, en consonancia con los objetivos de sostenibilidad y descarbonización.

Análisis regional

Geográficamente, los países cubiertos en el mercado de analizadores de gases de combustión de EE. UU., América Central, América del Sur, Europa y Asia son EE. UU., Alemania, Francia, Reino Unido, Italia, España, Rusia, Turquía, Bélgica, Países Bajos, Suiza, Dinamarca, Polonia, Suecia, Noruega, Finlandia, Resto de Europa, China, Japón, India, Corea del Sur, Singapur, Malasia, Tailandia, Indonesia, Filipinas, Taiwán, Vietnam, Resto de Asia, Panamá, Costa Rica, Guatemala, Resto de América Central, Brasil, Argentina, Chile, Colombia, Perú, Paraguay y Resto de América del Sur.

Asia Pacífico domina y presenta la mayor tasa de crecimiento anual compuesta (TCAC) en el mercado de analizadores de gases de combustión de EE. UU., Centroamérica, Sudamérica, Europa y Asia debido a la rápida industrialización, la creciente demanda energética y las estrictas regulaciones ambientales en países como China e India. El creciente enfoque de la región en la reducción de la contaminación atmosférica y la mejora de los sistemas de control de emisiones impulsa la demanda de analizadores de gases de combustión. Además, las inversiones en centrales eléctricas, sectores manufactureros y el desarrollo de infraestructura contribuyen a la expansión del mercado en esta región.

Para obtener información más detallada sobre el informe de mercado de analizadores de gases de combustión de EE. UU., América Central, América del Sur, Europa y Asia, haga clic aquí: https://www.databridgemarketresearch.com/reports/us-central-america-south-america-europe-and-asia-flue-gas-analyzer-market