El yogur cuenta con una variedad de propiedades favorables y ofrece probióticos que ayudan a la digestión y promueven la salud intestinal. Rico en proteínas, vitaminasy minerales, apoya el bienestar general. Su versatilidad brilla en aplicaciones como refrigerio independiente, opción de desayuno o ingrediente en creaciones culinarias como batidos y aderezos. Beneficioso para la salud ósea debido a su contenido de calcio, el yogur también se adapta a diversas preferencias dietéticas. Con su textura cremosa y diversos sabores, el yogur sigue siendo una opción versátil y llena de nutrientes para los consumidores preocupados por su salud.

Acceder al informe completo @ https://www.databridgemarketresearch.com/reports/europe-yogurt-market

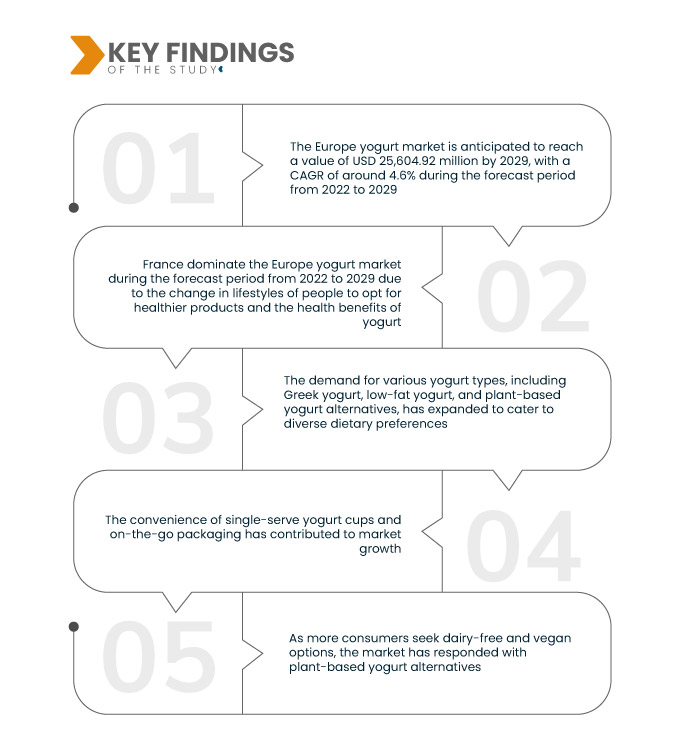

Data Bridge Market Research analiza que el Mercado europeo del yogur está creciendo con una tasa compuesta anual del 4,6% en el período previsto de 2022 a 2029 y se espera que alcance los 25.604,92 millones de dólares en 2029 desde los 17.867,75 millones de dólares en 2021. El creciente reconocimiento de las ventajas para la salud del yogur, incluido su contenido de probióticos y proteínas, impulsa su popularidad entre las personas que priorizan su bienestar. Esta conciencia alienta a los consumidores preocupados por su salud a elegir el yogur como una opción nutritiva que apoya la salud digestiva y proporciona nutrientes esenciales.

Hallazgos clave del estudio

Se espera que una amplia variedad de sabores impulse la tasa de crecimiento del mercado.

El yogur con sabor se ha vuelto cada vez más popular entre los clientes en los últimos diez años. Los fabricantes han incorporado varios sabores, incluidos fresa, arándano, plátano y cereza, en sus yogures para satisfacer la demanda de los consumidores. Además, la mayoría de los productos lácteos vienen en variedades aromatizadas, como leche aromatizada, queso aromatizado, queso ahumado aromatizado, yogur bebible, yogur normal aromatizado y más. Para mejorar el sabor de los productos lácteos, los fabricantes también añaden sus gustos. Las variedades comunes de yogur que se encuentran en las tiendas incluyen fresa, arándano, frambuesa, vainilla, chocolate, plátano, coco, frutos rojos y frutas tropicales, entre otros.

Alcance del informe y segmentación del mercado

|

Métrica de informe

|

Detalles

|

|

Período de pronóstico

|

2022 a 2029

|

|

Año base

|

2021

|

|

Años históricos

|

2020 (Personalizable para 2014-2019)

|

|

Unidades Cuantitativas

|

Ingresos en millones de dólares, volúmenes en unidades, precios en dólares

|

|

Segmentos cubiertos

|

Tipo de yogur (yogur regular, yogur probiótico, yogur bio vivo, yogur preparado, yogur SKYR/estilo islandés, yogur concentrado, yogur batido y otros), tipo de producto (yogur bebible, yogur con cuchara, yogur congelado y otros), contenido de grasa ( Con grasa completa, baja en grasa y sin grasa), sabor (natural y aromatizado), tipo de fuente (de origen animal, de origen vegetal y artificial), formulación (endulzada y sin endulzar), marca (Yoplait, Stonyfield Greek, Oikos, Chobani, Yeo , Activia, Islandic Provisions Skyr, Corner, Arla Skyr, Isey Skyr y otros), categoría de inclusión (simple y con inclusiones y aderezos), fortificación (regular y fortificada), declaración (sin gluten,Sin lactosa, Sin conservantes artificiales, sin lácteos, sin soja, sin OGM, sin azúcar, sin calorías, con todas las afirmaciones anteriores, regular sin afirmaciones y otras), categoría orgánica (convencional y orgánica), marca (de marca y privada) ), Embalaje (Bag-In-Box, Bolsas, Frascos, Vasos, Botellas, Tetra Packs y otros), Tamaño del embalaje (Menos de 100 Gramos, 100-200 Gramos, 201-300 Gramos y Más de 300 Gramos), Canal de Distribución (Venta al por menor en tiendas y venta al por menor fuera de tiendas)

|

|

Países cubiertos

|

Alemania, Francia, Italia, Reino Unido, Bélgica, España, Rusia, Turquía, Países Bajos, Suiza y Resto de Europa

|

|

Actores del mercado cubiertos

|

J Sainsbury plc (Reino Unido), arla Foods amba (Dinamarca y Suecia), DANONE (Francia), ICELANDIC PROVISIONS (Islandia) ÍSEY SKYR (Islandia), Yoplait USA, Inc. (EE.UU.), Chobani, LLC. (EE.UU.), MENCHIE'S GLOBAL HEADQUARTE (EE.UU.), COYO Pty Ltd. (Australia), Flor de Burgos (España), Dorfchäsi Noflen (Suiza), Yogurt Barn (Países Bajos), stornetta farms, inc. (Estados Unidos), Ariete Fattoria Latte Sano SpA (Italia), entre otros

|

|

Puntos de datos cubiertos en el informe

|

Además de la información sobre escenarios de mercado como el valor de mercado, la tasa de crecimiento, la segmentación, la cobertura geográfica y los principales actores, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de expertos en profundidad, producción de empresas representadas geográficamente y capacidad, diseños de red de distribuidores y socios, análisis detallado y actualizado de tendencias de precios y análisis de déficit de la cadena de suministro y la demanda.

|

Análisis de segmentos:

El mercado europeo del yogur está segmentado según el tipo de yogur, el tipo de producto, el contenido de grasa, el sabor, el tipo de fuente, la formulación, la marca, la categoría de inclusión, la fortificación, la declaración, la categoría orgánica, la marca, el empaque, el tamaño del empaque y el canal de distribución.

- Según el tipo de yogur, el mercado europeo del yogur se segmenta en yogur normal, yogur skyr/estilo islandés, yogur concentrado, yogur probiótico, yogur preparado, yogur bio vivo, yogur batido y otros.

- Según el tipo de producto, el mercado europeo del yogur se segmenta en yogur bebible, yogur con cuchara, yogur helado y otros.

- Según el contenido de grasa, el mercado europeo del yogur se divide en entero, bajo en grasa y sin grasa.

- Según el sabor, el mercado europeo del yogur se divide en natural y aromatizado.

- Según su origen, el mercado europeo del yogur se divide en de origen animal y de origen vegetal.

- Según la formulación, el mercado europeo del yogur se divide en endulzado y sin endulzar.

- Según la marca, el mercado europeo del yogur se segmenta en Yoplait, Chobani, Stonyfield Greek, Corner, Actiia, Yeo, Okus, Arla Skyr, Islandic Provisions Skyr, Isey Skyr y otros.

- Según la categoría de inclusión, el mercado europeo del yogur se segmenta en natural y con inclusiones y aderezos.

- Según el enriquecimiento, el mercado europeo del yogur se divide en regular y fortificado.

- Sobre la base de esta afirmación, el mercado europeo del yogur se divide en regular, sin gluten, sin lactosa, sin conservantes artificiales, sin lácteos, sin soja, sin OGM, sin azúcar, sin calorías, con todos de los reclamos anteriores, regular sin reclamos y otros

- Según la categoría orgánica, el mercado europeo del yogur se segmenta en convencional y orgánico.

- Según la marca, el mercado europeo del yogur se segmenta en marcas privadas y de marca.

- Según el envasado, el mercado europeo del yogur se segmenta en bag-in-box, bolsas, frascos, tazas, botellas, tetra packs y otros

- Según el tamaño del envase, el mercado europeo del yogur se segmenta en menos de 100 gramos, 100-200 gramos, 201-300 gramos y más de 300 gramos.

- Según el canal de distribución, el mercado europeo del yogur se segmenta en venta minorista en tiendas y venta minorista fuera de tiendas.

Principales actores

Data Bridge Market Research reconoce a las siguientes empresas como los principales actores del mercado del yogur en Europa: arla Foods amba (Dinamarca y Suecia), DANONE (Francia), ICELANDIC PROVISIONS (Islandia) ÍSEY SKYR (Islandia), Yoplait USA, Inc. (Estados Unidos), Chobani, LLC. (EE.UU.), SEDE GLOBAL DE MENCHIE (EE.UU.), COYO Pty Ltd. (Australia)

Desarrollos del mercado

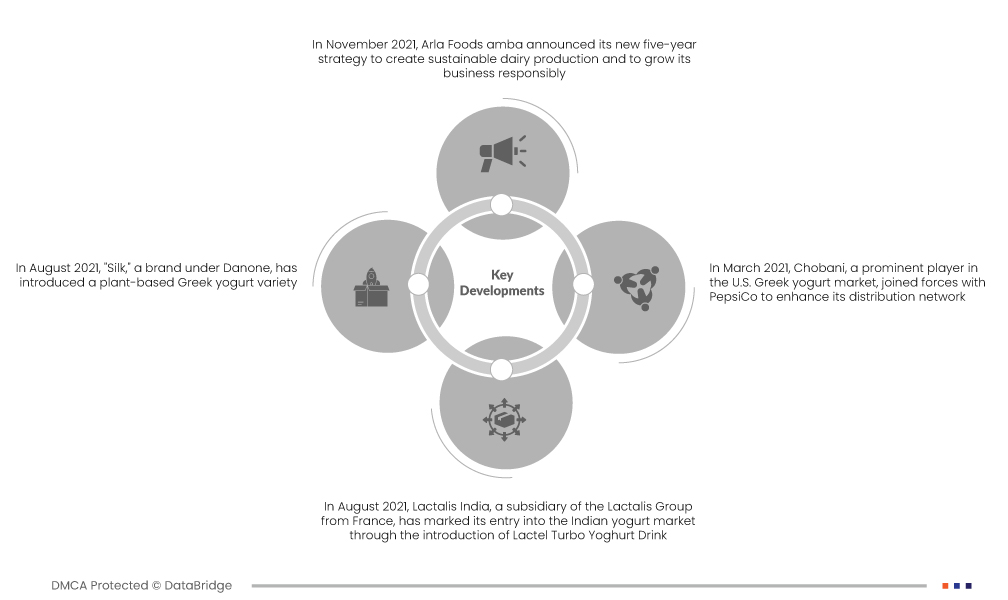

- En noviembre de 2021, Arla Foods amba anunció su nueva estrategia quinquenal para crear una producción láctea sostenible y hacer crecer su negocio de manera responsable. Su objetivo es aumentar sus inversiones en más de un 40 % hasta más de 4 mil millones de euros centrados en la sostenibilidad, la digitalización, nuevas tecnologías de producción y el desarrollo de productos, al mismo tiempo que aumenta su dividendo a más de 1 mil millones de euros para apoyar a sus agricultores propietarios en su viaje hacia la sostenibilidad. Esto ayudará a la empresa a mejorar su negocio y sus capacidades.

- En agosto de 2021, "Silk", una marca de Danone, presentó una variedad de yogur griego de origen vegetal. Elaborada con leche de coco y proteína de guisantes, la colección de yogur de leche de coco estilo griego Silk ofrece cuatro sabores: vainilla, fresa, limón y arándano. Cada porción está certificada como apta para veganos, contiene 10 gramos de proteína y presenta cultivos activos vivos para promover la salud digestiva.

- En agosto de 2021, Lactalis India, una filial del grupo Lactalis de Francia, marcó su entrada en el mercado indio del yogur con la introducción de Lactel Turbo Yoghurt Drink. Esta bebida para llevar está disponible en sabores de mango y fresa y es claramente más espesa que el lassi debido a la incorporación de proteínas y frutas. Envasada en bolsas abiertas, la bebida de yogur tiene un precio de INR 15, lo que ofrece a los consumidores una opción cómoda y sabrosa.

- En marzo de 2021, Chobani, un actor destacado en el mercado del yogur griego de EE. UU., unió fuerzas con PepsiCo para mejorar su red de distribución. En virtud de esta colaboración, PepsiCo facilitará la distribución de las bebidas de yogur completo de Chobani y otras ofertas a tiendas de conveniencia, colegios y universidades en toda la región noreste de Estados Unidos.

Análisis Regional

Geográficamente, los países cubiertos en el informe del mercado europeo del yogur son Alemania, Francia, Italia, Reino Unido, Bélgica, España, Rusia, Turquía, Países Bajos, Suiza y el resto de Europa.

Según el análisis de investigación de mercado de Data Bridge:

Francia es la región dominante en el Mercado europeo del yogur durante el período de previsión 2022-2029

Francia domina el mercado europeo del yogur y está preparado para un crecimiento significativo. El aumento se debe a los cambios en los estilos de vida, en los que los consumidores eligen cada vez más opciones más saludables. Los beneficios inherentes para la salud del yogur impulsan aún más esta tendencia. A medida que Francia toma la delantera, el mercado anticipa un aumento de la demanda, lo que refleja una tendencia social más amplia hacia opciones conscientes de la salud. Este dominio es un testimonio de la influencia de Francia e indica una preferencia creciente por productos lácteos nutritivos en todo el panorama europeo.

Para obtener información más detallada sobre el Informe del mercado europeo del yogur, haga clic aquí –https://www.databridgemarketresearch.com/reports/europe-yogurt-market